BURCON NUTRASCIENCE CORPORATION

Notice of Annual General and Special Meeting of Shareholders

to be held on September 18, 2024

Management Proxy Circular

TABLE OF CONTENTS

BURCON NUTRASCIENCE CORPORATION

Suite 490 - 999 West Broadway

Vancouver, British Columbia V5Z 1K5

Telephone: (604) 733-0896

LETTER TO SHAREHOLDERS

August 1, 2024

Dear Fellow Shareholders,

Fiscal 2024 was a transformative year for Burcon. We are pleased to have made significant strides along each of our three strategic imperatives: to identify alternative revenue sources; to get closer to customers; and to have significant influence over the manufacturing process of Burcon's proteins. Through the evaluation of market data and internal estimates, we validated the opportunity to capture a meaningful share of the billions of dollars in potential sales to be generated in the global ingredient market for high purity proteins. We remain convinced that Burcon's proteins taste and perform better than anything else on the market today. Speed to market and agility are now critical to our overall success.

Over the past year, we achieved many critical milestones, including,

- a route to market by establishing a capital-light production supply-chain,

- established our own direct to customer pipeline,

- multiple commercial scale production runs validating commercial scale capability,

- our first direct commercial sales of hemp protein,

- launch of our canola protein, a product addressing specific customer requirements, and

- raising the funds to execute our business plan.

These achievements enable us to confidently pursue our next phase of growth - to produce and sell. Generating revenue will be our top priority in the coming year. We will leverage what we have built to ramp up the production of hemp and canola proteins to meet the strong market demand for Burcon's proteins. We expect to expand the customer funnel for both our hemp and canola proteins, while simultaneously commercializing Burcon's portfolio of other protein technologies.

During the 2024 fiscal year, we were successful in raising funds through a blend of equity financings, debt and non-dilutive government funding. We value the trust that shareholders and new investors have placed in us and are dedicated to growing Burcon into the company it has always aspired to be. Our achievements to-date would not have been possible without your support.

Lorne Tyrrell, one of Burcon's longest serving directors will not be standing to return at this year's AGM. Lorne witnessed significant changes at Burcon over the years, making considerable contributions along the way. We are grateful for his counsel throughout his years of service and will miss it going forward.

On behalf of the Board of Directors, I would like to express our sincere gratitude to Jade Cheng, our former Chief Financial Officer, for her considerable contributions to Burcon. Having been with Burcon since its inception, Jade helped navigate through many years of financial and corporate management. We can't thank her enough and wish her all the best.

In closing, I would like to sincerely thank my fellow shareholders for their continued support, trust, and belief in our company. I would also like to thank the Burcon team for their unwavering dedication and commitment to our vision. We look forward to announcing additional achievements over the coming year.

Yours truly,

"Peter H. Kappel"

Peter H. Kappel

Chair of the Board of Directors

BURCON NUTRASCIENCE CORPORATION

Suite 490 - 999 West Broadway

Vancouver, British Columbia V5Z 1K5

Telephone: (604) 733-0896

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

TO OUR SHAREHOLDERS:

Burcon NutraScience Corporation (the "Corporation" or "Burcon") is conducting a virtual only Annual General and Special Meeting (the "Meeting") on September 18, 2024, at 10:00 a.m. (Vancouver time). Registered Shareholders and duly appointed proxyholders (as defined in this Management Proxy Circular) can attend the Meeting online at https://meetnow.global/MFNPD5P to participate, vote, or submit questions during the Meeting's live webcast. The Meeting will be conducted for the following purposes:

a) to receive the report of the directors;

b) to receive the audited consolidated financial statements of the Corporation for the fiscal year ended March 31, 2024, together with the report of the auditors thereon;

c) to elect directors for the ensuing year;

d) to appoint auditors and to authorize the directors to fix their remuneration;

e) to consider, and, if thought advisable, to pass an ordinary resolution to approve the issuance of certain compensation warrants to John A. Vassallo as more particularly set out on page 14 of the attached management proxy circular (the "Management Proxy Circular");

f) to consider, and, if thought advisable, to pass an ordinary resolution to approve the consolidation of all of the issued and outstanding common shares of the Corporation on the basis of a consolidation ratio to be selected by the directors of the Corporation of up to twenty (20) pre- consolidation common shares for one (1) post-consolidation common share, as more particularly set out on page 16 of the Management Proxy Circular;

g) to transact such other business as may properly come before the Meeting or any adjournment of the Meeting; and

h) to consider any amendment to or variation of any matter identified in this Notice.

Our Management Proxy Circular and form of proxy accompany this Notice. The Management Proxy Circular contains details of matters to be considered at the Meeting.

If you are unable to attend the Meeting and wish to ensure that your shares will be voted at the Meeting, you must complete, date, execute and deliver the accompanying form of proxy by fax at 1-866-249-7775 (within North America) or (416) 263-9524 (outside North America), by hand or by mail to Computershare Investor Services Inc. at Proxy Dept., 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1, in accordance with the instructions set out in the form of proxy and in the Management Proxy Circular.

If you plan to attend the Meeting online you must follow the instructions set out in the form of proxy and in the Management Proxy Circular to ensure that your shares will be voted at the Meeting.

DATED at Vancouver, British Columbia on August 1, 2024.

BY ORDER OF THE BOARD OF DIRECTORS

"Kip Underwood"

Kip Underwood

Chief Executive Officer

BURCON NUTRASCIENCE CORPORATION

Suite 490 - 999 West Broadway

Vancouver, British Columbia V5Z 1K5

Telephone: (604) 733-0896

MANAGEMENT PROXY CIRCULAR

as at August 1, 2024

The board of directors (the "Board") of Burcon NutraScience Corporation (the "Corporation") is delivering this management proxy circular (the "Management Proxy Circular") to you in connection with the solicitation of proxies for use at the annual general and special meeting of its shareholders (the "Meeting") to be held on September 18, 2024 at the time and place and for the purposes set forth in the accompanying Notice of Meeting. In this Management Proxy Circular, unless the context otherwise requires, all references to "Burcon NutraScience Corporation", "Burcon", "we", "us" and "our" refer to Burcon NutraScience Corporation.

GENERAL PROXY INFORMATION

Who Can Vote

Burcon is authorized to issue an unlimited number of common shares ("Common Shares") without nominal or par value. As of August 1, 2024, we had outstanding 142,098,096 Common Shares. Persons who on August 1, 2024 are recorded on our share register as holders of our Common Shares can vote at the Meeting. Each Common Share has the right to one vote.

To the knowledge of our directors and officers, as of August 1, 2024, the only person or corporation who beneficially owns, directly or indirectly, or exercises control or direction over, Common Shares carrying 10% or more of the voting rights attached to all outstanding Common Shares of Burcon is:

| Number of Shares Held | Percentage of Voting Shares |

Firewood Elite Limited ("Firewood") (a British Virgin Islands Company) | 25,643,932* | 18.05% |

Note:

* 17,584,458 of these shares are held by Large Scale Investments Limited and 8,059,474 of these shares are held by Great Intelligence Limited, both of which are British Virgin Islands companies and direct wholly-owned subsidiaries of Firewood. Firewood is wholly-owned by Mr. Alan Chan, a director of the Corporation.

Obtaining a Paper Copy of Management Proxy Circular and Financial Statements

In lieu of mailing the Notice of Meeting, Management Proxy Circular and our audited financial statements and management's discussion and analysis for the year ended March 31, 2024, the Corporation is using notice-and-access to provide an electronic copy of these documents to registered shareholders and beneficial shareholders of the Corporation's Common Shares by posting them on www.burcon.ca and on the Corporation's profile on www.SEDAR.com.

If you wish to obtain a paper copy of these documents or for more information regarding notice-and-access, you may call us toll free at 1-888-408-7960 from Canada or the United States, or 604-733-0896 (press 2) if you are calling from another country. You must call to request a paper copy by August 28, 2024 in order to receive a paper copy prior to the deadline for submission of your voting instructions or form of proxy. If your request is received on or after the date of the Meeting, then the documents will be sent to you within ten calendar days of your request. Burcon will provide a paper copy of the documents to any registered or beneficial shareholder upon request for a period of one year following the date of the filing of this Management Proxy Circular on www.SEDAR.com.

If you are a registered shareholder and have standing instructions to receive paper copies of these documents and would like to revoke them, you may call us toll free at 1-888-408-7960 from Canada or the United States, or 604-733-0896 (press 2) if you are calling from another country.

Registered & Non-Registered Shareholders

Registered Shareholder: You are a Registered Shareholder if your name appears on a share certificate or a Direct Registration System statement confirming your holdings. If you are a Registered Shareholder, you have received a "Form of Proxy" for this Meeting.

Non-Registered Shareholder: You are a Non-Registered Shareholder if your shares are held through an intermediary (broker, trustee or other financial institution). If you are a Non-Registered Shareholder, you have received a "Voting Instruction Form" for this Meeting. Please make sure to follow instructions on your Voting Instruction Form to be able to attend and vote at this Meeting.

Attending the Virtual Only Meeting

Shareholders and duly appointed proxyholders can attend the Meeting online by going to https://meetnow.global/MFNPD5P .

- Registered Shareholders and duly appointed proxyholders can participate in the Meeting by clicking "Shareholder" and entering a Control Number or an Invite Code before the start of the Meeting.

- Registered Shareholders: the 15-digit control number is located on the Form of Proxy or in the email notification you received.

- Duly appointed proxyholders: Computershare Investor Services Inc. ("Computershare") will provide the proxyholder with an Invite Code by email after the voting deadline has passed.

- Attending and voting at the Meeting will only be available for Registered Shareholders and duly appointed proxyholders.

- Non-Registered Shareholders who have not appointed themselves as proxyholders to participate and vote at the Meeting may login as a guest, by clicking on "Guest" and complete the online form; however, they will not be able to vote or submit questions.

Shareholders who wish to appoint a third-party proxyholder to represent them at the virtual meeting must submit their Form of Proxy or Voting Instruction Form (as applicable) prior to registering their proxyholder. Registering the proxyholder is an additional step once a Shareholder has submitted their Form of Proxy or Voting Instruction Form. Failure to register a duly appointed proxyholder will result in the proxyholder not receiving an Invite Code to participate in the meeting.

To register a proxyholder, Shareholders MUST visit https://www.computershare.com/burcon by September 16, 2024, 10 a.m. (Vancouver Time) and provide Computershare with their proxyholder's contact information, so that Computershare may provide the proxyholder with an Invite Code by email.

In order to participate online, Shareholders must have a valid 15-digit control number and proxyholders must have received an email from Computershare containing an Invite Code.

The virtual meeting platform is fully supported across most commonly used web browsers (note: Internet Explorer is not a supported browser). We encourage you to access the Meeting prior to the start time. It is important that you are connected to the internet at all times during the Meeting in order to vote when balloting commences.

Participating in the Meeting

The Meeting will only be hosted online by way of a live webcast. Shareholders will not be able to attend the Meeting in person. A summary of the information Shareholders will need to attend the virtual meeting is provided below.

- Registered Shareholders and appointed proxyholders: Only those who have a 15-digit control number, along with duly appointed proxyholders who were assigned an Invite Code by Computershare (see details under the heading "Appointment of Proxies"), will be able to vote and submit questions during the meeting. To do so, please go to https://meetnow.global/MFNPD5P prior to the start of the Meeting to login. Click on "Shareholder" and enter your 15-digit control number or click on "Invitation" and enter your Invite Code.

- United States Beneficial Shareholders: To attend and vote at the virtual meeting, you must first obtain a valid Legal Proxy from your broker, bank or other agent and then register in advance to attend the Meeting. Follow the instructions from your broker or bank included with the Proxy materials or contact your broker or bank to request a Legal Form of Proxy. After first obtaining a valid Legal Proxy from your broker, bank or other agent, you must submit a copy of your Legal Proxy to Computershare in order to register to attend the meeting. Requests for registration should be sent:

By mail to: COMPUTERSHARE

100 UNIVERSITY AVENUE 8TH FLOOR

TORONTO, ON M5J 2Y1

By email at: USLegalProxy@computershare.com

Requests for registration must be labeled as "Legal Proxy" and be received no later than September 16, 2024, 10 a.m. (Vancouver Time). You will receive a confirmation of your registration by email after we receive your registration materials. You may attend the Meeting and vote your shares at https://meetnow.global/MFNPD5P during the Meeting. Please note that you are required to register your appointment at https://www.computershare.com/burcon.

How You Can Vote

If you are a Registered Shareholder you may vote your Common Shares either by attending the online Meeting or, if you do not plan to attend the Meeting, by completing the accompanying Form of Proxy and following the delivery instructions contained in it and this Management Proxy Circular.

If you are a Non-registered shareholder, you must follow the instructions on the Voting Instruction Form, which is similar to a form of proxy, but is provided to you by your stock broker or financial intermediary. If you do not follow the special procedures described by your broker or financial intermediary, you will not be entitled to vote. If you are unsure as to how to follow these procedures, please contact your stockbroker.

A Registered Shareholder (or a Non-Registered Shareholder) who has appointed themselves or appointed a third-party proxyholder to represent them at the Meeting, will appear on a list of proxyholders prepared by Computershare, who is appointed to review and tabulate proxies for this meeting. To be able to vote their shares at the Meeting, each Registered Shareholder or proxyholder will be required to enter their control number or Invite Code provided by Computershare at https://meetnow.global/MFNPD5P prior to the start of the Meeting.

In order to vote, Non-Registered Shareholders who appoint themselves as a proxyholder MUST register with Computershare at https://www.computershare.com/burcon AFTER submitting their Voting Instruction Form in order to receive an Invite Code (see details under the heading "Appointment of Proxies" for details).

Distribution of Meeting Materials to Beneficial Shareholders

The Corporation has distributed copies of the notice-and-access notice and Voting Instruction Form to the depositories and intermediaries for onward distribution to beneficial shareholders. In addition, the notice-and-access notice and Voting Instruction Form may have been sent directly by the Corporation or its agent, rather than through an intermediary, to non-objecting beneficial owners under National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer ("NI 54-101"). Beneficial shareholders who have previously provided standing instructions will receive a paper copy of the Notice of Meeting, Management Proxy Circular, financial statements and related management discussion and analysis. If you are a non-objecting beneficial shareholder and the Corporation or its agent has sent these materials directly to you, your name and address and information about your holdings and securities have been obtained in accordance with the requirements of NI 54-101 from the intermediary holding on your behalf. All costs of deliveries to beneficial shareholders will be borne by Burcon.

Solicitation of Proxies

The solicitation of proxies will be primarily by mail, but proxies may be solicited personally or by telephone by directors, officers and regular employees of Burcon. All costs of this solicitation will be borne by Burcon.

Appointment of Proxies

The individuals named in the accompanying Form of Proxy and Voting Instruction Form are the Chief Executive Officer of Burcon and the Senior Vice President, Legal and Corporate Secretary of Burcon. Shareholders who wish to appoint a third-party proxyholder to represent them at the Meeting must submit their Form of Proxy or Voting Instruction Form (as applicable) prior to registering their proxyholder. Registering the proxyholder is an additional step once a Shareholder has submitted their Form of Proxy/Voting Instruction Form. Failure to register a duly appointed proxyholder will result in the proxyholder not receiving an Invite Code to participate in the Meeting.

To register a proxyholder, Shareholders MUST visit https://www.computershare.com/burcon by September 16, 2024, 10:00 a.m. (Vancouver Time) and provide Computershare with their proxyholder's contact information, so that Computershare may provide the proxyholder with an Invite Code via email.

Without an Invite Code, proxyholders will not be able to attend and vote at the Meeting.

Revocation of Proxies

Registered Shareholders

A proxy will not be valid unless the completed, signed and dated Form of Proxy is delivered to Computershare Investor Services Inc. by fax at 1-866-249-7775 (within North America) or (416) 263-9524 (outside North America), by mail or by hand at its office at Proxy Dept., 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1, or via the internet at www.investorvote.com not less than 48 hours (exclusive of non-business days) before the Meeting or any adjournment thereof at which the proxy is to be used.

A Registered Shareholder may revoke a proxy by

(a) providing a written notice of revocation to Computershare Investor Services Inc. by fax at 1-866-249-7775 (within North America) or (416) 263-9524 (outside North America), by mail or by hand at its office at Proxy Dept., 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1 at any time up to and including the last business day that precedes the day of the Meeting or, if the Meeting is adjourned, that precedes the reconvening thereof,

(b) providing a written notice of revocation to Burcon at its head office which is located at Suite 490 - 999 West Broadway, Vancouver, British Columbia, V5Z 1K5 at any time up to and including the last business day that precedes the day of the Meeting or, if the Meeting is adjourned, that precedes the reconvening thereof,

(c) providing a written notice of revocation to the Chairman of the Meeting on the day of the Meeting and before any vote in respect of which the proxy to be used is taken that you are revoking your proxy and voting online at the Meeting, or

(d) any other manner provided by law.

Your revocation of a proxy will not affect a matter on which any vote has already been taken. If a Registered Shareholder who has submitted a Form of Proxy attends the Meeting via webcast and has accepted the terms and conditions when entering the Meeting online, any votes cast online by such shareholder on a ballot will be counted and the votes previously submitted will be disregarded.

Non-registered Shareholders

If you are a Non-registered Shareholder and wish to revoke your Voting Instruction Form, you should contact your stock broker or financial intermediary directly.

Exercise of Discretion

The nominees named in the accompanying Form of Proxy/Voting Instruction Form will vote or withhold from voting the Common Shares represented by the proxy in accordance with your instructions on any ballot that may be called for and if you specify a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly. The proxy grants the nominees the discretion to vote on

(a) each matter or group of matters identified in the proxy where you do not specify how you want to vote, except for the election of directors and the appointment of auditors,

(b) any amendment to or variation of any matter identified in the proxy, and

(c) any other matter that properly comes before the Meeting.

If on a particular matter to be voted on, you do not specify in your proxy the manner in which you want to vote, your Common Shares will be voted as recommended by management.

As of the date of this Management Proxy Circular, we know of no amendment, variation or other matter that may come before the Meeting, but if any amendment, variation or other matter properly comes before the Meeting each proxyholder named in the proxy can vote in accordance with their discretion.

Votes Necessary to Pass Resolutions

Burcon's articles provide that a quorum for the transaction of business at any shareholders' meeting is shareholders present in person or by proxy representing in the aggregate, at least 5% of the outstanding Common Shares entitled to vote at the Meeting, irrespective of the number of persons actually present at the Meeting. A simple majority of affirmative votes cast at the Meeting is required to pass the resolutions other than the election of directors and appointment of auditor. If there are more nominees for election as directors or appointment as Burcon's auditor than there are vacancies to fill, those nominees receiving the greatest number of votes will be elected or appointed, as the case may be, until all such vacancies have been filled. If the number of nominees for election or appointment is equal to the number of vacancies to be filled all such nominees will be declared elected or appointed by acclamation.

Majority Voting for Directors

The Board has adopted a majority voting policy for the election of directors. Pursuant to this policy, any nominee proposed for election as a director in an uncontested election who receives, from the shares voted at the meeting in person or by proxy, a greater number of shares withheld than shares voted in favour of his or her election, must promptly tender his or her resignation to the board of directors of the Corporation. The Board will promptly accept the resignation unless it is determined that there are extraordinary circumstances relating to the composition of the board or the voting results that should delay the acceptance of the resignation or justify rejecting it. The Board will make its decision and reasons available to the public within 90 days of the annual meeting.

MATTERS TO BE ACTED UPON AT THE MEETING

Election of Directors

Burcon's articles provide that the Board is to be comprised of a minimum of three directors. The number of directors is fixed by the Board, and has been fixed at eight for the ensuing year. The term of office of each of the present directors expires at the conclusion of the Meeting. The persons named below will be presented for election at the Meeting as management's nominees and the persons named in the accompanying form of proxy intend to vote for the election of these nominees. Management does not contemplate that any of these nominees will be unable to serve as a director; however, if for any reason any proposed nominee does not stand for election or is unable to serve as such, proxies in favour of management's designees will be voted for another nominee in its discretion unless the shareholder has specified in his proxy that his or her Common Shares are to be withheld from voting on the election of directors. Each director elected will hold office until the conclusion of the next annual general meeting of shareholders of Burcon or until his or her successor is elected or appointed, unless his or her office is earlier vacated in accordance with our articles or with the provisions of the Business Corporations Act (British Columbia).

The following table sets out the names of the nominees for election as directors, the province/state and/or country in which each is ordinarily resident, all offices of Burcon now held by each of them, their principal occupations, the period of time for which each has been a director of Burcon, and the number of Common Shares of Burcon beneficially owned by each, directly or indirectly, or over which control or direction is exercised, as at August 1, 2024. A biography of each director, which includes a five year history of employment, follows under "Biographies of Directors".

Name, Position and

Country of

Residence(1) | Principal Occupation During the

Previous Five Years(1) | Period as a

Director of the

Corporation | Common

Shares Held(1) |

Alan Chan,

Director,

Hong Kong, China | Executive Director of ITC Properties Group Ltd. (property development and investment) since March 2010; Founder and Managing Partner or Vectr Ventures (Global VC Firm) since 2013 | Since April 20, 2010 | 25,643,932(2) |

Peter H. Kappel

Chairman of the Board and Director,

British Columbia, Canada

| Corporate Director; Interim Chief Executive Officer of Burcon from March 1, 2022 to November 7, 2022 | Since January 28, 2016 | 1,452,206(3) |

Debora S. Fang

Director,

London, United Kingdom | Independent advisor, F&F Advisory from 2018 to present; VP, M&A, Unilever from 2013 to 2018

| Since July 6, 2020 | 162,795(4) |

Jeanne McCaherty

Director,

Minnesota, United States of America

| Chief Executive Officer, Guardian Energy Management from 2016 to present; President, Kae Partners, LLC (2015 to present); Executive in Residence, Agspring -Leaworth, KS Private Equity Firm (2015 to 2016); Vice President, Regional Director of Texturizing Business Unit, Cargill, Inc. (2008 to 2015); prior thereto held various other executive management positions at Cargill Inc. | Since July 8, 2021 | 157,940 |

Name, Position and

Country of

Residence(1) | Principal Occupation During the

Previous Five Years(1) | Period as a

Director of the

Corporation | Common

Shares Held(1) |

Alfred T. L. Lau,

Director,

British Columbia, Canada | Director, Chair and Member of Board Committees, WealthOne Bank of Canada ("WOBC") (2018 to present); Retired Partner, KPMG (1980 to 2017)

| Since September 15, 2021 | 100,000(5) |

Aaron T. Ratner

Director,

Pennsylvania, United States of America

| Executive Director, Alternus Clean Energy (2024-Present), CEO, Clean Earth Acquisitions Corp (2021-2023), Co-Founder CC Risk Solutions (2022-Present), Co-Founder & Managing Partner, Vectr Carbon Partners (2022-Present), Operating Partner, Nexus PMG (2020-2022), President, Cross River Infrastructure Partners (2020-2021), Managing Director, Ultra Capital (2016-2020), Developer in Residence, Generate Capital (2014-2016), President, i2 Capital (2012-2014)

| Since November 23, 2022 | NIL |

John A. Vassallo

Director

Texas, United States of America

| Founder and CEO of Mos RE,

LLC (property acquisition &

development) Founder and CEO

of Global Restaurant Systems,

LLC (restaurant acquisitions,

development & management).

Controlling Interest in

GuestBridge Inc (sold to

OpenTable); CEO and Director of

Bluer Duck, LLC (electric

scooters).

| Since September 20, 2023 | 8,270,056(6) |

James Peter Pekar

Nominee

Wisconsin, United States of America | Retired businessman, prior thereto, President, from 1994 to 2021, of First Choice Ingredients, a dairy based enzyme-modified reaction company.

| N/A | 3,129,767(7) |

(1) The information as to province or state, country of residence, principal occupation, and Common Shares beneficially owned has been furnished by the respective nominees.

(2) Alan Chan's wholly-owned company, Firewood Elite Limited, holds through its wholly-owned subsidiaries Large Scale Investments Limited and Great Intelligence Limited, 25,643,932 Common Shares, representing 18.05% of the outstanding Common Shares. Great Intelligence also holds warrants to purchase 2,777,358 Common Shares at $0.35 per share.

(3) 84 of these Common Shares are held by Philip Kappel (son) and 446,495 of these Common Shares are held by Stefanie Kappel (spouse). Mr. Kappel and Stefanie Kappel also hold warrants to purchase 125,000 and 75,000 Common Shares, respectively, at $0.27 per share.

(4) Ms. Fang also hold warrants to purchase 81,397 Common Shares at $0.27 per share.

(5) Mr. Lau also hold warrants to purchase 50,000 Common Shares at $0.27 per share.

(6) 3,129,767 of these Common Shares are held by Nocrub, LLC, a company wholly-owned by Mr. Vassallo. Mr. Vassallo also holds warrants to purchase 2,568,302 Common Shares at $0.35 per share and 5,216,061 Common Shares at $0.27 per share, while Nocrub, LLC holds warrants to purchase 1,564,883 Common Shares at $0.27 per share.

(7) The Common Shares are held by the James P. Pekar Family Endowment Trust, which also holds warrants to purchase 1,564,884 Common Shares at $0.27 per share.

Biographies of Directors

Alan Chan - Director

Mr. Chan is an executive director of ITC Properties Group Limited ("ITC Properties"). At ITC Properties, Mr. Chan is involved with the investment and development of commercial, hospitality and residential projects. In addition, he is the lead in developing new policies for green and sustainable practices throughout the group. Mr. Chan is the founder and managing partner of Vectr Ventures, a global VC firm with investments in early to growth stage companies across Climate, Fintech, Biotech, SaaS, Media, and Proptech. Prior to joining ITC Properties, Mr. Chan worked in the Investment Banking Division of Goldman Sachs Group focused on financial institutions in APAC. Mr. Chan is a graduate of Duke University majoring in Political Science - International Relations and minoring in Philosophy and Economics.

Peter H. Kappel - Chairman of the Board and Director

Mr. Kappel is a former investment banker who now manages a private investment portfolio. A former chartered accountant with KPMG in Vancouver and Frankfurt, he made the transition to investment banking with JP Morgan (New York/Frankfurt) after business school. He also served in senior roles at Nomura, Dresdner Kleinwort Wasserstein, Calyon and DVB Bank in London. In the latter three, he was the Managing Director in charge of their respective European Securitisation businesses. He holds an MBA from the Institut Européen d'Administration des Affaires ("INSEAD"), a Bachelor of Arts (Honours) degree in Economics from the University of Victoria and received his Chartered Accountant designation through the Institute of Chartered Accountants of British Columbia.

Debora S. Fang - Director

Ms. Debora Fang has over 20 years' experience in the Fast Moving Consumer Goods industry, across mergers and acquisitions, strategy, finance and marketing roles in Unilever (London, UK), Danone (Paris, France and Amsterdam, Netherlands), Kraft Foods (Sao Paulo, Brazil) and as a consultant for Bain & Company (Los Angeles, USA). While at Unilever as VP Mergers & Acquisitions, Ms. Fang was responsible for a range of acquisitions and disposals in the Foods, Ice cream and Tea categories, leading multidisciplinary teams and covering a global scope. She is now an independent advisor for Private Equity and strategic clients in the Foods and Beverage space as well as a private investor. Ms. Fang holds an MBA from the Kellogg Graduate School of Management at Northwestern University in Chicago, USA and a Bachelor of Arts in Business from the University of Sao Paulo, Brazil.

Jeanne McCaherty - Director

Ms. McCaherty is the Chief Executive Officer of Guardian Energy Management, an ethanol manufacturing company with production sites in Ohio, Minnesota, and North Dakota. These corn dry milling sites produce ethanol, DDGS (distiller's dried grains with solubles), and corn oil. Prior to joining Guardian in 2016, Ms. McCaherty spent a year consulting in Private Equity in the areas of specialty grains and value-added ingredients. The majority of Ms. McCaherty's career was in various global management roles in Cargill, Inc. The most recent Cargill role was as the Regional Director of the Global Texturizing Business Unit. This business sourced raw materials, manufactured, and sold specialty food ingredients to Food companies around the world. Ms. McCaherty's R&D career culminated in the position of VP/Global Director of Food R&D. This role included functional leadership for the Basic and Applied R&D, Applications and Sensory groups for Cargill's Global Food Ingredients businesses. Ms. McCaherty currently serves on the board of directors for the RFA (Renewable Fuels Association) and the RPMG (Renewable Products Marketing Group).

Alfred T. L. Lau - Director

Mr. Lau is a Director of WealthOne Bank of Canada ("WOBC"), a Canadian Schedule I Bank. Prior to his current role, Mr. Lau was a partner of KPMG with over 35 years of experience at key locations around the world, including Beijing, Vancouver and London. He has held senior positions within KPMG including co-leader of the audit practice in Beijing and co-leader of the China Practice in Canada. He was the Audit Engagement Partner for a number of multi-national Fortune 500 companies and listed companies on the TSX. Mr. Lau has been an independent member of the WOBC Board of Directors since 2018 and is currently Chairman of the Audit Committee and a member of the Risk Committee. Moreover, Mr. Lau is a former director and Chairman of the Audit Committee of SUCCESS, one of the largest nonprofit organizations in Canada. He graduated from the University of British Columbia with a Bachelor of Commerce degree in 1980 and received his Chartered Accountant designation in 1982.

Aaron T. Ratner - Director

Mr. Ratner is an Executive Director with Alternus Clean Energy (Nasdaq: ALCE), as well as Co-Founder of CC Risk Solutions, a climate insurance platform. He is also a Co-Founder and Managing Partner with Vectr Carbon Partners in Hong Kong, was an Operating Partner with Nexus PMG, a leading infrastructure advisory and project development company, from 2020-2022. He has over 20 years of domestic and international investment and advisory experience, including 8 years in Asia, focusing on project finance, venture capital, climate technology, energy, and agriculture. Mr. Ratner began his career as a foreign market entry strategist at WKI, a global strategic consulting firm based in Virginia, and then as an Analyst in the Internet Investment Banking Group at Merrill Lynch in Palo Alto, CA. In 2000, he moved to Hong Kong to work for Simon Murray & Company, a Pan-Asian multi-strategy investment and advisory firm. Thereafter, he held senior positions in various merchant banks and investment firms. Mr. Ratner attended the Stanford University Graduate School of Business and completed his undergraduate education at the University of Pennsylvania (Economics, Honors) and Jochi University, Tokyo.

John A. Vassallo - Director

Mr. Vassallo has over 30 years' experience in asset acquisition, development and management across several industries in multiple states. As Founder and CEO of Mos RE, LLC, Mr. Vassallo focuses on real estate development, land entitlements, redevelopment and strategic reuse of underutilized buildings by utilizing multi-source financing packages, including historic tax credits, tax incremental financing and state development programs. Mr. Vassallo headed multiple capital raises for a variety of developments and acquisitions. Mr. Vassallo also has experience in purchasing distressed debt for profitable returns. As Founder and CEO of Global Restaurant Systems, LLC, Mr. Vassallo established a multi-faceted management and consulting company providing inclusive restaurant development and operating services including accounting, human resources, real estate analysis and acquisition, legal, marketing, IT and administrative support to its clients.

James Peter Pekar - Nominee

Mr. Pekar has over 30 years' of experience in the dairy and food industry. Born and raised in Wisconsin, United States, Mr. Pekar received a full athletic scholarship to attend the University of Iowa to play football. His football career spanned from 1978 to 1987, from playing with the Iowa Hawkeyes to the LA Express and San Antonio Gunslingers, two USFL football teams. In 1994, Mr. Pekar started a dairy based enzyme-modified reaction company, named First Choice Ingredients, which specialized in reaction, fermentation and distillation technologies. First Choice became world renowned for developing dairy based flavor systems and dairy notes using cultures and enzymes in the fermentation process. Started in the basement of his first home, Mr. Pekar grew First Choice from one employee to over 150 employees and three plants (which included 150,000+ square feet of office and manufacturing space) and operated the business successfully for 27 years. In 2021, Mr. Pekar sold First Choice to international powerhouse DSM for US$460 million.

Board Committees

Burcon does not have an executive committee of its directors. Burcon has an audit committee, a corporate governance and nominating committee and a compensation committee. Membership on the committees is set out in the following table.

| Director | Audit

Committee | Compensation

Committee | Corporate

Governance and

Nominating

Committee |

| Debora S. Fang | √ | √ | |

| Peter H. Kappel | √ | √ | √ |

| Alfred T. L. Lau | √ | | √ |

| Jeanne McCaherty | | √ | √ |

| Aaron T. Ratner | √ | √ | |

| D. Lorne Tyrrell | √ | | √ |

| John A. Vassallo | | √ | √ |

Mr. Alan Chan is not a member of any committees of the board of directors. Mr. Peter Kappel is member of the audit committee and an ex-officio member of the compensation committee and corporate governance and nominating committee. Mr. J. Douglas Gilpin was a member of the audit committee and the compensation committee until September 20, 2023, when he retired from Burcon's board of directors. Mr. Aaron Ratner was a member of the audit committee from September 30, 2023 to February 1, 2024.

During fiscal year 2024, an ad hoc Merit special committee was formed to consider issues relating to Merit Functional Foods Corporation. The members of this committee were Alan Chan, Jeanne McCaherty, Peter Kappel and John Vassallo.

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

Other than as set out below, none of the persons nominated for election as a director:

(a) is, as at the date of this Management Proxy Circular, or has been within 10 years before the date of this Management Proxy Circular, a director or chief executive officer or chief financial officer of any company (including Burcon) that:

(a) was subject to an order that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or

(b) was subject to an order that was issued after the proposed director ceased to be a director, chief executive officer, or chief financial officer, and which resulted from an event that occurred while that person was acting in the capacity as a director, chief executive officer, or chief financial officer;

(b) is at the date hereof, or has been within 10 years before the date of this Management Proxy Circular, a director or executive officer of any company (including Burcon) that while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets;

(c) has, within the 10 years before this Management Proxy Circular become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director;

(d) has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or

(e) has been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor in making an investment decision.

Ms. Jeanne McCaherty and Mr. Peter Kappel acted as directors of Merit Functional Foods Corporation ("Merit") from October 1, 2021 and February 2022, respectively and resigned on March 1, 2023. Through its subsidiary, Burcon NutraScience Holdings Corp., Burcon holds a 31.6% interest in Merit. On March 1, 2023, PricewaterhouseCoopers Inc. was appointed by order by The Court of King's Bench (Manitoba) to be Receiver of all the assets, properties and undertakings of Merit and Merit's wholly-owned subsidiary, 11410083 Canada Ltd.

Appointment of Auditor

KPMG LLP, Chartered Professional Accountants ("KPMG") of 777 Dunsmuir Street, 11th Floor, Vancouver, BC, V7Y 1K3 will be nominated at the Meeting for re-appointment as auditor of Burcon at a remuneration to be fixed by the directors. KPMG has been Burcon's auditor since November 23, 2022.

Approval of Warrants Issued to John A. Vassallo

On March 6, 2024, Burcon entered into a Strategic Advisory and Consulting Agreement (the "Advisory and Consulting Agreement") with Mr. John Vassallo, a director of Burcon, pursuant to which the Mr. Vassallo will provide Burcon with ongoing consulting services including, among other things, providing strategic and financial advice to Burcon, meeting with potential investors and strategic partners of Burcon and advising on strategic transactions of Burcon, all beyond the scope of Mr. Vassallo's usual duties as a director (collectively, the "Consulting Services"). The Advisory and Consulting Agreement has a one year term that may be extended by mutual written agreement between the parties. Given Mr. Vassallo's business experience, the board of directors of Burcon believed it would be in the Corporation's best interest to engage Mr. Vassallo as an advisor to the Corporation as Burcon transitions from a research and development company and implements its Burcon 2.0 strategy with the view of producing and selling products to generate revenues.

In order to appropriately compensate Mr. Vassallo for the Consulting Services, and in order to align Mr. Vassallo's interests with the interests of Burcon's shareholders, Burcon agreed to pay Mr. Vassallo a fixed fee of 5,000,000 non-transferable common share purchase warrants (the "Compensation Warrants"), with each Compensation Warrant exercisable into one Common Share at a price of $0.27 per Common Share for a period of 27 months following the date of issue of the Compensation Warrants.

On March 25, 2024, Burcon issued the Compensation Warrants to Mr. Vassallo upon receipt of conditional approval from the Toronto Stock Exchange ("TSX"). As the grant of Compensation Warrants to Mr. Vassall is considered a form of security based compensation arrangement pursuant to the policies of the TSX, the Compensation Warrants were granted to Mr. Vassallo subject to shareholder approval. Accordingly, the Compensation Warrants may not be exercised by Mr. Vassallo unless and until such time as a simple majority of the shareholders of the Corporation, on a disinterested basis, approve the Compensation Warrants at a duly called meeting of Shareholders (the "Disinterested Shareholder Approval").

Other than the requirement to receive Disinterested Shareholder Approval, the Compensation Warrants have no other vesting provisions and will become immediately exercisable if Disinterested Shareholder Approval is received. The exercise price of the Compensation Warrants was determined by the Board (excluding Mr. Vassallo) in negotiations with Mr. Vassallo. The exercise price of the Compensation Warrants represents a 43% premium to the five-day volume weighted average trading price of the Corporation's Common Shares between February 28, 2024 and March 5, 2024 of $0.19, being the five trading days prior to the date of Advisory and Consulting Agreement. The Compensation Warrants represent 3.52% of the Corporation's issued and outstanding Common Shares as of the date hereof.

If the Disinterested Shareholder Approval is not received, the Compensation Warrants shall expire after the Meeting and the Corporation will, in lieu of the Compensation Warrants and as per the terms of the Advisory and Consulting Agreement, pay Mr. Vassallo a cash amount of $450,000 as an alternative form of compensation for the Consulting Services (the "Cash Compensation"). Payment of the Cash Compensation will be subject to TSX approval.

At the Meeting, shareholders are being asked to consider, and if deemed appropriate, to approve the ordinary resolution set forth below (the "Warrant Grant Resolution"), with the votes attached to Common Shares held by John A. Vassallo and his respective affiliates and associates being excluded from such vote. Management unanimously recommends Shareholders vote FOR the Warrant Grant Resolution.

"BE IT RESOLVED AS AN ORDINARY RESOLUTION THAT:

1. The issuance of 5,000,000 non-transferable common share purchase warrants (the "Compensation Warrants") to John A. Vassallo pursuant to the Strategic Advisory and Consulting Agreement dated March 6, 2024 (the "Advisory and Consulting Agreement") as compensation for the Consulting Services (as defined in the Advisory and Consulting Agreement), being a security-based compensation arrangement for the purposes of the TSX rules, be and is hereby authorized, ratified and approved.

2. Any one director or officer is authorized and directed on behalf of the Corporation to perform all such acts, deeds and things and execute, under seal of the Corporation if applicable, all such documents, instruments, certificates and other writings as may be necessary or desirable to give effect to this resolution."

In order for the Warrant Grant Resolution to be passed, it requires the positive approval of a simple majority (greater than 50%) of the votes cast thereon at the Meeting, with the 8,270,056 votes attached to the Common Shares held by John A. Vassallo and his respective affiliates and associates, representing 5.82% of the outstanding Common Shares as of the date hereof, being excluded from such vote. The directors of the Corporation believe the passing of the foregoing ordinary resolution is in the best interests of the Corporation and recommend that shareholders of the Corporation vote in favour of the resolution. The persons named as proxies in the enclosed Proxy intend to cast the votes represented by proxy in favour of the foregoing resolution unless the holder of Common Shares who has given such proxy has directed that the votes be otherwise cast.

Share Consolidation

At the Meeting, Shareholders will be asked to consider, and, if deemed appropriate, to approve an ordinary resolution set forth below (the "Consolidation Resolution"), authorizing the Board, at its description, to effect a consolidation of all of the issued and outstanding Common Shares on the basis of a consolidation ratio, to be determined by the Board, of up to twenty (20) pre-consolidation Common Shares for one (1) post-consolidation Common Share (the "Share Consolidation"), provided that effective date shall be before September 18, 2026 (the "Effective Time").

The Board believes it is in the best interests of the Corporation and its Shareholders to provide the Board with the ability to complete the Share Consolidation, should it determine to do so, in its sole discretion. The Board believes that a Share Consolidation could lead to increased interest by a wider audience of potential investors and result in less volatility resulting in a more efficient market for the Common Shares. The Board also regularly evaluates other opportunities to increase the Corporation's access to capital markets and a potential Share Consolidation could allow the Corporation to access other exchanges that have minimum listing requirements.

Approval of the Consolidation Resolution does not necessarily mean that the Board will implement a Share Consolidation. Although Shareholder approval for a Share Consolidation is being sought at the Meeting, a Share Consolidation would only become effective at a future date to be determined by the Board, in its sole discretion, prior to the Effective Time, if and when it is considered to be in the best interest of the Corporation to implement a Share Consolidation. The Board may determine not to implement a Share Consolidation at any time after the Meeting without further action on the part of or notice to the Shareholders.

Effects of the Share Consolidation

If the Share Consolidation is implemented, its principal effect will be to proportionately decrease the number of issued and outstanding Common Shares by a factor equal to the consolidation ratio of up to twenty (20) pre-consolidation Common Shares for one (1) post-consolidation Common Shares. The Share Consolidation would result in each Shareholder owning fewer Common Shares than they owned immediately before the Share Consolidation, and convertible rights to acquire Common Shares would become exercisable to purchase a fewer number of Common Shares at an exercise price per share increased by a factor equal to the consolidation ratio selected.

For illustrative purposes only, the following table sets out, based on the number of issued and outstanding Common Shares as of the date hereof, without giving effect to the cancellation of fractional Common Shares, following the implementation of a Share Consolidation at various consolidation ratios:

Consolidation Ratio | Common Shares

Outstanding |

No Consolidation | 142,098,096 |

2 Pre-Consolidation Common Shares for 1 Post-Consolidation Common Share | 71,049,048 |

5 Pre-Consolidation Common Shares for 1 Post-Consolidation Common Share | 28,419,619 |

10 Pre-Consolidation Common Shares for 1 Post-Consolidation Common Share | 14,209,810 |

20 Pre-Consolidation Common Shares for 1 Post-Consolidation Common Share | 7,104,905 |

The Corporation does not expect the Share Consolidation itself to have any economic effect on holders of Common Shares or securities convertible into or exercisable to acquire Common Shares, except to the extent the Share Consolidation will result in fractional Common Shares. Fractional Common Shares will be rounded up or down to the nearest whole number, with any fractional share interest of 0.50 or higher being rounded up to one whole Common Share, and any fractional share interest of less than 0.50 being cancelled.

If a proposed Share Consolidation is approved by the Shareholders and all relevant regulatory authorities, and a Share Consolidation is ultimately implemented by the Board before the Effective Time, following the announcement by the Corporation of the effective date of the Share Consolidation, Registered Shareholders will be sent a letter of transmittal by the Corporation's transfer agent, Computershare Investor Services Inc., containing instructions on how to exchange their share certificates representing pre-consolidation Common Shares for new share certificates representing post-consolidation Common Shares or, alternatively, a Direct Registration System ("DRS") Advice/Statement representing the number of post-consolidation Common Shares they hold following the Share Consolidation. The DRS is an electronic registration system which allows Shareholders to hold Shares in their name in book-based form, as evidenced by a DRS Advice/Statement rather than a physical share certificate. Non-Registered Shareholders holding their Common Shares through a broker, trustee or other financial institution should note that such broker, trustee or other financial institution may have different procedures for processing the Share Consolidation than those that will be put in place by the Corporation for the Registered Shareholders. If you hold your Common Shares with such a broker, trustee or other financial institution and if you have any questions in this regard, you are encouraged to contact your nominee.

Until surrendered to the transfer agent, each share certificate representing old pre-consolidation Common Shares will be deemed for all purposes to represent the number of new post-consolidation Common Shares to which the Registered Shareholder is entitled as a result of a Share Consolidation. Until Registered Shareholders have returned their properly completed and duly executed letter of transmittal and surrendered their old share certificate(s) for exchange, Registered Shareholders will not be entitled to receive any distributions, if any, that may be declared and payable to holders of record following a Share Consolidation.

Any Registered Shareholder whose old certificate(s) have been lost, destroyed or stolen will be entitled to a replacement share certificate only after complying with the requirements that the Corporation and the transfer agent customarily apply in connection with lost, stolen or destroyed certificates. The method chosen for delivery of share certificates and letters of transmittal to the Corporation's transfer agent is the responsibility of the Registered Shareholder and neither the transfer agent nor the Corporation will have any liability in respect of share certificates and/or letters of transmittal which are not actually received by the transfer agent.

REGISTERED SHAREHOLDERS SHOULD NEITHER DESTROY NOR SUBMIT ANY SHARE CERTIFICATE UNTIL HAVING RECEIVED A LETTER OF TRANSMITTAL.

Holders of Corporation options, warrants, or other convertible units will be contacted directly if a proposed Share Consolidation is completed with respect to the procedures required to update their securities, if any.

Following the completion of a Share Consolidation, the Common Shares would continue to be listed on the TSX under the symbol "BU". Pre-consolidation voting rights and other rights of the Shareholders will not be affected by the Share Consolidation, other than as a result of the disposition of fractional Common Shares.

TSX Approval

Assuming Shareholder approval is received at the Meeting, and assuming that the Board determines to proceed with a Share Consolidation, the Share Consolidation will be subject to acceptance by the TSX, and confirmation that, on a post Share Consolidation basis, the Corporation would meet all of the TSX's continued listing requirements. If the TSX does not accept the Share Consolidation, the Corporation will not proceed with the Share Consolidation.

Rists Associated with the Share Consolidation

Reducing the number of issued and outstanding Common Shares through the Share Consolidation is intended, absent other factors, to increase the per-Common Share market price of the Common Shares by a factor approximately equal to the consolidation ratio. However, the market price of the Common Shares will also be affected by the Corporation's financial and operational results, its financial position, including its liquidity and capital resources, industry conditions, the market's perception of the Corporation's business and other factors, which are unrelated to the number of Common Shares outstanding. There is no assurance that the anticipated market price immediately following the implementation of the Share Consolidation will be realized or, if realized, will be sustained or will increase. There is a risk that the total market capitalization of the Common Shares (the market price of the Common Shares multiplied by the number of Common Shares outstanding) after the implementation of the Share Consolidation may be lower than the total market capitalization of the Common Shares prior to the implementation of the Share Consolidation.

Having regard to these other factors, there can be no assurance that the market price of the Common Shares will increase following the implementation of a Share Consolidation.

If a Share Consolidation is implemented and the market price of the Common Shares (adjusted to reflect the ratio of the Share Consolidation) declines, the percentage decline as an absolute number and as a percentage of the Corporation's overall market capitalization may be greater than would have occurred if the Share Consolidation had not been implemented. Both the total market capitalization of a company and the adjusted market price of such company's shares following a consolidation or reverse split may be lower than they were before the consolidation or reverse split took effect. The reduced number of Common Shares that would be outstanding after the Share Consolidation is implemented could adversely affect the liquidity of the Common Shares.

Approval of the Share Consolidation

For the reasons outlined above, the Board believes that obtaining shareholder approval at the Meeting to implement the Share Consolidation is in the best interests of the Corporation and the Shareholders. Accordingly, management unanimously recommends that Shareholders vote FOR the Consolidation Resolution set out below.

"BE IT RESOLVED AS AN ORDINARY RESOLUTION THAT:

1. The authorized share structure of the Corporation may be altered by consolidating all of the issued and outstanding common shares of the Corporation at a ratio to be selected by the Corporation's board of directors (the "Board"), in its absolute discretion, provided that the consolidation shall be no greater than twenty (20) pre-consolidation common shares for every one (1) post-consolidation common share (the "Share Consolidation").

2. The date of completion of the Share Consolidation shall be determined at the discretion of the Board, provided that such date shall be before September 18, 2026.

3. Any fractional common shares resulting from the consolidation of the common shares be converted to whole common shares pursuant to the provisions of Section 83 of the Business Corporation Act (British Columbia).

4. The Board be and it is hereby authorized to revoke, without further approval of the shareholders, this ordinary resolution at any time prior to the completion thereof, notwithstanding the approval by the shareholders of same, if determined, in the Board's sole discretion to be in the best interest of the Corporation.

5. Any one director or officer is authorized and directed on behalf of the Corporation to perform all such acts, deeds and things and execute, under seal of the Corporation if applicable, all such documents, instruments, certificates and other writings as may be necessary or desirable to give effect to this resolution."

In order for the Consolidation Resolution to be passed, it requires the positive approval of a simple majority (greater than 50%) of the votes cast thereon at the Meeting. If the Corporation obtains shareholder approval, the Consolidation Resolution would be valid until the Effective Time. The directors of the Corporation believe the passing of the foregoing ordinary resolution is in the best interests of the Corporation and recommend that shareholders of the Corporation vote in favour of the resolution. The persons named as proxies in the enclosed Proxy intend to cast the votes represented by proxy in favour of the foregoing resolution unless the holder of Common Shares who has given such proxy has directed that the votes be otherwise cast.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

EQUITY COMPENSATION PLAN INFORMATION AS AT MARCH 31, 2024 |

Plan Category | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

(a) | Weighted-average

exercise price of

outstanding options,

warrants and rights

(b) | Number of securities

remaining available for

future issuance under

equity compensation plans

[excluding securities

reflected in column (a)]

(c) |

Equity compensation plans approved by Securityholders: | | | |

(1) Amended and Restated 2001 Share Option Plan | 9,689,931 | $1.35 | 4,518,962 |

(2) Restricted Share Unit Plan | 341,000 | N/A | 562,935 |

Equity compensation plans not approved by Securityholders | Nil | N/A | Nil |

The numbers in the above chart are as at March 31, 2024. As at the date of this Management Proxy Circular, a total of 9,685,900 stock options are issued and outstanding under the Amended and Restated Plan (as defined below) representing approximately 6.82% of our issued and outstanding capital. Of the total options outstanding, 6,821,024 options are granted to insiders representing approximately 4.73% of our outstanding capital. Currently, 4,523,909 options are available for grant under the Amended and Restated Plan representing approximately 3.18% of the issued and outstanding Common Shares as of the date hereof. As of the date of this Management Proxy Circular, a total of 323,000 restricted share units are outstanding and 571,772 units are available for grant under the Restricted Share Unit Plan.

Burn Rate of the Amended and Restated Plan and Restricted Share Unit Plan

The chart below sets out the burn rate of the Amended and Restated Plan for the three most recently completed fiscal years ended March 31, 2024, March 31, 2023 and March 31, 2022. The annual burn rate is expressed as a percentage by dividing the number options granted under the Amended and Restated Plan during the applicable fiscal year by the weighted average number of common shares outstanding for the applicable fiscal year.

Fiscal Year | Number of Stock Options

Granted | Weighted Average Number of

Common Shares | Stock Option Burn

Rate |

2024 | 2,901,000 | 121,398,318 | 2.39% |

2023 | 2,320,000 | 108,728,742 | 2.13% |

2022 | 1,245,000 | 108,588,454 | 1.15% |

The chart below sets out the burn rate of the Restricted Share Unit Plan for the most recently completed fiscal year ended March 31, 2024, March 31, 2023 and March 31, 2022. The annual burn rate is expressed as a percentage by dividing the number units granted under the Restricted Share Unit Plan during the fiscal year by the weighted average number of common shares outstanding for the fiscal year.

Fiscal Year | Number of Restricted Share

Units Granted | Weighted Average Number of

Common Shares | Restricted Share

Unit Burn Rate |

2024 | 112,000 | 121,398,318 | 0.09% |

2023 | 307,181 | 108,728,742 | 0.28% |

2022 | 121,000 | 108,558,454 | 0.11% |

Description of Amended and Restated 2001 Share Option Plan

At Burcon's annual and special meeting held on September 19, 2001, the shareholders of Burcon approved the terms of the 2001 Share Option Plan (the "Plan") under which directors, officers, employees, management company employees and consultants ("Service Providers") of Burcon may be granted options to acquire Common Shares of Burcon. The principal purpose of the Plan is to encourage equity participation in Burcon by its Service Providers so that they have an interest in preserving and maximizing shareholder value in the longer term while enabling Burcon to attract and retain individuals with experience and ability and reward individuals for current and expected future performance. The Plan had a fixed number of options that could be granted to Service Providers. The Plan was amended in 2003, 2004, 2007 and 2009 to increase the number of Common Shares issuable under the Plan. At Burcon's annual meeting on September 1, 2011, the shareholders of Burcon approved the amendment to the Plan to convert it from a fixed plan to a rolling plan (the "Amended and Restated Plan"). A rolling plan has a plan maximum expressed as a percentage of the total number of common shares outstanding on a non-diluted basis and all exercised, cancelled, expired or terminated options become available for future grant. The Amended and Restated Plan permits the issuance of that number of options up to a maximum of 10% of the issued and outstanding Common Shares of Burcon from time to time. As of the date hereof, Burcon has 142,098,096 Common Shares outstanding of which 10% is 14,209,809.

During the year ended March 31, 2013, the Board amended the Amended and Restated Plan to provide optionees with an alternative method to exercise stock options. An optionee may elect to exercise an option using the cashless method, whereby the optionee receives the number of shares the value of which is equal to the amount by which the fair market value of the Common Shares exceeds the option exercise price. The fair market value is determined by the weighted average trading price of the Common Shares during the five trading days preceding the date of exercise.

The TSX requires that rolling plans, such as the Amended and Restated Plan, be approved by a majority of directors and by shareholders every three years. Since inception, the Amended and Restated Plan was re-approved by directors and shareholders every three years as follows:

Re-approval Every 3 Years | By Directors | By Shareholders |

First 3-year Anniversary | July 24, 2014 | September 10, 2014 |

Second 3-year Anniversary | July 18, 2017 | September 7, 2017 |

Third 3-year Anniversary | July 23, 2020 | September 7, 2020 |

Fourth 3-year Anniversary | July 24, 2023 | September 20, 2023 |

The next three-year anniversary on which the Amended and Restated Plan must be approved by Shareholders is September 20, 2026.

The principal terms of the Amended and Restated Plan are summarized as follows:

• The aggregate number of optioned shares that may be granted under the Amended and Restated Plan, shall not exceed 10% of the Common Shares then issued and outstanding on a non-diluted basis. Any increase in the issued and outstanding Common Shares will result in an increase in the number optioned shares available under the Amended and Restated Plan and any exercise, conversion, redemption, expiry, termination, cancellation or surrender of options granted will make additional optioned shares available under the Amended and Restated Plan;

• The Board is responsible for the general administration of the Amended and Restated Plan and the proper execution of its provisions and its interpretation;

• The Amended and Restated Plan contains limitations on option issuances. The limitations are unless disinterested shareholder approval is obtained: (a) insiders cannot be granted awards under the Amended and Restated Plan or any other security based compensation plan to purchase more than 10% of the listed Common Shares within any 12 month period; and (b) the aggregate number of outstanding awards granted to insiders under the Amended and Restated Plan or any other security based compensation plan may not exceed 10% of the listed Common Shares at any time;

• Other than in the case of an optionee's death, where options become exercisable by the deceased optionee's lawful personal representatives, heirs or executors, all options granted under the Amended and Restated Plan continue to be non-assignable and non-transferable, however, the Amended and Restated Plan allows for a transfer to a Service Provider's registered retirement savings plan, registered retired income fund or tax-free savings account, or the equivalent thereof, established by or for the benefit of the optionee;

• A Service Provider who is no longer employed by Burcon, except in the case of death, retirement or the participant becoming totally disabled, has up to the lesser of 30 days after ceasing to be a Service Provider, and the expiration of the term applicable to such option, to exercise their options;

• In the case of an optionee's death, any vested option held on the date of death is exercisable by the optionee's lawful personal representatives, heirs or executors until the earlier of one year from death and the expiration of the option's term, while in the case where a Service Provider has retired, become totally disabled or died after ceasing to be a Service Provider, outstanding options whether vested or unvested can be exercised by the optionee, or if the optionee has died by their personal representatives, until the earlier of the option's expiry date and 90 days after the date of retiring, becoming totally disabled or death after ceasing to be a Service Provider;

• The exercise price of the options will be set by the Board at the time the options are allocated but cannot be less than the price per Burcon's common share traded on the TSX as at the closing on the last trading day before the date that the options are granted;

• The Board at their discretion has the power to determine the time, or times when options will be granted, vest and be exercisable, to determine when it is appropriate to accelerate when options otherwise subject to vesting may be exercised and provide a cashless exercise feature to an option or the Amended and Restated Plan, provided that the Board will not have the right to (i) reduce the exercise price of any option or cancel any option and replace such option with a lower exercise price under such replacement option without shareholder approval or unless otherwise permitted under the Amended and Restated Plan; or (ii) affect in a manner that is adverse or prejudicial to, or that impairs, the benefits and rights of any Service Provider under any option previously granted under the Amended and Restated Plan except with the consent of the Service Provider or otherwise permitted under the Amended and Restated Plan or for the purposes of complying with the requirements of the TSX or a regulatory authority to which the Corporation is subject;

• The term of an option will not exceed 10 years from the date of grant, however, if the expiry date of any vested option falls during or within nine business days of a black-out period or other trading restriction imposed by Burcon, then the option's expiry date shall be automatically extended for ten business days following the date of the relevant black-out period or other trading restriction being lifted, terminated or removed;

• The Board has the ability to: (a) with shareholder approval by ordinary resolution make any amendment to any option commitment, option or the Amended or Restated Plan; and (b) without shareholder approval make any amendments: (i) of a clerical nature, (ii) to reflect regulatory requirements, (iii) to vesting provisions, (iv) to expiration dates as long as there is no extension past the original date of expiration, and (v) providing for a cashless exercise feature; and

• The Amended and Restated Plan allows Burcon to satisfy its withholding obligations from any amount payable to a Service Provider that is an optionee as is required by law to be withheld or deducted upon an option exercise.

Description of Restricted Share Unit Plan

At Burcon's annual and special meeting held on September 15, 2021, the shareholders of Burcon approved the terms of the restricted share unit plan (the "Restricted Share Unit Plan") under which directors, officers, employees, management company employees and consultants of Burcon may be granted restricted share units redeemable for Common Shares of Burcon. The Restricted Share Unit Plan was approved by the Board on July 20, 2021 (the "Effective Date"). The purposes of the Restricted Share Unit Plan are to (i) promote a greater alignment of interests between directors, executive officers, employees and consultants of the Corporation and its affiliates and shareholders; (ii) assist the Corporation and its affiliates to attract and retain individuals with experience and ability to serve as directors, executive officers, key employees and consultants; and (iii) allow the certain eligible persons to participate in the long-term success of the Corporation. As of the date hereof, 323,000 restricted share units are outstanding.

The principal terms of the Restricted Share Unit Plan are summarized as follows:

• Under the Restricted Share Unit Plan, the Corporation may grant restricted share units to directors, executive officers, employees and consultants of the Corporation and its affiliates (each an "Eligible Person").

• The Board, or a committee designated by the Board from time to time, is responsible for the general administration of the Restricted Share Unit Plan and the proper execution of its provisions and its interpretation. The Board has the power to determine the time, or times when restricted share units will be granted, will vest and be redeemed, and to determine when it is appropriate to accelerate restricted share units;

• The aggregate number of Common Shares which may be issuable upon the redemption of all restricted share units under the Restricted Share Unit Plan shall not exceed 1,084,879, which represents 1% of the issued and outstanding Common Shares of the Corporation as at the Effective Date. If a restricted share unit expires, is forfeited or is cancelled for any reason, the Common Share(s) subject to that restricted share unit shall again be available for grant under the Restricted Share Unit Plan, subject to any required prior approval of the TSX;

• The Restricted Share Unit Plan also contains the following limitations on grants of restricted share units (unless disinterested shareholder approval is obtained) to insiders: (a) the aggregate number of Common Shares issuable to insiders and their associates at any time pursuant to the redemption of restricted share units, including Common Shares issuable under any other security based compensation plan, shall not exceed 10% of the Common Shares; and (b) the aggregate number of Common Shares that may be issued to insiders and their associates within any 12-month period pursuant to the redemption of restricted share units shall not exceed 10% of the Common Shares;

• The Restricted Share Unit Plan does not provide for a maximum number of restricted share units which may be issued to an individual pursuant to the Restricted Share Unit Plan (expressed as a percentage or otherwise);

• Other than in the case of an optionee's death, where restricted share units become redeemable by the deceased Eligible Person's legal personal representatives, all restricted share units granted under the Restricted Share Unit Plan are non-assignable and non-transferable;

• An Eligible Person who resigns before the vesting date of their restricted share units shall forfeit all rights, title and interest in the restricted share units for which the vesting date is on or after the earlier of: (i) the date of delivery of the notice of resignation; and (ii) the effective date of the resignation;

• If an Eligible Person's employment is terminated for reasons other than resignation, retirement or permanent disability, cause or death (each as determined in accordance with the Restricted Share Unit Plan) before the vesting date of such Eligible Person's restricted share units, any unvested restricted share units shall vest pro-rata based on the number of completed months of service since the grant date to the termination date of such Eligible Person. Such vested restricted share units will be payable in Common Shares or cash based on the market value of the Common Shares at the termination date of such Eligible Person;

• In the case of an Eligible Person's death, any unvested restricted share units held by such Eligible Person shall vest on the Eligible Person's termination date and the Corporation will redeem all such vested restricted share units and the Common Shares issuable upon such redemption will be issued to the legal representatives of the estate of such Eligible Person;

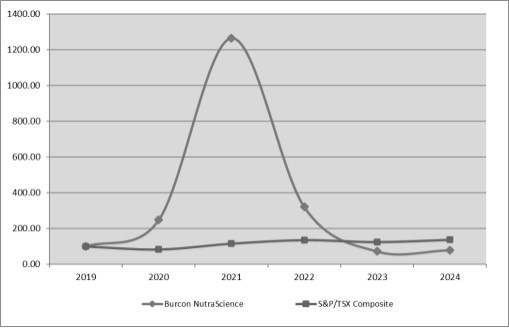

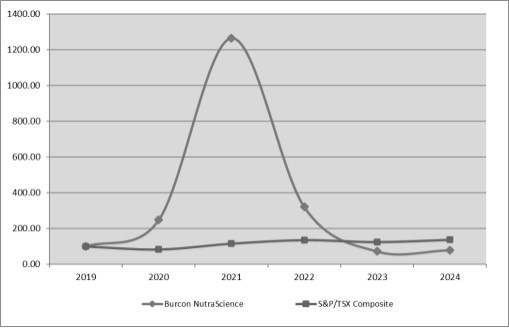

• In the case of an Eligible Person's employment ceasing as a result of retirement or permanent disability, any unvested restricted share units held by such Eligible Person shall, at the discretion of the Board, either: (i) continue to vest according to the vesting schedule set out in the applicable restricted share unit grant agreement; or (ii) vest pro-rata based on the number of completed months of service since the grant date to the termination date of such Eligible Person. Such vested restricted share units will be payable in Common Shares or cash based on the market value of the Common Shares at the applicable vesting date;