Filed Pursuant to Rule 424(b)(4)

Reg. No. 333-128744

PROSPECTUS

1,000,000 Shares

CAROLINA NATIONAL CORPORATION

| | | | |

| | |  ™ ™ | | |

Common Stock

Carolina National Corporation is the holding company for Carolina National Bank and Trust Company, a commercial bank headquartered in Columbia, South Carolina.

We are offering 1,000,000 shares of common stock.

Prior to the offering, there has been only limited trading in our common stock and no established market for our common stock has existed. Following the offering, we anticipate that our common stock will be listed on the Nasdaq Capital Market under the symbol “CNCP.”

Investing in our common stock involves risks. See“Risk Factors” beginning on page 6 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The shares of common stock we are offering are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| | | | | | |

| | | Per Share

| | Total

|

Price to public | | $ | 16.00 | | $ | 16,000,000 |

Underwriting discount (1) | | $ | 1.04 | | $ | 952,500 |

Proceeds, before expenses, to Carolina National Corporation (1) | | $ | 14.96 | | $ | 15,047,500 |

| (1) | The underwriter has agreed that the underwriting discount will be $0.48 per share for up to 156,250 shares that may be purchased by our directors and executive officers. The total underwriting discount and total proceeds of the offering assume the purchase of 156,250 shares by these persons. |

This is a firm commitment underwriting. We have granted Scott & Stringfellow, Inc. a 30-day option to purchase up to 150,000 additional shares from us at the public offering price, less the underwriter’s discount, to cover over-allotments.

Scott & Stringfellow, Inc. expects to deliver the shares to purchasers on December 20, 2005.

Scott & Stringfellow, Inc.

This prospectus is dated December 15, 2005

In connection with this offering, the underwriter may over-allot or effect transactions which stabilize or maintain the market price of our common stock at levels above those which might otherwise exist in the open market. If the underwriter commences stabilizing activities, it may discontinue them at any time.

SUMMARY

This summary highlights selected information about us and the offering that is contained elsewhere in this prospectus. The summary does not contain all the information that you should consider before investing in our common stock. You should read this summary together with the entire prospectus. Except as otherwise indicated by the context, references in this prospectus to the “company” refer to Carolina National Corporation and references to “our bank” or “the bank” refer to the company’s subsidiary, Carolina National Bank and Trust Company. References to “we,” “our” or “us” are to the combined business of the company and the bank.

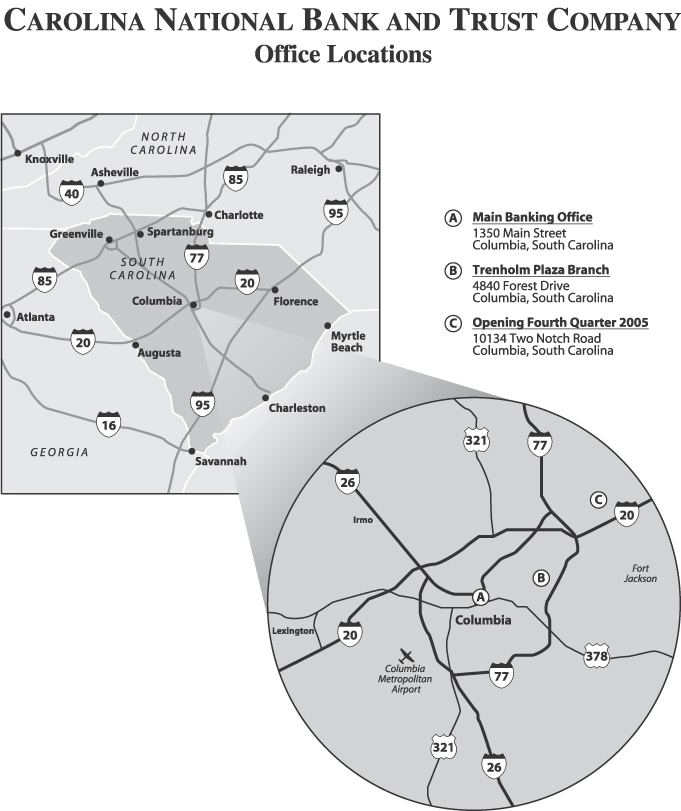

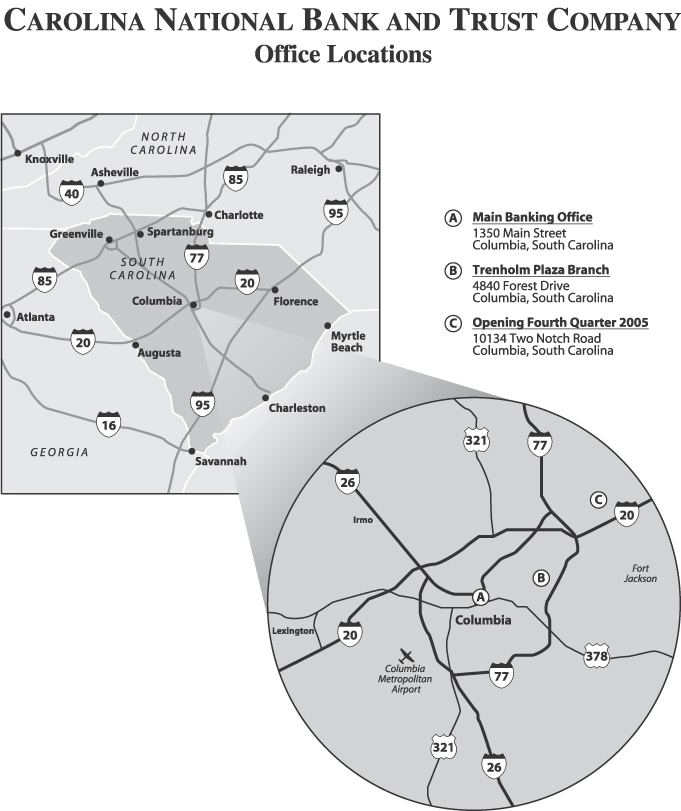

Carolina National Corporation

Carolina National Corporation is a bank holding company headquartered in Columbia, South Carolina. The company’s wholly owned subsidiary, Carolina National Bank and Trust Company, commenced operations as a national bank on July 15, 2002 and currently operates two full service banking offices and a loan production office serving the Greater Columbia market area. We plan to open an additional full service banking office, which will be located at the corner of Two Notch Road and Sparkleberry Lane in Northeast Columbia, before the end of 2005. Our bank engages in a general commercial banking business with a particular focus on the needs of small to medium-sized businesses, their principals and professionals.

We have experienced significant growth in assets and deposits and an improvement in income during our three years of operation. We experienced our first quarter of positive earnings in the last quarter of 2004 and have had positive earnings for all of the first three quarters of 2005. As of September 30, 2005, we had assets of $151.2 million, representing a 61.9% increase from September 30, 2004. Total loans outstanding as of September 30, 2005 amounted to $128.7 million, an improvement of 60.9% from September 30, 2004. Our deposits were $135.2 million at September 30, 2005, an increase of 65.3% from September 30, 2004. For the nine months ended September 30, 2005, our net income was $399,896, compared to a loss of $454,192 for the nine months ended September 30, 2004. Earnings per basic share for the same period increased to $.28 from a loss of $.32 for the prior nine-month period.

As of December 31, 2004, we had assets of $98.5 million, representing a 56.8% increase from December 31, 2003. Total loans outstanding as of December 31, 2004 amounted to $90.3 million, an improvement of 64.4% from December 31, 2003. Our deposits were $86.1 million at December 31, 2004, an increase of 70.0% from December 31, 2003. For the year ended December 31, 2004, we had a net loss of $432,770, compared to a loss of $1.2 million for the year ended December 31, 2003. Our loss per basic share for the same period decreased to $0.30 from a loss of $0.85 for the prior twelve-month period.

Management Team

Our bank’s senior management team consists of six officers that average over 21 years of experience in the banking industry. These officers received much of their industry training at both large regional financial institutions as well as with community banks and other financial institutions. They have experience managing loan portfolios much larger than Carolina National’s current loan portfolio as well as building out and managing retail branch networks and developing operational infrastructures and asset and liability management policies.

The table below identifies our key managers.

| | | | |

Name

| | Position

| | Years Experience

|

Roger Whaley | | Chief Executive Officer | | 34 |

Rollo Ingram | | Chief Financial Officer | | 35 |

Jack McElveen | | Senior Credit Officer | | 21 |

Beau Long | | Commercial Bank Executive | | 11 |

Mary Ellis Gabriel | | Consumer Bank Executive | | 11 |

Kathy Morales | | Vice President - Operations | | 19 |

1

The Columbia Market

Columbia is South Carolina’s capital city, the largest city in the state and the county seat of Richland County. Richland County and adjoining Lexington County are our primary target markets for the next few years. South Carolina is located in the southern region of the United States, which is one of the fastest growing areas in the country. From 1998 to 2003, the combined estimated population of Richland and Lexington counties grew 9.5% to 558,275 and continued growth is expected for the foreseeable future. Per capita income in Richland County was $26,144 in 2003, a 13.7% increase from 1998. Per capita income in Lexington County was $30,048 in 2003, a 20.3% increase from 1998. FDIC insured deposits in the combined counties increased by 45.2% to $7.3 billion from 1998 to 2003.

Columbia is geographically positioned in the center of South Carolina and serves as its economic hub. The city is located approximately midway between the industrialized Upstate region of South Carolina and the bustling coastal city of Charleston. Charleston, which is the busiest container shipping port along the Southeast and Gulf coasts, provides ready access to international markets. Columbia’s strategic location and interstate highway networks have contributed greatly to its overall commercial growth, particularly warehousing and distribution. Three major interstate highways serve Columbia (I-20, I-77 and I-26), directly connecting Columbia to Charlotte, Atlanta, Greenville and Charleston and providing access to other important centers of commercial activity.

The Columbia area has a diverse and relatively stable economy. Major employment sectors include health care, finance and insurance, retail, services, public administration and manufacturing. Major private sector employers in the region include Palmetto Health Alliance, Blue Cross and Blue Shield of South Carolina, Wal-Mart, Lexington Medical Center, SCANA Corporation, Providence Hospital and Michelin Tire Corporation At the other end of the employment scale, in 2003 Lexington and Richland counties had a combined total of 14,063 businesses with fewer than 100 employees, which represents our primary targeted market.

Columbia, as the capital city of the state, is the center of government on city, county, state and federal levels. Government exercises a substantial stabilizing influence on the area economy as a purchaser, service provider and employer. Federal, state and local governments are the area’s largest employers. Established in World War I, Fort Jackson is the largest and most active Initial Entry Training Center of the United States Army. Recent decisions of the Federal Base Realignment and Closure Commission may result in an expansion of programs and employment at Fort Jackson. There are eight institutions of higher education in the Columbia area with an aggregate enrollment in excess of 40,000 students, including the University of South Carolina which has the state’s largest number of enrollees in higher education with over 25,000 students. (For more information about the Columbia market and the sources of the information, see “Description of Business – Market Area” beginning on page 37.)

Growth Strategy

We provide personalized banking services to satisfy the needs of our customers, while investing our funds in accordance with sound banking practices and striving to earn the maximum profit for shareholders. Our growth strategy has the following components:

| | • | | Expand our branch network. We intend to expand our footprint by establishing new branches or acquiring existing branches from other financial institutions that present attractive growth opportunities within the Greater Columbia market. We have received approval from the Office of the Comptroller of the Currency to open a third full service branch by the end of 2005 and plan to open four other new branches over the next two to three years. |

We believe that with the increased demand for banking services arising from steady growth in population and personal income, the banking market will continue to grow in Columbia. Our growth demonstrates that there is a market for a locally owned and managed bank to serve the needs of the community, including individuals and small and medium-sized business enterprises. We concentrate on

2

this hometown market with a professional staff that is responsive to local needs and believe we are well positioned to take full advantage of the demographic and economic characteristics of our market area. Our existing and planned new branches should provide us with the core deposit growth needed to support continued asset and loan growth resulting from our planned hiring of additional loan officers.

| | • | | Continue our successful recruiting practices. We have taken a two-pronged approach to recruiting our commercial bankers. First, we have hired highly experienced local banking professionals with successful track records and established customer relationships. We currently have four seasoned commercial loan officers with an average of over 20 years of experience in the financial services industry. Our plan calls for the hiring of three additional seasoned in-market commercial bankers by the end of 2006 to support loan growth as we expand our footprint. Second, we have hired five high caliber college graduates and have trained them to be our future leaders. Two of them have become commercial loan producers. Two others have assumed staff support roles and another is being trained to become a branch manager. We plan to hire two college graduates each year as we continue to develop our future banking professionals internally. |

We provide personalized banking services, with emphasis on knowledge of the individual financial needs and objectives of our customers and an appropriate array of services to meet those needs and objectives, coupled with timely response. We seek to promote continuous long-term relationships between officers and customers by minimizing transfers of account officers to different customers, departments or locations. We seek to manage the number of accounts served by each officer in a manner that will permit personal attention to each customer and full development of each customer’s business relationship with us. Because our management is located in Columbia, all credit and related decisions are made locally, which facilitates prompt response.

| | • | | Capitalize on the continued bank consolidation in our market. A considerable amount of consolidation among financial institutions has occurred in South Carolina over the past decade. Many independent community banks have been acquired by larger regional institutions that are headquartered outside the state. We believe this consolidation creates an opportunity for us to increase our market share of deposits as well as attract disenchanted customers seeking the more personalized service that a local community bank can offer.One of our primary objectives is to provide citizens and small and medium-sized businesses of Greater Columbia with more opportunity to have their banking needs met locally. Our directors live in and are involved extensively in business in the Greater Columbia market area and we have made meeting the credit needs of this area a first priority. We believe that a large number of potential bank customers will prefer our local bank which can make credit decisions locally and quickly, and that this preference should result in a successful and profitable operation for us. |

| | • | | Expand our lending activities while maintaining excellent asset quality. We are undertaking our branch expansion strategy to build a stable and growing base of “core” deposits to help fund our loan growth. With an increased legal lending limit as a result of this offering and broadened deposit base we plan to aggressively grow our loan portfolio while maintaining superior asset quality through conservative underwriting practices. We do not expect there to be any material changes to the fundamental composition of our loan portfolio or to its overall credit quality. Since inception we have had minimal charge-offs and have never had a loan more than 30 days past due at any reporting period end. While we believe this exceptional record illustrates the quality of our loan portfolio, it is not necessarily indicative of the results that may be expected in the future. Like other lending institutions, we expect to have past due loans and loan charge-offs. |

3

The Offering

| | |

Shares Offered | | 1,000,000 shares of common stock. |

| |

Offering Price | | $16.00 per share. |

| |

Shares Outstanding After the Offering | | 2,427,303 shares. |

| |

Use of Proceeds | | We intend to use the proceeds of the offering for general corporate purposes, including: • repayment of indebtedness; • contribution to our bank’s capital, which will enable it to maintain its status as a “well capitalized” institution as our assets increase; • pursuit of future growth opportunities through further expansion of our existing lending and investment activities; • opening of a new branch office in Northeast Columbia during 2005; and further branch expansion in the next few years. See “Use of Proceeds” at page 11. |

| |

Dividend Policy | | To date, we have not paid any cash dividends on our common stock. We do not expect that we will pay cash dividends in the foreseeable future. See “Market for Common Stock and Dividends” at page 11. |

| |

Nasdaq Capital Market symbol | | Following the offering, we anticipate that our common stock will be listed on the Nasdaq Capital Market under the symbol “CNCP.” |

| |

Risk Factors | | Investing in our common stock involves investment risks. You should carefully review the information contained under “Risk Factors” beginning at page 6 before deciding to purchase shares of our common stock. |

The number of shares of our common stock outstanding after this offering is based on the number of shares outstanding on September 30, 2005, and excludes 300,856 shares of common stock issuable upon exercise of warrants and stock options outstanding on September 30, 2005, of which 251,435 were exercisable.

Except as otherwise indicated, all information in this prospectus assumes no exercise of the underwriter’s over-allotment option.

We were founded as a South Carolina corporation in May 2000 for the sole purpose of becoming a holding company for Carolina National Bank and Trust Company, our wholly owned subsidiary, which began operating as a national bank on July 15, 2002.

Our principal executive offices are located at 1350 Main Street, Columbia, South Carolina 29201. Our telephone number is (803) 779-0411.

4

Summary Consolidated Financial Data

The following table provides summary consolidated financial data for Carolina National Corporation. The financial data for each of the years ended December 31, 2004, 2003 and part of 2002 is derived from our consolidated financial statements. The financial data for the nine months ended September 30, 2005 and 2004 is derived from our unaudited consolidated financial statements. Operating results for the nine months ended September 30, 2005 are not necessarily indicative of the results that may be expected for the year ended December 31, 2005. You should read this summary consolidated financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 14, and our financial statements, including the accompanying notes, and other financial data, included elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | |

| | | Nine Months

Ended September 30,(1)

| | | Years Ended

December 31,

| | | From Inception (July 15, 2002) through December 31,

| |

| | | 2005

| | | 2004

| | | 2004

| | | 2003

| | | 2002

| |

| | | (Dollars in thousands, except per share data) | |

Period Ending Balances: | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 151,150 | | | $ | 93,339 | | | $ | 98,505 | | | $ | 62,810 | | | $ | 32,810 | |

Total loans (2) | | | 128,725 | | | | 79,982 | | | | 90,304 | | | | 54,931 | | | | 10,145 | |

Total deposits | | | 135,207 | | | | 81,798 | | | | 86,094 | | | | 50,646 | | | | 20,152 | |

Stockholders’ equity | | | 11,332 | | | | 10,912 | | | | 10,925 | | | | 11,383 | | | | 12,594 | |

| | | | | |

Results of operations: | | | | | | | | | | | | | | | | | | | | |

Total interest income | | $ | 5,466 | | | $ | 2,663 | | | $ | 3,926 | | | $ | 1,686 | | | $ | 316 | |

Total interest expense | | | 1,951 | | | | 832 | | | | 1,206 | | | | 511 | | | | 164 | |

Net interest income | | | 3,515 | | | | 1,830 | | | | 2,720 | | | | 1,176 | | | | 152 | |

Provision for loan losses | | | 448 | | | | 375 | | | | 506 | | | | 676 | | | | 152 | |

Net interest income after provision for loan losses | | | 3,067 | | | | 1,456 | | | | 2,214 | | | | 499 | | | | — | |

Noninterest income | | | 271 | | | | 208 | | | | 273 | | | | 305 | | | | 151 | |

Noninterest expense | | | 2,722 | | | | 2,358 | | | | 3,148 | | | | 2,631 | | | | 1,503 | |

Income (loss) before income taxes | | | 616 | | | | (695 | ) | | | (661 | ) | | | (1,827 | ) | | | (1,352 | ) |

Net income (loss) | | | 400 | | | | (454 | ) | | | (433 | ) | | | (1,211 | ) | | | (633 | ) |

| | | | | |

Per share data: | | | | | | | | | | | | | | | | | | | | |

Net income (loss), basic | | $ | 0.28 | | | $ | (0.32 | ) | | $ | (0.30 | ) | | $ | (0.85 | ) | | $ | (0.91 | ) |

Net income (loss), diluted (3) | | | 0.27 | | | | (0.32 | ) | | | (0.30 | ) | | | (0.85 | ) | | | (0.91 | ) |

Book value, basic | | | 7.94 | | | | 7.65 | | | | 7.65 | | | | 7.98 | | | | 8.82 | |

Shares outstanding, basic | | | 1,427 | | | | 1,427 | | | | 1,427 | | | | 1,427 | | | | 1,427 | |

Shares outstanding, diluted (3) | | | 1,502 | | | | 1,455 | | | | 1,455 | | | | 1,455 | | | | 1,440 | |

| | | | | |

Asset Quality Ratios: | | | | | | | | | | | | | | | | | | | | |

Allowance for loan losses to loans | | | 1.38 | % | | | 1.50 | % | | | 1.47 | % | | | 1.50 | % | | | 1.50 | % |

Nonperforming loans to loans | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

Allowance for loan losses to nonperforming loans | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

Net loan charge offs to average loans | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

| | | | | |

Selected Ratios: | | | | | | | | | | | | | | | | | | | | |

Tier 1 risk-based capital ratio (4) | | | 7.84 | % | | | 7.82 | % | | | 7.07 | % | | | 12.99 | % | | | 41.93 | % |

Total risk-based capital ratio (4) | | | 9.06 | % | | | 10.27 | % | | | 10.37 | % | | | 14.24 | % | | | 42.82 | % |

Tier 1 leverage ratio (4) | | | 7.81 | % | | | 8.29 | % | | | 6.88 | % | | | 14.33 | % | | | 23.18 | % |

Efficiency ratio (5) | | | 71.89 | % | | | 115.72 | % | | | 105.21 | % | | | 177.87 | % | | | 496.23 | % |

Equity to assets | | | 7.50 | % | | | 11.69 | % | | | 11.09 | % | | | 18.12 | % | | | 38.38 | % |

Return on average total assets (6) | | | 0.43 | % | | | (0.78 | %) | | | (0.51 | %) | | | (2.81 | %) | | | (2.38 | %) |

Return on average stockholders’ equity (6) | | | 5.62 | % | | | (5.43 | %) | | | (3.98 | %) | | | (10.19 | %) | | | (5.35 | %) |

Net interest margin (6) | | | 3.95 | % | | | 3.21 | % | | | 3.34 | % | | | 2.86 | % | | | 0.54 | % |

| (2) | Loans are stated at gross amounts before allowance for loan losses. |

| (3) | Diluted shares outstanding assume that all exercisable options and warrants are exercised at the end of the period and accounted for by the treasury stock method. |

| (4) | Ratios for dates other than September 30, 2005 are for our bank because the Federal Reserve uses subsidiary bank ratios for bank holding companies with less than $150 million in consolidated assets. At September 30, 2005, our consolidated assets exceeded $150 million and the capital ratios at that date are calculated according to the Federal Reserve guidelines. |

| (5) | We compute our efficiency ratio by dividing noninterest expense by the sum of net interest income and noninterest income. Comparison of our efficiency ratio with those of other companies may not be possible, because other companies may calculate the efficiency ratio differently. |

| (6) | Selected ratios for periods less than one year have been annualized. |

5

RISK FACTORS

Investment in our common stock involves a significant degree of risk. Before you decide to purchase our common stock, you should consider the risks and speculative features that are inherent in and affect our business. You should only make an investment after careful consideration of the risk factors set forth below. You should not invest in our stock unless you can afford an investment involving such risks.

Risks Related to Our Business

We have a limited operating history, and as a result our financial performance to date may not be a reliable indicator of whether our business strategy will be successful.

We did not commence operations until July 2002, and therefore have a limited historical basis upon which to rely for gauging our business performance. Our prospects are subject to the risks and uncertainties frequently encountered by companies in their early stages of development, including the risk that we will not be able to successfully implement our business plan. Accordingly, our financial performance to date may not be representative of our long-term future performance or indicative of whether our business strategy will be successful.

Our growth strategy may not be successful.

We have plans to maintain our asset and deposit growth through the opening of additional branch locations and the hiring of additional bankers. We may not be successful in identifying or obtaining suitable new branch locations or receiving regulatory approval for them, or employing and retaining suitable bankers, on terms that we can afford and that are attractive to us. Even if we successfully open additional branch locations and hire additional bankers, we may not achieve the asset and deposit growth that we seek because of competition or poor economic conditions, or for other reasons.

Our growth strategy will reduce our earnings in the near term.

We expect each new office we open to take several years to become profitable and we cannot guarantee that any new office will ever become profitable. We expect that by having a number of new offices our ability to operate at higher levels of profitability will be impeded until most of our offices can operate at substantial levels of profitability.

Our growth strategy will require future increases in capital that we may not be able to accomplish.

We are required by banking regulators to maintain various ratios of capital to assets. As our assets grow we expect our capital ratios to decline unless we can increase our earnings or raise new capital sufficiently to keep pace with asset growth. If we are unable to limit a capital ratio decline by increasing our capital, we will have to restrict our asset growth as we approach the minimum required capital to asset ratios.

We may be unable to successfully manage our sustained growth using the net proceeds from this offering.

We have grown substantially since we began operating. Although we may not continue to grow as fast as we have in the past, we intend to expand our asset base. In particular, we intend to use the funds raised in this offering to support anticipated increases in our loans. Additional capital also would increase our legal lending limit under federal law, which in turn would allow us to compete more actively in our market area for larger loans. Our future profitability will depend in part on our ability to manage growth successfully. Our ability to manage growth successfully will depend on our ability to maintain cost controls and asset quality while attracting

6

additional loans and deposits, as well as on factors beyond our control, such as economic conditions and interest rate trends. If we grow too quickly and are not able to control costs and maintain asset quality, growth could materially adversely affect our financial performance.

We depend on the services of a number of key personnel, and a loss of any of those personnel could disrupt our operations and result in reduced revenues.

We are a relationship-driven organization. Our growth and development to date have depended in large part on the efforts of our senior management team. These senior officers have primary contact with our customers and are extremely important in maintaining personalized relationships with our customer base, which are key aspects of our business strategy, and in increasing our market presence. The unexpected loss of services of one or more of these key employees could have a material adverse effect on our operations and possibly result in reduced revenues if we were unable to find suitable replacements promptly.

If our loan customers do not pay us as they have contracted to, we may experience losses.

Our principal revenue producing business is making loans. If our customers do not repay the loans, we will suffer losses. Even though we maintain an allowance for loan losses, the amount of the allowance may not be adequate to cover the losses we experience. We attempt to mitigate this risk by a thorough review of the creditworthiness of loan customers. Nevertheless, there is risk that our credit evaluations will prove to be inaccurate due to changed circumstances or otherwise.

Our business is concentrated in Greater Columbia, and a downturn in the economy of the Columbia area, a decline in Columbia area real estate values or other events in our market area may adversely affect our business.

Substantially all of our business is located in the Greater Columbia area. As a result, our financial condition and results of operations may be affected by changes in the Columbia economy. A prolonged period of economic recession, a general decline in Columbia area real estate values or other adverse economic conditions in Columbia and South Carolina may result in decreases in demand for our services, increases in nonpayment of loans and decreases in the value of collateral securing loans, which could have a material adverse effect on our business, future prospects, financial condition or results of operations.

We face strong competition from larger, more established competitors which may adversely affect our ability to operate profitably.

We encounter strong competition from financial institutions operating in the Greater Columbia, South Carolina area. In the conduct of our business, we also compete with credit unions, insurance companies, money market mutual funds and other financial institutions, some of which are not subject to the same degree of regulation as we are. Many of these competitors have substantially greater resources and lending abilities than we have and offer services, such as investment banking, trust and international banking services that we do not provide. We believe that we have been able to, and will continue to be able to, compete effectively with these institutions because of our experienced bankers and personalized service, as well as through loan participations and other strategies and techniques. However, we cannot promise that we are correct in our belief. If we are wrong, our ability to operate profitably may be negatively affected.

Risks Related to Our Common Stock

Our common stock has a limited trading market, which may make the prompt execution of sale transactions difficult.

Although our common stock may be traded from time to time on an individual basis, and we anticipate that it will be listed on the Nasdaq Capital Market after this offering, no active trading market has developed and

7

none may develop in the foreseeable future. Our common stock is not traded on any exchange or on the Nasdaq National Market System. Accordingly, if you wish to sell shares you may experience a delay or have to sell them at a lower price in order to sell them promptly, if at all.

We do not plan to pay cash dividends in the foreseeable future.

We do not plan to pay cash dividends in the foreseeable future. We plan to use the funds that might otherwise be available to pay dividends to expand our business.

Declaration and payment of dividends are within the discretion of our board of directors. Our bank will be our most likely source of funds with which to pay cash dividends. Our bank’s declaration and payment of future dividends to us are within the discretion of the bank’s board of directors, and are dependent upon its earnings, financial condition, its need to retain earnings for use in the business and any other pertinent factors. The bank’s payment of dividends is also subject to various regulatory requirements.

Provisions in our articles of incorporation and South Carolina law may discourage or prevent takeover attempts, and these provisions may have the effect of reducing the market price for our stock.

Our articles of incorporation include several provisions that may have the effect of discouraging or preventing hostile takeover attempts, and therefore of making the removal of incumbent management difficult. The provisions include staggered terms for our board of directors and requirements of supermajority votes to approve certain business transactions. In addition, South Carolina law contains several provisions that may make it more difficult for a third party to acquire control of us without the approval of our board of directors, and may make it more difficult or expensive for a third party to acquire a majority of our outstanding common stock. To the extent that these provisions are effective in discouraging or preventing takeover attempts, they may tend to reduce the market price for our stock.

Our directors have significant voting power.

Our present directors beneficially own 31.12% of our stock now and are expected to beneficially own approximately 25.12% after this offering. Because they own over 20%, if they vote together, they will be able to prevent any merger, consolidation, share exchange, sale of substantial assets, dissolution, removal of directors or amendment to the articles of incorporation they do not want. See “Description of Capital Stock.”

We have broad discretion to use the net proceeds of this offering.

We expect to use a substantial portion of the net proceeds to enhance and support the equity capital of our bank and retain the balance of the net proceeds in the holding company. The net proceeds we retain will be used for working capital and other general corporate purposes, including providing additional contributions to the bank’s capital as needed to support future loan production and asset growth, branch expansion in new and existing markets, and potential acquisitions to expand our retail branch network. Accordingly, we will have broad discretion as to the application of such proceeds. You will not have an opportunity to evaluate the economic, financial or other information on which we base our decisions as to how to use these net proceeds. Our failure to use these funds effectively could have an adverse effect on our financial condition and results of operations.

Our common stock is not insured, so you could lose your total investment.

Our common stock is not a deposit or savings account, and will not be insured by the Federal Deposit Insurance Corporation or any other government agency. Should our business fail you could lose your total investment.

8

Risks Related to Our Industry

We are subject to governmental regulation which could change and increase our cost of doing business or have an adverse affect on our business.

We operate in a highly regulated industry and are subject to examination, supervision and comprehensive regulation by various federal and state agencies. Our compliance with the requirements of these agencies is costly and may limit our growth and restrict certain of our activities, including, payment of dividends, mergers and acquisitions, investments, loans and interest rates charged, and locations of offices. We are also subject to capitalization guidelines established by federal authorities and our failure to meet those guidelines could result, in an extreme case, in our bank’s being placed in receivership. Supervision, regulation and examination of banks and bank holding companies by financial institution regulatory agencies are intended for the protection of depositors and our other customers rather than the holders of our common stock. We have also recently been subjected to the extensive and expensive requirements imposed on public companies by the Sarbanes-Oxley Act of 2002 and related regulations.

The laws and regulations applicable to the banking industry could change at any time, and we cannot predict the impact of these changes on our business or profitability. Because government regulation greatly affects the business and financial results of all commercial banks and bank holding companies, our cost of compliance could adversely affect our ability to operate profitably.

We are susceptible to changes in monetary policy and other economic factors which may adversely affect our ability to operate profitably.

Changes in governmental, economic and monetary policies may affect the ability of our bank to attract deposits and make loans. The rates of interest payable on deposits and chargeable on loans are affected by governmental regulation and fiscal policy as well as by national, state and local economic conditions. All of these matters are outside of our control and affect our ability to operate profitably.

9

FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of the securities laws. All statements that are not historical facts may be “forward-looking statements.” You can identify these forward-looking statements through our use of words such as “may,” “will,” “expect,” “anticipate,” “believe,” “intend, “ “estimate,” “project, “ “continue,” or other similar words. Forward-looking statements include, but are not limited to, statements regarding our future business prospects, revenues, working capital, liquidity, capital needs, interest costs, income, business operations and proposed services.

These forward-looking statements are based on current expectations, estimates and projections about our industry, management’s beliefs, and assumptions made by management. Such information includes, without limitation, discussions as to estimates, expectations, beliefs, plans, strategies, and objectives concerning our future financial and operating performance. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict, particularly in light of the fact that we are a relatively new company with limited operating history. Therefore, actual results may differ materially from those expressed or forecasted in such forward-looking statements. The risks and uncertainties include, but are not limited to:

| | • | | our growth and our ability to maintain growth; |

| | • | | governmental monetary and fiscal policies, as well as legislative and regulatory changes; |

| | • | | the effect of interest rate changes on our level and composition of deposits, loan demand and the value of our loan collateral and securities; |

| | • | | the effects of competition from other financial institutions operating in our market area and elsewhere, including institutions operating locally, regionally, nationally and internationally, together with competitors that offer banking products and services by mail, telephone and computer and/or the Internet; |

| | • | | failure of assumptions underlying the establishment of our allowance for loan losses, including the value of collateral securing loans; |

| | • | | loss of consumer confidence and economic disruptions resulting from terrorist activities; and |

| | • | | the factors discussed in “Risk Factors” beginning on page 6 of this prospectus. |

| | • | | We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties, and assumptions, the forward-looking events discussed in this prospectus might not occur. |

10

USE OF PROCEEDS

We estimate that we will receive $14.9 million in net proceeds from the sale of 1,000,000 shares of our common stock, using the public offering price of $16.00 per share and after deducting the underwriting discount and other estimated offering expenses. We will receive additional net proceeds of up to $2.2 million if the underwriter exercises the option granted to it in connection with this offering to cover over-allotments.

We will use some of the net proceeds of this offering to repay indebtedness of approximately $2.5 million and to increase the capital of our bank by approximately $8.0 million, which will enable it to maintain its status as a “well capitalized” institution as its assets increase, as well as to fund the costs of new branches. Our business plan calls for the addition of four new branches in the next few years and we estimate that each branch will cost approximately $1.5 to $2.0 million. We may also use some of the proceeds for our administrative expenses. Except for payment of such expenses, the remaining net proceeds will be temporarily invested and will be available to further increase the capital of the bank or for other activities in which a bank holding company is permitted to engage.

The following table demonstrates the distribution of our planned use of the net proceeds described above:

| | | | | | |

(Dollars in thousands)

| | Approximate

Amount

| | % of Net

Proceeds

| |

Repayment of indebtedness | | $ | 2,500 | | 16.8 | % |

Capital contribution to our bank | | | 8,000 | | 53.8 | % |

Administrative expenses and other permitted uses | | | 4,368 | | 29.4 | % |

| | |

|

| |

|

|

Total | | $ | 14,868 | | 100.0 | % |

| | |

|

| |

|

|

The principal reasons for the offering are to acquire additional capital to support our future growth, including the opening of a new banking office in Northeast Columbia during 2005 and further branch expansion in the next few years. See “Business—Management Philosophy and Policy” on page 36.

CAPITALIZATION

The following table shows (a) our actual capitalization at September 30, 2005, and (b) our pro forma capitalization as if this offering had been completed on that date. The pro forma capitalization assumes the sale of 1,000,000 shares, our receipt of $14.9 million in estimated net proceeds, after deducting the underwriting discount and our estimated offering expenses and there is no exercise of the underwriter’s over-allotment option.

| | | | | | | | |

| | | September 30, 2005

| |

| | | (Unaudited) | |

| | | Actual

| | | Pro Forma

| |

| | | (in thousands) | |

Shareholders’ Equity | | | | | | | | |

Preferred stock (10,000,000 shares authorized), none issued | | | — | | | | — | |

Common Stock, no par value (20,000,000 shares authorized)

1,427,303 shares issued and outstanding | | $ | 13,995 | | | | — | |

2,427,303 shares issued and outstanding (pro forma) | | | — | | | $ | 28,863 | |

Retained deficit | | | (2,645 | ) | | | (2,645 | ) |

Accumulated Other Comprehensive Loss | | | (18 | ) | | | (18 | ) |

| | |

|

|

| |

|

|

|

Total Shareholders’ Equity | | $ | 11,332 | | | $ | 26,200 | |

| | |

|

|

| |

|

|

|

MARKET FOR COMMON STOCK AND DIVIDENDS

Market for Common Stock. Although our common stock may be traded from time to time on an individual basis, no established trading market has developed. Our stock is not traded on any exchange or on the Nasdaq National Market System, nor are there any present market makers known to management. In two public offerings in 2002, we sold an aggregate of 1,341,303 shares of common stock for $10.00 per share. Since completion of those offerings, trading of our common stock has been limited and sporadic, and management is not aware of the prices at which all shares of stock have been traded. During 2003, management was aware of a few transactions in which our common stock traded for $11.00 per share. In 2004, the trades of which management was aware

11

were in the range of $11.00 to $12.00 per share in the first quarter, at $12.00 per share in the second quarter, in the range of $12.00 to $12.50 per share in the third quarter and in the range of $12.50 to $13.50 per share in the fourth quarter. In 2005, all of the trades of which management is aware were at $13.50 per share. However, management has not ascertained that these transactions are the result of arm’s length negotiations between the parties, and because of the limited number of shares involved, these prices may not be indicative of the market value of our common stock. Upon completion of the offering, we anticipate that our common stock will be listed on the Nasdaq Capital Market under the symbol “CNCP.”

As of September 30, 2005, we had 1,427,303 shares of common stock outstanding held by approximately 1,148 holders of record. As of September 30, 2005, we had outstanding options to purchase 100,301 shares of our common stock and outstanding warrants to purchase 200,555 shares of our common stock.

Dividends. We do not plan to pay cash dividends in the foreseeable future and may never pay cash dividends. We plan to use any funds that might otherwise be available to pay dividends to expand our business.

If we ever pay cash dividends, the most likely source of funds would be cash dividends paid to the company by the bank. The bank is restricted in its ability to pay dividends under the national banking laws and by regulations of the Comptroller of the Currency. A national bank may not pay dividends from its capital. All dividends must be paid out of net profits then on hand, after deducting losses and bad debts. A national bank is further prohibited from declaring a dividend on its shares of common stock until its surplus equals the amount of its capital, unless there has been transferred to surplus not less than 1/10 of the bank’s net profits of the preceding two consecutive half year periods (in the case of an annual dividend). Also, the approval of the Comptroller of the Currency is required if the total of all dividends declared by a national bank in any calendar year will exceed the total of its net income for that year combined with its retained net profits for the preceding two years, less any required transfers to surplus. The Comptroller of the Currency has issued policy statements that indicate that insured banks should generally only pay cash dividends out of current operating earnings. As a practical matter, a national bank cannot pay dividends until sufficient net income has been earned to eliminate any retained deficit. As of September 30, 2005, the bank had a retained deficit of $2.6 million, which means the bank will not be able to pay dividends to the Company until the bank earns cumulative net income of at least $2.6 million.

The payment of cash dividends by the bank may also be affected or limited by other factors, such as the requirements to maintain adequate capital above regulatory guidelines. In addition, if, in the opinion of the applicable regulatory authority, a bank under its jurisdiction is engaged in or is about to engage in an unsafe or unsound practice (which, depending on the financial condition of the bank, could include the payment of cash dividends), such authority may require, after notice and hearing, that such bank cease and desist from such practice. Paying dividends that deplete a bank’s capital base to an inadequate level may constitute an unsafe and unsound banking practice.

12

Selected Consolidated Financial Data

The following table provides summary consolidated financial data for Carolina National Corporation. The financial data for each of the years ended December 31, 2004, 2003 and part of 2002 is derived from our consolidated financial statements. The financial data for the nine months ended September 30, 2005 and 2004 is derived from our unaudited consolidated financial statements. Operating results for the nine months ended September 30, 2005 are not necessarily indicative of the results that may be expected for the year ended December 31, 2005. You should read this summary consolidated financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 14, and our financial statements, including the accompanying notes, and other financial data, included elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended

September 30,(1)

| | | Years Ended

December 31,

| | | From Inception (July 15, 2002) through December 31,

| |

| | | 2005

| | | 2004

| | | 2004

| | | 2003

| | | 2002

| |

| | | (Dollars in thousands, except per share data) | |

Period Ending Balances: | | | | |

Total assets | | $ | 151,150 | | | $ | 93,339 | | | $ | 98,505 | | | $ | 62,810 | | | $ | 32,810 | |

Total loans (2) | | | 128,725 | | | | 79,982 | | | | 90,304 | | | | 54,931 | | | | 10,145 | |

Total deposits | | | 135,207 | | | | 81,798 | | | | 86,094 | | | | 50,646 | | | | 20,152 | |

Stockholders’ equity | | | 11,332 | | | | 10,912 | | | | 10,925 | | | | 11,383 | | | | 12,594 | |

Results of operations: | | | | |

Total interest income | | $ | 5,466 | | | $ | 2,663 | | | $ | 3,926 | | | $ | 1,686 | | | $ | 316 | |

Total interest expense | | | 1,951 | | | | 832 | | | | 1,206 | | | | 511 | | | | 164 | |

Net interest income | | | 3,515 | | | | 1,830 | | | | 2,720 | | | | 1,176 | | | | 152 | |

Provision for loan losses | | | 448 | | | | 375 | | | | 506 | | | | 676 | | | | 152 | |

Net interest income after provision for loan losses | | | 3,067 | | | | 1,456 | | | | 2,214 | | | | 499 | | | | — | |

Noninterest income | | | 271 | | | | 208 | | | | 273 | | | | 305 | | | | 151 | |

Noninterest expense | | | 2,722 | | | | 2,358 | | | | 3,148 | | | | 2,631 | | | | 1,503 | |

Income (loss) before income taxes | | | 616 | | | | (695 | ) | | | (661 | ) | | | (1,827 | ) | | | (1,352 | ) |

Net income (loss) | | | 400 | | | | (454 | ) | | | (433 | ) | | | (1,211 | ) | | | (633 | ) |

Per share data: | | | | |

Net income (loss), basic | | $ | 0.28 | | | $ | (0.32 | ) | | $ | (0.30 | ) | | $ | (0.85 | ) | | $ | (0.91 | ) |

Net income (loss), diluted (3) | | | 0.27 | | | | (0.32 | ) | | | (0.30 | ) | | | (0.85 | ) | | | (0.91 | ) |

Book value, basic | | | 7.94 | | | | 7.65 | | | | 7.65 | | | | 7.98 | | | | 8.82 | |

Shares outstanding, basic | | | 1,427 | | | | 1,427 | | | | 1,427 | | | | 1,427 | | | | 1,427 | |

Shares outstanding, diluted (3) | | | 1,502 | | | | 1,455 | | | | 1,455 | | | | 1,455 | | | | 1,440 | |

Asset Quality Ratios: | | | | |

Allowance for loan losses to loans | | | 1.38 | % | | | 1.50 | % | | | 1.47 | % | | | 1.50 | % | | | 1.50 | % |

Nonperforming loans to loans | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

Allowance for loan losses to nonperforming loans | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

Net loan charge offs to average loans | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

Selected Ratios: | | | | |

Tier 1 risk-based capital ratio (4) | | | 7.84 | % | | | 7.82 | % | | | 7.07 | % | | | 12.99 | % | | | 41.93 | % |

Total risk-based capital ratio (4) | | | 9.06 | % | | | 10.27 | % | | | 10.37 | % | | | 14.24 | % | | | 42.82 | % |

Tier 1 leverage ratio (4) | | | 7.81 | % | | | 8.29 | % | | | 6.88 | % | | | 14.33 | % | | | 23.18 | % |

Efficiency ratio (5) | | | 71.89 | % | | | 115.72 | % | | | 105.21 | % | | | 177.87 | % | | | 496.23 | % |

Equity to assets | | | 7.50 | % | | | 11.69 | % | | | 11.09 | % | | | 18.12 | % | | | 38.38 | % |

Return on average total assets (6) | | | 0.43 | % | | | (0.78 | %) | | | (0.51 | %) | | | (2.81 | %) | | | (2.38 | %) |

Return on average stockholders’ equity (6) | | | 5.62 | % | | | (5.43 | %) | | | (3.98 | %) | | | (10.19 | %) | | | (5.35 | %) |

Net interest margin (6) | | | 3.95 | % | | | 3.21 | % | | | 3.34 | % | | | 2.86 | % | | | 0.54 | % |

| (2) | Loans are stated at gross amounts before allowance for loan losses. |

| (3) | Diluted shares outstanding assume that all exercisable options and warrants are exercised at the end of the period and accounted for by the treasury stock method. |

| (4) | Ratios for dates other than September 30, 2005 are for our bank because the Federal Reserve uses subsidiary bank ratios for bank holding companies with less than $150 million in consolidated assets. At September 30, 2005, our consolidated assets exceeded $150 million and the capital ratios at that date are calculated according to the Federal Reserve guidelines. |

| (5) | We compute our efficiency ratio by dividing noninterest expense by the sum of net interest income and noninterest income. Comparison of our efficiency ratio with those of other companies may not be possible, because other companies may calculate the efficiency ratio differently. |

| (6) | Selected ratios for periods less than one year have been annualized. |

13

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our financial statements and the notes thereto and the other financial data included elsewhere in this prospectus. The financial information provided below has been rounded in order to simplify its presentation. However, the ratios and percentages provided below are calculated using the detailed financial information contained in the financial statements, the notes thereto and the other financial data included elsewhere in this prospectus.

Overview

For the nine months ended September 30, 2005, our net income was $399,896 compared to a net loss of $454,192 for the same period in 2004. Earnings per share for the first nine months of 2005 were $0.28 per basic share compared to a loss of $0.32 for the comparable period of 2004 This increase primarily resulted from loan growth and an increase in net interest margin. Our net interest margin was 3.95% for the first nine months of 2005 compared to 3.21% for the first nine months of 2004.

For the year ended December 31, 2004, we had a net loss of $432,770 compared to a net loss of $1.2 million for the year ended December 31, 2003, our first full year of operations. Our loss per basic share was $0.30 in 2004 compared to $0.85 in 2003.

During the first nine months of 2005, total loans increased 42.5% from $90.3 million at December 31, 2004 to $128.7 million at September 30, 2005. Total deposits at September 30, 2005 were $135.2 million, a 57.0% increase from $86.1 million at December 31, 2004. During 2004, our total loans grew 64.4% from $54.9 million at year end 2003 to $90.3 million at year end 2004. Our deposits grew by 70.0% from $50.6 million at December 31, 2003 to $86.1 million at December 31, 2004. The growth in our loans and deposits reflects our bank’s acceptance and penetration in its markets.

Our allowance for loan losses was $1.8 million at September 30, 2005 compared to $1.2 million at September 30, 2004. The allowance for loan losses as a percentage of period end loans was 1.38% at September 30, 2005 and 1.51% at September 30, 2004. The provisions for loan losses were $448,462 and $374,607 for the nine months ended September 30, 2005 and 2004, respectively. We had minimal charge-offs and no non-accruing loans or loans 30 days or more past due at any reporting period end.

We intend to make a capital contribution of approximately $8.0 million of the proceeds of this offering to our bank for the purpose of continuing our branch expansion plan and to support the bank’s continued asset growth. Based on current market conditions and our current assessment of opportunities available to us, we expect to acquire, build or lease four new branches over the next two to three years in addition to the branch in Northeast Columbia we plan to open in December, 2005. Approximately $1.5 to $2.0 million will be committed to each branch for land, facility construction and equipment if we own the branch, or, a relatively similar amount of capital lease commitment and equipment costs will be incurred if we lease the branch. We expect that it will take between two and two and a half years for each branch to begin contributing profit to the bank. The effect on our results of operations will be dependent on a number of factors including how quickly the new branches become profitable, the rate at which we implement the expansion program, general economic conditions and competition in the marketplace. It is possible that some of our branch sites may never reach profitability and may have to be abandoned with a loss of a considerable portion of our capital investment. It is also possible that we may deviate significantly from our expansion plan if prudent banking practices, including capital preservation or better wealth building opportunities, so dictate.

14

Year ended December 31, 2004 compared with year ended December 31, 2003

Results of Operations

Net interest income increased $1.5 million, or 131.6% in 2004 from $1.2 million in 2003. The increase in net interest income was due primarily to an increase in average earning assets, which increased $40.5 million, or 98.9%, due to continued growth in the loan portfolio during this second full year of operation. The primary component of interest income was interest on loans, including fees, of $3.8 million.

Our net interest spread and net interest margin were 2.89% and 3.34%, respectively, in 2004 compared to 2.18% and 2.86%, respectively, in 2003. The increase in net interest spread was primarily the result of a higher interest rate environment. Yields on all earning assets increased in 2004. Yields on average earning assets increased from 4.11% in 2003 to 4.82% in 2004. Yields on average interest-bearing liabilities were 1.93% for 2004 and 2003.

The provision for loan losses was $505,607 in 2004 compared to $675,660 in 2003. We continue to maintain the allowance for loan losses at a level we believe to be sufficient to cover known and inherent losses in the loan portfolio.

| | • | | Noninterest income decreased $31,651, or 10.4%, to $272,876 in 2004 from $304,527 in 2003. The decrease is primarily attributable to a decrease in residential mortgage origination fees, which decreased $131,997, or 57.0%, to $99,502 for the year ended December 31, 2004 due to decreased mortgage loan demand in a rising interest rate environment. Service charges on deposit accounts increased by $82,855 or 165.1% to $133,028 for the year ended December 31, 2004, when compared to 2003 as a result of increased deposit account volume. |

| | • | | Noninterest expense increased $517,642, or 19.7%, to $3.1 million in 2004 from $2.6 million in 2003. Noninterest expenses increased in all categories as a result of our continued growth during the second full year of operations. Salaries and employee benefits increased $265,605 to $1.8 million for the year ended December 31, 2004. This increase is attributable to normal pay increases and the hiring of additional staff to meet needs associated with our growth. Our efficiency ratio was 105.2% in 2004 compared to 177.9% in 2003. The efficiency ratio is defined as noninterest expense divided by the sum of net interest income and noninterest income, net of gains and losses on sales of assets. |

Net loss was $432,770 in 2004 compared to a net loss of $1.2 million in 2003. The decline in net loss reflects our continued growth, as average earning assets increased from $41.0 million for the year ended December 31, 2003 to $81.5 million for the year ended December 31, 2004. Return on average assets during 2004 was (0.51%) compared to (2.81%) during 2003. Net loss is after the recognition of an income tax benefit of $228,631 and $616,174 for the years 2004 and 2003, respectively. The income tax benefit was based on an effective tax rate of 34%.

Net Interest Income

General. The largest component of our net income is net interest income, which is the difference between the income earned on assets and interest paid on deposits and borrowings used to support such assets. Net interest income is determined by the yields earned on our interest-earning assets and the rates paid on our interest-bearing liabilities, the relative amounts of interest-earning assets and interest-bearing liabilities, and the degree of mismatch and the maturity and repricing characteristics of its interest-earning assets and interest-bearing liabilities. Net interest income divided by average interest-earning assets represents our net interest margin.

15

Average Balances, Income and Expenses, and Rates and Yields. The following table sets forth, for the periods indicated, information related to our average balance sheet and its income and yields on average earning assets and average costs and rates of liabilities. Such yields and rates are derived by dividing income or expense by the average balance of the corresponding assets or liabilities and are then annualized. Average balances have been derived from the daily balances throughout the periods indicated.

| | | | | | | | | | | | | | | | | | | | |

| | | For the Year Ended

December 31, 2004

| | | For the Year Ended

December 31, 2003

| |

| (Dollars in thousands) | | Average Balance

| | | Income/

Expense

| | Yield/

Rate

| | | Average

Balance

| | | Income/

Expense

| | Yield/

Rate

| |

Assets: | | | | | | | | | | | | | | | | | | | | |

Earning Assets: | | | | | | | | | | | | | | | | | | | | |

Loans (1) | | $ | 71,713 | | | $ | 3,765 | | 5.25 | % | | $ | 30,412 | | | $ | 1,538 | | 5.06 | % |

Securities, taxable | | | 2,782 | | | | 56 | | 2.01 | | | | 4,294 | | | | 79 | | 1.84 | |

Federal funds sold and other | | | 7,037 | | | | 105 | | 1.49 | | | | 6,281 | | | | 69 | | 1.10 | |

| | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | |

Total earning assets | | | 81,532 | | | | 3,926 | | 4.82 | | | | 40,987 | | | | 1,686 | | 4.11 | |

| | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | |

Cash and due from banks | | | 1,669 | | | | | | | | | | 982 | | | | | | | |

Premises and equipment | | | 1,746 | | | | | | | | | | 533 | | | | | | | |

Other assets | | | 625 | | | | | | | | | | 1,131 | | | | | | | |

Allowance for loan losses | | | (1,056 | ) | | | | | | | | | (436 | ) | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | |

Total assets | | $ | 84,516 | | | | | | | | | $ | 43,197 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | | | |

Interest-Bearing Liabilities: | | | | | | | | | | | | | | | | | | | | |

Interest-bearing transaction accounts | | $ | 5,202 | | | $ | 9 | | 0.17 | % | | $ | 3,887 | | | $ | 9 | | 0.23 | % |

Savings deposits | | | 22,906 | | | | 380 | | 1.66 | | | | 9,589 | | | | 133 | | 1.39 | |

Time deposits | | | 34,512 | | | | 817 | | 2.37 | | | | 12,953 | | | | 367 | | 2.83 | |

Federal funds purchased | | | 7 | | | | — | | — | | | | 54 | | | | 1 | | 1.85 | |

| | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | |

Total interest-bearing liabilities | | | 62,627 | | | | 1,206 | | 1.93 | | | | 26,483 | | | | 510 | | 1.93 | |

| | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | |

Demand deposits | | | 10,551 | | | | | | | | | | 4,719 | | | | | | | |

Accrued interest and other liabilities | | | 461 | | | | | | | | | | 113 | | | | | | | |

Shareholders’ equity | | | 10,877 | | | | | | | | | | 11,882 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | |

Total liabilities and shareholders’ equity | | $ | 84,516 | | | | | | | | | $ | 43,197 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | |

Net interest spread | | | | | | | | | 2.89 | % | | | | | | | | | 2.18 | % |

| | | | | | | | | |

|

| | | | | | | | |

|

|

Net interest income | | | | | | $ | 2,720 | | | | | | | | | $ | 1,176 | | | |

| | | | | | |

|

| | | | | | | | |

|

| | | |

Net interest margin | | | | | | | | | 3.34 | % | | | | | | | | | 2.86 | % |

| | | | | | | | | |

|

| | | | | | | | |

|

|

| (1) | There were no loans in nonaccrual status in 2004 or 2003. The effect of fees amortized on loans in 2004 totaling $133,701 increased the annualized yield on loans by .19% from 5.06%. The effect on the annualized yield on earning assets in 2004 was an increase of .17% from 4.65%. The effect on net interest spread and net interest margin in 2004 was an increase of .17% and .17% from 2.72% and 3.17%, respectively. |

16

Analysis of Changes in Net Interest Income. Net interest income can also be analyzed in terms of the impact of changing rates and changing volume. The following table reflects the extent to which changes in interest rates and changes in the volume of earning assets and interest-bearing liabilities have affected our interest income and interest expense during the periods indicated. Information on changes in each category attributable to (i) changes due to volume (change in volume multiplied by prior period rate), (ii) changes due to rates (changes in rates multiplied by prior period volume) and (iii) changes in rate/volume (change in rate multiplied by the change in volume) is as follows:

| | | | | | | | | | | | | | | | |

| | | 2004 compared to 2003

| |

| | | Due to increase (decrease) in | |

| (Dollars in thousands) | | Volume(1)

| | | Rate(1)

| | | Volume/

Rate

| | | Total

| |

Interest income: | | | | | | | | | | | | | | | | |

Loans | | $ | 2,089 | | | $ | 59 | | | $ | 79 | | | $ | 2,227 | |

Securities, taxable | | | (27 | ) | | | 8 | | | | (3 | ) | | | (22 | ) |

Federal funds sold and other | | | 8 | | | | 24 | | | | 3 | | | | 35 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total interest income | | | 2,070 | | | | 91 | | | | 79 | | | | 2,240 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Interest expense: | | | | | | | | | | | | | | | | |

Interest-bearing deposits | | | 798 | | | | (38 | ) | | | (65 | ) | | | 695 | |

Short-term borrowings | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total interest expense | | | 798 | | | | (38 | ) | | | (65 | ) | | | 695 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net interest income | | $ | 1,272 | | | $ | 129 | | | $ | 144 | | | $ | 1,545 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (1) | Volume-rate changes have been allocated to each category based on a consistent basis between rate and volume. |

Interest Sensitivity. We monitor and manage the pricing and maturity of our assets and liabilities in order to diminish the potential adverse impact that changes in interest rates could have on its net interest income. The principal monitoring technique we employ is the measurement our interest sensitivity “gap”, which is the positive or negative dollar difference between assets and liabilities that are subject to interest rate repricing within a given period of time. Interest rate sensitivity can be managed by repricing assets or liabilities, selling securities available for sale, replacing an asset or liability at maturity, or adjusting the interest rate during the life of an asset or liability. Managing the amount of assets and liabilities repricing in this same time interval helps to hedge the risk and minimize the impact on net interest income of rising or falling interest rates.

17

The following table sets forth our interest rate sensitivity at December 31, 2004.

Interest Sensitivity Analysis

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | Within

Three Months

| | | After Three

Through

Twelve Months

| | | One

Through

Five Years

| | | Greater

Than

Five Years

| | | Total

| |

Assets | | | | | | | | | | | | | | | | | | | | |

Earning Assets: | | | | | | | | | | | | | | | | | | | | |

Federal funds sold | | $ | 1,767 | | | $ | — | | | $ | — | | | $ | — | | | $ | 1,767 | |

Loans | | | 58,077 | | | | 1,600 | | | | 29,557 | | | | 1,281 | | | | 90,515 | |

Investment securities | | | — | | | | — | | | | 2,969 | | | | 393 | | | | 3,362 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total earning assets | | | 59,844 | | | | 1,600 | | | | 32,526 | | | | 1,674 | | | | 95,644 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Liabilities | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits: | | | | | | | | | | | | | | | | | | | | |

Demand deposits | | | 6,047 | | | | — | | | | — | | | | — | | | | 6,047 | |

Savings deposits | | | 24,763 | | | | — | | | | — | | | | — | | | | 24,763 | |

Time deposits | | | 13,181 | | | | 21,181 | | | | 10,547 | | | | — | | | | 44,909 | |

Note payable | | | — | | | | — | | | | 900 | | | | — | | | | 900 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total interest-bearing liabilities | | | 43,991 | | | | 21,181 | | | | 11,447 | | | | — | | | | 76,619 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Period gap | | $ | 15,853 | | | $ | (19,581 | ) | | $ | 21,079 | | | $ | 1,674 | | | $ | 19,025 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Cumulative gap | �� | $ | 15,853 | | | $ | (3,728 | ) | | $ | 17,351 | | | $ | 19,025 | | | $ | 19,025 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Ratio of cumulative gap to total earning assets | | | 16.6 | % | | | (3.9 | )% | | | 18.1 | % | | | 19.9 | % | | | 19.9 | % |

The above table reflects the balances of interest-earning assets and interest-bearing liabilities at the earlier of their repricing or maturity dates. Overnight federal funds are reflected at the earliest pricing interval due to the immediately available nature of the instruments. Debt securities are reflected at each instrument’s ultimate maturity date. Scheduled payment amounts of fixed rate amortizing loans are reflected at each scheduled payment date. Scheduled payment amounts of variable rate amortizing loans are reflected at each scheduled payment date until the loan may be repriced contractually; the unamortized balance is reflected at that point. Interest-bearing liabilities with no contractual maturity, such as savings deposits and interest-bearing transaction accounts, are reflected in the earliest repricing period due to contractual arrangements which give us the opportunity to vary the rates paid on those deposits within a thirty-day or shorter period. Fixed rate time deposits, principally certificates of deposit, are reflected at their contractual maturity date. The note payable is reflected at its contractual maturity date.

We generally would benefit from increasing market rates of interest when our gap position is asset-sensitive and generally would benefit from decreasing market rates of interest when it is liability-sensitive. At December 31, 2004 we were cumulatively asset sensitive over all periods, except for after three through twelve months. However, our gap analysis is not a precise indicator of our interest sensitivity position. The analysis presents only a static view of the timing of maturities and repricing opportunities, without taking into consideration that changes in interest rates do not affect all assets and liabilities equally. Net interest income may be impacted by other significant factors in a given interest rate environment, including changes in the volume and mix of earning assets and interest-bearing liabilities.

18

Provision and Allowance for Loan Losses

General. There are risks inherent in making all loans, including risks with respect to the period of time over which loans may be repaid, risks resulting from changes in economic and industry conditions, risks inherent in dealing with individual borrowers, and, in the case of a collateralized loan, risks resulting from uncertainties about the future value of the collateral. We have developed policies and procedures for evaluating the overall quality of our credit portfolio and the timely identification of potential problem credits. On a quarterly basis, our board of directors reviews and approves the appropriate level for our allowance for loan losses based upon management’s recommendations, the results of the internal monitoring and reporting system, and an analysis of economic conditions in its market. Through December 31, 2004 our objective was to initially fund the allowance for loan losses at approximately 1.50% of total loans outstanding based upon the prior experience of management and other new banks to provide for a risk of loss inherent in the loan portfolio until a history was established. We have subsequently revised our procedure and it is described on page 30.

Additions to the allowance for loan losses, which are expensed as the provision for loan losses on our income statement, are made periodically to maintain the allowance at an appropriate level based on management’s analysis of the estimated losses inherent in the loan portfolio. Loan losses and recoveries are charged or credited directly to the allowance. The amount of the provision is a function of the level of loans outstanding, the level of nonperforming loans, historical loan loss experience, the amount of loan losses actually charged against the reserve during a given period, and current and anticipated economic conditions.

Our allowance for loan losses is based upon judgments and assumptions about risk elements in the portfolio, future economic conditions, and other factors affecting borrowers. The process includes identification and analysis of loss potential in various portfolio segments utilizing a credit risk grading process and specific reviews and evaluations of significant problem credits. In addition, we monitor the overall portfolio quality through observable trends in delinquencies, charge-offs, and general and economic conditions in the service area. The adequacy of the allowance for loan losses and the effectiveness of our monitoring and analysis system are also reviewed periodically by the banking regulators and our independent auditors.

We assign each of our loans a numerical grade of one through nine based on our analysis of the risks of loss for the loan. The loans with a grade of one are those we believe have the least amount of risk of loss, while loans that are charged off are given a grade of nine, representing the highest risk of loss. Criticized loans (risk grade five) are loans that have potential weaknesses that deserve close attention and which could, if uncorrected, result in deterioration of the prospects for repayment or our credit position at a future date. Classified loans (risk grades six, seven and eight) are loans that are inadequately protected by the sound worth and paying capacity of the borrower or any collateral and as to which there is a distinct possibility or probability that we will sustain a loss if the deficiencies are not corrected.

We account for impaired loans in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 114, “Accounting by Creditors for Impairment of a Loan”. This statement requires that all lenders value a loan at the loan’s fair value if it is probable that the lender will be unable to collect all amounts due according to the terms of the loan agreement. Fair value may be determined based upon the present value of expected cash flows, market price of the loan, if available, or value of the underlying collateral. Expected cash flows are required to be discounted at the loan’s effective interest rate. SFAS No. 114 was amended by SFAS No. 118, “Accounting by Creditors for Impairment of a Loan–Income Recognition and Disclosures,” to allow a lender to use existing methods for recognizing interest income on an impaired loan and by requiring additional disclosures about how a creditor recognizes interest income on an impaired loan.

Under SFAS No. 114, as amended by SFAS No. 118, when the ultimate collectibility of an impaired loan’s principal is in doubt, wholly or partially, all cash receipts are applied to principal. Once the reported principal balance has been reduced to zero, future cash receipts are applied to interest income, to the extent that any interest has been foregone. Further cash receipts are recorded as recoveries of any amounts previously charged off. When this doubt does not exist, cash receipts are applied under the contractual terms of the loan agreement first to interest income then to principal.

19

A loan is also considered impaired if its terms are modified in a troubled debt restructuring. For these accruing impaired loans, cash receipts are typically applied to principal and interest receivable in accordance with the terms of the restructured loan agreement. Interest income is recognized on these loans using the accrual method of accounting.