|

STRONG GROWTH IN FIRST-HALF 2006 RESULTS |

First-half 2006 saw a further improvement in Group results, with net income at€ 2.2 billion.

The rate of organic growth in revenues (+9.5%) and in EBITDA (+9.6%) are above the Group’s medium-term objectives. Net debt decreased to€ 13.2 billion at June 30, 2006, compared with€ 13.8 billion at December 31, 2005.

First-half organic growth in revenues, at +9.5%, surpassed Group objectives

During first-half 2006, SUEZ achieved sustained total revenue growth (+10.2%) to€ 22.4 billion. Organic growth (excluding changes in Group structure, exchange rate fluctuations, and natural gas price variations) was +9.5%. Revenue growth was especially strong in electricity and natural gas.

Operating profitability indicators increased faster than revenues

EBITDA,€ 3.7 billion, grew by +10.0%. Excluding changes in Group structure and exchange rate fluctuations, EBITDA grew +9.6%. Changes in Group structure arose mainly from SUEZ Environment reorganization and disposals in Latin America. Exchange rate fluctuations largely resulted from Brazilian real appreciation. EBITDA improvement was due mainly to favorable market conditions, the startup of energy sector power plants, continued recovery of SUEZ Energy Services, and good results in environment activities.

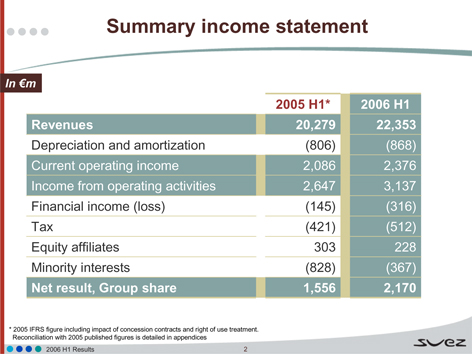

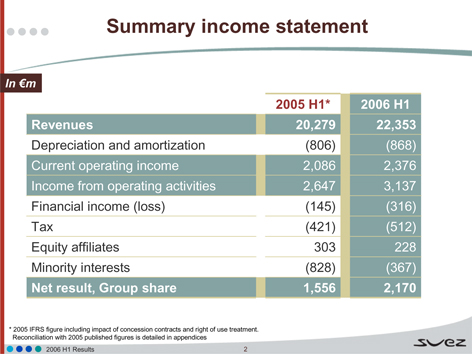

Current Operating Income amounted to€ 2.4 billion, +13.9% in total growth and +11.4% in organic growth at June 30, 2006.

Profitability improvement programs on track with established objectives

Since January 1, 2005,€ 429 million in cost savings have been realized. The two-year 2005/2006 objective of€ 550 million is confirmed.

The synergies linked to the combined public offer for Electrabel have already been identified:€ 85 million for operational synergy (3-year objective:€ 250 million) and€ 40 million in financial synergy (2-year objective:€ 100 million) on a full year basis for 2006.

Net income Group share:€ 2.2 billion

Net income from ordinary activities increased +18.5% to€ 3.1 billion, benefiting from€ 726 million in first-half 2006 capital gains (versus€ 1,024 million in 2005), arising principally from the sale of a portion of the Group’s holdings in Flemish inter-municipal companies (€ 194 million), sale of the remaining M6 shares (€ 120 million), Reva (€ 130 million) and of Colbùn (€ 84 million).

Net income Group share amounted to€ 2.2 billion, i.e. a + 39.5% increase, versus€ 1.6 billion in H1 2005.

|

Solid performance across divisions |

SUEZ Energy Europe (SEE): sustained progress in operating result

Revenues were up +19.1% to€ 8,391 million at June 30, 2006. On a comparable basis, excluding in particular the impact of higher natural gas prices (€ 542 million), revenues rose on an organic basis by€ 973 million, for an organic growth rate of +13.5%.

EBITDA, amounting to€ 1,790 million, saw organic growth of +13.1%, or€ 207 million, mainly accounted for by operating elements and favorable market conditions.

Also contributing were the greater availability of power plants in the Netherlands, which in 2005 had been hit by prolonged shutdowns, and the full impact of new plants start up during the last 12 months, mainly in Italy. Meanwhile, growth drivers outside the Benelux continued to advance. Natural gas activity, whose growth is mainly accounted for by Distrigas, benefited from rougher weather than in 2005, as well as from commercial successes. Distrigas’ supply portfolio enabled it to ride out pressures on market prices (between November 2005 and March 2006).

Page 2 sur 6

Current Operating Income amounted to€ 1,240 million, +18.9% in terms of organic growth (or€ 197 million), considerably more than the EBITDA growth rate (+13.1%).

SUEZ Energy International (SEI): Commercial dynamism in a fast-growing environment

SEI recorded a +9.2% increase inrevenues (+€ 258 million), on a comparable Group structure, exchange rate, and natural gas price basis. Revenues were€ 3,058 million at June 30, 2006. This new increase is the fruit of SEI’s commercial dynamism in a fast-growing international economy, price increases related to reduced reserve electricity production capacity in several markets, and fuel price increases.

SEI EBITDA came to€ 753 million (+11.9%).

Current Operating Income for first-half 2006 rose +15.7% in total growth to€ 516 million. Organic growth was +5.6% with a strong contribution from South America (+9.9%), particularly Brazil which benefited from the replacement in 2005 of the last portion of initial contracts by new bilateral contracts at more favorable margins. Improvement of merchant plant performance in North America partially offset the momentary decline in natural gas activities during the first quarter of 2006. Commercial successes in Middle East/Asia also contributed to this growth.

SUEZ Energy Services (SES): Sustained activity and strong improvement in operating results

Revenues came to€ 5,362 million. Organic growth of SES revenues was +6.7% or€ 334 million.

In France, progression of the activity was especially well-sustained in the installation and maintenance segments (Ineo) (+€165 million, +12.2%) as a result of an increase in business with service sector and infrastructure customers (mainly transport, telecom, and public lighting).

Services activities in France (Elyo) recorded organic growth of +9.2%, mainly the result of commercial activity and related work.

On the international side, SES benefited from expanded business activity, mainly in Switzerland and Italy.

EBITDA saw substantial organic growth (+8.5%), to€ 315 million.

Current operating incomegrew 6.5% in organic terms during first-half 2006 to€ 221 million. On a constant structural basis the June 30, 2005 figure was€ 207 million.

This progression, in line with the revenue growth, stems mainly from the sustained level of services and installation activities in France and an improvement in operating results for project engineering.

SUEZ Environment: solid foundation for accelerated, profitable growth

SUEZ Environment generated€ 5,543 million inrevenues at June 30, 2006.Suez Environment organic growth amounted to€ 341 million, for an organic growth rate of 6.7% (+4.4% in total growth).

EBITDA came to€ 948 million, for organic growth of +11.3%, compared with +4.0% for the first half of 2005. Increased EBITDA growth is explained by:

| | - | excellent operational performances by Waste Services Europe (€ 47 million, or +13.5%) related to a very satisfactory level of activity, particularly in waste processing in France (increased volumes and favorable price trend) and in the United Kingdom (prices), to the impact of new plants start up during second-half 2005 (including the Zorbau incinerator in Germany and the Spolana treatment platform in the Czech Republic), and to strict costs controls. |

| | - | sustained growth in Water Europe (+€ 25 million, or +7%) thanks to expanding business activity, to a favorable price trend, and to good cost control. |

| | - | the fine six months turned in by Degrémont thanks to ongoing business mainly in Australia and Spain. |

Current operating income of SUEZ Environment grew by +4.3% in total growth and +6% in organic growth. Before reversal of provisions for the Puerto Rico contract during the first half of 2005, organic growth of current operating income was similar to that of EBITDA.

Page 3 sur 6

|

Sound financial structure |

The Group’s financial structure strengthened during first-half 2006.

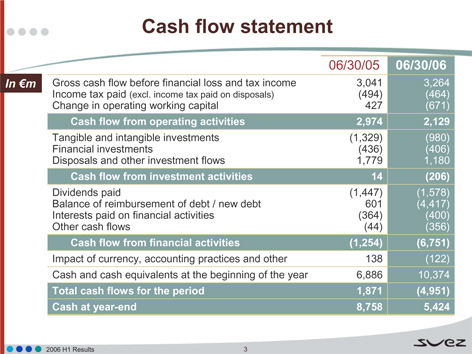

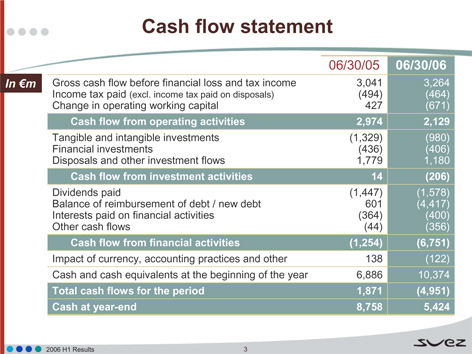

Gross cash flow before tax and financial expenses totaled€ 3.3 billion at June 30, 2006, up +7.4% in total growth versus the first half of 2005.

On the whole, cash flow from operating activity generated a treasury surplus of€ 2.1 billion despite seasonal factors and favorable non-recurring elements that occurred at the end of 2005 on working capital.

Total investments during the first half of 2006 reached close to€ 1.4 billion.

Disposals came to€ 0.9 billion at June 30, 2006 and relate mainly to the sale of the remaining shares in M6 (€ 163 million), Colbùn (€ 349 million) and Hanjin City Gas (€ 110 million).

Dividends paid during the first half of 2006 were higher than those paid in 2005 and amounted to€ 1.6 billion.

Net debt declined to€ 13.2 billion at June 30, 2006, compared with€ 13.8 billion at December 31, 2005. It is worth noting that the cash flow related to Flemish inter-municipal company securities transactions on September 5, 2006 again reduced net debt, by€ 1.2 billion.

The sharp reduction in gross debt (€ 5 billion) is due to improved circulation of cash flow within the Group.

Total equity was€ 20.7 billion at June 30, 2006, an increase of€ 1.6 billion from December 31, 2005 (€ 19.1 billion)

The Group’s gearing at the end of June 2006 was 64%, compared with 72% at the end of December 2005.

SUEZ, an international industrial Group, designs sustainable and innovative solutions for the management of public utility services as a partner of public authorities, businesses and individuals. The Group aims to meet essential needs in electricity, natural gas, energy services, water and waste management. SUEZ is listed on the Brussels, Luxembourg, Paris, New York and Zurich stock exchanges and is represented in the major international indices: CAC 40, BEL 20, DJ STOXX 50, DJ EURO STOXX 50, Euronext 100, FTSE Eurotop 100, MSCI Europe and ASPI Eurozone. The Group employs 157,650 people worldwide and achieved revenues of€41.5 billion in 2005, 89% of which were generated in Europe and in North America.

Disclaimer

This press release does not constitute an offer to purchase or exchange or the solicitation of an offer to sell or exchange any securities of Suez or an offer to sell or exchange or the solicitation of an offer to buy or exchange any securities of Gaz de France, nor shall there be any sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

In connection with the proposed business combination, the required information document will be filed with theAutorité des marchés financiers (“AMF”) and to any other relevant financial market authorities.

Forward-Looking Statements

This press release contains certain forward-looking statements, particularly with respect to future events, trends, plans or objectives. These statements are based on management’s current views and assumptions and involve a number of risks and uncertainties that may lead to a significant difference between actual results and those suggested either explicitly or implicitly in these statements (or suggested by past results). Additional information about these risks and uncertainties appears in documents filed by SUEZ with the U.S. Securities and Exchange Commission and the Autorité des Marchés Financiers (French securities regulator). The present forward-looking statements are made as of the date of the present release, with no undertaking by SUEZ to update or revise them, whether in connection with new information, future events, or any other factor.

| | | | | | | | |

Press

Contacts: | | | | | | Analyst Contacts: | | |

France: | | Catherine Guillon: | | +33(0)1 4006 6715 | | Arnaud Erbin: | | +33(0)1 4006 6489 |

| | Caroline Lambrinidis: | | +33(0)1 4006 6654 | | Bertrand Haas: | | +33(0)1 4006 6609 |

| | Antoine Lenoir: | | +33(0)1 4006 6650 | | Eléonore de Larboust: | | +33(0)1 4006 1753 |

Belgium: | | Guy Dellicour: | | +32 2 370 34 05 | | | | |

This release is also available on the Internet:http://www.suez.com

Page 4 sur 6

Page 5 sur 6

Page 6 sur 6