UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

SITO Mobile, Ltd.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Copies to:

Marcelle S. Balcombe, Esq. Sichenzia Ross Ference Kesner LLP 61 Broadway, 32nd Floor New York, NY 10006 (212) 930-9700 | Keith E. Gottfried, Esq. Morgan, Lewis & Bockius LLP 1111 Pennsylvania Avenue, N.W. Washington, DC 20004-2541 (202) 739-5947 |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

SITO Mobile, Ltd., a Delaware corporation (“SITO”), is filing materials contained in this Schedule 14A with the U.S. Securities and Exchange Commission (“SEC”) in connection with SITO’s solicitation of consent revocations from its stockholders in response to the solicitation of consents from SITO’s stockholders (the “Consent Solicitation”) by Stephen D. Baksa, Thomas Candelaria. Michael Durden, Itzhak Fisher, Thomas J. Pallack, Matthew Stecker and Thomas Thekkethala (the “Baksa Group”) to, among other things, remove and replace all of the current members of SITO’s Board of Directors (the “SITO Board”) other than Brent D. Rosenthal who previously collaborated with Mr. Baksa on an activist campaign at another public company. On May 2, 2017, SITO filed a definitive consent revocation solicitation statement (the “Consent Revocation Solicitation Statement”) with the SEC in connection with its solicitation of consent revocations.

Letter to SITO Stockholders First Used on May 10, 2017

Attached hereto is a letter dated May 10, 2017 from the SITO Board to SITO’s stockholders that SITO is first making available to its stockholders on May 10, 2017 in which the SITO Board comments on why SITO’s stockholders should not execute any gold consent cards sent to them by the Baksa Group or any of the participants in its Consent Solicitation and should elect against surrendering control of SITO by executing and returning to SITO a WHITE consent revocation card. This letter is being filed herewith because it may be deemed to be solicitation material in connection with SITO’s solicitation of consent revocations in response to the Consent Solicitation.

Important Additional Information And Where To Find It

SITO, its directors and certain of its executive officers are deemed to be participants in a solicitation of consent revocations from SITO’s stockholders in connection with the Consent Solicitation. On May 2, 2017, SITO filed the Consent Revocation Statement and accompanying WHITE consent revocation card with the SEC in connection with the Consent Solicitation. Information regarding the identity of participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the Consent Revocation Solicitation Statement, including the schedules and appendices thereto. INVESTORS AND STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ ANY SUCH CONSENT REVOCATION SOLICITATION STATEMENT AND THE ACCOMPANYINGWHITE CONSENT REVOCATION CARD AND OTHER DOCUMENTS FILED BY SITO WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders can obtain the Consent Revocation Solicitation Statement, any amendments or supplements to the Consent Revocation Solicitation Statement, the accompanying WHITE consent revocation card, and other documents filed by SITO with the SEC for no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Investor Relations section of SITO’s corporate website at www.sitomobile.com, by writing to SITO’s Corporate Secretary at SITO Mobile, Ltd., The Newport Corporate Center, 100 Town Square Place, Suite 204, Jersey City, NJ 07301, or by calling SITO at (201) 275-0555.

IMPORTANT!

THE FUTURE OF YOUR COMPANY IS AT STAKE!

DO NOT LET THE BAKSA GROUP OR GARY A. SINGER

DISRUPT THE SUBSTANTIAL PROGRESS BEING MADE BY SITO MOBILE IN

BUILDING A SOLID FOUNDATION FOR GROWTH AND STOCKHOLDER VALUE CREATION

PLEASE DO NOT EXECUTE ANY GOLD CONSENT CARD

May 10, 2017

Dear Fellow Stockholders:

Protect the value of your investment by discarding any gold consent card or other consent solicitation materials sent to you by the Baksa Group or any of its purported proposed nominees, including Matthew Stecker and Thomas Thekkethala, both of whom have close ties to the family of Gary A. Singer, and by executing, dating and mailing each and everyWHITE consent revocation card you receive.

SITO Mobile, Ltd.’s business plan is producing real value for stockholders. Our first quarter 2017 results exceeded expectations and SITO Mobile expects record results in the second quarter.

Notably, SITO Mobile has achieved:

| ● | Revenue of $6.6 million, an increase of 33% compared to first quarter 2016, driven by strong performance in the Media Placement Business. |

| ● | Gross profit of $3.4 million (52% gross margin), up from $2.6 million (53% gross margin) in Q1 2016. |

| ● | Expected record second quarter 2017 revenue of $10 million - $13 million. |

SITO MOBILE IS HITTING ITS STRIDE AND CREATING VALUE FOR ALL STOCKHOLDERS

The SITO Mobile management team has made excellent progress on a number of fronts, including:

| ● | Enhancing the management team and Board, including the addition of a well-regarded and highly-experienced independent director, Lowell W. Robinson; |

| ● | Adding sales talent and improving our sales management process; |

| ● | Improving our overall product set by offering advertisers new and enhanced visibility into their ad campaign targeting and effectiveness; |

| ● | Growing our customer base, campaign volume and average campaign dollars; |

| o | In Q1, SITO Mobile ran over 350 unique campaigns - an increase of more than 70 campaigns compared to the same period last year |

| o | Campaigns averaged in excess of $34,000 for Q1, up from around $26,000 a year ago |

| ● | Adding meaningful channel partners; and |

| ● | Beginning to monetize our data management platform. |

PLEASE DO NOT EXECUTE ANY GOLD CONSENT CARD

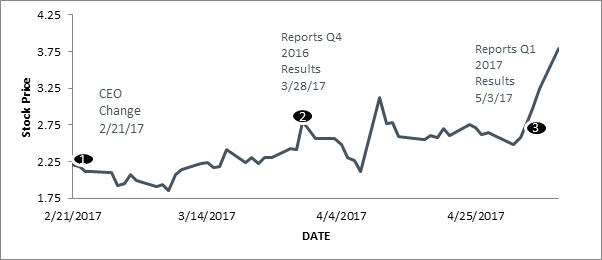

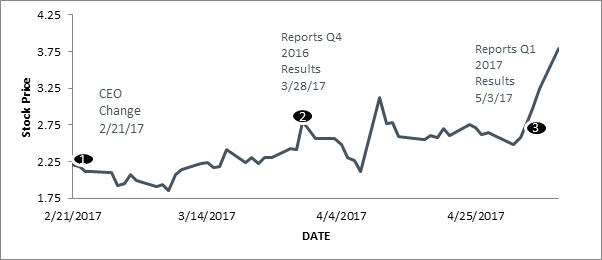

Since the new management team took over at SITO Mobile less than three months ago, the Company’s stock is up nearly 74%, including an approximately 39% improvement since the Company’s strong earnings report on May 3rd. We are excited about the future of our company!

SITO Mobile (SITO) Share Price Performance Since Management Change

THE BAKSA GROUP HAS NO PLAN OTHER THAN TAKING ABRUPT CONTROL OF YOUR COMPANY WITHOUT PAYING A CONTROL PREMIUM – AND WE BELIEVE THIS WOULD DISRUPT SITO MOBILE’S SUBSTANTIAL PROGRESS AND MOMENTUM

We believe that the Baksa Group is attempting to take control of SITO Mobile for the benefit of Gary A. Singer’s family and Evolving Systems, Inc. Additionally, the Baksa Group has been abundantly clear that it wants control of SITO Mobilewithout paying our stockholders any control premium for their shares.We believe this is intended to benefit the family of Gary A. Singer and the Singer family’s 21.2% ownership of Evolving Systems, Inc.

Importantly, the Baksa Group has:

| ● | NOTarticulated any credible alternative strategic plan to grow stockholder value if it were to abruptly gain control of the Company. |

| ● | NOTprovided any information regarding the management team that the Baksa Group would recruit to manage SITO Mobile and create value. |

| ● | NOTprovided any detail on how the Baksa Group would prevent an abrupt change in control from causing the perception of a change in the direction of the business, instability or lack of continuity which could be exploited by SITO Mobile’s competitors. |

Now is NOT the time to disrupt the extraordinary positive momentum SITO Mobile has created. We believe it is essential for stockholders that our management team continues to execute on its strategic initiatives underway to enhance SITO Mobile’s value.

PLEASE DO NOT EXECUTE ANY GOLD CONSENT CARD

Simply put, SITO Mobile has the right platform, strategy and team in place to guide the Company forward during this pivotal time in our history. We urge you not to let the Baksa Group’s and Gary A. Singer’s pursuit of what we believe is a self-interested and undisclosed agenda disrupt thesubstantial progress SITO Mobile and its new management team have demonstrated in laying a solid foundation for growth and the creation of long-term stockholder value.

IT IS IMPORTANT THAT STOCKHOLDERS HAVE THE FACTS

ABOUT SITO MOBILE’S HIGHLY QUALIFIED AND EXPERIENCED MANAGEMENT TEAM

In an effort to distract stockholders from the fact that neither the Baksa Group nor Gary A. Singer has any credible plan on how to operate SITO, the family of Gary A. Singer, who was convicted of fraud, among other criminal charges, in 1994 after a jury trial in federal court and who is permanently banned by the SEC1 from ever serving as an officer or director of a public company, has put forward a number of highly inflammatory, misleading, inaccurate and factually unsupported assertions, including by insinuating that Mr. O’Connell was the subject of investigations by the DOJ, SEC and IRS. This is patently false. All of the allegations targeted at Emergent Capital, Inc. by the DOJ, SEC and IRS and the resulting shareholder lawsuits, were regarding sales practices that pre-dated Mr. O’Connell’s employment at Emergent Capital, Inc.Given these facts, it is not surprising that Mr. O’Connell was never named as a target, suspect or even a witness in these investigations.

In addition, the family of Gary A. Singer claims that Mr. Firestone, formerly the Chief Executive Officer of Qualstar Corporation, was terminated for cause by Qualstar Corporation. Again, this is highly misleading. The litigation commenced by Qualstar in 2013 focused on the severance owed to Mr. Firestone following his removal as CEO, which occurred after an activist shareholder abruptly took control of Qualstar. In January 2015, the litigation was dismissed with prejudice and without any admission or finding of liability or wrongdoing as to the allegations made against Mr. Firestone in the complaint and without any admission or finding that Mr. Firestone’s termination was "for cause."

The SITO Mobile Board remains steadfast in the belief that Messrs. O’Connell and Firestone are individuals of unquestionable integrity and highly relevant expertise and experience. The Board believes they are the right people to lead the Company forward at this pivotal point time in SITO Mobile’s history.

PROTECT THE VALUE OF YOUR INVESTMENT –

WE URGE YOU TONOT EXECUTE ANY GOLD CONSENT CARD

This may be the most important vote you have ever made regarding SITO Mobile and its future.To protect your investment in SITO Mobile, the SITO Mobile Board urges you to NOT execute any gold consent card and to DISCARD all materials sent to you by the Baksa Group or any member of the family of Gary A. Singer.

The SITO Mobile Board urges you to:

| ● | Discard the Baksa Group’s solicitation materials; |

| ● | Not sign the Baksa Group’s gold consent card; |

| ● | If you have signed the Baksa Group’s gold consent card, revoke that consent by signing, dating and mailing the enclosed WHITE consent revocation card immediately; and |

| ● | Even if you have not signed the Baksa Group’s gold consent card, show your support for the SITO Mobile Board and your fellow stockholders by signing, dating and mailing the enclosed WHITE consent revocation card today. |

1This discussion of the SEC enforcement action against Gary A. Singer is qualified in its entirety by reference to the complete text of the SEC’s March 10, 1997 Litigation Release No. 15278 which can be accessed at the SEC’s website at the following internet address: https://www.sec.gov/litigation/litreleases/lr15278.txt.

PLEASE DO NOT EXECUTE ANY GOLD CONSENT CARD

On behalf of your Board of Directors, we thank you for your continued support.

Sincerely,

/s/ Betsy J. Bernard

Betsy J. Bernard

Lead Independent Director

Morgan, Lewis & Bockius LLP and Sichenzia Ross Ference Kesner LLP are serving as legal advisors to SITO. Mackenzie Partners, Inc. is serving as SITO’s proxy solicitor.

About SITO Mobile Ltd.

SITO Mobile provides a mobile engagement platform that enables brands to increase awareness, loyalty, and ultimately sales. For more information, visitwww.sitomobile.com.

| YOUR VOTE IS IMPORTANT - TIME IS SHORT! |

| We strongly urge you not to sign or return any gold consent card sent to you. |

| |

| If you have any questions or need assistance in completing theWHITErevocation card |

| to revoke any gold consent card you may have previously submitted, please contact our solicitor: |

|

| 105 Madison Avenue |

| New York, New York 10016 |

| (212) 929-5500 (Call Collect) |

| Call Toll-Free (800) 322-2885 |

| Email: proxy@mackenziepartners.com |

PLEASE DO NOT EXECUTE ANY GOLD CONSENT CARD

Cautionary Statement Regarding Certain Forward-Looking Information

This letter contains forward-looking statements. These statements are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements include statements concerning the following: SITO’s plans and initiatives, campaign volume and average campaign dollars, our guidance and/or expectations for future quarters, our possible or assumed future results of operations; our business strategies; our ability to attract and retain customers; our ability to sell additional products and services to customers; our competitive position; our industry environment; our potential growth opportunities; and risks, disruption, costs and uncertainty caused by or related to the actions of activist stockholders, including that if individuals are elected to our Board with a specific agenda, it may adversely affect our ability to effectively implement our business strategy and create value for our stockholders and perceived uncertainties as to our future direction as a result of potential changes to the composition of our Board may lead to the perception of a change in the direction of our business, instability or a lack of continuity which may be exploited by our competitors, cause concern to our current or potential customers, and may result in the loss of potential business opportunities and make it more difficult to attract and retain qualified personnel and business partners. You should not place undue reliance on forward-looking statements, because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under “Risk Factors” in our Annual Report on Form 10-K and the reports we file with the SEC. Actual events or results may vary significantly from those implied or projected by the forward-looking statements due to these risk factors. No forward-looking statement is a guarantee of future performance. You should read our Annual Report on Form 10-K and the documents that we reference in our Annual Report on Form 10-K and have filed as exhibits thereto with the Securities and Exchange Commission, or the SEC, with the understanding that our actual future results and circumstances may be materially different from what we expect. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as may be required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Important Additional Information and Where To Find It

SITO Mobile, Ltd. (“SITO”), its directors and certain of its executive officers are deemed to be participants in a solicitation of consent revocations from SITO’s stockholders in connection with a pending consent solicitation by a stockholder (the “Consent Solicitation”). On May 2, 2017, SITO filed a definitive consent revocation statement (the “Consent Revocation Statement”) and accompanying WHITE consent revocation card with the SEC in connection with the Consent Solicitation. Information regarding the identity of participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the Consent Revocation Solicitation Statement, including the schedules and appendices thereto. INVESTORS AND STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ ANY SUCH CONSENT REVOCATION STATEMENT AND THE ACCOMPANYING WHITE CONSENT REVOCATION CARD AND OTHER DOCUMENTS FILED BY SITO WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders can obtain the Consent Revocation Statement, any amendments or supplements to the Consent Revocation Statement, the accompanying WHITE consent revocation card, and other documents filed by SITO with the SEC for no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Investor Relations section of SITO’s corporate website at www.sitomobile.com, by writing to SITO’s Corporate Secretary at SITO Mobile, Ltd., The Newport Corporate Center, 100 Town Square Place, Suite 204, Jersey City, NJ 07301, or by calling SITO at (201) 275-0555.

PLEASE DO NOT EXECUTE ANY GOLD CONSENT CARD

5