QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

DJ ORTHOPEDICS |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

April 30, 2004

To Our Stockholders:

You are cordially invited to attend the 2004 Annual Meeting of Stockholders of dj Orthopedics, Inc. to be held at the Company's headquarters located at 2985 Scott Street, Vista, California on Thursday, June 3, 2004 at 10:00 a.m., Pacific Daylight Time.

The matters to be acted upon at the meeting are described in detail in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement. At the meeting, we will also report on our operations and respond to any questions you may have.

Please use this opportunity to take part in the Company's affairs by voting on the business to come before this Meeting.YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Annual Meeting of Stockholders, we urge you to vote and submit your proxy in order to ensure the presence of a quorum. If your shares are held by a broker or nominee holder, you may vote by telephone or through the internet. If you attend the meeting, you will, of course, have the right to revoke the proxy and vote your shares in person. If you hold your shares through an account with a broker, nominee, fiduciary or other custodian, please follow the instructions you receive from them to vote your shares. A copy of our 2003 Annual Report to Stockholders is also enclosed.

We hope to see you at the meeting.

dj ORTHOPEDICS, INC.

2985 Scott Street

Vista, California 92081-8339

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2004 Annual Meeting of Stockholders (the "Annual Meeting") of dj Orthopedics, Inc. (the "Company") will be held at the Company's headquarters located at 2985 Scott Street, Vista, California, on Thursday, June 3, 2004 at 10:00 a.m., Pacific Daylight Time.

At the Annual Meeting, you will be asked to consider and vote upon the following matters:

- 1.

- To elect two Class III directors to serve for a term expiring at the Annual Meeting of Stockholders to be held in 2007.

- 2.

- To ratify the appointment of Ernst & Young LLP as the Company's independent auditors for the fiscal year ending December 31, 2004.

- 3.

- To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

Only stockholders of record at the close of business on April 23, 2004 (the "Record Date") will be entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Financial and other information concerning the Company is contained in the Annual Report to Stockholders for the fiscal year ended December 31, 2003.

Vista, California

April 30, 2004

YOUR VOTE IS IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING OF STOCKHOLDERS, WE URGE YOU TO VOTE AND SUBMIT YOUR PROXY BY TELEPHONE, BY MAIL OR THROUGH THE INTERNET AS PROMPTLY AS POSSIBLE TO ENSURE THE PRESENCE OF A QUORUM FOR THE MEETING. FOR ADDITIONAL INSTRUCTIONS ON VOTING BY TELEPHONE OR THROUGH THE INTERNET, PLEASE REFER TO YOUR PROXY CARD. TO VOTE AND SUBMIT YOUR PROXY BY MAIL, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED POSTAGE PRE-PAID ENVELOPE. IF YOU ATTEND THE MEETING, YOU MAY, OF COURSE, REVOKE THE PROXY AND VOTE IN PERSON. IF YOU HOLD YOUR SHARES THROUGH AN ACCOUNT WITH A BROKER, NOMINEE, FIDUCIARY OR OTHER CUSTODIAN, PLEASE FOLLOW THE INSTRUCTIONS YOU RECEIVE FROM THEM TO VOTE YOUR SHARES.

dj ORTHOPEDICS, INC.

2985 Scott Street

Vista, California 92081-8339

PROXY STATEMENT

for the 2004

ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement is furnished on or about April 30, 2004 by the Board of Directors of dj Orthopedics, Inc., a Delaware corporation (the "Company"), in connection with the solicitation of proxies for use at the 2004 Annual Meeting of Stockholders of the Company to be held at 10:00 a.m. (Pacific Daylight Time) on Thursday, June 3, 2004 (the "Annual Meeting") at the Company's headquarters at 2985 Scott Street, Vista, California and at any adjournment or postponement thereof. This Proxy Statement and the accompanying form of proxy were first mailed on or about April 30, 2004 to the stockholders of record as of the close of business on April 23, 2004.

Only holders of record of the Company's common stock at the close of business on April 23, 2004 (the "Record Date") will be entitled to vote at the Annual Meeting. The presence at the Annual Meeting (in person or by proxy) of a majority of the shares outstanding on the Record Date will constitute a quorum for the transaction of business at the Annual Meeting. At the close of business on the Record Date, the Company had 21,655,079 shares of common stock outstanding and entitled to vote. Each holder of common stock is entitled to one vote for each share held as of the Record Date. There were no outstanding shares of any other class of stock.

VOTING OF PROXIES

All shares represented by proxies will be voted by one or more of the persons designated on the enclosed proxy card in accordance with the stockholders' directions. If the proxy card is signed and returned without specific directions with respect to the matters to be acted upon, the shares of common stock represented by the proxy will be votedFOR the election of all nominees for director (Proposal 1 on the enclosed proxy card),FOR the ratification of the appointment of Ernst & Young LLP as the Company's independent auditors for 2004 (Proposal 2 on the enclosed proxy card), and in the discretion of such proxies on other matters that may come before the meeting.

A stockholder who delivers an executed proxy pursuant to this solicitation may revoke it at any time before it is exercised by (i) executing and delivering a later dated proxy card to the Secretary of the Company prior to the Annual Meeting, (ii) delivering written notice of revocation of the proxy to the Secretary of the Company prior to the Annual Meeting, or (iii) attending and voting in person at the Annual Meeting. Attendance at the Annual Meeting, in and of itself, will not constitute a revocation of a proxy. The Chairman of the Board will announce the closing of the polls during the Annual Meeting. Proxies must be received prior to the closing of the polls in order to be counted.

When the stockholder is not the record holder, such as when the shares are held through a broker, nominee, fiduciary or other custodian, the stockholder must provide voting instructions to the record holder of the shares in accordance with the record holder's requirements in order to ensure the shares are properly voted.

Instead of submitting a signed proxy card, stockholders may submit their proxies by telephone or through the Internet using the control number and instructions indicated on the proxy card. Telephone and Internet proxies must be used in conjunction with, and will be subject to, the information and terms contained on the proxy card. These procedures may also be available to stockholders who hold their shares through a broker, nominee, fiduciary or other custodian.

The presence, in person or by proxy, of holders of a majority of the outstanding shares of common stock on the Record Date is required to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and "broker non-votes" (shares held by a broker or nominee that does not have the authority, either expressed or discretionary, to vote on a particular matter) are counted for purposes of determining the presence of a quorum for the transaction of business at the Annual Meeting.

The election of directors (Proposal 1) requires the affirmative vote of a plurality of the shares of common stock present, in person or by proxy, and entitled to vote at the Annual Meeting (that is, nominees receiving the greatest number of votes will be elected). Accordingly, abstentions and broker "non-votes" are not counted and have no effect for purposes of the election of directors. Approval of Proposal 2, requires the affirmative vote of a majority of the shares of common stock present, in person or by proxy, and entitled to vote at the Annual Meeting. Accordingly, abstentions on that proposal will be equivalent to votes against such proposal, but broker "non-votes" are not counted as having been voted for this purpose and will have no effect on the outcome of the voting on Proposal 2.

The shares of common stock have no cumulative voting rights. In the event that sufficient votes in favor of the proposals are not received by the date of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit further solicitations of proxies. Any such adjournment would require the affirmative vote of a majority of the shares of common stock present, in person or by proxy, and entitled to vote at the Annual Meeting. Proxies and ballots will be received and tabulated by Mellon Investor Services LLC, the Company's transfer agent and the inspector of elections for the Annual Meeting.

The cost of soliciting proxies will be paid by the Company. Directors, officers or employees of the Company, without additional remuneration, may also solicit proxies on behalf of the Company in person or by telephone or facsimile transmission. The Company will also request brokers, nominees, fiduciaries or other custodians to forward proxy materials to the beneficial owners of shares of common stock as of the Record Date and will reimburse such persons for the cost of forwarding the proxy materials in accordance with customary practice. Your cooperation in promptly voting your shares and submitting your proxy by telephone, through the Internet or by completing and returning the enclosed proxy card will help to avoid additional expense. If you plan to attend the Annual Meeting, please check the box on the proxy card indicating your desire to attend. In accordance with Delaware law, a list of stockholders entitled to vote at the Annual Meeting will be available at the location of the Annual Meeting and for the 10 days prior to the meeting at the Company's headquarters located at 2985 Scott Street, Vista, California 92081-8339.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the ownership of the common stock of the Company by (i) those persons known by management of the Company to own beneficially more than 5% of the Company's outstanding common stock, (ii) each director and nominee for director of the Company, (iii) the executive officers named in the Summary Compensation Table set forth in the "Executive Compensation" section of this Proxy Statement, and (iv) all current directors and executive officers of the Company as a group. The information for the officers and directors is provided as of March 31, 2004, and the information for 5% holders is as of the date of the most recent filings with the Securities and Exchange Commission ("SEC") that were provided to the Company. Under the SEC's rules for beneficial ownership, more than one person may be deemed to be a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which that person has no economic interest. In addition, a person is deemed to be the beneficial owner of shares underlying currently exercisable options or options that become exercisable within 60 days of March 31, 2004. The Company understands that, except as provided in the footnotes to the table, each holder has sole voting and dispositive power over the shares beneficially owned, subject to community property laws where applicable.

| | Shares Beneficially

Owned

| |

|---|

Name

| |

|---|

| | Number

| | Percentage

| |

|---|

| J.P. Morgan DJ Partners, LLC(1) | | 2,993,880 | | 13.8 | % |

| J.P. Morgan Partners (23A SBIC), L.P.(1)(2) | | 3,072,379 | | 14.2 | % |

| Mitchell J. Blutt, M.D.(3) | | — | | — | |

| Charles T. Orsatti(4) | | 3,038,880 | | 14.0 | % |

| Federated Investors, Inc.(5) | | 1,594,282 | | 7.4 | % |

| Leslie H. Cross(6)(7) | | 434,278 | | 2.0 | % |

| Vickie L. Capps(6)(8) | | 73,901 | | * | |

| Kirby L. Cramer(6)(9) | | 79,748 | | * | |

| Luke T. Faulstick(6)(10) | | 44,282 | | * | |

| Jack R. Blair(6)(11) | | 41,000 | | * | |

| Lewis Parker(6)(12) | | 31,000 | | * | |

| Donald M. Roberts(6)(13) | | 24,419 | | * | |

| Lesley H. Howe(6)(14) | | 15,000 | | * | |

| Louis T. Ruggiero(6) | | — | | — | |

| All directors and executive officers as a group (11 persons)(15) | | 3,782,508 | | 17.5 | % |

- *

- Less than 1%

- (1)

- The address of J.P. Morgan DJ Partners, LLC ("JPMDJ Partners") and J.P. Morgan Partners (23A SBIC), L.P., formerly J.P. Morgan Partners (23A SBIC), LLC, ("JPMP (23A SBIC)") is c/o J.P. Morgan Partners, LLC, 1221 Avenue of the Americas, New York, New York 10020. JPMP (23A SBIC) owns approximately 86.9%, Wachovia Capital Partners owns approximately 9.6%, the affiliates of Trust Company of the West own approximately 3.1% and Orsatti and Partners, LLC (formerly J.P. Morgan Fairfield Partners, LLC) owns approximately 0.4% of the membership interests in JPMDJ Partners. The managing member of JPMDJ Partners is JPMP (23A SBIC).

- (2)

- Includes 78,499 shares owned directly by JPMP (23A SBIC). The remaining 2,993,880 shares are owned by JPMDJ Partners of which JPMP (23A SBIC) may be deemed the beneficial owner given its status as the managing member of JPMDJ Partners and the owner of approximately 86.9% of JPMDJ Partners' membership interests. The general partner of JPMP (23A SBIC) is J.P. Morgan Partners (23A SBIC Manager), Inc., ("JPMP (23A SBIC Manager)"), a wholly owned subsidiary of J.P. Morgan Chase Bank ("JPM Chase Bank"), a wholly-owned subsidiary of J.P. Morgan

3

Chase & Co. ("JPM Chase"), a publicly traded company. Each of JPMP (23A SBIC Manager), JPM Chase Bank and JPM Chase may be deemed beneficial owners of the shares held by JPMP (23A SBIC), however, each disclaim beneficial ownership except to the extent of its pecuniary interest.

- (3)

- Dr. Blutt is Executive Advisor at J.P. Morgan Partners, LLC and a limited partner of JPMP Master Fund Manager, L.P. ("JPMP MFM"), an entity which has a carried interest in investments of JPMP 23A SBIC. While Dr. Blutt does not have beneficial ownership of the shares beneficially owned by JPMP 23A SBIC, under Section 13(d) of the Securities Exchange Act of 1934, as amended, and the rules and regulations of the Securities and Exchange Commission thereunder because he does not have the ability to control the voting or investment power of JPMP 23A SBIC Manager, the general partner of JPMP 23A SBIC, he does have an indirect pecuniary interest in shares of the Company beneficially owned by JPMP 23A SBIC as a result of his status as a limited partner of JPMP MFM. Dr. Blutt disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. The actual pecuniary interest that may be attributable to Dr. Blutt is not readily determinable because it is subject to several variables, including without limitation, JPMP 23A SBIC's internal rate of return and vesting. The address of Dr. Blutt and JPMP (23A SBIC Manager) is c/o J.P. Morgan Partners, LLC, 1221 Avenue of the Americas, New York, New York 10020.

- (4)

- Includes 2,993,880 shares owned by JPMDJ Partners in which Orsatti and Partners, LLC ("Orsatti Partners") owns a less than 1% interest. Mr. Orsatti is the managing member of Orsatti Partners, and he and Orsatti Partners disclaim beneficial ownership of these shares except to the extent of their respective pecuniary interest, which is not readily determinable because it is subject to several variables, including without limitation, JPMP (23A SBIC)'s internal rate of return and vesting. Includes 30,000 shares owned by Fairfield Capital Partners, Inc., of which Mr. Orsatti is an officer, director and the majority stockholder, as to which shares Mr. Orsatti disclaims beneficial ownership except to the extent of his pecuniary interest. Also, includes 15,000 shares issuable upon exercise of options which vest within 60 days of the date of this table. The address of Mr. Orsatti is Orsatti and Partners, LLC, 600 Cleveland Street, Suite 1100, Clearwater, Florida 33755.

- (5)

- Based on the information provided in a Schedule 13G filed on February 13, 2004 by Federated Investors, Inc. The address of Federated Investors, Inc. is Federated Investors Tower, Pittsburgh, PA 15222-3779.

- (6)

- The address of Messrs. Cross, Cramer, Faulstick, Blair, Parker, Roberts, Howe and Ruggiero and Ms. Capps is 2985 Scott Street, Vista, California 92081.

- (7)

- Includes 214,010 shares issuable upon exercise of currently exercisable options.

- (8)

- Includes 43,375 shares issuable upon exercise of currently exercisable options.

- (9)

- Includes 58,248 shares issuable upon exercise of currently exercisable options and options which vest within 60 days of the date of the table and rights to purchase common stock.

- (10)

- Includes 40,024 shares issuable upon exercise of currently exercisable options and options which vest within 60 days of the date of the table.

- (11)

- Includes 35,000 shares issuable upon exercise of currently exercisable options and options which vest within 60 days of the date of the table.

- (12)

- Includes 30,000 shares issuable upon exercise of options which vest within 60 days of the date of the table.

- (13)

- Includes 18,375 shares issuable upon exercise of currently exercisable options.

- (14)

- Includes 10,000 shares issuable upon exercise of currently exercisable options.

- (15)

- Includes 464,032 shares issuable upon exercise of currently exercisable options, options that vest within 60 days of the date of the table and rights to purchase common stock.

4

PROPOSAL 1—ELECTION OF DIRECTORS

The Board of Directors is divided into three classes, designated Class I, Class II and Class III, and currently consists of seven directors, three of whom are in Class I and two each in Class II and III. The Board consisted of eight members until March 2004, at which time Benjamin B. Edmands resigned from the Board in connection with the reduction in ownership of common stock of the Company by JPMDJ Partners from approximately 47% to approximately 14% of the outstanding shares. Mr. Edmands had served in Class II and was considered one of the two directors nominated by JPMDJ Partners.

Nominees for a class are elected to serve a three-year term ending on the date of the Company's third annual meeting of stockholders following the annual meeting at which such nominee was elected. The current terms of the Class III directors, Mr. Jack R. Blair and Mitchell J. Blutt, M.D., expire at the Annual Meeting. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has nominated Mr. Blair and Dr. Blutt for election to the Board of Directors in Class III at the Annual Meeting, to serve until the annual meeting of stockholders to be held in 2007 or until their successors have been elected and duly qualified. The terms of the Class I and Class II directors expire at the annual meetings of stockholders to be held in 2005 and 2006, respectively.

The nominees have consented to serve as directors of the Company if elected. If, at the time of the Annual Meeting, any nominee is unable or declines to serve as a director, the discretionary authority provided in the enclosed proxy will be exercised to vote for a substitute candidate designated by the Board of Directors. The Board of Directors has no reason to believe that any of the nominees will be unable or will decline to serve as a director.

Although the Company does not have a formal policy regarding attendance by the members of the Board of Directors at annual meetings, the Company encourages all members of the board to be present at annual stockholder meetings and anticipates that all directors, including the two nominees, will be present at the Annual Meeting. All directors were present at the 2003 Annual Meeting of Stockholders.

Vote Required for Election

The two nominees receiving the greatest number of votes cast at the Annual Meeting will be elected as Class III members of the Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE ELECTION OF MR. BLAIR AND DR. BLUTT TO THE BOARD OF DIRECTORS

Set forth below is certain information furnished to the Company by the director nominees and by each of the incumbent directors whose terms will continue following the Annual Meeting. There are no family relationships between any directors or executive officers of the Company.

Nominees for Class III:

Jack R. Blair, 61, has been a director since January 2002 and has served as non-executive Chairman of the Board of dj Orthopedics since August 2002. From 1980 until his retirement in 1998, Mr. Blair served in various capacities with the healthcare company, Smith & Nephew, plc., and with Richards Medical Company, which was acquired by Smith & Nephew in 1986. Prior to his retirement, Mr. Blair served as a main board director of Smith & Nephew and as Group President in charge of that company's North American, South American and Japanese operations. Before joining Richards Medical Company, Mr. Blair served as Vice President of Marketing, Planning and Business Development for American Hospital Supply Corporation's International Pacific Division. He currently

5

serves on the boards of NuVasive Inc, a San Diego-based spinal company and Buckman Laboratories, Inc., a Memphis-based chemical company. He holds an M.B.A. (Finance) from the University of California, Los Angeles and a B.A. (Government) from Miami University in Oxford, Ohio.

Mitchell J. Blutt, M.D., 47, has been a director since August 2001. He was a Manager of DonJoy, L.L.C., the predecessor of the Company, from June 1999 to November 2001. He is Executive Advisor to J.P. Morgan Partners, LLC, and served as Executive Partner to such company, or its predecessor, Chase Capital Partners (CCP), from 1992 to 2003. J.P. Morgan Partners, LLC is the private equity organization within J.P. Morgan Chase & Co. Dr. Blutt was a General Partner of CCP from 1988 to 1992. Dr. Blutt earned his B.A. and M.D. from the University of Pennsylvania and received his M.B.A. at the Wharton School of the University of Pennsylvania from the Clinical Scholars Fellowship sponsored by the Robert Wood Johnson Foundation. He completed his medical residency at the New York Hospital/Cornell Medical School. He serves as a director of MedQuest Associates Inc. and Ryko Corp. He is an Adjunct Professor of Medicine at Weill Medical College and Graduate School of Medical Sciences of Cornell University. He also serves on the Board of the Michael J. Fox Foundation for Parkinson's Research. Dr. Blutt is a member of the Board of Trustees of the University of Pennsylvania and is also a member of the Board of Overseers of the University of Pennsylvania's School of Arts and Sciences and is a member of the Executive Committee and Board of Penn Medicine. He is also a member of the Finance Committee of Penn Medicine. He is also on the Board of the Brearley School. He formerly served on the Board of the National Venture Capital Association.

Continuing Directors in Class I (term expires in 2005):

Kirby L. Cramer, 67, has been a director since November 2001. He was a Manager of DonJoy, L.L.C., the predecessor of the Company, from December 1999 until November 2001. Mr. Cramer is a professional corporate director, having served as Chairman of five companies. He is Chairman Emeritus of Hazleton Laboratories Corporation (HLC), the world's largest contract biological and chemical research laboratory. The company was sold to Corning, Inc. in 1987 and is now Covance, Inc. He is also Chairman of the Board of The Harris Trust Company and Chairman of SonoSite, Inc., a medical device company, and a Chairman of Corus Pharma, a pharmaceutical company, Landec Corporation, a material sciences company, and Harris Bank, N.A., a Chicago, Illinois bank. Mr. Cramer served as Chairman of Kirschner Medical Corporation during its inception as a publicly traded company, and then as Chairman of the Executive Committee. He also served as the Senior Director of Immunex, a biopharmaceutical company. Additionally, he is a Trustee Emeritus and Past President of Virginia's Colgate Darden Graduate School of Business Administration, former Chairman of the Major Gifts Committee of the University of Washington Foundation, and has served as Chairman of the Advisory Board of the School of Business Administration of the University of Washington. In 1997, Mr. Cramer received the University of Washington's Business School's Alumni Service Award. Mr. Cramer completed Harvard Business School's Advanced Management Program, received his M.B.A. degree from the University of Washington and obtained his B.A. degree from Northwestern University. He is a Chartered Financial Analyst and, in 1988, he received an honorary Doctor of Laws degree from James Madison University.

Leslie H. Cross, 53, has been the Chief Executive Officer, President and a director since August 2001. He served as the Chief Executive Officer and a Manager of DonJoy, L.L.C., the predecessor of the Company, from June 1999 until November 2001, and has served as President of dj Orthopedics, LLC, the Company's wholly-owned operating subsidiary, or its predecessor, the Bracing & Support Systems division of Smith & Nephew, Inc. (the "BASS Division") since June 1995. From 1990 to 1994, Mr. Cross held the position of Senior Vice President of Marketing and Business Development of the BASS Division. He was a Managing Director of two different divisions of Smith & Nephew, Inc. from 1982 to 1990. Prior to that time, he worked at American Hospital Supply Corporation. Mr. Cross

6

earned a diploma in Medical Technology from Sydney Technical College in Sydney, Australia and studied Business at the University of Cape Town in Cape Town, South Africa.

Lesley H. Howe, 59, has been a director since October of 2002. Mr. Howe has over 35 years of experience in accounting, finance and business management within a variety of industries. He was employed by KPMG Peat Marwick LLP, an international accounting and auditing firm from 1967 to 1997 and became an audit partner in that firm in 1974. He served as area managing partner/managing partner of the Los Angeles office from 1994 to 1997. After retiring from KPMG in 1997, Mr. Howe was an independent financial and business consultant advising clients on acquisition due diligence and negotiation strategies, as well as financing strategies. For the past two years, he has served as Chief Executive Officer at Consumer Networks LLC, a San Diego-based Internet marketing and promotions company. Mr. Howe also serves on the boards of directors of P.F. Chang's China Bistro and NuVasive, Inc., and Mr. Howe chairs the Audit Committee of the boards of these two companies.

Continuing Directors in Class II (term expires in 2006):

Charles T. Orsatti, 60, has been a director since August 2001 and served as Chairman of the Board of Directors from August 2001 until July 2002. He was a Manager of DonJoy, L.L.C., the predecessor of the Company, from June 1999 to November 2001. Since 1998, he has been the Managing Member of Orsatti and Partners, LLC (formerly, J.P. Morgan Fairfield Partners, LLC), a private equity firm with holdings exclusively in the Company. He is also the Managing Partner of Fairfield Capital Partners, Inc., a private equity fund with investments in securities, commercial real estate and business equity investments. From 1995 to 1998, Mr. Orsatti was a senior consultant to Chase Capital Partners (CCP), a predecessor of J.P. Morgan Partners, LLC. He had previously served as an advisor and business consultant to CCP since 1987. Until 1995, Mr. Orsatti was the Chairman and Chief Executive Officer of Fairfield Medical Products Corporation, a worldwide manufacturer of critical care products sold to hospitals and alternative care facilities. He previously held executive positions with British Oxygen Corporation, Johnson & Johnson, Coloplast, A/S Denmark and Air Products and Chemicals, Inc. Mr. Orsatti is a member of the Board of Directors of SRI/Surgical Express, Inc. and serves on the Compensation and Nominating Committees of that board. Mr. Orsatti earned a B.S. (Management and Marketing) from Pennsylvania State University. He also serves as a Vice-Chairman of Vitagen, Inc.

Lewis Parker, 62, has been a director since May 2003. Mr. Parker is also a director of Interpore International, Inc., where he has served since 2001. From 2000 to 2001, he was a director and Chief Financial Officer of American Osteomedix, a company founded in 1999 to engage in the market for minimally invasive spine surgery. American Osteomedix was sold to Interpore in 2001. Mr. Parker began his experience in the orthopedic business in 1991 when he joined Kirschner Medical Corporation as its Senior Vice President and Chief Financial Officer. He was later named President for all of Kirschner's orthopedic operations. Kirschner was sold to Biomet, Inc. in 1994. Prior to Kirschner, Mr. Parker was President and Chief Executive Officer of ProScience Corporation, a company he founded to engage in the application of high technology biology to veterinary diagnostics. From 1976 to 1987 he served as a Vice President of Hazleton Laboratories Corporation where he began as Chief Financial Officer and later became President of the American laboratory subsidiary. Mr. Parker is currently a principal in Lochinvar, LLC, an organization engaged in turn around consulting, and in Parkwood, LLC, a venture investing firm. Mr. Parker received a B.S. degree in engineering from Lehigh University and an M.B.A. from the Wharton School at the University of Pennsylvania.

Committees of the Board of Directors and Meetings

Board of Directors. During 2003, the Board met seven times and acted by written consent three times. During 2003, each director attended at least 75% percent of the aggregate of all Board meetings and meetings of committees on which such director served. Standing committees of the Board consist

7

of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee.

�� The Nominating and Corporate Governance Committee evaluates each year the independence of the members of the Board under the listing standards of the New York Stock Exchange ("NYSE") and applicable rules of the SEC. In connection with this evaluation, the Committee refers to the Director Independence Standards set forth in Exhibit A to this Proxy Statement. A majority of the members of the Board and all of the members of the standing committees must meet these independence standards. In addition, members of the Audit Committee must meet certain additional criteria to be considered independent for purposes of that committee. The Board has affirmatively determined that each of its directors, other than Messrs. Cross and Orsatti, has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and is "independent" within the meaning of the Director Independence Standards and the NYSE listing standards currently in effect and approved by the SEC.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee has three members, Jack R. Blair, who serves as Chairman, Mitchell Blutt and Les Howe, all of whom are independent under the rules of the NYSE and SEC. During 2003 and until his resignation from the Board in March 2004, Benjamin Edmands served on the Committee. The Committee was formed in 2003 and met twice during that year. The purpose of the Committee is to evaluate and recommend candidates for election as directors, make recommendations concerning the size and composition of the Board of Directors, develop and implement the Company's corporate governance policies, develop specific criteria for director independence, and assess the effectiveness of the Board of Directors. The Committee has adopted a written charter governing its activities, and a copy of the charter is appended to this Proxy Statement as Exhibit B.

In evaluating and determining whether to nominate a candidate for a position on the Company's Board, the Committee will consider the criteria outlined in the Company's corporate governance guidelines, which include high professional ethics and values, relevant management and/or manufacturing experience and a commitment to enhance stockholder value. The Committee will also consider whether the candidate is independent of the Company under the NYSE and SEC rules. The Committee regularly assesses the size of the Board, whether any vacancies are expected due to retirement or otherwise, and the need for particular expertise on the Board. Candidates may come to the attention of the Committee from current Board members, stockholders, professional search firms, officers, or other persons. The Committee will review all candidates in the same manner regardless of the source of the recommendation. The Committee will consider stockholder recommendations of candidates when the recommendations are properly submitted. After review and deliberation of all feedback and data, the Committee makes its recommendation to the Board of Directors for approval as a director nominee.

Any stockholder recommendations which are submitted should include the candidate's name and qualifications for Board membership and should be addressed to:

For the purposes of potential candidates to be considered at the 2005 annual stockholder meeting, the Corporate Secretary must receive this information by not earlier than December 1, 2004 and not later than December 31, 2004. The notice must set forth the candidate's name, age, business address, residence address, principal occupation or employment, the number of shares beneficially owned by the candidate, and information that would be required to solicit a proxy under federal securities law. In

8

addition, the notice must include the nominating stockholder's name, address, and the number of shares beneficially owned (and the period they have been held).

Compensation Committee. Messrs. Cramer (who acts as Chairman), Blair and Parker are the current members of the Compensation Committee, all of whom are independent under the rules of the NYSE and SEC. Mr. Orsatti served as a member of the Compensation Committee during 2003, and he resigned from the Committee in February 2004 as a result of the independence requirements of the NYSE. During 2003, the Compensation Committee met five times and acted by written consent three times. The Compensation Committee recommends compensation for the Company's executive officers and grants options and stock awards under the Company's stock option plans. The Compensation Committee has approved a written charter governing its activities, and copy of that is appended to this proxy statement as Exhibit C.

Audit Committee. Messrs. Howe (who acts as Chairman), Cramer and Parker are the current members of the Audit Committee. The Audit Committee met nine times during 2003. The Audit Committee appoints the independent accountants who audit the Company's financial statements and approves the fees for such accountants. The Committee also provides assistance to the board in fulfilling its legal and fiduciary obligations in matters involving the Company's accounting, auditing, financial reporting, internal control and legal compliance functions. The Audit Committee has revised the written charter governing its activities, and a copy of the new charter is appended to this Proxy Statement as Exhibit D.

The Board of Directors has determined that all Audit Committee members are independent within the meaning of applicable NYSE and SEC rules and are financially literate under the current listing standards of the NYSE. The Board also determined that Lesley Howe and Lewis Parker qualify as "audit committee financial experts" as defined in the rules adopted by the SEC pursuant to the Sarbanes-Oxley Act of 2002.

Executive Sessions. The non-management directors hold executive sessions on a periodic basis and not less than two times per year. In 2003 the non-management directors held two such executive sessions. In addition, the non-management directors will hold executive sessions of only independent directors at least once annually. In accordance with the Company's Corporate Governance Guidelines, Jack R. Blair, the Chairman of the Board, will preside at these meetings.

Compensation of Board of Directors

Directors, other than the chairman, who are not employed by the Company receive compensation for services on the Company's Board of Directors of $20,000 per year, plus $1,000 for each Board and Committee meeting attended. The Chairman of the Board receives an annual fee of $80,000 and does not receive the per meeting fee or an additional fee for serving as Chairman of the Nominating and Corporate Governance Committee. The Chairman of the Audit Committee receives an additional fee of $10,000 per year, and the Chairman of the Compensation Committee receives an additional $5,000 per year. All directors are reimbursed for out-of-pocket expenses incurred in connection with their service on the Board.

The Company has adopted the dj Orthopedics, Inc. 2001 Non-Employee Director Stock Option Plan (the "Plan"). Members of the Board of Directors who are neither employed by the Company (or by a subsidiary of the Company) nor serving on the Board as representatives of J.P. Morgan DJ Partners, LLC, are eligible for the grant of options under the Plan. The Plan, provides that each eligible director will automatically receive an option grant covering 30,000 shares of common stock on the date on which such director joins the Board. In addition, each such eligible director will receive an automatic grant of options for 15,000 shares on the date of each annual meeting of the stockholders of the Company that occurs more than 12 months after such director was first elected to the Board. The

9

Plan also permits an eligible director to elect to receive options under the Plan in lieu of the annual cash retainer for such director for service on the Board. The Board shall determine the number of shares subject to an option received in lieu of the annual cash retainer, and such an option shall be on the terms and conditions as provided for other options granted under the Plan. A total of 1,500,000 shares of the Company's common stock have been reserved for issuance under the Plan. The purchase price of shares covered by an option granted under the Plan is the fair market value (as defined in the Plan) of the Company's common stock on the date of grant of the option. Generally, fair market value is defined as the closing selling price for such stock in the public trading market on the date of the grant. Each option granted under the Plan, as amended by the first amendment to the plan at the 2002 annual stockholders meeting becomes exercisable in full on the first anniversary of the date on which it was granted. Options granted prior to the first amendment vest over a three-year period, with one-third of the shares vesting on each of the first three anniversary dates of the grant date.

Communication with the Board

The Board of Directors have established a procedure for receiving communications from stockholders of the Company. Stockholders may communicate with the Board of Directors by sending a letter to the dj Orthopedics, Inc. Board of Directors, c/o Corporate Secretary, 2985 Scott Street, Vista, California 92081. The Corporate Secretary has the authority to disregard inappropriate communications or to take other appropriate actions with respect to any such inappropriate communications. If deemed an appropriate communication, the Corporate Secretary will submit the correspondence to the Chairman of the Board or to any specific committee or director to whom the correspondence is directed.

Corporate Governance Documents

The Company's corporate governance documents, including the Corporate Governance Guidelines, Code of Business Conduct and Ethics, Audit Committee Charter, Compensation Committee Charter and Nominating and Corporate Governance Committee Charter, are available, free of charge, on the Company's website atwww.djortho.com. Please note, however, that the information contained on the website is not incorporated by reference in, or considered part of, this Proxy Statement. The Company will also provide copies of these documents, free of charge, to any stockholder upon written request to:

10

PROPOSAL 2—RATIFICATION OF THE APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee has appointed the firm of Ernst & Young LLP, certified public accountants, as independent accountants to audit the accounts of the Company and its subsidiaries for the fiscal year ending December 31, 2004. Ernst & Young LLP has audited the accounts and records of the Company and its subsidiaries since 1998. Representatives of Ernst & Young LLP are expected to attend the Annual Meeting and will have the opportunity to make a statement if they desire. They also will be available to answer appropriate questions. If the stockholders do not ratify the appointment of Ernst & Young LLP, the Audit Committee will reconsider its appointment.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS, WHICH IS DESIGNATED AS PROPOSAL 2 ON THE ENCLOSED PROXY CARD.

Ernst & Young LLP acts as the principal auditor for the Company and provides certain other services as described below.

Audit Fees. Fees for audit services totaled approximately $350,000 in both 2003 and 2002, respectively, including fees associated with the annual audit, the reviews of the Company's quarterly reports on Form 10-Q, review of financial information presented in the Company's Current Report on Form 8-K covering the acquisition of the bone growth stimulation device business of OrthoLogic Corp., the Company's post-effective amendment to its registration statement in connection with its outstanding senior subordinated notes and the Company's shelf registration statement on Form S-3 filed in December 2003.

Audit-Related Fees. Fees for audit-related services totaled approximately $295,000 and $100,000 in 2003 and 2002, respectively. Audit-related services included due diligence procedures performed in connection with the acquisition of the bone growth stimulation device business of OrthoLogic Corp in 2003, and other potential acquisitions in 2002.

Tax Fees. Fees for tax services totaled approximately $50,000 and $400,000 in 2003 and 2002, respectively, and principally included services for tax compliance and tax planning.

All Other Fees. Fees for all other services not included above totaled approximately $3,000 in 2003 principally including fees for accounting research software. There were no fees paid in 2002 in this category.

Fee Approval Policy. All of the foregoing fees charged by Ernst & Young LLP were approved in accordance with the fee approval policy of the Audit Committee. For services that are scheduled in advance, the Audit Committee approves such fees at least quarterly. Any services required that were not scheduled or that will involve fees in excess of those scheduled require approval by the full Committee in advance or if no Committee meeting is scheduled before the services are required, the fees are subject to the pre-approval of the Chairman of the Audit Committee. Approvals by the Chairman are reviewed by the full Committee at its next meeting.

AUDIT COMMITTEE INFORMATION

The following "Report of Audit Committee" shall not be deemed to be "soliciting material" or to be "filed" with the SEC, nor shall such information be incorporated by reference by any general statement incorporating this Proxy Statement into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference.

11

Report of Audit Committee

The Audit Committee acts under a written charter adopted and approved by the Board of Directors, and has recently revised its existing charter, as well as its processes and procedures, to conform to the rules adopted by the SEC and the NYSE in response to various provisions of the Sarbanes-Oxley Act of 2002. All of the members of the Audit Committee satisfy the independence requirements for members of such committee established by the SEC and the NYSE, and are financially literate in the in the judgment of the Board of Directors. Two of the members, Messrs. Howe and Parker, qualify as "audit committee financial experts" under applicable SEC rules.

The Audit Committee is responsible for appointing the independent accountants and approving their fees. In addition, the Committee assists the Board of Directors in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls. The independent accountants are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with accounting standards generally accepted in the United States and to issue a report thereon. The Audit Committee's responsibility is to monitor and oversee these processes. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2003 with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of the disclosures in the financial statements.

In this context, the Audit Committee has met and held discussions with management and the independent auditors. Management represented to the Audit Committee that the Company's consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Audit Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (Communication With Audit Committees) as currently in effect.

In addition, the Audit Committee has discussed with the independent auditors the auditors' independence from the Company and its management, including the matters in the written disclosures and the letter from the independent auditors required by the Independence Standards Board Standard No. 1 (Independence Discussions With Audit Committees). The Audit Committee has considered whether the provision of non-audit services is compatible with maintaining the independence of Ernst & Young LLP, and has concluded that the provision of such services is compatible with maintaining the independence of the Company's auditors.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board of Directors approved, that the Company's audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2003, for filing with the SEC. The Audit Committee also reappointed, subject to stockholder ratification, Ernst & Young LLP as the Company's independent auditors for 2004 and the Board of Directors concurred in such reappointment.

12

EXECUTIVE COMPENSATION

The following table sets forth summary information on the compensation earned during 2003 and the preceding two years for services rendered in all capacities by the Company's Chief Executive Officer and each of the Company's four other most highly compensated executive officers (the "Named Executive Officers") whose salary and bonuses for 2003 exceeded $100,000.

Summary Compensation Table

| |

| | Annual Compensation(1)

| |

| |

|

|---|

Name and Position

| |

| | Stock Option

Grants

(No. of Shares)

| | All Other

Compensation(3)

|

|---|

| | Year

| | Salary

| | Bonus

| | Other(2)

|

|---|

Leslie H. Cross

Chief Executive Officer, President | | 2003

2002

2001 | | $

| 322,505

310,658

289,502 | | $

| 203,027

75,000

— | | $

| 2,218

2,095

3,703 | | 109,500

50,000

— | |

$

| —

49,456

— |

Vickie L. Capps(4)

Senior Vice President,Finance, Chief Financial Officer and Treasurer |

|

2003

2002 |

|

$

|

252,024

110,041 |

|

$

|

134,114

70,000 |

|

|

—

— |

|

43,500

160,000 |

|

$

|

32,968

— |

Luke T. Faulstick(5)

Senior Vice President, Operations |

|

2003

2002

2001 |

|

$

|

204,608

171,383

92,727 |

|

$

|

108,633

48,000

25,000 |

|

$

|

3,950

2,404

990 |

|

46,500

60,000

23,785 |

|

$

|

—

64,690

— |

Donald M. Roberts(6)

Vice President, General Counsel and Secretary |

|

2003

2002 |

|

$

|

207,000

17,250 |

|

$

|

107,590

18,000 |

|

|

—

— |

|

43,500

60,000 |

|

|

—

— |

Louis T. Ruggiero(7)

Senior Vice President, Sales and Marketing |

|

2003 |

|

$ |

91,598 |

|

$ |

47,580 |

|

|

— |

|

100,000 |

|

$ |

102,578 |

- (1)

- Amounts shown include cash earned and received by executive officers as well as amounts earned but deferred at the election of these officers under the Company's 401(k) Plan.

- (2)

- Amounts in this column consist of matching contributions made by the Company under its 401(k) Plan. They do not include the dollar value of certain perquisites the recipient received as personal benefits. Although such amounts cannot be determined precisely, the Company has concluded that the aggregate amount thereof does not exceed as to any of the Named Executive Officers the lesser of $50,000 or 10% of the total salary and bonus paid to such individual for 2003.

- (3)

- For Mr. Cross, consists of payments by Smith and Nephew, the Company's former parent, representing the gain on stock options in Smith and Nephew stock exercised and sold by Mr. Cross. For Ms. Capps, represents the forgiveness of a loan, as required by its terms, from the Company made at the time of hiring. For Mr. Faulstick, consists of reimbursement of relocation expenses. For Mr. Ruggiero, consists of a signing bonus made at the time he joined the Company.

- (4)

- Ms. Capps joined the Company in July 2002.

- (5)

- Mr. Faulstick joined the Company in June 2001.

- (6)

- Mr. Roberts joined the Company in December 2002.

- (7)

- Mr. Ruggiero joined the Company in August 2003.

13

Stock Option Grants in 2003

The following table sets forth information regarding options to purchase shares of the Company's common stock granted to the Named Executive Officers during 2003. The Company has no outstanding stock appreciation rights.

| | Individual Grants(1)

| |

| |

|

|---|

| | Number of

securities

underlying

options

granted

| | Percent of total options granted to employees in 2003

| |

| |

| | Potential Realizable Value at Assumed Annual

Rates of Stock Price Appreciation

for Option Term (2)

|

|---|

Name

| | Exercise

price

($ /sh)

| | Expiration

date

|

|---|

| | 5%

| | 10%

|

|---|

| Leslie H. Cross | | 34,500

75,000 | | 2.0

4.4 | %

| $

| 7.24

25.30 | | 5/29/2013

12/9/2013 | | $

| 157,085

1,193,328 | | $

| 398,085

3,024,126 |

Vickie L. Capps |

|

13,500

30,000 |

|

*

1.7 |

|

|

7.24

25.30 |

|

5/29/2013

12/9/2013 |

|

|

61,468

477,331 |

|

|

155,772

1,209,651 |

Luke T. Faulstick |

|

13,500

3,000

30,000 |

|

*

*

1.7 |

|

|

7.24

13.90

25.30 |

|

5/29/2013

10/7/2013

12/9/2013 |

|

|

61,468

26,255

477,331 |

|

|

155,772

66,459

1,209,651 |

Donald M. Roberts |

|

13,500

30,000 |

|

*

1.7 |

|

|

7.24

25.30 |

|

5/29/2013

12/9/2013 |

|

|

61,468

477,331 |

|

|

155,772

1,209,651 |

Louis T. Ruggiero |

|

100,000 |

|

5.8 |

|

|

10.55 |

|

8/22/2013 |

|

|

663,484 |

|

|

1,681,398 |

- *

- Less than 1%

- (1)

- All options were issued under the 2001 Omnibus Plan.

- (2)

- The potential realizable value listed in the table represents hypothetical gains that could be achieved for the options if exercised at the end of the option term. These gains are based on assumed annual rates of stock price appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date. The assumed 5% and 10% rates of appreciation are provided in accordance with rules of the SEC and do not represent the Company's estimate or projection of the Company's future stock value. Actual gains, if any, on option exercises will depend on the future performance of the Company's common stock and overall market conditions. The potential realizable value computation does not take into account federal or state income tax consequences of option exercises or sales of appreciated stock.

Aggregated Fiscal Year-End Option Values

The following table sets forth information regarding options held by each of the Named Executive Officers at December 31, 2003. Also reported are values of "in-the money" options that represent the positive spread between the respective exercise prices of outstanding stock options and $26.80, which

14

was the closing sales price of the Company's common stock on the New York Stock Exchange on December 31, 2003. None of the Named Executive Officers exercised any options in 2003.

| | Number of common shares underlying

unexercised options at

December 31, 2003

| | Value of unexercised

in-the-money options at December 31, 2003

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Leslie H. Cross | | 205,385 | | 147,000 | | $ | 3,669,703 | | $ | 1,640,445 |

| Vickie L. Capps | | 40,000 | | 163,500 | | | 942,400 | | | 3,136,260 |

| Luke T. Faulstick | | 31,649 | | 98,636 | | | 534,483 | | | 1,385,927 |

| Donald M. Roberts | | 15,000 | | 88,500 | | | 340,500 | | | 1,330,560 |

| Louis T. Ruggiero | | — | | 100,000 | | | — | | | 1,625,000 |

Equity Compensation Plan Information

The following table sets forth information regarding outstanding options and shares reserved for future issuance under all equity compensation plans of the Company as of December 31, 2003.

Plan Category

| | Number of Shares to be Issued Upon Exercise of Outstanding Options

| | Weighted Average Exercise Price of Outstanding Options

| | Number of Shares Remaining Available for Future Issuance (excluding shares reflected in column (a))

| |

|---|

| | (a)

| | (b)

| | (c)

| |

|---|

| Equity compensation plans approved by stockholders(1) | | 3,332,231 | | $ | 13.78 | | 5,167,158 | (2) |

| Equity compensation plans not approved by stockholders | | — | | | — | | — | |

| | |

| |

| |

| |

| Total | | 3,332,231 | | $ | 13.78 | | 5,167,158 | |

| | |

| |

| |

| |

- (1)

- Consists of four plans: 1999 Stock Option Plan, 2001 Omnibus Plan, 2001 Non-Employee Director Stock Option Plan, and 2001 Employee Stock Purchase Plan.

- (2)

- On January 1, 2004, the number of shares reserved for issuance for 2004 increased automatically by 732,170 pursuant to the terms of the 2001 Omnibus Plan (providing for an annual increase of 3% of the Company's outstanding stock, or 549,128 shares in 2004) and the 2001 Employee Stock Purchase Plan (providing for an annual increase of 1% of the Company's outstanding stock, or 183,042 shares in 2004).

15

REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors is responsible for making recommendations to the Board of Directors regarding the compensation of and benefits provided to the Chief Executive Officer and reviewing and approving the compensation and benefits of the other executive officers of the Company. The Compensation Committee also develops the compensation philosophy of the Company and oversees the compensation and incentive plans and programs for employees.

General Compensation Policies

The Company competes in an aggressive and dynamic industry and, as a result, hiring and retaining quality employees are key factors to our success. The Compensation Committee believes that the compensation packages for executive officers should be designed to (1) attract and retain individuals of superior ability and managerial talent, (2) motivate executive officers to increase the Company's performance for the benefit of stockholders, and (3) reward executive officers for exceptional individual contributions to the achievement of the Company's business objectives. To these ends, the Company's executive compensation package consists of salary, variable annual cash compensation (bonus) and stock-based long-term incentive awards. The Company also provides a comprehensive package of employee benefits intended to be competitive in its industry.

Compensation Components

Cash Compensation

Base Salary. In general, the level of base salary is intended to provide appropriate base pay to executive officers of the Company taking into account their historical contribution to the Company's success, each person's unique value, overall performance of the executive team, and the recommendation of the Chief Executive Officer. To determine the general parameters for base salaries, a salary range is established annually for each position based on market data involving a broad market group and a selection of companies with comparable profiles. Base salary ranges are developed for executive officers with a midpoint of these ranges targeted to reflect the average of the market data. The Committee reviews the performance of the Chief Executive Officer and provides the Board with a recommendation on his base salary. The Committee evaluates the performance of the other executive officers, with input from the Chief Executive Officer, and establishes their base salaries.

Incentive Bonus. Each executive is assigned a target bonus in the beginning of each fiscal year which is expressed as a percentage of the executive's base salary. Target bonuses vary in relation to each executive's responsibilities. In setting target bonus levels, the Committee takes into account market data and other considerations the Committee determines in its sole discretion to be appropriate under the circumstances. For 2004, the target bonus for the Chief Executive Officer is 60% of base salary and for the other executive officers it is 50% of base salary. A portion of the target bonus can be earned on a quarterly basis if quarterly targets are met. The majority of the bonus is earned following the end of the fiscal year after the annual results are determined. Incentive bonuses are earned based on (1) the performance of the Company as a whole, based on the achievement of specific financial and operating objectives, which in 2003 and 2004 were and are targeted results for operating income, and (2) the achievement of individual objectives, as well as the Committee's subjective assessment of the executives' individual performances. In addition, 25% of the amount of operating income in excess of targeted results is reserved as an overachievement pool for additional bonuses. The operating income targets for 2003 were met. In light of this and other strategic accomplishments in 2003, the Chief Executive Officer and each of the other executive officers who had been with the Company for all of 2003 received the full target bonus plus a discretionary amount above the target bonus.

16

Long-Term, Equity-Based Incentive Awards

The goal of the Company's long-term, equity-based incentive awards is to align the interests of each executive officer with those of the stockholders and provide each individual with a significant incentive to manage the Company from the perspective of a stockholder with an equity stake in the business. The Company is currently utilizing stock options under its 2001 Omnibus Plan for its long-term incentives. Employees must remain employed by the Company for a fixed period of time in order for the options to vest fully. Typically, the options vest over a four-year period at the rate of 25% per year. All options granted in 2003 were granted at an exercise price of 100% of the closing price of the stock on the date of grant, and options granted in the future are planned to be granted on the same basis. Executive officers of the Company may also participate at their sole discretion in the Company's 2001 Employee Stock Purchase Plan.

The size of the equity based awards to each executive officer is designed to create a meaningful opportunity for stock ownership. In granting equity based awards, the Committee takes into account such factors as it determines to be appropriate under the circumstances, including without limitation the officer's current position with the Company, internal comparability with awards made to other Company executives and in similarly situated companies, the officer's current level of performance, the officer's long-term value to the Company and the extent of the executive's equity ownership in the Company. The Compensation Committee also takes into account the number of vested and unvested options held by the officer in order to maintain an appropriate level of equity incentive for that individual.

All of the stock options granted in the year ended December 31, 2003 were approved by the Compensation Committee.

Chief Executive Officer Compensation

Leslie H. Cross has served as the Chief Executive Officer of the Company or its predecessors since 1995. The compensation payable to Mr. Cross during 2003 was determined by the Board of Directors upon the recommendation of the Compensation Committee. Mr. Cross' base salary was set at a level which the Compensation Committee felt would be competitive with the base salary levels in effect for chief executive officers at comparable companies within the industry. During 2003, Mr. Cross' annual salary was $325,000. Mr. Cross was eligible to earn a bonus of up to a maximum of 50% of his base salary based on the achievement of 2003 Company financial objectives. The Company did achieve these objectives, and Mr. Cross was awarded a bonus of $203,027, consisting of the full target bonus plus an additional amount of approximately 10% of his base salary as a discretionary bonus grant. Mr. Cross received stock option grants under the 2001 Omnibus Plan in 2003 for a total of 109,500 shares.

Mr. Cross' current base annual salary is $365,000. Based on an understanding of relevant compensation information, the Compensation Committee believes that the cash compensation currently paid to the Company's Chief Executive Officer is fixed at a level which is reasonable in relation to the amounts paid to other chief executive officers with comparable qualifications, experience, responsibilities and proven results at other companies of similar size and similar industries.

Tax Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code disallows a tax deduction to publicly held companies for compensation paid to certain of the Company's executive officers, to the extent that compensation exceeds $1.0 million per covered officer in any year. The limitation applies only to compensation which is not considered to be performance-based. The non-performance based compensation paid in cash to the Company's executive officers for 2003 did not exceed the $1.0 million limit per officer, and the Compensation Committee does not anticipate that the non-performance based compensations to be paid in cash to the Company's executive officers for 2004 will exceed that limit. The Company's 2001

17

Omnibus Plan has been structured so that any compensation deemed paid in connection with the exercise of stock option grants made under that plan with an exercise price equal to fair market value of the option shares on the grant date will qualify as performance-based compensation which will not be subject to the $1.0 million limitation. Other types of equity-based awards which may be granted under that plan may also be structured so as to qualify as performance based compensation. Because it is unlikely that the cash compensation payable to any of the Company's executive officers in the foreseeable future will approach the $1.0 million limit, the Compensation Committee has decided at this time not to take any action to limit or restructure the elements of cash compensation payable to the Company's executive officers. The Compensation Committee will reconsider this decision should the individual cash compensation of the other executive officers approach the $1.0 million threshold.

It is the opinion of the Compensation Committee that the executive compensation policies and plans provide the necessary total remuneration program to properly align the Company's performance and the interests of the Company's stockholders through the use of competitive and equitable executive compensation in a balanced and reasonable manner, for both the short and long-term.

| | | Respectfully submitted, |

|

|

Kirby L. Cramer (Chairman)

Lewis Parker

Jack R. Blair |

Compensation Committee Interlocks and Insider Participation

During 2003, the Compensation Committee consisted of Kirby L. Cramer, Chairman, Charles T. Orsatti and Jack R. Blair. In the first quarter of 2004, Mr. Orsatti resigned from the committee and Lewis Parker was appointed to replace him. None of the current members of the Company's Compensation Committee is an officer or employee of the Company, and no such member serves as a member of the Board of Directors or compensation committee of any entity that has one or more executive officers serving as members of the Company's Board of Directors or Compensation Committee.

Mr. Orsatti served as Chairman of the Board of the Company from August 2001 to July 2002. He is the managing member of Orsatti and Partners, LLC. (formerly, J.P. Morgan Fairfield Partners, LLC) and he received an annual consulting fee from the Company until June 2002, as more fully described under "Certain Relationships and Related Party Transactions—Transactions with Affiliates."

18

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Loans to Executive Officers

The Company received full recourse promissory notes from the Company's Chief Executive Officer, Leslie H. Cross and from another member of senior management, Michael R. McBrayer, as partial consideration for their purchase of common units of DonJoy, L.L.C., the predecessor of the Company, in June 1999, July 2000 and June 2001. Mr. McBrayer was an executive officer when these notes were issued. He resigned from his role as an executive officer in December 2003, but he continues to participate as a senior member of the management of the Company. The initial principal amount of these notes was $1,363,863.67 in the case of Mr. Cross and $283,316 in the case of Mr. McBrayer. Each of the notes matures on the seventh anniversary of its issue date and bears interest at the rate of 5.30% per annum in the case of the notes issued in 1999, 6.62% per annum in the case of the notes issued in 2000 and 5.25% per annum in the case of the notes issued in 2001. Each note permits the management investor to increase the principal amount due under the note by the amount of a scheduled interest payment (the PIK Option). If the management investor elects the PIK Option, the principal amount of this note is increased by the amount of the scheduled interest payment and interest accrues on the principal amount of the note as so increased. The notes issued in June 1999 were amended in June 2000 to include the PIK Option. As a result of this amendment, the principal amount of each June 1999 note was increased to reflect the amount of accrued and unpaid interest from June 30, 1999 to June 28, 2000. The notes of each management investor are secured by all of the common stock of the Company acquired by that management investor in the transactions that gave rise to the notes. At December 31, 2003, the aggregate principal amount and accrued interest of the notes outstanding was $1,703,781 in the case of Mr. Cross and $340,759 in the case of Mr. McBrayer. These amounts also represented the largest amounts outstanding in 2003 to each of these management investors as a result of the PIK Option discussed above.

Mr. McBrayer paid the entire balance of principal and accrued interest on his notes in February 2004 and the notes have been canceled.

Transactions with Affiliates

The Company previously entered into an arrangement with Orsatti and Partners, LLC (Formerly, J.P. Morgan Fairfield Partners, LLC) an entity controlled by Charles T. Orsatti, a member of the Board of Directors of the Company, for the provision of financial advisory services. This arrangement provided for an annual fee of $250,000. The Company made three annual payments of $250,000, and the arrangement was terminated in 2002.

J.P. Morgan Chase Bank, an affiliate of JPMDJ and JPMP (23A SBIC), was the agent and a lender under the Company's bank credit facility entered into in 1999 (the "prior facility"). The prior facility was replaced with a new credit agreement in November 2003, and the remaining balance of approximately $15.5 million on the prior facility was repaid. J.P. Morgan Chase bank is not participating in the new arrangement. Based on J.P. Morgan Chase Bank's percentage participation in the prior facility, the Company estimates that the amount of interest and fees paid to the bank totaled $0.2 million in 2003. J.P. Morgan Chase Bank also received its pro rata portion of a $20.0 million prepayment made by the Company under the prior facility in 2003. In addition, J.P. Morgan Chase Bank received its pro rata portion, totaling $18.5 million, of the net proceeds from the Company's November 2001 initial public offering used to repay borrowings under the revolving credit portion of the prior facility. J.P. Morgan Chase Bank also holds $8.7 million principal amount of the Company's outstanding $75 million principal amount of 125/8% subordinated notes, and said bank received interest payments in 2003 totaling $1.1 million.

19

COMPANY STOCK PRICE PERFORMANCE

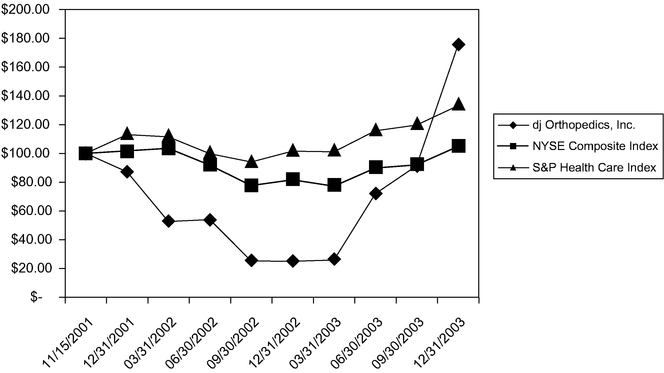

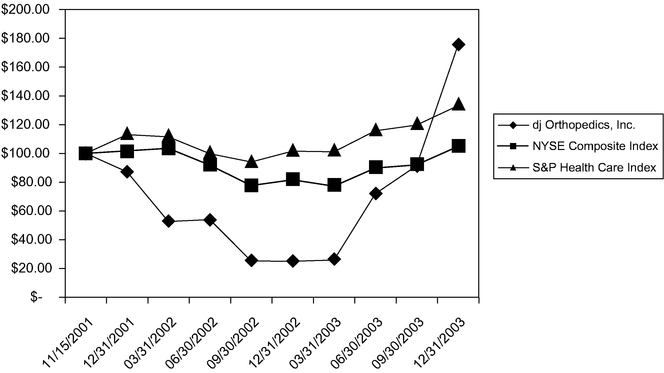

The above graph illustrates the Company's cumulative total return to stockholders (change in stock price plus reinvested dividends) from November 15, 2001, the date on which the common stock commenced trading on the NYSE, through December 31, 2003, relative to the performance of the NYSE Composite Index and the Standard & Poor's Health Care Equipment Index ("S&P Health Care Index"). The graph assumes an investment of $100 on November 15, 2001 and the reinvestment of all dividends paid since that date. The Company has never paid cash dividends on its common stock. The comparisons in the graph are required by the SEC and are not intended to forecast or be indicative of possible future performance of the Company's common stock.

| | dj Orthopedics, Inc.

| | NYSE Composite Index

| | S&P Health Care Index

|

|---|

| November 15, 2001 | | $ | 100.00 | | $ | 100.00 | | $ | 100.00 |

| December 31, 2001 | | | 87.21 | | | 101.73 | | | 113.19 |

| March 31, 2002 | | | 52.46 | | | 103.56 | | | 111.50 |

| June 30, 2002 | | | 53.77 | | | 91.94 | | | 99.93 |

| September 30, 2002 | | | 25.05 | | | 77.65 | | | 94.07 |

| December 31, 2002 | | | 24.66 | | | 81.56 | | | 101.57 |

| March 31, 2003 | | | 25.64 | | | 77.16 | | | 101.20 |

| June 30, 2003 | | | 71.87 | | | 89.80 | | | 115.73 |

| September 30, 2003 | | | 91.48 | | | 92.06 | | | 119.94 |

| December 31, 2003 | | | 175.74 | | | 105.05 | | | 133.36 |

20

STOCKHOLDER PROPOSALS

Stockholders may present proposals for inclusion in the proxy statement and form of proxy to be used in connection with the 2005 Annual Meeting of Stockholders of the Company, provided such proposals are received by the Company no later than December 31, 2004 and are otherwise in compliance with applicable laws and regulations. If a stockholder notifies the Company in writing prior to March 15, 2005 that he or she intends to present a proposal at the Company's 2005 Annual Meeting of Stockholders, the proxy holders designated by the Board of Directors may exercise their discretionary voting authority with regard to the stockholder's proposal only if the Company's proxy statement discloses the nature of the stockholder's proposal and the proxyholder's intentions with respect to the proposal. If the stockholder does not notify the Company by such date, the proxy holders may exercise their discretionary voting authority with respect to the proposal without such discussion in the proxy statement.

The Company's Amended By-laws also establish an advance notice procedure with respect to stockholder proposals and director nominations. If a stockholder wishes to have a stockholder proposal considered at the Company's next annual meeting, the stockholder must give timely notice of the proposal in writing to the Secretary of the Company. To be timely, a stockholder's notice of the proposal must be delivered to or mailed and received at the executive offices of the Company not less than 90 days nor more than 120 days prior to the first anniversary of the previous year's annual meeting. The notice must provide information as required by the Amended By-laws. A copy of these by-law requirements will be provided upon request in writing to the Secretary of the Company at its principal executive offices.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE