Western New England Bancorp, Inc. 8-K

Exhibit 99.2

Local banking is better than ever. INVESTOR PRESENTATION SECOND QUARTER 2022

FORWARD - LOOKING STATEMENTS 2 We may, from time to time, make written or oral “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 , including statements contained in our filings with the Securities and Exchange Commission (the “SEC”), our reports to shareholders and in other communications by us . This presentation contains “forward - looking statements” with respect to the Company’s financial condition, liquidity, results of operations, future performance, business, measures being taken in response to the coronavirus disease 2019 (“COVID - 19 ”) pandemic and the impact of COVID - 19 on the Company’s business . Forward - looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” and “potential . ” Examples of forward - looking statements include, but are not limited to, estimates with respect to our financial condition, results of operations and business that are subject to various factors which could cause actual results to differ materially from these estimates . These factors include, but are not limited to : • the duration and scope of the COVID - 19 pandemic and the local, national and global impact of COVID - 19; • actions governments, businesses and individuals take in response to the COVID - 19 pandemic ; • the speed and effectiveness of COVID - 19 vaccine and treatment developments and their deployment, including public adoption rates of COVID - 19 vaccines; • the emergence of new COVID - 19 variants, such as the Omicron variant, and the response thereto; • the pace of recovery when the COVID - 19 pandemic subsides; • changes in the interest rate environment that reduce margins; • the effect on our operations of governmental legislation and regulation, including changes in accounting regulation or standa rds , the nature and timing of the adoption and effectiveness of new requirements under the Dodd - Frank Act Wall Street Reform and Consumer Protection Act of 2010 ( “Dodd - Frank Act”), Basel guidelines, capital requirements and other applicable laws and regulations; • the highly competitive industry and market area in which we operate; • general economic conditions, either nationally or regionally, resulting in, among other things, a deterioration in credit qua lit y; • changes in business conditions and inflation; • changes in credit market conditions; • the inability to realize expected cost savings or achieve other anticipated benefits in connection with business combinations an d other acquisitions; • changes in the securities markets which affect investment management revenues; • increases in Federal Deposit Insurance Corporation deposit insurance premiums and assessments; • changes in technology used in the banking business; • the soundness of other financial services institutions which may adversely affect our credit risk; • certain of our intangible assets may become impaired in the future; • our controls and procedures may fail or be circumvented; • new lines of business or new products and services, which may subject us to additional risks; • changes in key management personnel which may adversely impact our operations; • severe weather, natural disasters, acts of war or terrorism and other external events which could significantly impact our bu sin ess; and • other factors detailed from time to time in our SEC filings . Although we believe that the expectations reflected in such forward - looking statements are reasonable, actual results may differ materially from the results discussed in these forward - looking statements . You are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date hereof . We do not undertake any obligation to republish revised forward - looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except to the extent required by law .

WHO WE ARE Every day, we focus on showing Westfield Bank customers “ what better banking is all about . ” For us, the idea of better banking starts with putting customers first, while adhering to our core values . Our Core Values : • Integrity • Enhance Shareholder Value • Customer Focus • Community Focus Our Core Mission : Our purpose is to help customers succeed in our community, while creating and increasing shareholder value . The Company’s purpose drives the outcome we envision for Western New England Bancorp . 3 70 Center Street, Chicopee, MA.

SENIOR MANAGEMENT TEAM James C . Hagan, President & Chief Executive Officer Guida R . Sajdak, Executive Vice President, Chief Financial Officer & Treasurer Allen J . Miles III, Executive Vice President & Chief Lender Officer Kevin C . O’Connor, Executive Vice President & Chief Banking Officer Louis O . Gorman, Senior Vice President & Chief Credit Officer Leo R . Sagan, Jr . , Senior Vice President & Chief Risk Officer Darlene Libiszewski , Senior Vice President & Chief Information Officer John Bonini , Senior Vice President & General Counsel Christine Phillips , Senior Vice President, Human Resources Cidalia Inacio , Senior Vice President, Retail Banking & Wealth Management 4

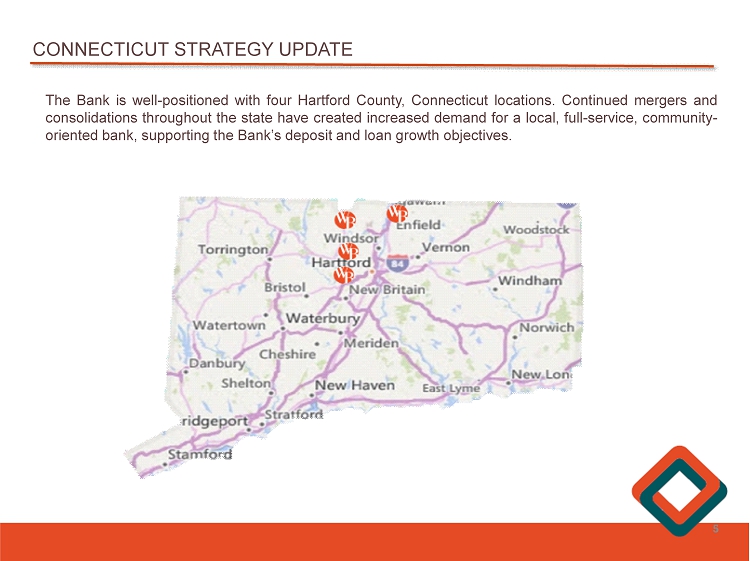

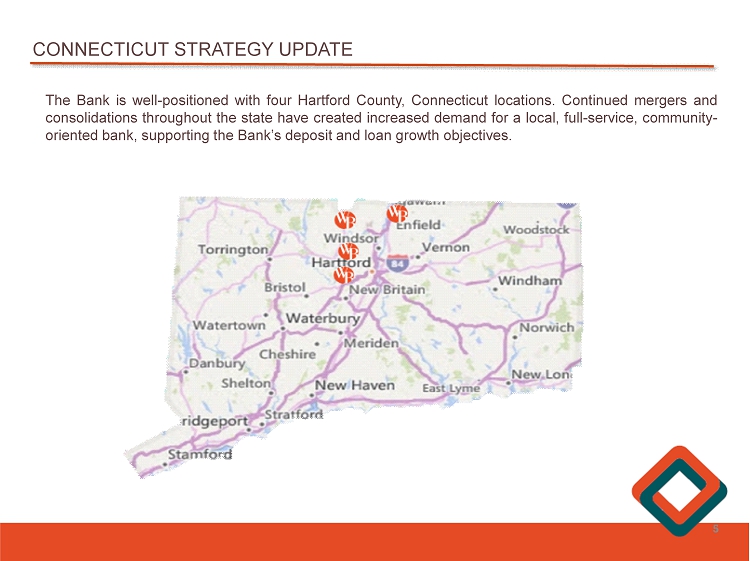

5 CONNECTICUT STRATEGY UPDATE The Bank is well - positioned with four Hartford County, Connecticut locations . Continued mergers and consolidations throughout the state have created increased demand for a local, full - service, community - oriented bank, supporting the Bank’s deposit and loan growth objectives .

6 CONNECTICUT STRATEGY UPDATE Congratulations to the West Hartford Financial Services Center team on being recognized as “Best Bank/Financial Institution” in the annual Best of West Hartford , marking two consecutive years that the Bank has earned the top spot.

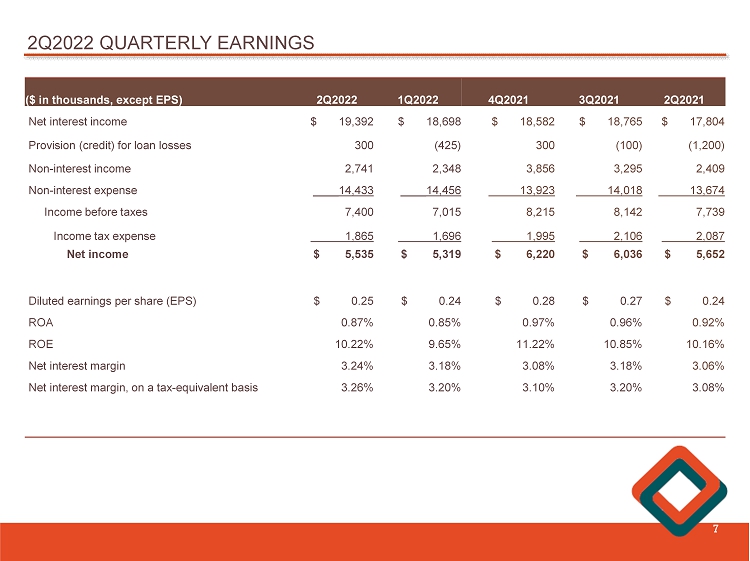

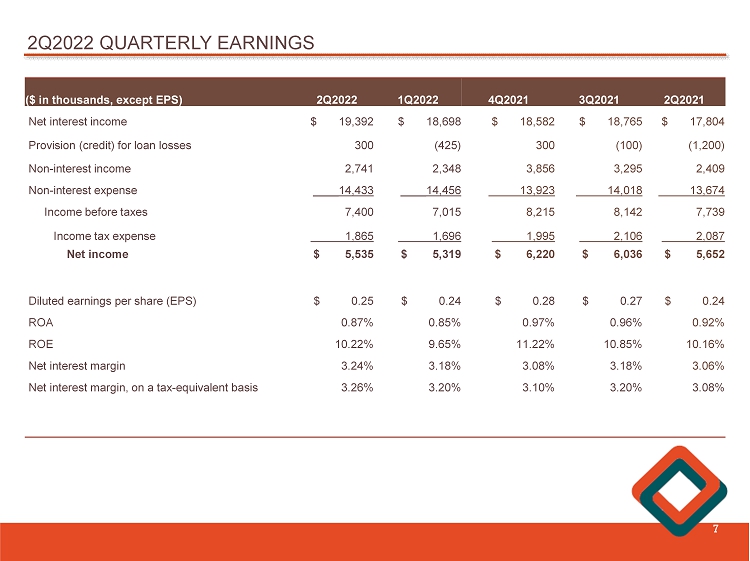

2Q2022 QUARTERLY EARNINGS 7 ($ in thousands , except EPS) 2Q2022 1Q2022 4Q2021 3Q2021 2Q2021 Net interest income $ 19,392 $ 18,698 $ 18,582 $ 18,765 $ 17,804 Provision (credit) for loan losses 300 (425) 300 (100) (1,200) Non - interest income 2,741 2,348 3,856 3,295 2,409 Non - interest expense ____ 14,433 ____ 14,456 13,923 14,018 13,674 Income before taxes 7,400 7,015 8,215 8,142 7,739 Income tax expense 1,865 1,696 1,995 2,106 2,087 Net income $ 5,535 $ 5,319 $ 6,220 $ 6,036 $ 5,652 Diluted earnings per share (EPS) $ 0.25 $ 0.24 $ 0.28 $ 0.27 $ 0.24 ROA 0.87% 0.85% 0.97% 0.96% 0.92% ROE 10.22% 9.65% 11.22% 10.85% 10.16% Net interest margin 3.24% 3.18% 3.08% 3.18% 3.06% Net interest margin, on a tax - equivalent basis 3.26% 3.20% 3.10% 3.20% 3.08%

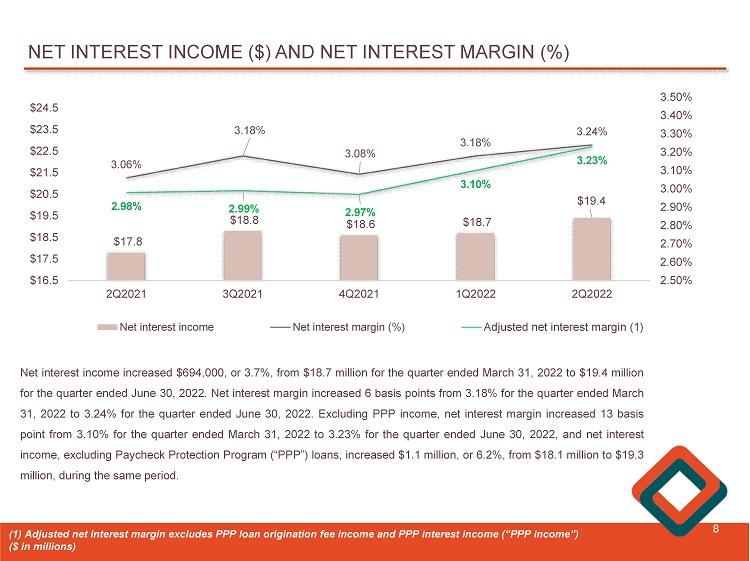

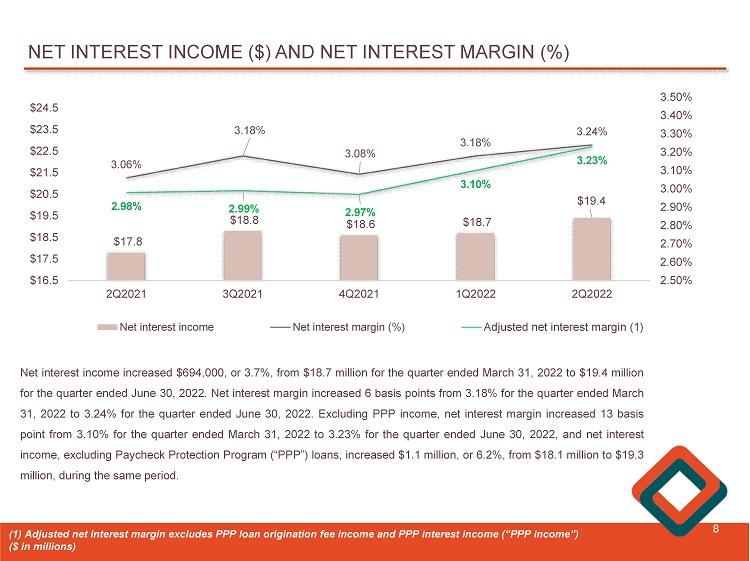

NET INTEREST INCOME ($) AND NET INTEREST MARGIN (%) 8 $17.8 $18.8 $18.6 $18.7 $19.4 3.06% 3.18% 3.08% 3.18% 3.24% 2.98% 2.99% 2.97% 3.10% 3.23% 2.50% 2.60% 2.70% 2.80% 2.90% 3.00% 3.10% 3.20% 3.30% 3.40% 3.50% 2Q2021 3Q2021 4Q2021 1Q2022 2Q2022 $16.5 $17.5 $18.5 $19.5 $20.5 $21.5 $22.5 $23.5 $24.5 Net interest income Net interest margin (%) Adjusted net interest margin (1) Net interest income increased $ 694 , 000 , or 3 . 7 % , from $ 18 . 7 million for the quarter ended March 31 , 2022 to $ 19 . 4 million for the quarter ended June 30 , 2022 . Net interest margin increased 6 basis points from 3 . 18 % for the quarter ended March 31 , 2022 to 3 . 24 % for the quarter ended June 30 , 2022 . Excluding PPP income, net interest margin increased 13 basis point from 3 . 10 % for the quarter ended March 31 , 2022 to 3 . 23 % for the quarter ended June 30 , 2022 , and net interest income, excluding Paycheck Protection Program (“PPP”) loans, increased $ 1 . 1 million, or 6 . 2 % , from $ 18 . 1 million to $ 19 . 3 million, during the same period . (1) Adjusted net interest margin excludes PPP loan origination fee income and PPP interest income (“PPP income”) ($ in millions)

TOTAL LOANS 9 $1,756 $1,787 $1,809 $1,880 $1,946 3.81% 3.75% 3.75% 3.75% 3.79% 3.20% 3.40% 3.60% 3.80% 4.00% 4.20% 4.40% 2Q2021 3Q2021 4Q2021 1Q2022 2Q2022 $1,200 $1,300 $1,400 $1,500 $1,600 $1,700 $1,800 $1,900 $2,000 Average Loans Outstanding (excludes PPP loans) Average Loans Outstanding Average Loan Yield $1,771 $1,786 $1,839 $1,920 $1,973 $106 $59 $25 $6 $3 2Q2021 3Q2021 4Q2021 1Q2022 2Q2022 $1,500 $1,550 $1,600 $1,650 $1,700 $1,750 $1,800 $1,850 $1,900 $1,950 $2,000 Period - end Loans Outstanding Loans PPP Loans Excluding PPP loans, average loans of $ 1 . 9 billion increased $ 66 . 6 million, or 3 . 5 % , from the linked quarter . Average PPP loans of $ 3 . 1 million decreased $ 12 . 0 million, or 79 . 7 % , from the linked quarter . Total loans outstanding of $ 2 . 0 billion at June 30 , 2022 increased $ 111 . 0 million , or 6 . 0 % , from December 31 , 2021 , driven by an increase of $ 94 . 9 million, or 9 . 7 % , in commercial real estate loans, and an increase of $ 24 . 2 million, or 3 . 7 % , in residential real estate loans, partially offset by a decrease of $ 8 . 8 million, or 3 . 9 % , in commercial and industrial loans . Excluding PPP loans, total loans increased $ 133 . 7 million, or 7 . 3 % , from year - end . ($ in millions)

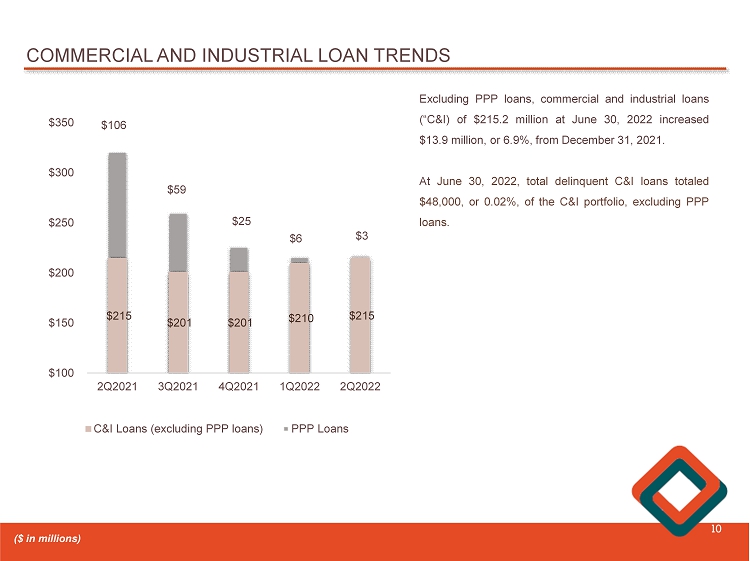

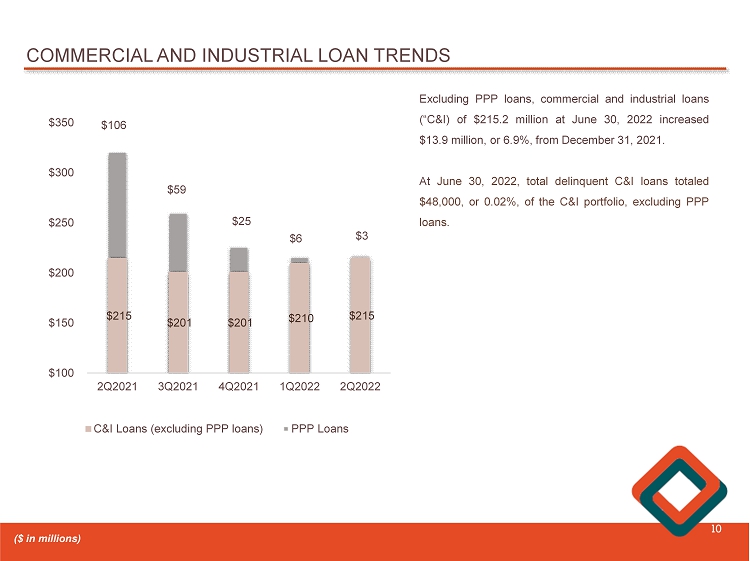

COMMERCIAL AND INDUSTRIAL LOAN TRENDS 10 $215 $201 $201 $210 $215 $106 $59 $25 $6 $3 2Q2021 3Q2021 4Q2021 1Q2022 2Q2022 $100 $150 $200 $250 $300 $350 C&I Loans (excluding PPP loans) PPP Loans Excluding PPP loans, commercial and industrial loans (“ C&I) of $ 215 . 2 million at June 30 , 2022 increased $ 13 . 9 million, or 6 . 9 % , from December 31 , 2021 . At June 30 , 2022 , total delinquent C&I loans totaled $ 48 , 000 , or 0 . 02 % , of the C&I portfolio, excluding PPP loans . ($ in millions)

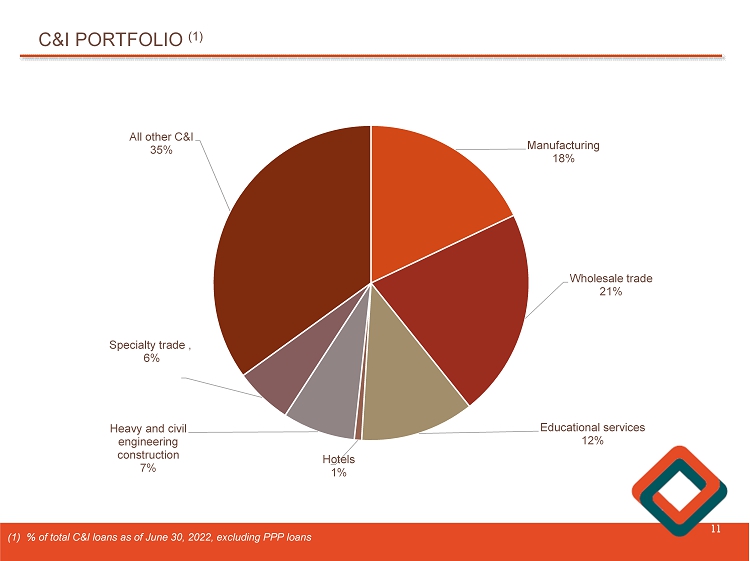

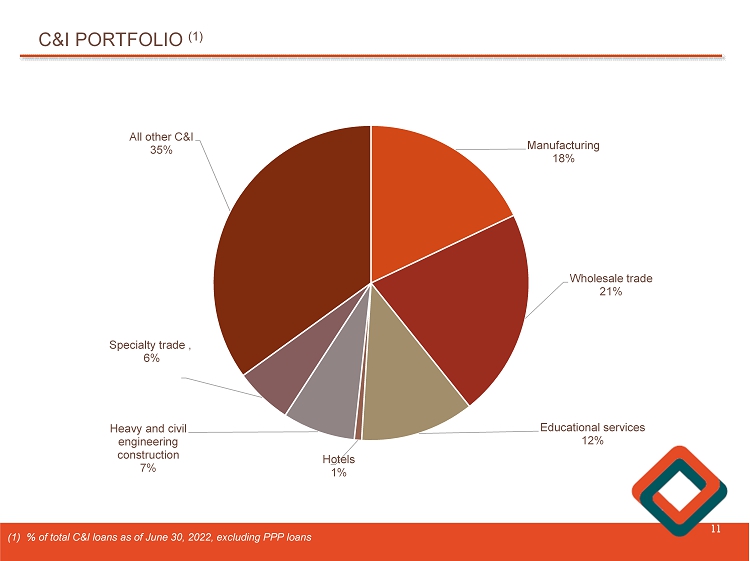

C&I PORTFOLIO (1) 11 (1) % of total C&I loans as of June 30, 2022, excluding PPP loans Manufacturing 18% Wholesale trade 21% Educational services 12% Hotels 1% Heavy and civil engineering construction 7% Specialty trade , 6% All other C&I 35%

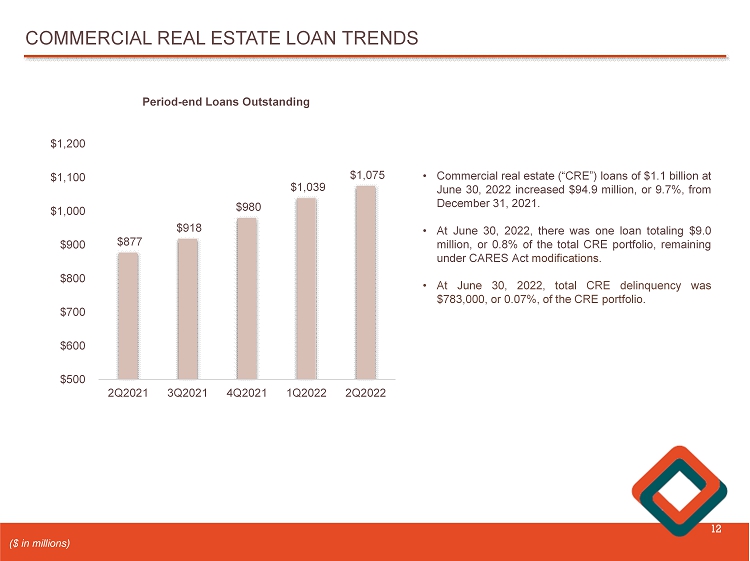

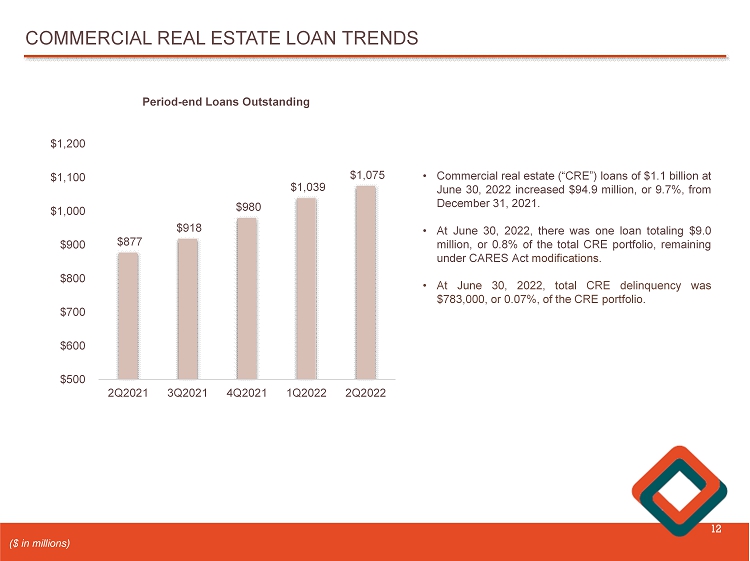

COMMERCIAL REAL ESTATE LOAN TRENDS 12 $877 $918 $980 $1,039 $1,075 2Q2021 3Q2021 4Q2021 1Q2022 2Q2022 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 • Commercial real estate (“CRE”) loans of $ 1 . 1 billion at June 30 , 2022 increased $ 94 . 9 million, or 9 . 7 % , from December 31 , 2021 . • At June 30 , 2022 , there was one loan totaling $ 9 . 0 million, or 0 . 8 % of the total CRE portfolio, remaining under CARES Act modifications . • At June 30 , 2022 , total CRE delinquency was $ 783 , 000 , or 0 . 07 % , of the CRE portfolio . ($ in millions) Period - end Loans Outstanding

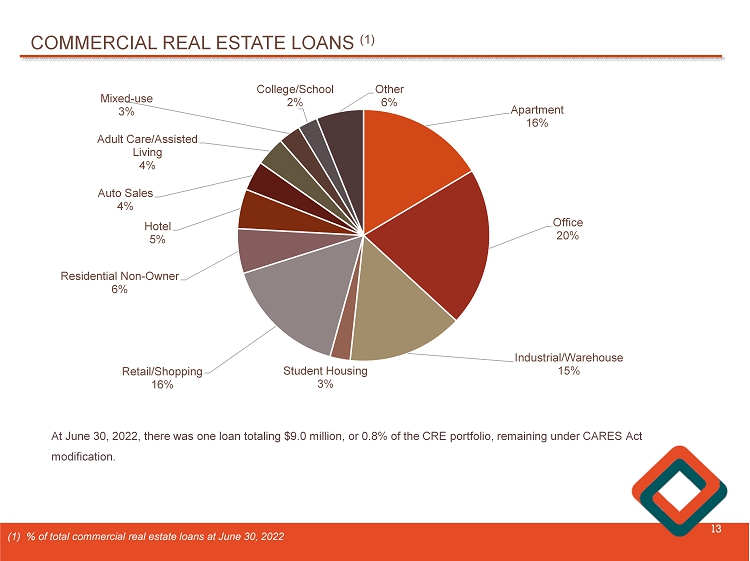

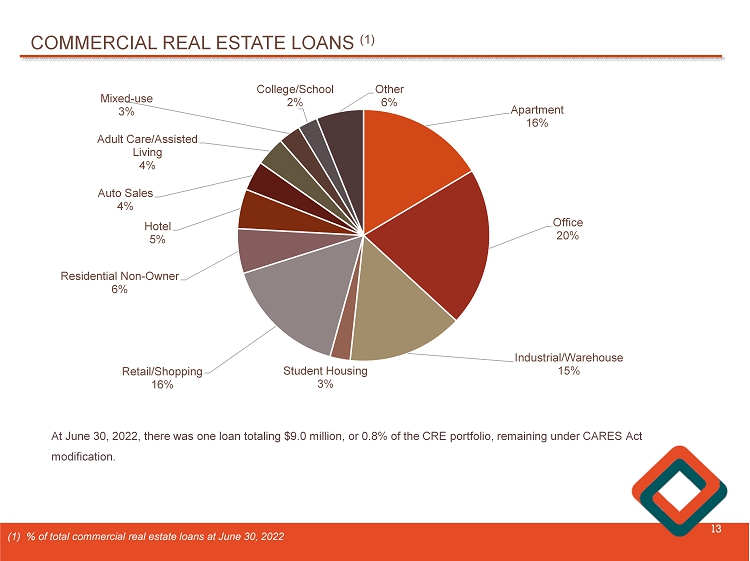

COMMERCIAL REAL ESTATE LOANS (1) 13 (1) % of total commercial real estate loans at June 30, 2022 At June 30, 2022, there was one loan totaling $9.0 million, or 0.8% of the CRE portfolio, remaining under CARES Act modification. Apartment 16% Office 20% Industrial/Warehouse 15% Student Housing 3% Retail/Shopping 16% Residential Non - Owner 6% Hotel 5% Auto Sales 4% Adult Care/Assisted Living 4% Mixed - use 3% College/School 2% Other 6%

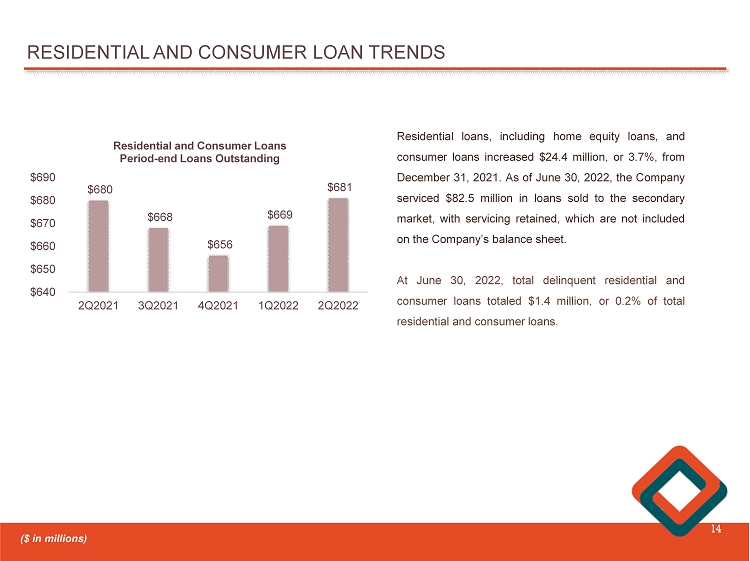

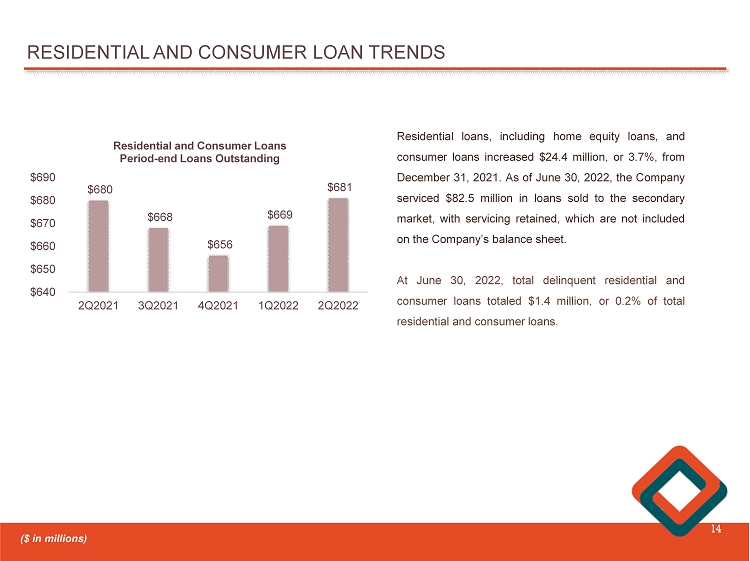

RESIDENTIAL AND CONSUMER LOAN TRENDS 14 $680 $668 $656 $669 $681 2Q2021 3Q2021 4Q2021 1Q2022 2Q2022 $640 $650 $660 $670 $680 $690 Residential and Consumer Loans Period - end Loans Outstanding Residential loans, including home equity loans, and consumer loans increased $ 24 . 4 million, or 3 . 7 % , from December 31 , 2021 . As of June 30 , 2022 , the Company serviced $ 82 . 5 million in loans sold to the secondary market, with servicing retained, which are not included on the Company’s balance sheet . At June 30 , 2022 , total delinquent residential and consumer loans totaled $ 1 . 4 million, or 0 . 2 % of total residential and consumer loans . ($ in millions)

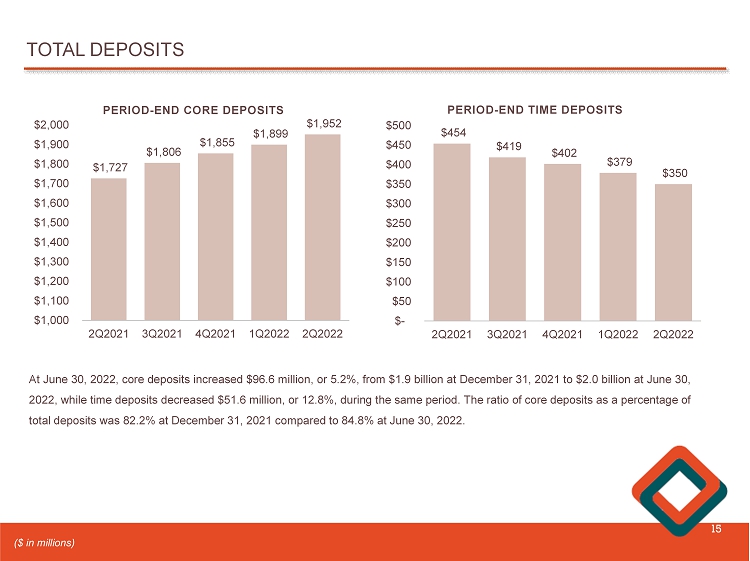

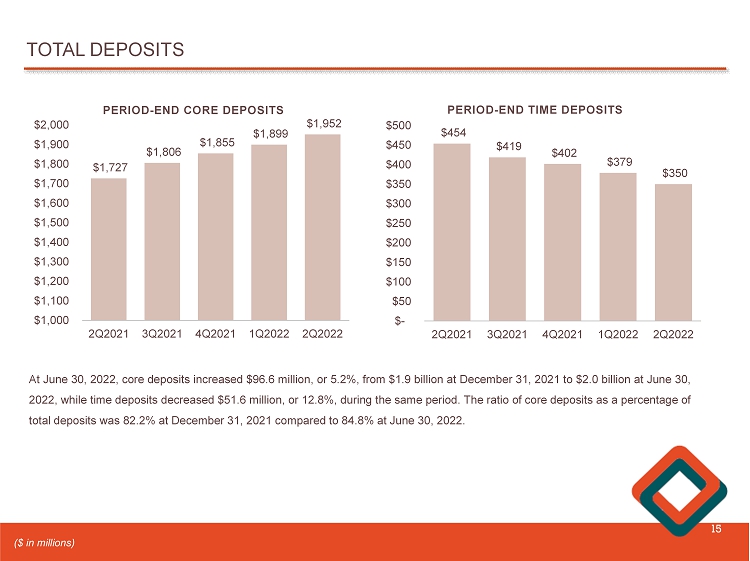

TOTAL DEPOSITS 15 $1,727 $1,806 $1,855 $1,899 $1,952 2Q2021 3Q2021 4Q2021 1Q2022 2Q2022 $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 $1,700 $1,800 $1,900 $2,000 PERIOD - END CORE DEPOSITS At June 30 , 2022 , core deposits increased $ 96 . 6 million, or 5 . 2 % , from $ 1 . 9 billion at December 31 , 2021 to $ 2 . 0 billion at June 30 , 2022 , while time deposits decreased $ 51 . 6 million, or 12 . 8 % , during the same period . The ratio of core deposits as a percentage of total deposits was 82 . 2 % at December 31 , 2021 compared to 84 . 8 % at June 30 , 2022 . $454 $419 $402 $379 $350 2Q2021 3Q2021 4Q2021 1Q2022 2Q2022 $- $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 PERIOD - END TIME DEPOSITS ($ in millions)

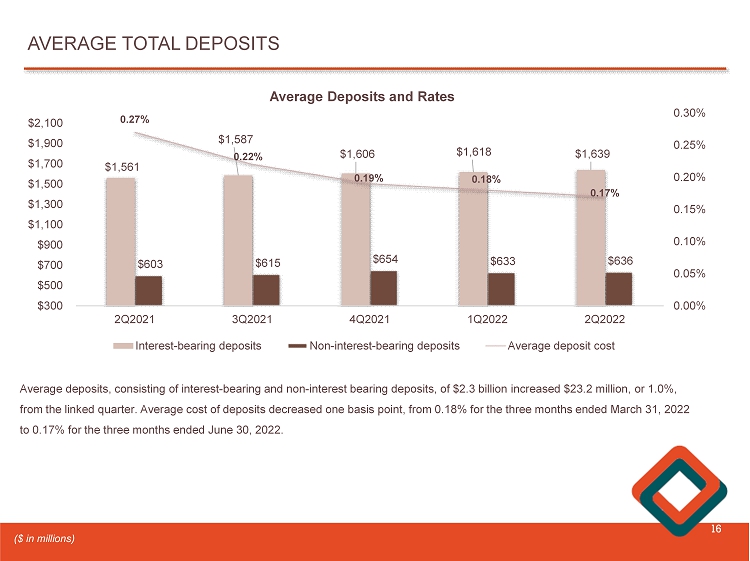

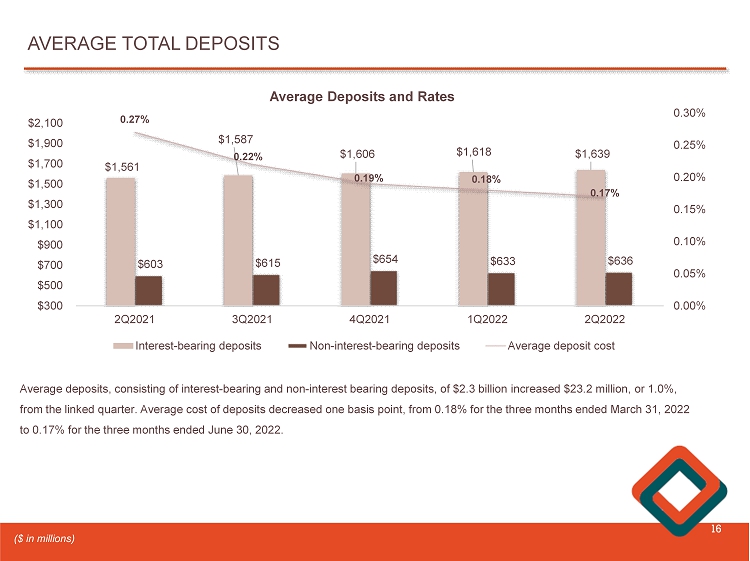

AVERAGE TOTAL DEPOSITS 16 $1,561 $1,587 $1,606 $1,618 $1,639 $603 $615 $654 $633 $636 0.27% 0.22% 0.19% 0.18% 0.17% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 2Q2021 3Q2021 4Q2021 1Q2022 2Q2022 $300 $500 $700 $900 $1,100 $1,300 $1,500 $1,700 $1,900 $2,100 Average Deposits and Rates Interest-bearing deposits Non-interest-bearing deposits Average deposit cost Average deposits, consisting of interest - bearing and non - interest bearing deposits, of $2.3 billion increased $23.2 million, or 1.0%, from the linked quarter. Average cost of deposits decreased one basis point, from 0.18% for the three months ended March 31, 202 2 to 0.17% for the three months ended June 30, 2022. ($ in millions)

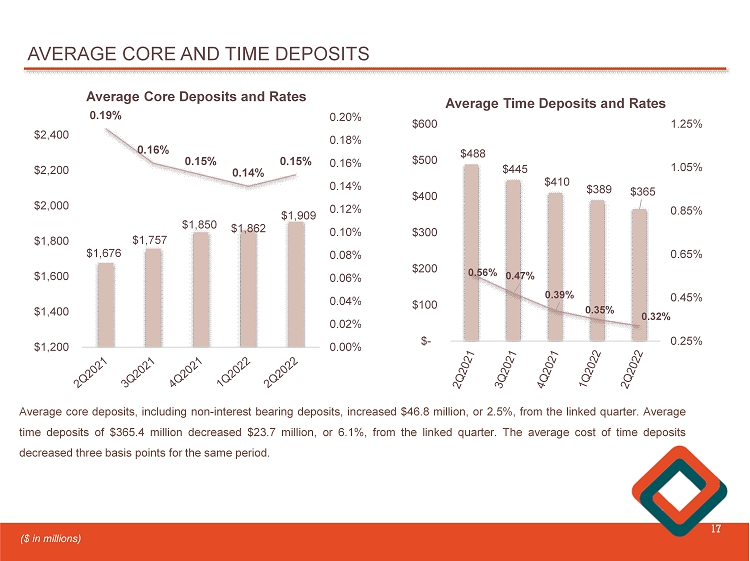

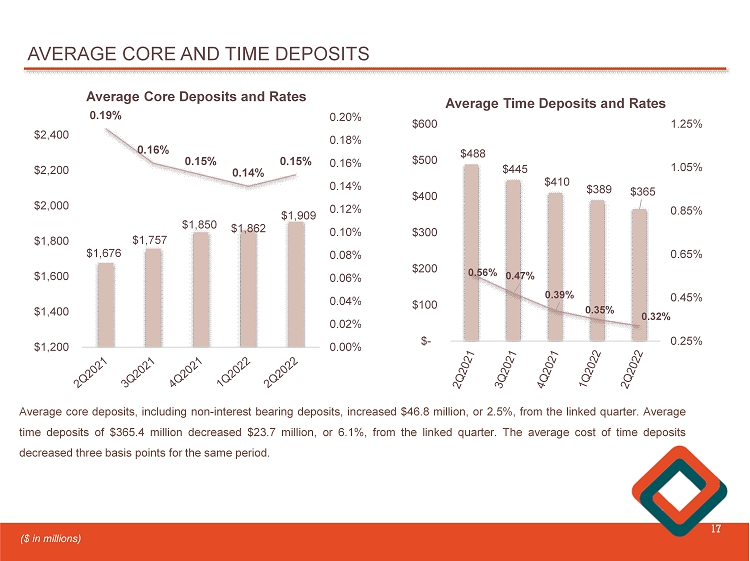

AVERAGE CORE AND TIME DEPOSITS 17 $1,676 $1,757 $1,850 $1,862 $1,909 0.19% 0.16% 0.15% 0.14% 0.15% 0.00% 0.02% 0.04% 0.06% 0.08% 0.10% 0.12% 0.14% 0.16% 0.18% 0.20% $1,200 $1,400 $1,600 $1,800 $2,000 $2,200 $2,400 Average Core Deposits and Rates Average core deposits, including non - interest bearing deposits, increased $ 46 . 8 million, or 2 . 5 % , from the linked quarter . Average time deposits of $ 365 . 4 million decreased $ 23 . 7 million, or 6 . 1 % , from the linked quarter . The average cost of time deposits decreased three basis points for the same period . ($ in millions) $488 $445 $410 $389 $365 0.56% 0.47% 0.39% 0.35% 0.32% 0.25% 0.45% 0.65% 0.85% 1.05% 1.25% $- $100 $200 $300 $400 $500 $600 Average Time Deposits and Rates

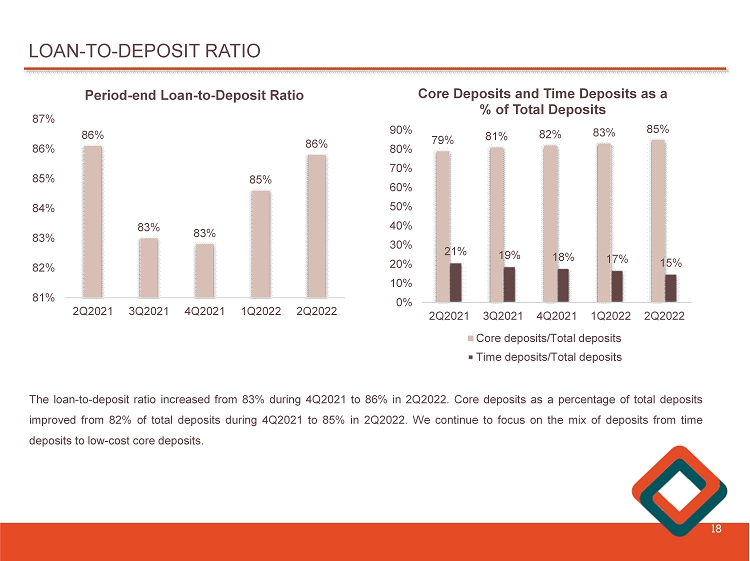

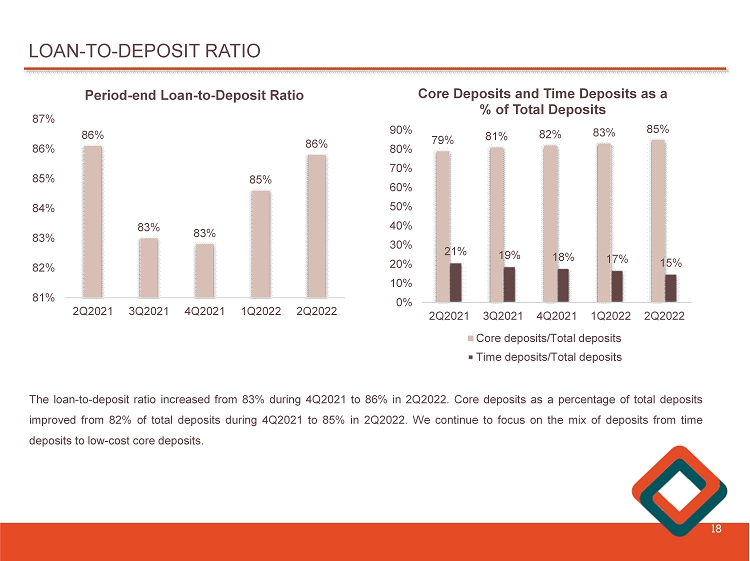

LOAN - TO - DEPOSIT RATIO 18 86% 83% 83% 85% 86% 2Q2021 3Q2021 4Q2021 1Q2022 2Q2022 81% 82% 83% 84% 85% 86% 87% Period - end Loan - to - Deposit Ratio 79% 81% 82% 83% 85% 21% 19% 18% 17% 15% 2Q2021 3Q2021 4Q2021 1Q2022 2Q2022 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Core Deposits and Time Deposits as a % of Total Deposits Core deposits/Total deposits Time deposits/Total deposits The loan - to - deposit ratio increased from 83 % during 4 Q 2021 to 86 % in 2 Q 2022 . Core deposits as a percentage of tota l deposits improved from 82 % of total deposits during 4 Q 2021 to 85 % in 2 Q 2022 . We continue to focus on the mix of deposits from time deposits to low - cost core deposits .

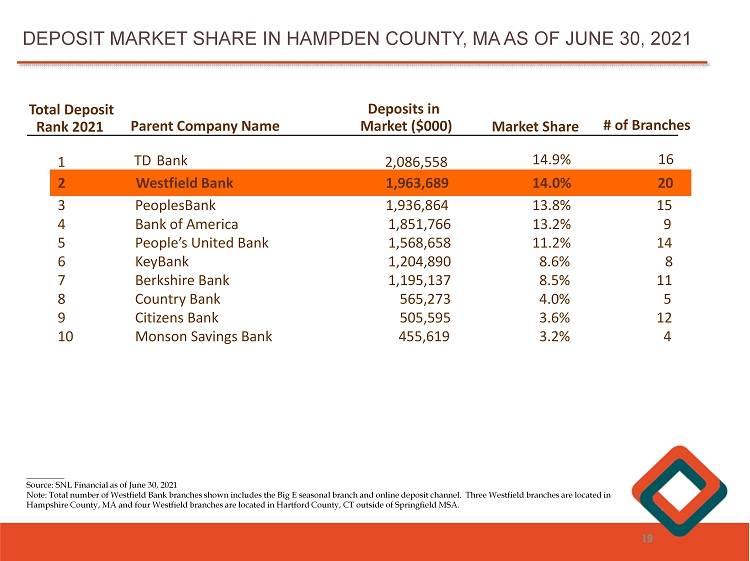

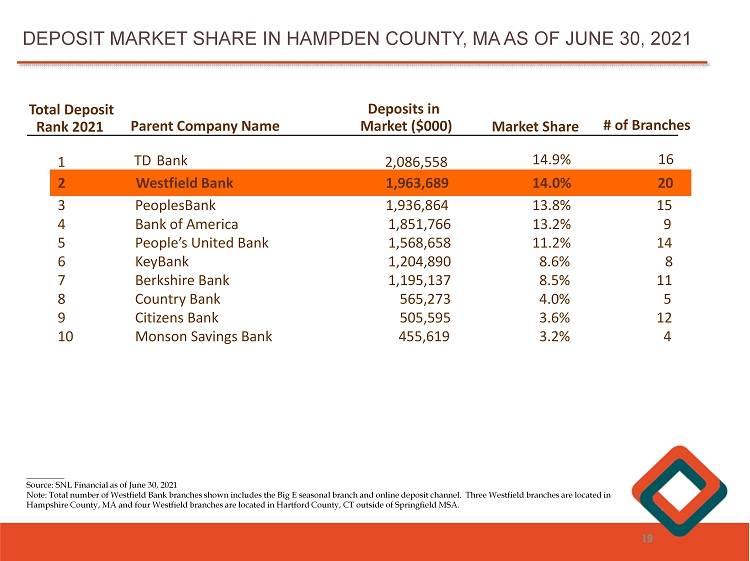

________ Source: SNL Financial as of June 30, 2021 Note: Total number of Westfield Bank branches shown includes the Big E seasonal branch and online deposit channel. Three Wes tfi eld branches are located in Hampshire County, MA and four Westfield branches are located in Hartford County, CT outside of Springfield MSA. DEPOSIT MARKET SHARE IN HAMPDEN COUNTY, MA AS OF JUNE 30, 2021 19 Total Deposit Rank 2021 Parent Company Name Deposits in Market ($000) Market Share # of Branches 1 TD Bank 2,086,558 14.9% 16 1,762,519 13.1% 20 2 Westfield Bank 1,963,689 14.0% 20 3 PeoplesBank 1,936,864 13.8 % 15 4 Bank of America 1,851,766 13.2 % 9 5 People’s United Bank 1,568,658 11.2 % 14 6 KeyBank 1,204,890 8.6% 8 7 Berkshire Bank 1,195,137 8.5 % 11 8 Country Bank 565,273 4.0 % 5 9 Citizens Bank 505,595 3.6 % 12 10 Monson Savings Bank 455,619 3.2 % 4

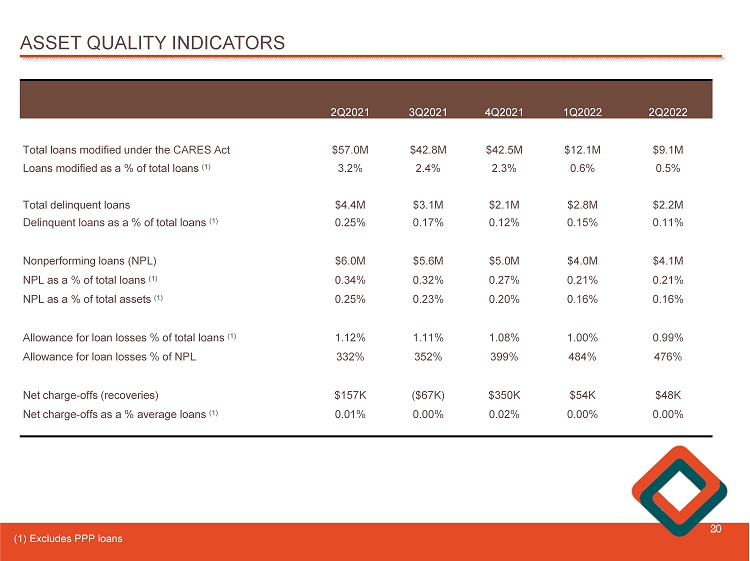

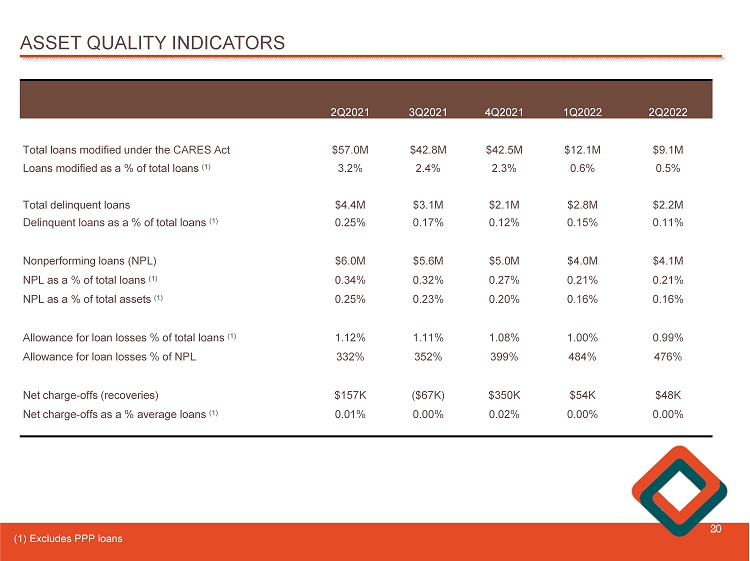

ASSET QUALITY INDICATORS 20 2Q2021 3Q2021 4Q2021 1Q2022 2Q2022 Total loans modified under the CARES Act $57.0M $42.8M $42.5M $12.1M $9.1M Loans modified as a % of total loans (1) 3.2% 2.4% 2.3% 0.6% 0.5% Total delinquent loans $4.4M $3.1M $2.1M $2.8M $2.2M Delinquent loans as a % of total loans (1) 0.25% 0.17% 0.12% 0.15% 0.11% Nonperforming loans (NPL) $6.0M $5.6M $5.0M $4.0M $4.1M NPL as a % of total loans (1) 0.34% 0.32% 0.27% 0.21% 0.21% NPL as a % of total assets (1) 0.25% 0.23% 0.20% 0.16% 0.16% Allowance for loan losses % of total loans (1) 1.12% 1.11% 1.08% 1.00% 0.99% Allowance for loan losses % of NPL 332% 352% 399% 484% 476% Net charge - offs (recoveries) $157K ($67K) $350K $54K $48K Net charge - offs as a % average loans (1) 0.01% 0.00% 0.02% 0.00% 0.00% (1) Excludes PPP loans

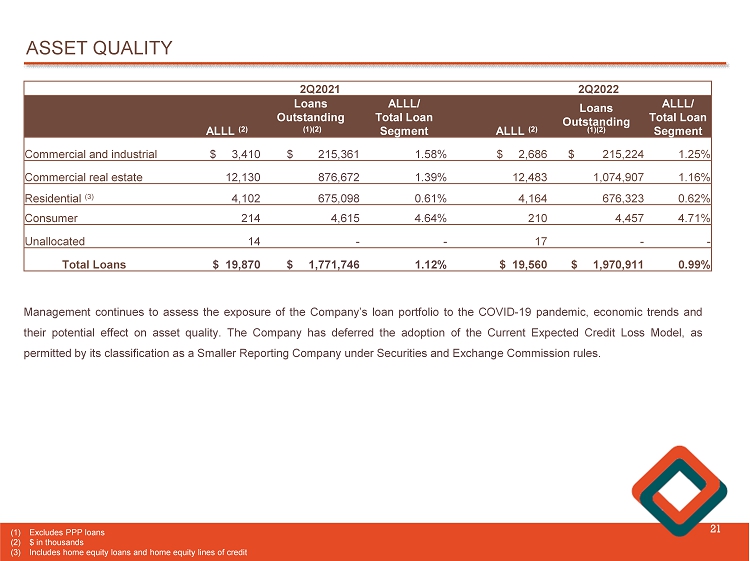

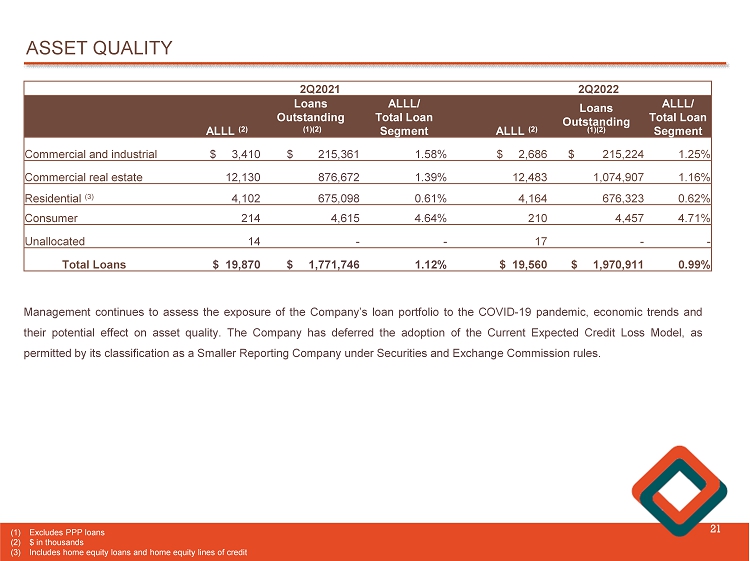

ASSET QUALITY 21 Management continues to assess the exposure of the Company’s loan portfolio to the COVID - 19 pandemic, economic trends and their potential effect on asset quality . The Company has deferred the adoption of the Current Expected Credit Loss Model , as permitted by its classification as a Smaller Reporting Company under Securities and Exchange Commission rules . 2Q2021 2Q2022 ALLL (2) Loans Outstanding (1)(2) ALLL/ Total Loan Segment ALLL (2) Loans Outstanding (1)(2) ALLL/ Total Loan Segment Commercial and industrial $ 3,410 $ 215,361 1.58% $ 2,686 $ 215,224 1.25% Commercial real estate 12,130 876,672 1.39% 12,483 1,074,907 1.16% Residential (3) 4,102 675,098 0.61% 4,164 676,323 0.62% Consumer 214 4,615 4.64% 210 4,457 4.71% Unallocated 14 - - 17 - - Total Loans $ 19,870 $ 1,771,746 1.12% $ 19,560 $ 1,970,911 0.99% (1) Excludes PPP loans (2) $ in thousands (3) Includes home equity loans and home equity lines of credit

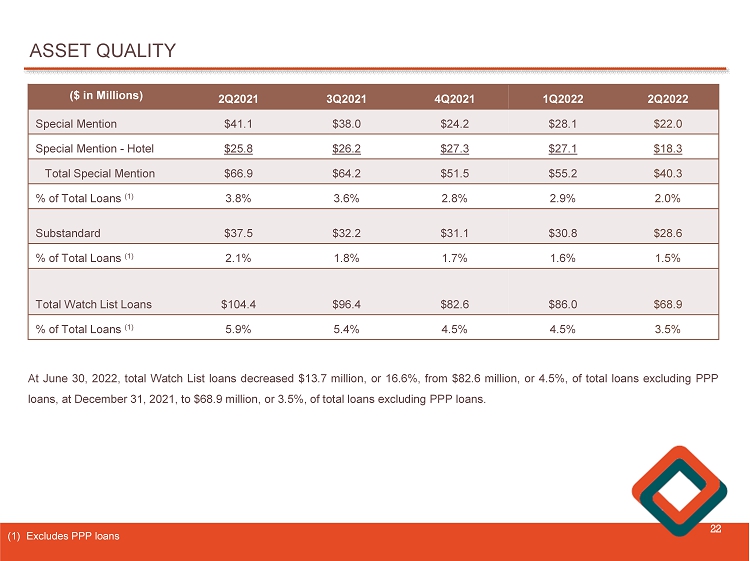

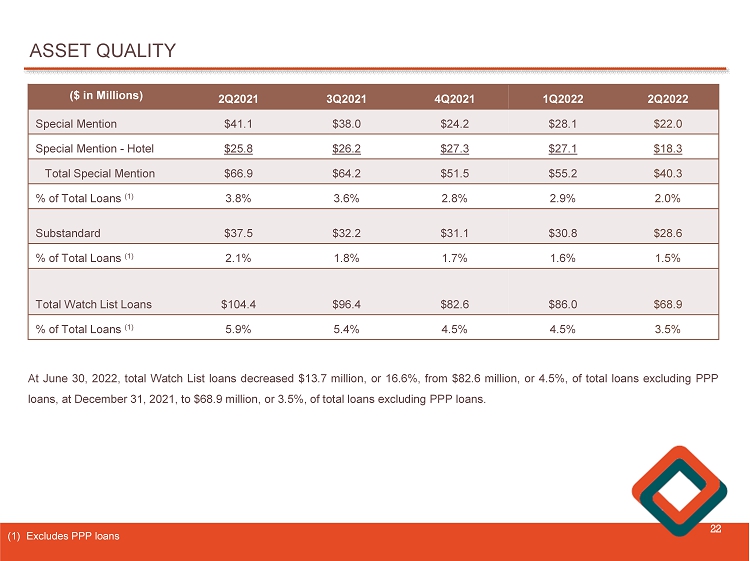

ASSET QUALITY 22 ($ in Millions) 2Q2021 3Q2021 4Q2021 1Q2022 2Q2022 Special Mention $41.1 $38.0 $24.2 $28.1 $22.0 Special Mention - Hotel $25.8 $26.2 $27.3 $27.1 $18.3 Total Special Mention $66.9 $64.2 $51.5 $55.2 $40.3 % of Total Loans (1) 3.8% 3.6% 2.8% 2.9% 2.0% Substandard $37.5 $32.2 $31.1 $30.8 $28.6 % of Total Loans (1) 2.1% 1.8% 1.7% 1.6% 1.5% Total Watch List Loans $104.4 $96.4 $82.6 $86.0 $68.9 % of Total Loans (1) 5.9% 5.4% 4.5% 4.5% 3.5% At June 30 , 2022 , total Watch List loans decreased $ 13 . 7 million, or 16 . 6 % , from $ 82 . 6 million, or 4 . 5 % , of total loans excluding PPP loans, at December 31 , 2021 , to $ 68 . 9 million, or 3 . 5 % , of total loans excluding PPP loans . (1) Excludes PPP loans

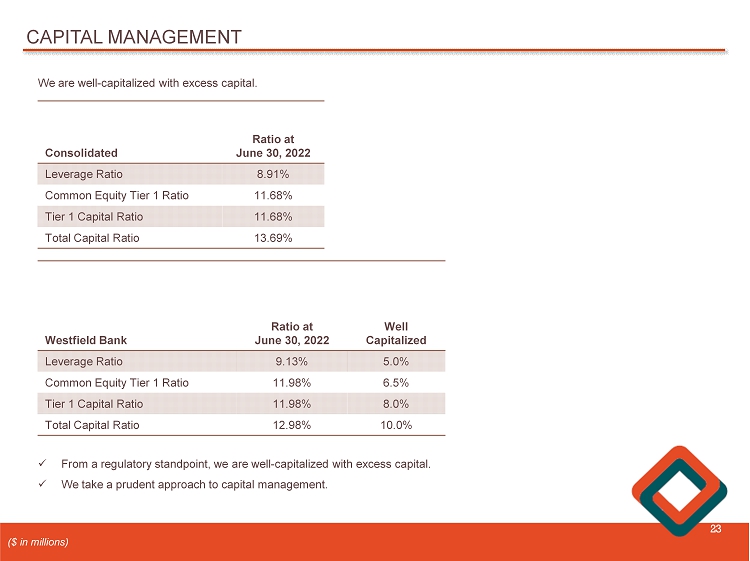

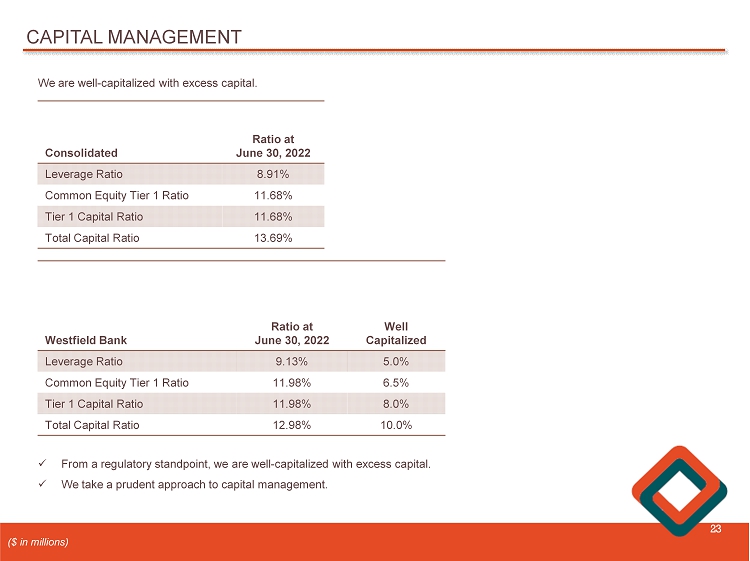

CAPITAL MANAGEMENT 23 We are well - capitalized with excess capital. Consolidated Ratio at June 30, 2022 Leverage Ratio 8.91% Common Equity Tier 1 Ratio 11.68% Tier 1 Capital Ratio 11.68% Total Capital Ratio 13.69% x From a regulatory standpoint, we are well - capitalized with excess capital. x We take a prudent approach to capital management. ($ in millions) Westfield Bank Ratio at June 30 , 2022 Well Capitalized Leverage Ratio 9.13% 5.0% Common Equity Tier 1 Ratio 11.98% 6.5% Tier 1 Capital Ratio 11.98% 8.0% Total Capital Ratio 12.98% 10.0%

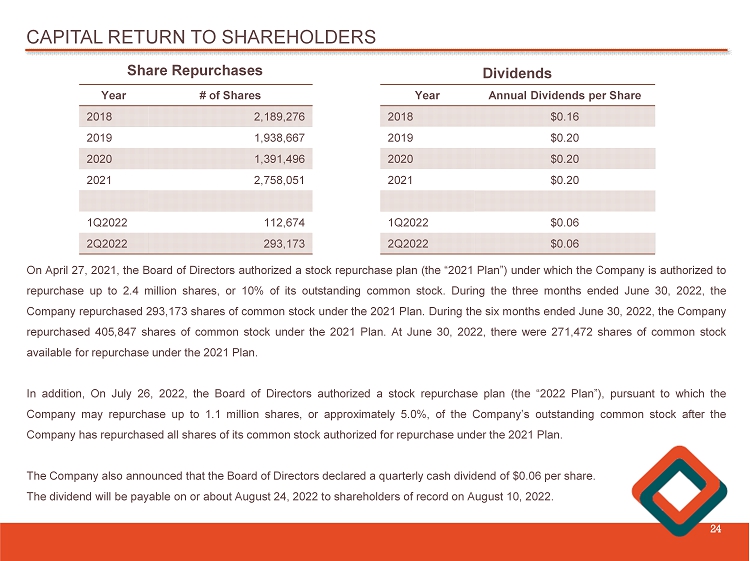

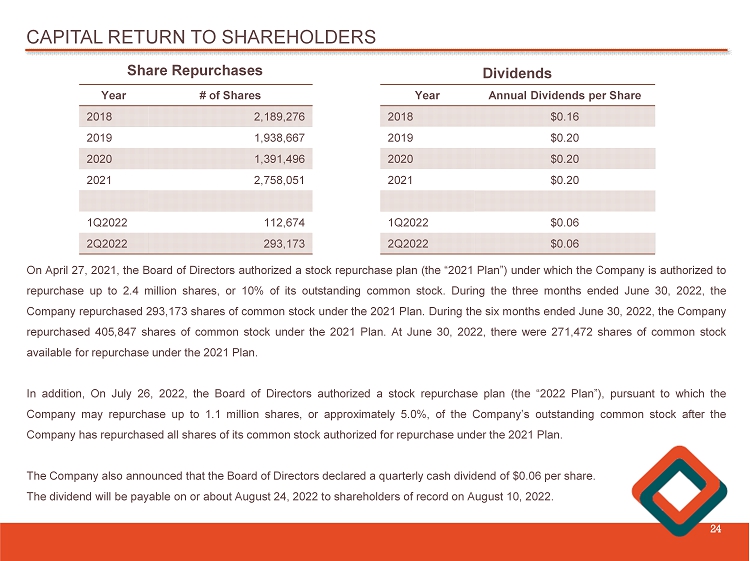

CAPITAL RETURN TO SHAREHOLDERS 24 Year # of Shares 2018 2,189,276 2019 1,938,667 2020 1,391,496 2021 2,758,051 1Q2022 112,674 2Q2022 293,173 Year Annual Dividends per Share 2018 $0.16 2019 $0.20 2020 $0.20 2021 $0.20 1Q2022 $0.06 2Q2022 $0.06 Share Repurchases Dividends On April 27 , 2021 , the Board of Directors authorized a stock repurchase plan (the “ 2021 Plan”) under which the Company is authorized to repurchase up to 2 . 4 million shares, or 10 % of its outstanding common stock . During the three months ended June 30 , 2022 , the Company repurchased 293 , 173 shares of common stock under the 2021 Plan . During the six months ended June 30 , 2022 , the Company repurchased 405 , 847 shares of common stock under the 2021 Plan . At June 30 , 2022 , there were 271 , 472 shares of common stock available for repurchase under the 2021 Plan . In addition , On July 26 , 2022 , the Board of Directors authorized a stock repurchase plan (the “ 2022 Plan”), pursuant to which the Company may repurchase up to 1 . 1 million shares, or approximately 5 . 0 % , of the Company’s outstanding common stock after the Company has repurchased all shares of its common stock authorized for repurchase under the 2021 Plan . The Company also announced that the Board of Directors declared a quarterly cash dividend of $ 0 . 06 per share . The dividend will be payable on or about August 24 , 2022 to shareholders of record on August 10 , 2022 .

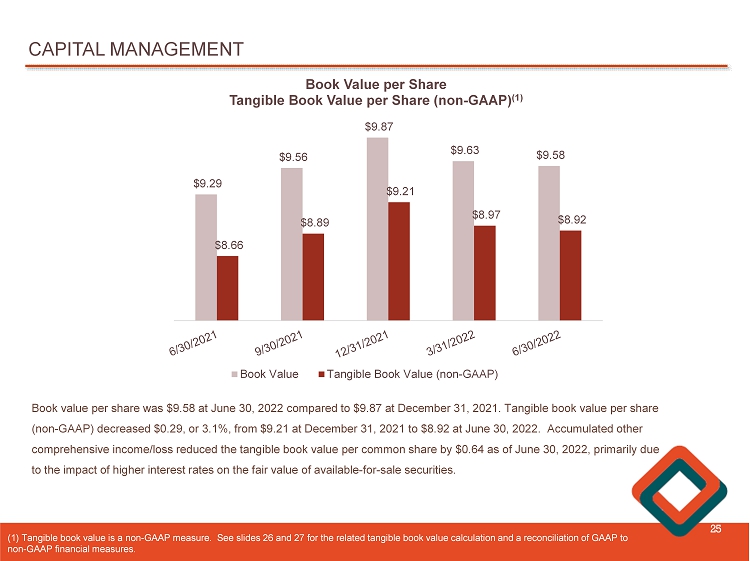

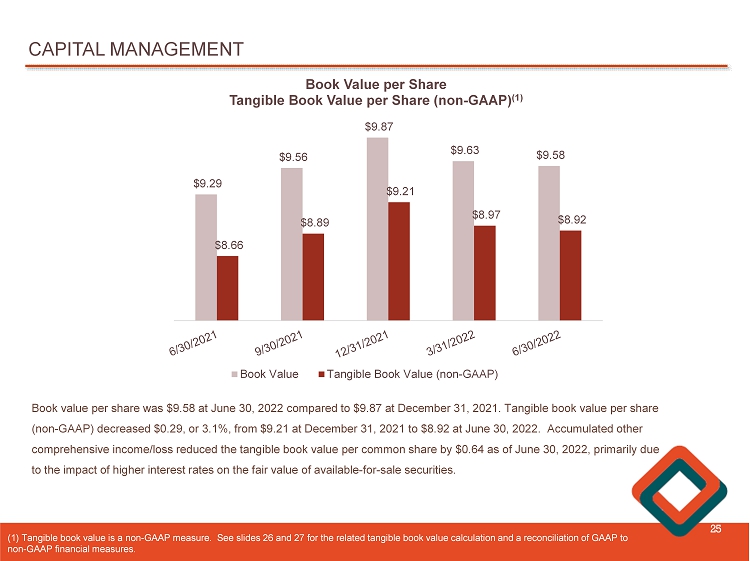

CAPITAL MANAGEMENT 25 $9.29 $9.56 $9.87 $9.63 $9.58 $8.66 $8.89 $9.21 $8.97 $8.92 Book Value per Share Tangible Book Value per Share (non - GAAP) (1) Book Value Tangible Book Value (non-GAAP) Book value per share was $ 9.58 at June 30, 2022 compared to $9.87 at December 31, 2021. Tangible book value per share (non - GAAP) decreased $ 0.29, or 3.1%, from $9.21 at December 31, 2021 to $ 8.92 at June 30, 2022. Accumulated other comprehensive income/loss reduced the tangible book value per common share by $0.64 as of June 30, 2022, primarily due to the impact of higher interest rates on the fair value of available - for - sale securities. ( 1) Tangible book value is a non - GAAP measure. See slides 26 and 27 for the related tangible book value calculation and a reconc iliation of GAAP to non - GAAP financial measures.

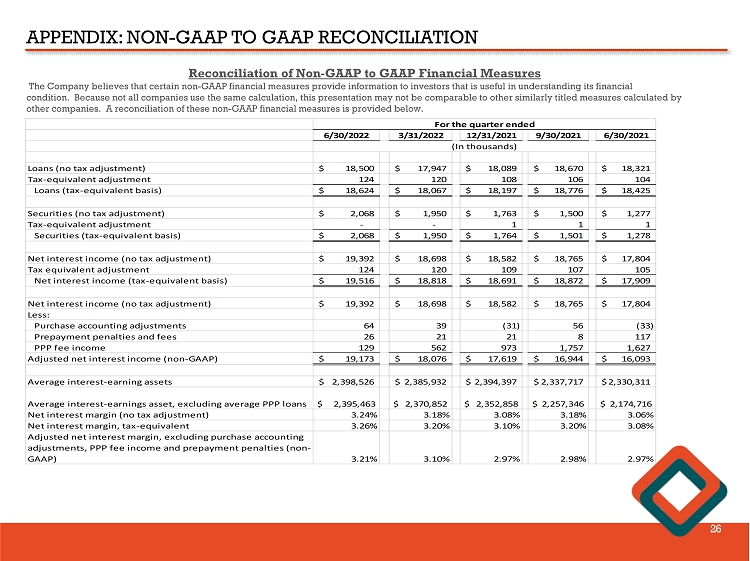

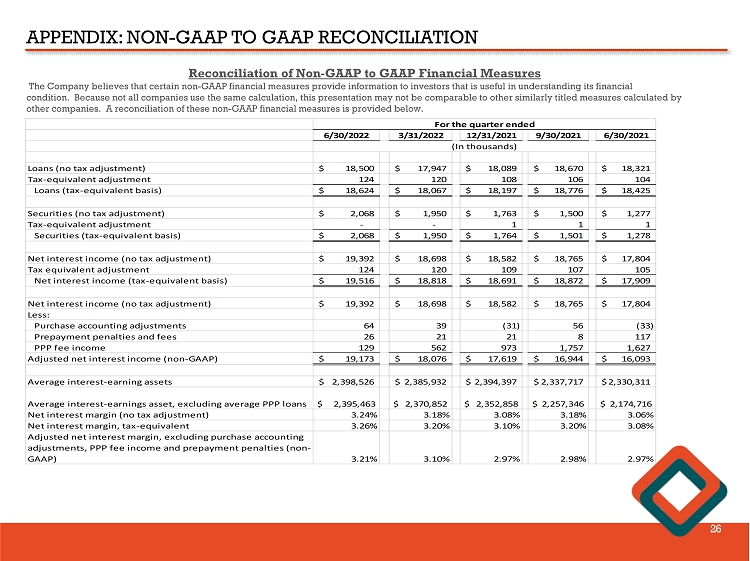

APPENDIX: NON - GAAP TO GAAP RECONCILIATION 26 Reconciliation of Non - GAAP to GAAP Financial Measures The Company believes that certain non - GAAP financial measures provide information to investors that is useful in understanding i ts financial condition. Because not all companies use the same calculation, this presentation may not be comparable to other similarly title d measures calculated by other companies. A reconciliation of these non - GAAP financial measures is provided below. 6/30/2022 3/31/2022 12/31/2021 9/30/2021 6/30/2021 Loans (no tax adjustment) 18,500$ 17,947$ 18,089$ 18,670$ 18,321$ Tax-equivalent adjustment 124 120 108 106 104 Loans (tax-equivalent basis) 18,624$ 18,067$ 18,197$ 18,776$ 18,425$ Securities (no tax adjustment) 2,068$ 1,950$ 1,763$ 1,500$ 1,277$ Tax-equivalent adjustment - - 1 1 1 Securities (tax-equivalent basis) 2,068$ 1,950$ 1,764$ 1,501$ 1,278$ Net interest income (no tax adjustment) 19,392$ 18,698$ 18,582$ 18,765$ 17,804$ Tax equivalent adjustment 124 120 109 107 105 Net interest income (tax-equivalent basis) 19,516$ 18,818$ 18,691$ 18,872$ 17,909$ Net interest income (no tax adjustment) 19,392$ 18,698$ 18,582$ 18,765$ 17,804$ Less: Purchase accounting adjustments 64 39 (31) 56 (33) Prepayment penalties and fees 26 21 21 8 117 PPP fee income 129 562 973 1,757 1,627 Adjusted net interest income (non-GAAP) 19,173$ 18,076$ 17,619$ 16,944$ 16,093$ Average interest-earning assets 2,398,526$ 2,385,932$ 2,394,397$ 2,337,717$ 2,330,311$ Average interest-earnings asset, excluding average PPP loans $ 2,395,463 $ 2,370,852 $ 2,352,858 $ 2,257,346 $ 2,174,716 Net interest margin (no tax adjustment) 3.24% 3.18% 3.08% 3.18% 3.06% Net interest margin, tax-equivalent 3.26% 3.20% 3.10% 3.20% 3.08% Adjusted net interest margin, excluding purchase accounting adjustments, PPP fee income and prepayment penalties (non- GAAP) 3.21% 3.10% 2.97% 2.98% 2.97% (In thousands) For the quarter ended

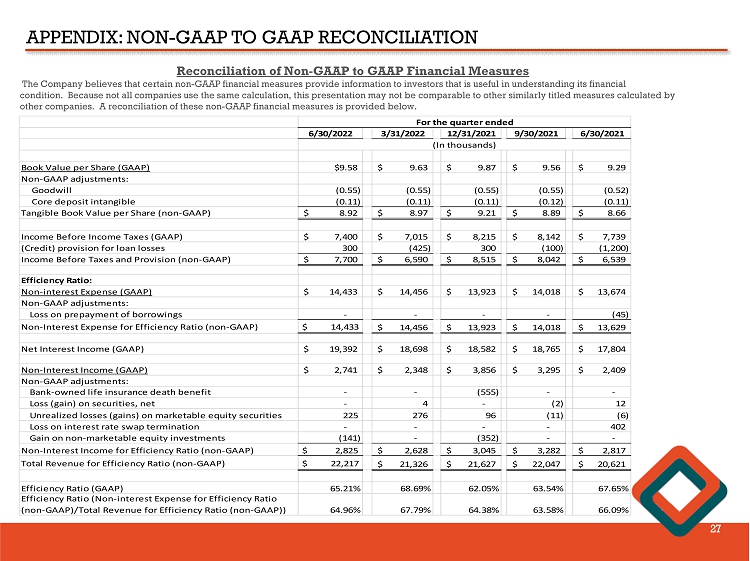

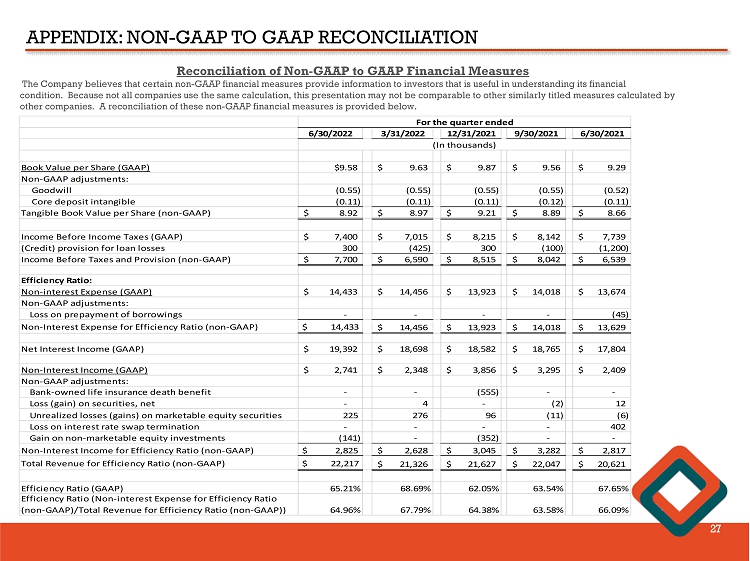

APPENDIX: NON - GAAP TO GAAP RECONCILIATION 27 Reconciliation of Non - GAAP to GAAP Financial Measures The Company believes that certain non - GAAP financial measures provide information to investors that is useful in understanding i ts financial condition. Because not all companies use the same calculation, this presentation may not be comparable to other similarly title d measures calculated by other companies. A reconciliation of these non - GAAP financial measures is provided below. 6/30/2022 3/31/2022 12/31/2021 9/30/2021 6/30/2021 Book Value per Share (GAAP) $9.58 9.63$ 9.87$ 9.56$ 9.29$ Non-GAAP adjustments: Goodwill (0.55) (0.55) (0.55) (0.55) (0.52) Core deposit intangible (0.11) (0.11) (0.11) (0.12) (0.11) Tangible Book Value per Share (non-GAAP) 8.92$ 8.97$ 9.21$ 8.89$ 8.66$ Income Before Income Taxes (GAAP) 7,400$ 7,015$ 8,215$ 8,142$ 7,739$ (Credit) provision for loan losses 300 (425) 300 (100) (1,200) Income Before Taxes and Provision (non-GAAP) 7,700$ 6,590$ 8,515$ 8,042$ 6,539$ Efficiency Ratio: Non-interest Expense (GAAP) 14,433$ 14,456$ 13,923$ 14,018$ 13,674$ Non-GAAP adjustments: Loss on prepayment of borrowings - - - - (45) Non-Interest Expense for Efficiency Ratio (non-GAAP) $ 14,433 14,456$ 13,923$ 14,018$ 13,629$ Net Interest Income (GAAP) 19,392$ 18,698$ 18,582$ 18,765$ 17,804$ Non-Interest Income (GAAP) 2,741$ 2,348$ 3,856$ 3,295$ 2,409$ Non-GAAP adjustments: Bank-owned life insurance death benefit - - (555) - - Loss (gain) on securities, net - 4 - (2) 12 Unrealized losses (gains) on marketable equity securities 225 276 96 (11) (6) Loss on interest rate swap termination - - - - 402 Gain on non-marketable equity investments (141) - (352) - - Non-Interest Income for Efficiency Ratio (non-GAAP) $ 2,825 2,628$ 3,045$ 3,282$ 2,817$ Total Revenue for Efficiency Ratio (non-GAAP) $ 22,217 21,326$ 21,627$ 22,047$ 20,621$ Efficiency Ratio (GAAP) 65.21% 68.69% 62.05% 63.54% 67.65% Efficiency Ratio (Non-interest Expense for Efficiency Ratio (non-GAAP)/Total Revenue for Efficiency Ratio (non-GAAP)) 64.96% 67.79% 64.38% 63.58% 66.09% (In thousands) For the quarter ended

WESTFIELD BANK “WHAT BETTER BANKING’S ALL ABOUT” James C. Hagan , President and Chief Executive Officer Guida R. Sajdak , Executive Vice President and Chief Financial Officer Meghan Hibner , Vice President and Investor Relations Officer 28 141 Elm Street, Westfield, MA