UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-10467

Causeway Capital Management Trust

(Exact name of registrant as specified in charter)

11111 Santa Monica Boulevard, 15th Floor

c/o Causeway Capital Management LLC

Los Angeles, CA 90025

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington DE, 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-866-947-7000

Date of fiscal year end: September 30, 2018

Date of reporting period: September 30, 2018

| Item 1. | Reports to Stockholders. |

The registrant’s schedules as of the close of the reporting period, as set forth in §§ 210.12-12 through 210.12-14 of Regulation S-X [17 CFR §§ 210-12.12-12.14], are attached hereto.

TABLE OF CONTENTS

LETTER TO SHAREHOLDERS

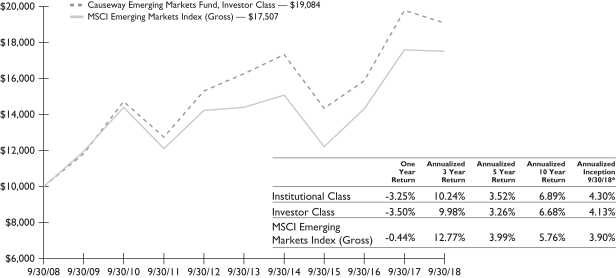

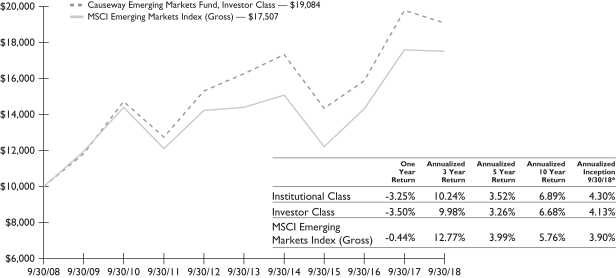

For the fiscal year ended September 30, 2018, Causeway Emerging Markets Fund’s (the “Fund’s”) Institutional Class returned -3.25% and Investor Class returned -3.50%, compared to -0.44% for the MSCI Emerging Markets Index (Gross) (“EM Index”). Since the Fund’s inception on March 30, 2007, the Fund’s average annual total returns are 4.30% for the Institutional Class and 4.13% for the Investor Class, compared to 3.90% for the EM Index.

Performance Review

Despite strength in the first half of the fiscal year, US dollar strength and trade tensions weighed on emerging markets equities to finish the fiscal year relatively flat. The increased pace of US interest rate hikes during the period supported dollar strength, a headwind for emerging markets. Continuing trade tensions between the US and China were a source of uncertainty for the asset class, as both US and Chinese officials seem to be resolute in their respective positions. The strongest performing sectors in the EM Index over the fiscal year were energy and materials. The weakest performers in the EM Index were the consumer discretionary and industrials sectors. The strongest performing region during the fiscal year was the emerging Asia region. The emerging Europe, Middle East, and Africa (“EMEA”) and emerging Latin America regions both posted negative returns.

We use a combination of stock-specific factors and country, currency, sector, and macroeconomic analysis to rank the stocks in our investable universe. Of the bottom-up factors we use to forecast alpha (performance in excess of the EM Index), our earnings growth factors demonstrated the strongest performance during the fiscal year. Our technical factors, which measure six- and twelve-month price momentum, were also positive. Our bottom-up valuation factors were relatively flat for the period. Our top-down currency, sector, and macroeconomic factors were positive during the fiscal year. Of our top-down factors, only our country factors delivered negative performance.

Holdings in the information technology, industrials, and financials sectors were the largest detractors from the Fund’s performance versus the performance of the EM Index during the fiscal year. Holdings in the energy, materials, and real estate sectors offset some of the underperformance. The Fund’s overweight positions relative to the EM Index in electronic components manufacturer, Yageo Corp. (Taiwan) and airline loyalty program platform, Smiles Fidelidade SA (Brazil), along with an underweight position in energy & industrials holding company, Reliance Industries Ltd. (India), detracted from relative performance. The top stock–level contributors to performance relative to the EM Index were overweight positions in oil & gas exploration & production company, China Petroleum & Chemical Corp. (China), state-owned oil & gas company, PTT Public Co., Ltd. (Thailand), and oil & gas exploration company, Lukoil (Russia).

Significant Portfolio Changes

The Fund’s active exposure to several sectors and countries changed during the fiscal year as a result of our quantitative investment process. The largest increases in active weightings (compared to EM Index weightings) were to the consumer discretionary and energy sectors, and the biggest reductions in active weightings were to the information technology and utilities sectors. Notable changes in the Fund’s active country weightings included increases to exposures in Mexico, India, and South Korea. We reduced exposures to China, Thailand, and Turkey, though we still maintain a positive active weight relative to the EM Index in all three countries.

| | | | | | |

| 2 | | Causeway Emerging Markets Fund | | | | |

Significant purchases over the fiscal year included new positions in internet services provider, Baidu (China), oil & exploration company, Gazprom PJSC (Russia), information technology services provider, Tata Consultancy Services Ltd. (India), and oil & exploration company, CNOOC Ltd. (China), along with increased exposure to cement manufacturer, Anhui Conch Cement Co., Ltd. (China). The largest sales included full sales of internet services provider, Netease.com (China), industrial conglomerate, Hyosung Corp. (South Korea), electric utility, Korea Electric Power Corp. (South Korea), and agro-industrial group, Charoen Pokphand Foods Public Co. Ltd. (Thailand), along with decreased exposure to electronics contract manufacturer, Hon Hai Precision Industry Co., Ltd. (Taiwan).

Investment Outlook

In September, the US Federal Reserve raised the target federal funds rate by 0.25% to a range of 2-2.25%. This was the third increase this calendar year and the eighth increase since December 2015. Longer term interest rates in the US also rose during the month as the yield on the US 10-year Treasury Note increased from 2.86% to 3.06%. Rising longer term yields in the US allow the Federal Reserve to continue raising interest rates without inverting the yield curve. Despite rising interest rates in the US, emerging market currencies generally rallied during the month as a number of emerging market central banks have been tightening monetary policy in an effort to support their currencies. Central banks in Russia, India, Indonesia, Mexico, the Philippines, and the Czech Republic have been raising interest rates. Turkey’s central bank increased its policy rate from 17.75% to 24%, outpacing the consensus expectation of 21.5%. This announcement was viewed favorably by financial markets as it signaled that the central bank retained independence and appeared committed to supporting the currency. The Fund maintains a modest overweight to Turkish stocks due to attractive valuations.

After underperforming growth stocks in 2017, emerging market value stocks delivered positive returns in the third calendar quarter of 2018 and are outperforming emerging market growth stocks over the calendar year-to-date period. The Fund did not fully participate in the value rally as overweight positions in India and Taiwan detracted from relative performance. Our focus on stocks with attractive valuations and positive momentum detracted from performance as investors rotated out of outperforming stocks, regardless of valuations. As a result, the momentum factor’s underperformance more than offset the value factor’s outperformance in the third calendar quarter. We emphasize the value factor in our investment process and we also include earnings growth and momentum factors in our alpha model to help the Fund navigate a variety of style regimes, including environments in which value stocks are out of favor.

Recent underperformance is also attributable to the Fund’s exposure to small cap stocks. The MSCI Emerging Markets Small Cap Index underperformed the broader EM Index by 2.8% in September. This effect was especially pronounced in India, where the Fund has exposure to a number of smaller capitalization stocks. The Fund’s underperformance in India is also attributable to tightening liquidity conditions in the country, which have been driven by a weak rupee and increasing interest rates. The Fund maintains an overweight to Indian equities due to attractive earnings growth and momentum characteristics at the stock-level, as well as favorable OECD Leading Indicators at the country-level.

| | | | | | |

| | | Causeway Emerging Markets Fund | | | 3 | |

We thank you for your continued confidence in Causeway Emerging Markets Fund, and look forward to serving you in the future.

September 30, 2018

| | | | |

| |  | |  |

| | |

| Arjun Jayaraman | | MacDuff Kuhnert | | Joseph Gubler |

| Portfolio Manager | | Portfolio Manager | | Portfolio Manager |

The above commentary expresses the portfolio managers’ views as of the date shown and should not be relied upon by the reader as research or investment advice. These views are subject to change. There is no guarantee that any forecasts made will come to pass.

Investing involves risk including loss of principal. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Diversification does not prevent all investment losses.

The OECD system of Composite Leading Indicators (CLIs) is designed to provide early signals of turning points in business cycles—fluctuation in the output gap, i.e. fluctuation of the economic activity around its long term potential level. This approach, focusing on turning points (peaks and troughs), results in CLIs that provide qualitative rather than quantitative information on short-term economic movements.

| | | | | | |

| 4 | | Causeway Emerging Markets Fund | | | | |

Comparison of Change in the Value of a $10,000 Investment in Causeway Emerging Markets Fund, Investor Class shares versus the MSCI Emerging Markets Index (Gross) as of September 30, 2018

The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares.

* Inception is March 30, 2007.

The performance data represents past performance and is not an indication of future results. Investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth less than their original cost and current performance may be higher or lower than the performance quoted. For performance data current to the most recent month end, please call 1-866-947-7000 or visit www.causewayfunds.com. Investment performance reflects contractual fee waivers during certain periods. In the absence of such fee waivers, total return would be reduced. Total returns assume reinvestment of dividends and capital gains distributions at net asset value when paid. Investor Class shares pay a shareholder service fee of up to 0.25% per annum of average daily net assets. Institutional Class shares pay no shareholder service fee. Pursuant to the current July 24, 2018 prospectus, the Fund’s expense ratios were 1.15% and 1.40% for the Institutional Class and Investor Class, respectively. The Fund imposes a 2% redemption fee on the value of shares redeemed less than 60 days after purchase. If your account incurred a redemption fee, your performance will be lower than the performance shown here. For more information, please see the prospectus.

The MSCI Emerging Markets Index (Gross) (the “Index”) is a free float-adjusted market capitalization index, designed to measure equity market performance of emerging markets, consisting of 24 emerging country indices. The Index is gross of withholding taxes, assumes reinvestment of dividends and capital gains, and does not reflect the payment of transaction costs, fees and expenses associated with an investment in the Fund. It is not possible to invest directly in an index. There are special risks in foreign investing (please see Note 5 in the Notes to Financial Statements).

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations, and is not liable whatsoever for any data in this report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

| | | | | | |

| | | Causeway Emerging Markets Fund | | | 5 | |

SCHEDULE OF INVESTMENTS (000)*

September 30, 2018

| | | | | | | | |

| Causeway Emerging Markets Fund | | Number of Shares | | | Value | |

COMMON STOCK | | | | | | | | |

| Brazil — 3.7% | | | | | | |

Banco do Brasil SA1 | | | 4,160,200 | | | $ | 30,275 | |

Cia de Saneamento Basico do Estado de Sao Paulo ADR1 | | | 16 | | | | — | |

JBS SA | | | 9,600,100 | | | | 22,226 | |

Smiles Fidelidade SA | | | 1,166,600 | | | | 13,314 | |

Suzano Papel e Celulose SA | | | 2,753,400 | | | | 32,718 | |

Vale SA, Class B ADR | | | 5,332,739 | | | | 79,138 | |

| | | | | | | | |

| | | | | | | 177,671 | |

| | | | | | | | |

| China — 31.8% | | | | | | |

Agile Group Holdings Ltd. | | | 10,910,000 | | | | 15,460 | |

Alibaba Group Holding Ltd. ADR1 | | | 1,021,371 | | | | 168,281 | |

Anhui Conch Cement Co. Ltd., Class H | | | 10,037,500 | | | | 60,274 | |

Baidu Inc. ADR1 | | | 279,402 | | | | 63,894 | |

Bank of China Ltd., Class H | | | 109,728,000 | | | | 48,482 | |

Beijing Enterprises Holdings Ltd. | | | 3,020,000 | | | | 16,926 | |

China Communications Construction Co. Ltd., Class H | | | 29,082,000 | | | | 29,651 | |

China Construction Bank Corp., Class H | | | 191,004,000 | | | | 166,957 | |

China Everbright International Ltd. | | | 15,032,000 | | | | 12,979 | |

China Lumena New Materials Corp.1,2,3 | | | 10,564,000 | | | | — | |

China Mobile Ltd. | | | 3,964,500 | | | | 38,978 | |

China Mobile Ltd. ADR | | | 574,636 | | | | 28,117 | |

China Petroleum & Chemical Corp., Class H | | | 111,682,000 | | | | 112,213 | |

China Railway Construction Corp. Ltd., Class H | | | 15,326,000 | | | | 20,697 | |

China Railway Group Ltd., Class H | | | 17,644,000 | | | | 17,484 | |

Citic Pacific Ltd. | | | 11,468,000 | | | | 17,080 | |

CNOOC Ltd. | | | 23,768,000 | | | | 47,064 | |

Country Garden Holdings Co. Ltd. | | | 19,730,000 | | | | 24,863 | |

Dongfeng Motor Group Co. Ltd., Class H | | | 13,558,000 | | | | 13,971 | |

Fosun International Ltd. | | | 14,016,000 | | | | 24,697 | |

Geely Automobile Holdings Ltd. | | | 10,189,000 | | | | 20,291 | |

Guangzhou Automobile Group Co. Ltd., Class H | | | 14,155,200 | | | | 15,640 | |

Guangzhou R&F Properties Co. Ltd., Class H | | | 9,257,200 | | | | 16,984 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 6 | | Causeway Emerging Markets Fund | | | | |

SCHEDULE OF INVESTMENTS (000)* (continued)

September 30, 2018

| | | | | | | | |

| Causeway Emerging Markets Fund | | Number of Shares | | | Value | |

| China — (continued) | | | | | | |

Kweichow Moutai Co. Ltd., Class A | | | 193,862 | | | $ | 20,574 | |

KWG Property Holding Ltd. | | | 14,050,000 | | | | 12,857 | |

New Oriental Education & Technology Group ADR1 | | | 405,177 | | | | 29,987 | |

PetroChina Co. Ltd., Class H | | | 15,512,000 | | | | 12,555 | |

Ping An Insurance Group Co. of China Ltd., Class H | | | 9,779,000 | | | | 99,063 | |

Shanghai Pharmaceuticals Holding Co. Ltd., Class H | | | 9,045,900 | | | | 22,613 | |

Shimao Property Holdings Ltd. | | | 8,268,500 | | | | 20,534 | |

Sinopharm Group Co. Ltd., Class H | | | 6,386,400 | | | | 31,245 | |

Tencent Holdings Ltd. | | | 6,214,900 | | | | 253,759 | |

Xinyi Glass Holdings Ltd. | | | 7,036,000 | | | | 8,871 | |

YY Inc. ADR1 | | | 346,738 | | | | 25,978 | |

Zhejiang Expressway Co. Ltd., Class H | | | 13,650,000 | | | | 11,354 | |

| | | | | | | | |

| | | | | | | 1,530,373 | |

| | | | | | | | |

| Czech Republic — 0.3% | | | | | | |

CEZ AS | | | 544,943 | | | | 13,947 | |

| | | | | | | | |

| India — 9.9% | | | | | | |

Adani Ports & Special Economic Zone Ltd. | | | 2,122,857 | | | | 9,635 | |

Biocon Ltd. | | | 2,060,033 | | | | 19,650 | |

Cipla Ltd. | | | 2,276,459 | | | | 20,540 | |

Graphite India Ltd. | | | 639,855 | | | | 7,447 | |

HCL Technologies Ltd. | | | 2,623,472 | | | | 39,370 | |

Hindalco Industries Ltd. | | | 10,651,885 | | | | 33,766 | |

Hindustan Petroleum Corp. Ltd. | | | 4,200,929 | | | | 14,568 | |

Hindustan Unilever Ltd. | | | 1,674,597 | | | | 37,165 | |

ICICI Bank Ltd. ADR | | | 2,810,635 | | | | 23,862 | |

Indiabulls Housing Finance Ltd. | | | 1,763,675 | | | | 20,857 | |

Jubilant Foodworks Ltd. | | | 1,319,088 | | | | 22,390 | |

Larsen & Toubro Ltd. | | | 1,820,314 | | | | 31,965 | |

Mahindra & Mahindra Ltd. | | | 2,042,278 | | | | 24,262 | |

Maruti Suzuki India Ltd. | | | 244,352 | | | | 24,774 | |

Radico Khaitan Ltd. | | | 858,959 | | | | 4,113 | |

Reliance Capital Ltd. | | | 2,464,999 | | | | 9,601 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | Causeway Emerging Markets Fund | | | 7 | |

SCHEDULE OF INVESTMENTS (000)* (continued)

September 30, 2018

| | | | | | | | |

| Causeway Emerging Markets Fund | | Number of Shares | | | Value | |

| India — (continued) | | | | | | |

Reliance Infrastructure Ltd. | | | 1,837,307 | | | $ | 7,615 | |

Rural Electrification Corp. Ltd. | | | 6,126,501 | | | | 8,283 | |

State Bank of India1 | | | 2,679,124 | | | | 9,819 | |

Tata Consultancy Services Ltd. | | | 1,657,712 | | | | 49,939 | |

Titan Co. Ltd. | | | 2,074,767 | | | | 23,066 | |

UPL Ltd. | | | 792,709 | | | | 7,266 | |

Vedanta Ltd. | | | 8,412,668 | | | | 26,968 | |

| | | | | | | | |

| | | | | | | 476,921 | |

| | | | | | | | |

| Indonesia — 0.3% | | | | | | |

Gudang Garam Tbk PT | | | 1,985,500 | | | | 9,864 | |

Indofood Sukses Makmur Tbk PT | | | 16,278,600 | | | | 6,446 | |

| | | | | | | | |

| | | | | | | 16,310 | |

| | | | | | | | |

| Malaysia — 2.5% | | | | | | |

AirAsia Group Bhd | | | 25,057,800 | | | | 19,128 | |

CIMB Group Holdings Bhd | | | 18,856,900 | | | | 27,377 | |

Malayan Banking Bhd | | | 15,181,132 | | | | 35,905 | |

Tenaga Nasional Bhd | | | 10,057,600 | | | | 37,605 | |

| | | | | | | | |

| | | | | | | 120,015 | |

| | | | | | | | |

| Mexico — 2.5% | | | | | | |

Alfa SAB de CV, Class A | | | 17,915,200 | | | | 23,033 | |

Gruma SAB de CV, Class B | | | 1,360,035 | | | | 17,290 | |

Grupo Financiero Banorte SAB de CV, Class O | | | 6,484,400 | | | | 46,909 | |

Grupo Mexico SAB de CV, Class B | | | 4,454,100 | | | | 12,819 | |

Wal-Mart de Mexico SAB de CV | | | 6,395,500 | | | | 19,401 | |

| | | | | | | | |

| | | | | | | 119,452 | |

| | | | | | | | |

| Peru — 0.9% | | | | | | |

Credicorp Ltd. | | | 182,015 | | | | 40,604 | |

| | | | | | | | |

| Poland — 0.7% | | | | | | |

Polski Koncern Naftowy Orlen SA | | | 636,817 | | | | 17,456 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 8 | | Causeway Emerging Markets Fund | | | | |

SCHEDULE OF INVESTMENTS (000)* (continued)

September 30, 2018

| | | | | | | | |

| Causeway Emerging Markets Fund | | Number of Shares | | | Value | |

| Poland — (continued) | | | | | | |

Powszechny Zaklad Ubezpieczen SA | | | 1,569,190 | | | $ | 16,887 | |

| | | | | | | | |

| | | | | | | 34,343 | |

| | | | | | | | |

| Russia — 4.9% | | | | | | |

Gazprom PJSC ADR | | | 11,239,713 | | | | 56,086 | |

Lukoil PJSC ADR | | | 1,183,883 | | | | 90,654 | |

Mobile Telesystems ADR | | | 2,741,792 | | | | 23,387 | |

Sberbank of Russia ADR | | | 5,266,766 | | | | 66,596 | |

| | | | | | | | |

| | | | | | | 236,723 | |

| | | | | | | | |

| Saudi Arabia — 0.4% | | | | | | |

Saudi Kayan Petrochemical Co.1 | | | 4,779,709 | | | | 21,064 | |

| | | | | | | | |

| South Africa — 2.5% | | | | | | |

Absa Group Ltd. | | | 1,434,068 | | | | 15,381 | |

Barloworld Ltd. | | | 1,636,570 | | | | 14,257 | |

Exxaro Resources Ltd. | | | 1,973,830 | | | | 20,291 | |

FirstRand Ltd. | | | 8,063,832 | | | | 38,681 | |

Nedbank Group Ltd. | | | 931,699 | | | | 17,429 | |

Redefine Properties Ltd.4 | | | 18,170,516 | | | | 12,875 | |

| | | | | | | | |

| | | | | | | 118,914 | |

| | | | | | | | |

| South Korea — 15.8% | | | | | | |

Daelim Industrial Co. Ltd. | | | 180,818 | | | | 13,465 | |

Hana Financial Group Inc. | | | 1,195,210 | | | | 47,991 | |

Hanwha Corp. | | | 644,868 | | | | 19,072 | |

Hyundai Marine & Fire Insurance Co. Ltd. | | | 516,988 | | | | 19,543 | |

KB Financial Group Inc. | | | 1,261,328 | | | | 61,432 | |

Kia Motors Corp. | | | 808,425 | | | | 25,572 | |

LG Corp. | | | 461,997 | | | | 30,240 | |

LG Electronics Inc. | | | 352,744 | | | | 22,572 | |

POSCO | | | 131,817 | | | | 34,991 | |

POSCO ADR | | | 209,291 | | | | 13,813 | |

Samsung Electronics Co. Ltd. | | | 5,784,740 | | | | 242,096 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | Causeway Emerging Markets Fund | | | 9 | |

SCHEDULE OF INVESTMENTS (000)* (continued)

September 30, 2018

| | | | | | | | |

| Causeway Emerging Markets Fund | | Number of Shares | | | Value | |

| South Korea — (continued) | | | | | | |

SK Hynix Inc. | | | 1,472,594 | | | $ | 97,424 | |

SK Innovation Co. Ltd. | | | 307,767 | | | | 59,658 | |

SK Telecom Co. Ltd. | | | 174,396 | | | | 44,215 | |

SK Telecom Co. Ltd. ADR | | | 228,156 | | | | 6,361 | |

Woori Bank | | | 1,518,873 | | | | 23,128 | |

| | | | | | | | |

| | | | | | | 761,573 | |

| | | | | | | | |

| Taiwan — 11.2% | | | | | | |

Catcher Technology Co. Ltd. | | | 3,975,000 | | | | 43,697 | |

Compal Electronics Inc. | | | 18,060,316 | | | | 11,202 | |

Compeq Manufacturing Co. Ltd. | | | 10,973,000 | | | | 8,655 | |

FLEXium Interconnect Inc. | | | 2,869,904 | | | | 8,127 | |

Formosa Plastics Corp. | | | 11,516,000 | | | | 44,115 | |

Fubon Financial Holding Co. Ltd. | | | 23,804,000 | | | | 40,375 | |

HON HAI Precision Industry Co. Ltd. | | | 20,154,623 | | | | 52,264 | |

Inventec Corp. | | | 18,875,000 | | | | 16,936 | |

Lite-On Technology Corp. | | | 10,114,202 | | | | 12,709 | |

Pegatron Corp. | | | 12,222,000 | | | | 24,458 | |

Powertech Technology Inc. | | | 7,264,000 | | | | 19,791 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 3,708,000 | | | | 31,642 | |

Taiwan Semiconductor Manufacturing Co. Ltd. ADR | | | 3,554,990 | | | | 156,989 | |

TCI Co. Ltd. | | | 707,998 | | | | 11,382 | |

WPG Holdings Ltd.2 | | | 6,621,240 | | | | 8,837 | |

Yageo Corp. | | | 1,651,000 | | | | 24,792 | |

Yuanta Financial Holding Co. Ltd. | | | 47,867,850 | | | | 25,234 | |

| | | | | | | | |

| | | | | | | 541,205 | |

| | | | | | | | |

| Thailand — 4.1% | | | | | | |

Charoen Pokphand Foods PCL | | | 26,119,600 | | | | 20,394 | |

Kiatnakin Bank PCL | | | 7,560,600 | | | | 17,597 | |

PTT PCL | | | 52,874,100 | | | | 88,764 | |

Sansiri PCL | | | 187,517,266 | | | | 9,633 | |

Thai Oil PCL | | | 8,731,900 | | | | 23,909 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 10 | | Causeway Emerging Markets Fund | | | | |

SCHEDULE OF INVESTMENTS (000)* (continued)

September 30, 2018

| | | | | | | | |

| Causeway Emerging Markets Fund | | Number of Shares | | | Value | |

| Thailand — (continued) | | | | | | |

Thanachart Capital | | | 10,267,000 | | | $ | 17,064 | |

Tisco Financial Group PCL | | | 8,259,100 | | | | 21,394 | |

| | | | | | | | |

| | | | | | | 198,755 | |

| | | | | | | | |

| Turkey — 1.1% | | | | | | |

Tekfen Holding AS | | | 5,936,653 | | | | 21,223 | |

Turkcell Iletisim Hizmetleri AS | | | 8,204,527 | | | | 15,634 | |

Turkiye Garanti Bankasi AS | | | 10,577,979 | | | | 13,486 | |

| | | | | | | | |

| | | | | | | 50,343 | |

| | | | | | | | |

| United Arab Emirates — 0.4% | | | | | | |

DAMAC Properties Dubai Co. PJSC | | | 11,151,560 | | | | 6,195 | |

Dubai Investments PJSC | | | 15,386,350 | | | | 7,921 | |

Dubai Islamic Bank PJSC | | | 3,944,601 | | | | 5,778 | |

| | | | | | | | |

| | | | | | | 19,894 | |

| | | | | | | | |

Total Common Stock | | | | | | | | |

(Cost $4,100,893) — 93.0% | | | | | | | 4,478,107 | |

| | | | | | | | |

PREFERENCE STOCK | | | | | | | | |

| Brazil — 2.0% | | | | | | |

Braskem SA | | | 1,651,087 | | | | 23,827 | |

Itausa — Investimentos Itau SA | | | 28,639,221 | | | | 71,340 | |

| | | | | | | | |

| | | | | | | 95,167 | |

| | | | | | | | |

| South Korea — 0.8% | | | | | | |

Samsung Electronics Co. Ltd. | | | 1,112,544 | | | | 37,946 | |

| | | | | | | | |

Total Preference Stock | | | | | | | | |

(Cost $108,381) — 2.8% | | | | | | | 133,113 | |

| | | | | | | | |

EXCHANGE TRADED FUNDS | | | | | | | | |

iShares MSCI Emerging Markets ETF | | | 11,420 | | | | 490 | |

Vanguard FTSE Emerging Markets ETF | | | 821,666 | | | | 33,688 | |

| | | | | | | | |

Total Exchange Traded Funds | | | | | | | | |

(Cost $34,022) — 0.7% | | | | | | | 34,178 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | Causeway Emerging Markets Fund | | | 11 | |

SCHEDULE OF INVESTMENTS (000)* (continued)

September 30, 2018

| | | | | | | | |

| Causeway Emerging Markets Fund | | Number of Shares | | | Value | |

SHORT-TERM INVESTMENT | | | | | | | | |

Blackrock Liquidity Funds Treasury Trust Fund, Institutional Class, 1.940%** | | | 140,210,650 | | | $ | 140,211 | |

| | | | | | | | |

Total Short-Term Investment | | | | | | | | |

(Cost $140,211) — 2.9% | | | | | | | 140,211 | |

| | | | | | | | |

Total Investments — 99.4% | | | | | | | | |

(Cost $4,383,507) | | | | | | | 4,785,609 | |

| | | | | | | | |

Other Assets in Excess of Liabilities — 0.6% | | | | | | | 28,711 | |

| | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 4,814,320 | |

| | | | | | | | |

A list of the open futures contracts held by the Fund at September 30, 2018 is as follows:

| | | | | | | | | | | | | | | | | | | | |

| Type of Contract | | Number of

Contracts

Long | | | Expiration

Date | | | Notional

Amount

(Thousands) | | | Value

(Thousands) | | | Unrealized

Appreciation

(Thousands) | |

MSCI Emerging Markets | | | 1,790 | | | | Dec-2018 | | | $ | 92,022 | | | $ | 93,948 | | | $ | 1,926 | |

| | | | | | | | | | | | |

| ** | The rate reported is the 7-day effective yield as of September 30, 2018. |

| 1 | Non-income producing security. |

| 2 | Level 3 security in accordance with fair value hierarchy. Security fair valued using methods determined in good faith by the Fair Value Committee designated by the Board of Trustees. The total market value of such securities as of September 30, 2018 was $8,837 and represented 0.2% of net assets. |

| 3 | Securities considered illiquid. The total market value of such securities as of September 30, 2018 was $– and represented 0.0% of net assets. |

| 4 | Real Estate Investment Trust. |

| ADR | American Depositary Receipt |

Amounts designated as “—” are $0 or are rounded to $0.

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 12 | | Causeway Emerging Markets Fund | | | | |

SCHEDULE OF INVESTMENTS (000)* (continued)

September 30, 2018

The following table sets forth information about the levels within the fair value hierarchy at which the Fund’s investments and other financial instruments are measured at September 30, 2018:

| | | | | | | | | | | | | | | | |

| Investments in Securities | | Level 1 | | | Level 2† | | | Level 3†† | | | Total | |

Common Stock | | | | | | | | | | | | | | | | |

Brazil | | $ | 177,671 | | | $ | — | | | $ | — | | | $ | 177,671 | |

China | | | 347,502 | | | | 1,182,871 | | | | — | ^ | | | 1,530,373 | |

Czech Republic | | | — | | | | 13,947 | | | | — | | | | 13,947 | |

India | | | 23,862 | | | | 453,059 | | | | — | | | | 476,921 | |

Indonesia | | | — | | | | 16,310 | | | | — | | | | 16,310 | |

Malaysia | | | — | | | | 120,015 | | | | — | | | | 120,015 | |

Mexico | | | 119,452 | | | | — | | | | — | | | | 119,452 | |

Peru | | | 40,604 | | | | — | | | | — | | | | 40,604 | |

Poland | | | — | | | | 34,343 | | | | — | | | | 34,343 | |

Russia | | | 23,387 | | | | 213,336 | | | | — | | | | 236,723 | |

Saudi Arabia | | | — | | | | 21,064 | | | | — | | | | 21,064 | |

South Africa | | | 12,875 | | | | 106,039 | | | | — | | | | 118,914 | |

South Korea | | | 20,174 | | | | 741,399 | | | | — | | | | 761,573 | |

Taiwan | | | 156,988 | | | | 375,380 | | | | 8,837 | | | | 541,205 | |

Thailand | | | — | | | | 198,755 | | | | — | | | | 198,755 | |

Turkey | | | — | | | | 50,343 | | | | — | | | | 50,343 | |

United Arab Emirates | | | — | | | | 19,894 | | | | — | | | | 19,894 | |

| | | | |

Total Common Stock | | | 922,515 | | | | 3,546,755 | | | | 8,837 | | | | 4,478,107 | |

| | | | |

Preference Stock | | | | | | | | | | | | | | | | |

Brazil | | | 95,167 | | | | — | | | | — | | | | 95,167 | |

South Korea | | | — | | | | 37,946 | | | | — | | | | 37,946 | |

| | | | |

Total Preference Stock | | | 95,167 | | | | 37,946 | | | | — | | | | 133,113 | |

| | | | |

Exchange Traded Funds | | | 34,178 | | | | — | | | | — | | | | 34,178 | |

| | | | |

Short-Term Investment | | | 140,211 | | | | — | | | | — | | | | 140,211 | |

| | | | |

Total Investments in Securities | | $ | 1,192,071 | | | $ | 3,584,701 | | | $ | 8,837 | | | $ | 4,785,609 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | Causeway Emerging Markets Fund | | | 13 | |

SCHEDULE OF INVESTMENTS (000)* (concluded)

September 30, 2018

| | | | | | | | | | | | | | | | |

| Other Financial Instruments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Futures Contracts* | | | | | | | | | | | | | | | | |

Unrealized Appreciation** | | $ | 1,926 | | | $ | — | | | $ | — | | | $ | 1,926 | |

| | | | |

Total Other Financial Instruments | | $ | 1,926 | | | $ | — | | | $ | — | | | $ | 1,926 | |

| | | | |

| * | Futures contracts are valued at the unrealized appreciation on the instruments. |

| ** | Only variation margin of the future contracts is reported within the Statement of Assets and Liabilities. |

| † | Holdings represent securities trading outside the United States, the values of which were adjusted as a result of significant market movements following the close of local trading and/or due to “foreign line” securities using “local line” prices. Securities with a value of $31,245, which represented 0.6% of the net assets of the Fund, transferred from Level 2 to Level 1 at the fiscal year end since the prior fiscal year end, primarily due to market movements following the close of local trading that triggered the fair valuation of certain securities at the prior fiscal year end, but did not trigger fair valuation at the at the end of the current fiscal year. |

| †† | A reconciliation of Level 3 investments and disclosures of significant unobservable inputs are presented when the Fund has a significant amount of Level 3 investments at the beginning and/or end of the period in relation to net assets. Management has concluded that Level 3 investments are not material in relation to net assets. Securities with a value of $8,837, which represented 0.18% of the net assets of the Fund, transferred from Level 2 to Level 3 at the fiscal year end since the prior fiscal year end, due to such securities being fair valued at fiscal year end. |

| ^ | Security is fair valued at zero due to company’s insolvency. Level 3 security in accordance with fair value hierarchy. |

For more information on valuation inputs, see Note 2 in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 14 | | Causeway Emerging Markets Fund | | | | |

SECTOR DIVERSIFICATION

As of September 30, 2018, the sector diversification was as follows (Unaudited):

| | | | | | | | | | | | |

| Causeway Emerging Markets Fund | | Common

Stock | | | Preference

Stock | | | % of

Net Assets | |

| | | |

Financials | | | 20.8 | % | | | 1.5 | % | | | 22.3 | % |

| | | |

Information Technology | | | 17.6 | | | | 0.8 | | | | 18.4 | |

| | | |

Energy | | | 11.3 | | | | 0.0 | | | | 11.3 | |

| | | |

Communication Services | | | 10.7 | | | | 0.0 | | | | 10.7 | |

| | | |

Consumer Discretionary | | | 8.6 | | | | 0.0 | | | | 8.6 | |

| | | |

Materials | | | 7.6 | | | | 0.5 | | | | 8.1 | |

| | | |

Industrials | | | 6.9 | | | | 0.0 | | | | 6.9 | |

| | | |

Consumer Staples | | | 3.5 | | | | 0.0 | | | | 3.5 | |

| | | |

Real Estate | | | 2.5 | | | | 0.0 | | | | 2.5 | |

| | | |

Health Care | | | 1.9 | | | | 0.0 | | | | 1.9 | |

| | | |

Utilities | | | 1.6 | | | | 0.0 | | | | 1.6 | |

| | | | | | | | | | | | |

| Total | | | 93.0 | | | | 2.8 | | | | 95.8 | |

| | | |

| Exchange Traded Funds | | | | | | | | | | | 0.7 | |

| | | | | | | | | | | | |

| Short-Term Investment | | | | | | | | | | | 2.9 | |

| | | | | | | | | | | | |

| Other Assets in Excess of Liabilities | | | | | | | | | | | 0.6 | |

| | | | | | | | | | | | |

| Net Assets | | | | | | | | | | | 100.0 | % |

| | | | | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | Causeway Emerging Markets Fund | | | 15 | |

STATEMENT OF ASSETS AND LIABILITIES (000)*

| | | | |

| | | CAUSEWAY EMERGING

MARKETS FUND | |

| |

| | | 9/30/18 | |

ASSETS: | | | | |

Investments at Value (Cost $4,383,507) | | $ | 4,785,609 | |

Cash pledged as collateral for futures contracts | | | 9,308 | |

Foreign Currency (Cost $410) | | | 409 | |

Receivable for Fund Shares Sold | | | 20,097 | |

Due from Broker | | | 9,618 | |

Receivable for Dividends | | | 11,731 | |

Receivable for Investment Securities Sold | | | 4,236 | |

Receivable for Tax Reclaims | | | 610 | |

Unrealized Appreciation on Spot Foreign Currency Contracts | | | 7 | |

Prepaid Expenses | | | 46 | |

| | | | |

Total Assets | | | 4,841,671 | |

| | | | |

LIABILITIES: | | | | |

Payable for Investment Securities Purchased | | | 15,204 | |

Payable for Fund Shares Redeemed | | | 4,764 | |

Payable Due to Adviser | | | 3,885 | |

Payable for Custody Fees | | | 1,969 | |

Payable for Variation Margin | | | 618 | |

Accrued Foreign Capital Gains Tax on Appreciated Securities | | | 340 | |

Payable for Shareholder Service Fees — Investor Class | | | 170 | |

Payable Due to Administrator | | | 106 | |

Payable for Trustees’ Fees | | | 54 | |

Unrealized Depreciation on Spot Foreign Currency Contracts | | | 4 | |

Other Accrued Expenses | | | 237 | |

| | | | |

Total Liabilities | | | 27,351 | |

| | | | |

Net Assets | | $ | 4,814,320 | |

| | | | |

NET ASSETS: | | | | |

Paid-in Capital (unlimited authorization — no par value) | | $ | 4,415,927 | |

Undistributed Net Investment Income | | | 70,682 | |

Accumulated Net Realized Loss on Investments, Futures Contracts, and Foreign Currency Transactions | | | (75,936 | ) |

Net Unrealized Appreciation on Investments | | | 402,102 | |

Accumulated Foreign Capital Gains Tax on Appreciated Securities | | | (340 | ) |

Net Unrealized Depreciation on Foreign Currencies and Translation of Other Assets and Liabilities Denominated in Foreign Currencies | | | (41 | ) |

Net Unrealized Appreciation on Futures Contracts | | | 1,926 | |

| | | | |

Net Assets | | $ | 4,814,320 | |

| | | | |

Net Asset Value Per Share (based on net assets of

$4,239,059,440 ÷ 332,079,976 shares) — Institutional Class | | | $12.77 | |

| | | | |

Net Asset Value Per Share (based on net assets of

$575,260,355 ÷ 44,791,834 shares) — Investor Class | | | $12.84 | |

| | | | |

| * | Except for Net Asset Value Per Share data. |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 16 | | Causeway Emerging Markets Fund | | | | |

STATEMENT OF OPERATIONS (000)

| | | | |

| | | CAUSEWAY EMERGING

MARKETS FUND | |

| |

| | | 10/01/17 to

9/30/18 | |

INVESTMENT INCOME: | | | | |

Dividend Income (net of foreign taxes withheld of $17,650) | | $ | 147,185 | |

Interest Income | | | 710 | |

| | | | |

Total Investment Income | | | 147,895 | |

| | | | |

EXPENSES: | | | | |

Investment Advisory Fees | | | 49,292 | |

Custodian Fees | | | 4,686 | |

Shareholder Service Fees — Investor Class | | | 1,937 | (1) |

Administration Fees | | | 1,342 | |

Transfer Agent Fees | | | 350 | |

Professional Fees | | | 318 | |

Printing Fees | | | 194 | |

Registration Fees | | | 194 | |

Trustees’ Fees | | | 172 | |

Pricing Fees | | | 27 | |

Line of Credit | | | 10 | |

Other Fees | | | 184 | |

| | | | |

Total Expenses | | | 58,706 | |

| | | | |

Net Expenses | | | 58,706 | |

| | | | |

Net Investment Income | | | 89,189 | |

| | | | |

Net Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions: | | | | |

Net Realized Gain on Investments(2) | | | 167,419 | |

Net Realized Loss on Futures Contracts | | | (5,478 | ) |

Net Realized Loss from Foreign Currency Transactions | | | (3,347 | ) |

Net Change in Unrealized Depreciation on Investments | | | (458,603 | ) |

Net Change in Unrealized Appreciation on Futures Contracts | | | 3,278 | |

Net Change in Accrued Foreign Capital Gains Tax on Appreciated Securities | | | 4,440 | |

Net Change in Unrealized Depreciation on Foreign Currency and Translation of Other Assets and Liabilities Denominated in Foreign Currency | | | (5 | ) |

| | | | |

Net Realized and Unrealized Loss on Investments and Foreign Currency Transactions | | | (292,296 | ) |

| | | | |

| Net Decrease in Net Assets Resulting from Operations | | $ | (203,107 | ) |

| | | | |

| (1) | Fees have been reduced by a one-time adjustment as a result of a management change in accrual estimate in the amount of $56. Excluding the adjustment, shareholder service fees would have been $1,993. |

| (2) | Includes realized gains as a result of an in-kind redemption (see Note 10 in the Notes to Financial Statements). |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | Causeway Emerging Markets Fund | | | 17 | |

STATEMENTS OF CHANGES IN NET ASSETS (000)

| | | | | | | | |

| | | CAUSEWAY EMERGING

MARKETS FUND | |

| | |

| | | 10/01/17 to

9/30/18 | | | 10/01/16 to

9/30/17 | |

OPERATIONS: | | | | | | | | |

Net Investment Income | | $ | 89,189 | | | $ | 62,353 | |

Net Realized Gain on Investments | | | 167,419 | (1) | | | 69,127 | |

Net Realized Gain/(Loss) on Futures Contracts | | | (5,478 | ) | | | 13,916 | |

Net Realized Loss from Foreign Currency Transactions | | | (3,347 | ) | | | (1,338 | ) |

Net Change in Unrealized Appreciation (Depreciation) on Investments | | | (458,603 | ) | | | 666,740 | |

Net Change in Unrealized Appreciation (Depreciation) on Futures Contracts | | | 3,278 | | | | (1,352 | ) |

Net Change in Accrued Foreign Capital Gains Tax on Appreciated Securities | | | 4,440 | | | | (2,095 | ) |

Net Change in Unrealized Depreciation on Foreign Currency and Translation of Other Assets and Liabilities Denominated in Foreign Currency | | | (5 | ) | | | (25 | ) |

| | | | | | | | |

Net Increase (Decrease) in Net Assets Resulting From Operations | | | (203,107 | ) | | | 807,326 | |

| | | | | | | | |

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Dividends from Net Investment Income: | | | | | | | | |

Institutional Class | | | (61,887 | ) | | | (36,520 | ) |

Investor Class | | | (11,833 | ) | | | (7,296 | ) |

| | | | | | | | |

Total Dividends from Net Investment Income | | | (73,720 | ) | | | (43,816 | ) |

| | | | | | | | |

Net Increase in Net Assets Derived from Capital Share Transactions(2) | | | 713,969 | | | | 560,606 | |

Redemption Fees(3) | | | 149 | | | | 124 | |

| | | | | | | | |

Total Increase in Net Assets | | | 437,291 | | | | 1,324,240 | |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of Year | | | 4,377,029 | | | | 3,052,789 | |

| | | | | | | | |

End of Year | | $ | 4,814,320 | | | $ | 4,377,029 | |

| | | | | | | | |

Undistributed Net Investment Income | | $ | 70,682 | | | $ | 56,787 | |

| | | | | | | | |

| (1) | Includes realized gains as a result of an in-kind redemption (see Note 10 in the Notes to Financial Statements). |

| (2) | See Note 7 in Notes to Financial Statements. |

| (3) | See Note 2 in Notes to Financial Statements. |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 18 | | Causeway Emerging Markets Fund | | | | |

This page intentionally left blank.

FINANCIAL HIGHLIGHTS

For the fiscal years ended September 30,

For a Share Outstanding Throughout the Fiscal Years

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Asset

Value,

Beginning

of Year ($) | | | Net

Investment

Income ($)† | | |

Net Realized

and

Unrealized

Gain

(Loss) on

Investments ($) | | | Total

from

Operations ($) | | | Dividends

from Net

Investment

Income ($) | | | Distributions

from

Capital

Gains ($) | | | Total

Dividends

and

Distributions ($) | | | Redemption

Fees ($) | |

CAUSEWAY EMERGING MARKETS FUND | |

Institutional | |

2018 | | | 13.41 | | | | 0.26 | | | | (0.68 | ) | | | (0.42 | ) | | | (0.22 | ) | | | — | | | | (0.22 | ) | | | — | (1) |

2017 | | | 10.89 | | | | 0.22 | | | | 2.46 | | | | 2.68 | | | | (0.16 | ) | | | — | | | | (0.16 | ) | | | — | (1) |

2016 | | | 10.00 | | | | 0.19 | | | | 0.86 | | | | 1.05 | | | | (0.16 | ) | | | — | | | | (0.16 | ) | | | — | (1) |

2015 | | | 12.33 | | | | 0.24 | | | | (2.29 | ) | | | (2.05 | ) | | | (0.28 | ) | | | — | | | | (0.28 | ) | | | — | (1) |

2014 | | | 11.65 | | | | 0.28 | | | | 0.51 | | | | 0.79 | | | | (0.11 | ) | | | — | | | | (0.11 | ) | | | — | |

Investor | |

2018 | | | 13.49 | | | | 0.20 | | | | (0.66 | ) | | | (0.46 | ) | | | (0.19 | ) | | | — | | | | (0.19 | ) | | | — | (1) |

2017 | | | 10.96 | | | | 0.19 | | | | 2.48 | | | | 2.67 | | | | (0.14 | ) | | | — | | | | (0.14 | ) | | | — | (1) |

2016 | | | 10.06 | | | | 0.14 | | | | 0.90 | | | | 1.04 | | | | (0.14 | ) | | | — | | | | (0.14 | ) | | | — | (1) |

2015 | | | 12.40 | | | | 0.29 | | | | (2.39 | ) | | | (2.10 | ) | | | (0.24 | ) | | | — | | | | (0.24 | ) | | | — | (1) |

2014 | | | 11.72 | | | | 0.23 | | | | 0.53 | | | | 0.76 | | | | (0.08 | ) | | | — | | | | (0.08 | ) | | | — | |

| † | Per share amounts calculated using average shares method. |

| (1) | Amount represents less than $0.01 per share (See Note 2 in the Notes to Financial Statements). |

| (2) | The expense ratio includes a one-time adjustment as a result of a management change in accrual estimate relating to shareholder service fees. Had this adjustment been excluded, the ratios would have been 1.40%, 1.40% and 1.39%, respectively. |

Amounts designated as “—” are $0 or round to $0.

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| 20 | | Causeway Emerging Markets Fund | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset

Value, End

of Year ($) | | | Total

Return (%) | | | Net Assets,

End of

Year

($000) | | | Ratio of

Expenses to

Average Net

Assets (%) | | | Ratio of

Expenses

to Average

Net Assets

(Excluding

Reimburse-

ments) (%) | | | Ratio

of Net

Investment

Income

to Average

Net Assets (%) | | | Portfolio

Turnover

Rate (%) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 12.77 | | | | (3.25 | ) | | | 4,239,060 | | | | 1.15 | | | | 1.15 | | | | 1.89 | | | | 49 | |

| | 13.41 | | | | 25.08 | | | | 3,565,886 | | | | 1.15 | | | | 1.15 | | | | 1.82 | | | | 50 | |

| | 10.89 | | | | 10.70 | | | | 2,469,222 | | | | 1.18 | | | | 1.18 | | | | 1.89 | | | | 73 | |

| | 10.00 | | | | (16.94 | ) | | | 1,348,773 | | | | 1.19 | | | | 1.19 | | | | 2.06 | | | | 100 | |

| | 12.33 | | | | 6.84 | | | | 852,202 | | | | 1.20 | | | | 1.20 | | | | 2.31 | | | | 112 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 12.84 | | | | (3.50 | ) | | | 575,260 | | | | 1.39 | (2) | | | 1.39 | (2) | | | 1.40 | (2) | | | 49 | |

| | 13.49 | | | | 24.71 | | | | 811,143 | | | | 1.40 | | | | 1.40 | | | | 1.56 | | | | 50 | |

| | 10.96 | | | | 10.23 | | | | 583,567 | | | | 1.43 | | | | 1.43 | | | | 1.43 | | | | 73 | |

| | 10.06 | | | | (17.17 | ) | | | 614,307 | | | | 1.46 | | | | 1.46 | | | | 2.55 | | | | 100 | |

| | 12.40 | | | | 6.55 | | | | 68,113 | | | | 1.45 | | | | 1.45 | | | | 1.89 | | | | 112 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | Causeway Emerging Markets Fund | | | 21 | |

NOTES TO FINANCIAL STATEMENTS

Causeway Emerging Markets Fund (the “Fund”) is a series of Causeway Capital Management Trust (the “Trust”). The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”) and is a Delaware statutory trust that was established on August 10, 2001. The Fund began operations on March 30, 2007. The Fund is authorized to offer two classes of shares, the Institutional Class and the Investor Class. The Declaration of Trust authorizes the issuance of an unlimited number of shares of beneficial interest of the Fund. The Fund is diversified. The Fund’s prospectus provides a description of the Fund’s investment objectives, policies and strategies. The Trust has five additional series, the financial statements of which are presented separately.

| 2. | | Significant Accounting Policies |

The following is a summary of the significant accounting policies consistently followed by the Fund.

Use of Estimates in the Preparation of Financial Statements – The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The Fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of net assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Security Valuation – Except as described below, securities listed on a securities exchange (except the NASDAQ Stock Market (“NASDAQ”)) or Over-the-Counter (“OTC”) for which market quotations are available) are valued at the last reported sale price as of the close of trading on each business day, or, if there is no such reported sale, at the last reported bid price for long positions. For securities traded on NASDAQ, the NASDAQ Official Closing Price is used. Securities listed on multiple exchanges or OTC markets are valued on the exchange or OTC market considered by the Fund to be the primary market. The prices for foreign securities are reported in local currency and converted to U.S. dollars using currency exchange rates. Prices for most securities held in the Fund are provided daily by recognized independent pricing agents. If a security price cannot be obtained from an independent pricing agent, the Fund seeks to obtain a bid price from at least one independent broker. Investments in money market funds are valued daily at the net asset value per share. Futures contracts are valued at the settlement price established each day by the board of exchange on which they are traded, and such settlement prices are provided by an independent source. On days when there is excessive volume or market volatility or when a futures contract does not end trading by the time the Fund calculates its net asset value, the settlement price may not be available at the time the Fund calculates its net asset value. On such days, the best available price (which is typically the last sale price) may be used to value the Fund’s futures contracts.

Securities for which market prices are not “readily available” are valued in accordance with fair value pricing procedures approved by the Fund’s Board of Trustees (the “Board”). The Fund’s fair value pricing procedures are implemented through a Fair Value Committee (the “Committee”) designated by the Board. Some of the

| | | | | | |

| 22 | | Causeway Emerging Markets Fund | | | | |

NOTES TO FINANCIAL STATEMENTS

(continued)

more common reasons that may necessitate that a security be valued using fair value pricing procedures include: the security’s trading has been halted or suspended; the security has been delisted from a national exchange; the security’s primary trading market is temporarily closed at a time when under normal conditions it would be open; or the security’s primary pricing source is not able or willing to provide a price. When the Committee values a security in accordance with the fair value pricing procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee.

The Fund uses a third party vendor to fair value certain non-U.S. securities if there is a movement in the U.S. market or a designated exchange-traded fund that trades in the U.S. that exceeds thresholds established by the Committee. The vendor provides fair values for foreign securities based on factors and methodologies involving, generally, tracking valuation correlations between the U.S. market and each non-U.S. security and such fair values are applied by the administrator if a pre-determined confidence level is reached for the security.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest

priority to unobservable inputs (Level 3).The guidance establishes three levels of fair value hierarchy as follows:

| | • | | Level 1 — Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | • | | Level 2 — Quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets which are not active, or prices based on inputs that are observable (either directly or indirectly); and |

| | • | | Level 3 — Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 which fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the reporting period. Changes in the classification between Levels 1 and 2 occur primarily when foreign equity securities are fair valued by the Fund’s third party vendor using other observable market–based inputs in place of closing exchange prices due to events occurring after foreign market closures and/or due to adjustments to security values for “foreign line” securities using “local line” prices. Due to currency and ownership restrictions on foreign persons in certain countries, including without limitation Russia and Thailand, securities sometimes trade in a “foreign line” (designated for foreign ownership) or via a “local line”

| | | | | | |

| | | Causeway Emerging Markets Fund | | | 23 | |

NOTES TO FINANCIAL STATEMENTS

(continued)

(shares traded locally and held by residents). Liquidity of shares held in the foreign line is often more limited than those held in the local line. As the last traded price of a foreign line may not represent fair value, if the securities can readily be traded through a broker to access the local line, the securities may be priced using the last traded local line price.

For the fiscal year ended September 30, 2018, there were no changes to the Fund’s fair value methodologies.

Federal Income Taxes – The Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and to distribute substantially all of its taxable income. Accordingly, no provision for Federal income taxes has been made in the financial statements.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is “more-likely-than not” (i.e., greater than 50-percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more likely-than-not threshold are recorded as tax benefits or expenses in the current year. The Fund did not record any tax provision in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (during the last 3 tax years, as applicable), and on-going analysis of and changes to tax laws, regulations and interpretations thereof.

As of and during the fiscal year ended September 30, 2018, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax

benefits as income tax expense in the Statement of Operations. During the fiscal year, the Fund did not incur any significant interest or penalties.

Security Transactions and Related Income – Security transactions are accounted for on the date the security is purchased or sold (trade date). Dividend income is recognized on the ex-dividend date, and interest income is recognized using the accrual basis of accounting. Costs used in determining realized gains and losses on the sales of investment securities are those of the specific securities sold.

Foreign Currency Translation – The books and records of the Fund are maintained in U.S. dollars on the following basis:

(1) the market value or fair value of investment securities, assets and liabilities is converted at the current rate of exchange; and

(2) purchases and sales of investment securities, income and expenses are converted at the relevant rates of exchange prevailing on the respective dates of such transactions.

The Fund does not isolate that portion of gains and losses on investments in equity securities that is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities.

Foreign Currency Exchange Contracts – When the Fund purchases or sells foreign securities, it enters into corresponding foreign currency exchange contracts to settle the securities transactions. Losses from these foreign exchange transactions may arise from changes in the value of the foreign currency between trade date and settlement date or if the counterparties do not perform under the contract’s terms.

Expense/Classes – Expenses that are directly related to one Fund of the Trust are charged directly to that Fund.

| | | | | | |

| 24 | | Causeway Emerging Markets Fund | | | | |

NOTES TO FINANCIAL STATEMENTS

(continued)

Other operating expenses of the Trust are prorated to the Fund and the other series of the Trust on the basis of relative daily net assets. Class specific expenses are borne by that class of shares. Income, realized and unrealized gains/losses and non-class specific expenses are allocated to the respective classes on the basis of relative daily net assets.

Dividends and Distributions – Dividends from net investment income, if any, are declared and paid on an annual basis. Any net realized capital gains on sales of securities are distributed to shareholders at least annually.

Redemption Fee – The Fund imposes a redemption fee of 2% on the value of shares redeemed less than 60 days after purchase. The redemption fee also applies to exchanges from the Fund. The redemption fee is paid to the Fund. The redemption fee does not apply to shares purchased through reinvested distributions or shares redeemed through designated systematic withdrawal plans. The redemption fee does not normally apply to accounts designated as omnibus accounts with the transfer agent. These are arrangements through financial intermediaries where the purchase and sale orders of a number of persons are aggregated before being communicated to the Fund. However, the Fund may seek agreements with these intermediaries to impose the Fund’s redemption fee or a different redemption fee on their customers if feasible, or to impose other appropriate restrictions on excessive short-term trading. The officers of the Fund may waive the redemption fee for shareholders in asset allocation and similar investment programs believed not to be engaged in short-term market timing, including for holders of shares purchased by Causeway Capital Management LLC (the “Adviser”) for its clients to rebalance their portfolios. For the fiscal year ended September 30, 2018, the

Institutional Class and Investor Class retained $125,906 and $22,959 in redemption fees, respectively.

| 3. | | Investment Advisory, Administration, Shareholder Service and Distribution Agreements |

The Trust, on behalf of the Fund, has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Under the Advisory Agreement, the Adviser is entitled to a monthly fee equal to an annual rate of 1.00% of the Fund’s average daily net assets. The Adviser has contractually agreed through September 30, 2019 to waive its fee and, to the extent necessary, reimburse the Fund to keep total annual fund operating expenses (excluding brokerage fees and commissions, interest, taxes, shareholder service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) from exceeding 1.35% of Institutional Class and Investor Class average daily net assets. No waivers or reimbursements were required for the fiscal year ended September 30, 2018.

The Trust and SEI Investments Global Funds Services (the “Administrator”) have entered into an Administration Agreement. Under the terms of the Administration Agreement, the Administrator is entitled to an annual fee which is calculated daily and paid monthly based on the aggregate average daily net assets of the Trust subject to a minimum annual fee.

The Trust has adopted a Shareholder Service Plan and Agreement for Investor Class shares that allows the Trust to pay broker-dealers and other financial intermediaries a fee of up to 0.25% per annum of average daily net assets for services provided to Investor Class shareholders. For the year ended September 30, 2018, the Investor Class paid 0.24% of average daily net assets under this plan.

| | | | | | |

| | | Causeway Emerging Markets Fund | | | 25 | |

NOTES TO FINANCIAL STATEMENTS

(continued)

The Trust and SEI Investments Distribution Co. (the “Distributor”) have entered into a Distribution Agreement. The Distributor receives no fees from the Fund for its distribution services under this agreement.

The officers of the Trust are also officers or employees of the Administrator or Adviser. They receive no fees for serving as officers of the Trust.

As of September 30, 2018, approximately $367 thousand of the Fund’s shares were held by investors affiliated with the Adviser.

| 4. | | Investment Transactions |

The cost of security purchases and the proceeds from the sale of securities, other than short-term investments, during the fiscal year ended September 30, 2018, for the Fund were as follows (000):

| | | | | | |

| Purchases | | | Sales | |

| $ | 3,019,160 | | | $ | 2,317,220 | |

| 5. | | Risks of Foreign Investing |

Because the Fund invests most of its assets in foreign securities, the Fund is subject to additional risks. For example, the value of the Fund’s securities may be affected by social, political and economic developments and U.S. and foreign laws relating to foreign investments. Further, because the Fund invests in securities denominated in foreign currencies, the Fund’s securities may go down in value depending on foreign exchange rates. Other risks include trading, settlement, custodial, and other operational risks; withholding or other taxes; and the less stringent investor protection and disclosure standards of some foreign markets. All of these factors can make foreign securities less liquid, more volatile and harder to value than U.S. securities. These risks are higher for emerging markets investments.

The Fund may use futures contracts, including futures contracts based on emerging markets indices, to obtain exposures to emerging markets for cash management or other reasons.

| 6. | | Federal Tax Information |

The Fund is classified as a separate taxable entity for Federal income tax purposes. The Fund intends to continue to qualify as a separate “regulated investment company” under Subchapter M of the Internal Revenue Code and make the requisite distributions to shareholders that will be sufficient to relieve it from Federal income tax and Federal excise tax. Therefore, no Federal tax provision is required. To the extent that dividends from net investment income and distributions from net realized capital gains exceed amounts reported in the financial statements, such amounts are reported separately.

The Fund may be subject to taxes imposed by countries in which it invests in issuers existing or operating in such countries. Such taxes are generally based on income earned. The Fund accrues such taxes when the related income is earned. Dividend and interest income is recorded net of non-U.S. taxes paid. Gains realized by the Fund on the sale of securities in certain countries are subject to non-U.S. taxes. The Fund records a liability based on unrealized gains to provide for potential non-U.S. taxes payable upon the sale of these securities. For the fiscal year ended September 30, 2018, non-U.S. taxes paid on realized gains were $0 and non-U.S. taxes accrued on unrealized gains were $340,085.

The amounts of distributions from net investment income and net realized capital gains are determined in accordance with Federal income tax regulations, which may differ from those amounts determined under U.S. GAAP. These book/tax differences are either temporary

| | | | | | |

| 26 | | Causeway Emerging Markets Fund | | | | |

NOTES TO FINANCIAL STATEMENTS

(continued)

or permanent in nature. The character of distributions made during the year from net investment income or net realized gains, and the timing of distributions made during the year may differ from those during the year that the income or realized gains (losses) were recorded by the Fund. To the extent these differences are permanent, adjustments are made to the appropriate equity accounts in the period that the differences arise.

Accordingly, the following permanent differences, which are primarily due to realized losses on foreign currency transactions, excise taxes and gains on passive foreign investment companies, were reclassified to/(from) the following accounts as of September 30, 2018 (000):

| | | | | | | | | | |

Paid in

Capital | | | Undistributed

Net

Investment

Income | | | Accumulated

Net Realized

Gain | |

| $ | 67,429 | | | $ | (1,574 | ) | | $ | (65,855 | ) |

The reclassifications had no impact on net assets or net asset value per share.

The tax character of dividends and distributions declared during the fiscal years ended September 30, 2018 and September 30, 2017 were as follows (000):

| | | | | | | | |

| | | Ordinary

Income | | | Total | |

| 2018 | | $ | 73,720 | | | $ | 73,720 | |

| 2017 | | | 43,816 | | | | 43,816 | |

As of September 30, 2018, the components of distributable earnings on a tax basis were as follows (000):

| | | | |

Undistributed Ordinary Income | | $ | 70,685 | |

Capital Loss Carryforwards | | | (60,568 | ) |

Unrealized Appreciation | | | 388,281 | |

Other Temporary Differences | | | (5 | ) |

| | | | |

Total Distributable Earnings | | $ | 398,393 | |

| | | | |

The Fund is permitted to carry forward capital losses for an unlimited period. Capital losses that are carried forward will retain their character as either short-term or long-term capital losses. Losses carried forward are as follows:

| | | | | | | | |

Short-Term Loss | | Long-Term Loss | | | Total | |

| $60,568 | | $ | — | | | $ | 60,568 | |

At September 30, 2018, the total cost of investments for Federal income tax purposes and the aggregate gross unrealized appreciation and depreciation on investments for the Fund were as follows (000):

| | | | | | | | | | | | | | |

Federal

Tax Cost | | | Appreciated

Securities | | | Depreciated

Securities | | | Net

Unrealized

Appreciation | |

| $ | 4,490,899 | | | $ | 710,143 | | | $ | (321,522 | ) | | $ | 388,621 | |

| | | | | | |

| | | Causeway Emerging Markets Fund | | | 27 | |

NOTES TO FINANCIAL STATEMENTS

(continued)

| 7. | | Capital Shares Issued and Redeemed (000) |

| | | | | | | | | | | | | | | | |

| | | Fiscal Year Ended

September 30, 2018 | | | Fiscal Year Ended

September 30, 2017 | |

| | | Shares | | | Value | | | Shares | | | Value | |

Institutional Class | | | | | | | | | | | | | | | | |

Shares Sold | | | 123,003 | | | $ | 1,701,575 | | | | 91,853 | | | $ | 1,094,101 | |

Shares Issued in Reinvestment of Dividends and Distributions | | | 3,729 | | | | 51,903 | | | | 2,940 | | | | 29,814 | |

Shares Redeemed | | | (60,540 | ) | | | (837,985 | ) | | | (55,550 | ) | | | (645,731 | ) |

| | | | | | | | | | | | | | | | |

Increase in Shares Outstanding Derived from Institutional Class Transactions | | | 66,192 | | | | 915,493 | | | | 39,243 | | | | 478,184 | |

| | | | | | | | | | | | | | | | |

Investor Class | | | | | | | | | | | | | | | | |

Shares Sold | | | 34,580 | | | | 465,556 | | | | 14,147 | | | | 169,231 | |

Shares Issued in Reinvestment of Dividends and Distributions | | | 840 | | | | 11,782 | | | | 712 | | | | 7,272 | |

Shares Redeemed | | | (50,740 | ) | | | (678,862 | ) | | | (7,981 | ) | | | (94,082 | ) |

| | | | | | | | | | | | | | | | |

Increase (Decrease) in Shares Outstanding Derived from Investor Class Transactions | | | (15,320 | ) | | | (201,524 | ) | | | 6,878 | | | | 82,421 | |

| | | | | | | | | | | | | | | | |

Net Increase in Shares Outstanding from Capital Share Transactions | | | 50,872 | | | $ | 713,969 | | | | 46,121 | | | $ | 560,605 | |

| | | | | | | | | | | | | | | | |

| 8. | | Significant Shareholder Concentration |

As of September 30, 2018, three of the Fund’s shareholders of record owned 58% of Institutional Class shares. The Fund may be adversely affected when a shareholder purchases or redeems large amounts of shares, which may impact the Fund in the same manner as a high volume of redemption requests. Such large shareholders may include, but are not limited to, other funds, institutional investors, and asset allocators who make investment decisions on behalf of underlying clients. Significant shareholder purchases and redemptions may adversely impact the Fund’s portfolio management and may cause the Fund to make investment decisions at inopportune times or prices or miss attractive investment opportunities. Such transactions may also increase the Fund’s transaction costs, accelerate the realization of taxable income if sales of

securities result in gains, or otherwise cause the Fund to perform differently than intended.

Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is indemnified against certain liabilities that may arise out of the performance of his or her duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote.

| | | | | | |

| 28 | | Causeway Emerging Markets Fund | | | | |

NOTES TO FINANCIAL STATEMENTS

(concluded)

| 10. | | In-Kind Transfers of Securities |

During the fiscal year ended September 30, 2018, an investor redeemed shares of beneficial interest from the Fund in exchange for securities. These securities were transferred at their fair value on the date of such transactions.

| | | | | | | | | | | | |

| | | Shares

Redeemed

(000) | | | Value

($000) | | | Gain

($000) | |

6/15/18 | | | (53,944 | ) | | | 119,582 | | | | 31,487 | |

6/29/18 | | | (52,582 | ) | | | 111,095 | | | | 35,943 | |

The Fund, along with certain other series of the Trust, entered into an agreement on February 24, 2015, as amended by Amendment No. 1, dated as of February 24, 2016, Amendment No. 2, dated as of February 22, 2017, and Amendment No. 3, dated as of February 21, 2018, which enables it to participate in a $10 million secured committed revolving line of credit with The Bank of New York Mellon which expires February 21, 2019. The proceeds from the borrowings, if any, must be used to finance the Fund’s short-term general working capital requirements, including the funding of shareholder redemptions. Interest, if any, is charged to the Fund

based on its borrowings during the period at the applicable rate plus 1.5%. The Fund is also charged a portion of a commitment fee of 0.175% per annum. Throughout and for the fiscal year ended September 30, 2018, there were no borrowings outstanding under the line of credit.

| 12. | | New Accounting Pronouncements |

In August 2018, The FASB issued Accounting Standards Update 2018-13, Fair Value Measurement (Topic 820). The new guidance includes additions and modifications to disclosures requirements for fair value measurements. For public entities, the amendments are effective for financial statements issued for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years. At this time, management is currently evaluating the impact of this new guidance on the financial statements and disclosures.

The Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the financial statements were available to be issued. Based on this evaluation, no adjustments were required to the financial statements.

| | | | | | |

| | | Causeway Emerging Markets Fund | | | 29 | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Causeway Capital Management Trust and Shareholders of the

Causeway Emerging Markets Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Causeway Emerging Markets Fund (one of the funds constituting Causeway Capital Management Trust, referred to hereafter as the “Fund”) as of September 30, 2018, the related statement of operations for the year ended September 30, 2018, the statement of changes in net assets for each of the two years in the period ended September 30, 2018, including the related notes, and the financial highlights for each of the five years in the period ended September 30, 2018 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended September 30, 2018 and the financial highlights for each of the five years in the period ended September 30, 2018 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of September 30, 2018 by correspondence with the custodian, transfer agent and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Los Angeles, California

November 27, 2018

We have served as the auditor of one or more investment companies in Causeway Capital Management investment company group since 2001.

| | | | | | |

| 30 | | Causeway Emerging Markets Fund | | | | |

NOTICE TO SHAREHOLDERS (Unaudited)

The information set forth below is for the Fund’s fiscal year as required by federal laws. Shareholders, however, must report distributions on a calendar year basis for income tax purposes, which may include distributions for portions of two fiscal years of the Fund. Accordingly, the information needed by shareholders for income tax purposes will be sent to them in early 2019. Please consult your tax adviser for proper treatment of this information.

For the fiscal year ended September 30, 2018, the Fund is designating the following items with regard to distributions paid during the year:

| | | | | | | | | | | | | | | | | | |

| (A) | | | (B) | | | (C) | | | (D) | | | (E) | |

| | | | |

Long Term

Capital Gains