3Q21 EARNINGS PRESENTATION OCTOBER 26, 2021

2 SAFE HARBOR Forward-Looking Information Statements in this Presentation (or otherwise made by JetBlue or on JetBlue’s behalf) contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which represent our management’s beliefs and assumptions concerning future events. These statements are intended to qualify for the “safe harbor” from liability established by the Private Securities Litigation Reform Act of 1995. When used in this Presentation, the words “expects,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve risks, uncertainties, and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the coronavirus ("COVID-19") pandemic and the outbreak of any other disease or similar public health threat that affects travel demand or behavior; restrictions on our business related to the financing we accepted under various federal government support programs such as the CARES Act, the Consolidated Appropriations Act, 2021, and the American Rescue Plan Act; and the outcome of the lawsuit filed by the DOJ related to our Northeast Alliance; our significant fixed obligations and substantial indebtedness; risk associated with execution of our strategic operating plans in the near-term and long-term; the recording of a material impairment loss of tangible or intangible assets; our extremely competitive industry; volatility in financial and credit markets which could affect our ability to obtain debt and/or lease financing or to raise funds through debt or equity issuances; volatility in fuel prices, maintenance costs and interest rates; our reliance on high daily aircraft utilization; our ability to implement our growth strategy; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on a limited number of suppliers, including for aircraft, aircraft engines and parts and vulnerability to delays by those suppliers; our dependence on the New York and Boston metropolitan markets and the effect of increased congestion in these markets; our reliance on automated systems and technology; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; our presence in some international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from information security breaches or cyber- attacks; changes in or additional domestic or foreign government regulation, including new or increased tariffs; changes in our industry due to other airlines' financial condition; acts of war or terrorism; global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel; adverse weather conditions or natural disasters; and external geopolitical events and conditions. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. Further information concerning these and other factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to, the Company's 2020 Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. In light of these risks and uncertainties, the forward-looking events discussed in this Presentation might not occur. Our forward-looking statements speak only as of the date of this Presentation. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise. This Presentation also includes certain “non-GAAP financial measures” as defined under the Exchange Act and in accordance with Regulation G. We have included reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and provided in accordance with U.S. GAAP within Appendices A and B of this Presentation.

3 3Q 2021 EARNINGS UPDATE ROBIN HAYES CHIEF EXECUTIVE OFFICER

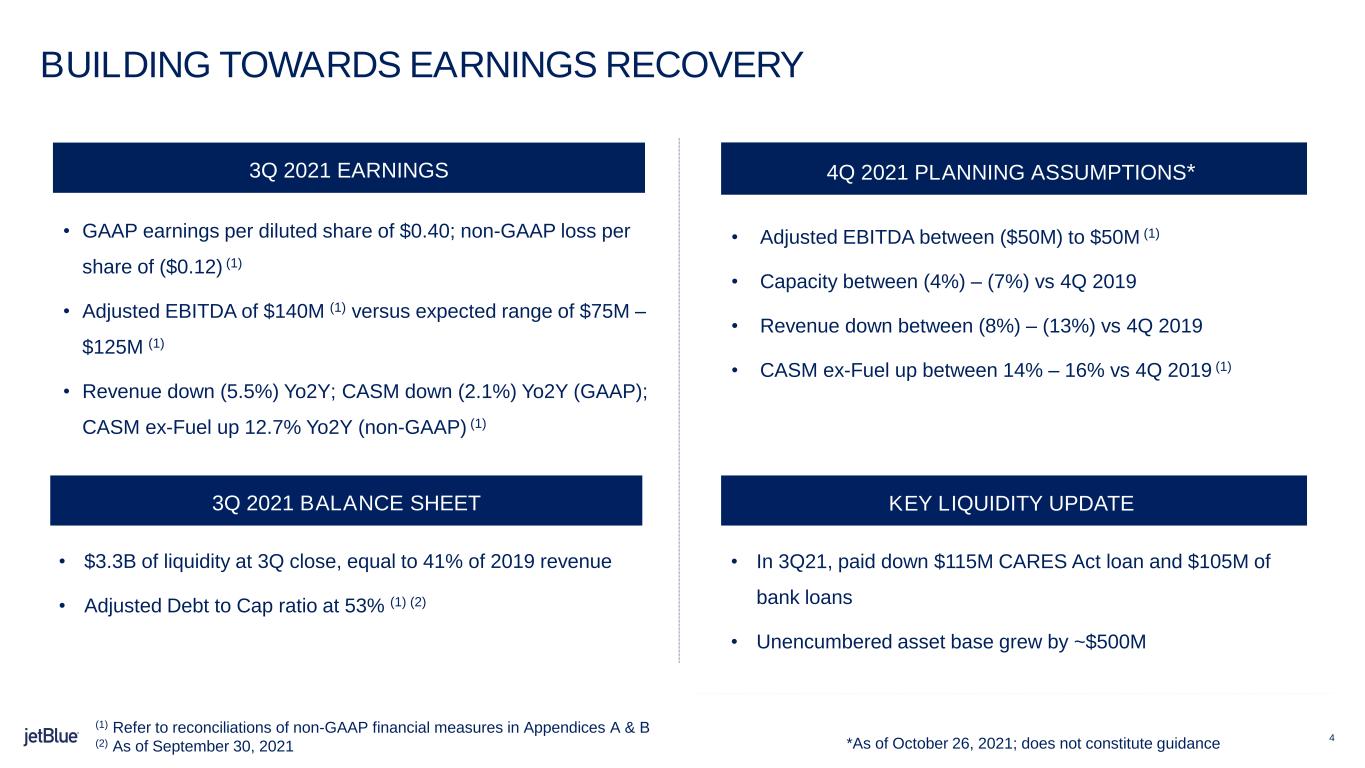

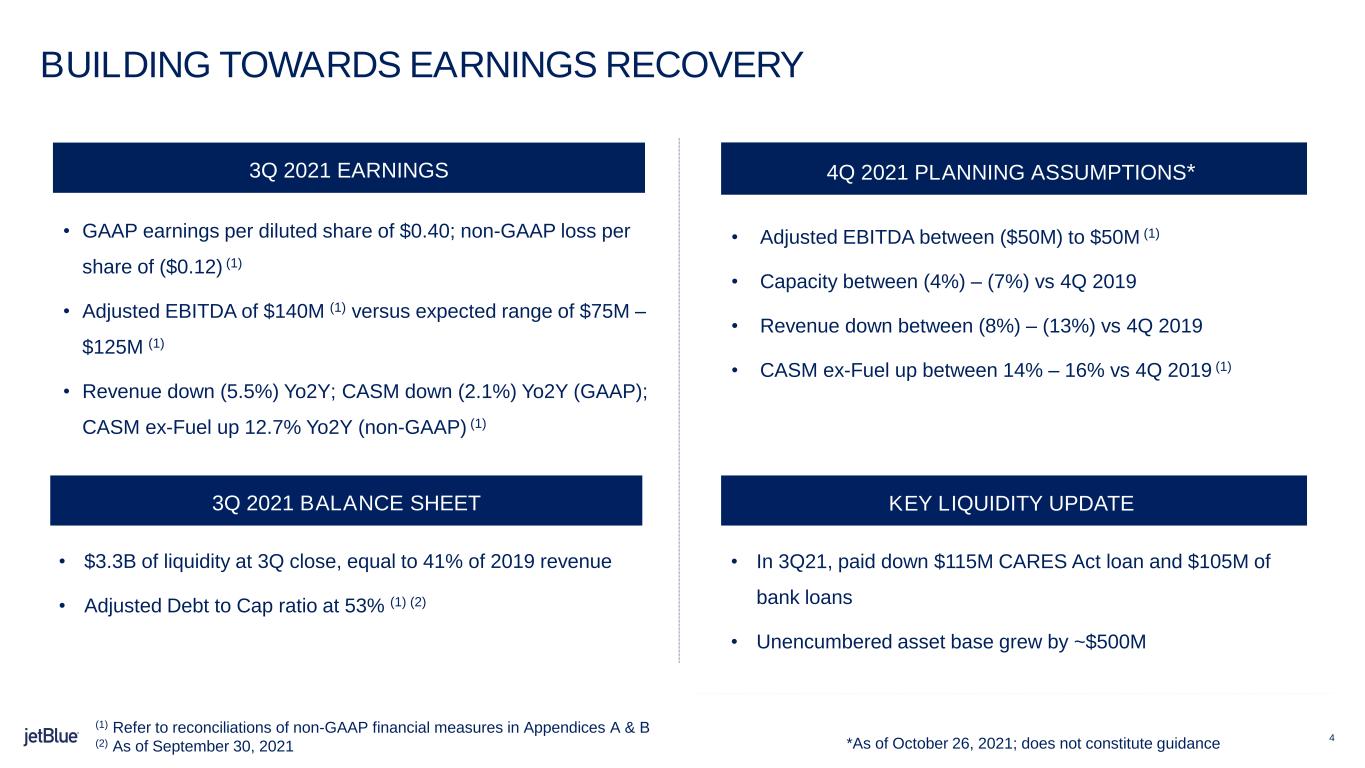

4 BUILDING TOWARDS EARNINGS RECOVERY KEY LIQUIDITY UPDATE (1) Refer to reconciliations of non-GAAP financial measures in Appendices A & B (2) As of September 30, 2021 • GAAP earnings per diluted share of $0.40; non-GAAP loss per share of ($0.12) (1) • Adjusted EBITDA of $140M (1) versus expected range of $75M – $125M (1) • Revenue down (5.5%) Yo2Y; CASM down (2.1%) Yo2Y (GAAP); CASM ex-Fuel up 12.7% Yo2Y (non-GAAP) (1) 3Q 2021 EARNINGS • Adjusted EBITDA between ($50M) to $50M (1) • Capacity between (4%) – (7%) vs 4Q 2019 • Revenue down between (8%) – (13%) vs 4Q 2019 • CASM ex-Fuel up between 14% – 16% vs 4Q 2019 (1) 2Q 2021 PLANNING ASSUMPTIONS* • In 3Q21, paid down $115M CARES Act loan and $105M of bank loans • Unencumbered asset base grew by ~$500M 4 • $3.3B of liquidity at 3Q close, equal to 41% of 2019 revenue • Adjusted Debt to Cap ratio at 53% (1) (2) 3Q 2021 BALANCE SHEET *As of October 26, 2021; does not constitute guidance

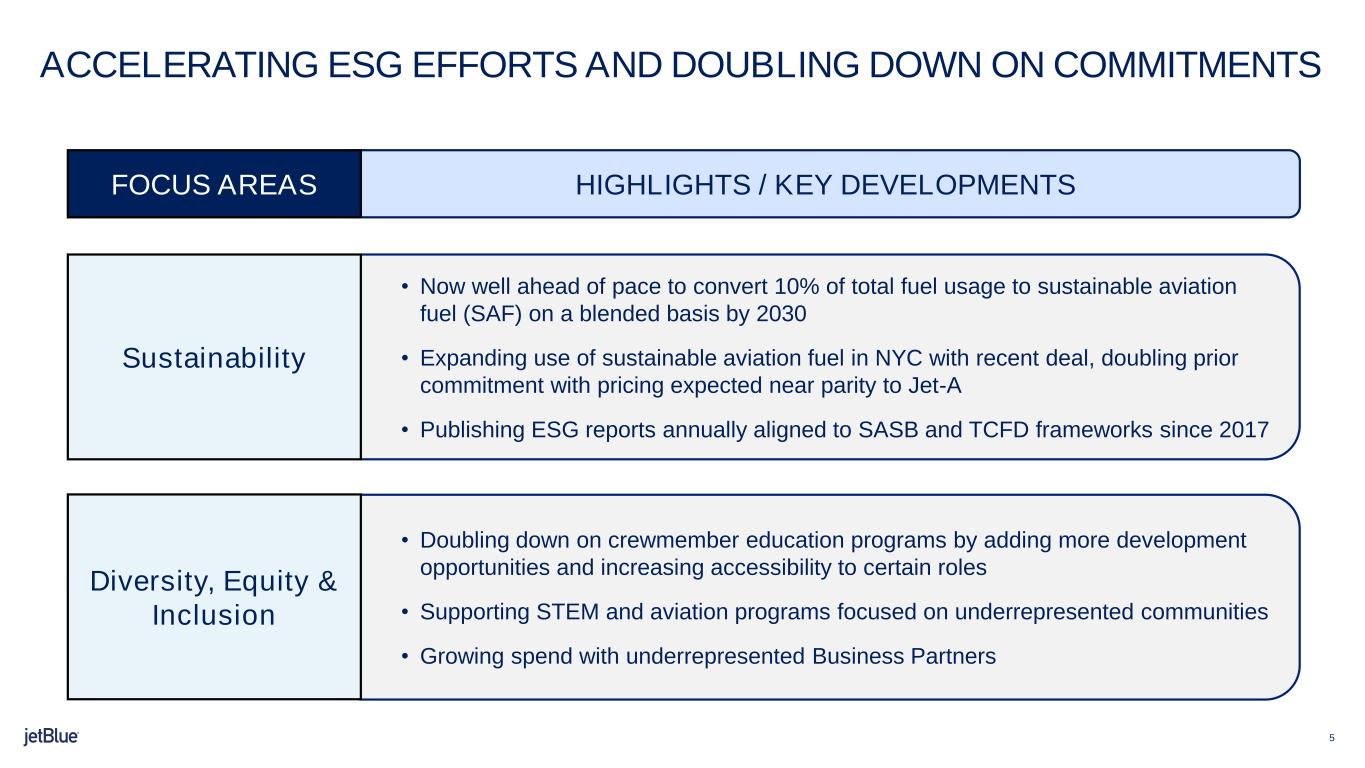

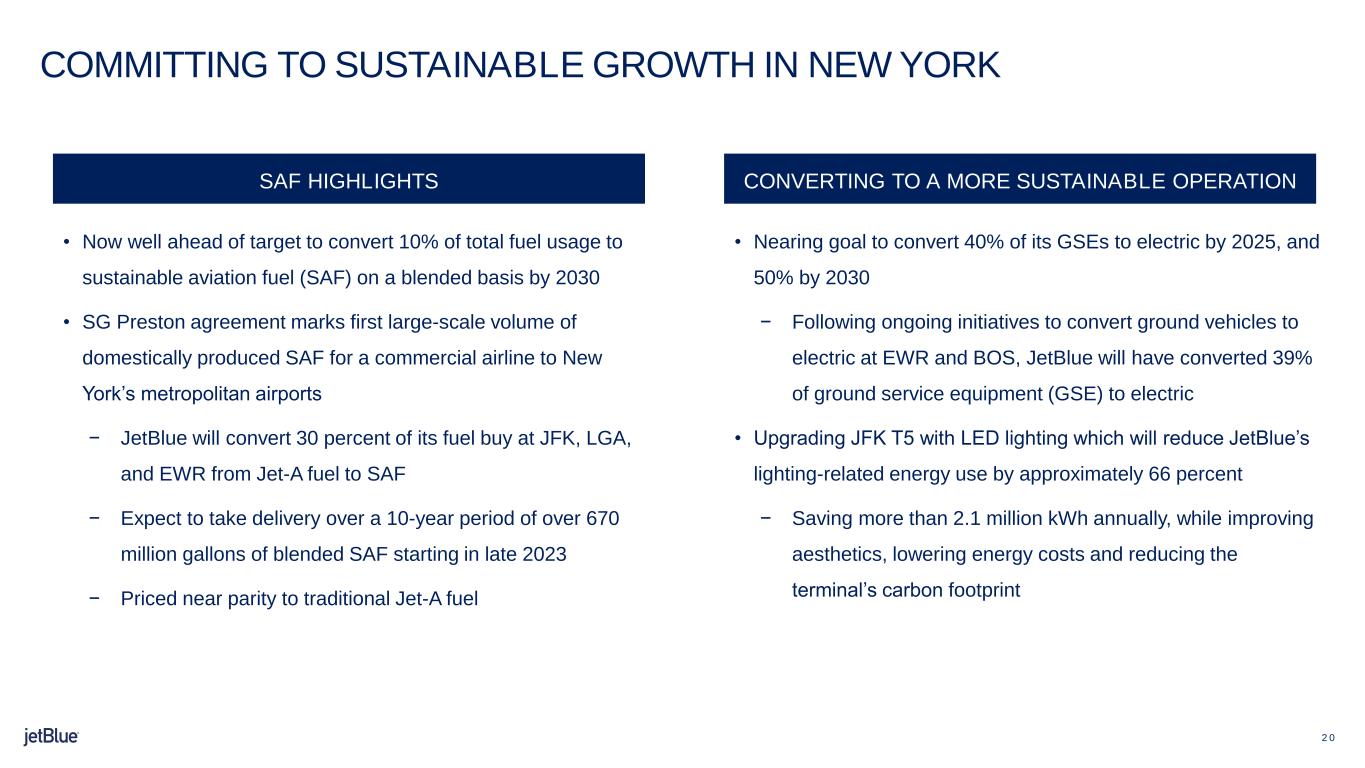

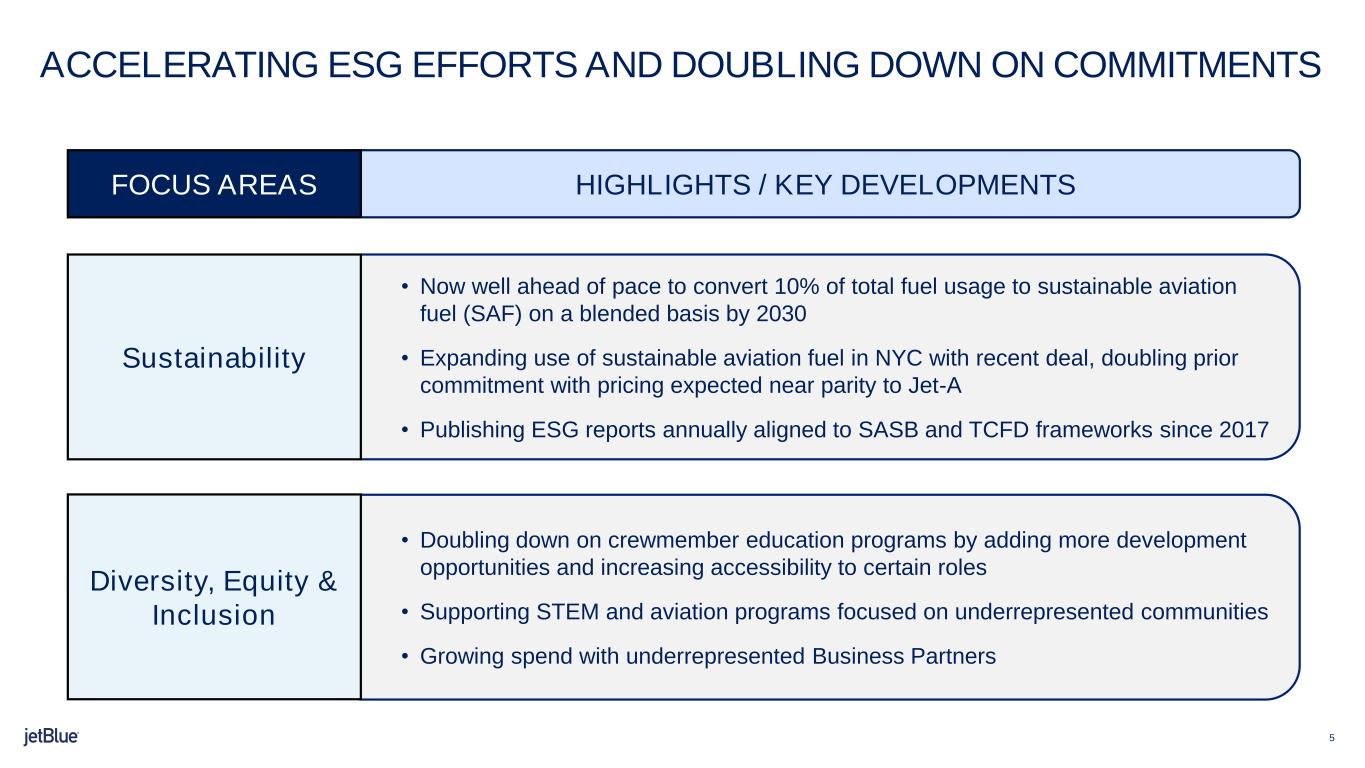

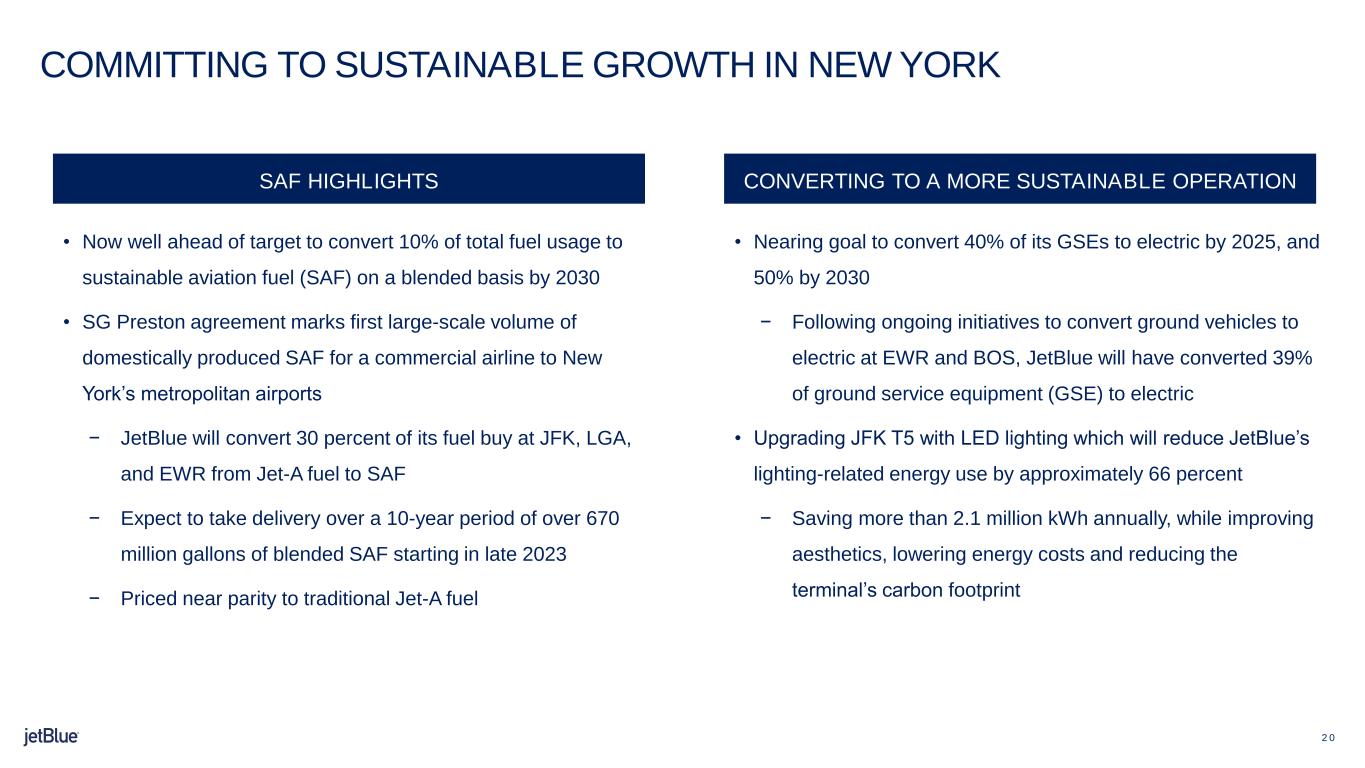

5 • Doubling down on crewmember education programs by adding more development opportunities and increasing accessibility to certain roles • Supporting STEM and aviation programs focused on underrepresented communities • Growing spend with underrepresented Business Partners • Now well ahead of pace to convert 10% of total fuel usage to sustainable aviation fuel (SAF) on a blended basis by 2030 • Expanding use of sustainable aviation fuel in NYC with recent deal, doubling prior commitment with pricing expected near parity to Jet-A • Publishing ESG reports annually aligned to SASB and TCFD frameworks since 2017 ACCELERATING ESG EFFORTS AND DOUBLING DOWN ON COMMITMENTS HIGHLIGHTS / KEY DEVELOPMENTSFOCUS AREAS Sustainability Diversity, Equity & Inclusion

6 RESTORING MARGINS AND BALANCE SHEET STRENGTH Executing margin accretive revenue and network initiatives Remaining focused on cost control to drive superior margins Implementing Northeast Alliance to deliver customer benefits Maintaining fixed cost savings as enterprise scales Enhancing value proposition for Loyalty program and JetBlue Travel Products Executing Fare Options Update to give customers choice Doubling-down on productivity to drive operating leverage Managing maintenance events thoughtfully Taking a balanced approach to capital allocation to maximize value Maintaining net debt below pre- pandemic levels Investing in fuel efficient, margin-accretive aircraft Targeting debt to capital ratio of 30 – 40% by end of 2024 COMMERCIAL COSTS CAPITAL ALLOCATION Restoring earnings and expanding margins beyond 2019 levels

7 THE NEA SUPERCHARGES COMPETITION Generating benefits for all of our stakeholders Delivering Broader BenefitsSpurring CompetitionBenefitting Consumers The NEA challenges the dominance of entrenched carriers in New York and Boston by creating a third, full-scale competitor • Competitors have announced significant expansion in New York and Boston in response to the NEA • The “virtual” NEA network offers a third option for customers, providing greater choice without diminishing competition The NEA is estimated to generate more than $800 million in consumer benefits annually • JetBlue and American are investing in a seamless experience, including: – $50 million in airport CAPEX – $7.5 million in IT investments • Increasing capacity by delaying retirement of 30 owned E190s • JetBlue plans to hire 1,800 new crewmembers for the NEA The NEA expands low fares, increased choices, and a high-quality product to more customers • Increasing frequencies and launching 58 new routes, including 18 international routes • Meaningfully expanding in the Northeast: – JetBlue plans to grow daily departures by ~20% at JFK & BOS – JetBlue has a path to grow daily departures by ~2x at EWR and ~3x at LGA, enabled by the NEA

8 COMMERCIAL UPDATE & OUTLOOK JOANNA GERAGHTY PRESIDENT & CHIEF OPERATING OFFICER

9 (3.3%) (2.9%) (12.3%) (28.8%) (5.5%) Jul '21 Aug '21Sep '21 2Q21 3Q21 4Q21* REVENUE TRENDS NORMALIZING REVENUE YO2Y GROWTH • Strong revenue performance during summer − Delta-variant predominantly impacted September with its thinner leisure demand and higher mix of business traffic − Bookings began recovering in mid-September − Strong baggage revenue fueling continued Fare Options outperformance • 4Q21 reflecting seasonality and delayed corporate travel recovery − While corporate travel recovery is delayed, the NEA will help accelerate recovery − VFR and leisure travel continue to lead recovery − Thanksgiving and December peak holiday bookings holding up relatively well compared to troughs − Expect demand improvement throughout the quarter EstimateActual Note: Versus 2019. *Current planning assumption as of October 26, 2021; does not constitute guidance (8) – (13)%

1 0 (1.9%) (0.4%) 0.0% (14.9%) (0.8%) Jul '21 Aug '21Sep '21 2Q21 3Q21 4Q21* CAPACITY DEPLOYMENT ALIGNED WITH DEMAND TRENDS ASM YO2Y GROWTH PlannedFlown • 4Q21 capacity aligned with demand trends − Seeing progressive normalization of booking patterns − Sequential capacity deployment reflects seasonality of leisure demand, coupled with delay in corporate traffic − Remaining nimble given future risks from COVID variants, yet optimistic about current trends • Adapting network for long-term success − Executing on long-term strategy and building relevance in our focus cities − Operating near 2019 capacity levels, partly enabled by Northeast Alliance − Expect corporate recovery, albeit delayed, to continue through 2022 (4%) – (7%) Note: Versus 2019. *Current planning assumption as of October 26, 2021; does not constitute guidance

1 1 FINANCIAL UPDATE & OUTLOOK URSULA HURLEY CHIEF FINANCIAL OFFICER

1 2 SUMMARY FINANCIALS 3Q 2021 METRIC 3Q 2021 3Q 2019 Change vs ‘19 Revenue (US$ million) 1,972 2,086 (5%) Operating Expenses (GAAP) 1,786 1,839 (3%) Operating Expenses (Non-GAAP) (1) 1,972 1,839 7% EBITDA (Adjusted) (US$ million) (1) 140 381 (63%) Earnings per Diluted Share (GAAP) 0.40 0.63 (36%) Earnings/(Loss) per Share(1) (Non-GAAP) (1) (0.12) 0.59 NM (1) Refer to reconciliations of non-GAAP financial measures in Appendix A

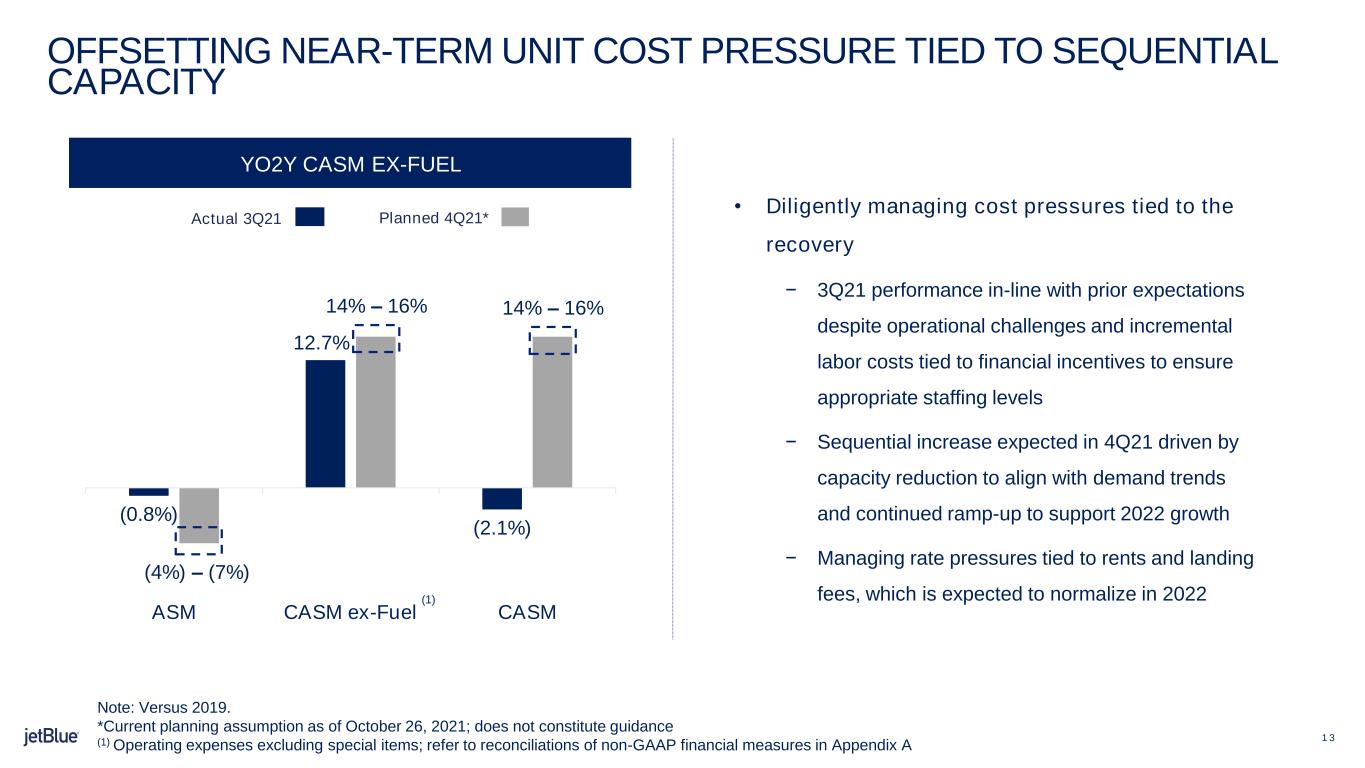

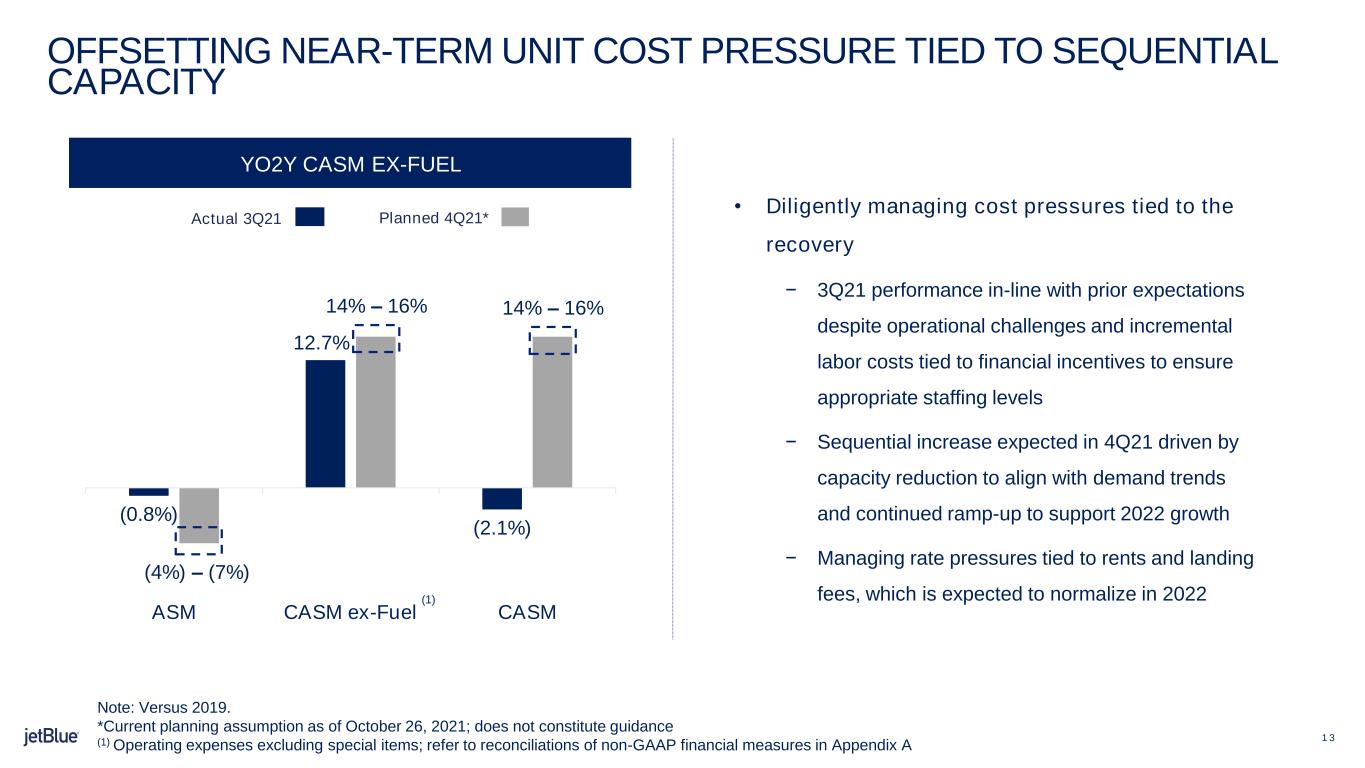

1 3 (0.8%) 12.7% (2.1%) ASM CASM ex-Fuel CASM YO2Y CASM EX-FUEL COST INITIATIVES Actual 3Q21 Planned 4Q21* • Diligently managing cost pressures tied to the recovery − 3Q21 performance in-line with prior expectations despite operational challenges and incremental labor costs tied to financial incentives to ensure appropriate staffing levels − Sequential increase expected in 4Q21 driven by capacity reduction to align with demand trends and continued ramp-up to support 2022 growth − Managing rate pressures tied to rents and landing fees, which is expected to normalize in 2022 OFFSETTING NEAR-TERM UNIT COST PRESSURE TIED TO SEQUENTIAL CAPACITY 14% – 16% (4%) – (7%) Note: Versus 2019. *Current planning assumption as of October 26, 2021; does not constitute guidance (1) Operating expenses excluding special items; refer to reconciliations of non-GAAP financial measures in Appendix A 14% – 16% (1)

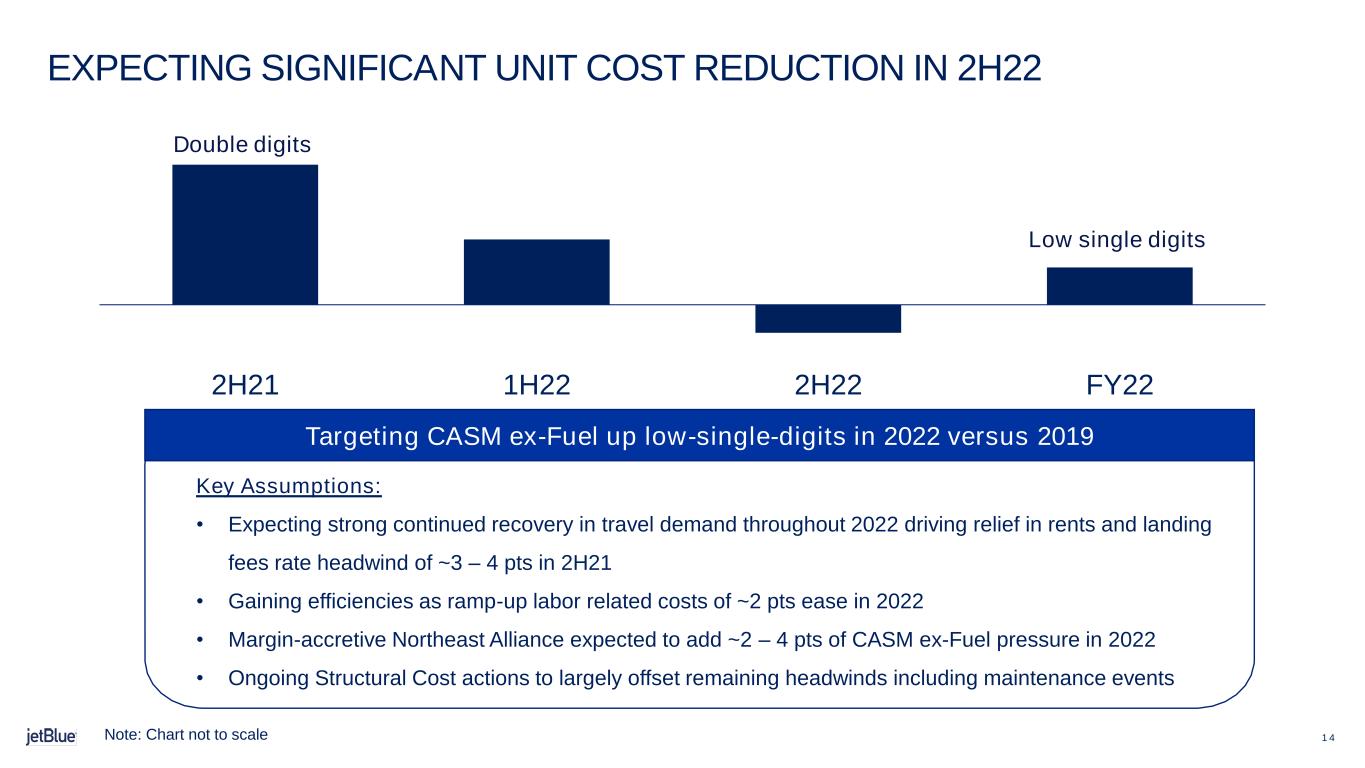

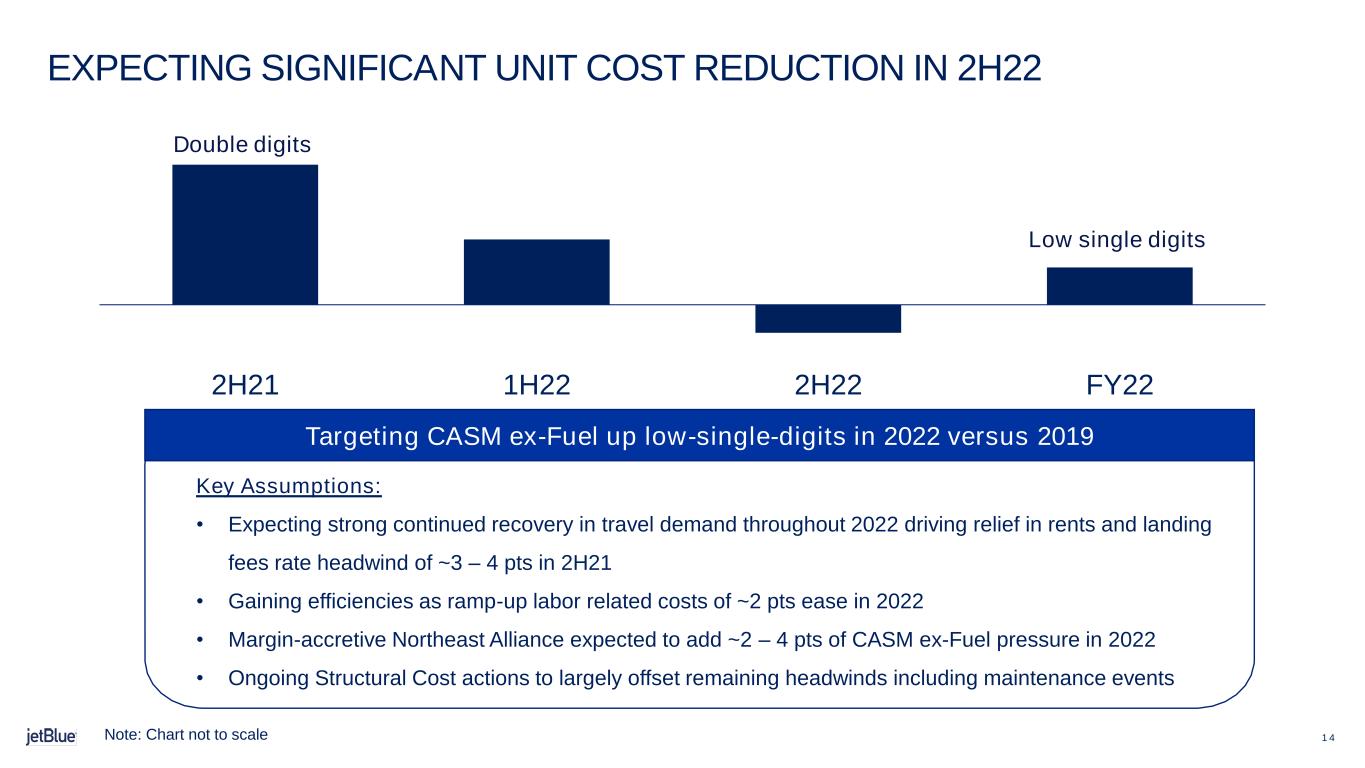

1 4 EXPECTING SIGNIFICANT UNIT COST REDUCTION IN 2H22 2H21 1H22 2H22 FY22 Key Assumptions: • Expecting strong continued recovery in travel demand throughout 2022 driving relief in rents and landing fees rate headwind of ~3 – 4 pts in 2H21 • Gaining efficiencies as ramp-up labor related costs of ~2 pts ease in 2022 • Margin-accretive Northeast Alliance expected to add ~2 – 4 pts of CASM ex-Fuel pressure in 2022 • Ongoing Structural Cost actions to largely offset remaining headwinds including maintenance events Targeting CASM ex-Fuel up low-single-digits in 2022 versus 2019 Note: Chart not to scale Low single digits Double digits

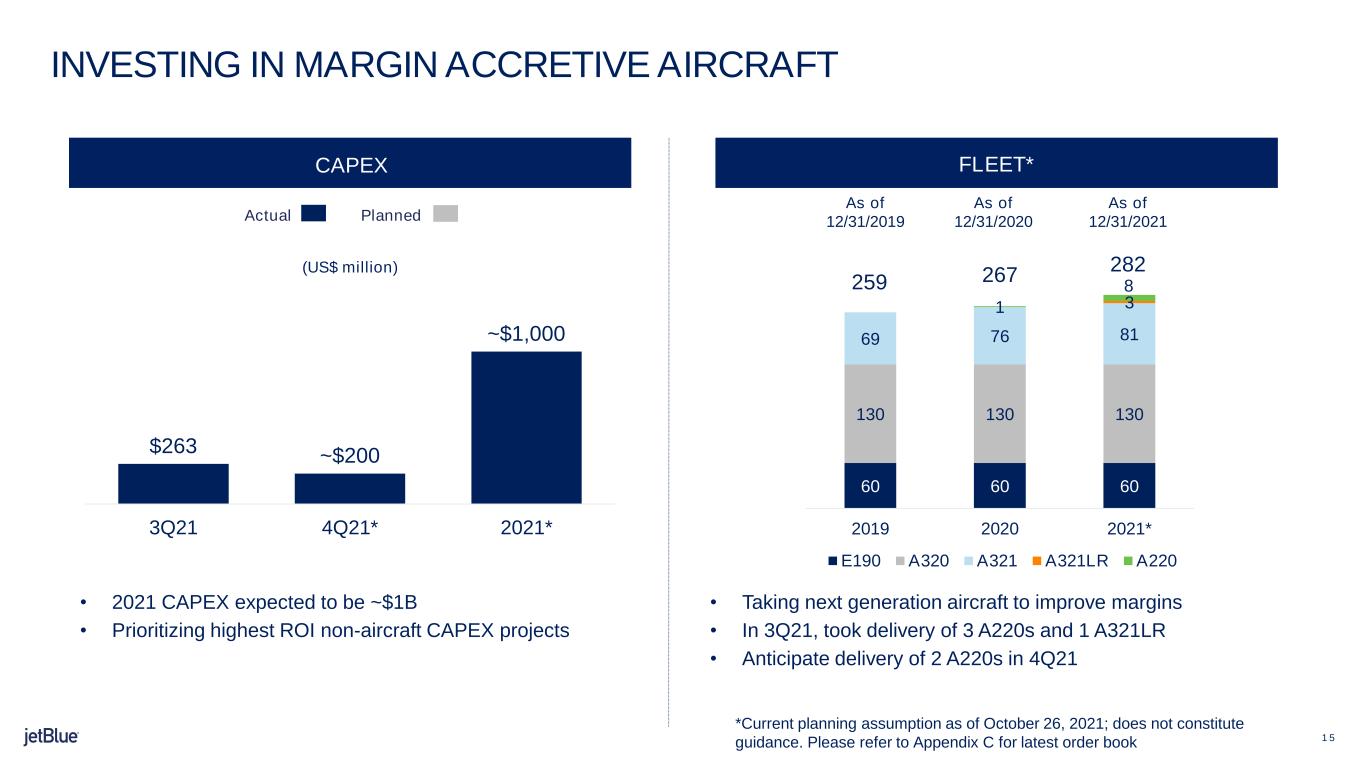

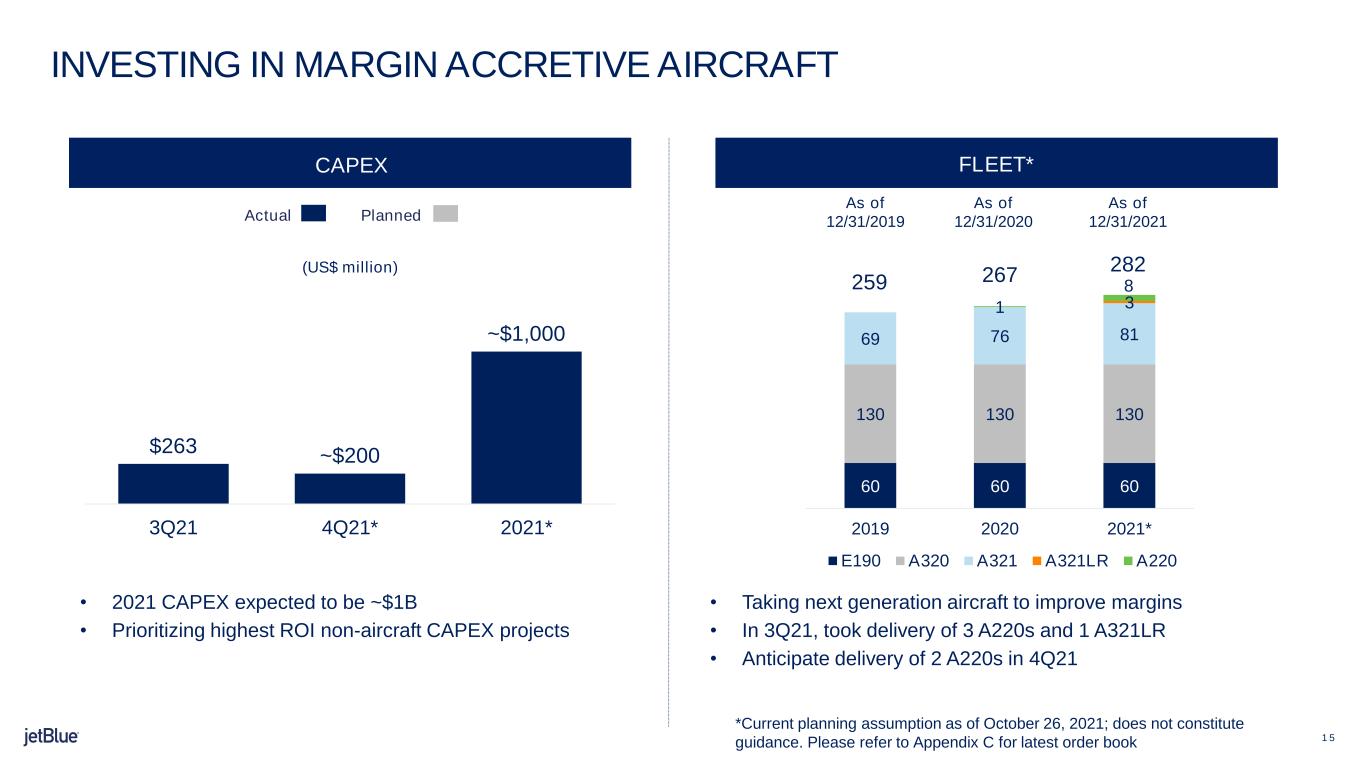

1 5 $263 ~$200 ~$1,000 3Q21 4Q21* 2021* • 2021 CAPEX expected to be ~$1B • Prioritizing highest ROI non-aircraft CAPEX projects CAPEX INVESTING IN MARGIN ACCRETIVE AIRCRAFT FLEET* PlannedActual (US$ million) • Taking next generation aircraft to improve margins • In 3Q21, took delivery of 3 A220s and 1 A321LR • Anticipate delivery of 2 A220s in 4Q21 *Current planning assumption as of October 26, 2021; does not constitute guidance. Please refer to Appendix C for latest order book As of 12/31/2020 As of 12/31/2021 282 267259 As of 12/31/2019 60 60 60 130 130 130 69 76 81 31 2019 2020 2021* E190 A320 A321 A321LR A220 8

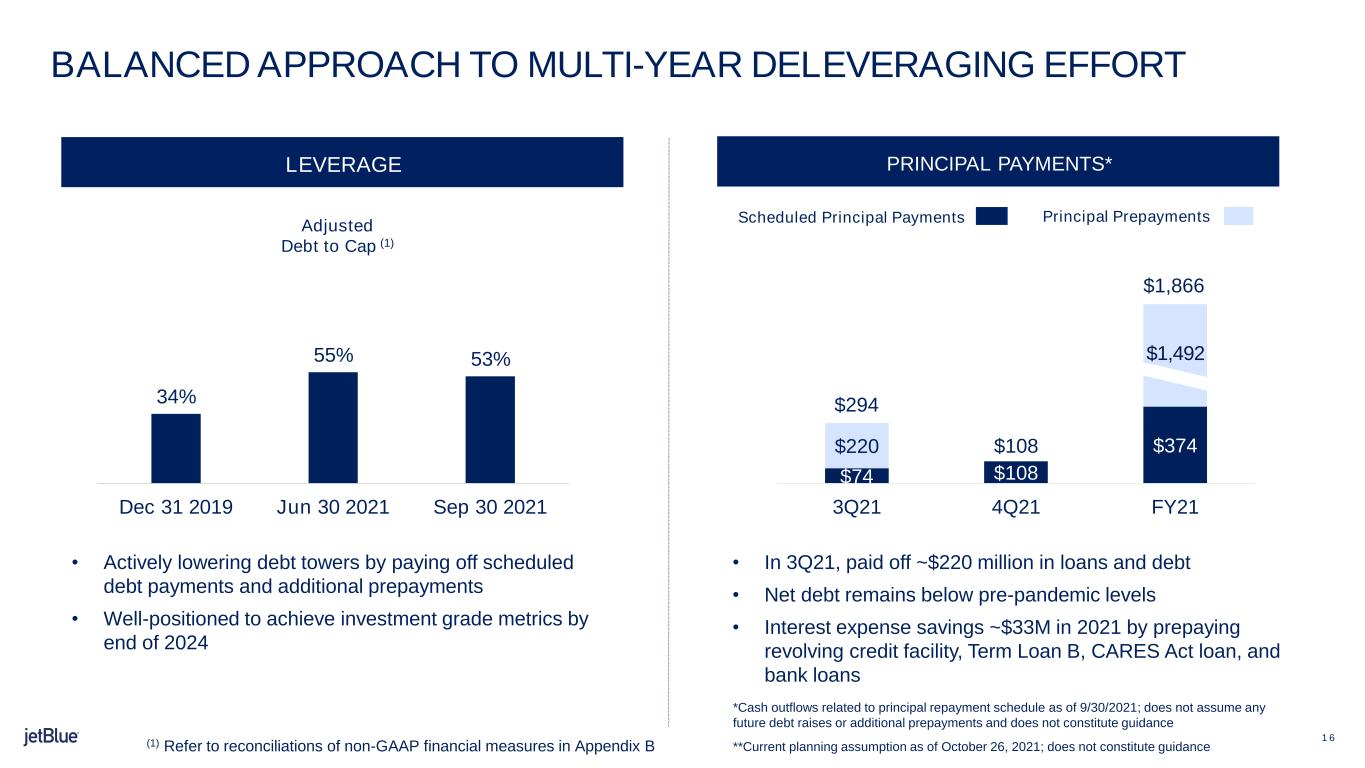

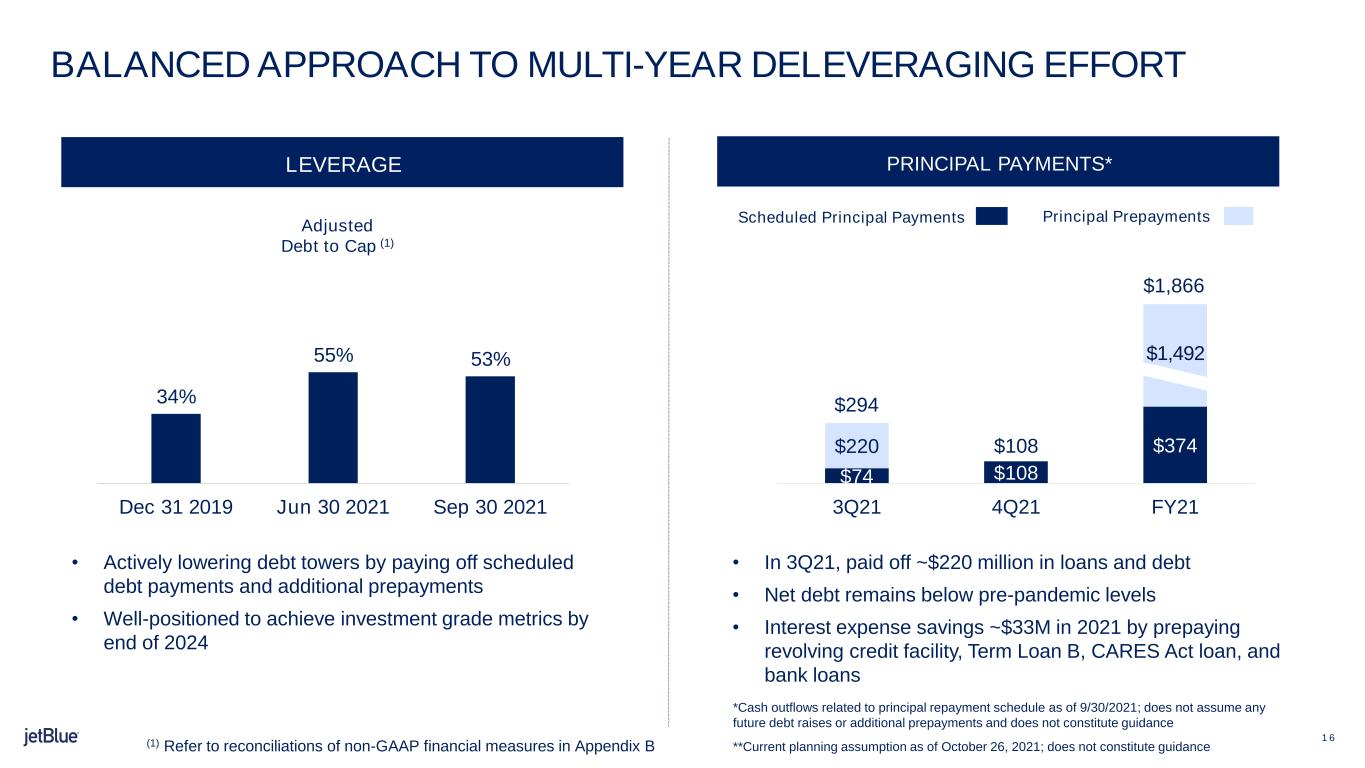

1 6 BALANCED APPROACH TO MULTI-YEAR DELEVERAGING EFFORT LEVERAGE (1) Refer to reconciliations of non-GAAP financial measures in Appendix B Adjusted Debt to Cap (1) • Actively lowering debt towers by paying off scheduled debt payments and additional prepayments • Well-positioned to achieve investment grade metrics by end of 2024 • In 3Q21, paid off ~$220 million in loans and debt • Net debt remains below pre-pandemic levels • Interest expense savings ~$33M in 2021 by prepaying revolving credit facility, Term Loan B, CARES Act loan, and bank loans 34% 55% 53% Dec 31 2019 Jun 30 2021 Sep 30 2021 PRINCIPAL PAYMENTS* Principal PrepaymentsScheduled Principal Payments *Cash outflows related to principal repayment schedule as of 9/30/2021; does not assume any future debt raises or additional prepayments and does not constitute guidance **Current planning assumption as of October 26, 2021; does not constitute guidance $74 $108 $374 $220 3Q21 4Q21 FY21 $1,492 $294 $108 $1,866

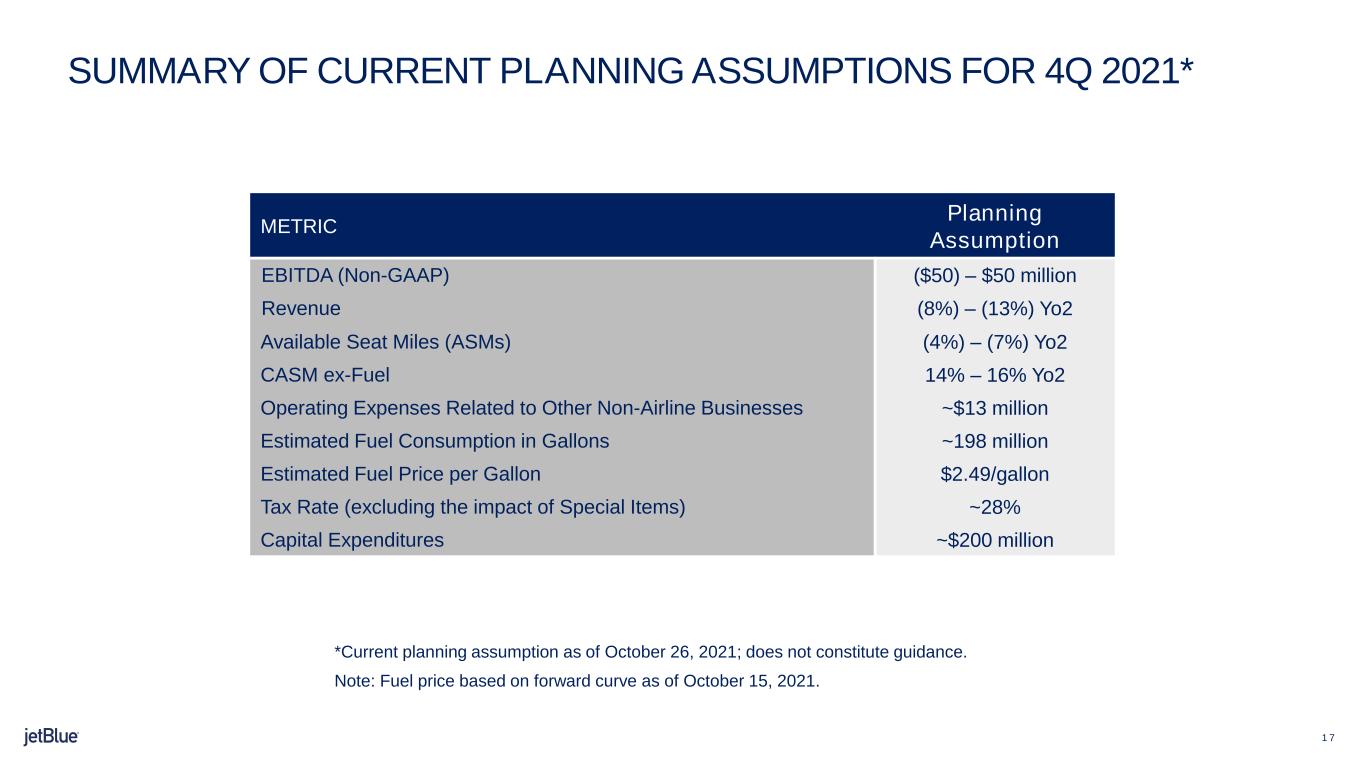

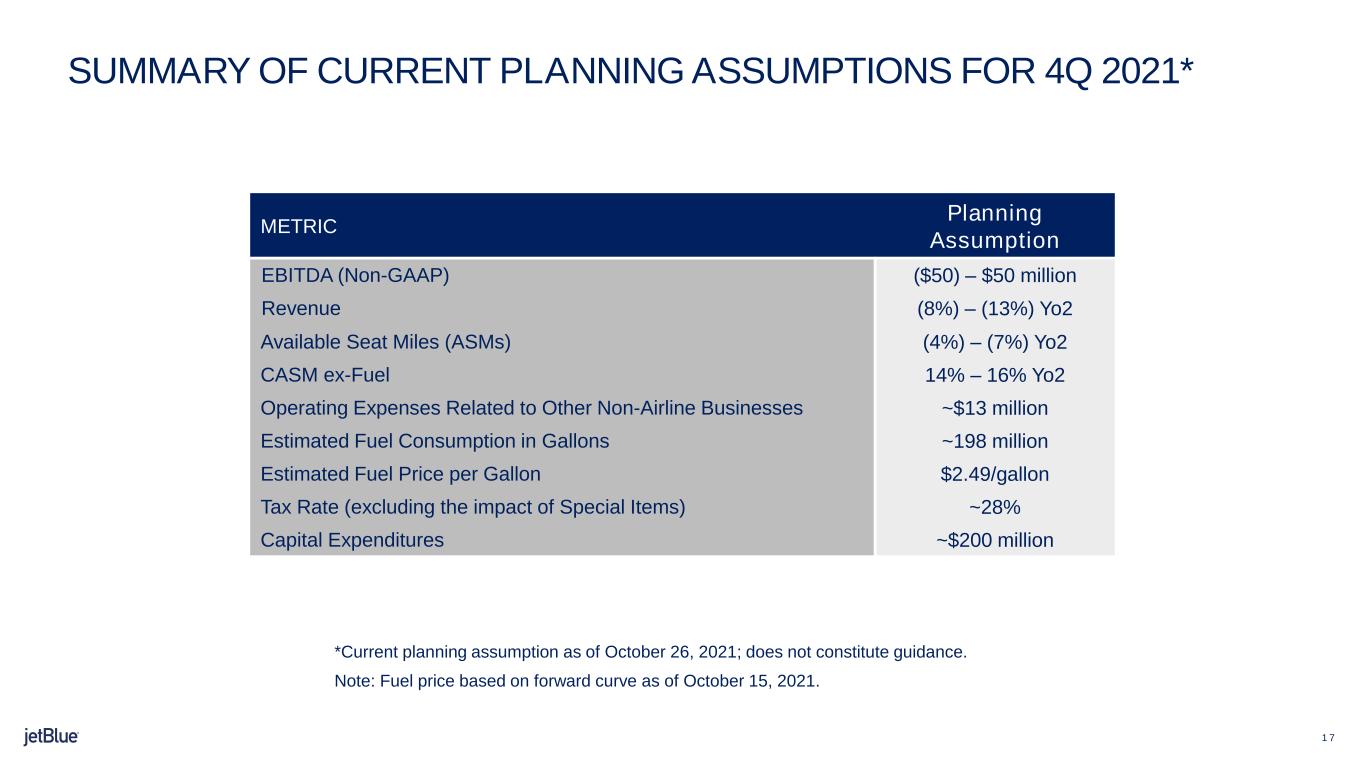

1 7 SUMMARY OF CURRENT PLANNING ASSUMPTIONS FOR 4Q 2021* METRIC Planning Assumption EBITDA (Non-GAAP) ($50) – $50 million Revenue (8%) – (13%) Yo2 Available Seat Miles (ASMs) (4%) – (7%) Yo2 CASM ex-Fuel 14% – 16% Yo2 Operating Expenses Related to Other Non-Airline Businesses ~$13 million Estimated Fuel Consumption in Gallons ~198 million Estimated Fuel Price per Gallon $2.49/gallon Tax Rate (excluding the impact of Special Items) ~28% Capital Expenditures ~$200 million *Current planning assumption as of October 26, 2021; does not constitute guidance. Note: Fuel price based on forward curve as of October 15, 2021.

1 8 QUESTIONS?

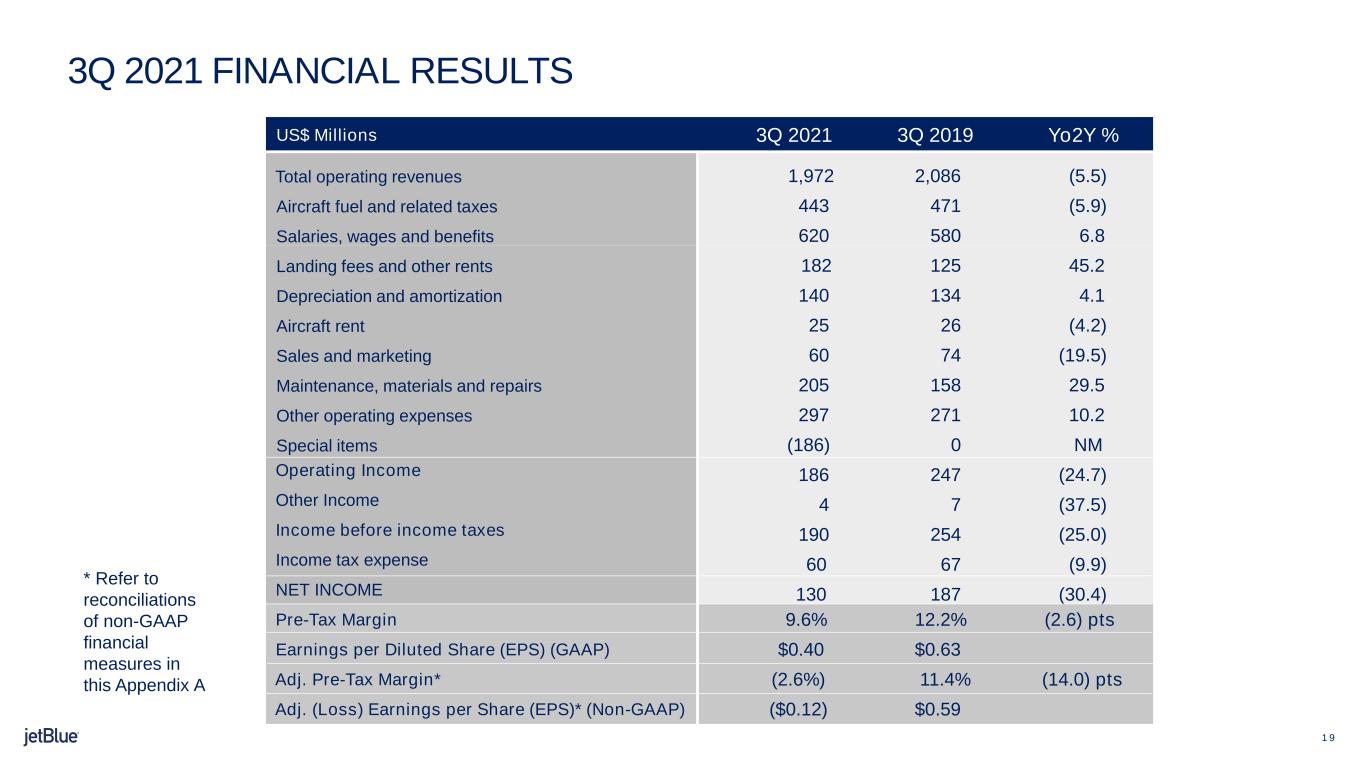

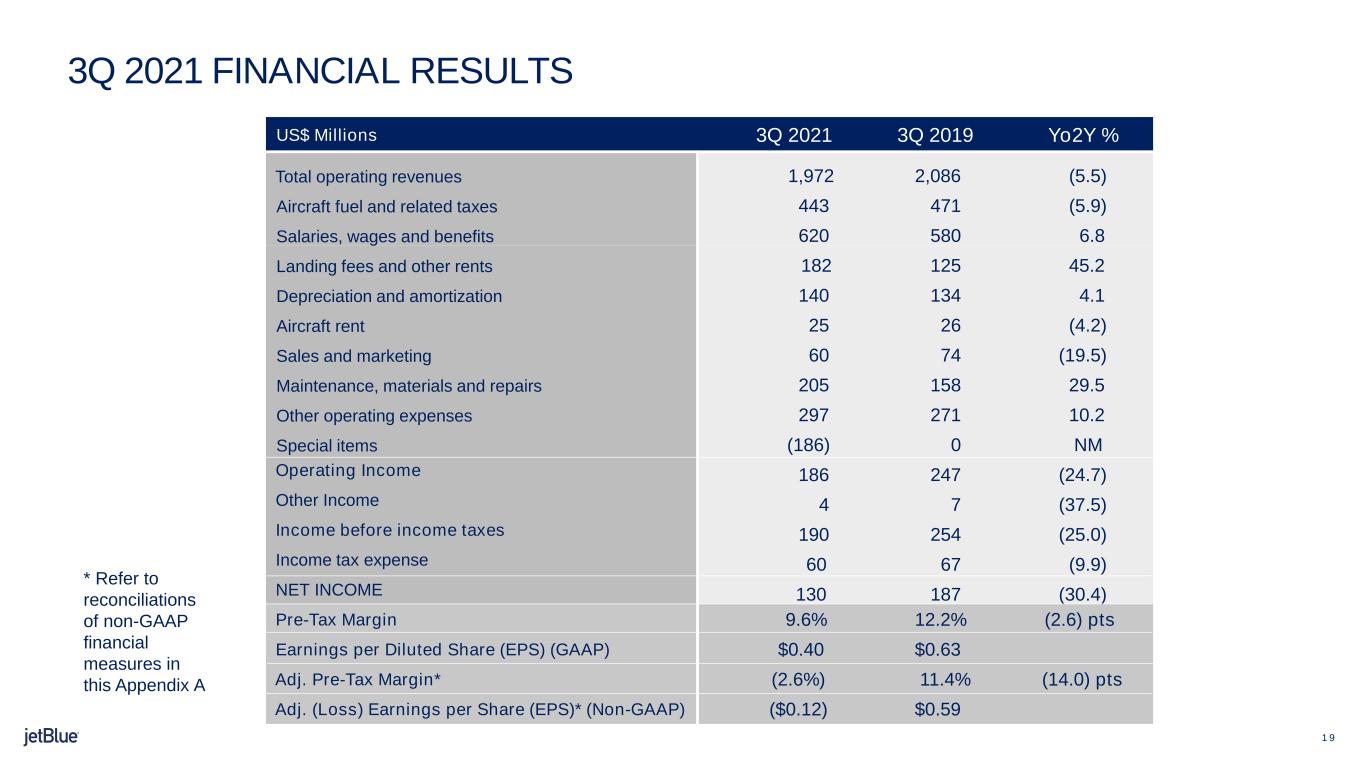

1 9 3Q 2021 FINANCIAL RESULTS US$ Millions 3Q 2021 3Q 2019 Yo2Y % Total operating revenues 1,972 2,086 (5.5) Aircraft fuel and related taxes 443 471 (5.9) Salaries, wages and benefits 620 580 6.8 Landing fees and other rents 182 125 45.2 Depreciation and amortization 140 134 4.1 Aircraft rent 25 26 (4.2) Sales and marketing 60 74 (19.5) Maintenance, materials and repairs 205 158 29.5 Other operating expenses 297 271 10.2 Special items (186) 0 NM Operating Income 186 247 (24.7) Other Income 4 7 (37.5) Income before income taxes 190 254 (25.0) Income tax expense 60 67 (9.9) NET INCOME 130 187 (30.4) Pre-Tax Margin 9.6% 12.2% (2.6) pts Earnings per Diluted Share (EPS) (GAAP) $0.40 $0.63 Adj. Pre-Tax Margin* (2.6%) 11.4% (14.0) pts Adj. (Loss) Earnings per Share (EPS)* (Non-GAAP) ($0.12) $0.59 * Refer to reconciliations of non-GAAP financial measures in this Appendix A

2 0 COMMITTING TO SUSTAINABLE GROWTH IN NEW YORK • Now well ahead of target to convert 10% of total fuel usage to sustainable aviation fuel (SAF) on a blended basis by 2030 • SG Preston agreement marks first large-scale volume of domestically produced SAF for a commercial airline to New York’s metropolitan airports − JetBlue will convert 30 percent of its fuel buy at JFK, LGA, and EWR from Jet-A fuel to SAF − Expect to take delivery over a 10-year period of over 670 million gallons of blended SAF starting in late 2023 − Priced near parity to traditional Jet-A fuel SAF HIGHLIGHTS • Nearing goal to convert 40% of its GSEs to electric by 2025, and 50% by 2030 − Following ongoing initiatives to convert ground vehicles to electric at EWR and BOS, JetBlue will have converted 39% of ground service equipment (GSE) to electric • Upgrading JFK T5 with LED lighting which will reduce JetBlue’s lighting-related energy use by approximately 66 percent − Saving more than 2.1 million kWh annually, while improving aesthetics, lowering energy costs and reducing the terminal’s carbon footprint CONVERTING TO A MORE SUSTAINABLE OPERATION

2 1 Non-GAAP Financial Measures JetBlue uses non-GAAP financial measures in this presentation. Non-GAAP financial measures are financial measures that are derived from the consolidated financial statements, but that are not presented in accordance with generally accepted accounting principles in the United States, or GAAP. We believe these non-GAAP financial measures provide a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies. The information in Appendices A and B provides an explanation of each non-GAAP financial measure and shows a reconciliation of non-GAAP financial measures used in this presentation to the most directly comparable GAAP financial measures. APPENDIX A

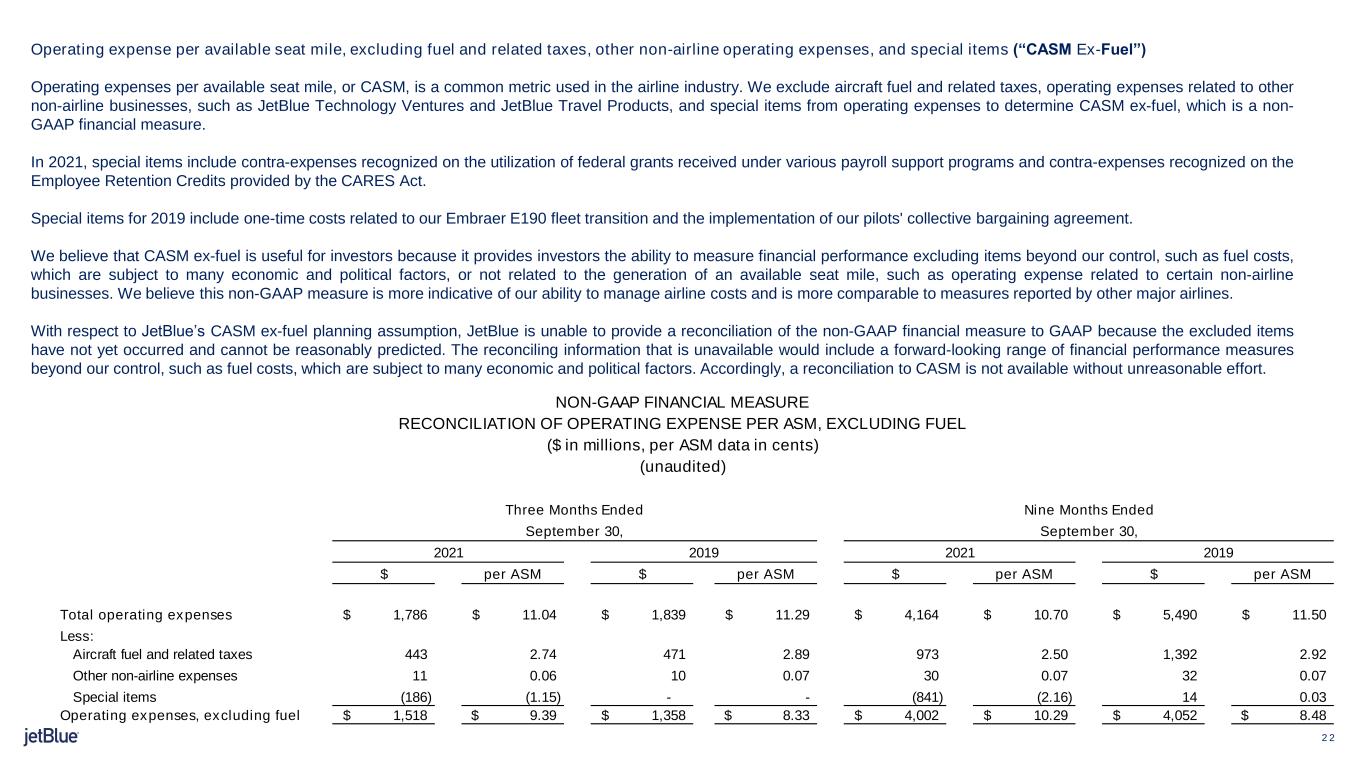

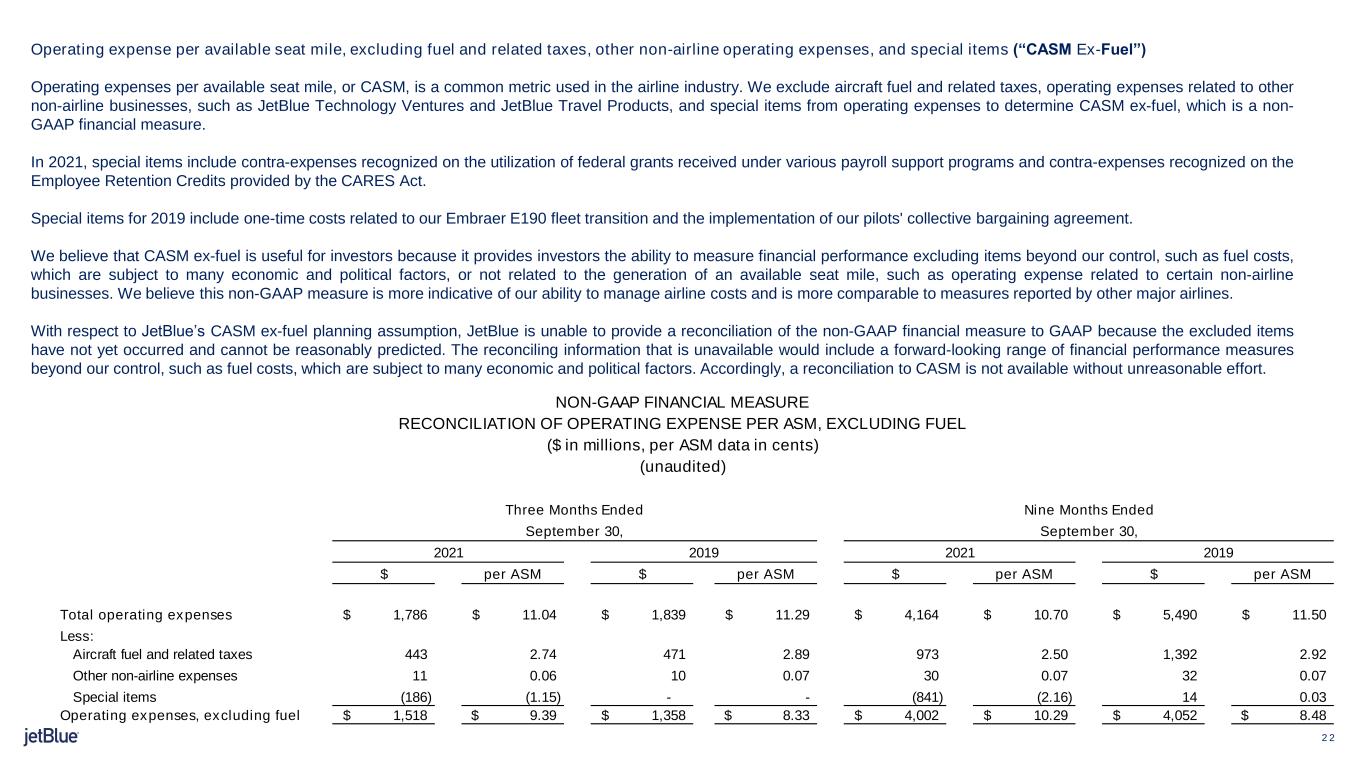

2 2 Operating expense per available seat mile, excluding fuel and related taxes, other non-airline operating expenses, and special items (“CASM Ex-Fuel”) Operating expenses per available seat mile, or CASM, is a common metric used in the airline industry. We exclude aircraft fuel and related taxes, operating expenses related to other non-airline businesses, such as JetBlue Technology Ventures and JetBlue Travel Products, and special items from operating expenses to determine CASM ex-fuel, which is a non- GAAP financial measure. In 2021, special items include contra-expenses recognized on the utilization of federal grants received under various payroll support programs and contra-expenses recognized on the Employee Retention Credits provided by the CARES Act. Special items for 2019 include one-time costs related to our Embraer E190 fleet transition and the implementation of our pilots' collective bargaining agreement. We believe that CASM ex-fuel is useful for investors because it provides investors the ability to measure financial performance excluding items beyond our control, such as fuel costs, which are subject to many economic and political factors, or not related to the generation of an available seat mile, such as operating expense related to certain non-airline businesses. We believe this non-GAAP measure is more indicative of our ability to manage airline costs and is more comparable to measures reported by other major airlines. With respect to JetBlue’s CASM ex-fuel planning assumption, JetBlue is unable to provide a reconciliation of the non-GAAP financial measure to GAAP because the excluded items have not yet occurred and cannot be reasonably predicted. The reconciling information that is unavailable would include a forward-looking range of financial performance measures beyond our control, such as fuel costs, which are subject to many economic and political factors. Accordingly, a reconciliation to CASM is not available without unreasonable effort. $ per ASM $ per ASM $ per ASM $ per ASM Total operating expenses 1,786$ 11.04$ 1,839$ 11.29$ 4,164$ 10.70$ 5,490$ 11.50$ Less: Aircraft fuel and related taxes 443 2.74 471 2.89 973 2.50 1,392 2.92 Other non-airline expenses 11 0.06 10 0.07 30 0.07 32 0.07 Special items (186) (1.15) - - (841) (2.16) 14 0.03 Operating expenses, excluding fuel 1,518$ 9.39$ 1,358$ 8.33$ 4,002$ 10.29$ 4,052$ 8.48$ RECONCILIATION OF OPERATING EXPENSE PER ASM, EXCLUDING FUEL ($ in millions, per ASM data in cents) (unaudited) NON-GAAP FINANCIAL MEASURE 2019 Three Months Ended September 30, 20212021 2019 Nine Months Ended September 30,

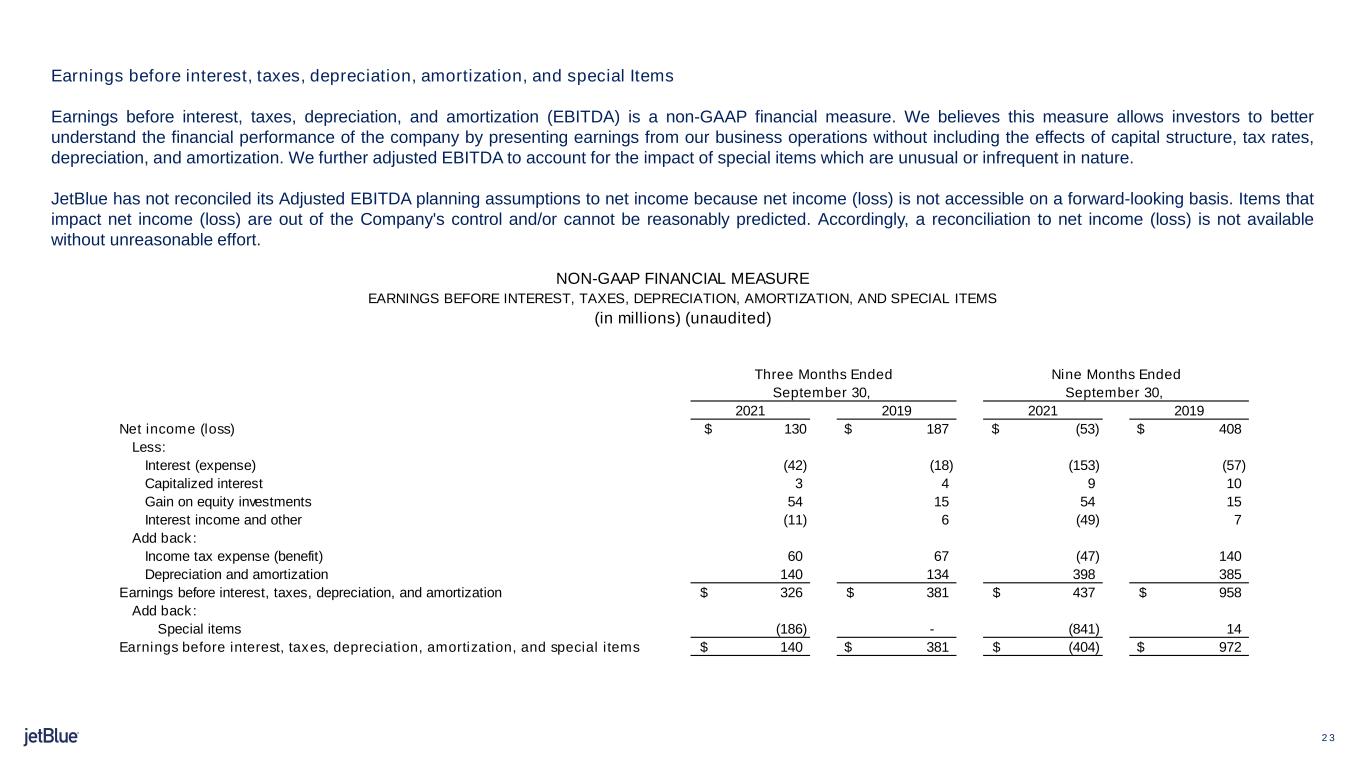

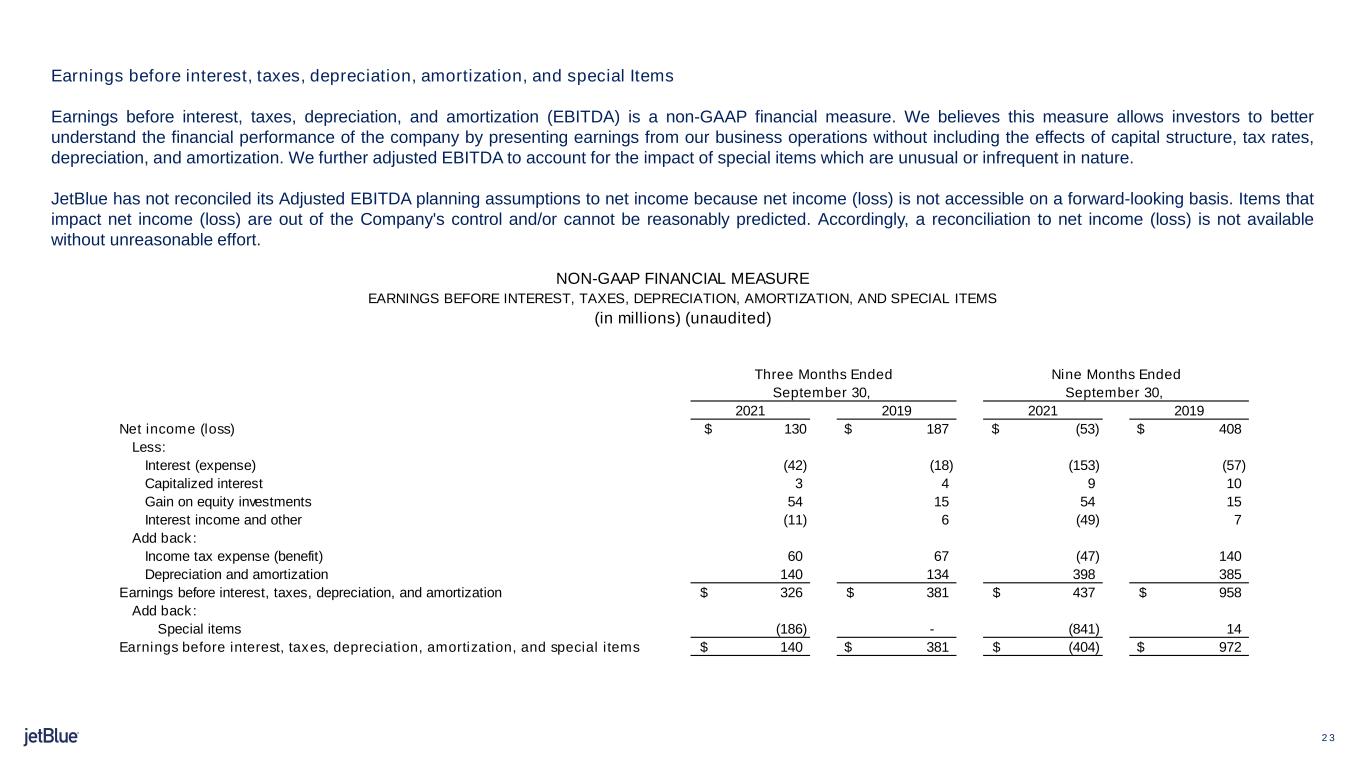

2 3 LOCATION Earnings before interest, taxes, depreciation, amortization, and special Items Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a non-GAAP financial measure. We believes this measure allows investors to better understand the financial performance of the company by presenting earnings from our business operations without including the effects of capital structure, tax rates, depreciation, and amortization. We further adjusted EBITDA to account for the impact of special items which are unusual or infrequent in nature. JetBlue has not reconciled its Adjusted EBITDA planning assumptions to net income because net income (loss) is not accessible on a forward-looking basis. Items that impact net income (loss) are out of the Company's control and/or cannot be reasonably predicted. Accordingly, a reconciliation to net income (loss) is not available without unreasonable effort. 2021 2019 2021 2019 Net income (loss) $ 130 187$ $ (53) 408$ Less: Interest (expense) (42) (18) (153) (57) Capitalized interest 3 4 9 10 Gain on equity investments 54 15 54 15 Interest income and other (11) 6 (49) 7 Add back: Income tax expense (benefit) 60 67 (47) 140 Depreciation and amortization 140 134 398 385 Earnings before interest, taxes, depreciation, and amortization 326$ 381$ 437$ 958$ Add back: Special items (186) - (841) 14 Earnings before interest, taxes, depreciation, amortization, and special items 140$ 381$ (404)$ 972$ Three Months Ended September 30, Nine Months Ended September 30, NON-GAAP FINANCIAL MEASURE EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION, AMORTIZATION, AND SPECIAL ITEMS (in millions) (unaudited)

2 4 Operating expense, income (loss) before taxes, net income (loss) and earnings (loss) per share, excluding special items and gain on equity investments Our GAAP results in the applicable periods were impacted by credits and charges that were deemed special items. In 2021, special items include contra-expenses recognized on the utilization of federal grants received under various payroll support programs and contra-expenses recognized on the Employee Retention Credits provided by the CARES Act. Special items for 2019 include one-time costs related to our Embraer E190 fleet transition and the implementation of our pilots' collective bargaining agreement. One-time gains on our equity investments were also excluded from our 2021 and 2019 GAAP results. We believe the impact of these items distort our overall trends and that our metrics are more comparable with the presentation of our results excluding the impact of these items. The table below provides a reconciliation of our GAAP reported amounts to the non- GAAP amounts excluding the impact of these items. 2021 2019 2021 2019 Total operating revenues 1,972$ 2,086$ 4,203$ 6,063$ Total operating expenses 1,786$ 1,839$ 4,164$ 5,490$ Less: Special items (186) - (841) 14 Total operating expenses excluding special items 1,972$ 1,839$ 5,005$ 5,476$ Operating income 186$ 247$ 39$ 573$ Add back: Special items (186) - (841) 14 Operating income (loss) excluding special items -$ 247$ (802)$ 587$ Operating margin excluding special items 0.0% 11.8% -19.1% 9.7% Income (loss) before income taxes 190$ 254$ (100)$ 548$ Add back: Special items (186) - (841) 14 Less: Gain on equity investments 54 15 54 15 Income (loss) before income taxes excluding special items and gain on equity investments (50)$ 239$ (995)$ 547$ Pre-tax margin excluding special items and gain on equity investments -2.6% 11.4% -23.7% 9.0% Net income (loss) 130$ 187$ (53)$ 408$ Add back: Special items (186) - (841) 14 Less: Income tax (expense) benefit related to special items (55) - (250) 3 Less: Gain on equity investments 54 15 54 15 Less: Income tax (expense) related to gain on equity investments (16) (4) (16) (4) Net income (loss) excluding special items and gain on equity investments (39)$ 176$ (682)$ 408$ Earnings (Loss) Per Common Share: Basic 0.41$ 0.63$ (0.17)$ 1.36$ Add back: Special items, net of tax (0.41) - (1.86) 0.03 Less: Gain on equity investments, net of tax 0.12 0.04 0.12 0.04 Basic excluding special items and gain on equity investments (0.12)$ 0.59$ (2.15)$ 1.35$ Diluted 0.40$ 0.63$ (0.17)$ 1.35$ Add back: Special items, net of tax (0.40) - (1.86) 0.03 Less: Gain on equity investments, net of tax 0.12 0.04 0.12 0.03 Diluted excluding special items and gain on equity investments (0.12)$ 0.59$ (2.15)$ 1.35$ Three Months Ended September 30, Nine Months Ended September 30, NON-GAAP FINANCIAL MEASURE RECONCILIATION OF OPERATING EXPENSE, INCOME (LOSS) BEFORE TAXES, NET INCOME (LOSS) AND EARNINGS (LOSS) PER SHARE EXCLUDING SPECIAL ITEMS AND GAIN ON EQUITY INVESTMENTS (in millions, except per share amounts) (unaudited)

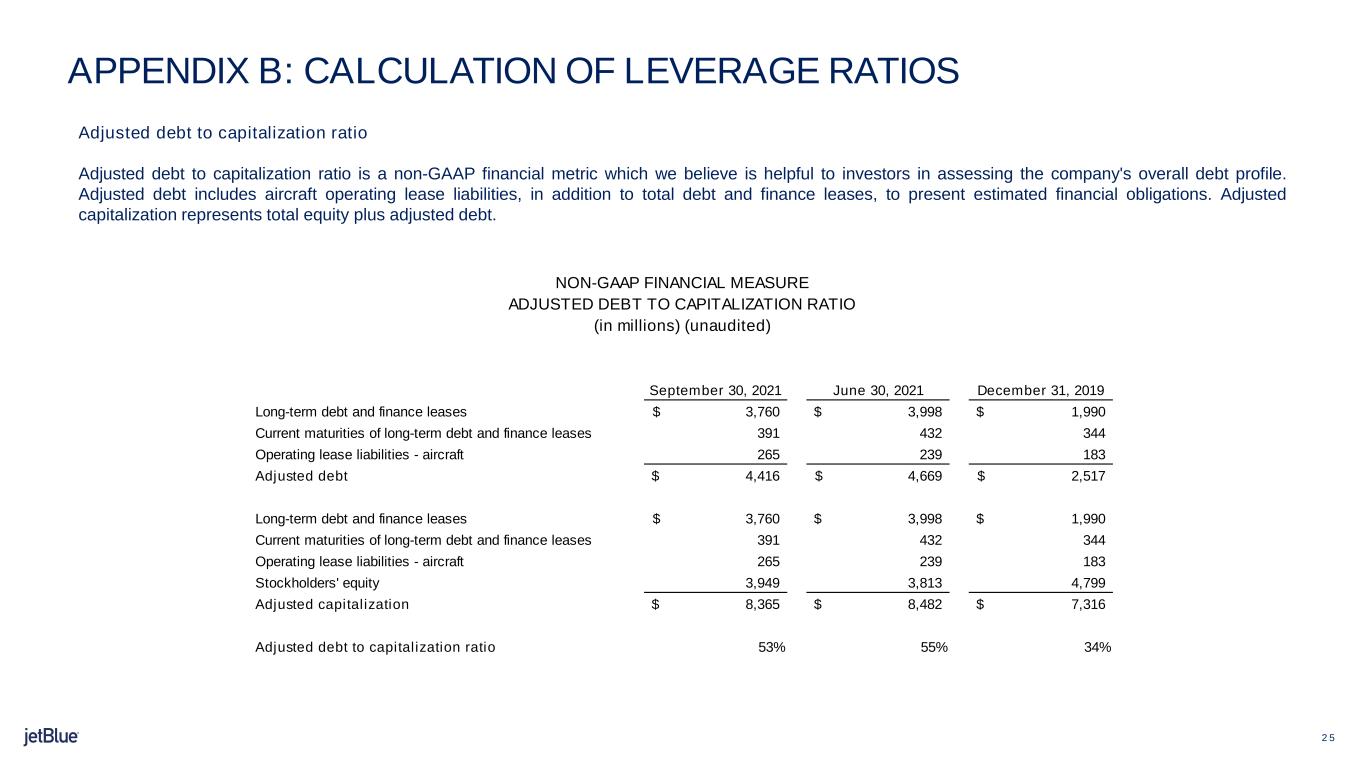

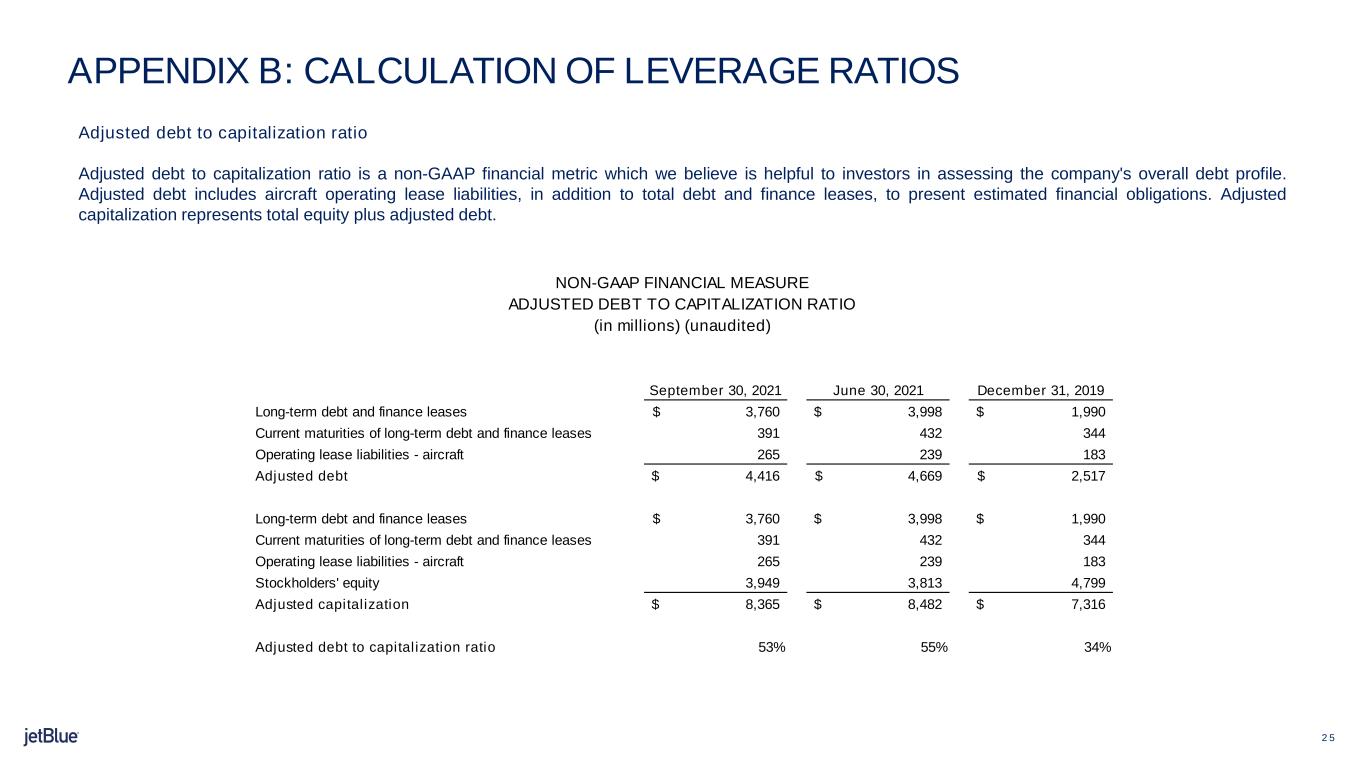

2 5 APPENDIX B: CALCULATION OF LEVERAGE RATIOS LOCATION Adjusted debt to capitalization ratio Adjusted debt to capitalization ratio is a non-GAAP financial metric which we believe is helpful to investors in assessing the company's overall debt profile. Adjusted debt includes aircraft operating lease liabilities, in addition to total debt and finance leases, to present estimated financial obligations. Adjusted capitalization represents total equity plus adjusted debt. September 30, 2021 June 30, 2021 December 31, 2019 Long-term debt and finance leases 3,760$ 3,998$ 1,990$ Current maturities of long-term debt and finance leases 391 432 344 Operating lease liabilities - aircraft 265 239 183 Adjusted debt 4,416$ 4,669$ 2,517$ Long-term debt and finance leases 3,760$ 3,998$ 1,990$ Current maturities of long-term debt and finance leases 391 432 344 Operating lease liabilities - aircraft 265 239 183 Stockholders' equity 3,949 3,813 4,799 Adjusted capitalization 8,365$ 8,482$ 7,316$ Adjusted debt to capitalization ratio 53% 55% 34% NON-GAAP FINANCIAL MEASURE ADJUSTED DEBT TO CAPITALIZATION RATIO (in millions) (unaudited)

2 6 LOCATION Adjusted Net Debt Adjusted net debt is a non-GAAP financial measure which we believe is helpful to investors in assessing our overall debt profile. We reduce our adjusted debt by cash, cash equivalents, and short-term investments resulting in adjusted net debt, to present the amount of assets needed to satisfy our debt obligations. September 30, 2021 June 30, 2021 December 31, 2019 Long-term debt and finance leases 3,760$ 3,998$ 1,990$ Current maturities of long-term debt and finance leases 391 432 344 Operating lease liabilities - aircraft 265 239 183 Adjusted Debt 4,416$ 4,669$ 2,517$ Cash and cash equivalents 2,193$ 2,409$ 959$ Short-term investments 1,100 1,317 369 Total Liquidity 3,293$ 3,726$ 1,328$ Adjusted Net Debt 1,123$ 943$ 1,189$ NON-GAAP FINANCIAL MEASURE ADJUSTED NET DEBT (in millions) (unaudited)

2 7 A220 A321NEO A321NEO LR Total 2021* 7 5 3 15 2022 9 - 3 12 Delivery schedule, as of October 26, 2021 *Includes 13 deliveries received through 3Q21 APPENDIX C: CONTRACTUAL ORDER BOOK

2 8 Investor Presentations http://blueir.investproductions.com/investor-relations/events-and-presentations/presentations Earnings Releases http://blueir.investproductions.com/investor-relations/financial-information/quarterly-results Annual Reports http://blueir.investproductions.com/investor-relations/financial-information/reports/annual-reports SEC Filings http://blueir.investproductions.com/investor-relations/financial-information/sec-filings Proxy Statements http://blueir.investproductions.com/investor-relations/financial-information/reports/proxy-statements Investor Updates http://blueir.investproductions.com/investor-relations/financial-information/investor-updates Traffic Reports http://blueir.investproductions.com/investor-relations/financial-information/traffic-releases ESG Reports* http://blueir.investproductions.com/investor-relations/financial-information/reports/sustainable-accounting-standards-board-reports www.investor.jetblue.com/investor-relations DOCUMENT LOCATION * Environmental, Social, and Governance Reports APPENDIX D: RELEVANT JETBLUE MATERIALS