Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

Greer Bancshares Incorporated

(Name of Registrant as Specified in Its Charter)

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 28, 2005

NOTICE IS HEREBY GIVEN that the Annual Meeting of the Shareholders of Greer Bancshares Incorporated will be held on Thursday, April 28, 2005, at 3:00 p.m., local time, at the West Poinsett Street office of Greer State Bank, 1111 West Poinsett Street, Greer, South Carolina, for the following purposes:

| | 1. | To elect four directors to hold office until the 2008 Annual Meeting of Shareholders or until their successors have been duly elected and qualified; |

| | 2. | To approve the Company’s 2005 Equity Incentive Plan; and |

| | 3. | To transact such other business as may properly come before the Annual Meeting or any adjournments of the meeting. |

Only those shareholders of the Company of record at the close of business on March 11, 2005 are entitled to vote at the Annual Meeting or any adjournments thereof. A complete list of shareholders will be available at the Company’s offices prior to the meeting.

YOU ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING IN PERSON.EACH SHAREHOLDER IS REQUESTED TO DATE, SIGN, AND RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE PAID, RETURN ENVELOPE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING. YOU MAY, IF YOU WISH, WITHDRAW YOUR PROXY AND VOTE YOUR SHARES IN PERSON AT THE ANNUAL MEETING.

| | | | |

| | | | | By Order of the Board of Directors, |

| | |

| | | | |  |

Greer, South Carolina March 31, 2005 | | | | Gary M. Griffin Chairman, Board of Directors Greer Bancshares Incorporated |

GREER BANCSHARES INCORPORATED

1111 West Poinsett Street

Greer, South Carolina 29650

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD APRIL 28, 2005

Our Board of Directors is soliciting proxies for the 2005 Annual Meeting of Shareholders to be held on Thursday, April 28, 2005 at 3:00 p.m., local time. The meeting will be held at Greer State Bank’s West Poinsett Street office, 1111 West Poinsett Street, Greer, South Carolina for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. The approximate date of the mailing of this Proxy Statement and accompanying Proxy is March 31, 2005.

Who is Entitled to Vote; Other Voting Matters

The Board has set March 11, 2005 as the record date for the meeting. Only shareholders owning the Company’s common stock on that date will be entitled to vote at the meeting. At the close of business on that day, there were outstanding 2,433,839 shares of the Company’s common stock. Each share of common stock is entitled to one vote on all matters presented at the Annual Meeting. In accordance with the Company’s articles of incorporation, cumulative voting will not be permitted.

The presence, in person or by proxy, of the holders of one third of the total number of shares of common stock entitled to vote at the meeting is necessary to constitute a quorum at the meeting. Since many shareholders cannot attend the meeting, it is necessary that a large number be represented by proxy. Accordingly, the Board of Directors has designated proxies to represent those shareholders who cannot be present in person and who desire to be so represented. In the event there are not sufficient votes for a quorum or to approve or ratify any proposal at the time of the Annual Meeting, the meeting may be adjourned in order to permit the further solicitation of proxies.

Many of our shareholders hold their shares through a stockbroker, bank, or other nominee rather than directly in their own name. If you hold our shares in a stock brokerage account or by a bank or other nominee, you are considered thebeneficial owner of shares held in street name, and these materials are being forwarded to you by your broker or nominee, which is considered theshareholder of record with respect to those shares. As thebeneficial owner, you have the right to direct your broker or nominee how to vote and are also invited to attend the annual meeting. However, since you are not theshareholder of record, you may not vote these shares in person at the meeting unless you obtain a signed proxy from theshareholder of record giving you the right to vote the shares. Your broker or nominee has enclosed or provided a voting instruction card for you to use to direct your broker or nominee how to vote these shares.

2

The election of directors will be determined by a plurality vote. The 2005 Equity Incentive Plan will be approved if the votes cast in favor of approval exceed the votes cast opposing the plan. We will count abstentions and broker non-votes, which are described below, in determining whether a quorum exists. Brokers who hold shares for the accounts of their clients may vote these shares either as directed by their clients or in their own discretion if permitted by the exchange or other organization of which they are members. Proxies that brokers do not vote on some proposals but that they do vote on others are referred to as “broker non-votes” with respect to the proposals not voted upon. A broker non-vote does not count as a vote in favor of or against a particular proposal for which the broker has no discretionary voting authority. In addition, if a shareholder abstains from voting on a particular proposal, the abstention does not count as a vote in favor of or against the proposal.

Availability of Voting by Proxy; Revocability of Proxies

When you sign the proxy card, you appoint Walter M. Burch, Paul D. Lister, Theron C. Smith, III. and C. Don Wall as your representatives at the meeting. Mr. Burch, Mr. Lister, Mr. Smith and Mr. Wall will vote your proxy as you have instructed them on the proxy card. If you submit a proxy but do not specify how you would like it to be voted, Mr. Burch, Mr. Lister, Mr. Smith and Mr. Wall will vote your proxy for the election to the Board of Directors of all nominees listed below under “Election of Directors” and will vote your proxy for the approval of the Company’s 2005 Equity Incentive Plan. We are not aware of any other matters to be considered at the meeting. However, if any other matters come before the meeting, Mr. Burch, Mr. Lister, Mr. Smith and Mr. Wall will vote your proxy on such matters in accordance with their judgment.

You may revoke your proxy and change your vote at any time before the polls close at the meeting. You may do this by signing and delivering another proxy with a later date or by voting in person at the meeting.

Solicitation of Proxies

We are paying for the costs of preparing and mailing the proxy materials and of reimbursing brokers and others for their expenses of forwarding copies of the proxy materials to our shareholders. Our officers and employees may assist, by telephone or otherwise, in soliciting proxies but will not receive additional compensation for doing so. We are distributing this proxy statement on or about March 31, 2005.

We are mailing our 2004 Annual Report along with this proxy statement. The annual report contains financial statements reflecting our financial position and results of operations at and for the three years ended December 31, 2004. The annual report, however, is not part of this proxy statement.

3

ELECTION OF DIRECTORS

Proposal 1 on the Proxy

General Information Regarding Election of Directors

The Board of Directors is divided into three classes with staggered terms, so that the terms of only approximately one-third of the board members expire at each annual meeting. The Board of Directors is currently comprised of 11 directors.

Shareholders will elect four nominees at the meeting to serve three-year terms, expiring at the 2008 annual meeting of shareholders. The directors will be elected by a plurality of the votes cast at the meeting. This means that the four nominees receiving the highest number of votes will be elected.

The board of directors recommends that you elect the four nominees identified below as directors. If you submit a proxy but do not specify how you would like it to be voted, Mr. Burch, Mr. Lister, Mr. Smith and Mr. Wall will vote your proxy to elect these nominees. If any of these nominees is unable or fails to accept nomination or election (which we do not anticipate), Mr. Burch, Mr. Lister, Mr. Smith and Mr. Wall will vote instead for a replacement to be recommended by the board of directors, unless you specifically instruct otherwise in the proxy.

Identification of Nominees

The following table sets forth information concerning the four persons nominated as directors, as well as directors continuing in office.

| | | | | | |

Name

| | Age

| | Position or Office with the Company

| | Director Since

|

| Nominees for Three Year Terms Expiring in 2008 | | | | |

| Gary M. Griffin | | 50 | | Director | | 1992 |

| Kenneth M. Harper | | 40 | | Director, President | | 2004 |

| R. Dennis Hennett | | 62 | | Director, CEO | | 1988 |

| David M. Rogers | | 50 | | Director | | 1988 |

| | |

| Continuing Directors with Terms Expiring in 2006 | | | | |

| Mark S. Ashmore | | 48 | | Director | | 2002 |

| Harold K. James | | 53 | | Director | | 1988 |

Anthony C. Cannon | | 40 | | Director | | 2000 |

4

| | | | | | |

| Continuing Directors with Terms Expiring in 2007 | | | | |

| Walter M. Burch | | 63 | | Director | | 1988 |

| Paul D. Lister | | 60 | | Director | | 1988 |

| C. Don Wall | | 61 | | Director | | 1988 |

| Theron C. Smith, III | | 56 | | Director | | 2000 |

Experience of the Board of Directors (All directors have been at their present occupation at least five years.)

Mr. Ashmore is President of Ashmore Bros., Inc./Century Concrete, a local paving company.

Mr. Burch is General Manager and Co-Publisher ofThe Greer Citizen, a local weekly newspaper.

Mr. Cannon is the Energy Manager for Greer Commission of Public Works.

Mr. Griffin is Vice President of Mutual Home Stores, a group of retail stores in the Greenville-Spartanburg area.

Mr. James is Vice President and Broker-in-Charge of the James Agency, a local insurance and real estate company.

Mr. Lister is a Certified Public Accountant, with a local practice.

Mr. Rogers is President of Joshua’s Way Inc., a local non-profit organization.

Mr. Smith is an optometrist with a local practice.

Mr. Wall is a pharmacist and President of Professional Pharmacy, Incorporated, located in Greer.

5

GOVERNANCE OF THE COMPANY

Our business and affairs are managed under the direction of the Board of Directors in accordance with the South Carolina Business Corporation Act of 1988 and our Articles of Incorporation and Bylaws. Members of the Board of Directors are kept informed of our business through discussions with management, by reviewing materials provided to them and by participating in meetings of the Board of Directors and its committees. The corporate governance practices that we follow are summarized below:

Code of Ethics

The Board of Directors has approved a Code of Ethics for our directors and senior officers. The Code of Ethics addresses such topics as the ethical handling of actual and apparent conflicts of interest; full, fair, accurate, timely and understandable disclosure in SEC filings and other public communications; compliance with laws; prompt reporting of ethics violations; and adherence to the code. The Code of Ethics supplements our personnel policy guidelines for ethical conduct applicable to all employees.

Meeting Attendance

Board and Committee Meetings. The Board of Directors held 12 meetings in 2005. All of the directors attended at least 75% of the aggregate of such Board meetings and the meetings of each committee on which they served.

Annual Meeting of Shareholders.Our policy regarding attendance by members of the Board of Directors at our annual shareholders’ meetings is that directors are expected to attend, unless there is an unavoidable conflict that prevents their attendance. All ten of our directors who were serving at the time attended the annual meeting in 2004.

Committees of the Board.Our Board of Directors has appointed a number of committees, including a personnel committee, a nominating committee, and an audit committee.

Personnel Committee.Our personnel committee, which met seven times in 2004, establishes and monitors our employee benefits program and personnel policies. This committee also performs the duties of a compensation committee and reviews annually the recommendations of executive management regarding administration of salaries and benefits costs. In 2004, the personnel committee was comprised of Mr. Rogers, Chairman; Mr. Cannon, Mr. Griffin, and Mr. Smith. In addition, Mr. Hennett, as our Chief Executive Officer, and Mr. Harper, as our President, present recommendations from executive management and participate in discussions affecting the compensation of all employees, except themselves. The personnel committee also administers our executive officer and director compensation plans. If it is approved by the shareholders, the 2005 Incentive Equity Plan will also be administered by the personnel committee, which will decide awards of stock options to be granted to key employees.

Nominating Committee.The Chairman of the Board of Directors annually appoints the nominating committee. The committee typically consists of not less than three directors. The nominating committee has the principal function of recommending to the Board of Directors nominees for election as directors. The current members of the nominating committee are Messrs. Smith (Chairman), Cannon and Lister, each of whom is considered to be independent under the National Association of Securities Dealers listing standards. Effective May 1, 2005 the Nominating Committee will be a standing committee of the Board, whose

6

members will serve three year terms. The Nominating Committee will adopt a formal charter after May 1, 2005.

For directors previously elected by shareholders to serve on the Board and whose terms of service are expiring, the nominating committee considers whether to recommend to the Board the nomination of those directors for re-election for another term of service. The nominating committee also considers whether to recommend to the Board the nomination of persons to serve as directors whose nominations have been recommended by shareholders.

Any shareholder may recommend the nomination of any person to serve on the Board. Our policy is to require a shareholder to submit the name of the person to the secretary of the Company in writing no later than (i) with respect to an election to be held at an annual meeting of shareholders, 90 days in advance of such meeting; and (ii) with respect to an election to be held at a special meeting of shareholders for the election of directors, no more than seven days after notice of the special meeting is given to shareholders. Each notice must set forth: (i) the name and address of the shareholder who intends to make the nomination and of the person or persons to be nominated; (ii) a representation that the shareholder is a holder of record of stock of the company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (iii) a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder; (iv) such other information regarding each nominee proposed by such shareholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission, had the nominee been nominated, or intended to be nominated, by the Board of Directors; and (v) the consent of each nominee to serve as a director of the company if so elected. The chairman of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure. Any person recommended for nomination as a director must, according to South Carolina law, own not less than 100 shares of Company stock.

The nominating committee considers a number of factors in determining whether to recommend to the Board the nomination of any person for election as a director. While no single factor is determinative, the following factors are considered by the nominating committee in considering any potential nominee:

| | • | | educational background, |

| | • | | ability to grasp business and financial concepts, |

| | • | | knowledge or experience related to banking or financial services, |

| | • | | previous service on boards (particularly of public companies), |

| | • | | willingness and ability to devote time and energy to the duties of a director, |

7

| | • | | a desire and ability to help enhance shareholder value, |

| | • | | reputation in the community, |

| | • | | whether the nominee has any history of criminal convictions or violations of SEC rules, |

| | • | | actual or potential conflicts of interest, and |

| | • | | any other factor that the nominating committee considers relevant to a person’s potential service on the Board of Directors. |

The Board of Directors also considers the foregoing criteria in determining whether to nominate any person for election by the shareholders.

In determining whether to nominate any person for election by the shareholders, the Board assesses the appropriate size of the Board of Directors, consistent with the bylaws of the Company, and whether any vacancies on the Board are expected due to retirement or otherwise. If vacancies are anticipated, or otherwise arise, the Board will consider various potential candidates for director recommended by the nominating committee. Candidates may come to the attention of the nominating committee or Board through a variety of sources including, but not limited to, current members of the Board, shareholders, or other persons. The nominating committee and Board of Directors consider properly submitted recommendations by shareholders who are not directors, officers, or employees of the Company on the same basis as candidates recommended by any other person.

The Company does not pay a third party to assist in identifying and evaluating candidates.

Audit Committee.The audit committee, which met five times in 2004, selects the Company’s independent auditors, determines the scope of the annual audit, determines whether the Company has adequate administrative, operational, and internal accounting controls, and determines whether the Company is operating according to established policies and procedures. The members of the audit committee are Messrs. Lister (Chairman), Ashmore, and Smith. The Board of Directors has adopted a formal Audit Committee Charter which establishes the audit committee and its responsibility for engaging a qualified CPA firm to audit the Company’s financial statements annually to be presented to the shareholders. A copy of the Charter is attached asAnnex A.

It is our policy that the committee be comprised of outside directors, who will ensure that the Company’s internal audit function is independent of Company management and the audit is performed competently. Each of the members of our audit committee is considered “independent” under Rule 4350 of the National Association of Securities Dealers listing standards. The Board of Directors has also determined that Mr. Lister is an Audit Committee Financial Expert, based on his qualifications and the requirements of the Sarbanes-Oxley Act.

Compensation of Directors

Base Compensation.During 2004, directors received $1,300 for each regular meeting of the Board of Directors. The Company’s policy was to pay $1,300 per special meeting, beginning with the third special

8

meeting of the year. No more than $2,600 could have been paid to a director in any one month regardless of the number of regular or special meetings attended. No special meetings of the Board were held in 2004. Directors are not compensated for committee meetings. In addition to the monthly fees paid, each director who was not an employee of the Company was paid a bonus of $1,300 in February 2005 for service in 2004.

Directors’ Deferred Compensation Plan.A Directors’ Deferred Compensation Plan was instituted in 1996. The plan allows directors’ board fees to be deferred and earn interest at a rate equal to the Company’s return on average equity (with a minimum interest rate of 7% and a maximum of 12%). The rate of interest paid during 2004 was 12%. The following directors participated in the plan:

| | | | | | | | | |

| | | Total

Deferred As of 12/31/04

| | Total Amount

Deferred -2004

| | Total Interest

Earned - 2004

|

Anthony C. Cannon | | $ | 10,863.32 | | $ | 3,600.00 | | $ | 975.65 |

Gary M. Griffin | | $ | 35,434.43 | | $ | 12,000.00 | | $ | 3,168.74 |

R. Dennis Hennett | | $ | 43,959.02 | | $ | 15,600.00 | | $ | 3,893.19 |

Harold K. James | | $ | 45,322.79 | | $ | 15,600.00 | | $ | 4,039.67 |

Paul D. Lister | | $ | 164,730.59 | | $ | 15,600.00 | | $ | 16,864.65 |

David M. Rogers | | $ | 142,206.28 | | $ | 15,600.00 | | $ | 14,445.43 |

Charles D. Wall | | $ | 163,370.28 | | $ | 15,600.00 | | $ | 16,718.54 |

Directors’ Supplemental Life Insurance/Split Dollar Plan. The Company’s Board of Directors believes it to be in the best interests of the Company to enter into Split Dollar Life Insurance Agreements with the directors. The agreements provide the directors with the opportunity to receive supplemental life insurance benefits of $100,000 after seven years of service, increased each year until termination of service by an inflation factor of 4%. The life insurance acquired will help finance the interest paid on the directors’ deferred compensation. The Bank applied for and owns a life insurance policy on certain directors (listed below). By way of a separate split dollar agreement, the policy interests are divided between the Bank and the director. The Bank owns the policy cash surrender value, including the accumulated policy earnings, and the policy death benefits over and above the cash surrender value are endorsed to the director and his named beneficiary. The Bank will report to the participant each year the economic value of the insurance coverage as taxable income. The following individuals are included in the plan:

| | | | | | |

| | | Initial Split

Dollar Death

Benefit

| | Projected Post

Retirement

Death Benefit

|

Walter M. Burch | | $ | 100,000 | | $ | 173,168 |

Gary Griffin | | | 100,000 | | | 277,247 |

Harold K. James | | | 100,000 | | | 246,472 |

Paul D. Lister | | | 100,000 | | | 194,790 |

David M. Rogers | | | 100,000 | | | 288,337 |

C. Don Wall | | | 100,000 | | | 180,094 |

9

Security Holders’ Communications with the Board

Any shareholder desiring to communicate with the board of directors, or with specific individual directors, may do so by writing to the secretary of the board, Anthony C. Cannon, at Greer Bancshares Incorporated, Post Office Box 1029, Greer, South Carolina 29652. The secretary has been instructed to promptly forward all such communications to the individual to whom the correspondence is addressed.

EXECUTIVE OFFICERS

We have defined our executive officer classification to include only officers at the senior vice president level and above. The only executive officers of the Company are Mr. Hennett, our Chief Executive Officer, Mr. Harper, our President and Mr. Medlock, our Chief Financial Officer. Our executive officers of the Bank and Greer Financial Services Corporation include:

| | | | | | |

Name

| | Age

| | Title

| | Bank Officer Since

|

R. Dennis Hennett | | 62 | | Chief Executive Officer | | 1987 |

Kenneth M. Harper | | 40 | | President | | 2004 |

Sandra I. Burdette | | 62 | | EVP & Chief Operations Officer | | 1988 |

J. Richard Medlock, Jr. | | 48 | | EVP & Chief Financial Officer | | 1988 |

E. Pierce Williams, Jr. | | 49 | | EVP — Commercial Lending | | 1992 |

William S. Harrill, Jr. | | 53 | | SVP — Mortgage Lending Officer | | 1988 |

John W. Hughes | | 58 | | SVP — Consumer Lending Officer | | 1989 |

Roger Sims | | 49 | | President –Greer Financial Services Corp | | 1998 |

Business Experience Of Executive Officers

Ms. Burdette is an Executive Vice President and the Chief Operations Officer of Greer State Bank and has managed the Operations area of the Bank since the Bank’s opening in 1989.

Mr. Harrill is a Senior Vice President, Senior Mortgage Lending Officer and manager of retail banking for Greer State Bank. He has managed the Bank’s mortgage lending function since the Bank’s opening in 1989.

10

Mr. Harper was named President of the Bank in July 2004. From 1995 until joining Greer State Bank, he served as a commercial lending officer, commercial banking manager, and executive vice president and market president at Carolina First Bank in Greenville, SC.

Mr. Hennett has been Chief Executive Officer of Greer State Bank since the Bank’s inception in 1988. He also served as President from 1988, until Mr. Harper was named President in July 2004.

Mr. Hughes is a Senior Vice President and Consumer Lending Officer of Greer State Bank and has been a senior lender for the Bank since 1989.

Mr. Medlock is an Executive Vice President and the Chief Financial Officer of the Company. He has been with the Bank since its opening in 1989 and in his current capacity since 1992.

Mr. Williams is an Executive Vice President and Senior Commercial Lending Officer of Greer State Bank. He was hired by the Bank in 1992 and has been a lender since 1993.

Mr. Sims is President of Greer Financial Services Corporation, which is an alternative investment subsidiary of Greer State Bank. He has been employed by the Bank since 1996.

Family and Other Relationships

The only family relationships among executive officers and directors are as follows: William S. Harrill, Jr. (Executive Officer) and Gary M. Griffin (director) are brothers-in-law. In addition, David Rogers (director) is married to the sister of Roger Sims’ (Executive Officer) wife.

None of the executive officers serve as directors of other companies.

11

COMPENSATION OF EXECUTIVE OFFICERS

Summary of Cash and Certain Other Compensation

The following table sets forth the compensation we paid for the fiscal years ended December 31, 2004, 2003 and 2002 to our Chief Executive Officer. No other executive officers received aggregate cash compensation in excess of $100,000 in 2004.

| | | | | | | | | | | | | | | | |

Name & Principal Position

| | Fiscal Year

| | Salary1

| | Bonus

| | | Other Annual Compensation

| | Securities Underlying Options/SARS(#) Granted

| | All Other Compensation2

|

R. Dennis Hennett, CEO | | 2004

2003

2002 | | $

| 208,427

190,694

172,127 | | $

| 20,000

22,500

25,000 | 3

4

5 | | —

—

— | | 0 / 19,750

0/0

0/0 | | $

| 11,786

11,186

9,331 |

| 1 | Represents salary, directors’ fees, and deferred compensation expense (which totaled $27,827 in 2004) for Mr. Hennett. |

| 2 | This amount represents 401(k) employer match ($7,851 in 2004), disability insurance premium ($2,668 in 2004), and group life premium ($1,267 in 2004). |

| 3 | Includes bonus paid Mr. Hennett in 2005 for fiscal year 2004. |

| 4 | Represents bonus paid Mr. Hennett in 2004 for fiscal year 2003. |

| 5 | Represents bonus paid Mr. Hennett in 2003 for fiscal year 2002. |

12

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table lists the aggregate number of stock options exercised by executive officers whose aggregate cash compensation exceeded $100,000. Also listed are the number of exercisable and unexercisable stock options and the value of exercisable and unexercisable “in-the-money” stock options at December 31, 2004:

| | | | | | | | | | |

Name

| | Number of Shares Acquired

on Exercise

| | Value Realized1

| | Number of

Securities

Underlying

Options as of

Year-end

Exercisable/ Unexercisable

| | Value of

Unexercised In-the-Money

Securities Underlying

Options as of

Year-end Exercisable/

Unexercisable

|

R. Dennis Hennett | | 600 | | $ | 2,952 | | 0 / 3,400 | | $ | 0 / $26,928 |

| 1 | Market value of underlying securities on the exercise date, minus the exercise or base price. The market value of $14.50 was used and was based on information obtained from the website www.NASDAQ.com as of November 16, 2004 (the exercise date). |

Stock Appreciation Rights Agreement

On July 13, 2004, the Company and R. Dennis Hennett, the Company’s Chief Executive Officer, entered into a Stock Appreciation Rights Agreement (the “SAR Agreement”) under which Mr. Hennett was granted certain rights to participate in the increase in the book value of the Company’s common stock. Those rights were granted to Mr. Hennett as an incentive for him to remain employed with the Company and to provide him with a future retirement benefit.

A copy of the SAR Agreement is filed as an exhibit to our 2004 Report on Form 10-K. The following general description of the principal features of the SAR Agreement is qualified in its entirety by reference to the SAR Agreement.

General Information. The SAR Agreement provides that the Company will establish a Stock Appreciation Rights Account (the “Account”) on its books. The Account is not and will not be funded by the Company and is used only as a measuring tool to determine the benefits to which Mr. Hennett is entitled. Neither the SAR Agreement nor the Account involves the purchase, sale or issuance of any stock of the Company or any rights with respect thereto. All benefits payable to Mr. Hennett under the SAR Agreement will be paid by the Company in cash and not stock in lieu of cash. The benefits payable to Mr. Hennett under the SAR Agreement are calculated based upon the number of shares of “Phantom Stock” credited to the Account. Phantom Stock is a term used in the SAR Agreement representing a hypothetical number of shares of common stock of the Company awarded to Mr. Hennett and credited to the Account. The number of shares of Phantom Stock credited to the Account is tied to the appreciation in the book value of the Company’s

13

common stock. The Company will also not fund the benefits payable to Mr. Hennett under this SAR Agreement in advance. Obligations of the Company under the SAR Agreement are simply promises to pay benefits to Mr. Hennett in the future. Under the SAR Agreement, it is intended that Mr. Hennett would begin receiving benefits upon his retirement at normal retirement age, or termination of employment as a result of disability, death or an event such as a merger, sale or liquidation of the Company in which the control of the Company was changed. The Company will receive an income tax deduction as a compensation expense when the benefits are paid to Mr. Hennett and Mr. Hennett will then report the benefits as ordinary income.

Initial Phantom Stock Award. The SAR Agreement is effective January 1, 2004 and it is provided that the Account will be credited with an initial award of 13,167 shares (19,750 shares as adjusted for a 3-for-2 stock split effective as of March 15, 2004) of Phantom Stock. The shares of Phantom Stock credited to the Account as of January 1, 2004 were given an initial price per share of $11.52 ($7.68 per share as adjusted for a 3-for-2 stock split effective as of March 15, 2004). The price per share was determined by reference to the Company’s book value divided by the total number of shares of common stock outstanding. Book value means the total shareholder’s equity on the Company’s consolidated balance sheet as of a given date. Therefore, the benefits payable to Mr. Hennett are not tied to the increases in the market value of the common stock, but increases in the book value of the common stock.

Future Appreciation and Additional Phantom Stock Awards. Under the SAR Agreement, the shares of Phantom Stock in the account will be valued each year based on the then book value of the Company’s common stock. The value of each share of Phantom Stock in the Account as of each valuation date shall be the amount, if any, by which the then book value per share exceeds the initial price of $11.52 ($7.68 per share as adjusted for a 3-for-2 stock split effective as of March 15, 2004). The SAR Agreement provides that the book value per share shall never be less than $11.52 ($7.68 per share as adjusted for a 3-for-2 stock split effective as of March 15, 2004). The SAR Agreement provides that if Mr. Hennett is still employed by the Company as of each January 1st and the Company achieved a minimum of 12% return on equity for the immediately preceding year, additional Phantom Stock Awards will be credited to the Account. The SAR Agreement provides for annual Phantom Stock credits beginning January 1, 2005 of 13,167 shares (19,750 shares as adjusted for a 3-for-2 stock split effective as of March 15, 2004) each year through January 1, 2008. No Phantom Stock credits to the Account will be made for a year if the return on equity threshold is not reached during the immediately preceding year and there will be no Phantom Stock credits to the Account after January 1, 2008.

Payment of Benefits. Upon Mr. Hennett’s termination of employment at normal retirement age (which is defined to be on December 31st of the year in which Mr. Hennett reaches the age of 65 years and 10 months), the value of the Account would be determined and the Company would commence paying the value of the Account to Mr. Hennett upon his retirement. If Mr. Hennett’s employment is terminated prior to normal retirement age (other than by death or disability of Mr. Hennett), the Account would be valued at termination but the benefits payable to Mr. Hennett are subject to a four-year vesting requirement, with 25% of the value of the Account vesting at the end of each year, beginning with 2004. If Mr. Hennett’s

14

employment is terminated due to disability or death, the Account would be valued as of the date of termination with no vesting schedule for determination of the benefits payable. If Mr. Hennett’s employment is terminated due to a change of control, the benefits payable to Mr. Hennett would be equal to the greater of the value of the Account on the date of termination of employment or $373,017. The SAR Agreement does provide that if Mr. Hennett’s employment is terminated due to his gross negligence or gross neglect of duties, conviction of a felony, or fraud, disloyalty or willful violation of law or company policy, his rights to the benefits will be forfeited. In addition, if Mr. Hennett begins receiving benefits and participates in a competing enterprise with the Company, the benefits payable to him will cease. All benefits payable to Mr. Hennett, regardless of the circumstances of employment termination, are payable in 180 consecutive equal monthly installments together with 7% interest per annum, compounded monthly.

SAR Grants in Last Fiscal Year.The table below sets forth certain information concerning the Phantom Stock or SAR’s granted to Mr. Hennett and the potential realizable value of such grants.

| | | | | | | | | | | | | | | | |

Individual Grants

| | |

| | | Number of

Securities

Underlying

Option/SARSs

Granted (#)1

| | Percent of

Total

Options/SARs

Granted To

Employees In

Fiscal Year

| | | Exercise or

Base Price

($/sh)2

| | Expiration

Date

| | Potential Realized Value

at Assumed Annual

Rates of Stock Price Appreciation for Option

Term

|

Name

| | | | | | 5% ($)

| | 10% ($)

|

R. Dennis Hennett | | 19,750 | | 100 | % | | $ | 7.68 | | 6/30/08 | | $ | 130,755 | | $ | 281,586 |

| 1 | Number of shares has been adjusted for a 3-for-2 stock split effective on March 15, 2004. |

| 2 | Represents the book value per share on the date of grant, as adjusted for a 3-for-2 stock split effective on March 15, 2004. |

Salary Continuation Plan

Following is information regarding the Salary Continuation Plan for executive officers whose aggregate cash compensation exceeded $100,000 in 2004. R. Dennis Hennett, President and Chief Executive Officer of the Company, will receive $3,333.33 each month for 180 consecutive calendar months, beginning the first month following his termination of employment after his “normal retirement date.” “Normal retirement date” is defined by the Salary Continuation Plan as being the date upon which the executive attains 65 years of age.

The purpose of the Salary Continuation Plan is to encourage the executive to remain in the employ of the Company. The plan is funded by life insurance written on the executive. Under the plan, the Company promises to pay certain supplemental retirement or death benefits to the executive or his beneficiaries.

15

Compensation Committee Interlocks and Insider Participation

The Company’s personnel committee performs the duties of a compensation committee and reviews annually the recommendations of executive management regarding administration of salaries and benefits costs. In 2004, the personnel committee was comprised of David M. Rogers, Chairman; Anthony C. Cannon, Gary M. Griffin, and Theron C. Smith, III. R. Dennis Hennett, the Company’s Chief Executive Officer, presents recommendations from executive management and participates in discussions affecting the compensation of all employees except his own.

Board Compensation Committee Report on Executive Compensation

The personnel committee has approved and implemented a formal salary administration program with job grades and salary ranges for all personnel of the Company. Each grade or level has been assigned a salary range based on salary surveys for other financial institutions of comparable markets, size, and complexity. The personnel committee reviews job grades periodically and makes changes as warranted by market conditions or the needs of the Company. The personnel committee typically reviews salary ranges at least every two years and makes adjustments as the committee deems necessary in light of changes in the employment marketplace, salary surveys of peer banks, economic conditions, and increases in the cost of living.

Annual base salaries are generally set at competitive levels with similar financial institutions and within the Company’s salary administration program. The personnel committee periodically reviews the job performance and individual goal attainment of the Bank’s officers. The job performance and individual goal attainment of non-officers are periodically reviewed by their supervisors. Salary increases are typically based on individual performance and achievement and cost of living increases.

In 2004, the personnel committee approved, and the board ratified, an incentive cash award in light of the Company’s performance and profitability for the year. Non-officer employees participated in the incentive cash award based on evaluations and recommendations by each employee’s immediate supervisor. The Chief Executive Officer recommended incentive cash awards for the Company’s officers, excluding himself. The personnel committee evaluated, approved and recommended that the Board approve these incentive cash awards. As to the incentive cash award for the Chief Executive Officer, the personnel committee evaluated the job performance of the CEO, the performance of the Company, the profitability of the Company, and information from peer data to determine the incentive cash award for the CEO. The Board ratified all incentive cash awards recommended by the personnel committee. The personnel committee will annually evaluate what cash awards are appropriate for the Company’s employees.

The Company’s overall compensation program for its chief executive officer and senior management is intended to attract, motivate, and retain key employees; maintain a base salary structure that is competitive in the Company’s marketplace; link annual incentive cash awards with specific financial performance goals;

16

and provide long-term incentive awards in the form of incentive stock options that align management ownership with shareholder value.

The Personnel Committee:

| | | | | | |

David M. Rogers, Chairman | | Anthony C. Cannon | | Gary M. Griffin | | Theron C. Smith, III |

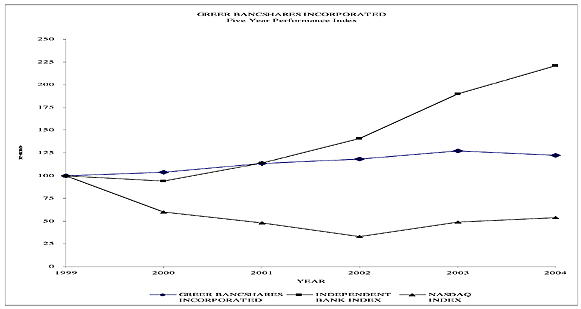

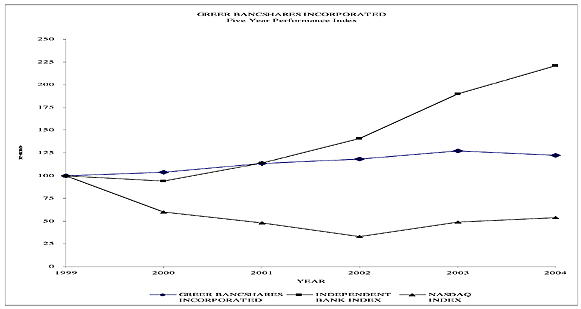

Performance Graph

We are required to provide our shareholders with a line graph comparing our cumulative total shareholder return with a performance indicator of the overall stock market and either a published industry index or a Company-determined peer comparison. The purpose of the graph is to help shareholders determine the reasonableness of the personnel committee’s decisions with respect to the setting of various levels of executive officer compensation. Shareholder return (measured through increases in stock price and payment of dividends) is often a benchmark used in assessing corporate performance and the reasonableness of compensation paid to executive officers.

However, shareholders should recognize that corporations often use a number of other performance benchmarks (in addition to shareholder return) to set various levels of executive officer compensation. Our 2004 Annual Report to Shareholders contains a variety of relevant performance indicators concerning the Company. Thus, Company shareholders may wish to consider other relevant performance indicators which may be more closely related to officer performance in assessing the reasonableness of Company executive officer compensation, such as growth in earnings per share, book value per share, and cash dividends per share, along with Return on Equity (ROE) and Return on Assets (ROA) percentages.

The performance graph included in this proxy compares the Company’s cumulative total shareholder return over the previous five fiscal years with both the NASDAQ stock index and The Carson Medlin Company’s Independent Bank Index (an index published by the Carson Medlin Company, Investment Bankers). The NASDAQ stock index reflects overall stock market performance. The Independent Bank Index is the compilation of the total return to shareholders over the past five years of a group of 22 independent community banks located in the southeastern states of Alabama, Florida, Georgia, North Carolina, South Carolina, Tennessee, Virginia, and West Virginia. The total five year return was calculated for each of the banks in the peer group taking into consideration changes in stock price, cash dividends, stock dividends, and stock splits since December 31, 1999. The individual results were then weighted by the market capitalization of each bank relative to the entire peer group. The total return approach and the weighting based upon market capitalization are consistent with the preparation of the NASDAQ total return index. The Company believes the Independent Bank Index is a more relevant standard by which community banks should measure their own performance because the peer group is comprised of banks that are closer in size and style of doing business. Furthermore, this index more closely reflects the actual trading patterns of community bank stocks.

17

Returns assume a beginning stock index price of $100 per share. The value of the Company’s stock as used to develop the graph was based on information obtained by the Company from the website NASDAQ.com regarding trading prices of the Company’s stock. Because the Company’s stock is not actively traded, the information is based on a limited number of transactions.

| | | | | | | | | | | | |

| | | 1999

| | 2000

| | 2001

| | 2002

| | 2003

| | 2004

|

Greer Bancshares Incorporated | | 100 | | 104 | | 113 | | 118 | | 127 | | 123 |

Independent Bank Index | | 100 | | 94 | | 114 | | 141 | | 190 | | 221 |

NASDAQ Index | | 100 | | 60 | | 48 | | 33 | | 49 | | 54 |

18

Equity Compensation Plan Information

The following table sets forth equity compensation plan information at December 31, 2004.

| | | | | | | |

Plan Category

| | Number of securities

to be issued

upon exercise of

outstanding options,

warrants and rights (a)

| | Weighted-average

exercise price of

outstanding options,

warrants and rights (b)

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

|

Equity Compensation Plans approved by security holders | | 102,819 | | $ | 14.91 | | 98,325 |

Equity Compensation Plans not approved by security holders | | — | | | — | | — |

Total | | 102,819 | | $ | 14.91 | | 98,325 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of March 11, 2005 information with respect to the common stock owned beneficially by each of the directors and nominees individually, by the named executive officer, by all directors and executive officers of the Company as a group, and by each holder of at least 5% of the Company’s common stock.

The address of each person or group is 1111 West Poinsett Street, Greer, South Carolina 29650, unless otherwise specified.

19

| | | | | | |

| | | Amount and Nature of Beneficial Ownership (1)(2)

| | | Percent of Class (3)

| |

Walter M. Burch | | 54,639 | | | 2.2 | % |

Paul D. Lister | | 111,403 | (4) | | 4.6 | % |

C. Don Wall | | 155,310 | (5) | | 6.4 | % |

Theron C. Smith, III | | 7,620 | (6) | | * | |

Gary M. Griffin | | 44,889 | (7) | | 1.8 | % |

R. Dennis Hennett | | 3,677 | | | * | |

David M. Rogers | | 13,117 | (8) | | * | |

Mark S. Ashmore | | 3,667 | | | * | |

Harold K. James | | 49,629 | (9) | | 2.0 | % |

Anthony C. Cannon | | 6,331 | | | * | |

Kenneth M. Harper | | 525 | | | * | |

All Directors/Executive Officers as a Group (17 persons) | | 479,215 | | | 19.7 | % |

| (1) | Under the rules of the Securities Exchange Commission, a person is deemed to be the beneficial owner of a security if that person, directly or indirectly, has or shares the power to direct the voting of the security or the power to dispose of or direct the disposition of the security. Accordingly, more than one person may be deemed to be a beneficial of the same securities. A person is also deemed to be a beneficial owner of any securities if that person has the right to acquire beneficial ownership within 60 days of the relevant date. Unless otherwise indicated by footnote, the named individuals have sole voting and investment power with respect to the shares of our stock beneficially owned. |

| (2) | Amounts disclosed include shares that may be acquired within the next 60 days by exercising vested stock options, as follows: Mr. Burch – 1,500; Mr. Lister – 0; Mr. Wall – 12,000; Mr. Smith – 6,000; Mr. Griffin – 9,000; Mr. Hennett – 0; Mr. Rogers – 3,000; Mr. Ashmore – 3,000; Mr. James – 9,000; Mr. Cannon – 6,000; and Mr. Harper – 0, and all directors and officers as a group, 4,257. |

| (3) | The calculation is based on 2,433,839 shares of common stock, which is the actual number of shares outstanding as of the record date. Pursuant to Rule 13d-3 promulgated under the Securities Exchange Act of 1934, percentages of total outstanding shares have been computed on the assumption that shares of common stock that can be acquired within 60 days upon the exercise of options by a given person or group are outstanding, but no other shares similarly subject to acquisition by other persons are outstanding. |

| (4) | Includes 23,074 shares owned by Mr. Lister’s spouse. |

| (5) | Includes 58,040 shares owned by Mr. Wall’s spouse, 59,866 shares owned by companies of which Mr. Wall is majority owner and 18,708 shares owned by Mr. Wall’s mother, for whom he has power of attorney. |

| (6) | Includes 385 shares owned by Mr. Smith’s son. |

| (7) | Includes 3,021 shares owned by Mr. Griffin’s spouse, 11,894 shares owned by Mr. Griffin’s children and 7,990 shares owned by a trust for which he is custodian. |

| (8) | Includes 164 shares owned by Mr. Rogers’ spouse and 2,040 shares owned by Mr. Rogers’ daughter. |

| (9) | Includes 23,380 shares owned by a company in which Mr. James has an ownership interest, 283 shares owned by Mr. James’ spouse and 3,261 shares for which Mr. James is Trustee under an estate. |

20

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Carter, Smith, Merriam, Rogers & Traxler, P.A. has provided professional legal services to the Company in 2004. David M. Rogers, a member of the Board of Directors, is an attorney with the Carter, Smith, Merriam, Rogers & Traxler, P.A. law firm. The legal services provided to the Company were at prices and on terms comparable to those provided to their other clients.

The Bank has had, and expects to have in the future, banking transactions in the ordinary course of business with officers, directors, shareholders, and their associates on the same terms, including interest rates and collateral on loans, as those prevailing at the same time for comparable transactions with others. Such loans have not involved more than normal risks of collectability, nor have they presented any other unfavorable features.

Some of the Company’s directors and officers are at present, as in the past, customers of the Bank, and the Company has had, and expects to have in the future, banking transactions in the ordinary course of business with directors and officers and their affiliates, on substantially the same terms, including interest rates and collateral on loans, as those prevailing at the same time for comparable transactions with others. These transactions do not involve more than the normal risk of collectability or present other unfavorable features.

There are no legal proceedings to which any of the Company’s directors or executive officers, or any of their affiliates, is a party that is adverse to the Company.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Based on a review of Forms 3, 4, and 5 and any representations made to us, it appears that all executive officers and directors have made timely filings of Statements of Beneficial Ownership on Form 3, Form 4 and Form 5 during 2004, except the one transaction listed below, for which a Form 4 was not filed within the required two days of the transaction.

| | • | | Mr. Rogers reported on December 17, 2004 the sale of 255 shares on December 6, 2004 by Joshua’s Way, Inc., of which he is President. |

As noted above, the Form 4 for the transaction was subsequently filed.

21

APPROVAL OF 2005 EQUITY INCENTIVE PLAN

Proposal 2 on the Proxy

The Board of Directors has approved, and recommends that the Company’s shareholders approve, the Greer Bancshares Incorporated 2005 Equity Incentive Plan (the “Incentive Plan”). The Company’s experience with stock options and other stock-based incentives has convinced the Board of Directors of their important role in recruiting and retaining officers, directors and employees with ability and initiative and in encouraging such persons to have a greater financial investment in the Company.

The complete text of the Incentive Plan is attached to this Proxy Statement asAnnex B. The following general description of the principal features of the Incentive Plan is qualified in its entirety by reference toAnnex B.

General Information

The Incentive Plan authorizes the Board of Directors (the “Board”) or a committee approved by the Board of Directors (the “Committee”) to grant one or more of the following awards to directors, employees and consultants to the Company and its affiliates who are designated by the Board or the Committee:

| | • | | incentive stock options; and |

| | • | | nonstatutory stock options. |

The Board or the Committee will administer the Incentive Plan and may delegate all or part of its authority to one or more subcommittees. As used in this summary, the term “administrator” means the Board or the Committee and any other committee or subcommittee to which authority has been delegated.

No determination has been made as to the identity of all persons eligible to participate in the Incentive Plan who will receive awards under the Incentive Plan, and therefore, except as to the individuals identified in table below, the benefits to be allocated to any individual or to various groups of eligible participants are not presently determinable.

22

On September 23, 2004, our Board of Directors approved the award of options for 75,000 shares to the following executive officers. The awards were subject to approval of the Incentive Plan by the shareholders within the following twelve months. The exercise price for each option is $15.50, which was the market price of the shares on the date granted.

| | | | |

Name

| | Title

| | Number of Shares

of Common Stock

Underlying Options

|

| Ken Harper | | President | | 50,000 |

| E. Pierce Williams, Jr. | | Executive Vice President | | 5,000 |

| J. Richard Medlock, Jr. | | Chief Financial Officer | | 5,000 |

| John W Hughes | | Senior Vice President | | 5,000 |

| William S. Harrill, Jr. | | Senior Vice President | | 5,000 |

| Roger C. Sims | | President of Greer Financial Services Corp. | | 5,000 |

If the shareholders approve the Incentive Plan, the Company will be authorized to issue initially under the Incentive Plan options to acquire up to 250,000 shares of common stock of the Company. The Incentive Plan provides that beginning with the annual meeting of the shareholders in 2006 and continuing for the next eight annual meetings, the aggregate number of shares of common stock that can be issued under the Incentive Plan will automatically be increased by a number of shares equal to the least of (1) 2% of the diluted shares outstanding, (2) 20,000 shares, or (3) a lesser number of shares determined by the Board. Diluted shares outstanding mean the sum of (a) the number of shares of common stock outstanding on the date of the applicable annual meeting of shareholders, (b) the number of shares of common stock issuable on such date assuming all outstanding shares of preferred stock and convertible notes are then converted, and (c) the additional number of shares of common stock that would be outstanding as a result of any outstanding options or warrants during the fiscal year of such meeting using the treasury stock method.

Generally, if an award expires or is terminated, the shares allocated to that award under the Incentive Plan may be reallocated to new awards under the Incentive Plan.

The Incentive Plan provides that if there is a stock split, stock dividend or other event that affects the Company’s capitalization, appropriate adjustments will be made in the number of shares that may be issued under the Incentive Plan and in the number of shares and price of all outstanding grants and awards made before such event.

The Incentive Plan also provides that no award may be granted more than 10 years after the date it was approved by the Board, which was September 23, 2004.

23

Grants and Awards under the Incentive Plan

The principal features of awards under the Incentive Plan are summarized below.

Incentive Stock Options

The Incentive Plan permits the grant of incentive stock options, but only to employees. The exercise price for Incentive Stock Options will not be less than the fair market value of a share of common stock on the date of grant. However, any employee who owns stock in the Company possessing more than 10% of the voting power of the Company must pay at least 110% of that fair market value as of the date of grant upon exercise and is prohibited from exercising the option after 5 years following the date of grant. Other than in connection with a corporate recapitalization, the option price may not be reduced after the date of grant. Except for the five year period imposed on an employee who is a 10% stockholder, the period in which an option may be exercised is determined by the administrator on the date of grant, but may not exceed 10 years. Payment of the option exercise price may be in cash, with other shares of common stock, with a combination of cash and other shares of common stock (provided that such other shares have been held for more than 6 months) or other legal consideration acceptable to the administrator. The Incentive Plan provides that a participant may not be granted options in a calendar year for more than 100,000 shares of common stock, whether Incentive Stock Options, Nonstatutory Stock Options or a combination thereof.

Nonstatutory Stock Options

The Incentive Plan permits the grant of non-qualified stock options to any employee, director or consultant as determined by the administrator. The exercise price for options will not be less than 85% of the fair market value of a share of common stock on the date of grant. Other than in connection with a corporate recapitalization, the option price may not be reduced after the date of grant. The period in which an option may be exercised is determined by the administrator on the date of grant, but may not exceed 10 years. Payment of the option exercise price may be in cash, with other shares of common stock, with a combination of cash and other shares of common stock (provided that such other shares have been held for more than 6 months) or other legal consideration acceptable to the administrator. The Incentive Plan provides that a participant may not be granted options in a calendar year for more than 100,000 shares of common stock, whether Incentive Stock Options, Nonstatutory Stock Options or a combination thereof.

Change of Control Provisions

The Incentive Plan provides that in the event of a “Corporate Transaction” (as defined in the Incentive Plan), unless the award is to be assumed, replaced or converted to the equivalent award by the continuing entity, all outstanding awards will become fully exercisable as of a date prior to the consummation of the Corporate Transaction as determined by the administrator and the applicable restrictions on such awards will lapse.

24

Federal Income Tax Consequences

The principal federal tax consequences to participants and to the Company of grants and awards under the Incentive Plan are summarized below.

Incentive Stock Options

Incentive Stock Options granted to an employee under the Incentive Plan are not taxable at the time of grant or at the time of exercise, if the exercise occurs while the employee is still employed by the Company or within three months following termination of employment. The employee will recognize income upon the sale of the common stock purchased through exercise of the option. If that stock is not sold by the employee until after he or she has owned it for one year and the second anniversary of the date of the grant has passed, the income recognized by the employee on the sale will be taxed at more favorable capital gains rates. Otherwise, the income will be taxed at ordinary income rates. The Company gets no federal income tax deduction either on exercise of the option or sale of the underlying stock. However, if the employee’s income on sale is taxed as ordinary income, the Company gets to deduct the amount of such income as a business expense in the year of sale.

Nonstatutory Stock Options

Nonqualified stock options granted under the Incentive Plan are not taxable to an optionee at grant but result in taxation at exercise, at which time the individual will recognize ordinary income in an amount equal to the difference between the option exercise price and the fair market value of the common stock on the exercise date. The Company will be entitled to deduct a corresponding amount as a business expense in the year the optionee recognizes this income.

State tax consequences may in some cases differ from those described above. Grants and awards under the Incentive Plan may in some instances be made to employees who are subject to tax in jurisdictions other than the United States and may result in tax consequences differing from those described above.

Amendment and Termination

The Board of Directors may amend, suspend or terminate the Incentive Plan at any time, provided that a suspension or termination shall not impair the rights and obligations under any award granted while the Incentive Plan is in effect without the written consent of the employer, director or consultant to whom the award has been granted. Also, no amendment shall be effective unless approved by the shareholders to the extent shareholder approval is necessary to satisfy the requirements of Section 422 of the Internal Revenue Code of 1986, as amended, relating to Incentive Stock Options. Unless the plan is sooner terminated, it shall terminate on the tenth anniversary of its adoption by the Board, or September 23, 2014.

25

Vote Required

The Incentive Plan will be approved if the votes cast in favor of approval of the Incentive Plan exceed the votes cast opposing the plan.

AUDIT INFORMATION

Auditing and Related Fees

The audit committee of the board engages our independent auditors and approves the amount to be paid for audit services, audit-related services, and tax services. The board of directors approves an annual budget for professional audit fees that includes all fees paid to the independent auditors. Dixon Hughes PLLC was auditor of our financial statements for the year ended December 31, 2004. The following table shows the fees that we paid or accrued for the audit and other services provided Dixon Hughes PLLC for the fiscal years ended December 31, 2004 and 2003:

| | | | | | |

| | | Year Ended December 31, 2004

| | Year Ended December 31, 2003

|

Audit Fees | | $ | 33,584 | | $ | 25,775 |

Audit-Related Fees | | | — | | | 3,000 |

Tax Fees | | | 2,475 | | | 2,200 |

All Other Fees | | | 3,070 | | | 4,205 |

| | |

|

| |

|

|

Total | | $ | 39,129 | | $ | 35,180 |

| | |

|

| |

|

|

Audit Fees. This category includes aggregate fees billed for professional services rendered by Dixon Hughes PLLC for the audit of our annual consolidated financial statements for the years ended December 31, 2004 and 2003 and for the limited reviews of our quarterly condensed consolidated financial statements included in our periodic reports filed with the SEC during 2004 and 2003.

Audit-Related Fees. This category includes aggregate fees billed for non-audit services, exclusive of the fees disclosed relating to audit fees, rendered by Dixon Hughes PLLC during the fiscal years ended December 31, 2004 and 2003. These services principally include fees relating to a required collateral examination of the Company’s line of credit with the Federal Home Loan Bank of Atlanta in 2003.

Tax Fees. This category includes the aggregate fees billed for tax services rendered by Dixon Hughes PLLC during the fiscal years ended December 31, 2004 and 2003. These services consisted primarily of tax compliance.

26

All Other Fees.This category includes the aggregate fees billed for all other services, exclusive of the fees disclosed above, rendered to us by Dixon Hughes PLLC during the fiscal years ended December 31, 2004 and 2003. These other services included administrative fees relating to the Company’s 401(k) plan, and other consultative fees.

Pre-approved Services

The Company’s Audit Committee Charter, which is attached asAnnex A, stipulates that the audit committee will pre-approve all audit and non-audit services (subject to de minimis exceptions as defined by law for non-audit services) provided by the independent auditors in accordance with applicable regulations. The audit committee may delegate its authority to pre-approve non-audit services to one or more designated audit committee members. The decisions of the designated member(s) shall be presented to, and ratified by, the full audit committee at the next subsequent meeting. In 2004, all audit related services, tax services and other services were pre-approved by the audit committee.

Auditor Independence

The audit committee of the Board believes that the non-audit services provided by Dixon Hughes PLLC are compatible with maintaining the auditor’s independence. None of the time devoted by Dixon Hughes PLLC on its engagement to audit our financial statements for the year ended December 31, 2004 is attributable to work performed by persons other than Dixon Hughes PLLC employees.

Selection of 2005 Auditor

As of the date of this proxy statement, the audit committee is in the process of evaluating proposals from Dixon Hughes PLLC and other CPA firms to perform the 2005 audit of the financial statements. The audit committee will make a recommendation to the Board of Directors concerning the engagement of independent certified public accountants to audit the books of the Company for the 2005 fiscal year and to perform such other appropriate accounting and related services as may be required by management. A representative of Dixon Hughes PLLC will be present at the Annual Meeting and will have the opportunity to make a statement and will be available to respond to appropriate questions that shareholders may have.

Report of the Audit Committee of the Board of Directors

The audit committee of the Board of Directors is responsible for providing independent oversight of the Company’s accounting functions and internal controls. Management is responsible for the Company’s internal controls and financial reporting process. The independent accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The audit committee’s responsibility is to monitor and oversee these processes.

27

In connection with these responsibilities, the audit committee has reviewed the audited financial statements for the year ended December 31, 2004 and has discussed the audited financial statements with management. The audit committee has discussed with our independent accountants, Dixon Hughes PLLC, the matters required to be discussed by Statement on Auditing Standards No. 61 – Codification of Statements on Auditing Standards (having to do with accounting methods used in the financial statements). The audit committee has received written disclosures and the letter from Dixon Hughes PLLC required by Independence Standards Board Standard No. 1 (having to do with matters that could affect the auditor’s independence), and has discussed with Dixon Hughes PLLC the accountants’ independence. Based on this, the audit committee recommended to the Board that the audited financial statements be included in Greer Bancshares Incorporated’s SEC Form 10-K for the fiscal year ended December 31, 2004 for the filing with the SEC.

| | | | |

| The Audit Committee: | | | | |

| Paul D. Lister, Chairman | | Mark S. Ashmore | | Theron C. Smith, III |

DEADLINE FOR SUBMITTING SHAREHOLDER PROPOSALS

If shareholders wish a proposal to be included in the Company’s proxy statement and form of proxy relating to the 2006 annual meeting, they must deliver a written copy of their proposal to the principal executive offices of the Company no later than December 1, 2005. To ensure prompt receipt by the Company, the proposal should be sent by certified mail, return receipt requested. Proposals must also comply with SEC federal proxy rules relating to shareholder proposals in order to be included in the Company’s proxy materials.

Any shareholder proposal to be made at an annual meeting, but which is not requested to be included in the Company’s proxy materials, must comply with the following requirements: proposals for director nominations must be delivered to the Company in accordance with the nominating committee guidelines which are discussed beginning on page seven of this proxy statement. Other proposals must be delivered between 60 and 90 days prior to the first anniversary of the preceding year’s annual meeting. However, if the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, the shareholder notice must be delivered between 60 and 90 days prior to the annual meeting or within 10 days following the day on which public announcement of the date of the meeting is first made.

AVAILABLE FINANCIAL INFORMATION

The Company will provide free of charge to any shareholder of record as of March 11, 2005, and to each person to whom this Proxy Statement is delivered in connection with the Annual Meeting of Shareholders, upon written

28

request of such shareholder or person, a copy of the Company’s Annual Report on Form 10-K, including financial statements and financial statement schedules (but excluding exhibits), filed with the Securities and Exchange Commission. Any such request should be directed to Greer Bancshares Incorporated, Post Office Box 1029, Greer, South Carolina 29652, Attention: J. Richard Medlock, Jr., Treasurer and Secretary.

Other Matters

We do not know of any other matters to be brought before the Annual Meeting of the Shareholders. However, if any other matters do properly come before the Annual Meeting of the Shareholders, it is intended that the shares represented by the proxies in the accompanying form will be voted in accordance with the best judgment of the persons voting the proxies.

| | | | |

| | | | | By Order of the Board of Directors, |

| | |

| | | | |

|

| | | | | Gary M. Griffin |

Greer, South Carolina | | | | Chairman, Board of Directors |

March 31, 2005 | | | | Greer Bancshares Incorporated |

29

ANNEX A

Greer State Bank

Audit Committee Charter

Approved by Audit Committee: 2/22/05

The Board of Directors of the Greer State Bank has delegated to the Audit Committee the Board’s responsibility for monitoring the audit function of the Company, which includes the selection of independent auditors, determination of the independence of the independent auditors, and internal auditing and internal accounting controls.

Members of the Audit Committee shall discharge their committee duties using their business judgment in accordance with standards prescribed for directors by applicable state corporate law and rules adopted from time to time by the Securities and Exchange Commission.

Membership of the Audit Committee

The Audit Committee is made up of three or more members of the Board of Directors who meet applicable independence standards and have the ability to read and understand basic financial statements.

Members of the Audit Committee are encouraged to make use of training opportunities and consultants to enhance their ability to perform their committee responsibilities.

Scope of Responsibilities

| | 1. | Recommend to the Board of Directors the selection of the Company’s independent accountants, who shall be accountable to the Board of Directors and the Audit Committee, and, when appropriate, their dismissal. |

| | 2. | Review with the independent accountants their independence under applicable standards of independence and report the results of the review to the Board of Directors. |

| | 3. | On an annual basis, in conjunction with commencement of the annual audit, review the independent auditors’ audit plan and consider its scope, staffing, reliance upon management and internal audit functions, general audit approach, and the methods, practices, and policies governing the audit work. |

| | 4. | Review the budget, audit plans, changes in audit plans, activities, organizational structure, and qualifications of the internal audit department, as needed. |

| | 5. | Approve all fees and other compensation (subject to de minimis exceptions as defined by law for non-audit services) to be paid to the independent auditors. |

A-1

| | 6. | Pre-approve all audit and non-audit services (subject to de minimis exceptions as defined by law for non-audit services) provided by the independent auditors in accordance with applicable regulations. The Audit Committee may delegate its authority to pre-approve nonaudit services to one or more designated Audit Committee members. The decisions of the designated member(s) shall be presented to, and ratified by, the full Audit Committee at the next subsequent meeting. |

| | 7. | In consultation with management, the independent auditors, and the internal auditors, review management’s periodic evaluations of the Company’s financial reporting processes and controls, including disclosure controls and procedures and internal controls, and all reports or attestations of the independent auditors on the Company’s internal controls. Review significant financial risk exposures identified in such reports and the steps management has taken to monitor, control, and report such exposures. Review significant findings prepared by the independent auditors and the internal audit department together with management’s responses. |

| | 8. | Meet with the independent accountants to review: (a) any problems encountered in the audit including any restrictions imposed by management; and (b) the adequacy and effectiveness of administrative, operating and accounting policies of the Company. Establish a communications channel for the independent accountants to be able to contact the Audit Committee directly without going through management. |

| | 9. | Meet with the internal auditors to review: (a) any problems encountered in internal audits including any restrictions imposed by management; and (b) the adequacy and effectiveness of administrative, operating, and accounting policies of the Company. Establish a communications channel for the internal auditors to be able to contact the Audit Committee directly without going through management. |

| | 10. | Review and approve all significant proposed accounting changes. |

| | 11. | Review and discuss with management and the independent auditors the Company’s annual audited financial statements prior to the filing of its Form 10-K, including disclosures made in the “Management’s Discussion and Analysis or Plan of Operation.” Report to the Board of Directors the Audit Committee’s recommendation of whether to include the audited financial statements in the Company’s Annual Report on Form 10-K. |

| | 12. | Review and discuss with management and the independent auditor the Company’s quarterly financial statements included in its Form 10-Q, including disclosures made in the “Management’s Discussion and Analysis or Plan of Operation.” |

| | 13. | Investigate any matter which the Audit Committee deems to be in the interest of the Company and report its findings to the Board of Directors. |

| | 14. | Review and approve any Audit Committee report to be included in the Company’s proxy statement. |

A-2

| | 15. | Discuss with management and the independent auditor the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on the Company’s financial statements. |

| | 16. | Prior to releasing the annual audit report, discuss with the independent auditor the matters required to be discussed by Statement and Auditing Standards No. 61 relating to the conduct of the audit, including any difficulties encountered in the course of the audit work, any restrictions on the scope of activities or access to requested information, and any significant disagreements with management. |