1 1 JETBLUE INVESTOR DAY NOVEMBER 19, 2014

2 2 This presentation contains statements of a forward-looking nature which represent our management's beliefs and assumptions concerning future events. When used in this document and in documents incorporated herein by reference, the words “expects,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, our extremely competitive industry; volatility in financial and credit markets which could affect our ability to obtain debt and/or lease financing or to raise funds through debt or equity issuances; increases and volatility in fuel prices, maintenance costs and interest rates; our ability to implement our growth strategy; our significant fixed obligations and substantial indebtedness; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on high daily aircraft utilization; our dependence on the New York metropolitan market and the effect of increased congestion in this market; our reliance on automated systems and technology; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; our reliance on a limited number of suppliers; our presence in some international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from information security breaches; changes in or additional government regulation; changes in our industry due to other airlines' financial condition; economic downturn leading to a continuing or accelerated decrease in demand for domestic and business air travel; any outbreak of, or worsening of, a disease that affects travel behavior; and external geopolitical events and conditions. Further information concerning these and other factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to, the Company's 2013 Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. We undertake no obligation to update any forward-looking statements to reflect events or circumstances that may arise after the date of this presentation. The following presentation also includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. We refer you to the reconciliations made available on our website at Jetblue.com in connection with our October 2014 third quarter earnings call, which reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP. SAFE HARBOR

INTRODUCTION DAVE BARGER CHIEF EXECUTIVE OFFICER

ROBIN HAYES | PRESIDENT BUILDING A SUSTAINABLE PATH ROBIN HAYES PRESIDENT

5 5 MISSION: INSPIRE HUMANITY

6 6 Differentiated Product & Culture Competitive Costs High Value Geography 1 2 3 SERVING THE UNDERSERVED

7 7 DIFFERENTIATED PRODUCT & CULTURE Picture on competitive costs DIFFERENTIATED PRODUCT & CULTURE

8 8 COMPETITIVE COSTS COMPETITIVE COSTS

9 9 HIGH-VALUE GEOGRAPHY HIGH-VALUE GEOGRAPHY

10 10 WINNING OVER THE NEXT THREE YEARS FARE FAMILIES CABIN REFRESH NEW & ONGOING INITIATIVES UNIT COST CONTROL TARGETED GROWTH FLEET OPTIMIZATION FOCUS ON RETURNS

ROBIN HAYES | PRESIDENT MARGIN EXPANSION THROUGH DIFFERENTIATED PRODUCT & CULTURE MARTY ST. GEORGE SVP COMMERCIAL

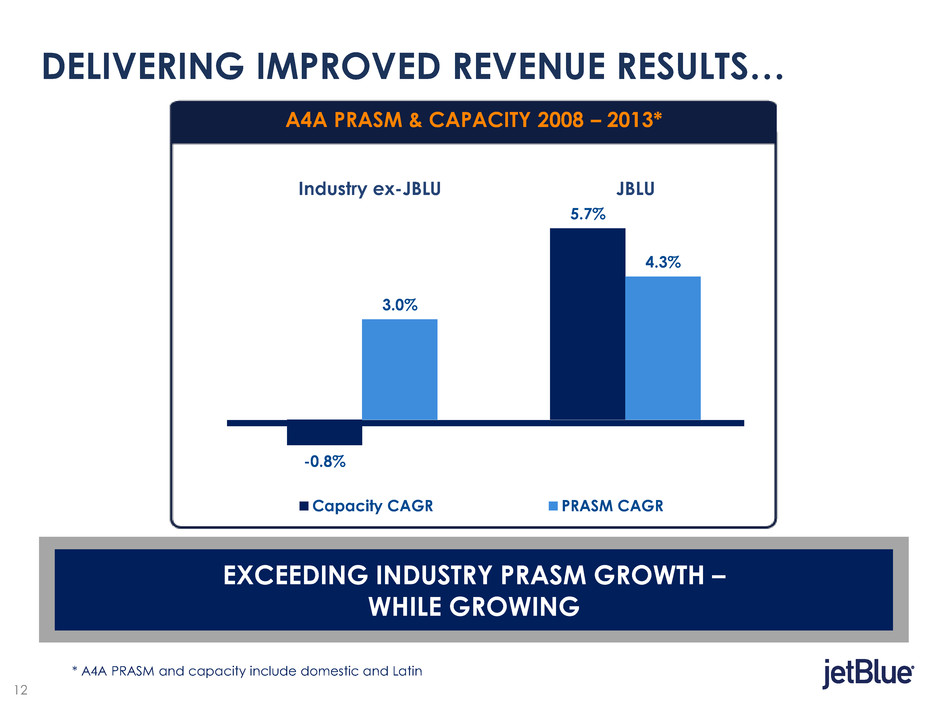

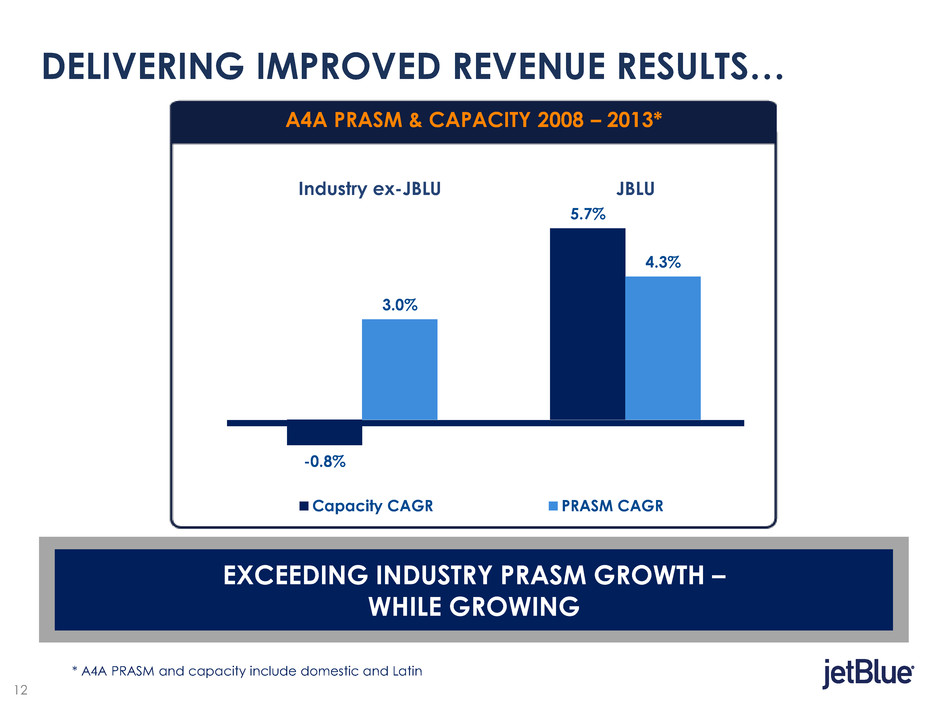

12 12 DELIVERING IMPROVED REVENUE RESULTS… Industry ex-JBLU JBLU A4A PRASM & CAPACITY 2008 – 2013* -0.8% 5.7% 3.0% 4.3% Capacity CAGR PRASM CAGR Industry ex-JBLU JBLU v EXCEEDING INDUSTRY PRASM GROWTH – WHILE GROWING * A4A PRASM and capacity include domestic and Latin

13 13 …THROUGH SOLID EXECUTION EVEN MORE REVENUE v EVEN MORE REVENUE PER CUSTOMER UP ~200% SINCE 2008 * As of 10/23/14 guidance $45M $75M $85M $120M $150M $170M $190M* 2008 2009 2010 2011 2012 2013 2014E Even More ($)

14 14 MINT: SOLVING A STRUCTURAL DISADVANTAGE JBLU JFK-LAX REVENUE PER DEPARTURE BEFORE MINT $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 JBLU OA Competitor Economy Premium 10% deficit Source: US DOT Database 1A

15 15 MINT: SURPRISING & DELIGHTING “The seats, the amenities, and most of all the service. Jennel was great. She was so kind and professional with a sincere warmth.” “The food and service was amazing, Angel and Rolando were top notch. I felt like I was dining at a 5 star restaurant and the food was out of this world.” “Well done JetBlue – loved flying Mint!”

16 16 MINT: SOLVING A STRUCTURAL DISADVANTAGE JFK-LAX REV/DEPARTURE BEFORE MINT SEPTEMBER YOY ACTUALS* REVENUE: + 24% COST **: + 6% Margin: + 17 pts v MINT EXPECTED TO SIGNIFICANTLY IMPROVE TRANSCON PERFORMANCE * Measured on a per departure basis ** Adjusted for constant fuel price Source: US DOT Database 1A $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 JBLU OA Competitor Economy Premium

17 17 FLY-FI: INDUSTRY-LEADING CONNECTIVITY FEATURE SPEED 12-20Mbps/ Customer 3-8Mbps 1-5Mbps TAKE RATE 43% 6% 7% PRICE $0-9 $12-40 $5 PRODUCT COMPARISON MONETIZATION LEVERS Brand sponsorships (4Q14) Digital ad technology (3Q15) TrueBlue acquisition (3Q15) Ecommerce/streaming revenue (4Q15)

18 18 ROIC LEVER: FARE FAMILIES UNIT COST CONTROL TARGETED GROWTH FOCUS ON RETURNS FLEET OPTIMIZATION FARE FAMILIES CABIN REFRESH NEW & ONGOING INITIATIVES

19 19 FARE FAMILIES: A TAILORED APPROACH Customer Spend ($) Trip Purpose OUR CUSTOMER SWEET SPOT Business Leisure High Value Leisure Mixed Wallets Ultra Price Sensitive Road Warriors

20 20 FARE FAMILIES: JETBLUE’S NEW MERCHANDISING PLATFORM v EXPECT ANNUAL INCREMENTAL OPERATING INCOME OF >$200M* v Departs Arrives Duration 3:26PM HPN 6:29PM FLL 3h 3m Flight 813 | View Seats | Amenities | A320 Better Even Better Best • Free TV • Free Snacks • Award Winning Service • Most Legroom in Coach • 6 TB Points per dollar • 1 Bag • Free TV • Free Snacks • Award Winning Service • Most Legroom in Coach • Other Benefits • (6+x) TB Points per dollar • 2 Bags • Free TV • Free Snacks • Award Winning Service • Most Legroom in Coach • Other Benefits • Increased Flexibility • (6+y) TB Points per dollar $ $ $ $ $ $ * At steady-state; expected incremental margin in 2015 ~$65 million

21 21 ROIC LEVER: CABIN REFRESH UNIT COST CONTROL TARGETED GROWTH FOCUS ON RETURNS FLEET OPTIMIZATION FARE FAMILIES CABIN REFRESH NEW & ONGOING INITIATIVES

22 22 CABIN REFRESH: OFFERING THE MOST LEGROOM IN COACH… Typical Economy Seat Pitch (inches) 29 30 31 32 33 34 35 2000 2005 2010 2015 JetBlue Other Airlines

23 23 CABIN REFRESH: …MAINTAINS HIGH NPS… v NPS Refreshed Core (A321) vs Traditional Core (A320) JFK LAX JFK ALL DEPARTURES +15 pts TRADITIONAL** REFRESHED* * Includes B/E Pinnacle Seats at 33”, LiveTV4 with 15/1” Mint screen and 10/1” Core screen, In-seat Power ** Includes Weber/Recaro Seats at 34”, LiveTV2e, No In-Seat Power

24 24 CABIN REFRESH: …WHILE ENHANCING MARGINS AVERAGE FLEET-WIDE SEAT PITCH* v EXPECT ANNUAL INCREMENTAL OPERATING INCOME OF $100M BY 2019 A320 CABIN REFRESH Current A320: 150 Core seats 15 Core seats Future A320: 165 Core seats *Weighted average of anticipated and/or announced fleet-wide narrow body seat pitch on US mainline carriers (excludes regional subsidiaries) Note: A320 cabin refresh program expected to commence in 3Q16 and take place over a ~2-year period 28.3 31.3 31.4 31.4 31.5 31.6 31.8 31.8 31.9 31.9 32.6 33.1 34.7 Spirit Delta Southwest Hawaiian US Airways Frontier United American WestJet Alaska Virgin JetBlue (future) JetBlue (current)

25 25 ROIC LEVER: NEW & ONGOING INITIATIVES UNIT COST CONTROL TARGETED GROWTH FOCUS ON RETURNS FLEET OPTIMIZATION FARE FAMILIES CABIN REFRESH NEW & ONGOING INITIATIVES

26 26 SUMMARY OF ROIC ACCRETIVE INITIATIVES Fare families Cabin refresh* New & ongoing Initiatives** 1 2 3 2015E 2016E 2017E Run rate >$200M ~$100M ~$150M Timeline & Margin Contribution ~$65M ~$40M * Assumes cabin refresh begins in 3Q16 and is completed over a ~2 year time frame ** Includes expected incremental margin from Even More, Co-Brand, Mint, Fly-Fi, Getaways and partnerships

QUESTIONS

BREAK

ROBIN HAYES | PRESIDENT MAINTAINING COMPETITIVE COSTS JEFF MARTIN SVP OPERATIONS

30 30 9 10 11 12 13 14 15 16 17 OUR COST POSITION IMPERATIVE Features & Benefits Network carriers Low High * Mainline stage-length adjusted CASM to 1,000 miles from AAL, ALGT, ALK, DAL, JBLU, LUV, SAVE, UAL for quarter ended September 30, 2014 Source: Company reports CASM SLA* Low cost carriers

31 31 ROIC LEVER: UNIT COST CONTROL UNIT COST CONTROL TARGETED GROWTH FOCUS ON RETURNS FLEET OPTIMIZATION FARE FAMILIES CABIN REFRESH NEW & ONGOING INITIATIVES

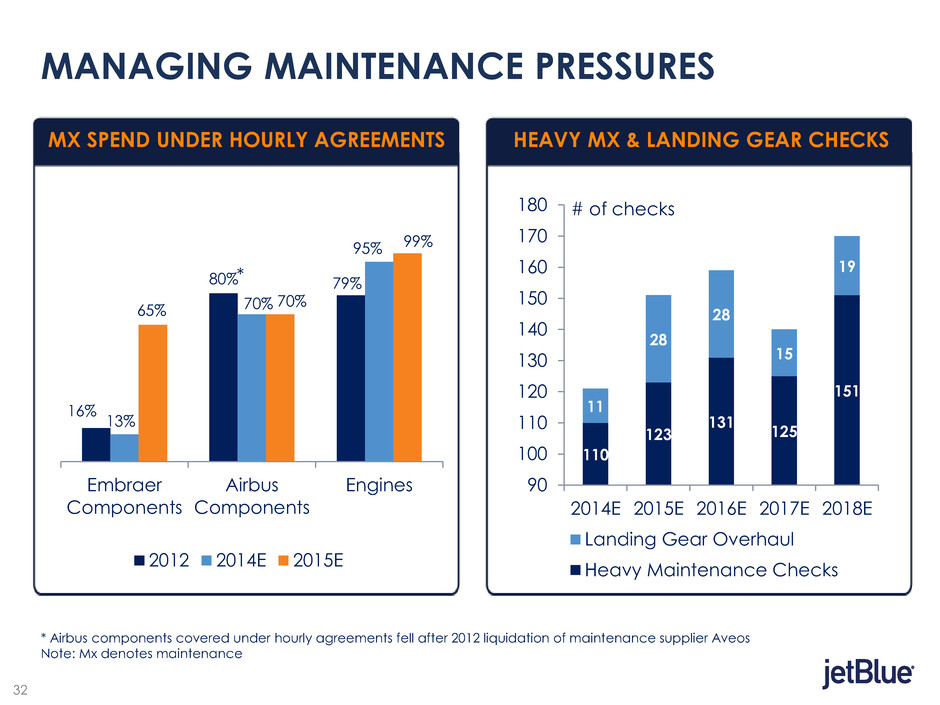

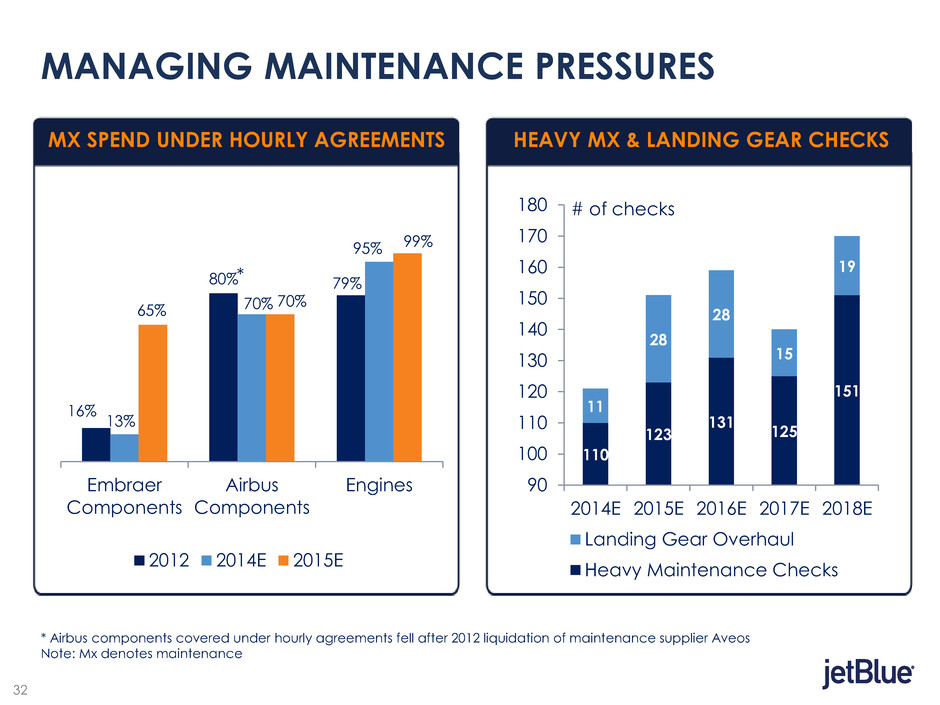

32 32 MANAGING MAINTENANCE PRESSURES MX SPEND UNDER HOURLY AGREEMENTS 110 123 131 125 151 11 28 28 15 19 90 100 110 120 130 140 150 160 170 180 2014E 2015E 2016E 2017E 2018E Landing Gear Overhaul Heavy Maintenance Checks # of checks HEAVY MX & LANDING GEAR CHECKS * Airbus components covered under hourly agreements fell after 2012 liquidation of maintenance supplier Aveos Note: Mx denotes maintenance * 16% 80% 79% 13% 70% 95% 65% 70% 99% Embraer Components Airbus Components Engines 2012 2014E 2015E

33 33 INVESTING IN FLEET & FUEL EFFICIENCY CASM BENEFIT RELATIVE TO A320CEO* * All figures are compared to A320ceo without sharklets currently in JetBlue’s fleet and does not include benefit from A320 cabin refresh ** Fuel efficiency benefit shown on a per ASM basis Note: Current A320 fleet CASM stage-length adjusted to 1,000 miles ~1% ~6% ~12% ~17% A320ceo w/o sharklets A320ceo w/ sharklets A320neo A321ceo A321neo ~3% ~12% 9-11% 17-19% Fuel efficiency benefit**

34 34 96.9 97.0 97.1 97.2 97.3 97.4 97.5 97.6 97.7 97.8 97.9 A320 E190 System 2013 2014 YTD 66% 68% 70% 72% 74% 76% 78% 80% 1Q* 2Q 3Q 2013 2014 IMPROVING OPERATIONAL EFFICIENCY Technical Dispatch Reliability (TDR) On Time Performance (A14) Increased Operational Resources Dynamic Operational Philosophy * January and February 2014 on-time performance adversely impacted by severe winter weather

35 35 COMMITTED TO KEEPING COSTS LOW YOY CASM EXCLUDING FUEL & PROFIT SHARING *As of 10/23/14 guidance v TARGETING <2% CASM-EX FUEL 0.9% 3.2% 3.8% 2.5 - 4.5%* ~Sub-inflation 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 2011 2012 2013 2014E 2015E-2017E C ASM e x- Fu el & P rofit Sh ar in g 0.9% 3.2% 3.8% 2.5 - 4.5%* < 2% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 2011 2012 2013 2014E 2015E-2017E C ASM e x - F u el & P r ofit Sh a r i n g

BUILDING A RETURN-DRIVEN NETWORK IN HIGH-VALUE GEOGRAPHY SCOTT LAURENCE SVP AIRLINE PLANNING

38 38 DRIVING BROAD, SUSTAINABLE PROFITABILITY P&L TTM 3Q14 in JFK, BOS, FLL, MCO, SJU, LGB NYC is JFK, LGA, EWR, HPN. L.A. Basin is LAX, LGB, BUR. New York Boston L.A. Basin Orlando San Juan Fort Lauderdale Margin 0% +

39 39 ROIC LEVER: TARGETED GROWTH UNIT COST CONTROL TARGETED GROWTH FOCUS ON RETURNS FLEET OPTIMIZATION FARE FAMILIES CABIN REFRESH NEW & ONGOING INITIATIVES

40 40 APPROACHES TO RETURN-DRIVEN GROWTH 1. Increased density & gauge 2. Incremental aircraft 3. Aircraft redeployment

41 41 DRIVING RETURNS THROUGH GAUGE & DENSITY 2008 2010 2012 2014 2016 2018 NYC PROFIT MARGIN* A320 VS A321HD PERFORMANCE RASM: (3)% CASM: (14)% Margin: ~ +10 pts 2017E * TTM as of 3Q 2014 in JFK, LGA, EWR, HPN Note: HD denotes high-density (190 seat all Core configuration)

42 42 DRIVING RETURNS THROUGH INCREMENTAL AIRCRAFT Margin before growth Margin after growth (with estimate) Pre Post San Juan Est. Pre To-date Fort Lauderdale Pre Post Boston

43 43 DRIVING RETURNS THROUGH AIRCRAFT REALLOCATION TYPICAL MARKET RAMP PERIOD* Breakeven Margin *TTM fully allocated P&L figures ** Reductions greater than (10%) year-over-year Routes with significant ASM reduction or closure** Aircraft unlocked 2010 33 6.0 2011 33 3.5 2012 33 5.5 2013 29 3.0 2014 23 3.5 Total 151 21.5 JFK-BGI FLL-NAS MCO-BOG Year 1 Year 2 Year 3

44 44 2015 CAPACITY OUTLOOK 2015E YOY Growth* Region % of Total Capacity ASMs Low High Transcon 31% 15% 17% Florida 29% 4% 6% Latin 28% 4% 6% East 5% 4% 6% West 3% 3% 5% Central 4% (5)% (3)% System 100% 6% 8% v 2015 CAPACITY GROWTH DRIVEN BY MINT AND FLL EXPANSION * Scheduled vs scheduled capacity

QUESTIONS

ROBIN HAYES | PRESIDENT FINANCIAL SUMMARY MARK POWERS EVP CHIEF FINANCIAL OFFICER

47 47 STRENGTHENING THE BALANCE SHEET RIGHT-SIZED LIQUIDITY BALANCE† REDUCED LEVERAGE LARGER PRODUCTIVE ASSET BASE 4.0x 2.8x YE 2011 3Q 14 Net Debt***/EBITDAR 169 199 YE 2011 3Q 14 Fleet size † Calculated as a percentage of trailing twelve month revenue * Includes additional $50M credit revolver capacity effective November 3, 2014 ** Liquidity benefit assuming 50% LTV *** Adjusted net debt calculated as short-term debt + long-term debt + 7x TTM leases –cash and short-term investments 27% 13% 1% 10% 7% YE 2011 3Q 14* Credit revolver Unencumbered aircraft & engines** Cash & ST investments

48 48 ROIC LEVER: FLEET OPTIMIZATION UNIT COST CONTROL TARGETED GROWTH FOCUS ON RETURNS FLEET OPTIMIZATION FARE FAMILIES CABIN REFRESH NEW & ONGOING INITIATIVES

49 49 REDUCING AIRCRAFT CAPITAL COMMITMENTS AIRCRAFT DELIVERY SCHEDULE v AIRCRAFT DEFERRAL REDUCES CAPEX BY $900M THROUGH 2018 12 10 10 1 6 15 15 16 (5) (5) (8) 16 2 2015 2016 2017 2018 2019 2020 2021 2022 2023 Airbus ceo deliveries Airbus neo deliveries Change

50 50 REDUCING NON-AIRCRAFT CAPITAL COMMITMENTS T5i DCA slots Customer technologies 2014E non-aircraft capex*: $320M 2015E non-aircraft capex: $150 – 200M Major 2014 Projects *As of 10/23/14 guidance

51 51 LEVERS FOR MARGIN AND ROIC EXPANSION REVENUE* COST CAPEX • Fare families • Cabin refresh • New & ongoing initiatives • Fleet investments • Fuel efficiency • Operational excellence • Reduced non-aircraft capex • Aircraft deferral ESTIMATED INCREMENTAL BENEFIT * Run rate incremental operating margin ** Estimated annual YOY CASM-ex increase 2015 – 2017 *** Reduction in non-aircraft capex in 2015 vs. 2014 † Savings through 2018 >$200M ~$100M ~$150M < 2% CASM-Ex ** $900M† $120-170M***

52 52 2015 OUTLOOK Metric Guidance Range CASM excluding fuel & profit sharing <2% Capacity* 6 – 8% Capex (aircraft) ~$675M Capex (non-aircraft) $150 – 200M * Scheduled vs scheduled ASMs Note: Detailed 2015 guidance will be provided in January 2015 on JetBlue’s fourth quarter and full year earnings call

QUESTIONS

ROBIN HAYES | PRESIDENT CLOSING REMARKS ROBIN HAYES PRESIDENT

55 55 WINNING OVER THE NEXT THREE YEARS Competitive Costs Differentiated Product & Culture High-Value Geography

THANK YOU