|

Exhibit 99.1

|

ALLERGAN THERAPEUTICS TO ACQUIRE AND ACQUIRES TOBIRA AKARNA THERAPEUTICS

ALLERGAN PHARMACEUTICALS TO ACQUIRE VITAE

Taking a Leading R&D Position in

NASH and Expanding Global Dermatology Pipeline

ALLERGAN CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This presentation contains “forward-looking statements” relating to the acquisitions of Tobira Therapeutics, Inc. (“Tobira”), Vitae

Pharmaceuticals, Inc. (“Vitae”) and Akarna Therapeutics, Ltd (“Akarna”) by Allergan. Such forward-looking statements include statements about the ability of the parties to the Tobira merger agreement to complete the transactions contemplated thereby and the ability of the parties to the Vitae merger agreement to complete the transactions contemplated thereby, including the parties’ ability to satisfy the conditions to the consummation of the offers and the other conditions set forth in the respective merger agreement and the possibility of any termination of such merger agreement. Such forward-looking statements are based upon current expectations that involve risks, changes in circumstances, assumptions and uncertainties. Actual results may differ materially from current expectations because of risks associated with uncertainties as to the timing of the offers and the subsequent mergers; uncertainties as to how many of Tobira’s or Vitae’s stockholders will tender their shares in the applicable offer; the risk that competing offers or acquisition proposals will be made; the possibility that various conditions to the consummation of the offers or the mergers may not be satisfied or waived; the effects of disruption from th e transactions contemplated by the merger agreements on Tobira’s or Vitae’s businesses and the fact that the announcement and pendency of the transactions may make it more difficult to establish or maintain relationships with employees, suppliers and other business p artners; the risk that stockholder litigation in connection with the offers or the mergers may result in significant costs of defense, indemnification and liability; other uncertainties pertaining to the business of Tobira or Vitae, including those set forth in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Tobira’s and Vitae’s Annual Reports on Form 10-K for the year ended December 31, 2015 and Quarterly Reports on Form 10-Q for the quarter ended June 30, 2016, which are on file with the

Securities and Exchange Commission and available on the Securities and Exchange Commission’s website at www.sec.gov. In addition to the risks described above and, with respect to Tobira and Vitae, in Tobira’s or Vitae’s other filings with the Securities and Exchange

Commission, other unknown or unpredictable factors could also affect Tobira’s, Vitae’s and Akarna’s results. No forward-looking statements can be guaranteed and actual results may differ materially from such statements. The information contained in this presentation is provided only as of the date of this report, and none of Allergan, Vitae, Tobira or Akarna undertake any obligation to update any forward-looking statements either contained in or incorporated by reference into this report on account of new information, future events, or otherwise, except as required by law.

2

NOTICE TO TOBIRA INVESTORS

The tender offer for the outstanding common stock of Tobira referred to in this communication has not yet commenced. The description contained in this communication is neither an offer to purchase nor a solicitation of an offer to sell any securities. The so licitation and the offer to buy shares of Tobira common stock will be made pursuant to an offer to purchase and related materials that Allergan intends to file with the Securities and Exchange Commission. At the time the offer is commenced, Allergan will file a tender offer statement on Schedule TO with the Securities and Exchange Commission, and thereafter Tobira will file a solicitation/recommendation statement on Schedule 14D-9 with respect to the offer. The tender offer statement (including an offer to purchase, a related letter of transmittal and other offer documents) and the solicitation/recommendation statement will contain important information that should be read carefully and considered before any decision is made with respect to the tender offer. Additionally, Tobira and Allergan will file other relevant materials in connection with the proposed acquisition of Tobira by Allergan pursuant to the terms of the merger agreement. These materials will be sent free of charge to all stockholders of Tobira when available. In addition, all of these materials (and all other materials filed by Tobira with the Securities and Exchange Commission) will be available at no charge from the Securities and Exchange Commission through its we bsite at www.sec.gov. Free copies of the offer to purchase, the related letter of transmittal and certain other offering documents will be made available by Allergan and when available may be obtained by directing a request to Allergan’s Investor Relations Department at (862) 261-7488. Investors and security holders may also obtain free copies of the documents filed with the Securities and Exchange Commission by Tobira by contacting Tobira Investor Relations at (215) 461-2000.

INVESTORS AND SHAREHOLDERS OF TOBIRA ARE ADVISED TO READ THE SCHEDULE TO AND THE SCHEDULE 14D-9, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE

SECURITIES AND EXCHANGE COMMISSION WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER OR MERGER, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES THERETO.

3

NOTICE TO VITAE INVESTORS

The tender offer for the outstanding common stock of Vitae referred to in this communication has not yet commenced. The description contained in this communication is neither an offer to purchase nor a solicitation of an offer to sell any securities. The so licitation and the offer to buy shares of Vitae common stock will be made pursuant to an offer to purchase and related materials that Allergan intends to file with the Securities and Exchange Commission. At the time the offer is commenced, Allergan will file a tender offer statement on Schedule TO with the Securities and Exchange Commission, and thereafter Vitae will file a solicitation/recommendation statement on Sch edule 14D-9 with respect to the offer. The tender offer statement (including an offer to purchase, a related letter of transmittal and other offer documents) and the solicitation/recommendation statement will contain important information that should be read carefully and considered before any decision is made with respect to the tender offer. Additionally, Vitae and Allergan will file other relevant materials in connection with the proposed acquisition of Vitae by Allergan pursuant to the terms of the merger agreement. These materials will be sent free of charge to all stockholders of Vitae when available. In addition, all of these materials (and all other materials filed by Vitae with the Se curities and Exchange Commission) will be available at no charge from the Securities and Exchange Commission through its website at www.se c.gov.

Free copies of the offer to purchase, the related letter of transmittal and certain other offering documents will be made available by Allergan and when available may be obtained by directing a request to Allergan’s Investor Relations Department at (862) 261-7488. Investors and security holders may also obtain free copies of the documents filed with the Securities and Exchange Commission by Vitae by contacting Vitae Investor Relations at (215) 461-2000.

INVESTORS AND SHAREHOLDERS OF VITAE ARE ADVISED TO READ THE SCHEDULE TO AND THE SCHEDULE 14D-9, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER OR MERGER, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

PROPOSED TRANSACTION AND THE PARTIES THERETO.

4

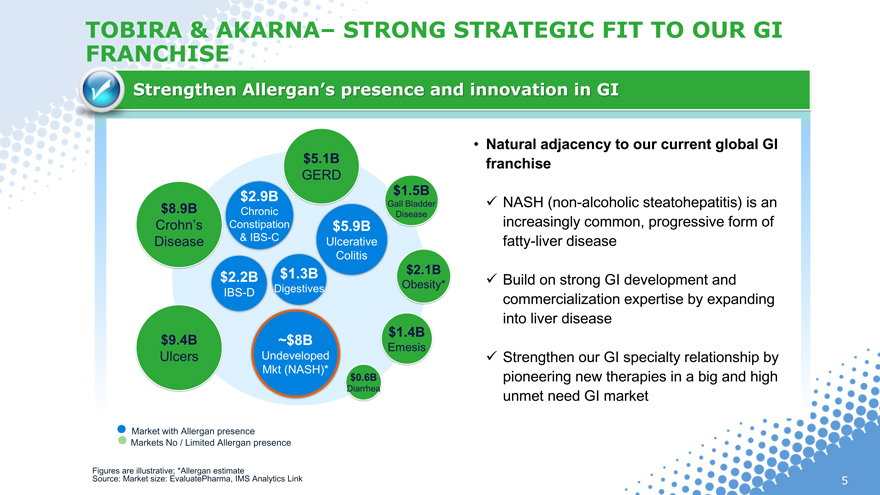

TOBIRA & AKARNA– STRONG STRATEGIC FIT TO OUR GI FRANCHISE

Strengthen Allergan’s presence and innovation in GI

• Natural adjacency to our current global GI

franchise

NASH (non-alcoholic steatohepatitis) is an

increasingly common, progressive form of

fatty-liver disease

Build on strong GI development and

commercialization expertise by expanding

into liver disease

Strengthen our GI specialty relationship by

pioneering new therapies in a big and high

unmet need GI market

Market with Allergan presence

Markets No / Limited Allergan presence

Figures are illustrative; *Allergan estimate

Source: Market size: EvaluatePharma, IMS Analytics Link

5

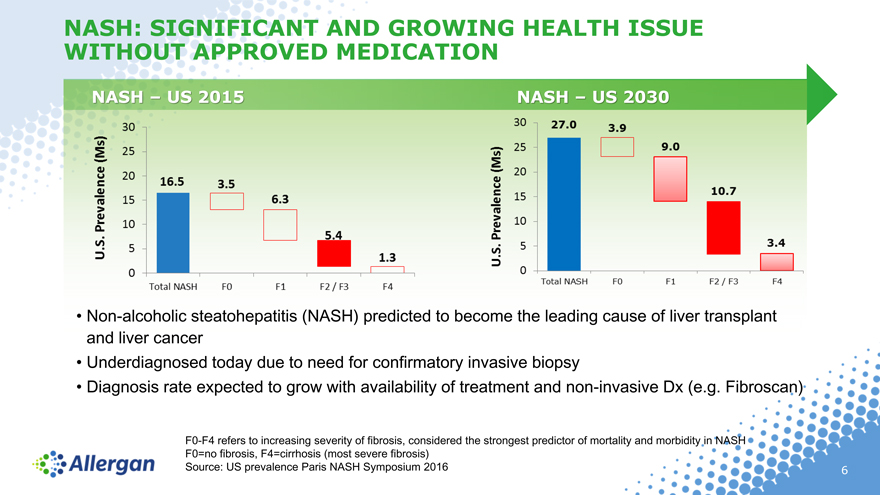

NASH: SIGNIFICANT AND GROWING HEALTH ISSUE WITHOUT APPROVED MEDICATION

NASH – US 2015 NASH – US 2030

Non-alcoholic steatohepatitis (NASH) predicted to become the leading cause of liver transplant and liver cancer

Underdiagnosed today due to need for confirmatory invasive biopsy

Diagnosis rate expected to grow with availability of treatment and non-invasive Dx (e.g. Fibroscan)

F0-F4 refers to increasing severity of fibrosis, considered the strongest predictor of mortality and morbidity in NASH F0=no fibrosis, F4=cirrhosis (most severe fibrosis) Source: US prevalence Paris NASH Symposium 2016

6

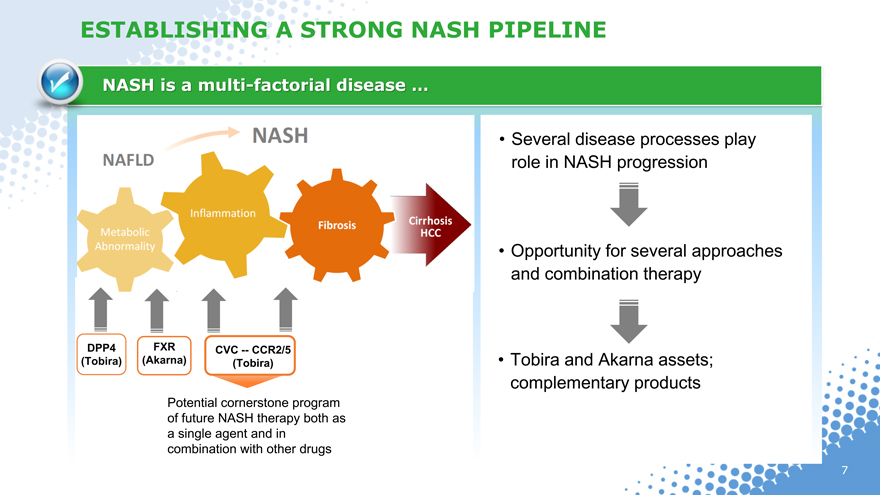

ESTABLISHING A STRONG NASH PIPELINE

NASH is a multi-factorial disease …

• Several disease processes play

role in NASH progression

• Opportunity for several approaches

and combination therapy

DPP4 FXR CVC — CCR2/5

(Tobira)(Akarna)(Tobira) • Tobira and Akarna assets;

complementary products

Potential cornerstone program

of future NASH therapy both as

a single agent and in

combination with other drugs

7

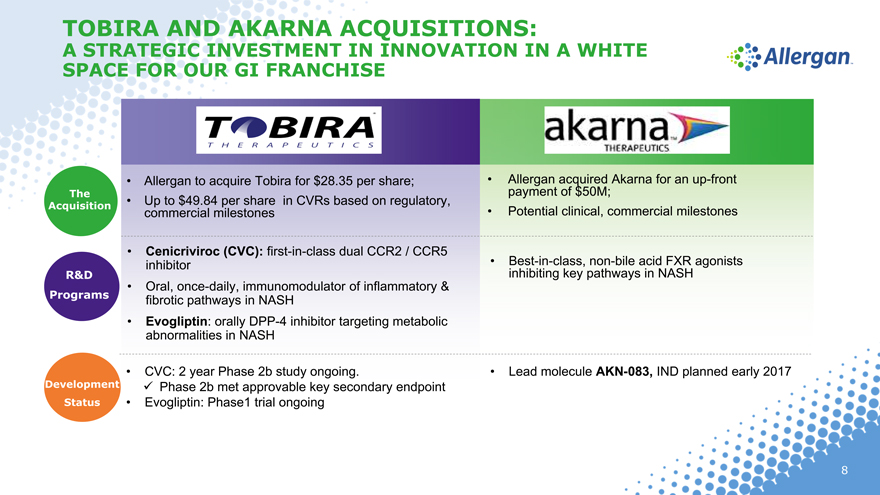

TOBIRA AND AKARNA ACQUISITIONS:

A STRATEGIC INVESTMENT IN INNOVATION IN A WHITE SPACE FOR OUR GI FRANCHISE

• Allergan to acquire Tobira for $28.35 per share; • Allergan acquired Akarna for an up-front

The payment of $50M;

Acquisition • Up to $49.84 per share in CVRs based on regulatory,

commercial milestones • Potential clinical, commercial milestones

• Cenicriviroc (CVC): first-in-class dual CCR2 / CCR5

inhibitor • Best-in-class, non-bile acid FXR agonists

R&D inhibiting key pathways in NASH

• Oral, once-daily, immunomodulator of inflammatory &

Programs fibrotic pathways in NASH

• Evogliptin: orally DPP-4 inhibitor targeting metabolic

abnormalities in NASH

• CVC: 2 year Phase 2b study ongoing. • Lead molecule AKN-083, IND planned early 2017

Development Phase 2b met approvable key secondary endpoint

Status • Evogliptin: Phase1 trial ongoing

8

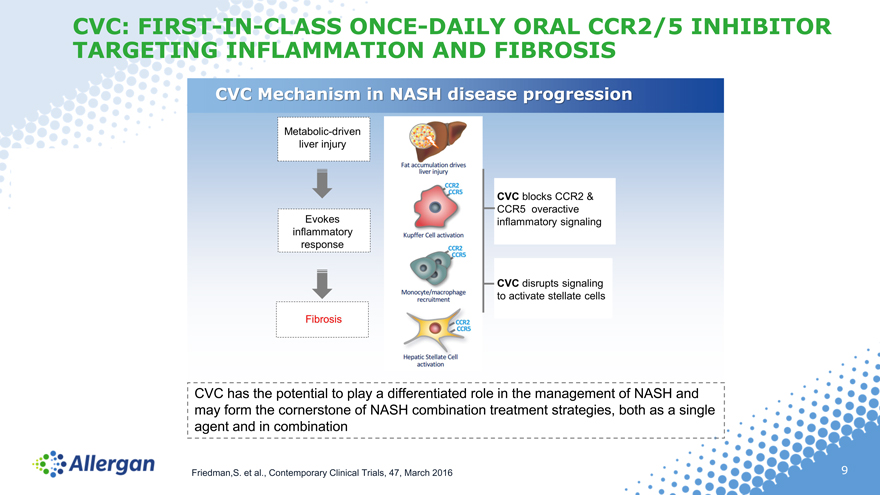

CVC: FIRST-IN-CLASS ONCE-DAILY ORAL CCR2/5 INHIBITOR TARGETING INFLAMMATION AND FIBROSIS

CVC Mechanism in NASH disease progression

CVC has the potential to play a differentiated role in the management of NASH and

may form the cornerstone of NASH combination treatment strategies, both as a single

agent and in combination

Friedman,S. et al., Contemporary Clinical Trials, 47, March 2016

9

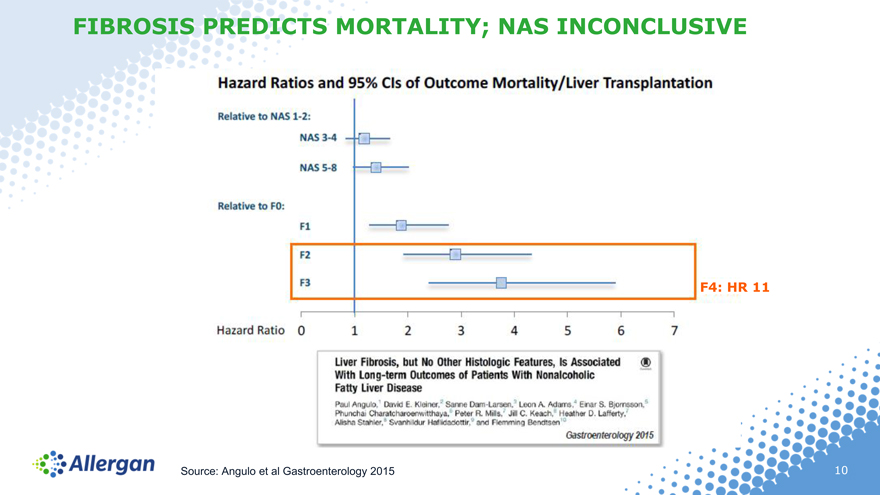

FIBROSIS PREDICTS MORTALITY; NAS INCONCLUSIVE

F4: HR 11

Source: Angulo et al Gastroenterology 2015

10

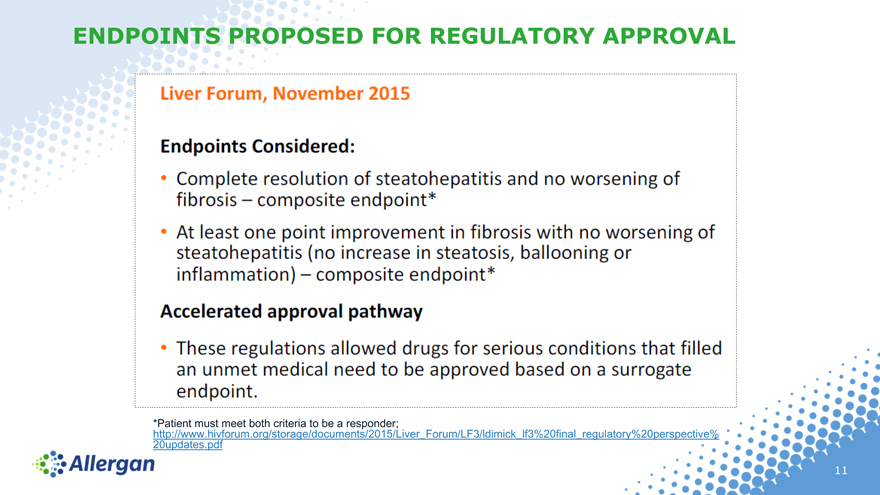

ENDPOINTS PROPOSED FOR REGULATORY APPROVAL

*Patient must meet both criteria to be a responder; http://www.hivforum.org/storage/documents/2015/Liver_Forum/LF3/ldimick_lf3%20final_regulatory%20perspective% 20updates.pdf

11

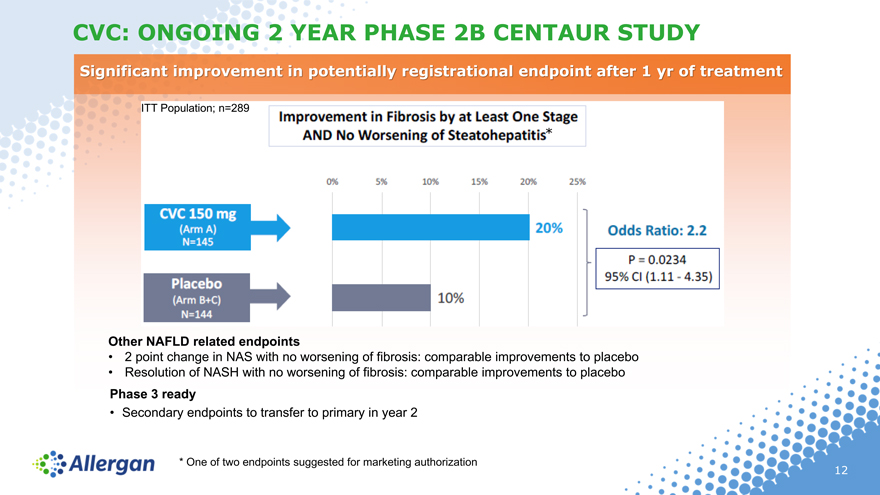

CVC: ONGOING 2 YEAR PHASE 2B CENTAUR STUDY

Significant improvement in potentially registrational endpoint after 1 yr of treatment

ITT Population; n=289

*

Other NAFLD related endpoints

• 2 point change in NAS with no worsening of fibrosis: comparable improvements to placebo

• Resolution of NASH with no worsening of fibrosis: comparable improvements to placebo

Phase 3 ready

• Secondary endpoints to transfer to primary in year 2

* One of two endpoints suggested for marketing authorization

12

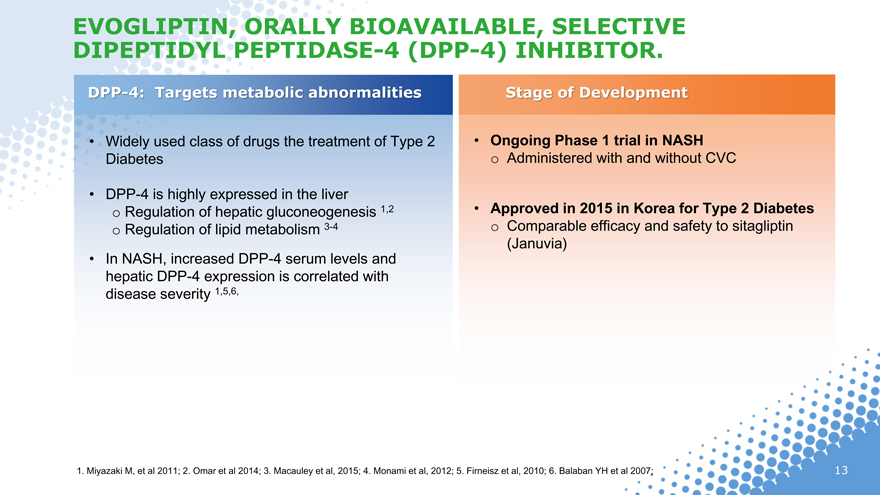

EVOGLIPTIN, ORALLY BIOAVAILABLE, SELECTIVE DIPEPTIDYL PEPTIDASE-4 (DPP-4) INHIBITOR.

DPP-4: Targets metabolic abnormalities Stage of Development

Widely used class of drugs the treatment of Type 2 Ongoing Phase 1 trial in NASH Diabetes o Administered with and without CVC

DPP-4 is highly expressed in the liver o Regulation of hepatic gluconeogenesis 1,2 Approved in 2015 in Korea for Type 2 Diabetes o Regulation of lipid metabolism 3-4 o Comparable efficacy and safety to sitagliptin (Januvia)

In NASH, increased DPP-4 serum levels and hepatic DPP-4 expression is correlated with disease severity 1,5,6,

1. Miyazaki M, et al 2011; 2. Omar et al 2014; 3. Macauley et al, 2015; 4. Monami et al, 2012; 5. Firneisz et al, 2010; 6. Balaban YH et al 2007;

13

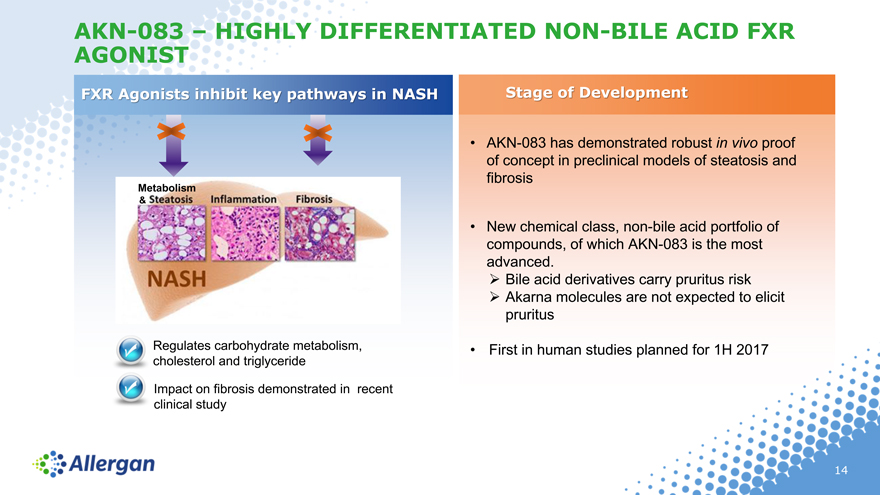

AKN-083 – HIGHLY DIFFERENTIATED NON-BILE ACID FXR AGONIST

FXR Agonists inhibit key pathways in NASH Stage of Development

• AKN-083 has demonstrated robust in vivo proof

of concept in preclinical models of steatosis and

fibrosis

Metabolism

&

• New chemical class, non-bile acid portfolio of

compounds, of which AKN-083 is the most

advanced.

? Bile acid derivatives carry pruritus risk

? Akarna molecules are not expected to elicit

pruritus

Regulates carbohydrate metabolism, • First in human studies planned for 1H 2017

cholesterol and triglyceride

Impact on fibrosis demonstrated in recent

clinical study

14

MOVING FORWARD…

We are committed to enhancing our global presence and innovation in gastroenterology

We are committed to invest in best and first in class compounds to bring innovation that can provide future treatments for NASH

Tobira & Akarna are differentiated, complementary approaches to treat patients with NASH

The molecular targets are validated and the compounds are first or best in class

Combination therapy should further enhance efficacy

15

ALLERGAN TO ACQUIRE VITAE PHARMACEUTICALS

Strengthening Allergan’s Medical

Dermatology Pipeline

16

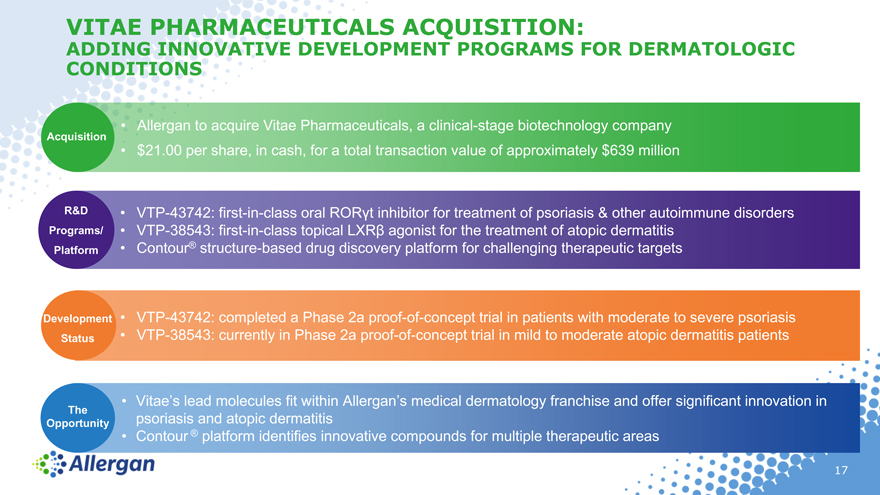

VITAE PHARMACEUTICALS ACQUISITION:

ADDING INNOVATIVE DEVELOPMENT PROGRAMS FOR DERMATOLOGIC

CONDITIONS

• Allergan to acquire Vitae Pharmaceuticals, a clinical -stage biotechnology company

Acquisition

• $21.00 per share, in cash, for a total transaction value of approximately $639 million

R&D • VTP-43742: first-in-class oral ROR?t inhibitor for treatment of psoriasis & other autoimmune disorders

Programs/ • VTP-38543: first-in-class topical LXR? agonist for the treatment of atopic dermatitis

Platform • Contour® structure-based drug discovery platform for challenging therapeutic targets

Devel opment • VTP-43742: completed a Phase 2a proof -of -concept trial in patients with moderate to severe psoriasis

Status • VTP-38543: currently in Phase 2a proof -of -concept trial in mild to moderate atopic dermatitis patients

• Vitae’s lead molecules fit within Allergan’s medical dermatology franchise and offer significant innovation in

The

Opportunity psoriasis and atopic dermatitis

• Contour ® platform identifies innovative compounds for multiple therapeutic areas

17

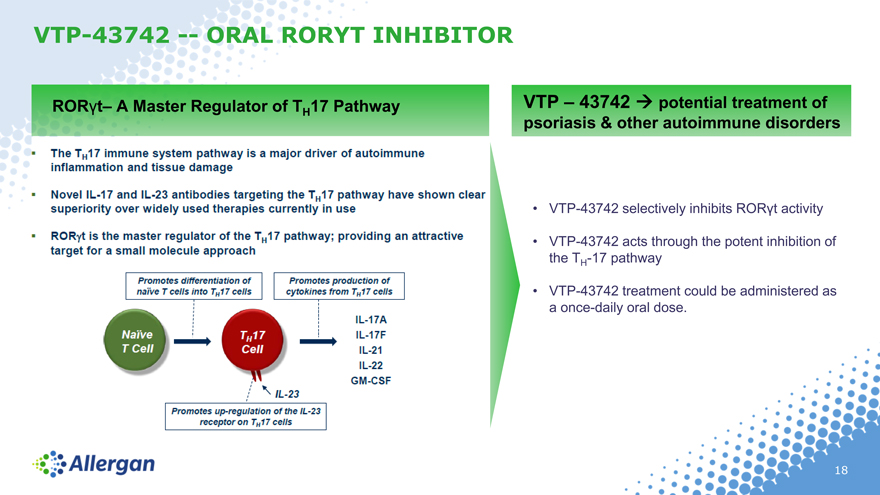

VTP-43742 — ORAL RORYT INHIBITOR

RORt– A Master Regulator of TH 17 Pathway

VTP – 43742 potential treatment of psoriasis & other autoimmune disorders

VTP-43742 selectively inhibits RORt activity

VTP-43742 acts through the potent inhibition of the TH-17 pathway

VTP-43742 treatment could be administered as a once-daily oral dose.

18

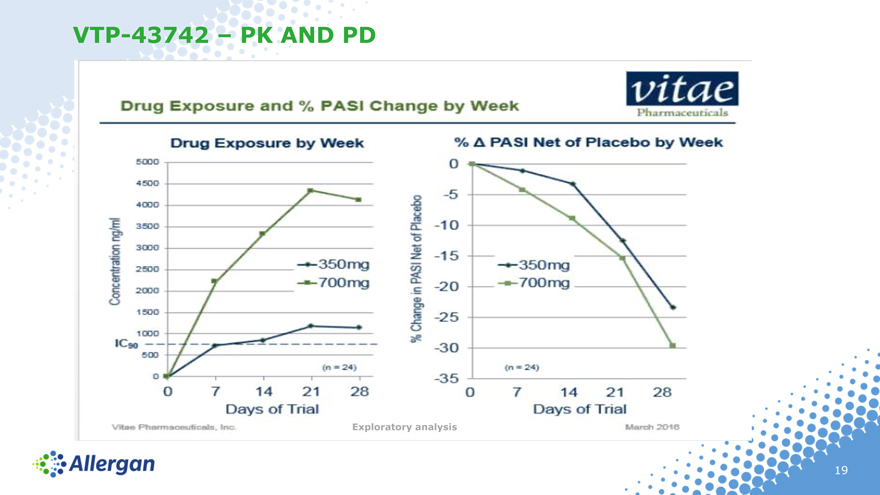

VTP-43742 – PK AND PD

Exploratory analysis

19

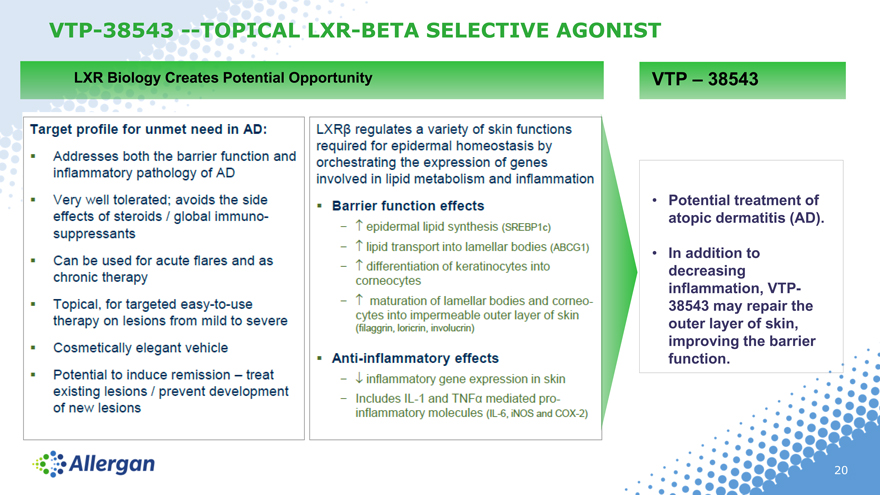

VTP-38543 —TOPICAL LXR-ETA SELECTIVE AGONIST

LXR Biology Creates Potential Opportunity

VTP – 38543

Potential treatment of atopic dermatitis (AD).

In addition to decreasing inflammation, VTP- 38543 may repair the outer layer of skin, improving the barrier function.

20