UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-10467

Causeway Capital Management Trust

(Exact name of registrant as specified in charter)

11111 Santa Monica Boulevard, 15th Floor

c/o Causeway Capital Management LLC

Los Angeles, CA 90025

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington DE, 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-866-947-7000

Date of fiscal year end: September 30, 2021

Date of reporting period: September 30, 2021

| Item 1. | Reports to Stockholders. |

The registrant’s schedules as of the close of the reporting period, pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), are attached hereto.

TABLE OF CONTENTS

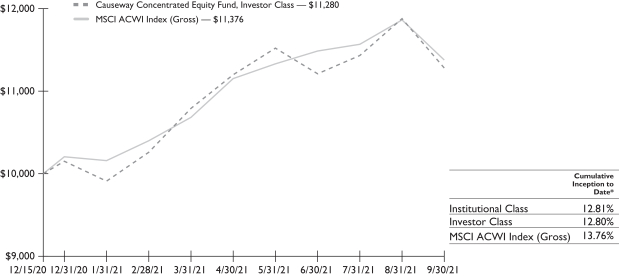

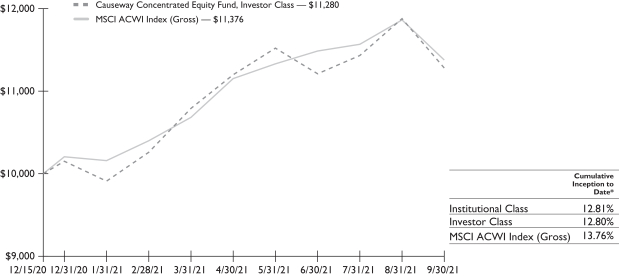

LETTER TO SHAREHOLDERS

For the period ended September 30, 2021 since inception on December 15, 2020, Causeway Concentrated Equity Fund’s (the “Fund’s”) Institutional Class returned 12.81% and Investor Class returned 12.80% compared to the MSCI ACWI Index (Gross) (“Index”) return of 13.76%. As of September 30, 2021, the Fund had net assets of $5.8 million.

Performance Review

With the news of effective vaccines in November 2020 portending a light at the end of the tunnel of the Covid-19 pandemic, equity markets experienced a sharp reversal in momentum. Cyclically exposed stocks, particularly those hardest hit by the coronavirus lockdowns (such as companies exposed to air travel), rebounded strongly during the fourth quarter of 2020 and first quarter of 2021. Announcements of effective vaccines and subsequent rollouts amplified investor sentiment for a normalization in global air traffic and further economic reopening. Tempering some of the end-of-lockdown euphoria, however, was the spread of the more-transmissible Delta variant, which has caused concern for global health officials and highlighted the urgent need to increase the pace of vaccinations. Towards the end of the period, equities declined in September 2021 amid concerns over a moderation in economic growth rates, supply chain disruptions, and rising inflation. Global economic data that emerged at the end of the period revealed a modest loss of momentum in the recovery, including headwinds from China. Virtually all companies we queried reported rising input costs across geographies as supply chain disruptions exacerbated inflationary pressures. Energy shortages present another downside risk to growth and will likely intensify price pressures. The US Federal Reserve (“Fed”) announced it will slow the pace of asset purchases soon (potentially in November 2021) and end the program in mid-2022. Furthermore, Fed Funds futures indicate increased interest rates to 1.75% by the end of 2024. The Bank of England (“BoE”) delivered a hawkish tone and UK government bond yields rose sharply in September. We currently expect the BoE to raise interest rates early next year. In the Eurozone, monetary policy is set to remain accommodative, in contrast to the Fed and BoE. The European Central Bank announced a reduction in the pace of asset purchases but stressed that it was not the beginning of tapering. In China, the stream of negative news flow in the latter portion of the period has proved relentless. The impending restructuring of China’s second largest property developer, Evergrande, following its liquidity crisis, has implications for both the Chinese real estate sector and the Chinese economy. Although uneven, in our view, the bulk of new regulations appear pragmatic and transparent, promoting rules around labor and working conditions, healthcare, and housing. The best performing markets in the Index included the Czech Republic, Saudi Arabia, Austria, the United Arab Emirates, and Russia. The biggest laggards included Peru, Pakistan, China, Egypt, and New Zealand. The best performing sectors were energy, financials, and information technology, while consumer discretionary, utilities, and consumer staples were the worst performing Index sectors.

Fund holdings in the consumer services, pharmaceuticals & biotechnology, technology hardware & equipment, and commercial & professional services industry groups detracted the most from the Fund’s performance relative to the Index. Holdings in the capital goods, media & entertainment, and health care equipment & services industry groups, as well as underweight positions in the retailing and food beverage & tobacco industry groups, contributed to relative performance. The largest detractor from performance was casino & resort company, Las Vegas Sands Corp. (United States). Other notable detractors included electric, gas & renewables power generation & distribution company, Enel

| | | | | | |

| | | |

| 2 | | Causeway Concentrated Equity Fund | | | | |

SpA (Italy), electronic equipment manufacturer, Samsung Electronics Co., Ltd. (South Korea), electric utility provider, RWE AG (Germany), and financial services technology company, Fiserv, Inv. (United States). The largest contributor to absolute return was technology conglomerate, Alphabet Inc. (United States). Additional top contributors included enterprise management software provider, Oracle Corp. (United States), medical technology provider, Hill-Rom Holdings (United States), banking & financial services company, UniCredit S.p.A. (Italy), and HVAC manufacturer, Carrier Global Corp. (United States).

Investment Outlook

As the global economy recovers from the pandemic, stocks in Covid-impacted industries performed well during the period. We believe that many of the, in our view, world class companies in aviation, travel, leisure, and hospitality should continue to outperform markets. With a turnaround in cash flows, many of these companies should be well positioned for a return to normalcy. We believe improvements to their cost structures, balance sheets, and competitive position (as weaker competitors lost market share) suggest that future levels of profitability should exceed pre-pandemic levels, even at lower volumes. After pausing dividends and share buybacks for much of the Covid era, key regulators in our investable universe have approved banks and insurance companies to resume capital returns in the fourth quarter of 2021. Many of these companies held in our client portfolios have accrued dividends throughout the pandemic, which we believe should result in not only normal dividend payments but also the return of excess capital. With dividend income constituting an important component of total return, we eagerly anticipate the normalization of dividend policy for portfolio companies that have maintained strong capital positions over the last year and a half. Finally, the prospect of global bond yields rising further — even to levels that are still low versus historical yields — should favor undervaluation and exposure to economic recovery.

The Fund leverages Causeway’s experience in rigorous, bottom-up fundamental stock selection and quantitative risk management abilities. Typically consisting of 25 to 35 stocks, we believe the Fund has the potential to generate alpha (returns in excess of a benchmark) over full market cycles. We designed the Fund with a concentrated approach, employing Causeway’s proprietary quantitative risk controls. We believe this will allow us to maximize long-term returns while controlling for volatility.

| | | | | | |

| | | |

| | Causeway Concentrated Equity Fund | | | 3 | |

We thank you for your continued confidence in Causeway Concentrated Equity Fund.

September 30, 2021

| | | | |

| | |

| |  | |  |

| | |

Brian Cho Portfolio Manager | | Jonathan Eng Portfolio Manager | | Joseph Gubler Portfolio Manager |

| | | | |

| | |

| |  | |  |

| | |

Harry Hartford Portfolio Manager | | Sarah Ketterer Portfolio Manager | | Ellen Lee Portfolio Manager |

| | | | |

| | |

| |  | |  |

| | |

Conor Muldoon Portfolio Manager | | Steven Nguyen Portfolio Manager | | Alessandro Valentini Portfolio Manager |

The above commentary expresses the portfolio managers’ views as of the date shown and should not be relied upon by the reader as research or investment advice. These views are subject to change. There is no guarantee that any forecasts made will come to pass.

Holdings are subject to change. Current and future holdings are subject to risk. Securities mentioned do not make up the entire portfolio and, in the aggregate, may represent a small percentage of the portfolio.

Investing involves risk including loss of principal. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Diversification does not prevent all investment losses.

A company may reduce or eliminate its dividend, causing losses to the Fund.

| | | | | | |

| | | |

| 4 | | Causeway Concentrated Equity Fund | | | | |

Comparison of Change in the Value of a $10,000 Investment in Causeway Concentrated Equity Fund, Investor Class shares versus the MSCI ACWI Index (Gross) as of September 30, 2021

The performance in the above graph does not reflect the deduction of taxes the shareholder will pay on Fund distributions or the redemptions of Fund shares.

* Inception is December 15, 2020.

The performance data represents past performance and is not an indication of future results. Investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth less than their original cost and current performance may be higher or lower than the performance quoted. For performance data current to the most recent month end, please call 1-866-947-7000 or visit www.causewayfunds.com. Investment performance reflects expense reimbursements in effect during certain periods. In the absence of such expense reimbursements, total return would be reduced. The contractual expense limits are in effect until January 31, 2022. Total returns assume reinvestment of dividends and capital gains distributions at net asset value when paid. Investor Class shares pay a shareholder service fee of up to 0.25% per annum of average daily net assets. Institutional Class shares pay no shareholder service fee. Pursuant to the current January 28, 2021 prospectus, the Fund’s annualized gross ratios of expenses in relation to average net assets, based on estimates, were 1.70% and 1.95% for the Institutional Class and Investor Class, respectively, and the Fund’s annualized ratios of expenses in relation to net assets after fee waivers and reimbursements were 0.85% and 1.10% for the Institutional Class and Investor Class, respectively. For more information, please see the prospectus.

The MSCI ACWI Index (Gross) (the “Index”) is a free float-adjusted market capitalization index, designed to measure the equity market performance of developed and emerging markets, consisting of 23 developed country indices, including the U.S, and 27 emerging market country indices. The Index is gross of withholding taxes, assumes reinvestment of dividends and capital gains, and does not reflect the payment of transaction costs, fees and expenses associated with an investment in the Fund. It is not possible to invest directly in an index. There are special risks in foreign investing (please see Note 5 in the Notes to Financial Statements).

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations, and is not liable whatsoever for any data in this report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

| | | | | | |

| | | |

| | Causeway Concentrated Equity Fund | | | 5 | |

SCHEDULE OF INVESTMENTS (000)*

September 30, 2021

| | | | | | | | |

| Causeway Concentrated Equity Fund | | Number of Shares | | | Value | |

| | |

COMMON STOCK | | | | | | | | |

| | |

| France — 9.1% | | | | | | |

| | |

AXA SA | | | 9,106 | | | $ | 252 | |

| | |

Sanofi | | | 2,873 | | | | 277 | |

| | | | | | | | |

| | |

| | | | | | | 529 | |

| | | | | | | | |

| | |

| Germany — 5.1% | | | | | | |

| | |

RWE AG | | | 3,546 | | | | 125 | |

| | |

SAP SE | | | 1,246 | | | | 169 | |

| | | | | | | | |

| | |

| | | | | | | 294 | |

| | | | | | | | |

| | |

| Italy — 5.2% | | | | | | |

| | |

Enel SpA | | | 14,189 | | | | 109 | |

| | |

UniCredit SpA | | | 14,805 | | | | 196 | |

| | | | | | | | |

| | |

| | | | | | | 305 | |

| | | | | | | | |

| | |

| Japan — 4.8% | | | | | | |

| | |

Takeda Pharmaceutical Co. Ltd. | | | 8,500 | | | | 280 | |

| | | | | | | | |

| | |

| Netherlands — 2.3% | | | | | | |

| | |

Akzo Nobel NV | | | 1,240 | | | | 135 | |

| | | | | | | | |

| | |

| South Korea — 4.3% | | | | | | |

| | |

Samsung Electronics Co. Ltd. | | | 4,011 | | | | 249 | |

| | | | | | | | |

| | |

| Spain — 2.9% | | | | | | |

| | |

CaixaBank SA | | | 53,895 | | | | 167 | |

| | | | | | | | |

| | |

| Switzerland — 10.4% | | | | | | |

| | |

Novartis AG | | | 2,587 | | | | 212 | |

| | |

Roche Holding AG | | | 711 | | | | 260 | |

| | |

Zurich Insurance Group AG | | | 326 | | | | 133 | |

| | | | | | | | |

| | |

| | | | | | | 605 | |

| | | | | | | | |

| | |

| United Kingdom — 4.0% | | | | | | |

| | |

Rolls-Royce Holdings PLC1 | | | 125,576 | | | | 234 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | |

| 6 | | Causeway Concentrated Equity Fund | | | | |

SCHEDULE OF INVESTMENTS (000)* (continued)

September 30, 2021

| | | | | | | | |

| Causeway Concentrated Equity Fund | | Number of Shares | | | Value | |

| | |

| United States — 49.9% | | | | | | |

| | |

Alphabet Inc., Class C1 | | | 114 | | | $ | 304 | |

| | |

Ashland Global Holdings Inc. | | | 3,153 | | | | 281 | |

| | |

Berry Global Group Inc.1 | | | 2,662 | | | | 162 | |

| | |

Booking Holdings Inc.1 | | | 68 | | | | 161 | |

| | |

Carrier Global Corp. | | | 3,206 | | | | 166 | |

| | |

Essent Group Ltd. | | | 6,380 | | | | 281 | |

| | |

Exelon Corp. | | | 3,288 | | | | 159 | |

| | |

Fiserv Inc.1 | | | 2,580 | | | | 280 | |

| | |

Genpact Ltd. | | | 5,660 | | | | 269 | |

| | |

Las Vegas Sands Corp.1 | | | 6,837 | | | | 250 | |

| | |

Quest Diagnostics Inc. | | | 1,059 | | | | 154 | |

| | |

Sabre Corp.1 | | | 19,400 | | | | 230 | |

| | |

Westrock Co. | | | 4,256 | | | | 212 | |

| | | | | | | | |

| | |

| | | | | | | 2,909 | |

| | | | | | | | |

| | |

Total Common Stock | | | | | | | | |

| | |

(Cost $5,469) — 98.0% | | | | | | | 5,707 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENT | | | | | | | | |

| | |

Invesco Short-Term Investment Trust: Government & Agency Portfolio, Institutional Class, 0.026%** | | | 131,089 | | | | 131 | |

| | | | | | | | |

| | |

Total Short-Term Investment | | | | | | | | |

| | |

(Cost $131) — 2.2% | | | | | | | 131 | |

| | | | | | | | |

| | |

Total Investments — 100.2% | | | | | | | | |

| | |

(Cost $5,600) | | | | | | | 5,838 | |

| | | | | | | | |

| | |

Liabilities in Excess of Other Assets — (0.2)% | | | | | | | (14 | ) |

| | | | | | | | |

| | |

Net Assets — 100.0% | | | | | | $ | 5,824 | |

| | | | | | | | |

| ** | The rate reported is the 7-day effective yield as of September 30, 2021. |

| 1 | Non-income producing security. |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | |

| | Causeway Concentrated Equity Fund | | | 7 | |

SCHEDULE OF INVESTMENTS (000) (concluded)

September 30, 2021

The table below sets forth information about the Levels within the fair value hierarchy at which the Fund’s investments are measured at September 30, 2021:

| | | | | | | | | | | | | | | | |

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stock | | | | | | | | | | | | | | | | |

France | | $ | — | | | $ | 529 | | | $ | — | | | $ | 529 | |

Germany | | | — | | | | 294 | | | | — | | | | 294 | |

Italy | | | — | | | | 305 | | | | — | | | | 305 | |

Japan | | | — | | | | 280 | | | | — | | | | 280 | |

Netherlands | | | — | | | | 135 | | | | — | | | | 135 | |

South Korea | | | — | | | | 249 | | | | — | | | | 249 | |

Spain | | | — | | | | 167 | | | | — | | | | 167 | |

Switzerland | | | — | | | | 605 | | | | — | | | | 605 | |

United Kingdom | | | — | | | | 234 | | | | — | | | | 234 | |

United States | | | 2,909 | | | | — | | | | — | | | | 2,909 | |

| | | | |

Total Common Stock | | | 2,909 | | | | 2,798 | | | | — | | | | 5,707 | |

| | | | |

Short-Term Investment | | | 131 | | | | — | | | | — | | | | 131 | |

| | | | |

Total Investments in Securities | | $ | 3,040 | | | $ | 2,798 | | | $ | — | | | $ | 5,838 | |

| | | | |

For the period ended September 30, 2021, there were no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | |

| 8 | | Causeway Concentrated Equity Fund | | | | |

SECTOR DIVERSIFICATION

As of September 30, 2021, the sector diversification was as follows (Unaudited):

| | | | | | | | |

| Causeway Concentrated Equity Fund | | Common

Stock | | | % of

Net Assets | |

| | |

Information Technology | | | 20.6% | | | | 20.6% | |

| | |

Health Care | | | 20.4 | | | | 20.4 | |

| | |

Financials | | | 17.6 | | | | 17.6 | |

| | |

Materials | | | 13.5 | | | | 13.5 | |

| | |

Consumer Discretionary | | | 7.1 | | | | 7.1 | |

| | |

Industrials | | | 6.9 | | | | 6.9 | |

| | |

Utilities | | | 6.7 | | | | 6.7 | |

| | |

Communication Services | | | 5.2 | | | | 5.2 | |

| | | | | | | | |

| Total | | | 98.0 | | | | 98.0 | |

| | |

| Short-Term Investment | | | | | | | 2.2 | |

| | | | | | | | |

| Liabilities in Excess of Other Assets | | | | | | | (0.2) | |

| | | | | | | | |

| Net Assets | | | | | | | 100.0% | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | |

| | Causeway Concentrated Equity Fund | | | 9 | |

STATEMENT OF ASSETS AND LIABILITIES (000)*

| | | | |

| | | CAUSEWAY

CONCENTRATED

EQUITY FUND | |

| |

| | | 9/30/21 | |

ASSETS: | | | | |

Investments at Value (Cost $5,600) | | $ | 5,838 | |

Receivable Due from Adviser | | | 4 | |

Receivable for Tax Reclaims | | | 9 | |

Receivable for Dividends | | | 9 | |

Prepaid Expenses | | | 6 | |

| | | | |

Total Assets | | | 5,866 | |

| | | | |

LIABILITIES: | | | | |

Payable for Professional Fees | | | 18 | |

Payable due to Transfer Agent Fees | | | 10 | |

Payable due to Printing Fees | | | 7 | |

Payable for Custodian Fees | | | 5 | |

Other Accrued Expenses | | | 2 | |

| | | | |

Total Liabilities | | | 42 | |

| | | | |

Net Assets | | $ | 5,824 | |

| | | | |

NET ASSETS: | | | | |

Paid-in Capital (unlimited authorization — no par value) | | $ | 5,175 | |

Total Distributable Earnings | | | 649 | |

| | | | |

Net Assets | | $ | 5,824 | |

| | | | |

Net Asset Value Per Share (based on net assets of

$4,639,303 ÷ 411,231 shares) — Institutional Class | | $ | 11.28 | |

| | | | |

Net Asset Value Per Share (based on net assets of

$1,185,117 ÷ 105,045 shares) — Investor Class | | $ | 11.28 | |

| | | | |

| * | Except for Net Asset Value Per Share data. |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | |

| 10 | | Causeway Concentrated Equity Fund | | | | |

STATEMENT OF OPERATIONS (000)

| | | | |

| | | CAUSEWAY

CONCENTRATED

EQUITY FUND | |

| |

| | | 12/15/20 to

9/30/21* | |

INVESTMENT INCOME: | | | | |

Dividend Income (net of foreign taxes withheld of $14) | | $ | 100 | |

| | | | |

Total Investment Income | | | 100 | |

| | | | |

EXPENSES: | | | | |

Investment Advisory Fees | | | 36 | |

Transfer Agent Fees | | | 49 | |

Professional Fees | | | 36 | |

Custodian Fees | | | 10 | |

Administration Fees | | | 8 | |

Printing Fees | | | 8 | |

Registration Fees | | | 3 | |

Line of Credit | | | 1 | |

Other Fees | | | 4 | |

| | | | |

Total Expenses | | | 155 | |

| | | | |

Waiver of Investment Advisory Fees | | | (36 | ) |

Reimbursement of Other Expenses | | | (81 | ) |

| | | | |

Total Waiver and Reimbursement | | | (117 | ) |

| | | | |

| |

Net Expenses | | | 38 | |

| | | | |

Net Investment Income | | | 62 | |

| | | | |

Net Realized and Unrealized Gain (Loss) on Investments: | | | | |

Net Realized Gain on Investments | | | 349 | |

Net Unrealized Appreciation on Investments | | | 238 | |

| | | | |

Net Realized and Unrealized Gain on Investments | | | 587 | |

| | | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 649 | |

| | | | |

| * | Commenced operations on December 15, 2020. |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | |

| | Causeway Concentrated Equity Fund | | | 11 | |

STATEMENT OF CHANGES IN NET ASSETS (000)

| | | | |

| | | CAUSEWAY

CONCENTRATED

EQUITY FUND | |

| |

| | | 12/15/20 to

9/30/21* | |

OPERATIONS: | | | | |

Net Investment Income | | $ | 62 | |

Net Realized Gain on Investments | | | 349 | |

Net Unrealized Appreciation on Investments | | | 238 | |

| | | | |

Net Increase in Net Assets Resulting From Operations | | | 649 | |

| | | | |

DISTRIBUTIONS: | | | | |

Institutional Class | | | — | |

| | | | |

Investor Class | | | — | |

| | | | |

Total Distributions to Shareholders | | | — | |

| | | | |

Net Increase in Net Assets Derived from Capital Share Transactions(1) | | | 5,175 | |

| | | | |

Total Increase in Net Assets | | | 5,824 | |

| | | | |

NET ASSETS: | | | | |

Beginning of Period | | | — | |

| | | | |

End of Period | | $ | 5,824 | |

| | | | |

| * | Commenced operations on December 15, 2020. |

| (1) | See Note 7 in the Notes to Financial Statements. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | |

| 12 | | Causeway Concentrated Equity Fund | | | | |

This page intentionally left blank.

FINANCIAL HIGHLIGHTS

For the Period Ended September 30,

For a Share Outstanding Throughout the Period

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Asset

Value,

Beginning

of Period ($) | | | Net

Investment

Income ($)† | | | Net Realized

and

Unrealized

Gain on

Investments ($) | | | Total

from

Operations ($) | | | Dividends

from Net

Investment

Income ($) | | | Distributions

from

Capital

Gains ($) | | | Total

Dividends

and

Distributions ($) | |

CAUSEWAY CONCENTRATED EQUITY FUND | |

Institutional | |

2021(1)(2) | | | 10.00 | | | | 0.12 | | | | 1.16 | | | | 1.28 | | | | — | ^ | | | — | | | | — | |

Investor | |

2021(1)(2) | | | 10.00 | | | | 0.12 | | | | 1.16 | | | | 1.28 | | | | — | | | | — | | | | — | |

| † | Per share amounts calculated using average shares method. |

| ^ | Amount represents less than $0.01 per share. |

| (1) | Commenced operations on December 15, 2020. |

| (2) | All ratios for periods less than one year are annualized. Total returns and portfolio turnover rate are for the period indicated and have not been annualized. |

Amounts designated as “—” are $0 or round to $0.

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | |

| 14 | | Causeway Concentrated Equity Fund | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset

Value, End

of Period ($) | | | Total

Return (%) | | | Net Assets,

End of

Period

($000) | | | Ratio of

Expenses to

Average Net

Assets (%) | | | Ratio of

Expenses

to Average

Net Assets

(Excluding

Waivers and

Reimburse-

ments) (%) | | | Ratio

of Net

Investment

Income

to Average

Net Assets (%) | | | Portfolio

Turnover

Rate (%) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 11.28 | | | | 12.81 | | | | 4,639 | | | | 0.85 | | | | 3.47 | | | | 1.40 | | | | 37 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 11.28 | | | | 12.80 | | | | 1,185 | | | | 0.85 | | | | 3.47 | | | | 1.40 | | | | 37 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| | | |

| | Causeway Concentrated Equity Fund | | | 15 | |

NOTES TO FINANCIAL STATEMENTS

Causeway Concentrated Equity Fund (the“Fund”) is a series of Causeway Capital Management Trust (the “Trust”). The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”) and is a Delaware statutory trust that was established on August 10, 2001. The Fund began operations on December 15, 2020. The Fund is authorized to offer two classes of shares, the Institutional Class and the Investor Class. The Declaration of Trust authorizes the issuance of an unlimited number of shares of beneficial interest of the Fund. The Fund is diversified. The Fund’s prospectus provides a description of the Fund’s investment objectives, policies and strategies. As of September 30, 2021, the Trust has five additional series, the financial statements of which are presented separately.

| 2. | | Significant Accounting Policies |

The following is a summary of the significant accounting policies consistently followed by the Fund.

Use of Estimates in the Preparation of Financial Statements – The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The Fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of net assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net

assets from operations during the reporting period. Actual results could differ from those estimates.

Security Valuation – Except as described below, securities listed on a securities exchange (except the NASDAQ Stock Market (“NASDAQ”)) or Over-the-Counter (“OTC”) for which market quotations are available are valued at the last reported sale price as of the close of trading on each business day, or, if there is no such reported sale, at the last reported bid price for long positions. For securities traded on NASDAQ, the NASDAQ Official Closing Price is used. Securities listed on multiple exchanges or OTC markets are valued on the exchange or OTC market considered by the Fund to be the primary market. The prices for foreign securities are reported in local currency and converted to U.S. dollars using currency exchange rates. Prices for most securities held in the Fund are provided daily by recognized independent pricing agents. If a security price cannot be obtained from an independent pricing agent, the Fund seeks to obtain a bid price from at least one independent broker. Investments in money market funds are valued daily at the net asset value per share.

Securities for which market prices are not “readily available” are valued in accordance with fair value pricing procedures approved by the Fund’s Board of Trustees (the “Board”). The Fund’s fair value pricing procedures are implemented through a Fair Value Committee (the “Committee”) designated by the Board. Some of the more common reasons that may necessitate that a security be valued using fair value pricing procedures include: the security’s trading has been halted or suspended; the security has been delisted from a national exchange; the security’s primary trading market is temporarily closed at a time when under normal conditions it would be open; or the security’s primary pricing source is not able or willing to provide a price.

| | | | | | |

| | | |

| 16 | | Causeway Concentrated Equity Fund | | | | |

NOTES TO FINANCIAL STATEMENTS

(continued)

When the Committee values a security in accordance with the fair value pricing procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee.

The Fund uses a third party vendor to fair value certain non-U.S. securities if there is a movement in the U.S. market that exceeds thresholds established by the Committee. The vendor provides fair values for foreign securities based on factors and methodologies involving, generally, tracking valuation correlations between the U.S. market and each non-U.S. security and such fair values are applied by the administrator if a pre-determined confidence level is reached for the security.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The guidance establishes three levels of fair value hierarchy as follows:

| | • | | Level 1 — Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | • | | Level 2 — Quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets which |

| | | are not active, or prices based on inputs that are observable (either directly or indirectly); and |

| | • | | Level 3 — Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 which fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the reporting period. Changes in the classification between Levels 1 and 2 occur primarily when foreign equity securities are fair valued by the Fund’s third party vendor using other observable market–based inputs in place of closing exchange prices due to events occurring after foreign market closures or when foreign markets are closed.

For the period ended September 30, 2021, there were no changes to the Fund’s fair value methodologies.

Federal Income Taxes – The Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and to distribute substantially all of its taxable income. Accordingly, no provision for Federal income taxes has been made in the financial statements.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is “more-likely-than-not” (i.e., greater than 50-percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions

| | | | | | |

| | | |

| | Causeway Concentrated Equity Fund | | | 17 | |

NOTES TO FINANCIAL STATEMENTS

(continued)

not deemed to meet the “more-likely-than-not” threshold are recorded as a tax benefit or expense in the current year. The Fund did not record any tax provision in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., the last 3 tax years, as applicable), and on-going analysis of and changes to tax laws, regulations and interpretations thereof.

As of and during the period ended September 30, 2021, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any significant interest or penalties.

Security Transactions and Related Income – Security transactions are accounted for on the date the security is purchased or sold (trade date). Dividend income is recognized on the ex-dividend date, and interest income is recognized using the accrual basis of accounting. Costs used in determining realized gains and losses on the sales of investment securities are those of the specific securities sold.

Foreign Currency Translation – The books and records of the Fund are maintained in U.S. dollars on the following basis:

(1) the market value or fair value of investment securities, assets and liabilities is converted at the current rate of exchange; and

(2) purchases and sales of investment securities, income and expenses are converted at the relevant rates of exchange prevailing on the respective dates of such transactions.

The Fund does not isolate that portion of gains and losses on investments in equity securities that is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities.

Foreign Currency Exchange Contracts – When the Fund purchases or sells foreign securities, it enters into corresponding foreign currency exchange contracts to settle the securities transactions. Losses from these foreign exchange transactions may arise from changes in the value of the foreign currency between trade date and settlement date or if the counterparties do not perform under the contract’s terms.

Expense/Classes – Expenses that are directly related to one Fund of the Trust are charged directly to that Fund. Other operating expenses of the Trust are prorated to the Fund and the other series of the Trust on the basis of relative daily net assets. Expenses of the Shareholder Service Plan and Agreement for the Investor Class are borne by that class of shares. Income, realized and unrealized gains (losses) and non-class specific expenses are allocated to the respective classes on the basis of relative daily net assets.

Dividends and Distributions – Dividends from net investment income, if any, are declared and paid on an annual basis. Any net realized capital gains on sales of securities are distributed to shareholders at least annually.

Cash – Idle cash may be swept into various time deposit accounts and is classified as cash on the Statement of Assets and Liabilities. The Fund maintains cash in bank deposit accounts which, at times, may exceed United States federally insured limits. Amounts invested and earned income are available on the same business day.

| | | | | | |

| | | |

| 18 | | Causeway Concentrated Equity Fund | | | | |

NOTES TO FINANCIAL STATEMENTS

(continued)

| 3. | | Investment Advisory, Administration, Shareholder Service and Distribution Agreements |

The Trust, on behalf of the Fund, has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Under the Advisory Agreement, the Adviser is entitled to a monthly fee equal to an annual rate of 0.80% of the Fund’s average daily net assets. The Adviser has contractually agreed through January 31, 2022 to waive its fee and to the extent necessary, reimburse the Fund to keep total annual fund operating expenses (excluding brokerage fees and commissions, interest, taxes, shareholder service fees, fees and expenses of other funds in which the Fund invests, and extraordinary expenses) from exceeding 0.85% of Institutional Class and Investor Class average daily net assets. For the period ended September 30, 2021, the Adviser waived its entire advisory fee of $35,527 and reimbursed expenses of $80,965. The expense waivers and reimbursements are not subject to recapture.

The Trust and SEI Investments Global Funds Services (the “Administrator”) have entered into an Administration Agreement. Under the terms of the Administration Agreement, the Administrator is entitled to an annual fee which is calculated daily and paid monthly based on the aggregate average daily net assets of the Trust subject to a minimum annual fee.

The Trust has adopted a Shareholder Service Plan and Agreement for Investor Class shares that allows the Trust to pay broker-dealers and other financial intermediaries a fee of up to 0.25% per annum of average daily net assets for services provided to Investor Class shareholders. For the period ended September 30, 2021, the Investor Class did not pay any fees under this plan.

The Trust and SEI Investments Distribution Co. (the “Distributor”) have entered into a Distribution Agreement. The Distributor receives no fees from the Fund for its distribution services under this agreement.

The officers of the Trust are also officers or employees of the Administrator or Adviser. They receive no fees for serving as officers of the Trust.

As of September 30, 2021, approximately $5,449 (000) of the Fund’s net assets were held by investors affiliated with the Adviser.

| 4. | | Investment Transactions |

The cost of security purchases and the proceeds from the sales of securities, other than short-term investments, during the period ended September 30, 2021, for the Fund were as follows (000):

| | | | | | |

| Purchases | | | Sales | |

| $ | 7,119 | | | $ | 1,999 | |

| 5. | | Risks of Foreign Investing |

Because the Fund invests most of its assets in foreign securities, the Fund is subject to additional risks. For example, the value of the Fund’s securities may be affected by social, political and economic developments and U.S. and foreign laws relating to foreign investments. Further, because the Fund invests in securities denominated in foreign currencies, the Fund’s securities may go down in value depending on foreign exchange rates. Other risks include trading, settlement, custodial, and other operational risks; withholding or other taxes; and the less stringent investor protection and disclosure standards of some foreign markets. All of these factors can make foreign securities less liquid, more volatile and harder to value than U.S. securities. These risks are higher for emerging markets investments.

| | | | | | |

| | | |

| | Causeway Concentrated Equity Fund | | | 19 | |

NOTES TO FINANCIAL STATEMENTS

(continued)

Beginning in January 2020, global financial markets have experienced and may continue to experience significant volatility resulting from the spread of a novel coronavirus known as COVID-19. The outbreak of COVID-19 has resulted in travel and border restrictions, quarantines, supply chain disruptions, lower consumer demand and general market uncertainty. The effects of COVID-19 have adversely affected and may continue to adversely affect the global economy, the economies of certain nations and individual issuers, all of which may negatively impact the Fund. Similar consequences could arise as a result of other infectious diseases.

| 6. | | Federal Tax Information |

The Fund is classified as a separate taxable entity for Federal income tax purposes. The Fund intends to continue to qualify as a separate “regulated investment company” under Subchapter M of the Internal Revenue Code and make the requisite distributions to shareholders that will be sufficient to relieve it from Federal income tax and Federal excise tax. Therefore, no Federal tax provision is required. To the extent that dividends from net investment income and distributions from net realized capital gains exceed amounts reported in the financial statements, such amounts are reported separately.

The Fund may be subject to taxes imposed by countries in which it invests in issuers existing or operating in such countries. Such taxes are generally based on income earned. The Fund accrues such taxes when the related income is earned. Dividend and interest income is recorded net of non-U.S. taxes paid.

The amounts of distributions from net investment income and net realized capital gains are determined in accordance with Federal income tax regulations, which may differ from those amounts determined under U.S.

GAAP. These book/tax differences are either temporary or permanent in nature. The character of distributions made during the year from net investment income or net realized gains, and the timing of distributions made during the year may differ from those during the year that the income or realized gains (losses) were recorded by the Fund.

During the period ended September 30, 2021, there were no permanent differences credited or charged to Paid-in Capital and Distributable Earnings.

The tax character of dividends and distributions declared during the period ended September 30, 2021was as follows (000):

| | | | | | | | |

| | | Ordinary

Income | | | Total | |

2021 | | $ | — | | | $ | — | |

Amounts designated as “—” round to $0.

As of September 30, 2021, the components of distributable earnings on a tax basis were as follows (000):

| | | | |

Undistributed Ordinary Income | | $ | 411 | |

Unrealized Appreciation | | | 238 | |

| | | | |

Total Distributable Earnings | | $ | 649 | |

| | | | |

For the period ended September 30, 2021, the Fund did not use any capital loss carryforwards.

At September 30, 2021, the total cost of investments for Federal income tax purposes and the aggregate gross unrealized appreciation and depreciation on investments for the Fund were as follows (000):

| | | | | | | | | | | | | | |

Federal

Tax Cost | | | Appreciated

Securities | | | Depreciated

Securities | | | Net

Unrealized

Appreciation | |

| $ | 5,600 | | | $ | 474 | | | $ | (236 | ) | | $ | 238 | |

| | | | | | |

| | | |

| 20 | | Causeway Concentrated Equity Fund | | | | |

NOTES TO FINANCIAL STATEMENTS

(continued)

| 7. | | Capital Shares Issued and Redeemed (000) |

| | | | | | | | |

| | | Period Ended

September 30, 2021* | |

| | | Shares | | | Value | |

Institutional Class | | | | | | | | |

Shares Sold | | | 411 | | | $ | 4,125 | |

| | | | | | | | |

Increase in Shares Outstanding Derived from Institutional Class Transactions | | | 411 | | | | 4,125 | |

| | | | | | | | |

Investor Class | | | | | | | | |

Shares Sold | | | 105 | | | | 1,050 | |

| | | | | | | | |

Increase in Shares Outstanding Derived from Investor Class Transactions | | | 105 | | | | 1,050 | |

| | | | | | | | |

Net Increase in Shares Outstanding from Capital Share Transactions | | | 516 | | | $ | 5,175 | |

| | | | | | | | |

| * | Commenced operations December 15, 2020. |

| 8. | | Significant Shareholder Concentration |

As of September 30, 2021, the Fund’s only shareholder records owned 97% of the Institutional Class shares. The Fund may be adversely affected when a shareholder purchases or redeems large amounts of shares, which may impact the Fund in the same manner as a high volume of redemption requests. Such large shareholders may include, but are not limited to, institutional investors and asset allocators who make investment decisions on behalf of underlying clients. Significant shareholder purchases and redemptions may adversely impact the Fund’s portfolio management and may cause the Fund to make investment decisions at inopportune times or prices or miss attractive investment opportunities. Such transactions may also increase the Fund’s transaction costs, accelerate the realization of taxable income if sales of securities result in gains, or otherwise cause the Fund to perform differently than intended.

Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust is

indemnified against certain liabilities that may arise out of the performance of his or her duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote.

The Fund, along with certain other series of the Trust, is party to an agreement which enables it to participate in a $10 million secured committed revolving line of credit with The Bank of New York Mellon which expires February 16, 2022. The proceeds from the borrowings, if any, are used to finance the Fund’s short-term general working capital requirements, including the funding of shareholder redemptions. Interest, if any, is charged to the Fund based on its borrowings during the period at the applicable rate plus 1.5%. The Fund is also charged a portion of a commitment fee of 0.20% per annum. As of September 30, 2021, there were no borrowings outstanding under the line of credit.

The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole, due to, for example: a reason directly related to the issuer; management performance; financial leverage; reduced demand for the issuer’s goods or services; the historical and prospective earnings of the issuer; or the value of the issuer’s assets. In particular, because the Fund will typically hold between 25 and 35

| | | | | | |

| | | |

| | Causeway Concentrated Equity Fund | | | 21 | |

NOTES TO FINANCIAL STATEMENTS

(concluded)

investments, which may be a smaller number of holdings than those held by other similar funds, the Fund is subject to increased issuer risk, including the risk that the value of a security may decline.

The Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no disclosures and/or adjustments were required to the financial statements.

| | | | | | |

| | | |

| 22 | | Causeway Concentrated Equity Fund | | | | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Causeway Capital Management Trust and Shareholders of the

Causeway Concentrated Equity Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Causeway Concentrated Equity Fund (one of the funds constituting Causeway Capital Management Trust, referred to hereafter as the “Fund”) as of September 30, 2021, the related statements of operations, changes in net assets, including the related notes, and the financial highlights for the period December 15, 2020 (commencement of operations) through September 30, 2021 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2021, the results of its operations, changes in its net assets, and the financial highlights the period December 15, 2020 (commencement of operations) through September 30, 2021 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of September 30, 2021 by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Los Angeles, California

November 26, 2021

We have served as the auditor of one or more investment companies in Causeway Capital Management Investment Company Complex since 2001.

| | | | | | |

| | | |

| | Causeway Concentrated Equity Fund | | | 23 | |

NOTICE TO SHAREHOLDERS (Unaudited)

The information set forth below is for the Fund’s fiscal year as required by federal laws. Shareholders, however, must report distributions on a calendar year basis for income tax purposes, which may include distributions for portions of two fiscal years of the Fund. Accordingly, the information needed by shareholders for income tax purposes will be sent to them in early 2022. Please consult your tax adviser for proper treatment of this information.

For the fiscal year ended September 30, 2021, the Fund is designating the following items with regard to distributions paid during the year:

| | | | | | | | | | | | | | | | | | |

| (A) | | | (B) | | | (C) | | | (D) | | | (E) | |

| | | | |

Long Term Capital Gains Distributions (Tax Basis) | | | Ordinary

Income

Distributions

(Tax Basis) | | | Tax Exempt

Distributions

(Tax Basis) | | | Total

Distributions

(Tax Basis) | | | Dividends(1)

for Corporate

Dividends Received

Deduction

(Tax Basis) | |

| | 0.00% | | | | 100.00% | | | | 0.00% | | | | 100.00% | | | | 4.96% | |

| | | | |

| (F) | | | (G) | | | (H) | | | | | | | |

| | | | |

Qualified Dividend Income | | | Interest

Related

Dividends | | | Qualified

Short-Term

Capital

Gain

Dividends | | | | | | | |

| | 24.76% | | | | 0.00% | | | | 0.00% | | | | | | | | | |

Foreign taxes accrued during the fiscal year ended September 30, 2021, amounted to $0 and are expected to be passed through to shareholders as foreign tax credits on Form 1099 – Dividend for the year ending December 31, 2021. In addition, for the fiscal year ended September 30, 2021, gross income derived from sources within foreign countries amounted to $101,610 for the Fund.

| (1) | Qualified Dividends represent dividends which qualify for the corporate dividends received deduction. |

Items (A), (B), (C) and (D) are based on a percentage of the Fund’s total distribution including pass-through as foreign tax credit.

Item (E) is based on a percentage of ordinary income distributions of the Fund.

Item (F) represents the amount of “Qualified Dividend Income” as defined in the Jobs and Growth Tax Relief Reconciliation Act of 2003 and is reflected as a percentage of “Ordinary Income Distributions.” It is the Fund’s intent to designate the maximum amount permitted by the law up to 100%.

Item (G) is the amount of “Interest Related Dividends” as created by the American Jobs Creation Act of 2004 and is reflected as a percentage of net investment income distributions that is exempt from U.S. withholding tax when paid to foreign investors.

Item (H) is the amount of “Qualified Short-Term Capital Gain Dividends” as created by the American Jobs Creation Act of 2004 and is reflected as a percentage of short-term capital gain distributions that is exempt from U.S. withholding tax when paid to foreign investors.

| | | | | | |

| | | |

| 24 | | Causeway Concentrated Equity Fund | | | | |

TRUSTEES AND OFFICERS INFORMATION (Unaudited)

Information pertaining to the Trustees and Officers of the Trust is set forth below. Trustees who are not deemed to be “interested persons” of the Trust as defined in the 1940 Act are referred to as “Independent Trustees.” The Trust’s Statement of Additional Information (“SAI”) includes additional information about the Trustees and Officers. The SAI may be obtained without charge by calling 1-866-947-7000.

| | | | | | | | | | |

Name Address, Age1 | | Position(s) Held with the Company | | Term of Office and Length of Time Served2 | | Principal Occupation(s) During Past Five Years | | Number of Portfolios in Trust Complex Overseen by Trustee3 | | Other Directorships Held by Trustee4 |

INDEPENDENT TRUSTEES | | | | | | | | | | |

John R. Graham

Age: 60 | | Trustee; Chairman of the Board since 1/19 | | Trustee since 10/08; Audit Chairman 4/13-12/18 | | Film Composer (since 2005); Senior Vice President, Corporate Financial Development and Communications, The Walt Disney Company (2004-2005); Senior Vice President, Mergers and Acquisitions, Lehman Brothers Inc. (2000-2004). | | 6 | | None |

| | | | | |

Lawry J. Meister

Age: 59 | | Trustee | | Since 10/08 | | President, Steaven Jones Development Company, Inc. (real estate firm) (since 1995); President, Creative Office Properties (real estate firm) (since 2012). | | 6 | | None |

| | | | | |

Victoria B. Rogers

Age: 60 | | Trustee | | Since 4/13 | | President, Chief Executive Officer and Director, The Rose Hills Foundation (since 1996). | | 6 | | Director, TCW Funds, Inc. and TCW Strategic Income Fund, Inc. |

| | | | | |

Eric H. Sussman

Age: 55 | | Trustee; Chairman of the Audit Committee since 1/19 | | Trustee since 9/01; Audit Chairman 10/04-4/12; Board Chairman 4/13-12/18 | | Adjunct Professor (since July 2017), Senior Lecturer (June 2011-July 2017) and Lecturer (1995-June 2011), Anderson Graduate School of Management, University of California, Los Angeles; President, Amber Capital, Inc. (real estate investment and financial planning firm) (since 1993); Managing Partner, Clear Capital, LLC (real estate investment firm)(since 2008). | | 6 | | None |

| | | | | | |

| | | |

| | Causeway Concentrated Equity Fund | | | 25 | |

TRUSTEES AND OFFICERS INFORMATION (Unaudited)

(continued)

| | | | | | | | | | |

Name Address, Age1 | | Position(s) Held with the Company | | Term of Office and Length of Time Served2 | | Principal Occupation(s) During Past Five Years | | Number of Portfolios in Trust Complex Overseen by Trustee3 | | Other Directorships Held by Trustee4 |

OFFICERS | | | | | | | | | | |

Gracie V. Fermelia

11111 Santa Monica Blvd.,

15th Floor

Los Angeles, CA 90025

Age: 60 | | President | | Since 10/20 | | Chief Operating Officer and member of the Investment Adviser or the Investment Adviser’s parent (since 2001); Chief Compliance Officer of the Investment Adviser and the Trust (2005-2015). | | N/A | | N/A |

| | | | | |

Kurt J. Decko

11111 Santa Monica Blvd.,

15th Floor

Los Angeles, CA 90025

Age: 46 | | Chief Compliance Officer and Assistant Secretary | | Since 1/15 | | Chief Compliance Officer of the Investment Adviser (since January 2015); General Counsel of the Investment Adviser (since October 2020); Partner, K&L Gates LLP (2010-2014). | | N/A | | N/A |

| | | | | |

Eric Olsen5

One Freedom Valley Drive

Oaks, PA 19456

Age: 51 | | Treasurer | | Since 3/21 | | Director, Fund Accounting, SEI Investments Global Funds Services (since 2021); Deputy Head of Fund Operations, Traditional Assets, Aberdeen Standard Investments (2013 to 2021). | | N/A | | N/A |

| | | | | |

Gretchen W. Corbell

11111 Santa Monica Blvd.,

15th Floor

Los Angeles, CA 90025

Age: 50 | | Secretary | | Since 10/11 | | Senior Attorney of the Investment Adviser (since 2004). | | N/A | | N/A |

| | | | | |

Matthew M. Maher5

One Freedom Valley Drive

Oaks, PA 19456

Age: 46 | | Vice President and Assistant Secretary | | Since 2/20 | | Corporate Counsel of the Administrator (since 2018). | | N/A | | N/A |

| | | | | |

Faith Kim

11111 Santa Monica Blvd.,

15th Floor

Los Angeles, CA 90025

Age: 40 | | Anti-Money Laundering Compliance Officer | | Since 8/19 | | Senior Fund Administrator of the Investment Adviser (since 2018). Portfolio Administrator of the Investment Adviser (2015-2018). | | N/A | | N/A |

| | | | | | |

| | | |

| 26 | | Causeway Concentrated Equity Fund | | | | |

TRUSTEES AND OFFICERS INFORMATION (Unaudited)

(concluded)

| 1 | Each Trustee may be contacted by writing to the Trustee c/o Causeway Capital Management Trust, One Freedom Valley Drive, Oaks, PA 19456. |

| 2 | Each Trustee holds office during the lifetime of the Trust or until his or her sooner resignation, retirement, removal, death or incapacity in accordance with the Trust’s Declaration of Trust. The president, treasurer, secretary and other officers each holds office at the pleasure of the Board of Trustees or until he or she sooner resigns in accordance with the Trust’s Bylaws. |

| 3 | The “Trust Complex” consists of all registered investment companies for which Causeway Capital Management LLC serves as investment adviser. As of September 30, 2021, the Trust Complex consisted of one investment company with six portfolios — International Value Fund, Emerging Markets Fund, Global Value Fund, International Opportunities Fund, International Small Cap Fund, and Concentrated Equity Fund. |

| 4 | Directorships of companies required to report to the Securities and Exchange Commission under the Securities Exchange Act of 1934 (i.e., “public companies”) or other investment companies registered under the 1940 Act. |

| 5 | These officers of the Trust also serve as officers of one or more mutual funds for which SEI Investments Company or an affiliate acts as investment manager, administrator or distributor. |

| | | | | | |

| | | |

| | Causeway Concentrated Equity Fund | | | 27 | |

DISCLOSURE OF FUND EXPENSES (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees, shareholder service fees, and other Fund expenses. It is important for you to understand the impact of these costs on your investment returns.

Ongoing operating expenses are deducted from a mutual fund’s gross income and directly reduce its final investment return. These expenses are expressed as a percentage of a mutual fund’s average net assets; this percentage is known as a mutual fund’s expense ratio.

The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period (April 1, 2021 to September 30, 2021).

The table on the next page illustrates the Fund’s costs in two ways:

Actual Fund Return. This section helps you to estimate the actual expenses after fee waivers that the Fund incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return.

You can use this information, together with the actual amount you invested in the Fund, to estimate the expenses you paid over that period. Simply divide your actual account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown under “Expenses Paid During Period.”

Hypothetical 5% Return. This section helps you compare the Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual 5% return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to make this 5% calculation. You can assess the Fund’s comparative cost by comparing the hypothetical result for the Fund in the “Expenses Paid During Period” column with those that appear in the same charts in the shareholder reports for other mutual funds.

NOTE: Because the return is set at 5% for comparison purposes — NOT the Fund’s actual return — the account values shown may not apply to your specific investment.

| | | | | | |

| | | |

| 28 | | Causeway Concentrated Equity Fund | | | | |

DISCLOSURE OF FUND EXPENSES (Unaudited)

(concluded)

| | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

4/01/21 | | | Ending

Account

Value

9/30/21 | | | Annualized

Expense

Ratios | | | Expenses

Paid

During

Period* | |

Causeway Concentrated Equity Fund | | | | | | | | | | | | | | | | |

| | | | |

Actual Fund Return | | | | | | | | | | | | | | | | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,044.40 | | | | 0.86 | % | | $ | 4.41 | |

| | | | |

Hypothetical 5% Return | | | | | | | | | | | | | | | | |

| Institutional Class | | $ | 1,000.00 | | | $ | 1,020.76 | | | | 0.86 | % | | $ | 4.36 | |

| | | | |

Actual Fund Return | | | | | | | | | | | | | | | | |

Investor Class | | $ | 1,000.00 | | | $ | 1,045.40 | | | | 0.86 | % | | $ | 4.41 | |

| | | | |

Hypothetical 5% Return | | | | | | | | | | | | | | | | |

| Investor Class | | $ | 1,000.00 | | | $ | 1,020.76 | | | | 0.86 | % | | $ | 4.36 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period shown). |

| | | | | | |

| | | |

| | Causeway Concentrated Equity Fund | | | 29 | |

INVESTMENT ADVISER:

Causeway Capital Management LLC

11111 Santa Monica Boulevard

15th Floor

Los Angeles, CA 90025

DISTRIBUTOR:

SEI Investments Distribution Co.

One Freedom Valley Drive

Oaks, PA 19456

To determine if the Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. Please read the summary or full prospectus carefully before you invest or send money. To obtain additional information including charges, expenses, investment objectives, or risk factors, or to open an account, call 1.866.947.7000, or visit us online at www.causewayfunds.com.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“Commission”) for the first and third quarters of each fiscal year on Form N-PORT within sixty days after the end of the period. The Fund’s Forms N-PORT are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, will be available (i) without charge, upon request, by calling 1-866-947-7000; and (ii) on the Commission’s website at http://www. sec.gov.

CCM-AR-013-0100

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer and principal accounting officer. During the fiscal year ended September 30, 2021, there were no material changes or waivers to the code of ethics.

| Item 3. | Audit Committee Financial Expert. |

(a)(1) The registrant’s board of trustees has determined that the registrant has at least one audit committee financial expert serving on the audit committee.

(a)(2) The audit committee financial experts are Eric Sussman, Lawry Meister, John Graham and Victoria B. Rogers. Each audit committee financial expert is “independent” as that term is defined in Form N-CSR Item 3(a)(2).

| Item 4. | Principal Accountant Fees and Services. |

Aggregate fees billed to the registrant for professional services rendered by the registrant’s principal accountant for the fiscal years ended September 30, 2021 and 2020 were as follows:

| | | | |

| | | 2021 | | 2020 |

| (a) Audit Fees | | $262,580 | | $227,160 |

| (b) Audit-Related Fees | | None | | None |

| (c) Tax Fees(1) | | $61,680 | | $59,340 |

| (d) All Other Fees | | None | | $3,300 |

Note:

| | (1) | Tax fees include amounts related to tax return and excise tax calculation reviews and foreign tax reclaim services. |

(e)(1) The registrant’s audit committee has adopted a charter that requires it to pre-approve the engagement of auditors to (i) audit the registrant’s financial statements, (ii) provide other audit or non-audit services to the registrant, or (iii) provide non-audit services to the registrant’s investment adviser if the engagement relates directly to the operations and financial reporting of the registrant.

(e)(2) No services included in paragraphs (b) through (d) of this Item were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable.

(g) For the fiscal year ended September 30, 2021, the aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant and the registrant’s investment adviser were $691,495. For the fiscal year ended September 30, 2020, the aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant and the registrant’s investment adviser were $859,422.

(h) The audit committee considered whether the provision of non-audit services rendered to the registrant’s investment adviser by the registrant’s principal accountant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X was compatible with maintaining the principal accountant’s independence.

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable to open-end management investment companies.

| Item 6. | Schedule of Investments |

Schedule of Investments is included as part of the Report to Shareholders filed under Item 1 of this form.

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. |

Not applicable to open-end management investment companies.

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies |

Not applicable. Effective for closed-end management investment companies for fiscal years ending on or after December 31, 2005.

| Item 9. | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. |

Not applicable to open-end management investment companies.

| Item 10. | Submission of Matters to a Vote of Security Holders. |

There have been no material changes to the registrant’s procedures by which shareholders may recommend nominees to the registrant’s board of trustees during the period covered by the report.

| Item 11. | Controls and Procedures. |

(a) The registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant’s disclosure controls and procedures, as defined in Rule 30a-3(c) under the Act (17 CFR§270.30a-3(c)) as of a date within 90 days of the filing date of the report, are effective based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Act (17 CFR §270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Exchange Act (17 CFR §270.30a-15(b) or §240.15d-15(b)).

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act (17CFR §270.3a-3(d)) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

| Items 12. | Disclosure of Securities Lending Activities for Closed-End Management Investment Companies. |

Not applicable to open-end management investment companies.

(a)(1) Code of Ethics attached hereto.

(a)(2) Separate certifications for the principal executive officer and the principal financial officer of the registrant as required by Rule 30a-2(a) under the Investment Company Act of 1940, as amended (17 CFR §270.30a-2(a)) are filed herewith.

(b) Officer certifications as required by Rule 30a-2(b) under the Investment Company Act of 1940, as amended (17 CFR §270.30a-2(b)) also accompany this filing as an exhibit.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | |

| (Registrant) | | | | | | Causeway Capital Management Trust |

| | | |

| By | | | | | | /s/ Gracie V. Fermelia |

| | | | | | Gracie V. Fermelia, President |

Date: December 8, 2021

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | | | | | |

| By | | | | | | /s/ Gracie V. Fermelia |

| | | | | | Gracie V. Fermelia, President |

Date: December 8, 2021

| | | | | | |

| By | | | | | | /s/ Eric Olsen |

| | | | | | Eric Olsen, Treasurer |

Date: December 8, 2021