UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-50262

Intelsat, Ltd.

(Exact Name of Registrant as Specified in Its Charter)

| | |

| Bermuda | | 98-0346003 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| |

Wellesley House North, 2nd Floor 90 Pitts Bay Road Pembroke, Bermuda | | HM 08 |

| (Address of principal executive offices) | | (Zip Code) |

(441) 294-1650

Registrant’s telephone number, including area code

Securities registered or to be registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non- accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s voting stock held by non-affiliates is zero. The registrant is a privately held corporation.

As of April 11, 2006, 12,000 common shares, par value $1.00 per share, were outstanding.

Documents incorporated by reference: None

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

Some of the statements in this Annual Report constitute forward-looking statements that do not directly or exclusively relate to historical facts. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for certain forward-looking statements as long as they are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from the expectations expressed or implied in the forward-looking statements.

When used in this Annual Report, the words “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “intend,” “potential” and “continue,” and the negative of these terms, and other similar expressions are intended to identify forward-looking statements. Examples of these forward-looking statements include, but are not limited to, statements regarding the following: our goal to sustain our leadership position in the fixed satellite services sector and enhance our free cash flow; our plan to expand the broadcast communities on selected satellites in our fleet; our belief that the direct-to-home transmission of television programming via satellite could contribute to future growth in the demand for satellite services as programmers seek to add programming to established networks and as new networks develop; our intent to continue to evaluate and pursue strategic transactions that can broaden our customer base, provide enhanced geographic presence, provide complementary technical and commercial capabilities, further utilize our infrastructure, modify our service application mix, and create operational efficiencies; our belief that our corporate network customers increasingly require managed solutions best addressed by a network that combines space and terrestrial infrastructure; our expectation that the fixed satellite services sector will experience relatively flat to moderate growth over the next few years; with respect to video contribution, our intent to expand our hybrid infrastructure to grow our business; our expectation that growth in high-definition television programming will increase the demand for wholesale satellite capacity; the trends that we believe will impact our revenue and operating expenses in the future; our intent to utilize our enhanced North American coverage as a result of the Intelsat Americas Transaction, as defined in this Annual Report; our expectation that the positive impact of the Intelsat Americas Transaction on our revenue will continue; our current assessment as to how long the IA-7 satellite should be able to provide service on its transponders; our belief that the chances of an anomaly on the IA-6 similar to that on the IA-7 are low; our belief that there is no connection between the IS-804 satellite anomaly and the IA-7 satellite anomaly; our current expectation that the IA-7 anomaly and the total loss of the IS-804 satellite will not result in the acceleration of capital expenditures to replace the IA-7 and IS-804 satellites, respectively; our plans for satellite launches in the near term; our expected capital expenditures in 2006 and during the next several years; our belief that our balanced geographic mix provides some protection from adverse regional economic conditions; the impact on our financial position or results of operations of pending legal proceedings; our intent to utilize our enhanced capabilities as a result of the COMSAT General Transaction, as defined in this Annual Report, to strengthen our position in the government customer sector; our belief that the COMSAT General Transaction will positively impact our revenue from lease services; the impact of the Acquisition Transactions, the Transfer Transactions and the timing of, our ability to consummate and the impact (including on our strategy and plans) of the PanAmSat Acquisition Transactions, each as defined in this Annual Report.

The forward-looking statements made in this Annual Report reflect our intentions, plans, expectations, assumptions and beliefs about future events. These forward-looking statements are not guarantees of future performance or results and are subject to risks, uncertainties and other factors, many of which are outside of our control. These factors could cause actual results or developments to differ materially from the expectations expressed or implied in the forward-looking statements and include known and unknown risks. Known risks include, among others, the risks discussed in Item 1A—Risk Factors, the political, economic and legal conditions in the markets we are targeting for communications services or in which we operate and other risks and uncertainties inherent in the telecommunications business in general and the satellite communications business in particular.

1

Other factors that may cause results or developments to differ materially from the forward-looking statements made in this Annual Report include, but are not limited to:

| | • | | the quality and price of comparable communications services offered or to be offered by other satellite operators; and |

| | • | | the perceptions of our business, operations and financial condition and the industry in which we operate by the financial community and ratings agencies. |

In connection with our acquisition of PanAmSat Holding Corporation as described in this Annual Report under Item 1—Business—The Transactions—The PanAmSat Acquisition Transactions, factors that may cause results or developments to differ materially from the forward-looking statements made in this Annual Report include, but are not limited to:

| | • | | the failure to complete the proposed Merger Transaction (as defined in Item 1—Business—The Transactions—The PanAmSat Acquisition Transactions) within the time period specified in the Merger Agreement or at all or the need to modify aspects of the proposed Merger Transaction in order to obtain regulatory approvals or satisfy other conditions specified in the Merger Agreement (as defined in Item 1—Business—The Transactions—The PanAmSat Acquisition Transactions); |

| | • | | the possibility that a third party may file an opposition action or an objection with one or more regulatory agencies and authorities reviewing the proposed Merger Transaction; |

| | • | | our inability to obtain regulatory approvals or sufficient funds on reasonable and acceptable terms in order to consummate the proposed Merger Transaction; |

| | • | | a change in the health of, or a catastrophic loss during the in-orbit operations of, one or more of, the PanAmSat satellites to be acquired; |

| | • | | the failure to achieve our strategic objectives for the acquisition of PanAmSat; and |

| | • | | the failure to successfully integrate or to obtain expected synergies from our acquisition of PanAmSat on the expected timetable or at all. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee our future results, level of activity, performance or achievements. Because actual results could differ materially from our intentions, plans, expectations, assumptions and beliefs about the future, you are urged not to rely on forward-looking statements in this Annual Report and to view all forward-looking statements made in this Annual Report with caution. We do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

INTERNET ACCESS TO COMPANY’S REPORTS

Our website iswww.intelsat.com. We make available free of charge through our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendment to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, or the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission, or the SEC. Material contained on our website is not incorporated by reference into, and you should not consider it part of, this Annual Report on Form 10-K. The SEC maintains an internet site (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

2

PART I

Unless otherwise indicated, this description of Intelsat, Ltd., referred to as “we,” “us,” and “our,” and our business does not give effect to, nor reflects the impact of, the PanAmSat Acquisition Transactions. For information on the PanAmSat Acquisition Transactions, see “—The Transactions—The PanAmSat Acquisition Transactions.”

Our History

We are the successor entity to the International Telecommunications Satellite Organization, referred to as the IGO. The IGO was a public intergovernmental organization created on an interim basis by its initial member states in 1964 and formally established in February 1973 upon entry into force of an intergovernmental agreement.

The member states that were party to the treaty governing the IGO, referred to as the Parties, designated certain entities, known as the Signatories, to market and use the IGO’s communications system within their territories and to hold investment share in the IGO. Signatories were either private telecommunications entities or governmental agencies of the applicable Party’s country or territory. Some Signatories authorized certain other entities located within their territories that used the IGO’s satellite system, known as the Investing Entities, to invest in the IGO as well. Both Signatories and Investing Entities made capital contributions to the IGO and received capital repayments from the IGO in proportion to their investment share in the IGO. Signatories and Investing Entities were also the IGO’s principal customers. Each Signatory’s and Investing Entity’s investment share in the IGO was based on its level of use of the IGO’s satellite system as compared to the use by other Signatories and Investing Entities.

As a public intergovernmental organization, the IGO was exempt from various taxes and enjoyed privileges, exemptions and immunities in many of its member states. However, due to its status as an intergovernmental organization, the IGO’s business was subject to certain operating restrictions. For example, the IGO could not own or operate its own earth stations or provide retail services directly to end users in certain countries. It also could not set market-based pricing for its services or engage in business relationships with non-Signatories without first obtaining Signatory approval.

The Privatization

Our management began contemplating privatization in the mid-1990s in order to be able to operate our business free of the restrictions described above and to better position us to be responsive to a number of commercial, competitive and regulatory forces. In November 2000, the Assembly of Parties unanimously approved our management’s specific plan for our privatization and set the date of privatization for July 18, 2001. On July 18, 2001, substantially all of the assets and liabilities of the IGO were transferred to us.

The privatization required the amendment of the two formal agreements establishing the IGO. These two agreements were the Agreement Relating to the International Telecommunications Satellite Organization “INTELSAT,” known as the INTELSAT Agreement, and the Operating Agreement Relating to the International Telecommunications Satellite Organization “INTELSAT,” known as the Operating Agreement, which both entered into force in February 1973. Because the process to formally ratify the amendments to the INTELSAT Agreement was expected to be lengthy, the IGO’s Assembly of Parties decided to provisionally apply, or rapidly implement, the amendments on a consensus basis with effect from July 18, 2001, pending their formal ratification. Formal entry into force of the amendments to the INTELSAT Agreement occurred on November 30, 2004.

Upon our privatization, the IGO’s Signatories and Investing Entities became the shareholders of all of the outstanding ordinary shares of Intelsat, Ltd. Ordinary shares were allocated among the IGO’s Signatories and

3

Investing Entities in proportion to their investment share in the IGO. Each Signatory and Investing Entity that executed and delivered the required privatization agreements, including a shareholders agreement, received shares in Intelsat, Ltd. in proportion to its investment share in the IGO.

The IGO, referred to post-privatization as ITSO, continues to exist as an intergovernmental organization and will continue to exist as such for a period of at least 12 years after July 18, 2001, and then may be terminated by a decision of a governing body of ITSO called the Assembly of Parties. Pursuant to an agreement among ITSO and Intelsat, Ltd. and certain of our subsidiaries, we have an obligation to provide our services in a manner consistent with the core principles of global coverage and connectivity, lifeline connectivity and non-discriminatory access, and ITSO monitors our implementation of this obligation. These core principles are described below under “—Certain Customer Service Agreements—Novation Agreements—Lifeline Connectivity Obligation Contracts.”

The Transactions

Acquisition by Intelsat Holdings

On January 28, 2005, Intelsat, Ltd. was acquired by Intelsat Holdings, Ltd., referred to as Intelsat Holdings, for total cash consideration of approximately $3.2 billion with pre-acquisition debt of approximately $1.9 billion remaining outstanding. Intelsat Holdings is a Bermuda company which was formed at the direction of funds advised by or associated with Apax Partners Worldwide LLP and Apax Partners, Inc., referred to jointly as Apax Partners, Apollo Management V, L.P., referred to as Apollo, MDP Global Investors Limited, referred to as MDP Global, and Permira Advisers LLC, referred to as Permira. Each of Apax Partners, Apollo, MDP Global and Permira is referred to as a Sponsor and the funds advised by or associated with each Sponsor are referred to as an Investor group. The Investor groups collectively are referred to as the Investors. As part of the Acquisition Transactions, the Investors and certain members of management purchased preferred and ordinary shares of Intelsat Holdings, referred to as the equity contributions. Prior to the Acquisition Transactions, funds advised by or associated with MDP Global transferred less than 0.1% of their interest in Intelsat Holdings to an unaffiliated investment partnership. References to the Investors include this partnership. In connection with this acquisition transaction, the following transactions, referred to as the Amalgamation Transactions, occurred:

| | • | | Zeus Merger One Limited, referred to as Zeus Merger 1, a wholly owned direct subsidiary of Intelsat Holdings, amalgamated with Intelsat, Ltd., with the resulting company being a direct wholly owned subsidiary of Intelsat Holdings and being named Intelsat, Ltd.; upon this amalgamation, Intelsat, Ltd.’s equity holders immediately prior to the amalgamation ceased to hold shares or other equity interests in Intelsat, Ltd.; and |

| | • | | Zeus Merger Two Limited, referred to as Zeus Merger 2, a wholly owned direct subsidiary of Zeus Merger 1, amalgamated with Intelsat (Bermuda), Ltd., referred to as Intelsat Bermuda, which is the direct or indirect parent of all of our operating subsidiaries, with the resulting company being a direct wholly owned subsidiary of resulting Intelsat, Ltd. and being named Intelsat (Bermuda), Ltd. |

Intelsat Holdings, Zeus Merger 1 and Zeus Merger 2 were Bermuda companies that were newly formed for the purpose of consummating the Acquisition Transactions.

In connection with the completion of the Amalgamation Transactions, Zeus Merger 2, which later amalgamated with Intelsat Bermuda, established a new $300 million revolving credit facility and borrowed approximately $150 million under a new $350 million term loan facility, referred to together as the senior secured credit facilities, and issued $1 billion of Floating Rate Senior Notes due 2012, referred to as the floating rate notes, $875 million of 8 1/4% Senior Notes due 2013, and $675 million 8 5/8% Senior Notes due 2015, referred to collectively as the acquisition finance notes. The proceeds from the equity contributions, borrowings under the senior secured credit facilities and the issuance of the acquisition finance notes, together with cash on hand, were used to consummate the transactions described above and to pay related fees and expenses.

4

The Amalgamation Transactions occurred concurrently with the establishment of the senior secured credit facilities and the issuance of the acquisition finance notes. Following the consummation of the Amalgamation Transactions, Intelsat Bermuda became the borrower under the senior secured credit facilities and the obligor under the acquisition finance notes. Following the consummation of the Amalgamation Transactions, the acquisition finance notes and the senior secured credit facilities were guaranteed by Intelsat, Ltd. and certain subsidiaries of Intelsat Bermuda.

The acquisition transactions and related financings described above are referred to collectively in this Annual Report as the Acquisition Transactions.

On February 28, 2005, Intelsat Bermuda drew $200 million under the $350 million term loan facility to fund the payment of Intelsat, Ltd.’s then existing $200 million of Eurobond 8 1/8% notes due 2005, referred to herein as the 2005 Eurobond Notes, at maturity in February 2005. Approximately $1.7 billion of Intelsat, Ltd.’s existing debt remained outstanding following the Acquisition Transactions and repayment at maturity of the 2005 Eurobond Notes.

The Transfer Transactions

Following the Acquisition Transactions, Intelsat, Ltd. formed a new wholly owned subsidiary, Zeus Special Subsidiary Limited (which we refer to as Finance Co.), and Intelsat Bermuda formed a new wholly owned subsidiary, Intelsat Subsidiary Holding Company, Ltd., referred to as Intelsat Sub Holdco. On February 11, 2005, Finance Co. issued $478.7 million aggregate principal amount at maturity of 9 1/4% Senior Discount Notes due 2015, referred to as the discount notes, which yielded approximately $305 million of proceeds at issuance.

Following the issuance of the discount notes and the deposit of the gross proceeds by Finance Co. in a special account established by Finance Co., the following transactions took place:

| | • | | we filed applications with the U.S. Federal Communications Commission, referred to as the FCC, for approval of the pro forma indirect transfer of control of, and the change in indirect foreign ownership of, the five subsidiaries of our company holding FCC authorizations; |

| | • | | on March 3, 2005, Intelsat Bermuda transferred substantially all of its assets to Intelsat Sub Holdco and Intelsat Sub Holdco assumed substantially all of the then-existing liabilities of Intelsat Bermuda, including the acquisition finance notes; and Intelsat Bermuda also became a guarantor of the senior secured credit facilities and the acquisition finance notes upon the consummation of the Transfer Transactions; and |

| | • | | Finance Co. amalgamated with Intelsat Bermuda, with the resulting company being named Intelsat (Bermuda), Ltd. and Intelsat Bermuda becoming an obligor on the discount notes. |

Following consummation of these transactions, the proceeds of the offering of the discount notes, together with cash on hand, were used to pay a dividend from Intelsat Bermuda to its parent, Intelsat, Ltd., which Intelsat, Ltd. used to make a return of capital distribution equal to the amount of the dividend to its parent, Intelsat Holdings, which in turn used those funds to repurchase a portion of the outstanding preferred shares of Intelsat Holdings. The repurchased preferred shares were held by the Investors and certain members of our management. We refer to all of these transactions collectively as the Transfer Transactions.

The PanAmSat Acquisition Transactions

On August 28, 2005, Intelsat Bermuda entered into a Merger Agreement, referred to as the Merger Agreement, with PanAmSat Holding Corporation, referred to as PanAmSat, and Proton Acquisition Corporation, a wholly owned subsidiary of Intelsat Bermuda and referred to as Merger Sub. Pursuant to the Merger Agreement, Intelsat Bermuda agreed to acquire PanAmSat for total cash consideration of approximately $3.2 billion, with the shareholders of PanAmSat generally being entitled to receive $25.00 per common share (plus a

5

pro rata share of undeclared regular quarterly dividends, if any, for the quarter in which the acquisition is consummated). Merger Sub was newly formed for the purpose of consummating the PanAmSat Acquisition Transactions (as defined below) and currently has no independent operations or assets. As part of this transaction, approximately $3.2 billion in debt of PanAmSat and its subsidiaries will either be refinanced or remain outstanding.

In connection with, and in order to effect, the transactions contemplated by the Merger Agreement and the related financing, the following transactions have occurred or are expected to occur:

| | • | | Intelsat Bermuda has created a new direct wholly owned subsidiary, Intelsat Intermediate Holding Company, Ltd., referred to as Intermediate Holdco; |

| | • | | Intelsat Bermuda will transfer substantially all its assets (other than the capital stock of Merger Sub) and liabilities (including the discount notes) to Intermediate Holdco, but will remain a guarantor of the notes and the senior secured credit facilities and will become a guarantor of the discount notes; and |

| | • | | Merger Sub will merge with PanAmSat, with PanAmSat continuing as the surviving corporation and being a direct wholly owned subsidiary of Intelsat Bermuda. Upon completion of this merger, referred to as the Merger Transaction, PanAmSat’s equity holders immediately prior to the merger will cease to hold shares or other equity interests in PanAmSat. |

Consummation of the Merger Transaction is subject to various closing conditions, including but not limited to the satisfaction or waiver of conditions regarding the receipt of requisite regulatory approvals, the receipt of financing by Intelsat Bermuda and the adoption of the Merger Agreement by a majority of PanAmSat’s stockholders. Under the terms of the Merger Agreement, if the agreement is terminated under specified circumstances relating to our inability to obtain financing or requisite regulatory approvals, we may be required to pay PanAmSat a termination fee of $250 million. Investment vehicles affiliated with Kohlberg Kravis Roberts & Co., the Carlyle Group and Providence Equity Partners together own approximately 58% of PanAmSat’s common stock and agreed to vote in favor of the adoption of the Merger Agreement. On October 26, 2005, PanAmSat informed us that a majority of its stockholders approved and adopted the Merger Agreement. We believe that the Merger Transaction could close in the second or third quarter of 2006.

Upon completion of the PanAmSat Acquisition Transactions, PanAmSat and Intelsat Sub Holdco will be direct or indirect wholly owned subsidiaries of Intelsat Bermuda, and PanAmSat and its subsidiaries will continue as separate corporate entities.

David McGlade will continue to serve as Chief Executive Officer, or CEO, and a Director of Intelsat, Ltd. following the consummation of the Merger Transaction. Joseph Wright, the current Chief Executive Officer and a Director of PanAmSat, is expected to become our Chairman upon completion of the Merger Transaction, pending successful negotiation of the terms and conditions of his employment. James Frownfelter, the current Chief Operating Officer of PanAmSat, is expected to become our Chief Operating Officer upon completion of the Merger Transaction. Phillip Spector, our current Executive Vice President, General Counsel and Assistant Secretary, will continue to serve in his current role upon completion of the Merger Transaction. Jeffrey Freimark, who will be appointed our Executive Vice President and Chief Financial Officer upon the resignation of our current Acting Chief Financial Officer, J. Robert Medlin, expected in April 2006, will continue to serve in that role upon completion of the Merger Transaction. Mr. Medlin, Senior Managing Director at FTI Consulting, Inc., will continue to assist Intelsat in its financial operations on an interim basis as a consultant.

Intelsat Bermuda has received financing commitments for the full amount of the purchase price from a group of financial institutions. The funding of the commitments is subject to certain conditions, including satisfaction of the conditions to the Merger Transaction. A substantial portion of the financing for the PanAmSat Acquisition Transactions is expected to be raised by Intelsat Bermuda, with additional financing expected to be raised by PanAmSat, PanAmSat Corporation (a direct subsidiary of PanAmSat) and Intelsat Sub Holdco. A portion of the financing raised by Intelsat Bermuda may be guaranteed by Intelsat Sub Holdco and certain of its

6

subsidiaries. The net proceeds from these funding transactions, together with cash on hand will be used to consummate the PanAmSat Acquisition Transactions and to pay related fees and expenses. In light of the Merger Transaction and the associated financing transactions, we do not expect that Intelsat Holdings will issue a cash dividend to its shareholders from now until the completion of the PanAmSat Acquisition Transactions, and for a period of at least 12 months following such completion, absent an initial public offering of equity securities of Intelsat Holdings or one of its direct or indirect subsidiaries, and assuming that the PanAmSat Acquisition Transactions are completed during the second or third quarter of 2006.

Consummation of the Merger Transaction is expected to result in a change of control under the indentures governing certain outstanding notes of PanAmSat and its subsidiary, PanAmSat Corporation, giving the holders of these notes the right to require the issuers thereof to repurchase these notes at the prices stated in these indentures. In addition, consummation of the Merger Transaction will require us to seek consents and obtain certain amendments under our existing senior secured credit facilities and the secured credit facilities of PanAmSat Corporation. We believe we will be able to obtain these consents and amendments, although there is no assurance that this will be the case. The financing commitments referred to above include a commitment from the financial institutions party thereto to provide us with funding to cover these repurchase obligations in the event the holders of these notes exercise these repurchase rights and to provide us and PanAmSat Corporation with replacement credit facilities in the event the required consents and amendments under existing credit facilities are not obtained.

The transactions described above, including the Merger Transaction, the funding transactions and the use of cash on hand, are referred to collectively in this Annual Report as the PanAmSat Acquisition Transactions. For more information regarding the PanAmSat Acquisition Transactions, see “—The PanAmSat Acquisition Transactions” in our Registration Statement on Form S-4, file no. 333-129465, filed on November 4, 2005.

The Acquisition Transactions, the Transfer Transactions and the PanAmSat Acquisition Transactions are referred to collectively as the Transactions.

Our Company

We are a leading provider of fixed satellite services, with customers that include leading telecommunications companies, multinational corporations, internet service providers, media broadcasters and government/military organizations. Founded in 1964, we have provided communications capacity for milestone events in the 20th century, including transmitting worldwide the video signals of the first moon walk, providing the “hot line” connecting the White House and the Kremlin and transmitting live television coverage of every Olympics since 1968.

Our goal is to connect people and businesses around the world with reliable, flexible and innovative communications services. We supply voice, data and video connectivity in over 200 countries and territories for over 700 customers, many of which we have had relationships with for over 30 years. We operate in an attractive, well-developed segment of the satellite communications industry that is characterized by steady and predictable contracted revenue streams and strong free cash flows, which represent cash flows from operating activities less capital expenditures. In 2004, the fixed satellite services, or FSS, sector generated revenue of approximately $7.05 billion, and by that measure we were the second largest operator, according toEuroconsult. We generate revenue primarily from leasing capacity on our satellites, which is generally contracted for periods of up to 15 years. Our backlog, which is our expected actual future revenue under our customer contracts, was approximately $3.8 billion as of December 31, 2005, 98% of which relates to contracts that are non-cancelable or cancelable only upon payment of substantial termination fees.

We believe that we have one of the largest, most flexible and reliable satellite fleets in the world. Our in-orbit satellite fleet, which covers 99% of the world’s population, currently includes 27 satellites and leased capacity on one additional satellite. Many of our satellites have steerable beams that can be reconfigured to

7

provide different areas of coverage, and many of our satellites can be relocated to other orbital locations. The flexibility of our fleet allows us to respond quickly to changes in market conditions and customer demand. During the past 30 years, other than the IS-804 satellite which experienced an anomaly that resulted in a total loss, each of the station-kept satellites we launched or acquired in the Intelsat Americas Transaction has exceeded, or is expected to exceed, its design life. Our satellite fleet is operated via ground facilities used to monitor and control our satellites and is complemented by a terrestrial network of teleports, points of presence and leased fiber links for the provision of our managed solutions.

We have invested heavily in our communications network over the past several years. Consequently, in the near term, we expect our level of capital expenditures to be significantly lower than during periods prior to 2005. We have spent approximately $2.5 billion on nine satellite launches since June 2001 in connection with our most recent satellite fleet renewal and deployment cycle, which was completed with the launch of our IA-8 satellite on June 23, 2005. The IA-9 is currently our only satellite under construction, and we do not plan to launch this satellite until 2007. The average remaining orbital maneuver life of our satellites was approximately 11.2 years as of December 31, 2005, weighted on the basis of nominally available capacity for the 23 station-kept satellites of the 28 satellites we owned and operated at that time. Assuming we complete our proposed acquisition of PanAmSat, our capital expenditures are expected to increase as PanAmSat Corporation is planning to launch a number of satellites over the next few years. See “—The Transactions—The PanAmSat Acquisition Transactions.”

In 2004, we completed two transactions in growing parts of the FSS sector. In March 2004, we purchased the North American satellites and related customer contracts and other assets from Loral Space & Communications Corporation and certain of its affiliates, which we refer to as the Intelsat Americas Transaction. The satellites and related assets acquired in the Intelsat Americas Transaction have further strengthened our leading position in the FSS sector by enhancing our capabilities for video, corporate network and government/military applications. We also purchased the business of COMSAT General Corporation and certain of its affiliates in October 2004. This transaction, which we refer to as the COMSAT General Transaction, has further strengthened our leading position in providing services for government and other military service applications.

As described above in “—The Transactions,” on January 28, 2005, we were acquired by Intelsat Holdings and on August 28, 2005, our subsidiary, Intelsat Bermuda, entered into a Merger Agreement to acquire PanAmSat.

Our Service Sectors

We provide satellite capacity and related communications services for the transmission of voice, data and video connectivity. Our customer contracts offer different service types, which fall primarily into four categories: leases, channel, managed solutions and mobile satellite services. Our services are used to serve three sectors: network services and telecom, media and government.

Network Services and Telecom

The network services and telecom sector represented 62% of our revenue for the year ended December 31, 2005. We provide satellite capacity and managed solutions to telecommunications carriers, internet service providers or ISPs, and multinational corporations to support voice and data applications, including point-to-point and point-to-multipoint connections between telecommunication hubs. Highlights include the following:

| | • | | We were the leading provider of satellite capacity for voice and data applications in 2004, derived from data presented by Euroconsult. |

| | • | | We believe that the demand for satellite capacity for certain niche voice and data applications will grow. For example, the proliferation of wireless services worldwide has created demand to use satellite services for backhaul and network extensions in developing regions, due to unreliable or non-existent |

8

| | terrestrial infrastructure. In addition, the growth in voice over internet protocol or VoIP, applications is driving growth for satellite-based managed solutions for ISPs in developing countries. |

| | • | | Our revenue from voice and data applications is highly predictable and benefits from primarily non-cancelable contracts. Based on our backlog at December 31, 2005, we expect to recognize $637 million in voice and data applications revenue for the year ended December 31, 2006. |

| | • | | We provide point-to-multipoint connections for corporate network applications, including very small aperture terminals, or VSATs. |

Because the IGO was created to provide capacity for international public telecommunications services, the use of our capacity for voice and data applications has historically been our largest source of revenue. However, the market for satellite-based voice and data services has faced, and is expected to continue to face, competition from fiber optic cable. See Item 1A—Risk Factors—Risk Factors Relating to Our Business for a discussion of the competition from fiber optic cable. Despite the migration to fiber of our point-to-point carrier customers on certain routes, we believe that we will continue to earn a significant portion of our revenue from our network services and telecom sector in the near term. In addition, we believe that the growth of our managed solutions business will substantially offset the expected decline in this business. For a discussion of our strategy with respect to voice and data services, see “—Our Business Strategy—Network Services and Telecom.”

Media

The media sector represented 17% of our revenue for the year ended December 31, 2005. Video applications currently use more FSS capacity than any other application, representing about 61% of total global FSS transponder demand in 2004, with North America being the largest user of satellite capacity for video applications, according toNorthern Sky Research. We currently offer the following services to our media customers:

| | • | | video distribution services, which include the transmission of television programming for broadcasters, cable networks, direct-to-home, or DTH, service providers and other redistribution systems; and |

| | • | | video contribution services, which include the transmission of news, sports and other video programming from various locations to a central video production studio. |

Highlights include the following:

| | • | | In North America, we believe that we are a leading provider of FSS capacity for the distribution of broadcast video. We also believe that we are one of the leading providers of FSS capacity for ethnic programming distribution in North America, with over 150 channels broadcast. |

| | • | | We are a leading provider of FSS capacity for DTH services, delivering programming to millions of viewers and supporting 11 DTH platforms around the world. |

| | • | | Global transponder demand for FSS video applications is forecasted to grow overall at a compound annual growth rate, or CAGR, of approximately 4.1% from 2005 to 2010, according toNorthern Sky Research. |

Government

The government sector represented 20% of our revenue for the year ended December 31, 2005. We provide satellite capacity and managed solutions for a variety of applications to various government and military entities, including the U.S. government and its defense and civilian agencies, as well as NATO members. Highlights include the following:

| | • | | We were the largest FSS provider of government satellite services in 2004, according toEuroconsult. |

9

| | • | | The reliability of, and the ability to reconfigure, our fleet allow us to address changing demand for satellite coverage and provide mission-critical communications capability. |

| | • | | The U.S. government and military is the largest end user of commercial FSS satellites for government/military applications on a global basis. We currently serve more than 60 U.S. government and military users and NATO entities, either directly or as a sub-contractor. |

| | • | | Demand for transponder capacity on commercial FSS satellites to support U.S. government and military applications is expected to grow at a CAGR of approximately 8.4% between 2005 and 2010, according toNorthern Sky Research. |

Our Strengths

Our business is characterized by the following key strengths:

Strong Free Cash Flow and Near-Term Revenue Visibility

We believe that our increasing revenues, combined with our modest capital expenditures profile, low tax obligations and limited working capital requirements, will result in the generation of significant free cash flow. The FSS sector requires sizable up-front investment to develop and launch satellites. However, once satellites are operational, the costs of sales and operations do not vary significantly as usage of our system increases and are, with sufficient scale, low relative to the revenue that may be generated, typically resulting in high margins and strong free cash flow. We have spent approximately $2.5 billion on nine satellites launched since June 2001 in connection with our most recent satellite fleet renewal and deployment cycle, which was completed with the launch of our IA-8 satellite on June 23, 2005, and approximately $967.1 million to acquire four operational satellites and other assets in the Intelsat Americas Transaction. The IA-9 is currently our only satellite under construction, and we do not plan to launch this satellite until 2007. As a result, in the near term, we expect our level of capital expenditures to be significantly lower than during periods prior to 2005. Due to available capacity in our fleet, we have the potential to add customers and increase revenue without near term satellite investment or a significant increase in our costs of operations, which should increase cash flow. Assuming we complete our proposed acquisition of PanAmSat, our capital expenditures are expected to increase as PanAmSat Corporation is planning to launch a number of satellites over the next few years.

Our backlog was approximately $3.8 billion as of December 31, 2005. We currently expect to deliver services associated with $908 million, or 24%, of our December 31, 2005 backlog over the twelve months ending December 31, 2006. Our backlog provides significant near-term revenue visibility, particularly since 98% of our total backlog as of December 31, 2005 relates to contracts that either are non-cancelable or have substantial termination fees. In the last three years, the revenue that we expected to generate from our backlog at the beginning of each year represented on average 80% of that year’s actual revenue. See Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations—Backlog for further information regarding our backlog.

Fleet of Reliable, Flexible, Healthy Satellites

We believe that we have one of the most technologically advanced and largest fleets of satellites in the FSS sector. Other than the IS-804 satellite which experienced an anomaly resulting in a total loss, the average remaining orbital maneuver life of our satellites was approximately 11.2 years as of December 31, 2005, weighted on the basis of available capacity for the 23 station-kept satellites of the 28 satellites we owned and operated at that time. Our state-of-the-art engineering standards, with built-in redundancies on all of our satellites, provide for a reliable, flexible, healthy fleet. For the 365-day period ended December 31, 2005, the transponder availability rate for satellites owned and operated by us, including the IS satellites (which are satellites we owned prior to the closing of the Intelsat Americas Transaction) and IA satellites (which are satellites we acquired in connection with or since the date of the Intelsat Americas Transaction) was 99.9952%. During the past 30 years, other than the IS-804 satellite, each of our station-kept satellites has exceeded, or is expected to exceed, its design life.

10

Our satellites cover 99% of the world’s population, and we provide satellite capacity in the C- and Ku-bands in over 200 countries and territories. With the launch of our IA-8 satellite, we are also able to provide satellite capacity in the Ka-band. Our fleet includes satellites in prime orbital locations with coverage of key regions such as North America and the Middle East. We also have terrestrial assets consisting of teleports, points of presence and leased fiber connectivity that complement our satellite network and enable us to provide customized managed solutions.

We believe that the flexibility of our satellite fleet provides us with an advantage relative to other satellite providers. Many of our satellites are equipped with steerable beams that can be moved to cover areas with higher demand. In addition, many of our satellites can be relocated to different orbital locations. The design flexibility of our satellites enables us to respond rapidly to changing market conditions and to changes in demand for satellite capacity. As an example, in 2004, the consolidation of our fleet in the Pacific Ocean Region and deployment of the 10-02 satellite to 359º E resulted in the release of two Intelsat satellites that were redeployed to address the increased demand for satellite capacity in the Africa and Middle East regions.

Diversified Revenue and Backlog

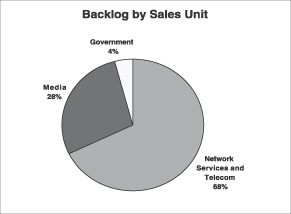

Our revenue and backlog are diversified among service sectors, geographic regions, satellites and customers. For details regarding the distribution of our revenue by geographic region and service type, refer to Note 20 of our consolidated financial statements appearing elsewhere in this Annual Report. None of our satellites generated more than 10% of our revenue for the year ended December 31, 2005, and no single customer accounted for more than approximately 5% of our revenue during this period. The diversity of our revenue allows us to benefit from changing market conditions and minimizes our risk from fluctuations in any one of these categories and from difficulties that any one customer may experience. By service sector and region, our backlog as of December 31, 2005 was as follows:

| Note: | Backlog data is calculated based on our backlog as of December 31, 2005. Regional designation for backlog is based on customer billing addresses. |

11

Established Relationships with Premier Customers

We provide satellite services to over 700 customers, including many of the world’s leading telecommunications companies, multinational corporations, ISPs, media broadcasters and government/military organizations. We have served many of our largest customers, including the majority of our top ten customers and their predecessors, for over 30 years. The following table includes examples of our customers for each service sector.

| | |

Service Sector Category | | Customers |

| Network Services and Telecom | | AT&T, British Telecommunications, Cable and Wireless, Central Bank of the Russian Federation, China Telecom, Gateway Corporation, Hughes Network Services, Schlumberger, Sprint, Telkom South Africa, United Nations, Vodacom, World Bank |

| |

| Media | | BBC World, Canal Digital, CBS, Globecast WorldTV, MTV3, Playboy Entertainment |

| |

| Government | | Artel, National Oceanic and Atmospheric Administration, U.S. Department of Defense’s Armed Forces Radio & Television Service, U.S. Department of State, U.S. Navy |

Strong Position in Growing Customer Sectors

We have strong positions in areas of the FSS sector that are experiencing growth, such as data applications, primarily for corporate and broadband data, and government/military applications. We were the leading provider of capacity for voice and data services worldwide in 2004, derived from data presented byEuroconsult. Global transponder demand for all voice and data services is forecasted to grow at a CAGR of approximately 1.4% from 2005 to 2010, according to Northern Sky Research. Of this growth, the majority is expected to come from enterprise and small and medium enterprise, or SME, broadband IP VSAT services, which is forecasted to grow at a CAGR of approximately 9.2% from 2005 to 2010, according toNorthern Sky Research. We expect growth in the use of VSATs to continue as businesses further globalize and realize the benefits of communicating via a comprehensive satellite-based network. We also believe growth in this business will be facilitated by the continued growth of virtual private networks, referred to as VPNs, and emerging applications such as VoIP and video over internet protocol. Satellites are inherently well suited to deliver multiregional internet protocol-based, or IP networks, due to their multicasting capabilities and large geographic footprints.

We were the largest FSS provider of government satellite services in 2004, according toEuroconsult.U.S. government and military demand for capacity on commercial FSS satellites is expected to grow at a CAGR of approximately 8.4% between 2005 and 2010, according toNorthern Sky Research. Government/military customers currently rely on commercial satellite capacity for a growing portion of their mission-critical communications and customized managed solutions. As a result of the current geopolitical environment and the increasing homeland security requirements of the U.S. government, government/military customers are expected to require greater commercial communications capacity for mission-critical defense and civilian applications. We attribute our strength in this area to the flexibility of our satellite fleet, and the reliability of our satellites in transmitting mission-critical communications. We intend to utilize our well-established customer relationships, our enhanced capabilities as a result of the COMSAT General Transaction and our enhanced North American coverage as a result of the Intelsat Americas Transaction to strengthen our position in this sector.

Strong Position in Growing Media Services

We are a leading provider of FSS capacity for broadcast video distribution in North America and for video contribution and DTH services around the world. Global transponder demand for FSS video applications is

12

forecasted to grow overall at a CAGR of approximately 4.1% from 2005 to 2010, according toNorthern Sky Research. We believe that growth will be driven by, among other things, the demand for high-definition television, or HDTV, and non-English programming in developed countries and the expansion of DTH services in several regions around the world.

HDTV programming, which requires significantly more satellite capacity to transmit a given amount of content than standard-definition programming requires, is expected to grow rapidly in the near to mid term, especially in North America, as programmers seek to increase their audiences by offering high-definition sports and other entertainment programming where the high-definition format can enhance the content. As one of the leaders in serving North American broadcast networks, we are using our position to enable early high-definition adopters, such as CBS Sports, to move high-definition content from the creation source to their studios via our satellite network and terrestrial networks. We believe that our Intelsat Americas satellites are well positioned to serve both the cable and broadcast communities and to meet any expected increase in demand for distribution of HDTV programming.

Non-English language programming in the United States has increased dramatically in the last few years to over 300 channels. The growth in non-English language programming in the United States is driven by the demand for tailored channels from different ethnic groups within the country’s diverse population, including the desire to access sports, news and entertainment programming from non-U.S. countries. Our IA-5 satellite carries over 150 channels offering ethnic programming, including many that are brought to the United States on our system, and we believe that IA-5 carries more non-English and non-Spanish language programming than any other satellite in North America. In addition, our global network carries international programming from the source and delivers it to our North American distribution system for customers that include GlobeCast WorldTV, the largest international content aggregator in North America.

We believe that we are well positioned in another growing video application, the distribution of DTH programming around the world. Currently, our network supports 11 DTH platforms, providing content to millions of households. We will continue our focus on higher-growth regions including Eastern Europe, Africa and parts of Asia, where we believe that we are well positioned. Given the flexible nature of our capacity, including the ability to reconfigure beam coverage on a number of our satellites in response to customer demand, we believe we will be able to respond to new customer requirements as they develop. Our position in the video market is further strengthened by the fact that, on a system-wide basis, Intelsat carries video services which are 90% digital.

Our Business Strategy

Our goal is to sustain our leadership position in the FSS sector and enhance our profitability and free cash flow by pursuing the following key business strategies:

Grow Our Business in the Network Services and Telecom, Media, and Government Sectors

We believe that the network services and telecom, media and government sectors represent opportunities for revenue growth over the long term for operators in FSS services. We intend to focus our resources on penetrating these sectors further in order to increase our revenue and cash flow and to continue to diversify our customer base.

Network Services and Telecom

We believe the primary growth area for voice and data customers will be our managed solutions business. Customers are increasingly looking for more integrated services to meet their communications needs. We intend to use our leadership in providing voice and data services, as well as our flexible and reliable network, technical expertise and well-established customer relationships, to offer new services, such as our managed solutions, to

13

existing customers and to broaden the types of customers we serve. For example, we are providing ISPs in developing markets with complete internet backbone access services, including hardware from third-party resellers, satellite capacity, internet backbone connections and network management. They in turn use our capacity to provide internet services and VoIP services in their markets.

We are also planning to increase our marketing focus on, and to target customers in, newly deregulated regions. We believe new carrier companies and providers of competitive services, such as wireless communications and internet services, in these regions are seeking to introduce their services quickly and independently of the established local carriers. In addition, there are still many regions of the world that lack direct access to cable interconnects or whose internal infrastructure either does not exist or is unreliable. We intend to increase our focus on customers requiring satellite capacity for reliable connections between low-traffic communications hubs in smaller cities and from cable interconnects and communications hubs to telecommunications central offices in remote and underserved areas where we can provide a critical portion of the telecommunications infrastructure. We also intend to introduce new, more cost-effective technologies and managed solutions to our existing customers, which we believe will enhance our retention rates and provide our customers with more efficient use of our network.

Media

We believe that we are well positioned to grow both the distribution and contribution portions of our video business. We believe that the demand for transponder capacity dedicated to broadcast content distribution will grow as the demand for HDTV programming, as well as for solutions leveraging new technology, such as internet protocol television, or IPTV, and video on demand, or VoD, increases over the next several years, particularly in the United States and Western Europe. We also intend to continue to expand our ability to offer high-definition programmers an end-to-end service, using our terrestrial network with points of presence at sports stadiums and top media centers to capture content in high definition at the creation source and to transport it through our satellite network and terrestrial networks. This strategy has proven particularly successful in supporting HD coverage of major professional sports such as baseball and basketball.

Because broadcasters, cable systems and other television content redistribution systems install a large number of fixed antennas in order to be able to access popular programming for their viewers and subscribers, the use of our satellites by a popular broadcaster could attract other broadcasters to distribute their programming using the same satellites and thereby create distribution neighborhoods on these satellites. As a result of the Intelsat Americas Transaction, we currently operate several neighborhoods for the distribution of broadcast network video content in the United States. We also serve a number of video communities worldwide, including a cable distribution neighborhood in Latin America and DTH platforms in Europe and the Middle East. In Latin America, we successfully created a new cable distribution community on our IS-805 satellite by securing anchor customers such as Telefe of Argentina and TV Globo of Brazil and by providing antennas to facilitate access to the satellite from cable head-ends. By attracting additional broadcasters of popular television programming to selected satellites in our fleet, we plan to expand the broadcast communities on those satellites.

We believe that the acquisition of the Intelsat Americas fleet has strengthened our position in the North America media sector, particularly in the areas of broadcast contribution and distribution, as well as the distribution of niche and ethnic programming. We also believe we have the ability to further strengthen our position in the distribution of ethnic programming. Our IA-5 satellite carries over 150 such channels, including many that are brought to the United States on our system, and we believe that IA-5 carries more non-English and non-Spanish language programming than any other satellite in North America. We intend to expand the non-English language programming neighborhood on our IA-5 satellite to accommodate demand. In addition, many U.S. cable operators are increasingly faced with the need to offer non-English language programming to compete effectively with providers of direct broadcast satellite services in the United States. We believe we can offer cable operators a rebroadcast package of international channels that is attractive from the standpoint of both cost and technical efficiency.

14

Our satellite system currently distributes DTH programming for a number of regional providers. We will continue to develop our DTH platform business, targeting Eastern Europe, Africa, Latin America and regions within Asia where we can use our available capacity and the flexibility of our satellite fleet to capture opportunities. In particular, we intend to grow our share of the DTH distribution market by building on our success with existing customers as programmers seek to add programming to established networks and as new networks develop.

With respect to video contribution, we intend to expand our hybrid infrastructure and distribution partnerships to grow our business. Our end-to-end, managed contribution service, which we call our TMTsm network, addresses the needs of broadcasters and video programmers and provides customers with the ability, on demand, to move video content around the world using a cost-effective infrastructure that integrates the global coverage of our satellite fleet and our network of teleports and fiber interconnections to major video exchange points. Our North American network infrastructure was further upgraded during the second quarter of 2005 through a joint marketing agreement with Broadwing Communications to increase our video points of presence to 20 cities. Our upgraded infrastructure provides redundancy for both transmission media and associated equipment and includes updated centralized management and monitoring for both network status and service quality.

Government

We were the largest provider of wholesale commercial satellite capacity to the U.S. government and military in 2004, according toEuroconsult. We believe that the defense and civilian agencies of various governments are experiencing an increased need for commercial satellite communications services, due in part to anti-terrorism efforts, conflicts in the Middle East and increased worldwide military activity. We believe we are well positioned to increase our leading position in the growing area of commercial satellite-based government/military service applications as we continue to capitalize on our strong government relationships, serving more than 60 U.S. government and NATO users, and our flexible and reliable network.

We believe that our acquisition of the Intelsat Americas fleet has strengthened our position in this sector by providing us with greater coverage of North America, which allows us to offer additional satellite capacity and services to various defense and civilian agencies of the U.S. government. The COMSAT General Transaction further strengthened our leading position serving this customer sector with the addition of certain managed solutions capabilities and high-level personnel who have long-standing government customer relationships. We believe that our expanded service capability as a result of the Intelsat Americas and COMSAT General Transactions and our emphasis on managed solutions will attract additional government business and enable us to work with a broader scope of government contractors and integrators.

Pursue a Disciplined Acquisition Strategy

Over the past several years, the FSS sector has been, and continues to be, reshaped as a result of consolidation, deregulation, privatization and, more recently, the increase in private equity ownership of satellite operators. We have sought to strengthen our business through targeted acquisitions, and we have a successful track record of executing strategic transactions. For example, the Intelsat Americas Transaction provided us with additional coverage of North America, which has significantly enhanced our video business, and the COMSAT General Transaction strengthened our ability to provide services to government and other customers. In connection with our acquisition of the Intelsat Americas assets, we have integrated the acquired customers and assumed full control and operation of the acquired satellites, with minimal increases in operational and sales staff and ahead of schedule. We have also pursued the strategic acquisition of rights to operate at certain new orbital locations, and have recently entered into a Merger Agreement with PanAmSat. See “—The Transactions—The PanAmSat Acquisition Transactions.” We believe that our two companies are complementary in customer, geographic and product focus, and that the acquisition will enable us to offer our customers expanded coverage and enhanced flexibility and redundancy.

15

We also intend to continue to evaluate, and may pursue, strategic transactions that we believe could:

| | • | | broaden our customer base, including in corporate network, video and government/military applications; |

| | • | | provide us with complementary technical and commercial capabilities; |

| | • | | further utilize our existing hybrid infrastructure; |

| | • | | shift our service application mix to include more point-to-multipoint traffic; and |

| | • | | create operational and capital spending efficiencies. |

Our Network

Our in-orbit fleet is currently comprised of 27 satellites owned by us and leased capacity on one satellite owned by another satellite operator in the Asia-Pacific region, as well as ground facilities related to the operation and control of our satellites. Our IA-8 satellite was launched on June 23, 2005 and provides additional capacity in the Americas. Our network also includes ground assets consisting of teleports or leased teleport facilities supporting commercial services in Germany, the United States, Australia, China, Colombia, Argentina, UAE, Italy, and South Africa and points of presence in New York, China, Frankfurt, Los Angeles and London. Our satellite operations are supported by ground assets and leased facilities in the United States, Germany, Italy, South Korea, Australia, and South Africa. We upgraded our North American infrastructure in 2004 to include an expanded number of video points of presence as we seek to grow our video business following the completion of the Intelsat Americas Transaction.

Our customers depend on our global communications network and our operational and engineering leadership, including our:

| | • | | 41-year operating history and pioneering achievements in satellite communications; |

| | • | | highly redundant network; |

| | • | | ability to relocate or reconfigure capacity on many satellites to cover different geographic regions; and |

| | • | | consistently high transponder availability levels. |

We believe that our operational and engineering achievements are due primarily to our satellite procurement and operations philosophy, which we believe has been different from that of other satellite operators. Our operations and engineering staff is involved from the design through the decommissioning of each satellite that we procure. With our own staff working on site to monitor progress, we maintain close technical collaboration with our contractors during the process of designing, manufacturing and launching a satellite. We continue our engineering involvement throughout the operating lifetime of each satellite. Extensive monitoring of earth station operations and around-the-clock satellite control and network operations support ensure our consistent operational quality, as well as timely corrections when problems occur. In addition, we have in place contingency plans for technical problems that may occur during the lifetime of a satellite.

Satellite Systems

There are three primary types of commercial communications satellite systems: low-earth orbit systems, medium-earth orbit systems and geosynchronous systems. Geosynchronous communications satellites such as ours are located approximately 22,300 miles, or 35,700 kilometers, above the equator. These satellites can receive radio frequency communications from an origination point, relay those signals over great distances and distribute those signals to a single receiver or multiple receivers within the coverage areas of the satellites’ transmission beams.

Geosynchronous satellites send these signals using various parts of the radio frequency spectrum. The satellites in our fleet are designed to provide capacity using the C- and Ku-bands of this spectrum. A third

16

frequency band, the Ka-band, is not widely used at this time, but is being considered for use in new projects, especially broadband services. A Ka-band satellite may be accessed by a smaller antenna, which is an important consideration for residential and small business markets. Our IA-8 satellite has transponders available for transmitting and receiving in the C-, Ku- and Ka-bands.

A geosynchronous satellite is referred to as geostationary, or station-kept, when it is operated within an assigned orbital control, or station-keeping box, which is defined by a specific range of latitudes and longitudes. Geostationary satellites revolve around the earth with a speed that corresponds to that of the earth’s rotation and appear to remain above a fixed point on the earth’s surface at all times. Geosynchronous satellites that are not station-kept are in inclined orbit. The daily north-south motion of a satellite in inclined orbit exceeds the specified range of latitudes of its assigned station-keeping box, and the satellite appears to oscillate slowly, moving above and below the equator every day. An operator will typically operate a satellite in inclined orbit toward the end of its useful life because the operator is able to save significant amounts of fuel by not controlling the north-south position of the satellite and is thereby able to extend substantially the useful life of the satellite. However, the types of services and customers that can access an inclined orbit satellite are limited due to the daily variations in the satellite’s footprint, and we typically offer capacity on these satellites at a discount. As a result, the revenue we can earn from these satellites is limited. In order to extend the orbital maneuver lives of our five Intelsat VI series satellites, we are operating these satellites in inclined orbit and, as a result, are continuing to earn revenue beyond our original estimates for these satellites.

In-Orbit Satellites

With our satellites located over North America and over all of the principal ocean regions—the Atlantic, Pacific and Indian—and leased capacity available in the Asia-Pacific region, we provide coverage of 99% of the world’s population. The following diagram shows the locations as of December 31, 2005 of the 28 satellites we owned and operated at that time, and of the one non-Intelsat satellite on which we currently sell lease capacity.

17

Our fleet has been designed to provide a high level of redundancy for our customers. The features of our network that provide this redundancy are as follows:

| | • | | most places on the surface of the earth are covered by more than one of our satellites; |

| | • | | many of our satellites have flexible design features and steerable beams that enable us to reconfigure capacity to provide different areas of coverage; |

| | • | | many of our satellites also have the ability to be relocated to different orbital locations; and |

| | • | | subject to availability, our in-orbit fleet includes sparing capacity on operational satellites. |

The design flexibility of some of our satellites enables us to meet customer demand and respond to changing market conditions. As noted above, these features also contribute to the redundancy of our network, which enables us to ensure the continuity of service that is important for our customers and to retain revenue in the event that we need to move customers to alternative capacity.

We measure the reliability of our network over a given period of time by calculating the total transponder hours in service for satellites owned and operated by us as a percentage of the total number of potential transponder hours during that time period, including hours during which transponders were not in service due to interruption or other outage. We exclude from this calculation the transponders on our satellites that are unusable due to satellite orbital location, inter-system coordination issues or beam configurations or that are permanently unusable due to the impact of certain anomalies. See Item 1A—Risk Factors for a discussion of anomalies. For the 365-day period ended December 31, 2005, the transponder availability rate for satellites owned and operated by us, including the IS and the Intelsat Americas satellites, was 99.9952%. This availability rate was achieved by accumulating nearly 8.5 million transponder hours in service, with approximately 410 hours of accumulated transponder outage. Our transponder availability rate has averaged 99.997% from 1985 through 2005, and during the past 30 years, other than the IS-804 satellite, each of our station-kept satellites has exceeded, or is expected to exceed, its design life.

Our system fill factor represents the percentage of our total available station-kept transponder capacity, including the capacity that we lease, that is in use or that is reserved at a given time. As of December 31, 2005, we had an average system fill factor, including guaranteed reservations for service, of approximately 63%.

As of December 31, 2005, our in-orbit fleet had 1,057 and 459 36 MHz equivalent transponders available for transmitting in the C-band and the Ku-band, respectively. These totals measure transponders on station-kept satellites, including the transponders that we lease from other satellite operators. Except as otherwise indicated, the table below provides a summary of our in-orbit satellite fleet as of December 31, 2005.

| | | | | | | | | | |

Satellite | | Manufacturer | | Orbital

Location | | Launch Date | | End of Orbital

Design Life | | Estimated End of

Orbital Maneuver Life (1) |

Station Kept: | | | | | | | | | | |

IS-701 | | SS/L(4) | | 180.0°E | | 10/93 | | 8/04 | | 4/12 |

IS-702 | | SS/L | | 54.85°E(2)(3) | | 6/94 | | 4/05 | | 10/12 |

IS-704 | | SS/L | | 66.0°E | | 1/95 | | 11/05 | | 1/09 |

IS-705 | | SS/L | | 310.0°E | | 3/95 | | 1/06 | | 12/09 |

IS-706 | | SS/L | | 50.25°E(2)(3) | | 5/95 | | 3/06 | | 2/13 |

IS-707 | | SS/L | | 307.0°E | | 3/96 | | 1/07 | | 2/13 |

IS-709 | | SS/L | | 85.15°E | | 6/96 | | 4/07 | | 9/12 |

IS-801 | | LMC(5) | | 328.5°E | | 3/97 | | 3/07 | | 3/09 |

IS-802 | | LMC | | 32.9°E | | 6/97 | | 6/07 | | 11/14 |

IS-805 | | LMC | | 304.5°E | | 6/98 | | 6/08 | | 6/16 |

IS-901 | | SS/L | | 342.0°E | | 6/01 | | 6/14 | | 7/19 |

18

| | | | | | | | | | |

Satellite | | Manufacturer | | Orbital

Location | | Launch Date | | End of Orbital

Design Life | | Estimated End of

Orbital Maneuver Life (1) |

IS-902 | | SS/L | | 62.0°E | | 8/01 | | 8/14 | | 1/20 |

IS-903 | | SS/L | | 325.5°E | | 3/02 | | 3/15 | | 3/19 |

IS-904 | | SS/L | | 60.0°E | | 2/02 | | 2/15 | | 3/20 |

IS-905 | | SS/L | | 335.5°E | | 6/02 | | 6/15 | | 2/21 |

IS-906 | | SS/L | | 64.15°E | | 9/02 | | 9/15 | | 11/21 |

IS-907 | | SS/L | | 332.5°E | | 2/03 | | 2/16 | | 10/21 |

IS-10-02 (6) | | EADS Astrium | | 359.0°E | | 6/04 | | 6/17 | | 12/21 |

IA-5 | | SS/L | | 121.0°W | | 5/97 | | 5/09 | | 2/21 |

IA-6 | | SS/L | | 193.0°W | | 2/99 | | 2/11 | | 7/22 |

IA-7 | | SS/L | | 129.0°W | | 9/99 | | 9/11 | | 9/15(7) |

IA-8 | | SS/L | | 89°W | | 6/05 | | 6/20 | | 5/22 |

IA-13 (8) | | SS/L | | 121.0°W | | 8/03 | | 8/18 | | 10/24 |

APR-1 (9) | | ISRO(10) | | 83.0°E | | N/A | | N/A | | N/A |

| | | | | |

Inclined Orbit: | | | | | | | | | | |

IS-601 | | Hughes(11) | | 64.25°E | | 10/91 | | 10/01 | | 5/11 |

IS-602 | | Hughes | | 150.5°E(2) | | 10/89 | | 10/99 | | 11/08 |

IS-603 | | Hughes | | 340.05°E | | 3/90 | | 3/00 | | 7/09 |

IS-604 | | Hughes | | 178°E(12) | | 6/90 | | 6/00 | | 3/06 |

IS-605 | | Hughes | | 174°E | | 8/91 | | 8/01 | | 7/09 |

| (1) | Engineering estimates as of December 31, 2005 determined by remaining fuel levels and consumption rates and assuming no relocation of the satellite. |

| (2) | Rights to use this orbital location are held by one of our customers. |

| (3) | Authorization to operate at this location is limited to operation on a non-interference basis. |

| (4) | Space Systems/Loral, Inc. |

| (5) | Lockheed Martin Corporation. |

| (6) | Telenor Inma AS owns 18 of this satellite’s Ku-band transponders. |

| (7) | The orbital maneuver life of IA-7 was not materially impacted as a direct result of either the anomaly in 2004 or our efforts to recover the satellite. |

| (8) | EchoStar Communications Corporation owns all of this satellite’s Ku-band transponders and a portion of the common elements of the satellite. |

| (9) | Operated by another satellite operator with capacity leased by us. |

| (10) | Indian Space Research Organization. |

| (11) | Hughes Aircraft Company, now Boeing Satellite Systems, Inc. |

| (12) | The satellite was drifting toward the listed orbital location as of December 31, 2005. On April 11, 2006, we completed de-orbiting maneuvers and this satellite is no longer in service. |

In addition to the satellites shown in the table above, we own an interest in Marisat-F2, an older satellite in inclined orbit that we acquired in the COMSAT General Transaction and that is currently used to provide services to Antarctica.

Owned Satellites

The design life of a satellite is the length of time that the satellite’s hardware is designed by the manufacturer to remain operational under normal operating conditions. In contrast, a satellite’s orbital maneuver life is the length of time the satellite has enough fuel to remain operational. Over the past 30 years, other than the IS-804 satellite which exceeded 70% of its design life before experiencing an anomaly which resulted in a total loss, each of our station-kept satellites we launched or acquired in the Intelsat Americas Transaction has exceeded or is expected to exceed its design life. We believe we have one of the youngest satellite fleets in the

19

FSS sector. The average remaining orbital maneuver life of our satellites was approximately 11.2 years as of December 31, 2005, weighted on the basis of nominally available capacity for the station-kept satellites we own.

Other than the IS-804 satellite which experienced an anomaly resulting in a total loss:

| | • | | we have experienced some technical problems with our current fleet but have been able to minimize the impact of these problems on our customers, our operations and our business. |

| | • | | most of these problems have been component failures and anomalies that have had little long-term impact to date on the overall transponder availability in our satellite fleet. |