1Q22 EARNINGS PRESENTATION APRIL 26, 2022

2 SAFE HARBOR This Presentation (or otherwise made by JetBlue or on JetBlue’s behalf) contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which represent our management’s beliefs and assumptions concerning future events. These statements are intended to qualify for the “safe harbor” from liability established by the Private Securities Litigation Reform Act of 1995. When used in this document and in documents incorporated herein by reference, the words “expects,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the coronavirus (“COVID-19”) pandemic including existing and new variants, and the outbreak of any other disease or similar public health threat that affects travel demand or behavior; restrictions on our business related to the financing we accepted under various federal government support programs such as the Coronavirus Aid, Relief, and Economic Security Act, the Consolidated Appropriations Act, and the American Rescue Plan Act; our significant fixed obligations and substantial indebtedness; risk associated with execution of our strategic operating plans in the near-term and long-term; the recording of a material impairment loss of tangible or intangible assets; our extremely competitive industry; volatility in financial and credit markets which could affect our ability to obtain debt and/or lease financing or to raise funds through debt or equity issuances; volatility in fuel prices, maintenance costs and interest rates; our reliance on high daily aircraft utilization; our ability to implement our growth strategy; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on a limited number of suppliers, including for aircraft, aircraft engines and parts and vulnerability to delays by those suppliers; our dependence on the New York and Boston metropolitan markets and the effect of increased congestion in these markets; our reliance on automated systems and technology; the outcome of the lawsuit filed by the Department of Justice and certain state Attorneys General against us related to our Northeast Alliance entered into with American Airlines, our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; our presence in some international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from information security breaches or cyber-attacks; changes in or additional domestic or foreign government regulation, including new or increased tariffs; changes in our industry due to other airlines’ financial condition; acts of war or terrorism; global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel; adverse weather conditions or natural disasters; and external geopolitical events and conditions; the outcome of any discussions between JetBlue and Spirit Airlines, Inc. (“Spirit”) with respect to a possible transaction, including the possibility that the parties will not agree to pursue a business combination transaction or that the terms of any such transaction will be materially different from those described herein or previously announced; the conditions to the completion of the possible transaction, including the receipt of any required stockholder and regulatory approvals, and, in particular, our expectation as to the likelihood of receipt of antitrust approvals; JetBlue’s ability to finance the possible transaction and the indebtedness JetBlue expects to incur in connection with the possible transaction; the possibility that JetBlue may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all and to successfully integrate Spirit’s operations with those of JetBlue; and the possibility that such integration may be more difficult, time-consuming or costly than expected or that operating costs and business disruption (including, without limitation, disruptions in relationships with employees, customers or suppliers) may be greater than expected in connection with the possible transaction. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Any outlook or forecasts in this document have been prepared without taking into account or consideration a possible transaction with Spirit. Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Presentation, could cause our results to differ materially from those expressed in the forward-looking statements. In light of these risks and uncertainties, the forward-looking events discussed in this Presentation might not occur. Our forward-looking statements speak only as of the date of this Presentation. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise. This Presentation also includes certain “non-GAAP financial measures” as defined under the Exchange Act and in accordance with Regulation G. We have included reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and provided in accordance with U.S. GAAP within this Presentation.

3 Additional Information and Where to Find It JetBlue has made a proposal for a business combination transaction with Spirit. In furtherance of this proposal and subject to future developments, JetBlue (and, if a negotiated transaction is agreed to, Spirit) may file one or more proxy statements or other documents with the Securities and Exchange Commission, or SEC. This communication is not a substitute for any proxy statement or other document JetBlue and/or Spirit may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF JETBLUE AND SPIRIT ARE URGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE POSSIBLE TRANSACTION. Any definitive proxy statement (if and when available) will be mailed to stockholders of Spirit. Investors and security holders of Spirit and JetBlue will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by JetBlue and Spirit through the web site maintained by the SEC at http://www.sec.gov. Participants in the Solicitation This presentation is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, JetBlue and certain of its directors and executive officers may be deemed to be participants in any solicitation with respect to the proposed transaction under the rules of the SEC. Information regarding the interests of these participants in any such proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be included in any proxy statement and other relevant materials to be filed with the SEC if and when they become available. These documents can be obtained free of charge as described in the preceding paragraph. No Offer or Solicitation This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. IMPORTANT INFORMATION FOR INVESTORS

4 1Q 2022 EARNINGS UPDATE ROBIN HAYES CHIEF EXECUTIVE OFFICER

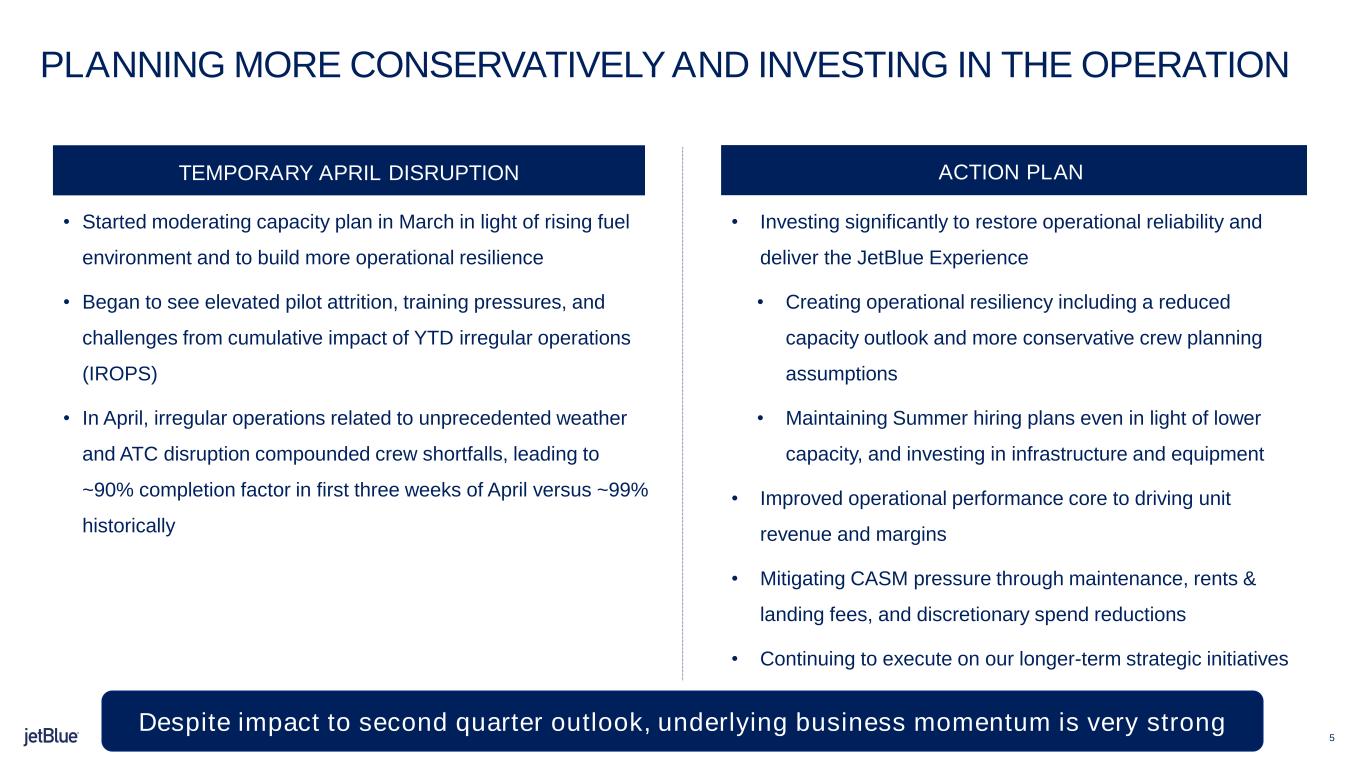

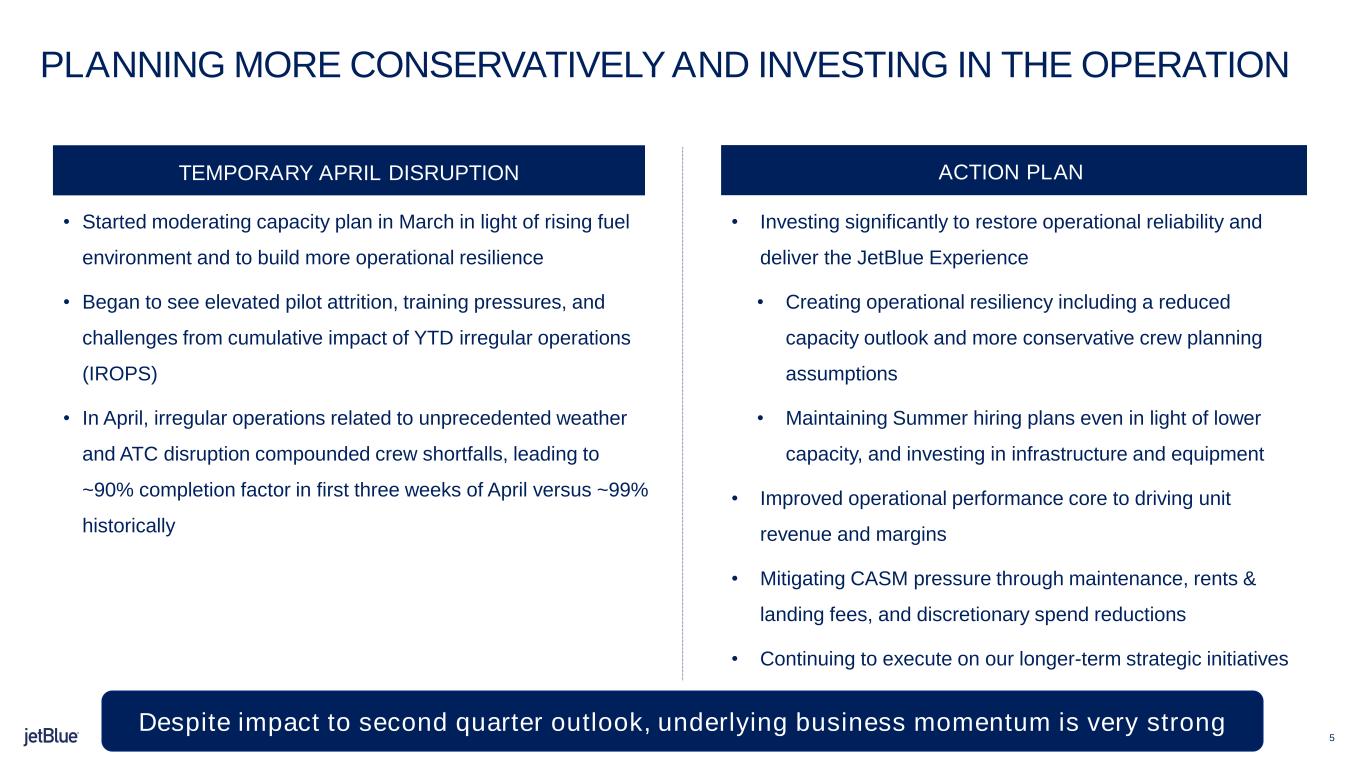

5 PLANNING MORE CONSERVATIVELY AND INVESTING IN THE OPERATION • Started moderating capacity plan in March in light of rising fuel environment and to build more operational resilience • Began to see elevated pilot attrition, training pressures, and challenges from cumulative impact of YTD irregular operations (IROPS) • In April, irregular operations related to unprecedented weather and ATC disruption compounded crew shortfalls, leading to ~90% completion factor in first three weeks of April versus ~99% historically TEMPORARY APRIL DISRUPTION • Investing significantly to restore operational reliability and deliver the JetBlue Experience • Creating operational resiliency including a reduced capacity outlook and more conservative crew planning assumptions • Maintaining Summer hiring plans even in light of lower capacity, and investing in infrastructure and equipment • Improved operational performance core to driving unit revenue and margins • Mitigating CASM pressure through maintenance, rents & landing fees, and discretionary spend reductions • Continuing to execute on our longer-term strategic initiatives ACTION PLAN Despite impact to second quarter outlook, underlying business momentum is very strong

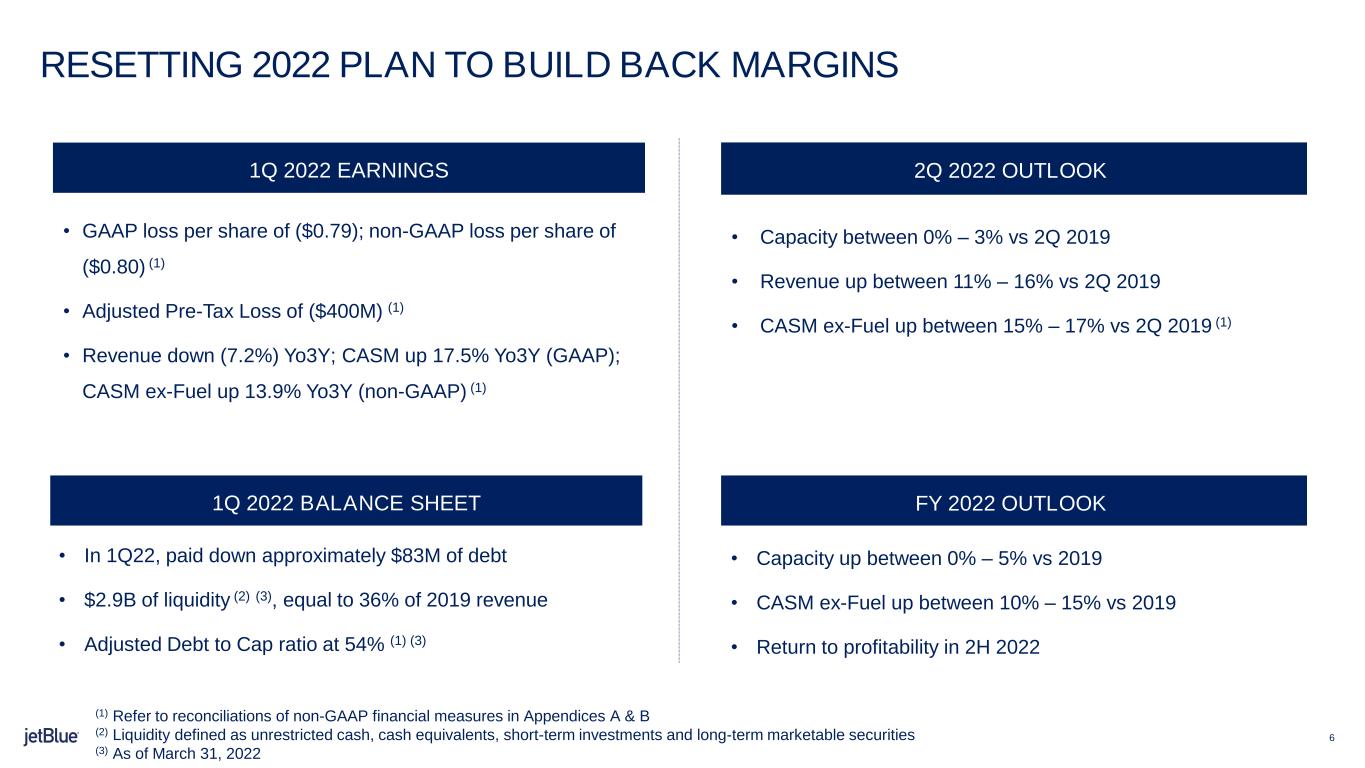

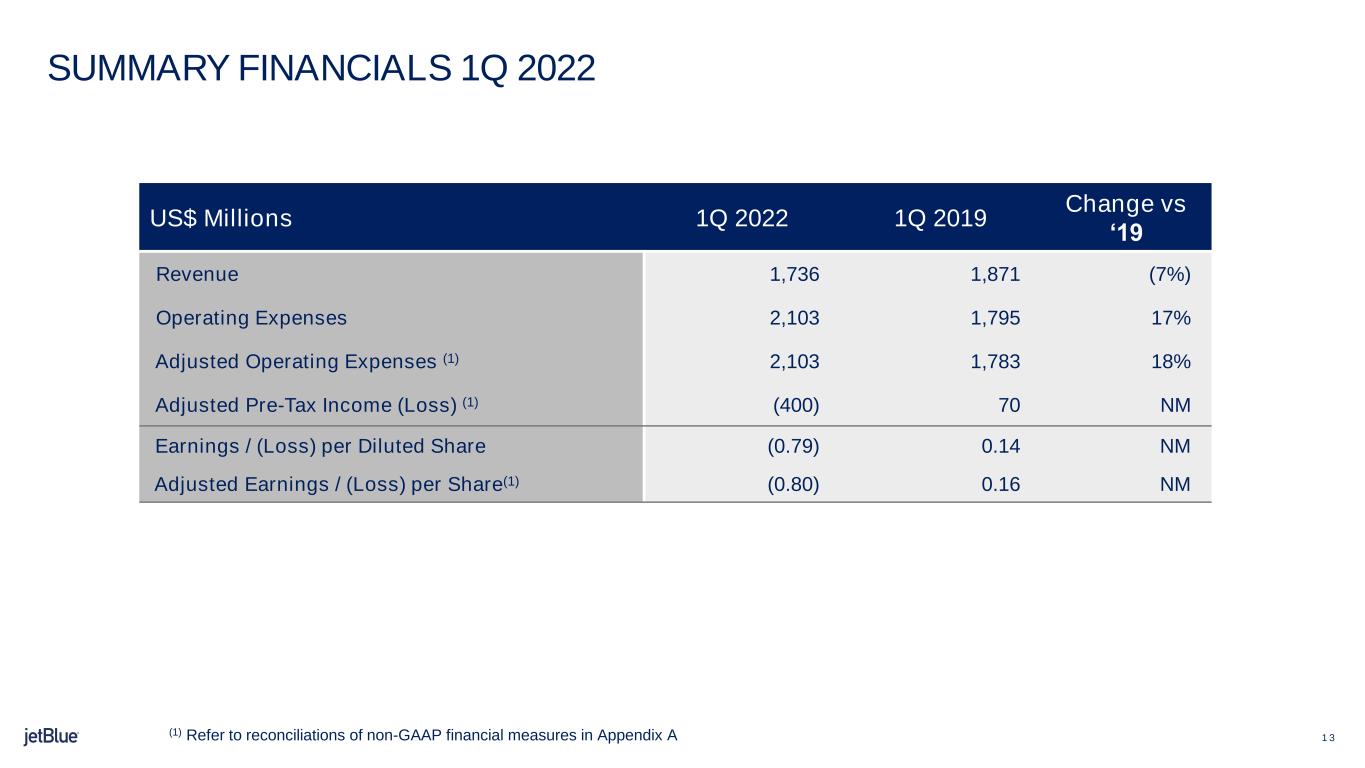

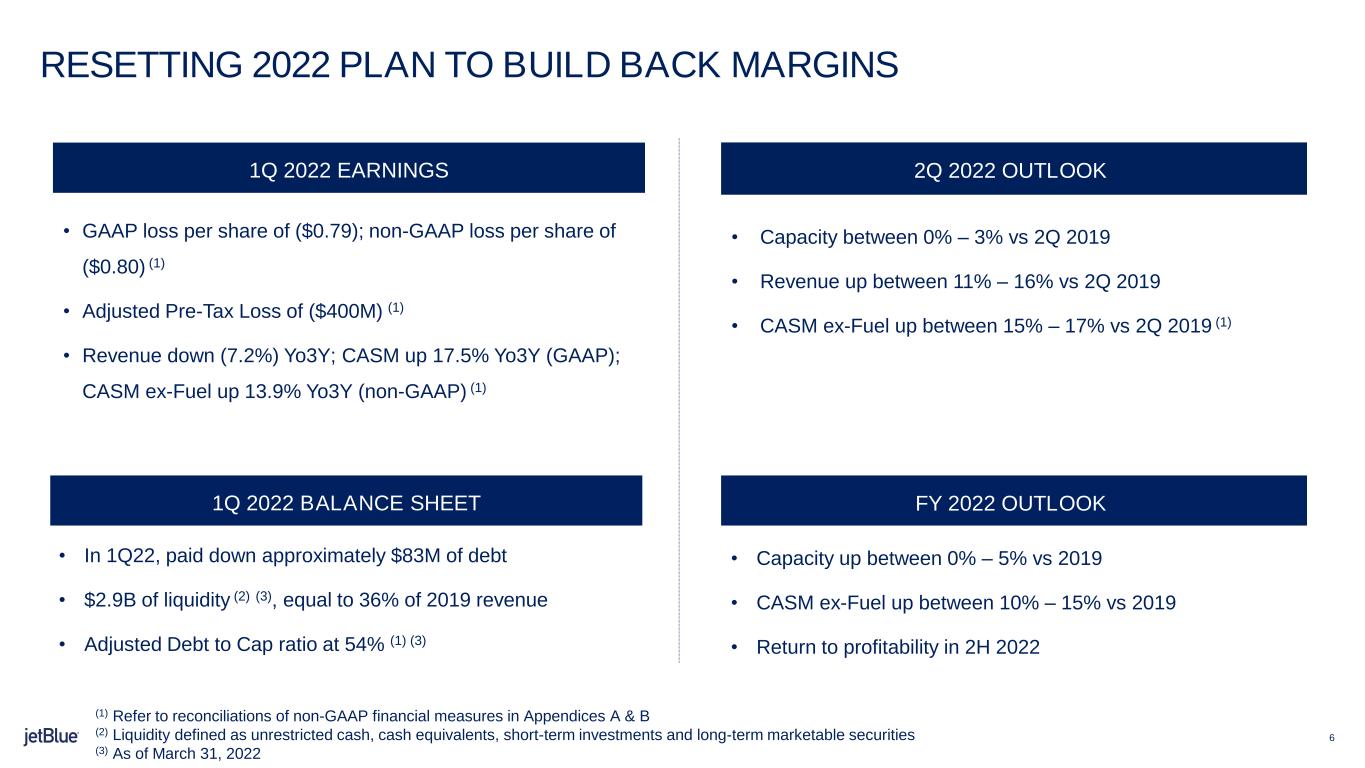

6 RESETTING 2022 PLAN TO BUILD BACK MARGINS FY 2022 OUTLOOK (1) Refer to reconciliations of non-GAAP financial measures in Appendices A & B (2) Liquidity defined as unrestricted cash, cash equivalents, short-term investments and long-term marketable securities (3) As of March 31, 2022 • GAAP loss per share of ($0.79); non-GAAP loss per share of ($0.80) (1) • Adjusted Pre-Tax Loss of ($400M) (1) • Revenue down (7.2%) Yo3Y; CASM up 17.5% Yo3Y (GAAP); CASM ex-Fuel up 13.9% Yo3Y (non-GAAP) (1) 1Q 2022 EARNINGS • Capacity between 0% – 3% vs 2Q 2019 • Revenue up between 11% – 16% vs 2Q 2019 • CASM ex-Fuel up between 15% – 17% vs 2Q 2019 (1) 2Q 2021 PLANNING ASSUMPTIONS* • Capacity up between 0% – 5% vs 2019 • CASM ex-Fuel up between 10% – 15% vs 2019 • Return to profitability in 2H 2022 2Q 2022 OUTLOOK • In 1Q22, paid down approximately $83M of debt • $2.9B of liquidity (2) (3), equal to 36% of 2019 revenue • Adjusted Debt to Cap ratio at 54% (1) (3) 1Q 2022 BALANCE SHEET

7 POSITIONING FOR LONG-TERM EARNINGS GROWTH COMMERCIAL COSTS CAPITAL ALLOCATION Restore earnings and expand margins beyond 2019 levels longer-term • Operating more service than ever in NYC through Northeast Alliance • Providing customers with value and choice through ancillary strategy • Driving value and rewarding loyal customers with TrueBlue • JTP business scaling nicely and contributing meaningfully to bottom-line • Progress in underlying cost structure masked by Spring operational challenges and Summer investments • Accelerating fleet modernization efforts for margin-accretive growth • New multi-year structural cost program to be unveiled at Investor Day • Maintaining balanced approach to capital allocation to maximize value • Investing in the business for future value creation

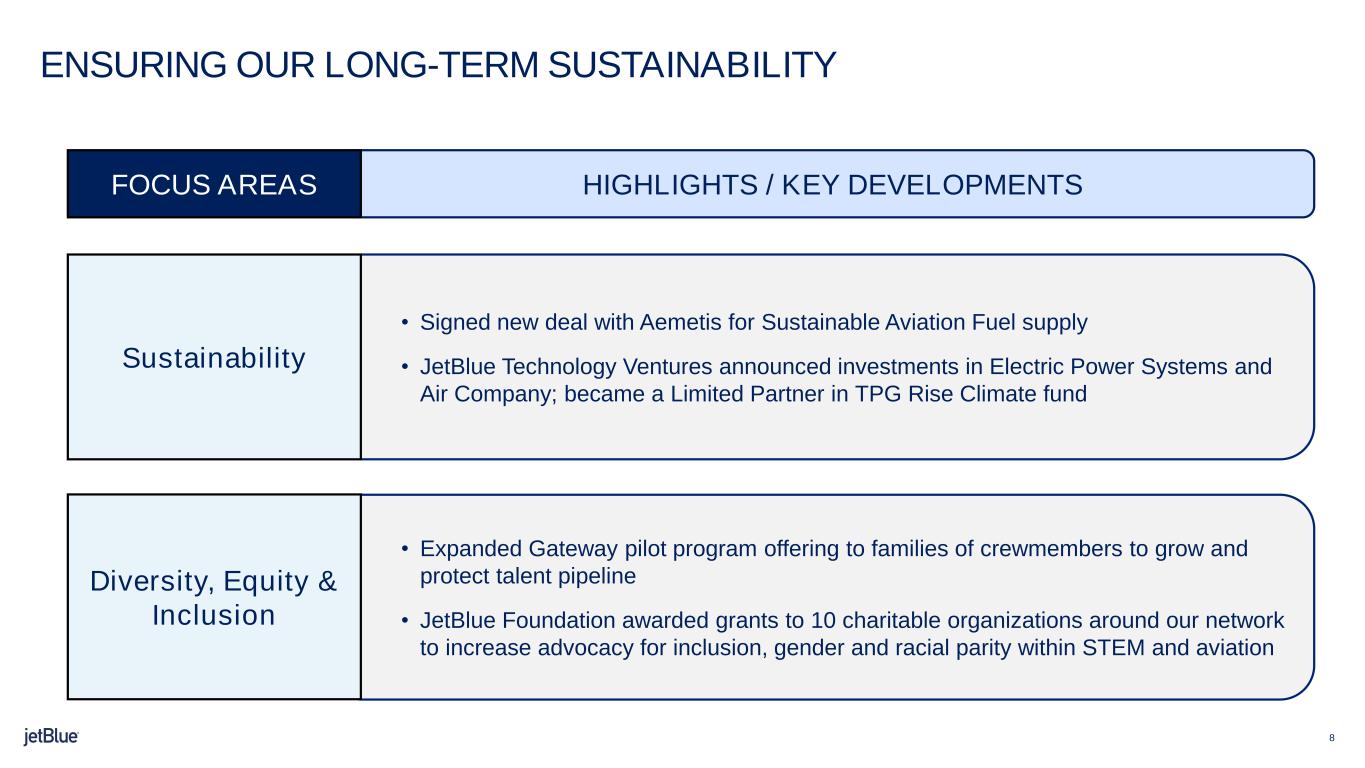

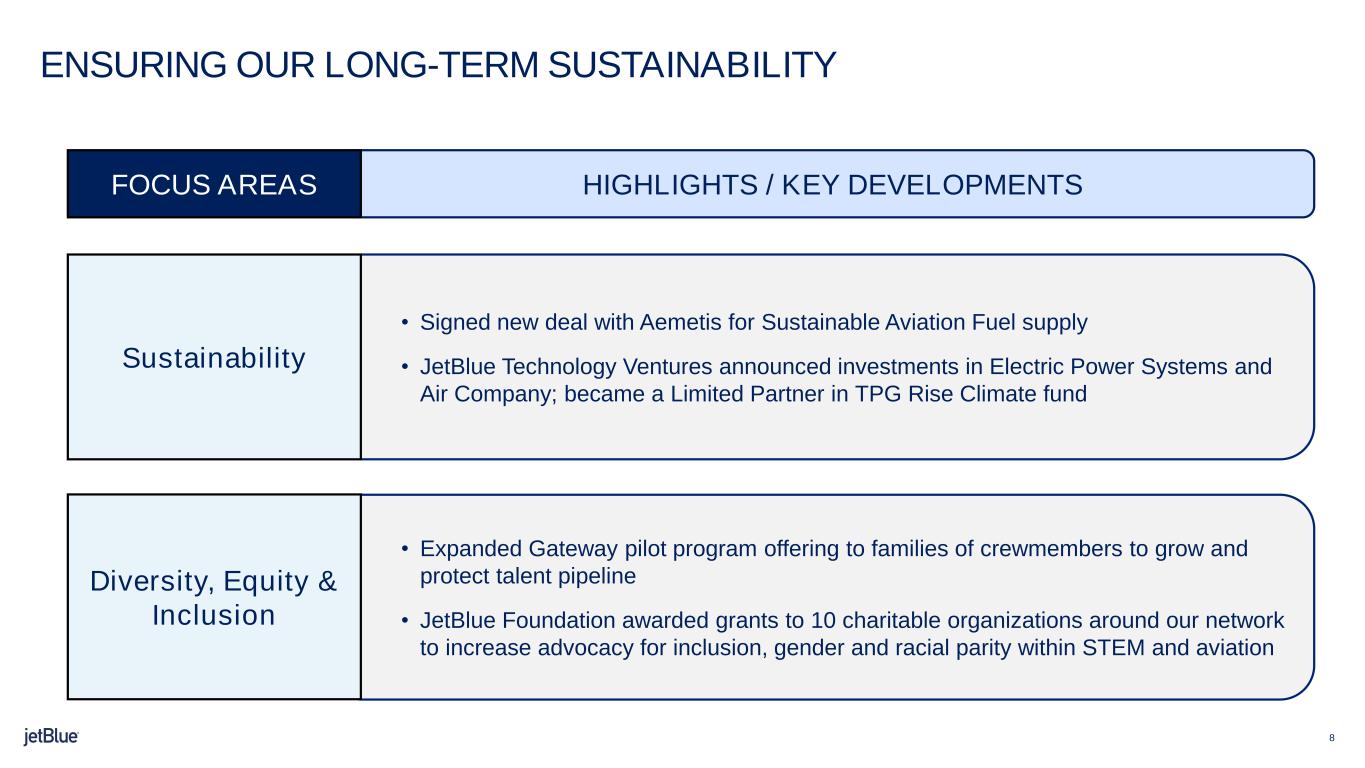

8 • Expanded Gateway pilot program offering to families of crewmembers to grow and protect talent pipeline • JetBlue Foundation awarded grants to 10 charitable organizations around our network to increase advocacy for inclusion, gender and racial parity within STEM and aviation • Signed new deal with Aemetis for Sustainable Aviation Fuel supply • JetBlue Technology Ventures announced investments in Electric Power Systems and Air Company; became a Limited Partner in TPG Rise Climate fund ENSURING OUR LONG-TERM SUSTAINABILITY HIGHLIGHTS / KEY DEVELOPMENTSFOCUS AREAS Sustainability Diversity, Equity & Inclusion

9 COMMERCIAL UPDATE & OUTLOOK JOANNA GERAGHTY PRESIDENT & CHIEF OPERATING OFFICER

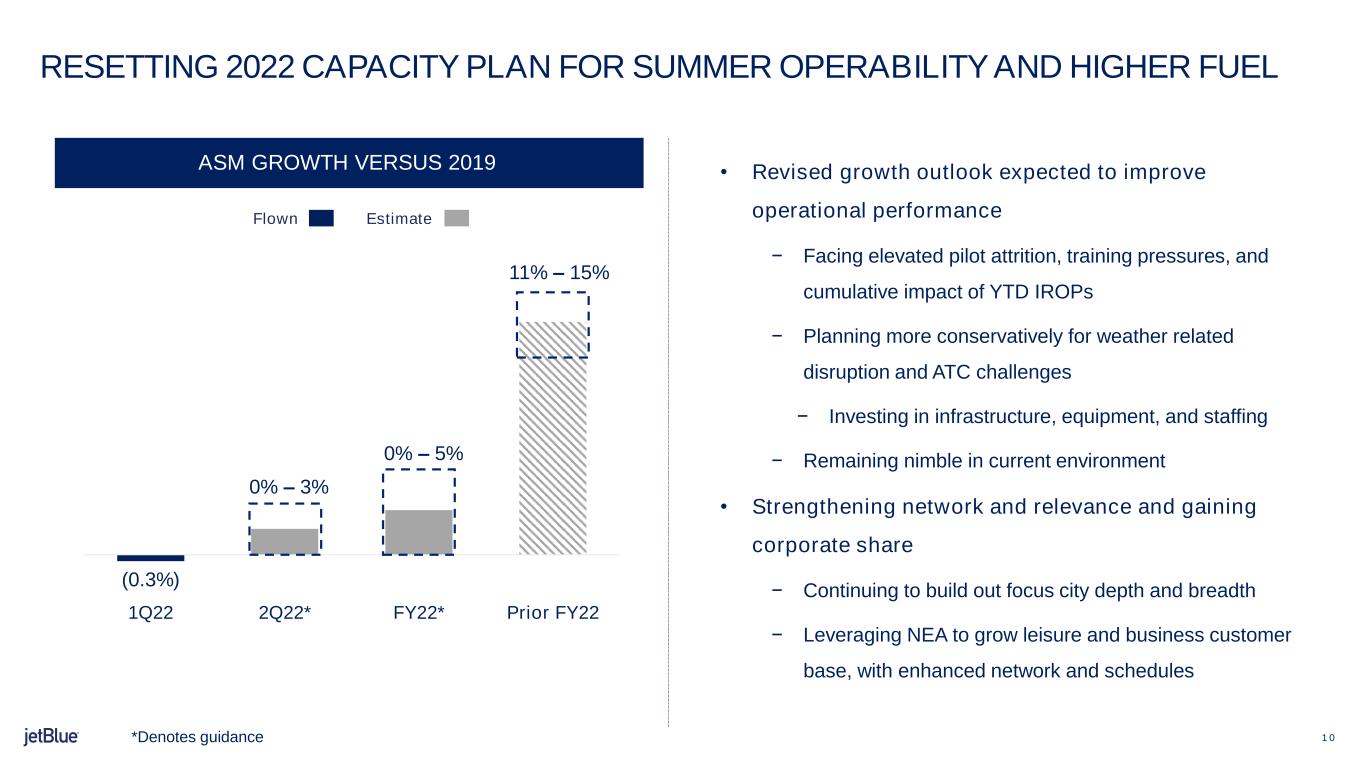

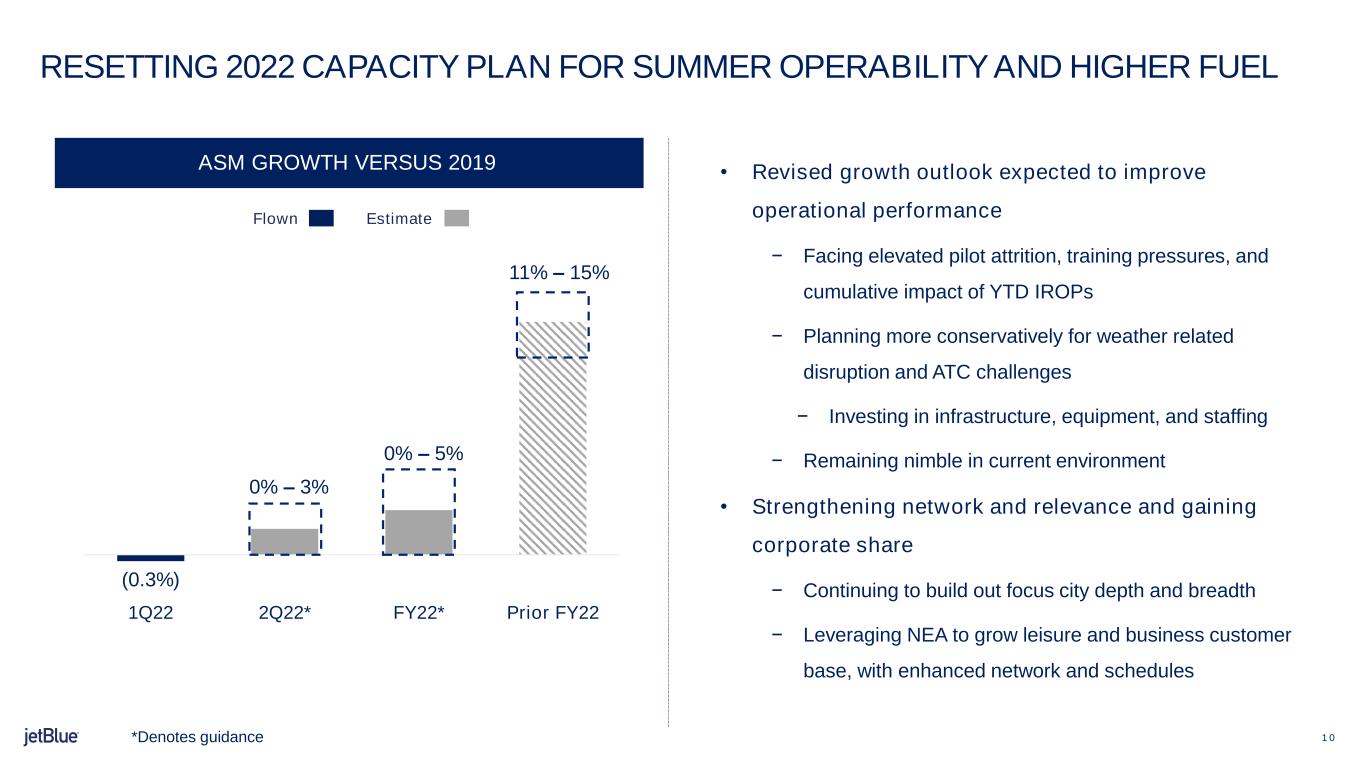

1 0 (0.3%) 1Q22 2Q22* FY22* Prior FY22 RESETTING 2022 CAPACITY PLAN FOR SUMMER OPERABILITY AND HIGHER FUEL ASM GROWTH VERSUS 2019 EstimateFlown • Revised growth outlook expected to improve operational performance − Facing elevated pilot attrition, training pressures, and cumulative impact of YTD IROPs − Planning more conservatively for weather related disruption and ATC challenges − Investing in infrastructure, equipment, and staffing − Remaining nimble in current environment • Strengthening network and relevance and gaining corporate share − Continuing to build out focus city depth and breadth − Leveraging NEA to grow leisure and business customer base, with enhanced network and schedules 0% – 5% 0% – 3% *Denotes guidance 11% – 15%

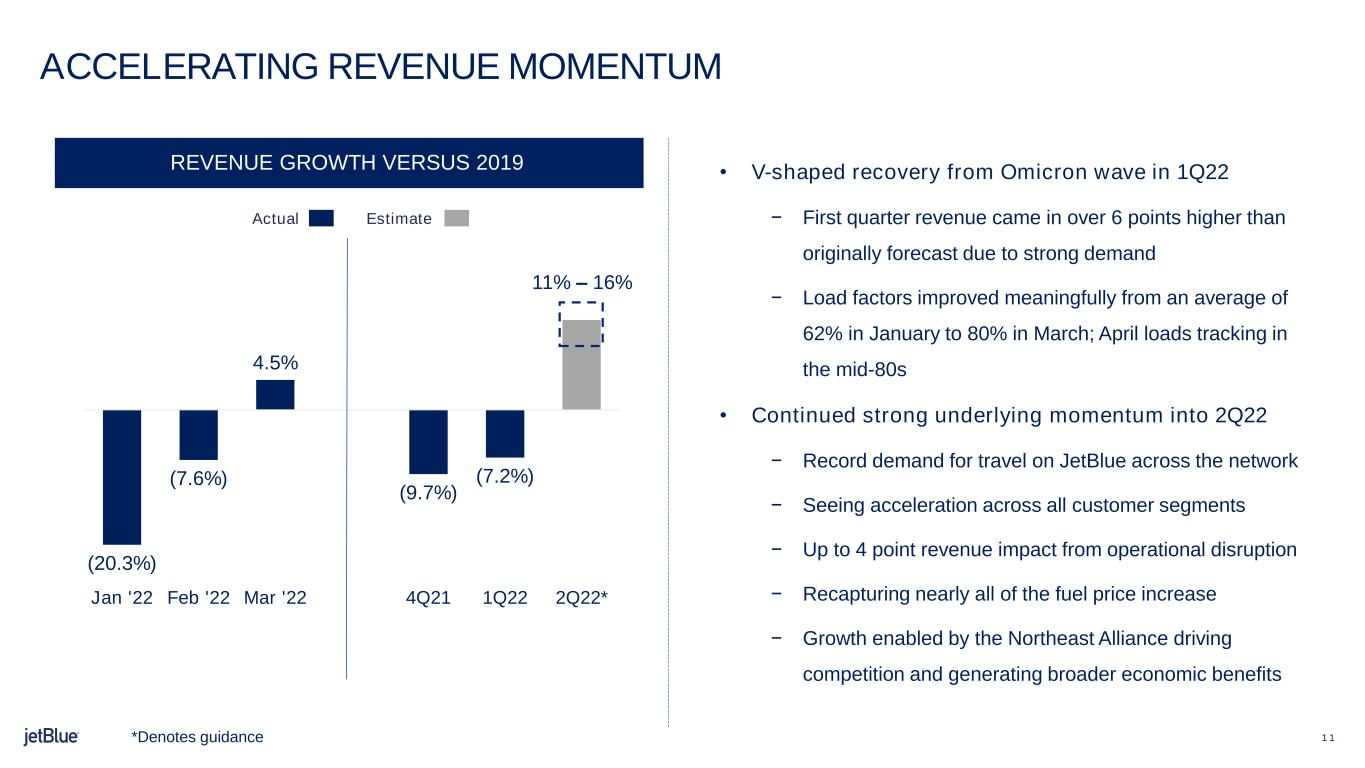

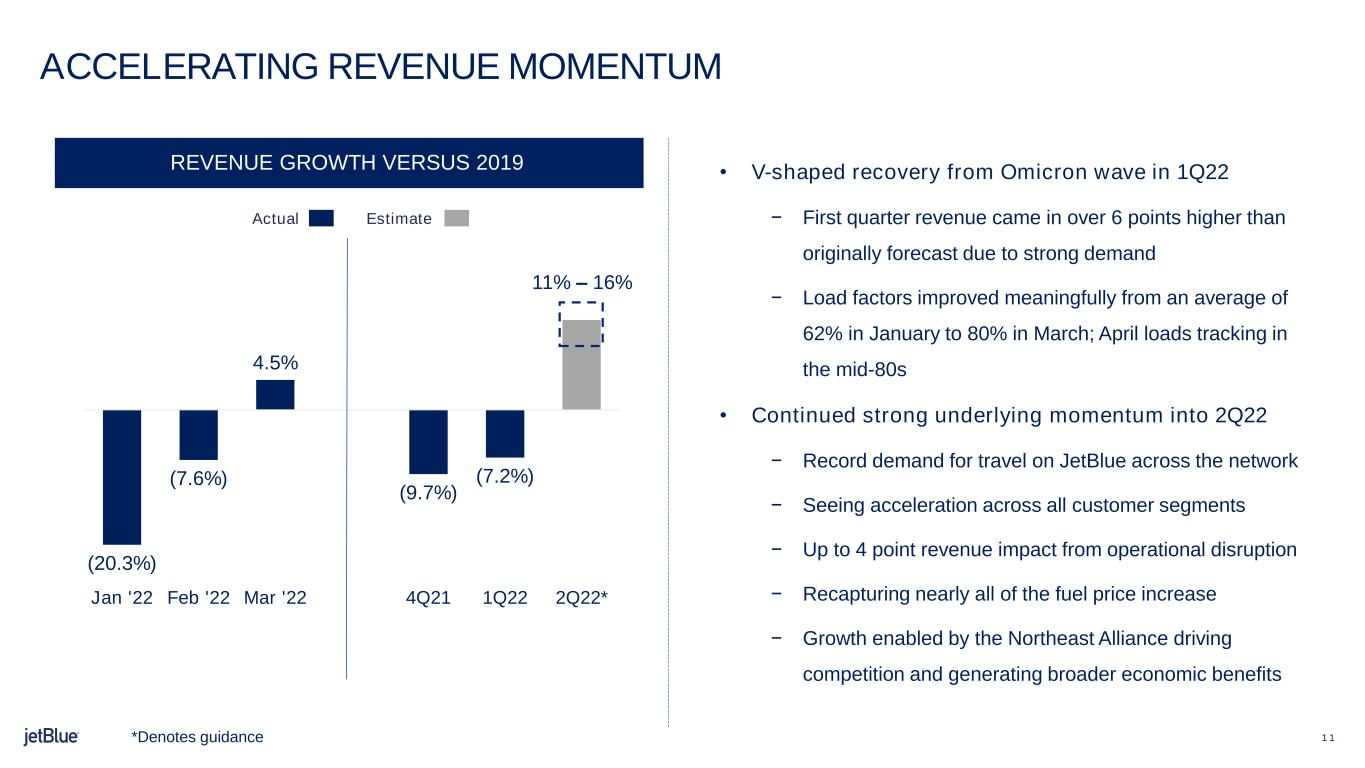

1 1 (20.3%) (7.6%) 4.5% (9.7%) (7.2%) Jan '22 Feb '22 Mar '22 4Q21 1Q22 2Q22* ACCELERATING REVENUE MOMENTUM REVENUE GROWTH VERSUS 2019 • V-shaped recovery from Omicron wave in 1Q22 − First quarter revenue came in over 6 points higher than originally forecast due to strong demand − Load factors improved meaningfully from an average of 62% in January to 80% in March; April loads tracking in the mid-80s • Continued strong underlying momentum into 2Q22 − Record demand for travel on JetBlue across the network − Seeing acceleration across all customer segments − Up to 4 point revenue impact from operational disruption − Recapturing nearly all of the fuel price increase − Growth enabled by the Northeast Alliance driving competition and generating broader economic benefits EstimateActual *Denotes guidance 11% – 16%

1 2 FINANCIAL UPDATE & OUTLOOK URSULA HURLEY CHIEF FINANCIAL OFFICER

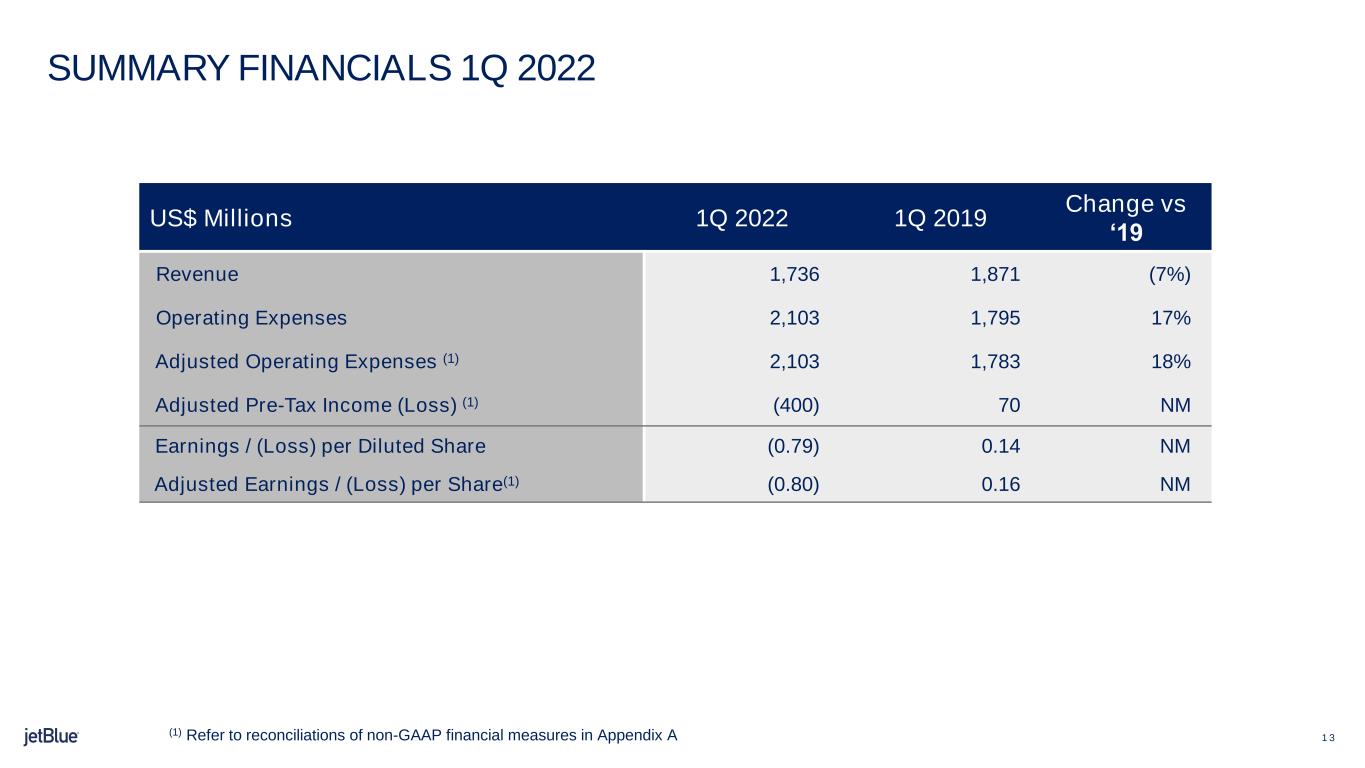

1 3 SUMMARY FINANCIALS 1Q 2022 US$ Millions 1Q 2022 1Q 2019 Change vs ‘19 Revenue 1,736 1,871 (7%) Operating Expenses 2,103 1,795 17% Adjusted Operating Expenses (1) 2,103 1,783 18% Adjusted Pre-Tax Income (Loss) (1) (400) 70 NM Earnings / (Loss) per Diluted Share (0.79) 0.14 NM Adjusted Earnings / (Loss) per Share(1) (0.80) 0.16 NM (1) Refer to reconciliations of non-GAAP financial measures in Appendix A

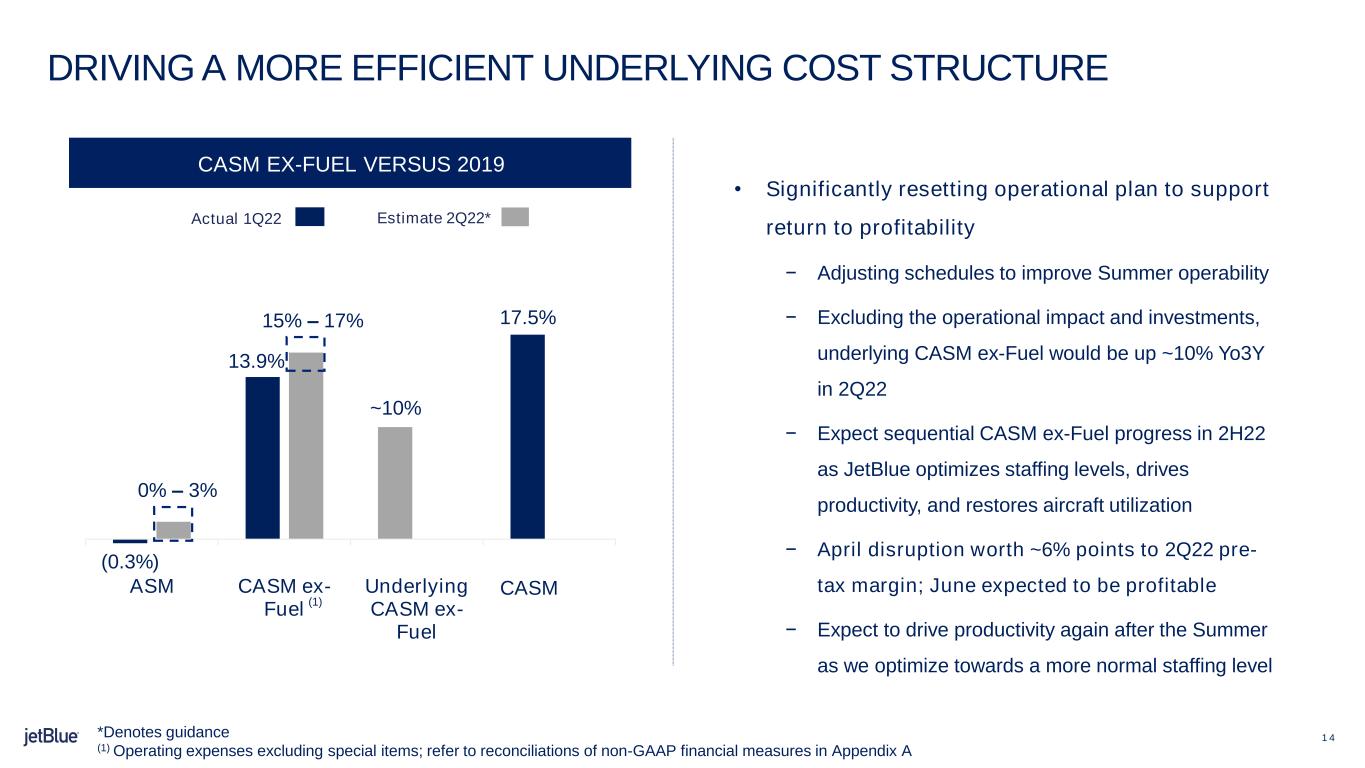

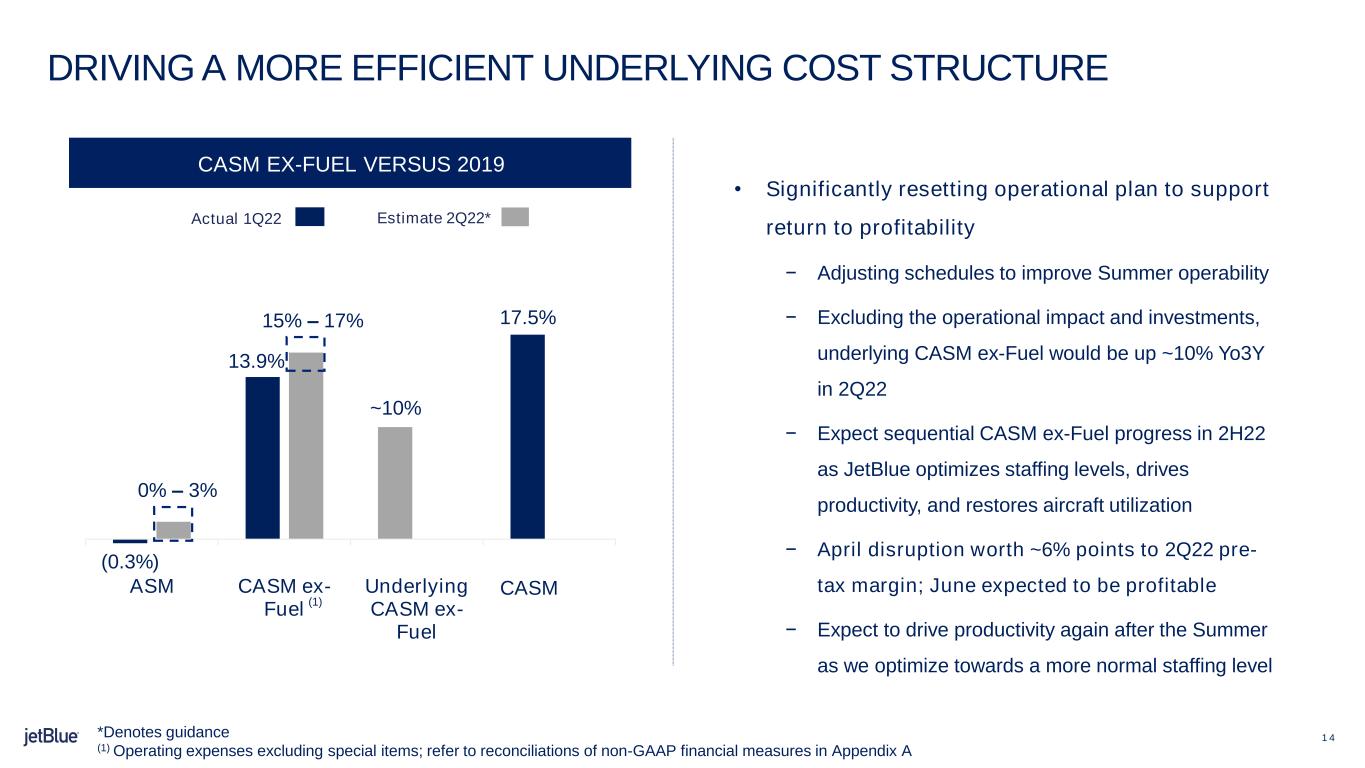

1 4 (0.3%) 13.9% 17.5% ASM CASM ex- Fuel Underlying CASM ex- Fuel CASM CASM EX-FUEL VERSUS 2019 COST INITIATIVES Actual 1Q22 Estimate 2Q22* • Significantly resetting operational plan to support return to profitability − Adjusting schedules to improve Summer operability − Excluding the operational impact and investments, underlying CASM ex-Fuel would be up ~10% Yo3Y in 2Q22 − Expect sequential CASM ex-Fuel progress in 2H22 as JetBlue optimizes staffing levels, drives productivity, and restores aircraft utilization − April disruption worth ~6% points to 2Q22 pre- tax margin; June expected to be profitable − Expect to drive productivity again after the Summer as we optimize towards a more normal staffing level DRIVING A MORE EFFICIENT UNDERLYING COST STRUCTURE 0% – 3% *Denotes guidance (1) Operating expenses excluding special items; refer to reconciliations of non-GAAP financial measures in Appendix A (1) CASM 15% – 17% ~10%

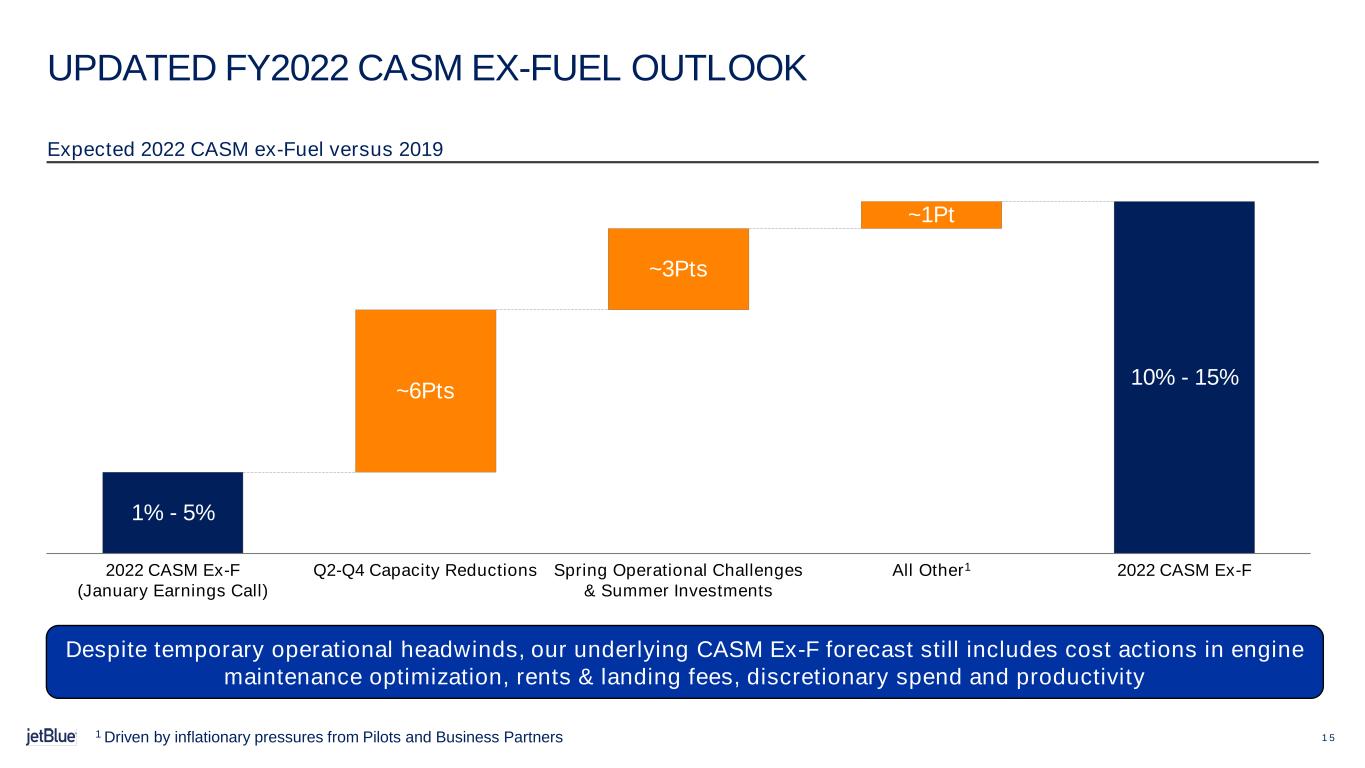

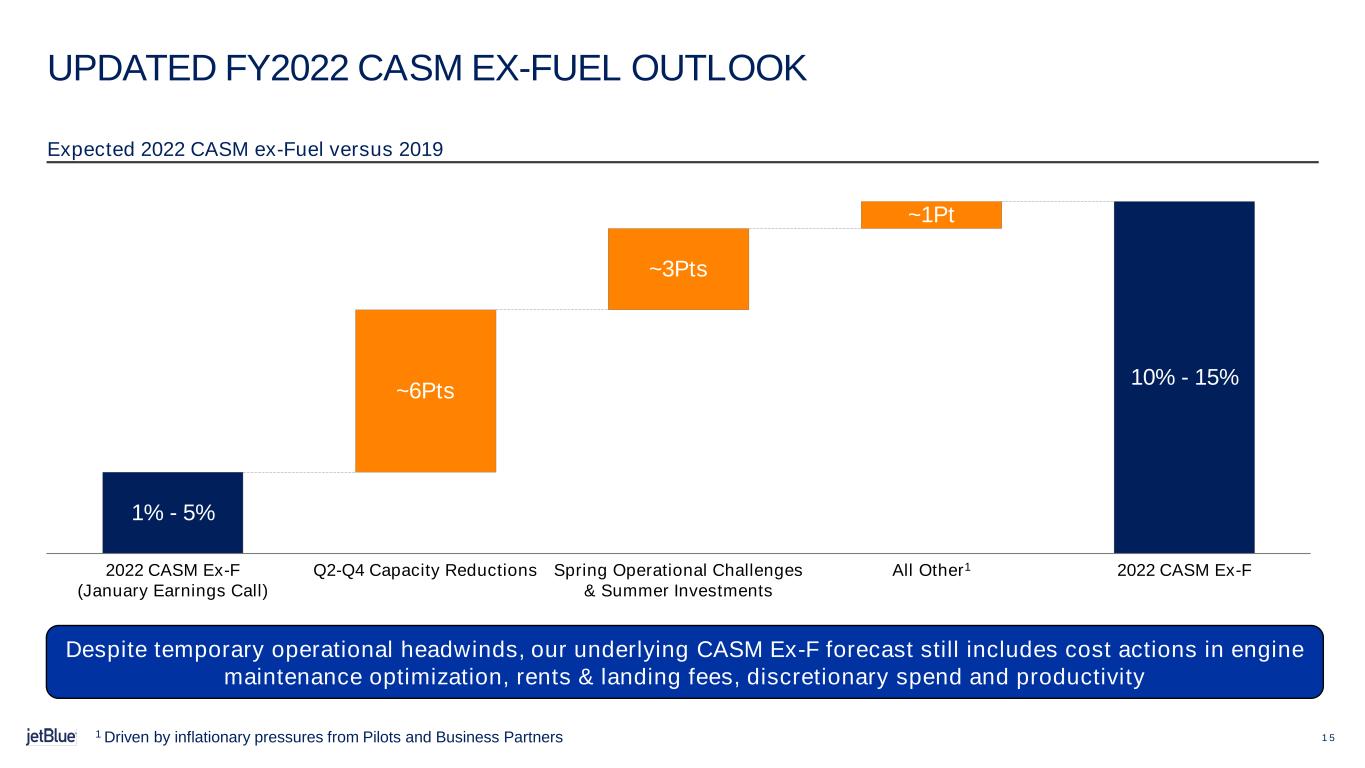

1 51 Driven by inflationary pressures from Pilots and Business Partners Expected 2022 CASM ex-Fuel versus 2019 Despite temporary operational headwinds, our underlying CASM Ex-F forecast still includes cost actions in engine maintenance optimization, rents & landing fees, discretionary spend and productivity UPDATED FY2022 CASM EX-FUEL OUTLOOK ~6Pts 2022 CASM Ex-F (January Earnings Call) 1% - 5% Q2-Q4 Capacity Reductions ~3Pts All Other1Spring Operational Challenges & Summer Investments ~1Pt 10% - 15% 2022 CASM Ex-F

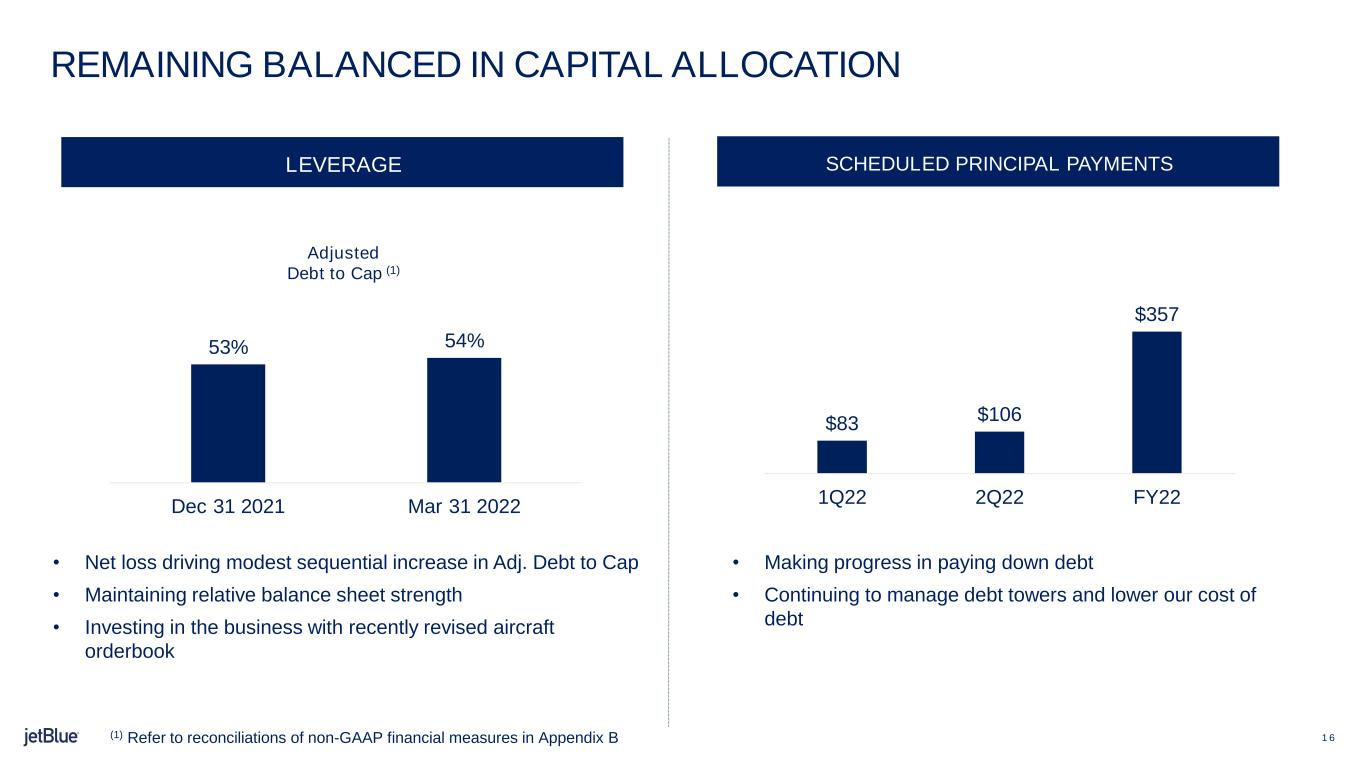

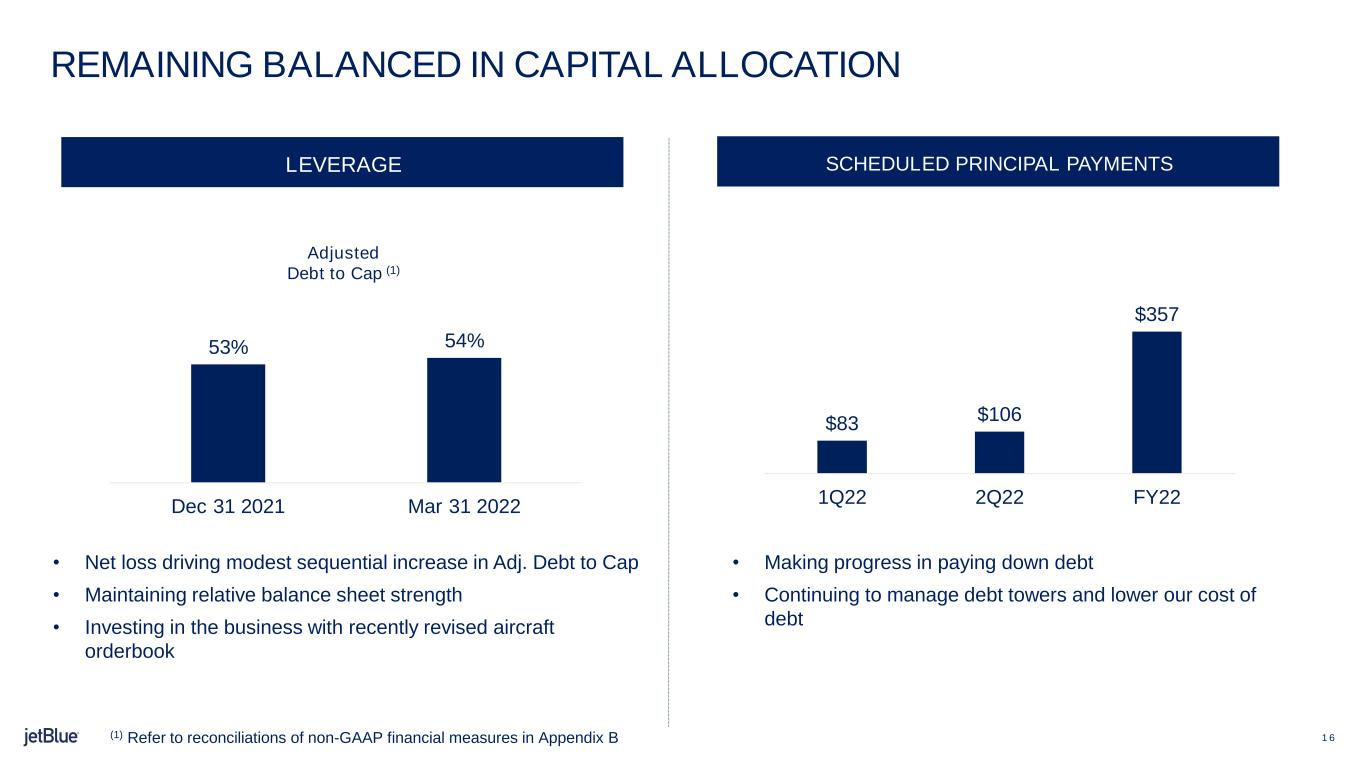

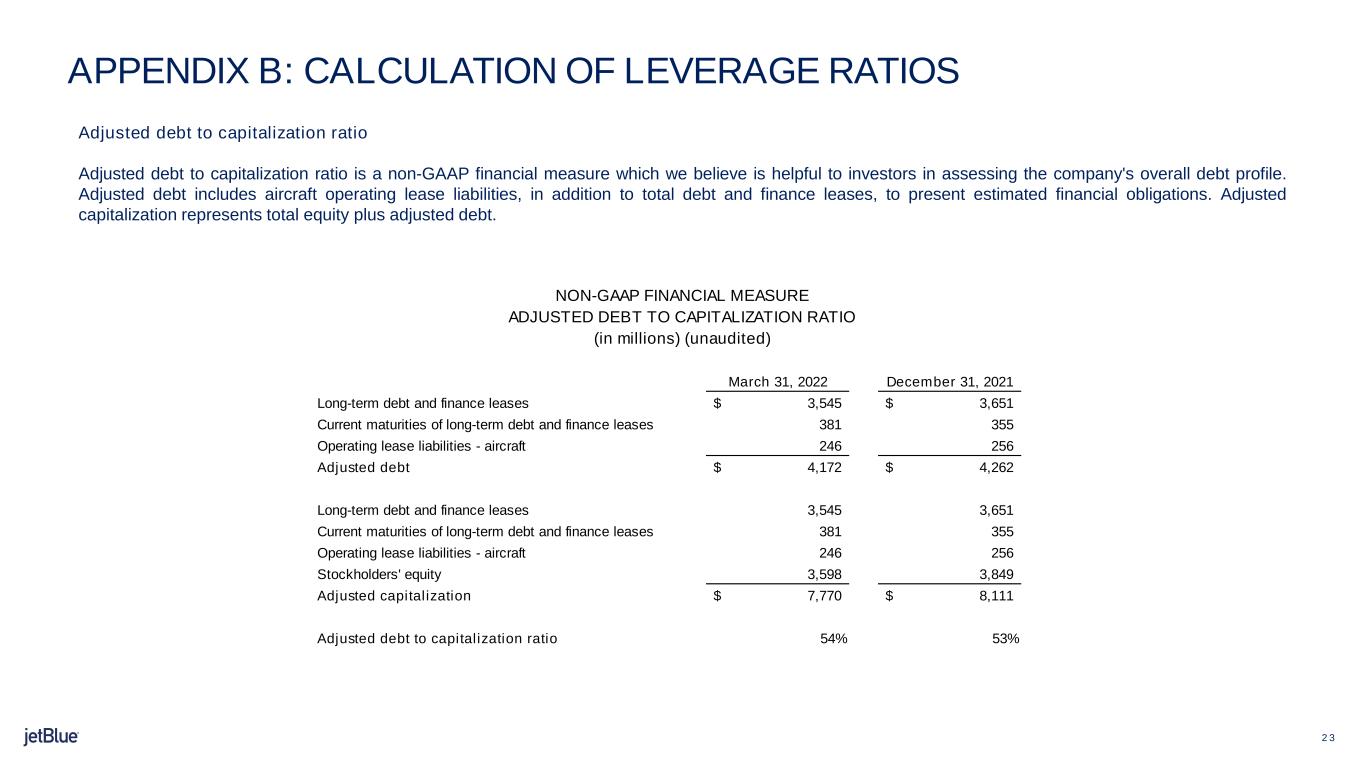

1 6 REMAINING BALANCED IN CAPITAL ALLOCATION LEVERAGE (1) Refer to reconciliations of non-GAAP financial measures in Appendix B Adjusted Debt to Cap (1) • Net loss driving modest sequential increase in Adj. Debt to Cap • Maintaining relative balance sheet strength • Investing in the business with recently revised aircraft orderbook • Making progress in paying down debt • Continuing to manage debt towers and lower our cost of debt SCHEDULED PRINCIPAL PAYMENTS 53% 54% Dec 31 2021 Mar 31 2022 $83 $106 $357 1Q22 2Q22 FY22

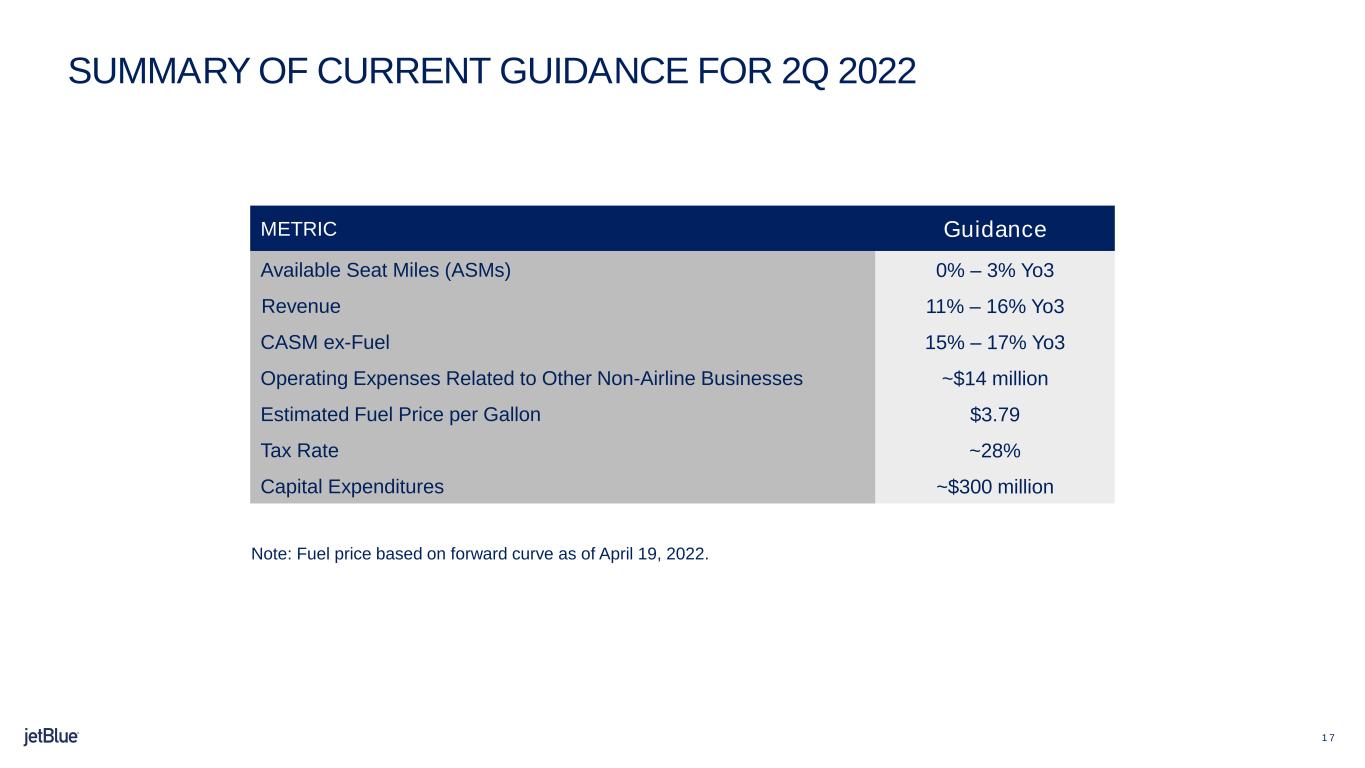

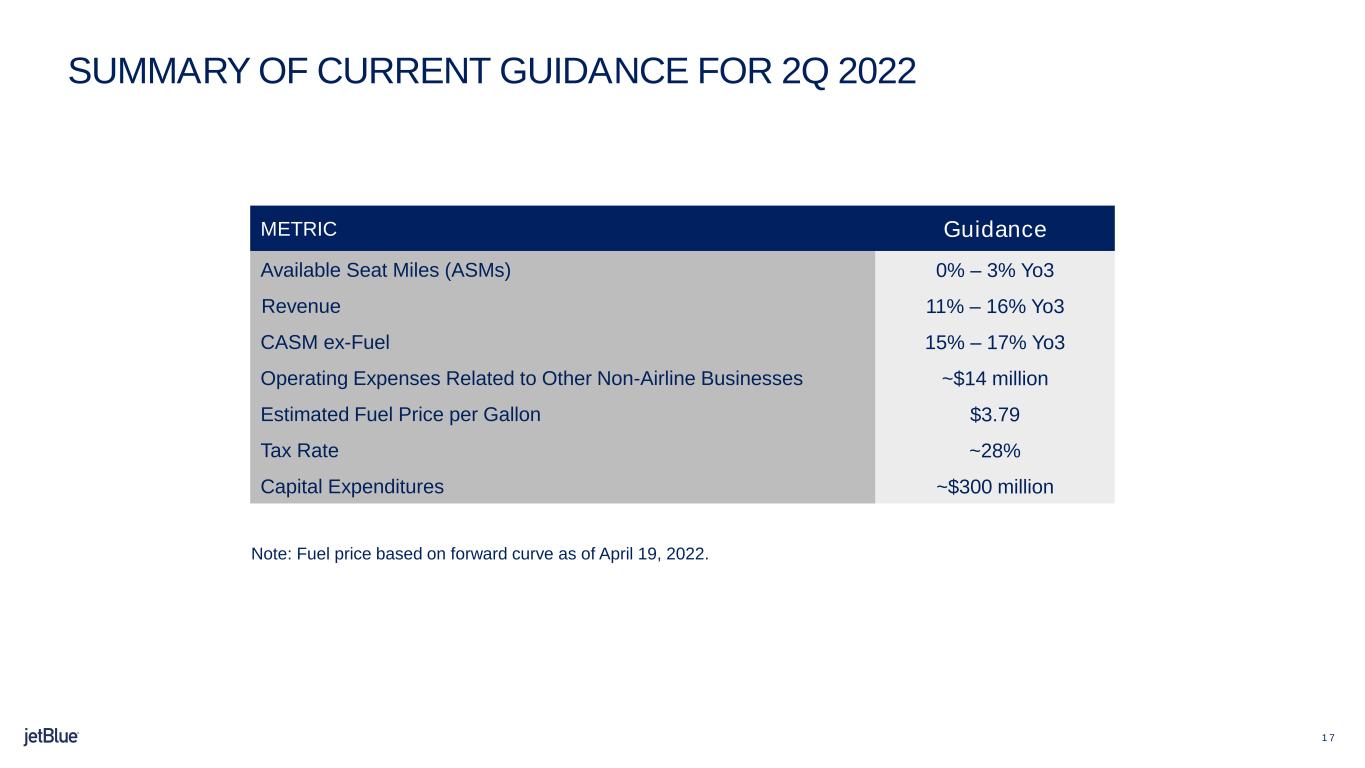

1 7 SUMMARY OF CURRENT GUIDANCE FOR 2Q 2022 METRIC Guidance Available Seat Miles (ASMs) 0% – 3% Yo3 Revenue 11% – 16% Yo3 CASM ex-Fuel 15% – 17% Yo3 Operating Expenses Related to Other Non-Airline Businesses ~$14 million Estimated Fuel Price per Gallon $3.79 Tax Rate ~28% Capital Expenditures ~$300 million Note: Fuel price based on forward curve as of April 19, 2022.

1 8 QUESTIONS?

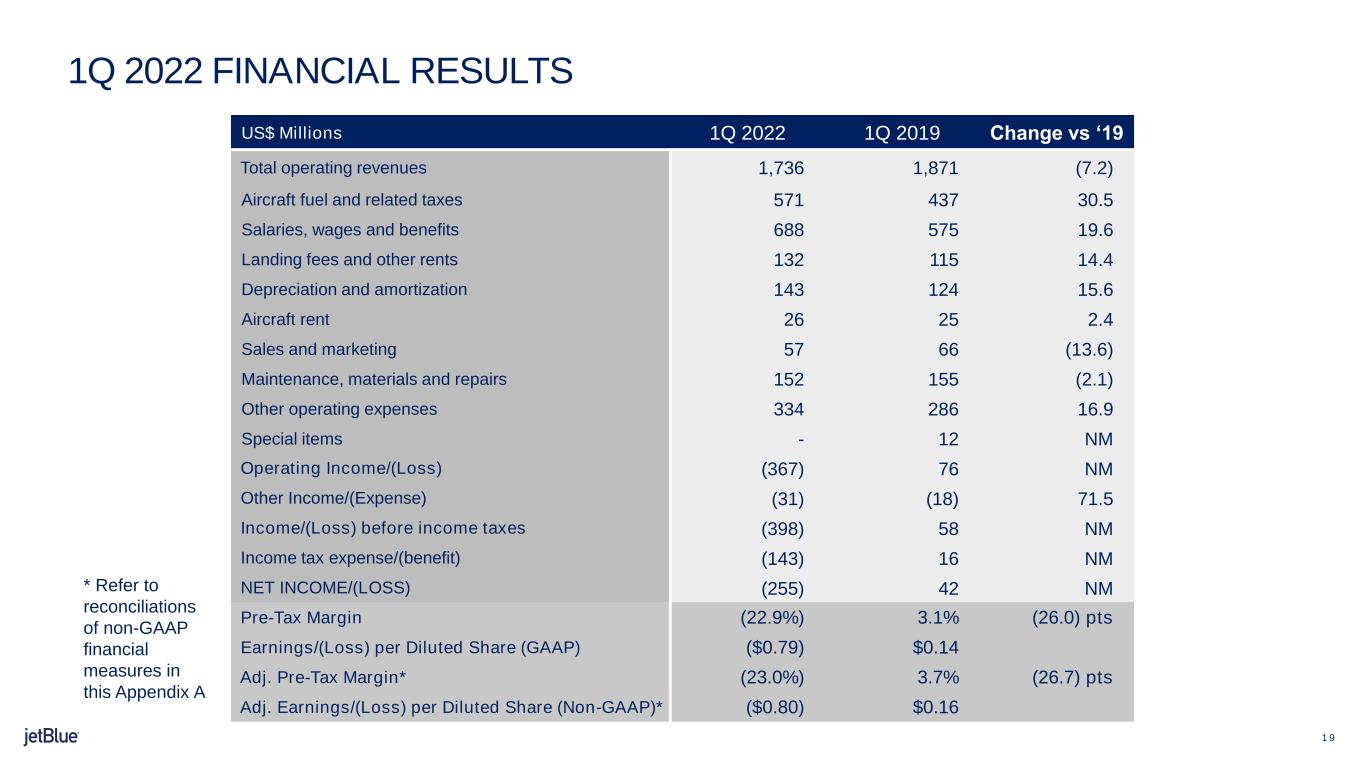

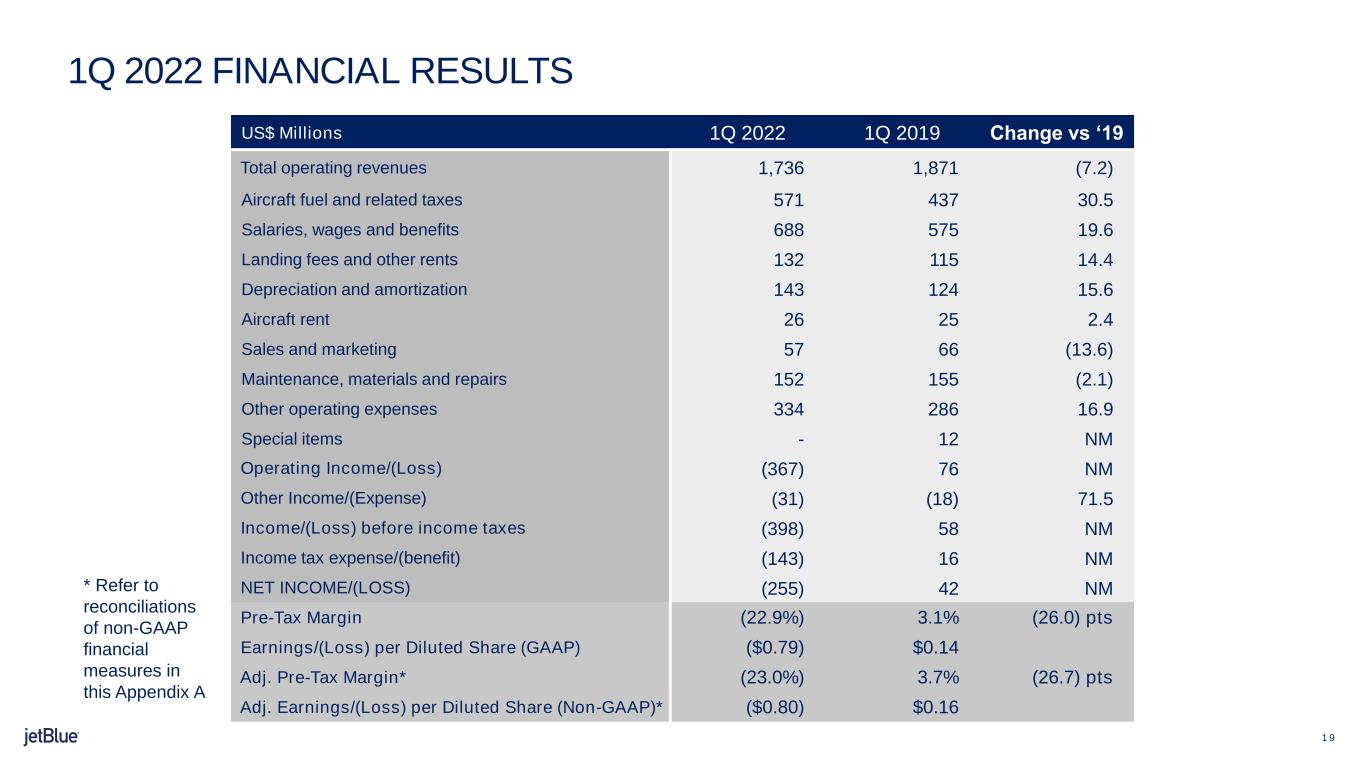

1 9 1Q 2022 FINANCIAL RESULTS US$ Millions 1Q 2022 1Q 2019 Change vs ‘19 Total operating revenues 1,736 1,871 (7.2) Aircraft fuel and related taxes 571 437 30.5 Salaries, wages and benefits 688 575 19.6 Landing fees and other rents 132 115 14.4 Depreciation and amortization 143 124 15.6 Aircraft rent 26 25 2.4 Sales and marketing 57 66 (13.6) Maintenance, materials and repairs 152 155 (2.1) Other operating expenses 334 286 16.9 Special items - 12 NM Operating Income/(Loss) (367) 76 NM Other Income/(Expense) (31) (18) 71.5 Income/(Loss) before income taxes (398) 58 NM Income tax expense/(benefit) (143) 16 NM NET INCOME/(LOSS) (255) 42 NM Pre-Tax Margin (22.9%) 3.1% (26.0) pts Earnings/(Loss) per Diluted Share (GAAP) ($0.79) $0.14 Adj. Pre-Tax Margin* (23.0%) 3.7% (26.7) pts Adj. Earnings/(Loss) per Diluted Share (Non-GAAP)* ($0.80) $0.16 * Refer to reconciliations of non-GAAP financial measures in this Appendix A

2 0 Non-GAAP Financial Measures JetBlue uses non-GAAP financial measures in this presentation. Non-GAAP financial measures are financial measures that are derived from the consolidated financial statements, but that are not presented in accordance with generally accepted accounting principles in the United States, or GAAP. We believe these non-GAAP financial measures provide a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies. The information in Appendices A and B provides an explanation of each non-GAAP financial measure and shows a reconciliation of non-GAAP financial measures used in this presentation to the most directly comparable GAAP financial measures. APPENDIX A

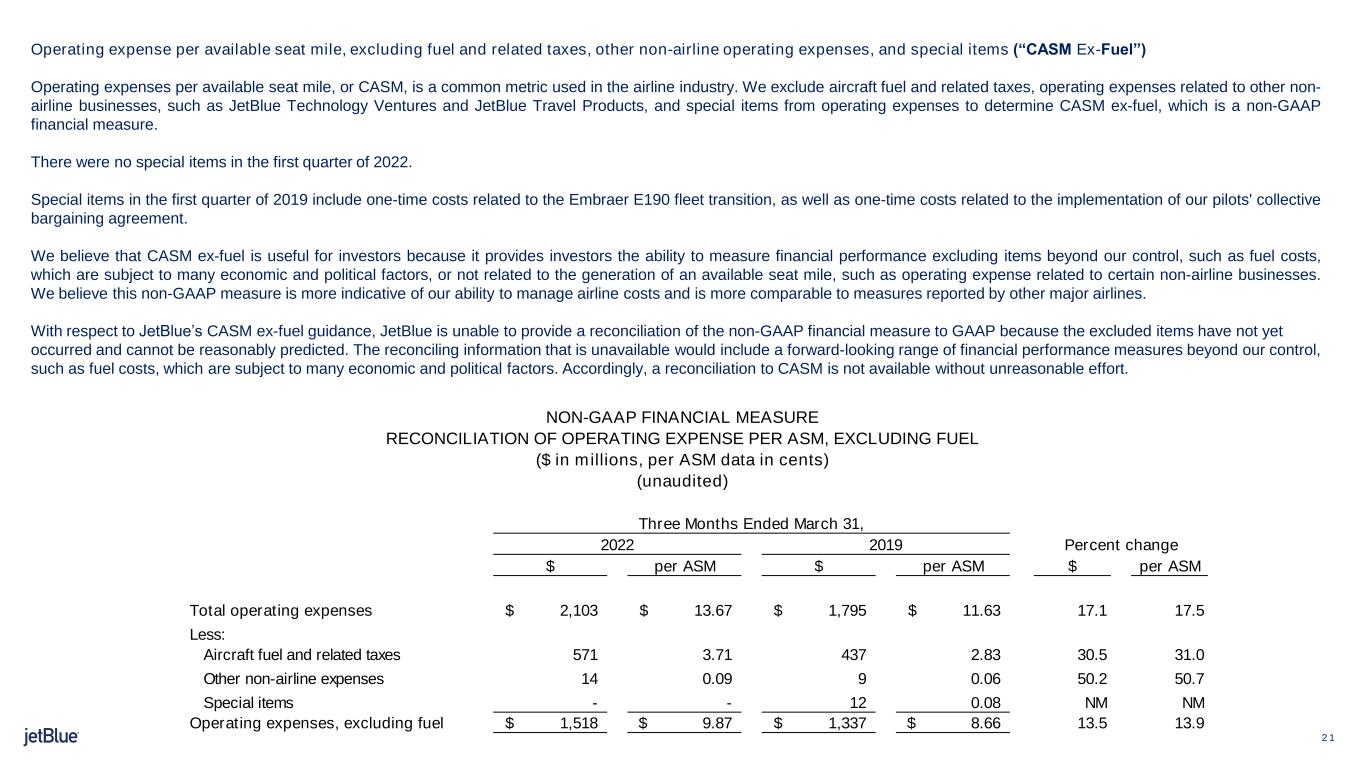

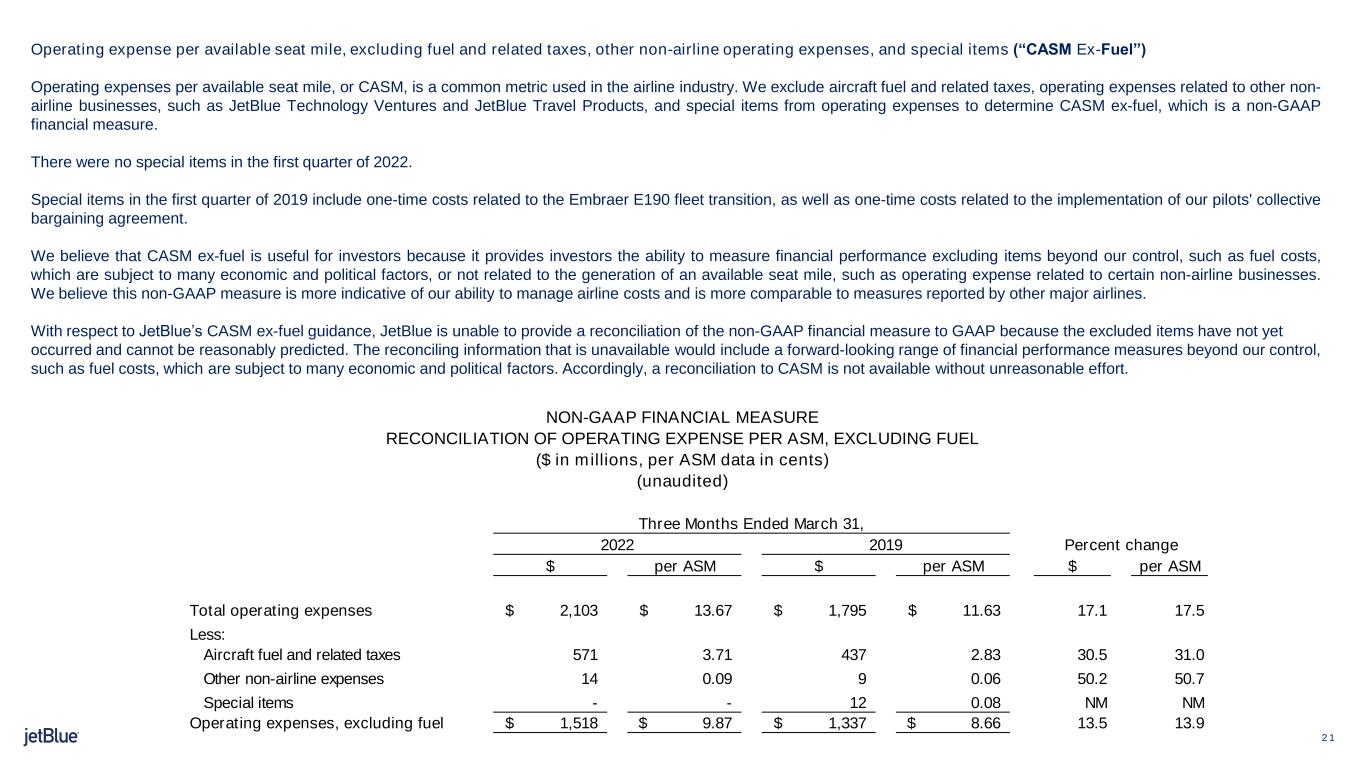

2 1 Operating expense per available seat mile, excluding fuel and related taxes, other non-airline operating expenses, and special items (“CASM Ex-Fuel”) Operating expenses per available seat mile, or CASM, is a common metric used in the airline industry. We exclude aircraft fuel and related taxes, operating expenses related to other non- airline businesses, such as JetBlue Technology Ventures and JetBlue Travel Products, and special items from operating expenses to determine CASM ex-fuel, which is a non-GAAP financial measure. There were no special items in the first quarter of 2022. Special items in the first quarter of 2019 include one-time costs related to the Embraer E190 fleet transition, as well as one-time costs related to the implementation of our pilots' collective bargaining agreement. We believe that CASM ex-fuel is useful for investors because it provides investors the ability to measure financial performance excluding items beyond our control, such as fuel costs, which are subject to many economic and political factors, or not related to the generation of an available seat mile, such as operating expense related to certain non-airline businesses. We believe this non-GAAP measure is more indicative of our ability to manage airline costs and is more comparable to measures reported by other major airlines. With respect to JetBlue’s CASM ex-fuel guidance, JetBlue is unable to provide a reconciliation of the non-GAAP financial measure to GAAP because the excluded items have not yet occurred and cannot be reasonably predicted. The reconciling information that is unavailable would include a forward-looking range of financial performance measures beyond our control, such as fuel costs, which are subject to many economic and political factors. Accordingly, a reconciliation to CASM is not available without unreasonable effort. $ per ASM $ per ASM $ per ASM Total operating expenses 2,103$ 13.67$ 1,795$ 11.63$ 17.1 17.5 Less: Aircraft fuel and related taxes 571 3.71 437 2.83 30.5 31.0 Other non-airline expenses 14 0.09 9 0.06 50.2 50.7 Special items - - 12 0.08 NM NM Operating expenses, excluding fuel 1,518$ 9.87$ 1,337$ 8.66$ 13.5 13.9 20192022 Percent change NON-GAAP FINANCIAL MEASURE RECONCILIATION OF OPERATING EXPENSE PER ASM, EXCLUDING FUEL ($ in millions, per ASM data in cents) (unaudited) Three Months Ended March 31,

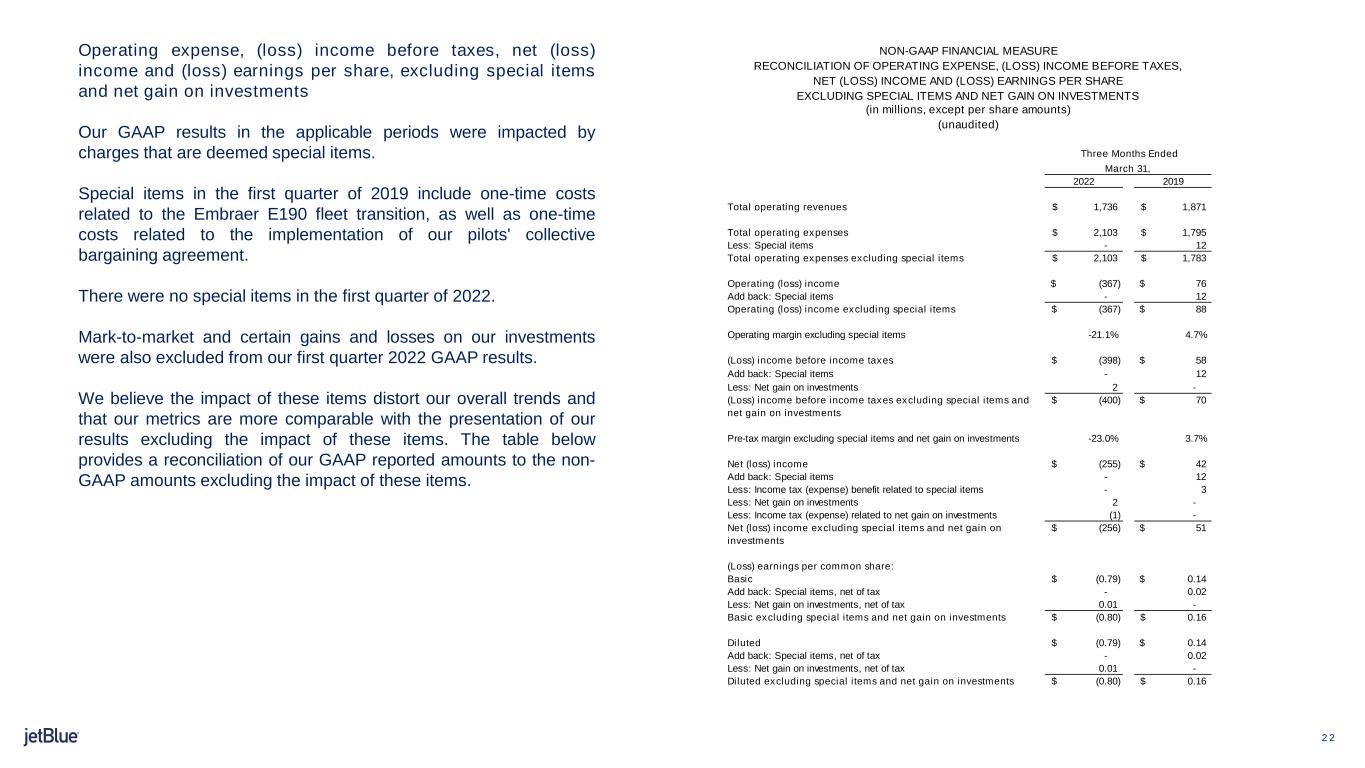

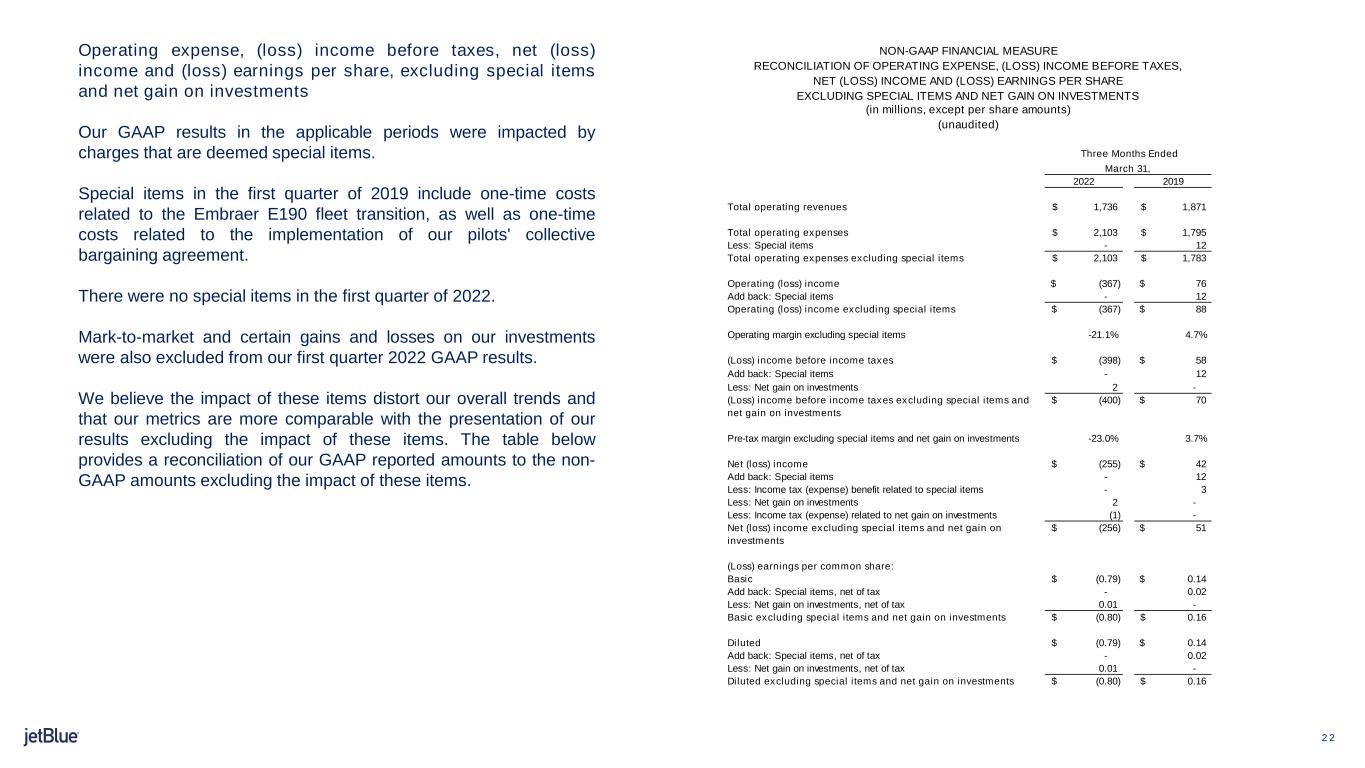

2 2 Operating expense, (loss) income before taxes, net (loss) income and (loss) earnings per share, excluding special items and net gain on investments Our GAAP results in the applicable periods were impacted by charges that are deemed special items. Special items in the first quarter of 2019 include one-time costs related to the Embraer E190 fleet transition, as well as one-time costs related to the implementation of our pilots' collective bargaining agreement. There were no special items in the first quarter of 2022. Mark-to-market and certain gains and losses on our investments were also excluded from our first quarter 2022 GAAP results. We believe the impact of these items distort our overall trends and that our metrics are more comparable with the presentation of our results excluding the impact of these items. The table below provides a reconciliation of our GAAP reported amounts to the non- GAAP amounts excluding the impact of these items. 2022 2019 Total operating revenues 1,736$ 1,871$ Total operating expenses 2,103$ 1,795$ Less: Special items - 12 Total operating expenses excluding special items 2,103$ 1,783$ Operating (loss) income (367)$ 76$ Add back: Special items - 12 Operating (loss) income excluding special items (367)$ 88$ Operating margin excluding special items -21.1% 4.7% (Loss) income before income taxes (398)$ 58$ Add back: Special items - 12 Less: Net gain on investments 2 - (Loss) income before income taxes excluding special items and net gain on investments (400)$ 70$ Pre-tax margin excluding special items and net gain on investments -23.0% 3.7% Net (loss) income (255)$ 42$ Add back: Special items - 12 Less: Income tax (expense) benefit related to special items - 3 Less: Net gain on investments 2 - Less: Income tax (expense) related to net gain on investments (1) - Net (loss) income excluding special items and net gain on investments (256)$ 51$ (Loss) earnings per common share: Basic (0.79)$ 0.14$ Add back: Special items, net of tax - 0.02 Less: Net gain on investments, net of tax 0.01 - Basic excluding special items and net gain on investments (0.80)$ 0.16$ Diluted (0.79)$ 0.14$ Add back: Special items, net of tax - 0.02 Less: Net gain on investments, net of tax 0.01 - Diluted excluding special items and net gain on investments (0.80)$ 0.16$ Three Months Ended March 31, NON-GAAP FINANCIAL MEASURE (in millions, except per share amounts) (unaudited) RECONCILIATION OF OPERATING EXPENSE, (LOSS) INCOME BEFORE TAXES, NET (LOSS) INCOME AND (LOSS) EARNINGS PER SHARE EXCLUDING SPECIAL ITEMS AND NET GAIN ON INVESTMENTS

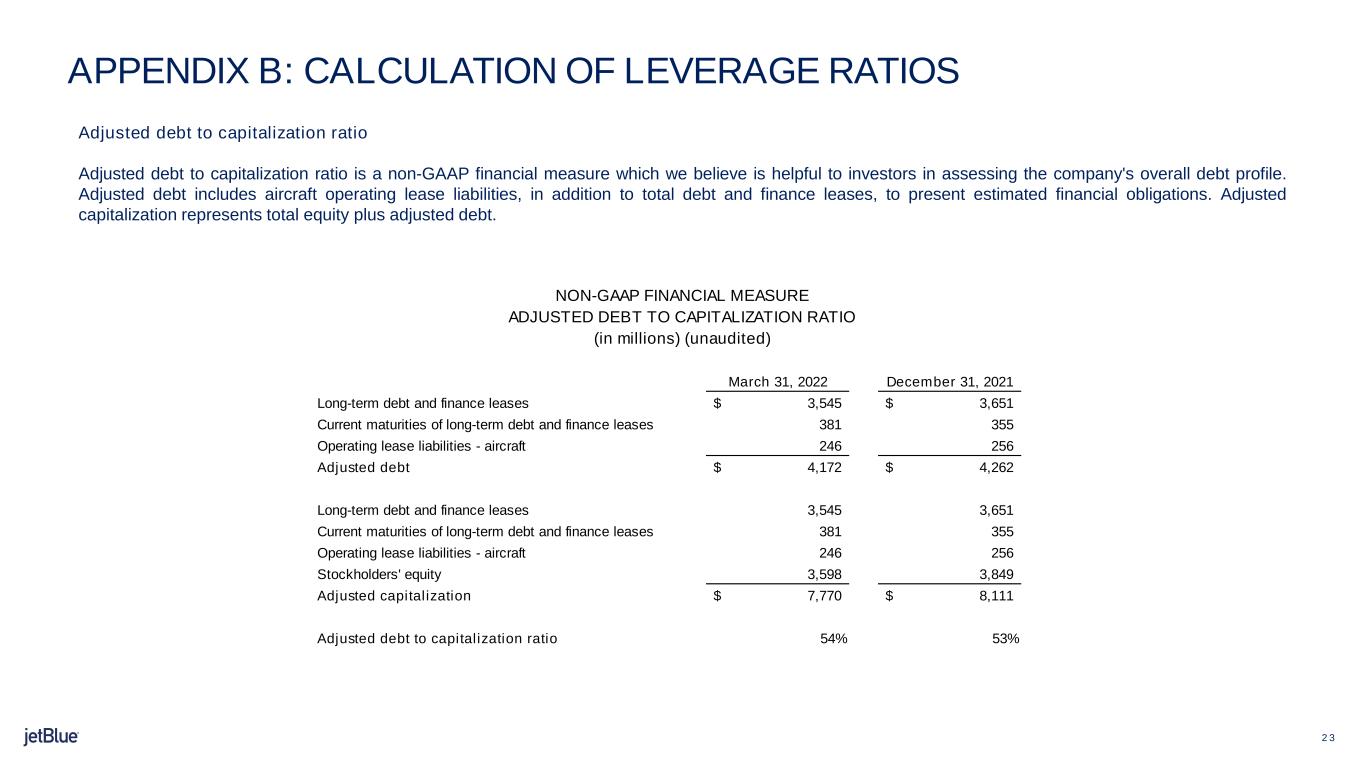

2 3 APPENDIX B: CALCULATION OF LEVERAGE RATIOS LOCATION Adjusted debt to capitalization ratio Adjusted debt to capitalization ratio is a non-GAAP financial measure which we believe is helpful to investors in assessing the company's overall debt profile. Adjusted debt includes aircraft operating lease liabilities, in addition to total debt and finance leases, to present estimated financial obligations. Adjusted capitalization represents total equity plus adjusted debt. March 31, 2022 December 31, 2021 Long-term debt and finance leases 3,545$ 3,651$ Current maturities of long-term debt and finance leases 381 355 Operating lease liabilities - aircraft 246 256 Adjusted debt 4,172$ 4,262$ Long-term debt and finance leases 3,545 3,651 Current maturities of long-term debt and finance leases 381 355 Operating lease liabilities - aircraft 246 256 Stockholders' equity 3,598 3,849 Adjusted capitalization 7,770$ 8,111$ Adjusted debt to capitalization ratio 54% 53% NON-GAAP FINANCIAL MEASURE ADJUSTED DEBT TO CAPITALIZATION RATIO (in millions) (unaudited)

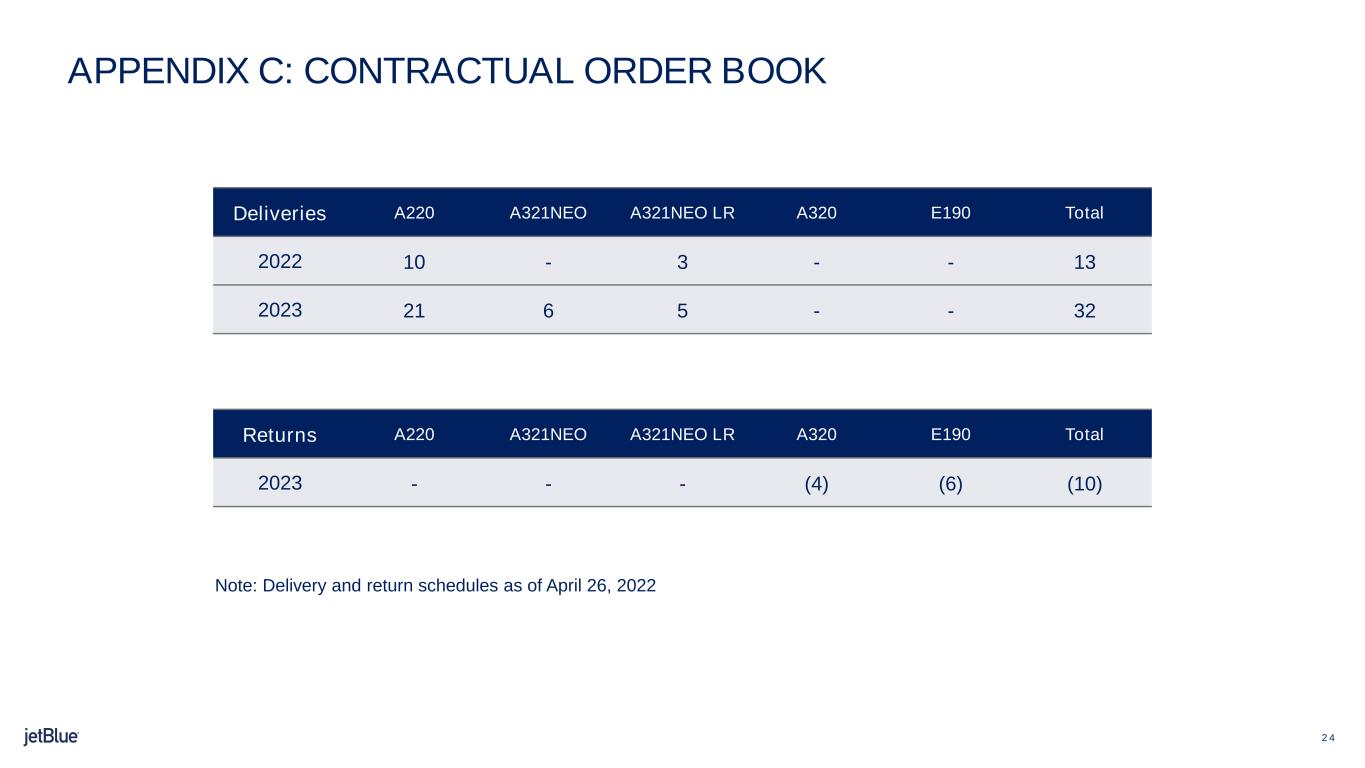

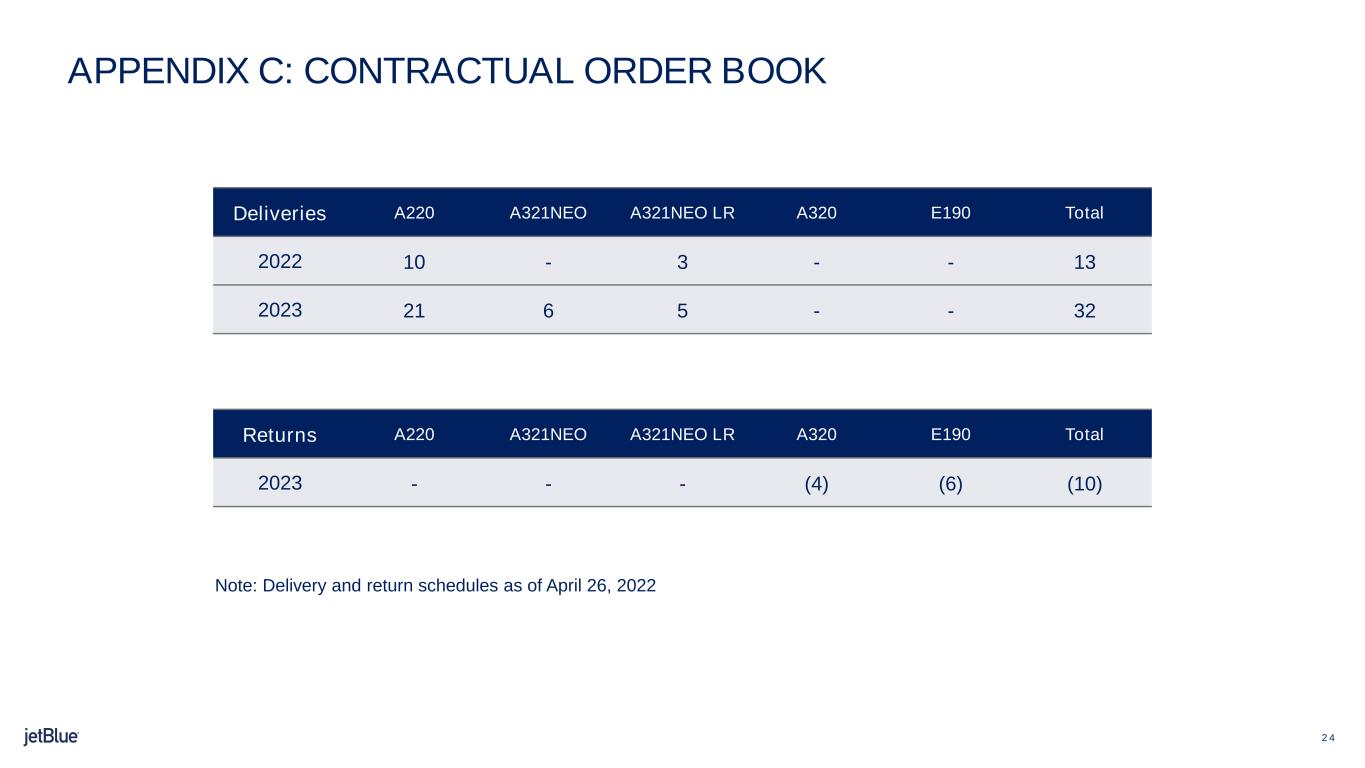

2 4 Deliveries A220 A321NEO A321NEO LR A320 E190 Total 2022 10 - 3 - - 13 2023 21 6 5 - - 32 Note: Delivery and return schedules as of April 26, 2022 APPENDIX C: CONTRACTUAL ORDER BOOK Returns A220 A321NEO A321NEO LR A320 E190 Total 2023 - - - (4) (6) (10)

2 5 Investor Presentations http://blueir.investproductions.com/investor-relations/events-and-presentations/presentations Earnings Releases http://blueir.investproductions.com/investor-relations/financial-information/quarterly-results Annual Reports http://blueir.investproductions.com/investor-relations/financial-information/reports/annual-reports SEC Filings http://blueir.investproductions.com/investor-relations/financial-information/sec-filings Proxy Statements http://blueir.investproductions.com/investor-relations/financial-information/reports/proxy-statements Investor Updates http://blueir.investproductions.com/investor-relations/financial-information/investor-updates ESG Reports* http://blueir.investproductions.com/investor-relations/financial-information/reports/sustainable-accounting-standards-board-reports www.investor.jetblue.com/investor-relations DOCUMENT LOCATION * Environmental, Social, and Governance Reports APPENDIX D: RELEVANT JETBLUE MATERIALS