UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ¨ | Definitive Proxy Statement | |||

| x | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

CME GROUP INC. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

The following communication was sent to certain shareholders of CME Group Inc. beginning May 25, 2011.

Dear CME Group Shareholder:

Our upcoming annual meeting provides an occasion to communicate with shareholders regarding the principles that make CME Group a successful public company, among them the principle ofpay for performance.

Glass Lewis has recommended that CME Group shareholders vote for the approval of our compensation program for our named executive officers. But, ISS has recommended that shareholders vote against the advisory proposal. While we acknowledge the role proxy advisory firms play in assisting fiduciaries to fulfill their obligations, we strongly disagree with both ISS’ methodology and its conclusions with respect to our executive compensation and recommend that you voteFOR Proposal 3 – the advisory vote on the compensation of our named executive officers.

As you prepare to submit your proxy for the June 8 meeting, we ask that you consider our accomplishments and the design of our program to align compensation with performance. Please also consider this an invitation to engage in direct dialogue regarding our compensation program, and feel free to contact Meg Wright atmeg.wright@cmegroup.com to arrange for a more detailed discussion.

Our operating results evidence our strong performance which builds long-term shareholder value.We believe that the our 2010 and first quarter 2011 operating results show that we have continued to grow our business and generate long-term value for our shareholders despite the economic crisis, increased competition and the uncertain regulatory environment.

| • | Strong cash earnings generation of $1.1 billion, up approximately 12% from 2009 |

| • | Increase in our quarterly dividend to $1.40 in 2011 from $1.15 in 2010 |

| • | Highest quarterly level of cash earnings in our history in the first quarter 2011 |

| • | Operating cash flow less capex per share increased from $7.60 in 2005 to $17.90 in 2010 |

| • | Quarter over quarter EBITDA (earnings before income taxes, depreciation and amortization) growth: Q4 2009 ($450 million) to Q1 2011 ($605 million), up 35% |

| • | Operating margin of 61% in 2010 and 63% in Q1 2011 |

| • | Net income per share of $14.31 in 2010 up from $11.60 in 2006 and $8.81 in 2005 |

| • | Debt to EBITDA ratio below 1x |

| • | Share repurchase program of up to $750 million announced in 2011 |

| • | Continued investment in our core business and global growth initiatives |

Our industry and CME Group in particular have been subject to the uncertainty arising from the implementation of the Dodd-Frank Act as well as the continued effects of the economic crisis which we believe have had a negative impact on our stock price. For example, the breadth and diversity of our product line is beneficial to our overall performance when an individual product line is impacted by macroeconomic factors. However, despite this diversity, our interest rate product line which accounted for 23% of our revenue mix in the fourth quarter of 2010 was negatively impacted by exogenous economic factors, including the liberal monetary policy, the zero interest rate environment and quantitative easing. Our competitors and companies within ISS’ peer group, including ICE, which do not have such a concentration of interest rate products, were not impacted by these factors in a comparable manner.

Our CEO’s compensation is designed to pay for performance and the terms and conditions of Mr. Donohue’s current contract are reasonable and competitive.Our “pay-for-performance” approach, and the program structure approved by our independent compensation committee, is central to our ability to attract, retain, and motivate individuals who can achieve superior financial results for our shareholders. In support of those objectives, a significant portion of the pay package provided to our senior management is delivered in the form of stock-based compensation, the value of which rises and falls in alignment with our stock price.

| • | Mr. Donohue’s contract was scheduled to expire at the end of 2009 during a time when we continued to endure the effects of the unprecedented financial crisis and continuity of leadership was a priority. |

| • | In connection with the negotiations, the Board retained an outside consultant to provide it with independent advice regarding CEO compensation who confirmed that the terms of Mr. Donohue’s pay package were consistent with the market median (page 39 of the Proxy Statement). |

| • | The terms of his current employment agreement were negotiated on an arms-length basis, were approved by our independent compensation committee and the entire Board and were designed to align Mr. Donohue’s compensation package with the market median of our 16-company peer group comprised of exchanges, asset managers, brokerages and transaction processors. |

| • | Under the revised terms, the only contractual increase in pay from 2009 to 2010 was a $150,000 increase in base pay. The other compensation opportunities for equity and bonus awards remained the same as a multiple of his base pay in 2009 and 2010. |

The primary driver of Mr. Donohue’s increase in compensation in 2010 was in fact based upon the performance of the Company as measured by cash earnings.We believe this metric provides a transparent view of our performance. In 2010, we derived cash earnings under our annual incentive bonus plan at 110% of the target. As disclosed in the Proxy Statement, the compensation committee awarded Mr. Donohue’s 2010 bonus at the level derived solely from the cash earnings performance without the use of any positive discretion. In 2009, cash earnings under our bonus plan were achieved at 85% of the target level. This difference in cash earnings performance from 2009 to 2010 as compared to the target level (85% to 110%) further explains in the increase in CEO pay and its alignment with our performance.

Importantly, the increases in Mr. Donohue’s compensation as a result of his new contract were the only increases since 2006.Under Mr. Donohue’s leadership, our Company’s competitive position has strengthened despite unprecedented turmoil in the economy. Since 2006, we have completed two significant mergers; grown our business globally as represented by key strategic partnerships with other global exchanges and increased trading volume during non-U.S. hours; increased our market capitalization by approximately $7.5 billion; and experienced the most significant economic crisis in history during which numerous financial institutions performed poorly and in some instances failed. In light of these significant changes in our business, we believe the increases in Mr. Donohue’s compensation were reasonable and competitive.

We question the appropriateness of the CEO peer group set forth in the ISS report.ISS has identified the following companies as our CEO peer group: E*Trade Financial Corporation; Interactive Brokers Group, Inc.; IntercontinentalExchange, Inc.; Jeffries Group, Inc.; Nelnet, Inc.; Raymond James Financial, Inc.; The Student Loan Corporation; and MF Global Ltd. We note that of these eight companies, three experienced a change in their CEO leadership during 2010, one deferred its equity compensation grant to January 2011, and one has a CEO that is a controlling shareholder of the company and therefore elected to forgo incentive compensation. As a result, ISS reported median pay for its CEO peer group that was less than the ISS-reported median pay provided to the other named executive officers within those same companies. Since CEO pay is generally expected to be higher than the pay for his or her direct reports, we believe ISS’ market comparison for Mr. Donohue’s pay is flawed. We note that this peer group differs significantly from our CEO peer group comprised of exchanges, asset managers, brokerages and transaction processors (page 42 of the Proxy Statement.)

We also question thelack of inclusion of NASDAQ OMX Group, Inc. and NYSE Euronext in the ISS peer group – two key players in our industry and competitors with respect to our business and experienced talent. We continue to believe that our CEO peer group, established with the use of an outside compensation consultant familiar with our industry, is more appropriate to benchmark our compensation. Using this comparison, Mr. Donohue’s compensation package is in line with the market median.

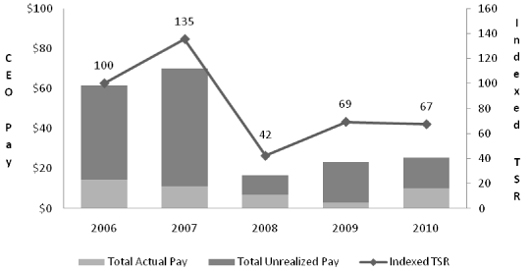

We believe that stock options serve the purpose of incenting the creation of long-term shareholder value.Unlike ISS, we believe that options do serve the purpose of aligning senior management with our shareholders and driving performance as they have no value unless CME Group’s stock price increases. We note our senior management has been significantly impacted by the decrease in our stock value. For example, at the end of 2010, 35% of all of our outstanding options were “under water” and 29% of unvested options were “under water.” Further, as described in more detail in the Compensation Discussion and Analysis section (page 37 of the Proxy Statement), Mr. Donohue’s total actual pay delivered plus the value of his total unrealized pay (including gains on his stock options and restricted stock grants) is aligned with our total shareholder return for each of the last five years.

CEO Pay-for-Performance Alignment

We have enhanced our program with the addition of performance shares.Our independent compensation committee designs our program to motivate our senior management to achieve our short- and long-term financial and strategic goals, in addition to increasing shareholder value. We have added performance shares to our compensation mix beginning with our 2011 annual equity award with total shareholder return relative to the S&P 500 and cash earnings as the performance metrics. We believe these awards will further serve to focus our executives on driving growth for the Company and its shareholders. Messrs. Duffy, Donohue and Gill agreed to amend their existing employment contracts to provide for the inclusion of the performance shares. Mr. Donohue’s contract previously provided for equity compensation with a mix of 50% options and 50% restricted stock.

The board recommends that you vote FOR the say-on-pay proposal because we believe that our executive compensation program is reasonable, competitive, and strongly focused on pay-for-performance principles. We emphasize compensation opportunities that reward our executives when they deliver financial performance as measured by our cash earnings as well as their individual performance goals. Through our stock ownership guidelines and equity incentives, we align the interests of our senior management group with those of our shareholders and the long-term interests of CME Group. Our compensation program has allowed us to attract and retain talented and experienced senior executives in a highly competitive market which we believe has benefitted the Company over time. We believe the compensation awarded and delivered to our named executive officers was appropriate and aligned with our financial results and overall performance during 2010.

CME Group is a unique company in many respects, and our investors seem to appreciate this fact. We hope that you will continue your support and accept the recommendation of your Board.Vote FOR Proposal 3 – the advisory vote on the compensation of named executive officers– for the reasons discussed in our Proxy Statement and summarized above.

| Sincerely, | ||

| Terrence A. Duffy | Alex J. Pollock | |

| Executive Chairman | Chairman, Compensation Committee | |

* * *

CME Group Inc. has filed a definitive proxy statement with the Securities and Exchange Commission (“SEC”) regarding the Annual Meeting of Shareholders to be held on June 8, 2011. Shareholders of CME Group Inc. are urged to read the definitive proxy statement and any other relevant materials filed by CME Group Inc. with the SEC because they contain, or will contain, important information about CME Group Inc. and the Annual Meeting. The definitive proxy statement and other relevant materials (when they become available), and any other documents filed by CME Group Inc. with the SEC, may be obtained free of charge at the SEC’s web site at www.sec.gov. In addition, shareholders may obtain free copies of these documents by contacting CME Group Inc., Shareholder Relations and Membership Services, 20 South Wacker Drive, Chicago, Illinois 60606. Shareholders are urged to read the definitive proxy statement and the other relevant materials (when they become available) before making any voting decision with respect to matters to be acted on at the Annual Meeting.