UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2008 OR |

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period fromto _______________________ |

| | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring shell company report |

Commission file number 0-31190

CANPLATS RESOURCES CORPORATION

(Exact name of Registrant as specified in its charter)

(Translation of Registrant’s name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

Suite 1510 – 999 West Hastings Street, Vancouver, British Columbia V6C 2W2

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class

None | Name of each exchange on which registered

Not Applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Stock without par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

56,748,056

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes þ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes þ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of theSecurities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þ Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | Accelerated filer þ | Non-accelerated filer |

Indicate by check mark which financial statement item the Registrant has elected to follow.

þ Item 17 Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes þ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes No

- ii -

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements concerning our operations and planned future acquisitions within the meaning of the safe harbor for such statements under the Private Securities Litigation Reform Act of 1995. Any statements that involve discussions with respect to predictions, expectations, belief, plans, projections, objectives, assumptions or future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, could”, “might”, or “will” be taken to occur or be achieved) are not statements of historical fact and may be “forward looking statements” and are intended to identify forward-looking statements, which include statements relating to, among other things, our ability to continue to successfully compete in its market. You are cautioned not to place undue reliance on forward looking statements. These forward-looking statements are based on the beliefs of our management as well as on assumptions made by and information currently available to us at the time such statements were made. We undertake no obligation to update forward-looking statements should circumstances or estimates or opinions change. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward looking statements, including, without limitation,

| | · | uncertainty of production at our mineral exploration properties; |

| | · | risks related to our ability to finance the continued exploration of our mineral properties; |

| | · | risks related to no Proven Mineral Reserves or Probable Mineral Reserves; |

| | · | our history of losses and expectation of future losses; |

| | · | risks related to factors beyond our control; |

| | · | risks and uncertainties associated with new mining operations; |

| | · | risks related to our ability to obtain adequate financing for our planned development activities; |

| | · | lack of infrastructure at our mineral exploration properties; |

| | · | risks and uncertainties relating to the interpretation of drill results and the geology, grade and continuity of our mineral deposits; |

| | · | unpredictable risks and hazards related to mining operations; |

| | · | uncertainties related to title to our mineral properties and the acquisition of surface rights; |

| | · | risks related to governmental regulations, including environmental regulations; |

| | · | commodity price fluctuations; |

| | · | our ability to attract and retain qualified personnel; |

| | · | risks related to reclamation activities on our properties; |

| | · | risks related to political instability and unexpected regulator change; |

| | · | increased competition in the mining industry for properties and qualified personnel; |

| | · | risks related to some of our directors and officers involvement with other natural resource companies; |

| | · | enforcement of U.S. judgments and laws in Canada; |

| | · | our ability to attract and retain qualified management; |

| | · | our ability to maintain adequate control over financial reporting; and |

| | · | our classification as a passive foreign investment company under the Internal Revenue Code. |

Actual results could differ materially from those projected in the forward-looking statements as a result of the matters set out or incorporated in this Annual Report generally and certain economic and business factors, some of which may be beyond our control. Some of the important risks and uncertainties that could effect forward looking statements as described further in this document under the headings “Risk Factors”, “History and Development of the Company”, “Business Overview”, “Descriptions of Properties” and “Operating and Financial Review and Prospects”.

In this Annual Report, “we”, “us”, “our”, “Canplats” and “the Company” refer to Canplats Resources Corporation, a company incorporated under the Business Corporations Act (British Columbia).

GLOSSARY OF GEOLOGICAL TERMS

DEFINITIONS AND ABBREVIATIONS

alteration - - usually referring to chemical reactions in a rock mass resulting from the passage of hydrothermal fluids.

breccia - rock consisting of more or less angular fragments in a matrix of finer-grained material or cementing material.

claim - that portion of public mineral lands, which a party has staked or marked out in accordance with provincial or state mining laws, to acquire the right to explore for the minerals under the surface.

cut-off grade - the minimum grade of mineralization that delimits mineralization that has a reasonable prospect of economic extraction from mineralization that does not have a reasonable prospect of economic extraction.

deposit - a natural occurrence of a useful mineral of sufficient extent and degree to invite exploitation.

fault - a fracture in a rock where there has been displacement of the two sides.

feasibility study means a detailed study of a deposit in which all geological, engineering, operating, economic and other relevant factors are engineered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production.

g/t - grams per tonne.

geophysics - - the study of the physical properties of rocks, minerals, and mineral deposits.

grade - the concentration of each ore metal in a rock sample, usually given as weight percent. Where extremely low concentrations are involved, the concentration may be given in grams per tonne (g/t) or ounces per ton (oz/ton). The grade of an ore deposit is calculated, often using sophisticated statistical procedures, as an average of the grades of a very large number of samples collected from throughout the deposit.

hectare - a square of 100 meters on each side.

host rock - - the rock within which the ore deposit occurs.

igneous - means a rock formed by the cooling of molten silicate material.

Indicated Mineral Resource - is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on December 11, 2005.

Inferred Mineral Resource - is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on December 11, 2005.

Measured Mineral Resource - is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on December 11, 2005.

Mineral Reserve - is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on December 11, 2005.

Mineral Resource - is a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on December 11, 2005.

mineralization - - usually implies minerals of value occurring in rocks.

net profits interest royalty - a royalty based on the profit, allowing for costs directly related to production. The expenses that the operator deducts from revenue are defined in the royalty agreement. Payments generally begin after payback of capital costs. The royalty holder is not responsible for contributing to capital expenses, covering operating losses or environmental liabilities.

net smelter return - means the amount actually paid to the mine or mill owner from the sale of ore, minerals and other materials or concentrates mined and removed from mineral properties.

oz/ton - ounces per ton.

Preliminary Feasibility Study - is a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, has been established and an effective method of mineral processing has been determined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, economic, social, and environmental factors and the evaluation of other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve. This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on December 11, 2005.

Probable Mineral Reserve - is the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on December 11, 2005.

Proven Mineral Reserve - is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on December 11, 2005.

Qualified Person - means an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; has experience relevant to the subject matter of the mineral project and the technical report; and is a member or licensee in good standing of a professional association.

sedimentary - - a rock formed from cemented or compacted sediments.

sediments - - are composed of the debris resulting from the weathering and breakup of other rocks that have been deposited by or carried to the oceans by rivers, or left over from glacial erosion or sometimes from wind action.

sulphide - a mineral compound characterized by the linkage of sulphur with a metal.

veins - the mineral deposits that are found filling openings in rocks created by faults or replacing rocks on either side of faults.

All disclosure about our exploration properties in this Annual Report conforms to the standards of United States Securities and Exchange Commission Industry Guide 7, Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations, other than disclosure of “Mineral Resources”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, which are Canadian geological and mining terms as defined in accordance with Canadian National Instrument 43-101 under the guidelines set out in the CIM Standards.

In this Annual Report references to “Canadian National Instrument 43-101” are references to National Instrument 43-101, Standards of Disclosure for Mineral Projects, of the Canadian Securities Administrators and references to “CIM Standards” are references to Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council on December 11, 2005 as may be amended from time to time by the CIM.

Cautionary Note to U.S. Investors concerning estimates of Measured Mineral Resources and Indicated Mineral Resources.

This Annual Report uses the terms “Measured Mineral Resource” and “Indicated Mineral Resource.” We advise U.S. investors that while such terms are recognized and permitted under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. U.S. investors are cautioned not to assume that any part or all of the Mineral Resources in these categories will ever be converted into Mineral Reserves.

Cautionary Note to U.S. Investors concerning estimates of Inferred Mineral Resources.

This Annual Report uses the term “Inferred Mineral Resources.” We advise U.S. investors that while such term is recognized and permitted under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not generally form the basis of feasibility or other economic studies. U.S. investors are cautioned not to assume that any part or all of an Inferred Mineral Resource exists, or is economically or legally mineable.

PART I

| Identity of Directors, Senior Management and Advisers |

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, as such, there is no requirement to provide any information under this item.

This Form 20-F is being filed as an annual report under the Exchange Act, and, as such, there is no requirement to provide any information under this item.

This Form 20-F is being filed as an annual report under the Exchange Act, and, as such, there is no requirement to provide any information under this item.

| Offer Statistics and Expected Timetable |

This Form 20-F is being filed as an annual report under the Exchange Act, and, as such, there is no requirement to provide any information under this item.

| | A. | Selected Financial Data |

The following table summarizes certain of our selected financial data. This information should be read in conjunction with the more detailed financial statements included in this Annual Report.

Table No. 1

Selected Financial Data

(expressed in thousands of Canadian dollars, except per share and number of shares data)

| | Year ended Jul 31, 2008 | Year ended Jul 31, 2007 | Year ended Jul 31, 2006 | Year ended Jul 31, 2005 | Year ended Jul 31, 2004 |

| 1.Revenues | Nil | Nil | Nil | Nil | Nil |

| 2.Loss for year* | (3,595,000) | (872,000) | (336,000) | (1,494,000) | (1,270,000) |

| 3.Loss per common share* | (0.07) | (0.02) | (0.01) | (0.05) | (0.06) |

| 4.Total assets | 22,680,000 | 5,891,000 | 4,071,000 | 2,326,000 | 3,458,000 |

| 5.Long term obligations | Nil | Nil | Nil | Nil | Nil |

| 6.Capital stock | 24,365,000 | 15,539,000 | 12,725,000 | 11,340,000 | 11,267,000 |

| 7.Cash dividends per common share | Nil | Nil | Nil | Nil | Nil |

| 8.Number of shares | 56,748,056 | 48,810,056 | 40,327,806 | 29,442,306 | 29,142,306 |

* All of our operations are continuing |

The selected financial data is presented in Table 1 above and in the financial statements in accordance with generally accepted accounting principles (“GAAP”) prevailing in Canada as of the dates shown.

The selected financial data under U.S. GAAP for the above periods is indicated below in Table 2:

Table No. 2

Selected Financial Data

(expressed in thousands of Canadian dollars, except per and number of shares data)

| | Year ended Jul 31, 2008 | Year ended Jul 31, 2007 | Year ended Jul 31, 2006 | Year ended Jul 31, 2005* | Year ended Jul 31, 2004 |

| 1.Revenues | Nil | Nil | Nil | Nil | Nil |

| 2.Loss for year* | (13,360,000) | (2,045,000) | (932,000) | (1,409,000) | (1,519,000) |

| 3.Loss per common share* | (0.25) | (0.05) | (0.03) | (0.05) | (0.07) |

| 4.Total assets | 8,638,000 | 2,306,000 | 1,676,000 | 610,000 | 1,734,000 |

| 5.Long term obligations | Nil | Nil | Nil | Nil | Nil |

| 6.Capital stock | 24,365,000 | 15,539,000 | 12,725,000 | 11,340,000 | 11,267,000 |

| 7.Cash dividends per common share | Nil | Nil | Nil | Nil | Nil |

| 8.Number of shares | 56,748,056 | 48,810,056 | 40,327,806 | 29,442,306 | 29,142,306 |

*Certain comparative figures have been restated - see note 14 to the July 31, 2006 financial statements |

Reference should be made to note 15 to the financial statements for a description of material differences between Canadian and U.S. GAAP.

U.S./Canadian Dollar Exchange Rates

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian dollars (Cdn$). The Government of Canada permits a floating exchange rate to determine the value of the Canadian dollar against the U.S. dollar (US$). In this Annual Report all references to “$” and “Cdn$” refer to Canadian Dollars and all references to “US$” refer to United States Dollars.

Table No. 3 below sets out the rate of exchange for the Canadian dollar at July 31 2008, July 31, 2007, July 31, 2006, July 31, 2005 and July 31, 2004, the average rates for the period and the range of high and low rates for the period. Table No. 4 sets out the high and low rates of exchange for the Canadian dollar for each month during the previous six months.

For purposes of these tables, the rate of exchange means the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. The tables set out the number of Canadian dollars required under that formula to buy one U.S. dollar. The average rate in Table No. 3 means the average of the exchange rates on the last day of each month during the period.

Table No. 3

U.S. Dollar/Canadian Dollar Exchange Rates for Five Most Recent Financial Years

| | Average | High | Low | Close |

| Fiscal Year Ended July 31, 2008 | 1.01 | 1.08 | 0.92 | 1.03 |

| Fiscal Year Ended July 31, 2007 | 1.13 | 1.18 | 1.04 | 1.07 |

| Fiscal Year Ended July 31, 2006 | 1.16 | 1.22 | 1.10 | 1.13 |

| Fiscal Year Ended July 31, 2005 | 1.24 | 1.33 | 1.18 | 1.23 |

| Fiscal Year Ended July 31, 2004 | 1.33 | 1.40 | 1.27 | 1.33 |

Table No. 4

U.S. Dollar/Canadian Dollar Exchange Rates for Previous Six Months

| | July | August | September | October | November | December |

High | 1.03 | 1.07 | 1.08 | 1.30 | 1.29 | 1.30 |

Low | 1.00 | 1.03 | 1.03 | 1.00 | 1.15 | 1.24 |

On January 26, 2009, the exchange rate of Canadian dollars into United States dollars, based upon the noon buying rate in New York City for cable transfers payable in Canadian dollars as certified for customs purposes by the Federal Reserve Board, was US $1.00 equals Cdn $1.2204.

This Form 20-F is being filed as an annual report under the Exchange Act, and, as such, there is no requirement to provide any information under this item.

This Form 20-F is being filed as an annual report under the Exchange Act, and, as such, there is no requirement to provide any information under this item.

Our exploration programs may not result in a commercial mining operation.

Mineral exploration involves significant risk because few properties that are explored contain bodies of ore that would be commercially economic to develop into producing mines. Our mineral properties are without a known body of commercial ore and our proposed programs are an exploratory search for ore. We cannot provide any assurance that our current exploration programs will result in any commercial mining operation. If the exploration programs do not result in the discovery of commercial ore, we will be required to acquire additional properties and write-off all of our investments in our existing properties.

We may not have sufficient funds to complete further exploration programs.

We have limited financial resources (working capital of approximately $5,825,000 at July 31, 2008), do not generate operating revenue, and must finance our exploration activity by other means, including financing through joint ventures, debt financing or equity financing. We cannot provide any assurance that additional funding will be available for further exploration of our projects or to fulfil our anticipated obligations under our existing property agreements. If we fail to obtain additional financing, we will have to delay or cancel further exploration of our properties, and we could lose all of our interest in our properties.

We do not have Proven Mineral Reserves or Probable Mineral Reserves.

We have not established the presence of any Proven Mineral Reserves or Probable Mineral Reserves (as such terms are defined in National Instrument 43-101 of the Canadian Securities Administrators) at any of our mineral properties. We cannot provide any assurance that future feasibility studies will establish Proven Mineral Reserves or Probable Mineral Reserves at our properties. The failure to establish Proven Mineral Reserves or Probable Mineral Reserves could restrict our ability to successfully implement our strategies for long-term growth.

We have a history of losses and expect to incur losses for the foreseeable future.

We have incurred losses during each of the following periods and expect to incur losses for the foreseeable future:

| | · | $3,595,000 for the year ended July 31, 2008; |

| | · | $872,000 for the year ended July 31, 2007: |

| | · | $336,000 for the year ended July 31, 2006; |

| | · | $1,494,000 for the year ended July 31, 2005; and |

| | · | $1,270,000 for the year ended July 31, 2004. |

As of July 31, 2008, we had an accumulated deficit of $14,510,000. We expect to continue to incur losses unless and until such time as one or more of our properties enter into commercial production and generate sufficient revenues to fund our continuing operations. If our exploration programs successfully locate an economic ore body, we will be subject to additional risks associated with mining including those set out in this Item 3.D - “Risk Factors” under the heading “We have no revenue from operations and no ongoing mining operations of any kind.”

Factors beyond our control may determine whether any mineral deposits we discover are sufficiently economic to be developed into a mine.

The determination of whether our mineral deposits are economic is affected by numerous factors beyond our control. These factors include:

| | · | the metallurgy of the mineralization forming the mineral deposit; |

| | · | market fluctuations for precious metals; |

| | · | the proximity and capacity of natural resource markets and processing equipment; and |

| | · | government regulations governing prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection |

We have no revenue from operations and no ongoing mining operations of any kind.

We are a mineral exploration company and have no revenues from operations and no ongoing mining operations of any kind. Our properties are in the exploration stage, and we have not defined or delineated any proven or probable reserves on any of our properties. If our exploration programs successfully locate an economic ore body, we will be subject to additional risks associated with mining:

| | · | We will require additional funds to place the ore body into commercial production. Substantial expenditures will be required to: |

| | o | establish ore reserves through drilling; |

| | o | develop metallurgical processes to extract the metals from the ore; and |

| | o | construct the mining and processing facilities at any site chosen for mining. |

The sources of external financing that we may use for these purposes include public or private offerings of debt, convertible notes and equity. In addition, we may enter into one or more strategic alliances and may utilize one or a combination of all these alternatives. We cannot provide any assurance that the financing alternative chosen by us will be available on acceptable terms, or at all. If additional financing is not available, we may have to postpone the development of, or sell, the property.

| | · | The majority of our property interests are not located in developed areas and as a result may not be served by appropriate: |

| | o | water and power supply; and |

| | o | other support infrastructure. |

These items are often needed for development of a commercial mine. If we cannot procure or develop roads, water, power and other infrastructure at a reasonable cost, it may not be economic to develop properties, where our exploration has otherwise been successful, into a commercial mining operation.

| | · | In making determinations about whether to proceed to the next stage of development, we must rely upon estimated calculations as to the mineral reserves and grades of mineralization on our properties. Until ore is actually mined and processed, mineral reserves and grades of mineralization must be considered as estimates only. These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling which may prove to be unreliable. We cannot provide any assurance that: |

| | o | these estimates will be accurate; |

| | o | resource or other mineralization figures will be accurate; or |

| | o | this mineralization can be mined or processed profitably. |

Any material changes in mineral reserve estimates and grades of mineralization will affect the economic viability of the placing of a property into production and a property’s return on capital.

| | · | Mining operations often encounter unpredictable risks and hazards that add expense or cause delay. These include: |

| | o | unusual or unexpected geological formations; |

| | o | metallurgical and other processing problems; |

| | o | periodic interruptions due to inclement or hazardous weather conditions; |

| | o | flooding, explosions, fire, rockbursts, cave-ins, landslides, and; |

| | o | inability to obtain suitable or adequate machinery, equipment or labour. |

| | · | We may become subject to liabilities in connection with: |

| | o | hazards against which we cannot insure against or which we may elect not to insure. |

The payment of these liabilities could require the use of financial resources that would otherwise be spent on mining operations.

| | · | Mining operations and exploration activities are subject to national and local laws and regulations governing: |

| | o | prospecting, development, mining and production; |

| | o | labour standards, occupational health and mine safety; |

| | o | waste disposal, toxic substances, land use and environmental protection. |

In order to comply, we may be required to make capital and operating expenditures or to close an operation until a particular problem is remedied. In addition, if our activities violate any such laws and regulations, we may be required to compensate those suffering loss or damage, and may be fined if convicted of an offence under such legislation.

| | · | Our profitability and long-term viability will depend, in large part, on the market price of gold and other metals. The market prices for these metals are volatile and are affected by numerous factors beyond our control, including: |

| | o | global or regional consumption patterns; |

| | o | supply of, and demand for, gold and other metals; |

| | o | expectations for inflation; and |

| | o | political and economic conditions. |

We cannot predict the effect of these factors on metals prices.

| | · | In order to bring our mineral properties into production we will experience significant growth in our operations. We expect this growth to create new positions and responsibilities for management personnel and increase demands on our operating and financial systems. There can be no assurance that we will successfully meet these demands and effectively attract and retain additional qualified personnel to manage our anticipated growth. The failure to attract such qualified personnel to manage growth effectively could have a material adverse effect on our business, financial condition and results of operations. |

Our properties may be subject to uncertain title.

We cannot assure you that title to our properties will not be challenged. We own, lease or have under option, unpatented and patented mining claims, mineral claims or concessions which constitute our property holdings. The ownership and validity, or title, of unpatented mining claims and concessions are often uncertain and may be contested. We also may not have, or may not be able to obtain, all necessary surface rights to develop a property. We have not conducted surveys of all of the claims in which we hold direct or indirect interests. A successful claim contesting our title to a property will cause us to lose our rights to explore and, if warranted, develop that property. This could result in our not being compensated for our prior expenditures relating to the property.

We are subject to significant governmental regulations.

Our exploration activities are subject to extensive federal, state, provincial, territorial and local laws and regulations governing various matters, including:

| | · | environmental protection; |

| | · | management and use of toxic substances and explosives; |

| | · | management of natural resources; |

| | · | exploration of mineral properties; |

| | · | labor standards and occupational health and safety, including mine safety; and |

| | · | historic and cultural preservation. |

Failure to comply with applicable laws and regulations may result in civil or criminal fines or penalties or enforcement actions, including orders issued by regulatory or judicial authorities enjoining or curtailing operations or requiring corrective measures, installation of additional equipment or remedial actions, any of which could result in significant expenditures. We may also be required to compensate private parties suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements. It is also possible that future laws and regulations, or more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspensions of our activities and delays in the exploration of our properties.

Land reclamation requirements for our exploration properties may be burdensome.

Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance. Reclamation may include requirements to:

| | · | control dispersion of potentially deleterious effluents; and |

| | · | reasonably re-establish pre-disturbance land forms and vegetation. |

In order to carry out reclamation obligations imposed on us in connection with our mineral exploration, we must allocate financial resources that might otherwise be spent on further exploration programs.

Political or economic instability or unexpected regulatory change in the countries where our properties are located could adversely affect our business.

Certain of our properties are located in countries, provinces and states more likely to be subject to political and economic instability, or unexpected legislative change, than is usually the case in certain other countries, provinces and states. Our mineral exploration activities could be adversely affected by:

| | · | political instability and violence; |

| | · | war and civil disturbance; |

| | · | expropriation or nationalization; |

| | · | changing fiscal regimes; |

| | · | fluctuations in currency exchange rates; |

| | · | high rates of inflation; |

| | · | underdeveloped industrial and economic infrastructure; and |

| | · | unenforceability of contractual rights; |

any of which may adversely affect our business in that country.

We may be adversely affected by fluctuations in foreign exchange rates.

We maintain our bank accounts mainly in Canadian dollars. Any appreciation in the currency of Mexico or other countries where we conduct exploration activities against the Canadian dollar will increase our costs of carrying out operations in such countries. In addition, any decrease in the U.S. dollar against the Canadian dollar will result in a loss on our books to the extent we hold funds in U.S. dollars.

We face industry competition in the acquisition of exploration properties and the recruitment and retention of qualified personnel.

We compete with other exploration companies, many of which have greater financial resources than us or are further in their development, for the acquisition of mineral claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees and other personnel. If we require and are unsuccessful in acquiring additional mineral properties or personnel, we will not be able to grow at the rate we desire or at all.

Table of Contents

Some of our directors and officers have conflicts of interest as a result of their involvement with other natural resource companies.

Some our directors and officers are directors or officers of other natural resource or mining-related companies and these associations may give rise to conflicts of interest from time to time. As a result of these conflicts of interest, we may miss the opportunity to participate in certain transactions, which may have a material, adverse effect on our financial position.

Enforcement of judgments or bringing actions outside the United States against us and our directors and officers may be difficult.

We are organized under the law of and headquartered in British Columbia, Canada, and the majority of our directors and officers are not citizens or residents of the United States. In addition, a substantial part of our assets are located outside the United States and Canada. As a result, it may be difficult or impossible for an investor to (a) enforce in courts outside the United States judgments against us and a majority of our directors and officers, obtained in United States’ courts based upon the civil liability provisions of United States’ federal securities laws or (b) bring in courts outside the United States an original action against us and our directors and officers to enforce liabilities based upon such United States’ securities laws.

We may experience difficulty attracting and retaining qualified management to grow our business, which could have a material adverse effect on our business and financial condition.

We are dependent on the services of key executives including our Chief Executive Officer, President and other highly skilled and experienced executives and personnel focused on advancing our corporate objectives as well as the identification of new opportunities for growth and funding. Due to our relatively small size, the loss of these persons or our inability to attract and retain additional highly skilled employees required for our activities may have a material adverse effect on our business and financial condition.

We may fail to achieve and maintain adequate internal control over financial reporting pursuant to the requirements of the Sarbanes-Oxley Act.

We documented and tested during our two most recent fiscal years our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act (“SOX”). SOX requires an annual assessment by management of the effectiveness of our internal control over financial reporting and, for fiscal years commencing with our fiscal year ended July 31, 2008, an attestation report by our independent auditors addressing the effectiveness of internal control over financial reporting. We may fail to achieve and maintain the adequacy of our internal control over financial reporting as such standards are modified, supplemented, or amended from time to time, and we may not be able to ensure that we can conclude, on an ongoing basis, that we have effective internal control over financial reporting in accordance with Section 404 of SOX. Our failure to satisfy the requirements of Section 404 of SOX on an ongoing, timely basis could result in the loss of investor confidence in the reliability of our financial statements, which in turn could harm our business and negatively impact the trading price or the market value of our securities. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations. Future acquisitions of companies, if any, may provide us with challenges in implementing the required processes, procedures and controls in our acquired operations. No evaluation can provide complete assurance that our internal control over financial reporting will detect or uncover all failures of persons within our Company to disclose material information otherwise required to be reported. The effectiveness of our processes, procedures and controls could also be limited by simple errors or faulty judgments. In addition, as we continue to expand, the challenges involved in implementing appropriate internal control over financial reporting will increase and will require that we continue to improve our internal control over financial reporting.

Under U.S. federal tax rules, we may be classified as a passive foreign investment company (a “PFIC”), which may result in special and generally unfavorable U.S. federal tax consequences to our U.S. shareholders.

As a non-U.S. corporation, we may be a PFIC depending on the percentage of our gross income which is “passive”, within the meaning of the U.S. Internal Revenue Code of 1986, as amended, or the percentage of our assets that produce or are held to produce passive income. We may have been a PFIC in our 2007 taxable year, and we may be a PFIC in subsequent taxable years. If we are a PFIC for any taxable year during a U.S. shareholder’s holding period in our common stock, such U.S. shareholder may be subject to increased U.S. federal income tax liability on the sale of common shares or on the receipt of dividends. See Item 10.E - “Taxation”. The PFIC rules are complex and may be unfamiliar to U.S. shareholders. Accordingly, U.S. shareholders are urged to consult their own tax advisors concerning the application of the PFIC rules to their investment in our common shares.

| | A. | History and Development of the Company |

General Background

We were incorporated under the laws of the Province of British Columbia, Canada on February 15, 1967 under the name Colby Mines Ltd. (N.P.L.). On January 11, 1977, we changed our name to Colby Mines Ltd. and then to Colby Resources Corp. on February 11, 1980. On October 14, 1999, we changed our name to International Colby Resources Corporation and consolidated our shares on a five for one basis. On March 15, 2000, we changed our name to “Canplats Resources Corporation”. On December 15, 2005, our shareholders adopted new articles as required by the then new British Columbia Business Corporations Act and authorized an increase in our authorized capital from 100,000,000 common shares without par value to an unlimited number of common shares without par value.

Our head office and registered and records office is located at: Suite 1510 - 999 West Hastings Street, Vancouver, British Columbia, Canada V6C 2W2. The contact person is R.E. Gordon Davis, Chairman and Chief Executive Officer. The telephone number is (604) 683-8218; the facsimile number is (604) 683-8350. We do not have a registered agent in the United States.

In October 2007, we announced the acquisition by staking of the Camino Rojo Project, located in the state of Zacatecas, Mexico. See Item 4.B - “Business Overview”.

In November 2008, we announced an initial resource estimate for the Camino Rojo Project located in the state of Zacatecas, Mexico. See Item 4.D - “Property, Plant and Equipment”.

The information contained in this Annual Report is current as at July 31, 2008, other than where a different date is specified.

All disclosure about our exploration properties in this Annual Report conforms to the standards of United States Securities and Exchange Commission Industry Guide 7, Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations, other than disclosure of “Mineral Resources”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, which are geological and mining terms as defined in accordance with Canadian National Instrument 43-101 under the guidelines set out in the CIM Standards. U.S. investors in particular are advised to read carefully the definitions of these terms as well as the explanatory and cautionary notes in the Glossary, and the cautionary notes below, regarding use of these terms.

Our primary business focus is the exploration for gold in Mexico. We are an exploration stage company and none of our properties are currently beyond the advanced exploration stage. There is no assurance that a commercially viable mineral deposit exists on any of our properties and further exploration work may be required before a final evaluation as to the economic and legal feasibility is determined. For further information, see Item 3.D - “Risk Factors”.

We currently have one principal mineral property, the Camino Rojo Project, located in Zacatecas State, Mexico. We expect to continue to expend the majority of our exploration efforts on the Camino Rojo Project in 2009. We have six secondary properties, all of which are located in Mexico: Rodeo Gold Prospect, Yerbabuena Gold Prospect, El Rincon Gold Prospect, Mecatona Gold Prospect, Maijoma Prospect and El Alamo Prospect. During 2009, we will be assessing our secondary properties to determine whether additional exploration is warranted.

Camino Rojo Project

In July 2007, we acquired, by staking, the Camino Rojo Project in Zacatecas State, Mexico, subject to the payment of a finder’s fee to LCI. Under the terms of the agreement with LCI, we are required to pay:

| | · | LCI US$5,000 on acquisition of the property (paid); |

| | · | every six months, the greater of US$5,000 and 2% of direct exploration expenditures made for the benefit of the property; and |

| | · | on commencement of commercial production on the property, a 0.25% net smelter return royalty; |

provided that the maximum amount payable to LCI for the Camino Rojo Project is US$2,000,000.

We currently hold a 100% interest in the Camino Rojo Project, subject to making the above described payments to LCI.

Rodeo Gold Prospect

In February 2003, we acquired by staking a 100% interest in the Rodeo gold prospect located 150 kilometres north of Durango, Mexico, subject to the payment of a finder’s fee to La Cuesta International, Inc. (“LCI”). Under an agreement dated February 20, 2003, we are required to pay LCI a finder’s fee in respect of our acquisition of the Rodeo prospect of:

| | · | US $10,000 on signing the agreement (paid); |

| | · | every six months commencing June 11, 2003, the greater of US $5,000 and 2% of direct exploration expenditures made for the benefit of the property; |

| | · | on commencement of commercial production on the property, a 0.25% net smelter returns royalty (net smelter returns (“NSR”) means the amount actually paid to the mine or mill owner from the sale of ore, minerals and other materials or concentrates mined and removed from mineral properties. This type of royalty provides cash flow that is free of any operating or capital costs and environmental liabilities.); |

provided that the maximum amount payable to LCI in respect of the finder’s fee for the Rodeo prospect is US $500,000.

In October 2003, we granted to Silver Standard Resources Inc. (“Silver Standard”) a right of first offer on all properties referred to us by Silver Standard. Under the terms of the right of first offer, if we intend to dispose of an interest in any referred property, we must give Silver Standard the first opportunity to acquire the interest. Our Rodeo property is subject to the right of first offer.

We currently hold a 100% interest in the Rodeo prospect, subject to making the above described payments to LCI and the right of first offer granted to Silver Standard.

Yerbabuena Gold Prospect

Under an agreement dated July 11, 2003, we acquired from LCI a lease with option to purchase a 100% interest in the Yerbabuena gold prospect located approximately 150 kilometres north-northwest of Durango, Mexico. In order to maintain the lease in good standing, we are required to pay LCI:

| | · | US $7,500 on signing the agreement (paid); |

| | · | US $5,000 on or before September 1, 2003 (paid); |

| | · | US $7,500 on or before March 1, 2004 (paid); |

| | · | US $7,500 on or before September 1, 2004 (paid); |

| | · | US $10,000 on or before March 1, 2005 (paid); |

| | · | US $10,000 on or before September 1, 2005 (paid); |

| | · | US $15,000 every six months thereafter commencing March 1, 2006 (paid); |

| | · | on commencement of commercial production on the property, the greater of US $25,000 per quarter and a 2% NSR; |

We can purchase the property from LCI at anytime on payment of US $2,000,000, less all lease payments described above.

Our Yerbabuena prospect is subject to the right of first offer granted to Silver Standard.

Under the terms of the lease with option to purchase, we have the exclusive right to explore and mine the Yerbabuena prospect, subject to making the above described payments to LCI and the right of first offer granted to Silver Standard.

El Rincon Gold Prospect

In May 2004, we acquired by staking a 100% interest in the El Rincon gold prospect located in Durango State, Mexico, subject to the payment of a finder’s fee to LCI and the back-in right to Silver Standard. Under an agreement dated August 24, 2004, we are required to pay LCI a finder’s fee in respect of our acquisition of the El Rincon prospect of:

| | · | US $5,000 on signing the agreement (paid); |

| | · | every six months commencing May 3, 2004, the greater of US $5,000 and 2% of direct exploration expenditures made for the benefit of the property; |

| | · | on commencement of commercial production on the property, a 0.25% NSR; |

provided that the maximum amount payable to LCI in respect of the finder’s fee for the El Rincon prospect is US $2,000,000.

Effective March 24, 2004, we granted Silver Standard a one-time right to acquire a 51% interest in any property we acquire that was referred to us by Silver Standard, which is known as the “back-in right”. This one-time right to acquire replaces the right of first offer, granted in 2003, for properties acquired after March 24, 2004. In order to exercise the back-in right in respect of any property, Silver Standard must (a) exercise the back-in right prior to, or on, our incurring US $1.5 million in exploration expenditures on the property and (b) incur exploration expenditures equal to twice the acquisition and exploration expenditures we have incurred on the property at the time of exercise. The El Rincon prospect is subject to the back-in right granted to Silver Standard.

We currently hold a 100% interest in the El Rincon gold prospect, subject to making the above described payments to LCI and the back-in right granted to Silver Standard.

Mecatona Gold Prospect

In December 2005, we acquired the Mecatona Gold Prospect consisting of:

| | · | an option to acquire 12 claims comprising 65.7301 hectares with the following payments: |

| | o | US $5,000 on signing the agreement (paid); |

| | o | US $10,000 on the first anniversary of signing the agreement (paid); |

| | o | US $20,000 on the second anniversary of signing the agreement (paid); |

| | o | US $215,000 on the third anniversary of signing the agreement; and |

| | o | a 1% NSR capped at US $250,000; |

| | · | an option to acquire one claim comprising 29.5896 hectares with the following payments: |

| | o | US $10,000 on signing the agreement (paid); |

| | o | US $20,000 on the first anniversary of signing the agreement (paid); |

| | o | US $30,000 on the second anniversary of signing the agreement (paid); |

| | o | US $50,000 on the third anniversary of signing the agreement; |

| | o | US $90,000 on the fourth anniversary of signing the agreement; and |

| | o | US $800,000 on the fifth anniversary of signing the agreement; and |

| | · | the acquisition of two claims covering approximately 4,000 hectares for staking costs. |

We are required to pay LCI a finder’s fee in respect of our acquisition of the Mecatona prospect of:

| | · | US $5,000 on signing the agreement (paid); |

| | · | every six months the greater of US $5,000 and 2% of direct exploration expenditures made for the benefit of the property; |

| | · | on commencement of commercial production on the property, a 0.25% NSR; |

provided that the maximum amount payable to LCI in respect of the finder’s fee for the Mecatona Gold Prospect is US $2,000,000.

In November 2008, we terminated the option to acquire 12 claims comprising 65.7301 hectares and the option to acquire one claim comprising of 29.5896 hectares. The Mecatona Gold Prospect now comprises two claims covering approximately 4,000 hectares.

The Mecatona Gold Prospect is subject to the back-in right granted to Silver Standard (See Item 4.B - “El Rincon Gold Prospect”).

We currently hold a 100% interest in the Mecatona Gold Prospect, subject to making the above described payments to LCI and the back-in right granted to Silver Standard.

Maijoma Prospect

In May 2006, we acquired by staking a 100% interest in the Maijoma Prospect located in Chihuahua State, Mexico, subject to the payment of a finder’s fee to LCI. Under an agreement dated January 1, 2006, we are required to pay LCI a finder’s fee in respect of our acquisition of the Maijoma Prospect of:

| | · | US $5,000 on signing the agreement (paid); |

| | · | every six months commencing October 28 2006, the greater of US $5,000 and 2% of direct exploration expenditures made for the benefit of the property; |

| | · | on commencement of commercial production on the property, a 0.25% NSR; |

provided that the maximum amount payable to LCI in respect of the finder’s fee for the Maijoma Prospect is US $2,000,000.

We currently hold a 100% interest in the Maijoma Prospect, subject to making the above described payments to LCI.

El Alamo Prospect

In December 2006, we acquired by staking a 100% interest in the El Alamo Prospect located in Chihuahua State, Mexico, subject to the payment of a finder’s fee to LCI. Under the terms of the agreement with LCI, we are required to pay:

| | · | LCI US$5,000 on acquisition of the property (paid); |

| | · | every six months, the greater of US$5,000 and 2% of direct exploration expenditures made for the benefit of the property; and |

| | · | on commencement of commercial production on the property, a 0.25% net smelter return royalty; |

provided that the maximum amount payable to LCI for the El Alamo Prospect is US$2,000,000.

We currently hold a 100% interest in the El Alamo Prospect, subject to making the above described payments to LCI.

We have one subsidiary: Canplats de Mexico S.A. de C.V., which was incorporated under the laws of Mexico on January 5, 2004. We hold a 100% beneficial interest in Canplats de Mexico S.A. de C.V.

Mexican Gold Prospects

Camino Rojo Project

Location, Access and Infrastructure

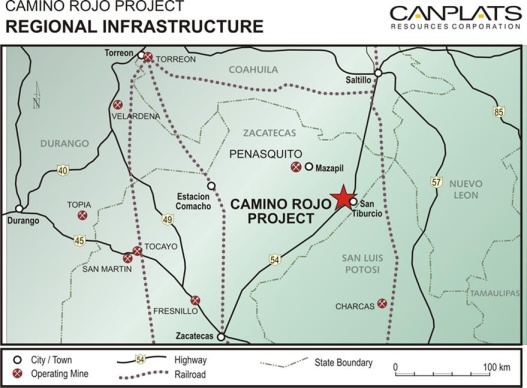

The Camino Rojo Project is located approximately 50 kilometres southeast of Goldcorp Inc.’s Peñasquito mine in the northeast corner of the State of Zacatecas, Mexico. The property is accessed by a series of gravel roads from paved Highway 54 and a high tension power line crosses the project. See the following Camino Rojo Property Location Map.

Land Tenure

The Camino Rojo Project consists of six claims covering approximately 340,872 hectares (~1,316 square miles). In order to maintain our rights to these claims, we are required to pay mining taxes to the Mexican government.

History

The Represa Zone, the main zone of mineralization outlined to date at the Camino Rojo Project was discovered in a small quarry dug for road aggregate. The zone was defined by a backhoe test-pitting program that included pits dug at 50-meter intervals along a 700 meter-long, east-west oriented base line and three north-south survey lines ranging from 400 meters to 650 meters in length. The pits were between 1.5 meters and 3.0+ meters deep. Generally, two or more representative samples were collected from bedrock in each pit. Values for individual samples ranged up to 6.18 grams of gold per tonne, 1.24% zinc and 1.46% lead.

Based on a cut-off grade of 0.20 grams of gold per tonne, pit sampling defined an area measuring 300 meters by 500 meters with the following average assay values (based on an arithmetic average of pit samples collected within the zone): gold: 0.65 grams/tonne; silver: 10.7 grams/tonne; zinc: 0.21%; and lead: 0.26%. Within this zone is a higher grade core measuring 175 meters by 275 meters with the following average assay values: gold: 1.00 gram/tonne; silver: 11.3 grams/tonne; zinc: 0.18%; and lead: 0.34%.

Geology

The wholly-owned claims are underlain by sub-horizontal, calcareous siltstones and sandstones of the Caracol Formation. Although most of the claims are covered by overburden, several small volcanic centers are located along a structural lineament 8 to 10 kilometres southeast of the main zone of mineralization on the property, known as the Represa Zone.

The mineralization is hosted by siltstones and sandstones which are bleached, iron-stained and locally brecciated, silicified and cut by quartz veinlets. The area is generally covered with overburden ranging from 0.25 meters to in excess of three meters in thickness. The Represa Zone is open to the east, west and to depth.

Status

To date, a total of 122 diamond and reverse circulation drill holes totalling 39,727 meters have been completed at the Camino Rojo Project. Metallurgical testwork is currently underway and a preliminary assessment of the economics of the project is expected to be commenced later in the year.

Resource Estimate

As of the date of this report, the Camino Rojo Project is without known Mineral Reserves, and any activity carried out on the property is exploratory in nature.

J. Douglas Blanchflower, P. Geo, of Aldergrove, British Columbia completed the following resource estimate for the Camino Rojo Project in accordance with the standards of Canadian National Instrument 43-101 and the definitions of the CIM Standards, in a report dated January 5, 2009.

Cautionary Note to U.S. Investors concerning estimates of Measured Mineral Resources.

Table No. 5 below uses the term “Measured Mineral Resource.” We advise U.S. investors that while such term is recognized and required under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. U.S. investors are cautioned not to assume that any part or all of the mineral deposits in this category will ever be converted into reserves.

Table No. 5

Canplats Resources Corporation

Camino Rojo Project - Represa

Measured Mineral Resource Estimate

(0.2 g/t Gold for oxide and transitional resources and

0.3 g/t Gold for sulphide resources - Cutoff Grade)

Classification | Tonnes (millions) | Gold Grade (g/t) | Silver Grade (g/t) | Zinc (%) | Lead (%) |

Measured | 9.58 | 0.76 | 13.40 | 0.34 | 0.29 |

Cautionary Note to U.S. Investors concerning estimates of Indicated Mineral Resources.

Table No. 6 below uses the term “Indicated Mineral Resource.” We advise U.S. investors that while such term is recognized and required under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. U.S. investors are cautioned not to assume that any part or all of the mineral deposits in this category will ever be converted into reserves.

Table No. 6

Canplats Resources Corporation

Camino Rojo Project - Represa

Indicated Mineral Resource Estimate

(0.2 g/t Gold for oxide and transitional resources and

0.3 g/t Gold for sulphide resources - Cutoff Grade)

Classification | Tonnes (millions) | Gold Grade (g/t) | Silver Grade (g/t) | Zinc (%) | Lead (%) |

Indicated | 153.81 | 0.65 | 11.44 | 0.37 | 0.18 |

Cautionary Note to U.S. Investors concerning estimates of Inferred Mineral Resources.

Table No. 7 below uses the term “Inferred Mineral Resources.” We advise U.S. investors that while such term is recognized and required under Canadian regulations, the SEC does not recognize it. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. U.S. investors are cautioned not to assume that any part or all of an Inferred Mineral Resource exists, or is economically or legally mineable.

Table No. 7

Canplats Resources Corporation

Camino Rojo Project - Represa

Inferred Mineral Resource Estimate

(0.2 g/t Gold for oxide and transitional resources and

0.3 g/t Gold for sulphide resources - Cutoff Grade)

Classification | Tonnes (millions) | Gold Grade (g/t) | Silver Grade (g/t) | Zinc (%) | Lead (%) |

Inferred | 31.03 | 0.56 | 7.63 | 0.31 | 0.10 |

Rodeo Gold Prospect

The Rodeo gold prospect is located approximately 150 kilometres north of Durango, Mexico and is comprised of two mineral claims covering an area of 13,820-hectare (53.4 square miles). The property is accessed by paved highway.

The Rodeo property is located along a major northwest-trending fault system, which places volcanic rocks against limestones and shales.

The Rodeo prospect was explored in the 1990s by Monarch Resources de Mexico, S.A. de C.V., whose objective was to locate near-surface, bulk tonnage gold mineralization. Monarch completed extensive mapping, selective and grid rock chip sampling, and reverse circulation drilling. Sampling demonstrated highly anomalous disseminated and vein-controlled values in gold, silver, arsenic, antimony and mercury. Strong geochemical anomalies were noted in multiple target areas over significant lengths and widths.

In January and February 2004, we carried out a Phase 1 drill program at Rodeo of reverse circulation drilling (a rotary percussion drill in which the drilling mud and cuttings return to the surface through the drill pipe). Results of the program ranged from 0.71 grams per tonne of gold over 10 metres (0.02 ounces per ton of gold over 32.8 feet) to 5.94 grams per tonne of gold over 27 metres (0.17 ounces of gold per ton over 88.6). In September 2004, we completed a Phase 2 drill program at Rodeo, with results ranging from holes with no significant values of gold to 2.04 grams of gold per tonne over 29 metres (0.06 ounces of gold per ton over 95.1 feet). During 2007, a follow up drill program was completed without encountering significant results. In the three programs, a total of 3,291 meters in 25 holes were drilled.

Yerbabuena Gold Prospect

The Yerbabuena gold prospect is located approximately 150 kilometres north-northwest of Durango, Mexico and is comprised of three mineral claims totaling 7,610 hectares (29.4 square miles). The property is accessed by gravel road.

The Yerbabuena prospect is located along a major northwest-trending fault system, which places volcanic rocks against limestones and shales. The property covers four distinct areas of mineralization.

In May 2005, we completed a Phase 1 drill program at Yerbabuena consisting of 12 reverse circulation drill holes totalling 1,882 meters and three diamond drill holes (a type of rotary drill in which the cutting is done by abrasion using diamonds embedded in a matrix with the drill cutting a core of rock which is recovered in long cylindrical sections) totalling 608 meters. Results of the program ranged from no significant values in certain drill holes to 0.57 grams per tonne of gold over 31.5 metres (0.02 ounces of gold per ton over 103 feet). We are currently assessing the property to determine whether follow up work is warranted.

El Rincon Gold Prospect

The El Rincon Gold Prospect is located approximately 100 kilometres north of Durango, Mexico and is comprised of one mineral claim totaling 13,300 hectares (51.4 square miles). The property is accessed by gravel road.

The El Rincon prospect is located along a northeast-trending structural corridor which hosts two nearby gold deposits. The property covers geophysical anomalies, for which mapping, sampling and detailed geophysics are recommended prior to drilling.

Mecatona Gold Prospect

The Mecatona Gold Prospect is located approximately 12 miles south of Parral, Mexico and is comprised of two claims covering approximately 15.4 square miles (4,000 hectares). The property is accessed by gravel road.

The Mecatona Gold Prospect now covers the perceived extensions of the principal veins of the Mecatona gold-silver district where historic mining activities focused on gold-silver production from epithermal veins measuring from one to five meters in thickness. In late 2005, a mapping and sampling program was completed to identify drill sites. In March 2006, a drill program comprised of 10 holes totalling 1,010 meters was completed that tested the Maria and Plateada veins on the Mecatona Gold Prospect. The best results from the drill program came from the Maria Vein where drilling intersected up to 2.4 grams of gold-equivalent per tonne over 42 meters (0.07 ounces of gold-equivalent per ton over 137.8 feet) from surface in hole MC-08. Drilling tested approximately 600 meters of strike length of the vein, which has been mapped over 2,000 meters. In November 2008, we terminated our option agreements that covered the area of historic mining activities. We are currently assessing the remainder of the property, that covers the perceived extensions of the principal veins of the historic mining activities, to determine whether a follow up drill program is warranted.

Maijoma Prospect

The Maijoma Prospect is located approximately 70 kilometres southeast of Ojinaga, Mexico and is comprised of one claim block covering approximately 48 square miles (12,500 hectares). The property is accessed by gravel road from paved Highway 67.

The prospect covers a large (+25 kilometres²) area of hydrothermal alteration within the lower volcanic sequence. This alteration is associated with iron-stained and locally silicified volcanic breccias, rhyolite-to-latite dikes and domes, and highly calcified intrusive rocks. Several small windows through the volcanic sequence have exposed intensely altered limestone and skarn with associated jasperoids, hematite, jarosite, sulphide casts and local gossans up to two meters thick. Exploration targets for the property include massive sulphide veins and replacement zones (mantos and chimneys) localized along structures peripheral to a variably skarned intrusive; and precious and base metals disseminated in the host sedimentary and volcanic rocks around the intrusive. An initial drill program has been recommended based on prospecting, geological mapping and a limited geophysical study; however, the program has been held in abeyance as we focus our financial and technical resources on the Camino Rojo Project.

El Alamo Prospect

The El Alamo Prospect is located 66 kilometres southeast of Presidio, Texas and 42 kilometres northeast of the Maijoma Prospect. We also hold a 100% interest in the Aqua Loca and Los Volcanes claims that cover the area between the ElAlamo Prospect and the Maijoma Prospect (located 42 kilometres to the southwest). The El Alamo Prospect is accessed by gravel road from paved Highway 67.

At El Alamo, a large area of variably-altered sediments and carbonates is enclosed by weakly-altered rhyolite volcanics. Several northwest-trending structures have been mapped and sampled over a strike length of 6 kilometres. Showings along the structure are marked by quartz veining, from 1 meter to 5 meters in width. The host rock has been altered to skarn and marble over varying widths of 5 meters to 25 meters from the vein. Samples along the vein generally assayed between 20 g/t silver and 260 g/t silver. An IP geophysical survey identified several anomalies at shallow to moderate depths which are closely associated with the structures. Further exploration of the El Alamo Prospect has been held in abeyance as we focus our financial and technical resources on the Camino Rojo Project.

Office Space

Under a Management Services Agreement with Silver Standard, we retained Silver Standard to provide us with general corporate management, accounting, administrative and technical services. For personnel, hourly rates charged are based on direct salary costs and benefits, as well as a factor for overhead costs, office equipment, usage, management services personnel, office space and furnishings. In July 2008, we agreed to lease our head office, 1510 - 999 West Hastings Street, for a six year term commencing in September 2008. Under the terms of the lease, we agreed to lease 2,209 square feet of office space at rates increasing from $77,315 in the first year to $88,360 in the sixth year. We have also agreed to pay our proportionate share of operating costs and property taxes over the term of the lease. On October 31, 2008, we gave notice of termination of our Management Services Agreement with Silver Standard. See Item 6D. - “Employees”. As of January 1, 2009, we have retained our own general corporate management, accounting and administrative and technical services staff. Certain Silver Standard personnel are continuing to provide us with services as we complete the transition to operating with our own staff.

| Operating and Financial Review and Prospects |

Management’s discussion and analysis is presented in relation to our financial statements, which statements are prepared in accordance with Canadian GAAP. Reference should be made to note 15 to our financial statements for a discussion of material differences from the amount presented to U.S. GAAP.

Year ended July 31, 2008 compared to year ended July 31, 2007.

During the fiscal year ended July 31, 2008, the Company incurred a loss of $3,595,000 ($0.07 per share) compared to a loss of $872,000 ($0.02 per share) for fiscal year ended July 31, 2007.

Total expenses for the year increased to $3,714,000 from the $931,000 recorded in the prior year. During the year, 2,815,000 (2007 - 2,040,000) stock options were granted to employees, directors and consultants. Stock-based compensation expense for the year was $2,689,000 (2007 - 562,000). The increase was attributed to amortization of the fair value of additional stock options granted during the current year, which increased in part as a result of the addition of management and consultants to advance the Camino Rojo project. Salaries expense was $277,000 compared to $61,000 in the prior year. The increase was also related to senior management added during the year. Without stock-based compensation expense, total expenses in the current year were $1,025,000, resulting in an increase of $656,000 in 2008 compared to 2007. Exploration expense decreased to $41,000 from $129,000 in the prior year as the Company reduced grass roots exploration and continued to focus on the Camino Rojo project after initial drilling results confirmed significant mineralization. The arrangement with G2 Consultants Corporation to provide investor relations services continued throughout fiscal 2008. Total investor relations costs for fiscal 2008 were $350,000 compared to $89,000 recorded in the prior year. Listing and filing fees of $18,000 (2007 - $10,000) increased in the current year due to financing activity. Professional fees of $134,000 (2007 - $34,000) increased in the current year due to accruals for higher audit fees and first year compliance with Bill-198 (Ontario) and Sarbanes-Oxley Act of 2002 (United States). Office costs of $139,000 (2007 - $14,000) increased in the current year due to the Company securing separate office space.

Interest income was $158,000 compared to $76,000 in the prior year. The increase in interest income was due to a higher cash balance on hand subsequent to the Company’s $15,750,000 private placement in February 2008. Foreign exchange gain for the year was $64,000 compared to a loss of $17,000 in the prior year. The foreign exchange gain reflects the fluctuation between the Canadian and US dollar exchange rates during the year. Write-down of mineral properties was $103,000 compared to $nil in the prior year. The write-down relates to the Mecatona property in Mexico after the Company determined to allow option agreements underlying a portion of the mineral claims that comprise the Mecatona property to lapse subsequent to year end.

Year ended July 31, 2007 compared to year ended July 31, 2006.

During the fiscal year ended July 31, 2007, the Company incurred a loss of $872,000 ($0.02 per share) compared to a loss of $336,000 ($0.01 per share) for fiscal year ended July 31, 2006.

Total expenses for the year increased to $931,000 from the $348,000 recorded in the prior year. During the year, 2,040,000 (2006 - nil) stock options were granted to employees, directors and consultants. Stock-based compensation expense for the year was $562,000 (2006 - nil). Without stock-based compensation expense, total expenses in the current year were $369,000, resulting in an increase of $21,000 in 2007 compared to 2006. Exploration expense decreased to $129,000 from $135,000 in the prior year. The arrangement with G2 Consultants Corporation to provide investor relations services continued throughout fiscal 2007. Investor relations costs for fiscal 2007 were $89,000 compared to $88,000 recorded in the prior year and of the amount expended in fiscal 2007. Listing and filing fees of $10,000 (2006 - $14,000) decreased in the current year due to less financing activity. Professional fees of $34,000 (2006 - $10,000) increased in the current year due to an under-accrual in audit fees for the 2006 year-end as well as higher than expected costs associated to the current year’s audit. Office costs of $14,000 (2006 - $7,000) increased in the current year due to additional mailing costs related to the calling of warrants in accordance with the warrant agreements.

Interest income increased to $76,000 in fiscal 2007, compared to $18,000 in fiscal 2006. This increase relates to higher cash balances available for investment and higher interest rates.

Selected Quarterly Financial Data (unaudited)

| | 2008 $ | 2007 $ |

| | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 |

| Total revenues | Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil |

| Loss for the quarter | (810,000)(1) | (583,000) | (417,000) | (1,785,000)(2) | (93,000) | (534,000)(3) | (154,000) | (91,000) |

Loss per share - basic and diluted | (0.01) | (0.01) | (0.01) | (0.04) | (0.00) | (0.01) | (0.00) | (0.01) |

| | (1) | During the first quarter of fiscal 2008, the Company issued 1,620,000 stock options at an exercise price of $0.44. The stock-based compensation expense that was recorded was $348,000. |

| | (2) | During the fourth quarter of fiscal 2008, the Company issued 410,000 stock options at exercise prices between $4.10 - $4.15. The stock-based compensation expense that was recorded was $1,377,000. |