QuickLinks -- Click here to rapidly navigate through this document

As filed with the Securities and Exchange Commission on August 3, 2001

Registration No. 333

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PCOM AG

(Exact Name of Registrant as Specified in its Charter)

| Federal Republic of Germany (State or Other Jurisdiction of Incorporation or Organization) | 4841 (Primary Standard Industrial Classification Code Number) | Not Applicable (I.R.S. Employer Identification Number) |

Hegelstrasse 61

55122 Mainz

011 49 6131 9440

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant's Principal Executive Offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10021

(212)894-8400

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent For Service)

Copy of all communications to:

| Thomas L. Philipp, Esq. Baker & McKenzie 100 New Bridge Street London, England EC4V 6JA 011 44 207 919 1841 | Garth Jensen, Esq. Holme Roberts & Owen LLP 1700 Lincoln Street, Suite 4100 Denver, CO 80203 (303) 861-7000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities To Be Registered | Amount To Be Registered | Proposed Maximum Offering Price Per Share(1) | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee | ||||

|---|---|---|---|---|---|---|---|---|

| Ordinary bearer shares, no nominal value | 19,786,052 | $5.21 | $103,085,331.00 | $25,771.33 | ||||

- (1)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(f)(1). The securities being registered are to be offered in connection with the merger of PrimaCom AG with and into PCOM AG, pursuant to which all of the shares of PrimaCom AG will be cancelled. The PrimaCom AG shares to be cancelled in the merger have an aggregate value of $103,085,331, determined in accordance with Rule 457(c), based on the high and low prices reported as of August 1, 2001 on the Nasdaq National Market for the American depositary receipts of PrimaCom AG, each of which represents one-half of one share of PrimaCom AG.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Notice to Owners of Amercian Depositary Receipts

Representing American Depositary Shares of

PrimaCom AG

This notice is addressed to owners of record on August 1, 2001 of American depositary shares, or ADSs, each representing one half of an ordinary bearer share of PrimaCom AG.

You are hereby notified that the management board of PrimaCom has called a shareholders' meeting to be held at 10:00 a.m. on August 28, 2001 at the Kurfürstliches Schloss in Mainz, Germany. At this meeting you will be asked to approve the business combination through which PrimaCom will expand its operations in Germany and The Netherlands by adding selected cable systems of United Pan-Europe Communications, N.V, which currently owns 25.0% of PrimaCom and, assuming shareholder approval, will own 52.0% of PCOM AG, the combined entity.

In particular, you are asked to vote on resolutions to:

- •

- approve the business combination on the basis of the business combination agreement and amendment described in the prospectus/proxy statement and attached as Annexes A and B to that document, and

- •

- approve the form of draft merger agreement attached as annex C to the prospectus/proxy statement.

After the business combination, your ownership interest in PrimaCom will become an interest in PCOM, which will then change its name to PrimaCom AG. Additional information about the meeting and the business combination can be found in the attached prospectus/proxy statement and its annexes, which form part of this notice.

Upon your written request received on or before August 20, 2001, The Bank of New York will endeavor to vote the deposited shares represented by your ADSs in accordance with the instructions set forth in your request. The Bank of New York will not vote deposited shares other than in accordance with these instructions.

The PrimaCom ADSs were issued under the deposit agreement dated as of February 21, 1999, among PrimaCom, The Bank of New York, as depositary, and the owners and holders of the American depositary receipts evidencing ADSs issued under the agreement. Once the business combination is approved and filings have been made with the appropriate German commercial court, which we expect will be on October 8, 2001, the shares of PrimaCom will be exchanged for shares of PCOM on a one-for-one basis. The PrimaCom ADSs will remain outstanding and will represent PCOM shares once the exchange has taken place.

In view of the fact that instructions must be received by August 20, 2001, a voting card and pre-addressed, postage-paid envelope are enclosed for the use of holders of ADSs representing shares of PrimaCom.

|  | |

| Paul Thomason | Hans Wolfert | |

| Member of the Management Board | Member of the Management Board |

Dated: August 3, 2001

PROSPECTUS/PROXY STATEMENT

PCOM AG

This is a proxy statement of PrimaCom AG, which is referred to as Old PrimaCom, and a prospectus of PCOM AG, which is referred to as New PrimaCom. This prospectus/proxy statement is being delivered to the U.S. holders of Old PrimaCom's shares and American depositary shares, or ADSs, to solicit proxies for use at a meeting of shareholders of Old PrimaCom that will take place on August 28, 2001 in Mainz, Germany. At the meeting, shareholders will be asked to approve a business combination through which Old PrimaCom will expand its operations in Germany and The Netherlands by adding selected cable systems of United Pan-Europe Communications, N.V., which currently owns 25.0% of your company and, assuming shareholder approval, will own 52.0% of the combined entity. In connection with this proxy solicitation, you should be aware that:

- •

- If the business combination is approved, each of your shares in Old PrimaCom will be exchanged for one share of New PrimaCom, and your Old PrimaCom ADSs will remain outstanding and will represent shares of New PrimaCom.

- •

- New PrimaCom's shares will have substantially the same rights and preferences as Old PrimaCom's shares.

- •

- Old PrimaCom cannot complete the business combination with New PrimaCom unless the holders of at least 75% of the shares represented at the shareholders' meeting, in person or by proxy, approve the business combination.

- •

- United Pan-Europe, Old PrimaCom's largest shareholder with 25.0% of its shares, has indicated that it intends to vote for this business combination, and assuming shareholder approval, will become New PrimaCom's majority shareholder.

Your vote is very important. Whether or not you plan to attend the shareholders' meeting, please take the time to vote by completing the enclosed voting card.

Old PrimaCom shares are traded on the Neuer Markt segment of the Frankfurt Stock Exchange under the symbol PRC and its ADSs are traded on the Nasdaq National Market under the symbol PCAG. If the business combination is approved, New PrimaCom's shares will begin trading under the same symbol on the Neuer Markt after registration of the merger agreement, which is expected on or about October 8, 2001. PrimaCom ADSs will continue to trade on Nasdaq under the same symbol, but will represent interests in New PrimaCom's shares after registration of the merger agreement.

Please see pages 16 to 28 for risk factors you should consider relating to the business combination of Old PrimaCom and New PrimaCom and New PrimaCom's business after the business combination, assuming shareholder approval is obtained.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this document or determined if this document is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus/proxy statement is August 3, 2001, and it is first being mailed

to U.S. shareholders and holders of Old PrimaCom ADSs on or about August 6, 2001.

| | Page | ||

|---|---|---|---|

| SUMMARY | 1 | ||

| Introduction | 1 | ||

| The Old PrimaCom shareholders' meeting | 3 | ||

| Market price of Old PrimaCom shares | 5 | ||

| Summary historical and pro forma financial data | 6 | ||

| Comparative per share data | 15 | ||

RISK FACTORS | 16 | ||

| Risks relating to the business combination | 16 | ||

| Risks relating to New PrimaCom's business | 18 | ||

| Risks relating to United Pan-Europe's ownership in New PrimaCom | 28 | ||

FORWARD LOOKING STATEMENTS | 30 | ||

EXCHANGE RATE INFORMATION | 31 | ||

| Exchange rates | 31 | ||

| Exchange controls | 32 | ||

THE TRANSACTIONS | 33 | ||

| Background and overview | 33 | ||

| The business combination agreement and related agreements | 35 | ||

| The chello agreement | 42 | ||

| The TeleColumbus option and assignment | 43 | ||

| Tax consequences of the proposed business combination | 44 | ||

VOTING, PROXIES AND SHAREHOLDERS' RIGHTS | 48 | ||

| Date, time and place | 48 | ||

| Purpose of the Old PrimaCom shareholders' meeting | 48 | ||

| Shares entitled to vote | 48 | ||

| Proxies | 48 | ||

| Revocation of proxies | 48 | ||

| Required vote | 49 | ||

| Mechanism of the share exchange | 49 | ||

| Dissenters' rights or comparable German shareholders' rights | 49 | ||

SELECTED HISTORICAL AND PRO FORMA FINANCIAL AND OPERATIONS DATA | 52 | ||

| Selected financial and operations data relating to Old PrimaCom | 52 | ||

| Selected financial and operations data relating to EWT | 56 | ||

| Unaudited pro forma consolidated financial information | 60 | ||

OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 69 | ||

| Operating and financial review and prospects of Old PrimaCom | 69 | ||

| Quantitative and qualitative disclosures of Old PrimaCom's market risk | 87 | ||

| Operating and financial review and prospects of EWT | 88 | ||

| Quantitative and qualitative disclosures of EWT's market risk | 102 | ||

| New PrimaCom's operating and financial review and prospects | 102 | ||

BUSINESS | 109 | ||

| Overview | 109 | ||

| Strategy | 110 | ||

| Subscribers | 112 | ||

i

| Networks | 114 | ||

| Programming and product offerings | 119 | ||

| Sales, marketing and customer services | 128 | ||

| Material Contracts | 129 | ||

| Litigation | 136 | ||

| Regulation | 139 | ||

| Employees | 150 | ||

| Competition | 151 | ||

| Organizational structure | 154 | ||

| Property and Equipment | 155 | ||

MANAGEMENT | 156 | ||

| New PrimaCom's management | 156 | ||

| Share Option Plan | 161 | ||

OWNERSHIP OF NEW PRIMACOM'S SHARES | 162 | ||

TAXATION | 165 | ||

DESCRIPTION OF CAPITAL SHARES | 173 | ||

COMPARISON OF RIGHTS OF SHAREHOLDERS OF NEW PRIMACOM AND THE SHAREHOLDERS OF OLD PRIMACOM | 181 | ||

DESCRIPTION OF NEW PRIMACOM'S AMERICAN DEPOSITARY SHARES AND AMERICAN DEPOSITARY RECEIPTS | 183 | ||

LEGAL MATTERS | 188 | ||

EXPERTS | 188 | ||

WHERE YOU CAN FIND MORE INFORMATION | 188 | ||

INDEX TO FINANCIAL STATEMENTS | F-1 | ||

ANNEX A | A-1 | ||

ANNEX B | B-1 | ||

ANNEX C | C-1 | ||

ii

This summary highlights selected information from this prospectus/proxy statement. The business combination is more fully described in other parts of this document. The business combination agreement, the amendment to the business combination agreement and the form of merger agreement are attached as Annexes A, B and C to this prospectus/proxy statement.

Introduction

At the Old PrimaCom shareholders' meeting, you will be asked to approve the business combination through which Old PrimaCom will expand its business operations in Germany and The Netherlands by adding selected cable systems of United Pan-Europe, which currently owns 25.0% of Old PrimaCom. If the business combination is approved, New PrimaCom expects that its increased size will enable it to benefit from cost synergies as it pursues its network upgrade strategy. In addition, New PrimaCom believes the business combination would increase its purchasing power when negotiating transactions involving digital television programming and Internet portal services.

New PrimaCom has entered into a business combination agreement with Old PrimaCom, United Pan-Europe and EWT Elektro- und Nachrichtentechnik GmbH, a subsidiary of United Pan-Europe. This agreement provides for a number of transactions which would result in the combination of the cable television assets of United Pan-Europe in Germany with those of Old PrimaCom and the expansion of Old PrimaCom's Dutch cable television operations through its acquisition of United Pan-Europe's Alkmaar subsidiary. The principal transactions provided for in the business combination agreement are the following:

- •

- United Pan-Europe will contribute EWT to New PrimaCom. EWT owns and operates cable television networks in many of the regions of Germany where Old PrimaCom operates. EWT has approximately E76,000,000 of indebtedness. In return, New PrimaCom will issue shares to United Pan-Europe.

- •

- United Pan-Europe will sell Alkmaar to New PrimaCom. Alkmaar owns and operates cable television networks in the same region of The Netherlands where Old PrimaCom operates. In return, New PrimaCom will pay United Pan-Europe E49,200,000 in cash and/or a note.

If the business combination is approved, United Pan-Europe will become New PrimaCom's majority shareholder, owning 52.0% of New PrimaCom's shares. This will more than double United Pan-Europe's shareholding in Old PrimaCom. New PrimaCom will acquire EWT and Alkmaar from United Pan-Europe and United Pan-Europe will receive from New PrimaCom approximately E107,253,000, comprised of New PrimaCom shares with a value of approximately E58,053,000, based on the current market price of Old PrimaCom's shares, and cash and/or a note for E49,200,000.

1

If the business combination is approved, New PrimaCom will have assets that, as of June 30, 2001, included the following:

| | Germany | The Netherlands | ||

|---|---|---|---|---|

| Cable networks (up to 450 MHz) | ||||

| Cable television homes passed | 2,113,583 | — | ||

| Analog television subscribers | 1,594,875 | — | ||

Broadband network (862 MHz) | ||||

| Homes passed by fiber | 207,045 | 362,972 | ||

| Ready for service homes | 120,045 | 342,222 | ||

| Analog television subscribers | 99,045 | 340,131 | ||

| Digital television subscribers | 2,045 | 4,877 | ||

| Internet subscribers | 2,356 | 24,786 |

Historically, Old PrimaCom has incurred significant losses. For the year ended December 31, 2000, Old PrimaCom had losses of approximately E64,000,000. New PrimaCom expects that it will continue to incur significant losses for the foreseeable future. As a result of the expenditures required to upgrade the networks acquired in the business combination, New PrimaCom is expected to incur losses for a longer period of time than would have been expected for Old PrimaCom. In addition, both Old PrimaCom and EWT have incurred significant indebtedness and make substantial debt payment under the terms of their debt facilities. As of March 31, 2001, Old PrimaCom and EWT had outstanding indebtedness of approximately E766,000,000 and E76,000,000.

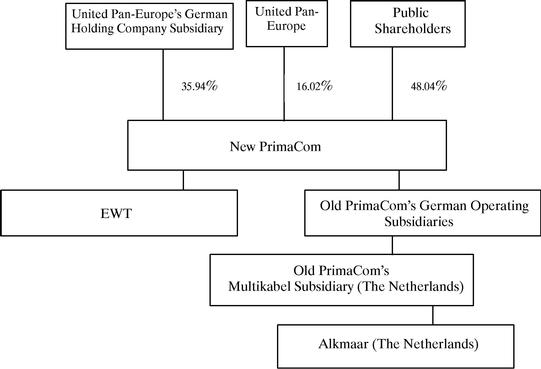

Assuming receipt of shareholder approval, the basic structure of New PrimaCom after completion of the business combination will be as follows:

As a result of the business combination New PrimaCom will also hold an option to purchase cable assets in Germany serving approximately 470,000 subscribers of a competitor referred to as TeleColumbus. The exercise price of the TeleColumbus option is approximately E340,000,000. While New PrimaCom gave notice on July 31, 2001 of its intention to conduct due diligence, it has not yet

2

determined whether or not to exercise the TeleColumbus option and any determination will only be made upon the conclusion of due diligence. In the absence of due diligence, New PrimaCom has not been able to determine whether the option price represents market value for the assets subject to the option and, as a result, whether it could obtain additional financing necessary to fund the purchase.

The market value of cable and broadband operators has declined significantly between the date the exercise price for the TeleColumbus option was negotiated in November 2000 and the present, which might lead New PrimaCom to conclude that the option price is in excess of the current market value of the assets subject to the option. Moreover, New PrimaCom believes that its ability to finance an exercise of the TeleColumbus option on acceptable terms in the present market is uncertain and New PrimaCom can give no assurance that sufficient financing would be available for it to fund the exercise price. If New PrimaCom exercises the TeleColumbus option, its increased leverage as a result of financing the exercise price and the capital expenditure that would be required to upgrade the acquired networks and the increased amortization resulting from the acquisition would result in New PrimaCom incurring operating losses for a longer period of time than would be expected if the option is not exercised.

If the business combination is approved and consummated, New PrimaCom's strategy will be to:

- •

- focus on core geographic regions,

- •

- exploit continuing consolidation opportunities,

- •

- continue Old PrimaCom's network upgrade,

- •

- increase network ownership and reduce signal delivery fees,

- •

- generate further internal revenue growth,

- •

- expand and promote Old PrimaCom's broadband service offering,

- •

- focus on attracting new subscribers,

- •

- improve efficiency and margins by streamlining operations, and

- •

- strengthen subscriber orientation.

The Old PrimaCom shareholders' meeting

At the Old PrimaCom shareholders' meeting, you will be asked to approve the business combination on the basis of the business combination agreement and the form of merger agreement. The first of these resolutions relates to the business combination as a whole and you will not be asked to approve the separate transactions or agreements which will implement the business combination, other than the merger agreement which is the subject of the second of these resolutions. In general, Old PrimaCom will seek additional approval of its shareholders only with respect to any amendments to or waivers of the terms and conditions of the business combination agreement occurring after its shareholders' meeting if the closing condition relating to delivery of an opinion on the absence of materially adverse tax effects to the parties is waived by it or if there is any other material waiver under or amendment to the agreement that will require it to seek further shareholder approval under any applicable laws, rules or regulations, including U.S. securities laws.

Only holders of Old PrimaCom shares who deposit their shares according to Old PrimaCom's articles of association or holders of Old PrimaCom's ADSs who give instructions to The Bank of New York no later than August 20, 2001, will be entitled to vote at the Old PrimaCom annual shareholders' meeting. There are no quorum requirements for the Old PrimaCom annual shareholders' meeting. As of June 29, 2001, there were 19,798,552 Old PrimaCom shares issued and outstanding. More

3

information about the Old PrimaCom annual shareholders' meeting is provided in the section entitled "Voting, Proxies and Shareholders' Rights."

Recommendation of Old PrimaCom's management and supervisory boards

The management and supervisory boards of Old PrimaCom have unanimously approved the business combination and they recommend that you vote FOR the resolutions to approve the business combination on the basis of the business combination agreement and the form of merger agreement. The business combination agreement is fully described in the section entitled "The Transactions—The business combination agreement and related agreements."

Tax consequences of the business combination

Old PrimaCom will not recognize a taxable gain or loss from the business combination under German tax law. No gain or loss will be recognized by U.S. persons upon receipt of New PrimaCom shares, including shares that will be represented by their ADSs, for their Old PrimaCom shares or ADSs under United States tax law. In addition, the aggregate tax basis under United States tax law of New PrimaCom shares or ADSs received in the business combination will be the same as the basis of the Old PrimaCom shares or ADSs, and the holding period of New PrimaCom shares or ADS, will include the holding period of the Old PrimaCom shares or ADSs.

Accounting treatment

Under United States generally accepted accounting principals, or U.S. GAAP, the transfer of EWT to New PrimaCom will be accounted for at historical cost in a manner similar to a transaction under pooling of interests accounting and the merger of Old PrimaCom into New PrimaCom will be accounted for under the purchase method as a reverse acquisition by Old PrimaCom of New PrimaCom. Accordingly, even though New PrimaCom will issue shares to Old PrimaCom's shareholders as consideration in the business combination and New PrimaCom will be the surviving legal entity, the shares issued by New PrimaCom will be treated as if issued by Old PrimaCom, as acquirer. To the extent the fair market value of those shares exceeds the value of New PrimaCom's tangible net assets, those assets will be adjusted to fair market value, with a portion of any remaining excess being assigned to goodwill and amortized over a period of 12 years. Under German tax and accounting regulations, however, New PrimaCom's merger with Old PrimaCom will be accounted for in a manner similar to a pooling of interests and New PrimaCom's shareholders' equity under German GAAP, which governs New PrimaCom's ability to pay dividends, will be lower than under U.S. GAAP.

Dissenters' rights or comparable German shareholders' rights

Shareholders in a German corporation, such as Old PrimaCom, do not have dissenters' rights. However, under the German Transformation Act (Umwandlungsgesetz), any shareholder of Old PrimaCom may bring a court valuation proceeding (Spruchverfahren) within two months after effective publication of the registration of the merger. The purpose of this court valuation proceeding would be for the court to determine the adequacy of the ratio of Old PrimaCom shares exchanged for New PrimaCom shares in the business combination. If the court were to determine that the exchange ratio is too low, New PrimaCom would be required to make supplemental compensatory cash payments to all shareholders of Old PrimaCom, not just those who voted against the business combination or those who brought the valuation proceeding.

In addition, a shareholder may also file an action to set aside the resolution approving the merger between New PrimaCom and Old PrimaCom. The action can be based on alleged procedural irregularities or material defects in relation to the merger resolution itself, but not the exchange ratio

4

reflected in the merger. If a proceeding to set aside the resolution approving the merger were to be brought, the merger could not be registered while the proceeding remained pending.

More information about actions to set aside a merger resolution and German valuation proceedings is provided in "Voting, Proxies and Shareholders' Rights—Dissenters' rights or comparable German shareholders' rights."

Market price of Old PrimaCom shares

Since February 22, 1999, Old PrimaCom's shares have traded on the Xetra trading platform of the Neuer Markt segment of the Frankfurt Stock Exchange under the symbol PRC and its ADSs have been quoted on the National Market segment of the Nasdaq Stock Market under the symbol PCAG. Each Old PrimaCom ADS represents one-half of one Old PrimaCom share.

The table below shows, for the periods indicated, the reported high and low quoted prices for the shares on the Frankfurt Stock Exchange using Xetra prices and for Old PrimaCom's ADSs on Nasdaq.

| | Nasdaq | Frankfurt Stock Exchange | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | High | Low | Average Daily Trading Volume | High | Low | Average Daily Trading Volume | ||||||

| | (in U.S.$) | | (in E) | | ||||||||

| Annual highs and lows | ||||||||||||

| 1999 (from February 22, 1999) | 29.63 | 15.00 | 30,291 | 64.00 | 29.50 | 11,373 | ||||||

| 2000 | 50.00 | 5.13 | 43,656 | 99.00 | 11.60 | 23,215 | ||||||

Quarterly highs and lows | ||||||||||||

| 1999 | ||||||||||||

| First Quarter (from February 22, 1999) | 20.00 | 15.00 | 81,493 | 34.00 | 29.50 | 26,611 | ||||||

| Second Quarter | 25.00 | 16.50 | 20,295 | 48.00 | 30.90 | 10,315 | ||||||

| Third Quarter | 29.63 | 22.63 | 28,036 | 56.00 | 44.75 | 8,036 | ||||||

| Fourth Quarter | 32.63 | 23.25 | 19,986 | 64.00 | 42.10 | 9,292 | ||||||

2000 | ||||||||||||

| First Quarter | 50.00 | 30.63 | 26,271 | 99.00 | 59.00 | 23,750 | ||||||

| Second Quarter | 43.50 | 18.13 | 38,968 | 86.10 | 36.00 | 12,640 | ||||||

| Third Quarter | 23.88 | 13.63 | 35,971 | 50.35 | 31.00 | 12,873 | ||||||

| Fourth Quarter | 13.13 | 5.13 | 73,324 | 32.00 | 11.60 | 44,071 | ||||||

Monthly highs and lows | ||||||||||||

| 2000 | ||||||||||||

| November | 11.00 | 5.13 | 55,567 | 24.60 | 12.19 | 38,640 | ||||||

| December | 7.50 | 5.13 | 85,625 | 17.60 | 11.60 | 43,941 | ||||||

2001 | ||||||||||||

| January | 8.00 | 5.38 | 112,581 | 16.70 | 10.50 | 33,219 | ||||||

| February | 7.50 | 5.50 | 27,479 | 16.40 | 12.97 | 16,031 | ||||||

| March | 7.94 | 6.38 | 15,973 | 17.98 | 13.89 | 32,880 | ||||||

| April | 6.63 | 4.39 | 34,165 | 15.45 | 9.50 | 41,688 | ||||||

| May | 5.55 | 4.28 | 14,991 | 11.90 | 9.03 | 28,383 | ||||||

| June | 4.49 | 3.70 | 18,719 | 9.97 | 8.33 | 23,732 | ||||||

| July | 4.19 | 1.90 | 24,175 | 9.40 | 4.38 | 12,322 | ||||||

5

Summary historical and pro forma financial data

The following tables set forth summary financial and operating data for Old PrimaCom and EWT as well as New PrimaCom's pro forma financial and operating data.

Summary financial and operations data relating to Old PrimaCom

The summary consolidated statement of operations and cash flow data for the years ended December 31, 1998, 1999 and 2000 and the summary consolidated balance sheet data as at December 31, 1998, 1999 and 2000 have been derived from Old PrimaCom's financial statements, included elsewhere in this prospectus/proxy statement, which have been prepared in accordance with U.S. GAAP and audited by Ernst & Young, independent auditors. The summary consolidated statement of operations and cash flow data for the three months ended March 31, 2000 and 2001 and the summary consolidated balance sheet data as at March 31, 2000 and 2001 have been derived from Old PrimaCom's unaudited financial statements contained elsewhere in this prospectus/proxy statement. In the opinion of management these unaudited financial statements contain all adjustments (consisting only of normally recurring adjustments) necessary for a fair presentation in accordance with U.S. GAAP of the consolidated financial position of Old PrimaCom at those dates and the results of operations of Old PrimaCom for those periods. The summary consolidated statement of operations and cash flow data for the years ended December 31, 1996 and 1997 and the summary consolidated balance sheet data as at December 31, 1996 and 1997 have been derived from Old PrimaCom's financial statements, which have been prepared in accordance with U.S. GAAP and audited by Ernst & Young.

Old PrimaCom commenced operations as a combined entity under the name PrimaCom AG following the merger of KabelMedia Holding AG and Süweda Elektronische Medien- und Kabelkommunikations AG, two similarly sized German cable television operators, on December 30, 1998. In this merger, shares of KabelMedia were issued to the shareholders of Süweda as consideration in the merger and KabelMedia was the surviving corporate entity, which then changed its name to PrimaCom AG. For purposes of U.S. GAAP, the merger was accounted for under the purchase method as a reverse acquisition of KabelMedia by Süweda and Süweda was treated as the accounting acquirer. As a result, Süweda's historical financial statements for periods prior to the merger are treated as Old PrimaCom's historical financial statements. The summary consolidated data should be read in conjunction with Old PrimaCom's consolidated financial statements and notes thereto included elsewhere in this prospectus/proxy statement.

The summary consolidated financial data for 1996, 1997 and 1998 were prepared using the Deutsche Mark and have been restated in euro using the Council of the European Union's official fixed conversion rate between the euro and the Deutsche Mark of DM1.95583 per E1.00. The Deutsche Mark and the euro will continue to have legal tender status through a transition period ending February 28, 2002. Old PrimaCom's summary consolidated financial data for 1999 and 2000 were prepared in euro and are not restated from the Deutsche Mark into euro. The summary consolidated

6

financial data is not comparable to financial data of other companies that report in euros and that restate amounts from currencies other than the Deutsche Mark.

| | Old PrimaCom Historical Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 1996 | 1997 | 1998 | 1999 | 2000 | 2000 | 2001 | ||||||||||

| Statement of Operations Data | E'000 | E'000 | E'000 | E'000 | E'000 | E'000 | E'000 | ||||||||||

| Revenues | 40,359 | 42,847 | 49,339 | 105,949 | 124,343 | 27,063 | 38,852 | ||||||||||

| Operating costs and expenses: | |||||||||||||||||

| Operations | 9,116 | 10,238 | 13,062 | 24,543 | 30,191 | 6,226 | 8,784 | ||||||||||

| Selling, general and administrative | 8,803 | 8,168 | 6,271 | 18,590 | 28,584 | 5,125 | 9,866 | ||||||||||

| Corporate overhead | — | — | 1,278 | 12,413 | 17,219 | 4,081 | 3,881 | ||||||||||

| Depreciation and amortization | 13,159 | 13,564 | 16,072 | 61,277 | 75,530 | 15,431 | 26,580 | ||||||||||

| Total | 31,078 | 31,970 | 36,683 | 116,823 | 151,524 | 30,863 | 49,111 | ||||||||||

| Operating profit (loss) | 9,281 | 10,877 | 12,656 | (10,874 | ) | (27,181 | ) | (3,800 | ) | (10,259 | ) | ||||||

| Interest expense: | |||||||||||||||||

| Related party | 366 | 288 | 11 | — | — | — | — | ||||||||||

| Bank debt | 2,646 | 2,618 | 2,550 | 9,995 | 24,629 | 3,105 | 16,660 | ||||||||||

| Sale-leaseback | 5,134 | 5,085 | 5,301 | 2,115 | 1,544 | 406 | 371 | ||||||||||

| Senior notes | — | — | — | 3,764 | — | — | — | ||||||||||

| Total | 8,146 | 7,991 | 7,862 | 15,874 | 26,173 | 3,511 | 17,031 | ||||||||||

| Other income (expense) benefit | — | 12,055 | (232 | ) | (767 | ) | 1,690 | — | 205 | ||||||||

| Income (loss) from continuing operations before income taxes and other items | 1,135 | 14,941 | 4,562 | (27,515 | ) | (51,664 | ) | (7,311 | ) | (27,085 | ) | ||||||

| Income tax (expense) benefit | 821 | 2,268 | 827 | 1,667 | 4,258 | (221 | ) | 460 | |||||||||

| Income (loss) from continuing operations before minority interest and equity earnings | 314 | 12,673 | 3,735 | (29,182 | ) | (55,922 | ) | (7,532 | ) | (26,625 | ) | ||||||

| Minority interest in net income of subsidiaries | 609 | 2,767 | 303 | 70 | 94 | 43 | 36 | ||||||||||

| Equity loss in affiliate | — | — | — | — | 128 | — | 64 | ||||||||||

| Income (loss) from continuing operations | (295 | ) | 9,906 | 3,432 | (29,252 | ) | (56,144 | ) | (7,575 | ) | (26,725 | ) | |||||

| Income (loss) from discontinued operations, net of income tax benefit | 959 | (6,977 | ) | (2,922 | ) | — | — | — | — | ||||||||

| Extraordinary loss, net of income tax | — | — | — | — | (8,180 | ) | — | — | |||||||||

| Cumulative effect of change in accounting principle | — | — | — | — | — | — | (946 | ) | |||||||||

| Net income (loss) | 664 | 2,929 | 510 | (29,252 | ) | (64,324 | ) | (7,575 | ) | (27,671 | ) | ||||||

| Net income (loss) per share: | |||||||||||||||||

| Basic and diluted: | |||||||||||||||||

| Continuing operations | (1.48 | ) | 49.53 | 0.22 | (1.53 | ) | (2.85 | ) | (0.38 | ) | (1.35 | ) | |||||

| Net income (loss) | 3.32 | (14.65 | ) | 0.03 | (1.53 | ) | (3.26 | ) | (0.38 | ) | (1.40 | ) | |||||

| Balance Sheet Data (at period end) | |||||||||||||||||

| Total assets | 127,501 | 132,500 | 609,229 | 586,636 | 1,077,845 | 585,189 | 1,061,267 | ||||||||||

| Total debt | 145,794 | 147,863 | 332,800 | 224,762 | 754,333 | 228,471 | 765,683 | ||||||||||

| Total liabilities | 159,338 | 158,160 | 368,757 | 257,961 | 808,463 | 263,027 | 817,815 | ||||||||||

| Shareholders' equity (deficiency) | (33,399 | ) | (31,748 | ) | 240,031 | 328,590 | 269,184 | 321,978 | 243,303 | ||||||||

| Cash Flow Data | |||||||||||||||||

| Net cash provided by (used in) operating activities | 15,120 | (3,121 | ) | 28,565 | 44,214 | 11,685 | 8,393 | 3,933 | |||||||||

| Net cash provided by (used in) investing activities | (8,594 | ) | 15,972 | 8,451 | (47,858 | ) | (387,759 | ) | (19,544 | ) | (14,659 | ) | |||||

| Net cash provided by (used in) financing activities | (7,638 | ) | (3,309 | ) | (39,706 | ) | 4,164 | 372,350 | 3,617 | 11,028 | |||||||

| Capital expenditures (excluding acquisitions) | 9,918 | 5 | 3,110 | 34,071 | 99,817 | 12,959 | 12,750 | ||||||||||

7

| | Year Ended December 31, | Three Months Ended March 31, | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 1996 | 1997 | 1998 | 1999 | 2000 | 2000 | 2001 | ||||||||

| Operations Data | |||||||||||||||

| Homes passed(1) | 608,681 | 612,590 | 1,335,052 | 1,422,826 | 1,916,870 | 1,466,227 | 1,924,339 | ||||||||

| Ready for service homes(2) | — | — | — | 30,456 | 413,000 | 44,000 | 418,000 | ||||||||

| Number of television subscribers | 325,514 | 329,010 | 877,152 | 919,641 | 1,302,297 | 925,768 | 1,310,878 | ||||||||

| Number of Internet subscribers | — | — | — | 150 | 16,256 | 420 | 24,442 | ||||||||

| Number of digital television subscribers | — | — | — | — | 4,570 | — | 5,997 | ||||||||

| Video penetration(3) | 53.5 | % | 53.7 | % | 65.7 | % | 64.6 | % | 67.9 | % | 63.1 | % | 68.1 | % | |

| Internet penetration(4) | — | — | — | 0.5 | % | 3.9 | % | 1.0 | % | 5.8 | % | ||||

| Digital penetration(5) | — | — | — | — | 1.1 | % | — | 1.4 | % | ||||||

| Average monthly revenue per subscriber (E)(6) | 10.54 | 10.84 | 11.41 | 9.46 | 9.49 | 9.72 | 9.27 | ||||||||

| EBITDA (E'000)(7) | 22,440 | 24,441 | 28,728 | 50,403 | 48,349 | 11,631 | 16,321 | ||||||||

| EBITDA margin(8) | 55.6 | % | 57.0 | % | 58.2 | % | 47.6 | % | 38.9 | % | 43.0 | % | 42.0 | % | |

| Adjusted EBITDA (E'000)(9) | 22,440 | 24,441 | 28,728 | 53,160 | 51,907 | 12,592 | 17,164 | ||||||||

| Adjusted EBITDA margin(10) | 55.6 | % | 57.0 | % | 58.2 | % | 50.2 | % | 41.7 | % | 46.5 | % | 44.2 | % | |

- (1)

- At end of the period. In 2000, approximately 1,393,870 homes were passed by coaxial cable networks and approximately 523,000 homes were passed by fiber optic cable networks.

- (2)

- Upgraded from the fiber node to the home (862 MHz and two-way capable).

- (3)

- Television subscribers as a percentage of homes passed.

- (4)

- Internet subscribers as a percentage of ready for service homes.

- (5)

- Number of digital subscribers as a percentage of ready for service homes.

- (6)

- Historical average monthly revenue per subscriber equals (a) the quotient of revenues for the period divided by the number of months in the period, divided by (b) the average monthly number of subscribers for the period.

- (7)

- Old PrimaCom defines EBITDA as earnings (loss) before discontinued operations, extraordinary items, equity earnings (loss) in affiliates, minority interests, gain (loss) on disposal of fixed assets, net interest expense, income taxes and depreciation and amortization. Other participants in the cable television and broadband industries also use EBITDA, defined in a similar but often not exactly comparable manner, as a measure of performance. Old PrimaCom believes that EBITDA is a useful supplement to net income and other income statement data in understanding cash flows generated from operations that are available for taxes, debt service and capital expenditures and because it is the most commonly used measure to analyze and compare cable television and broadband companies on the basis of operating performance, leverage and liquidity. EBITDA is not a U.S. GAAP measure of income (loss) or cash flow from operations and should not be considered as an alternative to net income as an indication of Old PrimaCom's financial performance or as an alternative to cash flow from operating activities as a measure of Old PrimaCom's liquidity.

- (8)

- EBITDA margin is EBITDA divided by revenues.

- (9)

- Adjusted EBITDA represents the EBITDA for Old PrimaCom adjusted to add back non-cash compensation expenses related to share options of approximately E3,558,000 in the year ended December 31, 2000, approximately E2,757,000 in the year ended December 31, 1999, approximately E843,000 for the three months ended March 31, 2001 and approximately E961,000 for the three months ended March 31, 2000. For more information about these adjustments, see "Operating and Financial Review and Prospects—Operating and financial review and prospects of Old PrimaCom—Selling, general and administrative." Other cable television and broadband companies may also measure performance with reference to adjusted EBITDA, but the nature of the adjustments made by these companies may differ from those made by Old PrimaCom, making analysis and comparison of these measures difficult. See also footnote 7.

- (10)

- Adjusted EBITDA margin is Adjusted EBITDA divided by revenues.

8

Summary financial and operations data relating to EWT

The summary consolidated statement of operations data for the years ended December 31, 1998, 1999, the nine months ended September 30, 2000 and the three months ended December 31, 2000, and the summary consolidated balance sheet data as at December 31, 1999 and 2000 have been derived from EWT's financial statements included elsewhere in this prospectus/proxy statement, which have been prepared in accordance with U.S. GAAP and audited by Arthur Andersen, independent auditors. The summary consolidated statement of operations and cash flow data for the three months ended March 31, 2000 and 2001 and the summary consolidated balance sheet data as of March 31, 2001 have been derived from EWT's unaudited financial statements included elsewhere in this prospectus/proxy statement. In the opinion of management these unaudited financial statements contain all adjustments (consisting only of normally recurring adjustments) necessary for a fair presentation in accordance with U.S. GAAP of the consolidated financial position of EWT at those dates and the results of operations of EWT for those periods. The summary consolidated balance sheet data for 1998 has been derived from EWT's accounting records. For the years ended December 31, 1996 and 1997, EWT only prepared the financial statements required for statutory reporting in Germany, which did not include financial statements for the consolidated group. Additionally, the information that is available for those years, relating to the individual group companies, is prepared on the basis of German GAAP. The process of consolidating the group companies and converting the information to U.S. GAAP could not be completed without unreasonable effort and expense to EWT. Accordingly, consolidated U.S. GAAP summary financial information for these periods has not been presented.

On October 2, 2000, EWT was acquired by a subsidiary of United Pan-Europe in a combination cash and share transaction. Accordingly, the consolidated statement of operations data for the year 2000 has been divided into the nine month period ended September 30, 2000 and the three month period ended December 31, 2000, representing the predecessor and successor periods.

The acquisition of EWT was accounted for using the purchase method of accounting, with all purchase accounting adjustments "pushed-down" to the consolidated financial statements of EWT and its subsidiaries. Accordingly, the purchase price was allocated to the underlying assets and liabilities using their fair values, based on a preliminary evaluation of the fair values of EWT's assets and liabilities at the date of acquisition using information currently available. The excess of cost over the fair value of net assets acquired was allocated to goodwill. We do not expect that the final purchase price allocation will differ materially from what has currently been recorded. As a result of the acquisition, the subsidiary of United Pan-Europe which acquired EWT pushed down its basis of accounting to EWT, establishing a new basis of accounting as of the acquisition date. Accordingly, summary information for the year ended December 31, 2000 has been divided into two periods representing the predecessor period of January 1, 2000 through September 30, 2000 and the successor period of October 1, 2000 through December 31, 2000. The summary consolidated data presented below should be read in conjunction with EWT's consolidated financial statements and notes thereto included elsewhere in this prospectus/proxy statement.

The summary consolidated financial data for 1998, 1999 and 2000 were prepared using the Deutsche Mark and have been restated in euro using the Council of the European Union's official fixed conversion rate between the euro and the Deutsche Mark of DM1.95583 per E1.00. The Deutsche Mark and the euro will continue to have legal tender status through a transition period ending February 28, 2002. The summary consolidated financial data is not comparable to financial data of

9

other companies that report in euros and that restate amounts from currencies other than the Deutsche Mark.

| | EWT Historical | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Year Ended December 31, | | | Three Months Ended March 31, 2000 (unaudited) (predecessor) | Three Months Ended March 31, 2001 (unaudited) (successor) | |||||||||

| | Nine Months Ended September 30, 2000 (predecessor) | Three Months Ended December 31, 2000 (successor) | ||||||||||||

| | (predecessor) 1998 | (predecessor) 1999 | ||||||||||||

| | E'000 | E'000 | E'000 | E'000 | E'000 | E'000 | ||||||||

| Statement of Operations Data | ||||||||||||||

| Revenues | 46,679 | 48,968 | 39,122 | 11,695 | 12,582 | 12,451 | ||||||||

| Operating expenses: | ||||||||||||||

| Operating | 18,768 | 19,431 | 16,866 | 3,961 | 5,522 | 3,853 | ||||||||

| Selling, general and administrative | 7,328 | 7,039 | 11,099 | 3,138 | 1,701 | 2,173 | ||||||||

| Depreciation | 12,817 | 12,911 | 10,140 | 3,874 | 3,254 | 3,560 | ||||||||

| Amortization of goodwill and other intangible assets | 83 | 756 | 645 | 18,947 | 224 | 18,930 | ||||||||

| Total operating expenses | 38,996 | 40,137 | 38,750 | 29,920 | 10,701 | 28,516 | ||||||||

| Operating profit (loss) | 7,683 | 8,831 | 372 | (18,225 | ) | 1,881 | (16,065 | ) | ||||||

| Gain (loss) on disposal of fixed assets | 423 | (638 | ) | — | — | — | — | |||||||

| Interest income | 154 | 117 | 83 | 72 | 31 | 10 | ||||||||

| Interest expense | (5,378 | ) | (5,044 | ) | (3,948 | ) | (1,396 | ) | (1,323 | ) | (1,392 | ) | ||

| Other non-operating income, net | 1,030 | 2,329 | 333 | 135 | 270 | 291 | ||||||||

| Income (loss) before minority interests and income taxes | 3,912 | 5,595 | (3,160 | ) | (19,414 | ) | 859 | (17,156 | ) | |||||

| Minority interests | (241 | ) | 4 | (28 | ) | (16 | ) | 70 | 18 | |||||

| Income tax benefit (expense) | (2,265 | ) | (3,047 | ) | 2,039 | 34,824 | (356 | ) | 727 | |||||

| Income (loss) before cumulative effect of change in accounting principle | 1,406 | 2,552 | (1,149 | ) | 15,394 | 573 | (16,411 | ) | ||||||

| Cumulative effect of change in accounting principle | — | — | — | — | — | (198 | ) | |||||||

| Net income (loss) | 1,406 | 2,552 | (1,149 | ) | 15,394 | 573 | (16,609 | ) | ||||||

| Balance Sheet Data (at period end) | ||||||||||||||

| Total assets | 103,310 | 102,788 | — | 1,175,620 | — | 1,157,729 | ||||||||

| Total debt | 82,763 | 78,660 | — | 80,279 | — | 76,336 | ||||||||

| Total liabilities | 97,338 | 94,462 | — | 174,802 | — | 173,539 | ||||||||

| Shareholders' equity | 5,972 | 7,262 | — | 1,000,574 | — | 983,965 | ||||||||

10

| Cash Flow Data | ||||||||||||||

| Net cash provided by (used in) operating activities | 10,134 | 15,841 | 16,899 | (9,583 | ) | 8,972 | 8,152 | |||||||

| Net cash used in investing activities | (6,535 | ) | (12,951 | ) | (14,442 | ) | (4,920 | ) | (4,330 | ) | (1,998 | ) | ||

| Net cash provided by (used in) financing activities | (5,194 | ) | (4,470 | ) | (3,428 | ) | 13,984 | (5,588 | ) | (4,982 | ) | |||

| Capital expenditures (excluding acquisitions) | 7,257 | 12,680 | 9,351 | 3,017 | 2,764 | 1,765 | ||||||||

| | Year Ended December 31, | | Three Months Ended December 31, 2000 (successor) | Three Months Ended March 31, 2000 (unaudited) (predecessor) | Three Months Ended March 31, 2001 (unaudited) (successor) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Nine Months Ended September 30, 2000 (predecessor) | ||||||||||||

| | (predecessor) 1998 | (predecessor) 1999 | |||||||||||

| | E'000 | E'000 | E'000 | E'000 | E'000 | E'000 | |||||||

| Operations Data | |||||||||||||

| Homes passed(1) | 694,410 | 700,430 | 707,712 | 710,786 | 701,000 | 710,786 | |||||||

| Ready for service homes(2) | — | — | — | — | — | — | |||||||

| Number of television subscribers | 562,978 | 571,985 | 580,884 | 585,335 | 572,800 | 586,153 | |||||||

| Number of Internet subscribers | — | 6 | 70 | 104 | 15 | 92 | |||||||

| Number of digital television subscribers | — | — | — | — | — | — | |||||||

| Video penetration(3) | 81.1 | % | 81.7 | % | 82.1 | % | 82.4 | % | 81.4 | % | 82.5 | % | |

| Internet penetration(4) | — | — | — | — | — | — | |||||||

| Digital penetration(5) | — | — | — | — | — | — | |||||||

| Average monthly revenue per subscriber (E)(6) | 6.25 | 6.31 | 6.47 | 6.56 | 6.48 | 6.54 | |||||||

| EBITDA (E'000)(7) | 20,583 | 22,498 | 11,157 | 4,596 | 5,359 | 6,425 | |||||||

| EBITDA margin(8) | 44.1 | % | 45.9 | % | 28.5 | % | 39.3 | % | 42.6 | % | 51.6 | % | |

| Compensation-adjusted EBITDA (E'000)(9) | 20,583 | 22,498 | 16,730 | 5,183 | 5,359 | 7,012 | |||||||

| Compensation-adjusted EBITDA margin(10) | 44.1 | % | 45.9 | % | 42.8 | % | 44.3 | % | 42.6 | % | 56.3 | % | |

- (1)

- At the end of the period. In 2000, approximately 710,786 homes were passed by coaxial cable networks.

- (2)

- Upgraded from the fiber node to the home (862 MHz and two-way capable).

- (3)

- Television subscribers as a percentage of homes passed.

- (4)

- Internet subscribers as a percentage of ready for service homes.

- (5)

- Number of digital subscribers as a percentage of ready for service homes.

- (6)

- Historical average monthly revenue per subscriber equals (a) the quotient of revenues for the period divided by the number of months in the period, divided by (b) the average monthly number of subscribers for the period.

- (7)

- EWT defines EBITDA as earnings (loss) before discontinued operations, extraordinary items, equity earnings (loss) in affiliates, minority interests, gain (loss) of disposal of fixed assets, net interest expense, income taxes

11

and depreciation and amortization. Other participants in the cable television and broadband industries also use EBITDA, defined in a similar but often not exactly comparable manner, as a measure of performance. EWT believes that EBITDA is a useful supplement to net income and other income statement data in understanding cash flows generated from operations that are available for taxes, debt service and capital expenditures and because it is the most commonly used measure to analyze and compare cable television and broadband companies on the basis of operating performance, leverage and liquidity. EBITDA is not a U.S. GAAP measure of income (loss) or cash flow from operations and should not be considered as an alternative to net income as an indication of EWT's financial performance or as an alternative to cash flow from operating activities as a measure of EWT's liquidity.

- (8)

- EBITDA margin is EBITDA divided by revenues.

- (9)

- Compensation-adjusted EBITDA represents the EBITDA for EWT, adjusted to remove the effects of the one-time compensation expense of approximately E6,160,000 for the year ended December 31, 2000, E120,000 in the three months ended March 31, 2000 and E587,000 for the three months ended March 31, 2001. For more information about this adjustment, see "Operating and Financial Review and Prospects—Operating and financial review and prospects of EWT—Selling, general and administrative." Other cable television and broadband companies may also measure performance with reference to adjusted EBITDA, but the nature of the adjustments made by these companies may differ from those made by EWT, making analysis and comparison of these measures difficult. See also footnote 7.

- (10)

- Compensation-adjusted EBITDA margin is Compensation-adjusted EBITDA divided by revenues.

Summary pro forma financial data

New PrimaCom's summary unaudited pro forma condensed consolidated financial data are presented to reflect the pro forma effect of the contribution of EWT to New PrimaCom and New PrimaCom's merger with Old PrimaCom. However, it does not reflect the Alkmaar transaction or the effects of a possible exercise by New PrimaCom of the TeleColumbus option.

The summary unaudited pro forma balance sheet data as of March 31, 2001 shows New PrimaCom's financial position based on an assumption that the contribution of EWT to New PrimaCom and the merger between New PrimaCom and Old PrimaCom were completed as at March 31, 2001. The summary unaudited pro forma consolidated statement of operations data for the year ended December 31, 2000, and the three months ended March 31, 2001, show New PrimaCom's results of operations based on the assumption that the contribution of EWT to New PrimaCom and the merger were completed as of January 1, 2000 and that Old PrimaCom's acquisition of Multikabel and its other acquisitions during 2000 were completed as of the same date. The pro forma impact of the 2001 acquisitions, including the Alkmaar transaction, on revenues, net loss and net loss per share is immaterial and the exercise of the TeleColumbus option cannot presently be characterized as being probable because due diligence has not yet been carried out to determine whether the option price represents market value for the assets subject to the option and, as a result, New PrimaCom has not determined whether it could obtain the additional financing necessary to fund the purchase. New PrimaCom derived this information from New PrimaCom's financial statements and the consolidated financial statements of Old PrimaCom and EWT, in addition to applying a number of assumptions and adjustments, including in relation to the assumed completion by Old PrimaCom of its Multikabel and other acquisitions in 2000 as of January 1, 2000, set out in the accompanying notes to this pro forma information. This information should be read together with New PrimaCom's, Old PrimaCom's and EWT's historical financial statements and related notes included elsewhere in this prospectus/proxy statement and "Selected Historical and Pro Forma Financial and Operations Data—Unaudited pro forma consolidated financial information."

12

The EWT contribution will be accounted for at historical cost in a manner similar to a transaction under pooling of interests accounting. New PrimaCom's merger with Old PrimaCom will be accounted for under purchase method accounting as a reverse acquisition of New PrimaCom by Old PrimaCom. This means that, for accounting and financial reporting purposes, the assets and liabilities of Old PrimaCom will remain at historical cost and New PrimaCom's assets and liabilities will be recorded at their fair value based on the value of the 11,100,000 New PrimaCom's shares to be held by United Pan-Europe's German subsidiary following completion of the business combination. These 11,100,000 shares include 11,048,871 of New PrimaCom's shares to be issued for the contribution to New PrimaCom of EWT together with the 51,129 of New PrimaCom's shares currently held by United Pan-Europe's German subsidiary, which are deemed to have no value under the business combination agreement. Using a five-day average of the closing price of the Old PrimaCom shares immediately before and after the signing of the business combination agreement, the value of the 11,100,000 shares is approximately E173,000,000. The excess of New PrimaCom's net book value over its fair value is recorded as a write-down on its books.

If the business combination is approved, United Pan-Europe will beneficially own 52.0% of the outstanding shares of New PrimaCom. United Pan-Europe has agreed to enter into an agreement effective upon the closing of the business combination which will place restrictions on the voting rights of United Pan-Europe. Under this agreement, United Pan-Europe will cast a number of abstention votes equaling 10% of New PrimaCom's registered share capital with respect to certain resolutions to be taken by shareholders. Specifically, United Pan-Europe will cast abstention votes in the election and removal of members of the supervisory board of New PrimaCom as well as matters regarding the management of the business of New PrimaCom if the management board requests a decision by the shareholders.

New PrimaCom, EWT and Old PrimaCom may have performed differently if the business combination had taken place as of January 1, 2000. You should not rely on the summary unaudited pro forma condensed consolidated financial information as being indicative of the historical results that New PrimaCom would have had or the future results that New PrimaCom will experience after actual completion of the business combination. The preliminary allocation of the purchase price to tangible and intangible assets of EWT reflects their estimated fair value based upon information available at the time of the preparation of the accompanying unaudited pro forma condensed consolidated financial statements.

13

| | New PrimaCom | ||||||

|---|---|---|---|---|---|---|---|

| | Pro forma For the contribution of EWT to New PrimaCom and the merger of Old PrimaCom with New PrimaCom | ||||||

| | Year ended December 31, 2000 | Three Months Ended March 31, 2001 | |||||

| Statement of Operations Data: | |||||||

| Revenues (E'000) | 203,523 | 51,303 | |||||

| Operating costs and expenses: | |||||||

| Operations (E'000) | 58,229 | 12,637 | |||||

| Selling, general and administrative (E'000) | 48,304 | 12,039 | |||||

| Corporate overhead (E'000) | 18,176 | 3,881 | |||||

| Depreciation and amortization (E'000) | 145,192 | 36,739 | |||||

| Total (E'000) | 269,901 | 65,296 | |||||

| Operating loss (E'000) | (66,378 | ) | (13,993 | ) | |||

| Interest expense (E'000) | 42,108 | 18,328 | |||||

| Other income (E'000) | 2,598 | 506 | |||||

| Loss from continuing operations before income tax and other items (E'000) | (105,888 | ) | (31,816 | ) | |||

| Net loss (E'000) | (74,782 | ) | (32,266 | ) | |||

| EBITDA(1) (E'000) | 78,814 | 22,746 | |||||

| EBITDA margin(2) | 38.7 | % | 44.3 | % | |||

| Adjusted/compensation-adjusted EBITDA(3) (E'000) | 88,532 | 24,176 | |||||

| Adjusted/compensation-adjusted EBITDA margin(4) | 43.5 | % | 47.1 | % | |||

Balance sheet data: | |||||||

| Total assets (E'000) | 1,450,346 | 1,432,486 | |||||

| Total bank and other debt (E'000) | 816,470 | 842,019 | |||||

| Total liabilities (E'000) | 1,007,765 | 1,015,854 | |||||

| Total equity (E'000) | 442,139 | 416,258 | |||||

- (1)

- New PrimaCom defines EBITDA as earnings (loss) before discontinued operations, extraordinary items, equity earnings (loss) in affiliate, minority interests, gain (loss) on disposal of fixed assets, net interest expense, income taxes and depreciation and amortization. Other participants in the cable television and broadband industries also use EBITDA, defined in a similar but often not exactly comparable manner, as a measure of performance. New PrimaCom believes that EBITDA is a useful supplement to net income and other income statement data in understanding cash flows generated from operations that are available for taxes, debt service and capital expenditures and because it is the most commonly used measure to analyze and compare cable television and broadband companies on the basis of operating performance, leverage and liquidity. EBITDA is not a U.S. GAAP measure of income (loss) or cash flow from operations and should not be considered as an alternative to net income as an indication of New PrimaCom's financial performance or as an alternative to cash flow from operating activities as a measure of New PrimaCom's liquidity.

- (2)

- EBITDA margin is EBITDA divided by revenues.

- (3)

- Adjusted/compensation-adjusted EBITDA represents (1) the Adjusted EBITDA of Old PrimaCom for the year ended December 31, 2000, which is EBITDA for Old PrimaCom adjusted to add back non-cash compensation expenses related to share options of approximately E3,558,000 in the year ended December 31, 2000, plus (2) compensation-adjusted EBITDA for EWT, which is EBITDA for EWT adjusted to remove the effects of the one-time compensation expense of approximately E

14

6,160,000 in the year ended December 31, 2000. For the three months ended March 31, 2001, adjusted/compensation adjusted EBITDA is impacted by the add back of non-cash compensation expense related to share options of approximately E843,000 at Old PrimaCom plus the removal of the one-time compensation expense of E587,000 at EWT. For more information about the pro forma financial information and these adjustments, see "Selected Historical and Operations and Pro Forma Financial Data—Unaudited pro forma consolidated financial information", "Operating and Financial Review and Prospects—Operating and financial review and prospects of Old PrimaCom—Selling, general and administrative" and "—Operating and financial review and prospects of EWT—Selling, general and administrative." Other cable television and broadband companies may also measure performance with reference to adjusted EBITDA, but the nature of the adjustments made by these companies may differ from those made by Old PrimaCom, making analysis and comparison of these measures difficult. See also footnote 1.

- (4)

- Adjusted/compensation-adjusted EBITDA margin is Adjusted/compensation-adjusted EBITDA divided by revenues.

Comparative per share data

The following table sets forth selected information regarding earnings, dividends and book value per share for New PrimaCom's shares and Old PrimaCom's shares on a pro forma and an historical basis. You should read this information in conjunction with New PrimaCom's unaudited pro forma consolidated financial information and the historical consolidated financial statements of Old PrimaCom, including the related notes, which are included elsewhere in this prospectus/proxy statement.

| | As at and for the twelve months ended December 31, 2000 | As at and for the three months ended March 31, 2001 | |||

|---|---|---|---|---|---|

| | (E) | (E) | |||

| New PrimaCom shares (pro forma) | |||||

| Net loss per share: | |||||

| Basic and diluted | 2.43 | 1.06 | |||

| Cash dividends per share | — | — | |||

| Book value per share | 14.31 | 13.49 | |||

Old PrimaCom shares (historical) | |||||

| Net loss per share: | |||||

| Basic and diluted | 3.26 | 1.40 | |||

| Cash dividends per share | — | — | |||

| Book value per share | 13.60 | 12.32 | |||

15

You should carefully consider the following risk factors, as well as the more detailed descriptions cross-referenced to the body of this prospectus/proxy statement and the information in the documents incorporated by reference. The following risk factors assume the completion of the business combination and include the risks to which Old PrimaCom is, and has been, exposed.

Risks relating to the business combination

New PrimaCom is subject to the following risks in connection with the proposed business combination.

New PrimaCom may not be able to obtain the governmental approvals required for the business combination in a timely manner, if at all, and the approvals New PrimaCom does obtain may include conditions which are costly to implement or overcome, or are otherwise harmful to New PrimaCom's business

The consummation of the business combination is subject to a number of remaining conditions. These include the approval of the German Federal Cartel Office and any other governmental and third-party approvals that may be required. If New PrimaCom does not receive all of the required regulatory and third party approvals, the business combination agreement could be terminated or some or all of elements of the business combination could be abandoned. In addition, New PrimaCom may not be able to receive the required approvals in a timely manner. A delay in receiving these approvals could delay the completion of the business combination and the realization of the expected benefits from the business combination. In addition, if New PrimaCom's merger with Old PrimaCom is not registered by March 1, 2002 because of a delay in obtaining governmental approvals or for any other reason, any of the parties to the business combination agreement could elect to terminate that agreement.

New PrimaCom has been notified that three German television stations have been allowed to intervene (beigeladen) in the proceedings before the German Federal Cartel Office considering New PrimaCom's merger with Old PrimaCom. In the event the German Federal Cartel Office issues a clearance decision, these three parties will be entitled to file a complaint against the decision with a German court and may also request the court to issue an order suspending the clearance decision of the Cartel Office pending resolution of the complaint. If the court grants this motion, New PrimaCom would be prevented from registering the merger until the court proceedings have been concluded by court judgment or otherwise. This would delay New PrimaCom's ability to integrate the businesses of Old PrimaCom, EWT and Alkmaar and the benefits New PrimaCom expects from doing so. In addition, there would be a possibility that the approval of the German Federal Cartel Office may be reversed or rescinded, which would also prevent registration of the merger.

Even if New PrimaCom succeeds in obtaining all necessary governmental approvals, these approvals could contain conditions, such as a required sale of some of the assets and businesses of EWT or Old PrimaCom or restrictions on New PrimaCom's combined operations which would deny it the significant benefits expected from the business combination. Any restrictions of this nature could adversely affect the conduct of New PrimaCom's business after the business combination and the value of its shares and ADSs. The approvals that New PrimaCom requires to consummate the business combination are more fully described in "The Transactions—The business combination agreement and related agreements—The business combination agreement—Closing conditions."

New PrimaCom may encounter difficulties in integrating the businesses and assets of Old PrimaCom, EWT and Alkmaar which are costly to overcome and may negatively impact its financial performance

The business combination agreement contemplates that New PrimaCom will assume the business of Old PrimaCom and will integrate into this business the networks of EWT and Alkmaar. This combination will increase the size of Old PrimaCom's subscriber base by almost 50% to over 2,000,000 subscribers. In addition to the difficulties associated with this significant increase in size, New

16

PrimaCom will face the challenges of integrating three distinct networks and support systems. This integration may take longer than New PrimaCom planned and use more resources than New PrimaCom expected. In particular, New PrimaCom may experience technical problems in integrating the billing, customer service or other systems of Old PrimaCom, EWT and Alkmaar.

The significant challenges required by the integration of these businesses will require New PrimaCom's management to develop and implement new business plans, policies, strategies and procedures to operate the businesses on a consolidated basis. Future acquisitions could require that New PrimaCom change these plans and strategies. This process will divert management attention from efforts to develop Old PrimaCom's subscriber base, product range and networks. Any material delay in developing and implementing these plans, policies, strategies or procedures, or any other material difficulties that may be experienced in connection with the integration of the businesses and the management of New PrimaCom's growth, could result in reduced revenues and higher operating costs than expected, as well as subscriber attrition.

If shareholders contest the approval of the proposed merger, New PrimaCom could be prevented from registering the merger and may be liable if the resolution approving the merger is improperly adopted

Under German law, New PrimaCom's shares will not be issued to shareholders of Old PrimaCom until the merger is registered with the commercial court. An Old PrimaCom shareholder could contest the merger by filing an action to set aside the resolution approving the merger within one month of the date the resolution receives shareholder approval. The merger will not be registered with the commercial court if a shareholder contest is pending and during that time the Old PrimaCom shares would remain outstanding. An action could be brought by an Old PrimaCom shareholder on the basis of alleged procedural irregularities or material defects in relation to the merger resolution itself. If an Old PrimaCom shareholder files this type of action, it could have the effect of delaying the business combination, which could adversely impact New PrimaCom's ability to integrate the EWT business with that of Old PrimaCom and the expected benefits from doing so. If the merger is not registered on or before March 1, 2002, as a result of a shareholder action or for any other reason, any of the parties to the business combination agreement could elect to terminate that agreement. In addition, even if New PrimaCom is successful in registering the merger by obtaining an affirmative accelerated court decision pursuant to the German Transformation Act (Umwandlungsgesetz), which may take several months, New PrimaCom still could be liable to pay damages to shareholders if it is determined that the approval of the merger was improper.

If a valuation proceeding (Spruchverfahren) is brought in a German court, New PrimaCom could be obligated to make a supplementary cash payment to all Old PrimaCom shareholders, which may significantly reduce the capital available to operate New PrimaCom's business and to implement its acquisition strategy

Under the German Transformation Act (Umwandlungsgesetz), any Old PrimaCom shareholder may bring a court valuation proceeding (Spruchverfahren) to determine whether the ratio of New PrimaCom shares to be exchanged for Old PrimaCom shares in the business combination is inadequate. An Old PrimaCom shareholder could institute a valuation proceeding within two months following effective publication of the registration of the merger, even if he voted in favor of the merger or acquired all of his shares after the date of the meeting at which the merger was approved by Old PrimaCom shareholders. If a valuation proceeding determines that the consideration paid by New PrimaCom pursuant to the merger of New PrimaCom with Old PrimaCom is inadequate, New PrimaCom would be obliged to make a supplementary cash payment to all Old PrimaCom shareholders. Any cash payment to shareholders will reduce the resources available to meet New PrimaCom's debt obligations and operating and capital expenses. Regardless of the outcome of the valuation proceeding, New PrimaCom would bear the cost of the proceeding unless the court determined that it would be inequitable for New PrimaCom to do so.

17

Risks relating to New PrimaCom's business

New PrimaCom's business and the value of its shares and ADSs to be issued in connection with the business combination are subject to the following risks, which include risks relating to the industry in which New PrimaCom will operate if the business combination is approved.

New PrimaCom expects to incur increasing net losses in the near term, and the value of New PrimaCom's business and its securities will likely decline if New PrimaCom is unable to generate net profits in the future

New PrimaCom's unaudited pro forma consolidated financial statements reflect that it would have incurred net losses of approximately E74,782,000 in the year ended December 31, 2000 and E32,266,000 in the three months ended March 31, 2001. Following the business combination, New PrimaCom expects to continue to incur net losses in the near term. As part of its strategy to generate profits, New PrimaCom intends to continue to upgrade its networks and develop new products including broadband services, which will give rise to substantial capital expenditure and interest expense. This planned upgrade and New PrimaCom's product development efforts will allow it to provide value-added services, which it believes will increase its revenues per subscriber in the future. At the same time, New PrimaCom will seek to reduce operating expenses, including reducing signal delivery fees by installing its own head-ends. See "Operating and Financial Review and Prospects—New PrimaCom's operating and financial review and prospects" and "Business—Strategy." However, New PrimaCom cannot assure you that its strategy will be successful or that it will be able to generate net profits in the future. New PrimaCom's inability to generate net profits in the future may have a significant negative impact on the value of its business and its securities.

New PrimaCom's degree of leverage could limit its ability to obtain additional financing and could make it more vulnerable to an economic downturn

New PrimaCom's unaudited pro forma consolidated financial statements reflect that New PrimaCom would have had a debt to equity ratio of approximately 2:1 as of March 31, 2001. You should be aware that New PrimaCom's degree of leverage could have important consequences to shareholders. For example, the degree of leverage could limit New PrimaCom's ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, product development or other general corporate purposes, making New PrimaCom more vulnerable to a downturn in business or the economy generally.

New PrimaCom may not be able to generate sufficient cash from operations to fund its planned capital expenditures, operating expenses, acquisition strategy and debt repayment obligations

New PrimaCom's unaudited pro forma consolidated financial statements reflect that New PrimaCom would have had approximately E842,019,000 in bank and other debt outstanding and approximately E416,258,000 in shareholders' equity as at March 31, 2001. A significant portion of New PrimaCom's cash flow from operations will have to be dedicated to servicing this debt, which will limit its cash flow that may be used for operating expenses, planned capital expenditures and acquisitions. If New PrimaCom's actual results of operations deviate from its business plan, New PrimaCom may be forced to:

- •

- reduce or delay capital expenditures, including those relating to the upgrade of New PrimaCom's networks in Germany,

- •

- sell assets on terms that would otherwise be unacceptable to New PrimaCom, or

- •

- forgo business opportunities.

Any of these actions could prevent New PrimaCom from obtaining some or all of the benefits expected from its business strategy.

In addition, New PrimaCom may not be able to refinance existing debt (which in virtually all cases requires substantial principal payments at maturity) and, if it can, the terms of such refinancing might

18

not be as favorable as the terms of existing indebtedness. If principal payments due at maturity cannot be refinanced, extended or paid with proceeds of other capital transactions such as new equity capital, New PrimaCom's cash flow may not be sufficient to repay maturing debt. If New PrimaCom is unsuccessful in this regard, it could be declared in default of its loan obligations, in which case its debts under these instruments could become payable prior to their scheduled payment date.

New PrimaCom's debt instruments will contain restrictive covenants which may prevent it from acquiring other businesses or otherwise fully implementing its business strategy

After the business combination, New PrimaCom's operating and financial flexibility will be limited by restrictions imposed by the existing debt instruments of Old PrimaCom and EWT. These contain financial and operating covenants including, among other things, maintenance of certain financial ratios, as well as limitations on New PrimaCom's ability to sell all or substantially all of its assets and engage in mergers, consolidations and other acquisitions. If New PrimaCom fails to comply with the covenants and other provisions of its debt instruments, its debts under these instruments could become payable prior to their scheduled payment date. The agreements governing Old PrimaCom's existing debt also limit, but do not prohibit, its ability to incur additional indebtedness and New PrimaCom anticipates that it will incur additional debt in the future. For example, provided New PrimaCom meets all conditions, it may incur up to E1.0 billion in debt under the senior secured credit facility entered into by Old PrimaCom. Old PrimaCom also has a E375,000,000 ten-year senior working capital facility.

New PrimaCom's future capital expenditures and acquisitions may require additional financing, which may be difficult to obtain on acceptable terms

New PrimaCom's future capital requirements will depend on the revenue it generates, acquisitions it makes, competitive conditions, regulatory and technological developments and equipment costs and other costs associated with the deployment of its upgraded broadband networks. In particular, the actual amounts and timing of New PrimaCom's capital requirements may vary significantly from its estimates. For example, New PrimaCom may need to seek additional capital sooner than it expects if:

- •

- it is unable to achieve a sufficient subscriber base and market penetration for broadband services within its projected timeframe,

- •

- its development plans (in particular its cable network upgrade and expansion plans) change or its projections concerning supply, demand, prices, customer preferences, technological or regulatory developments or the cost of pursuing strategic opportunities prove to be inaccurate with respect to amounts, rates or timing,

- •

- delays or cost overruns occur in the construction, testing or activation of its cable networks, or

- •

- it is unable to implement or renegotiate concession agreements in Germany as it expands or upgrades its cable networks.