QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

HERITAGE PROPERTY INVESTMENT TRUST, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

HERITAGE PROPERTY INVESTMENT TRUST, INC.

535 Boylston Street

Boston, Massachusetts 02116

April 4, 2003

Dear Stockholder:

We are pleased to invite you to attend the 2003 Annual Meeting of Stockholders of Heritage Property Investment Trust, Inc., which will be held on Friday, May 9, 2003, at 9:00 a.m. at The Park Plaza Hotel, 65 Arlington Street, Boston, Massachusetts. The accompanying Notice of Annual Meeting of Stockholders and Proxy Statement contain the matters to be considered and acted upon at the Annual Meeting. Please read these materials carefully. Matters scheduled for consideration at the Annual Meeting are to elect four Directors and to adopt certain amendments to our equity incentive plan as described in the accompanying Proxy Statement.

I am delighted that you have invested in our company, and I hope that, whether or not you plan to attend the Annual Meeting, you will vote as soon as possible by completing, signing and returning the enclosed Proxy in the envelope provided. Your vote is important. Voting by written proxy will ensure your representation at the Annual Meeting if you do not attend in person.

I look forward to seeing you on May 9, 2003 at our Annual Meeting.

HERITAGE PROPERTY INVESTMENT TRUST, INC.

535 Boylston Street

Boston, Massachusetts 02116

NOTICE OF 2003 ANNUAL MEETING OF STOCKHOLDERS

TO THE STOCKHOLDERS OF HERITAGE PROPERTY INVESTMENT TRUST, INC.:

NOTICE IS HEREBY GIVEN that the 2003 Annual Meeting of Stockholders of Heritage Property Investment Trust, Inc. (the "Company") will be held at The Park Plaza Hotel, 65 Arlington Street, Boston, Massachusetts 02116, on Friday, May 9, 2003, at 9:00 A.M., local time, for the following purposes:

- 1.

- To elect four directors to hold office for a three-year term until the 2006 Annual Meeting of Stockholders and until their successors have been duly elected and qualified. The current Board of Directors of the Company has nominated and recommends for such election as Directors the following persons: Kenneth K. Quigley, Jr., William M. Vaughn, III, Paul V. Walsh and Robert J. Watson.

- 2.

- To consider and approve certain amendments to the Company's Amended and Restated 2000 Equity Incentive Plan.

- 3.

- To consider and act upon any other matters which may properly come before the Annual Meeting or any adjournments or postponements thereof.

The Board of Directors has fixed March 7, 2003 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting. Accordingly, only stockholders of record at the close of business on March 7, 2003, will be entitled to notice of, and to vote at, the Annual Meeting or any adjournments thereof.

STOCKHOLDERS ARE URGED TO COMPLETE, DATE AND SIGN THE ACCOMPANYING PROXY CARD AND RETURN IT PROMPTLY IN THE POSTPAID ENVELOPE PROVIDED. STOCKHOLDERS WHO ARE PRESENT AT THE ANNUAL MEETING MAY WITHDRAW THEIR PROXY AND VOTE IN PERSON, IF THEY SO DESIRE.

April 4, 2003

HERITAGE PROPERTY INVESTMENT TRUST, INC.

535 Boylston Street

Boston, Massachusetts 02116

PROXY STATEMENT

GENERAL INFORMATION

Proxy Solicitation

This Proxy Statement is furnished to the holders of the common stock, $0.001 par value per share, of Heritage Property Investment Trust, Inc. (the "Company") in connection with the solicitation of proxies on behalf of our Board of Directors for use at the 2003 Annual Meeting of Stockholders to be held on May 9, 2003, or at any adjournment or postponement of the meeting. The purposes of the Annual Meeting and the matters to be acted upon are set forth in the accompanying Notice of 2003 Annual Meeting of Stockholders. The Board of Directors knows of no other business that will come before the Annual Meeting.

This Proxy Statement and proxies for use at the annual meeting will be first mailed to stockholders on or about April 4, 2003, and proxies will be solicited chiefly by mail, but additional solicitations may be made by telephone by our officers or regular employees. We may enlist the assistance of brokerage houses in soliciting proxies. We will bear all solicitation expenses, including costs of preparing, assembling and mailing proxy material.

Voting and Revocability of Proxy

If the accompanying Proxy Card is properly signed, returned to the Company and not revoked, it will be voted as directed by the stockholder. The persons designated as proxy holders on the Proxy Card will, unless otherwise directed, vote the shares represented by such proxy FOR the election of all nominees for the Board of Directors named in this Proxy Statement, FOR the amendments to the Company's equity incentive plan described in this Proxy Statement, and as recommended by the Board of Directors with regard to any other matters, or, if no recommendation is given, in their own discretion.

Stockholders may revoke the authority granted by their execution of proxies at any time before the effective exercise of such authority by filing with our Secretary a written revocation or a duly executed proxy bearing a later date or by voting in person at the annual meeting.

Record Date and Voting Rights

Only stockholders of record at the close of business on March 7, 2003, are entitled to notice of, and to vote at, the annual meeting, or any adjournment or postponement of the meeting. We had outstanding on March 7, 2003, 41,778,708 shares of common stock, each of which is entitled to one vote upon the matters to be presented at the annual meeting. The presence, in person or by proxy, of a majority of the issued and outstanding shares of common stock will constitute a quorum for the transaction of business at the annual meeting. Votes withheld from any nominee, abstentions, and broker "non-votes" are counted as present or represented for purposes of determining the presence or absence of a quorum for the annual meeting. A broker "non-vote" occurs when a nominee holding shares for a beneficial owner does not vote on one or more proposals because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner.

1

In the election of directors, the affirmative vote of a plurality of the shares of common stock present or represented and entitled to vote at the Annual Meeting, in person or by proxy, is required for the election of each of the nominees. Abstentions and broker "non-votes" will have no effect on the voting outcome with respect to the election of directors. The affirmative vote of the holders of a majority of the shares of common stock present or represented and entitled to vote at the Annual Meeting, in person or by proxy, is necessary for approval of the proposal to amend the Company's equity incentive plan. Abstentions have the practical effect of a vote against these proposals. Although counted as present for the purpose of determining a quorum, broker "non-votes" are not counted for any purpose in determining whether a matter has been approved.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

Principal Stockholders

The following table sets forth certain information with respect to each person known to us to be the beneficial owner of more than 5% of the issued and outstanding common stock as of March 7, 2003. As of March 7, 2003, 41,778,708 shares of common stock were outstanding.

| | Amount and Nature of

Beneficial Ownership*

| |

|

|---|

Name and Address of Beneficial Owner

| | Outstanding

Shares

| | Right to

Acquire

| | Total

Number

| | Percentage

of Class

|

|---|

New England Teamsters and Trucking Industry

Pension Fund(1) | | 18,000,000 | | — | | 18,000,000 | | 43.1% |

| Net Realty Holding Trust(2) | | 18,000,000 | | — | | 18,000,000 | | 43.1% |

| Prudential Insurance Company of America(3) | | 4,935,556 | | 375,000 | | 5,310,556 | | 12.6% |

- *

- Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options or warrants held by that person that are currently exercisable or exercisable within 60 days of March 7, 2003 are deemed outstanding. These shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Each stockholder named in the table has sole voting and investment power with respect to the shares set forth opposite such stockholder's name. Shares included in the table under "Right to Acquire" represent shares subject to outstanding warrants to purchase common stock currently exercisable.

- (1)

- The principal address of The New England Teamsters and Trucking Industry Pension Fund ("NETT") is 535 Boylston Street, Boston, Massachusetts 02116. NETT owns all of the outstanding interests in Net Realty Holding Trust, our largest stockholder and as such, may be deemed to be the beneficial owner of all the shares of our common stock owned by Net Realty Holding Trust.

- (2)

- The principal address of Net Realty Holding Trust is care of The New England Teamsters and Trucking Industry Pension Fund, 535 Boylston Street, Boston, Massachusetts 02116.

- (3)

- The principal address of The Prudential Insurance Company of America is care of Prudential Real Estate Investors, 8 Campus Drive, Parsippany, New Jersey 07054-4493. 120 current or former employees of Prudential, including Robert Falzon, one of our directors, own an aggregate of 2,400 shares of our common stock. Prudential disclaims beneficial ownership of all shares of common stock owned by these employees.

2

Management Stockholders

The following table sets forth information as of March 7, 2003, as reported to us, with respect to the beneficial ownership of the common stock by each of our directors and by each of the executive officers named in the summary compensation table below, and by all directors and these executive officers as a group. Except as otherwise set forth below, the principal address of each of the persons named below is care of Heritage Property Investment Trust, Inc., 535 Boylston Street, Boston, Massachusetts 02116.

| | Amount and Nature of

Beneficial Ownership

| |

| |

|---|

Name

| | Outstanding

Shares

| | Right to

Acquire

| | Total

Number

| | Percentage

of Class

| |

|---|

| Thomas C. Prendergast(1) | | 483,898 | | 690,000 | | 1,173,898 | | 2.8 | % |

| Gary Widett, Esq. | | 100,479 | | 230,000 | | 330,479 | | * | |

| David G. Gaw | | 48,000 | | 100,000 | | 148,000 | | * | |

| Robert Prendergast(2) | | 17,380 | | 74,000 | | 91,380 | | * | |

| Barry Rodenstein | | 10,000 | | 42,000 | | 52,000 | | * | |

| Joseph L. Barry | | 5,000 | | — | | 5,000 | | * | |

| Bernard Cammarata | | — | | 22,800 | | 22,800 | | * | |

| Robert M. Falzon(3) | | 20 | | — | | 20 | | * | |

| Richard C. Garrison | | 1,500 | | — | | 1,500 | | * | |

| David W. Laughton | | 1,000 | | — | | 1,000 | | * | |

| Kevin C. Phelan | | 2,000 | | — | | 2,000 | | * | |

| Kenneth K. Quigley, Jr. | | 500 | | — | | 500 | | * | |

| William M. Vaughn | | — | | — | | — | | — | |

| Paul V. Walsh | | — | | — | | — | | — | |

| Robert J. Watson | | 3,000 | | — | | 3,000 | | * | |

| All directors and executive officers as a group (15 persons) | | 672,777 | | 1,158,800 | | 1,831,577 | | 4.3 | % |

- *

- Less than 1% of the issued and outstanding shares of common stock.

- •

- Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options held by that person that are currently exercisable or exercisable within 60 days of March 7, 2003, are deemed outstanding. These shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as indicated below and pursuant to applicable community property laws, each stockholder named in the table has sole voting and investment power with respect to the shares set forth opposite such stockholder's name. Shares included below under "Right to Acquire" represent shares subject to outstanding stock options currently exercisable or exercisable within 60 days of March 7, 2003.

- (1)

- Mr. Prendergast is the brother of Robert Prendergast, our Vice President, Property Management and Construction. Mr. Prendergast disclaims beneficial ownership of all shares of our common stock owned by Robert Prendergast.

- (2)

- Mr. Prendergast is the brother of Thomas C. Prendergast, our Chairman, President and Chief Executive Officer. Mr. Prendergast disclaims beneficial ownership of all shares of our common stock owned by Thomas C. Prendergast.

- (3)

- Mr. Falzon is Managing Director of Prudential Real Estate Investors, an affiliate of The Prudential Insurance Company of America, and may be deemed to be the beneficial owner of all of the

3

shares of our common stock owned by Prudential. Mr. Falzon disclaims beneficial ownership of all of the shares of our common stock owned by Prudential. In addition, 120 current or former employees of Prudential, other than Mr. Falzon, own an aggregate of 2,400 shares of common stock. Mr. Falzon disclaims beneficial ownership of all shares of our common stock owned by these employees.

PROPOSAL ONE

ELECTION OF DIRECTORS

Pursuant to the Company's charter, the Directors are divided into three classes. The terms of current Directors Kenneth K. Quigley, Jr., William M. Vaughn, Paul V. Walsh and Robert J. Watson expire at the Annual Meeting, while the terms of the remaining Directors expire at the annual meetings of stockholders to be held in 2004 or 2005, as specified below. In accordance with a resolution duly adopted by the Board of Directors on February 7, 2003, Messrs. Quigley, Vaughn, Walsh and Watson have been nominated and recommended for election to serve as Directors for a three-year term until the annual meeting of stockholders to be held in 2006.

If, for any reason, any of the above-mentioned candidates for election becomes unavailable for election or service, the persons designated as proxy holders on the Proxy Card will vote for the substitute nominee recommended by the board of directors, or, if no recommendation is given, for any substitute nominee in their own discretion.

Vote Required

The affirmative vote of a plurality of all the votes cast at the Annual Meeting, assuming a quorum is present, is necessary for the election of a Director. Therefore, the four individuals with the highest number of affirmative votes will be elected to the four directorships. For purposes of the election of Directors, abstentions and other shares not voted will not be counted as votes cast and will have no effect on the result of the vote.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE NOMINEES SET FORTH ABOVE.

Information Regarding Directors

The information set forth below is submitted with respect to the nominees for election to the board of directors, as well as those Directors whose terms of office are continuing after the Annual Meeting.

Nominees for Election for Term Expiring at the 2006 Annual Meeting of Stockholders

Kenneth K. Quigley, Jr., age 45, has been a Director since April 2002. Since February 1996, Mr. Quigley has been President of Curry College, a private independent college offering undergraduate and graduate degrees located in Milton, Massachusetts. Prior to that time, Mr. Quigley served on the faculty of Curry College. Mr. Quigley has also previously taught undergraduate and graduate management courses at Suffolk University and Bentley College. During 2002, Mr. Quigley was a member of the audit and compensation committees of our board of directors.

William M. Vaughn III, age 62, has been a Director since our formation in July 1999. On January 1, 2003, Mr. Vaughn became Senior Vice President, Labor Relations of Ahold USA, Inc., the parent company of The Stop & Shop Supermarket Company, a grocery chain headquartered in Massachusetts with 335 stores throughout Connecticut, Massachusetts, Rhode Island, New York and

4

New Jersey. Prior to that time, Mr. Vaughn was Executive Vice President, Human Resources of The Stop & Shop Supermarket Company, with whom he has been employed since 1975. Mr. Vaughn is a co-trustee of NETT, the parent company of the Company's largest stockholder. During 2002, Mr. Vaughn was a member of the audit and nominating committees of our board of directors.

Paul V. Walsh, age 65, has been a Director since March 2002. Mr. Walsh has been President of the Teamsters Local Union 379, of Boston, Massachusetts for more than five years. Mr. Walsh is a co-trustee of NETT, the parent company of the Company's largest stockholder. During 2002, Mr. Walsh was a member of the nominating committee of our board of directors.

Robert J. Watson, age 52, has been a Director since April 2002. Mr. Watson is Chairman, Chief Executive Officer and principal stockholder of LPM Holding Company, a food service conglomerate that services principally the Eastern United States. Mr. Watson has been with LPM Holding Company and its predecessor entity, The Tobin Corporation, since 1988. During 2002, Mr. Watson was a member of the audit and compensation committees of our board of directors.

Incumbent Directors—Terms Expiring at the 2004 Annual Meeting

Joseph L. Barry, Jr., age 69, has been a Director since our formation in July 1999. Mr. Barry has served as President of Hallmark Mechanical Corp., a machinery service company, since 1990, and as President of Hallamore Corp., a transportation and rigging company, since 1956. Since 1975, Mr. Barry has served as Chairman of Northeast Concrete Products. Mr. Barry has served as co-chairman of NETT, the parent company of the Company's largest stockholder, since 1978. Mr. Barry is also a director of Bottomline Technologies, Inc., a publicly-traded software company. During 2002, Mr. Barry was a member of the audit committee of our board of directors.

Richard C. Garrison, age 54, has been a Director since April 2002. Mr. Garrison is President of Bink Inc., a management consulting firm located in Boston, Massachusetts which he founded in 2001. Prior to that time, Mr. Garrison was Chairman of Holland Mark Edmund Ingalls, a marketing, advertising and public relations firm, which was the product of the merger of two firms in 1999, one of which, Ingalls, Quinn & Johnson, Mr. Garrison was Chairman and Chief Executive Officer from 1981-1999. During 2002, Mr. Garrison was a member of the nominating committee of our board of directors.

Kevin C. Phelan, age 58, has been a Director since April 2002. Mr. Phelan is Executive Vice President and Director of Meredith & Grew, Incorporated, a full-service real estate company headquartered in Boston, Massachusetts, which provides real estate advisory services, counseling and valuation services, brokerage services, finance and capital markets and property and asset management services. Mr. Phelan has been employed with Meredith & Grew since 1978, when he joined the firm to start its finance and capital markets group. Mr. Phelan is also a director of Mellon Private Asset Management, a publicly-traded mutual fund. During 2002, Mr. Phelan was not a member of any of the committees of our board of directors.

David W. Laughton, age 54, has been a Director since our formation in July 1999. Mr. Laughton has been Secretary-Treasurer/Principal Officer of the Teamsters Local 633, of Manchester, New Hampshire for more than five years. Mr. Laughton serves as co-chairman of NETT, the parent company of the Company's largest stockholder. During 2002, Mr. Laughton was a member of the compensation committee of our board of directors.

Incumbent Directors—Terms Expiring at the 2005 Annual Meeting

Bernard Cammarata, age 63, has been a Director since July 1999. Mr. Cammarata is Chairman of the Board of TJX Companies, Inc., a leading publicly-traded off-price retailer of apparel and home fashions, a position he has held since June 1999. Mr. Cammarata founded TJX Maxx in 1976 and

5

served as its President until 1986. From 1986 to June 1999, Mr. Cammarata was President and Chief Executive Officer of TJX Companies, Inc. From June 1999 to April 2000, Mr. Cammarata served as Chairman and Chief Executive Officer of TJX Companies, Inc. During 2002, Mr. Cammarata was a member of the compensation and nominating committees of our board of directors.

Robert M. Falzon, age 43, has been a Director since September 2000. Mr. Falzon is Managing Director of Prudential Real Estate Investors, an affiliate of The Prudential Insurance Company of America, one of our principal stockholders, and head of Prudential's Merchant Banking Group in Parsippany, New Jersey. Before joining Prudential Real Estate Investors in June 1998, Mr. Falzon was a Managing Director in the Real Estate Investment Banking Group at Prudential Securities Incorporated in New York. Mr. Falzon joined Prudential Securities Incorporated in 1992. During 2002, following our initial public offering, Mr. Falzon was a member of the audit and nominating committees of our board of directors.

Thomas C. Prendergast, age 53, has served as our Chairman, President and Chief Executive Officer since our formation in July 1999. Prior to that time, from 1980 until July 1999, Mr. Prendergast was President and Chief Executive Officer of our predecessor company, the real estate company formed by NETT in 1970. Mr. Prendergast joined NETT's real estate company in 1974 as a leasing agent and became Vice President and Director of Leasing in 1978. Mr. Prendergast's employment agreement with the Company provides that he is to be a Director of the Company. Mr. Prendergast is the brother of Robert Prendergast, our Vice President, Property Management and Construction. During 2002, following our initial public offering, Mr. Prendergast was a member of the nominating committee of our board of directors.

Additional Disclosures Regarding NETT and Net Realty Holding Trust

In connection with the Company's initial public offering completed in April 2002, the Company entered into an amended stockholders agreement with its two largest stockholders, Net Realty Holding Trust and Prudential, pursuant to which, among other things, the Company agreed that as long as Net Realty Holding Trust owns at least 25% of the outstanding shares of our common stock, Net Realty Holding Trust will have the right to designate four members of our board of directors. If Net Realty Holding Trust's ownership percentage in our common stock is reduced to less than 25% but remains in excess of 10% of our common stock, two of Net Realty Holding Trust's designees will be required to resign from our board of directors. If Net Realty Holding Trust's ownership percentage in our common stock is reduced to less than 10%, Net Realty Holding Trust will no longer have the right to designate for nomination any of our directors. As of March 7, 2003, Net Realty Holding Trust owned approximately 43% of our outstanding common stock and has designated Messrs. Barry, Laughton, Vaughn and Walsh as its designees on our board of directors.

These four designees of Net Realty Holding Trust are also members of the Board of Trustees of NETT. NETT is a Taft-Hartley Pension Fund managed by a board of eight trustees, half of whom are members of the International Brotherhood of Teamsters, or the Teamsters, and the other half of whom are executives from industries that employ Teamsters in their businesses. Together, the Board of Trustees manages NETT's assets.

In January 2002, the U.S. Department of Justice brought criminal proceedings against George Cashman, President of the local Massachusetts branch of the Teamsters, and several other individuals alleging that Mr. Cashman and these other individuals caused health benefits to be provided by the Teamsters to several individuals who were not members of the Teamsters. In addition, in March 2003, the U.S. Department of Justice brought additional criminal proceedings against Mr. Cashman and other individuals alleging that Mr. Cashman and these individuals extorted $100,000 from a Massachusetts health care company to settle an employee pension dispute. Mr. Cashman, who is a member of the Board of Trustees of NETT, was a member of our board of directors from our formation in July 1999 until he resigned from our board in February 2002.

6

Committees of the Board of Directors

Audit Committee

Our board of directors has established an audit committee, which makes recommendations regarding the engagement of independent public accountants, reviews with the independent public accountants the scope and results of the audit engagement, approves professional services provided by the independent public accountants, reviews the independence of the independent public accountants, considers the range of audit and non-audit fees and reviews the adequacy of our internal accounting controls. The board of directors has adopted a written charter setting out more specifically the functions that the Audit Committee is to perform. A copy of this charter is attached to this Proxy Statement asExhibit A.

From January 1, 2002 until April 29, 2002, the members of our audit committee were Joseph L. Barry, Robert M. Falzon and William M. Vaughn, III. Upon completion of our initial public offering on April 29, 2002, the members of our audit committee became Robert J. Watson, who has served as chairman, Joseph L. Barry, Robert M. Falzon, Kenneth K. Quigley, Jr. and William M. Vaughn. The Audit Committee met four times during 2002. All of the members of the Audit Committee are independent of the Company (as defined in Sections 303.01(B)(2)(a) and (3) of the New York Stock Exchange's current listing standards).

Compensation Committee

Our board of directors has also established a compensation committee to establish compensation levels for our executive officers, to administer our equity incentive plan and to implement our incentive programs. From January 1, 2002 until April 29, 2002, the members of our compensation committee were Bernard M. Cammarata, Robert M. Falzon, David W. Laughton and Thomas C. Prendergast. Upon completion of our initial public offering on April 29, 2002, the members of our compensation committee became Bernard M. Cammarata, who has served as chairman, David W. Laughton, Kenneth K. Quigley, Jr. and Robert J. Watson. Each of Messrs. Laughton, Quigley and Watson is a "non-employee director" (as that term is defined in the rules and regulations of the SEC). The Compensation Committee met four times in 2002.

Nominating Committee

Our board of directors has also established a nominating committee, which is responsible for making recommendations to our board concerning nominees to serve as members of our board. During 2002, the members of our nominating committee were Richard C. Garrison, who has served as chairman, Bernard M. Cammarata, Robert M. Falzon, Thomas C. Prendergast, William M. Vaughn and Paul V. Walsh. The Nominating Committee did not meet in 2002. The Nominating Committee is to consider director nominees recommended by the board of directors and stockholders. Pursuant to Article II, Section 2 of the Company's By-Laws, a stockholder wishing to nominate a candidate must file a written notice of the nomination with the Secretary of the Company not less than ninety days nor more than one hundred and fifty days prior to the election of directors. When submitting a recommendation to the Secretary, the stockholder must include biographical information about the candidate, together with a statement of the candidate's qualifications and other information supporting the recommendation. If it is determined that the candidate has no conflicts of interest or directorships with other companies that would disqualify the candidate from serving as a director of the Company, the candidate's name will be presented to the nominating committee for consideration.

During 2002, our board of directors held eight meetings (including telephonic meetings) and took action by unanimous written consent two times. None of the directors who served as a Director attended during his period of service fewer than 75% of the aggregate of the total number of meetings

7

of the board of directors and of any meetings of committees on which he served during that period of service.

Management Committee

Acquisitions Committee

Our board of directors has also established an acquisitions committee, consisting of three of our executive officers, Thomas Prendergast, our Chairman, President and Chief Executive Officer, Gary Widett, our Senior Vice President and Chief Operating Officer, and David Gaw, our Senior Vice President, Chief Financial Officer and Treasurer, who are authorized to approve purchase, sale, mortgage and other actions, individually and collectively up to $35 million, by us with respect to real estate without the approval of our full board.

Compensation of Directors

Those of our directors who are also our employees or who are members of the Board of Trustees of NETT are not entitled to compensation for their service as directors. Our other directors receive an annual retainer of $25,000, as well as $1,000 for each board meeting attended in person, $750 for each telephonic board meeting attended and $1,000 for each board committee meeting attended. In addition, these directors receive, upon initial election to our board, an option to purchase 5,000 shares of our common stock, and annually each year after their initial election, receive an option to purchase 5,000 shares of our common stock.

Audit Committee Report

On July 23, 2002, our board of directors adopted a written charter for the Audit Committee. As required by the charter, the Audit Committee in fulfilling its oversight responsibilities regarding the audit process:

- •

- reviewed and discussed the fiscal year 2002 audited financial statements with management;

- •

- discussed with the Company's independent auditors, KPMG LLP, the matters required to be discussed by Statement on Accounting Standards No. 61 (Codification of Statements on Auditing Standards, AU 380, as amended or supplemented); and

- •

- reviewed the written disclosures and the letter from the Company's independent auditors required by Independence Standards Board Standard No. 1, and discussed with the independent auditors any relationships that may impact their objectivity and independence.

Based upon the review and discussions referred to above, the Audit Committee's review of management's representations, and the report of the independent auditors to the Audit Committee, the Audit Committee recommended to the board of directors that the audited financial statements for the year ended December 31, 2002, be included in the Company's Annual Report on Form 10-K and filed with the Securities and Exchange Commission.

Audit Fees. The aggregate fees billed by KPMG LLP for professional services rendered for the audit of the Company's annual financial statements for the year 2002 and the reviews of the financial statements included in the Company's Form 10-Qs for the year 2002 were $215,000.

Audit-Related Fees. KPMG LLP billed $337,701 in audit-related fees for 2002. Audit-related fees were primarily for the following services: (i) services performed in connection with the Company's initial public offering, and (ii) subsidiary and 401(k) financial statement audits.

Tax Fees. The aggregate fees billed by KPMG LLP for tax services were $175,900 for 2002. Those fees were for tax compliance services, tax consultations and tax planning services.

8

All Other Fees. There were no other fees billed by KPMG LLP for the year 2002 for services other than those described above.

The Audit Committee is comprised of five directors, all of whom are considered "independent" (as defined in Sections 303.01(B)(2)(a) and (3) of the New York Stock Exchange's current listing standards).

The Audit Committee has considered whether the non-audit services provided are compatible with maintaining the auditor's independence.

This report of the Audit Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under those acts.

The foregoing report has been furnished by the current members of the Audit Committee.

Robert J. Watson, Chairman, Joseph L. Barry, Robert M. Falzon, Kenneth K. Quigley, Jr. and William M. Vaughn, III.

Compensation Committee Report

Committee Responsibilities. The responsibilities of the Compensation Committee include:

- •

- reviewing the performance of the Chief Executive Officer and the other executive officers of the Company on at least an annual basis;

- •

- establishing the cash and equity-based compensation and benefits to be provided to the executive officers of the Company;

- •

- issuing and administering awards under the Company's equity incentive plan;

- •

- informally reviewing, to the extent available, information with respect to the compensation paid to executive officers of comparable equity real estate investment trusts and comparing this information with the overall compensation paid to the Company's executive officers;

- •

- recommending compensation for the members of the board of directors for their services as Directors; and

- •

- reporting periodically to the full board with respect to the foregoing.

To assist the Compensation Committee in its responsibilities, the Compensation Committee has engaged FPL Associates, Inc., a management compensation consulting firm, to review and make recommendations with respect to the compensation programs of the Company.

Compensation Philosophy for Executive Officers. The Compensation Committee's executive compensation philosophy is to align the interests of key executives with the interests of stockholders by developing appropriate compensation measures for its executives. The Compensation Committee believes that components of the total compensation package for senior executives should include

- (i)

- a base salary designated to compensate management near the 75th percentile of the Company's competitive market in order to effectively recruit and retain key personnel;

- (ii)

- an annual incentive bonus, the amount of which will depend upon the success of the Company and of the executives' involvement in achieving specified objectives; and

- (iii)

- a long-term performance incentive designed to (a) align the interests of management with the interests of stockholders, (b) deliver competitive levels of compensation to management

9

For 2002, the compensation of the Company's Chief Executive Officer and other executive officers was comprised of (i) an annual base salary, (ii) an annual incentive cash bonus, and (iii) long-term performance incentives in the form of grants of shares of restricted stock and nonqualified stock options made as of March 3, 2003 under the Company's equity incentive plan described below under "Long-Term Incentive Program."

Base Salary. In order to compete for and retain talented executives who are critical to the Company's long-term success, the Compensation Committee has determined that the base salaries of executive officers should approximate those of executives of equity REITs which compete with the Company for employees, investors and tenants while also taking into account the executive officers' performance and tenure. The Compensation Committee reviews base salaries annually and, if appropriate, modifies such salaries to reflect recent market practices and performance. The increase in base salary for 2002 over 2001 for Mr. Thomas Prendergast reflected in the summary compensation table below reflects modifications made by the Compensation Committee in July 2002. In November 2002, the Compensation Committee made modifications to the 2003 base salaries of the other executive officers named in the summary compensation table.

Annual Incentive Bonus. In order to motivate key executives to achieve annual strategic business goals, the Compensation Committee believes executives should receive annual incentive bonuses for their contributions in achieving these goals. In particular, the Compensation Committee seeks to provide key executives with a total compensation package that is competitive with comparable equity REITs when, among other things, the Company's per share Funds From Operations ("FFO") and "same store net operating income" ("NOI") grow. During each fiscal year, the Compensation Committee, in consultation with the Chief Executive Officer, establishes for each executive a range of incentive bonus opportunities, stated as percentages of that executive's base salary, which the executive is entitled to receive based in part upon that executive's position to impact the annual success of the Company and in part upon the level of performance achieved by the Company and the individual executive for that year. In general, the threshold, target and maximum amounts of the annual bonus are set at 40%, 100% and 160% of annual base salary in the case of the Chief Executive Officer and from 20% to 80% of annual base salary in the event of each other executive officer.

In accordance with the incentive award program, the Chief Executive Officer and the Compensation Committee set as the corporate performance measures for 2002 (i) growth in FFO per share (as adjusted to reflect completion of the initial public offering and related transactions), representing 75% of corporate performance, and (ii) growth in same store NOI, representing 25% of corporate performance. In order to achieve the maximum incentive bonus allocated to corporate performance, the Company's FFO per share (as adjusted to reflect completion of the initial public offering and related transactions) had to increase by 6% and its same store NOI had to increase by 1%. The Company's actual growth in FFO per share in 2002 (as adjusted to reflect completion of the initial public offering and related transactions) was 8.5% and its growth in same store NOI was 3.1%.

Based upon these achievements and the recommendation of the Chief Executive Officer, the Compensation Committee determined each senior executive was entitled to substantially the maximum incentive bonus allocated to individual performance. As a result of the above analysis, the Compensation Committee, in consultation with the Chief Executive Officer in the case of all officers other than himself, awarded to the named executive officers the following cash bonuses for 2002: $936,000 to Mr. Thomas Prendergast, $240,000 to Mr. Widett, $200,000 to Mr. Gaw, $120,000 to Mr. Robert Prendergast, and $120,000 to Mr. Rodenstein.

10

Long-Term Incentive Program. The Compensation Committee has determined that the Company's long-term incentive program would consist of the grant of shares of restricted stock and nonqualified stock options under the Company's equity incentive plan at the beginning of each year for prior year performance to senior executives of the Company, the exact numbers of which will vary, depending on the position and salary of the executive and the Company's success in delivering annual total stockholder returns that meet threshold, target or maximum returns established by the Compensation Committee. Awards of stock options vest ratably over three years and have exercise prices equal to the fair market value of the common stock on the date of grant. Awards of restricted stock are subject to transfer restrictions and risk of forfeiture that terminate ratably over three years.

In addition to the performance based grants of options and restricted stock, the board of directors made two additional special awards of options and shares in 2002. In April 2002, in connection with the completion of the Company's initial public offering, the board of directors approved special grants of options to purchase shares of our common stock to the executive officers named in the summary compensation table and other executive officers. These stock options vest ratably over a five year period and the exercise price of these options was equal to the initial public offering price, or $25.00 per share. As part of these grants, Mr. Thomas Prendergast was awarded an option to purchase 250,000 shares of common stock, Mr. Widett was awarded an option to purchase 50,000 shares of common stock, Mr. Gaw was awarded an option to purchase 50,000 shares of common stock, Mr. Robert Prendergast was awarded an option to purchase 25,000 shares of common stock and Mr. Rodenstein was awarded an option to purchase 10,000 shares of common stock.

In connection with the initial public offering, all stock options previously granted to the Company's officers accelerated and all restrictions and forfeiture provisions with respect to shares of restricted stock previously issued to the Company's officers terminated. Set forth in the table below is information with respect to options that vested and shares of restricted stock that accelerated in connection with the initial public offering with respect to the executive officers named in the summary compensation table.

Name

| | Accelerated Options

| | Accelerated

Restricted Shares

|

|---|

| Thomas C. Prendergast | | 606,667 | | 121,599 |

| Gary Widett | | 157,000 | | 31,653 |

| David G. Gaw | | 90,000 | | 14,000 |

| Robert Prendergast | | 52,733 | | 7,320 |

| Barry Rodenstein | | 40,000 | | 3,000 |

In July 2002, as part of the amendment to Mr. Thomas Prendergast's employment agreement, the board of directors approved the issuance over five years of an aggregate of up to 775,000 shares of restricted stock with no exercise price to members of senior management of the Company, including Mr. Thomas Prendergast. The Company issued the first installment of 155,000 shares in July 2002, of which, Mr. Thomas Prendergast received 120,000 shares, Mr. Widett receive 20,000 shares, Mr. Gaw received 10,000 shares, Mr. Robert Prendergast received 1,000 shares and Mr. Rodenstein received 1,000 shares. These shares were subject to risk of forfeiture and transfer restrictions, which terminated on March 1, 2003.

In March 2003, the second installment of 155,000 shares was issued, of which, Mr. Thomas Prendergast received 120,000 shares, Mr. Widett receive 20,000 shares, Mr. Gaw received 10,000 shares, Mr. Robert Prendergast received 1,000 shares and Mr. Rodenstein received 1,000 shares. Upon issuance, these shares are subject to risk of forfeiture and transfer restrictions, which will terminate in March 2004, subject to continued employment. The remaining installments of these special share grants are expected to be issued ratably over a three-year period beginning in 2004, subject to the satisfaction of certain performance milestones and other conditions during the three-year period. Upon issuance,

11

the remaining installments will also be subject to risk of forfeiture and transfer restrictions, which will terminate upon the first anniversary of the date of each installment, subject to continued employment.

Compensation of Chief Executive Officer. The Compensation Committee believes that Thomas Prendergast played a critical role in the Company's achieving its objectives for 2002 and performing well in difficult market conditions. Consistent with this view, in July 2002, the Compensation Committee recommended to the board of directors, and the board adopted, an amendment to Mr. Prendergast's employment agreement which, among other things, increased his base salary to $585,000 and increased the bonus opportunity to the percentages described above. Pursuant to this amendment, and in accordance with the goals and formulas established under the Compensation Committee's compensation programs, the Compensation Committee awarded Mr. Prendergast the maximum cash bonus of $936,000 for 2002. In addition, Mr. Prendergast was awarded 60,000 shares of restricted stock and 140,000 stock options under the Company's equity incentive plan. In addition, pursuant to his employment agreement, the Company also reimbursed Mr. Prendergast with respect to the payment of taxes on behalf of Mr. Prendergast in connection with the issuance and acceleration of restricted shares of common stock in 2002 and with respect to insurance premiums paid on his behalf during 2002. For 2002, this reimbursement amounted to $2,456,479.

Federal Tax Regulations. The Compensation Committee has considered the application of Section 162(m) of the Internal Revenue Code to the Company's compensation practices. Section 162(m) generally limits the tax deduction available to public companies for annual compensation paid to senior executives in excess of $1 million unless the compensation qualifies as performance-based compensation.

This report of the Compensation Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under those acts.

The foregoing report has been furnished by the current members of the Compensation Committee.

Bernard M. Cammarata, Chairman, David W. Laughton, Kenneth K. Quigley, Jr. and Robert J. Watson.

Audit and Compensation Committee Interlocks and Insider Participation

From and after the date of completion of the Company's initial public offering, no member of the Audit Committee or Compensation Committee was an officer, former officer or employee of the Company.

PROPOSAL NUMBER TWO—AMENDMENT TO EQUITY INCENTIVE PLAN

Introduction

On December 13, 2002, our board of directors voted to amend the Company's Amended and Restated 2000 Equity Incentive Plan to increase the number of authorized shares of our common stock available for issuance under the plan. The amendment to the plan would authorize the Company to issue up to 5,700,000 (or an additional 1,900,000) shares of common stock pursuant to various stock incentive awards under the plan. In addition, the board of directors also voted to amend the plan to increase the sub-limit with respect to the awards of restricted stock, performance shares, performance units and stock grants under the plan from 1,200,000 shares to 1,900,000. The plan was originally adopted by the board of directors as of January 1, 2000, and as amended and restated, was adopted by the board of directors on March 11, 2002 and approved by our stockholders on April 4, 2002.

12

Material Features of the Plan

The following description of certain features of the equity incentive plan, as amended, is intended to be a summary only. Except for the numbers of shares subject to the plan and the sublimit for awards of restricted stock, performance shares, performance units and stock grants, the amendments for which stockholder approval is sought make no changes in the plan as previously in effect. The essential features of the Plan are outlined below.

Purpose. The plan is intended to encourage ownership of common stock by employees and directors of the Company to provide additional incentives for them to promote the success of the Company's business.

Administration. The plan is administered by the Compensation Committee of the board of directors. Subject to the provisions of the plan, the Compensation Committee has discretion to determine the employee or director to receive an award, the form of award and any acceleration or extension of an award. Furthermore, the Compensation Committee has complete authority to interpret the plan, to prescribe, amend and rescind rules and regulations relating to it, to determine the terms and provisions of the respective award agreements (which need not be identical), and to make all other determinations necessary or advisable for the administration of the plan.

Eligibility. Awards may be granted to any employee of the Company or to a non-employee member of the board of directors. No more than 1,200,000 shares of common stock may currently be issued pursuant to or subject at any time to outstanding awards of restricted stock, performance shares, performance units or stock grants. No more than 400,000 shares of common stock may be covered by options granted to any one person in any one year.

Shares Subject to the Plan. The shares issued or to be issued under the plan are shares of our common stock. A maximum of 3,600,000 shares of common stock have currently been reserved for issuance pursuant to the plan.

Types of Awards. Awards under the plan include incentive stock options, nonstatutory stock options, restricted stock, stock appreciation rights and stock grants.

Nonstatutory stock options and incentive stock options (which are intended to meet the requirements of Section 422 of the Internal Revenue Code of 1986, as amended are rights to purchase our common stock. Each stock option is to be evidenced by an instrument in a form as the Compensation Committee prescribes and is to specify (i) the exercise price, (ii) the number of shares of common stock subject to the stock option and (iii) those other terms and conditions, including, but not limited to, the method of exercise and any restrictions upon the stock option or the common stock issuable upon exercise of the stock option, as the Compensation Committee, in its discretion, may establish.

A stock option may be immediately exercisable or become exercisable in installments, cumulative or non-cumulative, as the Compensation Committee may determine. A stock option may be exercised by the participant giving written notice to the Company, accompanied by payment of an amount equal to the exercise price of the shares to be purchased. The purchase price may be paid by cash, check or, to the extent not prohibited by applicable law and subject to those conditions, if any, as the Compensation Committee may deem necessary or desirable, by delivery to the Company of shares of common stock, the participant's executed promissory note, or through and under the terms and conditions of any formal cashless exercise program authorized by the Company.

Unless the Compensation Committee provides otherwise with respect to any stock option, if the participant's employment or other association with the Company ends for any reason, any outstanding stock option of the participant will cease to be exercisable in any respect not later than 90 days following that event and, for the period it remains exercisable following that event, is to be exercisable

13

only to the extent exercisable at the date of that event. No stock option will be exercisable after the tenth anniversary of the date it is granted, however.

Incentive stock options may be granted only to eligible employees of the Company and must have an exercise price of not less than 100% of the fair market value of the common stock on the date of grant (110% for incentive stock options granted to any 10% stockholder of the Company). Nonstatutory stock options must have an exercise price of not less than 100% of the fair market value of the common stock on the date of grant. Stock options must have a term of not more than ten years (five years in the case of an incentive stock option granted to any 10% stockholder of the Company). In the case of an incentive stock option, the amount of the aggregate fair market value of common stock (determined at the time of grant) with respect to which incentive stock options are exercisable for the first time by an employee during any calendar year (under all such plans of his employer corporation and its parent and subsidiary corporations) must not exceed $100,000.

Awards of restricted stock are grants or sales of common stock which are subject to a risk of forfeiture. Each award of restricted stock is to be evidenced by an instrument in a form as the Compensation Committee prescribes, which instrument will specify (i) the number of shares of common stock to be issued to a participant pursuant to the award and the extent, if any, to which they are to be issued in exchange for cash, other property or services or any combination thereof, and (ii) those other terms and conditions as the Compensation Committee, in its discretion, may establish. Unless the Compensation Committee provides otherwise for any award of restricted stock, upon termination of a participant's employment or other association with the Company for any reason during the restriction period, all shares of restricted stock still subject to risk of forfeiture will be forfeited or otherwise subject to return to or repurchase by the Company on the terms specified in the award agreement.

Stock appreciation rights are rights to receive (without payment to the Company) cash, property or other forms of payment, or any combination thereof, as determined by the Compensation Committee, based on the increase in the value of the number of shares of common stock specified in the stock appreciation right. Each award of a stock appreciation right is to be evidenced by an instrument in a form as the Compensation Committee may prescribe, which instrument will specify (i) a "hurdle" price in an amount determined by the Compensation Committee, (ii) the number of shares of common stock subject to the award, and (iii) those other terms and conditions as the Compensation Committee, in its discretion, may establish. A stock appreciation right may be exercised in accordance with a written instrument and at such time or times and in such installments as the Compensation Committee may establish.

A stock grant is a grant of shares of common stock not subject to restrictions or other forfeiture conditions.

Transferability. Except as otherwise provided in the plan, stock options and stock appreciation rights are not transferable, and no stock option, stock appreciation right may be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, other than by will or by the laws of descent and distribution. All of a participant's rights in any stock option or stock appreciation right may be exercised during the life of the participant only by the participant or the participant's legal representative.

Effect of Significant Corporate Event. In the event of any change in the outstanding shares of common stock through merger, consolidation, sale of all or substantially all the property of the Company, reorganization, recapitalization, reclassification, stock dividend, stock split, reverse stock split, or other distribution with respect to such shares of common stock, an appropriate and proportionate adjustment will be made in—

- (i)

- the maximum numbers and kinds of shares subject to the plan and the plan limits,

- (ii)

- the numbers and kinds of shares or other securities subject to the then outstanding awards,

14

- (iii)

- the exercise or hurdle price for each share or other unit of any other securities subject to then outstanding stock options or stock appreciation rights (without change in the aggregate purchase or hurdle price as to which stock options or stock appreciation rights remain exercisable), and

- (iv)

- the repurchase price of each share of restricted stock then subject to a risk of forfeiture in the form of a Company repurchase right.

Summary of Tax Consequences. The following is a brief and general discussion of the federal income tax rules applicable to awards granted under the plan.

Nonstatutory stock options. There are no Federal income tax consequences to the Company or the participants upon grant of nonstatutory stock options. Upon the exercise of such an option, (i) the participant will recognize ordinary income in an amount equal to the amount by which the fair market value of the common stock acquired upon the exercise of the option exceeds the exercise price, if any, and (ii) the Company will receive a corresponding deduction. A sale of common stock so acquired will give rise to a capital gain or loss equal to the difference between the fair market value of the common stock on the exercise and sale dates.

Incentive stock options. Except as noted at the end of this paragraph, there are no Federal income tax consequences to the Company or the participant upon grant or exercise of an incentive stock option. If the participant holds shares of common stock purchased pursuant to the exercise of an incentive stock option for at least two years after the date the option was granted and at least one year after the exercise of the option, the subsequent sale of common stock will give rise to a long-term capital gain or loss to the participant and no deduction will be available to the Company. If the participant sells the shares of common stock within two years after the date an incentive stock option is granted or within one year after the exercise of an option, the participant will recognize ordinary income in an amount equal to the difference between the fair market value at the exercise date and the option exercise price, and the Company will be entitled to an equivalent deduction, and any additional gain or loss will be a capital gain or loss. Some participants may have to pay alternative minimum tax in connection with exercise of an incentive stock option.

Restricted stock. A participant will generally recognize ordinary income on receipt of an award of restricted stock when his or her rights in that award become substantially vested, in an amount equal to the amount by which the then fair market value of the common stock acquired exceeds the price he or she has paid for it, if any. Recipients of restricted stock may, however, within 30 days of receiving an award of restricted stock, choose to have any applicable risk of forfeiture disregarded for tax purposes by making an "83(b) election." If the participant makes an 83(b) election, he or she will have to report compensation income equal to the difference between the value of the shares and the price paid for the shares, if any, at the time of the transfer of the restricted stock.

Stock appreciation rights. A participant will generally recognize ordinary income on receipt of cash or other property pursuant to an award of stock appreciation rights.

Stock grants. A participant will generally recognize ordinary income on receipt of a stock grant equal to the value of the common stock subject to the stock grant.

With respect to awards of restricted stock, stock appreciation rights and stock grants, whenever a participant is required to report compensation income, the Company will be entitled to deduct the same amount in computing its taxable income.

Although the foregoing summarizes the essential features of the plan, it is qualified in its entirety by reference to the full text of the plan as approved.

15

Proposed Amendments to the Plan. Under the terms of the plan, the aggregate number of shares which may be issued may not exceed 3,600,000, subject to certain adjustments. The board of directors recommends the amendment to the plan to increase the number of shares available for issuance under the plan to 5,700,000 shares. In addition, the board of directors also recommends the amendment to the plan to increase the sublimit with respect to the awards of restricted stock, performance shares, performance units and stock grants under the plan from 1,200,000 shares to 1,900,000. As of the record date for the Annual Meeting, options to purchase an aggregate of 2,705,427 shares of common stock had been granted under the plan and 695,732 shares of common stock had been issued under the plan in the form of restricted stock awards.

The board of directors believes that increasing the number of shares available for issuance under the plan is necessary in order for the Compensation Committee to have sufficient flexibility to carry out its responsibilities to (i) further the growth, development and financial success of the Company by providing additional incentives to its executives and (ii) enable the Company to obtain and retain the services of the type of executives considered essential to the long-range success of the Company.

The benefits or amounts received by or allocated to each of (i) the officers listed in the Summary Compensation Table, (ii) each of the nominees for election as a director, (iii) all directors of the Company who are not executive officers of the Company as a group, (iv) all present executive officers of the Company as a group, and (v) all employees of the Company, including all other current officers, as a group are not determinable.

Plan Category

| | Number of Securities to

be issued upon exercise

of outstanding options,

warrants or rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining eligible for

future issuance under

equity compensation plans

(excluding securities

reflected column(a))

|

|---|

| Equity compensation plans approved by security holders | | 3,401,159 | (1) | $ | 24.87 | (2) | 198,841 |

| Equity compensation plans not approved by security holders | | — | | | — | | — |

| | |

| |

| |

|

| Total | | 3,401,159 | | $ | 24.87 | | 198,841 |

- (1)

- Of the 3,401,159 shares to be issued upon exercise of outstanding options, warrants or rights, (a) 2,705,427 shares are subject to outstanding stock options and (b) 695,732 shares had been issued as restricted stock awards.

- (2)

- Computed only with respect to outstanding stock options. Restricted stock awards under the plan are issued without an exercise price.

Recommendation of the Board of Directors.

The board of directors believes that it is in the best interest of the Company to align the interests of the executive officers of the Company more closely with those of the stockholders in order to provide a greater incentive to such persons to maximize stockholder value. Assuming a quorum is present, the amendments must be approved by a majority of the votes cast on the proposal to be approved.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE PROPOSED AMENDMENTS TO THE PLAN.

16

EXECUTIVE COMPENSATION

Executive Officers

Thomas C. Prendergast, age 53, has served as our Chairman, President and Chief Executive Officer since our formation in July 1999. Prior to that time, from 1980 until July 1999, Mr. Prendergast was President and Chief Executive Officer of our predecessor company, the real estate company formed by NETT in 1970. Mr. Prendergast joined NETT's real estate company in 1974 as a leasing agent and became Vice President and Director of Leasing in 1978. Mr. Prendergast is the brother of Robert Prendergast, our Vice President, Property Management and Construction.

Gary Widett, Esq., age 53, joined us as Senior Vice President and Chief Operating Officer in July 1999. From 1978 until July 1999, Mr. Widett was in private practice as an attorney in Natick, Massachusetts. He has over 25 years experience in real estate development, acquisitions and management. While practicing law, he concentrated on zoning, permitting, tax abatement, leasing, commercial lending and other real estate related areas.

David G. Gaw, age 51, became our Senior Vice President, Chief Financial Officer and Treasurer in April 2001. Mr. Gaw was previously Senior Vice President and Chief Financial Officer of Boston Properties, Inc., a publicly-traded office REIT. While at Boston Properties, Mr. Gaw oversaw the accounting, control and financial management department. He joined Boston Properties in 1982 and was responsible for its financial operations until October 2000, including administering Boston Properties' financing and banking relationships.

Robert Prendergast, age 43, joined us as Vice President, Property Management and Construction in October 1999. Previously, he was an Asset Manager for Urban Retail Properties/Overseas Management, Inc., a publicly-traded retail REIT in Chicago, from 1990 until July 1999. Mr. Prendergast has over 18 years experience in the management and construction of retail properties. Mr. Prendergast is the brother of Thomas Prendergast, our President and Chief Executive Officer.

Barry Rodenstein, age 42, became our Vice President, Leasing in July 2001. Prior to that time, Mr. Rodenstein was with Trammell Crow Company, a nationwide real estate company, with whom he was employed from 1988 until 2001. While at Trammell Crow Company, he was responsible for overseeing its New England Retail Services Division. His responsibilities included project leasing, tenant representation, property management, land acquisitions, urban/specialty retail, investment sales, development and construction.

Patrick O'Sullivan, age 35, has been our Vice President, Finance & Accounting since our formation in July 1999. Prior to that time, he was Director of Finance at NETT's real estate company, which he joined in 1998. Previously, from 1990 to 1998, he was at KPMG Peat Marwick LLP (n/k/a KPMG LLP), where he was a senior manager from 1996 to 1998.

Louis C. Zicht, Esq., age 53, has served as our Vice President and General Counsel since our formation in July 1999. Prior to that time, he was General Counsel of NETT's real estate company, which he joined in 1974, and in 1980, he also assumed the title of Vice President. He has over 27 years of experience overseeing all legal aspects of our (and our predecessor's) acquisitions, dispositions, litigation and all major lease transactions.

MaryKate Herron, age 44, became our Vice President, Lease Management in September 2000. Prior to joining us, Ms. Herron was with WellsPark Group/New England Development as Vice President of Tenant Relations, where she was involved in property revenue enhancement, tenant workouts, collections and retail sales reporting for 37 regional malls. Prior to her role in tenant relations, she was Vice President of Lease Administration and was responsible for coordinating all income budgeting, streamlining procedures, improving recoveries and cash flow, and establishing portfolio benchmarks. Ms. Herron was with New England Development for 15 years.

17

Bruce Anderson, age 53, became our Vice President, Acquisitions in April 2002. Prior to that time, Mr. Anderson was previously Senior Vice President of Acquisitions and Development of Konover Property Trust, Inc., a publicly-traded community shopping center REIT in Raleigh, North Carolina from 1997 until March 2001. While at Konover, Mr. Anderson was responsible for all shopping center acquisitions, property sales and retail development and re-development. Mr. Anderson has 25 years experience in shopping center acquisitions, dispositions, development, asset and property management, brokerage and leasing.

Compensation Tables

The following table sets forth the compensation paid or accrued in 2002, to our Chief Executive Officer and our four other most highly compensated executive officers.

Summary Compensation Table

| |

| |

| |

| |

| |

| | Long-Term Compensation Awards

| |

| |

|---|

| |

| | Annual Compensation

| |

| |

| |

| |

|---|

| |

| |

| | Securities

Underlying

Options

(#)(1)

| |

| |

|---|

| | Year

| | Salary

($)

| | Bonus

($)(1)

| | Other Annual

Compensation

($)(2)

| | Restricted

Stock Awards

($)(1)(3)

| | All Other

Compensation

($)

| |

|---|

Thomas Prendergast

President and Chief

Executive Officer | | 2002

2001 | | $

| 585,000

500,000 | (4)

| $

| 936,000

500,000 | | $

| 2,456,279

1,000,800 | | 390,000

140,000 | | $

| 4,299,600

1,500,000 | | $

| 1,138,100

718,793 | (5)

(6) |

Gary Widett

Senior Vice President and

Chief Operating Officer |

|

2002

2001 |

|

|

300,000

300,000 |

|

|

240,000

240,000 |

|

|

105,537

59,376 |

|

130,000

80,000 |

|

|

911,480

450,000 |

|

|

201,542

147,033 |

(7)

(8) |

David Gaw (9)

Senior Vice President and

Chief Financial Officer |

|

2002

2001 |

|

|

250,000

250,000 |

|

|

200,000

200,000 |

|

|

—

— |

|

110,000

90,000 |

|

|

577,540

350,000 |

|

|

14,000

3,500 |

(10)

(11) |

Robert Prendergast

Vice President, Property

Management and Construction |

|

2002

2001 |

|

|

200,000

200,000 |

|

|

120,000

120,000 |

|

|

—

— |

|

50,000

30,000 |

|

|

169,810

100,000 |

|

|

13,148

12,679 |

(12)

(13) |

Barry Rodenstein (14)

Vice President, Leasing |

|

2002

2001 |

|

|

200,000

200,000 |

|

|

120,000

80,000 |

|

|

—

— |

|

40,000

40,000 |

|

|

145,450

75,000 |

|

|

12,600

2,200 |

(15)

(16) |

- (1)

- Cash and non-cash bonuses, option grants and restricted share grants are reported in the year in which the compensation service was performed, even if the bonuses, options grants or restricted shares were paid, granted or issued in a subsequent year.

- (2)

- Represents amounts reimbursed by us with respect to the payment of taxes on behalf of these individuals in connection with the vesting of restricted shares of common stock previously issued to these individuals and with respect to insurance premiums paid on their behalf during 2001 and 2002. For 2002 specifically, the Company reimbursed Mr. Prendergast $1,581,638 with respect to the payment of taxes on his behalf in connection with the acceleration of vesting of restricted shares as a result of of the Company's initial public offering.

- (3)

- Represents the dollar value of restricted stock awards, calculated by multiplying the fair market value of the Company's common stock on the date of grant (which, for 2001, was $25.00 per share and which, for 2002, was the closing market price of Company common stock on the date of grant) by the number of shares awarded. This valuation does not take into account the diminution in value attributable to the restrictions applicable to the shares. With respect to the 2001 restricted stock awards, all contractual restrictions on transfer and forfeiture provisions terminated upon completion of the Company's initial public offering in April 2002. With respect to the 2002 restricted stock awards, the contractual restrictions on transfer and forfeiture provisions lapse ratably over periods ranging from one to five years. In the event of a change in

18

control, under the terms of the restricted share agreements, all unvested restricted share awards would become immediately vested. These shares are forfeitable to us upon termination of employment and are subject to restrictions on transfer. Upon grant, the recipient has full voting and dividend rights with respect to all shares granted

As of December 31, 2002, each of the executive officers named in the summary compensation table held the following aggregate number of shares of restricted common stock—

Name

| | Total Number of

Restricted Shares Held

| | Value at

December 31, 2002

|

|---|

| Thomas C. Prendergast | | 120,000 | | $ | 2,996,400 |

| Gary Widett | | 20,000 | | | 499,400 |

| David G. Gaw | | 10,000 | | | 249,700 |

| Robert Prendergast | | 1,000 | | | 24,970 |

| Barry Rodenstein | | 1,000 | | | 24,970 |

The foregoing table does not include shares of restricted stock issued in March 2003 relating to 2002 performance shown in the summary compensation table above. In addition, the forfeiture provisions and transfer restrictions with respect to the restricted shares reflected in the table above terminated on March 1, 2003.

- (4)

- From January 1, 2002 until July 2002, Mr. Prendergast's base salary was $500,000. In July 2002, Mr. Prenergast's base salary was increased to $585,000.

- (5)

- Includes for 2002 (a) $28,175 in insurance premiums paid by us for a life insurance policy in favor of Mr. Prendergast, (b) $8,000 in contributions made to our 401(k) Plan on Mr. Prendergast's behalf, (c) $6,658 in compensation associated with a company car provided on Mr. Prendergast's behalf, (d) $10,000 in financial planning and other service fees paid on Mr. Prendergast's behalf and (e) $1,085,267 accrued by us under the supplemental executive retirement plan, or SERP, we established for Mr. Prendergast's benefit.

- (6)

- Includes for 2001 (a) $28,175 in insurance premiums paid by us for a life insurance policy in favor of Mr. Prendergast, (b) $6,800 in contributions made to our 401(k) Plan on Mr. Prendergast's behalf, (c) $6,155 in compensation associated with a company car provided on Mr. Prendergast's behalf, (d) $10,000 in financial planning and other service fees paid on Mr. Prendergast's behalf and (e) $667,663 accrued by us under the supplemental executive retirement plan, or SERP, we established for Mr. Prendergast's benefit.

- (7)

- Includes for 2002 (a) $11,826 in insurance premiums paid by us for a life insurance policy in favor of Mr. Widett, (b) $8,000 in contributions made to our 401(k) Plan on Mr. Widett's behalf, (c) $3,440 in compensation associated with a company car provided on Mr. Widett's behalf, and (d) $178,276 accrued by us under the SERP we established for Mr. Widett's benefit.

- (8)

- Includes for 2001 (a) $11,826 in insurance premiums paid by us for a life insurance policy in favor of Mr. Widett, (b) $6,800 in contributions made to our 401(k) Plan on Mr. Widett's behalf, (c) $4,012 in compensation associated with a company car provided on Mr. Widett's behalf, and (d) $124,395 accrued by us under the SERP we established for Mr. Widett's benefit.

- (9)

- Mr. Gaw became our Senior Vice President, Chief Financial Officer and Treasurer in April 2001.

- (10)

- Includes for 2002 (a) $6,000 in auto expenses paid on Mr. Gaw's behalf and (b) $8,000 in contributions made to our 401(k) Plan on Mr. Gaw's behalf.

- (11)

- Represents $3,500 in auto expenses paid on Mr. Gaw's behalf in 2001.

- (12)

- Includes for 2002 (a) $5,148 in compensation associated with a company car provided on Mr. Prendergast's behalf and (b) $8,000 in contributions made to our 401(k) Plan on Mr. Prendergast's behalf.

19

- (13)

- Includes for 2001 (a) $5,879 in compensation associated with a company car provided on Mr. Prendergast's behalf and (b) $6,800 in contributions made to our 401(k) Plan on Mr. Prendergast's behalf.

- (14)

- Mr. Rodenstein became our Vice President, Leasing in July 2001.

- (15)

- Includes for 2002 (a) $4,600 in auto expenses paid on Mr. Rodenstein's behalf and (b) $8,000 in contributions made to our 401(k) Plan on Mr. Prendergast's behalf.

- (16)

- Represents auto expenses paid on Mr. Rodenstein's behalf in 2001.

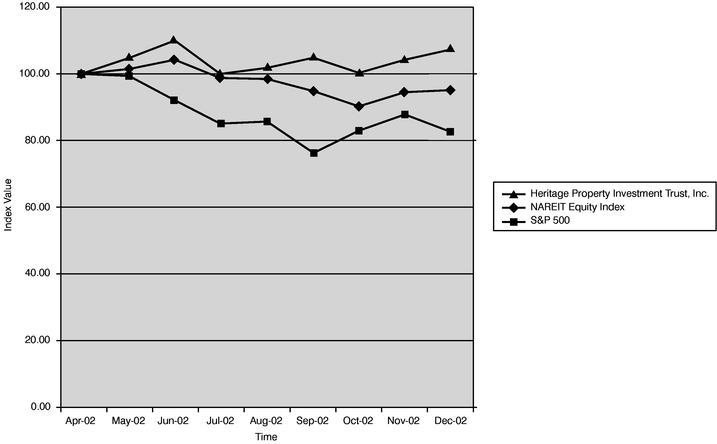

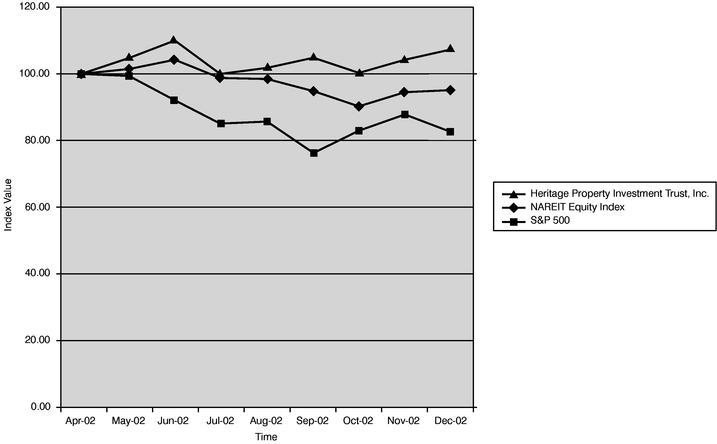

Supplemental Executive Retirement Plan