- ELV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Elevance Health (ELV) 425Business combination disclosure

Filed: 3 Mar 04, 12:00am

Filed by: Anthem, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: WellPoint Health Networks Inc.

Commission File Number for Related Registration Statement: 333-110830

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This document contains certain forward-looking information about Anthem, Inc. (“Anthem”), WellPoint Health Networks Inc. (“WellPoint”) and the combined company after completion of the proposed transactions that are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts. Words such as “expect(s)”, “feel(s)”, “believe(s)”, “will”, “may”, “anticipate(s)” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, financial projections and estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to future operations, products and services; and statements regarding future performance. Such statements are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the control of Anthem and WellPoint, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include: those discussed and identified in public filings with the U.S. Securities and Exchange Commission (“SEC”) made by Anthem and WellPoint; trends in health care costs and utilization rates; our ability to secure sufficient premium rate increases; competitor pricing below market trends of increasing costs; increased government regulation of health benefits and managed care; significant acquisitions or divestitures by major competitors; introduction and utilization of new prescription drugs and technology; a downgrade in our financial strength ratings; litigation targeted at health benefits companies; our ability to contract with providers consistent with past practice; our ability to consummate Anthem’s merger with WellPoint, to achieve expected synergies and operating efficiencies in the merger within the expected time-frames or at all and to successfully integrate our operations; such integration may be more difficult, time-consuming or costly than expected; revenues following the transaction may be lower than expected; operating costs, customer loss and business disruption, including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers, may be greater than expected following the transaction; the regulatory approvals required for the transaction may not be obtained on the terms expected or on the anticipated schedule; our ability to meet expectations regarding the timing, completion and accounting and tax treatments of the transaction and the value of the transaction consideration; future bio-terrorist activity or other potential public health epidemics; and general economic downturns. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Neither Anthem nor WellPoint undertakes any obligation to republish revised forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Readers are also urged to carefully review and consider the various disclosures in Anthem’s and WellPoint’s various SEC reports, including but not limited to the Anthem’s Annual Report on Form 10-K for the year ended December 31, 2003, WellPoint’s Annual Report on Form 10-K for the year ended December 31, 2002 and Anthem’s and WellPoint’s Quarterly Reports on Form 10-Q for the reporting periods of 2003.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

Anthem has filed on November 26, 2003 a preliminary registration statement on Form S-4, including the preliminary joint proxy statement/prospectus constituting a part thereof, with the SEC in connection with Anthem’s proposed merger with WellPoint. Anthem will file a final registration statement, including a definitive joint proxy statement/prospectus constituting a part thereof, and other documents with the SEC.SHAREHOLDERS OF ANTHEM AND STOCKHOLDERS OF WELLPOINT ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE JOINT PROXY STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The final joint proxy statement prospectus will be mailed to shareholders of Anthem and stockholders of WellPoint. Investors and security holders will be able to obtain the documents free of charge at the SEC’s web site, www.sec.gov, from Anthem Investor Relations at 120 Monument Circle, Indianapolis, IN 46204-4903, or from WellPoint Investor Relations at 1 WellPoint Way, Thousand Oaks, CA 91362.

PARTICIPANTS IN SOLICITATION

Anthem, WellPoint and their directors and executive officers and other members of their management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Anthem’s Current Report on Form 8-K, which was filed with the SEC on October 27, 2003, contains information regarding Anthem’s participants and their interests in the solicitation. Information concerning WellPoint’s participants is set forth in the proxy statement, dated March 31, 2003, for WellPoint’s 2003 annual meeting of stockholders as filed with the SEC on Schedule 14A. Additional information regarding the interests of Anthem’s and WellPoint’s participants in the solicitation of proxies in respect of the proposed transaction is included in the registration statement and joint proxy statement/prospectus filed with the SEC.

Anthem and WellPoint made the following presentation on March 3, 2004:

Larry Glasscock, Chairman, President and Chief Executive Officer

David Colby, Executive Vice President & Chief Financial Officer

March 3, 2004

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This presentation contains certain forward-looking information about Anthem, Inc. (“Anthem”), WellPoint Health Networks Inc. (“WellPoint”) and the combined company after completion of the transactions that are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts. Words such as “expect(s)”, “feel(s)”, “believe(s)”, “will”, “may”, “anticipate(s)” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, financial projections and estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to future operations, products and services; and statements regarding future performance. Such statements are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the control of Anthem and WellPoint, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include: those discussed and identified in public filings with the U.S. Securities and Exchange Commission (“SEC”) made by Anthem and WellPoint; trends in health care costs and utilization rates; our ability to secure sufficient premium rate increases; competitor pricing below market trends of increasing costs; increased government regulation of health benefits and managed care; significant acquisitions or divestitures by major competitors; introduction and utilization of new prescription drugs and technology; a downgrade in our financial strength ratings; litigation targeted at health benefits companies; our ability to contract with providers consistent with past practice; our ability to consummate Anthem’s merger with WellPoint, to achieve expected synergies and operating efficiencies in the merger within the expected time-frames or at all and to successfully integrate our operations; such integration may be more difficult, time-consuming or costly than expected; revenues following the transaction may be lower than expected; operating costs, customer loss and business disruption, including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers, may be greater than expected following the transaction; the regulatory approvals required for the transaction may not be obtained on the terms expected or on the anticipated schedule; our ability to meet expectations regarding the timing, completion and accounting and tax treatments of the transaction and the value of the transaction consideration; future bio-terrorist activity or other potential public health epidemics; and general economic downturns. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. Neither Anthem nor WellPoint undertakes any obligation to republish revised forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Readers are also urged to carefully review and consider the various disclosures in Anthem’s and WellPoint’s various SEC reports, including but

not limited to Annual Reports on Form 10-K for the year ended December 31, 2002 and Quarterly Reports on Form 10-Q for the reporting periods of 2003.

2

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This presentation may be deemed to be solicitation material in respect of the proposed merger of Anthem and WellPoint. In connection with the proposed transaction, a registration statement on Form S-4 has been filed with the SEC. SHAREHOLDERS OF ANTHEM AND STOCKHOLDERS OF WELLPOINT ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE JOINT PROXY STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

The final joint proxy statement / prospectus will be mailed to shareholders of Anthem and stockholders of WellPoint. Investors and security holders will be able to obtain the documents free of charge at the SEC’s web site, www.sec.gov, from Anthem Investor Relations at 120 Monument Circle, Indianapolis, IN 46204-4903, or from WellPoint Investor Relations at 1 WellPoint Way, Thousand Oaks, CA 91362.

PARTICIPANTS IN SOLICITATION

Anthem, WellPoint and their directors and executive officers and other members of their management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Anthem’s Current Report on Form 8-K, which was filed with the SEC on October 27, 2003, contains information regarding Anthem’s participants and their interests in the solicitation. Information concerning WellPoint’s participants is set forth in the proxy statement, dated March 31, 2003, for Wellpoint’s 2003 annual meeting of stockholders as filed with the SEC on Schedule 14A. Additional information regarding the interests of Anthem’s and WellPoint’s participants in the solicitation of proxies in respect of the proposed transaction will be included in the registration statement and joint proxy statement/prospectus filed with the SEC.

3

Agenda

• WellPoint Profile

• Anthem Profile

• Merger Summary

“This presentation contains non-GAAP financial measures, as defined in the rules of the Securities and Exchange Commission. As required by the rules, a reconciliation of those measures to the most directly comparable GAAP measures is available at the WellPoint website, which can be found at www.wellpoint.com.”

4

WellPoint Profile

• Second largest health plan in U.S.

• Broad range of medical and specialty products

• Organized by customer segment with a diverse customer base

• Regional geographic focus

• One Company, multiple brands

5

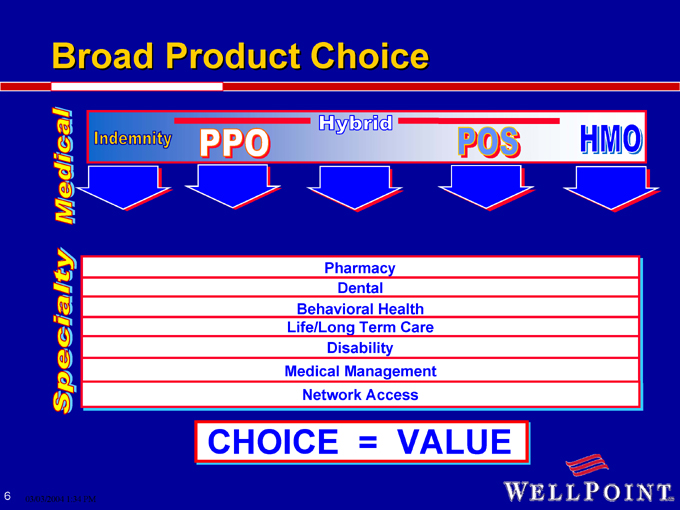

Broad Product Choice

Pharmacy

Dental

Behavioral Health

Life/Long Term Care

Disability

Medical Management

Network Access

CHOICE = VALUE

6

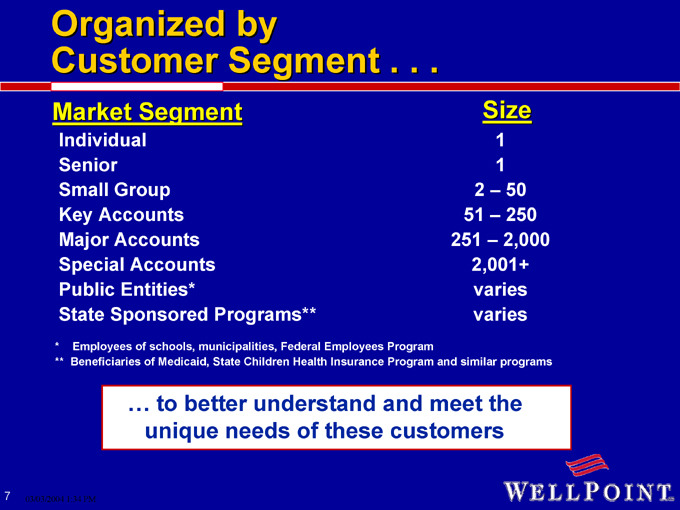

Organized by

Customer Segment . . .

Market Segment Size

Individual 1

Senior 1

Small Group 2 – 50

Key Accounts 51 – 250

Major Accounts 251 �� 2,000

Special Accounts 2,001+

Public Entities* varies

State Sponsored Programs** varies

* Employees of schools, municipalities, Federal Employees Program

** Beneficiaries of Medicaid, State Children Health Insurance Program and similar programs

… to better understand and meet the unique needs of these customers

7

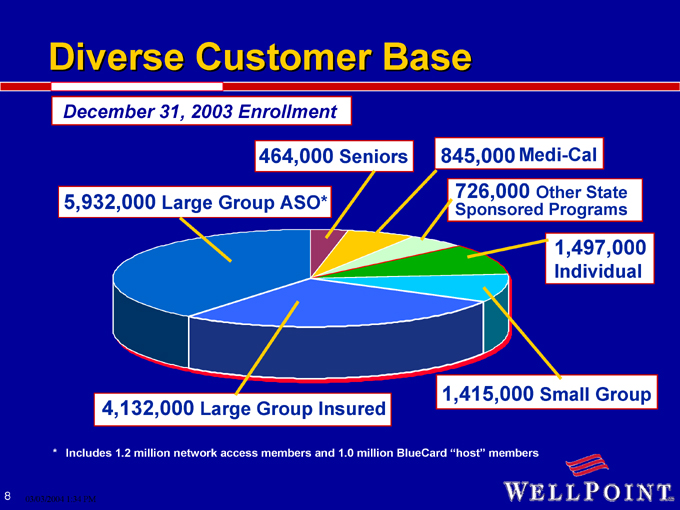

Diverse Customer Base

December 31, 2003 Enrollment

464,000 Seniors

845,000Medi-Cal

5,932,000 Large Group ASO*

726,000 Other State Sponsored Programs

1,497,000 Individual

4,132,000 Large Group Insured

1,415,000 Small Group

* Includes 1.2 million network access members and 1.0 million BlueCard “host” members

8

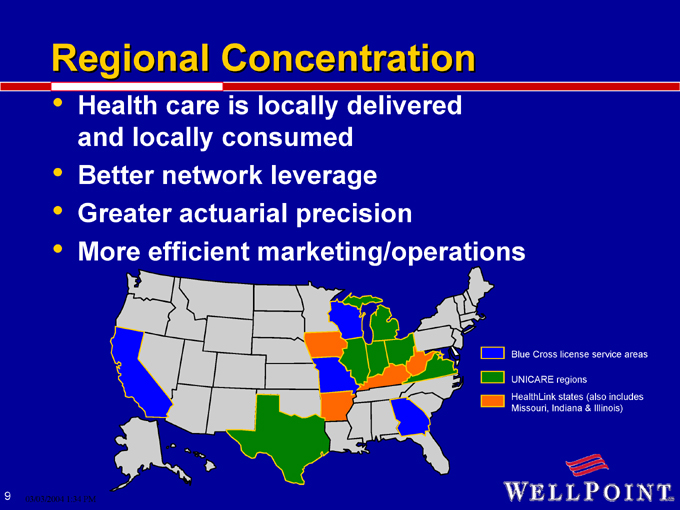

Regional Concentration

• Health care is locally delivered and locally consumed

• Better network leverage

• Greater actuarial precision

• More efficient marketing/operations

Blue Cross license service areas

UNICARE regions

HealthLink states (also includes Missouri, Indiana & Illinois)

9

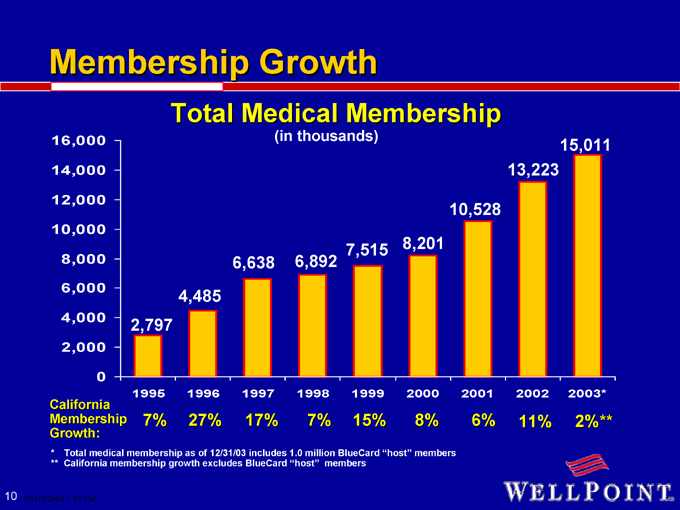

Membership Growth

Total Medical Membership

16,000 (in thousands)

2,797 4,485 6,638 6,892 7,515 8,201 10,528 13,223 15,011

California

Membership 7% 27% 17% 7% 15% 8% 6% 11% 2%**

Growth:

* Total medical membership as of 12/31/03 includes 1.0 million BlueCard “host” members

** California membership growth excludes BlueCard “host” members

10

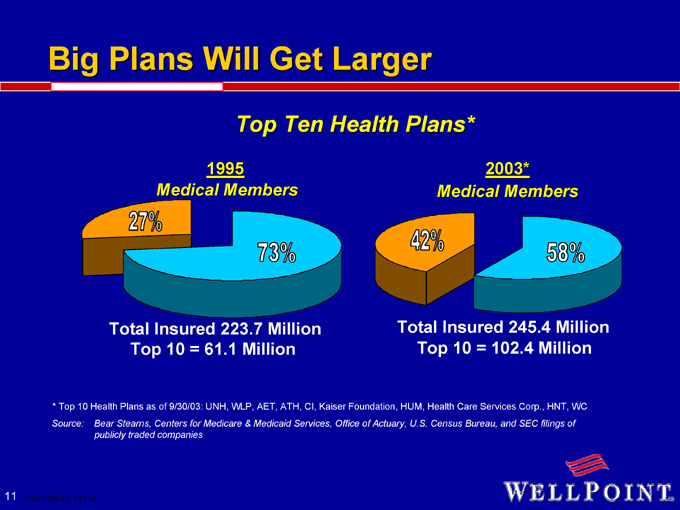

Big Plans Will Get Larger

Top Ten Health Plans*

1995

Medical Members

Total Insured 223.7 Million Top 10 = 61.1 Million

2003*

Medical Members

Total Insured 245.4 Million Top 10 = 102.4 Million

* Top 10 Health Plans as of 9/30/03: UNH, WLP, AET, ATH, CI, Kaiser Foundation, HUM, Health Care Services Corp., HNT, WC

Source: Bear Stearns, Centers for Medicare & Medicaid Services, Office of Actuary, U.S. Census Bureau, and SEC filings of publicly traded companies

11

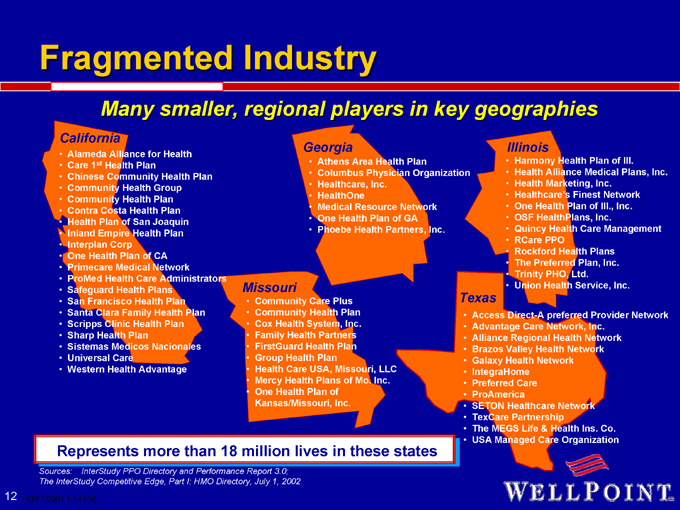

Fragmented Industry

Many smaller, regional players in key geographies

California

• Alameda Alliance for Health

• Care 1st Health Plan

• Chinese Community Health Plan

• Community Health Group

• Community Health Plan

• Contra Costa Health Plan

• Health Plan of San Joaquin

• Inland Empire Health Plan

• Interplan Corp

• One Health Plan of CA

• Primecare Medical Network

• ProMed Health Care Administrators

• Safeguard Health Plans

• San Francisco Health Plan

• Santa Clara Family Health Plan

• Scripps Clinic Health Plan

• Sharp Health Plan

• Sistemas Medicos Nacionales

• Universal Care

• Western Health Advantage

Georgia

• Athens Area Health Plan

• Columbus Physician Organization

• Healthcare, Inc.

• HealthOne

• Medical Resource Network

• One Health Plan of GA

• Phoebe Health Partners, Inc.

Missouri

• Community Care Plus

• Community Health Plan

• Cox Health System, Inc.

• Family Health Partners

• FirstGuard Health Plan

• Group Health Plan

• Health Care USA, Missouri, LLC

• Mercy Health Plans of Mo. Inc.

• One Health Plan of Kansas/Missouri, Inc.

Illinois

• Harmony Health Plan of Ill.

• Health Alliance Medical Plans, Inc.

• Health Marketing, Inc.

• Healthcare’s Finest Network

• One Health Plan of Ill., Inc.

• OSF HealthPlans, Inc.

• Quincy Health Care Management

• RCare PPO

• Rockford Health Plans

• The Preferred Plan, Inc.

• Trinity PHO, Ltd.

• Union Health Service, Inc.

• Union Health Service, Inc.

Texas

• Access Direct-A preferred Provider Network

• Advantage Care Network, Inc.

• Alliance Regional Health Network

• Brazos Valley Health Network

• Galaxy Health Network

• IntegraHome

• Preferred Care

• ProAmerica

• SETON Healthcare Network

• TexCare Partnership

• The MEGS Life & Health Ins. Co.

• USA Managed Care Organization

Represents more than 18 million lives in these states

Sources: InterStudy PPO Directory and Performance Report 3.0; The InterStudy Competitive Edge, Part I: HMO Directory, July 1, 2002

12

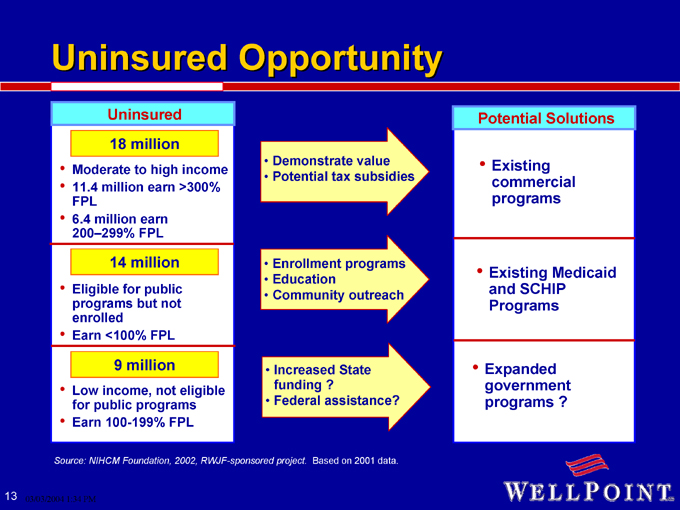

Uninsured Opportunity

Uninsured Potential Solutions

18 million

• Demonstrate value • Existing

Moderate to high income

• Potential tax subsidies commercial

• 11.4 million earn >300%

FPL programs

• 6.4 million earn

200–299% FPL

14 million • Enrollment programs •

• Education Existing Medicaid

• Eligible for public • Community outreach and SCHIP

programs but not Programs

enrolled

• Earn <100% FPL

9 million • Increased State • Expanded

• Low income, not eligible funding ? government

for public programs • Federal assistance? programs ?

• Earn 100-199% FPL

Source: NIHCM Foundation, 2002, RWJF-sponsored project. Based on 2001 data.

13

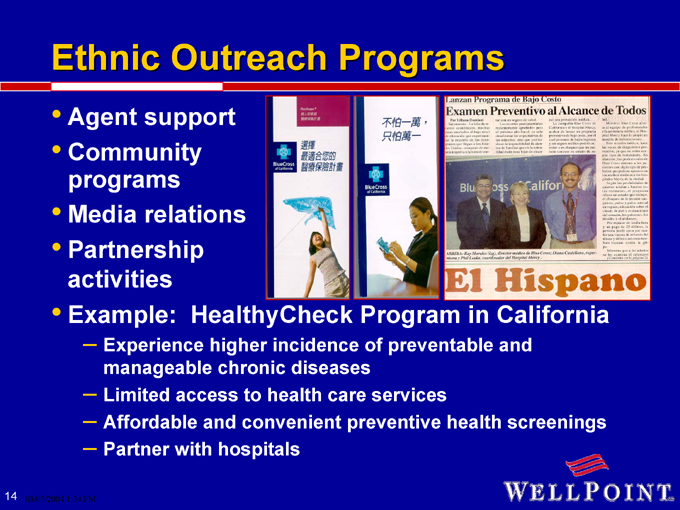

Ethnic Outreach Programs

• Agent support

• Community programs

• Media relations

• Partnership activities

• Example: HealthyCheck Program in California

– Experience higher incidence of preventable and manageable chronic diseases

– Limited access to health care services

– Affordable and convenient preventive health screenings

– Partner with hospitals

14

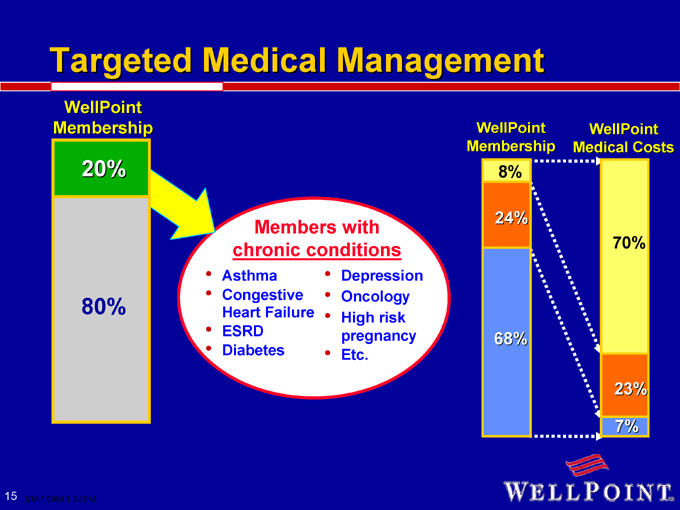

Targeted Medical Management

WellPoint Membership

20%

80%

Members with chronic conditions

• Asthma • Depression

• Congestive • Oncology Heart Failure • High risk

• ESRD pregnancy

• Diabetes • Etc.

WellPoint Membership

8%

24%

68%

WellPoint Medical Costs

70%

23%

7%

15

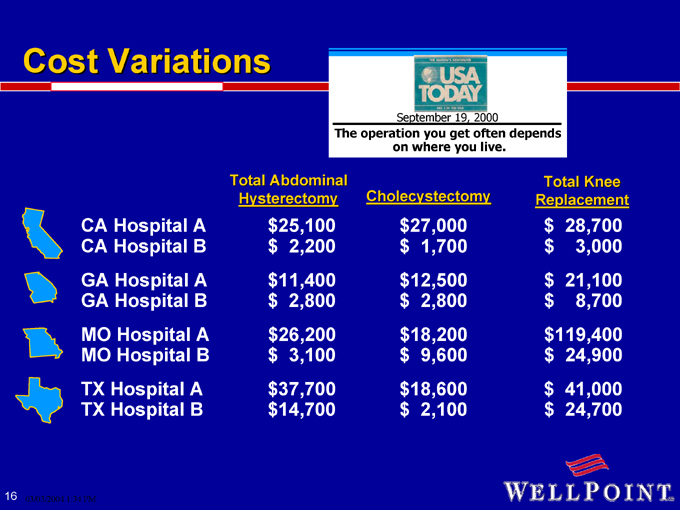

Cost Variations

September 19, 2000

The operation you get often depends on where you live.

Total Abdominal Total Knee

Hysterectomy Cholecystectomy Replacement

CA Hospital A $ 25,100 $ 27,000 $ 28,700

CA Hospital B $ 2,200 $ 1,700 $ 3,000

GA Hospital A $ 11,400 $ 12,500 $ 21,100

GA Hospital B $ 2,800 $ 2,800 $ 8,700

MO Hospital A $ 26,200 $ 18,200 $ 119,400

MO Hospital B $ 3,100 $ 9,600 $ 24,900

TX Hospital A $ 37,700 $ 18,600 $ 41,000

TX Hospital B $ 14,700 $ 2,100 $ 24,700

16

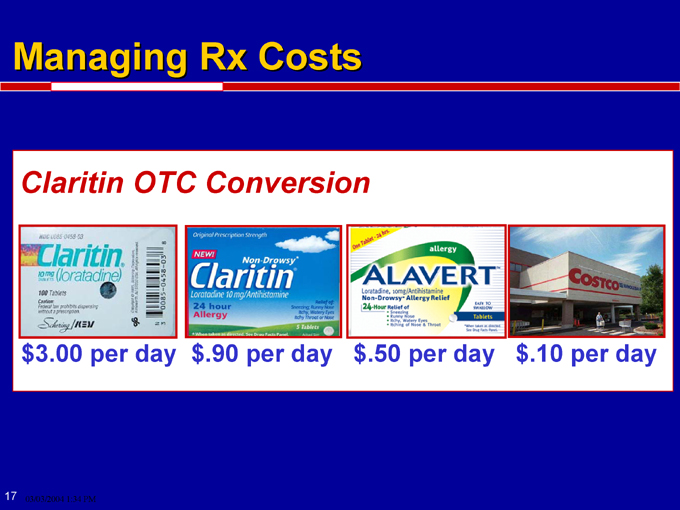

Managing Rx Costs

Claritin OTC Conversion $3.00 per day $.90 per day $.50 per day $.10 per day

17

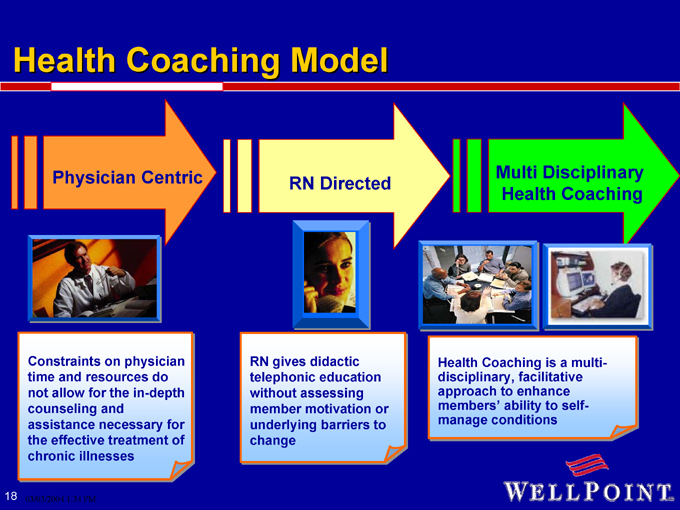

Health Coaching Model

Physician Centric

Constraints on physician time and resources do not allow for the in-depth counseling and assistance necessary for the effective treatment of chronic illnesses

RN Directed

RN gives didactic telephonic education without assessing member motivation or underlying barriers to change

Multi Disciplinary Health Coaching

Health Coaching is a multi-disciplinary, facilitative approach to enhance members’ ability to self-manage conditions

18

WellPoint Pharmacy Management

• Fourth largest PBM with more than 31 million members

• Offers full spectrum of PBM services

Clinical / Medical Management

Clinical Business Plan Therapy Management Patients-At-Risk

Intervention Programs Disease Management

Consultative Services

Incentive Programs Benefit Designs Interventions Account Management Sales Support Business Strategies

Claims Processing

Claims Keying Online DUR

Network Management

National Network

Customized Local Networks MAC Programs

PrecisionRx

Integrated Mail Service Pharmacy Specialty Pharmacy

Formulary Management

Treatment Guidelines P&T Committees Manufacturer Discounts Preferred Rx Programs Prior Auth Center

ReViewPoint®

Online Reporting

• Provide innovative programs to manage drug trend

• Clinical programs are outcomes-focused and patient-centric

19

Other Specialty Products

Dental PPO, DHMO & FFS

Life Basic & supplemental group term,

dependent coverage, AD&D

Disability Group STD & LTD

Behavioral Full range of Behavioral Health

Health services, including EAP plans

WC MCS Network management, bill review,

medical management and case

management, all on non-risk basis

20

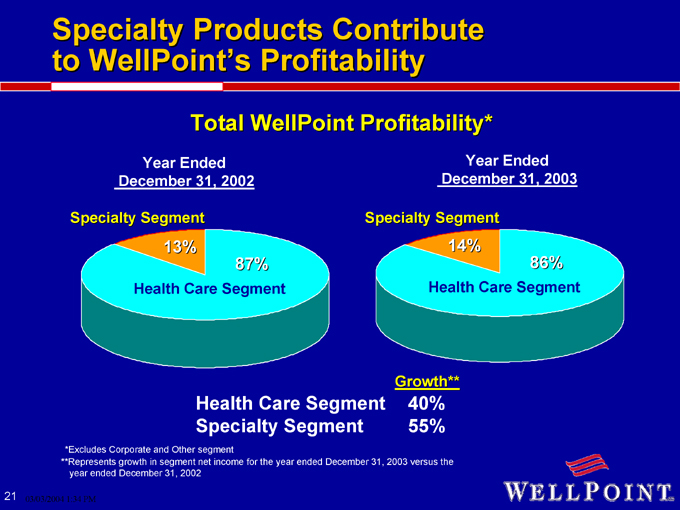

Specialty Products Contribute to WellPoint’s Profitability

Total WellPoint Profitability*

Year Ended December 31, 2002

Specialty Segment 13% 87%

Health Care Segment

Year Ended December 31, 2003

Specialty Segment 14% 86%

Health Care Segment

Growth**

Health Care Segment 40% Specialty Segment 55%

*Excludes Corporate and Other segment

**Represents growth in segment net income for the year ended December 31, 2003 versus the year ended December 31, 2002

21

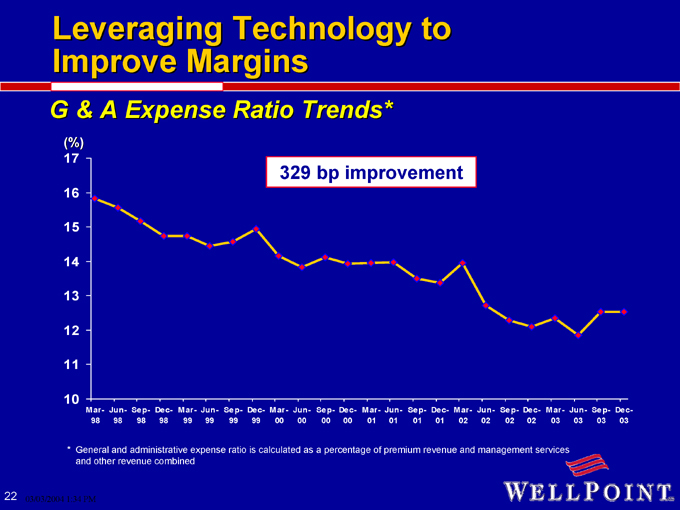

Leveraging Technology to Improve Margins

G & A Expense Ratio Trends*

329 bp improvement

* General and administrative expense ratio is calculated as a percentage of premium revenue and management services and other revenue combined

22

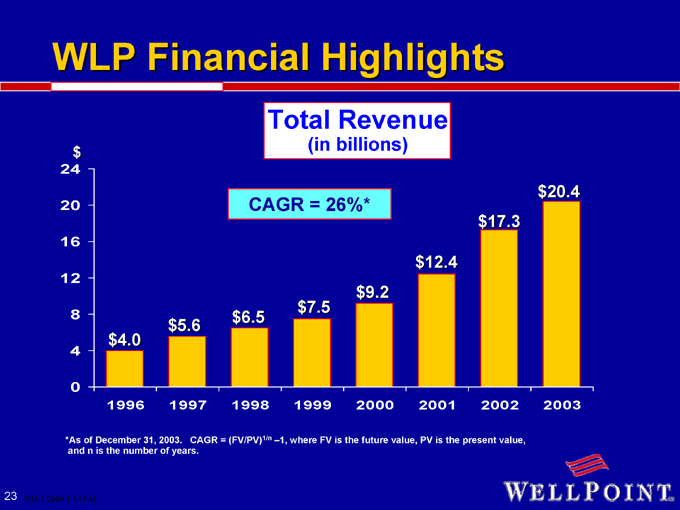

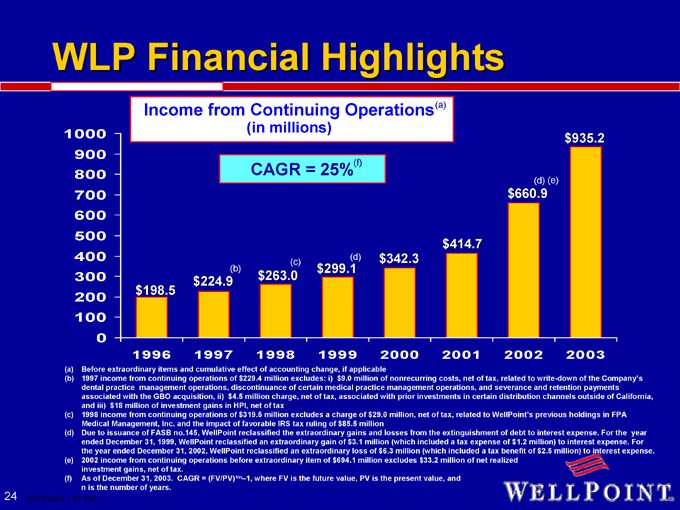

WLP Financial Highlights

Total Revenue

$ (in billions)

CAGR = 26%* $4.0 $5.6 $6.5 $7.5 $9.2 $12.4 $17.3 $20.4

*As of December 31, 2003. CAGR = (FV/PV)1/n –1, where FV is the future value, PV is the present value, and n is the number of years.

23

WLP Financial Highlights

Income from Continuing Operations(a)

1000 (in millions)

900

CAGR = 25%(f)

800 $198.5

$224.9 (b)

$263.0 (c)

$299.1 (d)

$342.3

$414.7 (d) (e)

$660.9

$935.2

(a) Before extraordinary items and cumulative effect of accounting change, if applicable

(b) 1997 income from continuing operations of $229.4 million excludes: i) $9.0 million of nonrecurring costs, net of tax, related to write-down of the Company’s dental practice management operations, discontinuance of certain medical practice management operations, and severance and retention payments associated with the GBO acquisition, ii) $4.5 million charge, net of tax, associated with prior investments in certain distribution channels outside of California, and iii) $18 million of investment gains in HPI, net of tax (c) 1998 income from continuing operations of $319.5 million excludes a charge of $29.0 million, net of tax, related to WellPoint’s previous holdings in FPA Medical Management, Inc. and the impact of favorable IRS tax ruling of $85.5 million (d) Due to issuance of FASB no.145, WellPoint reclassified the extraordinary gains and losses from the extinguishment of debt to interest expense. For the year ended December 31, 1999, WellPoint reclassified an extraordinary gain of $3.1 million (which included a tax expense of $1.2 million) to interest expense. For the year ended December 31, 2002, WellPoint reclassified an extraordinary loss of $6.3 million (which included a tax benefit of $2.5 million) to interest expense. (e) 2002 income from continuing operations before extraordinary item of $694.1 million excludes $33.2 million of net realized investment gains, net of tax.

(f) As of December 31, 2003. CAGR = (FV/PV)1/n–1, where FV is the future value, PV is the present value, and n is the number of years.

24

Agenda

• WellPoint Profile

• Anthem Profile

• Merger Summary

25

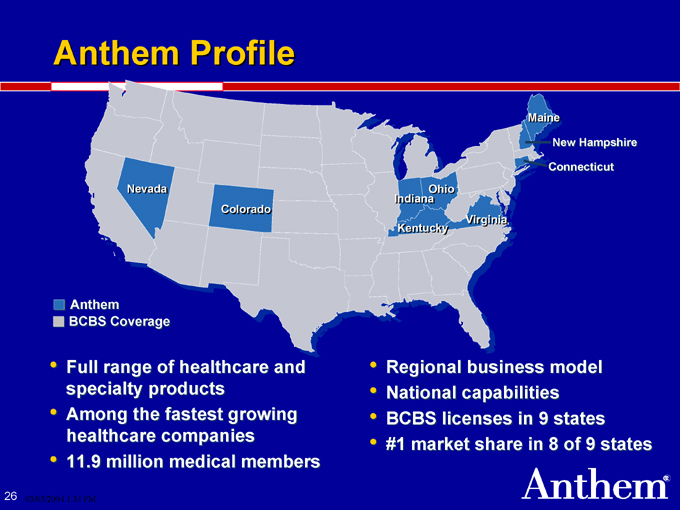

Anthem Profile

Anthem BCBS Coverage

Full range of healthcare and specialty products Among the fastest growing healthcare companies 11.9 million medical members

Regional business model National capabilities BCBS licenses in 9 states #1 market share in 8 of 9 states

26

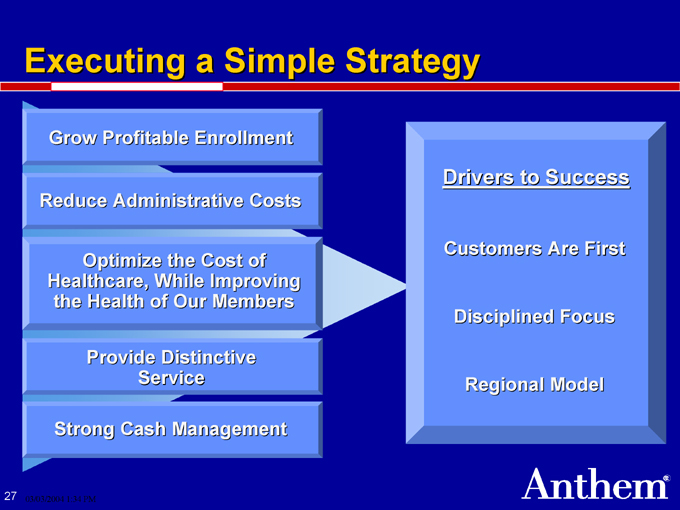

Executing a Simple Strategy

Grow Profitable Enrollment

Reduce Administrative Costs

Optimize the Cost of Healthcare, While Improving the Health of Our Members

Provide Distinctive Service

Strong Cash Management

Drivers to Success

Customers Are First Disciplined Focus Regional Model

27

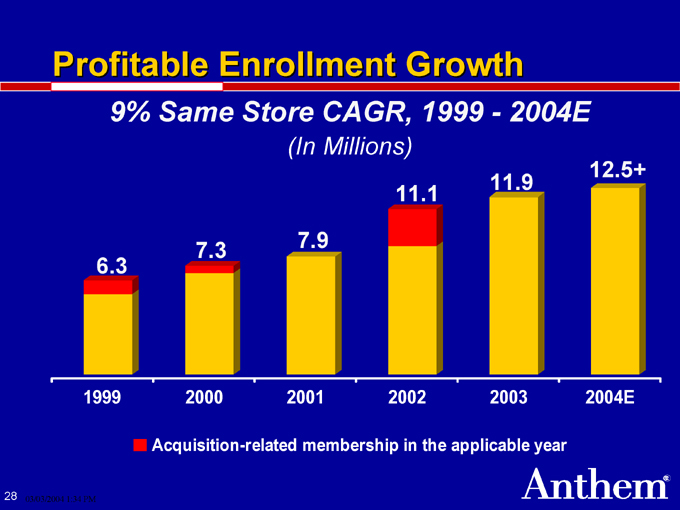

Profitable Enrollment Growth

9% Same Store CAGR, 1999—2004E

(In Millions)

6.3

7.3

7.9

11.1

11.9

12.5+

Acquisition-related membership in the applicable year

28

National Accounts

Gaining Strength in the Market Place

• Strong retention of existing accounts

• 30 new account wins for 1Q04

Value Proposition

• Blue Cross Blue Shield Brand

• Access to BlueCard networks nationwide

• ClaimsQuest

• Interactive Realtime Information System (IRIS)

• Dedicated Business Unit Model

29

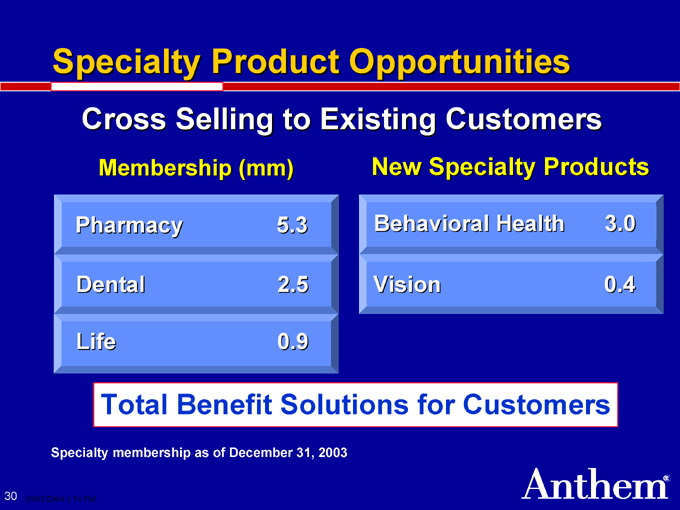

Specialty Product Opportunities

Cross Selling to Existing Customers

Membership (mm)

Pharmacy 5.3

Dental 2.5

Life 0.9

New Specialty Products

Behavioral Health 3.0

Vision 0.4

Total Benefit Solutions for Customers

Specialty membership as of December 31, 2003

30

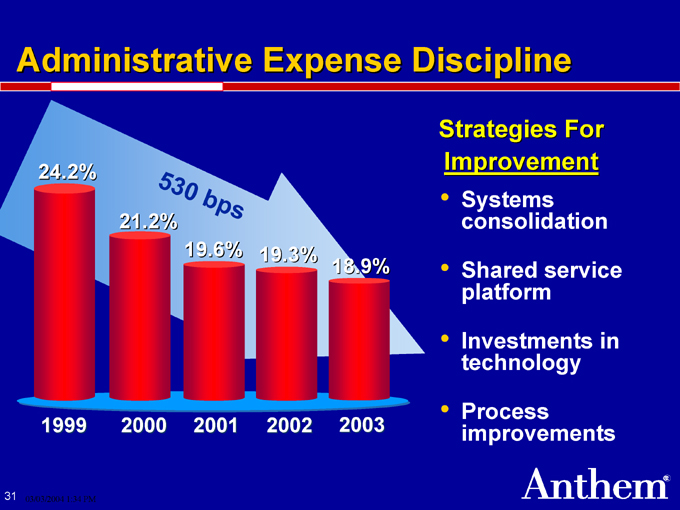

Administrative Expense Discipline

24.2%

21.2%

19.6%

19.3%

18.9%

Strategies For Improvement

• Systems consolidation

• Shared service platform

• Investments in technology

• Process improvements

31

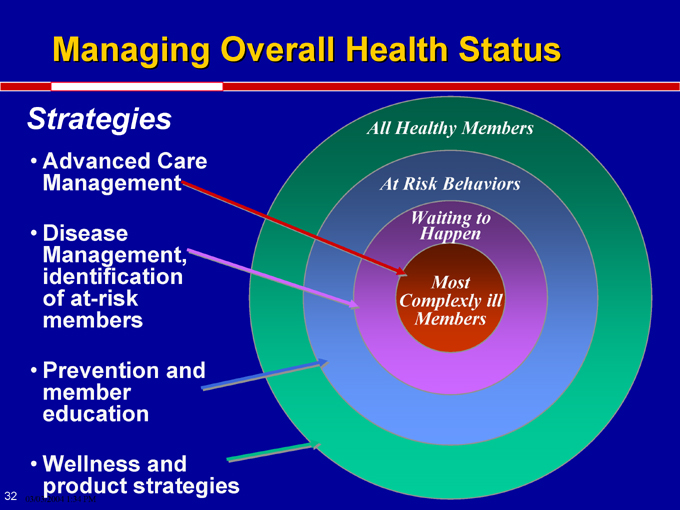

Managing Overall Health Status

Strategies

• Advanced Care Management

• Disease Management, identification of at-risk members

• Prevention and member education

• Wellness and product strategies

All Healthy Members

At Risk Behaviors

Waiting to Happen

Most Complexly ill Members

32

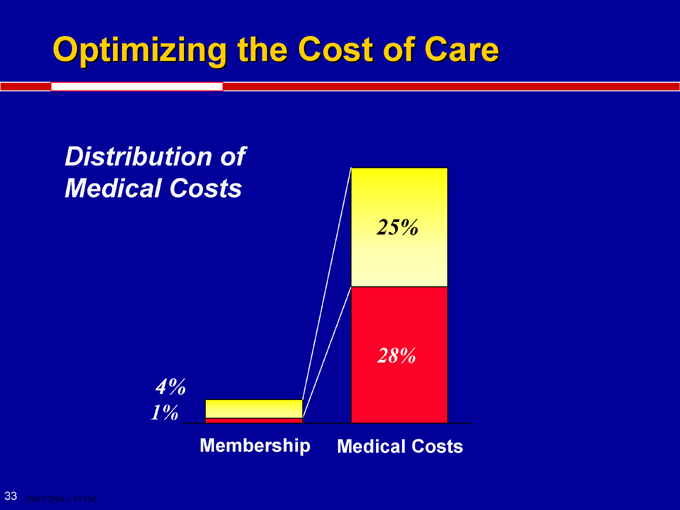

Optimizing the Cost of Care

Distribution of Medical Costs

Membership Medical Costs

25%

28%

33

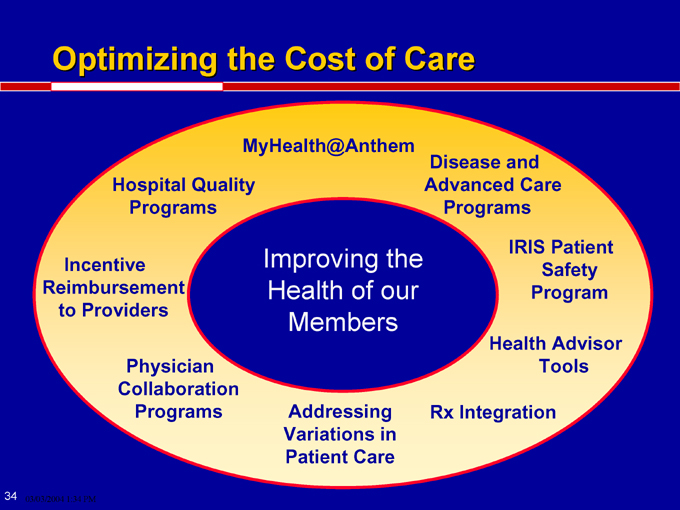

Optimizing the Cost of Care

Improving the Health of our Members

MyHealth@Anthem

Disease and Advanced Care Programs

IRIS Patient Safety Program

Health Advisor Tools

Rx Integration

Addressing Variations in Patient Care

Physician Collaboration Programs

Incentive Reimbursement to Providers

Hospital Quality Programs

34

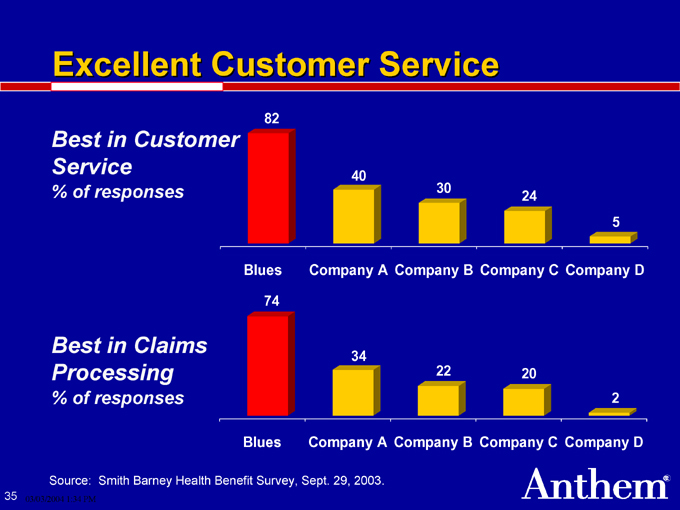

Excellent Customer Service

Best in Customer Service

% of responses

82 40 30 24 5

Best in Claims Processing

% of responses

74 34 22 20 2

Source: Smith Barney Health Benefit Survey, Sept. 29, 2003.

35

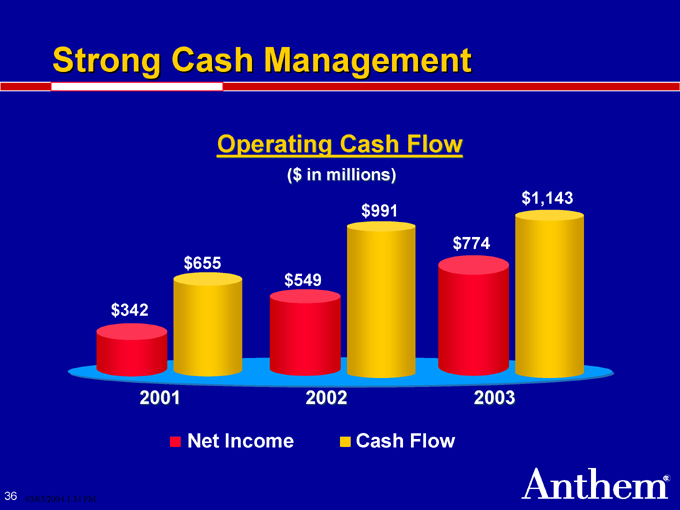

Strong Cash Management

Operating Cash Flow

($ in millions)

$342 $655 $549 $991 $774 $1,143

Net Income

Cash Flow

36

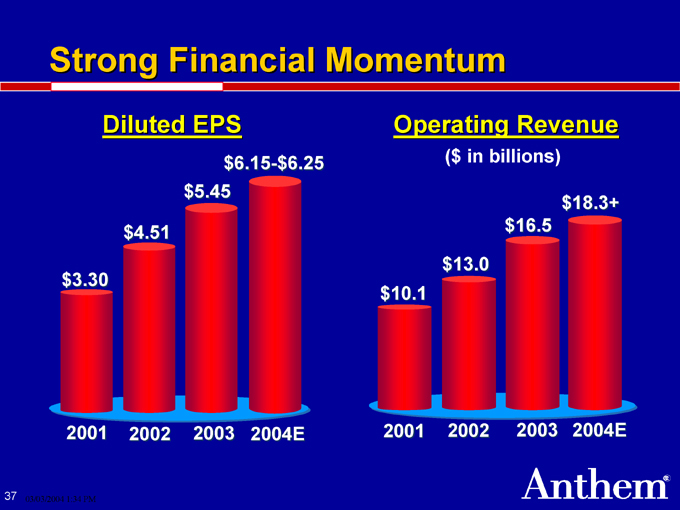

Strong Financial Momentum

Diluted EPS

$3.30 $4.51 $5.45 $6.15-$6.25

Operating Revenue

($ in billions) $10.1 $13.0 $16.5 $18.3+

37

Agenda

• WellPoint Profile

• Anthem Profile

• Merger Summary

38

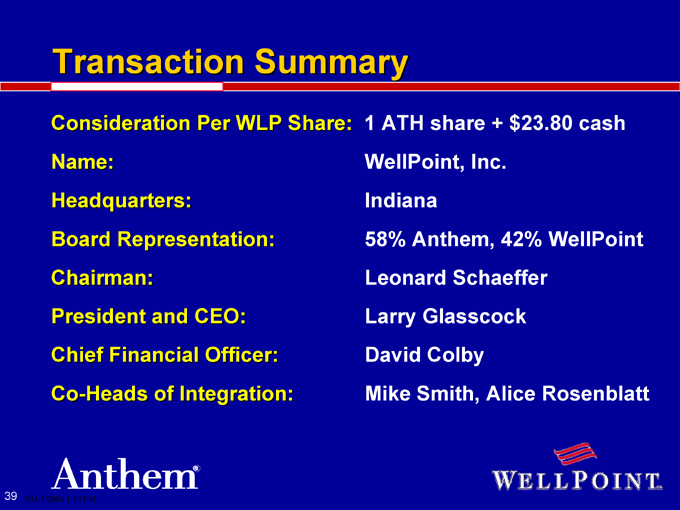

Transaction Summary

Consideration Per WLP Share: 1 ATH share + $23.80 cash

Name: WellPoint, Inc.

Headquarters: Indiana

Board Representation: 58% Anthem, 42% WellPoint

Chairman: Leonard Schaeffer

President and CEO: Larry Glasscock

Chief Financial Officer: David Colby

Co-Heads of Integration: Mike Smith, Alice Rosenblatt

39

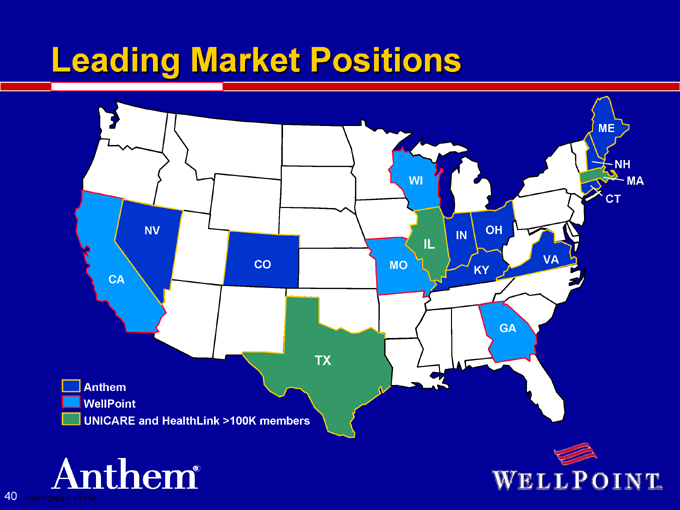

Leading Market Positions

Anthem WellPoint

UNICARE and HealthLink >100K members

40

Merger Benefits

Growth Opportunities

•

Target individual products in ATH markets – “Young invincibles”

– Early retirees

– Other uninsured

•

Utilize ATH experience with national accounts – ATH national accounts same store growth

14% in 2002 16% in 2003

– Multi-state employers focusing more on medical costs in addition to administrative expenses

– Enhanced e-commerce capabilities provide higher service levels

41

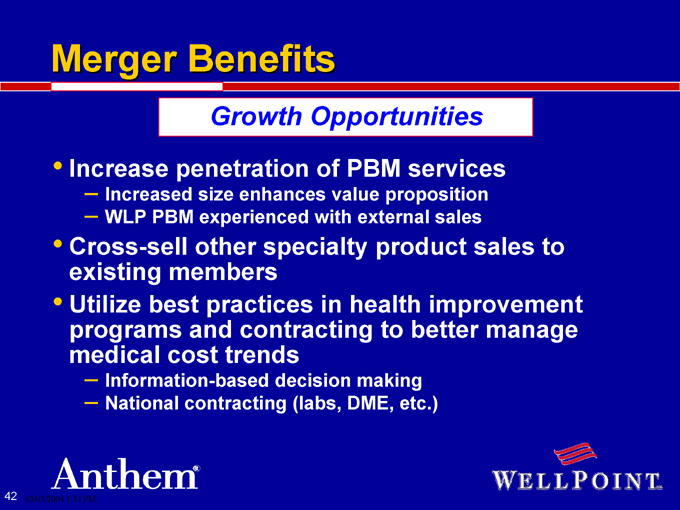

Merger Benefits

Growth Opportunities

• Increase penetration of PBM services

– Increased size enhances value proposition

– WLP PBM experienced with external sales

• Cross-sell other specialty product sales to existing members

• Utilize best practices in health improvement programs and contracting to better manage medical cost trends

– Information-based decision making

– National contracting (labs, DME, etc.)

42

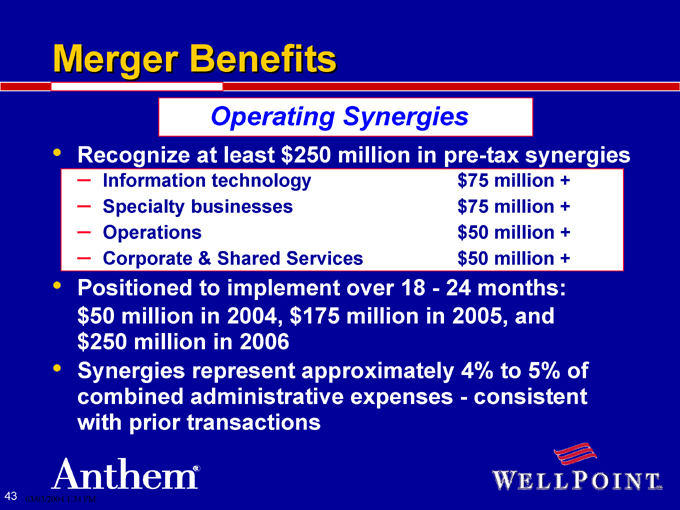

Merger Benefits

Operating Synergies

• Recognize at least $250 million in pre-tax synergies

– Information technology $75 million +

– Specialty businesses $75 million +

– Operations $50 million +

– Corporate & Shared Services $50 million +

• Positioned to implement over 18—24 months: $50 million in 2004, $175 million in 2005, and $250 million in 2006

• Synergies represent approximately 4% to 5% of combined administrative expenses—consistent with prior transactions

43

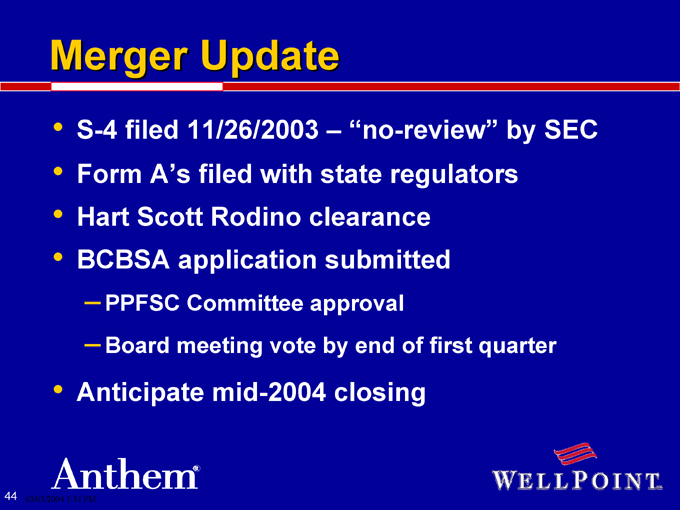

Merger Update

• S-4 filed 11/26/2003 – “no-review” by SEC

• Form A’s filed with state regulators

• Hart Scott Rodino clearance

• BCBSA application submitted

– PPFSC Committee approval

– Board meeting vote by end of first quarter

• Anticipate mid-2004 closing

44

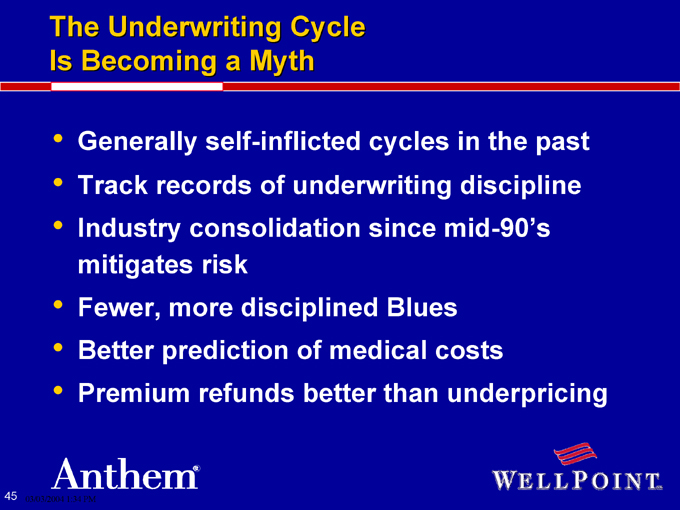

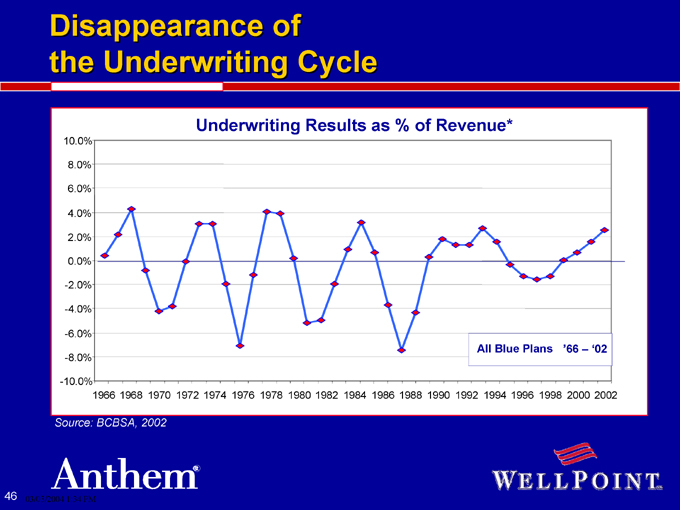

The Underwriting Cycle Is Becoming a Myth

• Generally self-inflicted cycles in the past

• Track records of underwriting discipline

• Industry consolidation since mid-90’s mitigates risk

• Fewer, more disciplined Blues

• Better prediction of medical costs

• Premium refunds better than underpricing

45

Disappearance of the Underwriting Cycle

Underwriting Results as % of Revenue*

All Blue Plans ‘66 – ‘02

Source: BCBSA, 2002

46

WellPoint + Anthem .. . .

. . . A Very Compelling Transaction . . .

• Geographic diversification with strong local focus and national reach

• Diversified membership base

• Realize significant growth potential in ISG, national accounts and specialty businesses

• Leverage technology

– Enhance product offerings, customer service and relationships with physicians and hospitals

– Better data management for clinical decision-making

– Improve productivity

• Identified synergies lower administrative expenses

47