- WRB Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

W. R. Berkley (WRB) CORRESPCorrespondence with SEC

Filed: 23 Jun 17, 12:00am

| 787 Seventh Avenue New York, NY 10019-6099 Tel: 212 728 8000 Fax: 212 728 8111 |

| Attn: | Jim B. Rosenberg, Senior Assistant Chief Accountant |

| Office of Healthcare and Insurance | |

| Division of Corporation Finance |

Re: | W. R. Berkley Corporation Form 10-K for the Fiscal Year Ended December 31, 2016 Filed February 28, 2017 File No. 001-15202 |

| 1. | Please provide us with the information that would be provided in separate claims development tables for each of the four lines of business identified in response to our previous comment 4, if available. If not available, demonstrate to us otherwise how these lines do not have significantly different characteristics and that useful information is not obscured by their aggregation into a single table. | |

| As mentioned in our previous response to comment 4, the other liability claims development tables contained in our 2016 Annual Report on Form 10-K include the following major lines of business: general liability, commercial multiple peril (CMP) liability, products liability and umbrella. As discussed with Mr. Brunhofer, general liability and CMP liability, which represent approximately 83% of the total net reserves, are essentially the same insurance product. When the coverage is sold on a stand-alone basis, it is referred to as “general liability;” when the coverage is sold together with a property policy, it is referred to as “CMP liability.” Otherwise the risks and coverage are the same. The property component of CMP is reported in a separate claims development table. | ||

| The two smaller components of the other liability development tables – umbrella and products liability – have risks and characteristics that are very similar to general liability, including loss development patterns, loss payment patterns, loss reserve duration, type of coverage and policy form and other characteristics. In accordance with ASC 944-40-50-4H, the Company has aggregated these similar lines of business in the other liability claims development tables. | ||

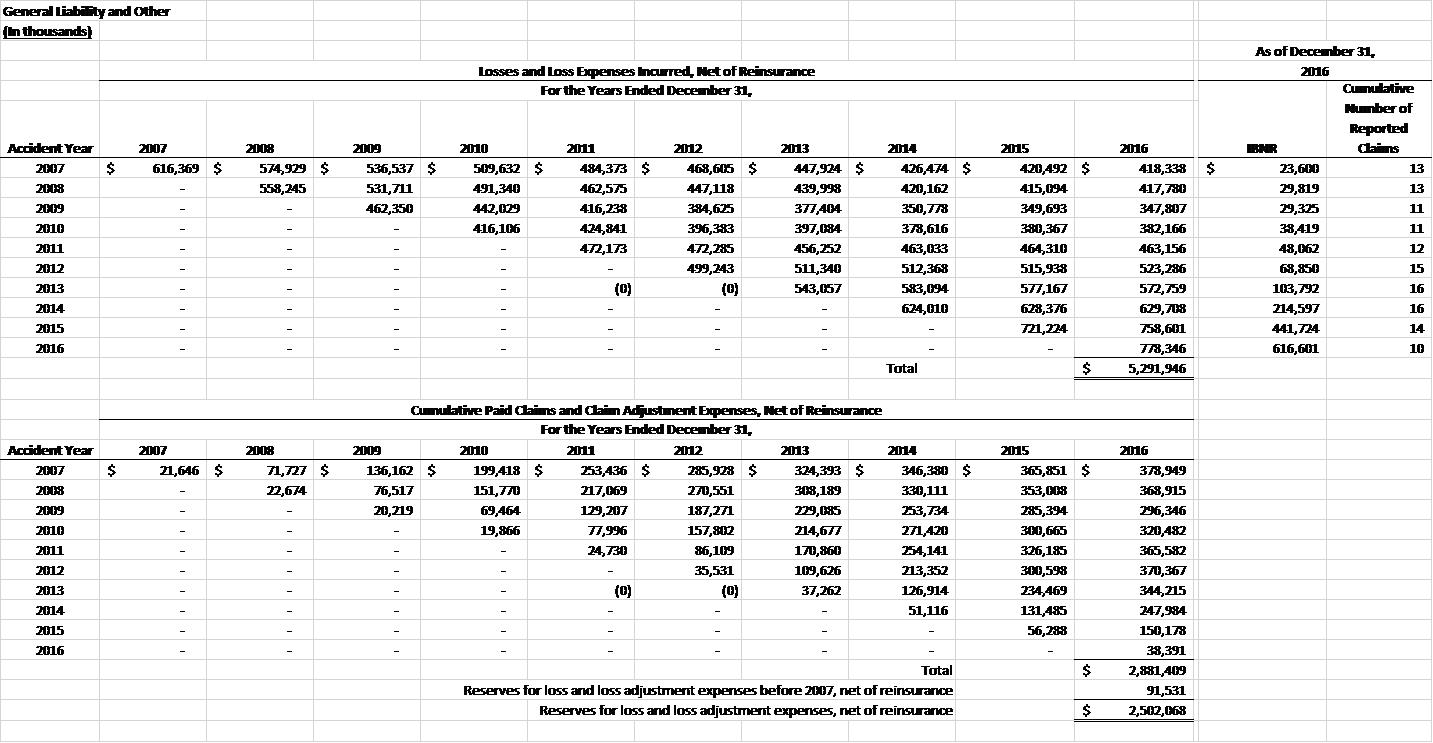

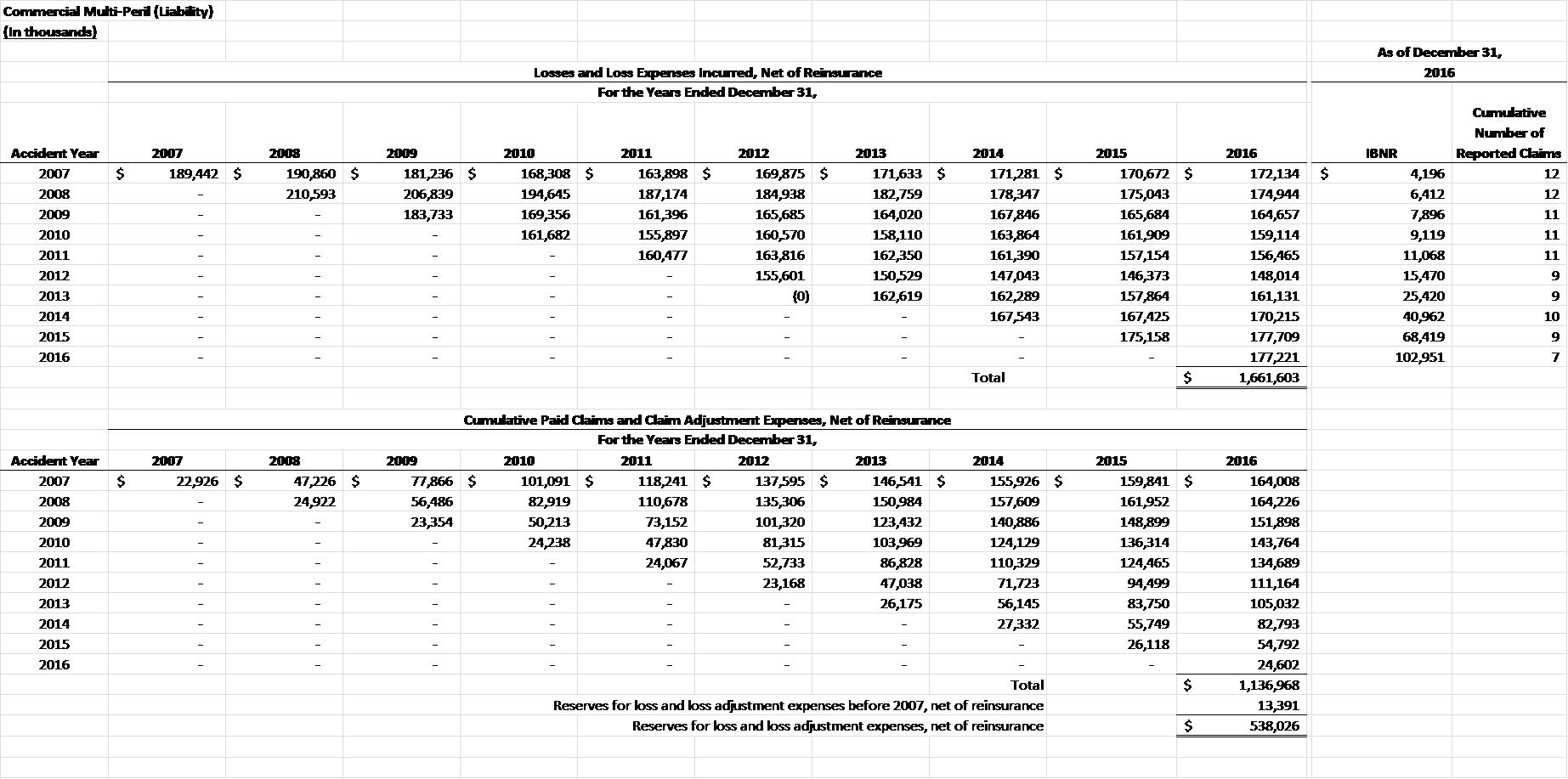

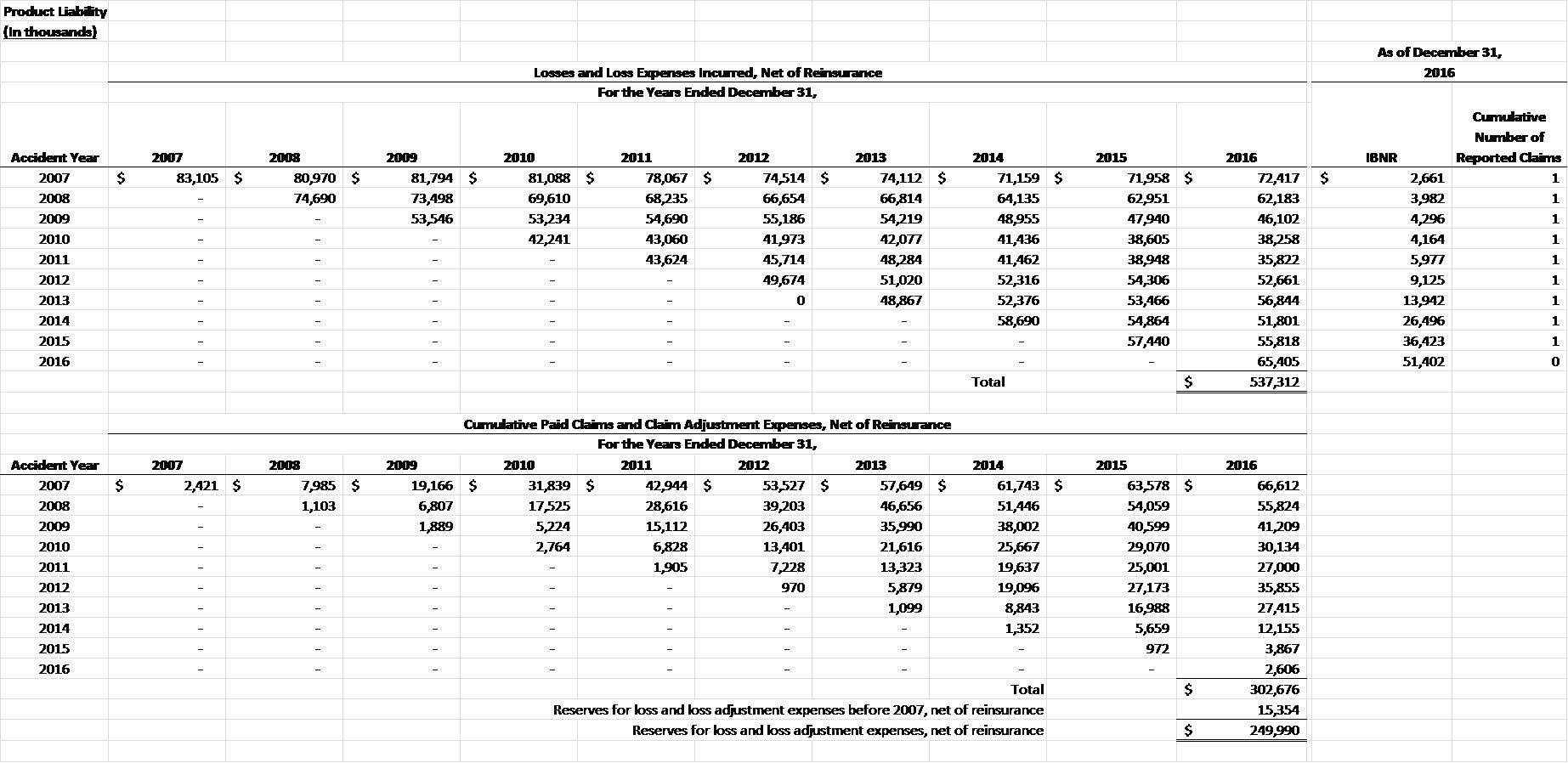

At the request of the Staff, in Appendix I hereto we have disaggregated the $3.3 billion in net reserves included in the other liability claims development tables into separate claims development tables for each of the following lines of business: |

| 1. | general liability and other (including umbrella but excluding CMP and products liability); | |

| 2. | CMP liability; and | |

| 3. | products liability. |

| The net reserve amounts included in the first table above are predominantly general liability (87%). The Company does not maintain separate historical claims development data for the umbrella business. |

| cc: | Mark Brunhofer (SEC) |

| Bonnie Baynes (SEC) | |

| W. Robert Berkley, Jr. (Berkley) | |

| Richard M. Baio (Berkley) | |

| Eugene G. Ballard (Berkley) | |

| Matthew M. Ricciardi (Berkley) |