Exhibit A

2002 Annual Information Form

TABLE OF CONTENTS

| | | | | |

| INFORMATION ABOUT THE ANNUAL INFORMATION FORM | | | 1 | |

| GLOSSARY OF TECHNICAL TERMS | | | 2 | |

| GENERAL GLOSSARY | | | 5 | |

| CORPORATE STRUCTURE | | | 10 | |

| GENERAL DEVELOPMENT OF THE BUSINESS | | | 10 | |

| DESCRIPTION OF THE BUSINESS AS CONSTITUTED ON DECEMBER 31, 2002 | | | 12 | |

| OTHER INFORMATION REGARDING FORDING | | | 19 | |

| RISKS AND OTHER TRENDS | | | 28 | |

| SUBSEQUENT EVENTS — THE ARRANGEMENT | | | 30 | |

| SELECTED CONSOLIDATED FINANCIAL INFORMATION | | | 50 | |

| DISTRIBUTION POLICIES | | | 50 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | | 51 | |

| MARKETS FOR SECURITIES | | | 51 | |

| BIOGRAPHIES OF TRUSTEES, DIRECTORS AND OFFICERS | | | 51 | |

| ADDITIONAL INFORMATION | | | 56 | |

| APPENDIX A DEFINITIONS FOR RESERVES AND RESOURCES | | | A-1 | |

| APPENDIX B GENERAL DESCRIPTION OF DECLARATION OF TRUST | | | B-1 | |

INFORMATION ABOUT THE ANNUAL INFORMATION FORM

Information Regarding Old Fording and the Trust

On February 28, 2003 Fording Inc., as it was then constituted (“Old Fording”), Teck Cominco Limited (“Teck”), Westshore Terminals Income Fund (“Westshore”), Sherritt Coal Partnership II (“SCPII”), the two partners of which are wholly-owned subsidiaries of each of Ontario Teachers’ Pension Plan Board (“OTPP”) and Sherritt International Corporation (“Sherritt”), and CONSOL of Canada Inc. (“CONSOL”), completed a multistep transaction which proceeded by way of a plan of arrangement (the “Arrangement”).

Pursuant to the Arrangement, the business of Old Fording was reorganized under an income trust called the Fording Canadian Coal Trust (the “Trust”) and the Fording Coal Partnership, which subsequently changed its name to Elk Valley Coal Partnership (the “Partnership”), was created. The Partnership is a general partnership, the partners of which are a subsidiary of the Trust (as to 65%), and Teck and its affiliates (as to 35%). As part of the Arrangement, Luscar Energy Partnership (the partners of which are affiliates of each of Sherritt and OTPP) and CONSOL contributed indirectly to the Partnership their respective interests in the Line Creek mine, the Luscar mine and the undeveloped Cheviot deposit as well as their collective 46.4% interest in Neptune Bulk Terminals (Canada) Ltd. Old Fording contributed to the Partnership its metallurgical coal business comprised substantially of the Fording River mine, the Coal Mountain mine and its interest in the Greenhills mine, and Teck contributed to the Partnership its North American metallurgical coal business comprised substantially of the Elkview mine.

In addition, and as part of the transaction, Old Fording sold its thermal coal business to SCPII, and each of Teck, Westshore, Sherritt and OTPP subscribed for units of the Trust.

Under the Arrangement, shareholders of Old Fording could elect to receive cash, units of the Trust (“Units”) or a combination of cash and Units in exchange for their common shares of Old Fording. The Trust is the successor issuer to Old Fording following the completion of the Arrangement. The Trust expressly adopts as its own the Annual Information Form of Old Fording dated May 16, 2002. This Renewal Annual Information Form is being distributed by the Trust to Unitholders in its capacity as successor issuer to Old Fording.

The disclosure provided in this annual information form describes the business of both Old Fording as at December 31, 2002 (in accordance with applicable Canadian securities laws) as well as the Arrangement and the business of the Trust resulting from the completion of such transaction. Specifically, the disclosure provided under the headings “Corporate Structure”, “General Development of the Business”, “Description of the Business as Constituted on December 31, 2002”, “Other Information Regarding Fording”, “Selected Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” relates, unless otherwise indicated, to the business and operations of Old Fording as at December 31, 2002.

The disclosure provided under the heading “Subsequent Events — The Arrangement” describes the Arrangement and its effect on the business and operations of the Trust, New Fording and the Partnership and their respective subsidiaries (collectively, the “Fording Group”). The disclosure provided under the heading “Risks and Other Trends” relates to both Old Fording and the Trust. The disclosure provided under the headings “Distribution Policies” and “Markets for Securities” relates to the Trust as the successor issuer to Old Fording. The disclosure provided under the heading “Biographies of Trustees, Directors and Officers” relates to the Fording Group.

Each of Teck, OTPP and Sherritt have provided or have caused to be provided information contained in this Annual Information Form and have represented the accuracy of such information. Fording assumes no responsibility for the accuracy or completeness of such information, nor for any omission on the part of Teck OTPP, Sherritt or Luscar Ltd. to disclose facts or events which may affect the accuracy of any such information.

Forward-Looking Information

This annual information form contains forward-looking information within the meaning of the United StatesPrivate Securities Litigation Reform Act of 1995 relating, but not limited to, the Trust’s expectations, intentions, plans and beliefs. Forward-looking information can often be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “estimate”, “may”, and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events

or performance. Unitholders and prospective investors should be aware that these statements are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the forward-looking statements.

Unitholders and prospective investors are cautioned not to place undue reliance on forward-looking information. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and various future events will not occur. These factors include, but are not limited to: changes in commodity prices; changes in steel making methods and other technological changes; the strength of various economies; changes in the manner in which use of the Fording Group’s products are regulated; the Trust’s distribution entitlement in the Partnership; the effectiveness of the managing partner of the Partnership in managing its affairs; the effects of competition and pricing pressures; the oversupply of, or lack of demand for, the Fording Group’s products; currency and interest rate fluctuations; various events which could disrupt operations, including labour stoppages and severe weather conditions; and the Fording Group’s ability to anticipate and manage the foregoing factors and risks.

The list of factors set forth above is not exhaustive and the Trust undertakes no obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other factors which affect this information, except as required by law.

Information relating to the magnitude or quality of mineral deposits is deemed to be forward-looking information. The reliability of such information is affected by, among other things, uncertainty involving geology of mineral deposits; uncertainty of estimates of their size or composition; uncertainty of projections relating to costs of production or estimates of market prices for the mineral; the possibility of delays in mining activities; changes in plans with respect to exploration, development projects or capital expenditures; and various other risks including those relating to health, safety and environmental matters.

Conversion Table

The following are standard conversions for measurements that may be given in Imperial measure or metric units:

| | | | | | | |

| To Convert To | | From | | Multiply By |

| |

| |

|

| Cubic Yards | | Cubic metres | | | 1.308 | |

| Feet | | Metres | | | 3.281 | |

| Miles | | Kilometres | | | 0.621 | |

| Acres | | Hectares | | | 2.471 | |

| Pounds | | Kilograms | | | 2.205 | |

| Short Tons | | Tonnes | | | 1.102 | |

| Long tons | | Tonnes | | | 0.984 | |

| BTU/lb | | kJ/kg | | | 0.430 | |

Currency

Unless otherwise noted, all references in this document to monetary amounts are expressed in Canadian dollars and “$” means Canadian dollars.

GLOSSARY OF TECHNICAL TERMS

“BCM” means bank cubic metre, which represents one cubic metre of material measured prior to disturbance.

“BTU” means a measure of energy required to raise the temperature of one pound of water one degree Fahrenheit.

“BTU/lb” means BTUs per pound, an imperial unit of measure used to describe the amount of heat released on combustion of one pound of material, such as coal, under specific conditions.

“calorific value” represents the heat energy released on combustion of a unit quantity of fuel under specific conditions.

2

“coal year” means the twelve month period commencing on April 1st and ending on March 31st of the following year.

“coke” means the substance formed when coking coal is heated in a coking oven to a very high temperature in the absence of air.

“dragline” means a large, electrically powered, mobile machine with a large bucket suspended from the end of a long boom used in the open pit mining process.

“fee simple” means the most absolute and unqualified interest that can be held in land and indicates that the owner is free to hold the land in perpetuity and transfer it without hindrance.

“freehold lease” means an interest in land granted by an entity which owns the land in fee simple.

“ISO” means the International Organization for Standardization, a worldwide federation of national standards bodies.

“kJ/kg” means kilojoules per kilogram, a metric unit of measure used to describe the amount of heat released on combustion of one kilogram of combustible material, such as coal, under specific conditions.

“metallurgical coal” means the various grades of coal suitable for making steel, such as coking coal, which is used to make coke, and PCI coal, which is used in the steelmaking process for its calorific value.

“mine mouth operation” means an operation whereby coal from a mine is directly supplied to an adjacent power plant.

“overburden” means materials that overlie a mineral deposit.

“PCI” means coal that is pulverized and injected into a blast furnace. Those grades of coal used in the PCI process are generally non-coking. However, since such grades are utilized by the metallurgical industry, they are considered to be a metallurgical coal. PCI grade coal is used primarily as a heat source in the steel making process in partial replacement for high quality coking coals which are typically more expensive.

“pit” means an open excavation from which the raw mineral being mined is extracted.

“preparation plant” means a facility for crushing, sizing and washing coal to prepare it for sale.

“raw coal” means coal that has been removed or exposed for removal from the mine, but that has not been processed in a preparation plant.

“seaborne metallurgical coal” means metallurgical coal that is exported by ocean going ships from the producing country to the consuming country.

“shovel” means a large electric or diesel powered machine used in the open pit mining process to remove and load overburden or coal.

“strip ratio” means the ratio of the volume of overburden moved to the tonnage of coal produced, measured in terms of BCM of overburden per tonne of coal produced. A lower strip ratio is an operational advantage because less overburden has to be removed in order to expose the raw coal.

“thermal coal” means coal that is used primarily for its heating value. Thermal coal tends not to have the carbonization properties possessed by metallurgical coals. Most thermal coal is used to produce electricity in thermal power plants.

“tonne” means a metric tonne, which is approximately 2,205 pounds, as compared to a “short” ton or “net” ton, which is 2,000 pounds, or a “long” ton or “British” ton, which is 2,240 pounds. Unless expressly stated otherwise, the metric tonne is the unit of measure used in this document.

3

“tonnes of coal” means, unless expressly stated otherwise, (i) in respect of metallurgical coal, tonnes of clean coal (coal that has been processed in a preparation plant); and (ii) in respect of thermal coal, tonnes of raw coal.

“tripoli” is a naturally occurring microcrystalline form of silica used in a variety of industrial applications.

“truck and shovel mining” is an open pit mining method that utilizes shovels to remove overburden from above the coal seam. The coal is then loaded with shovels or loaders and hauled out of the pit in large trucks.

“wollastonite” is a naturally occurring calcium silicate used in a variety of industrial applications.

4

GENERAL GLOSSARY

“Arrangement” means the transaction involving Fording, Teck, Westshore, Sherritt, OTPP and CONSOL, and certain of their affiliates, that was first announced on January 13, 2003 and that proceeded by way of a plan of arrangement under the CBCA pursuant to which, among other things, the business of Fording was reorganized under an income trust (being the Trust) and the Partnership was formed. The Arrangement became effective on February 28, 2003.

“CBCA” means theCanada Business Corporations Act.

“Combination Agreement” means the combination agreement among Fording, Teck, Westshore, OTPP and Sherritt dated January 12, 2003 pursuant to which the parties agreed to consummate the Arrangement.

“Common Shares” means common shares in the capital of Old Fording.

“CONSOL” means CONSOL of Canada Inc. and/or CONSOL Energy Canada Ltd., as the context requires.

“Declaration of Trust” means the declaration of trust dated February 26, 2003 by which the Trust was created. See Appendix B of this annual information form for a general description of certain of the terms of the Declaration of Trust.

“Distribution Entitlement” means a Partner’s proportional entitlement, expressed as a percentage, to share in the profits and losses of the Partnership and to participate in the distribution of assets on liquidation or dissolution of the Partnership.

“Effective Date” means February 28, 2003, the date on which the Arrangement became effective.

“Fording” means Old Fording in respect of the period of time preceding the effective time of the Arrangement, and the Trust in respect of the period commencing at the time the Arrangement became effective, unless the context otherwise requires.

“Fording Contributed Assets” means the businesses that Fording contributed to the Partnership pursuant to the Arrangement, comprised substantially of its Mountain Operations and the Luscar Contributed Assets, but excluding the Fording Excluded Assets.

“Fording Excluded Assets” means the Industrial Minerals Operations, the Fording Royalty, indebtedness under Old Fording’s bank credit facilities (other than its foreign exchange forward contracts) and Old Fording’s rights and obligations in connection with its interests in the Esquimault and Nanaimo railway lands, including a former mining operation located at Mount Washington on Vancouver Island.

“Fording Group” means the Trust, New Fording and its subsidiaries, and the Partnership and its subsidiaries, and where the context requires, their predecessors.

“Fording Royalty” means a right, retained by New Fording in connection with the sale of the Prairie Operations, in respect of the lands forming part of the Prairie Operations to receive a royalty (to be determined by good faith negotiations or, failing that, arbitration) in respect of (i) a property on which production has not commenced at or prior to February 28, 2003 (and that as of that date is not dedicated to any of the generating stations to which coal is supplied from the Prairie Operations) where, after February 28, 2003, either mining or other production is commenced on the property or it becomes part of the properties designated for any power generating station or other project; (ii) a property producing a mineral other than coal at or prior to February 28, 2003, on production in any year that exceeds the adjusted average annual amount of that mineral produced from that property over the period 1998-2002; and (iii) a property producing coal at February 28, 2003, on all coal production attributable to the net increase in the generating capacity of the related power generating station, where that generating capacity increases by more than 10% over and above the capacity as of February 28, 2003, excluding for this purpose coal from the Genesee mine permit area (as at February 28, 2003) utilized in the planned 2005 expansion of the Genesee generating facility. In each case the Fording Royalty in respect of any property is not to exceed 5% of gross revenues.

5

“Independent Director” means a director of New Fording who:

| | (a) | | is not an insider (as such term is defined under applicable securities laws) of any of the Principal Unitholders or their respective affiliates and, with respect to a director nominated by Sherritt and OTPP, is also not an insider of Luscar or its affiliates, so long as Sherritt and OTPP, jointly or severally, control Luscar; |

| |

| | (b) | | would qualify as an “unrelated director” (as defined in the TSX Guidelines) of each of the Principal Unitholders, if the director was a director or trustee of each of the Principal Unitholders; and |

| |

| | (c) | | would qualify as an “unrelated director” (as defined in the TSX Guidelines) of New Fording. |

“Independent Trustee” means a Trustee who:

| | (a) | | is not an insider (as such term is defined under applicable securities laws) of any of the Principal Unitholders or their respective affiliates and, with respect to a Trustee nominated by Sherritt and OTPP, is also not an insider of Luscar or its affiliates, so long as Sherritt and OTPP, jointly or severally, control Luscar; |

| |

| | (b) | | would qualify as an “unrelated director” (as defined in the TSX Guidelines) of each of the Principal Unitholders, if the Trustee was a director or trustee of each of the Principal Unitholders; and |

| |

| | (c) | | would qualify as an “unrelated director” (as defined in the TSX Guidelines) of the Trust. |

“Industrial Minerals Operations” means, collectively, those subsidiaries of Fording engaged in the production of industrial minerals such as tripoli and wollastonite, being NYCO Minerals, Inc. with operations at Willsboro, New York; Minera NYCO S.A. de C.V. with operations near Hermosillo in the northwestern state of Sonora, Mexico; and American Tripoli, Inc. with operations near Seneca, Missouri.

“Information Circular” means Old Fording’s Notice of Special Meeting, Notice of Petition and Information Circular dated November 20, 2002, as supplemented and amended.

“Luscar”means Luscar Ltd., a corporation existing under the laws of Alberta and a wholly-owned subsidiary of the Luscar Partnership.

“Luscar/CONSOL Joint Ventures” means the joint ventures in which Luscar and CONSOL are equal participants formed for the purpose of mining and preparing coal from the Luscar mine, the undeveloped Cheviot project and the Line Creek mine.

“Luscar Contributed Assets” means the assets of the Luscar/CONSOL Joint Ventures purchased by New Fording pursuant to the Arrangement and contributed to the Partnership. These assets consisted primarily of the Line Creek mine, the undeveloped Cheviot project, the Luscar mine and a 46.4% interest in Neptune.

“Luscar Partnership” means the Luscar Energy Partnership, a general partnership owned indirectly by Sherritt and OTPP as to 50% each.

“Luscar Royalty” means a royalty interest (retained by Luscar and CONSOL, each as to a 50% share, in connection with the sale of the Luscar Contributed Assets), of 5% of specified net revenues in respect of any coal mined and produced at any time after February 28, 2003 from the Cheviot, Folding Mountain, Cadomin East and Luscar North properties, as well as any other reserves at the Luscar mine that are not part of the A-6 pit at the Luscar mine.

“Mountain Operations” means the metallurgical mining operations undertaken at the Fording River mine, the Coal Mountain mine and the Greenhills mine in southeastern British Columbia.

“National Instrument” means National Instrument 43-101 — Standards of Disclosure for Mineral Projects.

6

“Neptune” means Neptune Bulk Terminals (Canada) Ltd., a corporation existing under the laws of British Columbia.

“Neptune Terminals” means the terminals operated by Neptune located in Port of Vancouver’s inner harbour.

“New Fording” means Fording Inc., the successor, by winding up, to Old FCL and Old Fording. New Fording was originally named 4123212 Canada Ltd. following its continuance under the CBCA but changed its name to “Fording Inc.” as part of the Arrangement.

“New Fording Common Shares” means the common shares in the capital of New Fording.

“New Fording Preferred Shares” means the preferred shares in the capital of New Fording.

“New Fording Subordinated Notes” means the unsecured, subordinated notes of New Fording.

“Non-Resident” means a person who is not a resident or deemed not to be a resident of Canada for the purposes of theIncome Tax Act(Canada).

“NYSE” means the New York Stock Exchange Inc.

“Old FCL” means Fording Coal Limited, a corporation existing under the laws of Canada. Old FCL was the principal operating subsidiary of Old Fording prior to the effective date of the Arrangement. Pursuant to the Arrangement, Old FCL and Old Fording were wound up into 4123212 Canada Ltd. which then changed its name to “Fording Inc.”

“Old Fording” means Fording Inc. as it was constituted prior to the effective date of the Arrangement. Pursuant to the Arrangement, Old FCL and Old Fording were wound up into 4123212 Canada Ltd., which then changed its name to “Fording Inc.” Prior to the completion of the Arrangement, Old Fording was a public company in Canada and the United States and its securities were listed on the TSX and the NYSE. The Trust is the successor issuer to Old Fording.

“OTPP” means Ontario Teachers’ Pension Plan Board, a non-share capital corporation existing under the laws of Ontario.

“Partners” means the partners of the Partnership following completion of the Arrangement, being New Fording, Teck and Teck’s affiliates, QCP and TBCI, and “Partner” means any one of the Partners.

“Partnership” means the Elk Valley Coal Partnership, previously known as the Fording Coal Partnership, a general partnership existing under the laws of Alberta formed in contemplation of the Arrangement.

“Partnership Distributable Cash”in respect of any period means without duplication:

| | (a) | | all cash received by the Partnership in the period from any source including cash generated by coal sales, cash received from the disposition of assets, decreases in non-cash working capital, proceeds from debt incurred and proceeds from the contributions of Partners; plus |

| |

| | (b) | | cash balances on hand at the beginning of the period; less |

| |

| | (c) | | all cash payments of any kind made in the period by the Partnership including operating and administration expenses, increases in non-cash working capital, capital expenditures (excluding those financed by capital leases), capital lease expenses, interest expenses and repayment of debt; less |

| |

| | (d) | | allocations to a reserve for reasonably anticipated cash requirements that are authorized by a resolution passed by Partners holding, in aggregate, not less than 95% of the outstanding Distribution Entitlements, either at a duly constituted meeting or in writing; |

7

provided that reasonable use will be made of the Partnership’s operating lines for working capital purposes.

“Partnership Sustaining Capital Expenditures” means expenditures in respect of additions, replacements or improvements to property, plant and equipment required to maintain the Partnership’s business operations.

“Prairie Operations” means the thermal coal business of Old Fording. These operations were substantially comprised of Old Fording’s joint venture interest at Genesee, its contract mining operations at the Whitewood and Highvale mines in Alberta, and its holdings of mineral properties and rights in Alberta, Manitoba and Saskatchewan. Pursuant to the Arrangement, the Prairie Operations were sold to an affiliate of OTPP and Sherritt.

“Principal Unitholders” means Teck, Westshore, Sherritt and OTPP (and their respective affiliates that own Units).

“QCP” means The Quintette Coal Partnership, a general partnership existing under the laws of British Columbia and an affiliate of Teck.

“SCAI” means Sherritt Coal Acquisition Inc., a corporation existing under the laws of Canada and a wholly-owned subsidiary of SCPII.

“SCPII” means Sherritt Coal Partnership II, a general partnership formed under the laws of Ontario, the two partners of which are wholly-owned subsidiaries of each of OTPP and Sherritt.

“SEC Guide 7” means United States Securities and Exchange Commission Guide 7 — Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations.

“Sherritt” means Sherritt International Corporation, a corporation existing under the laws of New Brunswick.

“TBCI” means Teck-Bullmoose Coal Inc., a corporation existing under laws of British Columbia and a wholly-owned subsidiary of Teck.

“Teck” means Teck Cominco Limited, a corporation existing under the laws of Canada. Teck is the managing partner of the Partnership.

“Teck Contributed Assets” means the assets that Teck contributed to the Partnership as part the Arrangement comprising substantially all of Teck’s North American metallurgical coal business, including the Elkview mine.

“Third Supplement” means the supplement dated January 27, 2003 to the Information Circular. The Third Supplement describes the terms of the Arrangement.

“Trust” means Fording Canadian Coal Trust, an open-ended mutual fund trust governed by the laws of Alberta. The Trust was created in contemplation of the Arrangement and is the successor issuer to Old Fording. The Trust is governed by the terms of the Declaration of Trust.

“Trust Distributable Cash” means in respect of each calendar year,

| | (a) | | the cash received by the Trust from New Fording; |

| |

| | (b) | | any other net cash investment income from any other sources, including from the disposition of Trust assets; and |

| |

| | (c) | | any net cash remaining from a prior period that has not previously been distributed, less, |

| |

| | (d) | | costs, expenses and other obligations of the Trust that in the opinion of the Trustees are accrued and owing or otherwise have been or will be incurred by the Trust, including any tax liabilities of the Trust; and |

| |

| | (e) | | any amounts paid in cash by the Trust in connection with the redemption of Units or other securities of the Trust. |

8

“Trustees” means trustees of the Trust from time to time.

“TSX” means the Toronto Stock Exchange.

“TSX Guidelines” means the corporate governance guidelines of the TSX, as amended from time to time.

“Unit” means a trust unit of the Trust.

“Unitholder” means a holder of one or more Units.

“Unitholder Rights Plan” means the unitholder rights plan implemented by the Trust on completion of the Arrangement.

“Westshore” means Westshore Terminals Income Fund, an open-ended trust existing under the laws of British Columbia.

9

CORPORATE STRUCTURE

At December 31, 2002, Old Fording was a corporation existing under the CBCA and its registered office and executive office was located at Suite 1000, 205-9th Avenue SE, Calgary, Alberta T2G 0R4. Old Fording’s business was principally conducted through its wholly-owned subsidiary, Old FCL.

Intercorporate Relationships as at December 31, 2002

The following chart sets forth all material subsidiaries of Old Fording as at December 31, 2002 and indicates their respective jurisdictions of incorporation or continuance and the percentage of voting securities of each subsidiary beneficially owned, or over which control or direction was exercised, by Old Fording. See “Subsequent Events —The Arrangement” for a description of the intercorporate relationships following completion of the Arrangement.

| (1) | | Fording Inc. (Old Fording) held a single voting share in Minera NYCO S.A. de C.V. in compliance with Mexican corporate law which requires that corporations have at least two shareholders. |

GENERAL DEVELOPMENT OF THE BUSINESS

Three-year History

The nature and development of Fording’s business during the three most recently completed financial years is described in “Mountain Operations — The Last Three Years”, “Prairie Operations — The Last Three Years” and “Industrial Minerals Operations — The Last Three Years”.

Significant Acquisitions and Dispositions

Old Fording did not complete any significant acquisitions or dispositions during the 2002 financial year. However, on January 12, 2003 Old Fording entered into the Combination Agreement and on February 28, 2003 the transactions contemplated by the Combination Agreement were completed and the Arrangement became effective. Among other things, the Arrangement resulted in the sale of the Prairie Operations to an affiliate of OTPP and Sherritt, and the contribution of the Mountain Operations and the Luscar Contributed Assets to the Partnership in exchange for, among other things, New Fording’s 65% interest in the Partnership. See “Subsequent Events — The Arrangement”.

10

Trends and Major Changes

The Arrangement

A series of events took place beginning in the fall of 2002 which ultimately resulted in the Arrangement and thereby had a material effect on Fording’s business.

On October 21, 2002 SCAI announced its intention to make an unsolicited offer to acquire all of the outstanding Common Shares for $29.00 in cash per share (the “First Offer”). On that same day, the board of directors of Old Fording determined that Old Fording would proceed with the reorganization of its business under an income trust and a press release was issued announcing this development. On November 6, 2002 Old Fording issued a directors’ circular recommending rejection of the First Offer. On November 20, 2002 Old Fording released the Information Circular describing the income trust conversion proposal.

On December 4, 2002 Old Fording, Teck and Westshore entered into a combination agreement that contemplated the reorganization of Old Fording’s business under an income trust, the creation of a partnership, the contribution of assets to the partnership by Old Fording and Teck, and the subscriptions of each of Teck and Westshore for units of the proposed trust. This combination proposal was described in a supplement to the Information Circular dated December 8, 2002.

On December 16, 2002 Sherritt and OTPP amended the First Offer to provide for the payment of $35.00 in cash per Common Share (to a maximum of $850 million) or the issuance of one exchange right per Common Share convertible into one unit of a new Sherritt income trust that would own the metallurgical coal assets of both Old Fording and the Luscar/CONSOL Joint Ventures (the “Amended Offer”). On December 22, 2002 Old Fording issued a directors’ circular recommending rejection of the Amended Offer.

On January 6, 2003 SCAI announced its intention to improve the Amended Offer and on January 7, 2003 SCAI filed a notice of variation describing the amended offer (the “Second Amended Offer”). Pursuant to the Second Amended Offer, Old Fording shareholders had the choice of receiving, subject to pro-ration, $35.00 in cash per Common Share to an increased maximum of $965 million, or one exchange right per Common Share convertible into one unit in the proposed Sherritt income trust.

On January 8, 2003 representatives of Old Fording, Teck, Westshore, Sherritt and OTPP commenced discussions which ultimately resulted, on January 12, 2003, in the execution of the Combination Agreement.

Pursuant to the Arrangement, Old Fording shareholders had the option of receiving Units on the basis of one Unit per Common Share, or $35.00 in cash per Common Share to a maximum amount of $1.05 billion, or a combination of cash and Units.

The Arrangement provided for the reorganization of Old Fording’s business under an income trust (being the Trust), the creation of the Partnership and the contribution to the Partnership of the metallurgical coal businesses of Old Fording, Teck and the Luscar/CONSOL Joint Ventures, the sale of the Prairie Operations to an affiliate of Sherritt and OTPP, and the subscription for Units by each of Teck, Westshore, OTPP and Sherritt.

The Arrangement was authorized by Fording shareholders at a special meeting held on February 19, 2003 and the final order of the Court of Queen’s Bench of Alberta was issued on February 20, 2003. The Arrangement became effective on February 28, 2003.

Coal Markets

While price increases were achieved in all of Fording’s metallurgical coal markets for the 2001 and 2002 coal years, protracted negotiations for the 2002 coal year resulted in sales volumes which were 18% lower than in 2001. Pricing for the 2003 coal year has decreased by approximately 3% over the previous year while sales volumes are anticipated to increase over 2002 levels. Looking forward, management believes that supply and demand for metallurgical coal will remain in balance over the near term.

11

Other than as described above, in “Risks and Other Trends” and in Fording’s other public disclosure documents, management is not aware of any other trends, major changes, events or uncertainties that would have a material effect on Fording’s business, results of operation or financial condition.

DESCRIPTION OF THE BUSINESS AS CONSTITUTED ON DECEMBER 31, 2002

Background

In 2002, Old Fording, through its wholly owned subsidiaries, produced metallurgical and thermal coal as well as wollastonite, tripoli and other industrial minerals at locations throughout North America. Old Fording sold metallurgical coal and industrial minerals to various customers throughout the world. Substantially all of the thermal coal was produced under contract for mine mouth power plants although a small amount of thermal coal was exported to customers in Asia.

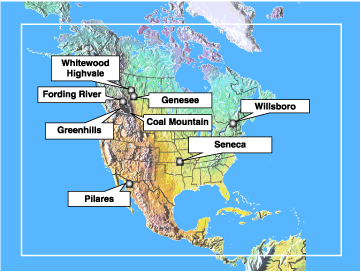

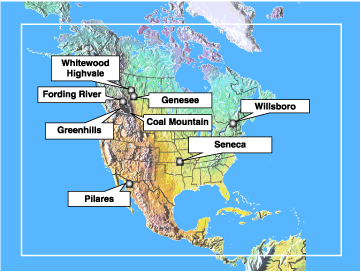

In 2002, Old Fording had three operating segments: the Mountain Operations; the Prairie Operations; and the Industrial Minerals Operations. The Mountain Operations mined and processed primarily metallurgical coal, principally for export, from three mines, Fording River, Greenhills and Coal Mountain, all of which are located in the Elk Valley region of southeastern British Columbia. In 2002, the Mountain Operations accounted for approximately 87% of Old Fording’s operating revenue. The Prairie Operations primarily mined thermal coal for mine mouth power plants from two mines at Genesee and Whitewood, both of which are located in central Alberta. The Prairie Operations also collected royalties from third party mining of its mineral properties at locations throughout the Prairie provinces. In 2002, the Prairie Operations accounted for approximately 8% of Old Fording’s operating revenue. The Industrial Minerals Operations mined and processed wollastonite and other industrial minerals from two operations in the United States, NYCO Minerals, Inc. (“Willsboro”) and American Tripoli, Inc. (“Seneca”), and one operation in Mexico, Minera NYCO S.A. de C.V (“Pilares”). In 2002, the Industrial Minerals Operations accounted for approximately 5% of Old Fording’s operating revenue. Pursuant to the Arrangement, the Mountain Operations were contributed to the Partnership and the Prairie Operations were sold to an affiliate of OTPP and Sherritt. The Trust continues to hold a 100% indirect interest in the Industrial Minerals Operations.

12

Mountain Operations

Overview

The Mountain Operations consist of open pit mines designed to operate 24 hours per day, seven days per week. However, the operating schedule can be varied depending on market conditions. The mines comprising the Mountain Operations are serviced by two-lane all weather roads.

The Mountain Operations sold 12.3 million tonnes of coal in 2002, 15.0 million tonnes in 2001 and 15.1 million tonnes in 2000. Sales from the Mountain Operations accounted for approximately 87% of Old Fording’s total operating revenues in 2002, approximately 87% in 2001 and approximately 84% in 2000.

The following map shows the location of the three mines which comprised the Mountain Operations as at December 31, 2002:

Principal Markets

The primary product of the Mountain Operations is metallurgical coal. Metallurgical coal is used primarily for making steel in integrated steel mills. Steel making is a global industry with integrated steel mills throughout North America, South America, Europe, Africa and Asia.

Geological Setting and Mineralization

The coal and rock strata found in the Mountain Operations slope downward from opposite directions to meet at a common point called a syncline. This syncline structure is folded and faulted. The coal deposits of this region occur in the Upper Jurassic to Lower Cretaceous periods. The deposits consist of medium to high volatile bituminous coal that is primarily of metallurgical quality, with minor amounts of thermal quality coal along the seam outcrops. Coal seams vary in thicknesses up to 12 metres and are interbedded with sandstones, shales, and siltstones.

The East Kootenay coal fields in the Elk Valley region of southeastern British Columbia have supported coal mining for decades. The Mountain Operations have extensive proven reserves capable of supporting continued operation for many years — see “Fording River”, “Greenhills” and “Coal Mountain”; also see “Other Information Regarding Fording — Reserves and Resources”.

13

Mining and Processing

The Mountain Operations employ conventional open pit mining techniques using truck and shovel and dragline methods. Overburden is drilled and blasted with explosives and loaded onto large trucks by shovels and loaders and hauled to waste dumps outside of the pit. Once the overburden is removed, the coal is loaded onto trucks for transport to the plant. The coal preparation plants employ rotary breakers, which break the coal to a predetermined size and remove rock. The coal is then washed using a variety of techniques and conveyed to coal fired dryers for drying.

Coal Transportation

Processed coal is conveyed to clean coal silos for storage and loadout to railcars. The loadout facility is set up to load and weigh unit trains (each train carrying up to 13,000 tonnes). A spray system coats the top of each railcar with a dust inhibitor to minimize the escape of coal dust during transportation. The majority of the processed coal is transported by rail to the Westshore Terminal at Robert’s Bank near Vancouver for shipment to customers outside of North America. Deliveries to customers in North America are made primarily by rail directly from the loadout facility.

Rail service at the Mountain Operations is provided by the Canadian Pacific Railway pursuant to an evergreen agreement that requires three years advance notice by either party to terminate. Prices are adjusted periodically under certain conditions tied to competitive rail rates and coal prices.

Westshore Terminals Ltd. provides ship-loading services at Robert’s Bank for approximately 90% of Fording’s metallurgical coal pursuant to a long-term contract expiring on February 29, 2012. See “Subsequent Events — The Arrangement”.

The Last Three Years

Between 1997 and 2000, the price of seaborne metallurgical coal dropped by more than 30%. In order to reduce inventories, some metallurgical coal producers elected to sell coal at significant discounts.

In 2000, metallurgical coal supply and demand returned to balance after many years of oversupply and remained tight through 2001. Price increases were achieved in all of Old Fording’s metallurgical coal markets for the 2001 and 2002 coal years. However, protracted negotiations for the 2002 coal year resulted in sales volumes which were 18% lower than in 2001. Pricing for the 2003 coal year has decreased by approximately 3% over the previous year while sales volumes are anticipated to increase over 2002 levels. Looking forward, management believes that supply and demand for metallurgical coal will remain in balance over the near term.

Over the last three years, capital investments have averaged $37 million per annum and have been primarily directed toward equipment replacement, preparation plant and mine improvements and pit development. These investments provided the Mountain Operations with technologically advanced facilities and equipment which in turn assisted in lowering production costs.

Old Fording’s Coal Sales By Geographical Area — Last Three Years

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Old Fording's Coal Sales By Area (millions of tonnes) |

| | |

|

| | | 2002 | | 2001 | | 2000 |

| | |

| |

| |

|

| | | % of sales | | Tonnes | | % of sales | | Tonnes | | % of sales | | Tonnes |

| | |

| |

| |

| |

| |

| |

|

| Europe | | | 33 | | | | 4.1 | | | | 37 | | | | 5.5 | | | | 36 | | | | 5.5 | |

| Japan | | | 28 | | | | 3.4 | | | | 27 | | | | 4.1 | | | | 32 | | | | 4.8 | |

| Korea | | | 20 | | | | 2.5 | | | | 15 | | | | 2.2 | | | | 17 | | | | 2.5 | |

| Taiwan | | | 4 | | | | 0.5 | | | | 5 | | | | 0.8 | | | | 7 | | | | 1.1 | |

| South America | | | 6 | | | | 0.7 | | | | 9 | | | | 1.3 | | | | 5 | | | | 0.7 | |

| North America | | | 9 | | | | 1.1 | | | | 7 | | | | 1.1 | | | | 3 | | | | 0.5 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Total | | | 100 | | | | 12.3 | | | | 100 | | | | 15.0 | | | | 100 | | | | 15.1 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

14

Fording River

The Fording River operation is located 29 kilometres northeast of the community of Elkford, in the southeastern part of British Columbia. The mine site is comprised of 20,304 hectares of coal lands of which 3,592 hectares are currently being mined or are scheduled for mining. See “Other Information Regarding Fording — Real Property”. A predecessor to Fording commenced construction of Fording River in 1969 as a 3 million tonne per year operation. It has been operated continuously since that time.

Coal mined at Fording River is primarily metallurgical coal, although a very small amount of thermal coal is also produced. The current annual production capacity of the mine and preparation plant is 10 and 9.5 million tonnes, respectively.

Coal production at Fording River has increased from approximately 2.2 million tonnes in 1973, the first full year of production, to 8.1 million tonnes in 2002. The strip ratio in 2002 was 8.0 BCM per tonne and is projected to decrease over the life of the mine.

The majority of current production is derived from the Eagle Mountain pit. Known reserves at Fording River are projected to support mining at 2002 production rates for in excess of 25 years. Fording River’s reserve areas include Eagle Mountain, Greenhills, Turnbull, Henretta, and Castle Mountain. See “Other Information Regarding Fording —Reserves and Resources”.

Fording River’s quality management system is in compliance with the ISO 9001 quality standard and its environmental management system is in compliance with the ISO 14001 environmental standard, all as verified by the Quality Management Institute.

Greenhills

The Greenhills operation is located eight kilometres northeast of the community of Elkford in the southeastern part of British Columbia. The mine site is comprised of 10,092 hectares of coal lands of which approximately 2,669 hectares are currently being mined or are scheduled for mining. See “Other Information Regarding Fording — Real Property”. Greenhills holds a forest licence and manages a 7,610 hectare forest located outside the active mining area.

The Greenhills operation was constructed in the early 1980’s by a predecessor of Westar Mining Limited (“Westar”). Fording purchased Greenhills from the trustee in the bankruptcy of Westar in December 1992 and has operated the mine continuously since 1993. Upon acquiring Greenhills, Old Fording followed a program of capital investment to re-equip and upgrade the operation with technologically advanced equipment and facilities.

In 2002, Greenhills was operated under a joint venture agreement (the “Greenhills Joint Venture Agreement”) among Old FCL, Pohang Steel Canada Limited (“Poscan”) and Poscan’s parent, Pohang Iron and Steel Company Limited (“Posco”). Pursuant to the agreement, Old FCL had an 80% interest in the joint venture while Poscan had a 20% interest. As part of the Arrangement, and pursuant to an amending and assignment agreement between Old FCL, Posco and Poscan (the “Amending Agreement”), Old FCL’s 80% interest was assigned to the Partnership.

In 2002, Old FCL was the operator of the Greenhills joint venture. Following completion of the Arrangement and pursuant to the Amending Agreement, the Partnership assumed this role. The mine equipment and preparation plant are owned by the Partnership and Posco in proportion to their respective joint venture interests. The Partnership and Posco bear all costs and expenses incurred in operating Greenhills in proportion to their respective joint venture interests. Poscan, pursuant to a property rights grant, has a right to 20% of all of the coal mined at Greenhills from certain defined lands until termination of the Greenhills Joint Venture Agreement, as amended by the Amending Agreement.

Pursuant to the terms of the Greenhills Joint Venture Agreement, as amended by the Amending Agreement, the Greenhills joint venture will be terminated on the earlier of: (i) the date the reserves on the defined lands have been depleted; (ii) March 31, 2004 if on or before December 31, 2003, Posco and the Partnership have not entered into coal sales contracts on mutually satisfactory terms providing for coal deliveries between April 1, 2004 and March

15

31, 2013; or (iii) March 31, 2013 if on or before December 31, 2003, Posco and the Partnership have entered into such new coal sales agreements.

Prior to the effective time of the Arrangement, Old FCL and Posco agreed to extend the coal sales agreements to March 31, 2004, and negotiations for longer term arrangements are continuing. If the Partnership decides to carry on mining after the termination of the joint venture, it is required to negotiate in good faith with Poscan regarding Poscan’s continued participation at Greenhills, and if agreement cannot be reached, to acquire Poscan’s interest in the mine equipment and preparation plant.

Coal mined at Greenhills is primarily metallurgical coal, although a small amount of thermal coal is also produced. The current annual production capacity of the mine and preparation plant is 4.5 and 5.5 million tonnes, respectively. Coal production at Greenhills has increased from approximately 3.1 million tonnes in 1994, the first full year of production following Old Fording’s purchase of Greenhills, to 3.8 million tonnes in 2002. The strip ratio in 2002 was 10.5 BCM per tonne and is expected to decrease over the life of the mine.

Production is derived from the Cougar reserve which is divided into two distinct pits, Cougar North and Cougar South. Cougar North has been fully developed and currently produces the bulk of the coal for the mine. Development and pre-stripping of Cougar South are underway and are expected to provide a long-term source of coal. Known reserves at Greenhills are projected to support mining at 2002 production rates for in excess of 25 years. See “Other Information Regarding Fording — Reserves and Resources”.

Greenhills’ quality management system is in compliance with the ISO 9001 quality standard, as verified by the Quality Management Institute.

Coal Mountain

The Coal Mountain operation is located 30 kilometres southeast of Sparwood in the southeastern part of British Columbia. The mine site is comprised of 2,521 hectares of coal lands of which approximately 650 hectares are currently being mined or are scheduled for mining. See “Other Information Regarding Fording — Real Property”.

Old Fording purchased the operation in 1994 from Corbin Creek Resources Ltd. (“Corbin”) and it has been operated continuously since that time. Corbin acquired the mine in the early 1990’s from Esso Resources Canada Ltd. Upon acquiring Coal Mountain, Old Fording implemented a program of capital investment to re-equip and upgrade the operation with technologically advanced equipment and facilities.

Coal Mountain produces both metallurgical and thermal coal. The current annual production capacity of the mine and preparation plant is 2.5 and 3.2 million tonnes, respectively.

Coal production has increased from approximately 1.1 million tonnes in 1995, the first full year of production following Old Fording’s purchase of Coal Mountain, to 2.1 million tonnes in 2002. The strip ratio in 2002 was 5.7 BCM per tonne and is anticipated to decrease over the life of the mine.

Known reserves at Coal Mountain are projected to support mining at 2002 production rates for in excess of 14 years. See “Other Information Regarding Fording — Reserves and Resources”.

Coal Mountain’s quality management system is in compliance with the ISO 9001 quality standard, as verified by the Quality Management Institute.

Prairie Operations

In 2002 Old Fording’s thermal coal business was consolidated in the Prairie Operations which consisted of two mine mouth operations (Genesee and Whitewood) in central Alberta and third party mining activities at various locations throughout Western Canada. Revenues from the Prairie Operations represented approximately 8% of Old Fording’s total operating revenues in 2002 as compared to approximately 8% in 2001 and 10% in 2000.

16

Description of the Operations

Coal produced at the Genesee mine is delivered to EPCOR Utilities Inc.’s (“EPCOR”) Genesee power plant. During 2002, Old Fording and EPCOR were parties to a joint venture agreement regarding the operation of the Genesee mine. Pursuant to such joint venture agreement, the mine and all mine equipment and facilities were owned in equal shares by EPCOR and Old Fording. Old Fording operated Genesee pursuant to an operating agreement with the joint venture pursuant to which Old Fording received revenues through cost reimbursement, a guaranteed rate of return on rate base, a management fee, incentive fees and royalties. Annual production at Genesee was 3.6 million tonnes in 2002, 3.5 million tonnes in 2001 and 3.5 million tonnes in 2000.

Coal produced at the Whitewood mine is delivered to TransAlta Power L.P.’s (“TransAlta”) Wabamun power plant. In 2002, Old Fording operated the Whitewood mine pursuant to a mining contract. Pursuant to such mining contract, the mine, major mine equipment, coal properties and power plant were owned by TransAlta, while Old Fording owned the support and service equipment. The Whitewood mining contract was a cost reimbursement, management fee and incentive fee based contract. Annual production at Whitewood was 2.8 million tonnes in 2002, 2.1 million tonnes in 2001 and 2.0 million tonnes in 2000.

On October 1, 2002 TransAlta awarded to Old Fording a five-year mining contract that covered both the Whitewood mine and the Highvale mine. The Highvale mine is located approximately 80 kilometres west of Edmonton, Alberta and is the largest coal mine in Canada with a production capacity of approximately 13 million tonnes per year. Coal produced at the Highvale mine is used by TransAlta at its Sundance and Keephills power plants. The new Whitewood/Highvale contract was on substantially the same terms and conditions as the previous Whitewood contract described above.

In 2002, the Prairie Operations derived additional revenue from third party mining of its extensive mineral holdings throughout Western Canada. In 2002, revenue from third party royalty arrangements represented approximately 2% of Old Fording’s total operating revenue. A total of 2.7 million tonnes of potash and 6.0 million tonnes of thermal coal were mined by third parties pursuant to such arrangements in 2002.

As part of the Arrangement, the Prairie Operations were sold to an affiliate of Sherritt and OTPP effective February 28, 2003 in consideration of $225 million, an amount on account of working capital and the retention of the Fording Royalty by New Fording.

Geological Setting and Mineralization

Genesee, Whitewood and Highvale operate in the sub-bituminous coal fields of central Alberta. The deposits consist of the Ardley coal measures. The coal seams are interbedded with partings of variable thicknesses and are flat lying which makes for easier mining when compared to dipping seams. See “Other Information Regarding Fording — Reserves and Resources”.

Mining

In 2002, the Prairie Operations employed an open pit mining method that utilized draglines to strip the overburden from above the coal seam. The coal was then loaded with shovels or loaders and hauled out of the pit in large trucks.

The Last Three Years

The nature of the contractual arrangements with EPCOR and TransAlta, which at a minimum allowed Old Fording to recover its costs of production plus a margin of profit, resulted in a stable revenue stream from the Prairie Operations over the last three years.

Industrial Minerals Operations

The Industrial Minerals Operations consist of mining operations producing wollastonite and tripoli located in Willsboro, New York, Sonora, Mexico and Seneca, Missouri. Revenues from the Industrial Minerals Operations represented approximately 5% of Old Fording’s total operating revenues in 2002, approximately 5% in 2001 and

17

approximately 6% in 2000. Pursuant to the Arrangement, the Trust holds a 100% indirect interest in the Industrial Minerals Operations.

Willsboro

The processing plant is located in Willsboro, New York, and the mine site is located 22 kilometres west of Willsboro. The processing facilities include dry processing equipment and a surface treatment plant, warehouse space and truck and rail loadout facilities. The mining operation consists of the active Lewis Pit and the Oak Hill deposit located about 1.6 kilometres from the Lewis Pit. The mine sites are comprised of 289 hectares of wollastonite lands that are held through direct ownership or controlled through mineral lease. Approximately 43 hectares of these lands are currently being mined or are scheduled for mining. See “Other Information Regarding Fording — Real Property”.

Willsboro’s primary product is wollastonite. It is extracted using open pit mining techniques and trucked to the Willsboro processing plant. In 2002, the Willsboro operation produced 49,500 tonnes of wollastonite (58,500 tonnes in 2001 and 76,400 tonnes in 2000). The current annual production capacity of the processing plant is 130,000 tonnes of wollastonite and the current annual production capacity of the mine is 300,000 tonnes of wollastonite ore. The current mine plan for the Willsboro operation contemplates the production of wollastonite from this property for in excess of 20 years at 2002 production rates. Willsboro products are marketed through a network of distributors, agents and direct sales personnel.

Willsboro’s quality management system is in compliance with the ISO 9002 quality standard, as verified by the Quality Management Institute.

Pilares

Pilares’ processing facilities, truck loadout and mine site are located approximately 50 kilometres northwest of Hermosillo, Sonora, Mexico. The processing facilities include wet and dry processing plants, a surface treatment plant, warehouse space and truck and railroad loadout facilities. A warehouse and rail loadout facility are located in Hermosillo. The mine site is comprised of 1,855 hectares of surface lands and mining concessions of which approximately 100 hectares are currently being mined or are scheduled for mining. See “Other Information Regarding Fording — Real Property”. Commercial production began at Pilares in 1998.

Pilares’ primary product is wollastonite. It is extracted using open pit mining techniques for processing at the property’s on-site plants. In 2002, the Pilares operation produced 29,200 tonnes of wollastonite (26,500 tonnes in 2001 and 30,800 tonnes in 2000). The current annual production capacity of the processing plants is 150,000 tonnes of wollastonite and the current annual production capacity of the mine is 240,000 tonnes of wollastonite ore. The operation’s annual production could be increased to 240,000 tonnes through wet plant equipment expansion to respond to an increase in market demand for wollastonite. Reserves at Pilares are sufficient to support annual production of 240,000 tonnes for in excess of 50 years. Pilares’ products are marketed through a network of distributors, agents and direct sales personnel. Pilares contracts with an affiliate, Nycomex S.A. de C.V. (“Nycomex”), for the supply of labour.

Pilares’ quality management system is in compliance with the ISO 9001 quality standard and the ISO 14001 environmental standard, as verified by the Quality Management Institute.

Seneca

Seneca’s processing facilities are located in Seneca, Missouri. The processing facilities include a processing plant and drying shed. The mine site is located approximately 12 kilometres northwest of Seneca in Ottawa County, Oklahoma. The mine site is comprised of 1,168 hectares of fee simple lands of which approximately 14 hectares are currently being mined or are scheduled for mining. See “Other Information Regarding Fording — Real Property”.

Seneca’s primary product is tripoli. It is extracted using open pit mining techniques and trucked to the Seneca processing facilities. In 2002, Seneca produced 12,700 tonnes of tripoli (11,700 tonnes in 2001 and 14,300 tonnes in 2000). The current annual production capacity of the mine and processing facility is 22,500 tonnes and 31,500 tonnes, respectively. The current mine plan for Seneca contemplates the production of tripoli from this property for

18

at least the next 30 years at 2002 production rates. Seneca directly markets a variety of abrasive products to the construction and manufacturing industries for use in buffing and polishing applications.

The Last Three Years

The principal factor that has affected the Industrial Minerals Operations over the last three years is the oversupply of wollastonite, the principal product produced by the Industrial Minerals Operations. The commencement of the Pilares operation, coincident with additional production from new entrants and established producers coming online, had the effect of reducing the price of wollastonite, particularly with respect to low-value wollastonite products. In 2002, sales of industrial minerals across Old Fording’s product categories declined primarily as a result of Old Fording’s exit from lower-priced markets and continued weak economies in the United States and Europe. Lower sales volumes were partially offset by higher average sales prices. In 2002, wollastonite sales volumes were 84,000 tonnes, a decrease of 15% from the previous year. Sales volumes of tripoli and other minerals declined approximately 6% to 15,000 tonnes. Sales of low-value wollastonite products continued to face intense competition, but sales of high-value wollastonite products for the automotive and appliance industries increased as manufacturers continued to convert traditional metal components to plastic.

In 2002, analyses of some of the wollastonite product produced and shipped from the Willsboro facility indicated the presence of small quantities of asbestiform tremolite at levels giving rise to certain labelling requirements in Canada and other jurisdictions, not including the United States. The source of asbestiform tremolite was traced to one of several ore sources supplying the operation and this ore source was segregated from Willsboro’s mining operations. Product testing since segregation of the ore source indicates only trace levels of asbestiform tremolite in some product shipped. Fording is not aware of any labelling or disclosure requirements relating to these trace levels. Independent analyses of on-going airborne particle sampling at the Willsboro operation indicate that the air quality meets the applicable standards mandated by the U.S. Mine Safety and Health Administration and the U.S. Occupational Safety and Health Administration. Product testing at Pilares indicates no detectable levels of asbestiform mineral.

Due to a history of operating losses and uncertainty around future improvement, Fording updated its assessment of the recoverability of its investment in assets related to the Pilares operation following completion of the most recent fiscal year. Projections of undiscounted future net cash flows generated by these assets were less than their carrying values and as a result, Old Fording wrote down these assets by $140 million in 2002.

OTHER INFORMATION REGARDING FORDING

Reserves and Resources

Reserves and resources as at December 31, 2002 have been estimated internally by Fording’s engineers and geologists in accordance with the National Instrument under the supervision of New Fording’s Manager, Energy Resource Planning, C.J. McKenny, Professional Geologist. Mr. McKenny is a “qualified person” for the purposes of the National Instrument. Estimates are reviewed and updated periodically to reflect new data from mining experience, drilling results and analysis.

The Trust is subject to the provisions of the National Instrument with respect to the manner in which it reports its reserves and resources, and it is also subject to United States securities laws. Accordingly, in this section, reserves and resources have been presented in tabular form in accordance with the National Instrument and a paragraph has been included after each reserve table reporting such information in accordance with SEC Guide 7.

Terminology

With respect to coal, Part One of Appendix A to this document contains the definitions ascribed by the Geological Survey of Canada Paper 88-21, “A Standardized Coal Resource/Reserve Reporting System for Canada” (the “GSC Standards”) to the terms “Reserve”, “Resource”, “Proven”, “Probable”, “Measured”, “Indicated” and “Inferred”, which are applicable to reporting coal deposits in accordance with the National Instrument.

19

With respect to minerals other than coal, Part Two of Appendix A to this document contains the definitions ascribed by the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Reserves Definitions and Guidelines, adopted August 20, 2000 (the “CIM Standards”), to the terms “Reserve”, “Resource”, “Proven”, “Probable”, “Measured”, “Indicated” and “Inferred”, which are applicable to reporting mineral deposits (other than coal) in accordance with the National Instrument.

Part Three of Appendix A to this document contains the definitions ascribed by SEC Guide 7 to the terms “Reserve”, “Proven Reserves” and “Probable Reserves”, which are applicable to Fording’s mineral reserves, including coal, when being reported on in accordance with SEC Guide 7. Unlike the National Instrument, SEC Guide 7 does not recognize the reporting of mineral deposits which do not meet the definition of “Reserve” contained in such guide.

Assumptions

Feasibility studies assume technological and economic conditions prevailing at the time the study is prepared.

Surface Mining

All coal Reserves and Resources in the following tables are mineable using conventional open pit mining methods.

20

Reserves and Resources

Proven and Probable Coal Reserves

The following table sets forth Old Fording’s Proven and Probable coal Reserves at December 31, 2002:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| COAL RESERVES |

| As At December 31, 2002 |

| (millions of tonnes)(1) |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | Calorific | | Sulphur |

| | | | | | | | | | | | | | | | | | | | Ownership | | Value | | Percent |

| Rank | | Proven(5) | | Probable(5) | | Total(5) | | Type of Coal | | (%)(2) | | kJ/kg(5) | | (by wt.)(5) |

| |

| |

| |

| |

| |

| |

| |

|

| Bituminous Coal | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fording River | | | 147 | | | | 117 | | | | 264 | | | Metallurgical | | | L | | | | 100 | | | | 32,600 | | | | 0.62 | % |

| | Greenhills | | | 99 | | | | 8 | | | | 107 | | | Metallurgical | | FS | | | 100 | | | | 32,600 | | | | 0.62 | % |

| | Coal Mountain | | | 31 | | | | 1 | | | | 32 | | | Metallurgical | | | L | | | | 100 | | | | 29,900 | | | | 0.35 | % |

| | | |

| | | |

| | | |

| | | | | | | | | | | | | | | | | | | | | |

Total | | | 277 | | | | 126 | | | | 403 | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | | | | | | | | | | | |

| Sub-bituminous Coal | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Genesee | | | 64 | | | | 70 | | | | 134 | | | Thermal | | FS/L | | | 83/17 | | | | 18,900 | | | | 0.23 | % |

| | Brooks(3) | | | 92 | | | | 74 | | | | 166 | | | Thermal | | FS | | | 100 | | | | 19,300 | | | | 0.61 | % |

| | Heatburg(3) | | | — | | | | 421 | | | | 421 | | | Thermal | | FS/L | | | 62/38 | | | | 16,000 | | | | 0.39 | % |

| | Other(4) | | | 122 | | | | — | | | | 122 | | | Thermal | | | | | | | | | | | | | | | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | | | | | | | | | | | |

Total | | | 278 | | | | 565 | | | | 843 | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | | | | | | | | | | | |

| Lignite Coal | | | 3 | | | | — | | | | 3 | | | Thermal | | FS | | | 100 | | | | 12,100 | | | | 0.43 | % |

| Notes: |

| |

| (1) | | Bituminous coal Reserves are reported in millions of metric tonnes of clean coal (i.e., tonnage remaining after mining and processing losses but including coal used in plant operations). Sub-bituminous and lignite coal Reserves are reported in millions of metric tonnes recoverable (i.e., tonnage remaining after mining losses). Reserves are reported exclusive of interests of third parties except at Greenhills where Reserves are reported inclusive of Poscan’s interest. For a description of Poscan’s interest, see “Description of the Business as Constituted on December 31, 2002 — Mountain Operations — Greenhills”. |

| |

| (2) | | Ownership of the coal Reserves is described as “FS” for fee simple or “L” for leasehold. If the Reserves are not entirely fee simple or leasehold, the ratio of the percentage of fee simple holdings to the total holdings and the leasehold holdings to the total holding is presented as FS%/L%. |

| |

| (3) | | Brooks and Heatburg are not currently being developed. |

| |

| (4) | | “Other” Reserves were not actively mined by Fording in 2002, but were mined by third parties pursuant to royalty arrangements. See “Description of the Business as Constituted on December 31, 2002 — Prairie Operations — Description of the Operations”. |

| |

| (5) | | Numbers have been rounded. |

Had Old Fording’s Proven and Probable coal Reserves been determined in accordance with SEC Guide 7, they would have been the same as those determined in accordance with the National Instrument as presented in the above table.

In 2002 Old Fording had all necessary permits which were required to mine the tonnes attributed to the above-noted mines. For information as to how Old Fording held its interest in the lands in which the above-noted Reserves are situate, see “Other Information Regarding Fording — Real Property”.

21

Measured and Indicated Coal Resources

The following table sets forth Fording’s coal Resources (consisting of “Measured” and “Indicated” coal Resources) as at December 31, 2002:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| COAL RESOURCES |

| As At December 31, 2002 |

| (millions of tonnes)(1) |

|

| | | | | | | | | | | | | | | | | | | | | | | | Calorific | | Sulphur |

| | | | | | | | | | | | | | | | | | | | | | | | Value | | Percent |

| Rank | | Measured(4) | | Indicated(4) | | Total(4) | | Type of Coal | | Ownership(2) | | kJ/kg(4) | | (by wt.)(4) |

| |

| |

| |

| |

| |

| |

| |

|

| Bituminous Coal | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fording River | | | 362 | | | | 276 | | | | 638 | | | Metallurgical | | | L | | | | 32,600 | | | | 0.62 | % |

| | Greenhills | | | 5 | | | | 325 | | | | 330 | | | Metallurgical | | FS | | | 32,600 | | | | 0.62 | % |

| | Coal Mountain | | | 70 | | | | 41 | | | | 111 | | | Metallurgical | | | L | | | | 29,900 | | | | 0.35 | % |

| | Elco(3) | | | 56 | | | | 39 | | | | 95 | | | Metallurgical | | | L | | | | 32,000 | | | | 0.60 | % |

| | Mt. Duke(3) | | | — | | | | 157 | | | | 157 | | | Metallurgical | | | L | | | | 32,000 | | | | 0.45 | % |

| | | |

| | | |

| | | |

| | | | | | | | | | | | | | | | | |

Total | | | 493 | | | | 838 | | | | 1,331 | | | | | | | | | | | | | | | | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | | | | | | | |

| Sub-bituminous Coal | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Genesee | | | — | | | | — | | | | — | | | | — | | | | — | | | | | | | | | |

| | Brooks(3) | | | 55 | | | | 65 | | | | 120 | | | Thermal | | FS | | | 19,300 | | | | 0.61 | % |

| | Other(4) | | | 2,252 | | | | 2,936 | | | | 5,188 | | | Thermal | | | — | | | | | | | | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | | | | | | | |

Total | | | 2,307 | | | | 3,001 | | | | 5,308 | | | | | | | | | | | | | | | | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | | | | | | | |

| Lignite Coal | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Notes: |

| |

| (1) | | Coal Resources are reported in millions of metric tonnes in the ground before recovery through mining and without the application of recovery factors. Coal Resources are reported exclusive of interests of third parties. Reserves are not included in Resources. |

| |

| (2) | | Ownership of the coal Resources is described as “FS” for fee simple holdings or “L” for leasehold holdings. |

| |

| (3) | | Elco, Mt. Duke, Brooks and “Other” are not currently being developed. |

| |

| (4) | | Numbers have been rounded. |

Although the terms “Measured Resources” and “Indicated Resources” are recognized by the National Instrument, they are not recognized by the United States Securities and Exchange Commission. Investors should not assume that all or any part of the mineral deposits identified as “Measured” or “Indicated” will ever be classified as Reserves. SEC Guide 7 only permits the quantification of coal deposits in public reports that meet the definition of “Reserves”. However, the National Instrument permits the quantification of Resources in disclosure documents and the Trust has elected to include such information in this document. In previous disclosure documents filed in the United States, Fording has referred to Resources as “non-reserves”.

22

Inferred Coal Resources

The following table sets forth Old Fording’s Inferred Resources for coal as at December 31, 2002:

| | | | | | | |

| INFERRED COAL RESOURCES |

| As At December 31, 2002 (millions of tonnes)(1) |

|

| Rank | | Inferred Resources(3) |

| |

|

| Bituminous Coal | | | | |

| | Fording River | | | 2,757 | |

| | Greenhills | | | 649 | |

| | Coal Mountain | | | 24 | |

| | Other(2) | | | 450 | |

| | | |

| |

| | | Total Bituminous | | | 3,880 | |

| | | |

| |

| Sub-bituminous Coal | | | | |

| | Genesee | | | — | |

| | Other(2) | | | 3,830 | |

| | | |

| |

| | | Total Sub-bituminous | | | 3,830 | |

| | | |

| |

| Lignite Coal | | | 29 | |

| Notes: |

| |

| (1) | | Coal Resources are reported in millions of metric tonnes in the ground before recovery through mining and without the application of recovery factors. Coal Resources are reported exclusive of interests of third parties. Reserves are not included in Resources. |

| |

| (2) | | Includes coal properties which are operated by third parties or currently not developed. |

| |

| (3) | | Numbers have been rounded. |

Although the term “Inferred Resource” is recognized by the National Instrument, it is not recognized by the United States Securities and Exchange Commission. “Inferred Resources” have a great amount of uncertainty as to their existence and economic and legal feasibility. Investors should not assume that all or any part of an “Inferred Resource” exists or will ever be upgraded to a higher category or be economically or legally mineable. SEC Guide 7 only permits the quantification of coal deposits in public reports that meet the definition of “Reserves”. However, the National Instrument permits the quantification of Inferred Resources in disclosure documents and the Trust has elected to include such information in this document. In previous documents filed in the United States, Fording has referred to Inferred Resources as “non-reserves”.

Proven and Probable Industrial Mineral and Potash Reserves

The following table sets forth Old Fording’s Proven and Probable Reserves of wollastonite, potash and tripoli as at December 31, 2002:

| | | | | | | | | | | | | | | | | | |

| INDUSTRIAL MINERAL AND POTASH RESERVES |

| As At December 31, 2002 (millions of tonnes)(1) |

|

| Minerals | | Proven(4) | | Probable(4) | | Total(4) | | Grade(3) |

| |

| |

| |

| |

|

| Wollastonite | | | | | | | | | | | | | | | | |

| | NYCO | | | 5 | | | | 1 | | | | 6 | | | | 54.5 | % |

| | Minera | | | 20 | | | | 85 | | | | 105 | | | | 54.8 | % |

| | | |

| | | |

| | | |

| | | | | |

Total Wollastonite | | | 25 | | | | 86 | | | | 111 | | | | | |

| | | |

| | | |

| | | |

| | | | | |

| Potash(2) | | | — | | | | — | | | | 264 | | | | 21-25 | % |

| Tripoli | | | 2 | | | | — | | | | 2 | | | | 94-98 | % |

| Notes: |

| |

| (1) | | Wollastonite and tripoli Reserves are reported in millions of metric tonnes in the ground before recovery through mining and without application of recovery factors. Reserves are reported exclusive of interests of third parties. |

| |

| (2) | | Potash Reserves have not been allocated into the categories of “Proven” and “Probable” consistent with industry practice. Reserves are described as tonnage remaining after reductions for geologic features and excavation and mining losses. Potash Reserves are in active mine permit areas operated by third parties. |

23

| (3) | | All grades are reported as a percentage (by weight) of material. For wollastonite, it is percentage of CaSi03 (wollastonite). For tripoli, it is reported as a percentage SiO2 (silicon dioxide) and for potash, it is reported as a percentage of K20 (potassium oxide) equivalent. |

| |

| (4) | | Numbers have been rounded. |

Had Old Fording’s industrial mineral and potash Reserves been determined in accordance with SEC Guide 7, they would have been the same as those determined in accordance with the National Instrument.

In 2002, Old Fording had all necessary permits which are required to mine the tonnes attributed to the above-noted mines.

For information relating to how Fording held its interest in the lands on which the above-noted reserves are situate in 2002, see “Other Information Regarding Fording — Real Property”.

Measured and Indicated Industrial Mineral and Potash Resources

The following table sets forth Old Fording’s industrial mineral and potash Resources (consisting of “Measured Resources” and “Indicated Resources” of wollastonite, potash and tripoli) as at December 31, 2002:

| | | | | | | | | | | | | | | | | | |

| INDUSTRIAL MINERAL AND POTASH RESOURCES |

| As At December 31, 2002 |

| (millions of tonnes)(1) |

|

| Minerals | | Measured(4) | | Indicated(4) | | Total(4) | | Grade(3) |

| |

| |

| |

| |

|

| Wollastonite | | | | | | | | | | | | | | | | |

| | NYCO | | | 1 | | | | 2 | | | | 3 | | | | 54.5 | % |

| | Minera | | | — | | | | — | | | | — | | | | — | |

| | | |

| | | |

| | | |

| | | | | |

Total Wollastonite | | | 1 | | | | 2 | | | | 3 | | | | | |

| | | |

| | | |

| | | |

| | | | | |

| Potash(2) | | | — | | | | 186 | | | | 186 | | | | 21-25 | % |

| Tripoli | | | — | | | | — | | | | — | | | | 94-98 | % |

| Notes: |

| |