Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

November 6, 2019

Date of Report (Date of earliest event reported)

Encana Corporation

(Exact name of registrant as specified in its charter)

| Canada | 1-15226 | 98-0355077 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

Suite 4400, 500 Centre Street SE, PO Box 2850

Calgary, Alberta, Canada, T2P 2S5

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (403)645-2000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Shares | ECA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Table of Contents

| ITEM 8.01 | Other Events. |

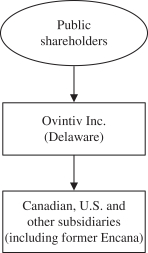

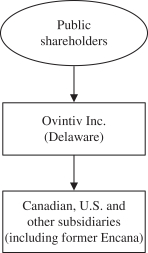

Encana Corporation (“Encana”) previously announced on October 31, 2019 its intention to establish corporate domicile in the United States. Encana is proposing and will be submitting to the holders (“Encana Shareholders”) of common shares of Encana (the “Encana Common Shares”) and the holders (“Encana Incentive Awardholders” and together with the Encana Shareholders, the “Encana Securityholders”) of incentive awards of Encana for approval, a special resolution approving the corporate reorganization of Encana. The proposed reorganization transactions (the “Reorganization”) include (i) a proposed plan of arrangement under the Canada Business Corporations Act, pursuant to which, among other things, Encana will complete a share consolidation on the basis of one post-consolidation share for each fivepre-consolidation shares and a wholly-owned subsidiary of Encana named “Ovintiv Inc.” (“Ovintiv”) will ultimately acquire all of the issued and outstanding Encana Common Shares in exchange for shares of Ovintiv on aone-for-one basis and become the parent company of Encana and its subsidiaries (collectively, the “Arrangement”), and (ii) as soon as practicable following completion of the Arrangement, Ovintiv migrating out of Canada and becoming a Delaware corporation. After the Reorganization is complete, Encana Shareholders will hold one share of common stock, par value US$0.01 per share, of Ovintiv, a Delaware corporation, for each five Encana Common Shares owned immediately prior to the Reorganization, but the business, assets, liabilities, directors and officers of Ovintiv will continue to be the same as the business, assets, liabilities, directors and officers of Encana immediately prior to the Reorganization. To be effective, the special resolution approving the Reorganization must be approved, with or without variation, by the affirmative vote of at leasttwo-thirds of the votes cast on the resolution, in person or by proxy, by both (i) Encana Shareholders and Encana Incentive Awardholders, voting together as a single class, and (ii) Encana Shareholders, voting separately.

In connection with the Reorganization, on November 6, 2019, 1847432 Alberta ULC (“184Co”), which is currently a wholly-owned subsidiary of Encana and will be a predecessor of Ovintiv following the completion of the Reorganization, filed a Registration Statement on FormS-4 (the “Registration Statement”), which includes a preliminary prospectus of Ovintiv and preliminary proxy statement of Encana (the “Proxy Statement/Prospectus”), with the Securities and Exchange Commission (the “SEC”). The information in the Registration Statement, including the information in the Proxy Statement/Prospectus, is subject to completion and amendment.

A copy of the preliminary Proxy Statement/Prospectus is attached as Exhibit 99.1 to this Current Report onForm 8-K.

Table of Contents

Important Information for Investors and Securityholders

This communication is not intended to and does not constitute an offer to sell, buy or exchange or the solicitation of an offer to sell, buy or exchange any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, purchase, or exchange of securities or solicitation of any vote or approval in any jurisdiction in contravention of applicable law. In connection with the proposed corporate reorganization that includes, among other things, the redomicile, Encana’s subsidiary 1847432 Alberta ULC, a predecessor to Ovintiv Inc. (“Ovintiv”), has filed a registration statement on FormS-4, which includes Ovintiv’s preliminary prospectus as well as Encana’s preliminary proxy statement (the “Proxy Statement/Prospectus”), with the U.S. Securities and Exchange Commission (the “SEC”) and Canadian securities regulatory authorities. Encana plans to mail the definitive Proxy Statement/Prospectus to its shareholders and holders of its equity incentives in connection with the proposed corporate reorganization. INVESTORS AND SECURITYHOLDERS OF ENCANA ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC AND CANADIAN SECURITIES REGULATORY AUTHORITIES CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ENCANA, OVINTIV, THE CORPORATE REORGANIZATION AND RELATED MATTERS. Investors and securityholders will be able to obtain free copies of the definitive Proxy Statement/Prospectus (when available) and other documents filed with the SEC by Encana or Ovintiv through the website maintained by the SEC at www.sec.gov. Investors and securityholders will also be able to obtain free copies of the definitive Proxy Statement/Prospectus (when available) and other documents filed with Canadian securities regulatory authorities by Encana, through the website maintained by the Canadian Securities Administrators at www.sedar.com. In addition, investors and securityholders will be able to obtain free copies of the documents filed with the SEC and Canadian securities regulatory authorities on Encana’s website at www.encana.com or by contacting Encana’s Corporate Secretary.

Participants in the Solicitation

Encana and certain of its directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed corporate reorganization. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the securityholders of Encana in connection with the corporate reorganization, including a description of their respective direct or indirect interests, by security holdings or otherwise, will be included in the definitive Proxy Statement/Prospectus described above when it is filed with the SEC and Canadian securities regulatory authorities. Additional information regarding Encana’s directors and executive officers is also included in Encana’s Notice of Annual Meeting of Shareholders and 2019 Proxy Statement, which was filed with the SEC and Canadian securities regulatory authorities on March 14, 2019. This document is available free of charge as described above.

Table of Contents

ADVISORY REGARDING FORWARD-LOOKING STATEMENTS – This communication contains forward-looking statements or information (collectively, “FLS”) within the meaning of applicable securities legislation, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. FLS include: completion and timing of the proposed corporate reorganization (including name change, share consolidation and U.S. domestication) and the benefits thereof, including opportunity to enhance long-term value for shareholders, liquidity and capital market access, exposure to larger pools of investment, comparability with U.S. peers, and increase in passive and index ownership; benefits of the new brand and logo; estimated tax impacts and other costs to the company and shareholders; timing of the special meeting of securityholders; the company’s sustainable business roadmap and elements thereof; improvements in returns and cash flow; and anticipated changes to debt rating. FLS involve assumptions, risks and uncertainties that may cause such statements not to occur or results to differ materially. These assumptions include: the ability to receive, in a timely manner and on satisfactory terms, required securityholder, stock exchange and court approvals; future commodity prices and differentials; assumptions in corporate guidance; data contained in key modeling statistics; availability of attractive hedges and enforceability of risk management program; access to transportation and processing facilities; and expectations and projections made in light of Encana’s historical experience and its perception of historical trends. Risks and uncertainties include: ability to achieve anticipated benefits of the corporate reorganization; receipt of securityholder, stock exchange and court approvals and satisfaction of other conditions; risks relating to the new company following the reorganization, including triggering provisions in certain agreements; publicity resulting from the reorganization and impacts to the company’s business and share price; ability to generate sufficient cash flow to meet obligations; commodity price volatility; ability to secure adequate transportation and potential pipeline curtailments; timing and costs of well, facilities and pipeline construction; business interruption, property and casualty losses or unexpected technical difficulties; counterparty and credit risk; impact of changes in credit rating and access to liquidity, including ability to issue commercial paper; currency and interest rates; risks inherent in Encana’s corporate guidance; changes in or interpretation of laws or regulations; risks associated with existing or potential lawsuits and regulatory actions; impact of disputes arising with partners, including suspension of certain obligations and inability to dispose of assets or interests in certain arrangements; and other risks and uncertainties as described in Encana’s Annual Report on Form10-K and Quarterly Report on Form10-Q and as described from time to time in Encana’s other periodic filings as filed on SEDAR and EDGAR.

Although Encana believes such FLS are reasonable, there can be no assurance they will prove to be correct. The above assumptions, risks and uncertainties are not exhaustive. FLS are made as of the date hereof and, except as required by law, Encana undertakes no obligation to update or revise any FLS.

Table of Contents

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| Exhibit No. | Description | |

| Exhibit 99.1 | Preliminary Proxy Statement/Prospectus | |

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

Table of Contents

EXHIBIT INDEX

| Exhibit No. | Description | |

| Exhibit 99.1 | Preliminary Proxy Statement/Prospectus | |

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 6, 2019

| ENCANA CORPORATION | ||

| (Registrant) | ||

| By: | /s/ Dawna I. Gibb | |

| Name: | Dawna I. Gibb | |

| Title: | Assistant Corporate Secretary | |

Table of Contents

Exhibit 99.1

Table of Contents

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This proxy statement/prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

PRELIMINARY – SUBJECT TO COMPLETION – DATED NOVEMBER 6, 2019

|  |

PROXY STATEMENT/PROSPECTUS

PROPOSED REORGANIZATION – YOUR VOTE IS IMPORTANT

As previously announced on October 31,2019, Encana Corporation (“Encana”), a Canadian corporation, is proposing and submitting to the holders (“Encana Shareholders”) of common shares of Encana (the “Encana Common Shares”) and the holders (“Encana Incentive Awardholders”, and together with the Encana Shareholders, the “Encana Securityholders”) of incentive awards of Encana (“Encana Incentive Awards”) for approval, a corporate reorganization of Encana that is described in detail below.

In order to implement the corporate reorganization, a special meeting of Encana Securityholders willbe held at the Oddfellows Building, Ballroom (Floor 4), 100 – 6th Avenue S.W., Calgary, Alberta, at[●] (Mountain Time) on[●], 2020 (the “Meeting”), at which Encana Securityholders will be asked to consider a resolution (the “Reorganization Resolution”) to approve a series of proposed reorganization transactions (the “Reorganization”), which will include (i) a proposed plan of arrangement under theCanada Business Corporations Act (the “CBCA”), pursuant to which, among other things, Encana will complete a share consolidation on the basis of one post-consolidation share for each fivepre-consolidation shares (the “Share Consolidation”) and a wholly-owned subsidiary of Encana named “Ovintiv Inc.” (“Ovintiv”) will ultimately acquire all of the issued and outstanding Encana Common Shares in exchange for shares of Ovintiv on aone-for-one basis and become the parent company of Encana and its subsidiaries (collectively, the “Arrangement”), and (ii) as soon as practicable following completion of the Arrangement, Ovintiv migrating out of Canada and becoming a Delaware corporation (the “U.S. Domestication”). After the Reorganization is complete, Encana Shareholders will hold one share of common stock, par value US$0.01 per share (“Common Stock”) of Ovintiv, a Delaware corporation, for each five Encana Common Shares owned immediately prior to the Reorganization, but the business, assets, liabilities, directors and officers of Ovintiv will continue to be the same as the business, assets, liabilities, directors and officers of Encana immediately prior to the Reorganization.

The board of directors of Encana (the “Encana Board”) unanimously recommends that Encana Securityholders voteFOR the Reorganization Resolution.

The Encana Board believes that the opportunity to enhance long-term value for shareholders will be greater as a U.S. company than as a Canadian company. Despite significantly and strategically repositioning our multi-basin portfolio in North America’s top liquids-rich basins while constantly innovating to drive quality returns and corporate financial performance, the Encana Board believes our valuation continues to be disconnected from our U.S. peers. This is due, in part, to our inability to access certain pools of capital in the United States that are limited in investing in securities of foreign companies. We believe as a U.S. company, we may be able to attract deeper and growing pools of passive investment capital in the U.S., particularly when our shares are able to be included in U.S. stock market indices and other investment vehicles that only include securities of U.S.-domiciled companies. The Encana Board believes the Reorganization will help capture the value we deeply believe exists within our company.

We believe the company is uniquely positioned in the exploration and production industry, with our abilities to generate free cash flow, return cash to shareholders and provide industry-competitive liquids growth from our multi-basin portfolio of assets in North America. We have strong connections to the United States, including (i) over 80% of our 2019 capital investments being made in the U.S., (ii) being listed on the New York Stock Exchange (the “NYSE”), (iii) having a majority of our operations, employees and shareholders located in the U.S., and (iv) complying with U.S. Securities and Exchange Commission (“SEC”) reporting requirements as a U.S. domestic issuer. Despite this, we do not believe we are perceived as a company with a substantial U.S. presence, but as a Canadian company with some U.S. operations. The Encana Board believes that by not being recognized among our U.S. peers, we may be prevented from maximizing certain opportunities and relationships with our U.S. stakeholders. Through the Reorganization, we will unambiguously establish ourselves as a U.S.-based company, which the Encana Board believes will level the playing field with our principal competitors, most of which are U.S.-based companies.

Adopting a new corporate name reflects our transformation and articulates our vision for the future – to make modern life possible for all. Today, we are a leader in the next generation of oil and gas exploration and production companies working to improve lives and driving progress – not just in the communities where we operate, but for everyone. “Ovintiv” stands for our commitment to deliver unmatched value through continuous innovation, while our new logo symbolizes the human connection made possible by the safe, reliable and affordable energy we produce. Through focused innovation, we are able to bring together the brightest minds, operating excellence and emerging technologies to create industry-leading improvements that maximize our operational, financial, safety and environmental performance.

Table of Contents

We have a long and proud history in Canada. Following the U.S. Domestication, we will maintain our existing Canadian presence with a business office in Calgary, Alberta, and field offices in Alberta, British Columbia and Nova Scotia to operate our portfolio of Canadian crude oil, natural gas liquids, condensate and natural gas properties and related assets. The Encana Board does not believe that the Reorganization will detract from our commitment to our business, employees, landowners, suppliers, lenders, partners and federal, provincial and local governments in Canada, and we intend to continue our productive relationships with our Canadian stakeholders.

The Encana Board further believes that conducting a share consolidation as part of the Reorganization will enhance comparability to our U.S. peers and reduce the volatility of our shares. Shares of Common Stock of Ovintiv are anticipated to begin trading on the NYSE and the Toronto Stock Exchange (the “TSX”) promptly following the date the Reorganization becomes effective under the CBCA (the “Effective Date”). See “The Reorganization – Certain Legal and Regulatory Matters – Stock Exchange Listings”.

For Encana Shareholders, much will remain unchanged following the Reorganization. The shareholders of Ovintiv will be the same persons who were Encana Shareholders immediately prior to the Reorganization (other than Dissenting Shareholders (as defined herein)). However, given the differences between the laws of Canada and Delaware law, your rights as a shareholder of Encana and a shareholder of Ovintiv will be different. In addition, there are differences between Encana’s existing articles of incorporation andby-law and Ovintiv’s Certificate of Incorporation (the “Ovintiv Certificate of Incorporation”) and bylaws (the “Ovintiv Bylaws”) as they will be in effect upon the completion of the Reorganization. See “Comparison of Rights of Encana Shareholders and Ovintiv Stockholders” and “Description of Ovintiv Capital Stock”.

The Encana Board weighed the estimated corporate tax liability arising from the Reorganization and, with the assistance of professional advisors and based on and subject to current assumptions and market value, does not anticipate we will incur material corporate-level Canadian or United States federal income tax in connection with the Reorganization. See “Risk Factors –The Reorganization may result in material Canadian federal income tax (including material Canadian “emigration tax”) and/or material U.S. federal income tax for Encana or Ovintiv”.

The Reorganization may have different tax consequences for Encana Shareholders resident in Canada and the United States. The Canadian federal income tax consequences of the Reorganization for Encana Shareholders will depend on a number of factors. See “The Reorganization – Particulars of the Reorganization” and “Certain Canadian Federal Income Tax Considerations”. As described in more detail in the section of the Proxy Statement/Prospectus entitled “Certain Canadian Federal Income Tax Considerations”, there are circumstances where the disposition of Encana Common Shares pursuant to the Reorganization may be a taxable transaction to an Encana Shareholder for Canadian federal income tax purposes.The U.S. federal income tax consequences of the Reorganization to U.S. Holders will also depend on a number of factors and certain U.S. Holders may be subject to U.S. federal income taxation in connection with the Reorganization. See “Certain U.S. Federal Income Tax Considerations”.Encana Shareholders are urged to carefully read the sections of the Proxy Statement/Prospectus entitled “Certain Canadian Federal Income Tax Considerations” and “Certain U.S. Federal Income Tax Considerations”, as applicable, and to consult with their own tax and other advisors.

Subject to the satisfaction or waiver of all other conditions precedent, if both (i) Encana Shareholders and Encana Incentive Awardholders, voting together as a single class, and (ii) Encana Shareholders, voting separately, approve the Reorganization Resolution, it is anticipated that the Reorganization will be completed as soon as practicable following the approval of the Court of Queen’s Bench of Alberta (the “Court”) in respect of the Arrangement.

This Proxy Statement/Prospectus is dated[●], 2019 and is first being mailed to Encana Shareholders of record on or about[●], 2019.

We urge you to read this Proxy Statement/Prospectus and the documents incorporated by reference herein carefully and in their entirety. In particular, you should consider the matters discussed in the section entitled “Risk Factors”, beginning on page 33 of this Proxy Statement/Prospectus.

Neither the U.S. Securities and Exchange Commission nor any state securities commission or Canadian securities regulatory authority has approved or disapproved of the securities to be issued in connection with the Reorganization described in this Proxy Statement/Prospectus or determined if this Proxy Statement/Prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Table of Contents

|  |

[●], 2019

Dear Encana Securityholders:

You are invited to attend a special meeting (the “Meeting”) of the holders (“Encana Shareholders”) of common shares (the “Encana Common Shares”) and the holders (“Encana Incentive Awardholders”, and together with the Encana Shareholders, the “Encana Securityholders”) of incentive awards (“Encana Incentive Awards”) of Encana Corporation (“Encana”) to be held at the Oddfellows Building, Ballroom (Floor 4), 100 – 6th Avenue S.W.,Calgary, Alberta, at[●](Mountain Time) on[●], 2020.

The Reorganization

At the Meeting, Encana Securityholders will be asked to consider a resolution (the “Reorganization Resolution”) to approve a series of proposed reorganization transactions (the “Reorganization”), which will include (i) a proposed plan of arrangement under theCanada Business Corporations Act (“CBCA”) involving, among others, Encana, Encana Securityholders and a wholly-owned subsidiary of Encana named “Ovintiv Inc.” (“Ovintiv”), pursuant to which, among other things, Encana will complete a share consolidation on the basis of one post-consolidation share for each fivepre-consolidation shares, and Ovintiv will ultimately acquire all of the issued and outstanding Encana Common Shares in exchange for shares of Ovintiv on aone-for-one basis and become the parent company of Encana and its subsidiaries (collectively, the “Arrangement”), and (ii) as soon as practicable following the Arrangement, Ovintiv migrating out of Canada and becoming a Delaware corporation (the “U.S. Domestication”), as more fully described in the enclosed proxy statement/management information circular and prospectus dated[●], 2019 (the “Proxy Statement/Prospectus”). After the Reorganization is complete, Encana Shareholders will hold one share of common stock, par value US$0.01 per share (“Common Stock”), of Ovintiv, a Delaware corporation, for each five Encana Common Shares owned immediately prior to the Reorganization, but the business, assets, liabilities, directors and officers of Ovintiv will continue to be the same as the business, assets, liabilities, directors and officers of Encana immediately prior to the Reorganization.

Board of Directors Recommendation

The board of directors of Encana (the “Encana Board”) unanimously recommends that Encana Securityholders voteFOR the Reorganization Resolution. In making its determination, the Encana Board considered a number of factors as described in the Proxy Statement/Prospectus under “The Reorganization – Reasons for the Reorganization”.

Tax Treatment for Encana Shareholders

The Reorganization may have different tax consequences for Encana Shareholders resident in Canada and the United States. Encana Shareholders are urged to carefully read the sections of the Proxy Statement/Prospectus entitled “Certain Canadian Federal Income Tax Considerations” and “Certain U.S. Federal Income Tax Considerations” and to consult with their own tax and other advisors.

Reorganization Completion Date

Subject to the satisfaction or waiver of all other conditions precedent, if both (i) Encana Shareholders and Encana Incentive Awardholders, voting together as a single class, and (ii) Encana Shareholders, voting separately, approve the Reorganization Resolution, it is anticipated that the Reorganization will be completed as soon as practicable following the approval of the Court of Queen’s Bench of Alberta in respect of the Arrangement.

i

Table of Contents

Please refer to the Proxy Statement/Prospectus for a more detailed description of the Reorganization and a more detailed description of Encana’s reasons for the Reorganization and the risk factors relating to the Reorganization. Please give the Proxy Statement/Prospectus your careful consideration and consult your financial, tax or other professional advisors regarding the consequences of the Reorganization to you.

The board of directors of Encana unanimously recommends that Encana Securityholders voteFOR the Reorganization Resolution.

Voting Your Encana Common Shares and/or Encana Incentive Awards

Your vote is very important regardless of the number of Encana Common Shares or EncanaIncentive Awards that you own. Enclosed with this letter is the Notice of Special Meeting and Proxy Statement/Prospectus and a form of proxy or voting instruction form.

If you are unable to attend the Meeting in person please complete and deliver either the enclosed form of proxy or voting instruction form, as applicable, on the Internet, or by telephone, mail or fax, so that it is received prior to [●] (Mountain Time) on[●], 2020, to ensure your representation at the Meeting.

If you require assistance with voting your Encana Common Shares or Encana Incentive Awards, please contact Encana’s proxy solicitors, Kingsdale Advisors or Innisfree M&A Incorporated, as follows:

|  | |

Kingsdale Advisors 130 King Street West, Suite 2950, P.O. Box 361 Toronto, Ontario M5X 1E2 Call Toll-Free (within North America): 1-866-229-8166 Call Collect (outside North America): 1-416-867-2272 |

Innisfree M&A Incorporated 501 Madison Avenue, 20th Floor New York, New York 10022 Call Toll-Free (within North America): 1-877-800-5192 Call Collect (outside North America): 1-212-750-5833 |

On behalf of Encana, I would like to thank you for your continuing support.

Sincerely,

| Clayton H. Woitas Chairman of the Encana Board | Douglas J. Suttles Chief Executive Officer |

ii

Table of Contents

NOTICE OF SPECIAL MEETING OF SECURITYHOLDERS

NOTICE IS HEREBY GIVEN that, pursuant to an order of the Court of Queen’s Bench of Alberta (the “Court”) dated[●], 2019 (the “Interim Order”), a special meeting (such meeting and any adjournments and postponements thereof referred to as the “Meeting”) of holders (“Encana Shareholders”) of common shares (“Encana Common Shares”) and holders (“EncanaIncentive Awardholders”, and together with the Encana Shareholders, the “Encana Securityholders”) of incentive awards (“EncanaIncentive Awards”)of Encana Corporation (“Encana”) will be held at the Oddfellows Building, Ballroom (Floor 4), 100 – 6th Avenue S.W., Calgary, Alberta, at[●](Mountain Time) on[●], 2020, for the following purposes:

| 1. | to consider and, if deemed advisable, to approve, with or without variation, a special resolution of the Encana Securityholders (the “Reorganization Resolution”) to approve a series of reorganization transactions (the “Reorganization”), which will include (i) a plan of arrangement under Section 192 of theCanada Business Corporations Act (the “CBCA”) involving, among others, Encana, Encana Securityholders and a wholly-owned subsidiary of Encana named “Ovintiv Inc.” (“Ovintiv”), pursuant to which, among other things, Encana will complete a share consolidation on the basis of one post-consolidation share for each fivepre-consolidation shares, and Ovintiv will ultimately acquire all of the issued and outstanding Encana Common Shares in exchange for shares of Ovintiv on aone-for-one basis and become the parent company of Encana and its subsidiaries (collectively, the “Arrangement”), and (ii) as soon as practicable following the Arrangement, Ovintiv migrating out of Canada and becoming a Delaware corporation (the “U.S. Domestication”), as more particularly described in the accompanying proxy statement/management information circular and prospectus of Encana dated[●], 2019 (as may be amended, supplemented or otherwise modified from time to time) (the “Proxy Statement/Prospectus”); and |

| 2. | to transact such other business as may properly come before the Meeting or any adjournment thereof. |

This notice of special meeting of Encana Securityholders (the “Notice of Special Meeting”) and the accompanying Proxy Statement/Prospectus are available on Encana’s website at www.encana.com, on SEDAR at www.sedar.com and on the SEC’s website at www.sec.gov.

The directors have fixed the close of business on[●], 2019 as the record date for determining Encana Securityholders who are entitled to attend and vote at the Meeting (the “Record Date”). Only Encana Shareholders and Encana Incentive Awardholders whose names have been entered in the registers of Encana Shareholders and Encana Incentive Awardholders, respectively, as of the close of business on the Record Date are entitled to receive notice of and vote at the Meeting.

Encana Securityholders who are unable to attend the Meeting are encouraged to complete, sign and return the enclosed form of proxy. To be valid, proxies must be received by Encana’s transfer agent, AST Trust Company (Canada), at its Toronto office (AST Trust Company (Canada), Proxy Department, P.O. Box 721, Agincourt, Ontario M1S 0A1) no later than[●](Mountain Time) on[●], 2020 or, if the Meeting is adjourned or postponed, by no later than 48 hours (excluding Saturday, Sunday and statutory holidays in Canada and the U.S.) before the Meeting resumes. Notwithstanding the foregoing, the Chairman of the Meeting has the discretion to accept proxies received after such deadline and the time limit for deposit of proxies may be waived or extended by the Chairman of the Meeting at his or her discretion, without notice.

If you are a beneficial(non-registered) holder of Encana Common Shares and receive these materials through a broker, bank, trust company or other intermediary or nominee, you must provide your voting instructions or complete, sign and return the voting instruction form in accordance with the instructions provided by your broker, bank, trust company or other intermediary or nominee.

Encana Securityholders who are planning to return the form of proxy or voting instruction form are encouraged to review the Proxy Statement/Prospectus carefully before submitting such form.

Pursuant to the Interim Order, registered Encana Shareholders have the right to dissent with respect to the Reorganization Resolution and, if the Reorganization becomes effective, to be paid the fair value of their Encana

i

Table of Contents

Common Shares in accordance with the provisions of Section 190(1) of the CBCA, as modified by the Interim Order and the plan of arrangement, which will effect the Arrangement under the CBCA (the “Plan of Arrangement”). Registered Encana Shareholders who wish to dissent must provide a written objection to the Reorganization Resolution (a “Dissent Notice”) to Encana, c/o Blake, Cassels & Graydon LLP, Suite 3500, 855 – 2nd Street S.W., Calgary, Alberta, T2P 4J8, Attention: Chad Schneider, which Dissent Notice must be received by 5:00 p.m. (Mountain Time) on[●], 2020, or such day that is two Business Days immediately preceding the date that any adjournment or postponement of the Meeting is reconvened, and must otherwise strictly comply with the dissent procedures prescribed by the CBCA, as modified by the Interim Order and the Plan of Arrangement. An Encana Shareholder’s right to dissent is more particularly described in the Proxy Statement/Prospectus under the heading “The Reorganization – Dissenting Shareholder Rights”. A copy of the Plan of Arrangement is attached as Schedule A to the Arrangement and Reorganization Agreement, which is set forth in Appendix B to the Proxy Statement/Prospectus. Copies of the text of Section 190 of the CBCA and the Interim Order are set forth in Appendices C and D,respectively, to the Proxy Statement/Prospectus.

Persons who are beneficial owners of Encana Common Shares registered in the name of a broker, bank, trust company or other intermediary or nominee who wish to dissent should be aware that only registered Encana Shareholders are entitled to dissent. Accordingly, a beneficial owner of Encana Common Shares desiring to exercise this right must make arrangements for the Encana Common Shares beneficially owned by such Encana Shareholder to be registered in the Encana Shareholder’s name prior to the time the Dissent Notice is required to be received by Encana, or, alternatively, make arrangements for the registered holder of such Encana Common Shares to dissent on the Encana Shareholder’s behalf. An Encana Shareholder that votes in favor of the Reorganization Resolution will not be entitled to dissent rights but an Encana Shareholder’s failure to vote against the Reorganization Resolution will not constitute a waiver of such shareholder’s dissent rights and a vote against the Reorganization Resolution will not be deemed to satisfy notice requirements under the CBCA with respect to dissent rights.

It is strongly suggested that any Encana Shareholder wishing to dissent seek independent legal advice, as the failure to strictly comply with the requirements set forth in Section 190(1) of the CBCA, as modified by the Interim Order and the Plan of Arrangement, may result in the loss of any right of dissent.

If you have any questions about the information contained in this Notice of Special Meeting and the accompanying Proxy Statement/Prospectus or require assistance in voting your Encana Common Shares, please contact Encana’s proxy solicitors, Kingsdale Advisors or Innisfree M&A Incorporated, as follows:

|  | |

Kingsdale Advisors 130 King Street West, Suite 2950, P.O. Box 361 Toronto, Ontario M5X 1E2 Call Toll-Free (within North America): Call Collect (outside North America): |

Innisfree M&A Incorporated 501 Madison Avenue, 20th Floor New York, New York 10022 Call Toll-Free (within North America): Call Collect (outside North America): |

DATED at Calgary, Alberta this[●] day of[●], 2019.

BY ORDER OF THE BOARD OF DIRECTORS

Joanne L. Alexander

Executive Vice-President, General Counsel & Corporate Secretary

ii

Table of Contents

Encana files annual, quarterly and current reports, proxy statements and other business and financial information with the U.S. Securities and Exchange Commission (the “SEC”). Financial information about Encana is provided in its annual consolidated financial statements as at and for the years ended December 31, 2018 and 2017 and accompanying management’s discussion and analysis (“MD&A”) for the year ended December 31, 2018 and in Encana’s unaudited consolidated financial statements for the three and nine months ended September 30, 2019 and accompanying MD&A for the nine months ended September 30, 2019. Encana files reports and other business and financial information with the SEC electronically, and the SEC maintains a website located at www.sec.gov containing this information. Such information is also available under Encana’s profile on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com. You can also obtain these documents, free of charge, from Encana at www.encana.com, under the heading “Investors”. The information contained on, or that may be accessed through, Encana’s website is not incorporated by reference into, and is not a part of, this Proxy Statement/Prospectus.

1847432 Alberta ULC (“184Co”), which is currently a wholly-owned subsidiary of Encana and will be a predecessor of Ovintiv following the completion of the Reorganization, has filed a registration statement onForm S-4 with respect to the shares of Common Stock of Ovintiv to be issued in connection with the Reorganization. This Proxy Statement/Prospectus forms a part of the registration statement. As permitted by SEC rules, this Proxy Statement/Prospectus does not contain all of the information included in the registration statement or in the exhibits or schedules to the registration statement. You may read and copy the registration statement, including any amendments, schedules and exhibits at the SEC’s website mentioned above. Statements contained in this Proxy Statement/Prospectus as to the contents of any contract or other documents referred to in this Proxy Statement/Prospectus are not necessarily complete. In each case, you should refer to the copy of the applicable agreement or other document filed as an exhibit to the registration statement.This Proxy Statement/Prospectus incorporates important business and financial information about Encana from documents that are not attached to this Proxy Statement/Prospectus.This information is available to you without charge upon your request.You can obtain the documents incorporated by reference into this Proxy Statement/Prospectus, including copies of financial statements and MD&A, free of charge by requesting them in writing or by telephone from Encana or from its proxy solicitors at the following addresses and telephone numbers:

|  | |

Kingsdale Advisors 130 King Street West, Suite 2950, P.O. Box 361 Toronto, Ontario M5X 1E2 Call Toll-Free (within North America): Call Collect (outside North America): |

Innisfree M&A Incorporated 501 Madison Avenue, 20th Floor New York, New York 10022 Call Toll-Free (within North America): Call Collect (outside North America): |

If you would like to request any documents, please do so by [●], 2019 in order to receive them before the Meeting.

For a more detailed description of the information incorporated by reference into this Proxy Statement/Prospectus and how you may obtain it, see “Where You Can Find More Information”.

i

Table of Contents

ABOUT THIS PROXY STATEMENT/PROSPECTUS

This Proxy Statement/Prospectus, which forms part of a registration statement onForm S-4 filed with the SEC, constitutes a prospectus under the U.S. Securities Act with respect to the shares of Common Stock of Ovintiv to be issued to Encana Shareholders in connection with the Reorganization. This Proxy Statement/Prospectus also constitutes a notice of meeting with respect to the Meeting.

You should rely only on the information contained in or incorporated by reference into this Proxy Statement/Prospectus. No one has been authorized to provide you with information that is different from that contained in, or incorporated by reference into, this Proxy Statement/Prospectus. This Proxy Statement/Prospectus is dated[●], 2019, and you should assume that the information contained in this Proxy Statement/Prospectus is accurate only as of such date. You should also assume that the information incorporated by reference into this Proxy Statement/Prospectus is only accurate as of the date of such information.

This Proxy Statement/Prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy in any jurisdiction to or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction.

ii

Table of Contents

| i | ||||

| ii | ||||

| 1 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

QUESTIONS AND ANSWERS ABOUT THE REORGANIZATION AND THE MEETING | 6 | |||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 28 | ||||

| 30 | ||||

| 36 | ||||

| 33 | ||||

| 33 | ||||

| 33 | ||||

| 36 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

iii

Table of Contents

REGISTERED SHAREHOLDER AND ENCANA INCENTIVE AWARDHOLDER VOTING | 42 | |||

| 43 | ||||

| 45 | ||||

| 45 | ||||

| 46 | ||||

| 46 | ||||

| 49 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

DIRECTORS AND OFFICERS OF OVINTIV FOLLOWING THE REORGANIZATION | 55 | |||

| 55 | ||||

| 56 | ||||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| 57 | ||||

| 57 | ||||

| 58 | ||||

| 58 | ||||

| 58 | ||||

| 58 | ||||

| 58 | ||||

| 60 | ||||

| 64 | ||||

| 64 | ||||

IMPLEMENTATION, INTERIM ORDER AND TERMS OF THE REORGANIZATION | 64 | |||

| 65 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

SELECTED UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION | 67 | |||

| 67 | ||||

| 68 | ||||

| 68 | ||||

| 68 | ||||

| 68 | ||||

iv

Table of Contents

| 68 | ||||

| 69 | ||||

| 70 | ||||

| 70 | ||||

| 70 | ||||

| 70 | ||||

| 71 | ||||

| 71 | ||||

| 71 | ||||

| 72 | ||||

| 72 | ||||

| 73 | ||||

| 73 | ||||

SUPPLEMENTAL HISTORICAL QUARTERLY FINANCIAL INFORMATION (UNAUDITED) OF ENCANA | 74 | |||

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION | 75 | |||

| 76 | ||||

| 77 | ||||

| 82 | ||||

| 85 | ||||

| 86 | ||||

| 92 | ||||

| 96 | ||||

| 96 | ||||

| 96 | ||||

| 97 | ||||

| 97 | ||||

| 97 | ||||

| 99 | ||||

| 99 | ||||

| 99 | ||||

| 99 | ||||

| 100 | ||||

COMPARISON OF RIGHTS OF ENCANA SHAREHOLDERS AND OVINTIV STOCKHOLDERS | 101 | |||

SHARE OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND DIRECTORS OF ENCANA | 121 | |||

SECURITY OWNERSHIP OF ENCANA DIRECTORS AND EXECUTIVE OFFICERS | 121 | |||

v

Table of Contents

| 123 | ||||

| 123 | ||||

| 123 | ||||

| 125 | ||||

| 126 | ||||

| A-1 | ||||

APPENDIX B – ARRANGEMENT AND REORGANIZATION AGREEMENT AND PLAN OF ARRANGEMENT | B-1 | |||

| C-1 | ||||

| D-1 | ||||

| E-1 | ||||

APPENDIX F – FORM OF THE OVINTIV CERTIFICATE OF INCORPORATION | F-1 | |||

| G-1 | ||||

APPENDIX H – UNAUDITED PRO FORMA FINANCIAL INFORMATION OF OVINTIV | H-1 | |||

vi

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Information both included and incorporated by reference in this Proxy Statement/Prospectus may contain certain forward-looking statements (collectively, “forward-looking statements”) within the meaning of Section 21E of the U.S. Exchange Act and the United States Private Securities Litigation Reform Act of 1995, as amended, and “forward-looking information” under applicable Canadian securities laws. All statements, other than statements of historical fact, included in this Proxy Statement/Prospectus that address activities, events or developments that Encana expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “target,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “should,” “would,” “may,” “foresee,” “plan,” “will,” “guidance,” “look,” “outlook,” “future,” “assume,” “forecast,” “focus,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements.

Forward-looking statements also include statements relating to: future financial performance and the future prospects of Encana’s business and operations; information concerning the Reorganization, including the U.S. Domestication; the anticipated benefits of the Reorganization; the likelihood of the Reorganization being completed; the anticipated outcomes of the Reorganization, including the U.S. Domestication, not being completed or not being completed within the anticipated timing; the principal steps of the Reorganization (including the Arrangement and the U.S. Domestication); the tax impact of the Reorganization on Encana, Ovintiv and the Encana Shareholders; the timing of the Meeting and the Final Order; the Required Securityholder Approvals and regulatory and stock exchange approval of the Reorganization and Court approval in respect of the Arrangement; the anticipated last day of trading of Encana Common Shares on the NYSE and the TSX and the anticipated trading of the shares of Common Stock of Ovintiv on the NYSE and the TSX following the Effective Date; the anticipated Effective Date; the timing of the implementation of the Reorganization and the potential benefits, risks and costs of the new corporate name, Share Consolidation and U.S. Domestication; our intent to continue productive relationships with our Canadian stakeholders; the opportunity to enhance long-term value for shareholders as a U.S. company; belief our valuation continues to be disconnected from our U.S. peers and reasons therefor; ability to attract passive investment capital in the U.S. and size of such increased investment; our position in the exploration and production industry; perception of Encana by investors, analysts, customers, lenders or potential strategic partners; the planned corporate, capital, governance and oversight structures of Ovintiv and Encana before and following the Reorganization; the business and future activities of Encana and Ovintiv after the date of this Proxy Statement/Prospectus; the composition of Encana’s core assets, including the allocation of capital and focus of development plans; the growth in long-term Encana Shareholder value; Encana’s vision of being a leading North American energy producer; Encana’s strategic objectives including capital allocation strategy, focus of investment, growth of high margin liquids volumes, operating and capital efficiencies and ability to preserve balance sheet strength; ability to deliver full-cycle returns, free cash flow and return of capital to Encana Shareholders; ability to lower costs and improve efficiencies to achieve competitive advantage; ability to repeat and deploy successful practices across Encana’s multi-basin portfolio; the expected synergies of the Newfield Exploration Company (“Newfield”) acquisition; anticipated commodity prices; the success of and benefits from technology and innovation, including cube development approach and advanced completion designs; ability to optimize well and completion designs; future well inventory; anticipated drilling, number of drilling rigs and the success thereof; anticipated drilling costs and cycle times; anticipated proceeds and future benefits from various joint venture, partnership and other agreements; estimates of reserves and resources; expected production and product types; anticipated cash flow,non-GAAP cash flow margin and leverage ratios; anticipated cash and cash equivalents; anticipated hedging and outcomes of risk management program, including exposure to certain commodity prices and foreign exchange fluctuations, amount of hedged production, market access and physical sales locations; the impact of changes in laws and regulations; compliance with environmental legislation and claims related to the purported causes and impact of climate change, and the costs therefrom; adequacy of provisions for abandonment and site reclamation costs; financial flexibility and discipline; ability to meet financial obligations, manage debt and financial ratios, finance growth and comply with financial covenants; impact to Encana as a result of changes to its credit rating; access to

1

Table of Contents

Encana’s credit facilities; planned dividend and the declaration and payment of future dividends, if any; adequacy of Encana’s provision for taxes and legal claims; projections and expectation of meeting the targets contained in Encana’s corporate guidance and related statements in respect of funding; ability to manage cost inflation and expected cost structures, including expected operating, transportation and processing and administrative expenses; the competitiveness and pace of growth of Encana’s assets within North America and against its peers; the outlook of oil and gas industry generally and impact of geopolitical environment; expected future interest expense; Encana’s commitments and obligations and anticipated payments thereunder; and the possible impact and timing of accounting pronouncements, rule changes and standards.

Readers are cautioned against unduly relying on forward-looking statements which, by their nature, involve numerous assumptions, risks and uncertainties that may cause such statements not to occur, or results to differ materially from those expressed or implied. These assumptions include: the ability to receive, in a timely manner and on satisfactory terms, the Required Securityholder Approvals, Court and stock exchange approvals, and regulatory approvals, if any, for the Reorganization; applicability of certain U.S. and Canadian securities regulations and exemptions; successful listing of the shares of Common Stock of Ovintiv on the NYSE and the TSX; the reaction of the capital markets to the Reorganization; the future marketability of the shares of Common Stock of Ovintiv; the ability of Encana to secure, maintain and comply with all required licenses, permits and certifications to carry out business in the jurisdictions in which it currently operates or intends to operate; general business, economic and market conditions; the competitive environment; anticipated and unanticipated tax consequences; anticipated and unanticipated costs; future commodity prices and differentials; foreign exchange rates; ability to access credit facilities and shelf prospectuses; assumptions contained in Encana’s corporate guidance, five-year plan and as specified herein; data contained in key modeling statistics; availability of attractive hedges and enforceability of risk management program; effectiveness of Encana’s drive to productivity and efficiencies; results from innovations; expectation that counterparties will fulfill their obligations under the gathering, midstream and marketing agreements; access to transportation and processing facilities where Encana operates; assumed tax, royalty and regulatory regimes; and expectations and projections made in light of, and generally consistent with, Encana’s historical experience and its perception of historical trends, including with respect to the pace of technological development, benefits achieved and general industry expectations.

Risks and uncertainties that may affect these business outcomes include: changes in the rights of Encana Shareholders as a result of the Reorganization; provisions that could discourage a takeover of Ovintiv in Ovintiv’s organizational documents and under the General Corporation Law of the State of Delaware (“DGCL”); potential limitations to stockholders’ ability to obtain a favorable judicial forum for disputes with Ovintiv or its directors or officers or other matters pertaining to Ovintiv’s internal affairs due to Ovintiv’s organizational documents designating the Court of Chancery of the State of Delaware as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by stockholders; volatility in the market price for the shares of Common Stock of Ovintiv; Ovintiv’s ability to enter into new arrangements on favorable terms; impact of a downgrade in credit rating and its impact on access to sources of liquidity; ability, variability and discretion of the Ovintiv Board to declare and pay dividends, if any; issuance of additional shares of Common Stock of Ovintiv may cause dilution; failure to obtain the Required Securityholder Approvals, regulatory, stock exchange and other third-party approvals in a timely manner or on conditions acceptable to Encana or the failure of the Reorganization to be completed for any other reason (or to be completed in a timely manner); failure to achieve the perceived benefits of the Reorganization and the Reorganization causing disruption to Encana’s business; unanticipated adverse tax consequences to Encana, Ovintiv and the Encana Shareholders in connection with the Reorganization, including the amount of corporate tax payable as a result of the Reorganization and disagreements with tax authorities on Encana’s estimates of value, resulting in an increase of the tax cost of the Reorganization; the incurrence of material Canadian federal income tax (including material Canadian “emigration tax”) and/or material U.S. federal income tax as a result of the Reorganization; disagreements with the Internal Revenue Service (“IRS”), which may cause certain U.S. Holders of shares of Common Stock of Ovintiv to have a positive (or a more positive than anticipated) U.S. federal income tax liability as a result of the Reorganization; the Reorganization may affect the timing of audit or reassessments by tax authorities; allocation of time and incurrence of costs (includingnon-recurring costs) associated with the Reorganization beyond those

2

Table of Contents

estimated; the unaudited pro forma financial information of Ovintiv may not be indicative of results following the Reorganization; Encana may choose to defer or abandon the Reorganization; negative publicity resulting from the Reorganization and its potential effect on Encana’s business and the market price of Encana Common Shares and the shares of Common Stock of Ovintiv; risk of triggering certain provisions in agreements to which Encana is a party as a result of the Reorganization; payments in connection with the exercise of Dissent Rights may impact Ovintiv’s financial resources; limitations of enforcement of rights against Ovintiv in Canada; the impact of the announcement and pendency of the Reorganization, including the U.S. Domestication, on Encana’s business, results of operations, and financial conditions; ability to generate sufficient cash flow to meet obligations; commodity price volatility; ability to secure adequate transportation and potential pipeline curtailments; timing and costs of well, facilities and pipeline construction; business interruption, property and casualty losses or unexpected technical difficulties, including impact of weather; counterparty and credit risk; ability to realize the anticipated benefits of acquisitions, including the Newfield acquisition; uncertainties relating to Encana’s ability to successfully integrate Newfield’s business, technologies, personnel and business partners; actions of the Organization of the Petroleum Exporting Countries, its members and other state-controlled oil companies relating to oil price and production controls; sustained declines in commodity prices resulting in impairment of assets; fluctuations in currency and interest rates; risks associated with inflation rates; risks inherent in Encana’s corporate guidance; failure to achieve cost and efficiency initiatives; risks inherent in marketing operations; risks associated with technology, including electronic, cyber and physical security breaches; changes in or interpretation of royalty, tax, environmental, greenhouse gas, carbon, accounting and other laws or regulations, including potential environmental liabilities that are not covered by an effective indemnity or insurance; risks associated with existing and potential lawsuits and regulatory actions made against Encana; impact of disputes arising with its partners, including suspension of certain obligations and inability to dispose of assets or interests in certain arrangements; Encana’s ability to acquire or find additional reserves; imprecision of reserves estimates and estimates of recoverable quantities, including future net revenue estimates; land, legal, regulatory and ownership complexities inherent in Canada and the U.S.; risks associated with past and future acquisitions or divestitures of certain assets or other transactions or receipt of amounts contemplated under the transaction agreements (such transactions may include third-party capital investments, farm-outs or partnerships, which Encana may refer to from time to time as “partnerships” or “joint ventures” and the funds received in respect thereof which Encana may refer to from time to time as “proceeds”, “deferred purchase price” and/or “carry capital”, regardless of the legal form) as a result of various conditions not being met; and other risks described in this Proxy Statement/Prospectus under the heading “Risk Factors”, which are incorporated herein by reference. See also “Item 1A Risk Factors” of Encana’s Annual Report for the fiscal year ended December 31, 2018 onForm 10-K incorporated by reference in this Proxy Statement/Prospectus, and risks and uncertainties impacting Encana’s business as described from time to time in Encana’s other periodic filings as filed on SEDAR at www.sedar.com and the SEC’s website at www.sec.gov.

Although Encana believes the expectations represented by such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Readers are cautioned that the assumptions, risks and uncertainties referenced above and in the documents incorporated by reference herein are not exhaustive. Forward-looking statements are made as of the date of this Proxy Statement/Prospectus (or, in the case of a document incorporated by reference, the date of such document incorporated by reference) and, except as required by law, Encana undertakes no obligation to update publicly or revise any forward-looking statements whether as a result of changes in internal estimates or expectations, new information, subsequent events or circumstances or otherwise. The forward-looking statements contained or incorporated by reference in this Proxy Statement/Prospectus are expressly qualified by these cautionary statements.

3

Table of Contents

The reader should read carefully the risk factors described in this Proxy Statement/Prospectus and in the documents incorporated by reference herein for a description of certain risks that could, among other things, cause actual results to differ from these forward-looking statements.

INFORMATION CONTAINED IN PROXY STATEMENT/PROSPECTUS

Management is soliciting proxies of all Encana Securityholders primarily by mail and electronic means, supplemented by telephone or other contact by employees of Encana (who will receive no additional compensation) and all such costs will be borne by Encana. Encana has also retained Kingsdale Advisors and Innisfree M&A Incorporated as its proxy solicitors (the “Proxy Solicitors”) to assist in the solicitation of proxies. For these proxy solicitation services, Kingsdale Advisors will receive an estimated fee of approximately C$65,000 andInnisfree M&A Incorporated will receive an estimated fee of approximately US$25,000, plus, in each case, reimbursement of reasonableout-of-pocket expenses and fees for any additional services. Encana will also reimburse brokers, banks and other nominees for their expenses in sending proxy solicitation materials to the beneficial owners of Encana Common Shares and obtaining their proxies.

This Proxy Statement/Prospectus and proxy-related materials are being sent to all Encana Securityholders. Encana does not send proxy-related materials directly to beneficial(non-registered) Encana Shareholders and is not relying on thenotice-and-access provisions of applicable securities laws for delivery of proxy-related materials to Encana Shareholders. Encana will deliver proxy-related materials to nominees, custodians and fiduciaries, and they will be asked to promptly forward them to the beneficial(non-registered) Encana Shareholders. Encana will reimburse such nominees, custodians and fiduciaries for their expenses in sending proxy-related materials to the beneficial (non-registered) Encana Shareholders and obtaining their proxies. If you are a beneficial(non-registered) Encana Shareholder, your nominee should send you a voting instruction form or form of proxy with this Proxy Statement/Prospectus. Encana has also elected to pay for the delivery of our proxy-related materials to objecting beneficial(non-registered) Encana Shareholders.

Encana has not authorized any person to give any information or to make any representation in connection with the Reorganization or any other matters to be considered at the Meeting other than those contained in this Proxy Statement/Prospectus. If any such information or representation is given or made, such information or representation should not be relied upon as having been authorized or as being accurate. For greater certainty, the information contained in, or that can be accessed through, Encana’s website is not incorporated into this Proxy Statement/Prospectus.

This Proxy Statement/Prospectus does not constitute an offer to sell, buy or exchange or a solicitation of an offer to sell, buy or exchange any securities, or the solicitation of any vote, proxy or approval, by any person in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such an offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such an offer or solicitation.

Encana Securityholders should not construe the contents of this Proxy Statement/Prospectus as legal, tax or financial advice and should consult with their own legal, tax, financial and other professional advisors.

All summaries of, and references to, the Arrangement and Reorganization Agreement and the Plan of Arrangement in this Proxy Statement/Prospectus are qualified in their entirety by the complete text thereof, which is set forth in Appendix B to the Proxy Statement/Prospectus. Encana Securityholders are urged to read carefully the full text of the Arrangement and Reorganization Agreement and the Plan of Arrangement.

If you have any questions about the information contained in this Proxy Statement/Prospectus or require assistance in voting your Encana Common Shares or Encana Incentive Awards, please contact: (i) Kingsdale Advisors by telephone at 1-866-229-8166 (toll-free in North America) or at 1-416-867-2272 (collect outside North America); or (ii) Innisfree M&A Incorporated by telephone at 1-877-800-5192 (toll-free in North America) or at 1-212-750-5833 (collect outside of North America).

4

Table of Contents

Except where the context otherwise requires or where otherwise indicated, references to “Encana”, “we”, “us” and “our” in this Proxy Statement/Prospectus refer to Encana Corporation and its consolidated subsidiaries.

Except as otherwise stated, the information contained in this Proxy Statement/Prospectus is given as of[●], 2019.

Notice Regarding Tax Consequences of Reorganization

Encana Shareholders should be aware that the disposition of Encana Common Shares pursuant to the Reorganization, and the acquisition, holding and disposition of shares of Common Stock of Ovintiv, may have tax consequences in Canada, the U.S. and/or in the jurisdictions in which the Encana Shareholders are resident which may not be described fully herein. The tax consequences to such Encana Shareholders of the Reorganization is dependent on their individual circumstances, including (but not limited to) their jurisdiction of residence. It is recommended that Encana Shareholders consult their own tax advisors in this regard.

The following table shows, for the periods and dates indicated, certain information regarding the Canadiandollar-to-U.S. dollar exchange rate. The information is based on the Bank of Canada’s closing Canadiandollar-to-U.S. dollar exchange rate. Such exchange rate on November 1, 2019 was C$1.00 = US$0.7601.

| Period End | Average(1) | Low | High | |||||||||||||

Nine months ended September 30, 2019 (C$ per US$) | 1.3243 | 1.3292 | 1.3038 | 1.3600 | ||||||||||||

Year ended December 31, (C$ per US$) | ||||||||||||||||

2018 | 1.3642 | 1.2957 | 1.2288 | 1.3642 | ||||||||||||

2017 | 1.2545 | 1.2986 | 1.2128 | 1.3743 | ||||||||||||

Note:

| (1) | The average of the daily exchange rates during the relevant period. |

Except as otherwise stated, in this Proxy Statement/Prospectus, all dollar amounts are expressed in United States dollars.

This Proxy Statement/Prospectus contains defined terms. For a glossary of defined terms used herein, see “Glossary”.

5

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE REORGANIZATION AND THE MEETING

The following questions and answers are intended to briefly address some commonly asked questions regarding the Reorganization and the Meeting. These questions and answers may not address all questions that may be important to you. To better understand these matters, and for a description of the legal terms governing the Reorganization, you should carefully read this entire Proxy Statement/Prospectus, including the attached appendices, as well as the documents that have been incorporated by reference into this Proxy Statement/Prospectus. For more information, see the section entitled “Information Contained in Proxy Statement/Prospectus”. Capitalized terms used but not otherwise defined in the questions and answers set forth below have the meanings set forth under the heading “Glossary”.

Q: Why am I receiving this Notice of Special Meeting and Proxy Statement/Prospectus?

You are receiving this Notice of Special Meeting and Proxy Statement/Prospectus because you are an Encana Shareholder or an Encana Incentive Awardholder as of the Record Date. You are entitled to vote for the Reorganization Resolution at the Meeting to be held on[●], 2020.

This Proxy Statement/Prospectus, which you should read carefully, contains important information about the proposed Reorganization and how to vote at the Meeting.

Q: When and where will the Meeting be held?

The Meeting will be held at[●] (Mountain Time) on[●], 2020 at the Oddfellows Building, Ballroom (Floor 4), 100 – 6th Avenue S.W., Calgary, Alberta.

Q: What is the Reorganization?

On October 31, 2019, Encana announced a proposed Reorganization, pursuant to which, among other things, (i) Encana will complete a share consolidation on the basis of one post-consolidation share for each fivepre-consolidation shares, (ii) Ovintiv will ultimately acquire all of the issued and outstanding Encana Common Shares in exchange for shares of Common Stock of Ovintiv on aone-for-one basis and become the parent company of Encana and its subsidiaries, and (iii) Ovintiv will migrate out of Canada and become a Delaware corporation. Following completion of the Reorganization, Encana Shareholders will hold one share of Common Stock of Ovintiv, a Delaware corporation, for each five Encana Common Shares owned immediately prior to the Reorganization.

Q: Does the Encana Board recommend that I voteFOR the Reorganization Resolution?

Yes. The Encana Board unanimously recommends that Encana Securityholders voteFOR the Reorganization Resolution.

Q: What are Encana’s reasons for the Reorganization?

The U.S. Domestication is the key reason for Encana proposing the Reorganization, which also includes the adoption of a new corporate name “Ovintiv Inc.,” and the Share Consolidation. The Encana Board, in unanimously determining that the Reorganization is in the best interests of Encana and is fair and reasonable, considered a number of factors as described under “The Reorganization – Reasons for the Reorganization”, including:

| • | the opportunity to enhance long-term value for shareholders, through attracting deeper and growing pools of passive investment capital in the U.S., particularly if shares of Common Stock of Ovintiv are able to be included in U.S. stock market indices and other investment vehicles that only include securities ofU.S.-domiciled companies; |

6

Table of Contents

| • | unambiguously establishing the company as a U.S.-based company, which the Encana Board believes will level the playing field with our principal competitors, most of which are U.S.-based companies; |

| • | adopting a new corporate name to reflect our transformation and articulates our vision for the future – to make modern life possible for all. “Ovintiv” stands for our commitment to deliver unmatched value through continuous innovation, while our new logo symbolizes the human connection made possible by the safe, reliable and affordable energy we produce; |

| • | continued business in Canada by maintaining our existing Canadian presence with a business office in Calgary, Alberta, and field offices in Alberta, British Columbia and Nova Scotia to operate our portfolio of Canadian crude oil, natural gas liquids, condensate and natural gas properties and related assets; |

| • | following the Reorganization, shares of Common Stock of Ovintiv being listed on the NYSE and the TSX. Ovintiv will also continue to report consolidated financial results in U.S. dollars and in accordance with U.S. GAAP, and will file reports with the SEC and relevant Canadian securities regulatory authorities; |

| • | enhancing comparability to our U.S. peers and enabling a broader range of potential investors to invest in our shares through the Share Consolidation; |

| • | incorporating in Delaware for greater comparability to other U.S. public companies, many of which are incorporated in Delaware; |

| • | based on and subject to current assumptions and market value, we do not anticipate we will incur material corporate-level Canadian or United States federal income tax in connection with the Reorganization; |

| • | the Reorganization is subject to obtaining the Required Securityholder Approvals and approval by the Court in respect of the Arrangement; and |

| • | registered Encana Shareholders will have the ability to exercise Dissent Rights in respect of the Reorganization and to be paid the fair value of their Encana Common Shares. |

Q: Will the business of Encana change following the Reorganization?

No. Ovintiv will continue to pursue Encana’s current strategic initiatives and maintain its existing portfolio of crude oil, natural gas liquids, condensate and natural gas properties and related assets. However, following the Reorganization, Ovintiv’s head office will be in Denver, Colorado.

Q: Who will be the directors and executive officers of Ovintiv following the Reorganization?

There will be no changes to the directors or executive officers as a result of the Reorganization. Once the Reorganization is complete, the same individuals at Encana will serve in the same capacity at Ovintiv. See “Information Concerning Ovintiv – Directors and Officersof Ovintiv”.

Q: How will the directors and executive officers of Encana vote?

The directors and executive officers of Encana are in favor of the Reorganization and are expected to voteFOR the Reorganization Resolution.

As of the Record Date for the Meeting, the directors and executive officers of Encana had the right to vote approximately[●]Encana Common Shares, representing approximately[●]% of the Encana Common Shares then issued and outstanding and entitled to vote at the Meeting, and [●]Encana Incentive Awards then issued and outstanding and entitled to vote at the Meeting.

Q: What will I receive for my Encana Common Shares under the Reorganization?

Pursuant to the Arrangement and Reorganization Agreement (including, in particular, the Plan of Arrangement), following completion of the Reorganization, Encana Shareholders will hold one share of Common Stock of Ovintiv for each five Encana Common Shares they owned immediately prior to the Reorganization.

7

Table of Contents

Q: Will the Reorganization dilute my economic interest?

No, your fully diluted relative economic ownership will not change as a result of the Reorganization. The shareholders of Ovintiv will be the same persons who were Encana Shareholders immediately prior to the Reorganization (other than those who validly exercise Dissent Rights) and Ovintiv will become the direct or indirect owner of all of the assets and liabilities of Encana.

Q: Will the shares of Common Stock of Ovintiv issued under the Reorganization be listed on an exchange?

Yes. Shares of Common Stock of Ovintiv will be listed on the NYSE. In addition, Encana has applied to have the shares of Common Stock of Ovintiv listed on the TSX. On both the NYSE and the TSX, the stock symbol for the shares of Common Stock of Ovintiv will be “OVV”. The Encana Common Shares currently trade on the NYSE and the TSX under the stock symbol “ECA”. When the Reorganization is completed, the Encana Common Shares currently listed on the NYSE and the TSX under the stock symbol “ECA” will cease to be traded on the NYSE and the TSX and will be deregistered under the U.S. Exchange Act. See “The Reorganization – Certain Legal and Regulatory Matters – Stock Exchange Listings”.

Q: How do I receive shares of Common Stock of Ovintiv in exchange for my Encana Common Shares?

Enclosed with this Proxy Statement/Prospectus is a Letter of Transmittal which is being delivered to all registered Encana Shareholders as of the Record Date. The Letter of Transmittal, when duly completed, executed and returned, together with the certificate or certificates representing the holder’s Encana Common Shares or surrender of book-entry Encana Common Shares and any other required documents, will enable the holder to ultimately receive one share of Common Stock of Ovintiv for each five Encana Common Shares. Beneficial Encana Shareholders will receive their shares of Common Stock of Ovintiv through the broker, financial institution or other nominee through which such Encana Common Shares are held.

IF YOU ARE A REGISTERED ENCANA SHAREHOLDER, YOU MUST SURRENDER YOUR ENCANA COMMON SHARES BY THE DAY THAT IS THREE YEARS LESS ONE DAY FROM THE EFFECTIVE DATE IN ORDER TO RECEIVE THE SHARES OF COMMON STOCK OF OVINTIV TO WHICH YOU ARE ENTITLED UNDER THE PLAN OF ARRANGEMENT.

Q: Can I sell my Encana Common Shares on the NYSE and the TSX for cash? Is there any restriction on selling Encana Common Shares prior to completion of the Reorganization?

Encana Common Shares will continue to trade on the NYSE and the TSX up to and including the Effective Date. Following the Effective Date, shares of Common Stock of Ovintiv will be listed on the NYSE. In addition, Encana has applied to have the shares of Common Stock of Ovintiv listed on the TSX. See “The Reorganization – Certain Legal and Regulatory Matters – Stock Exchange Listings”. Generally speaking, registered Encana Shareholders who have not delivered their Encana Common Shares to the Depositary and beneficial owners of Encana Common Shares whose shares are held through a broker, financial institution or other nominee may sell their Encana Common Shares through the facilities of the NYSE or the TSX for cash at any time up to and including the Effective Date. Registered Encana Shareholders will not be able to sell their Encana Common Shares once they have delivered their Encana Common Shares to the Depositary.

Q: Why am I being asked to approve the Reorganization Resolution, and what vote is required to approve the Reorganization Resolution?