QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| COGENT COMMUNICATIONS HOLDINGS, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

2450 N Street, NW

Washington, D.C. 20037

(202) 295-4200

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 4, 2016

The Annual Meeting of Stockholders of Cogent Communications Holdings, Inc., a Delaware corporation (the "Company"), will be held on May 4, 2016, at 9:00 a.m., local time, at the Company's offices at 2450 N Street, NW, Washington, D.C. 20037, for the following purposes:

- 1.

- To elect six directors to hold office until the next annual meeting of stockholders or until their respective successors have been elected or appointed.

- 2.

- To vote on the ratification of the selection by the Audit Committee of Ernst & Young LLP as the independent registered public accountants for the Company for the fiscal year ending December 31, 2016.

- 3.

- To hold an advisory vote to approve named executive officer compensation.

- 4.

- To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

The foregoing matters are described in more detail in the enclosed Proxy Statement.

The Board of Directors has fixed March 8, 2016 as the record date for determining stockholders entitled to vote at the Annual Meeting of Stockholders.

The Company's Proxy Statement is attached hereto. Financial and other information about the Company is contained in the enclosed 2015 Annual Report to Stockholders for the fiscal year ended December 31, 2015.

You are cordially invited to attend the meeting in person. Your participation in these matters is important, regardless of the number of shares you own. Whether or not you expect to attend in person, we urge you to complete, sign, date and return the enclosed proxy card as promptly as possible in the enclosed envelope. If you choose to attend the meeting you may then vote in person if you so desire, even though you may have executed and returned the proxy. Any stockholder who executes such a proxy may revoke it at any time before it is exercised. A proxy may be revoked at any time before it is exercised by delivering written notice of revocation to the Company, Attention: Ried Zulager; by delivering a duly executed proxy bearing a later date to the Company; or by attending the Annual Meeting and voting in person.

| By Order of the Board of Directors, | ||

| ||

| Ried Zulager,Secretary |

Washington, D.C.

March 28, 2016

COGENT COMMUNICATIONS HOLDINGS, INC.

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to Be Held at 9:00 a.m., May 4, 2016

The proxy statement and annual report to stockholders (Form 10-K) are available at: http://www.cogentco.com/en/about-cogent/investor-relations/reports.

The materials available at the website are the proxy statement and annual report to stockholders (Form 10-K).

The annual stockholder meeting of the stockholders of Cogent Communications Holdings, Inc. (the "Company") will be held at 9:00 a.m. on May 4, 2016 at Cogent's offices at 2450 N Street, NW, Washington, D.C. 20037. The matters to be covered are noted below:

- 1.

- Election of directors;

- 2.

- Ratification of appointment of Ernst & Young LLP as independent registered public accountants for the fiscal year ending December 31, 2016;

- 3.

- Non-binding advisory vote to approve the compensation of Company's named executive officers; and

- 4.

- Other matters as may properly come before the meeting.

The Board of Directors of Cogent recommends voting FOR Proposal 1—Election of Directors, FOR Proposal 2—Ratification of Appointment of Ernst & Young LLP as independent registered public accountants for the fiscal year ending December 31, 2016 and FOR Proposal 3—Non-binding Approval of Executive Compensation.

You are cordially invited to attend the meeting in person. Your participation in these matters is important, regardless of the number of shares you own. Whether or not you expect to attend in person, we urge you to complete, sign, date and return the enclosed proxy card as promptly as possible in the enclosed envelope. If you choose to attend the meeting you may then vote in person if you so desire, even though you may have executed and returned the proxy. Any stockholder who executes such a proxy may revoke it at any time before it is exercised. A proxy may be revoked at any time before it is exercised by delivering written notice of revocation to the Company, Attention: Ried Zulager; by delivering a duly executed proxy bearing a later date to the Company; or by attending the Annual Meeting and voting in person.

i

2450 N Street, NW

Washington, D.C. 20037

(202) 295-4200

The Board of Directors (the "Board") of Cogent Communications Holdings, Inc. (referred to herein as the "Company," "Cogent," "we," "us," or "our"), a Delaware corporation, is soliciting your proxy on the proxy card enclosed with this Proxy Statement. Your proxy will be voted at the Annual Meeting of Stockholders (the "Annual Meeting") to be held on May 4, 2016, at 9:00 a.m., local time, at the Company's offices at 2450 N Street, NW, Washington, D.C. 20037, and any adjournment or postponement thereof. This Proxy Statement, the accompanying proxy card and the 2015 Annual Report to Stockholders are first being mailed to stockholders on or about March 23, 2016.

Voting Rights and Outstanding Shares

Only stockholders of record on the books of the Company as of 5:00 p.m., March 8, 2016 (the "Record Date"), will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, the outstanding voting securities of the Company consisted of 45,265,999 shares of common stock, par value $0.001 per share.

Holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders. Votes cast by proxy or in person at the Annual Meeting will be tabulated by the Inspector of Elections with the assistance of the Company's transfer agent. The Inspector will also determine whether or not a quorum is present. In general, our bylaws (the "Bylaws") provide that a quorum consists of a majority of the shares issued and outstanding and entitled to vote, the holders of which are present in person or represented by proxy. Broker non-votes (which occur when a brokerage firm has not received voting instructions from the beneficial owner on a non-routine matter, as defined under applicable rules and as discussed in greater detail below) and abstentions are counted for purposes of determining whether a quorum is present.

Except in very limited circumstances, the affirmative vote of a majority of the shares having voting power present in person or represented by proxy at a duly held meeting at which a quorum is present is required under the Bylaws for approval of proposals presented to stockholders, including Proposals 1, 2 and 3.

Proxies

The shares represented by the proxies received, properly dated and executed and not revoked will be voted at the Annual Meeting in accordance with the instructions of the stockholders. A proxy may be revoked at any time before it is exercised by:

- •

- delivering written notice of revocation to the Company, Attention: Ried Zulager;

- •

- delivering a duly executed proxy bearing a later date to the Company; or

- •

- attending the Annual Meeting and voting in person.

Any proxy that is returned using the form of proxy enclosed and which is not marked as to a particular item will be voted "FOR" the election of directors, "FOR" the ratification of the selection by

the Audit Committee of the Board (the "Audit Committee") of Ernst & Young LLP as independent registered public accountants and "FOR" the non-binding approval of the compensation of the Company's named executive officers.

Proposals 1 and 3 are matters considered non-routine under applicable rules. A broker or other nominee cannot vote on these non-routine matters without specific voting instructions and therefore there may be broker non-votes on Proposals 1 and 3.

Proposal 2 is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters without specific voting instructions, and therefore no broker non-votes are expected to exist in connection with Proposal 2.

Broker non-votes will not be deemed to have voting power and thus will have no effect on voting. However, abstentions will be treated as present and having voting power, and accordingly will have the effect of a negative vote for purposes of determining the approval of Proposals 1, 2 and 3.

The Company believes that the tabulation procedures to be followed by the Inspector are consistent with the general statutory requirements in Delaware concerning voting of shares and determination of a quorum.

The cost of soliciting proxies will be borne by the Company. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may also be solicited by certain of the Company's directors, officers and regular employees, without additional compensation, personally or by telephone or email.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Six directors are to be elected at the Annual Meeting to serve until their respective successors are elected and qualified. Nominees for election to the Board shall be approved by a majority of the votes cast by holders of our common stock present in person or by proxy at the Annual Meeting, each share being entitled to one vote.

In the event any nominee is unable or unwilling to serve as a nominee, the proxies may be voted for the balance of those nominees named and for any substitute nominee designated by the present Board or the proxy holders to fill such vacancy, or for the balance of those nominees named without nomination of a substitute, or the Board may be reduced in accordance with the Bylaws. The Board has no reason to believe that any of the persons named will be unable or unwilling to serve as a nominee or as a director if elected.

Set forth below is certain information concerning the six directors of the Company nominated to be elected at the Annual Meeting:

Dave Schaeffer, age 59, founded our Company in August 1999 and is our Chairman of the Board, Chief Executive Officer and President. Prior to founding the Company, Mr. Schaeffer was the founder of Pathnet, Inc., a broadband telecommunications provider, where he served as Chief Executive Officer from 1995 until 1997 and as Chairman from 1997 until 1999. Mr. Schaeffer has been a director since 1999. Mr. Schaeffer serves as both Chairman and Chief Executive Officer ("CEO") because he is the founder of the Company and has successfully led the Company and the board since the Company was founded. For this reason he has been nominated to continue serving on the Board. Since 2014 Mr. Schaeffer has been a director of CyberArk Software Ltd., (NASDAQ: CYBR) an Israeli company that completed an initial public offering in September of 2014.

Steven D. Brooks, age 64, has served on our Board since October 2003. Mr. Brooks is a private investor. He was Managing Partner of BCP Capital Management from 1999 to 2009. From 1997 until 1999, Mr. Brooks headed the technology industry mergers and acquisition practice at Donaldson, Lufkin & Jenrette. Previously, Mr. Brooks held a variety of positions in the investment banking and private equity fields, including: Head of Global Technology Banking at Union Bank of Switzerland, Managing Partner of Corporate Finance at Robertson Stephens, founder and Managing Partner of West Coast technology investment banking at Alex Brown & Sons, and Principal at Rainwater, Inc., a private equity firm in Fort Worth, Texas. Mr. Brooks has been nominated to continue serving on the Board because of his extensive experience with firms such as Cogent and with public market activities of such companies. Having been involved with the Company since its early days he also brings extensive historical perspective to the Board.

Timothy Weingarten, age 40, has served on our Board since October 2003. Mr. Weingarten is currently a Product Manager at Pinterest. Prior to Pinterest, he was the co-founder & CEO of ShopTAP Inc. Prior to founding ShopTAP Inc., he was the Chairman and CEO of Visage Mobile. He is also a former General Partner of Worldview Technology Partners—an early stage venture capital fund with over $1 billion under management. From 1996 to 2000, Mr. Weingarten was a member of the telecom equipment research group at Robertson Stephens and Company. Mr. Weingarten has been nominated to continue serving on the Board because of his extensive knowledge of the U.S. venture capital backed companies making use of the Internet. The Board values this insight because Cogent's future growth depends to a great extent on the uses made of the Internet.

Richard T. Liebhaber, age 80, has served on our Board since March 2006. Mr. Liebhaber was with IBM from 1954 to 1985, where he held a variety of positions. Subsequently, he served as executive vice president and member of the management committee at MCI Communications, and served on the board of directors of MCI from 1992 to 1995. From 1995 to 2001, Mr. Liebhaber served as managing

3

director at Veronis, Suhler & Associates, a New York media merchant banking firm. Mr. Liebhaber has been nominated to continue serving on the Board because of his extensive operational experience with telecommunications companies.

D. Blake Bath, age 53, has served on our Board since November 2006. He is the Chief Executive Officer of Bay Bridge Capital Management, LLC, an investment firm in Bethesda, MD. From 1996 until 2006, Mr. Bath was Managing Director at Lehman Brothers and, as a senior equity research analyst for Lehman Brothers, was Lehman's lead analyst covering wireline and wireless telecommunications services. Prior to joining Lehman Brothers he was the primary telecommunications analyst at Sanford C. Bernstein from 1992 to 1996. From 1989 to 1992 he was an analyst in the Strategic Planning and Corporate Finance organizations at MCI Communications. Mr. Bath has been nominated to continue serving on the Board because of his wide experience with the telecommunications industry which allows him to contribute a broad perspective to discussions about the Company's future activities and its place in the current competitive landscape.

Marc Montagner, age 54, has served on our Board since April 2010. He is currently Chief Financial Officer at Endurance International Group Holdings, Inc. (NASDAQ: EIGI), which position he has held since September of 2015. He was previously Chief Financial Officer at LightSquared from 2012 until August 2015. Previously, he had been Executive Vice President of Strategy, Development and Distribution at LightSquared. On May 14, 2012, LightSquared filed for reorganization under Chapter 11 of the U.S. Bankruptcy Code. Prior to joining LightSquared in February of 2009, Mr. Montagner was Managing Director and Co-Head of the Global Telecom, Media and Technology Merger and Acquisition Group at Banc of America Securities. Until August of 2006, he was Senior Vice President, Corporate Development and M&A with the Sprint Nextel Corporation. Prior to this, Mr. Montagner had the same responsibilities with Nextel Communications. Prior to 2002, Mr. Montagner was a Managing Director in the Media and Telecom Group at Morgan Stanley. Prior to joining Morgan Stanley, Mr. Montagner worked for France Télécom in New York where he was Head of Corporate Development for North America. He holds an M.S. degree in Electrical Engineering from the École Nationale Supérieure des Télécommunications, in Paris, and an M.B.A. from Columbia University. Mr. Montagner has been nominated to the Board due to his extensive experience in the telecommunications industry, specifically with respect to operational, financial and strategic matters.

Unless marked otherwise, proxies received will be voted "FOR" the election of each of the nominees named above.

Recommendation of the Board of Directors:

The Board recommends a vote "FOR" the election of all nominees named above.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee of the Board has appointed Ernst & Young LLP as the Company's independent registered public accountants for the fiscal year ending December 31, 2016. Services provided to the Company and its subsidiaries by Ernst & Young LLP in fiscal years 2014 and 2015 are described under "Relationship with Independent Registered Public Accountants—Fees and Services of Ernst & Young LLP," below.

We are asking our stockholders to ratify the selection of Ernst & Young LLP as our independent registered public accountants. Although ratification is not required by the Bylaws or otherwise, the Board is submitting the selection of Ernst & Young LLP to our stockholders for ratification as a matter of good corporate practice.

4

Representatives of Ernst & Young LLP will be available by telephone at the Annual Meeting to respond to appropriate questions and will have the opportunity to make a statement if they desire to do so.

The affirmative vote of the holders of a majority of shares represented in person or by proxy and entitled to vote on this item will be required for ratification. The Board recommends that stockholders vote "FOR" ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accountants for fiscal year 2016. Unless marked otherwise, proxies received will be voted "FOR" the ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accountants for 2016.

In the event stockholders do not ratify the appointment, the appointment may be reconsidered by the Audit Committee and the Board. The Company believes that neither the Audit Committee nor the Board is obliged to make any such reconsideration under Delaware law, the rules of the stock exchange on which the Company is listed, or the rules promulgated by the Securities and Exchange Commission ("SEC") that frame certain specific obligations of the members of all public company audit committees with respect to the selection of independent registered public accountants. Even if the selection is ratified, the Audit Committee may, in its discretion, select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

Recommendation of the Board of Directors:

The Board recommends a vote "FOR" the ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accountants for 2016.

PROPOSAL NO. 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

In accordance with the requirements of Section 14A of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), we are asking stockholders to approve the following non-binding advisory resolution at the Annual Meeting:

RESOLVED that the compensation paid to the Company's named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby APPROVED.

In 2011, the Board recommended that this advisory resolution to approve named executive officer compensation be conducted annually and stockholders voted in favor of this recommendation by a substantial majority. Accordingly, the Board has determined that it will hold an advisory resolution to approve named executive officer compensation annually until the next vote to determine the frequency of such an advisory vote. Although the stockholder's vote is advisory and non-binding upon our Board, our Board will take your vote into consideration when making future decisions regarding executive compensation. However, our Board and the Compensation Committee will retain full responsibility for determining the final compensation of the executive management of the Company.

The affirmative vote of the holders of a majority of shares represented in person or by proxy and entitled to vote on this item will be required for approval.

As described in the Compensation Discussion and Analysis section of this Proxy Statement, the Company's executive compensation is designed to attract, reward and retain the executives of our Company in order to achieve our corporate goals and to align the interests of the executives with the long- term interests of our stockholders.

5

In 2015 the majority of stockholders did not approve the compensation of the named executive officers. The Board believes that this occurred as a result of recommendations by some organizations that advise stockholders on the votes to be cast at a company's annual meeting,e.g. Institutional Shareholder Services (ISS), which found cause for concern in the size of the restricted stock award made to the CEO in 2014, and the discretionary nature of and the lack of performance criteria used to determine the CEO's compensation. As further discussed in the Compensation Discussion and Analysis section of this Proxy Statement, the Board believes the CEO's compensation is reasonable and appropriate for the Company in light of the following factors:

- •

- Mr. Schaeffer founded and has successfully led the Company for more than 15 years. He is intimately involved in all aspects of the Company's business and his knowledge of the Company and marketplace in which it operates is unequalled and cannot be replaced;

- •

- The Company's overall compensation program is designed to provide incentives over 3-4 year periods and links a significant portion of our executive's overall compensation to the value of our equity; and

- •

- The total compensation of other CEOs and other executives at similar companies in our industry.

The Board believes the Company's overall compensation program is reasonable, effective, and appropriate for its size and nature of the Company.

The Board urges stockholders to carefully read the "Compensation Discussion and Analysis" section of this Proxy Statement, which describes in more detail our executive compensation philosophy, policies and procedures, as well as the Summary Compensation Table and other related compensation tables and the narrative discussion.

Recommendation of the Board of Directors:

The Board recommends a vote "FOR" the resolution set forth above thereby approving the compensation of the named executive officers as described in the Compensation Discussion and Analysis and Summary Compensation table and related disclosure set forth in this Proxy Statement.

6

THE BOARD OF DIRECTORS AND COMMITTEES

The Board of Directors met six times during 2015. Each director attended at least 75% of the meetings of the Board. Each director attended at least 75% of the meetings of the committees of the Board of which he was a member. The independent directors met four times. All of the directors attended the annual meeting of stockholders. During 2015, the Board had a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee.

Mr. Schaeffer serves as CEO and Chairman of the Board. He is the founder of the Company and owns approximately 8.11% of the Company's stock. His dual role was established more than 15 years ago when he founded the Company. The Board believes that at the Company's current stage of growth the Board is best served by a chairman who is involved with the Company on a full-time basis, fully knowledgeable of both the Company's financial and operational workings, and is therefore able to bring great depth of knowledge about the Company to this role. The Board does not have a designated lead independent director.

The Board's role in the Company is to provide general oversight of strategy and operations. As part of its oversight of operations it reviews the performance of the Company and the risks involved in the operations of the Company. The Board and the Audit Committee receive regular reports on the status of the Company's internal controls and each has reviewed key operational risks. The Board's risk oversight role has no effect on its leadership structure as all directors other than Mr. Schaeffer are independent directors and therefore have no conflict that might discourage critical review.

Nominating and Corporate Governance Committee

We established our Nominating and Corporate Governance Committee of the Board (the "Nominating and Governance Committee") in April 2005. During all of 2015 the members of this committee were Messrs. Brooks (Chairman) and Montagner, each of whom are independent members of our Board. Our Board has adopted a charter governing the activities of the Nominating and Corporate Governance Committee. The charter of the Nominating and Corporate Governance Committee may be found on the Company's website under the tab "About Cogent; Investor Relations; Corporate Governance" atwww.cogentco.com. Pursuant to its charter, the Nominating and Corporate Governance Committee's tasks include assisting the Board in identifying individuals qualified to become Board members, recommending to the Board director nominees to fill vacancies in the membership of the Board as they occur and, prior to each annual meeting of stockholders, recommending director nominees for election at such meeting.

The Nominating and Corporate Governance Committee seeks diversity of perspective in considering the membership of the Board. It does not have precise measures for the optimal range and type of diversity desirable. Instead it and the Board seek candidates with a range of experience. Board candidates are considered based upon various criteria, such as skills, knowledge, perspective, broad business judgment and leadership, relevant specific industry or regulatory affairs knowledge, business creativity and vision, experience, and any other factors appropriate in the context of an assessment of the committee's understood needs of the Board at that time. In addition, the Nominating and Corporate Governance Committee considers whether the individual satisfies criteria for independence as may be required by applicable regulations and personal integrity and judgment. Accordingly, the Company seeks to attract and retain highly qualified directors who have sufficient time to attend to their substantial duties and responsibilities to the Company.

The Nominating and Corporate Governance Committee has the sole authority to retain, compensate, and terminate any search firm or firms to be used in connection with the identification, assessment, and/or engagement of directors and director candidates. No such firm has been retained by the Company in the past.

7

The Nominating and Corporate Governance Committee considers proposed nominees whose names are submitted to it by stockholders; however, it does not have a formal process for that consideration. The Company has not to date adopted a formal process because it believes that the informal consideration process has been adequate. The Committee intends to review periodically whether a more formal policy should be adopted. If a stockholder wishes to suggest a proposed name for committee consideration, the stockholder should comply with the provisions of the Company's Bylaws, including without limitation, sending the name of that nominee and related personal information to the Nominating and Corporate Governance Committee, in care of our Secretary, at least three months before the next annual meeting to ensure meaningful consideration by the Nominating and Corporate Governance Committee. See "Stockholder Proposals" for Bylaw requirements for nominations.

The Nominating and Corporate Governance Committee had two formal meetings in 2015. All meetings and activities of the Nominating and Corporate Governance Committee were held in conjunction with a meeting of the full board to accommodate the views of all members of the Board concerning its membership and constitution.

Stockholder Communication with Board Members

Although the Company has not to date developed formal processes by which stockholders may communicate directly to directors, it believes that the informal process, in which stockholder communications that are received by the Secretary for the Board's attention, or summaries thereof, are then forwarded to the Board has served the Board's and the stockholders' needs. In the past several institutional investors communicated with the Board in this fashion. The investor letters were subsequently addressed by direct communications with representatives of the investors and a member of the Board with responsibility for the topics addressed by the investors, and the full Board was apprised of the conversations. Accordingly, the Board considers that an effective and well established traditional means of receiving communications from stockholders currently exists. In view of the SEC disclosure requirements relating to this issue, the Nominating and Corporate Governance Committee may consider development of more specific procedures. Until any other procedures are developed and posted on the Company's corporate website atwww.cogentco.com, any communications to the Board should be sent to it in care of our Secretary.

Code of Conduct

The Company's Code of Conduct may be found on the Company's website under the tab "About Cogent; Investor Relations; Corporate Governance" atwww.cogentco.com.

Board Member Attendance at Annual Meetings

The Company encourages all of its directors to attend the Annual Meeting of Stockholders. All of the directors attended the 2015 Annual Meeting. The Company generally holds a Board meeting coincident with the Annual Meeting to minimize director travel obligations and facilitate their attendance at the Annual Meeting.

Director Independence

Nasdaq Marketplace Rules require that a majority of the Board be independent. No director qualifies as independent unless the Board determines that the director has no direct or indirect relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In assessing the independence of its members, the Board examined the commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships of each member. The Board's inquiry extended to both direct and indirect relationships

8

with the Company. Based upon both detailed written submissions by its members and discussions regarding the facts and circumstances pertaining to each member, considered in the context of applicable Nasdaq Marketplace Rules, the Board has determined that all of the directors nominated for election, other than Mr. Schaeffer, are independent.

Audit Committee

The Audit Committee is established in accordance with Section 3(a)(58)(A) of the Exchange Act. During all of 2015 the members of this committee were Messrs. Liebhaber (Chairman), Bath and Montagner, each of whom is independent as the term "independence" is defined in the applicable listing standards of Nasdaq Marketplace Rules and Rule 10A-3 under the Exchange Act. The Board has determined that each of Messrs. Liebhaber, Bath and Montagner qualifies as a financial expert, as that term is defined in the Exchange Act. The responsibilities of this Audit Committee include:

- •

- the appointment, compensation, retention and oversight of our independent registered public accountants;

- •

- reviewing with our independent registered public accountants the plans and results of the audit engagement;

- •

- pre-approving professional services provided by our independent registered public accountants;

- •

- reviewing our critical accounting policies, our Annual and Quarterly reports on Forms 10-K and 10-Q, and our earnings releases;

- •

- reviewing the independence of our independent registered public accountants; and

- •

- reviewing the adequacy of our internal accounting controls and overseeing our ethics program.

The Audit Committee met six times during 2015. The charter of the Audit Committee may be found under the tab "About Cogent; Investor Relations; Corporate Governance" atwww.cogentco.com.

9

To the Board of Directors:

We have reviewed and discussed with management the Company's audited consolidated financial statements as of and for the year ended December 31, 2015.

We have discussed with the independent registered public accountants, Ernst & Young LLP, the matters required to be discussed with us by the American Institute of Certified Public Accountants, the Securities and Exchange Commission, the Nasdaq Stock Market and the Public Company Accounting Oversight Board, including those required by the Statement on Auditing Standard No. 16, Communications with Audit Committees.

We have received and reviewed the letter from Ernst & Young LLP required by the Public Company Accounting Oversight Board, and have discussed with Ernst & Young LLP their independence, including the written disclosures and letter required by Rule 3526 of the Public Company Accounting Oversight Board.

Based on the reviews and discussions referred to above, we recommended to the Board of Directors that the audited consolidated financial statements referred to above be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2015 for filing with the Securities and Exchange Commission. The Board of Directors caused the Form 10-K to be so filed.

| Audit Committee: Richard T. Liebhaber Marc Montagner D. Blake Bath |

Compensation Committee

During 2015 the Compensation Committee of the Board ("Compensation Committee") consisted of Messrs. Brooks and Weingarten, each of whom is independent as the term "independence" is defined in the applicable listing standards of Nasdaq Marketplace Rules. By agreement with the Board Messrs. Brooks and Weingarten serve as equals on this committee and neither is treated as chairman thereof. The Compensation Committee is responsible in conjunction with the other independent directors for determining compensation for our executive officers and other employees, and administering our compensation programs. The Compensation Committee had one formal meeting in 2015 and acted twice by written consent. In 2015 the functions of the Compensation Committee were largely undertaken by the full Board. Salary and equity compensation awards for all of the executive officers and key employees of the Company listed in this Proxy Statement were considered during these meetings and Mr. Schaeffer was absent from any discussions concerning his compensation. The charter of the Compensation Committee is available under the tab "About Cogent; Investor Relations; Corporate Governance" atwww.cogentco.com.

EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES

Set forth below is certain information concerning the executive officers and significant employees of the Company. Biographical information on Mr. Schaeffer is included under "Proposal 1—Election of Directors."

Thaddeus G. Weed, age 54, joined us in 2000 and served as Vice President and Controller until May 2004 when he became our Chief Financial Officer and Treasurer. From 1997 to 1999, Mr. Weed served as Senior Vice President of Finance and Treasurer at Transaction Network Services, Inc. where Mr. Weed undertook a broad range of financial management responsibilities. From 1987 to 1997, Mr. Weed was employed at Arthur Andersen LLP where he served as Senior Audit Manager.

10

Robert N. Beury, Jr., age 62, joined us in 2000 and serves as Chief Legal Officer (Vice President and General Counsel) and Assistant Secretary. Prior to joining us, Mr. Beury served as Deputy General Counsel of Iridium LLC, a mobile satellite service provider, from 1994 to 2000. From 1987 to 1994, Mr. Beury was General Counsel of Virginia's Center for Innovative Technology, a non-profit corporation set up to develop the high tech industry in Virginia.

R. Brad Kummer, age 67, joined us in 2000 and serves as Vice President of Optical Transport Engineering and Chief Technology Officer. Mr. Kummer spent the 25 years prior to joining us at Lucent Technologies (formerly Bell Laboratories), where he served in a variety of research and development and business development roles relating to optical fibers and systems. In his most recent work at Lucent, he was responsible for optical fiber systems engineering for long haul and metropolitan dense wavelength division multiplexing systems.

Timothy G. O'Neill, age 60, joined us in 2001 and serves as the Vice President of Field Engineering, Construction and Network Operations. He is responsible for network operation, construction and maintenance. From 1999 to 2001, Mr. O'Neill was employed at @Link Networks, Inc. where he served as Chief Network Officer. While at @Link Networks, Inc., Mr. O'Neill was responsible for engineering, implementing and operating a network for Internet access and layer 2 services.

Bryant Hird "Guy" Banks, age 51, joined us in 2000 and serves as Vice President of Real Estate. Prior to joining us Mr. Banks held positions with various affiliates of Security Capital Group Incorporated, including the positions of Vice President of Land Acquisition and Vice President of Development for CWS Communities Trust.

Henry W. Kilmer, age 47, joined us in 2011 and serves as Vice President of IP Engineering. Prior to joining us, Mr. Kilmer held positions with UUNET (now Verizon), Sprint, Digex/Intermedia and Metromedia Fiber Networks/Abovenet where he was Senior Vice President of Engineering and Operations. Most recently, Mr. Kilmer was President of Terrapin Communications, Inc., a small consulting firm which focused on network consulting and technical strategy development for companies like GPX, Airband, and Switch and Data (now part of Equinix).

James Bubeck, age 49, was appointed as our Chief Revenue Officer and Vice President of Global Sales effective October 1, 2015. Mr. Bubeck has served in the sales organization of Cogent in various capacities since May of 2000, most recently, since 2007, as Vice President of Central Region Sales, based in Chicago. From 1996 to 2000 he was a sales manager for MCI's internet network business, which was subsequently divested to Cable and Wireless due to the merger of MCI and Worldcom.

Compensation Discussion and Analysis

2015 Actions

The Company's 2015 compensation program for named executive officers had three simple components:

- •

- Base salary (except for the CEO, whose salary has been replaced with performance based cash compensation);

- •

- Prior grants of restricted stock that vest over time; and

- •

- Sales commissions for the Vice President of Global Sales.

These components generally apply to all of our employees, not just our executive officers. Other than commissions for our Vice President of Global Sales and Mr. Schaeffer's performance cash opportunity described below, the Company did not have any annual incentives for our named executive officers in 2015. The Company uses equity in the form of time-vested restricted stock as a significant

11

component of each executive's compensation—95% for the CEO and 56% for other executives (measured over time). The Board believes this compensation structure is in the interests of stockholders as it links a significant portion of the executive's compensation to the Company's fortunes as reflected in its stock price.

The only actions taken with respect to compensation of named executive officers in 2015 were the adjustment of the salary and a grant of restricted stock that vests over time to Mr. Bubeck in connection with his promotion to Chief Revenue Officer and Vice President of Global Sales and a 2% salary increase to the named executive officers (other than Mr. Schaeffer). This is the same salary increase that was granted to other employees.

In 2015 Mr. Bubeck received a 10% salary increase and a grant of 5,000 restricted shares of stock vesting over four years upon his promotion to Chief Revenue Officer. The salary increase was made in recognition of his increased responsibilities since he now supervises the entire sales force rather than only the central region of the U.S. The grant of restricted shares was made both for that reason and to further align his interests with those of the stockholders.

Under a policy adopted in 2014 Mr. Schaeffer received no salary in 2015. Instead he received cash compensation determined by the performance of the Company with respect to revenue and EBITDA, as adjusted, goals as explained below. The target for revenue growth, set in 2014, is 15% per year. The Company's revenue grew 6.4% from 2014 to 2015 so Mr. Schaeffer received 42.5% of his $250,000 target—$106,275. The target, set in 2014, for growth in EBITA, as adjusted, is 20% per year. The Company's EBITDA, as adjusted grew .5% from 2014 to 2015 so Mr. Schaeffer received 2.4% of his $250,000 target—$5,895.

Mr. Bubeck is paid cash compensation (commissions) based on sales revenue. During the period after he became Chief Revenue Officer (October 1, 2015) the sales department achieved 95% of its revenue target. Therefore he received 95% of his target of $25,000 (for the period from October 1, 2015 to December 31, 2015)—$23,691. (He also received commissions earned while he was head of the Company's central region sales.)

No equity grants were made to executive officers in 2015 (other than the grant of restricted stock to Mr. Bubeck upon his promotion). The Board and Compensation Committee intends to change the compensation program in 2016. Awards, if any, will be made under that revised program. The philosophy of the Board and Compensation Committee with respect to executive officer compensation is described below. Future compensation decisions will continue to reflect that philosophy. The outline of the process for determining future compensation is described in the section below "Decision Making Process for Future Compensation."

Compensation Philosophy

The Company's philosophy is to compensate all of its employees in a manner which reflects the competitive value of their skills and experience in the marketplace, to pay our sales force and sales management substantial cash commissions based upon revenue generated, and to tie senior executive compensation to the value of the Company's common stock through the grant of restricted stock vesting over multi-year periods. The Company believes the success of its philosophy is demonstrated by its record of growth, its stable and capable leadership and its equity appreciation.

The Company follows the following compensation practices:

- •

- 100% of our CEO's compensation is either incentive based cash or stock.

- •

- The Compensation Committee is composed solely of independent directors.

- •

- The Company does not offer any perquisites (such as automobiles, club dues, etc.).

12

- •

- The Company does not offer any supplemental retirement benefits to executives. They participate in the same defined contribution retirement (401(k)) plan as other employees.

- •

- Restricted stock awards vesting over a period of at least three years are used to align the interests of senior management (and other employees) with the interests of stockholders.

- •

- The Company does not provide any tax gross up benefits.

- •

- Restricted stock awards do not begin to vest prior to the first anniversary of the grant.

- •

- The Company uses commissions based on sales revenue to incent the sales department.

Salary

The general policy of the Compensation Committee and the Board is to grant to executive officers only the same general salary increase granted to all employees each year. Consistent with this policy executive officers received the same 2% salary increase as other employees for 2016 and 1.5% in 2015 and 2014. From time to time the Compensation Committee reviews the compensation of the Company's CEO and each executive officer and, based on recommendations from the CEO, has in the past given specific executive officers raises based on the officer's increased responsibilities as the Company has grown. Mr. Schaeffer no longer receives a salary, but is eligible for incentive cash compensation.

Bonus and Commissions

As discussed above, bonuses have not been a component of the Company's compensation structure for non-sales personnel. Instead, as further discussed below the Company has used only grants of restricted stock to align the interests of executives with those of the stockholders and incent performance. In addition, beginning in 2015 Mr. Schaeffer's salary was replaced with a cash performance incentive plan linked to two significant company performance measures used by stockholders and analysts—EBITDA (as adjusted) and revenue.

Due to the importance of his position in driving revenue and therefore stockholder value, the Company's Chief Revenue Officer and Vice President of Global Sales is paid monthly commissions based the Company's revenue for the month. The commission is based on actual revenue compared to a revenue goal. The percentage of the revenue goal achieved is multiplied by the Chief Revenue Officer's target commission to determine the amount to be paid. Since revenue growth is key to the Company's performance, the Board thinks it is important to directly link a significant portion of the Chief Revenue Officer's to achieving our monthly revenue targets. For information on the Chief Revenue Officer's payments under this plan for 2015 see the discussion of 2015 compensation above. Additional information is also set forth in the Grants of Plan Based Awards table below.

In 2014 the Compensation Committee made significant changes to the compensation program for the Company's CEO to better align Mr. Schaeffer's compensation opportunities with the Company's performance. Effective January 1, 2015, Mr. Schaeffer's annual base salary was reduced to $0 from $338,000. He is eligible for a performance-based cash bonus based on the Company's ability to grow revenue and EBITDA, as adjusted, year-over-year. If the revenue growth equals or exceeds 15%, he will receive $250,000 and, separately, if EBITDA, as adjusted, growth equals or exceeds 20%, he will receive $250,000. If the growth of the performance measures is less than the amount specified, he would receive a proportionally lesser amount. For example, if revenue growth equaled 7.5% and EBITDA growth equaled 15%, he would be paid 50% of $250,000 or $125,000 of the revenue growth bonus and 75% of $250,000 or $187,500 of the EBITDA growth bonus.

13

Options and Restricted Stock

The Company believes that the greatest alignment of shareholder and executive interests arises from their common ownership of equity. Accordingly, compensation of the Company's senior management is based in large part upon time-vested restricted stock and stock options whose value directly reflects the success of their efforts. The Compensation Committee, often in conjunction with the full Board of Directors, determines the size of awards in the process described above, in light of the executive's responsibilities and comparable compensation levels of similar positions in the industry.

Apart from initial hiring grants, it should be noted that restricted stock awards have in the past been made every other year. In the future the Compensation Committee and the Board plan to make smaller equity awards each year, rather than larger awards every other year. The awards will vest over a period of three to four years.

Over the last three years restricted stock awards have represented 95% of the CEO's total compensation, and 56% of the total compensation for other executive officers (based on grant date value of the stock compared to total compensation).

The "burn rate" at which the Company has awarded stock and options to employees, including the named executive officers, in the last three years is set out below. We believe this rate is reasonable and low compared to that of other companies in our industry. The "burn rate" is the sum of stock and option awards granted divided by the number of shares of stock outstanding.

| (shares and options in thousands) | 2015 | 2014 | 2013 | TOTAL | AVERAGE | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Options granted | 84 | 84 | 58 | 226 | 75 | |||||||||||

Shares granted | 63 | 793 | 176 | 1,032 | 344 | |||||||||||

| | | | | | | | | | | | | | | | | |

TOTAL | 147 | 877 | 234 | 1,258 | 419 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Weighted average shares—basic EPS | 45,199 | |||||||||||||||

| | | | | | | | | | | | | | | | | |

Burn rate—1 year | 0.33 | % | ||||||||||||||

| | | | | | | | | | | | | | | | | |

Burn rate—3 year average | 0.93 | % | ||||||||||||||

| | | | | | | | | | | | | | | | | |

We believe our grants of restricted stock have aligned the interests of our executives with those of the stockholders and resulted in the above market performance of the Company's stock price as demonstrated below.

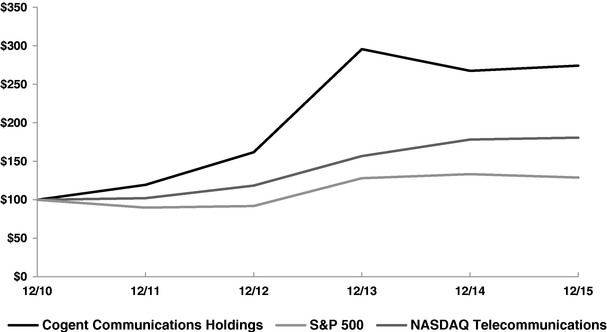

The graph below matches the Company's cumulative 5-Year total shareholder return on common stock with the cumulative total returns of the S&P 500 index and the NASDAQ Telecommunications

14

index. The graph tracks the performance of a $100 investment in our common stock and in each index (with the reinvestment of all dividends) from 12/31/2010 to 12/31/2015.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Cogent Communications Holdings, the S&P 500 Index

and the NASDAQ Telecommunications Index

- *

- $100 invested on 12/31/10 in stock or index, including reinvestment of dividends.

Fiscal year ending December 31.Copyright© 2016 S&P, a division of McGraw Hill Financial. All rights reserved.

| | 12/10 | 12/11 | 12/12 | 12/13 | 12/14 | 12/15 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Cogent Communications Holdings | 100.00 | 119.45 | 161.76 | 295.72 | 267.53 | 274.28 | |||||||||||||

S&P 500 | 100.00 | 102.11 | 118.45 | 156.82 | 178.29 | 180.75 | |||||||||||||

NASDAQ Telecommunications | 100.00 | 89.84 | 91.94 | 128.06 | 133.34 | 128.91 | |||||||||||||

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

Decision Making Process for Future Compensation

The Board regularly evaluates the Company's performance compared to others in the Internet infrastructure business. The companies used for comparison are:

| Sprint | Level 3 | Internap | ||

| Zayo | Bell Canada Enterprises | Verizon | ||

| Limelight | GTT | Rackspace | ||

| AT&T | Equinix | Akamai |

The Board routinely compares Cogent with the relative performance of these companies in terms of revenue growth, EBITDA margins and growth, free cash flow and balance sheet efficiency. These performance indicators, along with sales force productivity and return of capital to investors, are among

15

the most important to the Board in setting goals and rewarding achievement by the Company's executive team. In 2016, the Board has determined to reference compensation metrics from these companies as well, integrating this data with the existing approach currently employed by the Compensation Committee and Board. The Compensation Committee and the Board also anticipate the use of further outside data sources in an ongoing effort to maintain best policies and practices with respect to compensation of key employees.

Severance and Change of Control Compensation

Generally our named executive officers are entitled to receive 3-12 months of salary and continued vesting in restricted stock for 3-12 months in the event of discharge. The specific amounts that each executive officer would receive are described below in the section titled "Employment Agreements and Other Potential Post-Employment Payments." The Compensation Committee and the Board believe such termination arrangements are necessary to secure and retain the services of experienced managers and provide value by contributing to stability of management.

Additionally, restricted stock grants to our named executive officers fully vest upon a change of control, even if the named executive officer is not discharged; provided that, the value of the shares that vest immediately cannot not exceed three times the named executive officers annual compensation. The Compensation Committee and the Board believes that these arrangements encourage executives to be receptive to changes, such as sale of the company or management changes that may benefit the Company and its stockholders though they may place an individual executive at risk and uncertainty with respect to future employment.

Other Benefits

All Company executive officers also participate in the Company's benefit programs, including the Company's 401(k) plan (which matches employee contributions up to 2% of salary) and its medical, dental and other benefits plans, on the same basis as other employees.

Tax Deductibility of Compensation

Section 162(m) of the U.S. Internal Revenue Code limits the Company's federal income tax deduction for certain executive compensation in excess of $1,000,000 paid to the Chief Executive Officer and the three other most highly compensated executive officers (excluding the Chief Financial Officer). Stock awards made to the CEO and at times others will cause their compensation to exceed $1,000,000 in those years and such compensation will not be fully deductible for federal income tax purposes. The Compensation Committee considers the tax and accounting consequences of using various forms of compensation.

Consideration of 2015 Say on Pay Vote

In 2015 the stockholders did not approve the compensation of the named executive officers. No significant grants of equity or cash incentive bonuses were awarded in 2015. As described above, the Compensation Committee and Board intend during 2016 to re-evaluate and amend certain aspects of the decision-making process used in setting our executives' compensation.

16

The following table sets forth the cash and non-cash compensation paid or incurred on our behalf to our Chief Executive Officer, our principal financial officer, and each of our three other most highly compensated executive officers, or our named executive officers, whose annual compensation equaled or exceeded $100,000 for the year three years ended December 31, 2015.

Name | Principal Position | Year | Salary | Bonus | GRANT DATE VALUE Stock Awards(a) | Non Equity Incentive Plan Compensation(d) | All other Compensation(b) | TOTAL | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Dave Schaeffer | CEO | 2015 | $ | 0 | $ | 0 | $ | 0 | $ | 112,170 | $ | 5,236 | $ | 117,406 | ||||||||||

| 2014 | $ | 343,000 | $ | 0 | $ | 16,086,000 | (c) | $ | 7,000 | $ | 16,436,000 | |||||||||||||

| 2013 | $ | 338,000 | $ | 0 | $ | 0 | $ | 5,000 | $ | 343,000 | ||||||||||||||

Thaddeus Weed | CFO | 2015 | $ | 269,000 | $ | 0 | $ | 0 | $ | 5,300 | $ | 274,300 | ||||||||||||

| 2014 | $ | 265,000 | $ | 0 | $ | 1,204,000 | (e) | $ | 6,000 | $ | 1,475,000 | |||||||||||||

| 2013 | $ | 261,000 | $ | 0 | $ | 0 | $ | 5,000 | $ | 266,000 | ||||||||||||||

Robert Beury | Chief Legal Officer | 2015 | $ | 267,000 | $ | 0 | $ | 0 | $ | 5,300 | $ | 272,300 | ||||||||||||

| 2014 | $ | 263,000 | $ | 0 | $ | 803,000 | (i) | $ | 6,000 | $ | 1,072,000 | |||||||||||||

| 2013 | $ | 259,000 | $ | 0 | $ | 0 | $ | 5,000 | $ | 264,000 | ||||||||||||||

Timothy O'Neill | VP | 2015 | $ | 261,000 | $ | 0 | $ | 0 | $ | 5,300 | $ | 266,300 | ||||||||||||

| 2014 | $ | 257,000 | $ | 0 | $ | 803,000 | (i) | $ | 6,000 | $ | 1,066,000 | |||||||||||||

| 2013 | $ | 254,000 | $ | 0 | $ | 0 | $ | 5,000 | $ | 259,000 | ||||||||||||||

James Bubeck | Chief Revenue Officer(j) | 2015 | $ | 186,000 | $ | 0 | $ | 133,000 | (k) | $ | 77,700 | $ | 5,260 | $ | 401,960 | |||||||||

Ernest Ortega | Former Chief Revenue Officer(h) | 2015 | $ | 229,000 | $ | 0 | $ | 0 | $ | 107,739 | $ | 0 | $ | 336,739 | ||||||||||

| 2014 | $ | 300,000 | $ | 0 | $ | 502,000 | (f) | $ | 149,000 | $ | 0 | $ | 951,000 | |||||||||||

| 2013 | $ | 125,000 | $ | 0 | $ | 1,167,000 | (g) | $ | 63,000 | $ | 0 | $ | 1,355,000 | |||||||||||

- (a)

- Amounts represent the grant date fair value of stock awards computed in accordance with FASB Accounting Standards Codification 718. For additional information regarding the assumptions used in determining these values, see Note 8 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2015.

- (b)

- Consists of employer matching amounts contributed to the Company's 401(k) defined contribution plan.

- (c)

- Consists of a restricted stock award of 460,000 shares made on August 6, 2014 valued at $34.97 per share of which 10,000 shares vest monthly from January 1, 2016 to December 31, 2018 and 100,000 shares vest on December 31, 2018.

- (d)

- Consists of cash compensation earned for performance against financial targets. See Grants of Plan Based Awards for a description of the criteria.

- (e)

- Consists of a restricted stock award of 36,000 shares made on November 3, 2014 valued at $33.45 per share of which 4,500 shares vest quarterly from March 1, 2017 to December 1, 2018.

- (f)

- Consist of a restricted stock award of 15,000 shares made on November 3, 2014 valued at $33.45 per share of which 3,000 shares vest quarterly from December 1, 2017 to December 1, 2018.

- (g)

- Consists of a restricted stock award of 40,000 shares made on August 1, 2013 valued at $29.18 per share, of which 10,000 shares vest on August 1, 2014, 2,500 shares vest quarterly until August 1, 2017

- (h)

- Mr. Ortega left the Company on September 30, 2015.

- (i)

- Consists of a restricted stock award of 24,000 shares made on November 3, 2014 valued at $33.45 per share of which 3,000 shares vest quarterly from March 1, 2017 to December 1, 2018.

- (j)

- Mr. Bubeck was promoted to our Chief Revenue Officer on October 1, 2015. As of that date his annual salary was increased to $200,000.

- (k)

- Consists of a restricted stock award of 5,000 shares made on September 28, 2015 valued at $26.50 per share, of which 1,250 shares vest on October 1, 2016, 313 shares vest quarterly until October 1, 2019.

On January 1, 2013, 2014, 2015 and 2016 the executive officers received a 1.5%, 1.5%, 1.5% and 2%, respectively, salary increase which was the same percentage increase that was granted to all employees (who had been with the Company for one year). These increases were intended simply to compensate (partially) for inflation.

17

Grants of Plan-Based Awards in Fiscal 2015

In 2015, only Mr. Bubeck received a grant of restricted stock (upon his promotion to Chief Revenue officer).

Mr. Bubeck's commission is based on sales as measured by revenue. If revenue for the month is 100% of the revenue target, he will receive 100% of $8,333 for the month. If the percentage is more or less he receives a proportionally lesser or greater amount. For example if revenue were at 50% of the target for the month, then he would be paid 50% of $8,333 or $4,167 for the month. If revenue were 200% of the target he would receive $16,667 for the month. (Prior to becoming Chief Revenue Officer Mr. Bubeck managed the central region of the U.S. and received a commission in that position.)

Mr. Schaeffer's performance-based cash bonus began in 2015 and is based on the growth of the Company's revenue and EBITDA, as adjusted. If the revenue growth equals or exceeds 15%, he will receive $250,000 and, separately, if EBITDA, as adjusted, growth equals or exceeds 20%, he will received $250,000. If the growth of the performance measures is less than the amount specified, he would receive a proportionally lesser amount. For example, if revenue growth equaled 7.5% and EBITDA growth equaled 15%, he would be paid 50% of $250,000 or $125,000 of the revenue growth bonus and 75% of $250,000 or $187,500 of the EBITDA growth bonus.

| | | | Estimated Future Payouts Under Non-Equity Incentive Plan Awards | All Other Stock Awards: Number of Shares of Stock or Units | | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | Grant Date Fair Value of Stock and Option Awards(a) | |||||||||||||||||

Name | Grant Date | NOTES | Threshold ($) | Target ($) | Maximum ($) | |||||||||||||||

Dave Schaeffer | (e) | — | $ | 500,000 | $ | 500,000 | ||||||||||||||

Thaddeus Weed | ||||||||||||||||||||

Ernest Ortega | (c) | |||||||||||||||||||

Robert Beury | ||||||||||||||||||||

Timothy O'Neil | ||||||||||||||||||||

James Bubeck | 9/28/2015 | (b)(d) | — | $ | 100,000 | unlimited | 5,000 | $ | 133,000 | |||||||||||

FOOTNOTES

- (a)

- Except as otherwise noted, amounts represent the grant date fair value of stock awards computed in accordance with FASB Accounting Standards Codification 718. For additional information regarding the assumptions used in determining these values, see Note 8 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2015.

- (b)

- Consist of a restricted stock award of 5,000 shares made on September 28, 2015 valued at $26.50 per share of which 1,250 shares vests on October 1, 2016 and 313 shares vest quarterly until October 1, 2019.

- (c)

- Mr. Ortega left the Company on September 30, 2015.

- (d)

- Mr. Bubeck was promoted to our Chief Revenue Officer on October 1, 2015. While in theory Mr. Bubeck's commission is unlimited it is in practice limited by the Company's ability to accept and install service for new customers. The performance measures of this annual commission are described in the text above.

- (e)

- Mr. Schaeffer's annual cash award is based on achieving revenue and EBITDA, as adjusted, targets as described in the text above.

18

Outstanding Equity Awards at Fiscal Year End

The following table shows the information regarding the options and stock held by our named executive officers on December 31, 2015.

| | | OPTION AWARDS | STOCK AWARDS | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name | | Number of Securities Underlying Unexercised Options Exercisable (#) | Number of Securities Underlying Un-exercised Options Unexercisable (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($)(a) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(i) | ||||||||||||||||||

Dave Schaeffer | (b) | 100,000 | $ | 3,469,000 | |||||||||||||||||||||||

| (c) | 360,000 | $ | 12,488,400 | ||||||||||||||||||||||||

Thaddeus Weed | (d) | 36,000 | $ | 1,248,840 | |||||||||||||||||||||||

| (e) | 12,000 | $ | 416,280 | ||||||||||||||||||||||||

| (f) | 25,000 | $ | 867,250 | ||||||||||||||||||||||||

James Bubeck | (h) | 830 | $ | 28,793 | |||||||||||||||||||||||

| (g) | 5,000 | $ | 173,450 | ||||||||||||||||||||||||

Robert Beury | (i) | 24,000 | $ | 832,560 | |||||||||||||||||||||||

| (j) | 12,000 | $ | 416,280 | ||||||||||||||||||||||||

Timothy O'Neill | (i) | 24,000 | $ | 832,560 | |||||||||||||||||||||||

| (j) | 12,000 | $ | 416,280 | ||||||||||||||||||||||||

FOOTNOTES

- (a)

- Valued using the closing market price of our common stock on December 31, 2015—$34.69

- (b)

- Shares vest on December 31, 2018.

- (c)

- Shares vest 10,000 shares monthly from January 1, 2016 until fully vested on December 1, 2018.

- (d)

- Shares vest 4,500 shares quarterly from March 1, 2017 until fully vested on December 1, 2018.

- (e)

- Shares vest 1,000 shares monthly until fully vested on December 1, 2016.

- (f)

- Shares vest on December 31, 2016.

- (g)

- Shares vest 1,250 on October 1, 2016 and 313 shares vest quarterly until October 1, 2019.

- (h)

- Shares vest quarterly from December 1, 2015 to December 1, 2018.

- (i)

- Shares vest 3,000 shares quarterly from March 1, 2017 until fully vested on December 1, 2018.

- (j)

- Shares vest 1,000 shares monthly until fully vested on December 1, 2016.

19

Option Exercises and Stock Vested Value

The following table shows information regarding option exercises by our named executive officers during the fiscal year ended December 31, 2015, and the value of stock awards at the time of vesting for stock awards that vested during the year.

| | Option Awards | Stock Awards | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name | Number of Shares Acquired on Exercise | Value Realized On Exercise | Number of Shares Acquired on Vesting | Value Realized On Vesting | |||||||||

Dave Schaeffer | 220,000 | $ | 7,413,500 | ||||||||||

Thaddeus Weed | 12,000 | $ | 394,450 | ||||||||||

Ernest Ortega | 7,500 | $ | 259,925 | ||||||||||

James Bubeck | 1,545 | $ | 52,965 | ||||||||||

Robert Beury | 12,000 | $ | 394,450 | ||||||||||

Timothy O'Neill | 12,000 | $ | 394,450 | ||||||||||

Employment Agreements and Other Potential Post-Employment Payments

Dave Schaeffer Employment Agreement. Dave Schaeffer has an employment agreement that provides for his services as Chief Executive Officer. He also receives all of our standard employee benefits. If he is discharged without cause or resigns for "good reason" he is entitled to a lump sum amount equal to his annual salary at the time and continuation of his benefits for one year. Under the terms of the grants of restricted stock that have been made to him in the event of death, disability, retirement or a change of control, 100% of his then unvested restricted stock will vest immediately; provided that, in the event of a change of control, the total dollar value of the restricted stock that immediately vests shall not exceed three times his annual compensation. The value on December 31, 2015 of the unvested restricted stock that could have vested pursuant to these provisions was $15,957,400. Had his employment been terminated without cause or had he resigned for "good reason" on December 31, 2015 he would have received no cash payment because he is not currently receiving a salary. He would have continued to vest in his restricted stock during his one year severance period and would have vested in certain other grants after the end of that severance period. The value on December 31, 2015 of that stock was $7,631,800. "Good reason" for resignation includes removal from his position as CEO or failure to elect him as chairman of the Board of Directors.

Thaddeus G. Weed Employment Agreement. Thaddeus Weed has an employment agreement under which he serves as Chief Financial Officer and Treasurer. In the event that his employment with us is terminated without cause or he resigns for good reason, the agreement entitles him to twelve months of salary and continuation of benefits for twelve months. Had this occurred on December 31, 2015 he would have received $269,000 (12 months' salary). Under the terms of the grants of restricted stock he is also entitled to continued vesting of his restricted stock during his severance period. The value on December 31, 2015 of the unvested stock for which vesting would continue was $1,283,530. In the event of death, disability, retirement, or a change of control he becomes fully vested in his restricted stock; provided that, in the event of a change of control, the total dollar value of the restricted stock that immediately vests shall not exceed three times his annual compensation. If this had occurred on December 31, 2015 the value of the restricted stock that would have vested was $2,532,370. In the event of a change of control resulting in his termination without cause or resignation for good reason, 100% of his then restricted stock will vest immediately and he will receive his severance payment as a lump sum.

Robert N. Beury, Jr. Employment Agreement. Robert Beury's employment agreement entitles him to twelve months of salary and twelve months of benefits in the event that his employment with us is

20

terminated without cause or he resigns for good reason. Had this occurred on December 31, 2015 he would have received $267,000 (twelve months' salary). Under the terms of the grants of restricted stock he is also entitled to continued vesting of his restricted stock during his severance period. The value on December 31, 2015 of the unvested stock for which vesting would continue was $416,280. In the event of death, disability, retirement, or a change of control the vesting of his restricted stock accelerates so that he will be 100% vested; provided that, in the event of a change of control, the total dollar value of the restricted stock that immediately vests shall not exceed three times his annual compensation. Had this occurred on December 31, 2015 the value of the restricted stock that would have vested was $1,248,840. In the event of a change of control resulting in his termination without cause or resignation for good reason, 100% of his then restricted stock will vest immediately and he will receive his severance payment as a lump sum.

James Bubeck. James Bubeck does not have an employment agreement with us. In the event of death, disability, retirement, or a change of control the vesting of his restricted stock accelerates so that he will be 100% vested; provided that, in the event of a change of control, the total dollar value of the restricted stock that immediately vests shall not exceed three times his annual compensation. Had this occurred on December 31, 2015 the value of the restricted stock that would have vested was $202,243.

Timothy G. O'Neill Employment Agreement. Timothy O'Neill's employment agreement provides that in the event his employment with us is terminated without cause or he resigns for good reason he will receive six months' salary and continuation of benefits for six months. Had this occurred on December 31, 2015 he would have received $130,500 (six months' salary). Under the terms of the grants of restricted stock he is also entitled to continued vesting of his restricted stock during his severance period. The value on December 31, 2015 of the unvested stock for which vesting would continue was $208,140. In the event of death, disability, retirement, or a change of control the vesting of his restricted stock accelerates so that he will be 100% vested; provided that, in the event of a change of control, the total dollar value of the restricted stock that immediately vests shall not exceed three times his annual compensation. Had this occurred on December 31, 2015 the value of the restricted stock that would have vested was $1,248,840. In the event of a change of control resulting in his termination without cause or resignation for good reason, 100% of his then restricted stock will vest immediately and he will receive his severance payment as a lump sum.

Director Compensation

Our non-management Board members were compensated in 2015 as follows for their services:

- •

- 7,500 shares of the Company's common stock paid in increments of 1,875 shares per quarter, and

- •

- $1,000 per in-person board meeting for each non-management director.

The following table shows the amounts earned or paid in 2015.

| | Fees Earned in Cash | Stock Awards(a) | TOTAL | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Blake Bath | $ | 3,000 | $ | 245,644 | $ | 248,644 | ||||

Steven Brooks | $ | 3,000 | $ | 245,644 | $ | 248,644 | ||||

Richard Liebhaber | $ | 5,000 | $ | 245,644 | $ | 250,644 | ||||

Marc Montagner | $ | 4,000 | $ | 245,644 | $ | 249,644 | ||||

Timothy Weingarten | $ | 4,000 | $ | 245,644 | $ | 249,644 | ||||

The compensation of David Schaeffer, who is a director and our Chief Executive Officer is disclosed in the Summary Compensation Table, above, and is therefore not shown in the Director Compensation table. He does not receive compensation for serving as a director.

21

- (a)

- Amounts represent the grant date fair value of stock awards computed in accordance with FASB Accounting Standards Codification 718. For additional information regarding the assumptions used in determining these values, see Note 8 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2015.

The Compensation Committee of the Board is responsible for determining compensation for the Company's executive officers and other employees, and administering the Amended and Restated 2004 Incentive Award Plan, the Company's management bonus plan and other compensation programs. The committee reviewed and discussed the Compensation, Discussion and Analysis with management and based on that review and discussion, recommended its inclusion in this proxy statement.

Compensation Committee:

Steven Brooks

Timothy Weingarten

RISK ASSESSMENT IN COMPENSATION PROGRAMS

The Company has reviewed and considered all of its compensation policies and practices and does not believe that its compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the Company.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During 2015:

- •

- Messrs. Brooks, and Weingarten served on the Compensation Committee;

- •

- None of the members of the Compensation Committee were an officer (or former officer) or employee of the Company or any of its subsidiaries;

- •

- None of the members of the Compensation Committee entered into (or agreed to enter into) any transaction or series of transactions with the Company or any of its subsidiaries in which the amount involved exceeds $120,000;

- •

- None of the Company's executive officers served on the compensation committee (or another board committee with similar functions) of any entity where one of that entity's executive officers served on the Company's Compensation Committee;

- •

- None of the Company's executive officers was a director of another entity where one of that entity's executive officers served on the Company's Compensation Committee; and

- •

- None of the Company's executive officers served on the compensation committee (or another board committee with similar functions) of another entity where one of that entity's executive officers served as a director on the Company's Board of Directors.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table provides summary information regarding beneficial ownership of our outstanding capital stock based on information available to the Company as of February 29, 2016, for:

- •

- each person or group who beneficially owns more than 5% of our capital stock on a fully diluted basis;

22

- •

- each of the executive officers named in the Summary Compensation Table;

- •

- each of our directors and nominees to become a director; and

- •

- all of our directors and executive officers as a group.