Exhibit 99.2

| | |

|

| |

| Technical Report Preliminary Assessment based on Report Titled “Technical Assessment of Camino Rojo Project Zacatecas, Mexico” | |

|

Prepared by: Minorex Consulting Ltd. Mine and Quarry Engineering Services, Inc.

For Canplats Resources Corporation

Authors: J. Douglas Blanchflower, P. Geo Christopher Kaye, MAusIMM, B,Eng. (Chemical) Howard Steidtmann, MAusIMM, B. Sc. Mining Engineering

Report Date: October 16, 2009 | |

| | |

IMPORTANT NOTICE

This report was prepared as a National Instrument 43-101 Technical Report for Canplats Resources Corporation (“Canplats”) by Mine and Quarry Engineering Services, Inc. (“MQes”) and Minorex Consulting Ltd. (“Minorex”). The quality of information, conclusions, and estimates contained herein is consistent with the level of effort involved in MQes’ and Minorex’s services, based upon: i) information available at the time of preparation, ii) data supplied by outside sources, and iii) the assumptions conditions, and qualifications set for the in this report. This report is intended to be used by Canplats, subject to the terms and conditions of its contracts with MQes and Minorex. These contracts permit Canplats to file this report as a Technical Report with Canadian Securities Regulatory Authorities pursuant to provincial securities legislation. Except for the purposes legislated under provincial secur ities laws, any other use of this report by any third party is at that party’s sole risk.

| | | | |

| SECTION | PAGE |

| |

| 1.0 | SUMMARY | 1-1 |

| 1.1 | General Summary | 1-1 |

| 1.2 | Mineral Resource Estimate | 1-2 |

| 1.3 | Mining | 1-3 |

| 1.4 | Metallurgy | 1-4 |

| 1.5 | Operating Cost Estimate | 1-5 |

| 1.6 | Capital Cost Estimate | 1-6 |

| 1.7 | Economic Analysis | 1-7 |

| 1.8 | Project Development Schedule | 1-8 |

| 1.9 | Conclusions and Recommendations | 1-8 |

| 2.0 | INTRODUCTION AND TERMS OF REFERENCE | 2-1 |

| 2.1 | Sources of Information | 2-2 |

| 2.2 | Units of Measure | 2-3 |

| 3.0 | RELIANCE ON OTHER EXPERTS | 3-1 |

| 4.0 | PROPERTY DESCRIPTION AND LOCATION | 4-1 |

| 4.1 | Property Location | 4-1 |

| 4.2 | Property Description | 4-1 |

| 4.3 | Property Ownership | 4-6 |

| 4.4 | Environmental, Reclamation and Permitting Issues | 4-6 |

| 5.0 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE and PHYSIOGRAPHY | 5-1 |

| 5.1 | Accessibility | 5-1 |

| 5.2 | Physiography, Climate and Vegetation | 5-1 |

| 5.3 | Local Resources and Infrastructure | 5-1 |

| 6.0 | HISTORY | 6-1 |

| 7.0 | GEOLOGICAL SETTING | 7-1 |

| 7.1 | Regional Geology | 7-1 |

| 7.2 | Property Geology | 7-9 |

| | 7.2.1 | | Lithology | 7-9 |

| | 7.2.2 | | Structure | 7-10 |

| | 7.2.3 | | Alteration | 7-10 |

| 8.0 | DEPOSIT TYPES | 8-1 |

| 9.0 | MINERALIZATION | 9-1 |

| 10.0 | EXPLORATION | 10-1 |

| 10.1 | 2007 and Early Exploration Programs | 10-1 |

| 10.2 | Mid-2008 Exploration Program | 10-2 |

| 10.3 | Results of the Exploration Programs | 10-2 |

| 11.0 | DRILLING | 11-1 |

| 11.1 | Reverse Circulation Drilling | 11-1 |

| 11.2 | Diamond Drilling | 11-1 |

| 11.3 | Results of the Drilling Programs | 11-16 |

| 12.0 | SAMPLING METHOD and APPROACH | 12-1 |

i

| | | | |

| 12.1 | Trench Sampling and Logging | 12-1 |

| 12.2 | Reverse Circulation Sampling, Handling, Logging and Storage | 12-1 |

| | 12.2.1 | | Reverse Circulation Sample Handling | 12-1 |

| | 12.2.2 | | Reverse Circulation Sample Geological Logging | 12-1 |

| | 12.2.3 | | Reverse Circulation Sample Storage | 12-2 |

| 12.3 | Drill Core Handling, Logging, Sampling and Storage | 12-2 |

| | 12.3.1 | | Drill Core Photography | 12-2 |

| | 12.3.2 | | Geotechnical Logging | 12-2 |

| | 12.3.3 | | Geological Logging | 12-2 |

| | 12.3.4 | | Drill Core Storage | 12-3 |

| 13.0 | SAMPLE PREPARATION, ANALYSIS and SECURITY | 13-1 |

| 13.1 | Sample Preparation | 13-1 |

| 13.2 | Sample Analyses and Assays | 13-1 |

| 13.3 | Sample Security | 13-2 |

| 14.0 | DATA VERIFICATION | 14-1 |

| 14.1 | 2008 Quality Assurance and Quality Control Program | 14-1 |

| 14.2 | Drilling Data Verification | 14-3 |

| 14.3 | Independent Verification Sampling | 14-3 |

| 15.0 | ADJACENT PROPERTIES | 15-1 |

| 16.0 | MINERAL PROCESSING and METALLURGICAL TESTWORK | 16-1 |

| 16.1 | Metallurgical Testwork | 16-1 |

| | 16.1.1 | | Samples | 16-1 |

| | 16.1.2 | | Mineralogy, Bond Work Index and Crusher Abrasion Index | 16-3 |

| | 16.1.3 | | Column Leach Tests | 16-3 |

| | 16.1.4 | | Bottle Roll Tests | 16-9 |

| | 16.1.5 | | Flotation Tests | 16-14 |

| | 16.1.6 | | Metallurgical Testwork Recommendations | 16-15 |

| 16.2 | Process Description | 16-15 |

| | 16.2.1 | | Process Overview | 16-16 |

| | 16.2.2 | | Primary Crushing, Ore Stockpile and Reclaim | 16-16 |

| | 16.2.3 | | Fine Crushing and Reclaim, Fine Ore Stockpiles | 16-17 |

| | 16.2.4 | | Heap Leaching | 16-18 |

| | 16.2.5 | | Merrill-Crowe Refinery | 16-18 |

| | 16.2.6 | | Refinery | 16-19 |

| 17.0 | MINERAL RESOURCE and MINERAL RESERVE ESTIMATES | 17-1 |

| 17.1 | Introduction | 17-1 |

| 17.2 | Database | 17-1 |

| 17.3 | Data Verification | 17-2 |

| 17.4 | Compositing | 17-2 |

| 17.5 | Geological Modelling | 17-3 |

| 17.6 | Rock code Determination | 17-7 |

| 17.7 | Grade Capping | 17-7 |

| 17.8 | Bulk Density | 17-8 |

| 17.9 | Variography | 17-8 |

| 17.10 | Block Model | 17-9 |

| 17.11 | Interpolation | 17-9 |

ii

| | | | |

| 17.12 | Interpolation Validation | 17-12 |

| 17.13 | Resource classification | 17-13 |

| 17.14 | Resource Estimate | 17-14 |

| 17.15 | Resource Validation | 17-18 |

| 17.16 | Dilution and Mining Recovery | 17-20 |

| 17.17 | Open Pit Optimization | 17-20 |

| 17.18 | Reserve Estimate | 17-23 |

| 18.0 | OTHER RELEVANT DATA and INFORMATION | 18-1 |

| 19.0 | ADDITIONAL REQUIREMENTS for TECHNICAL REPORTS on DEVELOPMENT PROPERTIES and PRODUCTION PROPERTIES | 19-1 |

| 19.1 | Geotechnical | 19-1 |

| 19.2 | Proposed Mining Operations | 19-1 |

| | 19.2.1 | | Mining Method and Equipment | 19-1 |

| | 19.2.2 | | Open Pit Design | 19-1 |

| | 19.2.3 | | Waste Storage Area | 19-1 |

| | 19.2.4 | | Grade Control | 19-2 |

| | 19.2.5 | | Production Schedules and Blending | 19-2 |

| 19.3 | Hydrology and Hydrogeology | 19-4 |

| | 19.3.1 | | Open Pit Dewatering | 19-4 |

| | 19.3.2 | | Water Supply | 19-4 |

| 19.4 | Dam Designs and Management | 19-4 |

| 19.5 | Infrastructure and Services | 19-4 |

| | 19.5.1 | | Sterilization Drilling | 19-4 |

| | 19.5.2 | | Power Supply | 19-4 |

| | 19.5.3 | | Buildings | 19-4 |

| | 19.5.4 | | Roads | 19-4 |

| 19.6 | Project Development Schedule | 19-5 |

| 19.7 | Project Economics | 19-5 |

| | 19.7.1 | | Capital Cost Estimate | 19-5 |

| | 19.7.2 | | Operating Cost Estimate | 19-7 |

| | 19.7.3 | | Economic Analysis | 19-8 |

| 19.8 | Risk and Opportunity Analysis | 19-10 |

| | 19.8.1 | | Data Collection | 19-10 |

| | 19.8.2 | | Resources | 19-11 |

| | 19.8.3 | | Mining and Reserves | 19-11 |

| | 19.8.4 | | Geotechnics and Hydrology | 19-12 |

| | 19.8.5 | | Metallurgy and Processing | 19-12 |

| | 19.8.6 | | Infrastructure and Services | 19-13 |

| | 19.8.7 | | Environmental Impacts and Permitting | 19-13 |

| | 19.8.8 | | Project Implementation | 19-13 |

| | 19.8.9 | | Project Economics | 19-13 |

| 20.0 | INTERPRETATIONS AND CONCLUSIONS | 20-1 |

| 21.0 | RECOMMENDATIONS | 21-1 |

| 21.1 | Proposed Exploration Budget | 21-3 |

| 21.2 | Proposed Work Program to Advance Project to Prefeasibility Level | 21-3 |

| 22.0 | REFERENCES | 22-1 |

| | |

| 23.0 | DATE and SIGNATURE PAGE | 23-1 |

iii

| |

| TABLE | PAGE |

| |

| Table 1-1: Estimated Mineral Resources – Represa Zone | 1-3 |

| Table 1-2: Process Operating Costs | 1-6 |

| Table 1-3: Initial Capital Cost Summary | 1-6 |

| Table 1-4: Effect of Metal Prices on Project Economics | 1-7 |

| Table 4-1: Summary of Mining Concession Data | 4-2 |

| Table 11-1: Summary of Drilling Data Reverse Circulation Drill Holes | 11-3 |

| Table 11-2: Diamond Drill Holes for Metallurgical Sampling | 11-5 |

| Table 11-3: Summary of Drilling Data Diamond Drill Holes | 11-6 |

| Table 11-4: Summary of Drilling Reports Reverse Circulation Drill Hole Intercepts | 11-12 |

| Table 14-1: Description of Verification Samples | 14-4 |

| Table 16-1: Metallurgical Testwork Composites – SGS Program 1 | 16-2 |

| Table 16-2: Metallurgical Testwork Composites – SGS Program 2 | 16-3 |

| Table 17-1: Summary of Types of Sample Data | 17-2 |

| Table 17-2: Rock code Description | 17-7 |

| Table 17-3: Grade Capping Values | 17-7 |

| Table 17-4: Summary of Statistics of Uncapped and Capped Composites | 17-8 |

| Table 17-5: Block Model Parameters | 17-9 |

| Table 17-6: Interpolation Parameters | 17-10 |

| Table 17-7: Summary of ‘One Out’ Cross-Validation Results | 17-13 |

| Table 17-8: Cut-Off Gold Grade Data for Open Pit and Heap Leach Operations** | 17-15 |

| Table 17-9: Represa Mineral Resource Estimate | 17-15 |

| Table 17-10: Cut-Off Gold Grade Sensitivity for Represa Resource Estimate | 17-17 |

| Table 17-11: Reblocked Resource (10mx10mx5m SMU) at 0.2g/t Gold Cutoff | 17-20 |

| Table 17-12: Pit Optimization Economic Parameters | 17-21 |

| Table 17-13: Top Ten NPV5 Results | 17-22 |

| Table 19-1: Annual Mine Production Schedule | 19-3 |

| Table 19-2: Estimated Initial Capital Cost - Summary | 19-6 |

| Table 19-3: Conceptual Process Operating Cost Summary | 19-8 |

| Table 19-4: General and Administration Costs | 19-8 |

| Table 19-5: Effect of Metal Prices on Project Economics | 19-10 |

| Table 19-6: Comparison of NPV at 5% and IRR Versus Processing Rates | 19-10 |

| Table 20-1:Undiluted Global Resource-Oxide, Transition & Sulphide Mineralization | 20-2 |

| Table 21-1: Proposed Exploration Development Program – Estimated Expenses | 21-3 |

| Table 21-2: Requirements for Pre-Feasibility Study – Eng. & Design Perspective | 21-4 |

| Table 21-3: Estimated Budget to Advance Project to a Pre-Feasibility Level | 21-5 |

iv

| |

| FIGURE | PAGE |

| |

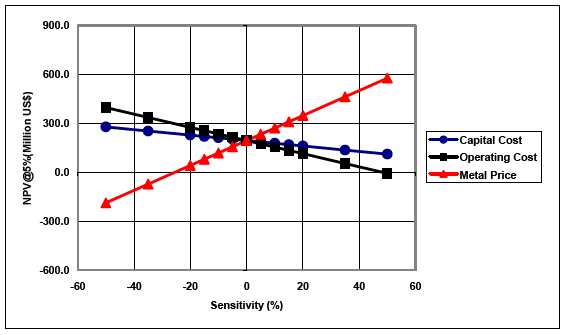

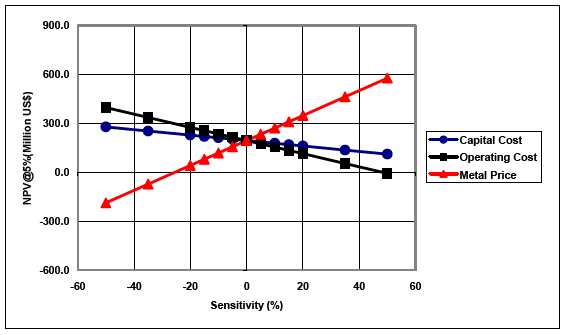

| Figure 1-1: NPV at 5% - Sensitivity Analysis | 1-7 |

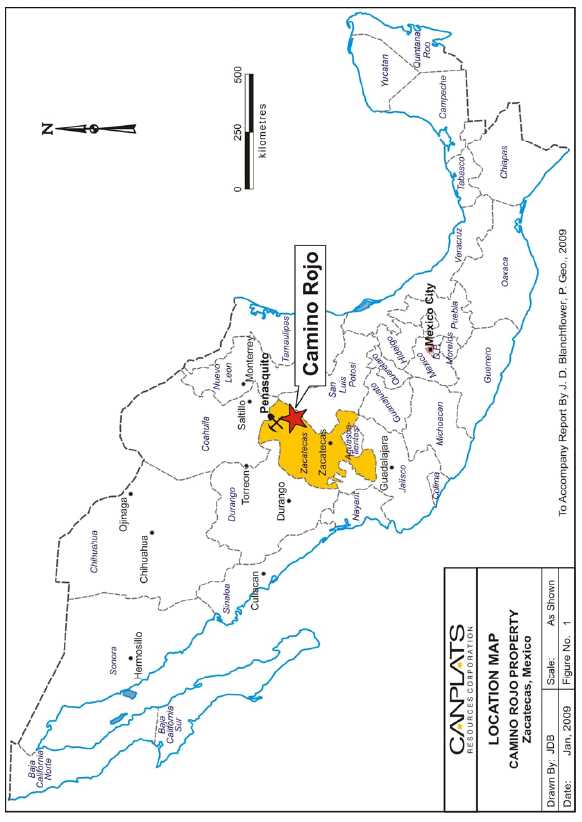

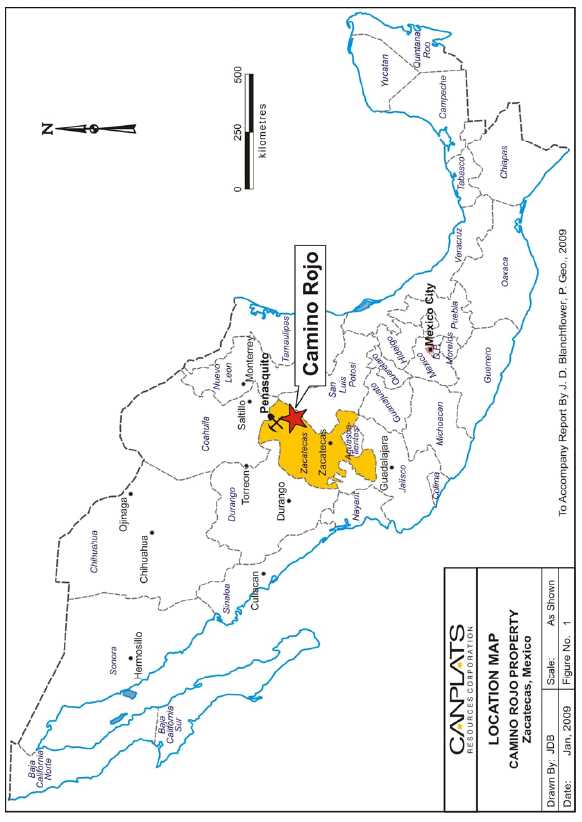

| Figure 4-1: Location Map | 4-3 |

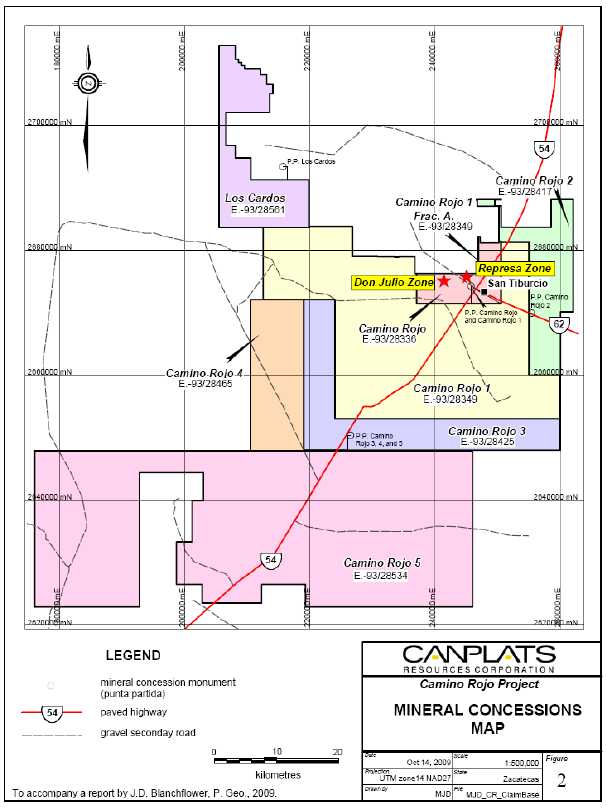

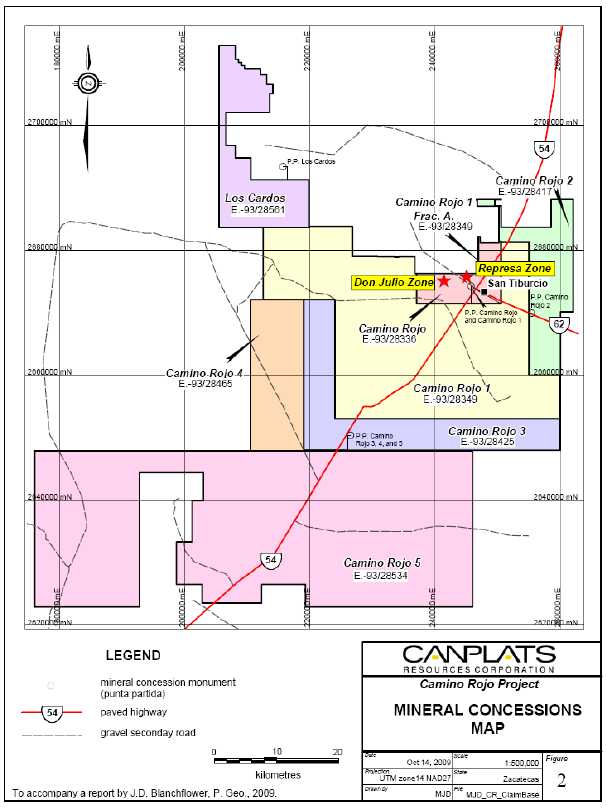

| Figure 4-2: Mineral Concessions Map | 4-4 |

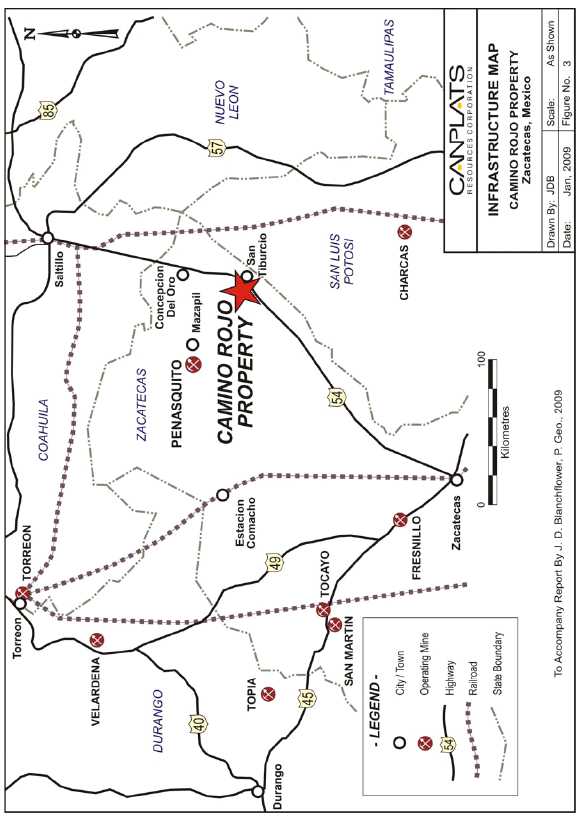

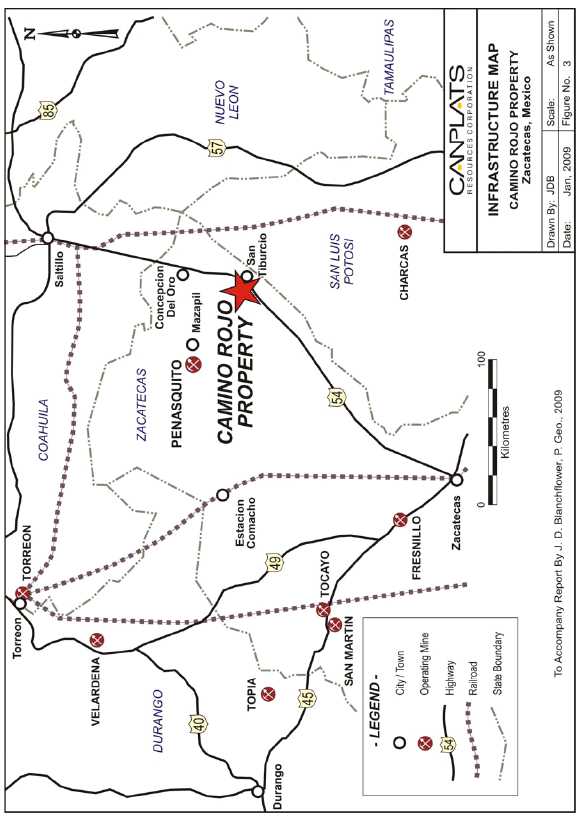

| Figure 4-3: Infrastructure Map | 4-5 |

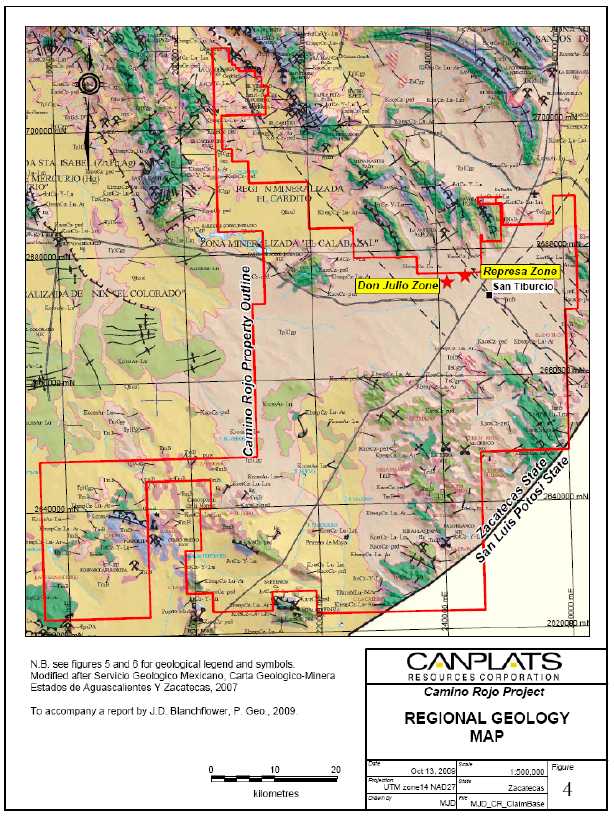

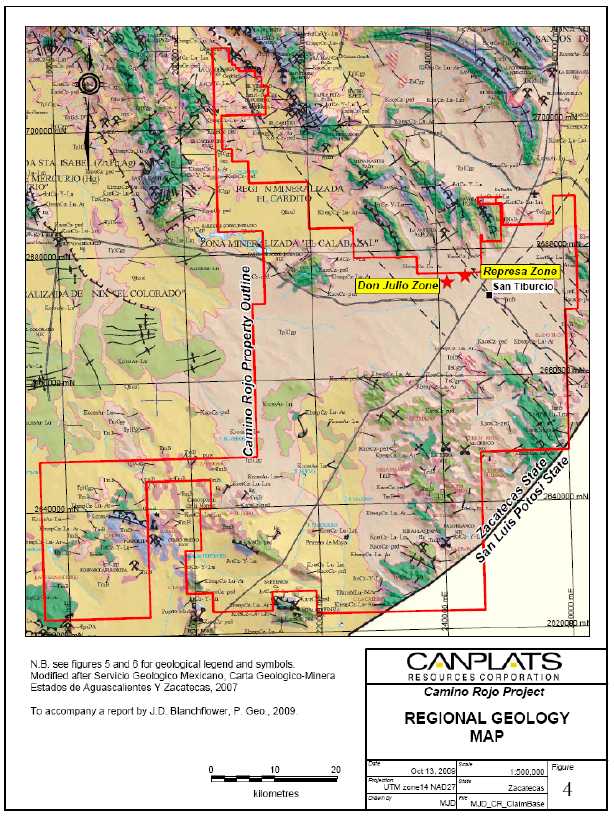

| Figure 7-1: Regional Geology Map | 7-3 |

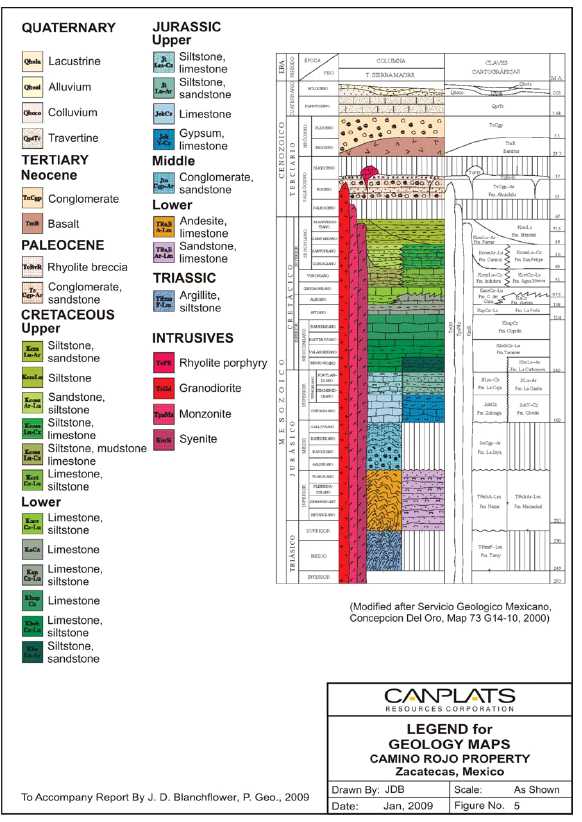

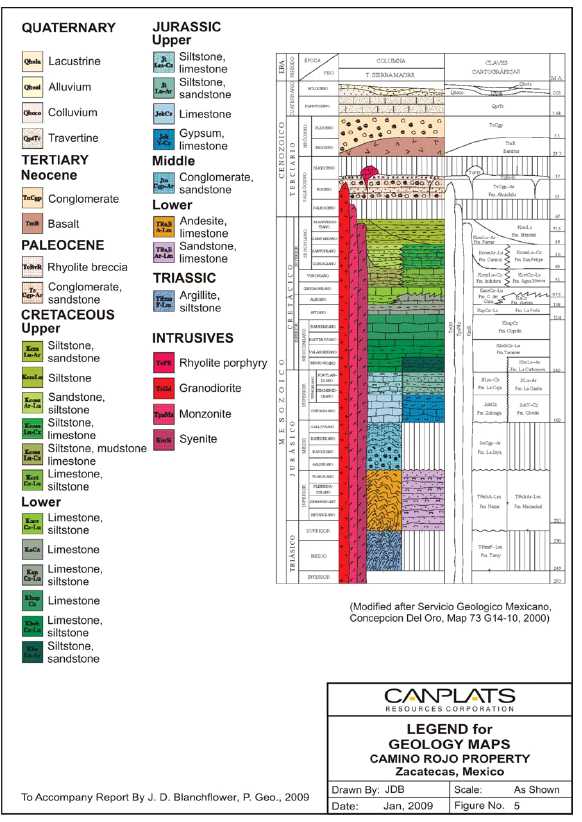

| Figure 7-2: Legend for Geology Maps | 7-4 |

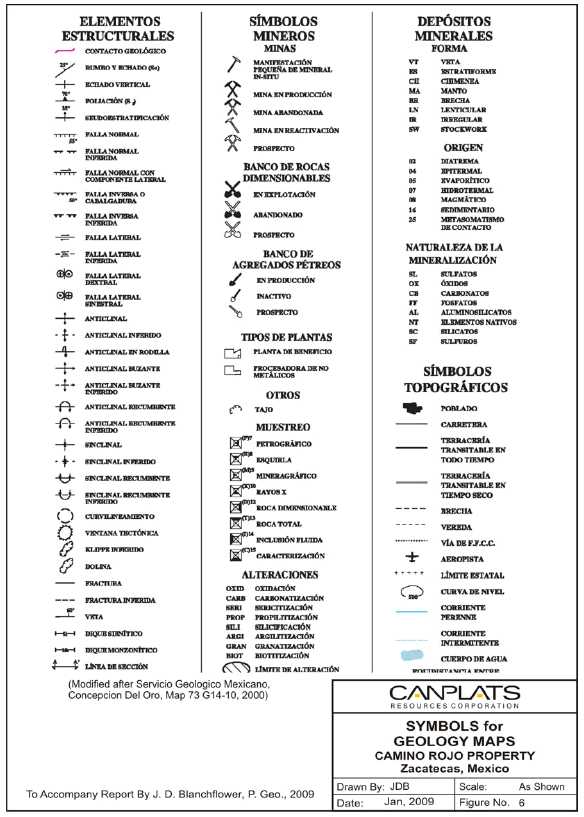

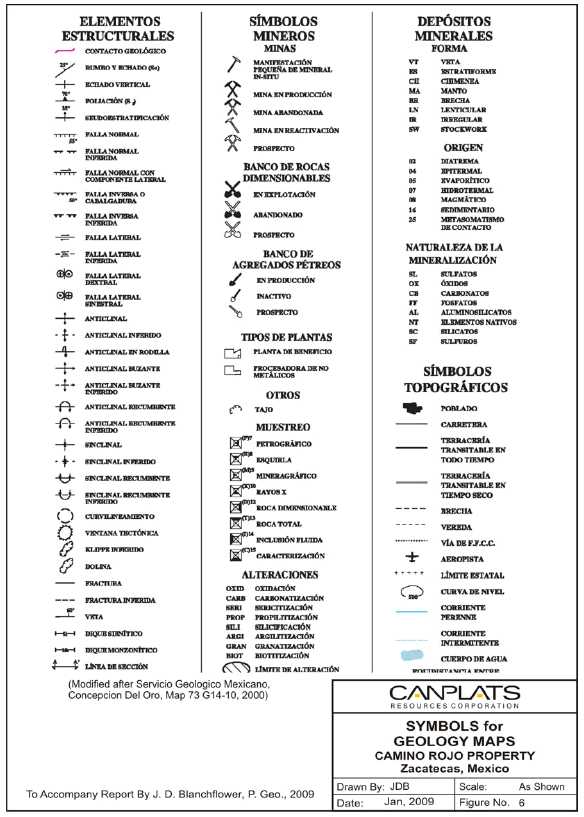

| Figure 7-3: Symbols for Geology Maps | 7-5 |

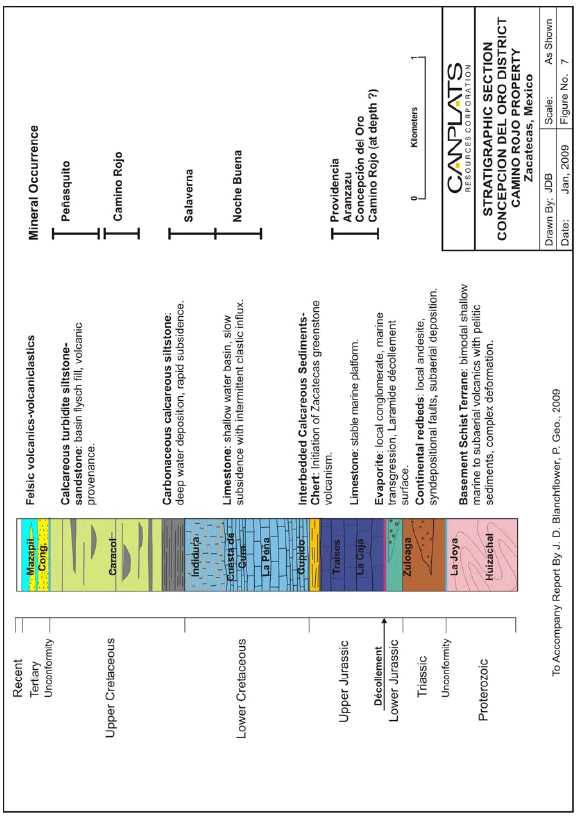

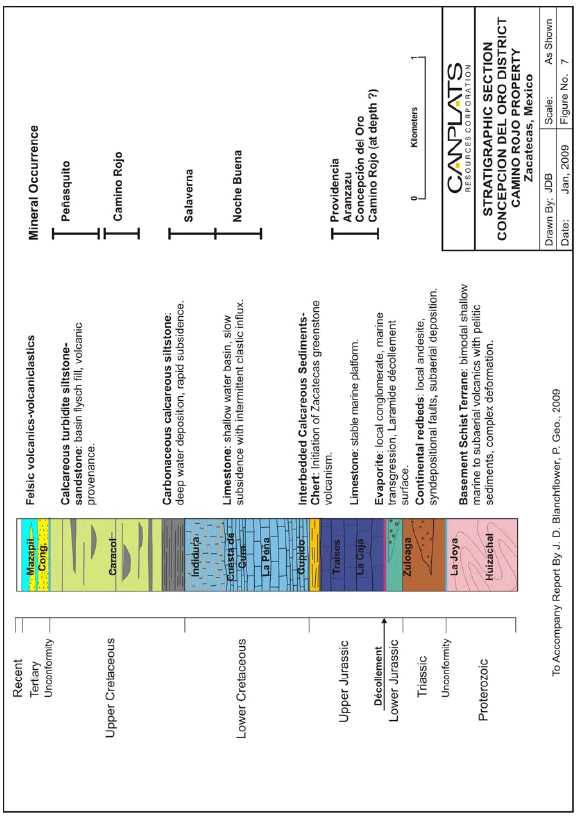

| Figure 7-4: Stratagraphic Section Concepcion Del Oro District | 7-6 |

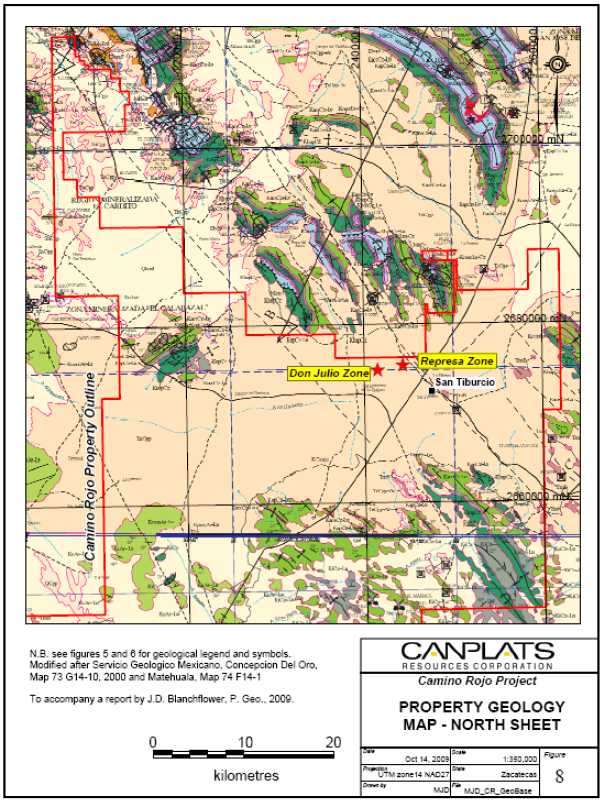

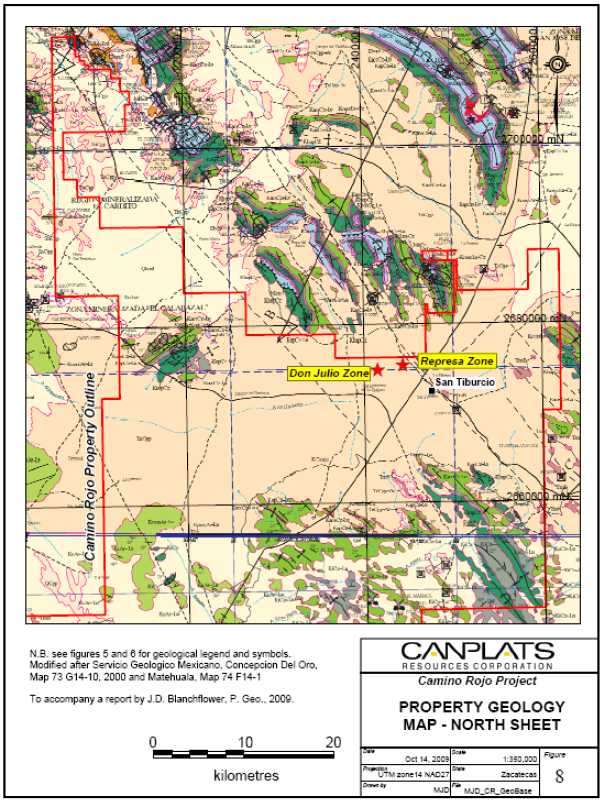

| Figure 7-5: Property Geology Map – North Sheet | 7-8 |

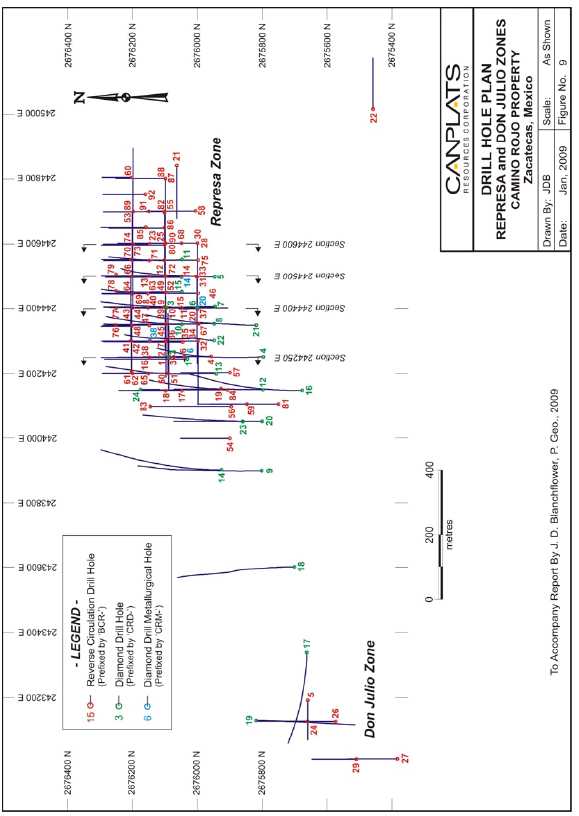

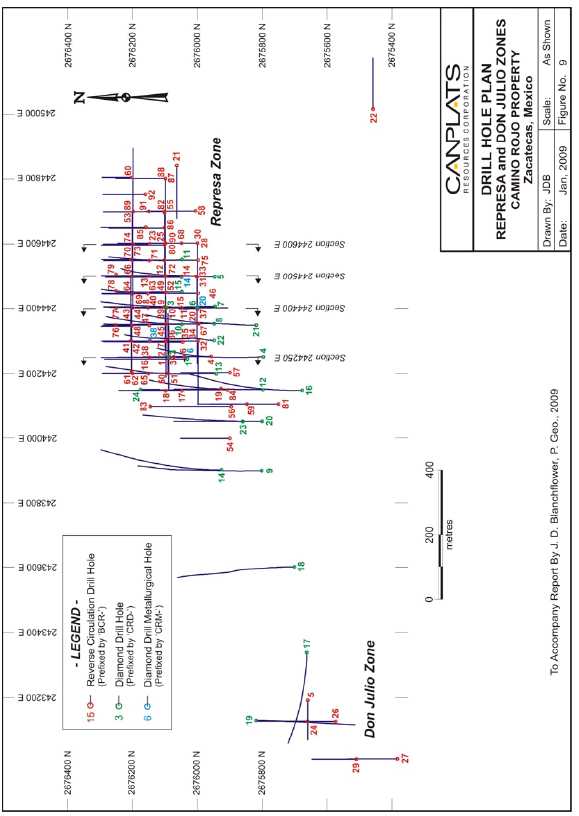

| Figure 11-1: Drill Hole Plan – Represa and Don Julio Zones | 11-7 |

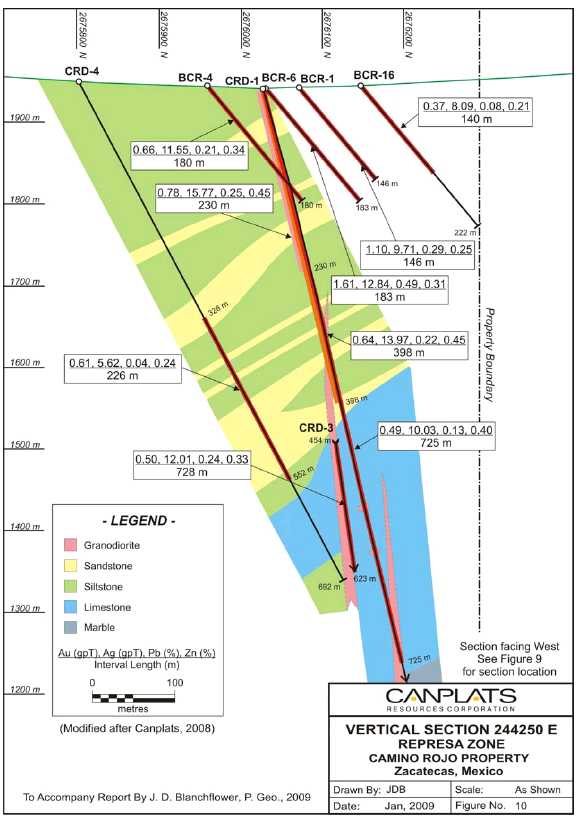

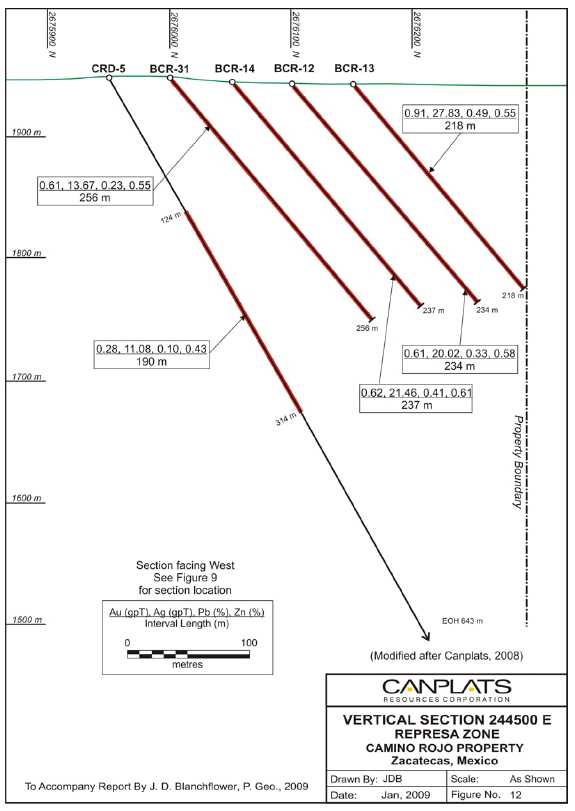

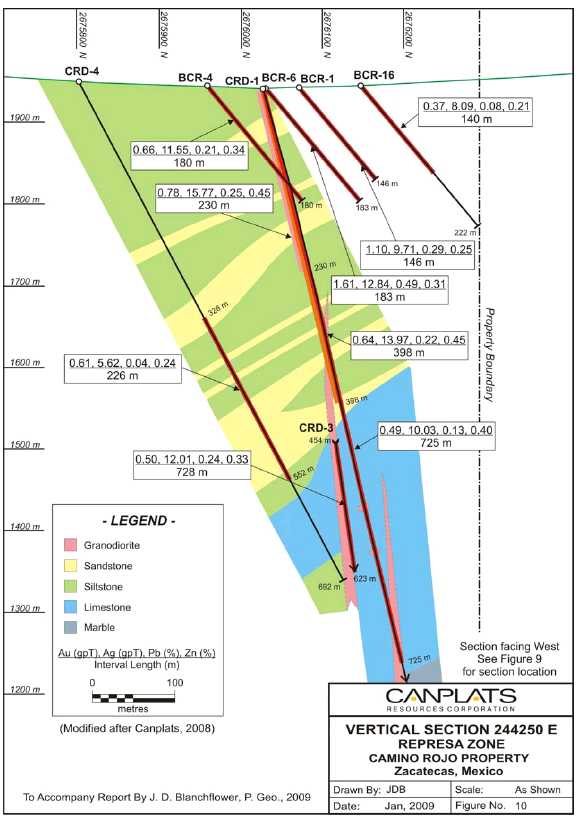

| Figure 11-2: Vertical Section 244250 E Represa Zone | 11-8 |

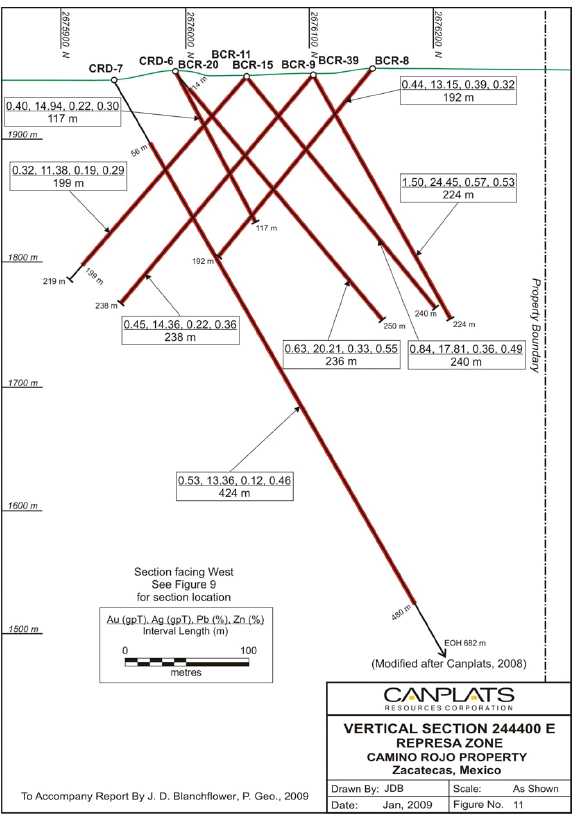

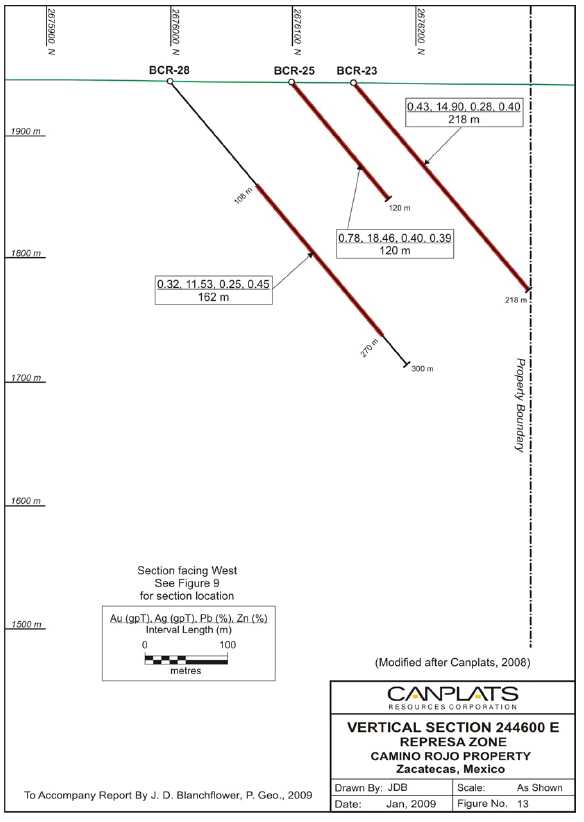

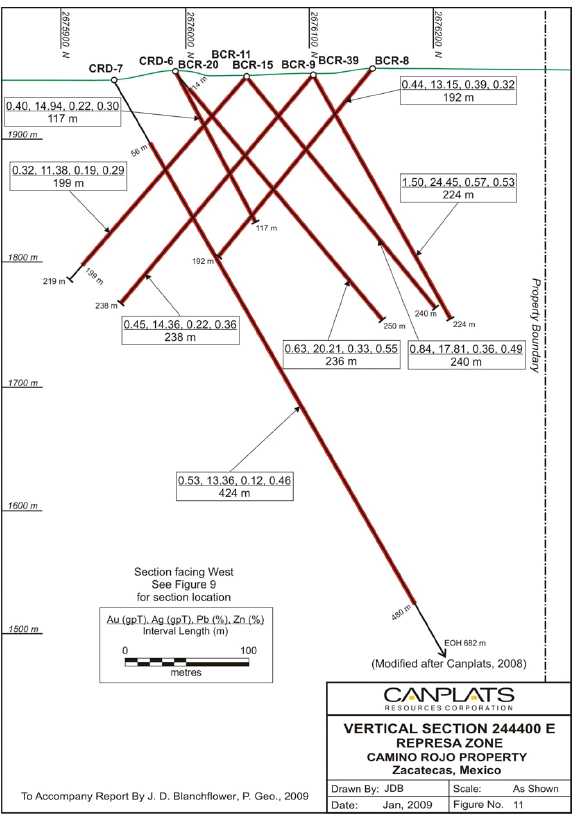

| Figure 11-3: Vertical Section 244400 E Represa Zone | 11-9 |

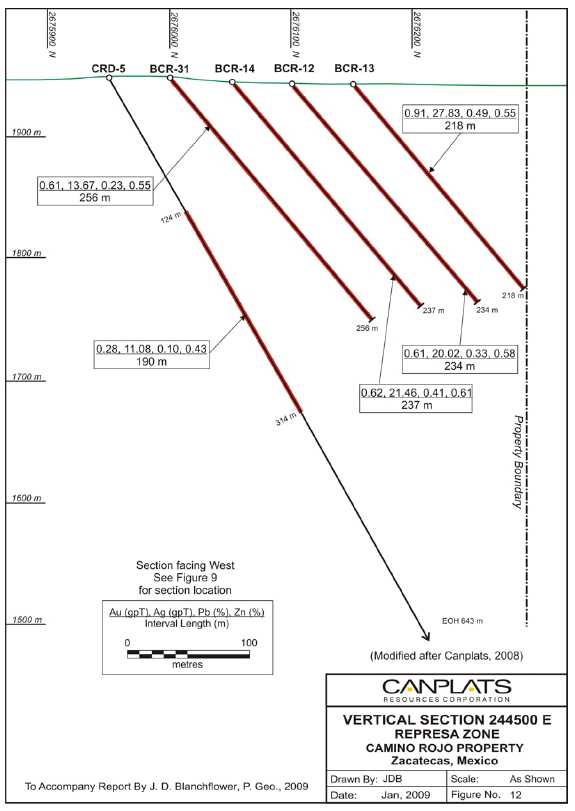

| Figure 11-4: Vertical Section 244500 E Represa Zone | 11-10 |

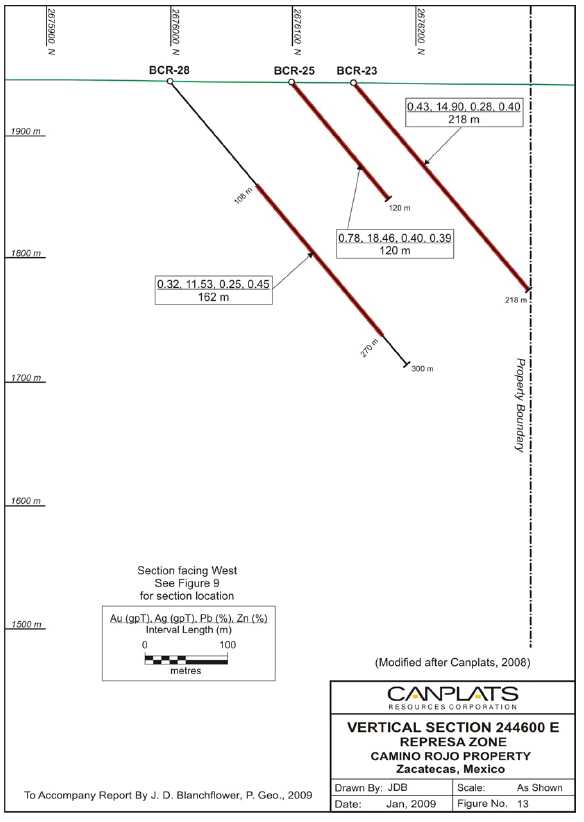

| Figure 11-5: Vertical Section 244600 E Represa Zone | 11-11 |

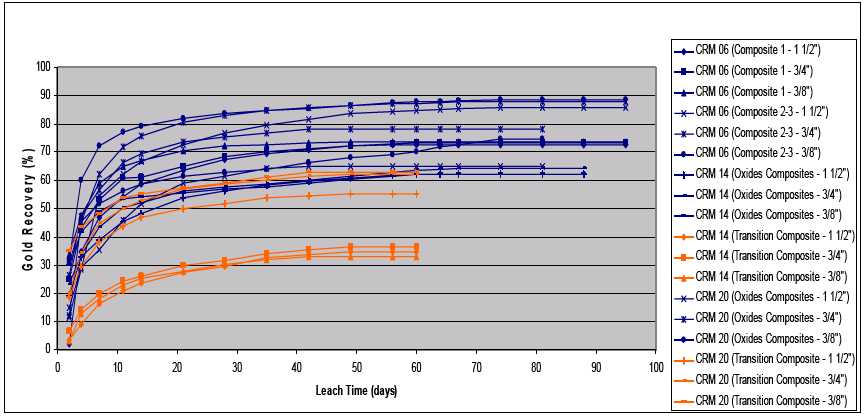

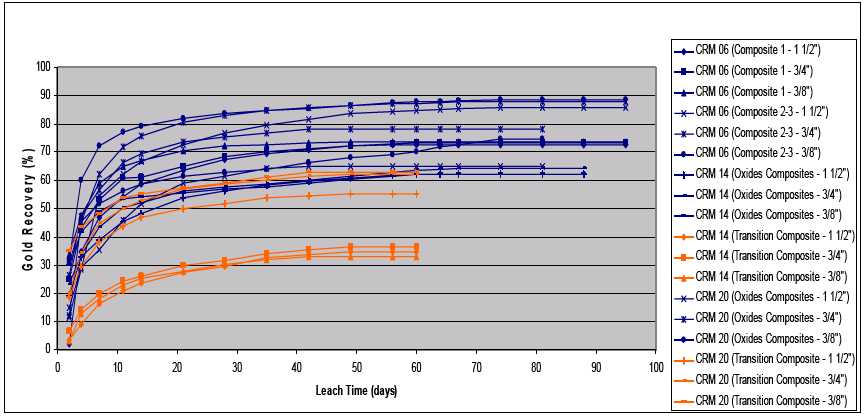

| Figure 16-1: Effect of Crush Size on Gold Recovery – Oxide Material | 16-4 |

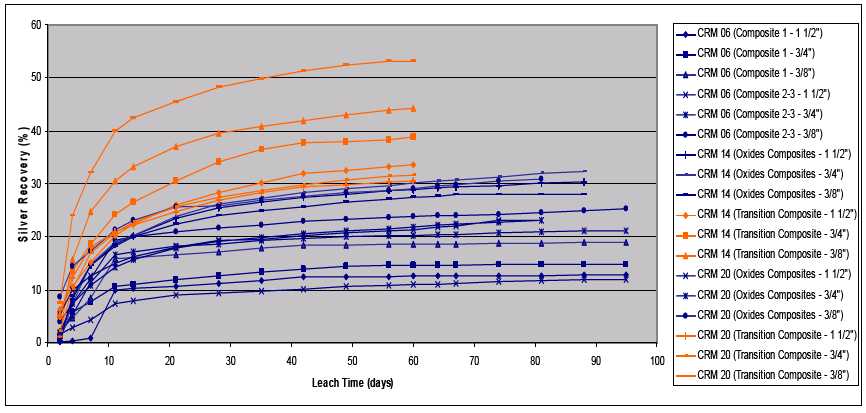

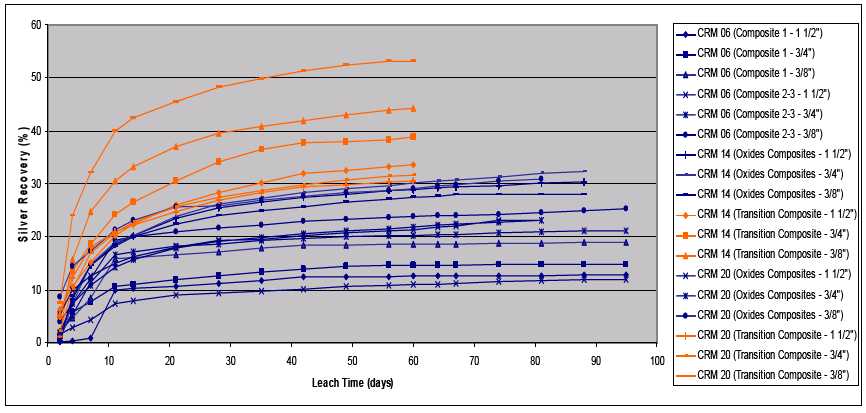

| Figure 16-2: Effect of Crush size on Silver Recovery – Oxide Material | 16-5 |

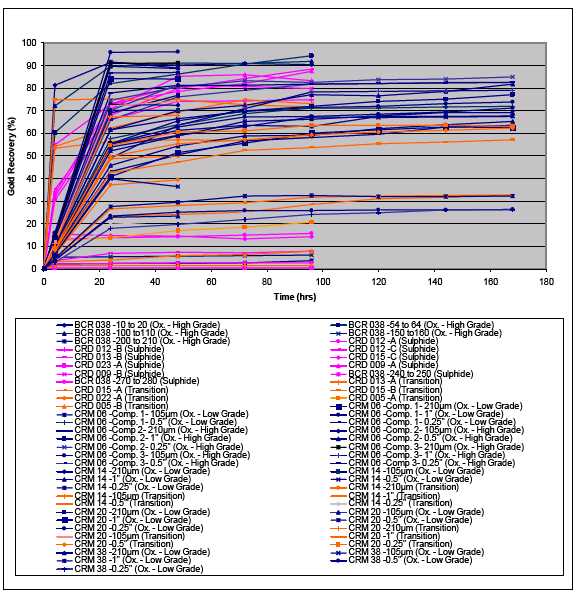

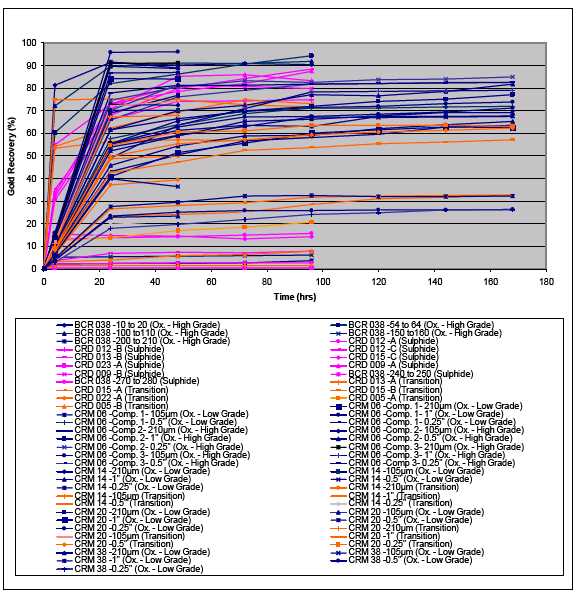

| Figure 16-3: Effect of Leach Time on gold Recovery | 16-6 |

| Figure 16-4: Effect of Leach Time on Silver Recovery | 16-7 |

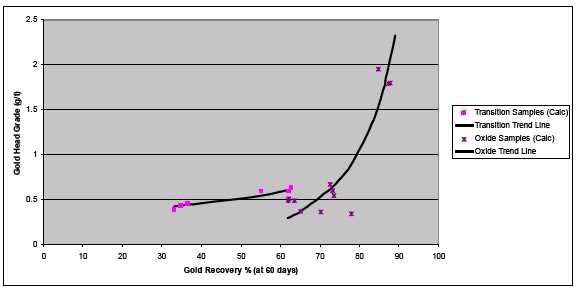

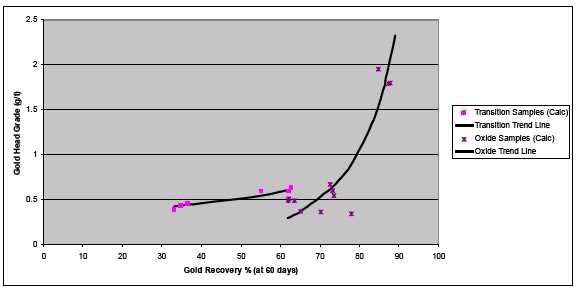

| Figure 16-5: Gold Recovery Versus Gold Head Grade | 16-8 |

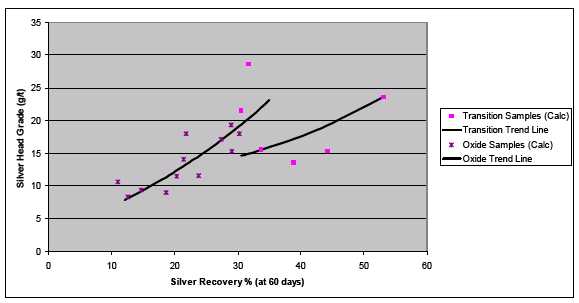

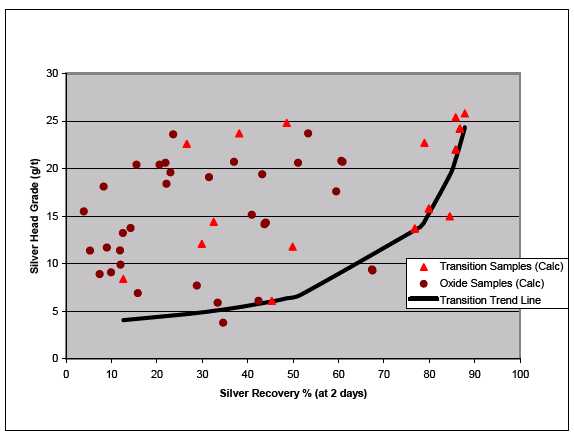

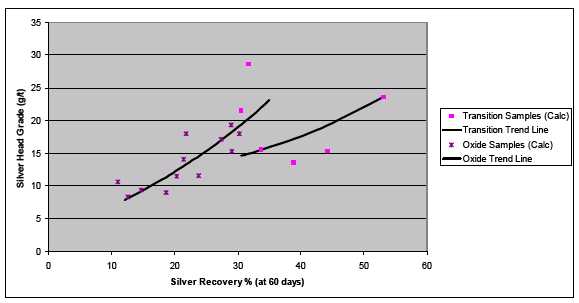

| Figure 16-6: Silver Recovery Versus Silver Head Grade | 16-9 |

| Figure 16-7: Effect of Leach Time on Gold Recovery | 16-10 |

| Figure 16-8: Effect of Leach Time on Silver Recovery | 16-11 |

| Figure 16-9: Gold Recovery Versus Gold Head Grade | 16-12 |

| Figure 16-10: Silver Recovery Versus Silver Head Grade | 16-13 |

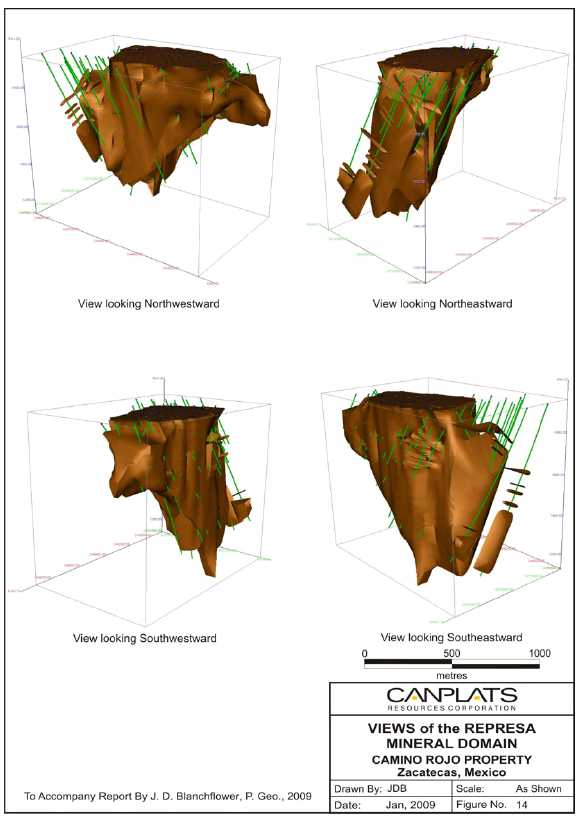

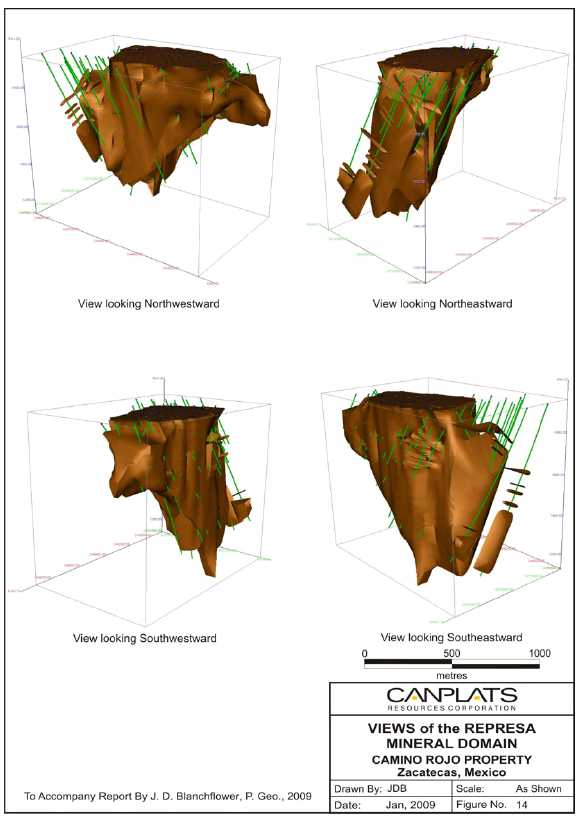

| Figure 17-1: Views of the Represa Mineral Domain | 17-5 |

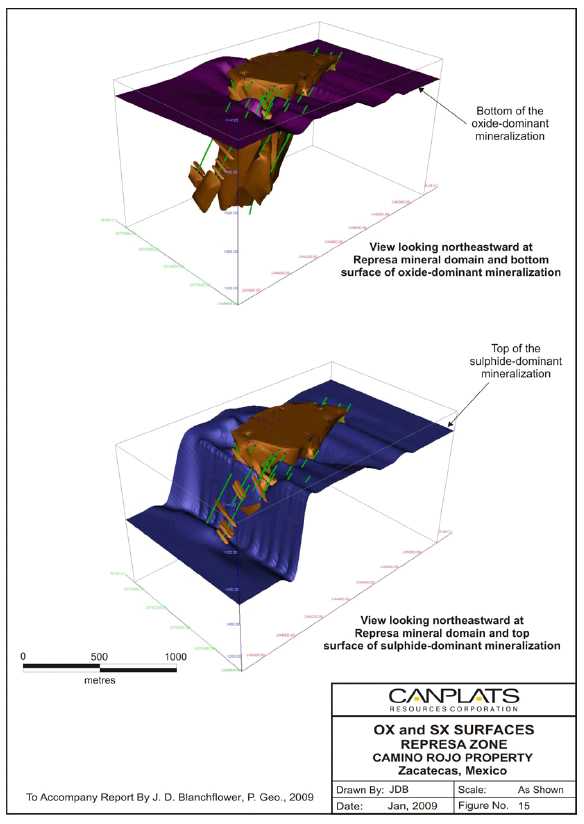

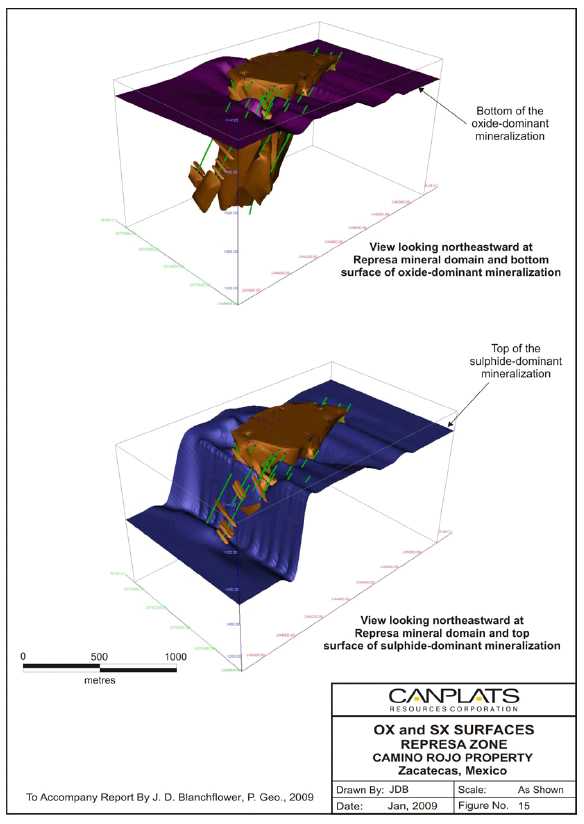

| Figure 17-2: OS and SX Surfaces Represa Zone | 17-6 |

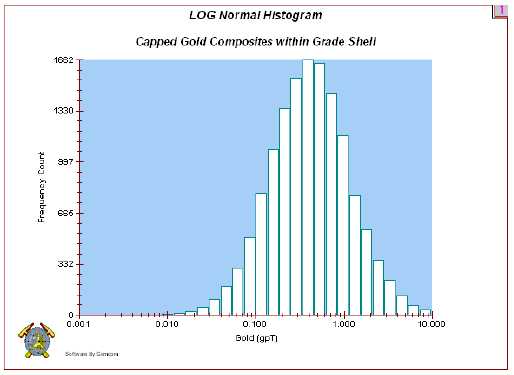

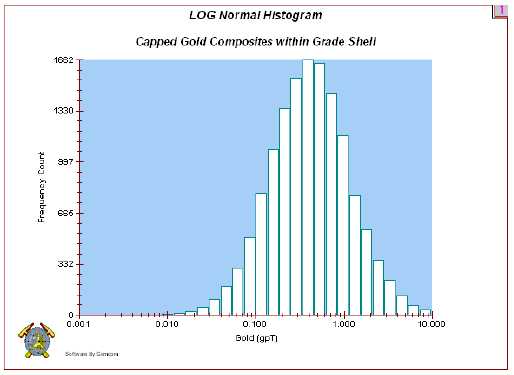

| Figure 17-3: Log Normal Histrogram Plot of Capped Gold Composites | 17-11 |

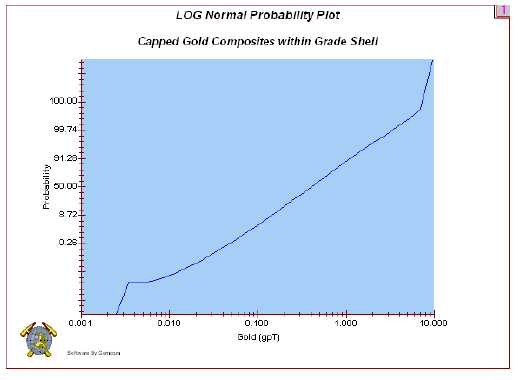

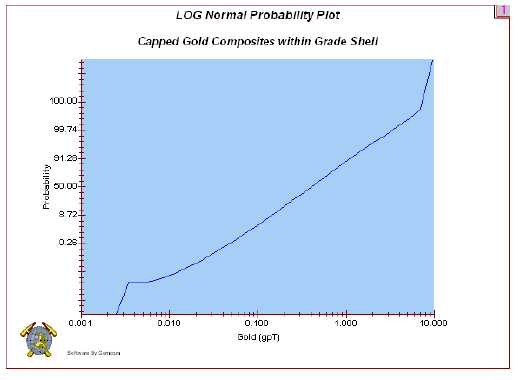

| Figure 17-4: Log Normal Probability Plot of Capped Gold Composites | 17-11 |

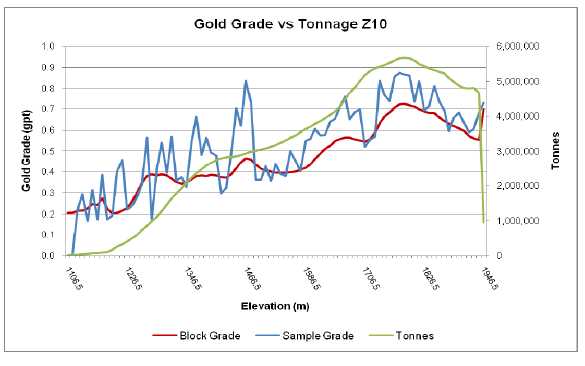

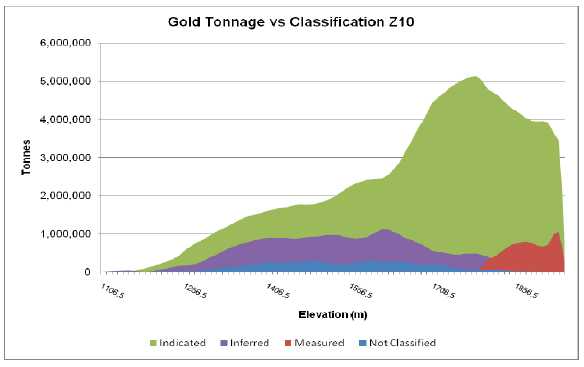

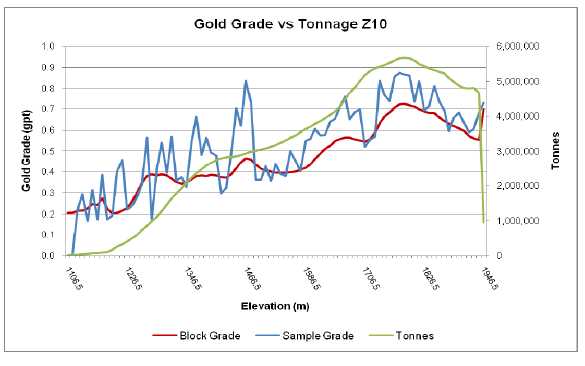

| Figure 17-5: Gold Block Grade, Gold Sample Grade and Tonnage | 17-18 |

| Figure 17-6: Number of Gold Composite Samples Versus Tonnage | 17-19 |

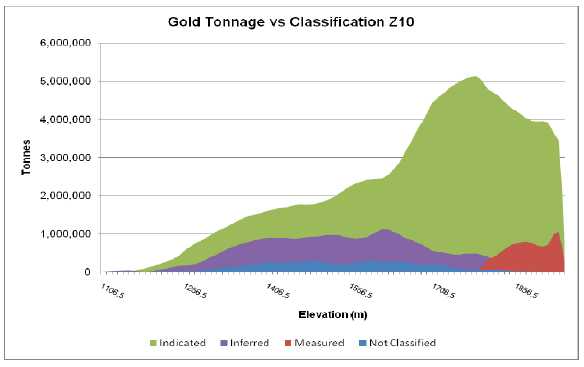

| Figure 17-7: Tonnage Versus Classification | 17-19 |

| Figure 17-8: Project Economic Performance NPV5: US$800/oz Au | 17-22 |

| Figure 17-9: Base Case Ultimate Pit Limit, Pit Shell 58 | 17-23 |

| Figure 19-1: NPV@5% - Sensitivity Analysis | 19-9 |

v

SECTION 1

SUMMARY

1.0

SUMMARY

1.1

General Summary

The Camino Rojo property is situated near the town of San Tiburcio within the southern portion of the Concepciòn del Oro district in the northeastern part of Zacatecas State, Mexico; approximately 206 kilometres northeast of the state capital city of Zacatecas. At the request of Canplats Resources Corporation (“Canplats”), Minorex Consulting Ltd. (“Minorex”) previously reviewed and compiled the 2007 and 2008 exploration results and estimated the mineral resources of the Represa zone within the property (Blanchflower, 2008 and 2009). Two preliminary metallurgical testwork programs have been completed investigating the recoveries of gold and silver from oxide and transition samples as well as recoveries of lead, zinc, gold and silver from sulphide samples from the Represa Zone. In April, 2009 Mine and Quarry Engineering Services, Inc. (“MQes”) was retained by Canplats Resource Corporation (“Canplats”) to perform a Technical Assessment which evaluated the recovery of gold and silver via heap leaching (20,000tpd) from oxide and transition material in the Represa zone.

The Camino Rojo property is comprised of six mining concessions and one fractional concession that are owned and operated by Canplats de Mexico, S.A. de C.V., a wholly-owned Mexican-registered subsidiary of Canplats Resource Corporation. These mining concessions are: ‘Camino Rojo’, ‘Camino Rojo 1’, ‘Camino Rojo 2’, ‘Camino Rojo 3’, ‘Camino Rojo 4’, ‘Camino Rojo 5’ and the fractional concession ‘Camino Rojo 1 Fracc. A’. Title to a seventh mining concession, the Los Cardos mining concession, is currently being transferred into Canplats de Mexico, S. A. de C.V. In total these concessions cover approximately 338,930 hectares or 1,309 square miles.

The Camino Rojo gold-silver-lead-zinc occurrence is a new discovery with no evidence of prior exploration. Canplats has carried out aggressive and continuous exploration work on the property since its discovery in July 2007. During the intervening time, this exploration work has included: prospecting, reconnaissance geological mapping, test pitting with geochemical sampling, trenching with geological mapping and geochemical sampling, induced polarization surveying, and reverse circulation and diamond drilling.

The 2007 to 2008 exploration work has dominantly focused on the Represa zone where a large occurrence of gold-, silver-, lead- and zinc-bearing mineralization is hosted by highly altered, silicified and oxidized metasedimentary rocks. The Represa zone has been traced by drilling for more than 1,000 m east-west, 460 m north-south and vertically to a depth of 820 m. Drill hole intercepts (not true widths) with gold and silver values exceeding 0.25g/t and 5g/t respectively range from 52 to 728 m. Within these drilling intercepts the precious metal-bearing mineralization has good lateral and vertical continuity.

1-1

A second nearby zone, the ‘Don Julio’ zone, has been identified by a 1,000 m long by 400 m wide induced polarization anomaly and tested by eight drill holes. This drilling has intersected favourable alteration of the country rocks with local gold values, and extended Represa-style mineralization to its eastern margin at depth. Only a small portion of the Don Julio zone has been tested and more extensive drilling is warranted. Two diamond drill holes also tested a favourable geophysical anomaly situated approximately 1,200 m west-southwest of the Don Julio zone. These drill holes intersected favourably altered country rocks but no significant mineralization.

A compilation of regional geological, geophysical and structural features shows that the Camino Rojo property covers at least seven additional geological and/or geophysical targets with good exploration potential. Three targets are hydrothermal alteration zones spatially associated with northwesterly trending regional faults, and the other four targets are inferred intrusive centres with possibly related precious metal mineralization.

1.2

Mineral Resource Estimate

The Represa zone has been explored with 86 reverse circulation drill holes, 25 diamond drill holes and more than 11 excavator trenches. Canplats provided an audited database that included multi-element analyses for 19,913 drill hole samples and 320 trench samples situated within the Represa zone.

Polylines were plotted on sections spaced at 25-metre intervals to define the greater than 0.1g/t gold assay boundary for the mineralization while maintaining zonal continuity along strike and downdip. Thirteen individual geometric solids were formed reflecting the three-dimensional boundaries of the Represa mineral domain. Using the constructed solids as constraints, statistical analyses were carried out on the assay samples within the mineral domain and grade capping levels were determined at: 9.50g/t for gold, 87.00g/t for silver, 1.40% for lead and 2.50% for zinc. Once the assay data had been capped 2-metre composites were calculated for grade interpolation.

The Represa block model was created with 5m by 5m by 5m blocks for 300 columns, 180 rows and 180 levels, it was not rotated, and it was coded to partial blocks. Ordinary kriging was used to interpolate grades for gold, silver, lead and zinc, and inverse distance power 2 (ID2) was utilized to define measured resource blocks for classification. A bulk density of 2.681 g/cc was used for tonnage calculations of all mineralized material. Mineral resources were estimated individually for the near-surface oxidized mineralization, transitional mixed oxidized and sulphide mineralization, and buried sulphide mineralization. The boundary for each type of mineralization was based upon data provided by Canplats. Cut-off gold grades were established at 0.2g/t gold for the oxide and transitional mineralization, and 0.3g/t for the sulphide mineralization. The undiluted mineral resources of the Represa zone ar e estimated as shown in Table 1-1.

1-2

Table 1-1: Estimated Mineral Resources – Represa Zone

| | | | | | | |

Oxide | Tonnes | Gold | Silver | Lead | Zinc | Gold | Silver |

0.2 g/t Au Cut-Off | (000's) | (g/t) | (g/t) | (%) | (%) | (000's oz) | (000's oz) |

Measured | 9,571 | 0.76 | 13.40 | 0.29 | 0.34 | 234 | 4,122 |

Indicated | 54,372 | 0.69 | 13.24 | 0.25 | 0.34 | 1,210 | 23,146 |

Meas & Ind | 63,943 | 0.70 | 13.26 | 0.26 | 0.34 | 1,444 | 27,268 |

Inferred | 2,407 | 0.55 | 10.89 | 0.19 | 0.27 | 42 | 843 |

| | | | | | | |

Transitional | Tonnes | Gold | Silver | Lead | Zinc | Gold | Silver |

0.2 g/t Au Cut-Off | (000's) | (g/t) | (g/t) | (%) | (%) | (000's oz) | (000's oz) |

Measured | 5 | 1.04 | 19.94 | 0.28 | 0.47 | 0.2 | 3 |

Indicated | 24,548 | 0.64 | 15.39 | 0.21 | 0.49 | 507 | 12,145 |

Meas & Ind | 24,553 | 0.64 | 15.39 | 0.21 | 0.49 | 507 | 12,148 |

Inferred | 2,411 | 0.51 | 11.74 | 0.16 | 0.41 | 39 | 910 |

| | | | | | | |

Sulphide | Tonnes | Gold | Silver | Lead | Zinc | Gold | Silver |

0.3 g/t Au Cut-Off | (000's) | (g/t) | (g/t) | (%) | (%) | (000's oz) | (000's oz) |

Measured | 4 | 0.77 | 8.85 | 0.15 | 0.19 | 0.1 | 1 |

Indicated | 74,890 | 0.62 | 8.84 | 0.13 | 0.36 | 1,494 | 21,290 |

Meas & Ind | 74,894 | 0.62 | 8.84 | 0.13 | 0.36 | 1,494 | 21,291 |

Inferred | 26,211 | 0.56 | 6.95 | 0.08 | 0.31 | 474 | 5,858 |

1.3

Mining

It was assumed the Camino Rojo project will be developed using conventional truck-shovel open pit mining technology involving contractor mining. It has been anticipated that the primary production equipment in the contractor’s mining fleet will consist of 14.3 cubic metre hydraulic excavators operating in backhoe configuration paired with 91 tonne capacity haul trucks. The open pit will operate 24 hours per day; 365 days per year with a five day allowance for bad weather and major holidays. Ore will be drilled and blasted on 5m high benches, while waste will be drilled and blasted on 10m high benches. Blasting will be performed using bulk ANFO (ammonium nitrate fuel oil) at powder factors in the range of 0.20 to 0.40kg/t. The waste storage area will be located east and adjacent to the open pit. A separate area will be devoted to topsoil storage near the waste storage area, with this material used du ring surface reclamation activities. Lower grade stockpile(s) will be located in the vicinity of the primary crusher.

This technical assessment has identified a Base Case ultimate pit containing 74.9Mt of mineralized material grading 0.71g/t Au and 14.2g/t Ag at a stripping ratio of 0.70 tonnes of waste per tonne of material processed. Due to a variety of deficiencies such as geotechnical studies, hydrological studies, metallurgical testwork and land status, this mine plan does not currently meet the criteria for a Mineral Reserve under NI 43-101 reporting requirements.

1-3

The northern edge of the open pit identified in this technical assessment extends onto land for which Canplats does not currently hold a mining concession. To clarify, the mineral resources identified in this technical assessment are located entirely within the mining concessions held by Canplats. While it is possible that the northern portion of the open pit may contain economically viable extensions of the Represa Zone, the existence of such extensions is currently unknown. As such, this technical assessment assumed only waste will be mined from this area; however, without such waste mining a portion of the mineral resources identified in this technical assessment may be inaccessible by open pit.

1.4

Metallurgy

Two metallurgical testwork programs have been completed investigating the metallurgical response of mineralized samples from the Camino Rojo project. The programs investigated the recovery of gold and silver from oxide and transition samples as well as recoveries of lead, zinc, gold and silver from oxide, transition and sulphide samples. Comparisons between assayed and calculated head grades in several of the tests were in excess of what is considered acceptable and this casts doubt on the accuracy of reported recoveries in some tests.

Column leach tests indicate crush sizes between 1.5 and 0.375 inches for oxide material has a negligible effect on gold recovery. Silver recoveries tend to increase as the crush size is reduced to 0.375 inches. The effect of crush size on transition material has only been evaluated on 2 samples and there is insufficient data to show any meaningful trends. In general, gold recovery is higher for oxide material than transition material. Silver recoveries are consistently higher in transition samples than in oxide samples. Head grades for silver in the transition material tested are slightly higher than in oxide material and this could partly explain this discrepancy. Maximum gold and silver recoveries for oxide material are achieved between 40 and 50 days. Different recovery trends for gold and silver based on material classification (oxide or transition) are evident.

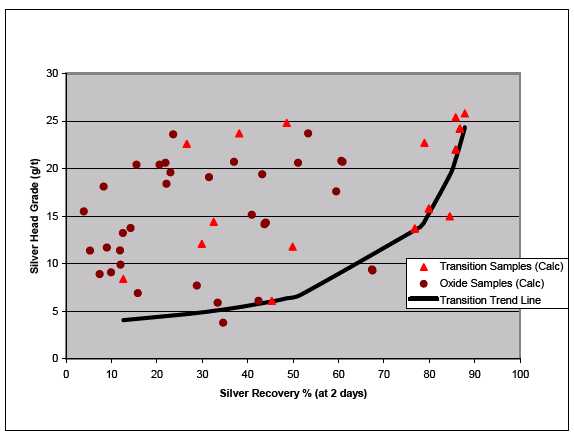

Bottle roll tests do not show any clear distinction between gold and silver recoveries for the oxide, transition and sulphide materials tested. It would be expected that oxide samples would show consistently higher gold recoveries followed by transition and then sulphide samples. Issues that can cloud this effect are head grade and crush/grind size, assaying and classification of samples. Mineralogical evaluations can give valuable insight into recovery details. Dissolution of gold and silver is essentially complete after 48 hours. Slightly different recovery trends for gold associated with oxide and transition material are evident with recoveries being marginally higher for oxide material. Results for silver in oxide material are too scattered to determine a trend.

Flotation tests indicate that oxide material is not amenable to treatment by flotation and sulphidization does not improve the metallurgical response of this material. Flotation tests on sulphide samples produced some encouraging results for recoveries of base metals. Considerable upgrading of both lead and zinc rougher concentrates, however, are required to produce a marketable concentrate. Recoveries of gold and silver to the lead rougher concentrate were reasonable in some tests. Additional flotation testwork is warranted and this should focus on sulphide material.

1-4

Metallurgical testwork performed on the Camino Rojo project to date is encouraging, however, very preliminary. In order to advance the project to pre-feasibility and feasibility levels additional metallurgical testwork is required. The objective of this testwork should be to focus on the recovery of gold and silver from the oxide and transition zones in order to better define metallurgical responses as well as develop criteria for ongoing engineering assessment. The recovery of silver in testwork to date has been very modest. Additional recovery of silver at current prices has considerable upside potential for the project and ongoing testwork should target improving this recovery.

The conceptual processing route chosen to recover gold and silver from oxide and transition material involves heap leaching at a treatment rate of 20,000tpd. The process comprises of a crushing plant supplying feed material to the heap leach processing circuit. Processing considers a primary gyratory crusher will reduce the run-of-mine (ROM) feed size to a P80 of 120mm. Primary crushed material will be stockpiled on a coarse ore stockpile and reclaimed by apron feeders. Secondary and tertiary crushing will reduce the size of material to a nominal minus 100% passing 19mm (¾"). Fine crushed material will be screened and fed to a fine ore bin. Material will discharge the fine ore bin through dump gates onto a conveyor where lime is added before feeding into the truck loadout bin. Material will discharge from the truck loadout bin into 91t haul trucks and transported to the heap le ach pad where it will be stacked. Gold and silver will be leached using sodium cyanide solution. The gold and silver will then be recovered from pregnant leach solution in a Merrill Crowe plant. Zinc precipitate will be mixed with fluxes and smelted to produce silver-gold doré, the final product from the processing facility.

1.5

Operating Cost Estimate

Mine production activities are considered to be performed by a mining contractor. The unit mining cost was estimated to be US$1.87/t moved.

Conceptual process operating costs, broken down into operating labor, maintenance labor, power, process consumables, maintenance spares and rehandling, are summarized in Table 1-2.

1-5

Table 1-2: Process Operating Costs

| | |

Category | Annual Cost US$ | Cost US$/t Processed |

Operating Labor | 836,700 | 0.11 |

Maintenance Labor | 378,200 | 0.05 |

Power | 2,345,563 | 0.32 |

Reagents and Consumables | 19,458,055 | 2.67 |

Spares | 1,100,000 | 0.15 |

Re-handling | 3,650,000 | 0.50 |

TOTAL | 27,768,518 | 3.80 |

The general and administration cost was estimated to be US$0.42/t processed.

1.6

Capital Cost Estimate

The Project’s initial capital cost to treat 20,000tpd was estimated to be US$133.8 million (±35% accuracy) and is summarized in Table 1-3. Costs are expressed in first quarter 2009 US dollars.

Table 1-3: Initial Capital Cost Summary

| |

Item | US$ (000’s) |

Direct Field Costs | |

Project Direct Costs | 81,356 |

Total Direct Field Costs | 81,356 |

| |

Indirect Costs | |

Project Indirect Costs | 20,622 |

Total Indirect Field Costs | 20,622 |

| |

Contingency | 30,593 |

Other Costs | 1,200 |

Total Project Costs | 133,770 |

Capital costs are confined to the battery limits of ROM delivery to the primary crusher dump hopper, barren solution distribution, pregnant solution handling, precipitation, smelting, raw water delivery and tie-in to the main power transmission line as defined in the equipment list, process flowsheets, and the narrative of the technical assessment document. Costs have been included for the initial haul road, waste haul road and in-plant roads.

As mining is assumed to be performed on a contract basis, initial and sustaining mine fleet capital requirements will be the responsibility of the contractor.

1-6

1.7

Economic Analysis

Estimated capital and operating costs, preliminary metallurgical parameters and projected third party refining and transportation charges were incorporated into a proforma, 100% equity, pre-tax cash flow model to evaluate project economics. A treatment rate of 20,000tpd was considered. The cash flow indicates that the project generates an IRR of 32.5% with an NPV at a 5% discount rate of US$195 million (assumes the prices of gold and silver are US$750 per ounce and US$13.50 per ounce respectively). The base case cash operating cost is estimated to be approximately $340/oz gold (includes credit for silver). The Project’s sensitivity to variations in capital cost, operating cost and metal prices in terms of NPV at 5% is shown in Figure 1-1. The effect of metal prices on the undiscounted cashflow, NPV at 5% and IRR is shown in Table 1-4.

Figure 1-1: NPV at 5% - Sensitivity Analysis

Table 1-4: Effect of Metal Prices on Project Economics

| | | | | |

Alternative | Metal Price (US$/oz) | NPV (US$ M)(ii) | IRR(ii) |

Au | Ag | 0% | 5% | % |

Base Case | 750 | 13.50 | 313.4 | 194.9 | 32.5 |

Alternative 1 | 850 | 15.30 | 457.5 | 296.8 | 44.7 |

Alternative 2 | 950 | 17.10 | 601.6 | 398.7 | 56.5 |

Spot Price(i) | 1036 | 17.19 | 711.9 | 477.2 | 65.7 |

(i)

=Source: www.Kitco.com on 6 October, 2009.

(ii)

=Amounts are on a Pre-Tax Basis.

The project economics at treatment rates of 15,000tpd, 20,000tpd and 25,000tpd were evaluated to assess the affects on IRR and NPV at 5%. Although these results indicate the maximum NPV at 5% and IRR are achieved at a throughput of 25,000tpd, the improvement is minimal.

1-7

The operational plans prepared by MQes as part of these economic analyses are preliminary in nature and too speculative to be categorized as mineral reserves under NI 43-101 guidelines.

1.8

Project Development Schedule

Assuming there are no a major impediments (land ownership, environmental impact study, permitting, etc.) to project development, and with no attempt to fast track the project schedule, it is estimated that approximately 4 years will be required to bring the Camino Rojo project into production.

1.9

Conclusions and Recommendations

The 2007 and 2008 exploration work on the Represa zone has identified a potentially economic gold-silver deposit with the continuity of a large, intrusive-related mineralizing system. Additional in-fill, technical and condemnation drilling will be required prior to a pre-feasibility study. It is the opinion of Minorex that continued exploration is justified.

Future exploration work should involve continued drilling of the Represa zone to better define the estimated resources, and to provide bore hole information for preliminary geotechnical, hydrological, environmental and site design studies required prior to a pre-feasibility study. In addition, there are several coincident geological, geochemical and/or geophysical exploration targets on the property that should be investigated during the advanced exploration work on the Represa zone. The following recommendations have been subdivided accordingly:

1)

Represa Zone

·

Carry out strategically-sited, in-fill diamond drilling to better define the mineral resources and provide bore holes for hydrological studies and/or samples for advanced metallurgical, geotechnical, and acid base accounting studies. The sites of such drilling will be determined by the technical personnel and project consultants involved with the various studies at the time;

·

Conduct reverse circulation and diamond drilling around the periphery of the known mineralization to delineate the limits of mineralization for pit slope design and geotechnical studies. This drilling should be continued to depths determined by preliminary pit design work;

·

Commence preliminary condemnation drilling of possible sites for waste dumps, leach pads and processing facilities. Bore holes should provide samples for sterilization determinations and sites for hydrological and environmental testing; and

·

All bore hole sampling should be subject to strict quality assurance – quality control protocols.

1-8

2)

Property-wide Exploration

·

Prospect, geologically map and sample the exploration target areas within the property;

·

Conduct reconnaissance induced polarization surveys over high priority exploration targets; and

·

Excavate trenches across any coincident geological, geochemical and/or geophysical targets, and map and sample the exposed bedrock.

The estimated expenses for the above recommended drilling and exploration program total US $4.35 Million.

Conclusions and recommendations from the technical assessment performed by MQes are as follows:

·

Metallurgical testwork results show higher than expected differences between calculated and assayed head samples. This casts doubt on the accuracy of some reported metal recoveries. Consequently, gold and silver recovery values should be treated with caution until additional testwork is performed to substantiate them. It is recommended that in ongoing testwork such differences are resolved by either re-assaying samples or repeating tests. Canplats should consider establishing a QA/QC program for future metallurgical testwork which involves submitting assays standards to the laboratory for confirmation checks.

·

The nominal crush size used in the technical assessment was 0.75 inches. This can be achieved with a three stage crushing circuit. A finer crush size would likely require an additional crushing stage and add to the capital for the project. There is insufficient testwork data at this time to support a final crush size. The 0.75 inch crush size has been chosen as a suitable interim size for this assessment. It is recommended the effect of crush size on gold and silver recoveries is further evaluated.

·

Column leach tests indicate that in general gold recovery is higher for oxide material than transition material; as expected. Silver recoveries are consistently higher in transition samples than in oxide samples. This is not as expected, however, it is noted that the head grades for silver in the transition material tested was slightly higher than in the oxide material and may partially explain this discrepancy. It is recommended that mineralogical evaluations be initiated to identify if there are reasons other than head grade for this. Maximum gold and silver recovery for oxide material is achieved between 40 and 50 days. It is recommended that additional testwork be performed to confirm this. For the purposes of the technical assessment a leach cycle of 45 days was chosen.

·

Bottle roll tests indicate gold and silver dissolution is essentially complete after 48 hours. Neither gold nor silver recoveries show clear distinction between oxide, transition and sulphide samples. It is expected that oxide samples would show consistently higher recoveries followed by transition and then sulphide samples. Issues that can cloud this effect are head grade and crush/grind size. It is recommended that Canplats check sample classifications (oxide, transition and sulphide) against their criteria and that mineralogical evaluations be performed to identify potential reasons.

1-9

·

Given the preliminary nature of the flotation tests to date, some encouraging results have been obtained. Additional flotation testwork is warranted and it is recommended that this be focused on sulphide material.

·

In order to advance the project to a pre-feasibility study level, additional metallurgical testwork is required. This testwork should focus on the recovery of gold and silver from the oxide and transition zones in order to better define metallurgical responses as well as develop criteria for ongoing engineering assessment. The recovery of silver in the testwork performed to date has been very modest. Additional silver recovery at current prices has considerable upside potential for the project and ongoing testwork should target improving this recovery. A secondary objective of future testwork should be to begin assessing the treatment of sulphides material.

·

It is recommended that the selection of metallurgical samples for ongoing metallurgical testwork be coordinated with Canplat’s geological staff to ensure that representative samples of the different zones and rock types are correctly chosen. The testwork goal should be to develop a geo-metallurgical model of the deposit which can be used to reasonably predict metallurgical responses. As mine planning progresses, it is recommended that metallurgical testwork samples be chosen which are representative of the mine plan and emphasize the early period of production. These samples should be tested to confirm that the metallurgical response is consistent with that predicted from the geo-metallurgical model.

·

The process developed for this assessment does not consider agglomeration of material for heap leaching. It is recommended that this be evaluated in ongoing testwork.

·

Assuming there are no major impediments (land ownership, environmental impact study, permitting, etc.) to project development and with no attempt to fast track the project schedule it is estimated that approximately 4 years is required to bring the Camino Rojo project into production.

·

It is recommended that work be commenced/progressed in the areas of land ownership, permits, geotechnical and hydrological investigations, metallurgical testwork, ARD testwork, infrastructure and environmental, so that the project can be advanced to a pre-feasibility study level

·

This technical assessment has addressed the treatment of oxide and transition material via heap leaching. Some of the metallurgical testwork to date indicates significantly higher recoveries for gold and silver at fine grinds. It is recommended that a CIP/CIL processing route be evaluated upon better definition of metallurgical recoveries. Evaluation of a ROM leaching alternative should also be considered.

·

Mine planning has assumed several basic design criteria. It is recommended that geotechnical and hydrological studies be performed to more definitively determine such criteria. Geotechnical studies should develop detailed slope design recommendations and hydrological studies should address pit dewatering requirements and costs from ground water intrusion and precipitation.

1-10

·

It is recommended that the ultimate pit design be re-evaluated using project specific geotechnical design criteria

·

Environmental impact studies should be performed that address the potential for ARD and environmental contamination from the waste storage area. Lake water chemistry (assuming the pit will flood when abandoned) should also be studied and mine closure reclamation requirements and a cost estimate developed.

·

Estimated contract mining costs have been developed. It is recommended that quotations from a recognized contract mining company be obtained using the mine plan prepared for the technical assessment.

·

It is recommended that owner operated mining be evaluated to determine its affect on the project economics. This will also help evaluate the contract miner quotations.

·

Future mine planning should investigate different phasing options, including splitting mining phase three into two parts.

·

A counter-clockwise ramp design was assumed for the technical assessment. It is recommended that future mine planning investigate other ramp layouts, including a clockwise design.

·

Mine planning for the technical assessment considered only in-pit road layouts. It is recommended that future mine planning include both in-pit and ex-pit road layouts.

·

The location of the waste storage area needs to be confirmed and condemnation drilling performed.

·

A detailed design of the waste storage area should be prepared, showing its build-up on an annual basis.

·

It is recommended that the drill density in the toe areas of the ultimate pit be investigated.

·

The northern edge of the open pit identified in this technical assessment extends onto land for which Canplats does not currently hold a mining concession. At this time, the area involved solely contains waste that must be removed in order to expose mineral resources that lie within Canplats’ mining concessions. Thus it is recommended that mining concession(s) for this area be acquired, or an arrangement to allow waste mining on the adjacent concession be made, as soon as possible.

·

MQes understands that Canplats is negotiating for the acquisition of surface rights for the project area. MQes recommends that this acquisition be completed as soon as possible.

·

The initial capital cost for the project is estimated to be $133.8 million with an accuracy of ±35%. In order to improve the accuracy of this estimate it is recommended that meteorological, geotechnical and hydrological data for the site be obtained. Other information that is required includes water availability (quantity and quality), power supply criteria/battery limits, local community infrastructure requirements, condemnation drilling, detailed topographical data and additional engineering.

·

The estimated operating costs for the project are $3.80/t material processed, $0.42/t material processed for general and administration and $1.87/t material moved for mining. The processing and G&A costs were based on preliminary data from metallurgical testwork and MQes in-house data for labor costs. Budgetary quotations have been obtained for reagent and consumable costs. It is recommended that reagent and consumable consumption rates be updated upon completion of additional testwork. Staffing levels should be confirmed, and accurate operating labor costs obtained for the project area, along with a more detailed build up of the general expenses.

1-11

·

A proforma, 100% equity pre-tax cash flow model indicates that at a treatment rate of 20,000tpd, the Camino Rojo project generates an IRR of 32.5% with an NPV at a 5% discount rate of US$195 million (assuming the prices of gold and silver are US$750 per ounce and US$13.50 per ounce respectively). The base case cash operating cost is estimated to be approximately $340/oz gold (includes credit for silver). The project is most sensitive to metal price/production followed by operating cost and capital cost.

·

Economic evaluations of 15,000tpd, 20,000tpd and 25,000tpd processing rates indicate that for the current resource, the 25,000tpd alternative yields the highest IRR and NPV at 5%. However, the improvement from 20,000tpd to 25,000tpd is within the accuracy of the evaluations.

The estimated expenses for the above recommended pre-feasibility work program totals US$1.99 Million, which combined with the recommended drilling and exploration programs brings the entire budget to US$6.34 Million. This budget is considered suitable for initiating the studies/work required for a pre-feasibility study but may need supplemental funding.

1-12

SECTION 2

INTRODUCTION AND TERMS OF REFERENCE

2.0

INTRODUCTION AND TERMS OF REFERENCE

The Camino Rojo property is situated near the town of San Tiburcio, approximately 206 kilometres northeast of the state capital city of Zacatecas in Zacatecas State, Mexico. The property is comprised of six mining concessions and one fractional concession, totalling 319,927 hectares or approximately 1,235 square miles, that are owned and operated by Canplats de Mexico, S.A. de C.V. (“Canplats Mexico”), a wholly-owned subsidiary of Canplats Resources Corporation (“Canplats”).

At the request of Canplats, Minorex reviewed and compiled the 2007 and 2008 exploration results, estimated the mineral resources of the Represa zone within the property, and prepared the relevant sections of this independent technical report with recommendations for future exploration work. In April, 2009 MQes was retained to perform a technical assessment of the project which evaluated the treatment of oxide and transition material in the Represa zone via heap leaching to recovery of gold and silver. The assessment included:

·

Reviewing metallurgical testwork data, preparing comments on the testwork and recommending ongoing metallurgical testwork programs.

·

Prepare conceptual process flowsheets for recovering gold and silver via heap leaching through to the production of doré at a treatment rate of 20,000tpd.

·

Preparing a major stream material balance for the proposed process flowsheets.

·

Preparing preliminary process design criteria.

·

Performing equipment sizing for major equipment and developing a major equipment list.

·

Preparing a preliminary electrical load analysis.

·

Preparing preliminary general arrangement drawings for crushing and gold recovery facilities as well as sketches for ancillary facilities.

·

Preparing a preliminary general site plan identifying the locations of the process plant and major ancillary facilities.

·

Developing a conceptual level capital cost estimate for the project.

·

Developing operating cost estimates for the proposed plant.

·

Developing general and administration cost estimates.

·

Preparing a Base Case pre-tax cashflow indicating expected net present value and internal rate of return.

·

Preparing a preliminary mine plan and production schedule.

·

Preparing a conceptual project development schedule.

The results of this study were presented in a report titled “Technical Assessment, Camino Rojo project, Zacatecas, Mexico” and is the basis on which the relevant sections of this report have been prepared. Use of the term “Ore” throughout this report is intended for mine design purposes but does not imply economic viability of currently defined resources. Under NI 43-101 reporting requirements, mineral resources that are not reserves do not have demonstrated economic viability.

2-1

This report has been prepared in accordance with the formatting requirements of National Instrument 43-101 (‘NI 43-101’) and Form 43-101F1 (Standards of Disclosure for Mineral Properties). It is intended to be read in its entirety.

2.1

Sources of Information

Mr. J. Douglas Blanchflower, an independent qualified person according to NI 43-101, visited the Camino Rojo property on February 8, 2008. Mr. Blanchflower examined the surface areas of the Represa and Don Julio zones; collected nine verification samples; and reviewed drilling results, sampling and shipping procedures, geological and geotechnical logging techniques, surveying records and documentation procedures with the field geological personnel. A technical report was later prepared by Minorex, titled ‘Technical Report on the Camino Rojo Property, Concepciòn del Oro District, Zacatecas, Mexico’ and dated June 18, 2008. This report is available for viewing or downloading from SEDAR.

Upon completion of the 2007-2008 drilling program in August 2008, Canplats provided Minorex with all exploration data, assay and analytical results, maps, company reports and other public and private information required to compile a database for estimation of the mineral resources within the Represa zone. Canplats also provided cross-sectional interpretations of the mineral distribution and oxidation boundaries of the mineralization. Minorex has no reason to believe that any of the information is inaccurate. Consistent with Form 43-101F1, portions of this report concerning information that has not changed substantially since January, 2009 are abbreviated since it was documented in detail by Minorex’s June 18, 2008 and January 5, 2009 technical reports (Blanchflower, 2008 and 2009).

Canplats contracted Ms. Caroline Vallat of GeoSpark Consulting, based in Nanaimo, British Columbia, to collate, compile, analyse and document their 2007 and 2008 Quality Assurance and Quality Control results. Minorex has referenced this work in the ‘Sample Verification’ section of this report. Survey documents pertaining to the locations of the relevant mining concessions and their current status were provided by Canplats, effective October 15, 2008. These documents were in addition to previous property status information and an earlier title opinion referenced in the technical report by Blanchflower (2008).

Mr. Blanchflower (Minorex) relies on over 38 years of field experience with intrusion-related precious metal deposits similar to that within the subject property. Minorex has assumed that all of the referenced information and technical documents are accurate and complete in all material aspects. All sources of information have been listed in the ‘References’ section of this report.

2-2

2.2

Units of Measure

Metric units are used throughout this report unless otherwise stated. A list of abbreviations that may be used in this report is provided below.

| | | |

°C | degree Celsius | % | percent |

°F | degree Fahrenheit | km2 | square kilometres |

CDN $ | Canadian dollars | kW | kilowatt |

cm | centimetre | l | litre |

cm2 | square centimetres | m | metre |

cm3 | cubic centimetres | m2 | square metres |

ft | feet | m3 | cubic metres |

ft2 | square feet | AMSL | above mean sea level |

ft3 | cubic feet | mm | millimetre |

g | gram | m.y. | million years |

g/t | gram per tonne | opT | ounces per short ton |

hr | hour | oz | troy ounce (31.1035 g) |

ha | hectare | ppm | part per million |

in | inch | ppb | parts per billion |

K | kilo (thousand) | T | short ton |

kg | kilogram | t | metric tonne |

km | kilometre | US$ | United States dollar |

2-3

SECTION 3

RELIANCE ON OTHER EXPERTS

3.0

RELIANCE ON OTHER EXPERTS

Minorex has relied on the following individuals to provide necessary information during the preparation of this report. Messrs Kenneth McNaughton, Canplats Qualified Person and Vice President Exploration until January, 2009, and Bruce Youngman, Canplats President and Chief Operating Officer, provided corporate information and data for the 2007 and 2008 exploration work. Mr. Zoran Lukic, Canplats Database Manager until January, 2009, provided drilling and assay data for the collation and compilation of the drilling database. Minorex considers the information of good quality and has no reason to believe that any of the information is inaccurate.

The November 26, 2008 report on the 2007 – 2008 Quality Assurance and Quality Control program, prepared for Canplats by Ms. Caroline Vallat, G.I.T., has been referenced and quoted in this report. In addition, other references to the title opinion by Mr. J. M. G. Olguin (2008); geological work, including the regional mapping and diamond drill core logging, undertaken by Mr. Tom Turner on behalf of Canplats; and the geophysical survey report titled ‘Report on Induced Polarization Surveys’ by Gerard Lambert, P. Eng., have been quoted in this report. Minorex considers the information contained in these reports of high quality and has no reason to believe that any of the information is inaccurate.

Minorex was not involved in any exploration work on the Camino Rojo property, and therefore this report has made extensive reference to the works undertaken by other qualified geologists, geophysicists and field personnel. Other non-project specific reports by qualified personnel have been referenced whenever possible. MQes has not carried out any independent exploration work, drilled any holes nor carried out any sampling and assaying.

The various agreements under which Canplats holds title to the mineral lands for the Camino Rojo project have not been investigated or confirmed by MQes or Minorex. MQes and Minorex were provided a list of tenements by Canplats and their land title lawyer (Bufete González Olguín, S.A.) for the concessions Camino Rojo, Camino Rojo 1, Camino Rojo 1 Fracc. A, Camino Rojo 2, Camino Rojo 3, Camino Rojo 4 and Camino Rojo 5. Canplats provided details for the Los Cardos concession. MQes/Minorex have relied upon the legal due diligence of Canplat’s land title lawyer and upon Canplats Resources Corporation to confirm the validity of the mineral title claimed by Canplats.

This report is for the sole use of Canplats Resources Corporation. It is not intended to be a guarantee of mineral title, nor is it intended to be a thorough description of past, existing, or future option, sale, or title agreements, nor is it intended to include a thorough description of all possible liabilities, environmental or otherwise, of assessment, access, land claims, and exploration requirements and programs completed, planned, or contemplated.

3-1

SECTION 4

PROPERTY DESCRIPTION AND LOCATION

4.0

PROPERTY DESCRIPTION AND LOCATION

4.1

Property Location

The property covers the area near the town of San Tiburcio within the southern portion of the Concepciòn del Oro district in the northeastern part of Zacatecas State, Mexico; approximately 206 kilometres northeast of the state capital city of Zacatecas. The geographic centre of the property is at 24˚00’ North latitude by 101˚45’ West longitude or U.T.M. 2,655,000 m North by 220,000 m East, within Mexico map sheets G14-10 and F14-1 (see Figures 4-1, 4-2 and 4-3).

4.2

Property Description

Canplats de Mexico, S.A. de C.V. is a mining company incorporated and existing pursuant to the laws of the United Mexican States. Canplats Mexico has been duly formed and exists per the terms of Public Instrument No. 10815, dated November 19, 2003 (Olguin, 2008).

The property is comprised of seven mining concessions with one of the mining concessions being subdivided as a fractional portion (see Figure 4-2 and Table 4-1). The mining concessions are dominantly located in the municipality of Mazapil, State of Zacatecas with the extreme southeastern corner of the property extending into the State of San Luis Potosi, Mexico (see Figure 7-1). According to concession applications filed by Canplats Mexico at the General Mining Bureau within the Ministry of Economy in Mexico City through the Mining Agency No. 8093 for Zacatecas (Olguin, 2008) and information provided by Canplats (2008), the mining concessions appear to be in good standing and owned by or are currently being transferred into Canplats Mexico.

4-1

Table 4-1: Summary of Mining Concession Data

| | | | |

Name of | Surface | Title | Date of | Date of |

Mining Claim | Area (ha) | Certificate | Title | Expiry |

Camino Rojo | 8,340.7905 | 230914 | 6-Nov-2007 | 5-Nov-2057 |

Camino Rojo 1 | 88,897.3255 | 231922 | 16-May-2008 | 15-May-2058 |

Camino Rojo 1 Fracc. A | 96.8888 | 231923 | 16-May-2008 | 15-May-2058 |

Camino Rojo 2 | 17,847.4398 | 232076 | 10-Jun-2008 | 9-Jun-2058 |

Camino Rojo 3 | 30,050.0000 | 232014 | 3-Jun-2008 | 2-Jun-2058 |

Camino Rojo 4 | 20,640.0000 | 232644 | 2-Oct-2008 | 1-Oct-2058 |

Camino Rojo 5 | 154,055.0200 | 232647 | 2-Oct-2008 | 1-Oct-2058 |

Los Cardos | 19,002.5020 | 232652 | 2-Oct-2008 | 1-Oct-2058 |

| | | | |

| Total Area: | 338,929.97 | hectares | |

| or | 1,308.62 | sq miles | |

4-2

Figure 4-1: Location Map

4-3

Figure 4-2: Mineral Concessions Map

4-4

Figure 4-3: Infrastructure Map

4-5

4.3

Property Ownership

Canplats de Mexico, S.A. de C.V., a wholly-owned subsidiary of Canplats Resource Corporation, owns entirely (100%) the rights to the six ‘Camino Rojo’, ‘Camino Rojo 1’, ‘Camino Rojo 2’, ‘Camino Rojo 3’, ‘Camino Rojo 4’ and ‘Camino Rojo 5’ mining concessions and the one fractional concession, ‘Camino Rojo 1 Fracc. A’. The titles to these mining concessions have been granted to Canplats Mexico by the Mexican Ministry of Economy for a period of 50 years, and are reportedly free of liens and encumbrances (Canplats, 2008; Olguin, October 7, 2009). The title to a seventh mining concession, the Los Cardos mining concession, is currently being transferred into Canplats de Mexico S.A. de C.V.

All minerals found in Mexico are the property of the government of Mexico, and may be exploited by private entities under concessions granted by the Mexican federal government. The process was defined under the Mexican Mining Law of 1992, and excludes petroleum and nuclear resources from consideration. The Mining Law also requires that non-Mexicans entities must either establish a Mexican corporation, or partner with a Mexican entity.

Under current Mexican mining law, amended April 29, 2005, the Direccion General de Minas (‘DGM’) grant concessions for a period of 50 years, provided the concession is maintained in good standing. There is no distinction between mineral exploration and exploitation concessions. As part of the requirements to maintain a concession in good standing, bi-annual fees must be paid based upon a per-hectare escalating fee, and a report submitted to the DGM each May. This report covers work conducted over the previous year on the concession.

The northern edge of the open pit identified in this technical assessment extends onto land for which Canplats does not currently hold a mining concession. To clarify, the mineral resources identified in this technical assessment are located entirely within the mining concessions held by Canplats. While it is possible that the northern portion of the open pit may contain economically viable extensions of the Represa Zone, the existence of such extensions is currently unknown. As such, this technical assessment assumed only waste will be mined from this area; however, without such waste mining a portion of the mineral resources identified in this technical assessment may be inaccessible by open pit.

4.4

Environmental, Reclamation and Permitting Issues

Minorex is not aware of any outstanding environmental, reclamation or permitting issues that would impact future exploration work. All drill sites were cleaned and rehabilitated on an ongoing basis. Future exploration work will require the usual permitting requirements and reclamation commitments appropriate with work in this area.

4-6

SECTION 5

ACESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE and PHYSIOGRAPHY

5.0

ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE and PHYSIOGRAPHY

5.1

Accessibility

The property is dominantly situated along a wide, flat valley near the town of San Tiburcio. San Tiburcio is situated on Mexican highway 54, a well-maintained, paved highway linking the major city of Zacatecas in Zacatecas State with Saltillo in Coahuila State (see Figure 4-3). Both of these cities have airports with regularly scheduled flights south to Mexico City or north to the U.S.A.

There are numerous gravel roads within the property linking the surrounding countryside with the two highways, Highways 54 and 62, which transect the property (see Figures 4-2 and 4-3). There are very few locations within the property that are not readily accessible by four-wheel drive vehicles.

5.2

Physiography, Climate and Vegetation

The broad valley around San Tiburcio is bounded to the north by the low rolling hills of Sierra La Arracada and Sierra El Barros, to the east by Sierra La Cucaracha, and to the south by the Sierra Los Colgados. The terrain is generally flat. Bedrock exposures are rare, limited to road cuts or creek beds. The elevations within the property range from approximately 1,850 to 2,460 m AMSL and relief is low.

The climate is typical of the high altitude Mesa Central, dry and semi-arid. Annual precipitation for the area is approximately 700 mm, mostly during the rainy season in June and July. Temperatures commonly range from +30o to 20o C in the summer and 15o to 0o C in the winter.

The vegetation is dominantly scrub bushes with cacti, maguey, sage and coarse grasses with rare yucca. The natural grasses are used to locally graze domestic livestock. Wild fauna is not abundant but several varieties of birds, rabbits, coyote, lizards, snakes and deer reportedly inhabit the area.

5.3

Local Resources and Infrastructure

There is a good network of road and rail services in the region. Road access to most of the property is possible via numerous gravel roads from both Highways 54 and 62. In addition, there is a railway approximately 40 km east of San Tiburcio that crosses both highways, and there is a high voltage power line transecting the property near San Tiburcio which might be accessed for future electrical requirements. See accompanying Figure 4-3 showing the regional transportation corridors.

5-1

The project site is generally flat with adequate space for any future development of mining and processing facilities. Surface rights are owned by local cooperative farmers, landowners and ranchers, and their permission is required to conduct any physical work. Any drilling access roads should be planned to assist the locals with access. Gates and/or cattle guards would be required. It is MQes’ understanding that Canplats is negotiating for the acquisition of surface rights for the project area.

Ground waters are currently being purchased from owners of local wells and trucked to the site for drilling fluid. Future exploration efforts should consider acquiring water rights within the property and casing any water producing drill holes. Most exploration supplies may be purchased in the nearby historic mining cities of Zacatecas, Fresnillo and Saltillo. Experienced mining personnel are available locally and from nearby mining towns of Concepciòn del Oro and Mazapil.

5-2

SECTION 6

HISTORY

6.0

HISTORY

Mexico is the second largest silver producer in the world (96.4 million ounces per annum), after Peru. It used to be the top global silver producer (http://www.silverinstitute.org/supply/production.php , 2008). This position is chiefly due to production from Zacatecas state, at Fresnillo and Somberete, which produces more silver than all the other Mexican states combined (http://www.coremisgm.gob.mx/productos/anuario/).

Zacatecas was founded in 1546, after the discovery of silver vein systems by Juan de Tolosa; although, it likely experienced some pre-Hispanic mining. In a little more than a century afterwards, Zacatecas became Mexico’s largest silver producer, and the city was the second largest in the country after Mexico City. As with many other mining districts in Mexico, production ceased during the Mexican Revolution of 1910 to 1917 but resumed in some areas by about 1936. Historic silver production estimates exceed 1.5 billion ounces from the state, and 750 million ounces from the Zacatecas district (Ponce and Clark, 1988).

The Mesa Central region near Concepciòn del Oro and San Tiburcio has experienced many periods of exploration and mining since the Spaniards. Recent exploration activity led to the discovery, exploration and development of the Peñasquito gold-silver-lead-zinc mine owned by Goldcorp (2009). The Peñasquito property has two main deposits, called Peñasco and Chile Colorado, that are being developed for open pit mining.

According to Goldcorp (http://www.goldcorp.com/operations/penasquito/project_

summary, 2009), “At December 31, 2008, proven and probable gold reserves totalled 17.4 million ounces. Silver reserves totalled 1,045.7 million ounces while lead and zinc rose to 7.07 million tonnes and 15.36 million tonnes respectively. Measured and indicated gold resources, inclusive of proven and probable reserves, increased 39% to 17.8 million ounces. Measured and indicated silver resources increased 55% to 1.3 billion ounces.

Mechanical completion at Peñasquito was achieved as of mid-July, 2009. Construction of the first sulphide process line (Line 1) is complete and commissioning work is advancing on schedule. The primary crusher is complete and has filled the coarse ore stockpile with crushed ore in preparation for initial milling. The Line 1 feeders and conveying systems are complete. Construction of the Line 1 SAG mill and two ball mills is complete and commissioning is under way. The Line 1 lead and zinc flotation circuits are essentially complete.

Annual production over the life of mine (estimated 22 years) is expected to ramp up to approximately 500,000 ounces of gold, 30 million ounces of silver and over 400 million pounds of zinc.”

6-1

The Camino Rojo gold-silver occurrence is a new discovery with no obvious evidence of prior exploration. According to Canplats, two contract geologists were driving along the gravel road north of San Tiburcio when they saw gossanous red gravel along the shoulder of the road. They returned to San Tiburcio and inquired where the source was for the local road building material. When told, they found a quarried ‘borrow’ pit approximately 500 m off the road that had exposed highly fractured and hematitized limy siltstone-sandstone bedrock, now called the ‘Represa’ zone. They collected samples of the gossanous bedrock material and sent the samples for analysis. Initial assay results returned values of 0.5 to over 1 g/t gold and 5 to 30 ppm silver with low lead and zinc values. These results led to the staking of the original ‘Camino Rojo’ (Red Road) mining concession which covered the site of the quarry and bedrock discovery.

Since its discovery Canplats has expanded the property; carried out geological mapping, geophysical surveying; excavator trenching and test pitting; and drill testing.

6-2

SECTION 7

GEOLOGICAL SETTING

7.0

GEOLOGICAL SETTING

This section has been summarized from the discussion of geology in the recent technical report by Blanchflower (2008). It is included to provide context for the mineral resources of the Represa zone but it is not essential to the resource estimation.

The following text is derived largely from regional geology maps and reports by the Servicios Geologico de Mexico (‘SGM’, 2007) and on geological reports by Mr. Tom Turner, a geological consultant to Canplats, who has worked extensively throughout the region (see accompanying Figures 7-1 to 7-5).

7.1

Regional Geology

The Camino Rojo gold-silver-lead-zinc prospect is situated in the southern part of the Concepciòn del Oro mineral district, a well-known silver-gold-copper-lead-zinc mineral district in northcentral Mexico. The district is situated regionally within the Mexico Geosyncline, a Jurassic- to Cretaceous-age, shelf-margin, carbonate sequence that sits unconformably on a basement of metamorphic rocks and is conformably overlain by a back-arc successor basin of Cretaceous-age marine siltstone-sandstone flysch origin.

Basement rocks are comprised of metamorphosed and complexly folded, subaerial to submarine rhyolite with lesser intercalated carbonaceous pelitic sediments and chloritic tuff ranging in age from Paleozoic to middle Precambrian. These rocks were unconformably overlain in Triassic time by a thin, irregular sequence of tuffaceous red beds, called the ‘La Joya’ Formation, and its more regional equivalent called the ‘Huizachal’ Formation. The La Joya Formation represents possible erosion prior to the onset of marine transgression, but it is discontinuous due to a regional series of northwesterly striking, normal, horst- and graben-producing faults that were active during its deposition.

Mesozoic carbonate platform limestones overlie the red beds, representing deposition on a slowly subsiding shallow marine shelf. The limestone group has been subdivided into six formations (Imlay, 1947), from oldest to youngest, the late Jurassic ‘Zualoga’ and ‘Caja’ Formations are overlain by the ‘Traises’, ‘El Cupido’, ‘La Peña’ and ‘Cuesta de Cura’ Formations which range from early to middle Cretaceous in age.

A late Cretaceous carbonaceous and calcareous turbiditic flysch sequence, subdivided into the ‘Indidura’ and ‘Caracol’ Formations comprising fine-grained calcareous, carbonaceous siltstone with thin basal sands and occasional thick ribbon channel sands, conformably overlies the carbonate platform stratigraphy. The flysch sequence is considered to represent deposition in a back-arc successor basin which formed as a result of subduction of the Pacific Ocean plates beneath the North American plate.

7-1

The Caracol Formation, an important host rock within the Camino Rojo property, grades upwards to one additional formation, ‘Difunta’ Formation, which is a shallow water deltaic sequence that was deposited around the margins of the Coahuila Platform at the end of Cretaceous time (see Figure 7-1).

Northcentral Mexico was subjected to the compressional Laramide orogeny in Late Cretaceous to Early Tertiary time. The geosynclinal limestone-flysch sequence was folded across all of northcentral Mexico. Deformation shifted from compressive folding to translational faulting in Eocene time. The pre-existing regional northwesterly striking fault-bounded horst and graben structures were reactivated with right-lateral offset and renewed extension. These fault systems often cut across and displace the Laramide folds and northeasterly striking basement faults.

7-2

Figure 7-1: Regional Geology Map

7-3

Figure 7-2: Legend for Geology Maps

7-4

Figure 7-3: Symbols for Geology Maps

7-5

Figure 7-4: Stratagraphic Section Concepcion Del Oro District

7-6

The southern half of the Concepciòn del Oro mining district covers a series of subparallel sierras that strike east and curve around to the south. Several of these sierras are anticlines or limbs of anticlines that are cored by the Jurassic to Cretaceous-age limestone. The sierras are separated by synclinal valleys underlain by the Upper Cretaceous Indidura and Caracol Formations. The synclinal keels are generally wide and flat lying with occasional small parasitic anticlines and drag folds along faults.

The Concepciòn del Oro district is bounded to the east and west by Eocene-age grabens that are filled with poorly consolidated alluvium. The western graben, named the ‘Cedros Graben’, has a regional north-northwesterly strike and is about five kilometres wide. It is bounded to the west by the Caopas horst block which is a regional northwesterly striking fault system that has been mapped for 250 kilometres from the village of San Tiburcio to Llano San Juan just east of Torreon, Coahuila.

Numerous intermediate to felsic stocks were emplaced across northcentral Mexico coincident with the Eocene translational deformation. They are a somewhat linear series of differentiated composite stocks that have a general east-west alignment. There are two age groups of intrusive rock that overlap in time. The older group ranges in age from 57 to 40 m.y. and tends towards weakly magnetic dioritic to granodioritic composition. The second set of intrusives ranges in age from about 30 to 20 m.y. and tends to be felsic in composition, usually described as dacitic to rhyolitic porphyry, quartz-feldspar porphyry and felsite. It is common to see the younger intrusions proximal or superimposed upon the older intrusives.

Coincident with the younger intrusive event, there were large eruptions of subaerial rhyolite ash flow tuff further to the west in the Sierra Madre Occidental. Slightly inboard or east of the rhyolite ignimbrite tuff, there is a regional series of elongate red rhyolitic flow domes that appear to have emplaced in an imbricated series of northwest-striking, shallow east-dipping extensional faults. They may represent the end of Laramide deformation, and the renewal of left-lateral translational-extensional fault offset.

Northcentral Mexico is famous for its mineral production, especially its rich silver deposits. Most of the mineral deposits are intrusive–related silver-gold-lead-zinc (+ copper) deposits. The styles of mineralization vary from low sulfidation epithermal vein deposits to limestone-hosted chimney, manto replacements and contact skarn deposits. Many of these deposits cropped out and were discovered by the Spanish in the late 16th century. Some of these deposits, such as Fresnillo, San Martin and Salaverna in Zacatecas State and Las Charcas and Santa Maria de la Paz in San Luis Potosi State are still in production.

Within the Concepciòn del Oro district, the Peñasquito property silver-gold-lead-zinc mineralization is hosted by intrusive-related stockwork veinlets and two diatreme breccias. Other district occurrences include the gold-copper-magnetite contact skarn and chimney deposits at Aranzazu on the western contact of the Concepciòn del Oro granodiorite, the silver-lead-zinc carbonate replacement deposits at Salaverna, and the copper-gold skarn deposits at Saltillito (see Figures 4-3 and 7-1).

7-7

Figure 7-5: Property Geology Map – North Sheet

7-8

7.2

Property Geology

The Camino Rojo property is situated in the southern half of the Concepciòn del Oro district at the possible junction of the regional northwesterly striking Caopas horst with the projected extension of the north-south trending San Carlos graben. It is in an area with very poor bedrock exposure, which may account for its mineralization not being recognized until recently. Most of the northern half of the property, except in the extreme northwestern corner, has been mapped as being extensively covered by alluvium (see Figure 7-5).

7.2.1

Lithology

Based upon 2006 regional mapping studies by the Servicios Geologico de Mexico, the oldest rocks within the property are reportedly Upper Jurassic limestones and cherts of the Zuloaga Formation that are overlain by a series of thinly bedded phosphatic chert and silty to sandy limestone units of the Upper Jurassic La Caja Formation, and by limestone and argillaceous limestone units of the Upper Jurassic to Lower Cretaceous Taraises and Cupido Formations. The Cupido Formation is in turn overlain by Lower Cretaceous cherty limestone of the La Pena Formation, the limestone units of the Cuesta del Cura Formation, a series of shales and calcareous siltstones and argillaceous limestones belonging to the Indidura Formation, and an Upper Cretaceous, interbedded shale and sandstone of the Caracol Formation. Tertiary-age conglomerate of the Mazapil Formation or erosion remnants of Tertiary basaltic flow and flow breccias are the youngest s tratigraphic units.

Drilling and trenching results indicate that much of the poorly exposed ‘Represa’ and ‘Don Julio’ zones are underlain by a thinly-bedded sequence of calcareous siltstones and calcareous sandstones belonging to the Upper Cretaceous Caracol Formation. According to Turner (2008c), the Caracol Formation is a thin to thick interbedded sequence of calcareous siltstone and sandstone with a distinct felsic volcaniclastic component in the sandy members. The bedding to core axis angles are consistently 70o to 80o implying a flat to very shallow dipping sequence with no folding and bedding tops up. Turner (2008c) has tentatively subdivided this upper formation into three members as follows:

·

Calcareous siltstone with more than 50% silty layers and moderate to thin bedding.

·

Calcareous sandstone with more than 50% sandy layers and coarse bedding up to 5 m thick.

·

Interbedded calcareous siltstone and sandstone with equal portions of silty and sandy layers and thin to moderate bedding.

All three members host fracture infilling and replacement mineralization with the more sandy members being better mineralized.

Trenching in the Represa zone has exposed a weak to moderate propylitically-altered hornblende-biotite granodioritic dyke cutting the calcareous sedimentary rocks. Channel sampling results indicate that gold- and silver-bearing mineralization increases adjacent to the dyke. Diamond drilling has also intersected two types of hydrothermally-altered intrusive breccia dykes cutting the limestone sequence (Turner, 2008c). They include a sedimentary clast breccia dyke and a mixed porphyry-sediment clast breccia dyke with a milled quartz porphyry groundmass. Both dyke types are reportedly propylitically altered but the sediment-clast breccia dyke is less altered. Turner (2008c) considers these dykes to be indicative of an advanced hydrothermal system spatially and genetically related to a buried calc-alkaline stock.

7-9

7.2.2

Structure

The central portion of the property is situated within the northwesterly striking Caopas horst that is bounded on the northeast and southwest by similarly-oriented strike-slip faulting (SGM, 2006). The Represa zone occurs immediately west of the eastern faulted boundary of the horst, and similarly oriented parasitic faults have been identified cutting the sedimentary country rocks within this zone (see Figures 7-1 and 7-4).