UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended | December 31, 2020 |

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number 001-33462

INSULET CORPORATION

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Delaware | | 04-3523891 |

| (State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| | | | |

| 100 Nagog Park | Acton | Massachusetts | | 01720 |

| (Address of Principal Executive Offices)

| | (Zip Code) |

Registrant’s telephone number, including area code: (978) 600-7000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 Par Value Per Share | PODD | The NASDAQ Stock Market, LLC |

| | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | x | | Non-accelerated filer | ¨ |

| | | | |

| Accelerated filer | ¨ | | Smaller reporting company | ☐ |

| | | | |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates of the registrant computed by reference to the last reported sale price of the Common Stock as reported on The NASDAQ Global Market on June 30, 2020 was approximately $12.7 billion.

The number of shares of common stock outstanding as of February 18, 2021 was 66,080,324.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file a proxy statement pursuant to Regulation 14A within 120 days of the end of the fiscal year ended December 31, 2020. Portions of such proxy statement are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

| | | | | | | | |

| | |

| Item 1 | | |

| Item 1A | | |

| Item 1B | | |

| Item 2 | | |

| Item 3 | | |

| Item 4 | | |

| | |

| | |

| Item 5 | | |

| Item 6 | | |

| Item 7 | | |

| Item 7A | | |

| Item 8 | | |

| Item 9 | | |

| Item 9A | | |

| Item 9B | | |

| | |

| | |

| Item 10 | | |

| Item 11 | | |

| Item 12 | | |

| Item 13 | | |

| Item 14 | | |

| | |

| | |

| Item 15 | | |

| Item 16 | | |

| | |

| | |

PART I

Item 1. Business

Overview

Insulet Corporation (“we” or the “Company”) is primarily engaged in the development, manufacture and sale of its proprietary Omnipod® System, a continuous insulin delivery system for people with insulin-dependent diabetes, which we have been selling since 2005. The Omnipod System includes: the Omnipod Insulin Management System (“Omnipod”) and the Omnipod DASHTM Insulin Management System (“Omnipod DASH” or “DASH”), our digital mobile Omnipod platform. In addition to the diabetes market space, we have partnered with pharmaceutical and biotechnology companies to tailor the Omnipod System technology platform for the delivery of subcutaneous drugs across other therapeutic areas. Most of our drug delivery revenue consists of sales of pods to Amgen for use in the Neulasta® Onpro® kit, a delivery system for Amgen’s white blood cell booster to help reduce the risk of infection after intense chemotherapy.

Market Opportunity: Management of Diabetes

Diabetes is a chronic, life-threatening disease for which there is no known cure. It is caused by the body’s inability to produce or effectively utilize the hormone insulin, which prevents the body from adequately regulating blood glucose levels. Glucose, the primary source of energy for cells, must be maintained at certain concentrations in the blood in order to permit optimal cell function and health. In people with diabetes, blood glucose levels fluctuate between very high levels, a condition known as hyperglycemia, and very low levels, a condition called hypoglycemia. Hyperglycemia can lead to serious short-term complications, such as confusion, vomiting, dehydration and loss of consciousness and long-term complications, such as blindness, kidney disease, nervous system disease, occlusive vascular diseases, stroke and cardiovascular disease, or death. Hypoglycemia can lead to confusion, loss of consciousness or death.

Diabetes is typically classified as either Type 1 or Type 2:

•Type 1 diabetes is characterized by the body’s nearly complete inability to produce insulin. It is frequently diagnosed during childhood or adolescence. Individuals with Type 1 diabetes require daily insulin therapy to survive. We estimate that four to four and a half million people have Type 1 diabetes in the countries we currently serve.

•Type 2 diabetes, the more common form, is characterized by the body’s inability to either properly utilize insulin or produce enough insulin. Historically, Type 2 diabetes has occurred in later adulthood, but its incidence is increasing among the younger population, due primarily to increasing obesity. Initially, many people with Type 2 diabetes attempt to manage their diabetes with improvements in diet, exercise and/or oral medications. As their diabetes advances, some individuals progress to multiple drug therapies, which often include insulin therapy. We estimate that approximately seven to seven and a half million people have Type 2 diabetes in the countries we currently serve.

We estimate that approximately one-third of the Type 1 diabetes population in the United States and even less of the Type 1 diabetes population outside the United States use insulin pump therapy. An even smaller portion of the Type 2 diabetes population in and outside of the United States who are insulin-dependent use insulin pump therapy. We believe these factors present a significant available market for the Omnipod System globally.

Throughout this Annual Report on Form 10-K, we refer to both Type 1 diabetes and insulin-requiring Type 2 diabetes as insulin-dependent diabetes.

Diabetes Management Challenges

Diabetes is often frustrating and difficult for people to manage. Blood glucose levels can be affected by the carbohydrate and fat content of meals, exercise, stress, illness or impending illness, hormonal releases, variability in insulin absorption and changes in the effects of insulin on the body. For people with insulin-dependent diabetes, many corrections, consisting of the administration of additional insulin or ingestion of additional carbohydrates, are needed throughout the day in order to maintain blood glucose levels within normal ranges. Achieving this result can be very difficult without multiple daily injections of insulin or insulin pump therapy. Individuals with diabetes attempting to control their blood glucose levels tightly to prevent the long-term complications associated with fluctuations in blood glucose levels are at greater risk for overcorrection and the resultant hypoglycemia. As a result, many people have difficulty managing their diabetes. Additionally, the time spent managing fluctuations in blood glucose levels and the fear associated with hypoglycemia can be incredibly stressful for individuals with diabetes and their families.

Current Insulin Therapy

People with insulin-dependent diabetes need a continuous supply of insulin, known as basal insulin, to provide for background metabolic needs. In addition to basal insulin, people with insulin-dependent diabetes require supplemental insulin, known as bolus insulin, to compensate for carbohydrates ingested during meals or snacks or for a high blood glucose level. There are two

primary types of insulin therapy practiced today: multiple daily injections (“MDI”) therapy using syringes or insulin pens and pump therapy using insulin pumps.

MDI therapy involves the administration of fast-acting insulin before meals (bolus) to lower blood glucose levels to a healthy range. MDI therapy may also require a separate injection of a long-acting (basal) insulin, to control glucose levels between meals; typically, once or twice per day. By comparison, insulin pump therapy uses only fast-acting insulin to fulfill both mealtime (bolus) and background (basal) requirements. Insulin pump therapy allows individuals to customize their bolus and basal insulin doses to meet their insulin needs throughout the day and is intended to more closely resemble the physiologic function of a healthy pancreas.

Insulin pumps are used to perform continuous subcutaneous insulin infusion and typically use a programmable device and an infusion set to administer insulin into the person’s body. Insulin pump therapy has been shown to provide numerous advantages relative to MDI therapy. For example, insulin pump therapy eliminates individual insulin injections (approximately five per day), delivers insulin more accurately and precisely than injections, often improves HbA1c (a common measure of blood glucose levels) over time, provides greater flexibility with meals, exercise and daily schedules, and can reduce severe low blood glucose levels. We believe that these advantages, along with technological advancements and increased awareness of insulin pump therapy will continue to generate demand for insulin pump devices.

Our Solution: The Omnipod System

The Omnipod System is a continuous insulin delivery system that provides all the benefits of insulin pump therapy in a unique way. We believe the Omnipod System’s innovative proprietary design and differentiated features allow people with insulin-dependent diabetes to live their lives and manage their diabetes, with unprecedented freedom, comfort, convenience and ease.

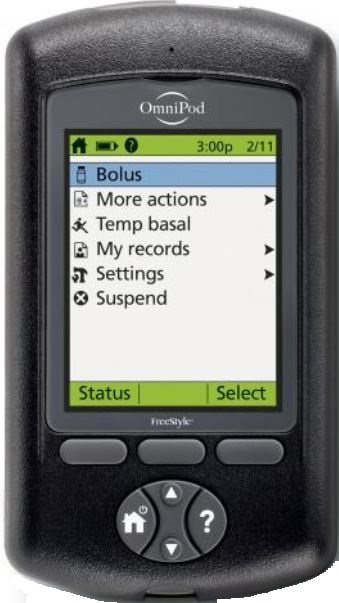

| | | | | | | | |

| | |

| Pod | Omnipod PDM | Omnipod DASH PDM |

The Omnipod System features two discreet and easy-to-use devices that eliminates the need for the external tubing required with conventional pumps:

•a small, lightweight, self-adhesive disposable tubeless Omnipod device (“Pod”) that the user fills with insulin and wears directly on the body. It can be worn in multiple locations, including the abdomen, hip, back of upper arm, upper thigh or lower back. The Pod delivers precise, personalized doses of insulin into the body through a small flexible tube (called a cannula); and

•the Personal Diabetes Manager (“PDM”), a wireless, handheld device that programs the Pod with the user’s personalized insulin-delivery instructions and, wirelessly monitors the Pod’s operation.

Omnipod DASH, launched in the United States in 2019 and in 2020 in our international markets, features a secure Bluetooth enabled Pod and PDM with a color touch screen user interface supported by smartphone connectivity. In addition, the updated release launched in June 2020 features an option to choose Spanish language, nightly automatic data uploads providing users and their clinicians with cloud access to data, and the ability for us to push software updates wirelessly to users.

The Omnipod System provides continuous insulin delivery at preset rates, eliminating the need for individual insulin injections. In addition, insulin delivery can be changed with the press of a button to adapt to snacks or unexpected changes in daily routine.

The Omnipod System works like the pancreas of a person without diabetes by delivering insulin in two ways:

•A small, constant background supply of insulin is delivered automatically at a programmed rate, all day and night.

•An extra dose of insulin can be delivered when needed to match the carbohydrates in a snack or meal to correct high blood glucose.

We have designed the Omnipod System to fit within the normal daily routines of users. The Omnipod System communicates wirelessly, provides for virtually pain-free automated cannula insertion and eliminates the need for traditional MDI therapy or the use of traditional pump and tubing. It can be worn for up to three days at a time and, because it is waterproof, there is no need to remove it when showering, swimming or performing other activities. The Omnipod System consists of just two devices as opposed to up to seven for conventional tubed insulin pumps. As a result, the Omnipod System is easy to use, which reduces the training burden on healthcare professionals and end-users. We believe that the Omnipod System’s overall ease of use, flexibility and substantially lower training burden make it very attractive to people with insulin-dependent diabetes and allows healthcare professionals to prescribe pump therapy to a broader group of people with diabetes.

The Omnipod System’s unique patented design and proprietary manufacturing process allow us to provide pump therapy at a relatively low or no up-front investment, which reduces the risk to third-party payors in the U.S., compared to conventional tubed insulin pumps.

Several publications over the past decade have found that compared to MDI therapy, the use of the Omnipod System by individuals with both Type 1 and Type 2 diabetes across all age groups is associated with good glycemic control and reduced frequency and severity of hypoglycemic episodes. These results are consistent with published literature of other continuous subcutaneous insulin infusion devices. In addition, research in adults with Type 1 diabetes has found that compared to prior treatment modality, the use of the Omnipod System is associated with improved quality of life. We believe that this data is clinically meaningful to healthcare providers and provides support for the use of the Omnipod System in the treatment of both Type 1 and Type 2 diabetes.

We have partnered with Glooko Inc. (“Glooko”) to connect our Omnipod System user data with Glooko’s comprehensive diabetes data management system (including Glooko and Diasend in selected regions). Glooko provides a cloud-based application for clinicians and users accessible through a kiosk, home computer or a mobile application on the user’s smartphone that provides users and their health care providers access to insulin delivery trends, blood glucose levels and other integrated data.

Third-Party Reimbursement

In the United States, our products are sold directly to wholesalers, private healthcare organizations, healthcare facilities, mail order pharmacies and independent retailers. These entities, and the Company in some cases, seek reimbursement from health insurance companies and/or government administrative payors. The Omnipod System is also marketed and sold through distributors, as well as marketed to physicians and consumers. Our products are subject to regulatory changes and competition in technological innovation, price, convenience of use, service and product performance. In the United States, consumers generally have commercial insurance, Medicare or Medicaid coverage that pays for the product. In certain non-U.S. locations in which we sell through a distributor or intermediary, our distribution partners and local intermediaries establish appropriate reimbursement contracts with healthcare systems in those countries and provinces.

Markets and Distribution Methods

The Omnipod System is currently available in the United States, Canada and in certain countries in Europe and the Middle East. We sell the Omnipod System directly to consumers, through distribution partners and in the U.S. also through the pharmacy channel. For the year ended December 31, 2020, approximately 70% of our Omnipod System sales were through intermediaries.

Revenue for customers comprising 10% or more of total revenue was as follows:

| | | | | | | | | | | | | | | | | | | | |

| | Years Ended December 31, |

| | 2020 | | 2019 | | 2018 |

| Anda, Inc. | | 11% | | * | | * |

| Cardinal Health Inc. and affiliates | | 10% | | 11% | | 12% |

| Amgen, Inc. | | * | | * | | 12% |

* Represents less than 10% of revenue for the period.

Our sales and marketing efforts are focused on customer retention and growing user, clinician and payor demand for the Omnipod System. We have a uniform sales and marketing approach, aligned across users, physicians and providers, to capitalize on the unique benefits of our Omnipod System technology. We have three areas of focus:

•Build consumer awareness about the features and benefits that the Omnipod System provides.

•Build physician support by increasing the clinical evidence that demonstrates the benefits that the Omnipod System provides and improving the monitoring data available to physicians providing diabetes care.

•Provide payors with the clinical and economic justification for why the Omnipod System provides a unique value to the people whom they insure.

Training

We believe that training consumers how to use the Omnipod System is an important factor to promote successful outcomes and customer retention. We have streamlined and standardized our training by developing improved online resources and increased our field clinician team to directly train new Omnipod System users. With the launch of Omnipod DASH, we created an online training program for Omnipod DASH customers transitioning from Omnipod. In addition, due to the challenges COVID-19 has presented, we have also been using virtual training to onboard new Omnipod customers transitioning from MDI. Our virtual capabilities have allowed us to continue to onboard new customers despite COVID-19 and in a cost-effective manner. Our distributors and intermediaries have also implemented virtual training programs.

Customer Support

We seek to provide our customers with high quality customer support, from product ordering to insurance investigation, order fulfillment and ongoing support. We have integrated our customer support systems with our sales, reimbursement and billing processes and offer support by telephone and through our website to provide customers with seamless and reliable support.

Competition

The diabetes medical device market is highly competitive, subject to rapid change and significantly affected by new product introductions. The Omnipod System competes for consumers in the insulin delivery market. Because most new Omnipod System end-users come from MDI therapy, which currently is the most prevalent method of insulin delivery, we believe that we primarily compete with companies that provide products and supplies for MDI therapy. To a lesser extent, we also compete with companies in the insulin pump market, which today consists of conventional tubed pump companies, including Medtronic MiniMed, a division of Medtronic public limited company (“Medtronic”), and Tandem Diabetes Care Inc. (“Tandem”). In addition, we compete with Roche Holdings Ltd. (“Roche”) and The Ypsomed Group (“Ypsomed”) outside the United States. Medtronic historically has held the majority share of the conventional tubed insulin pump market in the United States. The competitive landscape in our industry continues to undergo significant change. In addition to the established insulin pump competitors, several companies are working to develop and market new insulin pumps and smart pens. These companies are at various stages of development and the number of such companies often changes as they enter or exit the market. Our non-insulin drug delivery product line competes with drug delivery device companies such as West Pharmaceutical Services, Inc.

Research and Development

Our research and development efforts are primarily focused on making improvements to the Omnipod System, including adding features and functionality that will deliver economic value, convenience and simplicity to users.

Omnipod 5, powered by HorizonTM Automated Insulin Delivery System (“Omnipod 5”)

We are developing an automated insulin delivery (“AID”) system that utilizes the DASH mobile platform to allow the Pod, our automated insulin delivery algorithm located on the Pod and the glucose sensor values obtained directly from a third party’s continuous glucose monitor (“CGM”) to predict glucose levels into the future and automatically adjust the insulin dose required

to help reduce the occurrence of blood glucose highs and lows. We plan to launch Omnipod 5 with a CGM manufactured by Dexcom, Inc. and compatibility with the Android platform. In addition, we have signed a development agreement to integrate Abbott Diabetes Care, Inc.’s CGM in the future and are also working on developing compatibility with iOS. Omnipod 5 is intended to be controllable through a secure mobile app on the user’s smartphone (i.e. “phone control”). We completed the first phase of our Omnipod 5 pivotal trial in October 2020. We also recently completed our Omnipod 5 clinical study of pediatric users ages two to six years old and are planning for an expanded indication by the end of 2021. In addition, we have begun enrolling individuals with Type 2 diabetes in an Omnipod 5 feasibility study. Based on the results of the feasibility work, we plan to conduct additional studies with the goal of expanding Omnipod 5’s indications. Omnipod 5 was granted designation in the U.S. Food and Drug Administration’s (“FDA”) breakthrough device program, which is a program intended to help people have more timely access to certain medical devices and device-led combination products that provide for more effective treatment or diagnosis of life-threatening or irreversibly debilitating diseases or conditions by expediting the development and review process. We believe that recent and ongoing developments in the use of CGM technology and AID algorithms in conjunction with insulin pump therapy will continue to provide people with insulin-dependent diabetes benefits that will make insulin pump therapy an even more attractive treatment alternative to existing MDI therapy.

Paramount to our ability to deliver phone control is our commitment to cyber and information security. Omnipod DASH is the first FDA-cleared insulin pump certified under the Diabetes Technology Society’s “Standard for Wireless Diabetes Device Security” cybersecurity assurance standard and program, known as DTSec. This certification is a cybersecurity standard intended to raise confidence in the security of network connected medical devices through independent expert evaluation. In addition, Omnipod DASH is International Standards Organization (“ISO”) 27001 certified, which is the international standard for best practice in an information security management system globally. With the DTSec and ISO 27001 certifications, Omnipod DASH is globally recognized for incorporating the highest standards for cyber and information security and safety, including secure data transfer between the Pod and PDM, as well as secure cloud storage.

In addition to our focus on Omnipod 5, we are also working on innovation programs designed to drive:

•simplicity of user interaction with our systems;

•improved outcomes through algorithm advancements;

•insights and value from our growing datasets and analytics; and

•user choice of sensor and smartphone integrations.

Manufacturing and Quality Assurance

We believe a key contributing factor to the overall attractiveness and success of the Omnipod System is the disposable nature of the Pod. In order to manufacture sufficient volumes and achieve a cost-effective per unit production price for the Omnipod, we have designed the Omnipod System to be manufactured through automation.

In 2019, we began producing product at our highly automated manufacturing facility in Acton, Massachusetts and in 2020, we began producing on our second line in this facility. We completed the installation our third U.S. manufacturing line and expect to produce sellable product on this line in 2021. Our Acton facility has the capacity to house up to four lines. In addition to increasing supply redundancy and adding capacity closer to our North American customer base to support the growth of our business, we expect that once the Acton facility is fully utilized, the highly automated assembly process will be able to produce a globally cost competitive product.

In addition, we continue to produce our devices on varying degrees of semi-automated manufacturing lines at a facility in China operated by a contract manufacturer. In 2020, we invested in another contract manufacturer in China allowing us to leverage our local supplier base. These contract manufacturing agreements expire in December 2022 and October 2021, respectively, and are subject to automatic renewal, unless canceled by the parties under the terms of the contracts.

We also continue to invest in supply chain efficiencies, including automation improvements at our suppliers and contract manufacturer.

Raw Materials

We use a broad range of raw materials in the assembly and manufacturing of the Omnipod System. We purchase all our raw materials and select components used in the manufacturing of our products from external suppliers. We purchase some supplies from a single or limited number of sources for reasons of proprietary know-how, quality assurance, cost-effectiveness, or constraints resulting from regulatory requirements. We rely on a limited number of suppliers for certain of the components and sub-assemblies used in the manufacture of the Omnipod System, including application-specific integrated circuit chips, Bluetooth low-energy chips and other specialized parts. The design of certain of these components and sub-assemblies (including, in some instances, the raw materials used to manufacture them) is proprietary and the intellectual property rights

may be owned exclusively by one party. In such cases, we are sole sourced with the supplier controlling the intellectual property rights. These sole sourced components are critical to the design and functionality of the Omnipod System. In the case of sole sourced parts, we manage risk through holding inventory ourselves and at the supplier to ensure continuity of supply and low risk of disruption. We purchase other components and sub-assemblies from manufacturers with whom we are at least dual sourced. We work closely with all suppliers to ensure continuity of supply while maintaining high quality and reliability.

Quality Assurance

We utilize outside vendors for the supply of components, sub-assemblies and various services used in the manufacture of the Omnipod System. Our outside vendors produce the components to our specifications, and they are audited periodically by our Quality Assurance Department to confirm conformity with the specifications, policies and procedures for the Omnipod System. Our Quality Assurance Department also inspects and tests the Omnipod System at various steps in the manufacturing cycle to facilitate compliance with our specifications. We have received approval of our Quality Management System from BSI Group, an accredited Notified Body for CE Marking, and from ISO. Processes utilized in the manufacture, test and release of the Omnipod System have been verified and validated as required by the FDA and other regulatory bodies. As a medical device manufacturer and distributor, our manufacturing facilities and the facilities of our suppliers are subject to periodic inspection by the FDA, certain corresponding state agencies, and other regulatory bodies.

Intellectual Property

To maintain a competitive advantage, we believe we must develop and preserve the proprietary aspect of our technologies. We rely on a combination of copyright, patent, trademark, trade secret and other intellectual property laws, non-disclosure agreements and other measures to protect our proprietary rights. We require our employees, consultants and advisers to execute non-disclosure agreements in connection with their employment, consulting or advisory relationships with us, where appropriate. We also require employees, consultants and advisers who work on our products to agree to disclose and assign to us all inventions conceived during their work with us that are developed using our property or relate to our business. Despite measures taken to protect our intellectual property, unauthorized parties may attempt to copy aspects of the Omnipod System or obtain and use information that we regard as proprietary.

Patents

As of December 31, 2020, we had over 250 patents in the United States and in certain other countries, with expiration dates ranging from 2021 through 2042, and had over 130 patent applications pending. The issued patents and pending patent applications cover, among other things:

•the basic architecture of the Omnipod System, including the pump and the PDM;

•the Omnipod shape memory alloy drive system;

•the Omnipod System cannula insertion system;

•communication features between system components for the Omnipod System and next generation products;

•software, such as apps, for controlling the Omnipod System and next generation products; and

•various novel aspects of the Omnipod System, potential future generations of Omnipod Systems, and other mechanisms for the delivery of pharmaceuticals.

Trademarks

We have registered various trademarks associated with our business with the United States Patent and Trademark Office on the Principal Register and in other appropriate jurisdictions. Our trademarks include INSULETTM, OMNIPOD®, OMNIPOD® 5 Automated Insulin Delivery System, SIMPLIFY LIFETM, Omnipod DASH®, Omnipod CONTROLTM, Omnipod DISPLAY®, Omnipod VIEW®, OMNIPOD U-200TM, OMNIPOD U-500TM, Pod Pals® and PodderTM.

Government Regulation

United States FDA Regulation

The Omnipod System is a medical device subject to extensive and ongoing regulation by the FDA and other federal, state, and local regulatory bodies. FDA regulations govern, among other things, product design and development, preclinical and clinical testing, pre-market clearance or approval, manufacturing, labeling, product storage, advertising and promotion, sales and distribution, post-market adverse event reporting, post-market surveillance, complaint handling, repair or recall of products, and record keeping.

Unless an exemption applies, each medical device we seek to commercially distribute in the United States will require either prior 510(k) clearance or pre-market approval (“PMA”) from the FDA. Both the 510(k) clearance and PMA processes can be expensive and lengthy and entail significant user fees. We have obtained 510(k) clearance for the Omnipod and Omnipod DASH Systems and expect that regulatory approval will be needed for some of our future products. In addition, we may be required to obtain a new 510(k) clearance or pre-market approval for significant post-market modifications to our products.

510(k) Clearance. To obtain 510(k) clearance for any of our potential future devices (or for certain modifications to devices that have previously received 510(k) clearance), we must submit a pre-market notification demonstrating that the proposed device is substantially equivalent to a previously cleared 510(k) device. The FDA’s 510(k) clearance pathway generally takes three to twelve months from the date the application is completed but can take significantly longer. A 510(k) application must be supported by extensive data, including technical information, labeling, and potentially clinical data to meet any Special Controls and to demonstrate the safety and effectiveness of the device to the FDA’s satisfaction. After a medical device receives 510(k) clearance, any modification that could significantly affect its safety or effectiveness, or that would constitute a significant change in its intended use, requires a new 510(k) clearance or, depending on the modification, could require a PMA application. The FDA requires each manufacturer to make this determination initially, but the FDA can review any such decision and can disagree with a manufacturer’s determination. If the FDA disagrees with a manufacturer’s determination regarding whether a new pre-market submission is required for the modification of an existing device, the FDA can, at its discretion, require the manufacturer to cease marketing and/or recall the modified device until 510(k) clearance or PMA is obtained. In addition, in these circumstances, we may be subject to significant regulatory fines or penalties for failure to submit the requisite 510(k) or PMA application(s).

PMA. Devices deemed by the FDA to pose the greatest risk, such as life-sustaining, life-supporting or implantable devices, and devices deemed not substantially equivalent to a previously cleared 510(k) device generally require a PMA before they can be commercially distributed. A PMA application must be supported by extensive data, including technical information, pre-clinical and clinical trials, manufacturing information and labeling, to demonstrate the safety and effectiveness of the device to the FDA’s satisfaction. After a PMA application is complete, the FDA begins an in-depth review of the submitted information, which generally takes between one and three years, but may take significantly longer. During this review period, the FDA may request additional information or clarification of information already provided. Also, during the review period, an advisory panel of experts from outside the FDA may be convened to review and evaluate the application and provide recommendations to the FDA as to the approvability of the device. The FDA conducts a pre-approval inspection of the manufacturing facility to ensure compliance with Quality System Regulations (“QSR”), which impose elaborate design development, testing, control, documentation and other quality assurance procedures in the design and manufacturing process. The FDA may approve a PMA application with post-approval conditions intended to ensure the safety and effectiveness of the device including, among other things, restrictions on labeling, promotion, sale and distribution, and collection of long-term follow-up data from people in the clinical study that supported approval. Failure to comply with the conditions of approval can result in materially adverse enforcement action, including the loss or withdrawal of the approval. After pre-market approval, a new pre-market approval application or application supplement may be required in the event of modifications to the device, its labeling, intended use or indication, or its manufacturing process. PMA supplements often require submission of the same type of information as a PMA application, except that the supplement is limited to information needed to support any changes from the device covered by the original PMA application, and may not require as extensive clinical data or the convening of an advisory panel.

Clinical Trials. Clinical trials are almost always required to support a PMA application and may also be required to support 510(k) submissions. If the device presents a “significant risk” to human health as defined by the FDA, the FDA requires the device sponsor to submit an investigational device exemption (“IDE”) and obtain IDE approval prior to commencing human clinical trials. The IDE must be supported by appropriate data, such as animal and laboratory testing results, showing that it is safe to test the device in humans and that the testing protocol is scientifically sound. Clinical trials for a significant risk device may begin once an IDE is approved by the FDA and the appropriate Institutional Review Board (“IRB”) at each clinical trial site. If the product is deemed a “non-significant risk” device, IDE approval from the FDA would not be required, but the clinical trial would need to meet other requirements including IRB approval. Clinical trials for a significant risk device may begin once an IDE is approved by the FDA and the appropriate IRB at each clinical trial site.

Our clinical trials must be conducted in accordance with FDA regulations and federal and state regulations concerning human subject protection, including informed consent and healthcare privacy. A clinical trial may be suspended by the FDA or at a specific site by the relevant IRB at any time for various reasons, including a belief that the risks to the trial participants outweigh the benefits of participation in the clinical trial. Even if a clinical trial is completed, the results of our clinical testing may not demonstrate the safety and efficacy of the device or may be equivocal or otherwise not be sufficient for us to obtain approval of our product.

Ongoing Regulation. After a device is placed on the market, numerous regulatory requirements apply, including:

•establishment registration and device listing;

•QSR, which requires manufacturers, including third party manufacturers, to follow stringent design, testing, control, documentation and other quality assurance procedures during the development and manufacturing process;

•labeling regulations and prohibitions against the promotion of products for uncleared, unapproved or “off-label” uses, and other requirements related to promotional activities;

•medical device reporting regulations, which require that manufacturers report to the FDA if their device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if the malfunction were to recur;

•corrections and product recall reporting regulations, which require that manufacturers report to the FDA field corrections and product recalls or removals if undertaken to reduce a risk to health posed by the device or to remedy a violation of the federal Food, Drug and Cosmetic Act that may present a risk to health. In addition, the FDA may order a mandatory recall if there is a reasonable probability that the device would cause serious adverse health consequences or death; and

•post-market surveillance regulations, which apply when necessary to protect the public health or to provide additional safety and efficacy data for the device.

Failure to comply with applicable regulatory requirements can result in enforcement actions by the FDA and other regulatory agencies, which may include any of the following sanctions: untitled letters or warning letters, fines, injunctions, consent decrees, civil or criminal penalties, recall or seizure of our current or future products, operating restrictions, partial suspension or total shutdown of production, refusal of or delay in granting 510(k) clearance or PMA of new products or modified products, rescinding previously granted 510(k) clearances or withdrawing previously granted PMAs, or refusal to grant import or export approval of our products.

We are subject to announced and unannounced inspections by the FDA, and these inspections may include the manufacturing facilities of our subcontractors. If, as a result of these inspections, the FDA determines that our equipment, facilities, laboratories or processes do not comply with applicable FDA regulations and conditions of product approval, the FDA may seek civil, criminal or administrative sanctions and/or remedies against us, including the suspension of our manufacturing operations. Since approval of the Omnipod System, we have been subject to FDA inspections of our facilities on multiple occasions.

Other Regulations

Licensure. Several states require that durable medical equipment (“DME”) providers be licensed in order to sell products in that state. Certain of these states require, among other things, that DME providers maintain an in-state location. In order to sell our product through the pharmacy channel in the United States, we are required to work with intermediaries who have the appropriate pharmacy license for the applicable market.

In addition, we are subject to certain state laws regarding professional licensure. We believe that our certified diabetes educators are in compliance with all such state laws. However, if our educators or we were to be found non-compliant, we may need to modify our approach to providing education, clinical support and customer service.

Federal Anti-Kickback and Self-Referral Laws. The federal healthcare Anti-Kickback Statute prohibits the knowing and willful offer, payment, solicitation or receipt of any form of remuneration (anything of value) in return for, or to induce:

•the referral of an individual;

•furnishing or arranging for the furnishing of items or services reimbursable under Medicare, Medicaid or other federal health care programs; or

•the purchase, lease, or order of, or the arrangement or recommendation of the purchasing, leasing, or ordering of, any item or service reimbursable under Medicare, Medicaid or other federal health care programs.

The federal Anti-Kickback Statute has been interpreted to apply to arrangements between drug and medical device manufacturers and suppliers on one hand and prescribers, patients, purchasers and formulary managers on the other. Liability under the statute may be established without a person or entity having actual knowledge of the statute or specific intent to violate it. In addition, claims resulting from a violation of the federal Anti-Kickback Statute constitute false or fraudulent claims for purposes of the federal civil False Claims Act, which is addressed below. Although there are a number of statutory exemptions and regulatory safe harbors protecting certain common business practices from prosecution and administrative sanctions, the exemptions and safe harbors are drawn narrowly, and practices that involve remuneration that may be perceived

as inducing the prescription, purchase, or recommendation of the Omnipod System may be subject to scrutiny under the law. For example, we provide the initial training to users necessary for appropriate use of the Omnipod System either through our own diabetes educators or by contracting with outside diabetes educators that have completed a Certified Pod Trainer training course. We compensate outside diabetes educators for their services at contracted rates deemed to be consistent with the market. We have structured our arrangements with diabetes educators and other business practices to comply with statutory exemptions and regulatory safe harbors whenever possible, but our practices may be subject to scrutiny if they fail to strictly comply with the criteria in the exemption or regulatory safe harbor. Moreover, there are no safe harbors for many common practices such as providing reimbursement assistance, coding and billing information or other customer assistance and product support programs. If any of our practices, arrangements or programs are found not to be in compliance with the federal Anti-Kickback Statute, we could be subject to significant criminal, civil and administrative penalties, including imprisonment, fines, damages, and exclusion from Medicare, Medicaid or other governmental programs, any of which could have a material adverse effect on our business and results of operations.

Federal law also includes a provision commonly known as the “Stark Law,” which prohibits a physician from referring Medicare or Medicaid patients to an entity for the furnishing of certain “designated health services,” including durable medical equipment, in which the physician has an ownership or investment interest or with which the physician has entered into a compensation arrangement. Violation of the Stark Law could result in denial of payment, disgorgement of reimbursements received for items and services referred by a physician with a noncompliant arrangement, civil damages and penalties, and exclusion from Medicare, Medicaid or other governmental programs. Although there are a number of statutory and regulatory exceptions protecting certain common business practices implicating the Stark Law, and we have structured our arrangements with physicians and other providers to comply with these exceptions, these arrangements may not expressly meet the requirements for applicable exceptions from the law.

Federal Civil False Claims Act. The federal civil False Claims Act imposes penalties against any person or entity who, among other things, knowingly presents, or causes to be presented, a false or fraudulent claim for payment of government funds or knowingly making, using or causing to be made or used a false record or statement material to a false or fraudulent claim. Actions under the False Claims Act may be brought by the Attorney General or as a qui tam action by a private individual in the name of the government. Violations of the False Claims Act are subject to the imposition of significant per claim penalties, three times the amount of damages that the federal government sustained and possible exclusion from participation in federal health care programs like Medicare and Medicaid. We believe that we are in compliance with the federal government’s laws and regulations concerning the filing of claims for reimbursement. However, many drug and medical device manufacturers have been investigated or subject to lawsuits by whistleblowers and have reached substantial financial settlements with the federal government under the False Claims Act for a variety of alleged improper marketing activities, including providing free product to customers with the expectation that the customers would bill federal programs for the product; or causing submission of false claims by providing inaccurate coding or billing information to actual or prospective purchasers. Our business practices could be subject to scrutiny and enforcement under the federal False Claims Act. We also may be subject to other federal false claim laws, including federal criminal statutes that prohibit making a false statement to the federal government.

Civil Monetary Penalties Law. We are subject to the federal Civil Monetary Penalties Law, which prohibits, among other things, the offering or transferring of remuneration to a Medicare or Medicaid beneficiary that the person knows or should know is likely to influence the beneficiary’s selection of a particular supplier of Medicare or Medicaid payable items or services. Noncompliance can result in significant civil monetary penalties for each wrongful act, assessment of three times the amount claimed for each item or service and exclusion from the federal healthcare programs.

Federal Health Care Fraud Statutes. We are also subject to a federal health care fraud statutes that, among other things, impose criminal and civil liability for executing a scheme to defraud any health care benefit program including non-governmental programs, and prohibits knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false or fraudulent statement or representation, or making or using any false writing or document with knowledge that it contains a materially false or fraudulent statement in connection with the delivery of or payment for health care benefits, items or services. Violations of these statutes can result in significant civil, criminal and administrative penalties, fines, damages, and exclusion from federal health care programs.

State Fraud and Abuse Laws and Marketing Restrictions. Many states have adopted anti-kickback, anti-referral laws, and false claims laws and regulations analogous to the federal civil Anti-Kickback Statute and federal False Claims Act. In some cases, these state laws apply regardless of the payor, including private payors. We believe that we are in conformance with such laws. Moreover, several states have imposed requirements to disclose payments to health care providers, restrictions on marketing and other expenditures, and requirements to adopt a code of conduct or compliance program with specific elements. Liability under such laws could result in fines and penalties and restrictions on our ability to operate in these jurisdictions.

Administrative Simplification of the Health Insurance Portability and Accountability Act of 1996. The Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) mandated the adoption of standards for the exchange of electronic health information to encourage overall administrative simplification and enhance the effectiveness and efficiency of the healthcare industry. Ensuring privacy and security of patient information is one of the key factors driving the legislation. HIPAA regulations have been amended under the Health Information Technology for Economic and Clinical Health Act of 2009. If we are found to be in violation of HIPAA, we could be subject to civil or criminal penalties.

California Consumer Privacy Act and California Privacy Rights Act. The California Consumer Privacy Act (“CCPA”) is a consumer privacy law, which provides certain privacy rights and consumer protection for residents of the state of California that became effective in January 2020. These consumer rights include the right to know what personal information is collected, the right to know whether the data is sold or disclosed and to whom, the right to request a company to the delete personal information collected, the right to opt-out of the sale of personal information and the right to non-discrimination in terms of price or service when a consumer exercises a privacy right. The California Privacy Rights Act (“CPRA”) amends and expands the CCPA and is to take effect in January 2023 with respect to personal data collected beginning in January 2022. If we fail to comply with these regulations, we could be subject to civil sanctions, including fines and penalties for noncompliance.

Patient Protection and Affordable Care Act. The Patient Protection and Affordable Care Act as amended by the Health Care and Education Reconciliation Act of 2010 (“ACA”) enacted significant changes to the provision of and payment for healthcare in the United States. Under the ACA and related laws and regulations, federal and state government initiatives are focused on limiting the growth of healthcare costs and implementing changes to healthcare delivery structures. These reforms are intended in part to put increased emphasis on the delivery to patients of more cost-effective therapies and could adversely affect our business. Some of the provisions of the ACA have yet to be fully implemented, and certain provisions have been subject to judicial and Congressional challenges. In addition, there have been efforts to repeal or replace certain aspects of the ACA and to alter the implementation of the ACA and related laws. It is unclear how the ACA and its implementation, as well as efforts to repeal or replace, or invalidate, the ACA, or portions thereof, will affect our business. Additional legislative changes, regulatory changes, and judicial challenges related to the ACA remain possible. While some uncertainty exists regarding the future aspects of the ACA, we expect that the ACA will continue to have a significant impact on the delivery of healthcare in the United States and on our business in the near term.

Physician Payments Sunshine Act. The Physician Payments Sunshine Act, implemented as the Open Payments program, requires manufacturers of drugs and devices for which payment is available under Medicare, Medicaid, or the Children’s Health Insurance Program (with certain exceptions) to report annually to the Centers for Medicare & Medicaid Services (“CMS”) information related to direct or indirect payments and other transfers of value provided to physicians and teaching hospitals, as well as ownership and investment interests held by physician and their immediate family members. Beginning in 2022, applicable manufacturers also will be required to report information regarding payments and transfers of value provided to physician assistants, nurse practitioners, clinical nurse specialists, certified nurse anesthetists and certified nurse-midwives. Failure to disclose reportable payments could subject us to penalties and materially adversely impact our business and financial results. Certain states’ laws require additional reporting of payments and transfers of value to health care providers.

As these laws and regulations continue to evolve, we lack definitive guidance as to the application of certain key aspects of these laws and regulations as they relate to certain of our arrangements and programs, including those with providers with respect to user training. We cannot predict the final form of these federal and state regulations or the effect their application will have on us. As a result, our provider and training arrangements may ultimately be found not to be in compliance with applicable federal law. Moreover, these laws continue to evolve. The Bipartisan Budget Act of 2018 increased the criminal and civil penalties that can be imposed for violating certain federal health care laws, including the Anti‑Kickback Statute. Additionally, in late 2020, the United States Department of Health and Human Services’ Office of the Inspector General (“OIG”) finalized a rule that will remove protection from the discount safe harbor to the federal healthcare Anti-Kickback Statute for manufacturers rebates to pharmacy benefit managers (or “PBMs”), Medicare Part D plans and Medicaid managed care organizations (“MCOs”), effective January 2022. The rule also includes a new safe harbor for point-of sale-reductions offered by manufacturers to Part D plans, Medicaid MCOs and their PBMs, and a new safe harbor for certain fees manufacturers pay to PBMs for services to the manufacturers. The rule was finalized consistent with an Executive Order issued by the President in 2020; with the change in Administrations, it is possible that the rule may be revised before it is fully effective. If it takes effect as written, the rule will be one of the most significant amendments to the Anti-Kickback Statute regulatory safe harbors in decades and likely will transform manufacturer interactions with Part D plans, Medicaid MCOs and their PBMs.

Ensuring that our business arrangements and interactions with healthcare professionals, third‑party payors, customers and others comply with applicable healthcare laws and regulations requires substantial resources. Because of the breadth of these laws and the narrowness of the exceptions or safe harbors, it is possible that some of our business activities could be subject to challenge under one or more of these laws. Such a challenge could have a material adverse effect on our business, financial condition and results of operations. Even if we are not found to have violated the law, responding to lawsuits, government investigations or enforcement actions, defending any claims raised, and paying any resulting settlement amounts would be expensive and time-consuming, and could have a material adverse effect on our reputation and business operations.

U.S. Foreign Corrupt Practices Act (“FCPA”). We are also subject to FCPA and similar anti-bribery laws in non-U.S. jurisdictions, which generally prohibit companies and their intermediaries from making improper payments to non-U.S. officials for the purpose of obtaining or retaining business. Because of the predominance of government-sponsored healthcare systems around the world, our customer relationships outside of the United States may be with governmental entities and therefore subject to such anti-bribery laws. Our policies mandate compliance with these anti-bribery laws. We operate in parts of the world that have experienced governmental corruption to some degree, and in certain circumstances strict compliance with anti-bribery laws may conflict with local customs and practices. Despite our training and compliance programs, our internal control policies and procedures may not protect us from reckless or criminal acts committed by our employees or agents.

International Regulations

International sales of medical devices are subject to foreign government regulations, which may vary substantially from country to country. The time required to obtain approval by a foreign country may be longer or shorter than that required for FDA clearance or approval, and the requirements may differ. There is a trend towards harmonization of quality system standards among the European Union, United States, Canada and various other industrialized countries.

The primary regulatory body in Europe is that of the European Union, which includes most of the major countries in Europe. Other countries, such as Switzerland, have voluntarily adopted laws and regulations that mirror those of the European Union with respect to medical devices. The European Union has adopted numerous directives and standards regulating the design, clinical trials, manufacture, labeling and adverse event reporting for medical devices, including the Medical Device Directive (“MDD”) and the Medical Device Regulation (“MDR”), which will replace MDD in May 2021. Devices that comply with the requirements of the relevant directive will be entitled to bear the CE conformity marking and, accordingly, can be commercially distributed. The method of assessing conformity with the applicable directive varies depending on the class of the product, but normally involves a combination of self-assessment by the manufacturer and a third-party assessment by a “Notified Body”. The latter is required in order for a manufacturer to commercially distribute the product throughout the European Union. This third-party assessment may consist of an audit of the manufacturer’s quality system and specific testing of the manufacturer’s product. Outside of the European Union, regulatory approval needs to be sought on a country-by-country basis for us to market our products.

We have obtained the right to affix the CE Mark to the Omnipod and Omnipod DASH Systems, which allows us to distribute these products throughout the European Union and in other countries that recognize the CE Mark. In addition, we have Health Canada approval to sell these products in Canada.

Outside the United States a range of anti-bribery and anti-corruption laws, as well as industry specific laws and codes of conduct, apply to the medical device industry and interactions with government officials and entities and healthcare professionals. These laws include the U.K. Bribery Act and similar antibribery laws in other jurisdictions in which we operate. Such laws generally prohibit U.S.-based companies and their intermediaries from making improper payments for the purpose of obtaining or retaining business to non-U.S. officials, or in the case of the U.K. Bribery Act, to any person.

General Data Protection Regulation. The General Data Protection Regulation (“GDPR”) is a comprehensive update to the data protection regime in the European Economic Area that imposes requirements relating to, among other things, consent to process personal data of individuals, the information provided to individuals regarding the processing of their personal data, the security and confidentiality of personal data, notifications in the event of data breaches and use of third party processors. If we fail to comply with these standards, we could be subject to criminal penalties and civil sanctions, including fines and penalties for noncompliance.

Human Capital Resources

Employees

Our people are our most valuable asset and are the source of our innovation and our success. We strive to attract and retain the best talent with competitive compensation and benefits, opportunities for growth and development, and a culture that emphasizes fair and equitable treatment. As of December 31, 2020, we had approximately 1,900 full-time employees,

representing a 41% increase over the prior year. Approximately 84% of our employees are located in the United States and the remainder are located in 12 other countries.

To assess and improve employee retention and engagement, we survey employees annually with the assistance of third party consultants, and take timely action to address key areas of employee concern. In 2020, 90% of our employees responded to the survey. We supplement this anonymous survey with additional surveys throughout the year. Our senior leadership team assesses engagement to understand and identify potential opportunities for improvement.

Our executive leadership team conducts quarterly Town Hall meetings to ensure our global employees are highly engaged and receive timely business updates. To help our employees feel socially connected to their colleagues while working remotely due to COVID-19, we created our “Stay Connected” initiative, which includes weekly video updates from leaders around the world. This initiative also includes virtual meetings with our executive team members. These virtual meetings are designed as casual conversations with our executives so employees can talk about what is on their minds, get to know the executive leaders, and connect with colleagues from across the organization. We have also implemented new technology platforms, including a social networking tool, to ensure our global employees are engaged, motivated, and collaborating with one another.

Diversity, Equity and Inclusion

Our success thrives on the diversity of perspective, thought, experience, and background within our workforce. Our goal is to create an inclusive global culture that reflects the diversity of the customers we serve and fosters an environment where all employees feel welcomed, respected, and valued. Accordingly, we are committed to providing equal opportunity in all aspects of employment. Our annual three-day leadership program includes instruction in unconscious bias and hiring behaviors that support diversity. We have targeted recruitment programs for veterans and university students, including those of diverse backgrounds.

Our Employee Resource Groups (“ERG”) serve as a source of inclusion across seven categories: African Descent, LGBTQ+, Sustainability, Veterans and First Responders, Women, Working Parents, and Young Professionals. These ERG support the acquisition of diverse talent and are sponsored by senior leaders across our organization.

Training and Development

We are committed to fostering an environment in which our employees continuously learn and develop. We offer both leadership and professional skills development programs. All employees who join Insulet undergo a robust onboarding program called RITE Start that introduces our core values of respect, integrity, teamwork and excellence, and educates new employees about diabetes, our Omnipod products, our business strategy, and other business topics designed to engage and connect employees to each other and our mission. Employees have access to monthly learning programs and virtual and online learning programs. On June 1, 2020, we launched a new learning platform to all worldwide employees, which provides a daily professional development topic and includes a library of topics for our busy workforce. Since the launch, through December 31, 2020, over 45,000 lessons have been consumed by employees across the globe. Additionally, during our annual Compliance Week, employees logged over 4,300 training hours. We offer leadership development programs to support the growth of our future leaders. We also offer training for new managers and resources for experienced leaders. Additionally, we offer professional certification course reimbursement of up to $3,000 annually and tuition reimbursement of up to $5,250 annually for courses taken in pursuit of an undergraduate degree and up to $10,000 annually for courses taken in pursuit of a graduate degree. Finally, in response to COVID-19, we launched a series of virtual training programs and employee communications designed to support employees and leaders during a stressful transition to work at home, including programs on leading effective remote meetings, managing remotely and how to leverage collaborative learning tools.

Competitive Pay and Benefits

Our compensation program is designed to align employee compensation with our performance and to provide the proper incentives to attract, retain and motivate employees to achieve superior results. The structure of our compensation program balances incentive earnings for both short-term and long-term performance. Specifically,

•We provide employee wages that are competitive and consistent with employee positions, skill levels, experience, knowledge and geographic location.

•We engage internationally recognized outside compensation and benefits consulting firms to independently evaluate the effectiveness of our executive compensation and benefit programs and to provide benchmarking.

•We align our executives’ long-term equity compensation with our shareholders’ interests.

•Annual increases and incentive compensation are based on our performance as well as each individual’s contribution to the results achieved and are documented through our talent management process as part of our annual review process.

We are committed to providing comprehensive benefit options that allow our employees and their families to live healthier and more secure lives. Our wide-ranging benefits include: health insurance, telehealth, prescription drug benefits, dental insurance, vision insurance, accident insurance, critical illness insurance, life insurance, disability insurance, health savings accounts, flexible savings accounts, retirement plans, legal services, identity theft protection, maternity/paternity leave, and employee assistance program. In addition, we offer a free online wellness program; subsidized child, senior care or pet services and access to personal services; free virtual babysitting and tutoring services; Pod perks, which provides a free Omnipod System, including PDM and Pods to benefit eligible employees, interns or dependents; summer hours; and a flexible work policy. In addition, our employee stock purchase plan is available to all full-time employees and has a participation rate of over 50%.

Health and Safety

The health and safety of our employees is a top priority. Our safety focus is evident in our response to the COVID-19 pandemic around the globe, which includes the following:

•Creating a COVID-19 task force guided by several core principles, including protecting the health and safety of our employees and a COVID-19 response plan designed and guided by the World Health Organization, the Centers for Disease Control and Prevention, local governments, and health authorities and professionals;

•Adopting virtual on-boarding program for new employees and virtual customer training;

•Revising our flexible work policy to allow for greater work from home flexibility and providing equipment and tools to support remote work;

•Implementing health screening at our manufacturing facilities and corporate headquarters and enhanced cleaning procedures at all facilities;

•Providing meals for manufacturing employees to limit exposure and requiring manufacturing employees to quarantine for a period of time and produce two negative COVID-19 tests, if they travel to a “hotspot” location or attend a gathering where social distancing is not possible, before returning to the plant

•Providing 80 hours of COVID-19 paid sick time to all employees to use if they contract the virus or to care for family members and offering at-home COVID-19 testing to all U.S. full-time, part-time, and temporary employees and contractors;

•Requiring health and safety protocols training and site specific training for all employees before being allowed to return to the office;

•Installing signage at all facilities to remind employees to wear a mask, wash hands, and social distance;

•Installing cubicle panel extensions at our corporate headquarters to further protect employees within their designated workstations and plexiglass in the cafeteria to allow for safe food delivery and dining;

•Providing personal protective equipment and cleaning supplies to each employee at all facilities, globally and to all field personnel.

Company Information

Insulet Corporation is a Delaware corporation formed in 2000. Our principal office is located at 100 Nagog Park, Acton, Massachusetts, 01720 and our website address is http://www.insulet.com. We make available free of charge on our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and amendments to those reports as soon as reasonably practicable after we electronically file or furnish such materials to the U.S. Securities and Exchange Commission (“SEC”). We have also posted the charters for our Audit Committee, Compensation Committee and Nominating, Governance and Risk Committee, as well as our Code of Business Conduct and Ethics, under the heading “Corporate Governance” in the Investors section of our website. The information on our website is not incorporated in this report by reference. In addition, the SEC maintains a website (http//www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Item 1A. Risk Factors

Risks Related to Our Business and Industry

We currently rely on sales of the Omnipod System, and tailored versions of the Omnipod System in our drug delivery product line, to generate nearly all our revenue.

Our main product is the Omnipod System, from which we expect to continue to derive nearly all our revenue. Accordingly, our ability to continue to generate revenue is highly reliant on our ability to market and sell the Omnipod System and to retain consumers who currently use the product. Our sales of the Omnipod System may be negatively impacted by many factors, including:

•the failure of the Omnipod System to achieve and maintain wide acceptance among opinion leaders in the diabetes treatment community, insulin-prescribing physicians, third-party payors and people with insulin-dependent diabetes;

•manufacturing problems or capacity constraints;

•actual or perceived quality problems;

•reductions in reimbursement rates or coverage policies relating to the Omnipod System by third-party payors;

•claims that any portion of the Omnipod System infringes on intellectual property rights of others;

•adverse regulatory or legal actions relating to the Omnipod System;

•damage, destruction or loss of any of the facilities where our products are manufactured or stored or of the equipment therein or failure to successfully open or expand new facilities;

•the inability of users to continue paying for our products;

•attrition rates of consumers who cease using the Omnipod System;

•competitive pricing; and

•results of clinical studies relating to the Omnipod System or our competitors’ products.

If any of these events occurs, our ability to generate revenue could be significantly reduced, which would adversely affect our business, financial condition and results of operations.

If we fail to expand and maintain an effective sales force or successfully develop our relationships with intermediaries, our business, prospects and brand may be materially and adversely affected.

In addition to promoting, marketing and selling the Omnipod System through our own direct sales force, we also utilize domestic and international intermediaries to distribute our product to end-users. We need to expand our distribution network to maintain and grow our business and revenue. We cannot assure you that we will be able to successfully develop our relationships with third-party intermediaries. If we fail to do so, our sales could fail to grow or could decline, and our ability to grow our business could be adversely affected. Intermediaries that are in the business of selling other medical products may not devote a sufficient level of resources and the support required to generate awareness of our products and grow or maintain product sales. If our intermediaries are unwilling or unable to market and sell our products, or if they do not perform to our expectations, we could experience delayed or reduced market acceptance and sales of our products, which would adversely affect our business, financial condition and results of operations.

Our ability to grow our revenue depends in part on our retaining a high percentage of our customers.

A key to driving our revenue growth is the retention of a high percentage of our customers. We have developed retention programs aimed at both healthcare professionals and consumers, which include appeals assistance, ongoing customer communications, newsletters, support, training and an automatic re-order program for certain customers. We have had a satisfactory customer retention rate; however, we cannot assure you that we will maintain this retention rate in the future. Current uncertainty in global economic conditions, competition, higher levels of unemployment, changes in insurance reimbursement levels and negative financial news may negatively affect product demand. If demand for our products fluctuates as a result of economic conditions or otherwise, our ability to attract and retain customers could be harmed. The failure to retain a high percentage of our customers could negatively impact our revenue growth and may have a material adverse effect on our business, financial condition and results of operations.

If we do not effectively manage our growth, our business resources may become strained and we may not be able to deliver the Omnipod System in a timely manner, which could harm our results of operations.

As we continue to expand our sales, we expect to continue to increase our manufacturing capacity, our personnel and the scope of our sales and marketing efforts. This growth, as well as any other growth that we may experience in the future, will provide challenges to our organization and may strain our management and operations resources. In order to manage future growth, we will be required to improve existing, and implement new, sales and marketing efforts and distribution channels. The form and function of our enterprise information technology systems will need to change and be improved upon as our business needs change. We will need to manage our supply chain effectively, including the continued development of our manufacturing and our relationships with our contract manufacturers and other suppliers. We may also need to partner with additional third-party suppliers to manufacture certain components of the Omnipod System and install additional manufacturing lines. A transition to new suppliers may result in additional costs or delays. We may misjudge the amount of time or resources that will be required to effectively manage any anticipated or unanticipated growth in our business or we may not be able to manufacture sufficient inventory, or attract, hire and retain sufficient personnel to meet our needs. If we cannot scale our business appropriately, maintain control over expenses or otherwise adapt to anticipated and unanticipated growth, our business resources may become strained, we may not be able to deliver the Omnipod System in a timely manner and our results of operations may be adversely affected.

Failure to secure or retain adequate coverage or reimbursement for our products by third-party payors could adversely affect our business, financial condition and results of operations.

We expect that sales of the Omnipod System will be limited unless a substantial portion of the sales price of the Omnipod System is paid for by third-party payors, including private insurance companies, health maintenance organizations, preferred provider organizations, federal and state government healthcare agencies and other managed care providers. In the United States, we currently have contracts establishing reimbursement for the Omnipod System with national and regional third-party payors that provide reimbursement in all 50 states. While we anticipate entering into additional contracts with other third-party payors, we cannot assure you that our efforts will be successful. In addition, these contracts can generally be terminated by the third-party payor without cause. Healthcare market initiatives in the United States may also lead third-party payors to decline or reduce reimbursement for the Omnipod System. Moreover, compliance with administrative procedures or requirements of third-party payors may result in delays in processing approvals by those payors for consumers to obtain coverage for the use of the Omnipod System. Coverage decisions and rates of reimbursement increasingly require clinical evidence showing an improvement in user outcomes. Generating this clinical evidence requires substantial time and investment and there is no guarantee of a desired outcome.