BURCON NUTRASCIENCE CORPORATION

1946 West Broadway

Vancouver, B.C.

V6J 1Z2

Telephone: (604) 733-0896

Facsimile: (604) 733-8821

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED MARCH 31, 2018

June 18, 2018

TABLE OF CONTENTS

(i)

(ii)

(iii)

PRELIMINARY NOTES

Effective Date of Information

All information in this Annual Information Form ("AIF") is as of March 31, 2018 unless otherwise indicated.

Forward Looking Statements

This AIF contains certain "forward-looking statements" and "forward-looking information" as defined under applicable Canadian and US securities laws (collectively, "forward-looking statements") which may include, but are not limited to, statements with respect to possible events, conditions, acquisitions, or results of operations that are based on assumptions about future conditions and courses of action and include future oriented financial information with respect to prospective results of operations, financial position or cash flows that is presented either as a forecast or a projection, and also include, but are not limited to, statements with respect to the future financial and operating performance of the Company. All statements, other than statements of historical fact, are forward-looking statements. When used in this AIF the words "estimate", "budget", "project", "believe", "anticipate", "intend", "expect", "plan", "projects", "predict", "may", "should", "will", or the negatives of these words or other variations thereof and comparable terminology or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved are intended to identify forward-looking statements. The forward-looking statements pertain to, among other things:

- continued development of the Company's products and business;

- the Company's growth strategy;

- production costs and pricing of CLARISOY® soy protein, Peazazz® pea protein, Puratein®, Supertein® and Nutratein® canola protein isolates;

- marketing strategies for the Company's soy, pea and canola proteins;

- development of commercial applications for soy, pea and canola protein proteins;

- ability to produce proteins and protein isolates in commercial quantities with sufficient grade and quality at cost-effective prices;

- construction , commissioning and operation of production facilities;

- future protection of intellectual property and improvements to existing processes and products;

- input and other costs; and

- liquidity and working capital.

The forward-looking statements are based on a number of key expectations and assumptions made by management of the Company, including, but not limited to:

- the Company's ability to obtain required regulatory approvals;

- the Company's or its licensing partner's ability to generate new sales;

- the Company's or its licensing partner's ability to produce, deliver and sell the expected product volumes at the expected prices;

- the Company's ability to control costs;

- the Company's ability to obtain and maintain intellectual property rights and trade secret protection;

- market acceptance and demand for the Company's products;

- the successful execution of the Company's business plan;

- achievement of current timetables for product development programs and sales;

- the availability and cost of labour and supplies;

- the availability of additional capital; and

- general economic and financial market conditions.

Although the Company believes that the factors and assumptions used to develop the forward-looking statements are reasonable, undue reliance should not be placed on such forward-looking statements. The forward-looking statements reflect the Company's current views with respect to future events based on currently available information and are inherently subject to risks and uncertainties. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements contained in this AIF, including, but not limited to:

- the condition of the global economy;

- market acceptance of the Company's products;

- changes in product pricing;

- changes in the Company's customers' requirements, the competitive environment and related market conditions;

- delays in the construction, commissioning and operation of production facilities;

- product development delays;

- changes in the availability or price of labour and supplies;

- the Company's ability to attract and retain business partners, suppliers, employees and customers;

- changing food or feed ingredient industry regulations;

- the Company's access to funding and its ability to provide the capital required for product development, operations and marketing efforts, and working capital requirements; and

- the Company's ability to protect its intellectual property.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. The Company cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated, described or intended. The Company disclaims any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect changes in assumptions or the occurrence of anticipated or unanticipated events, except as required by law.

The Company qualifies all the forward-looking statements contained in this AIF by the foregoing cautionary statements.

Material risk factors that could cause actual results to differ materially from the forward-looking information are contained under the heading "Risk Factors" beginning on page 52.

Currency

All dollar amounts in this AIF are expressed in Canadian dollars, unless otherwise indicated.

Glossary

Certain terms used herein are defined in the attached Glossary.

CORPORATE STRUCTURE

Burcon NutraScience Corporation ("Burcon" or the "Company") was incorporated under the Business Corporations Act (Yukon) on November 3, 1998 under the name "Burcon Capital Corp." and extra-provincially registered in British Columbia on February 5, 1999. Burcon changed its name to "Burcon NutraScience Corporation" on October 18, 1999. The head office of Burcon is located at 1946 West Broadway, Vancouver, B.C., V6J 1Z2. The registered office of Burcon is located at Suite 200, Financial Plaza, 204 Lambert Street, Whitehorse, Yukon, Y1A 3T2.

INTERCORPORATE RELATIONSHIPS

Burcon owns 100% of the issued and outstanding shares of its subsidiary, Burcon NutraScience (MB) Corp. ("Burcon-MB") which was incorporated under the Corporations Act (Manitoba) on February 28, 1992 under the name B.M.W. Canola Inc. Its name was changed to Burcon NutraScience (MB) Corp. on May 30, 2000.

GENERAL DEVELOPMENT OF THE BUSINESS

Burcon was formed in November 1998 as a venture capital pool corporation whose principal business was to identify and evaluate assets, properties or businesses for acquisition. On October 8, 1999 Burcon acquired Burcon-MB.

Since October 1999, Burcon has raised gross proceeds of approximately $74.8 million through the sale of equity securities on both a public and private basis, the exercise of stock options and share purchase warrants, through rights offerings to existing shareholders and issuance of convertible securities. The proceeds have been used, and will continue to be used, to fund research, development, regulatory recognition and commercialization of Burcon's patented and patent-pending protein extraction and purification technologies. Burcon's technologies not only enable the production of plant proteins and protein isolates but also relate to applications of the proteins produced therefrom into products, including food and beverages.

Burcon's common shares were listed on the Toronto Stock Exchange (the "TSX") in June 2009. Prior thereto, Burcon's common shares were listed on the TSX Venture Exchange (the"TSXV"). The Company's common shares are also listed on the Frankfurt Stock Exchange under the symbol "BNE".

On October 27, 2011, Burcon's common shares commenced trading on The NASDAQ Global Market ("NASDAQ Global Market") under the symbol "BUR". On June 8, ,2017, the Company received a letter from the Listings Qualifications Department of the Nasdaq Stock Market LLC ("NASDAQ") notifying the Company that it was not in compliance with Listing Rule 5450(b)(2), which requires the listed securities of the Company to maintain a minimum market value of US$50 million. The Company had not met the requirement for a period of 30 consecutive business days prior to receipt of the NASDAQ letter. On August 21, 2017, the Company received a second letter from NASDAQ notifying the Company that it was not in compliance with Listing Rule 5450(a)(1), which requires the listed securities of the Company to maintain a minimum bid price of US$1 per share. The Company had not met the requirement for a period of 30 consecutive business days prior to receipt of the second NASDAQ letter. The receipt of the two NASDAQ letters did not result in the immediate delisting of the Company's common shares from the NASDAQ Global Market. The Company had a compliance period of 180 calendar days or until December 5, 2017 and February 19, 2018, to regain compliance with NASDAQ's minimum market value of listed securities requirement and minimum bid price requirement, respectively. On December 6, 2017, the Company received notification from NASDAQ stating the Company did not meet the December 5, 2017 deadline to regain compliance with NASDAQ's minimum market value of listed securities requirement. NASDAQ stated that the Company's common shares would be delisted from the NASDAQ Global Market at the opening of business on December 15, 2017 unless the Company submitted a request to appeal the determination to the NASDAQ hearing Panel (the "Panel") by December 13, 2017. On the same day, the Company received a further letter from NASDAQ notifying the Company that it was not in compliance with Listing Rule 5450(b)(2)(C), which requires the listed securities of the Company to maintain a minimum market value of publicly held shares of US$15 million. The Company had not met the requirement for a period of 30 consecutive business days prior to receipt of the second NASDAQ letter on December 6, 2017. The Company submitted an appeal to the Panel together with a plan for regaining compliance with the various continued listing requirements.

On February 5, 2018 the Company received notification from the Panel granting the Panel's approval for the Company to transfer its listing for its common shares from the NASDAQ Global Market to The NASDAQ Capital Market ("NASDAQ Capital Market"). Trading on the Company's common shares on the NASDAQ Capital Market became effective on February 7, 2018. The Panel subjected the continued listing of the Company's shares on the NASDAQ Capital Market to certain conditions, including closing its 2018 Rights Offering (defined below) and having shareholders' equity of over US$2.5 million on or before February 16, 2018. On February 14, 2018, Burcon announced that the 2018 Rights Offering had closed. However, because the 2018 Rights Offering was not fully subscribed, the Company was required to provide additional submissions to the Panel in support of its compliance plan. On April 24, 2018, the Company withdrew its appeal of the delisting. The board of directors of Burcon determined that it was in the overall best interest of the Company to withdraw the appeal of the delisting. The decision was based on several factors, including the board's assessment of the probability of the Company regaining compliance with the continued listing requirements, an analysis of the benefits of continued listing weighed against the onerous regulatory burden and significant costs associated with maintaining the continued listing. On April 27, 2018, the Company's common shares were suspended from trading on the NASDAQ Capital Market. The Company filed a Form 25 (Notification of Removal from Listing and/or Registration under Section 12(b) of the Securities Exchange Act of 1934) with the United States Securities and Exchange Commission (the "SEC") on June 4, 2018 to delist the Company's common shares from the NASDAQ Capital Market and to deregister its common shares under Section 12(b) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The delisting became effective on June 14, 2018 and the deregistration will become effective ninety days from June 4, 2018. On June 15, 2018, the Company filed a Form 15 with the SEC to suspend its reporting obligations under Section 15(d) of the Exchange Act. The Company's reporting obligations with the SEC were suspended upon the filing of the Form 15 and shall remain suspended for as long as the Company continues to meet the criteria for such suspension on the first day of any subsequent fiscal year. The common shares of Burcon are quoted for trading in the United States on the OTC Pink Open Market operated by OTC Markets Group, under the ticker "BUROF".

On March 23, 2015, Burcon announced that it would be offering rights (the "2015 Rights Offering") to holders of its common shares of record at the close of business on April 2, 2015 (the "2015 Record Date"). Pursuant to the 2015 Rights Offering, each holder of common shares on the 2015 Record Date received one transferable right for each common share held. Every 22 rights entitled a holder to purchase one common share at a price of $2.26 per share. Burcon announced on May 1, 2015 that it had completed the Rights Offering. The 2015 Rights Offering was fully subscribed and Burcon issued 1,552,044 common shares at a price of $2.26 per common share for aggregate gross proceeds to Burcon of $3,507,619.

Each of PT International Development Corporation Limited ("PT International"), E-Concept Ltd. ("E-Concept") and I-Global Ltd. ("I-Global") acted as guarantors of the 2015 Rights Offering, having agreed to purchase from Burcon such number of common shares available to be purchased, but not otherwise subscribed for, that would result in a minimum of 1,552,044 common shares being issued under the 2015 Rights Offering (the "2015 Standby Commitment"). As the 2015 Rights Offering was over-subscribed, PT International, E-Concept and I-Global were not required to fulfill their respective obligations under the 2015 Standby Commitment. However, to Burcon's knowledge, each of PT International, E-Concept and I-Global did exercise its basic subscription privilege under the 2015 Rights Offering in order to maintain its respective proportionate ownership interest in Burcon.

As compensation for providing the 2015 Standby Commitment, each of PT International, E-Concept and I-Global received non-transferrable common share purchase warrants (the "2015 Standby Warrants") entitling PT International to acquire up to 198,429 common shares, E-Concept to acquire up to 104,220 common shares and I-Global to acquire up to 85,362 common shares. The exercise price under the 2015 Standby Warrants was $2.26 per common share. The 2015 Standby Warrants had a term expiring two years after the closing of the 2015 Rights Offering, being April 30, 2017. In accordance with the policies of the TSX, the issuance of the 2015 Standby Warrants to each of PT International, E-Concept and I-Global was subject to shareholder approval. Shareholder approval was received at Burcon's annual and special meeting held on September 3, 2015. Upon completion of the 2016 Rights Offering (as defined below), the exercise price of the 2015 Standby Warrants was adjusted effective immediately after the 2016 Record Date (as defined below). After the adjustment, the exercise price of the 2015 Standby Warrants was reduced to $2.25 per common share. PT International, E-Concept and I-Global did not exercise their 2015 Standby Warrants prior to the expiry and such warrants lapsed on April 30, 2017.

On April 7, 2016, Burcon announced that it had entered into a convertible note purchase agreement pursuant to which it would issue a convertible note (the "Note") to Large Scale Investments Limited (the "Lender"), a wholly-owned subsidiary of PT International, for the principal amount of $2,000,000 (the "Principal Amount").

Funding by the Lender and the issuance of the Note occurred on May 12, 2016. The Note bears interest at a rate of 8% per annum, calculated daily, compounded monthly. Interest will accrue on the Principal Amount and will be payable on the earlier of three years from the issue of the Note, the occurrence of an event of default as set out in the Note, or voluntary prepayment by Burcon (the "Maturity Date").

The Lender may convert the Principal Amount in whole or in part into common shares in the capital of Burcon at any time commencing on or after July 1, 2016 and up to and including the Maturity Date. When issued, the conversion price of the Note was $4.01 per common share, which represented a premium of approximately 24% over the volume weighted average trading price of the common shares on the TSX for the 5 trading days immediately before April 7, 2016 (the "Conversion Price"). Burcon also has the right, before the Maturity Date, upon written notice to the Lender of not less than thirty (30) days, to prepay in cash all or any portion of the Principal Amount by paying to the Lender an amount equal to the Principal Amount to be prepaid multiplied by 110%. At any time on or after July 1, 2016 and up to the end of such 30-day notice period, the Lender will have the right to convert the Principal Amount in full or in part, into common shares at the Conversion Price. The Note was and any common shares issued upon the conversion of the Note will be subject to a four month hold period under applicable Canadian securities laws. Upon completion of the 2018 Rights Offering (as defined below), the Conversion Price of the Note was adjusted effective immediately after the 2018 Record Date (as defined below). After the adjustment, the Conversion Price was reduced to $3.94 per common share.

The payment of the Principal Amount and all accrued and unpaid interest thereon will be subordinated in right of payment to any amount owing in respect of secured indebtedness of Burcon. Subject to prior TSX approval and the consent of the Lender, Burcon may pay any interest that is due and payable under the Note through the issuance of common shares at a conversion price equal to the volume weighted average trading price of the common shares on the TSX for the 5 trading days immediately prior to the date such interest is due and payable.

On October 24, 2016, Burcon announced that it would be offering rights (the "2016 Rights Offering") to holders of its common shares of record at the close of business on November 3, 2016 (the "2016 Record Date"). Pursuant to the 2016 Rights Offering, each holder of common shares on the 2016 Record Date received one transferable right for each common share held. Every 18 rights entitled a holder to purchase one common share at a price of $2.58 per share. Burcon announced on December 1, 2016 that it had completed the Rights Offering. The 2016 Rights Offering was fully subscribed and Burcon issued 1,990,708 common shares at a price of $2.58 per common share for aggregate gross proceeds to Burcon of $5,136,027.

PT International and Allan Yap, Burcon's Chairman and Chief Executive Officer, acted as guarantors of the 2016 Rights Offering, having agreed to purchase from Burcon such number of common shares available to be purchased, but not otherwise subscribed for, that would result in 1,990,708 of common shares being issued under the 2016 Rights Offering (the "2016 Standby Commitment"). As the 2016 Rights Offering was over-subscribed, PT International and Allan Yap were not required to fulfill their respective obligations under the 2016 Standby Commitment. However, to Burcon's knowledge, each of PT International and Allan Yap did exercise their basic subscription privilege under the 2016 Rights Offering in order to maintain their respective proportionate ownership interest in Burcon.

As compensation for providing the 2016 Standby Commitment, each of PT International and Allan Yap received non-transferrable common share purchase warrants (the "2016 Standby Warrants") entitling PT International to acquire up to 253,815 common shares and Allan Yap to acquire up to 243,862 common shares. The exercise price under the 2016 Standby Warrants is $2.58 per common share. The 2016 Standby Warrants will expire two years after the closing of the 2016 Rights Offering, being November 30, 2018. In accordance with the policies of the TSX, the issuance of the 2016 Standby Warrants to each of PT International and Allan Yap was subject to shareholder approval. Shareholder approval was received at Burcon's annual and special meeting held on September 7, 2017. Upon completion of the 2018 Rights Offering (as defined below), the exercise price of the 2016 Standby Warrants was adjusted effective immediately after the 2018 Record Date (as defined below). After the adjustment, the exercise price of the 2016 Standby Warrants was reduced to $2.54 per common share.

On January 5, 2018, Burcon announced that it would be offering rights (the "2018 Rights Offering") to holders of its common shares of record at the close of business on January 16, 2018 (the "2018 Record Date"). Pursuant to the 2018 Rights Offering, each holder of common shares on the 2018 Record Date received one transferable right for each common share held. Every 4 rights entitled a holder to purchase one common share at a price of $0.57 per share. Burcon announced on February 14, 2018 that it had completed the Rights Offering. The 2018 Rights Offering was not fully subscribed and Burcon issued 6,114,361 common shares at a price of $0.57 per common share for aggregate gross proceeds to Burcon of $3,485,186.

Allan Yap, Burcon's Chairman and Chief Executive Officer, acted as guarantor of the 2018 Rights Offering, having agreed to purchase from Burcon such number of common shares available to be purchased, but not otherwise subscribed for, that would result in 4,728,397 of common shares being issued under the 2018 Rights Offering (the "2018 Standby Commitment"). As the total number of common shares subscribed for under the 2018 Rights Offering exceeded the number of common shares guaranteed by Allan Yap, Mr. Yap was not required to fulfill his obligations under the 2018 Standby Commitment.

As compensation for providing the 2018 Standby Commitment, Allan Yap is entitled to receive non-transferrable common share purchase warrants (the "2018 Standby Warrants") entitling him to acquire up to 1,182,099 common shares. The exercise price under the 2018 Standby Warrants is $0.69 per common share. The 2018 Standby Warrants will expire two years after the closing of the 2018 Rights Offering, being February 13, 2020. In accordance with the policies of the TSX, the issuance of the 2018 Standby Warrants to Allan Yap is subject to shareholder approval. Shareholder approval will be sought at Burcon's annual and special meeting, which is expected to be held in September, 2018.

The Company's fiscal year end is March 31. During fiscal years 2016 to 2018, Burcon raised a total of approximately $12.5 million in capital as follows:

- In April 2015, Burcon completed the 2015 Rights Offering and raised gross proceeds of approximately $3.5 million as described above.

- In March 2016, PT International exercised the 2014 Standby Warrants for gross proceeds of approximately $335,000.

- In November 2016, Burcon completed the 2016 Rights Offering and raised gross proceeds of approximately $5.1 million as described above.

- In February, 2018, Burcon completed the 2018 Rights Offering and raised gross proceeds of approximately $3.5 million as described above.

In addition to the capital raised, Burcon issued the Note for $2.0 million in May 2016 as described above.

The proceeds raised from the transactions described above have been used and will continue to be used to:

- further develop Burcon's protein extraction and purification technologies and pursue new related products;

- pursue and develop new applications from the functional attributes of Burcon's proteins;

- fund Burcon's patent activities;

- fund the activities associated with Burcon's obligations under the License and Production Agreement with ADM, for the commercialization of Burcon's CLARISOY® soy protein;

- supporting ADM in connection with its commercialization of CLARISOY® soy protein;

- fund the activities associated with identifying, negotiating terms and securing a strategic alliance for the commercialization of Burcon's Peazazz® pea protein;

- fund the activities associated with efforts relating to identifying a strategic partner for the commercialization of Burcon's canola protein isolates and other proteins;

- fund the design, engineering and construction of an initial semi-works facility for the commercial production of Peazazz® pea protein; and

- provide general working capital.

Soy

Soy protein isolate is used as a functional ingredient or fortifier in a wide variety of food products including protein shakes, power bars, soups and sauces, meats and meat analogs, and breads and baked goods. In addition to enhancing the protein content of foods, soy protein isolates are used by food manufacturers for their functional applications. These applications include the ability to emulsify, whip, bind and add viscosity to foods. See "Description of the Business".

Burcon has developed technologies to extract and purify soy protein from a variety of soy materials. These technologies encompass various processes to produce a soy protein which Burcon has branded as "CLARISOY®". One process for producing CLARISOY® soy protein results in a unique soy protein which is 100% soluble and transparent in applications with a pH of 4.0 and below. ADM has branded this soy protein as CLARISOY® 100. CLARISOY® 100 is specifically designed to enable beverage manufacturers to meet the demand for great-tasting, nutritionally enhanced beverages targeted to the ever-growing number of health and wellness minded consumers. Unique to any other proteins on the market, CLARISOY® 100 is the only vegetable-based protein that offers clarity and complete protein nutrition for low pH beverage systems. Potential beverage applications for CLARISOY® 100 include: sports nutrition beverages, citrus-based drinks, fruit-flavoured beverages, lemonades, powdered beverage mixes, fruit juice blends and fortified waters.

Another process for producing CLARISOY® soy protein allows for the production of a soy protein specifically processed for use in beverage systems with a pH of less than 4.0 with cloud systems or beverages neutralized to a pH of 7.0 or higher. ADM has branded this soy protein CLARISOY® 150. Due to its clean flavour and high solubility in higher pH ranges, CLARISOY® 150 allows for greater use of soy protein in mildly flavoured neutral beverages such as meal replacement, weight management products and in numerous non-beverage applications such as foods and nutritional products.

On March 4, 2011, Burcon, Burcon-MB and ADM entered into the License and Production Agreement for the worldwide, exclusive production, marketing and sale by ADM of soy protein products using Burcon's CLARISOY® soy protein technology. See "Material Contracts".

On June 18, 2012, Burcon announced that ADM had constructed and was operating a commercial-scale production plant in Decatur, Illinois to produce CLARISOY® 100, the first product to launch in ADM's line of CLARISOY® soy proteins.

On June 26, 2012, Burcon announced that ADM would launch CLARISOY® 150, the first extension of the CLARISOY® product line at the opening of the 2012 Institute of Food Technologists Annual Meeting and Food Expo ("IFT Expo") in Las Vegas on June 26, 2012.

On October 22, 2012, Burcon announced that ADM earned the Best Beverage Ingredient Concept prize for CLARISOY® soy protein at the 2012 InterBev Awards ceremony in Las Vegas, Nevada.

On December 19, 2012, Burcon announced that it had been notified by ADM of the first commercial sale of CLARISOY® soy protein produced by ADM.

On August 13, 2013, Burcon announced that the Canadian Institute of Food Science and Technology recognized the development and introduction of CLARISOY® as a "significant innovation" with its 2013 Food Innovation Award, and highlighted CLARISOY® as the world's first vegetable-based protein that offers clarity and high quality protein nutrition in low pH food systems. Burcon also announced that ADM launched CLARISOY® 120 in a powdered mix prototype called "Pineapple Shakeup" at the IFT Expo in July 2013. CLARISOY® 120 is designed for powdered drinks and drink mixes allowing for easy and rapid dispersibility when added to a liquid.

On March 6, 2014, Burcon announced that it received written notice from ADM that ADM intends to expand to full-scale commercial production of CLARISOY® soy protein pursuant to the License and Production Agreement. ADM's intention to expand commercial production of CLARISOY® ensures that its production capacity meets the required obligations under the License and Production Agreement to retain its exclusive license for CLARISOY®.

On June 23, 2014, Burcon announced that ADM would be demonstrating CLARISOY® 170, the newest product in the CLARISOY® portfolio, at the 2014 IFT Expo in New Orleans. CLARISOY® 170 is formulated to be ideal for dairy protein replacement, which could include neutral beverage applications with pH of 7.0 or higher.

At the 2015 Institute of Food Technologists Annual Meeting & Food Expo in Chicago, ADM sampled a high protein smoothie product which included 17 grams of protein per 8 ounce serving, where the primary protein source was CLARISOY®. At the same show, ADM demonstrated a 100% dairy-free vegan rich vanilla soft serve where CLARISOY® was the sole protein source. For customers seeking a convenient, delicious and nutritious beverage, ADM showcased a dairy-free cold brew coffee that featured CLARISOY® containing, non-dairy creamer, adding 5 grams of soy protein to the beverage.

These applications demonstrate how CLARISOY® is well-suited for adding protein, nutrition and functionality to everyday products, and how it excels particularly in beverage applications due to its clean favor and smooth mouthfeel. These applications can help meet consumer demand for good-tasting, convenient products featuring plant-based protein and also provide solutions for customers looking to replace dairy protein for products that appeal to consumers who choose a vegan or other healthy lifestyles. ADM's focus on dairy replacement using CLARISOY® not only provides a price-stable and sustainable ingredient for food and beverage manufacturers, but also addresses the large consumer base that is lactose intolerant or sensitive to dairy products.

At the 2016 Institute of Food Technologists Annual Meeting & Food Expo in Chicago, ADM showcased three unique products that emphasize the current trends of convenient wellness, plant-based protein ingredients and free-from. ADM sampled a high protein vegan smoothie which contained 17 grams of protein per 8 ounce serving, where the primary protein source was CLARISOY™. ADM also demonstrated a non-dairy Greek yogurt that contained 12 grams of protein per 150 gram serving, in which only CLARISOY® was used as the sole protein source. Targeting the convenient ready-to-drink beverage market, ADM showcased a drinkable yogurt beverage that contained 4 grams of CLARISOY® soy protein per serving.

At the 2017 Institute of Food Technologists Annual Meeting & Food Expo in Las Vegas, ADM featured two products containing CLARISOY® soy protein and other ADM ingredients: Plant Power Frappe - a cold-brewed coffee containing 10 grams of soy protein where the primary protein source was CLARISOY®; and Bourbon Barrel Coffee Creamer - a low calorie, non-dairy creamer where CLARISOY® was gain the primary protein source.

ADM has also launched an energy drink suitable for vegans made with CLARISOY®. This product is available in the United States and European markets.

ADM continues to market CLARISOY® as a versatile soy protein ingredient well-suited to boosting the nutritional and functional profile of many different products. CLARISOY®, having clean flavor and high solubility, is exceptional in beverage products including ready-to-drink beverages. Customers that are looking for plant-based protein ingredients to formulate vegan or non-dairy products will find CLARISOY® to be an attractive protein source. Not only is CLARISOY® suitable for high protein fortification products such as meal replacements and sport nutrition smoothies but is also suitable for casual wellness products that require a bit of protein boost.

On December 17, 2015, Burcon announced that it expected ADM's first full-scale commercial CLARISOY® production facility to be operational by mid-2016. On November 8, 2016, Burcon announced that ADM had successfully commissioned the first full-scale CLARISOY® production facility.

Since March 2013 to the date of this AIF, Burcon has been granted fourteen U.S. patents covering its soy protein composition and extraction and purification processes.

Pea

Pea protein is increasing in popularity as a plant-based protein ingredient which can be used in a wide variety of food products. One of the reasons is that pea protein is able to deliver functionality and protein nutrition to products without the issues of allergenicity and genetic modification that may be present with other proteins. Pea proteins currently available in the market are sold for use in a variety of food products including: snacks and cereals; diet products (high protein foods); gluten-free and vegetarian and vegan foods as well as in nutritional supplements such as meal replacement shakes.

In November 2011, Burcon announced that it had developed a novel pea protein which it has branded as "Peazazz®". Peazazz® is 100% soluble and transparent in low pH solutions with clean flavour characteristics. It is heat stable permitting hot fill applications. See "Description of the Business".

On January 29, 2013, Burcon announced that it had commenced building a Peazazz® semi-works production facility to produce Peazazz® pea protein at small commercial scale in Winnipeg, Manitoba to provide market development quantities to customers for product and market development activities.

On June 25, 2013, Burcon announced that it had completed, on schedule, the construction of its new semi-works plant in Winnipeg for Peazazz®. The Peazazz® semi-works plant utilizes commercial-scale equipment capable of producing the tonnage amounts required by food and beverage makers looking to conduct full-scale, real world market evaluations of Peazazz® in their consumer products.

In July 2013, Burcon officially launched Peazazz® pea protein at the 2013 IFT Expo. Burcon demonstrated two products: Peach Mango Rhythm, made from 30% real juice, with all natural flavors and containing five grams of Peazazz® pea protein per 250ml serving and Vanilla Jazz, a neutral pH milk-style beverage with a faint hint of vanilla flavoring, fortified with vitamins and minerals and five grams of Peazazz® pea protein per 250ml serving.

On August 23, 2013, Burcon announced that the startup and commissioning of the Peazazz® pea protein semi-works plant had been completed, allowing it to begin producing sample quantities for shipment to interested parties who had signed material transfer agreements ("MTAs") with Burcon. While the semi-works plant utilizes commercial-scale equipment, it is only used to produce the amounts of Peazazz® needed for targeted market development activities with certain prospective customers. By functioning as a model for potential manufacturing partners to emulate, the plant can also ultimately shorten their time-to-market. Burcon has entered into a number of MTAs with parties interested in Peazazz®. Such parties include major food and beverage makers, suppliers and potential industry production and sales partners. Since August 2013, Burcon has shipped samples of Peazazz® pea protein to various key potential multi-national production and/or distribution partners and undertook applications work in response to requests from certain potential commercialization partners. Burcon continued discussions with certain multi-national food ingredient providers about a royalty or a joint operations agreement for Peazazz® during fiscal 2018. As of the date of this AIF, discussions are still on-going with these parties.

Canola

Burcon's technologies allow it to extract and purify three types of canola protein isolates from canola meal, a co-product (together with canola oil) of the canola seed crushing industry. Burcon has branded these protein isolates under the trade names "Puratein®", "Supertein®" and "Nutratein®".

The goal of Burcon's research is to develop its patented and patent-pending processes to utilize inexpensive oilseed meals, such as canola meal, for the production of purified plant proteins that exhibit nutritional, functional or nutraceutical profiles. Burcon expects that Puratein® canola protein isolate and Supertein® canola protein isolate will participate and compete with soy, dairy, and egg proteins in the expanding global protein ingredient market, with potential uses in prepared foods, nutritional supplements and personal care products. Nutratein®, having an excellent amino acid profile, is expected to be suitable in nutritional supplements, meal replacement products, high-protein foods and beverages and high-value animal feed.

During fiscal 2018, Burcon's key focus was on its pea protein commercialization efforts. However, Burcon continued to work on securing interest from potential partners to establish the commercial value of all three of its canola proteins. Burcon's goal is to work with food and beverage manufacturers to establish the value of Burcon's proteins in their food products, as well as to work with upstream canola processors to demonstrate how Burcon's technologies can add value to their canola meal products.

Specialty Proteins and Phytochemical Extractions

Burcon's extraction and purification technologies can also be used to produce specialty proteins such as flax and hemp proteins. Burcon's core extraction and purification technology is versatile and can be adapted to process a range of oilseed and non-oilseed meals to produce high-value protein products for use in the food and beverage industries.

The demand for plant proteins in the protein market continues to grow and as such, Burcon believes that there may be niche market opportunities for its specialty protein ingredients. Burcon plans to explore these opportunities in the near future.

In February 2018, Burcon applied for accreditation from Health Canada's Office of Controlled Substances to conduct research for the future commercial production of purified cannabinoid extracts. Burcon submitted an application for a Controlled Drugs and Substances Dealers License to Health Canada and intends to also pursue partnering opportunities with growers and suppliers of hemp and cannabis input materials. The Office of Controlled Substances commits to a service delivery standard of 180 business days for the issuance of a decision on an application for a new dealer's licence for controlled substances, from the receipt of a complete application. If Burcon receives the license, it expects to apply its extensive experience in phytochemical extraction technologies to develop technologies for the production of highly-purified cannabis-derived compounds.

DESCRIPTION OF THE BUSINESS

The protein ingredient industry continues to experience rapid growth, with plant proteins in particular experiencing high demand. This increase in demand for plant proteins is fuelled in part by scientific advances, changing demographics as well as by the public's changing perception of the safety of animal-based products. External issues such as melamine tampering/contamination, mad cow disease, E. coli, swine flu, avian flu and the growing use of antibiotics in animal production, as well as demographic trends are all combining to produce significant demand for plant proteins.

Two major attributes are relevant to the commercial value of protein as an ingredient: functional value and nutritional value.

Functional Value

Proteins possess a wide range of attributes essential to the structure and textural integrity of food products. These relevant properties include: solubility, viscosity, water-binding, gelation, cohesion, adhesion, elasticity, emulsification, foaming, whipping, fat-binding, film forming and flavour-enhancing qualities.

In weighing the commercial potential of any protein ingredient, functional utility is at least as important as nutritional value. For example, although the nutritional value of wheat protein is comparatively low, (the Protein Digestibility Corrected Amino Acid Score ("PDCAAS") of whole wheat is 0.40, only wheat protein-called gluten-will make a traditional loaf of bread. Thus, the functionality of wheat protein makes it a staple in the North American diet. At the

top end of the functional scale, egg white protein will whip, coagulate, and form films. Such functional versatility makes egg white one of the most valuable food proteins. Certain of Burcon's proteins can be made to mimic many of egg's functions, and in certain instances can outperform egg.

Nutritional Value

Proteins are organic compounds made up of carbon, hydrogen, oxygen and nitrogen. It is the presence of the nitrogen that sets proteins apart from other nutrients. Nitrogen is essential to human life, but since we have no other source of nitrogen-unlike plants, we are unable to absorb it as a nutrient from the ground-one of the most important roles of dietary protein is to bring nitrogen into the body.

Proteins are made up of sub-units called amino acids. There are twenty dietary amino acids, typically subdivided into two categories: non-essential amino acids, which can be made within the body, and essential amino acids which must come from diet.

Amino acids supplied from dietary protein are needed for synthesis of body proteins in muscle, organs, bone and skin, and for synthesis of enzymes, certain hormones, antibodies and a host of bodily processes.

The essential amino acids are lysine, methionine + cysteine, threonine, tryptophan, leucine, isoleucine, valine, phenylalanine, arginine and histidine (adults do not require a dietary supply of arginine).

A diet deficient in one or more of the essential amino acids impairs growth in children, causes adults to lose muscle mass, and lowers the body's resistance to a variety of diseases. Extreme protein deficiency can be a cause of death. An adequate daily supply of high-quality protein is essential to optimal growth and health.

The nutritional supplements industry has seen rapid growth in the use of protein ingredients over the past ten years. Protein bars, once consumed only by endurance athletes, are now widely available and protein-rich meal-replacement products and dietary supplements have become supermarket staples and are sold in large quantities through all the major multi-level marketing companies. Protein supplements are also increasingly and successfully being promoted to the expanding market of geriatric consumers. Potential nutritional applications for protein isolates include power shakes, protein bars, protein powders and any other concentrated protein supplement.

Soy

The soybean had its beginnings in China. Chinese historical documents suggest that soybeans have been a diet staple in Asia since the 11th Century BC.

According to the Soyfoods Association of North America, the soybean was introduced to North America around the 1760s. Today, soybeans are grown in many parts of the world with the United States being the largest producer of this crop, followed by Brazil, Argentina and China. The United States Department of Agriculture ("USDA") notes that the forecasted value of U.S. soybean production in 2017 was approximately US$41‡ billion, similar to the previous year, which was up 17% from the year before, which represented the second-highest value among U.S. produced crops, behind corn. Production of soybeans has remained stable in the United States. U.S. soybean farmers planted approximately 90.1 million acres‡§ of soy in 2017, which represented approximately an 8% increase from 2016. The USDA Foreign Agricultural Service estimated that approximately 336.7‡ million metric tons of soybeans were produced during 2017/2018, with U.S. production accounting for approximately 119‡ million metric tons or 35%.

Soybeans are similar in size and colour to peas and are primarily cultivated for their oil and protein. Soybeans are the largest single source of edible oil and accounted for approximately 59%§ of the world's total oilseed production in 2017. In addition to being a source of oil and protein, soybean meal is used in animal feed for the production of meat and eggs. Soy flour is used in the commercial baking industry while soy hulls are processed to make breads, cereal and snacks.

Each soybean is comprised of approximately 40% protein, 35% carbohydrate (including fiber), 20% oil, and 5% ash.

Soy Protein

Commercially sold soy protein is available in predominantly three forms: soy flour, soy concentrates and soy protein isolates. After cracking and dehulling the soybean, soy processors roll them into flakes. Oil from the soybean flakes is removed and then the flakes are dried. The defatted flakes are then further processed into soy protein.

Soy protein isolate is the purest of the three forms of soy protein and contains over 90% protein, on a moisture free basis. Soy protein isolates are relatively neutral in flavour and odour and are used primarily by the food industry. Today, soy protein isolate is used in a variety of food applications, including as a protein replacement for dairy proteins in food or in products such as protein shakes, power bars, soups and sauces, meat analogs, breads and baked goods. Soy protein isolates are desired by food manufacturers for their functional applications. These applications include the ability to emulsify, whip, bind and add viscosity to foods.

____________________

‡ Source: United States Department of Agriculture website.

§ Source: www.soystats.com

In addition to its functional attributes, soy protein isolate provides nutritional enhancement to foods. Soy protein contains all the essential amino acids required for human nutrition.

Numerous studies have been conducted on the health benefits of soy protein. In October 1999, the FDA approved a health claim for soy protein and its role in reducing the risk of coronary heart disease. Food manufacturers may label foods containing soy protein by stating that "Diets low in saturated fat and cholesterol that include 25 grams of soy protein daily may reduce the risk of heart disease. One serving of (name of food) provides __ grams of soy protein." To qualify for the claim, the food must contain per serving:

- 6.25 grams of soy protein;

- low fat (less than 3 grams);

- low in saturated fat (less than 1 gram);

- low in cholesterol (less than 20 milligrams); and

- sodium value of less than 480 milligrams for individual foods, less than 720 milligrams if considered a main dish, and less than 960 milligrams if considered a meal.

In March 2015, after a meta-analysis of scientific studies, Health Canada's Food Directorate concluded that scientific evidence exists to support a health claim about soy protein and blood cholesterol lowering. The evidence supports a direction of effect towards a reduction in total and LDL cholesterol levels when soy protein is consumed. Foods containing soy protein may state on its label, "[Serving size] of (brand name) [name of food] supplies/provides X% of the daily amount of soy protein shown to help reduce/lower cholesterol." The daily amount referred to is 25 grams of soy protein. For example, "150g of tofu supplies 70% of the daily amount of soy protein shown to help lower cholesterol".

The quest for healthier lifestyles has led consumers to search for healthier alternatives to animal protein. The FDA's and Health Canada's approval of a health claim for soy protein has fuelled soy protein's increasing popularity and general acceptance among consumers. These factors, along with the desire by consumers for food producers to find eco-friendly ways to produce food for humans, are expected to sustain market demand for soy protein isolates. Burcon intends to participate in this growing market through its CLARISOY® soy protein.

CLARISOY®

In November 2008, Burcon announced that it had developed a soy protein which it branded as CLARISOY®. Burcon has developed technologies to extract and purify soy protein from a variety of soy materials. These technologies encompass various processes to produce CLARISOY® soy protein. One process for producing CLARISOY® soy protein results in a soy protein that is 100% soluble, transparent and heat stable in applications with a pH of 4.0 and below. ADM has branded this soy protein as CLARISOY™ 100. CLARISOY® soy protein is specifically designed to enable beverage manufacturers to meet the demand for great-tasting, nutritionally enhanced beverages targeted to the ever-growing number of health and wellness minded consumers. ADM is currently marketing CLARISOY® as an economical, high-quality plant-based dairy alternative that provides greater cost stability and comparable nutrition. Food and beverage manufacturers who are looking to manage cost and product margins should be able to rely on CLARISOY® soy protein as a reliable source of plant-based protein with uncompromising taste, nutrition and performance. CLARISOY® soy protein is expected to be an ideal protein ingredient to replace or partially replace dairy protein in food, drinks and snacks without affecting taste.

Another process for producing CLARISOY® soy protein allows for the production of a soy protein specifically processed for use in beverage systems with a pH of less than 4.0 with cloud systems or beverages neutralized to a pH of 7.0 or higher. ADM has branded this soy protein CLARISOY® 150. Due to its clean flavour and high solubility in higher pH ranges, CLARISOY® 150 allows for greater use of soy protein in mildly flavoured neutral beverages such as meal replacement, weight management products and in numerous non-beverage applications such as foods and nutritional products.

ADM launched CLARISOY™ 120 in a powdered mix prototype called "Pineapple Shakeup" at the IFT Expo in July 2013. CLARISOY™ 120 is designed for powdered drinks and drink mixes allowing for easy and rapid dispersibility when added to a liquid.

ADM launched CLARISOY® 170, at the 2014 IFT Expo in New Orleans. CLARISOY® 170 is formulated to be ideal for dairy protein replacement, which could include neutral beverage applications with pH of 7.0 or higher.

ADM also launched CLARISOY® 180 as part of its CLARISOY® line of soy protein specifically designed for neutral applications and dairy replacements. CLARISOY® 180 is formulated for high protein replacement beverages at neutral pH.

The following is a table showing the CLARISOY® product lines marketed by ADM as of the date of this AIF:

Product Line | Product Characteristics | Transparent | Applications |

CLARISOY®100 | High viscosity | Yes | Low pH beverage systems |

CLARISOY®110 | Low viscosity | Yes | Low pH shots High protein meal replacement beverages Collagen replacement |

CLARISOY®120 | Agglomerated High viscosity | Yes | Powdered Low Protein Low pH beverages |

CLARISOY®150 | High viscosity | No | Low pH beverage systems Coffee creamers |

CLARISOY®170 | High viscosity | No | Neutral pH for dairy protein replacement |

CLARISOY®180 | Low viscosity | No | Neutral pH for high protein replacement beverages |

Based on the recommendations of the Joint Expert Consultation of the Food and Agricultural Organization ("FAO") and World Health Organization ("WHO") in 1989, the FDA and the FAO/WHO adopted in 1993 the PDCAAS as the preferred method for measuring the quality of a protein based on the amino acid requirements of humans. The PDCAAS method for evaluating protein quality is based on the needs of humans. The quality of a protein is based on the amino acid requirements of a 2 to 5 year old child, which is considered to be the most nutritionally demanding age group, other than infants. After adjusting for digestibility, the protein quality rankings of a specific protein evaluated under the PDCAAS method are compared to a standard amino acid profile with the highest possible score being a 1.0. A PDCAAS score of 1.0 means that, after digestion of the protein, it provides 100% or more of all the essential amino acids required. Proteins with a PDCAAS of 1.0 include egg and cow's milk.

The PDCAAS scoring system has since been updated by the FAO/WHO/United Nations University ("UNU") in 2002, altering the reference amount of specific amino acids and also dividing the requirement by age groups of children 1-2 years and 3-10 years. In the Report of a Joint FAO/WHO expert consultation on protein and amino acid requirements in human nutrition, the FAO/WHO/UNU came to the conclusion that previous reports considerably overestimated the protein requirements. Despite the foregoing, the FDA has neither formally adopted the updated levels recommended in the 2002 report nor advised food companies to use these updated levels when calculating PDCAAS values.

Based on the PDCAAS method, Burcon's CLARISOY® soy protein has a score of 0.98 and 1.00 under the 1989 FAO/WHO pattern and the 2002 FAO/WHO/UNU pattern, respectively, suggesting that Burcon's CLARISOY® soy protein is a good quality protein source.

Soy Protein Production

Processes used in the production of common and traditional soy protein isolates involve the use of harsh caustics and acids to separate the soy proteins from the other constituents of defatted soy. This harsh chemical treatment causes some denaturation of the soy proteins resulting in a lack of solubility and stability in aqueous products and, notably, a lack of solubility in acid beverages (juices, sport energy drinks, fortified waters, flavoured waters etc.) and produces soy proteins with substantial flavour compounds imparting beany or earthy flavours. Burcon has developed and filed applications to obtain patent protection for novel processes allowing for the production of uniquely soluble soy proteins with clean flavour characteristics.

Pursuant to the terms of the License and Production Agreement (see "Material Contracts"), Burcon has licensed its CLARISOY® soy protein technology to ADM, on an exclusive basis, to use, market and sell the products (the "Soy Products") that use the CLARISOY® technology. Under the License and Production Agreement, ADM is the primary party responsible for the commercialization efforts for CLARISOY®, including:

- developing the necessary process engineering for scaling up the production of the Soy Products;

- developing applications for the Soy Products; and

- designing, building and commissioning an initial production facility to manufacture the Soy Products.

During the term of the license under the License and Production Agreement, Burcon will continue to refine its protein extraction and purification technology for soy protein in its Winnipeg Technical Centre.

On March 6, 2014, Burcon announced that it received written notice from ADM that ADM intends to expand to full-commercial scale production of CLARISOY® soy protein pursuant to the License and Production Agreement ("Full Commercial Production"). On November 8, 2016, Burcon announced that ADM had successfully commissioned the first full-scale CLARISOY® production facility.

Pea

Field pea, or Pisum sativum in Latin, is part of the legume family and was one of the earliest cultivated food crops. A pea is most commonly the green or yellow small spherical seed inside a peapod that contains multiple peas. The pea plant is grown in cool-weather conditions in many parts of the world, including Canada, Europe and temperate regions of Asia.

Peas are consumed as a vegetable worldwide for their high nutritional value and health benefits. Not only are peas high in protein, fibre, starch, vitamins and minerals, but they are also non-allergenic and environmentally sustainable. As part of the legume family, pea plants have the ability to lock in nitrogen from the atmosphere and store it in their root nodules. This nitrogen-fixation ability allows producers to use less fertilizer and replenish the soil with nitrogen, making peas a much desired sustainable crop.

In November 2011, Burcon announced that it had developed a novel pea protein which it has branded as "Peazazz®", its first technology platform to extract added-value proteins from a non-oilseed source. Burcon's technology extracts and purifies a novel pea protein from field peas. Both the nutritional and functional characteristics of pea protein allow for a host of great tasting food and beverage product applications as well as for use in nutritional supplements.

Pea protein is increasing in popularity as a plant-based protein ingredient which can be used in a wide variety of food products. One of the reasons is that pea protein is able to deliver functionality and protein nutrition to products without the issues of allergenicity and genetic modification that may be present with other proteins. Pea proteins currently available in the market are sold for use in a variety of food products including: snacks and cereals; diet products (high protein foods); gluten-free and vegetarian and vegan foods as well as in nutritional supplements such as meal replacement shakes.

Peazazz®

Peazazz® pea protein is uniquely soluble and clean-tasting pea protein that is suitable for dairy alternative food and beverages. Peazazz® has clean flavour characteristics and is well suited for use in low and neutral pH beverages as well as a variety of other healthy and great tasting food and beverage product applications. Its valuable nutritional and functional characteristics make Peazazz® an attractive product to companies looking for an alternative plant protein ingredient.

Pea is a widely accepted and consumed vegetable, recognized for its nutritional value and health benefits. Burcon has successfully extracted added-value proteins that contain essential amino acids into a white powder that can easily be incorporated into a variety of foods and beverages including dairy alternative products, dry-blended beverages, ready-to-drink beverages, protein bars and crisps, weight management and meal replacement products, and vegetarian and vegan foods.

Burcon's Peazazz® pea protein is non-allergenic and can be produced from a non-GMO source. Consumers are increasingly looking for clean-label and "free-from" products. Burcon's Peazazz® pea protein is dairy-free, soy-free, gluten-free, allergen and GMO-free.

Pea proteins currently available on the market are sold for use in a variety of food products including: snacks and cereals; high-protein weight management products; gluten-free and vegetarian and vegan foods. Burcon is not aware of any pea protein isolate in the market that is clean-tasting with superior solubility like Peazazz®. Burcon expects the introduction of Peazazz® pea protein to be able to gain a share of the pea protein market, as well as expand the pea protein market to include (what it previously could not) a broader range of product applications such as low pH beverages.

On January 29, 2013, Burcon announced that it had commenced building a Peazazz® semi-works production facility to produce Peazazz® pea protein at small commercial scale in Winnipeg, Manitoba to provide market development quantities to customers for product and market development activities.

On June 25, 2013, Burcon announced that it had completed, on schedule, the construction of its new semi-works plant in Winnipeg for Peazazz®. The Peazazz® semi-works plant utilizes commercial-scale equipment capable of producing the tonnage amounts required by food and beverage makers looking to conduct full-scale, real world market evaluations of Peazazz® in their consumer products. The plant also supports Burcon's ongoing discussions with companies who are potential partners with Burcon for the production and marketing of Peazazz®.

In July 2013, Burcon officially launched Peazazz® pea protein at the 2013 IFT Expo. Burcon demonstrated two products: Peach Mango Rhythm, made from 30% real juice, with all natural flavors and containing five grams of Peazazz® pea protein per 250ml serving and Vanilla Jazz, a neutral pH milk-style beverage with a faint hint of vanilla flavoring, fortified with vitamins and minerals and five grams of Peazazz® pea protein per 250ml serving.

On August 23, 2013, Burcon announced that the start-up and commissioning of the Peazazz® pea protein semi-works plant had been completed, allowing it to begin producing sample quantities for shipment to interested parties who had signed MTAs with Burcon. While the semi-works plant utilizes commercial-scale equipment, it will only be used to produce the amounts of Peazazz® needed for targeted market development activities with certain prospective customers. By functioning as a model for potential manufacturing partners to emulate, the plant can also ultimately shorten their time-to-market.

Burcon has entered into a number of MTAs with parties interested in Peazazz®. Such parties include major food and beverage makers, suppliers and potential industry production and sales partners. Since August 2013, Burcon has shipped samples of Peazazz® pea protein to various key potential multi-national production and/or distribution partners and undertook applications work in response to requests from certain potential commercialization partners. During fiscal 2018, Burcon continued discussions with certain multi-national food ingredient providers about a royalty or a joint operations agreement for Peazazz®. As of the date of this AIF, discussions are still on-going with these parties.

Canola

Canola is the North American name for the enhanced variation of rapeseed first developed and introduced in 1974 when a Canadian researcher bred a "double low" variety of rapeseed with reduced levels of the two negative elements naturally occurring in rapeseed: erucic acid and glucosinolates. This type of rapeseed is known in Europe and parts of Asia as rapeseed or oilseed rape and has become the world's second largest oilseed crop. The growth of rapeseed as an international crop can be attributed to three factors: the ability to grow rapeseed in temperate climates; favourable production costs; and a beneficial fatty acid profile for the oil, which is high in monounsaturates.

Each canola plant produces yellow flowers which produce pods that are similar in shape to pea pods and about 1/5th the size. Within the pods are tiny round seeds that are crushed to obtain canola oil. After the oil is removed through processing at a canola crushing plant, the remainder of the seed (approximately 60% by weight) is canola meal. Canola meal is the raw material from which Burcon intends to extract protein commercially to produce Puratein® canola protein isolate, Supertein® canola protein isolate and Nutratein® canola protein isolate. Canola meal is comprised of approximately 35% protein. Canola meal is in abundant and relatively inexpensive supply and is sold almost exclusively as an animal feed ingredient; however, its protein value, even in feed applications, is limited by the presence of a large amount of fiber and other anti-nutritional factors naturally present in canola seed. Burcon's extraction process separates the protein from the fiber and from most of the naturally occurring anti-nutritional factors.

In the past, numerous attempts have been made at finding an economically viable method to extract canola protein from canola meal. There is a significant amount of scientific publications describing various methods to do so, most of which publications also underscore numerous reasons for the scientific interest in obtaining canola protein isolate, including, amongst others: a unique amino acid profile, rich in sulfur containing amino acids; an abundant source of protein; and two distinct protein fractions. However, none of the existing technologies described in the scientific literature is commercially applied at present. Major drawbacks of the existing technologies, which often use alkaline extraction followed by isoelectric precipitation, include the insufficient purity of the canola protein isolate, unacceptable colour and taste of the canola protein products as well as the resulting protein's limitations regarding functionality. Phenolics that are naturally present in canola oxidize readily in alkaline conditions causing dark coloration of the final protein product.

Burcon's canola protein extraction process does not use harsh chemicals but rather is based primarily on making use of physical separation and purification techniques. At the core of Burcon's canola protein isolate production process is a micelle formation step, which separates the two naturally occurring proteins in canola: napin and cruciferin. Processing of these two fractions results in the cruciferin-rich canola protein isolate Puratein® canola protein isolate and the napin-rich canola protein isolate Supertein® canola protein isolate. Burcon has also developed Nutratein® canola protein isolate, which consists of a blend of the two fractions.

Canola Protein

Potential nutritional applications for canola protein isolates include power shakes, protein bars, protein powders and any other concentrated protein supplement.

Based on the PDCAAS method, the PDCAAS scores for Burcon's canola proteins are as follows:

Canola Protein Isolate | FAO/WHO 1989 mg/g protein (2-5 years old) | FAO/WHO/UNU 2002 mg/g protein (3-10 years old) |

Puratein® | 0.60 | 0.72 |

Supertein® | 0.71 | 0.91 |

Nutratein® | 0.90 | 1.00 |

Burcon's canola protein has a score in the range of 0.60 to 0.90 under the 1989 FAO/WHO pattern and a score in the range of 0.72 - 1.00 under the 2002 FAO/WHO/UNU pattern, suggesting that Burcon's canola protein is a good quality protein source.

Puratein®

Puratein® canola protein isolate's key functionalities are emulsifying, gelling and binding. Puratein® canola protein isolate has potential in a wide variety of food types.

Puratein® canola protein isolate is a canola protein isolate comprised mainly of globulin proteins. The functional properties of Puratein® canola protein isolate include emulsification, gel formation, thickening, formation of heat-stable foams, and water- and ingredient-binding. Applications for Puratein® canola protein isolate include dressings and sauces, meat substitutes, baked goods and protein bars. Puratein® canola protein isolate has good taste characteristics with no off-flavours.

Supertein®

Supertein® canola protein isolate is a highly soluble canola protein isolate comprised principally of albumin proteins. The functional properties of Supertein® canola protein isolate include solubility, the ability to form transparent solutions, foaming and nutrition. Applications for Supertein® canola protein isolate include beverages, confectionery, aerated desserts, and protein bars, among many others. Supertein® canola protein isolate has a slightly sweet taste with no off-flavours.

The exceptional cysteine content of canola protein (rapeseed protein) has long been of interest to nutritional scientists. A potential link between canola protein's high cysteine content and disease prevention has been reported in a study in the British Journal of Nutrition entitled "Rapeseed protein inhibits the initiation of insulin resistance by a high-saturated fat, high-sucrose diet in rats" by Mariotti F., Hermier D., Sarrat C., Magné J., Fénart E., Evrard J., et al 2008 Nov; 100(5):984-91. The study's aim was to determine whether rapeseed protein, described by the study's authors as "an emergent cysteine-rich protein" could inhibit the onset of the metabolic syndrome. The main finding of the study "is that rapeseed protein substituted for milk protein inhibited the onset of insulin resistance in rats fed the high-saturated fat, high-sucrose diet". The authors further noted that rapeseed protein mitigated certain factors associated with metabolic syndrome: "The study's result highlights the importance of the type of protein as a major component of diet quality, in terms of cardiovascular and diabetic risks."Supertein® canola protein isolate is rich in sulfur-containing amino acids and particularly rich in cysteine. The typical cysteine content of Burcon's Supertein® canola protein isolate is nearly double that of whey protein, which is recognized for its high cysteine content. The findings in the study reported in the British Journal of Nutrition suggest that Supertein® may have potential applications in the prevention of metabolic syndrome.

During fiscal 2018, Burcon's key focus was on its pea protein commercialization efforts. However, Burcon continued to work on securing interest from potential partners to establish the commercial value of its canola protein isolates. Burcon's goal is to continue to work with food and beverage manufacturers to establish the value of Burcon's Puratein® and Supertein® canola proteins in their food products.

Nutratein®

Nutratein® is a canola protein isolate comprised of a mixture of globulin and albumin proteins. Nutratein® is a fine powder that has good solubility across a broad pH range. Nutratein® has an excellent amino acid profile and its PDCAAS score makes it a suitable in nutritional supplements, meal replacement products, high-protein foods and beverages and initially participate as a protein ingredient in high-value animal feed. Burcon continues to work on pursuing an animal nutrition application with companies in the animal feed industry with the intention of using Nutratein® canola protein isolate to replace or partially replace dairy protein in certain high-value animal feed applications. Applications in human nutrition include nutritional supplements, meal replacement products, protein bars, meat applications, baked goods or nutritional beverages. Nutratein® canola protein isolate is bland in taste with no off-flavours.

Research and Development

Burcon has designed and built a large-scale pilot production facility, complete with an analytical laboratory, for the development and small-scale production of proteins from various plant sources. On January 29, 2013, Burcon announced that it had commenced building a Peazazz® semi-works production facility to produce Peazazz® pea protein at commercial scale in Winnipeg, Manitoba. On June 25, 2013, Burcon announced that it had completed, on schedule, the construction of its new semi-works plant in Winnipeg for Peazazz®. The Peazazz® semi-works plant utilizes commercial-scale equipment and will be capable of producing the tonnage amounts required by food and beverage makers looking to conduct full-scale market evaluations of Peazazz® in their consumer products. Start-up and commissioning of the plant was completed in August 2013. During fiscal 2018, the semi-works plant continued to produce samples to provide to potential strategic partners for evaluation as well as conduct work required to support Burcon's intellectual property portfolio.

Burcon has over 18 years of experience in developing high-quality vegetable protein ingredients and has successfully developed CLARISOY® soy protein and is developing Peazazz® pea protein, three unique canola protein isolates, Supertein®, Puratein® and Nutratein® canola protein isolates and other specialty proteins such as flax and hemp. After years of research on developing these products and the associated extraction technologies and in running large-scale pilot operations to a standard that meets Burcon's expectations of commercial quality, Burcon has amassed significant experience and know-how.

Objectives

For fiscal 2019, Burcon's main objective will continue to be to further the development and commercialization of its products, with its primary focus on commercializing its Peazazz® pea protein technology.

Burcon's pea protein product development and commercialization objectives include:

- Identifying additional multi-national food ingredient providers to secure a royalty or a joint operations agreement for Peazazz®;

- Continuing to operate the Peazazz® semi-works facility to produce sample products to

- supply the potential strategic alliance partners with sufficient product development quantities of Peazazz® samples so that such potential partners can conduct full-scale, real-world testing;

- demonstrate to such major protein ingredient participants and food and beverage makers that Burcon's Peazazz® technology is scalable and produces a consistent quality product;

- Conducting further research to develop additional applications for Peazazz® pea protein into food products; and

- Continuing to file patent applications to protect the Peazazz® pea protein extraction process as well as the composition of Peazazz® pea protein and applications for Peazazz® pea protein into food products.

In addition, Burcon will also:

- continue to refine its protein extraction and purification technologies, develop new technologies and related products;

- conduct research to develop extraction and purification technologies for the production of highly-purified cannabis-derived products, if the respective license is granted by Health Canada;

- further strengthen and expand its core intellectual property portfolio;

- support ADM in connection with its commercialization of CLARISOY® soy protein products;

- explore opportunities for acquiring or licensing into Burcon, novel technologies that will complement or enhance Burcon's intellectual property portfolio and business initiatives;

- pursue product development agreements with major food, beverage and nutritional product companies to develop improved or novel applications for Supertein®, Puratein® and Nutratein® canola protein isolates as well as Burcon's other specialty proteins into their products;

- pursue a strategic alliance with a potential partner in connection with the development of a commercial facility for the production, marketing and sale of Burcon's canola protein isolates and Burcon's other specialty proteins; and

- pursue activities to support the expansion of Burcon's investor base by raising awareness about Burcon through various media channels, analyst coverage and investor relations.

Marketing Strategies

Burcon's CLARISOY® soy protein, Peazazz® pea protein, Puratein®, Supertein® and Nutratein® canola protein isolates are expected to compete with soy, whey, milk and egg proteins in the expanding global multi-billion dollar protein ingredient market. Burcon's proteins are expected to specifically compete with whey protein isolates, casein/caseinates and dried egg-white as well as with existing traditional soy and pea proteins.

Food Business News reported the following average prices for the major protein ingredients that Burcon expects its products to compete with:

Whey protein isolate US $5.10 /pound1 CDN $15.41 /kg. 2

Casein/caseinates US $2.76 /pound3 CDN $7.92 /kg. 2

Dried Egg-white US $5.10 /pound3 CDN $14.64 /kg. 2

Soy and pea protein prices are not readily available to the public. However, through discussions with industry participants and market data research, Burcon management estimates that soy protein isolate and pea protein isolate prices are approximately as follows:

Soy protein isolate US $3.50 /pound CDN $10.04 /kg.2

Pea protein isolate US $3.00 /pound CDN $8.61 /kg. 2

Notes:

1. Price based on last available listing in Food Business News (November 22, 2011 edition). There is no current available price listing for whey protein isolate (90% edible).

2. Conversion into Canadian dollars made by Burcon, based on Bank of Canada exchange rate of C$1.00 = US$0.7680 on May 29, 2018.

3. Prices based on the May 1, 2018 edition of Food Business News for the week ending April 27, 2018.

Burcon expects the average selling price of Peazazz® pea protein to achieve an average price level that would equate to a premium over current pea pricing and at a discount to some animal-based proteins. Burcon expects the cost to produce Peazazz® pea protein to be materially consistent with the cost to produce traditional pea protein isolates.

Pursuant to the License and Production Agreement, ADM has the sole discretion in developing the sales and marketing strategies for CLARISOY® soy protein. Given ADM's extensive experience in the sale and marketing of soy protein products, Burcon expects that CLARISOY® will be strategically priced amongst ADM's current product portfolio and other competing protein products in the global market.

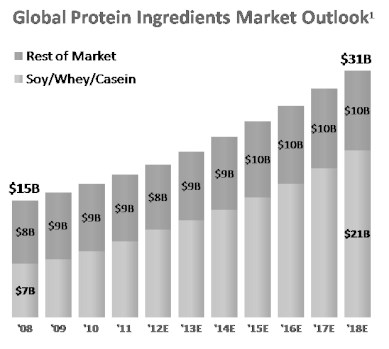

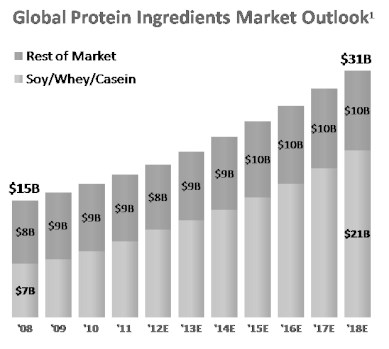

Plant Protein

According to Frost & Sullivan, the global protein-ingredient market is expected to grow at a compounded annual growth rate (CAGR) of 7.7% to reach $31.5 billion by 2018. The global protein ingredient market is currently dominated by soy, whey and casein. This combined market segment alone is projected to grow at 12% CAGR to reach $21.3 billion by 2018. Soy-derived proteins are the largest segment in the plant protein market, accounting for 53.4 percent volume share. Wheat and pea proteins are second and third, respectively. Demand outweighs supply in the plant protein market and volume is expected to grow steadily at 5.3% CAGR.

1) Based on current market prices and using volume projections from Frost & Sullivan Report, "Strategic Insight into the Global Plant Protein Ingredients Market," May 2012. Volume outlook based on 2011 base year.