UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-10467

Causeway Capital Management Trust

(Exact name of registrant as specified in charter)

11111 Santa Monica Boulevard, 15th Floor

Los Angeles, CA 90025

(Address of principal executive offices) (Zip code)

SEI Investments Global Funds Services

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-866-947-7000

Date of fiscal year end: September 30, 2013

Date of reporting period: September 30, 2013

| Item 1. | Reports to Stockholders. |

TABLE OF CONTENTS

LETTER TO SHAREHOLDERS

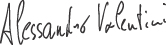

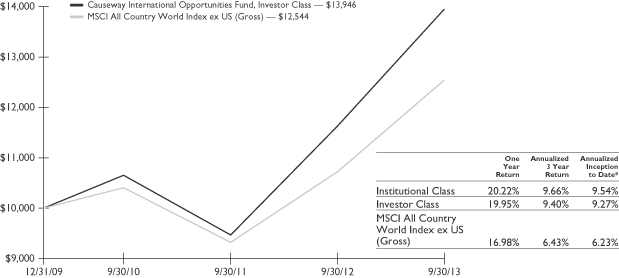

For the fiscal year ended September 30, 2013, Causeway International Opportunities Fund’s (the “Fund” or “Fund’s”) Institutional Class returned 20.22% and Investor Class returned 19.95%, compared to 16.98% for the MSCI All Country World Index ex US (Gross) (“ACWI ex US Index”). Since the Fund’s inception on December 31, 2009, its average annual total returns are 9.54% for the Institutional Class and 9.27% for the Investor Class, compared to 6.23% for the ACWI ex US Index for the same period. At fiscal year-end the Fund had net assets of $44.16 million.

Performance Review

The Fund is a fund-of-funds that allocates substantially all of its assets in Causeway International Value Fund (the “Value Fund”) and Causeway Emerging Markets Fund (the “EM Fund,” and together the “underlying funds”). References to holdings and industries are based on the holdings of the underlying funds in proportion to the Fund’s allocation.

Other than a brief pullback from May through June, international developed equities ascended virtually unabated during fiscal 2013. Liquidity fueled demand for developed market equities, as monetary authorities in the United States, Japan and Europe continued to provide substantial “quantitative easing.” The brief disruption in performance was caused by the introduction of the term, “tapering” — a reduction in the pace of the bond purchasing program by the United States Federal Reserve (the “Fed”). Markets were spooked briefly, but investors calmed down after the Fed provided further clarity, stating that its ability to remove stimulus is data-dependent, and the rate of unemployment would need to decline further.

For the full fiscal year, emerging markets underperformed developed international markets by over 20 percentage points, reflecting concerns about slowing growth in China and the threat of reduced central bank stimulus. Several developing countries fell victim to large-scale withdrawals of foreign capital, which depreciated local currencies and compounded negative returns for US dollar-based investors. Countries with current account deficits, including South Africa, India, Turkey and Brazil, were the most vulnerable to capital outflows.

For the Value Fund, holdings in the materials, pharmaceuticals & biotechnology, utilities, telecommunication services, and automobiles & components industry groups contributed the most to the Fund’s performance relative to the MSCI EAFE Index. Holdings in the capital goods, consumer durables & apparel, insurance, and food & staples retailing industry groups, as well as an overweight to the energy industry group detracted from relative performance. Two of the largest individual contributors to absolute return this year were automobile manufacturers, Toyota Motor (Japan) and Daimler (Germany). Additional top contributors to absolute return included database provider & publisher, Reed Elsevier (Netherlands), global financial services company, UBS (Switzerland), and telecommunication services provider, KDDI (Japan). The biggest laggard was energy services company, Petrofac (United Kingdom). Additional top individual detractors included insurance company, Sony Financial (Japan), marine & offshore engineering

| | | | |

| 2 | | Causeway International Opportunities Fund | | |

company, Sembcorp Marine (Singapore), athletic footwear manufacturer & retailer, Yue Yuen (Hong Kong), and government-contracted construction company, Balfour Beatty (United Kingdom).

We use a quantitative factor-based investment process to select stocks for the EM Fund, analyzing both “bottom-up” and “top-down” factors. All of our factors posted positive performance for the fiscal year. Of our stock-specific factors, earnings growth delivered the strongest performance. Investors preferred companies with earnings upgrades to those being downgraded. Stocks with positive price momentum, and stocks that appear attractive using valuation metrics also were strong. Macroeconomic factors differentiated the performance of emerging market countries. Countries with favorable profiles including trade account surpluses and low or declining real interest rates outperformed those with structural headwinds. Our aggregate country and sector factors also were positive: countries and sectors with attractive equity valuation and growth characteristics outperformed. Stock selection drove the EM Fund’s excess return versus the MSCI Emerging Markets Index (“EM Index”). Holdings in the energy and real estate industry groups were top drivers of outperformance. The EM Fund’s stock selection in materials, in combination with an underweight to the industry group also contributed. The EM Fund’s underweights to strong-performing industry groups — banks, software & services and media — were the greatest detractors from relative performance. From a geographic perspective, the EM Fund outperformed the EM Index in every region. Outperformance in emerging Asia was most pronounced, with top contributions from holdings in China and South Korea. The EM Fund’s exposure to Latin America created the least excess return, although it outperformed the EM Index. The top individual contributor to relative performance was an underweight to state-run oil producer, Petroleo Brasileiro (Brazil). Other top relative performers were the EM Fund’s overweights to wireless telecommunications operator, SK Telecom (South Korea) and Turk Hava Yollari “Turkish Airlines” (Turkey). The top detractors from performance were underweights to internet company, Tencent Holdings (China), and media company, Naspers (South Africa), which has a 34% interest in Tencent. An overweight to power distributor Eletropaulo Metropolitana Eletricidade de Sao Paulo SA (Brazil) also detracted.

Equity Allocation Model Update

We use a proprietary quantitative equity allocation model that assists the portfolio managers in determining the weight of emerging versus developed markets in the Fund. In constructing the model, we identified five primary factors as most indicative of the ideal allocation target: valuation, financial strength, macroeconomic, earnings growth, and risk aversion. Currently, our allocation factor categories are mixed on emerging markets and we remain modestly underweight. Our valuation factor is positive, indicating the emerging markets’ asset class is fairly valued when compared to developed markets’ asset class. Our risk aversion factor, which assesses the emerging markets bond yield spread over U.S. Treasuries, the CBOE Volatility Index (VIX), and the CBOE Emerging Markets ETF Volatility Index (VXEEM), indicates investors’ appetite for risk is decreasing. We interpret this decrease as a positive signal for emerging markets, as we prefer to buy the asset class when investors are fearful. Our earnings

| | | | | | |

| | | Causeway International Opportunities Fund | | | 3 | |

growth factor recently turned positive for emerging markets, indicating that the near-term earnings revisions profile of emerging markets is superior to that of developed markets. Our financial strength metrics, which include such measures as interest coverage and return on equity, are negative for emerging markets. Our macroeconomic factor, which measures the slope of the global yield curve, also is negative on emerging markets.

As of September 30, 2013, the Fund invested 79.5% of its net assets in the Value Fund and 20.5% in the EM Fund. At the beginning of the period, the Fund’s investment in the EM Fund was even more underweight the emerging markets weight in the ACWI ex US Index, as all five factors in our allocation model were negative at that time. Our allocation decision therefore, provided a modest contribution to relative performance over the fiscal year.

Investment Outlook

At present, for the Value Fund, we are seeking a balance between stocks with the potential for earnings recovery, typically via restructuring and improved management, and those offering ballast. The higher equity markets rise, the more we emphasize stocks for the Value Fund that could help reduce risk in changing market conditions. In the wake of the recent equity bull market, our portfolio managers are attempting to emphasize stability of future returns. This is not an easy task when many of the lower-volatility stocks carry full valuations. Our fundamental research team has found several interesting candidates with recovery potential, and some prospect of earnings stability. These stocks also offer competitive risk-adjusted estimated returns in our ranking model. We also aim to have large portfolio weights in companies that we believe will enjoy the tailwinds of a favorable industry position.

We are encouraged by the gradual improvement in performance in some of the more controversial of the Value Fund’s portfolio holdings such as those in the energy and banking sectors. Commodity-related stocks have disappointed with concerns of slowing Chinese growth. Add to this the problems associated with current account deficits in other major emerging markets such as India and Indonesia. Reflecting this pessimism, energy stocks have fared poorly relative to buoyant market indices over the past 12 months. We have spent this year positioning the portfolio to take advantage of stable energy demand and likely crude oil supply disruptions. We have emphasized companies in the oil & gas services sector globally, as they should benefit from the inexorable need for more exploration, even in hostile, deep-water environments. In banking, our emphasis remains tilted toward Europe and the slow and steady recovery in property values and a more normal environment ahead for net interest margins and bad debts. As major developed markets regions (US, Europe, and Japan) must endure years of public sector deleveraging ahead, we expect monetary policy conditions to remain accommodative, thereby supporting the case for equities.

| | | | |

| 4 | | Causeway International Opportunities Fund | | |

Although growth expectations for developing economies have declined, prolonged monetary support from the United States should improve global capital flows to emerging markets. For the EM Fund, we continue to prefer countries with current account surpluses that are less reliant on foreign capital flows. For those countries battling a capital exodus, we take some comfort in the fact that governments have tools at their disposal to temper their currencies’ devaluation. Most of the affected emerging countries have considerably larger stores of foreign exchange reserves than in prior crises. These reserves can be used to combat currency volatility. Although interest rate increases can suppress near-term growth, governments may choose to deploy abundant foreign exchange reserves to convert a dramatic currency scare into a modest growth scare. Inflation across most developing economies remains stable, allowing central banks to pursue stimulative policies.

In recent years, many emerging markets investors sought a low-risk approach to equity investing, favoring companies with low financial leverage and stable earnings growth. This has stretched the valuations of these companies and left investors with concentrated sector exposures in their emerging market portfolios. We believe the reign of defensive stocks is coming to an end, and we continue to identify investment opportunities in cyclical stocks. These stocks not only appear undervalued, but also exhibit growth prospects superior to companies with predictable yet modest earnings growth. Cyclical markets reach a floor many months before even the slightest hint of recovery becomes apparent. By investing in these markets during periods of capital flight, we can reap the lowest-risk portion of the up-cycle. And, with a healthy weighted average dividend yield of the stocks in the EM Fund’s portfolio, the EM Fund is paid to wait until these beleaguered markets return to popularity.

We thank you for your investment in Causeway International Opportunities Fund and look forward to serving you in the future.

October 31, 2013

| | | | | | |

| |  | |  | |  |

| | | |

| Harry W. Hartford | | Sarah H. Ketterer | | James A. Doyle | | Jonathan P. Eng |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

| | | | | | |

| |  | |  | |  |

| | | |

| Kevin Durkin | | Conor Muldoon | | Arjun Jayaraman | | MacDuff Kuhnert |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

| | | | | | |

| | | Causeway International Opportunities Fund | | | 5 | |

| | |

| |  |

| |

| Foster Corwith | | Alessandro Valentini |

| Portfolio Manager | | Portfolio Manager |

The above commentary expresses the portfolio managers’ views as of the date shown and should not be relied upon by the reader as research or investment advice. These views are subject to change. There is no guarantee that any forecasts made will come to pass.

Investing involves risk including loss of principal. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Diversification does not prevent all investment losses.

| | | | |

| 6 | | Causeway International Opportunities Fund | | |

Comparison of Change in the Value of a $10,000 Investment in Causeway International Opportunities Fund, Investor Class shares versus the MSCI All Country World Index ex US (Gross)

The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares.

* The inception date of Causeway International Opportunities Fund was December 31, 2009. The MSCI All Country World Index ex US (Gross) return is from December 31, 2009.

The performance data represents past performance and is not an indication of future results. Investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth less than their original cost and current performance may be higher or lower than the performance quoted. For performance data current to the most recent month end, please call 1-866-947-7000 or visit www.causewayfunds.com. Investment performance reflects fee waivers in effect. In the absence of such fee waivers, total return would be reduced. Total returns assume reinvestment of dividends and capital gains distributions at net asset value when paid. Investor Class shares pay a shareholder service fee of up to 0.25% per annum of average daily net assets. Institutional Class shares pay no shareholder service fee. The Fund imposes a 2% redemption fee on the value of shares redeemed less than 60 days after purchase. If your account incurred a redemption fee, your performance will be lower than the performance shown here. For more information, please see the prospectus.

The MSCI All Country World Index ex US (Gross) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the US. The Index does not reflect the payment of transaction costs, fees and expenses associated with an investment in the Fund. It is not possible to invest directly in an index. There are special risks in foreign investing (please see Note 5 in the Notes to Financial Statements).

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations, and is not liable whatsoever for any data in this report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

| | | | | | |

| | | Causeway International Opportunities Fund | | | 7 | |

SCHEDULE OF INVESTMENTS (000)*

September 30, 2013

| | | | | | | | |

| Causeway International Opportunities Fund | | Number of Shares | | | Value | |

AFFILIATED MUTUAL FUNDS | | | | | | | | |

Causeway Emerging Markets Fund, Institutional Class | | | 775,489 | | | $ | 9,034 | |

Causeway International Value Fund, Institutional Class1 | | | 2,286,372 | | | | 35,096 | |

| | | | | | | | |

Total Affiliated Mutual Funds | | | | | | | | |

(Cost $38,334) — 99.9% | | | | | | | 44,130 | |

| | | | | | | | |

SHORT-TERM INVESTMENT | | | | | | | | |

Dreyfus Cash Management, Institutional Class, 0.040% ** | | | 49,132 | | | | 49 | |

| | | | | | | | |

Total Short-Term Investment | | | | | | | | |

(Cost $49) — 0.1% | | | | | | | 49 | |

| | | | | | | | |

Total Investments — 100.0% | | | | | | | | |

(Cost $38,383) | | | | | | | 44,179 | |

| | | | | | | | |

Liabilities in Excess of Other Assets — 0.0% | | | | | | | (19 | ) |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 44,160 | |

| | | | | | | | |

| ** | The rate reported is the 7-day effective yield as of September 30, 2013. |

| 1 | The Fund’s investment in Institutional Class shares of Causeway International Value Fund represents greater than 75% of the Fund’s total investments. Causeway International Value Fund seeks long-term growth of capital and income. The annual report as of September 30, 2013 for Causeway International Value Fund is attached to these financial statements. Further financial information on Causeway International Value Fund is available on the Securities and Exchange Commission’s website at http://www.sec.gov. |

The accompanying notes are an integral part of the financial statements.

| | | | |

| 8 | | Causeway International Opportunities Fund | | |

SECTOR DIVERSIFICATION

As of September 30, 2013, the sector diversification was as follows (Unaudited):

| | | | |

| Causeway International Opportunities Fund | | % of Net Assets | |

| Affiliated Mutual Funds | | | 99.9% | |

| | | | |

| Short-Term Investment | | | 0.1 | |

| | | | |

| Net Assets | | | 100.0% | |

| | | | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | Causeway International Opportunities Fund | | | 9 | |

STATEMENT OF ASSETS AND LIABILITIES (000)*

| | | | |

| | | CAUSEWAY

INTERNATIONAL

OPPORTUNITIES

FUND | |

| |

| | | 9/30/13 | |

ASSETS: | | | | |

Affiliated Investments at Value (Cost $38,334) | | $ | 44,130 | |

Short-Term Investment at Value (Cost $49) | | | 49 | |

Receivable Due from Adviser | | | 15 | |

Prepaid Expenses | | | 9 | |

| | | | |

Total Assets | | | 44,203 | |

| | | | |

LIABILITIES: | | | | |

Payable Due to Administrator | | | 2 | |

Payable for Trustees’ Fees | | | 2 | |

Payable for Shareholder Services Fees — Investor Class | | | 1 | |

Other Accrued Expenses | | | 38 | |

| | | | |

Total Liabilities | | | 43 | |

| | | | |

Net Assets | | $ | 44,160 | |

| | | | |

NET ASSETS: | | | | |

Paid-in Capital (unlimited authorization — no par value) | | $ | 38,214 | |

Distributions in Excess of Net Investment Income | | | (23 | ) |

Accumulated Net Realized Gain on Affiliated Investments | | | 173 | |

Net Unrealized Appreciation on Affiliated Investments | | | 5,796 | |

| | | | |

Net Assets | | $ | 44,160 | |

| | | | |

Net Asset Value Per Share (based on net assets of

$42,476,380 ÷ 3,239,353 shares) — Institutional Class | | | $13.11 | |

| | | | |

Net Asset Value Per Share (based on net assets of

$1,683,600 ÷ 128,822 shares) — Investor Class | | | $13.07 | |

| | | | |

| * | Except for Net Asset Value data. |

The accompanying notes are an integral part of the financial statements.

| | | | |

| 10 | | Causeway International Opportunities Fund | | |

STATEMENT OF OPERATIONS (000)

| | | | |

| | | CAUSEWAY

INTERNATIONAL

OPPORTUNITIES

FUND | |

| |

| | | 10/01/12 to

9/30/13 | |

INVESTMENT INCOME: | | | | |

Dividend Income from Affiliated Investments | | $ | 692 | |

| | | | |

Total Investment Income | | | 692 | |

| | | | |

EXPENSES: | | | | |

Transfer Agent Fees | | | 54 | |

Professional Fees | | | 48 | |

Registration Fees | | | 42 | |

Printing Fees | | | 32 | |

Administration Fees | | | 17 | |

Custodian Fees | | | 5 | |

Trustees’ Fees | | | 4 | |

Shareholder Service Fees — Investor Class | | | 3 | |

Pricing Fees | | | 1 | |

Other Fees | | | 3 | |

| | | | |

Total Expenses | | | 209 | |

| | | | |

LESS: | | | | |

Reimbursement of expenses by Adviser | | | (170 | ) |

| | | | |

| |

Net Expenses | | | 39 | |

| | | | |

Net Investment Income | | | 653 | |

| | | | |

REALIZED AND UNREALIZED GAIN ON AFFILIATED INVESTMENTS: | | | | |

Net Realized Gain on Sale of Affiliated Investments | | | 176 | |

Net Change in Unrealized Appreciation on Affiliated Investments | | | 5,456 | |

| | | | |

Net Realized and Unrealized Gain on Affiliated Investments | | | 5,632 | |

| | | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 6,285 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | Causeway International Opportunities Fund | | | 11 | |

STATEMENTS OF CHANGES IN NET ASSETS (000)

| | | | | | | | |

| | | CAUSEWAY

INTERNATIONAL

OPPORTUNITIES FUND | |

| | |

| | | 10/01/12 to

09/30/13 | | | 10/01/11 to

09/30/12 | |

OPERATIONS: | | | | | | | | |

Net Investment Income | | $ | 653 | | | $ | 232 | |

Net Realized Gain on Sale of Affiliated Investments | | | 176 | | | | 61 | |

Net Change in Unrealized Appreciation on Affiliated Investments | | | 5,456 | | | | 1,568 | |

| | | | | | | | |

Net Increase in Net Assets Resulting from Operations | | | 6,285 | | | | 1,861 | |

| | | | | | | | |

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Dividends from Net Investment Income: | | | | | | | | |

Institutional Class | | | (665 | ) | | | (238 | ) |

Investor Class | | | (11 | ) | | | (5 | ) |

| | | | | | | | |

Total Dividends from Net Investment Income | | | (676 | ) | | | (243 | ) |

| | | | | | | | |

Distributions from Net Capital Gains: | | | | | | | | |

Institutional Class | | | (52 | ) | | | (26 | ) |

Investor Class | | | (1 | ) | | | — | |

| | | | | | | | |

Total Distributions from Net Capital Gains | | | (53 | ) | | | (26 | ) |

| | | | | | | | |

Total Dividends and Distributions to Shareholders | | | (729 | ) | | | (269 | ) |

| | | | | | | | |

Net Increase in Net Assets Derived from Capital Share Transactions(1) | | | 23,156 | | | | 6,337 | |

Redemption Fees(2) | | | — | | | | 1 | |

| | | | | | | | |

Total Increase in Net Assets | | | 28,712 | | | | 7,930 | |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of Year | | | 15,448 | | | | 7,518 | |

| | | | | | | | |

End of Year | | $ | 44,160 | | | $ | 15,448 | |

| | | | | | | | |

Distributions in Excess of Net Investment Income | | $ | (23 | ) | | $ | — | |

| | | | | | | | |

| (1) | See Note 7 in the Notes to Financial Statements. |

| (2) | See Note 2 in the Notes to Financial Statements. |

Amounts designated as “—” are $0.

The accompanying notes are an integral part of the financial statements.

| | | | |

| 12 | | Causeway International Opportunities Fund | | |

This page intentionally left blank.

FINANCIAL HIGHLIGHTS

For the Year or Period Ended September 30,

For a Share Outstanding Throughout the Periods

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

Net Asset

Value,

Beginning

of Period ($) | | | Net

Investment

Income

(Loss) ($) | | | Net Realized

and

Unrealized

Gain

(Loss) on

Investment ($) | | | Total

from

Operations ($) | | | Dividends

from Net

Investments

Income ($) | | | Distributions

from

Capital

Gains ($) | | | Total

Dividends

and

Distributions ($) | |

CAUSEWAY INTERNATIONAL OPPORTUNITIES FUND† | |

Institutional | | | | | | | | | | | | | | | | | | | | | | | | | |

2013 | | | 11.15 | | | | 0.24 | | | | 1.99 | | | | 2.23 | | | | (0.25 | ) | | | (0.02 | ) | | | (0.27 | ) |

2012 | | | 9.35 | | | | 0.20 | | | | 1.91 | | | | 2.11 | | | | (0.28 | ) | | | (0.03 | ) | | | (0.31 | ) |

2011 | | | 10.67 | | | | 0.05 | | | | (1.18 | ) | | | (1.13 | ) | | | (0.19 | ) | | | — | | | | (0.19 | ) |

2010(1)(2) | | | 10.00 | | | | (0.01 | ) | | | 0.68 | | | | 0.67 | | | | — | | | | — | | | | — | |

Investor | | | | | | | | | | | | | | | | | | | | | | | | | |

2013 | | | 11.12 | | | | 0.08 | | | | 2.11 | | | | 2.19 | | | | (0.22 | ) | | | (0.02 | ) | | | (0.24 | ) |

2012 | | | 9.32 | | | | 0.10 | | | | 1.98 | | | | 2.08 | | | | (0.25 | ) | | | (0.03 | ) | | | (0.28 | ) |

2011 | | | 10.65 | | | | 0.11 | | | | (1.27 | ) | | | (1.16 | ) | | | (0.17 | ) | | | — | | | | (0.17 | ) |

2010(1)(2) | | | 10.00 | | | | (0.03 | ) | | | 0.68 | | | | 0.65 | | | | — | | | | — | | | | — | |

| (1) | Commenced operations on December 31, 2009. |

| (2) | All ratios for periods of less than one year are annualized. Total returns and portfolio turnover rate are for the period indicated and have not been annualized. |

| † | Per share amounts calculated using average shares method. |

Amounts designated as “—” are $0 or round to $0.

The accompanying notes are an integral part of the financial statements.

| | | | |

| 14 | | Causeway International Opportunities Fund | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset

Value, End

of Period ($) | | | Total

Return (%) | | | Net Assets,

End of

Period

($000) | | | Ratio of

Expenses to

Average Net

Assets (%) | | | Ratio of

Expenses

to Average

Net Assets

(Excluding

Reimburse-

ments) (%) | | | Ratio

of Net

Investment

Income (Loss)

to Average

Net Assets (%) | | | Portfolio

Turnover

Rate (%) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 13.11 | | | | 20.22 | | | | 42,476 | | | | 0.11 | | | | 0.62 | | | | 2.00 | | | | 7 | |

| | 11.15 | | | | 23.11 | | | | 14,887 | | | | 0.11 | | | | 1.39 | | | | 1.95 | | | | 5 | |

| | 9.35 | | | | (10.90 | ) | | | 7,351 | | | | 0.11 | | | | 2.74 | | | | 0.46 | | | | 5 | |

| | 10.67 | | | | 6.70 | | | | 1,409 | | | | 0.11 | | | | 11.69 | | | | (0.11 | ) | | | 3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 13.07 | | | | 19.95 | | | | 1,684 | | | | 0.36 | | | | 0.88 | | | | 0.65 | | | | 7 | |

| | 11.12 | | | | 22.84 | | | | 561 | | | | 0.36 | | | | 1.61 | | | | 0.95 | | | | 5 | |

| | 9.32 | | | | (11.13 | ) | | | 167 | | | | 0.36 | | | | 3.62 | | | | 0.99 | | | | 5 | |

| | 10.65 | | | | 6.50 | | | | 142 | | | | 0.36 | | | | 11.36 | | | | (0.36 | ) | | | 3 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | Causeway International Opportunities Fund | | | 15 | |

NOTES TO FINANCIAL STATEMENTS

Causeway International Opportunities Fund (the “Fund”) is a series of Causeway Capital Management Trust (the “Trust”). The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”) and is a Delaware statutory trust that was established on August 10, 2001. The Fund began operations on December 31, 2009. The Fund is authorized to offer two classes of shares, the Institutional Class and the Investor Class. The Declaration of Trust authorizes the issuance of an unlimited number of shares of beneficial interest of the Fund. The Fund is diversified. The Fund’s prospectus provides a description of the Fund’s investment objectives, policies and strategies. The Trust has four additional series, the financial statements of which are presented separately.

| 2. | | Significant Accounting Policies |

The following is a summary of the significant accounting policies consistently followed by the Fund.

Use of Estimates in the Preparation of Financial Statements – The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amount of net assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Security Valuation – The assets of the Fund consist of investments in affiliated investment companies and money market funds which are valued at their daily net asset values per share. Investments in the Dreyfus Cash

Management money market fund are valued daily at the net asset value per share.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The guidance establishes three levels of fair value hierarchy as follows:

| | • | | Level 1 — Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | • | | Level 2 — Quoted prices in markets which are not active, or prices based on inputs that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| | • | | Level 3 — Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

| | | | |

| 16 | | Causeway International Opportunities Fund | | |

NOTES TO FINANCIAL STATEMENTS

(continued)

As of September 30, 2013, all of the Fund’s investments in affiliated funds and short term investments were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the reporting period. For the Fund there were no transfers between Level 1 and Level 2 during the reporting period, based on the input level assigned under the hierarchy at the beginning and end of the reporting period.

For the year ended September 30, 2013, there were no significant changes to the Fund’s fair value methodologies.

Federal Income Taxes – It is the Fund’s intention to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and to distribute all of its taxable income. Accordingly, no provision for Federal income taxes has been made in the financial statements.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is “more-likely-than not” (i.e., greater than 50-percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more likely-than-not threshold are recorded as a tax benefit or expense in the current year. The Fund did not record any tax provision in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., the last 3 tax year ends, as applicable), on-going analysis of and changes to tax laws, regulations and interpretations thereof.

As of and during the year ended September 30, 2013, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any significant interest or penalties.

Security Transactions and Related Income – Security transactions are accounted for on the date the security is purchased or sold (trade date). Dividend income received from the affiliated funds is recognized on the ex-dividend date and is recorded as dividend income in the Statement of Operations. Capital gain distributions received from the affiliated funds are recognized on ex-dividend date and are recorded on the Statement of Operations as such. Costs used in determining realized gains and losses on the sales of investment securities are those of the specific securities sold.

Expense/Classes – Expenses that are directly related to one Fund of the Trust are charged directly to that Fund. Other operating expenses of the Trust are prorated to the Fund and the other series of the Trust on the basis of relative daily net assets. Class specific expenses are borne by that class of shares. Income, realized and unrealized gains/losses and non-class specific expenses are allocated to the respective classes on the basis of relative daily net assets.

Dividends and Distributions – Dividends from net investment income, if any, are declared and paid on an annual basis. Any net realized capital gains on sales of securities are distributed to shareholders at least annually.

Redemption Fee – The Fund imposes a redemption fee of 2% on the value of capital shares redeemed by shareholders less than 60 days after purchase. The

| | | | | | |

| | | Causeway International Opportunities Fund | | | 17 | |

NOTES TO FINANCIAL STATEMENTS

(continued)

redemption fee also applies to exchanges from the Fund. The redemption fee is paid to the Fund. The redemption fee does not apply to shares purchased through reinvested distributions or shares redeemed through designated systematic withdrawal plans. The redemption fee does not normally apply to accounts designated as omnibus accounts with the transfer agent. These are arrangements through financial intermediaries where the purchase and sale orders of a number of persons are aggregated before being communicated to the Fund. However, the Fund may seek agreements with these intermediaries to impose the Fund’s redemption fee or a different redemption fee on their customers if feasible, or to impose other appropriate restrictions on excessive short-term trading. The officers of the Fund may waive the redemption fee for shareholders in asset allocation and similar investment programs reasonably believed not to be engaged in short-term market timing, including for holders of shares purchased by Causeway Capital Management LLC (the “Adviser”) for its clients to rebalance their portfolios. For the year ended September 30, 2013, the Fund did not retain any redemption fees.

| 3. | | Investment Advisory, Administration, Shareholder Service and Distribution Agreements |

The Trust, on behalf of the Fund, has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Under the Advisory Agreement, the Adviser is not paid any fees. The Fund invests primarily in Causeway International Value Fund and Causeway Emerging Markets Fund, which separately pay advisory fees to the Adviser. The Adviser has contractually agreed through January 31, 2014 to reimburse the Fund to the extent necessary to keep total annual fund operating expenses (excluding brokerage fees and commissions, interest, taxes, shareholder

service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) from exceeding 0.11% of Institutional Class and Investor Class average daily net assets. For the year ended September 30, 2013, the Adviser reimbursed expenses of $170,352.

The Trust and SEI Investments Global Funds Services (the “Administrator”) have entered into an Administration Agreement. Under the terms of the Administration Agreement, the Administrator is entitled to an annual fee which is calculated daily and paid monthly based on the aggregate average daily net assets of the Trust as follows: 0.06% up to $1 billion; 0.05% of the assets exceeding $1 billion up to $2 billion; 0.04% of the assets exceeding $2 billion up to $3 billion; 0.03% of the assets exceeding $3 billion up to $4 billion; and 0.02% of the assets exceeding $4 billion. The Fund is subject to a minimum annual fee of $10,000. If the Fund has three or more share classes, it is subject to an additional minimum fee of $20,000 per additional share class (over two).

The Trust has adopted a Shareholder Service Plan and Agreement for Investor Class shares that allows the Trust to pay broker-dealers and other financial intermediaries a fee of up to 0.25% per annum of average daily net assets for services provided to Investor Class shareholders. For the year ended September 30, 2013, the Investor Class paid 0.25% of average daily net assets under this plan.

The Trust and SEI Investments Distribution Co. (the “Distributor”) have entered into a Distribution Agreement. The Distributor receives no fees for its distribution services under this agreement.

The officers of the Trust are also officers or employees of the Administrator or Adviser. They receive no fees for serving as officers of the Trust.

| | | | |

| 18 | | Causeway International Opportunities Fund | | |

NOTES TO FINANCIAL STATEMENTS

(continued)

As of September 30, 2013, approximately $135,000 of net assets were held by affiliated investors.

| 4. | | Investment Transactions |

The cost of security purchases and the proceeds from the sale of securities, other than short-term investments, during the year ended September 30, 2013, for the Fund were as follows:

| | | | | | |

Purchases

(000) | | | Sales

(000) | |

| $ | 25,452 | | | $ | 2,406 | |

The following is a rollforward of affiliated investments as of September 30, 2013 (000):

| | | | | | | | |

| | | Causeway

Emerging

Markets Fund | | | Causeway

International

Value Fund | |

Beginning balance as of September 30, 2012 | | $ | 3,415 | | | $ | 12,037 | |

Purchases | | | 5,914 | | | | 19,538 | |

Sales | | | (459 | ) | | | (1,947 | ) |

Realized Gain (Loss) | | | (2 | ) | | | 178 | |

Unrealized Gain (Loss) | | | 166 | | | | 5,290 | |

| | | | |

Ending balance as of September 30, 2013 | | $ | 9,034 | | | $ | 35,096 | |

| | | | |

| 5. | | Risks of Foreign Investing |

Because Causeway International Value Fund and Causeway Emerging Markets Fund (the “underlying funds”) invest most of their assets in foreign securities, the Fund is subject to further risks. For example, the value of the underlying fund’s securities may be affected by social, political and economic developments and U.S. and foreign laws relating to foreign investment. Further, because the underlying funds invest in securities denominated in foreign currencies, the underlying fund’s securities may go down in value depending on foreign exchange rates. Other risks include trading, settlement, custodial, and other operational risks;

withholding or other taxes; and the less stringent investor protection and disclosure standards of some foreign markets. All of these factors can make foreign securities less liquid, more volatile and harder to value than U.S. securities. These risks are higher for emerging markets investments.

| 6. | | Federal Tax Information |

The Fund is classified as a separate taxable entity for Federal income tax purposes. The Fund intends to continue to qualify as a separate “regulated investment company” under Subchapter M of the Internal Revenue Code and make the requisite distributions to shareholders that will be sufficient to relieve it from Federal income tax and Federal excise tax. Therefore, no Federal tax provision is required. To the extent that dividends from net investment income and distributions from net realized capital gains exceed amounts reported in the financial statements, such amounts are reported separately.

The Fund may be subject to taxes imposed by countries in which it invests in issuers existing or operating in such countries. Such taxes are generally based on income earned. The Fund accrues such taxes when the related income is earned. Dividend and interest income is recorded net of non-U.S. taxes paid.

The amounts of distributions from net investment income and net realized capital gains are determined in accordance with Federal income tax regulations, which may differ from those amounts determined under U.S. GAAP. These book/tax differences are either temporary or permanent in nature. The character of distributions made during the year from net investment income or net realized gains, and the timing of distributions made during the year may differ from the year that the income or realized gains (losses) were recorded by the

| | | | | | |

| | | Causeway International Opportunities Fund | | | 19 | |

NOTES TO FINANCIAL STATEMENTS

(continued)

Fund. To the extent these differences are permanent, adjustments are made to the appropriate equity accounts in the period that the differences arise.

The tax character of dividends and distributions declared during the fiscal years ended September 30, 2013 and September 30, 2012 were as follows (000):

| | | | | | | | | | | | |

| | | Ordinary

Income | | | Long-Term

Capital Gain | | | Total | |

2013 | | $ | 676 | | | $ | 53 | | | $ | 729 | |

2012 | | | 231 | | | | 38 | | | | 269 | |

As of September 30, 2013, the components of distributable earnings on a tax basis were as follows (000):

| | | | |

Undistributed Long-Term Capital Gains | | $ | 188 | |

Unrealized Appreciation | | | 5,782 | |

Late-Year Loss Deferral | | | (24 | ) |

| | | | |

Total Distributable Earnings | | $ | 5,946 | |

| | | | |

Deferred late-year losses represent ordinary losses realized on investment transactions from January 1, 2013 through September 30, 2013 and specified losses realized on investment transactions from November 1, 2012 through September 30, 2013, that, in accordance with Federal income tax regulations, the Fund may elect to defer and treat as having arisen in the following fiscal year.

At September 30, 2013, the total cost of securities for Federal income tax purposes and the aggregate gross unrealized appreciation and depreciation on investment securities for the Fund were as follows (000):

| | | | | | | | | | | | |

Federal

Tax Cost | | Appreciated

Securities | | | Depreciated

Securities | | | Net

Unrealized

Appreciation | |

| $38,397 | | $ | 5,861 | | | $ | (79 | ) | | $ | 5,782 | |

| 7. | | Capital Shares Issued and Redeemed (000) |

| | | | | | | | | | | | | | | | |

| | | Year Ended

September 30, 2013 | | | Year Ended

September 30, 2012 | |

| | | Shares | | | Value | | | Shares | | | Value | |

Institutional Class | | | | | | | | | | | | | | | | |

Shares Sold | | | 1,987 | | | $ | 23,190 | | | | 549 | | | $ | 6,022 | |

Shares Issued in Reinvestment of

Dividends and Distributions | | | 61 | | | | 716 | | | | 28 | | | | 264 | |

Shares Redeemed | | | (144 | ) | | | (1,684 | ) | | | (29 | ) | | | (308 | ) |

| | | | | | | | | | | | | | | | |

Increase in Shares Outstanding

Derived from Institutional Class Transactions | | | 1,904 | | | | 22,222 | | | | 548 | | | | 5,978 | |

| | | | | | | | | | | | | | | | |

Investor Class | | | | | | | | | | | | | | | | |

Shares Sold | | | 95 | | | | 1,131 | | | | 33 | | | | 368 | |

Shares Issued in Reinvestment of

Dividends and Distributions | | | 1 | | | | 12 | | | | 1 | | | | 5 | |

Shares Redeemed | | | (18 | ) | | | (209 | ) | | | (1 | ) | | | (14 | ) |

| | | | | | | | | | | | | | | | |

Increase in Shares Outstanding

Derived from Investor Class Transactions | | | 78 | | | | 934 | | | | 33 | | | | 359 | |

| | | | | | | | | | | | | | | | |

Increase in Shares Outstanding from

Capital Share Transactions | | | 1,982 | | | $ | 23,156 | | | | 581 | | | $ | 6,337 | |

| | | | | | | | | | | | | | | | |

| | | | |

| 20 | | Causeway International Opportunities Fund | | |

NOTES TO FINANCIAL STATEMENTS

(concluded)

| 8. | | Significant Shareholder Concentration |

As of September 30, 2013, two of the Fund’s shareholders owned 59% of net assets in the Institutional Class.

| 9. | | New Accounting Pronouncement |

In June 2013, the FASB issued an update (“ASU 2013-08”) to ASC Topic 946, Financial Services – Investment Companies (“Topic 946”). ASU 2013-08 amends the guidance in Topic 946 for determining whether an entity qualifies as an investment company and requires certain additional disclosures. ASU 2013-08 is effective for interim and annual reporting periods in fiscal years that begin after December 15, 2013. Management is currently evaluating the impact, if any, of ASU 2013-08 on the Fund’s financial statements.

In December 2011, the Financial Accounting Standards Board (the “FASB”) issued a further update to the

guidance “Balance Sheet – Disclosures about Offsetting Assets and Liabilities.” The amendments to this standard require an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The amended guidance is effective for interim and annual reporting periods beginning after January 1, 2013. Management has evaluated the implications of this update and does not believe the adoption will have a material impact on the financial statements.

The Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no adjustments were required to the financial statements.

| | | | | | |

| | | Causeway International Opportunities Fund | | | 21 | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees and Shareholders of Causeway International Opportunities Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedules of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Causeway International Opportunities Fund (the “Fund”) at September 30, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at September 30, 2013 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Los Angeles, California

November 26, 2013

| | | | |

| 22 | | Causeway International Opportunities Fund | | |

NOTICE TO SHAREHOLDERS (Unaudited)

The information set forth below is for the Fund’s fiscal year as required by federal laws. Shareholders, however, must report distributions on a calendar year basis for income tax purposes, which may include distributions for portions of two fiscal years of the Fund. Accordingly, the information needed by shareholders for income tax purposes will be sent to them in early 2014. Please consult your tax adviser for proper treatment of this information.

For the fiscal year ended September 30, 2013, the Fund is designating the following items with regard to distributions paid during the year:

| | | | | | | | | | | | | | | | | | |

| (A) | | | (B) | | | (C) | | | (D) | | | (E) | |

| | | | |

Long Term

Capital Gains

Distributions

(Tax Basis) | | | Ordinary

Income

Distributions

(Tax Basis) | | | Tax Exempt

Distributions

(Tax Basis) | | | Total

Distributions

(Tax Basis) | | | Dividends(1)

for Corporate

Dividends Received

Deduction

(Tax Basis) | |

| | 6.45% | | | | 93.55% | | | | 0.00% | | | | 100.00% | | | | 0.00% | |

| | | | |

| (F) | | | (G) | | | (H) | | | | | | | |

| | | | |

Qualified

Dividend

Income | | | Interest

Related

Dividends | | | Qualified

Short-Term

Capital

Gain

Dividends | | | | | | | |

| | 86.80% | | | | 0.00% | | | | 0.00% | | | | | | | | | |

Since the fund is a “qualified fund-of-fund” under the Regulated Investment Company Modernization Act of 2010, it is expected to pass through foreign tax credits that it received from underlying RIC investments to shareholders. For fiscal year ended September 30, 2013, the fund received foreign tax credit in the amount of $85,008. In addition, for the fiscal year ended September 30, 2013, gross income derived from sources within foreign countries amounted to $645,082 for the Fund.

| (1) | Qualified Dividends represent dividends which qualify for the corporate dividends received deduction. |

Items (A), (B), (C) and (D) are based on a percentage of the Fund’s total distribution including pass-through as foreign tax credit.

Item (E) is based on a percentage of ordinary income distributions of the Fund.

Item (F) represents the amount of “Qualified Dividend Income” as defined in the Jobs and Growth Tax Relief Reconciliation Act of 2003 and is reflected as a percentage of “Ordinary Income Distributions”. It is the Fund’s intention to designate the maximum amount permitted by the law up to 100%.

Item (G) is the amount of “Interest Related Dividends” as created by the American Jobs Creation Act of 2004 and is reflected as a percentage of net investment income distributions that is exempt from U.S. withholding tax when paid to foreign investors.

Item (H) is the amount of “Qualified Short-Term Capital Gain Dividends” as created by the American Jobs Creation Act of 2004 and is reflected as a percentage of short-term capital gain distributions that is exempt from U.S. withholding tax when paid to foreign investors.

| | | | | | |

| | | Causeway International Opportunities Fund | | | 23 | |

TRUSTEES AND OFFICERS INFORMATION (Unaudited)

Information pertaining to the Trustees and Officers of the Trust is set forth below. Trustees who are not deemed to be “interested persons” of the Trust as defined in the 1940 Act are referred to as “Independent Trustees.” Trustees who are deemed to be “interested persons” of the Trust are referred to as “Interested Trustees.” The Trust’s Statement of Additional Information (“SAI”) includes additional information about the Trustees and Officers. The SAI may be obtained without charge by calling 1-866-947-7000.

| | | | | | | | | | |

Name

Address,

Age1 | | Position(s)

Held with the

Company | | Term of

Office

and

Length of

Time

Served2 | | Principal

Occupation(s)

During Past

Five Years | | Number of

Portfolios

in Trust

Complex

Overseen by

Trustee3 | | Other

Directorships

Held by

Trustee4 |

INDEPENDENT TRUSTEE | | | | | | | | | | |

John R. Graham

Age: 52 | | Trustee; Chairman of the Audit Committee | | Trustee

since 10/08; Chairman since 4/13 | | Film Composer (since 2005); Senior Vice President, Corporate Financial Development and Communications, The Walt Disney Company (2004-2005); Senior Vice President, Mergers and Acquisitions, Lehman Brothers Inc. (2000-2004). | | 5 | | None |

| | | | | |

Lawry J. Meister

Age: 51 | | Trustee | | Since 10/08 | | President, Steaven Jones Development Company, Inc. (real estate firm) (since 1995); President, Creative Office Properties (since 2012). | | 5 | | None |

| | | | | |

Victoria B. Rogers

Age: 51 | | Trustee | | Since 4/13 | | President, the Rose Hills Foundation (since 1996). | | 5 | | Director, TCW Funds, Inc. and TCW Strategic Income Fund, Inc. |

| | | | | |

Eric H. Sussman

Age: 47 | | Trustee; Chairman of the Board | | Trustee

since 9/01; Chairman since 4/13 | | Senior Lecturer (since July 2011) and Lecturer (1995-June 2011), Anderson Graduate School of Management, University of California, Los Angeles; President, Amber Capital, Inc. (real estate investment and financial planning firm) (since 1993). | | 5 | | Trustee, Presidio Funds

(until 2010) |

INTERESTED TRUSTEE5 | | | | | | | | | | |

Mark D. Cone

Age: 45 | | Trustee | | Since 10/08 | | Executive Vice President and Chief Marketing Officer of the Adviser (since 2001). | | 5 | | None |

| | | | |

| 24 | | Causeway International Opportunities Fund | | |

TRUSTEES AND OFFICERS INFORMATION (Unaudited)

(continued)

| | | | | | | | | | |

Name

Address,

Age1 | | Position(s)

Held with the

Company | | Term of

Office

and

Length of

Time

Served2 | | Principal

Occupation(s)

During Past

Five Years | | Number of

Portfolios

in Trust

Complex

Overseen by

Trustee3 | | Other

Directorships

Held by

Trustee4 |

OFFICERS | | | | | | | | | | |

Turner Swan

11111 Santa Monica Blvd.,

15th Floor

Los Angeles, CA 90025

Age: 51 | | President | | Since 8/01 | | General Counsel, Secretary, and Member of the Adviser (since 2001); Compliance Officer of the Adviser (since 2010). | | N/A | | N/A |

| | | | | |

Gracie V. Fermelia

11111 Santa Monica Blvd.,

15th Floor

Los Angeles, CA 90025

Age: 51 | | Chief Compliance Officer and Assistant Secretary | | CCO since 7/05; Asst. Sect. since 8/01 | | Chief Compliance Officer of the Adviser (since July 2005); Chief Operating Officer and Member of the Adviser (since 2001). | | N/A | | N/A |

| | | | | |

Michael Lawson6

One Freedom Valley

Drive

Oaks, PA 19456

Age: 52 | | Treasurer | | Since 7/05 | | Director of the Administrator’s Fund Accounting department (since July 2005); Manager in the Administrator’s Fund Accounting department (November 1998 to July 2005). | | N/A | | N/A |

| | | | | |

Gretchen W. Corbell

11111 Santa Monica Blvd.,

15th Floor

Los Angeles, CA 90025

Age: 42 | | Secretary | | Since 10/11 | | Associate Attorney of the Adviser (since 2004). | | N/A | | N/A |

| | | | | |

Lisa Whittaker6

One Freedom Valley Drive

Oaks, PA 19456

Age: 34 | | Vice President and Assistant Secretary | | Since 8/13 | | Corporate Counsel of the Administrator (since 2012); Associate Counsel and Compliance Officer, The Glendmede Trust Company, N.A. (2011-2012); Associate, Drinker Biddle & Reath LLP (2006-2011). | | N/A | | N/A |

| | | | | |

Carolyn F. Mead6

One Freedom Valley Drive

Oaks, PA 19456

Age: 56 | | Vice President and Assistant Secretary | | Since 7/08 | | Corporate Counsel of the Administrator (since 2007); Associate Counsel, Stradley, Ronan, Stevens & Young LLP (2004-2007). | | N/A | | N/A |

| | | | | | |

| | | Causeway International Opportunities Fund | | | 25 | |

TRUSTEES AND OFFICERS INFORMATION (Unaudited)

(concluded)

| | | | | | | | | | |

Name

Address,

Age1 | | Position(s)

Held with the

Company | | Term of

Office

and

Length of

Time

Served2 | | Principal

Occupation(s)

During Past

Five Years | | Number of

Portfolios

in Trust

Complex

Overseen by

Trustee3 | | Other

Directorships

Held by

Trustee4 |

Bernadette Sparling6

One Freedom Valley Drive Oaks, PA 19456 Age: 36 | | Vice President and Assistant Secretary | | Since 7/08 | | Corporate Counsel of the Administrator (since 2005); Associate Counsel, Blank Rome LLP (2001-2005). | | N/A | | N/A |

| 1 | Each Trustee may be contacted by writing to the Trustee c/o Causeway Capital Management Trust, One Freedom Valley Drive, Oaks, PA 19456. |

| 2 | Each Trustee holds office during the lifetime of the Trust or until his or her sooner resignation, retirement, removal, death or incapacity in accordance with the Trust’s Declaration of Trust. The president, treasurer and secretary each holds office at the pleasure of the Board of Trustees or until he or she sooner resigns in accordance with the Trust’s Bylaws. |

| 3 | The “Trust Complex” consists of all registered investment companies for which Causeway Capital Management LLC serves as investment adviser. As of September 30, 2013, the Trust Complex consisted of one investment company with five portfolios — the International Value Fund, the Emerging Markets Fund, the Global Value Fund, the International Opportunities Fund, and the Global Absolute Return Fund. |

| 4 | Directorships of companies required to report to the Securities and Exchange Commission under the Securities Exchange Act of 1934 (i.e., “public companies”) or other investment companies registered under the 1940 Act. |

| 5 | Mr. Cone is considered an “interested person” of the Trust as defined in the 1940 Act because he is an employee of the Adviser. |

| 6 | These officers of the Trust also serve as officers of one or more mutual funds for which SEI Investments Company or an affiliate acts as investment manager, administrator or distributor. |

| | | | |

| 26 | | Causeway International Opportunities Fund | | |

DISCLOSURE OF FUND EXPENSES (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees, shareholder service fees, and other Fund expenses. It is important for you to understand the impact of these costs on your investment returns.

Ongoing operating expenses are deducted from a mutual fund’s gross income and directly reduce its final investment return. These expenses are expressed as a percentage of a mutual fund’s average net assets; this percentage is known as a mutual fund’s expense ratio.

The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table on the next page illustrates the Fund’s costs in two ways:

Actual Fund Return. This section helps you to estimate the actual expenses after fee waivers that the Fund incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return.

You can use this information, together with the actual amount you invested in the Fund, to estimate the expenses you paid over that period. Simply divide your actual account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown under “Expenses Paid During Period.”

Hypothetical 5% Return. This section helps you compare the Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual 5% return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to make this 5% calculation. You can assess the Fund’s comparative cost by comparing the hypothetical result for the Fund in the “Expenses Paid During Period” column with those that appear in the same charts in the shareholder reports for other mutual funds.

NOTE: Because the return is set at 5% for comparison purposes — NOT the Fund’s actual return — the account values shown may not apply to your specific investment.

| | | | | | |

| | | Causeway International Opportunities Fund | | | 27 | |

DISCLOSURE OF FUND EXPENSES (Unaudited)

(concluded)

| | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

4/01/13 | | | Ending

Account

Value

9/30/13 | | | Annualized

Expense

Ratios | | | Expenses

Paid

During

Period* | |

Causeway International Opportunities Fund | | | | | | | | | | | | | |

| | | | |

Actual Portfolio Return | | | | | | | | | | | | | | | | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,107.30 | | | | 0.11 | % | | $ | 0.58 | |

| | | | |

Hypothetical 5% Return | | | | | | | | | | | | | | | | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,024.52 | | | | 0.11 | % | | $ | 0.56 | |

| | | | |

Actual Portfolio Return | | | | | | | | | | | | | | | | |

Investor Class | | $ | 1,000.00 | | | $ | 1,106.70 | | | | 0.36 | % | | $ | 1.90 | |

| | | | |

Hypothetical 5% Return | | | | | | | | | | | | | | | | |

| Investor Class | | $ | 1,000.00 | | | $ | 1,023.26 | | | | 0.36 | % | | $ | 1.83 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period.) |

| | | | |

| 28 | | Causeway International Opportunities Fund | | |

STATEMENT REGARDING BASIS FOR APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

Section 15(c) of the Investment Company Act of 1940, as amended (the “1940 Act”) requires the Board of Trustees (the “Board”) of Causeway Capital Management Trust (the “Trust”) annually to approve continuance of the investment advisory agreement (the “Advisory Agreement”) between the Trust and Causeway Capital Management LLC (the “Adviser”) with respect to Causeway International Opportunities Fund (the “Fund”). Continuance of the Advisory Agreement must be approved by a majority of the Trustees and a majority of the independent Trustees (i.e., Trustees who are not “interested persons” of the Trust as defined in the 1940 Act). The Board was comprised of four independent Trustees and one interested Trustee when continuation of the Advisory Agreement was last considered.

Information Received. At each regular quarterly meeting, the Board reviews a wide variety of materials relating to the nature, extent and quality of the Adviser’s services, including information concerning the Fund’s performance. At least annually, the Board is provided with additional quantitative and qualitative information to assist it in evaluating whether to approve the continuance of the Advisory Agreement. The Board met on August 7, 2013, to consider whether to approve the continuance of the Advisory Agreement for an additional one-year period. In connection with the meeting, the Trustees received and reviewed extensive materials prepared by the Adviser relating to the Advisory Agreement in response to information requested on the independent Trustees’ behalf by their independent legal counsel.

Factors Considered. In reviewing the Advisory Agreement, the Trustees considered a number of factors including, but not limited to: (1) the nature, extent and quality of the services provided by the Adviser, (2) the investment performance of the Fund, (3) comparisons of the services rendered and the amounts paid under the Advisory Agreement with those of other funds and those of the Adviser under other investment advisory agreements with other registered investment companies and other types of clients, (4) the costs of the services provided and estimated profits realized by the Adviser and its affiliates from their relationship with the Fund, (5) the extent to which economies of scale would be realized as the Fund grows and whether fee levels reflect these economies of scale for the benefit of Fund investors, and (6) any other benefits derived by the Adviser from its relationship with the Fund.

First, regarding the nature, extent and quality of the services provided by the Adviser, the Trustees considered, among other things, the Adviser’s personnel, experience, track record, and compliance program. The Trustees considered the qualifications, backgrounds and responsibilities of the Adviser’s principal personnel who provide services to the Fund, as well as the level of attention those individuals provide to the Fund. The Trustees noted the Adviser’s commitment to devoting resources to staffing and technology in support of its investment management services. They also reviewed the Adviser’s investment philosophy and processes and its compliance program, and considered the scope of the Adviser’s services. The Trustees concluded that the nature, extent and quality of the services provided by the Adviser continued to benefit the Fund and its shareholders and would do so during the next one-year contract renewal period.

Second, regarding the investment performance of the Fund, the Trustees reviewed the investment results of the Fund’s Institutional and Investor share classes for various periods ended June 30, 2013, compared to the results of the MSCI All Country World Index ex U.S. (the “Index”) and the averages of the mutual funds included in the Morningstar Foreign Large Blend category of funds. They noted that the Fund had outperformed the Index and the Morningstar category average for the one-year, three-year, and since inception periods. The Trustees concluded that the Adviser’s record in managing the Fund indicates that its continued management will benefit the Fund and its shareholders.

| | | | | | |

| | | Causeway International Opportunities Fund | | | 29 | |

STATEMENT REGARDING BASIS FOR APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

(continued)

Third, regarding the Fund’s advisory fee and total expenses:

| | • | | The Trustees compared the Fund’s advisory fee and expenses with those of other similar mutual funds. They recognized that while the Adviser does not receive an advisory fee for managing the Fund, because the Fund invests in other series of the Trust, the Adviser receives advisory fees from those other series with respect to assets invested by the Fund, and the shareholders of the Fund bear the expenses of those other series. They noted that although the Fund’s “effective” advisory fee is higher than the average and median advisory fees of the mutual funds in the Morningstar category(by 15 and 7 basis points, respectively), its “effective” expense ratio for Institutional Class shares, after application of the Adviser’s expense limit agreement, is below the average and median for the funds in its category, and its effective expense ratio for Investor Class shares is near the average and median for the funds in its category (within 3 and 11 basis points, respectively). |

| | • | | The Trustees compared the Fund’s effective advisory fee with the fees charged by the Adviser to other clients. The Trustees noted that the fees paid by the Adviser’s separate accounts are lower than the effective fee paid by the Fund, and the fees charged to the Adviser’s group trust investors are lower than the fee paid by the Fund after bundled custody and administration charges. With respect to the separate accounts and group trust investors, the Trustees concluded that the differences appropriately reflected the Adviser’s significantly greater responsibilities with respect to the Fund, which include the provision of many additional administrative and shareholder services (such as services related to the Fund’s disclosure documents, financial statements, 1940 Act compliance policies and procedures, preparation of Board and committee materials and meetings, annual Board reports and certifications, oversight of daily valuation, participation in regulatory examinations and legal and compliance matters, oversight of Fund service providers, negotiation of Fund intermediary agreements, coordination with Fund intermediaries providing shareholder recordkeeping services, shareholder communications, and due diligence for advisers, consultants and institutional investors). |

The Trustees concluded that the Fund’s effective advisory fee and effective expense ratio are reasonable and appropriate under the circumstances.

Fourth, the Trustees considered the Adviser’s costs of providing services to the Fund and the estimated profits or losses realized by the Adviser from its relationship with the Fund. They reviewed the Adviser’s after-tax net loss with respect to such services for the twelve months ended June 30, 2013 and the methodology used to generate that estimate, and noted that the cost allocation methodology presented to the Trustees was reasonable. They also noted that, due to its expense limit agreement with respect to the Fund, the Adviser may continue to experience losses managing the Fund for a period of time.

Fifth, regarding economies of scale, the Trustees observed that the Fund does not pay an advisory fee, and further observed that, although the fee schedules of the series of the Trust in which the Fund invests — Causeway International Value Fund and Causeway Emerging Markets Fund — do not have breakpoints, it is difficult to determine the existence or extent of any economies of scale. They noted that the Adviser is sharing economies of scale through

| | | | |

| 30 | | Causeway International Opportunities Fund | | |

STATEMENT REGARDING BASIS FOR APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

(concluded)

reasonable advisory fee levels, the expense limit agreement, and devoting additional resources to staff and technology to focus on continued performance and service to the Fund’s shareholders. They also noted that the Adviser has incurred significant losses in managing the Fund and may continue to incur losses in the future. The Trustees concluded that under the circumstances the Adviser is sharing any economies of scale with the Fund appropriately.

Sixth, regarding any other benefits derived by the Adviser from its relationship with the Fund – often called “fall-out” benefits — the Trustees observed that the Adviser does not earn common “fall-out” benefits such as affiliated custody fees, affiliated transfer agency fees, affiliated brokerage commissions, profits from rule 12b-1 fees, “contingent deferred sales commissions,” or “float” benefits on short-term cash. The Trustees concluded that the primary “fall-out” benefits received by the Adviser are advisory fees paid by the series of the Trust in which the Fund invests and research services provided by brokers used by those Funds, and that these benefits are reasonable in relation to the value of the services that the Adviser provides to the Fund.

Approval. At the August 7, 2013 meeting, the Trustees discussed the information and factors noted above and considered the approval of the Advisory Agreement with representatives of the Adviser. The independent Trustees also met in a private session with independent counsel at which no representatives of the Adviser were present. In their deliberations, the independent Trustees did not identify any particular information or factor that was determinative or controlling, each Trustee did not necessarily attribute the same weight to each factor, and the foregoing summary does not detail all the matters considered. Based on their review, the Trustees (including the independent Trustees) unanimously concluded that the Advisory Agreement is fair and reasonable to the Fund and its shareholders, the Fund’s advisory fee is reasonable and that renewal of the Advisory Agreement is in the best interests of the Fund and its shareholders, and the Board of Trustees approved the renewal of the Advisory Agreement for a twelve-month period beginning September 20, 2013.

| | | | | | |

| | | Causeway International Opportunities Fund | | | 31 | |

SUPPLEMENTAL FINANCIAL INFORMATION

CAUSEWAY INTERNATIONAL VALUE FUND:

ANNUAL REPORT AS OF SEPTEMBER 30, 2013

TABLE OF CONTENTS

LETTER TO SHAREHOLDERS

For the fiscal year ended September 30, 2013, Causeway International Value Fund’s (the “Fund” or “Fund’s”) Institutional Class returned 24.38% and Investor Class returned 24.07% compared to the MSCI EAFE Index (Gross) (“EAFE Index”) return of 24.29%. Since the Fund’s inception on October 26, 2001, its average annual total returns are 9.31% for the Institutional Class and 9.05% for the Investor Class compared to the EAFE Index’s average annual total return of 7.25%. At fiscal year-end the Fund had net assets of $3.15 billion.

Performance Review

Other than a brief pullback from May through June, international equities ascended virtually unabated during fiscal 2013. Liquidity fueled demand for developed market equities, as monetary authorities in the United States, Japan and Europe continued to provide substantial “quantitative easing.” The brief disruption in performance was caused by the introduction of the term, “tapering” — a reduction in the pace of the bond purchasing program by the Unites States Federal Reserve (the “Fed”). Markets were spooked briefly, but investors calmed down after the Fed provided further clarity, stating that its ability to remove stimulus is data-dependent, and the rate of unemployment would need to decline further.

Every market and every sector in the EAFE Index advanced during the fiscal year. The best performing markets included Greece, Finland, France, the Netherlands, and Switzerland. The biggest laggards (albeit each in positive territory) included Israel, Singapore, Norway and two markets that are not part of the EAFE Index, but are in the Fund’s investable universe — Canada and S. Korea. From a sector perspective, consumer discretionary, financials, industrials, and telecommunication services outperformed compared to the EAFE Index, while energy, materials, utilities, and consumer staples underperformed.