QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | |

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007 |

OR |

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number: 001-33277

SYNTA PHARMACEUTICALS CORP.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization) | | 04-3508648

(I.R.S. Employer

Identification No.) |

45 Hartwell Avenue

Lexington, Massachusetts

(Address of principal executive offices) |

|

02421

(Zip Code) |

Registrant's telephone number, including area code(781) 274-8200

Securities registered pursuant to Section 12(b) of the Exchange Act:

Title of each class

| | Name of each exchange on which registered

|

|---|

| Common Stock, $0.0001 Par Value Per Share | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý

(Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the registrant's common stock held by non-affiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate), computed by reference to the price at which the common stock was last sold on June 29, 2007, the last business day of the registrant's most recently completed second fiscal quarter, was $145,161,182.

As of March 14, 2008 the registrant had 33,873,538 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents (or parts thereof) are incorporated by reference into the following parts of this Annual Report on Form 10-K: Certain information required in Part III of this Annual Report on Form 10-K is incorporated from the registrant's Proxy Statement for the 2008 Annual Meeting of Stockholders to be held on June 11, 2008.

PART I

Item 1. BUSINESS

Overview

We are a biopharmaceutical company focused on discovering, developing, and commercializing small molecule drugs to extend and enhance the lives of patients with severe medical conditions, including cancer and chronic inflammatory diseases. We have a unique chemical compound library, an integrated discovery engine, and a diverse pipeline of clinical- and preclinical-stage drug candidates with distinct mechanisms of action and novel chemical structures. We have three drug candidates in clinical trials, one drug candidate in preclinical studies, and one program undergoing lead optimization. We discovered and developed each of our drug candidates internally using our compound library and discovery capabilities. At present, other than our lead drug candidate, elesclomol, we retain all rights to each of our drug candidates and programs, across all geographic markets and therapeutic indications. We have entered into a partnership with GlaxoSmithKline, or GSK, for the joint development and commercialization of elesclomol.

Our Lead Drug Candidate, Elesclomol (formerly, STA-4783)

Our most advanced clinical-stage drug candidate, elesclomol, is a novel, injectable, small molecule compound that triggers apoptosis, or programmed cell death, in cancer cells, which we believe has potential for the treatment of a broad range of cancer types.

In September 2006, we announced positive results for elesclomol in combination with paclitaxel, a leading chemotherapeutic agent, in a double-blind, randomized, controlled, multicenter Phase 2b clinical trial in patients with stage IV metastatic melanoma. We believe that this is the first blinded clinical trial of a drug candidate for the treatment of metastatic melanoma in 30 years to meet its primary endpoint with statistical significance. In November 2006, we received Fast Track designation from the U.S. Food and Drug Administration, or FDA, for the development of elesclomol for the treatment of metastatic melanoma. In December 2007, we received orphan drug designation for elesclomol in this indication in the United States from the FDA. Orphan drug status is designed to encourage biotechnology and pharmaceutical companies to develop drugs for rare diseases affecting fewer than 200,000 people in the United States. Assuming that elesclomol is approved by the FDA, we will be entitled to seven years of market exclusivity for elesclomol for the treatment of patients with metastatic melanoma.

Based on the results of our Phase 2b trial, we initiated a global, pivotal Phase 3 clinical trial of elesclomol in metastatic melanoma, called the SYMMETRY trial, in the third quarter of 2007. The SYMMETRY trial is being conducted under the terms of a Special Protocol Assessment, or SPA, agreed to by the FDA. The SPA process provides for a written agreement between a clinical trial sponsor and the FDA that the proposed design and planned analyses of the clinical trial is sufficient to support regulatory approval of a drug candidate, unless public health concerns unrecognized at the time of the protocol assessment become evident. The SYMMETRY trial is enrolling patients with stage IV metastatic melanoma who have not received prior chemotherapy but who may have already been treated with non-chemotherapeutic agents, such as biologics. Approximately 630 patients will be enrolled in the blinded, randomized, controlled study, which generally mirrors the design of our Phase 2b trial and will be conducted at approximately 150 centers worldwide.

As with our prior Phase 2b trial, patients enrolled in the SYMMETRY trial will be randomized to receive either elesclomol plus paclitaxel or paclitaxel alone. The dosage of each agent, the dosing schedule, and the primary endpoint—progression free survival, or PFS—are the same as in our prior Phase 2b trial. The SYMMETRY trial increases the total number of patients enrolled from the prior Phase 2b trial and includes central review of radiology scans, stratification to ensure balance between

1

treatment and control arms, and a no-crossover design for facilitating the assessment of overall survival, or OS.

Based on our current enrollment projections and event rate targets, we expect to complete enrollment and initiate the primary endpoint analysis of the SYMMETRY trial by the end of 2008. Assuming that the results of the PFS analysis are positive, we plan to submit a new drug application, or NDA, to the FDA in the first half of 2009. If actual enrollment or event rates differ from our current projections, our target dates for completing the PFS analysis and submitting the NDA will likely change.

In October 2007, we entered into a collaborative development, commercialization and license agreement with GSK for elesclomol (hereinafter referred to as the GSK Agreement), under which we are eligible to receive up to $1.01 billion in milestones and other payments, as well as share 40-50% of the profits and losses from sales in the United States and receive double-digit tiered royalties from sales outside of the United States. Under the terms of the GSK Agreement, the companies will jointly develop and commercialize elesclomol in the United States, and GSK will have exclusive responsibility for the development and commercialization of elesclomol outside the United States. Pursuant to the agreement, we received a non-refundable upfront cash payment of $80 million in November 2007. We are also eligible to receive potential pre-commercial milestone payments from GSK of up to $585 million, which include both payments for operational progress, such as trial initiation and enrollment, and payments for positive clinical and regulatory outcomes, such as regulatory approval. In addition, we are eligible to receive up to $300 million in potential commercial milestone payments from GSK based on achieving certain net sales thresholds.

�� Our Phase 2b clinical trial of elesclomol enrolled a total of 81 metastatic melanoma patients at 21 centers in the United States. This clinical trial was conducted in a double-blind, randomized, controlled fashion and compared the effects of elesclomol in combination with paclitaxel, a widely used chemotherapy, versus paclitaxel alone. The primary endpoint for assessing efficacy was PFS. PFS is calculated for each patient by measuring the time from the patient's assignment to a treatment group in the trial until a PFS event, which is the earlier of tumor progression or death. In published guidelines and actions related to clinical trials conducted by other companies, the FDA has previously indicated PFS is an acceptable endpoint for registration in metastatic melanoma and other cancer types.

In our Phase 2b trial, elesclomol plus paclitaxel demonstrated a statistically significant improvement in PFS compared to treatment with paclitaxel alone. In the intent-to-treat analysis, which includes all 81 patients, median PFS increased from 1.8 months for patients treated with paclitaxel alone to 3.7 months for patients treated with elesclomol plus paclitaxel. The percentage of patients who survived and were free of tumor progression at six months more than doubled from 15% for patients treated with paclitaxel alone to 35% for patients treated with elesclomol plus paclitaxel. The statistical significance of the improvement in PFS is described by aP-value, which measures the probability that the difference is due to chance alone. AP-value of less than 0.05 is considered statistically significant and unlikely due to chance. TheP-value in this analysis was 0.035.

In the per-protocol analysis of the trial results, which includes the 77 patients who could be evaluated for efficacy as specified in the trial protocol, median PFS increased from 1.8 months for patients treated with paclitaxel alone to 4.4 months for patients treated with elesclomol plus paclitaxel. The percentage of patients who survived and were free of tumor progression at six months more than doubled from 15% for patients treated with paclitaxel alone to 37% for patients treated with elesclomol plus paclitaxel. TheP-value in this analysis was 0.017.

A recently published meta-analysis by Korn et al. of 42 clinical trials incorporating 2,100 patients with stage IV metastatic melanoma showed a median PFS of 1.7 months and a six month PFS rate of

2

14.5%. Results for patients in the control arm of our Phase 2b trial—a median PFS of 1.8 months and a six month PFS rate of 15%—are consistent with the Korn et al. data and other historical data.

In addition to a statistically significant result for the primary endpoint, PFS, we observed a positive trend for the secondary endpoint, tumor response rate, which measures the percentage of patients who have experienced a substantial decrease in tumor size as defined by the industry standard Response Evaluation Criteria in Solid Tumors, or RECIST, criteria. Patients who received elesclomol plus paclitaxel showed a 15% tumor response rate, versus a 4% tumor response rate for patients who received paclitaxel alone. While the positive trend in the secondary endpoint for this trial was encouraging, it did not reach statistical significance. Our Phase 2b trial did not include a sufficient number of patients to detect this level of difference with statistical significance. In contrast, our Phase 3 trial will enroll a sufficient number of patients to detect this level of difference with statistical significance.

Our Phase 2b trial also included a planned analysis of OS, measuring the time from each patient's random treatment assignment until death from any cause. However, at the time that we performed this analysis, most patients were still alive and as a consequence, the results we obtained were not meaningful. After concluding the planned study, we filed a protocol amendment permitting collection of further OS data. We analyzed these data after those patients not known to have died had been followed for more than two years. The results of this further analysis demonstrated a median OS of 11.9 months for patients randomly assigned to elesclomol plus paclitaxel versus 7.8 months for patients randomly assigned to paclitaxel alone. As with the increased tumor response rate, the improvement in median OS was encouraging, but did not achieve statistical significance. Our Phase 2b trial did not have sufficient numbers of patients to detect this level of difference with statistical significance. In contrast, our Phase 3 trial has been designed to have sufficient statistical power to detect a difference from nine months to 12 months in OS.

In addition to an encouraging OS difference between the two arms of our Phase 2b trial, we believe that the 11.9 month median OS result and the one year OS rate of 49% in the patients who received elesclomol plus paclitaxel compare favorably with survival data from melanoma trials reported by others. As described in a 2006 paper by Tarhini and Agarwala, prior clinical trials in a similar patient population have shown median OS of six to nine months, and no current therapy has shown an OS benefit. The Korn et al. publication reported a median OS of 6.2 months and a one year survival rate of 25.5%.

Our Phase 2b trial included both first-line patients, those that had not received prior chemotherapy, and second-line patients, those that had received one prior chemotherapy regimen. We explored the effect on PFS in those two subgroups. While we saw a PFS benefit from treatment with elesclomol in both groups of patients, the benefit was greater in the first-line group. The second-line patient population (N=49) experienced an improvement in median PFS from 1.8 months to 2.6 months; the first-line patient population (N=32) experienced an improvement in median PFS from 1.8 months to 7.1 months. While these subset analyses are based on a smaller number of patients than the overall trial, the pronounced benefit in the first-line population did achieve statistical significance, with aP-value of 0.02. Together with our medical advisors, we decided to conduct the Phase 3 trial in the first-line patient population, which we believe is the most likely to show the greatest benefit from treatment with elesclomol.

We submitted the initial investigational new drug application, or IND, for elesclomol in September 2002. Including the patients treated in the Phase 2b metastatic melanoma clinical trial, we have treated a total of approximately 300 patients at over 50 medical centers in the United States and Canada with elesclomol. Elesclomol has been well tolerated, with toxicities of the elesclomol plus paclitaxel combination generally similar to those of paclitaxel alone, and the incidences of individual severe adverse events generally less than 10%.

3

Our Other Drug Candidates and Research Programs

Elesclomol was discovered and developed internally by our scientists, using our chemical compound library and our biology, chemistry, and pharmaceutical development capabilities. In addition to elesclomol, we have discovered and developed three other drug candidates currently in clinical or preclinical development, each of which has a distinct chemical structure, mechanism of action, and market opportunity. We also have one program in the lead optimization stage of discovery and other programs in earlier stages of discovery.

STA-9090. STA-9090 is a novel, injectable, small molecule drug candidate we are developing for the treatment of cancer. STA-9090 inhibits heat shock protein 90, or Hsp90, a chaperone protein that regulates the activity of numerous signaling proteins that trigger uncontrolled proliferation in cancer cells, in particular kinase proteins. Examples of kinase proteins include c-Kit, Bcr-Abl, Her2, EGFR, and others that are the targets of approved direct kinase inhibitors such as Gleevec, Herceptin, Tarceva, and Erbitux. We believe that inhibiting kinases indirectly, by disrupting the chaperone activities of Hsp90, provides two advantages: first, a means to simultaneously attack multiple cancer-promoting kinases; and, second, an ability to kill tumor cells with mutated kinases that have lost responsiveness to a direct kinase inhibitor. We have shown in preclinical experiments that STA-9090 is significantly more potent against certain types of cancer cells than Gleevec, as well as the two Hsp90 inhibitors furthest along in clinical development, 17-AAG and 17-DMAG. STA-9090 is further differentiated from these Hsp90 inhibitors because it is a novel chemical structure that is not a derivative or analog of the natural product geldanamycin. We believe that this creates a distinct activity profile for STA-9090 and is a competitive advantage. We are currently conducting two Phase 1 studies to identify the maximum tolerated dose of STA-9090 based on once- and twice-a-week intravenous dosing schedules, respectively. In addition to an evaluation of safety and tolerability, patients in these studies will be assessed for biological activity based on biomarker responses and clinical response rates based on the RECIST criteria. We intend to initiate a third STA-9090 Phase 1 trial in hematologic cancers in the second half of 2008.

STA-9584. STA-9584 is a novel, injectable, small molecule compound that disrupts the blood vessels that supply tumors with oxygen and essential nutrients. In preclinical experiments, STA-9584 has shown strong anti-tumor activity in a broad range of cancer models, including prostate, lung, breast, melanoma, and lymphoma. In preclinical testing, STA-9584 has been shown to act against established tumor vessels, a mechanism that is differentiated from the mechanism of anti-angiogenesis inhibitors such as Avastin, which prevents the formation of new tumor vessels. This program is currently in preclinical development.

Apilimod (STA-5326). Apilimod is a novel, orally administered, small molecule drug candidate we are developing for the treatment of autoimmune and other chronic inflammatory diseases. Apilimod inhibits the production of the cytokines interleukin-12, or IL-12, and interleukin-23, or IL-23, and thereby down-regulates the inflammation pathways that underlie certain autoimmune and inflammatory diseases. We submitted the initial IND for apilimod in March 2003. We are currently conducting a Phase 2a clinical trial of apilimod in patients with rheumatoid arthritis, or RA, and sponsoring a Phase 2a clinical trial in patients with gastrointestinal manifestations of common variable immunodeficiency, or CVID. Both the RA and CVID Phase 2a studies completed initial enrollment. Based on the data we have reviewed to date from the CVID trial and a strategic review of the apilimod program, we have decided to complete the ongoing CVID trial, but not to further pursue this indication for apilimod. The preliminary results of the first 22 patients in the RA trial showed encouraging biomarker and clinical signals suggesting activity of apilimod in this indication. We have

4

elected to enroll an additional cohort in the RA Phase 2a trial to explore a higher dose of apilimod. We expect to complete enrollment of this higher dose cohort in the second half of 2008.

CRAC ion channel inhibitor. We have developed novel, small molecule inhibitors of calcium release activated calcium, or CRAC, ion channels expressed on immune cells. The CRAC ion channel is the primary route for calcium entry into T cells and other immune cells, regulating multiple immune cell processes important for initiating and maintaining an inflammatory immune response. We have demonstrated in preclinical experiments that our CRAC ion channel inhibitors selectively inhibit the production of critical pro-inflammatory cytokines, such as interleukin-2, or IL-2, and TNFa by immune cells, and that these compounds are effective in multiple animal models of immune diseases, including models of arthritis. This program is in the lead optimization stage of discovery.

Our Drug Candidate Pipeline

The following table summarizes our most advanced drug candidates currently in clinical or preclinical development:

| | Product Candidate

| | Disease

| | Stage

| | Status

| | Worldwide

Commercial Rights

|

|---|

| Oncology | | Elesclomol (formerly STA-4783)

Oxidative stress inducer | | Metastatic melanoma | | Phase 2b | | Completed—met primary endpoint | | Synta and GSK share U.S. commercial rights

GSK has exclusive rights outside U.S. |

|

|

|

|

|

|

Phase 3 |

|

Expect to submit NDA 1H 2009 |

|

|

|

|

|

|

Additional cancers |

|

Phase 2 |

|

Expect to initiate in 2008 |

|

|

|

|

STA-9090

Hsp90 inhibitor |

|

Cancer |

|

Phase 1 |

|

Two Phase 1 trials ongoing |

|

Synta |

|

|

STA-9584

Vascular disrupting agent |

|

Cancer |

|

Preclinical development |

|

Ongoing |

|

Synta |

Inflammatory Diseases |

|

Apilimod (STA-5326) Oral IL-12/23 inhibitor |

|

Rheumatoid arthritis |

|

Phase 2a |

|

Expect to complete enrollment in 2H 2008 |

|

Synta |

|

|

Oral CRAC ion channel inhibitor |

|

Autoimmune diseases, transplant |

|

Lead optimization |

|

Ongoing |

|

Synta |

In the above table, lead optimization indicates that compounds have shown activity, selectivity, and efficacy inin vivo models, as well as an acceptable preliminary safety profile. These compounds are being optimized for potency, drug-like properties, and safety before entering into preclinical development. Preclinical development activities include manufacturing, formulation, and full toxicology studies in preparation for a Phase 1 clinical trial. Phase 1 indicates initial clinical safety testing and pharmacological profiling in healthy volunteers, with the exception that Phase 1 clinical trials in oncology are typically performed in patients with cancer. Phase 2 involves efficacy testing and continued safety testing in patients with a specific disease, and may include separate Phase 2a and Phase 2b clinical trials. Phase 2a clinical trials typically test the drug candidate in a small number of patients and are designed to provide early information on drug safety and efficacy. Phase 2b clinical trials typically involve larger numbers of patients and comparison with placebo, standard treatments, or other active comparators. Phase 3 indicates a confirmatory study of efficacy and safety in a larger patient population, and typically involves comparison with placebo, standard treatments, or other active comparators.

5

Oncology Programs

We have two clinical-stage programs and one preclinical-stage program in oncology:

- •

- Elesclomol. Our most advanced clinical-stage drug candidate, elesclomol, has achieved positive results in a double-blind, randomized, controlled, multicenter Phase 2b clinical trial in patients with stage IV metastatic melanoma. We are conducting the SYMMETRY trial, a global, pivotal Phase 3 clinical trial in metastatic melanoma, under the terms of an SPA agreement with the FDA. We have entered into a partnership with GSK to jointly develop and commercialize elesclomol.

- •

- STA-9090. STA-9090, our novel, small molecule Hsp90 inhibitor, is in two Phase 1 clinical trials.

- •

- STA-9584. STA-9584, our novel small molecule compound that disrupts the blood vessels that supply tumors with oxygen and essential nutrients, is in preclinical development.

Oncology Background

Cancers are diseases characterized by abnormal and uncontrolled cell growth and division, typically leading to tumor formation. As a tumor grows, it can directly disrupt organ function at its site of origin. In addition, cancer cells can also spread to other organs, such as the brain, bones and liver, by a process called metastasis. The growth of metastatic tumors at these new sites can disrupt the function of these other organs. There are many kinds of cancer, but all are characterized by uncontrolled growth of abnormal cells.

The World Health Organization estimates that more than 11 million people are diagnosed with cancer every year worldwide, and seven million people die from the disease annually. The American Cancer Society estimates that approximately 1.4 million people in the United States will be diagnosed with cancer in 2008, and approximately 566,000 people will die from the disease.

Anti-cancer agents are the second largest therapeutic class of pharmaceuticals in the world, with global sales of $34.6 billion in 2006.

Melanoma

Melanoma is the deadliest type of skin cancer and is the sixth most commonly diagnosed cancer in the United States. The National Cancer Institute has estimated that the prevalence of melanoma in the United States, or the number of patients alive who have been diagnosed with the disease, currently is more than 660,000. The American Cancer Society estimates that in 2008 the incidence, or number of newly diagnosed cases, of melanoma in the United States will be approximately 62,500, with 8,400 deaths from the disease. According to a December 2006 Datamonitor report, the incidence of melanoma has doubled every decade for the past 40 years, faster than any other cancer type, and is currently the fifth and sixth leading cause of global cancer mortality within males and females, respectively.

Melanoma is classified into four stages, which are based on well-defined criteria, including characteristics of the primary tumors, involvement of the regional lymph nodes, and the extent and location of metastases. When melanoma is discovered and treated in the early stages, where the cancer is confined to a local area, patients have a relatively high rate of survival. For example, stage I patients have a five-year survival rate of between 90 and 95%. Once melanoma has advanced to stage III, where the cancer has spread to the regional lymph nodes, or stage IV, where the cancer has spread to distant organs, the prognosis for patients is much worse, with five-year survival rates less than 20%. We are unaware of any reliable industry survey data specifically for the prevalence of metastatic melanoma in the United States or worldwide. Commonly used estimates assume that 5-10% of all patients diagnosed

6

have metastatic disease, which estimates the prevalence of metastatic melanoma at approximately 30,000 to 60,000 patients in the United States.

For early stage melanoma, surgical removal of the primary melanoma lesion is the standard of care. Surgical removal may also be performed to remove distant skin metastases, lymph nodes or other organs to which the cancer has spread. Sometimes interferon alpha-2b is administered to patients as an adjuvant to surgery to reduce the rate of disease relapse. This is the only drug approved by the FDA for use in such a role.

For metastatic melanoma, treatment options are limited. Single-agent chemotherapy has typically shown PFS of less than two months. Randomized trials comparing combination chemotherapy against single agent chemotherapy have shown significant toxicity with no significant improvement in survival. Dacarbazine, also known as DTIC, has been one of the most studied drugs in this setting, either alone or in combination, and is the only FDA-approved chemotherapy for the treatment of metastatic melanoma. However, when DTIC is used as a single agent, it has been shown to have limited clinical benefits. Various other single-agent chemotherapies such as temozolomide, fotemustine and oblimersen have been tested against or in combination with DTIC. Response rates from controlled studies have typically been between 6% to 25% with median time to progression/ PFS of 1.8 to 2.4 months. Immunotherapy with IL-2 has been approved by the FDA based on longer duration responses than typically observed with chemotherapy, but these responses occur only in a small subset of patients, and treatment with IL-2 is accompanied by severe toxicities. No agents other than DTIC or IL-2 have been approved by the FDA for the treatment of metastatic melanoma. Therefore, we believe there is an urgent need in metastatic melanoma for additional therapies demonstrating meaningful clinical benefit, favorable safety profiles, and broad patient applicability.

Taxanes

The class of drugs known as taxanes is the market-leading class of chemotherapeutic drugs, with over $2 billion in worldwide sales in 2005. Approved taxanes include Taxol, a formulation of paclitaxel first approved in 1992 and marketed by Bristol-Myers Squibb, which achieved peak sales of approximately $1.6 billion in 2000 before patent expiry; Taxotere (docetaxel), which is marketed by Sanofi-Aventis and had global sales of approximately 1.5 billion euros in 2006; Abraxane, a paclitaxel protein conjugate marketed by Abraxis Pharmaceutical Partners; and several generic versions of paclitaxel. Taxanes have shown efficacy across a wide range of cancer types and have been approved by the FDA for the treatment of prostate, ovarian, breast, and non-small cell lung cancers, as well as Kaposi's sarcoma. Additionally, we believe taxanes are prescribed off-label for other cancer types, including metastatic melanoma, head and neck, uterine, stomach, esophageal, and bladder. In metastatic melanoma, the response rate of single agent paclitaxel has been reported as less than 20%. A study published in 2002 inCancer Investigation showed that combining DTIC and paclitaxel for the treatment of metastatic melanoma was not superior to using either agent alone. Other anti-cancer agents that are sometimes added to taxanes in an attempt to improve efficacy include Paraplatin, a formulation of carboplatin marketed by Bristol-Myers Squibb. While in some cases the addition may increase treatment efficacy, carboplatin has been shown to add substantial toxicity. As a result, we believe there is a significant opportunity for agents that can enhance the anti-tumor effects of taxanes without adding undesirable side effects.

7

Our Lead Clinical Development Program—Elesclomol

Elesclomol is a novel, small molecule drug candidate that induces programmed cell death in a wide variety of cancer cell typesin vitro, and has demonstrated anti-cancer activity in a broad range of preclinical cancer models. We believe that the anti-cancer activity of elesclomol is due to its ability to directly increase oxidative stress, as measured by the level of reactive oxygen species, or ROS, inside cancer cells. Because cancer cells have an elevated level of oxidative stress relative to non-cancer cells, we believe that the increase in ROS induced by elesclomol causes cancer cells to exceed a breaking point that triggers tumor cell death, while causing minimal damage to normal cells. In our preclinical models, we have observed anti-cancer activity of elesclomol both as a single agent and in combination with widely used anti-cancer therapies, such as paclitaxel, docetaxel, gemcitabine, and rituximab.

We have completed six clinical trials with elesclomol in cancer patients, in which a total of approximately 300 patients have been treated at over 50 medical centers in the United States and Canada. Based on the positive results observed in our Phase 2b clinical trial in metastatic melanoma, we initiated a global, pivotal Phase 3 clinical trial in metastatic melanoma in the third quarter of 2007, the SYMMETRY trial. The protocol is being conducted under an SPA agreed to by the FDA. The SPA process may result in a written agreement between a clinical trial sponsor and the FDA that the design and planned analyses of the clinical trial will support regulatory approval, unless public health concerns unrecognized at the time of the protocol assessment become evident. However, the approval decision may be made on the basis of a number of factors, including the degree of clinical benefit, and the FDA is not obligated to approve elesclomol as a result of the SPA, even if the clinical outcome is positive.

Elesclomol has also received Fast Track designation from the FDA for the treatment of metastatic melanoma. The FDA grants Fast Track designation for drug candidates intended to treat serious or life threatening conditions and that demonstrate the potential to address unmet medical needs. Fast Track designation can facilitate the development of a drug candidate and expedite its review by allowing for more frequent and timely meetings with the FDA and submission of an NDA on a rolling basis. However, Fast Track designation does not alter the standards for approval of a drug candidate, including the need for clinical trials that demonstrate safety and efficacy, nor does it mean that the FDA will expedite approval of a drug candidate. In addition, Fast Track designation does not increase the likelihood of approval of a drug candidate.

In December 2007, we also received orphan drug designation for elesclomol for metastatic melanoma in the United States from the FDA. Orphan drug status is designed to encourage biotechnology and pharmaceutical companies to develop drugs for rare diseases affecting fewer than 200,000 people in the United States. Assuming that elesclomol is approved by the FDA, we will be entitled to seven years of market exclusivity for elesclomol for the treatment of patients with metastatic melanoma. In October 2007, we entered into a partnership with GSK for the joint development and commercialization of elesclomol.

Our Phase 2b Clinical Trial in Metastatic Melanoma

Our Phase 2b clinical trial enrolled a total of 81 metastatic melanoma patients at 21 centers in the United States. This clinical trial was conducted in a double-blind, randomized, controlled fashion and compared the effects of elesclomol in combination with paclitaxel, the most widely used taxane, versus paclitaxel alone. The primary endpoint for assessing efficacy was PFS. PFS is considered an acceptable endpoint for registration in metastatic melanoma and other cancer types, as supported by the current FDA draft guidance set forth inClinical Trial Endpoints for the Approval of Cancer Drugs and Biologics issued in April 2005, and by the EMEA guidance set forth in the draft of Appendix 1Methodological Considerations for Using Progression-Free Survival (PFS) as Primary Endpoint in Confirmatory Trials for

8

Registration issued in July 2006 to theGuideline on the Evaluation of Anti-cancer Medicinal Products in Man, which became effective in June 2006.

In September 2006, we presented the results from our Phase 2b clinical trial at the joint meeting of Perspectives in Melanoma X and the Third International Melanoma Research Congress, held in The Netherlands. Patients who received elesclomol plus paclitaxel showed a statistically significant improvement in PFS compared to those who received paclitaxel alone. Consistent with safety data for elesclomol gathered from other clinical trials, elesclomol was well tolerated in this clinical trial, with toxicities of the elesclomol plus paclitaxel combination generally similar to those of paclitaxel alone.

The primary objective of our Phase 2b clinical trial was to assess the efficacy in stage IV metastatic melanoma patients of once-weekly treatment of elesclomol plus paclitaxel versus paclitaxel alone, based on the endpoint of PFS. Secondary endpoints were objective response rate, duration of tumor responses, and studies of adverse events and laboratory abnormalities. Once-weekly treatments of elesclomol (213 mg/m2) plus paclitaxel (80 mg/m2) or paclitaxel alone (80 mg/m2) were delivered for three weeks, followed by one week with no treatment. Investigators were permitted to repeat these four-week cycles until disease progression. Tumor assessments were performed at baseline and every other cycle thereafter.

Disease progression and tumor response were defined based on industry standard RECIST criteria, which are the unified response assessment criteria agreed to by the World Health Organization, United States National Cancer Institute, and European Organisation for Research and Treatment of Cancer. RECIST defines disease progression and tumor response based on an assessment of target and non-target lesions. A 20% or greater increase in the sum of the greatest diameters in target lesions, or unequivocal progression in non-target lesions, or the appearance of a new lesion is defined as disease progression. A reduction in the sum of the diameters of at least 30% as compared to baseline is defined as a partial response, or PR. A complete disappearance of target and non-target lesions (and the normalization of any tumor markers) constitutes a complete response, or CR. Both PRs and CRs must be confirmed by repeat assessments at least four weeks after the PR or CR was first documented. A response assessment of stable disease indicates that a CR, a PR or disease progression has not occured at that timepoint. Non-progression refers to an assessment of CR, PR, or stable disease. Objective response rate is typically defined as the sum of PR and CR assessments.

In this clinical trial, we enrolled patients who had received up to one prior chemotherapy treatment. An unlimited number of prior immunotherapy treatments were also allowed, provided that a period of four weeks subsequent to the last treatment elapsed prior to trial entry. Patients with Eastern Cooperative Oncology Group, or ECOG, performance status greater than 2 were excluded, as were patients with any brain metastases. The ECOG performance status is a standard patient assessment tool used in determining the care of cancer patients. Patients with an ECOG score of 3 or 4 are significantly disabled by their disease and are often excluded from clinical trials.

Two-thirds of patients were assigned to treatment with elesclomol plus paclitaxel, with the remaining one-third of patients assigned to treatment with paclitaxel alone. We chose this 2:1 weighting ratio to contribute more productively to the safety database for elesclomol than an even randomization, while still allowing for a statistical comparison of treatment effects. Patients who progressed on paclitaxel alone were given the option to crossover to elesclomol plus paclitaxel and were then treated until further progression.

The intent-to-treat analysis, which includes all 81 randomly assigned patients, showed that patients assigned to elesclomol plus paclitaxel experienced a statistically significant increase in PFS, with a

9

P-value of 0.035. The median PFS in this analysis increased from 1.8 months for patients assigned to paclitaxel alone to 3.7 months for patients assigned to elesclomol plus paclitaxel. The percentage of patients who survived and were free of tumor progression at six months more than doubled from 15% for patients assigned to paclitaxel alone to 35% for patients assigned to elesclomol plus paclitaxel. The hazard ratio for PFS in this analysis was 0.58, indicating that patients assigned to elesclomol plus paclitaxel had a 42% reduction in the risk of disease progression or death relative to patients assigned to paclitaxel alone.

The objective response rate, counting complete and partial responses, was 15.1% for patients assigned to elesclomol plus paclitaxel versus 3.6% for patients assigned to paclitaxel alone (P-value=0.153). This result showed an encouraging trend but did not reach statistical significance. We were able to obtain complete progression data on only three of the nine patients that were responders in the trial, and as a result had insufficient data to perform an analysis on duration of response.

The table below summarizes the median PFS, the PFS at six months, the hazard ratio, and the objective response rates for the intent-to-treat population.

| |

| | Elesclomol + Paclitaxel

N=53

| | Paclitaxel alone

N=28

| | P-value(1)

| | Hazard ratio(2)

|

|---|

| Intent-to-treat | | PFS: | | | | | | 0.035 | | 0.583 |

| | analysis (N=81) | | • Median (months) | | 3.68 | | 1.84 | | | | |

| | | • At 6 months (% of patients) | | 35 | % | 15 | % | | | |

| | | Objective response rate(3) | | 15.1 | % | 3.6 | % | 0.153 | | |

- (1)

- P-value measures the probability that the difference is due to chance alone. AP-value of less than 0.05 is considered statistically significant and unlikely to be due to chance alone.

- (2)

- Hazard ratio is an estimate of comparative risk between the two treatment groups. A hazard ratio of 1 can be interpreted as no decrease in risk, while a hazard ratio of 0.58 can be thought of as a 42% reduction in risk of occurrence for the event as compared to the control group.

- (3)

- Objective response rate is defined as the sum of complete and partial tumor response rates, as assessed by RECIST.

The figure below shows the Kaplan-Meier plots of PFS in this clinical trial for the intent-to-treat population.

10

In the per-protocol analysis of the trial results, which includes the 77 patients who could be evaluated for efficacy as specified in the trial protocol, median PFS increased from 1.8 months for patients treated with paclitaxel alone to 4.4 months for patients treated with elesclomol plus paclitaxel. The percentage of patients who survived and were free of tumor progression at six months more than doubled from 15% for patients treated with paclitaxel alone to 37% for patients treated with elesclomol plus paclitaxel. TheP-value in this analysis was 0.017.

This Phase 2b trial also included a planned OS analysis, measuring the time from each patient's random treatment assignment until death from any cause. However, at the time that we performed this analysis, most patients were still alive and as a consequence, the results we obtained were not meaningful. After concluding the planned study, we filed a protocol amendment permitting collection of further OS data. We analyzed these data after those patients not known to have died had been followed for more than two years. The results of this further analysis demonstrated a median OS of 11.9 months for patients randomly assigned to elesclomol plus paclitaxel versus 7.8 months for patients randomly assigned to paclitaxel alone. As with the increased tumor response rate, the improvement in OS was encouraging, but did not achieve statistical significance. Our Phase 2b trial did not have sufficient numbers of patients to detect this level of difference with statistical significance.

As is common in Phase 2 trials focused on PFS, our Phase 2b trial used a crossover design, in which patients who were initially randomized to the paclitaxel control arm were eligible to crossover and receive elesclomol plus paclitaxel after their disease had progressed. As a result, the paclitaxel control arm of our study included both patients who eventually received elesclomol and patients who never received elesclomol. The crossover design makes it more difficult to compare in this trial OS in patients who received elesclomol with OS in patients who never received elesclomol. Therefore, we believe it is also helpful to consider survival times in studies reported in the medical literature. The 11.9 month median OS result and the one year OS rate of 49% in the patients who received elesclomol plus paclitaxel compare favorably with these historical data. As described in a 2006 paper by Tarhini and Agarwala, prior clinical trials in a similar patient population have shown median OS of six to nine months, and no current therapy has shown an OS benefit. The Korn et al. publication reported a median OS of 6.2 months and a one year survival rate of 25.5%. Our SYMMETRY Phase 3 trial does not employ a crossover design in order to provide a clear comparison of OS between the paclitaxel alone control arm and the elesclomol plus paclitaxel treatment arm.

Elesclomol was well tolerated in this clinical trial. As shown in the table below, the incidence of any specific high severity adverse event, as reported by investigators, was less than 10%. We believe this compares favorably with treatments for metastatic melanoma such as the CVD regimen (cisplatin, vinblastine, and DTIC) or the Dartmouth regimen (DTIC, cisplatin, carmustine, and tamoxifen) that have reported substantially greater incidences of high severity adverse events. The incidence of such events that occurred in 2% or more of the patients treated with elesclomol plus paclitaxel was as follows:

Grade 3 or Higher Adverse Events(1)(2)

| | Elesclomol + Paclitaxel (N=52)

| | Paclitaxel (N=28)

| |

|---|

| Neutropenia(3) | | 4(7.7 | %) | 0(0 | %) |

| Back pain | | 2(3.8 | %) | 2(7.1 | %) |

| Fatigue | | 2(3.8 | %) | 2(7.1 | %) |

| Neuropathy(4) | | 2(3.8 | %) | 1(3.6 | %) |

- (1)

- As specified in the clinical trial protocol, the patient population for evaluating safety includes only those patients who received at least one treatment with elesclomol plus paclitaxel or paclitaxel alone. This represents 80 of the total 81 patients enrolled in the trial.

11

- (2)

- Grade refers to the National Cancer Institute's Common Terminology Criteria, or CTC, for adverse events. The CTC are commonly used in cancer clinical trials and are based on a 5-point severity scale with the following classifications: mild=1, moderate=2, severe=3, life-threatening=4, and fatal=5.

- (3)

- Neutropenia is an abnormal decrease in a type of white blood cells.

- (4)

- Neuropathy is abnormal or diminished nerve sensation.

The adverse events seen across all severity grades in this clinical trial were typical of those expected from paclitaxel alone. The most common adverse events seen in the elesclomol plus paclitaxel group included fatigue, alopecia, constipation, nausea, hypoaesthesia, arthralgia, insomnia, diarrhea, and anemia.

Our Phase 2b trial included both patients who had received no prior chemotheraphy and patients who had received one prior regimen of chemotherapy, in order to help assess which group might benefit the most and help us design future clinical trials. In the analysis of these groups, we used the same definition for what type of treatment constitutes prior chemotherapy as is now being used in our Phase 3 trial. This definition was agreed to with the FDA in our SPA process. Although the prior chemotherapy subset analysis was performed post hoc and relies upon a relatively small number of patients, and must therefore be interpreted cautiously, we saw an especially pronounced benefit from treatment with elesclomol in the group that had not received any prior chemotherapy, also called the first-line or chemotherapy-naïve group. The median PFS more than tripled for first-line patients randomly assigned to elesclomol plus paclitaxel (N=24; 7.1 months) versus first-line patients randomly assigned to paclitaxel alone (N=8; 1.8 months). The hazard ratio describing the difference in PFS between the two groups was 0.315, denoting a 68.5% reduction in the risk of disease progression or death for first-line patients randomly assigned to elesclomol plus paclitaxel relative to first-line patients randomly assigned to paclitaxel alone. This difference had aP-value of .019. Based on the encouraging results for the first-line patient group, we have designed the SYMMETRY Phase 3 trial to enroll only first-line, chemotherapy-naïve metastatic melanoma patients.

The results are illustrated in the table below.

Prior chemotherapy treatment

| |

| | Elesclomol + Paclitaxel

| | Paclitaxel alone

|

|---|

None

(N=32) | | Median PFS | | 7.1 months | | 1.8 months |

| | | Median OS | | 15.9 months | | 10.0 months |

| | | Objective response rate | | 21%(5/24) | | 0%(0/8) |

One

(N=49) |

|

Median PFS |

|

2.8 months |

|

1.8 months |

| | | Median OS | | 9.0 months | | 7.8 months |

| | | Objective response rate | | 10%(3/29) | | 5%(1/20) |

We also observed that the results for treatment with paclitaxel alone in patients who have received no prior chemotherapy are comparable to results previously reported for patients treated with DTIC alone who had received no prior chemotherapy. For example, in a 771-patient, randomized clinical trial comparing treatment with DTIC versus DTIC plus oblimersen in patients with no prior chemotherapy, which was published in theJournal of Clinical Oncology in October 2006, the median PFS in patients who were treated with DTIC alone was 1.6 months.

12

Results From the Lead-in, Phase 2a Stage of the Trial

This clinical trial employed a two-stage, lead-in design, with an open-label, single-arm Phase 2a stage prior to the commencement of the blinded, randomized, controlled Phase 2b stage. The objective of the Phase 2a stage was to evaluate the safety of elesclomol plus paclitaxel, determine the recommended dose level, and to assess whether it demonstrated sufficient activity to warrant further study. A total of 31 patients were enrolled in this stage, of which 28 were treated at what was determined to be the elesclomol recommended dose level (213 mg/m2). Of these 28 patients, four achieved an objective response as assessed by RECIST, and an additional 11 achieved stable disease, for a total non-progression rate of 15 out of 28 (54%). This met the pre-specified efficacy criteria, supporting the decision to proceed with enrolling the 81 additional patients for the Phase 2b stage of the trial. The addition of elesclomol to paclitaxel was well tolerated on the weekly schedule. Median PFS was 5.2 months and median OS was 13.4 months in the 28 patients that received the 213 mg/m2 dose level.

Our Phase 3 SYMMETRY Trial

Based on the results of our Phase 2b trial, in the third quarter of 2007, we initiated a global, pivotal Phase 3 clinical trial of elesclomol in first-line, stage IV melanoma patients called the SYMMETRY trial. The SYMMETRY trial is being conducted under the terms of an SPA agreement with the FDA. The SPA process may result in a written agreement between a clinical trial sponsor and the FDA that the design and planned analyses of the clinical trial is sufficient to support regulatory approval. The agreement is binding on the FDA unless public health concerns that were not recognized at the time of the protocol assessment become evident. However, the FDA is not obligated to approve elesclomol as a result of the SPA, even if the clinical outcome is positive. The SYMMETRY trial is enrolling patients with stage IV metastatic melanoma who have not received prior chemotherapy but who may have already been treated with non-chemotherapeutic agents such as biologics. Approximately 630 patients will be enrolled in the blinded, randomized, controlled study, which will be conducted at approximately 150 centers worldwide. Patients will be randomized (1:1) to elesclomol (213 mg/m2) plus paclitaxel (80 mg/m2) or paclitaxel alone (80 mg/m2) and will receive three weekly treatments and one week without treatment per each four week cycle. If tolerated, treatment will continue until disease progression. Patients will be stratified according to lactate dehydrogenase, or LDH, levels (elevated or normal), M-grade status (Mla/b or Mlc), prior treatment history (zero or one prior regimen with biologics or other non-chemotherapies), and reason for discontinuation of prior treatment (disease progression or other). LDH is an enzyme that is normally present throughout the body, but blood levels of LDH become elevated when tissue damage occurs. Elevated LDH levels in melanoma patients are associated with a poorer disease prognosis and a decreased survival rate compared to normal LDH levels. Similarly, M-grade status is a measure of spread of disease and is considered to be a prognostic factor for OS in melanoma. By stratifying patients for these prognostic factors in addition to prior treatment history and reason for discontinuation, the Phase 3 trial design seeks to evenly balance patients with similar disease status across the treatment and control arms of the trial. Responses will be assessed using industry standard RECIST criteria at baseline and at a minimum every other cycle, with radiology scans being assessed by independent, blinded reviewers at a central site.

The control arm treatment, the combination arm treatment, the doses, the schedule, and the primary endpoint—PFS—are the same as in the Phase 2b trial. This trial increases the total number of patients enrolled from the prior trial and includes central review of radiology scans, stratification to ensure balance between treatment arms, and a no-crossover design for facilitating the assessment of OS. In addition, the SYMMETRY Phase 3 clinical trial is only enrolling patients who have not received prior chemotherapy, while the prior Phase 2b trial enrolled both chemotherapy-naïve patients as well as patients who received one prior treatment with chemotherapy.

13

There are two planned analyses for PFS, which is the primary endpoint of the SYMMETRY Phase 3 trial:

- •

- An interim analysis to assess safety and non-futility will be conducted by an independent Data Monitoring Committee.

- •

- The final analysis for PFS will be conducted after two criteria have been satisfied: a prespecified minimum number of PFS events, approximately 160 events, has occurred and full trial enrollment has been completed. At the time of the final analysis for PFS, a first interim analysis will also be performed for OS, a secondary endpoint.

Following the PFS analyses, two additional analyses for OS are planned in the SYMMETRY trial: a second interim analysis and a final OS analysis.

The SYMMETRY trial has been designed with at least 90% power to detect a statistically significant improvement in PFS, as well as 80% power to detect a difference in OS. Projections and powering assumptions are based on detecting an improvement of three to five months in PFS (hazard ratio 0.60), and nine to 12 months in OS (hazard ratio 0.75), respectively. These limits correspond to a minimum of approximately 160 PFS events and 390 OS events. Secondary endpoints in addition to OS include response rate, clinical benefit rate (defined as complete response, partial response, or stable disease at 24 weeks), and duration of response.

Additional Clinical Trial Results

We completed a Phase 1 clinical trial of elesclomol in combination with paclitaxel in October 2004. This clinical trial, which enrolled 35 patients, was designed to assess the safety, pharmacokinetics, and efficacy of elesclomol with paclitaxel in a broad cancer patient population. The combination of elesclomol plus paclitaxel was well tolerated, with minimal toxicity attributed to elesclomol at all doses tested. Partial response or stable disease was observed in several cancer types, including melanoma, ovarian, Kaposi's sarcoma, angiosarcoma, parotid gland adenocarcinoma, colorectal, pancreatic and paraganglioma. In some patients, these cancers had previously progressed to more advanced stages during treatment with paclitaxel alone.

Based on the promising signs of activity and safety results we observed in our Phase 1 clinical trial, we initiated Phase 2 clinical trials in malignant melanoma, soft tissue sarcoma, and non-small cell lung cancer. Together these trials have enrolled approximately 300 patients at over 50 medical centers throughout the United States and Canada. These trials were designed to assess response rates, non-progression rates, and PFS, and to further expand the safety database for elesclomol.

We completed a Phase 2 clinical trial of elesclomol in 84 patients with soft tissue sarcoma in 2005, the results of which were inconclusive. We designed this two-stage Phase 2 clinical trial to assess activity based on response rate and non-progression rate, or NPR. This clinical trial utilized a single-arm design. All patients received weekly treatments of the combination of paclitaxel (80 mg/m2) and elesclomol (213 mg/m2) for three weeks, followed by one week off-treatment. These four-week cycles were repeated until the earlier of disease progression, or a minimum of four months. We enrolled patients with soft tissue sarcoma who had failed at least one prior chemotherapy treatment. In the first stage, 30 eligible patients were evaluated for objective response or disease stabilization after three months and met the predefined criteria for expansion of enrollment. Upon completion of the trial, the Kaplan-Meier estimate of NPR at three months was 35%, with a 95% confidence interval of between 24.3% and 45.8%. A recent publication by Van Glabbeke et al. proposed a criterion of NPR at three months >=40% to suggest drug activity in this indication. Given that the observed confidence interval includes 40%, this result did not definitively establish evidence of clinical activity or lack thereof. The observed safety profile of elesclomol plus paclitaxel was acceptable. Pending the results of our SYMMETRY Phase 3 trial of elesclomol in malignant melanoma and further investigation of different

14

drug combinations, we may consider future development of elesclomol in sarcoma, based on a different elesclomol dose, dosing schedule or drug combination regimen.

We completed a Phase 2 clinical trial of elesclomol in 103 patients with non-small cell lung cancer in 2005. We designed this two-stage trial to compare the effect of a standard first-line lung cancer combination therapy, paclitaxel and carboplatin, with the effect of this same combination therapy plus elesclomol. Patients included in this study were diagnosed with either stage IIIb or stage IV non-small cell lung cancer and had not received prior chemotherapy. The objective of the first stage, open-label portion was to determine the recommended dose for the second stage. In the second stage, patients were randomly assigned either to receive elesclomol plus paclitaxel and carboplatin, or to receive paclitaxel and carboplatin alone. Patients received one treatment of paclitaxel and carboplatin, with or without elesclomol, every three weeks. These three-week cycles were repeated until the earlier of disease progression or completion of six cycles. Efficacy was assessed using RECIST, and the primary endpoint in this clinical trial was time-to-progression. No improvement was observed in time-to-progression between elesclomol plus paclitaxel plus carboplatin, compared to paclitaxel plus carboplatin. In comparison to patients in our Phase 2b metastatic melanoma trial, patients in this clinical trial received both a less frequent dose of elesclomol (once every three weeks compared to once a week for three weeks), and a lower total dose of elesclomol during each monthly cycle (266 mg/m2 compared to 639 mg/m2). Pending the results of our SYMMETRY Phase 3 trial of elesclomol in malignant melanoma and further investigation of different drug combinations, we may consider future development of elesclomol in non-small cell lung cancer, based on a different elesclomol dose, dosing schedule or combination regimen.

Safety Results from all Clinical Trials to Date with Elesclomol

In order to assess the safety profile of elesclomol based on all of the clinical trials completed to date, we collected and integrated the adverse event data for all 352 subjects who participated in the six clinical trials conducted with elesclomol, including the Phase 2b melanoma trial.

Of the 352 subjects in these trials, 298 received the elesclomol plus paclitaxel combination. Of these 298 subjects, 239 received elesclomol in combination with paclitaxel, and 59 received elesclomol in combination with paclitaxel and carboplatin. All participating subjects suffered from solid tumor cancers.

The following table presents the most recent findings of grade 3 or higher adverse events across all clinical trials that were reported in³3% of subjects in the elesclomol plus paclitaxel treatment group.

Grade 3 or Higher Adverse Events

| | Elesclomol plus Paclitaxel

(N = 239)(1)

| | Paclitaxel Alone (N = 30)(2)

|

|---|

| Neutropenia | | 15 (6%) | | 0 |

| Anemia | | 8 (3%) | | 1 (3%) |

| DVT | | 8 (3%) | | 1 (3%) |

| Fatigue | | 8 (3%) | | 2 (7%) |

| Hyperglycemia | | 8 (3%) | | 1 (3%) |

| Dyspnea | | 7 (3%) | | 1 (3%) |

| Hypophosphatemia | | 7 (3%) | | 1 (3%) |

| Leukopenia | | 6 (3%) | | 0 |

| Extremity Pain | | 6 (3%) | | 0 |

- (1)

- Of the 239 patients, 224 received the same or higher dose of elesclomol plus paclitaxel as we used in the Phase 2b melanoma trial. Of these 224 patients, 201 patients were on the same once per

15

week schedule as in the Phase 2b melanoma trial and 23 patients were on a once every three week schedule.

- (2)

- Includes the 28 patients in the control arm of the Phase 2b melanoma trial.

Consistent with the results observed in our melanoma Phase 2b trial, there was a small increase in observations of neutropenia: 6% of elesclomol plus paclitaxel subjects versus 0% of the paclitaxel alone subjects. Frequencies of other grade 3 or higher adverse events were similar for the two treatment groups, and in some cases, occurred at slightly lower frequencies in the elesclomol plus paclitaxel group. In addition, we did not observe any clinically relevant trends in any of the other hematology, serum chemistry, or urinalysis testing on these patients.

Frequencies of adverse events of all grades of severity were comparable between the two groups. Types of adverse events that were reported as occurring in at least 20% of subjects who received elesclomol plus paclitaxel were as follows, for the combination and for paclitaxel alone, respectively: asthenic conditions (54% versus 53%), nausea and vomiting symptoms (44% versus 53%), alopecias (44% versus 53%), musculoskeletal and connective tissue signs and symptoms (36% versus 43%), edema (27% versus 20%), gastrointestinal atonic and hypomotility disorders (24% versus 30%), non-infective diarrhea (23% versus 17%), peripheral neuropathies (23% versus 23%), anemias (21% versus 20%), appetite disorders (21% versus 20%), joint related signs and symptoms (21% versus 10%), and coughing and associated symptoms (21% versus 27%). Asthenic conditions generally refers to lack of strength or weakness throughout or in a particular area of the body. Edema is swelling caused by fluid accumulation in bodily tissues. Gastrointestinal atonic and hypomotility disorders generally refer to muscle weakness and decreased movement, respectively, in the gastrointestinal tract. Anemia is the abnormal reduction in red blood cells.

We believe the integrated analysis of adverse event data from all 239 subjects who received the elesclomol plus paclitaxel combination shows that elesclomol plus paclitaxel was well tolerated and that the adverse events and laboratory results were similar to those expected for paclitaxel alone.

Elesclomol Mechanism of Action

Elesclomol is a novel, injectable small molecule that we believe rapidly and potently induces the generation of ROS in cancer cells, increasing the level of oxidative stress in cancer cell and ultimately leading to cancer cell death by apoptosis (programmed cell death).

ROS is a collective term used to describe chemical species that are produced as byproducts of normal oxygen metabolism and include superoxide, hydrogen peroxide, and the hydroxyl radical. In normal cells, ROS are produced at low levels and are effectively neutralized by the cells' antioxidant system. In contrast, cancer cells produce elevated levels of ROS due to their increased metabolic activity, resulting in oxidative stress. Sustained levels of ROS that exceed the cells' antioxidant capacity can readily induce cell death by apoptosis. We believe that oxidative stress is one of the most fundamental differences between cancer cells and normal cells, and that this difference causes cancer cells to be particularly vulnerable to agents that can selectively elevate ROS.

We believe the evidence that the primary mechanism of action of elesclomol is through induction of ROS is strong. This evidence includes:

- •

- Gene transcript profiles of cancer cells before versus after application of elesclomol show the characteristic signatures of an immediate, potent oxidative stress response. This response includes the rapid induction of heat shock protein genes such as heat shock protein 70, or Hsp70, metallothioneins, antioxidants, and other stress response genes.

- •

- Direct cellular measurements of specific ROS agents, such as hydrogen peroxide, show strong time-dependent and dose-dependent induction by elesclomol.

- •

- The effects of elesclomol are eliminated by applying antioxidants known to reduce ROS, or inhibitors that block the generation of ROS.

16

Once ROS levels in cancer cells exceed the breaking point, cell death occurs through apoptosis from the intrinsic mitochondrial pathway. Apoptotic cell death through the mitochondrial pathway involves the oxidation of cardiolipin, release of cytochrome c from the mitochondria, and activation of the caspase cascade. By increasing ROS and activating the intrinsic mitochondrial apoptosis pathway, we believe that in addition to inducing apoptosis as a single agent, elesclomol can enhance the anti-cancer activity of other chemotherapeutic agents that act through the same pathway. We have shown in preclinicalin vivo models that elesclomol significantly enhanced the anti-tumor activity of paclitaxel, rituximab, and gemcitabine, while adding minimal additional toxicity. These results have been demonstrated in a variety of animal models of cancer, including breast, lung, lymphoma, colorectal, cervical carcinoma and melanoma.

Our preclinical safety studies showed that the addition of elesclomol added little or no toxicity to that seen with paclitaxel alone, and that elesclomol has a relatively high therapeutic index, or margin between effective dose and toxic dose. We believe that the favorable safety profile that has been observed preclinically and clinically with elesclomol is due to the pronounced difference between cancer cells and normal cells in their respective ability to recover from such an increase in oxidative stress.

Elevated oxidative stress is one of the most fundamental features that differentiates cancer cells from normal cells. By taking advantage of this fundamental difference, we believe elesclomol offers the potential for a novel anti-cancer approach that is broadly effective across cancer types in conjunction with ROS-sensitive chemotherapeutics such as paclitaxel, while maintaining an attractive safety profile.

Additional Cancer Types for Future Clinical Development

Based on the activity seen in a broad range of tumor models in preclinical experiments, and our understanding of the mechanism of action, which is not specific to melanoma, we believe that elesclomol has the potential to treat many forms of cancer. We prioritize our clinical development plans based on a number of criteria, including scientific rationale and degree of unmet medical need. Based on these criteria, we believe there are several attractive opportunities for the further clinical development of elesclomol, including:

- •

- Cancers having elevated levels of ROS. We believe that cancer types having elevated levels of oxidative stress may be particularly susceptible to the increase in ROS caused by treatment with elesclomol. In addition to melanoma, other solid tumor cancer types known to have high levels of oxidative stress include breast, prostate, ovarian, and pancreatic. Hematologic cancers, such as leukemias, are also known to have elevated levels of ROS, and may represent attractive potential development opportunities.

- •

- Cancers in which we have observed signs of activity of elesclomol in our Phase 1 clinical trial. In our Phase 1 clinical trial, partial response or disease stabilization was observed in several cancer types, including melanoma, ovarian, Kaposi's sarcoma, angiosarcoma, parotid gland adenocarcinoma, colorectal, pancreatic and paraganglioma. In particular, one patient with a history of recurrent ovarian cancer had a documented partial response to treatment with elesclomol plus paclitaxel after having failed multiple prior chemotherapeutic regimens. This patient received a special protocol exception from the FDA in order to continue on elesclomol plus paclitaxel beyond the end of the clinical trial and received a total of eight cycles of treatment. We believe that these cancer types may warrant further exploration.

- •

- Adjuvant treatment of earlier-stage melanoma. Adjuvant therapy with interferon alfa-2b, an immunotherapy marketed as Intron A by Schering-Plough, is FDA-approved for use following surgical removal of melanoma to reduce the likelihood of disease recurrence. We believe the safety profile, the results from our Phase 2b trial in malignant melanoma, and the mechanism of action of elesclomol suggest exploring usage of elesclomol in earlier-stage melanoma patients.

17

We are evaluating these opportunities with our partner, GSK, and expect to announce plans to initiate Phase 2 clinical trials in one or more of these indications in 2008.

New Formulations

To date, except for a human bridging study utilizing the salt form of elesclomol, all of our clinical trials have been conducted using the first formulation of elesclomol that we developed, a free acid form. We intend to continue to use this formulation in our SYMMETRY Phase 3 clinical trial of elesclomol for metastatic melanoma, as well as for our initial commercial product if elesclomol is approved. The free acid form of elesclomol is a powder that is dissolved in the paclitaxel-Cremophor solution, diluted in a saline infusion bag and co-administered via the same infusion line. In order to use the free acid form of elesclomol with other oncology products, including taxanes other than paclitaxel, it must be dissolved in an organic solvent, such as Cremophor, that may cause additional toxicities due to the presence of the organic solvent.

We have developed a second, water-soluble form of elesclomol, a sodium salt formulation, that does not require dissolving with an organic solvent such as Cremophor. This sodium salt formulation may be more easily used with other taxanes and other oncology products that are formulated differently than paclitaxel, or potentially used as a single agent without need for an organic solvent. In 2005, we conducted a human bridging study using this salt form and observed pharmacokinetic equivalence between the salt and free acid forms of elesclomol. We intend to explore the use of this new salt form of elesclomol in future clinical trials both as a single agent, and in combination with other anti-cancer agents. We expect to begin clinical trials with this new salt form in the second half of 2008.

Other Oncology Programs

STA-9090 and Our Hsp90 Inhibitor Program

We are using our internal chemistry and drug optimization expertise in the area of heat shock proteins to develop novel synthetic small molecule inhibitors of Hsp90 for the treatment of cancer. STA-9090 is a novel chemical entity that selectively inhibits the activity of Hsp90. This program is currently in Phase 1 clinical development, with two Phase 1 trials ongoing to explore once- and twice-a-week dosing regimens, respectively. We intend to initiate a third STA-9090 Phase 1 trial in hematologic cancers in the second half of 2008.

Hsp90 is a chaperone protein that regulates the folding, stability, and function of numerous signaling proteins that trigger uncontrolled proliferation in cancer cells. Many of the proteins that require Hsp90 for their folding and activity are kinases that regulate tumor survival, proliferation, and angiogenesis. These include well-recognized cancer targets such as Bcr-Abl, Her2, EGFR, c-Kit, c-Met, Flt3, and BRAF, which are the targets of approved anti-cancer drugs such as Gleevec, Herceptin, Tarceva, and Erbitux, all of which are direct inhibitors of these kinase proteins. We believe that inhibiting kinases indirectly, by disrupting the chaperone activities of Hsp90, provides two advantages: first, a means to simultaneously attack multiple cancer-promoting kinases; and, second, an ability to kill tumor cells with mutated kinases that have lost responsiveness to direct kinase inhibitors. Furthermore, because cancer cells have far greater levels of active Hsp90 than normal cells, we believe that inhibitors of Hsp90 may selectively halt proliferation of tumor cells and thereby cause cancer cell death.

A number of companies have programs targeting inhibition of Hsp90 for the treatment of various forms of cancer. Based on results from experiments we conducted in both cell models and preclinical animal models, we believe that our lead compound, STA-9090, displays substantially higher potency than competing Hsp90 inhibitors in development. In addition to the higher potency of STA-9090 in certain cancer types, these experiments also demonstrated that STA-9090 may be active against cancer cell types for which other Hsp90 inhibitors have not shown activity. We believe these findings suggest a potential competitive advantage for STA-9090 in treating those cancers.

18

To our knowledge, the Hsp90 inhibitors that are furthest along in clinical development are 17-AAG, or tanespimycin, and 17-DMAG, or alvespimycin. These compounds are being developed by Kosan Biosciences for several cancer types including multiple myeloma, breast cancer, and melanoma. Recently, Kosan announced that it plans to discontinue development of alvespimycin in favor of tanespimycin. Both of these compounds are derivatives of the natural product, geldanamycin, and have been observed to have certain serious side effects, including liver toxicities. In contrast, STA-9090 is a novel small molecule compound that is not a geldanamycin derivative or analog. In addition, while 17-AAG and 17-DMAG have complex routes of synthesis, STA-9090 has a relatively simple route of synthesis.

In the figures below we illustrate what we believe are the two key potential advantages of our Hsp90 inhibitor, STA-9090: improved potency and the activity against cancers that have developed resistance to kinase inhibitors.

Improved potency. One of the several kinases that we have observed in preclinical testing to be more sensitive to STA-9090 than to other Hsp90 inhibitors is c-Kit. c-Kit plays a critical role in several cancer types including gastrointestinal stromal tumors, or GIST, acute myelogenous leukemia, or AML, and mastocytomas. The c-Kit gene is often mutated in cancers and can drive uncontrolled cancer cell proliferation. Inhibition of Hsp90 leads to the degradation and loss of c-Kit. In preclinical testing we have found that STA-9090 is more effective in causing the loss of c-Kit relative to other Hsp90 inhibitors such as 17-AAG and 17-DMAG. This loss of c-Kit leads to the death of those cancer types that depend upon c-Kit for their growth and survival. The figure below shows the result of anin vitro experiment we conducted comparing the activity of STA-9090 against human AML tumor cells with the two leading Hsp90 inhibitors, 17-AAG and 17-DMAG, and with the Bcr-Abl and c-Kit kinase inhibitor Gleevec. This figure shows that STA-9090 was 25-fold to 170-fold more effective in tumor cell killing than these other agents in this experiment, as measured by the IC50 (the dose that killed 50% of tumor cells).

Activity against cancers that develop resistance to kinase inhibitors. In patients who are treated for cancers with kinase inhibitors such as Gleevec, an initial period of responding to treatment can be followed by a relapse, in which the disease rapidly worsens and no longer responds to further treatment with that kinase inhibitor. This relapse is believed to be due to the appearance of new mutations in the target kinase. In contrast to direct kinase inhibitors, STA-9090 is an indirect kinase inhibitor that acts

19

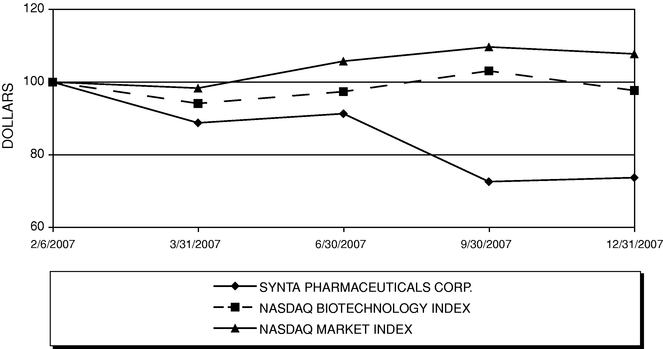

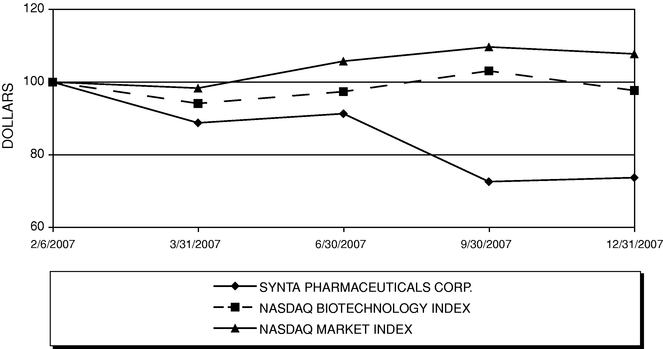

by inhibiting Hsp90 rather than the kinases themselves. STA-9090 therefore has the potential to be effective in inhibiting both the original and the mutant kinases. The figure below illustrates this point. In anin vitro experiment, a tumor cell line with a Gleevec-resistant mutation in c-Kit is no longer killed by Gleevec. In contrast, STA-9090 demonstrates potent killing of these cells. This figure also shows that STA-9090 is substantially more potent than the competing Hsp90 inhibitors, 17-AAG or 17-DMAG, in this model, as with the previous model.