1 2Q 2017 EARNINGS PRESENTATION JULY 25, 2017

2 SAFE HARBOR This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which represent our management's beliefs and assumptions concerning future events. When used in this document and in documents incorporated herein by reference, the words “expects,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, our extremely competitive industry; volatility in financial and credit markets which could affect our ability to obtain debt and/or financing or to raise funds through debt or equity issuances; volatility in fuel prices, maintenance costs and interest rates; our ability to implement our growth strategy; our significant fixed obligations and substantial indebtedness; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on high daily aircraft utilization; our dependence on the New York and Boston metropolitan markets and the Northeast Corridor of the United States and the effect of increased congestion in these markets; our reliance on automated systems and technology; our being subject to potential unionization, work stoppages, slowdowns and/or increased labor costs; our reliance on a limited number of suppliers; our presence in some international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from information security breaches or cyber-attacks; changes in or additional government regulation; changes in our industry due to other airlines' financial condition; acts of war or terrorism; global economic conditions or economic downturns leading to a continuing or accelerated decrease in demand for air travel; the spread of infectious diseases; adverse weather conditions or natural disasters; and external geopolitical events and conditions. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs and assumptions upon which we base our expectations may change prior to the end of each quarter or year and you should not place undue reliance on these statements. Further information concerning these and other factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to, the Company's 2016 Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. In light of these risks and uncertainties, the forward-looking events discussed in this presentation might not occur. We undertake no obligation to update any forward-looking statements to reflect events or circumstances that may arise after the date of this presentation. The following presentation also includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. We refer you to the reconciliations made available in our Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K (available on our website at jetblue.com and at sec.gov) and in our April 2017 first quarter earnings call, which reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP.

2Q 2017 EARNINGS UPDATE ROBIN HAYES PRESIDENT & CEO

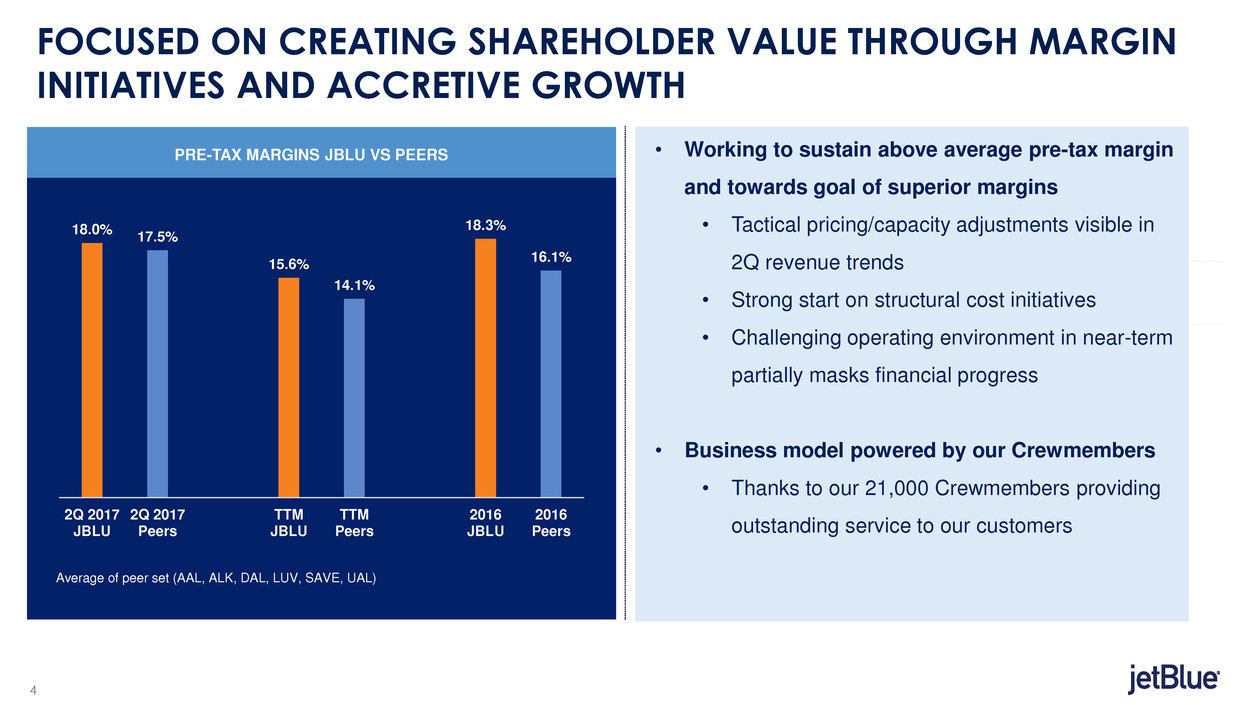

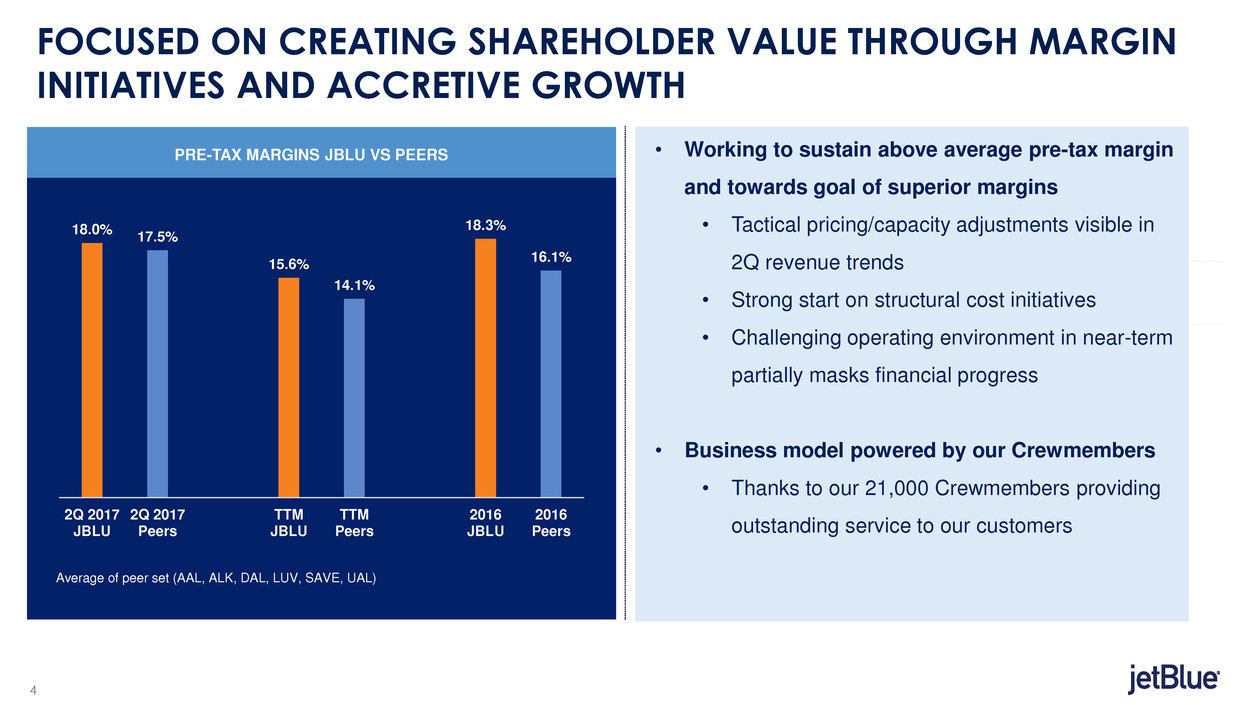

4 FOCUSED ON CREATING SHAREHOLDER VALUE THROUGH MARGIN INITIATIVES AND ACCRETIVE GROWTH PRE-TAX MARGINS JBLU VS PEERS Average of peer set (AAL, ALK, DAL, LUV, SAVE, UAL) 18.0% 17.5% 15.6% 14.1% 18.3% 16.1% 2Q 2017 JBLU 2Q 2017 Peers TTM JBLU TTM Peers 2016 JBLU 2016 Peers • Working to sustain above average pre-tax margin and towards goal of superior margins • Tactical pricing/capacity adjustments visible in 2Q revenue trends • Strong start on structural cost initiatives • Challenging operating environment in near-term partially masks financial progress • Business model powered by our Crewmembers • Thanks to our 21,000 Crewmembers providing outstanding service to our customers

5 2Q 2017 HIGHLIGHTS Structural cost initiatives Commercial initiatives Targeted growth STRATEGIC POSITIONING AND RESULTS • Early 2017 revenue and capacity initiatives exceeding expectations in 2Q/3Q • Over 20% YoY RASM improvement in Ft. Lauderdale Mint markets • Achieved $45m in annualized savings in first six months • Strength in Boston business markets; Boston highest margin focus city • Ft. Lauderdale RASM growth outperformed system in 2Q Commitment to delivering above-average industry margins • Balancing growth and returns with targeted expansion in existing focus cities

COMMERCIAL UPDATE & OUTLOOK MARTY ST. GEORGE EVP COMMERCIAL AND PLANNING

7 ASM YOY GROWTH 8.9% 4.2% 4.8% 2016 2017E* 2017E 1Q 2017 2Q 2017 3Q 2017E CAPACITY: MANAGING OPERATIONS AND GROWTH 6.5% - 8.5% 6.5% - 7.5% 5.5% - 6.5% * Guidance as of 1/26/17 • Modest reduction in 2017 capacity guidance to support the operation and margin commitments • 2H17 growth targeted to Boston, Ft. Lauderdale and converting markets to Mint • ~40% of growth in Boston; ~25% of growth in Ft. Lauderdale • Mint aircraft (Mint + Core seats) expected to contribute ~16% of 4Q scheduled ASMs • New routes expected to contribute ~3.5% of capacity in 2H vs ~4.5% in 1H

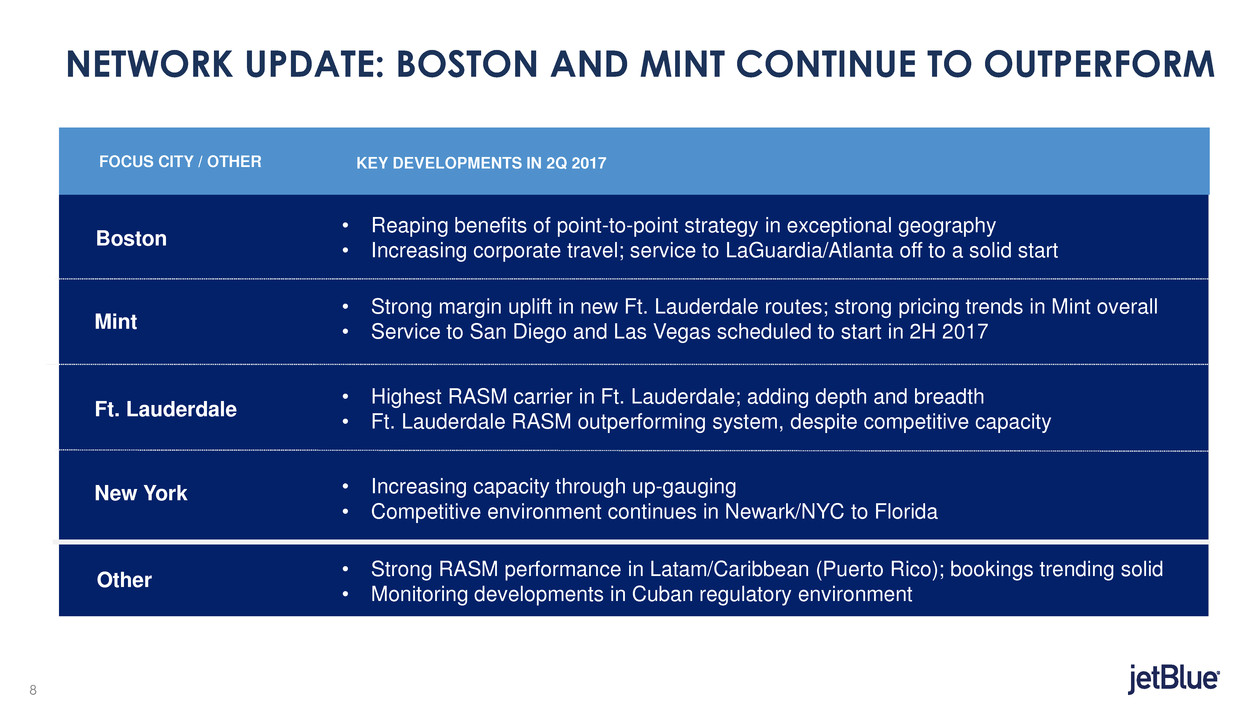

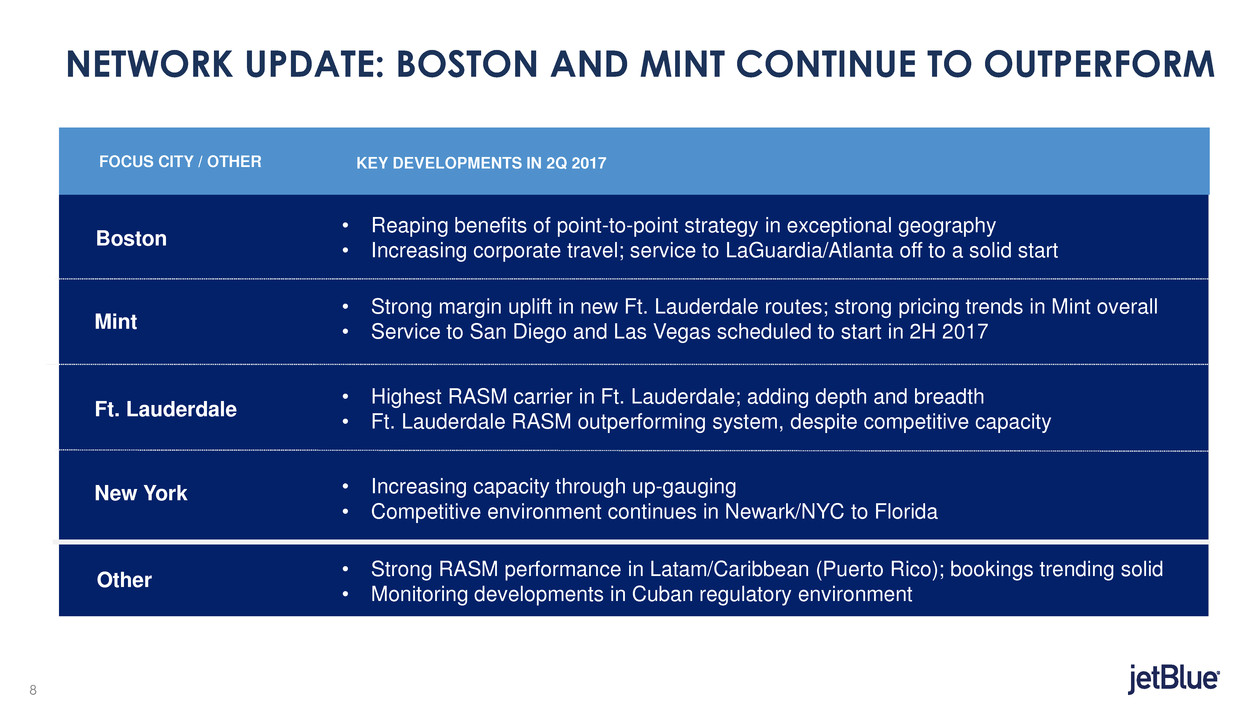

8 NETWORK UPDATE: BOSTON AND MINT CONTINUE TO OUTPERFORM New York Ft. Lauderdale Boston Other Mint FOCUS CITY / OTHER KEY DEVELOPMENTS IN 2Q 2017 • Increasing capacity through up-gauging • Competitive environment continues in Newark/NYC to Florida • Reaping benefits of point-to-point strategy in exceptional geography • Increasing corporate travel; service to LaGuardia/Atlanta off to a solid start • Highest RASM carrier in Ft. Lauderdale; adding depth and breadth • Ft. Lauderdale RASM outperforming system, despite competitive capacity • Strong margin uplift in new Ft. Lauderdale routes; strong pricing trends in Mint overall • Service to San Diego and Las Vegas scheduled to start in 2H 2017 • Strong RASM performance in Latam/Caribbean (Puerto Rico); bookings trending solid • Monitoring developments in Cuban regulatory environment

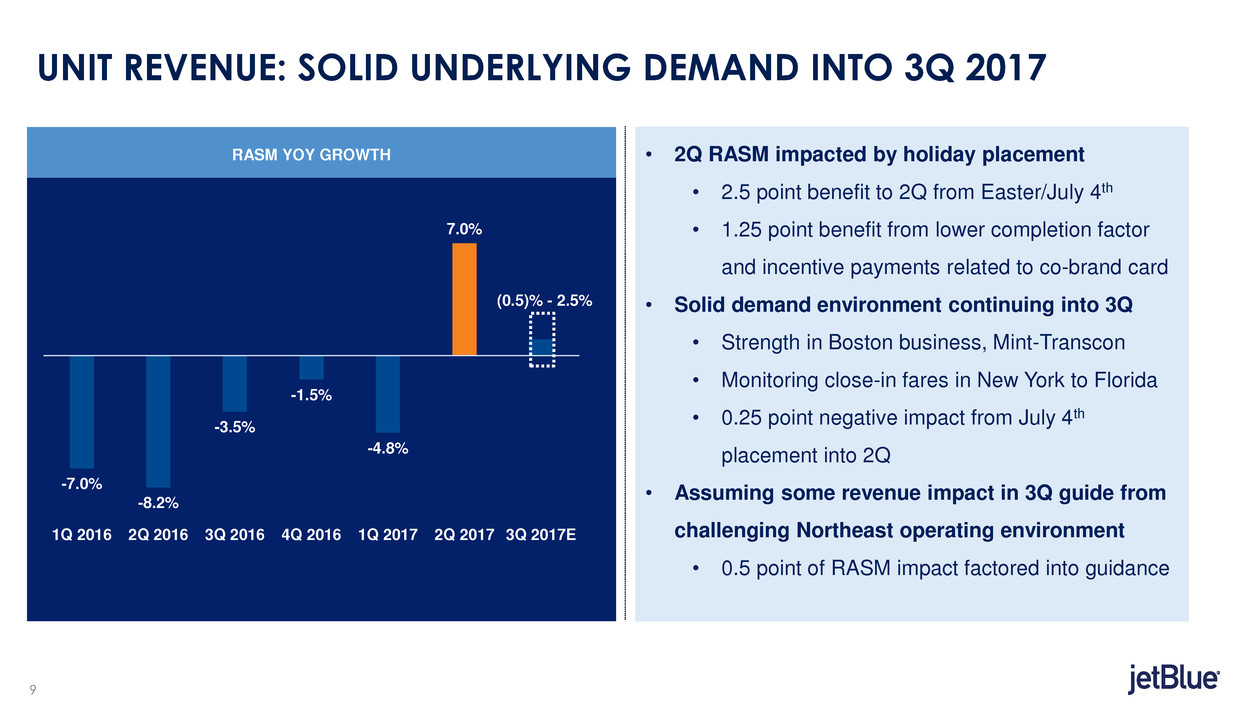

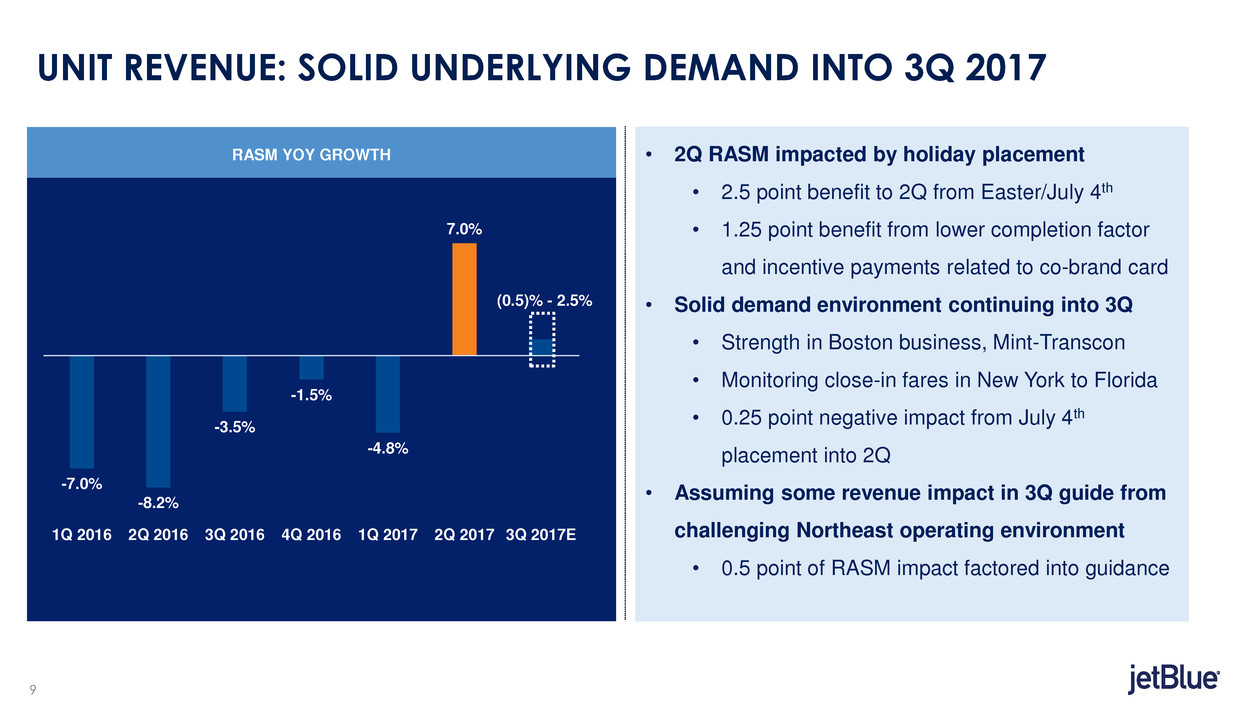

9 RASM YOY GROWTH -7.0% -8.2% -3.5% -1.5% -4.8% 7.0% 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017E UNIT REVENUE: SOLID UNDERLYING DEMAND INTO 3Q 2017 • 2Q RASM impacted by holiday placement • 2.5 point benefit to 2Q from Easter/July 4th • 1.25 point benefit from lower completion factor and incentive payments related to co-brand card • Solid demand environment continuing into 3Q • Strength in Boston business, Mint-Transcon • Monitoring close-in fares in New York to Florida • 0.25 point negative impact from July 4th placement into 2Q • Assuming some revenue impact in 3Q guide from challenging Northeast operating environment • 0.5 point of RASM impact factored into guidance (0.5)% - 2.5%

FINANCIAL UPDATE & OUTLOOK STEVE PRIEST EVP CHIEF FINANCIAL OFFICER

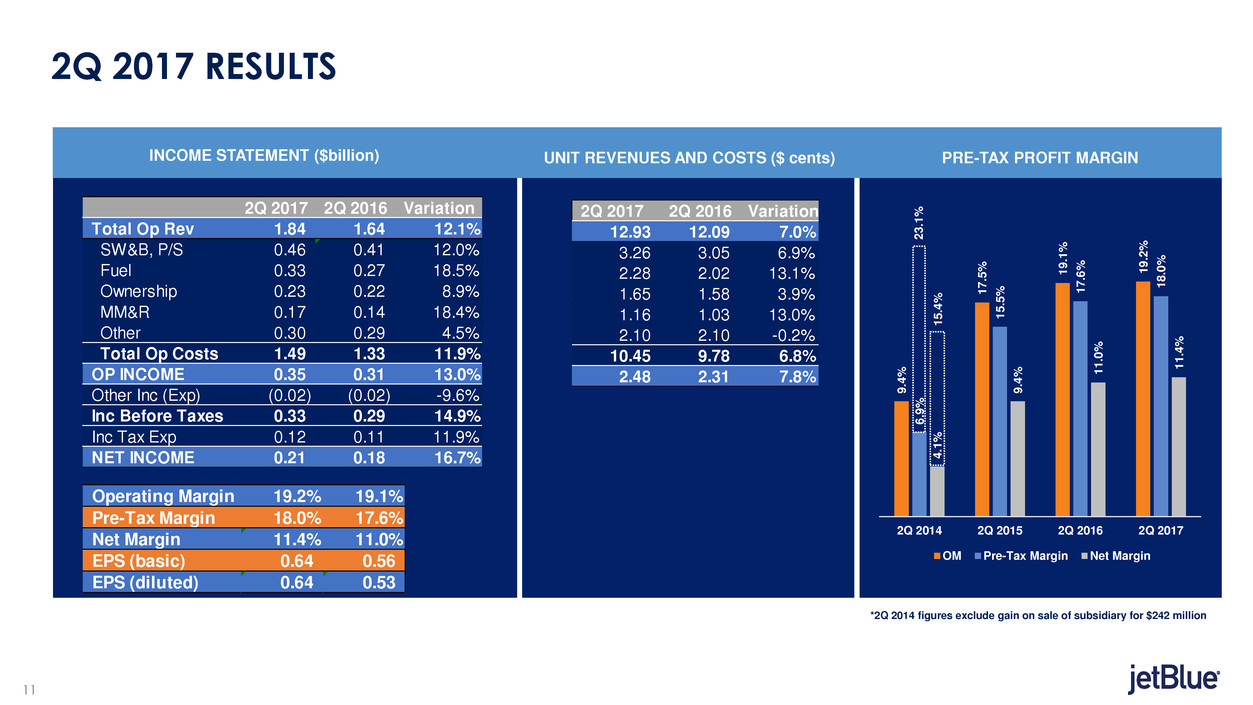

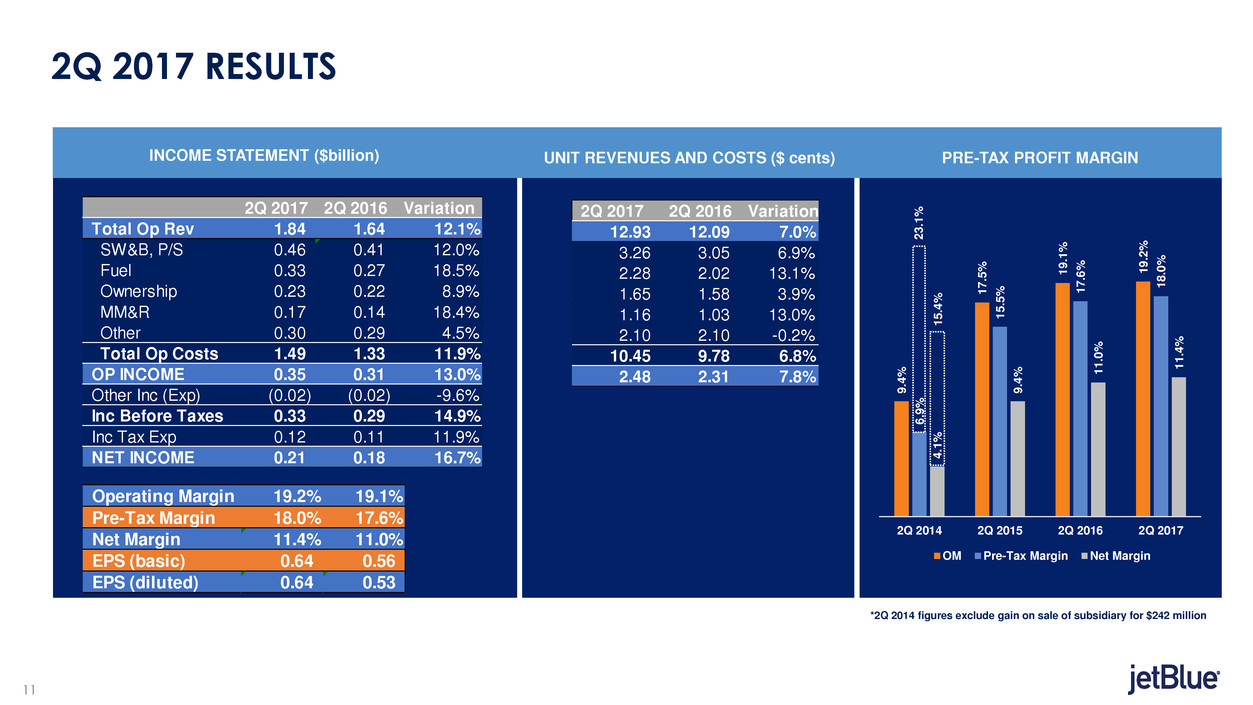

11 2Q 2017 RESULTS INCOME STATEMENT ($billion) PRE-TAX PROFIT MARGINUNIT REVENUES AND COSTS ($ cents) 9 .4 % 1 7 .5 % 1 9 .1 % 1 9 .2 % 6 .9 % 1 5 .5 % 1 7 .6 % 1 8 .0 % 4 .1 % 9 .4 % 1 1 .0 % 1 1 .4 % 2Q 2014 2Q 2015 2Q 2016 2Q 2017 OM Pre-Tax Margin Net Margin **2Q 2014 figures exclude gain on sale of subsidiary for $242 million Operating Margin 19.2% 19.1% Pre-Tax Margin 18.0% 17.6% Net Margin 11.4% 1. % EPS (basic) 0.64 0.56 EPS (diluted) 0.64 0.53 2Q 2017 2Q 2016 Variation Total Op Rev 1.84 1.64 12.1% SW&B, P/S 0.46 0.41 12.0% Fuel 0.33 0.27 18.5% Ownership 0.23 0.22 8.9% MM&R 0.17 0.14 18.4% Other 0.30 0.29 4.5% Total Op Costs 1.49 1.33 11.9% OP INCOME 0.35 0.31 13.0% Other Inc (Exp) (0.02) (0.02) -9.6% Inc Before Taxes 0.33 0.29 14.9% Inc Tax Exp 0 12 0.11 11.9% NET INCOME 0.21 0.18 16.7% 2 3 .1 % 1 5 .4 % 2Q 2017 2Q 2016 Variation 12.93 12. 9 7.0% 3.26 3.05 6.9% 2.28 2.02 13.1% 1.65 1.58 3.9% 1.16 1.03 13.0% 2.10 2. 0 -0.2% 10.45 9.78 6.8% 2.48 2.31 7.8%

12 QUARTERLY CASM EX-FUEL YOY GROWTH* -1.4% -0.8% 2.5% 4.6% 3.3% 5.1% 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017E 2017E UNIT COSTS: MANAGING NEAR TERM HEADWINDS • 2Q CASM ex-fuel below mid-point of guidance, despite lower completion factor • Inflationary pressures in maintenance and labor • Lower completion factor impacted CASM-ex fuel by ~0.5 points (via fewer ASMs, added costs) • 3Q CASM ex-fuel impacted by operational actions • Capacity adjustments add unit cost pressure but help mitigate cost risk • Raising lower end 2017 cost guidance • Managing to moderate 2H CASM ex-fuel growth • Higher profit sharing due to lower fuel prices • Lower capacity growth **Refer to Appendix A on Non-GAAP Financial Measures 1.5% - 3.5% 2.0% - 3.5%

13 STRUCTURAL COST PROGRAM UPDATE CATEGORY SAVINGS OPPORTUNITY COMPLETED + WORK IN PROGRESS ADDITIONAL DETAILS Tech Ops $100 – $125M Evaluate current and new maintenance agreements terms Optimize heavy maintenance and spare parts inventory via new technology Corporate $75 – $90M Achieved $13M in 2020 run rate savings from Business Partner contracts Reviewing data storage infrastructure and software license utilization Airports $55 – $65M Deploying self-service check-in capabilities at 12 airports by year-end; 6 completed thus far Consolidate airport Business Partner contracts Distribution ~$20M Re-negotiated PSS, GDS, and OTA contracts to achieve lowest distribution costs while maintaining flexibility TOTAL: $250 – $300M 2020 PROJECTED SAVINGS ACHIEVED: $45M *Green shading is category cost savings status in progress or completed

14 FLEET: RETURN ACCRETIVE FLEET GROWTH AIRBUS ORDER BOOK*FLEET DETAIL* *As of 7/25/17 CEO: Current Engine Option; NEO: New Engine Option • Flexibility in order book allows for selecting most margin- accretive configuration • Expect a mix of Mint/200-seat deliveries in 2018 *As of 7/25/17 60 60 60 60 130 130 130 130 20 21 21 2117 19 22 31 2016 1Q 2017 2Q 2017 2017E E190 A320 A321 HD A321 Mint 1 97 103 107169 227 230 233 2011 2016 1Q 2017 2Q 2017 Unencumbered Total Year A320neo A321ceo A321neo Total 2018 - 11 - 11 2019 - - 13 13 2020 6 - 7 13

15 3Q 2017E 2017E 2017-2020E LEVERAGE AND CAPEX: BALANCED CAPITAL ALLOCATION ADJUSTED DEBT / CAP RATIO CAPITAL EXPENDITURES Aircraft Non-Aircraft Adj Debt / Cap = On Balance Sheet Debt + 7x Aircraft Rent / Debt + Equity $150m - $175m $1.05bn - $1.15bn $195m - $245m $50m - $75m Average of ~$1.1bn* *Includes Aircraft and Non-Aircraft Capital Expenditures 70% 62% 46% 35% 34% 33% 2011 2013 2015 2016 1Q 2017 2Q 2017

16 2017 GUIDANCE SUMMARY Metric 3Q 2017E 2017E Capacity 6.5 – 7.5% 5.5 - 6.5% RASM (0.5) – 2.5% N/A CASM Excluding Fuel 1.5 - 3.5% 2.0 - 3.5% All-in Fuel Price $1.61 N/A Capex (aircraft) $195m – $245m $1.05bn – $1.15bn Capex (non-aircraft) $50m – $75m $150m – $175m Other Income/(Expense) ($20m - $25m) ($85m - $95m) 16

QUESTIONS

18 APPENDIX A: NOTE ON NON-GAAP FINANCIAL MEASURES Consolidated operating cost per available seat mile, excludes fuel and related taxes, and operating expenses related to other non-airline expenses (CASM Ex-Fuel) is a non-GAAP financial measure that we use to measure our core performance. Note A within our quarterly earnings release provides a reconciliation of non-GAAP financial measures used in this presentation and provides the reasons management uses those measures.