As filed with the Securities and Exchange Commission on June 28, 2004

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| | ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2003

OR

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-15232

SUEZ

(Exact name of Registrant as specified in its charter)

| | |

| SUEZ | | The Republic of France |

(Translation of Registrant’s name into English) | | (Jurisdiction of incorporation or organization) |

16, rue de la Ville l’Evêque, 75008 Paris, France

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of each class

| | Name of each exchange on which registered

|

| Shares of nominal value €2 each represented by American Depositary Shares | | The New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| | |

The number of outstanding shares of SUEZ on December 31, 2003 was | | 1,007,679,806 |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 x

TABLE OF CONTENTS

i

ii

INTRODUCTION

Forward-Looking Statements

This annual report contains certain statements that are forward-looking within the meaning of Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), including statements with respect to management’s business strategies, expansion and growth of operations, trends in our business, competitive advantage, and technological and regulatory changes, information on exchange rate risk and generally all statements preceded by, followed by or that include the words “believe”, “expect”, “project”, “anticipate”, “seek”, “estimate” or similar expressions. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward-looking statements as a result of various factors. The accompanying information contained in this annual report on Form 20-F, including, without limitation, the information under “Risk Factors”, “Information on the Company”, “Operating and Financial Review and Prospects” and “Financial Information”, identifies important factors that could cause such differences. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date hereof.

Financial and Certain Other Information

SUEZ is incorporated as a joint stock company (société anonyme) under the laws of France. As used in this annual report, “SUEZ”, “we” or the “Group” refers to the parent company and its consolidated subsidiaries unless the context otherwise requires. Our annual general meeting of shareholders of May 4, 2001, authorized the change of our name from SUEZ Lyonnaise des Eaux to SUEZ. Our legal life expires on December 31, 2040, unless we are dissolved prior to that date or it is extended. Our statutory documents may be consulted at our administrative office, 16, rue de la Ville l’Evêque, 75008 Paris, France, telephone (33-1) 40-06-64-00.

Our annual general meeting of shareholders of May 4, 2001 authorized a split of our shares whereby one share of common stock converted to five shares of common stock effective May 15, 2001. Unless otherwise indicated, all share amounts and related figures in this annual report have been restated to take into account the stock split.

In this annual report, references to “United States”, “US”, or “USA” are to the United States of America, references to “U.S. dollars” or “$” are to United States dollars and references to “euro” or “€”are to euros. References to the “Euronext Paris” are to the integrated national dealing system through which trading of all listed French securities occurs. References to kWh are to kilowatt hours, references to MW are to megawatts, references to GWh are to gigawatt hours, references to MWe are to megawatts of electricity, and references to MWth are to megawatts of thermal energy. References to EONIA are to Euro OverNight Index Average and to EURIBOR are to Euro Inter Bank Offering Rate.

Various amounts and percentages set out in this annual report have been rounded and accordingly may not total.

Exchange Rates

Unless otherwise indicated, U.S. dollar amounts herein have been translated from euro at the rate of €1.00 = $1.2597, the noon buying rate in New York City for cable transfers in euro as announced by the Federal Reserve Bank for customs purposes on December 31, 2003 on its website www.federalreserve.gov. The exchange rate in effect on June 21, 2004 was €1.00 = $1.2110.

1

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Consolidated Financial Data

The selected consolidated financial data at December 31, 2003, 2002 and 2001 and for the years ended December 31, 2003, 2002 and 2001 have been derived from our Consolidated Financial Statements included in this annual report. The selected consolidated financial data at year-end 1999 and 2000 and for the years ended December 31, 1999 and 2000 have been derived from our Consolidated Financial Statements that are not included in this annual report. Our Consolidated Financial Statements for the years ended December 31, 2003, 2002 and 2001 were audited by Barbier Frinault & Autres – Ernst and Young and Deloitte Touche Tohmatsu – Audit.

Our Consolidated Financial Statements have been prepared in accordance with French GAAP, which differs in certain significant respects from U.S. GAAP. Notes 26 to 28 to our Consolidated Financial Statements describe the principal differences between French GAAP and U.S. GAAP as they relate to us, and reconcile our net income and shareholders’ equity to U.S. GAAP.

You should read the following data together with the section entitled “Item 5. Operating and Financial Review and Prospects” and our Consolidated Financial Statements.

| | | | | | | | | | | | | | | | | | |

| | | As of and for the year ended December 31,

| |

| | | 2003

| | | 2003 (1)

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| |

| | | € | | | $ | | | € | | | € | | | € | | | € | |

| |

| | | (in millions, except per share amounts) | |

Income statement data: | | | | | | | | | | | | | | | | | | |

| | | | | | |

Amounts in accordance with French GAAP | | | | | | | | | | | | | | | | | | |

Revenues (2) | | 39,622 | | | 49,912 | | | 46,090 | | | 42,359 | | | 34,617 | | | 31,462 | |

Other income (3) | | 1,489 | | | 1,876 | | | 2,074 | | | 1,774 | | | 1,766 | | | 2,350 | |

Operating expenses | | (35,383 | ) | | (44,572 | ) | | (41,385 | ) | | (36,971 | ) | | (29,579 | ) | | (28,399 | ) |

Operating income before depreciation, amortization and provisions | | 5,727 | | | 7,214 | | | 6,779 | | | 7,163 | | | 6,804 | | | 5,413 | |

Depreciation, amortization and provisions | | (2,522 | ) | | (3,177 | ) | | (3,071 | ) | | (3,098 | ) | | (3,026 | ) | | (2,481 | ) |

Operating income | | 3,205 | | | 4,037 | | | 3,708 | | | 4,064 | | | 3,778 | | | 2,932 | |

Financial income (loss) | | (880 | ) | | (1,109 | ) | | (976 | ) | | (1,258 | ) | | (972 | ) | | (390 | ) |

Exceptional income (loss) | | (2,757 | ) | | (3,473 | ) | | (1,784 | ) | | 826 | | | 569 | | | 725 | |

Income tax | | (721 | ) | | (908 | ) | | (657 | ) | | (722 | ) | | (663 | ) | | (753 | ) |

Share in income of companies accounted for under the equity method | | 166 | | | 209 | | | 51 | | | 334 | | | 512 | | | 385 | |

Amortization of goodwill | | (267 | ) | | (336 | ) | | (383 | ) | | (423 | ) | | (368 | ) | | (198 | ) |

Minority interests | | (911 | ) | | (1,148 | ) | | (822 | ) | | (734 | ) | | (936 | ) | | (1,248 | ) |

Net income (loss) | | (2,165 | ) | | (2,727 | ) | | (863 | ) | | 2,087 | | | 1,919 | | | 1,453 | |

| | | | | | |

Basic earnings (loss) per share | | (2.18 | ) | | (2.75 | ) | | (0.87 | ) | | 2.12 | | | 2.01 | | | 1.89 | |

Diluted earnings (loss) per share | | (2.18 | ) | | (2.75 | ) | | (0.87 | ) | | 2.08 | | | 1.94 | | | 1.81 | |

2

| | | | | | | | | | | | | | | | |

| | | As of and for the year ended December 31,

|

| | | 2003

| | | 2003 (1)

| | | 2002

| | | 2001

| | | 2000

| | 1999

|

| | | € | | | $ | | | € | | | € | | | € | | € |

| |

| | | (in millions, except per share amounts) |

Amounts in accordance with U.S. GAAP | | | | | | | | | | | | | | | | |

Total revenue | | 35,644 | | | 44,901 | | | 27,387 | | | 25,606 | | | 24,775 | | 23,181 |

Operating income | | 765 | | | 964 | | | (76 | ) | | 967 | | | 1,126 | | 1,474 |

Income (loss) from continuing operations (4) | | (1,565 | ) | | (1,971 | ) | | (3,250 | ) | | 1,083 | | | | | |

Cumulative effect of adopting SFAS 143 | | (26 | ) | | (33 | ) | | | | | | | | | | |

Cumulative effect of adopting SFAS 133 | | | | | | | | | | | (132 | ) | | | | |

Income (loss) from discontinued operations (4) | | (712 | ) | | (897 | ) | | 81 | | | (55 | ) | | | | |

Net income (loss) | | (2,303 | ) | | (2,901 | ) | | (3,169 | ) | | 896 | | | 741 | | 1,020 |

Basic per share information | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations (4) | | (1.57 | ) | | (1.98 | ) | | (3.28 | ) | | 1.10 | | | | | |

Cumulative effect of adopting SFAS 143 | | (0.03 | ) | | (0.04 | ) | | | | | | | | | | |

Cumulative effect of adopting SFAS 133 | | | | | | | | | | | (0.13 | ) | | | | |

Income (loss) from discontinued operations (4) | | (0.72 | ) | | (0.90 | ) | | 0.08 | | | (0.06 | ) | | | | |

Net income (loss) per share | | (2.32 | ) | | (2.92 | ) | | (3.20 | ) | | 0.91 | | | 0.77 | | 1.33 |

Diluted per share information | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations (4) | | (1.57 | ) | | (1.98 | ) | | (3.28 | ) | | 1.08 | | | | | |

Cumulative effect of adopting SFAS 143 | | (0.03 | ) | | (0.04 | ) | | | | | | | | | | |

Cumulative effect of adopting SFAS 133 | | | | | | | | | | | (0.13 | ) | | | | |

Income (loss) from discontinued operations (4) | | (0.72 | ) | | (0.90 | ) | | 0.08 | | | (0.05 | ) | | | | |

Net income (loss) per share | | (2.32 | ) | | (2.92 | ) | | (3.20 | ) | | 0.90 | | | 0.76 | | 1.28 |

| | | | | | |

Balance sheet data: | | | | | | | | | | | | | | | | |

| | | | | | |

Amounts in accordance with French GAAP | | | | | | | | | | | | | | | | |

Tangible assets | | 27,127 | | | 34,172 | | | 33,276 | | | 37,992 | | | 37,003 | | 28,922 |

Borrowings and long-term debt | | 26,694 | | | 33,626 | | | 34,545 | | | 33,761 | | | 32,192 | | 25,623 |

Cash and cash equivalents | | 6,688 | | | 8,425 | | | 5,963 | | | 4,629 | | | 4,489 | | 4,812 |

Shareholders’ equity | | 6,896 | | | 8,687 | | | 10,578 | | | 14,397 | | | 13,134 | | 11,271 |

Minority interests | | 4,847 | | | 6,106 | | | 5,191 | | | 6,447 | | | 7,089 | | 6,418 |

Total assets | | 69,950 | | | 88,116 | | | 84,151 | | | 89,481 | | | 85,498 | | 76,897 |

| | | | | | |

Amounts in accordance with U.S. GAAP | | | | | | | | | | | | | | | | |

Borrowings and long-term debt | | 24,998 | | | 31,490 | | | 34,436 | | | 31,717 | | | 30,109 | | 22,948 |

Shareholders’ equity | | 14,520 | | | 18,291 | | | 18,397 | | | 25,100 | | | 25,112 | | 24,218 |

Minority interests | | 3,915 | | | 4,932 | | | 936 | | | 1,754 | | | 2,295 | | 2,929 |

Total assets | | 68,593 | | | 86,407 | | | 72,725 | | | 79,396 | | | 77,683 | | 71,296 |

| | | | | | |

Other data: | | | | | | | | | | | | | | | | |

Dividends per share | | 0.71 | | | 0.89 | | | 0.71 | | | 0.71 | | | 0.66 | | 0.60 |

| (1) | Translated for convenience into US dollars at the noon buying rate for euros in New York on December 31, 2003 as reported by the Federal Reserve Bank on its website www.federalreserve.gov. |

| (2) | For change in treatment in energy trading activities, see note 1-O to the consolidated financial statements. |

| (3) | Consists of income from mixed inter-municipal companies and joint operations, and other operating income. The mixed inter-municipal companies, which are located in Belgium, are jointly held by Belgian municipalities and by Electrabel. They service the end user for electricity, gas and cable television and do not have any employees. We provide all the services for the consumer and bill the companies for these services. |

| (4) | The Group sold Ondeo Nalco, Coditel and Codenet in 2003. The Results of operations from January 1, 2003 to the respective date of disposal of Ondeo Nalco, Coditel and Codenet has been eliminated from the |

3

| | Group’s ongoing operations, then the related results of operations for the current and prior periods (through 2001), including any related impairments, are reflected as Discontinued Operations in the U.S. GAAP Consolidated Income Statement. Presentation of amounts related to these discontinued operations for 2000 and 1999 is not included as the Group is unable to ascertain the related amounts. |

Exchange Rates

The following tables set forth, for the periods and dates indicated, information concerning the noon buying rate in U.S. dollars for euro for 1999, 2000, 2001, 2002, 2003 and 2004 (through June 21), based on rates reported by the Federal Reserve Bank of New York on its website www.federalreserve.gov. No representation is made that euro amounts have been, could have been or could be converted into U.S. dollars at the noon buying rates indicated for any given date.

| | | | | | | | |

Year ended December 31,

| | At end of

period

| | Average rate

(1)

| | High

| | Low

|

1999 | | 1.0070 | | 1.0588 | | 1.1812 | | 1.0016 |

2000 | | 0.9388 | | 0.9207 | | 1.0335 | | 0.8270 |

2001 | | 0.8901 | | 0.8909 | | 0.9535 | | 0.8370 |

2002 | | 1.0485 | | 0.9496 | | 1.0485 | | 0.8594 |

2003 | | 1.2597 | | 1.1411 | | 1.2597 | | 1.0361 |

2004 (through June 21, 2004) | | 1.2110 | | 1.2248 | | 1.2853 | | 1.1801 |

| | | | |

| Monthly | | | | | | | | |

December 31, 2003 | | 1.2597 | | — | | 1.2597 | | 1.1956 |

January 31, 2004 | | 1.2452 | | — | | 1.2853 | | 1.2389 |

February 29, 2004 | | 1.2441 | | — | | 1.2848 | | 1.2426 |

March 31, 2004 | | 1.2292 | | — | | 1.2431 | | 1.2088 |

April 30, 2004 | | 1.1975 | | — | | 1.2358 | | 1.1802 |

May 31, 2004 | | 1.2217 | | — | | 1.2274 | | 1.1801 |

through June 21, 2004 | | 1.2110 | | — | | 1.2320 | | 1.2006 |

| (1) | The average of the noon buying rates on the last day of each month during the relevant period. The “Noon Buying Rate” is the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. |

A substantial proportion of our assets, liabilities, revenues and expenses are denominated in currencies other than the euro. Accordingly, fluctuations in the value of the euro relative to other currencies can have an effect on the translation into euro of our assets, liabilities, revenues and expenses. For information with respect to the impact of fluctuations in exchange rates on our operations, see “Item 5. Operating and Financial Review and Prospects” and “Item 11. Quantitative and Qualitative Disclosures About Market Risk”.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Changes in laws and government regulations could significantly impact our business

Many aspects of our business are subject to strict European, national and local regulations (e.g. licenses, permits, authorizations). This is particularly true in electricity transmission and distribution, transport and

4

distribution of natural gas and liquefied natural gas, water management, nuclear plant operation and maintenance, and waste collection and treatment. Regulatory changes can affect our pricing, margins, operations, strategy, financial condition and profitability.

Our businesses are also subject to many laws and regulations related to respect for the environment, health protection and safety standards. These relate particularly to air quality, water pollution, drinking water quality, the treatment of hazardous and non-hazardous waste, nuclear plant management, and soil contamination. A change or toughening of regulations can lead to additional costs or investments for us that we cannot guarantee will be covered by sufficient revenues. In such cases, we may have to close down an operation without any assurance of being able to offset the costs related to such a shutdown. Furthermore, to engage in these activities, we must obtain or renew various permits and authorizations from regulatory authorities – an often long, unpredictable and costly process. Despite the substantial expense of applying for such permits or authorizations, they may in the end not be granted, or be granted too late.

Finally, regulations require investments and operational outlays not just by us, but also by our customers, particularly concession-granting municipalities, to upgrade their facilities to regulatory standards. If the customer does not meet these obligations, the operator’s reputation may be damaged and its development capacity impaired.

We operate in increasingly competitive and evolving markets, which has increased pressure on our market share and may have a negative effect on our financial results

Most of our services are subject to strong competition both from large international competitors and, in a number of markets, also from small niche players. Electricity or gas industry deregulation in the European Union and in the United States has opened most markets to new competitors, which could have a significant negative effect on our sales prices, margins and our market share, particularly in Belgium. In the field of Environment, our various Water and Waste activities are also subject to strong competitive pressure both from international and local players, the effect of which may be lower prices for our services to industrial or municipal customers or both. Such decreases in prices could have a negative effect on our business, results of operations and financial condition.

We may be negatively affected by the decision of our local and municipal partners to terminate or modify partnership agreements

We develop many of our local operations in partnership with municipal governments or private local entities. These partnerships are one of the ways in which we share the economic and financial risks associated with certain large projects by limiting the capital we commit and enhancing our ability to adapt to specific local-market conditions. Such partnerships may also be required by local regulations.

Changes in project plans, local political and economic conditions, or a partner’s financial condition may result in the termination of a partnership, i.e. partners request dissolution of the joint venture or exercise a preemptive right. As a result, we may be required to increase our financial commitment on certain projects to maintain our interests in such projects or, in the event of conflict with a partner, to seek resolution in litigation or arbitration. Such events may have a material adverse effect on our business, results of operations or financial condition.

Failure by significant customers and suppliers to meet their contractual obligations could significantly impact our business

In our energy and environment operations, our subsidiaries frequently enter into contracts with municipal authorities or private local entities, the performance of which can depend on a few or even a single customer. This is the case, for example, in delegated water-management contracts, certain electricity production and sales operations involving medium and long-term power purchase agreements, and in the management of non-hazardous waste incinerators.

5

A customer’s refusal or inability to uphold its contractual obligations, particularly regarding rate adjustments, can compromise the economic equilibrium of the contracts and the profitability of investments we or our subsidiaries may have made. Although we usually negotiate contractual provisions requiring compensation for non-performance, full compensation is not always recoverable, which can materially adversely affect our gross revenue and net income. We are currently facing such situations in Argentina, the Philippines and Indonesia.

Likewise, in managing our sanitation plants, certain power plants and waste treatment units, we frequently depend on a limited number of suppliers for water, non-hazardous waste, various types of fuel and equipment. Any supply interruption or delay, even in breach of contract, can materially adversely affect a project’s profitability.

Our energy trading activity (including fuel procurement and power marketing) exposes us to risks associated with the fluctuation of energy prices, the participation in evolving markets, exposures to our counterparties and other factors that may have a negative effect on our financial results

We trade natural gas, electricity, crude oil and other petroleum products on the spot market and other competitive power markets. We also enter into derivative contracts and a variety of other instruments to purchase and sell natural gas, electricity, petroleum products and coal as part of our energy trading operations or for our own use. With respect to such transactions, our revenues and results of operations are likely to depend, in large part, upon prevailing market prices for power in our regional markets and other competitive markets. These market prices may fluctuate substantially over relatively short periods of time. As a result, our energy trading (including fuel procurement and power marketing) activities expose us to risks of commodity price movements. We attempt to manage our exposure through enforcement of established risk limits and risk management activities. These risk limits and risk management activities may not always be followed or may not work as planned and cannot always eliminate the risks associated with these activities. As a result, we cannot predict the impact our energy trading and risk management decisions may have on our business, results of operations or financial position.

Authorities that have jurisdiction over wholesale power rates in the United Sates, Europe and elsewhere, as well as independent system operators that oversee some of these markets, may impose price limitations, bidding rules and other mechanisms which may adversely impact or otherwise limit trading margins and lead to diminished opportunities for gain.

We are also exposed to the risk that counterparties to our energy trading contracts owing us money or energy will breach their obligations. Should the counterparties to these arrangements fail to perform, we may be forced to enter into alternative hedging arrangements or honor underlying commitments at then-current market prices that may exceed our contractual prices, which would adversely affect our results of operations and might result in losses. Although our estimates take into account the expected probability of default by a counterparty, we cannot predict our actual exposure to default by counterparties to these arrangements.

Revenues from markets outside North America and Europe represent a significant portion of our total revenues and our capital employed

Revenues from markets outside North America and Europe represented approximately 10% of our revenues and 25% of our capital employed in 2003. Our activities in these countries entail a higher degree of risks than in developed countries. In particular, these include GDP volatility, economic and governmental instability, changing regulations, nationalization or expropriation of private assets, collection difficulties, social unrest, significant fluctuations in interest and exchange rates, income and other taxes levied by foreign governments and local authorities, exchange control measures, and other unfavorable interventions and restrictions imposed by foreign governments. We have faced such difficulties in Argentina, the Philippines and Indonesia (see Item 4.B.).

6

Currency exchange rate fluctuations may negatively affect our results of operations

We hold significant assets and liabilities, earn income and pay expenses of our subsidiaries in US dollars and a variety of foreign currencies. Our Consolidated Financial Statements are presented in euro. Therefore, when we prepare our Consolidated Financial Statements, we must translate our assets, liabilities, income and expenses in currencies other than the euro into euros at applicable exchange rates. Significant currency fluctuations, such as those experienced in Argentina and Brazil in 2002 and with respect to the US dollar in 2003 may have an adverse effect on our results of operations and financial condition. For example, increases and decreases in the value of the euro will affect the value of these items in our Consolidated Financial Statements, even if their value has not changed in their original currency. For example, an increase in the value of the euro may result in a decline in the reported value, in euros, of our interests held in foreign currencies and a corresponding negative effect on our financial condition as presented in our Consolidated Financial Statements. Similarly, many of the commodities and other goods that we purchase as part of our operations are indexed in currencies other than euro, particularly in US dollars. Decreases in the value of the euro against other currencies, particularly the US dollar, can effectively increase the price we have to pay for these commodities, even if their price in the index currency does not change, which could have a negative effect on our financial condition.

Our business may be negatively affected by changes in interest rates

As of December 31, 2003, approximately 40% of our gross debt was under a variable rate and 60% under a fixed rate, after taking into account derivative instruments to hedge underlying exposures to changes in interest rates. We may have exposure to interest-rate variations in the future as any rise in interest rates increases the cost of our debt.

A decline in the market price of the shares of our non-consolidated companies could adversely affect our financial condition

We hold a portfolio of securities in non-consolidated public companies, the market value of which is dependent on stock market prices. It is not our policy to resort systematically to hedging to limit the economic risk arising from fluctuations in the price of these securities. Hedging is not always an option depending on the quantities of securities held and the liquidity of the hedging instruments. Some securities have been used to back bonds exchangeable into shares so that we could benefit from the attractive terms of such financings. A consistent drop of 10% in the price of the companies held would result in an exceptional charge of approximately € 32 million, and an increase of 10% would result in a write-back of provisions of approximately € 41 million.

Exposure to specific environmental regulations, environmental risks generally and malicious acts may negatively affect our financial situation

Facilities that we own or manage for local industrial and municipal third parties pose risks to the natural environment – air, water, soil – as well as risks to the health of consumers, employees and subcontractors. These health and environmental risks are subject to strict and precise national and international regulations and regular audits by government authorities. Six of our sites in the European Union are Seveso “High Tier” sites, whose activities include chlorine solvent incineration, hazardous industrial waste treatment and underground natural gas storage.

In the course of our business, we handle or generate dangerous products or by-products, such as fissile materials, fuels, and certain chemical byproducts of water treatment. Some of our waste facilities have industrial and medical waste treatment operations that may be potentially toxic. A waste treatment permit for any given facility would be at risk in case of reception and treatment of a waste that is non-compliant with regulations applicable to that facility.

Evolving regulations covering environmental responsibility make it difficult to assess risks related to our past activities, particularly in the case of closed landfills. Even where past activities complied with regulations in

7

force when they were in operation, the conditions created by such past activities may nonetheless be a source of pollution to the natural environment in the future, and may be subject to retroactive regulation or litigation.

In waste management, the gaseous emissions of concern are greenhouse gases, precursors of acid rain, noxious gases, and dust. In the water business, the primary potential air pollutants are chlorine and gaseous by-products resulting from accidental releases of water treatment by-products. In addition, waste treatment and sewage treatment operations can create odor problems.

Potential impacts of activities on water in the natural environment include leachates from poorly controlled landfills, the release of heavy metals into the environment, and aqueous effluent discharges from systems for treating the fumes from incineration facilities. These various emissions can pollute groundwater and waterways.

Sewage treatment plants discharge treated water into the natural environment. It is possible that this water may not meet discharge standards in terms of its organic, nitrogen and phosphorus content. Also, some of the facilities we manage are not equipped to treat rainwater. In case of heavy rains, the water collected is entirely or partially discharged into the natural environment without being treated. This can degrade the quality of water used for swimming and recreation or shellfish farming. The operator cannot be held liable for such pollution, except insofar as it demonstrably failed to properly manage the facilities under its management.

Soil pollution issues include the storage of hazardous products and liquids, leaks during processes that use hazardous liquids, and sludge storage and surface spreading.

We also face external risks such as lightning, drought, flooding, earthquakes and land slides that could damage or destroy our installations and result in damage to the environment. In addition our production and distribution installations in the areas of energy and water could be the targets of terrorist or other malicious acts. The occurrence of any of these or similar events would negatively affect our business, results of operations and financial condition.

Our activities are likely to be covered by stricter national and international standards relating to climate change and related costs may negatively affect our financial position

Particularly in electrical power generation and waste treatment and waste recycling, we are engaged in activities that come under national, international and European Union climate change programs established pursuant to the Kyoto Protocol. Since none of the elements that would enter into quantifying the impact of the “carbon constraint” can be estimated with sufficient accuracy, the risk it represents cannot yet be quantified either. This uncertainty, however, should disappear once rules on how the “carbon market” will operate are formalized. Once formalized, we may have to incur significant costs to comply with these rules which could have a negative impact on our business, results of operations and financial condition.

We may incur substantial liability from our ownership and operation of nuclear facilities

We own and operate nuclear power facilities in Belgium for the production of electric power. Risks of substantial liability arise from the ownership and operation of nuclear facilities, including mechanical or structural problems at a nuclear facility, the storage, handling and disposal of radioactive materials, and uncertainties with respect to the technological and financial aspects of decommissioning nuclear facilities at the end of their useful lives. In addition, if the Belgian government were to discontinue the use of nuclear power facilities for the production of energy, that decision would also adversely affect our business, results of operations and financial condition.

8

ITEM 4. INFORMATION ON THE COMPANY

A. History and development of SUEZ

SUEZ was formed in June 1997 by the merger of Compagnie de Suez and Lyonnaise des Eaux. At that time Compagnie de Suez, which had built and operated the Suez Canal in Egypt until its nationalization in 1956, was a highly diversified holding company with operating units in financial services and energy, largely in Belgium and France. Lyonnaise des Eaux was a diversified company, with water, waste services, construction, communications, and on-site technical management services, largely in France, but with significant international activities.

We are a société anonyme, a joint stock company, established under French law until December 31, 2040. We are governed by the French Business Code and décret no. 67-236 of March 23, 1967. We are registered in the Registre du Commerce et des Sociétés de Paris, the Commercial and Companies’ Register of Paris, under reference number SIREN 542 062 559 R.C.S. Paris. Our registered office is at 16, rue de la Ville l’Evêque, 75008 Paris, France, telephone 33-1 40 06 64 00. Our agent for U.S. federal securities law purposes is Tim Dunne, General Counsel, Tractebel North America, Inc., 1990 Post Oak Boulevard, Suite 1900, Houston, Texas 77056.

B. Business overview

VISION AND STRATEGY

We provide services that meet the essential needs of a diversified clientele. In keeping with our announced intentions at the time of the merger in 1997, SUEZ has evolved from a conglomerate to a global industrial group promoting sustainable development and offering a comprehensive range of solutions in the energy and environment sector, water and waste services, for companies, individuals and municipalities.

We develop, design, implement, and operate systems and networks in each of these areas to meet the needs of our customers, whether they are companies, municipalities, or individual customers. We aim to provide our customers with the customized and innovative solutions they expect.

Our development is sustained by the diversity of our services, which benefit from our expertise, our long experience and extensive client base, our financial flexibility resulting from recurrent cash flow, and by our international network.

In each of our two major business areas, Energy and Environment, we enjoy leading positions:

| • | In Energy, we are a leading energy player with expertise in every phase of the value chain, whether electricity generation and supply, energy trading as a support activity, transmission, distribution and sale of electricity and natural gas, or related services such as cogeneration plant construction, on-site technical maintenance, complex systems management, and project engineering. |

| • | In Environment, we are one of the world’s leading companies in water-related services. We design and manage production and distribution systems for drinking water and sanitation, engineer sanitation facilities, and provide a broad range of industrial water-related services. We are also among the world’s leaders in waste services, serving municipal and business customers. We are experienced in every facet of the business, from waste collection and sorting to recycling, incineration and landfill disposal, and can handle most categories of both non-hazardous and hazardous waste. The merger of our water and waste services activities in 2002 led to the formation of SUEZ Environnement in May 2003. Following the sale of Ondeo Nalco, a world leader in industrial water treatment services, in September 2003, the activities of its subsidiary, Ondeo Industrial Solutions, which specialized in onsite operations and maintenance of industrial process water treatment, will be integrated into SUEZ Environnement in 2004 to supplement its range of services. |

9

We believe that our diversified clientele provides a constant source of business, with an organic growth potential greater than the rate of growth in GDP, depending on economic conditions. We target two main customer segments:

a) Municipal and individual customers

The use of the private sector is growing in three significant ways: partly at the pace of market deregulation, partly because public authorities are becoming increasingly aware of the limited nature of their resources and specialized expertise, and partly because of stricter environmental regulations in the case of waste services. This reliance on private operators can take the form of privatization, concessions, or operation and maintenance contracts. For numerous municipalities and international institutions, reliance on private sector providers is synonymous with greater efficiency, in the form of prices which better reflect economic reality, higher quality service, and the ability to serve a greater number of people.

Management believes there is strong long-term development potential for this market. In the energy sector, continuing deregulation in Europe will give us access to all residential customers from January 1, 2007. In the environmental sector, the scope of delegation of water-related services to the private sector is currently limited and we expect it to grow. Our presence in Europe and internationally places us in a sound position to meet the major long-term needs of our municipal and individual customers. The business model we offer is based on a partnership between us and the public authority, with a clear distribution of responsibilities. In this public/private partnership model, we are not the owner of the water resource, but are entrusted for the term of the contract with responsibility for the infrastructure, maintenance and, frequently, development of the water source for the benefit of the whole population. If ways can be found to avoid having the private operator take too great a share of the risk and to ensure that public authorities are in a position to honor their contractual commitments, particularly with respect to rates, the private sector can potentially play an increasingly important role in the management of public water resources. Because these conditions are not currently completely met, private operators, such as ourselves, have been forced to reduce levels of investment in order to limit our risk.

b) Business customers

The sale of Ondeo Nalco in September of 2003 does not diminish the importance of business customers to our current activities. The deregulation of the energy market potentially offers new opportunities. Industrial and service sector companies often seek custom-tailored solutions in areas of our expertise.

We offer:

| • | basic products and services (electricity, natural gas, water, waste management); |

| • | a wide array of specialized services, including hazardous industrial waste treatment, design and installation of sanitation plants and electrical and mechanical installations, and climate engineering; and |

| • | industrial on-site management services, from maintenance to complex outsourcing operations involving transfers of human resources and capital assets. |

We expect that the company services market will continue to grow in the coming years. The pace of growth will be determined by the strength of national economies. Strong trends in outsourcing include a gradual move from simple, maintenance-type services to more complex ones, such as facilities management, full water cycle management, and waste management. In addition, there is a growing expectation for service providers such as us to make commitments on results, not just on means, as well as the sharing or transfer of all or part of the industrial risk. Our international presence permits us to offer multi-site, mono-service, or even multi-service contracts, in accordance with customer needs. Such contracts could include, for example, ultra-pure water supply (Ondeo), electricity, natural gas and heating (EGI and EGE), incineration and waste treatment (SITA), and facilities management and management of on-site cogeneration facilities (Elyo).

10

In 2003, we streamlined our cross-business structures servicing industrial customers. We maintained a specific coordinating structure focusing on industrial customers, while making organizational changes to increase the involvement of our operating units.

Implementation of the 2003-2004 action plan

The period between 1997 and 2001 was characterized by sustained international expansion in our Energy and Environment activities and by the establishment of a platform for the future development of our businesses. Still, this growth was accompanied by an increase in our gross borrowings less marketable securities and cash and cash equivalents (“net debt”) which by the end of 2001 had reached €28 billion. Anticipating a weakened and uncertain economic climate for the period 2003-2004, we focused our strategic priorities on strengthening our financial position and consolidating our Energy and Environment businesses.

These priorities led to the development of an action plan for 2003-2004 which was announced on January 9, 2003 and whose objectives were:

| • | Enhanced and strengthened profitability resulting in improvements in return on capital employed (ROCE) and both cash flow and free cash flow1 generation of energy and environment activities, and by a reduction in exposure to emerging countries. |

| • | A one-third reduction in our debt by the end of the plan, and complete self-financing of each operating unit of its investments and dividend payments by 2004. |

To achieve these objectives, our action plan included five components:

(1) Continued debt reduction

Our asset disposal program was intended to reduce debt and enhance profitability, and focused not only on non-strategic assets but also on certain Energy and Environment assets in favor of activities offering a better risk/return ratio as well as improved cash flow generation. See Item 8.B. “Significant Changes”.

Our sale of Ondeo Nalco, which was completed on November 4, 2003 for $4.35 billion helped improve our financial structure and we expect it to help improve our return on capital employed, as we do our decision to gradually dispose of all of our Communication assets as part of our policy to focus on Energy and Environment.

The goal to reduce net debt by a third was exceeded in the year as a result of implementing the disposal plan. In 2003, we sold €7.8 billion of financial assets and the deconsolidation of entities sold reduced debt by €2.1 billion. The sales involved assets in the Environment sector (75% of Northumbrian, 100% of Ondeo Nalco and CESPA), certain non-strategic holdings (Fortis, Axa, Total, Vinci), and several assets in the Communications sector in Belgium (Coditel and Codenet). As a result, our net debt was reduced from €26 billion as of December 31, 2002 to €15 billion as of December 31, 2003. See Note 16 to our Consolidated Financial Statements. This debt reduction policy resulted in the recognition of losses, which explain a significant portion of our exceptional loss for the year (€2.8 billion). In addition, the sale of certain assets changed the scope of consolidation and had an impact on our income from operations.

(2) Improved profitability

We seek to reduce overhead and operating expenses though our “Optimax” program. Our objective was to save approximately €500 million in 2003. The savings actually achieved through our Optimax program in 2003 totaled €585 million, exceeding the target of €500 million for the full year set in January 2003.

1 Cash flow minus maintenance capital expenditures, plus or minus changes in working capital needs.

11

(3) Establishment of a more integrated organizational structure

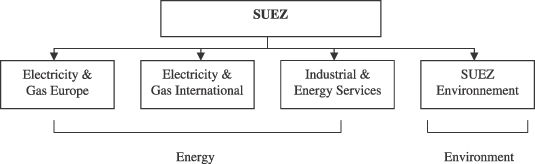

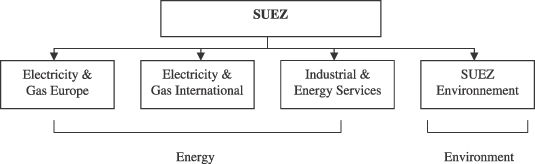

Our corporate structure was simplified with the merger on October 31, 2003 of Société Générale de Belgique and Tractebel, which formed SUEZ-TRACTEBEL, and with the creation of a single headquarters (in Paris and Brussels). Continuing uncertainties regarding the legislative and regulatory environment for gas activities in Belgium and Europe, rapid changes in international gas markets where we nonetheless gained strong positions, and progress achieved in generating synergies within the Group led to the decision not to pursue the study, begun in 2002, to transfer the service and gas entities of SUEZ-TRACTEBEL to Electrabel. Moreover, the disposal of Ondeo Nalco and the plans to integrate Ondeo Industrial Solutions (OIS) in SUEZ Environnement have resulted in an organization centered around our two business segments of Energy and Environment, carried on by four operating divisions.

(4) Slowing the pace of investments

We seek to reduce our investment and place our business branches in a position to self-finance their development. To achieve these objectives, more demanding cash flow requirements and risk limitation standards, particularly in the area of foreign exchange, were added to the existing criteria for the selection of capital expenditures.

Consistent with the action plan target of reducing investment to an average of €4 billion per year for 2003-2005 period, our total expenditure on tangible, intangible and financial investments was €4.3 billion for 2003 (see our Consolidated Statements of Cash Flows).

(5) Reduce risk exposure

We seek to reduce our exposure to the risks of operating in developing countries and to focus our activities on more stable core markets (European Union and North America).

Our exposure to the risks of developing countries has been reduced. At December 31, 2003, the capital employed in these countries was €6.2 billion compared with €7.9 billion at the end of the previous fiscal year.

12

Business activity growth despite a depressed international economic climate

Despite the year’s difficult economic picture, we continued to grow organically in 2003, with an organic growth rate in revenues of 6.1%,2 slightly higher than the increase achieved in 2002. Group revenues were €39.6 billion in 2003, of which Energy represented 67%, and Environment 31%.

| | | | | | | | | | | | | | | |

| | | 2003

| | | 2002(*)

| | | 2001(*)

| |

| | | (in € millions, except percentages) | |

Energy | | 26,635 | | 67 | % | | 24,242 | | 59 | % | | 26,374 | | 62 | % |

Environment | | 12,310 | | 31 | % | | 15,897 | | 39 | % | | 15,374 | | 36 | % |

Other | | 677 | | 2 | % | | 644 | | 2 | % | | 611 | | 2 | % |

| | |

| |

|

| |

| |

|

| |

| |

|

|

Group total | | 39,622 | | 100.0 | % | | 40,784 | | 100.0 | % | | 42,359 | | 100.0 | % |

| (*) | Fiscal year 2002 revenues are presented to reflect the change in presentation of energy trading activities. By contrast, the revenues for fiscal year 2001 are presented according to the method applicable prior to January 1, 2003 (see Note 1-O to our Consolidated Financial Statements). |

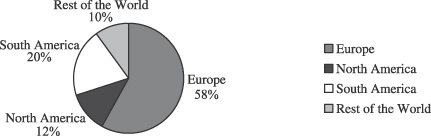

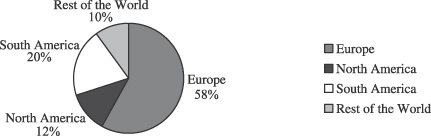

Organic growth for Energy activities was 7.3%3, while organic growth for Environment activities was 3.7%3. In Energy, Europe (EGE), which remains our most important market, recorded organic revenue growth at approximately 4%3 in 2003, due primarily to the optimization of production equipment, an increase in our contract portfolio and growth in electricity and gas sales outside Belgium. We believe the modest rate of growth was due primarily to the slowdown in the European economy, as Euro Zone countries experienced an average rate of growth of only 0.4% in 2003. In 2003 activities outside of Europe (EGI) recorded particularly strong organic growth at 39.7%3, due primarily to the commissioning of new plants and the increase in liquefied natural gas (LNG) sales in the United States. In Environment, organic growth was due primarily to the success of European operations in the water sector, mainly in France, due to exceptionally hot weather conditions during the summer.

While our activity is worldwide, Europe remains our largest market. In 2003, 80% of the our revenues were generated in Europe, to which the major contributors were France and Belgium with 54%. The proportion of revenues generated in Europe and North America continues to increase, and was 90% of total Group revenues in 2003 compared to 88% in 2002.

The table below summarizes consolidated revenue and profitability trends for the past three years.

| | | | | | | | | |

| | | 2003

| | | 2002

| | | 2001

| |

| | | (in € millions) | |

Revenues | | 39,622 | | | 40,784 | (*) | | 42,359 | (*) |

Net income (loss), Group share | | (2,165 | ) | | (863 | ) | | 2,087 | |

Gross Cash flow (1) | | 3,727 | | | 4,857 | | | 4,817 | |

Net debt (2) | | 14,991 | | | 26,006 | | | 28,009 | |

| (*) | Fiscal year 2002 revenues are presented to reflect the change in presentation of energy trading activities. By contrast, the revenues for fiscal year 2001 are presented according to the method applicable prior to January 1, 2003 (see Note 1-O to our Consolidated Financial Statements). |

| (1) | See “Item 5.B. Operating and Financial Review and Prospects – Liquidity and Capital Resources” |

| (2) | Gross borrowings less marketable securities and cash and cash equivalents. |

2,3 Revenue or gross operating income (“GOI” or “segment profitability”) organic growth is a non-GAAP measure which excludes the effects of acquisitions and disposals, exchange rate variations, gas price variations and Puerto Rico, the withdrawal from which was announced on January 13, 2004. For further discussion of this non-GAAP measure see “Item 5. Operating and Financial Review Prospects – Results of Operations – 2003 to 2002” for a reconciliation of organic growth.

13

We had a net loss of €2,165 million in 2003, which reflects non-recurring expenses resulting in part from the disposal of assets under the action plan (described above) and write-downs on certain assets in the Communications, Water and Waste Services sectors, as well as costs related to restructuring and the termination of unprofitable contracts.

However, the operating profitability of our activities has resisted this subdued economic context. Organic growth in Energy gross operating income was particularly strong at 8.3%,1 primarily attributable to the performance of EGE gas activities, the start-up of new facilities abroad, and the performance of our liquefied natural gas (LNG) operations. In Environment, organic growth in gross operating income was equally significant (up 3.8%1 for SUEZ Environnement), due primarily to Water and Waste Services in Europe, especially in France.

2004-2006 strategic priorities

2003 was a year of transition that allowed us to improve our results from financial investments and to redefine the scope of our activities. We are now refocused on our two businesses of Energy and Environment. The sale of our holdings in the Communications sector, initiated in 2003, continued, with the February 2004 sale of 29.2% of M6, with the signing of an agreement with United Global Com (UGC) for the sale of Noos in March 2004 and with the conclusion of the sale of Paris Première to M6 in May 2004.

In this context, the strategic business priorities for the period 2004-2006 are to continue our efforts to increase our operating profitability and generate cash in our two core businesses of Energy and Environment by implementing a strategy that primarily focuses on organic growth.

Our primary objectives are to achieve:

| | • | Average organic growth in revenue and gross operating income of between 4% and 7% per year. |

| | • | Growth in results and profitability with the return to positive net income in 2004 and a target of 11% ROCE (Return On Capital Employed) in 2006. |

| | • | Continued improvement in cash generation, with the objective of self financing all capital expenditure and dividends by 2005. |

In this context the main strategic objectives of our four operating business lines for 2004-2006 are as follows:

a) Electricity & Gas Europe (EGE)

| | • | Maintain a leading position and defend margins in the Benelux countries by giving priority to customer relations and reinforcing the competitiveness of the production facilities. |

| | • | Develop gas/electricity convergence. |

| | • | Continue commercial growth and targeted investments in priority markets such as France, Italy, and the Iberian Peninsula. |

b) Electricity & Gas International (EGI)

| | • | Give priority to organic growth in the four key EGI positions (the United States, Brazil, Thailand, and LNG) and in countries in which the growth in energy demand should be strong. |

14

| | • | Concentrate on sales activities with commercial and industrial customers. |

| | • | Continue the policy of rotating capital expenditure around EGI strong points. |

| | • | Maintain a balanced portfolio management plan to achieve optimum risk/profitability performance. |

c) Industrial & Energy Services (SEI)

| | • | Give priority to the consolidation of positions, organic growth, and the profitability of Tractebel Energy Services by developing commercial synergies with EGE. |

| | • | Reorganize Fabricom to restore profitability. |

| | • | Focus the activities of Tractebel Engineering on support for Energy and Services. |

d) SUEZ Environnement

| | • | Give priority to targeted profitable organic growth in Europe, developing the Group’s technical and commercial strengths in the context of stricter environmental legislation. |

| | • | Outside Europe, maintain strict selectivity in capital expenditure and improve profitability and financial results for less high-performance assets. |

Organizational Structure

The following is a simplified list of our major subsidiaries and our percentage of ownership interest as of December 31, 2003.

| | | | | | | | | | | |

Segment

| | Division

| | Activity

| | Subsidiary

| | Country

| | Ownership

| |

Energy | | | | | | SUEZ-TRACTEBEL | | Belgium | | 100.00 | % |

| | | Electricity & Gas Europe | | Electricity and gas in Europe | | Compagnie Nationale du Rhône | | France | | 24.00 | % |

| | | | | | | Energie du Rhône | | France | | 34.29 | % |

| | | | | | | Distrigas | | Belgium | | 46.83 | % |

| | | | | | | Dunamenti | | Hungary | | 37.50 | % |

| | | | | | | Electrabel | | Belgium | | 50.12 | % |

| | | | | | | Electrabel Customer Solutions | | Belgium | | 48.02 | % |

| | | | | | | Electrabel Nederland NV | | Netherlands | | 50.12 | % |

| | | | | | | Elia/Elia System Operator | | Belgium | | 32.10 | % |

| | | | | | | Fluxys | | Belgium | | 46.83 | % |

| | | | | | | Polaniec | | Poland | | 50.12 | % |

| | | | | | | Rosen | | Italy | | 49.87 | % |

| | | | | | | ACEA Electrabel SPA | | Italy | | 20.35 | % |

| | | | | | | ACEA Electrabel Produzione SPA | | Italy | | 35.24 | % |

| | | | | | | ACEA Electrabel Trading SPA | | Italy | | 25.06 | % |

| | | | | | | ACEA Electrabel Energia SPA | | Italy | | 20.35 | % |

| | | | | | | ACEA Electrabel Elettricita | | Italy | | 20.35 | % |

| | | Electricity & Gas International | | Electricity and gas outside Europe | | Glow SPP Public Cy Ltd | | Thailand | | 99.01 | % |

| | | | | | | Glow IPP Co Ltd | | Thailand | | 94.04 | % |

15

| | | | | | | | | | | |

Segment

| | Division

| | Activity

| | Subsidiary

| | Country

| | Ownership

| |

| | | | | | | Hanjin City Gas Co Ltd | | South Korea | | 75.00 | % |

| | | | | | | Tractebel North America Inc. | | USA | | 100.00 | % |

| | | | | | | Tractebel LNG NA | | USA | | 100.00 | % |

| | | | | | | Tractebel LNG Ltd | | United Kingdom | | 100.00 | % |

| | | | | | | Tractebel Energia SA | | Brazil | | 78.32 | % |

| | | | | | | Colbun SA | | Chile | | 29.21 | % |

| | | | | | | ElectroAndina SA | | Chile | | 33.25 | % |

| | | | | | | Edelnor SA | | Chile | | 27.38 | % |

| | | | | | | Gulf Total Tractebel Power Co | | UAE | | 20.00 | % |

| | | | | | | Baymina Enerji AS | | Turkey | | 95.00 | % |

| | | Industrial & Energy Services | | Industrial and energy services | | Axima Contracting & Refrigeration | | Belgium | | 100.00 | % |

| | | | | | | Endel | | France | | 99.99 | % |

| | | | | | | Fabricom GTI | | Belgium | | 100.00 | % |

| | | | | | | GTI | | Netherlands | | 100.00 | % |

| | | | | | | Ineo | | France | | 99.99 | % |

| | | | | | | Axima Services | | Belgium | | 100.00 | % |

| | | | | | | Elyo | | France | | 99.99 | % |

| | | | | | | Tractebel Engineering | | Belgium | | 100.00 | % |

Environment | | SUEZ Environnement | | Water | | Agbar | | Spain | | 25.79 | % |

| | | | | | | Aguas Andinas | | Chile | | 32.12 | % |

| | | | | | | Aguas Argentinas | | Argentina | | 46.30 | % |

| | | | | | | Aguas do Amazonas | | Brazil | | 100.00 | % |

| | | | | | | ASIM (LISCO) | | Mexico | | 50.00 | % |

| | | | | | | Bogotana de Aguas | | Colombia | | 100.00 | % |

| | | | | | | Eurawasser | | Germany | | 100.00 | % |

| | | | | | | Lydec | | Morocco | | 60.27 | % |

| | | | | | | Lyonnaise des Eaux France | | France | | 100.00 | % |

| | | | | | | Northumbrian Water | | United Kingdom | | 25.00 | % |

| | | | | | | Ondeo Degrémont | | France | | 100.00 | % |

| | | | | | | Ondeo de Puerto Rico | | Puerto Rico | | 100.00 | % |

| | | | | | | PALYJA | | Indonesia | | 95.00 | % |

| | | | | | | Macao Water (SAAM) | | Macao | | 42.50 | % |

| | | | | | | United Water (UWR) | | United States | | 100.00 | % |

| | | | | | | WSSA | | South Africa | | 50.00 | % |

| | | | | Waste services | | Ate-Geoclean | | France | | 100.00 | % |

| | | | | | | CLIBA | | Argentina | | 45.00 | % |

| | | | | | | Novergie | | France | | 98.68 | % |

| | | | | | | Scori | | France | | 65.98 | % |

16

| | | | | | | | | | | |

Segment

| | Division

| | Activity

| | Subsidiary

| | Country

| | Ownership

| |

| | | | | | | SITA Australia | | Australia | | 60.00 | % |

| | | | | | | SITA Belgium | | Belgium | | 100.00 | % |

| | | | | | | SITA Canada | | Canada | | 100.00 | % |

| | | | | | | SITA Deutschland | | Germany | | 100.00 | % |

| | | | | | | SITA Finland | | Finland | | 75.00 | % |

| | | | | | | SITA France | | France | | 99.90 | % |

| | | | | | | SITA Nederland | | Netherlands | | 100.00 | % |

| | | | | | | SITA Polska | | Poland | | 100.00 | % |

| | | | | | | SITA Sverige | | Sweden | | 75.00 | % |

| | | | | | | SITA UK | | United Kingdom | | 100.00 | % |

| | | | | | | Swire SITA | | Hong Kong | | 50.00 | % |

| | | | | | | Teris | | France | | 100.00 | % |

| | | | | | | Teris LLC | | United States | | 100.00 | % |

| | | | | | | VEGA (VEA) | | Brazil | | 100.00 | % |

| | | | | | | Wasteman | | South Africa | | 29.95 | % |

| | | | | Industrial services | | Ondeo Industrial Solutions (*) | | France | | 100.00 | % |

Other Interests | | Communications | | TV media | | M6 | | France | | 34.64 | % |

| | | | | | | Paris Première | | France | | 93.03 | % |

| | | | | High-output distribution | | Noos | | France | | 50.10 | % |

| | | Finance | | Fund Management | | SI Finance | | France | | 100.00 | % |

| (*) | Integration in SUEZ Environnement planned for 2004. |

ENERGY

Organization and key figures

In the following table, gross operating income represents our measure of segment profitability. For a reconciliation to our consolidated operating income, see Note 22 to our Consolidated Financial Statements. Capital employed represents our measure of segment assets. It is reconciled to total assets in Note 22 to our Consolidated Financial Statements.

| | | | | | | |

| | | Year ended

|

| | | Dec. 31, 2003

| | Dec. 31, 2002

| | | Dec. 31, 2001

|

| | | (in € millions, except employee data) |

Revenues | | 26,635 | | 24,242 | (*) | | 26,374 |

Gross operating income | | 4,001 | | 4,125 | | | 4,331 |

Capital employed | | 15,890 | | 17,513 | | | 21,382 |

Number of employees | | 89,000 | | 88,800 | | | 84,400 |

| (*) | The 2002 revenue figure is published after offsetting energy trading revenues of €5,306 million. See Note 1-O to our Consolidated Financial Statements. |

17

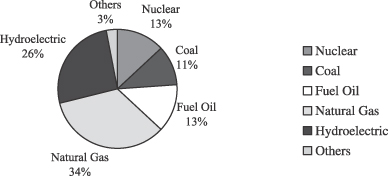

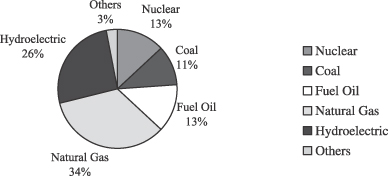

We are present throughout the world in the energy and services markets. Our core Energy activities are electricity and natural gas, which include production of electric power, energy trading, the management of transmission and distribution networks, as well as sale of electricity and natural gas. The complementary nature of our activities enables us to offer our customers other directly related services which include technical installations, energy and industrial services and engineering.

Our operations in the electric power and natural gas markets and the services sector are conducted through the following three operation divisions:

a) Electricity & Gas Europe:

Electricity & Gas Europe (EGE) conducts its electric power and natural gas related activities through subsidiaries and affiliates. The most important are:

| • | Electrabel (50.12%-owned at December 31, 2003) for electricity production, trading, sales and distribution networks and Elia (32.1%-owned at December 31, 2003) for electricity distribution. |

| • | Distrigas and Fluxys, created as a result of the separation of Distrigas’ distribution and gas trading operations (our ownership in these companies totaled 46.83% at December 31, 2003). |

| • | Electrabel, Distrigas and Fluxys are listed on Euronext Brussels. |

The activities of EGE represented approximately €12.7 billion in revenue in 2003 and employed approximately 16,600 people.

b) Electricity & Gas International:

Electricity & Gas International (EGI) is responsible for the worldwide energy and services activity outside of Europe.

EGI’s principal subsidiaries are:

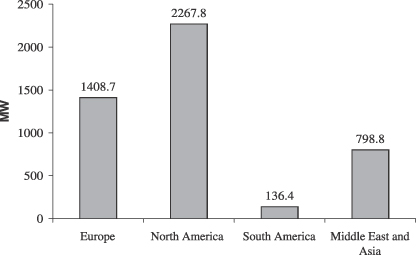

| • | Tractebel North America (TNA), a wholly-owned subsidiary in Houston, which operates all of EGI’s energy activities in the USA, Canada and Mexico, including the facilities for the regasification of LNG. |

| • | Tractebel Energia, a listed company owned 78.32% by us as of 31 December 2003, is responsible for EGI’s electric power production activities in Brazil. |

| • | Glow and Coco, owned respectively 94.04% and 99.01% by us as of December 31, 2003, manage EGI’s interests in electricity generation in Thailand. |

Tractebel LNG, a wholly-owned subsidiary located in London and Luxembourg, is responsible for short-term LNG operations, the coordination of transport and supplies and the management of EGI’s interest in liquefaction projects worldwide.

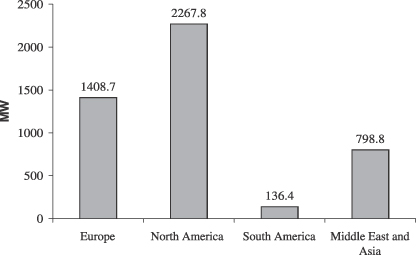

EGI’s operations represented approximately €4.5 billion in sales in 2003 and employed approximately 4,300 people.

c) Industrial & Energy Services:

ThroughIndustrial & Energy Services (IES), we offer integrated energy services and products to our customers and are a leading provider of industrial installation and maintenance services as well as in energy-related services.

18

IES provides these services through three entities:

| • | Fabricom, which generally provides short-term electrical and mechanical facility services for large projects, intended primarily for industrial companies, consists of Fabricom GTI in Belgium (with operations in Norway, England, Spain, and certain eastern European countries), GTI in the Netherlands, Ineo and Endel in France and Axima Contracting & Refrigeration which is primarily active in Belgium, France, Germany, Austria, Switzerland, Spain and England. |

| • | Tractebel Energy Services (TES) covers all of the management/maintenances services, management of heating and cogeneration facilities, management of local energy distribution networks and facilities management, intended for both the industrial and services sectors, local municipalities, and the residential sector. These services are generally covered by long-term contracts. TES offers a continuum of services and solutions that range from managing local energy networks (distribution of electricity and urban heating) to managing utilities on industrial sites, including the management and maintenance of technical and heating equipment and facilities management. The entities involved are Elyo and Axima Services. |

| • | Tractebel Engineering is responsible for engineering activities throughout the world, but a large proportion of its services are performed in Europe. |

IES activities represented approximately €9.4 billion in revenue in 2003 and employed approximately 68,100 people.

19

Strategy

We have established a strategy that aims to benefit from our competitive advantages rather than seeking merely to develop in size. Our principal advantages are:

| • | cost-competitiveness in production, on account of our flexible and efficient generating facilities; |

| • | ability to profit from synergies through electric power and natural gas convergence; |

| • | global dimension with operations in more than 100 countries; |

| • | expertise in trading and marketing electric power and natural gas, backed by significant production capacities (more than 50 GW worldwide, excluding capacities under development but including contracted capacity and plants under construction); |

| • | experience and manifold customer references in the energy and industry services sectors (through Fabricom, TES and Tractebel Engineering). |

This business strategy aims to exploit these advantages to a maximum within the following framework:

In Europe:

| • | defend EGE’s leadership position in the Benelux area; |

| • | consolidate the position of Distrigas in the European Union by maintaining a market share of at least 5% in the expanding European market, despite faster deregulation and slower growth in demand in Belgium; and |

| • | develop business in France, Italy and the Iberian peninsula. |

Outside Europe:

| • | extend electric power and natural gas synergies in regions as well as between regions, including by developing LNG activity; |

| • | develop activities around existing positions to take advantage of local expertise and maximize synergies with current operations; |

| • | balance positions taking into account developing countries risks as well as commercial risks; and |

| • | concentrate on sales to commercial and industrial customers. |

To achieve these goals, EGI, EGE and IES are working within the framework of a business model which seeks to achieve the best balance between physical assets such as electric power stations or liquified natural gas terminals and sales positions. Residual or possible temporary imbalances are managed by access to the market through our portfolio management and trading functions.

Significant Events

Electricity & Gas Europe

| | |

January 2003 | | • Launch of Berge Boston, a 138,000m3 methane tanker for shipping LNG (liquefied natural gas), owned jointly by the Norwegian ship-owner Bergesen (51%) and Distrigas S.A (49%). The ship is chartered by Tractebel LNG North America LLC. |

20

| | |

February 2003 | | Belgium |

| |

| | | • On February 28, 2003, Electrabel and the public producer SPE terminated by mutual agreement their industrial partnership for CPTE, creating an independent producer on the Belgian Market with a capacity of 1,600 MW. |

| |

March to October 2003 | | Italy |

| |

| | | • Electrabel strengthened its holdings in Acea, a leading company in the Italian electricity and water market, majority controlled by the City of Rome (51%), to bring the Group’s total stake to 2.6%. This stake consolidates the strategic cooperation agreement signed in 2002 in the electricity trading, marketing, and production segments. |

| |

May 2003 | | France |

| |

| | | • Since May 1, Electrabel has purchased all of the electricity output (773 MW produced by 49 hydroelectric plants) of Société Hydroélectrique du Midi (SHEM) as well as managing its generation operations. SHEM’s peak capacity is a valuable supplement to the energy that Electrabel sells within Energie du Rhône. |

| |

June 2003 | | Belgium |

| |

| | | • In June 2003, Electrabel inaugurated its first wind facility in Wallonia. This is the company’s largest wind facility in Belgium in terms of installed power (8 MW). |

| |

July 2003 | | Belgium |

| |

| | | • Between July 4, 2003 and January 16, 2004, within the framework of the electricity distribution operations and the separation of network management activities from sales to eligible customers, the Competition Board approved Electrabel’s acquisition of the sales operations to eligible customers in the mixed inter-municipal entities in Wallonia and Flanders. These activities are performed within an ad hoc legal vehicle controlled by Electrabel: Electrabel Customer Solutions. |

| |

| | | • The first mixed inter-municipal entities were officially designated as Distribution Network Managers (GRD) for their respective territories. |

| |

August 2003 | | Poland |

| |

| | | • Electrabel increased its interest in the Polaniec electric plant by 38.96% at the end of December 2002, and further increased its interest to 100% at the end of August 2003. |

| |

| | | Belgium |

| |

| | | • Fluxys LNG began negotiations with shippers interested in obtaining capacity at the LNG terminal in Zeebrugge after 2006. As a result, it may be necessary to double the terminal’s capacity. |

| |

November 2003 | | • Fluxys and GTS (the transport branch of Gasunie) reached an agreement for the industrial participation of Fluxys in the project to construct a gas pipeline that would connect Balgzand (Netherlands) to Bacton (United Kingdom) and be in service in 2006-2007. |

21

| | |

| | | Portugal |

| |

| | | • Generg, Electrabel’s Portuguese subsidiary (42.5% owned by the Group) commissioned a wind farm with a total capacity of 13MW in Vergao (northeast of Lisbon). This project is part of a general development plan in Portugal for 450 MW. |

| |

December 2003 | | Belgium |

| |

| | | • Electrabel, which had agreed to make available the equivalent of 1,200 MW of production capacities on the Belgian market for potential buyers, organized the first capacity auctions for 250 MW. |

| |

| | | France |

| |

| | | • Electrabel finalized the acquisition of shares in the Compagnie Nationale du Rhône (CNR) held by EDF, and acquired the CNR shares held by the Chamber of Commerce and Industry for Villefranche and Beaujolais. Following these transactions, Electrabel holds 47.88% of the capital of CNR. All these operations give Electrabel the resources to continue to develop on the French market and strengthen the strategic cooperation agreement between Electrabel and CNR. |

|

| Electricity & Gas International |

| |

January 2003 | | Thailand |

| |

| | | • The Bowin electrical power plant began commercial operation to provide a total capacity of 713 MW to EGAT (Electricity Generating Authority of Thailand). |

| |

February 2003 | | Mexico |

| |

| | | • Tractebel Mexico inaugurated a new power plant for the cogeneration of 245 MW in the city of Monterrey. Energy will be provided to 38 industrial facilities under 15-year supply contracts. |

| |

May 2003 | | Abu Dhabi |

| |

| | | • Inauguration of the power production and water desalination plant in Al Taweelah, which totals 1,360 MW of electrical capacity and 385,000 m3 of water per day. The facility represents approximately 25% of the total production of electricity and water for the Emirate. |

| |

June 2003 | | United States |

| |

| | | • Tractebel LNG North America LLC, operator of the first LNG import terminal in the United States, in Everett, Massachusetts, and the ship-owner Bergesen announced the launching of Berge Everett, a new liquefied natural gas 138,000 m3 tanker, chartered by the Group. |

| |

September 2003 | | • Contract signed with Statoil to supply 36 million MMBtu/year of LNG to Statoil Natural Gas LLC at the LNG terminal in Cove Point, Maryland (USA). |

22

| | |

| | | Peru |

| |

| | | • Tractebel LNG and Peru LNG signed a Memorandum of Understanding, which provides for the annual supply of 2.7 million metric tons of LNG over a period of 18 years; EGI will ship LNG from Melchorita, Peru to Mexico. |

| |

November 2003 | | United States |

| |

| | | • Tractebel North America commissioned the Chehalis 520 MW electrical plant. |

| |

December 2003 | | Singapore |

| |

| | | • EGI finalized the sale of its minority interests in three Singaporean joint ventures to its partner SembCorp Utilities Pte Ltd for approximately €93 million. This operation generated a capital gain of €40 million. |

|

| Industrial & Energy Services |

| |

January 2003 | | France |

| |

| | | • Naturfruit, a subsidiary of Danone and the Italian group San Benetto, signed a contract with Elyo to provide utilities for its new industrial site. The €11.5 million contract is for 10 years. |

| |

| | | France |

| |

| | | • BP France and Elyo signed a 5-year facilities management contract for €11.3 million for its 12,000 m2 corporate headquarters in Cergy-Pontoise. |

| |

| | | Belgium |

| |

| | | • Axima Services begins a 10-year contract for more the €20 million for the technical management of the Sidmar site in Zelzaete (Belgium). |

| |

| | | Spain |

| |

| | | • Tractebel Gas Engineering signed an engineering procurement construction (EPC) contract with Regonasa for the construction of an LNG terminal in La Coruña, Spain, including two 150,000 m3 storage reservoirs and unloading and distribution facilities. |

| |

March 2003 | | India |

| |

| | | • CORYS T.E.S.S. (the French subsidiary of Tractebel Engineering specializing in simulation) signed a contract with Indian Railways for the turnkey supply of train-performance simulators. |

| |

April 2003 | | French Polynesia |

| |

| | | • Electricité de Tahiti (EDT), a subsidiary of Elyo, equipped the Punaruu electrical plant with two new units of 17 MWe each. |

23

| | |

May 2003 | | France |

| |

| | | • Elyo won a contract to manage energy and utilities for a period of 10 years with COOP D’OR STL for a total amount of €21 million. |

| |

| | | Norway |

| |

| | | • Fabricom S.A. won a contract (approximately 800,000 man-hours of work) to supply 56 modules to the Statoil liquefaction plant to be built on Melkøya Island, near Hammerfest, the northernmost city of Norway. |

| |

June 2003 | | France |

| |

| | | • Elyo supplied energy fluids and multi-technical services to the Philips cathode tube production site in Dreux. |

| |

September 2003 | | Belgium |

| |

| | | • Belgatom, a subsidiary of SUEZ-TRACTEBEL, and Belgonucleaire, provide acceptance and start-up of a facility (Building 280) designed for the recovery, treatment, and conditioning of ‘historical’ radioactive waste stored at Site 2 of Belgoprocess, after providing the final radiological specifications. |

| |

| | | United Kingdom |

| |

| | | • Lehman Brothers extended the initial technical maintenance management of its headquarters in London with Elyo Services. This contract represents revenues of €14.4 million over 9 years. |

| |

| | | China |

| |

| | | • Coyne et Bellier, a French subsidiary of Tractebel Engineering, specializing in dams, was awarded the contract to supervise the dam and hydroelectric plant work in Zhongliang, China. |

| |

October 2003 | | Italy |

| |

| | | • Elyo Italia and Rockwood, Italia, the second-largest European manufacturer of natural pigments for industry, signed a 15-year contract for €91 million to provide maintenance management and thermal and electrical energy at its site in Turin. |

| |

November 2003 | | France |

| |

| | | • Elyo opened the technical center for the Airbus site in Toulouse (France) after 15 months’ work. |

| |

December 2003 | | Portugal |

| |