Filed by: SUEZ

pursuant to Rule 425 under the Securities Act of 1933

Subject Company: SUEZ

Exchange Act File Number: 001-15232

Date: May 22, 2006

Important Information

This communication does not constitute an offer to purchase or exchange or the solicitation of an offer to sell or exchange any securities of Suez or an offer to sell or exchange or the solicitation of an offer to buy or exchange any securities of Gaz de France, nor shall there be any sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares to be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration.

In connection with the proposed business combination, the required information document will be filed with theAutorité des marchés financiers (“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus. Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information. If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site at (www.sec.gov) and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website at (www.amf-france.org) or directly from Gaz de France on its web site at: (www.gazdefrance.com) or directly from Suez on its website at: (www.suez.com), as the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about Gaz de France, Suez and their combined businesses after completion of the proposed business combination. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with theAutorité des marchés financiers (“AMF”) made by Gaz de France and Suez, including those listed under “Facteurs de Risques” in theDocument de Base filed by Gaz de France on April 1, 2005 (under no: I.05-037) and in theDocument de Référence and its update filed by Suez on April 14, 2005 (under no: D.05-0429) and September 7 (under no: D.05-0429-A01), respectively, theNote d’opération filed by Suez on September 7, 2005 under no 05-673, and theNote d’opération filed by Suez on November 24, 2005 under no 05-810, as well as under “Risk Factors” in the Annual Report on Form 20-F for 2004 that Suez filed with the SEC on June 29, 2005. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements.

THE FOLLOWING IS A SPECIAL EDITION OF THE SUEZ IN HOUSE MAGAZINE

DEDICATED TO THE PROPOSED SUEZ-GAZ DE FRANCE MERGER

TERRE BLEUE

The SUEZ in house magazine - Special edition - April 2006

THE PROPOSED SUEZ–GAZ DE FRANCE MERGER

A European champion and a world player

in Energy and the Environment

2005 ANNUAL RESULTS

First-class operating performance

DISCLAIMER

IMPORTANT INFORMATION

This communication does not constitute an offer to purchase or exchange or the solicitation of an offer to sell or exchange any securities of SUEZ or an offer to sell or exchange or the solicitation of an offer to buy or exchange any securities of Gaz de France, nor shall there be any sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and SUEZ disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares to be issued in connection with the proposed business combination to holders of SUEZ ordinary shares (including SUEZ ordinary shares represented by SUEZ American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration.

In connection with the proposed business combination, the required information document will be filed with the Autorité des marchés financiers (“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus. Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information. If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site at www.sec.gov and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of SUEZ securities may obtain free copies of documents filed with the AMF at the AMF’s website at www.amf-france.org or directly from Gaz de France on its web site at: www.gazdefrance.com or directly from SUEZ on its website at: www.suez.com, as the case may be.

FORWARD-LOOKING STATEMENTS

This communication contains forward-looking information and statements about Gaz de France, SUEZ and their combined businesses after completion of the proposed business combination. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and SUEZ believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and SUEZ ordinary shares are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and SUEZ, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the Autorité des marchés financiers (“AMF”) made by Gaz de France and SUEZ, including those listed under “Facteurs de Risques” in the Document de Base filed by Gaz de France on April 1, 2005 (under no: I.05-037) and in the Document de Référence and its update filed by SUEZ on April 14, 2005 (under no: D.05-0429) and September 7 (under no: D.05-0429-A01), respectively, the Note d’opération filed by SUEZ on September 7, 2005 under no 05-673, and the Note d’opération filed by SUEZ on November 24, 2005 under no 05-810, as well as under “Risk Factors” in the Annual Report on Form 20-F for 2004 that SUEZ filed with the SEC on June 29, 2005. Except as required by applicable law, neither Gaz de France nor SUEZ undertakes any obligation to update any forward-looking information or statements.

2 | | TERREBLEUE - SPECIALEDITION - APRIL 2006 |

CONTENTS

THE PROPOSED SUEZ–GAZ DE FRANCE MERGER

A European champion and a world player

in Energy and the Environment

14

2005 annual results First-class operating performance

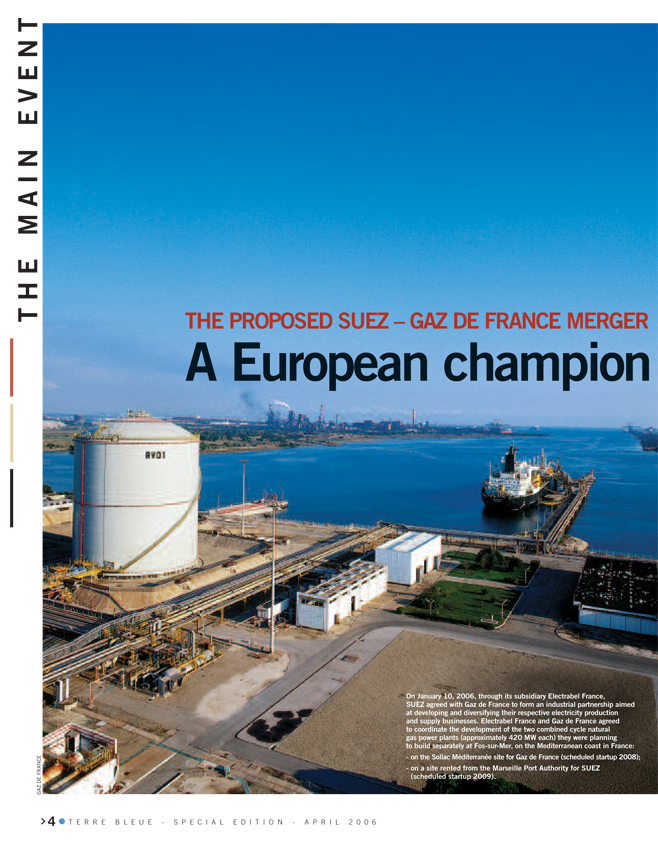

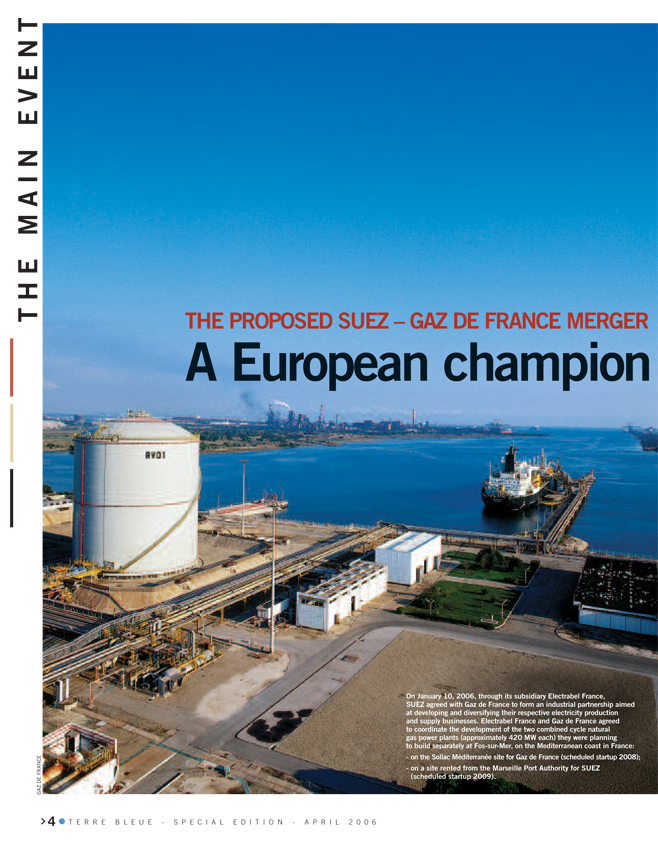

Gaz de France terminal at Fos-sur-Mer (France)

Gérard Mestrallet, Chairman and CEO of SUEZ, and Jean-François Cirelli, Chairman of Gaz de France, at the press conference announcing the plan to merge the two Groups

P.4 – 13 THE MAIN EVENT

THE PLANNED SUEZ–GAZ DE FRANCE MERGER: A European champion and a world player in Energy and the Environment

SUEZ had been exploring the feasibility of a strategic alliance with Gaz de France for months. The aim: to create a front-rank European player in Energy and the Environment. Today this vision is on the point of being fulfilled. Gérard Mestrallet, Chairman and Chief Executive Officer of SUEZ, explains.

The new Group worldwide

The new SUEZ–Gaz de France entity will have its roots in France and Belgium, with positions of strength elsewhere in Europe and the rest of the world. The story told in pictures.

10 good reasons for the merger

The challenges facing the new Group will be to secure plentiful energy supplies, and natural gas / electricity convergence. SUEZ has been addressing the latter for more than 10 years now, in its drive to promote energy efficiency.

P.14 – 15 RESULTS

2005 annual results

First-class operating performance

TERRE BLEUE The SUEZ in house magazine Special edition

Published by SUEZ Corporate Communications – 16, rue de la Ville-l’Évêque, 75008 Paris – France – Phone: 33 (0) 1 40 06 64 07 – Fax: 33 (0) 1 40 06 67 55 –N° ISSN 1268 9130 – Deposited with the French National Library at date of publication. Publisher Valérie Bernis.

Editorial director Jacques Van Hee. Editor-in-chief Élisabeth Richard. Contributors

Finance Division (SUEZ), Department of Legal Affairs (SUEZ). Designed and produced by

19, rue Galilée, 75116 Paris – France – Phone: 33 (0) 1 53 57 60 60.

Coordination ByTheWayCreacom Anne Brunet.

Written by Carol Galand.

Photo credits

Front: Angelini Design, Getty Images (Rosemary Calvert, David Trood, LWA). Back covers: Angelini Design.

Picture editor: Anne Bidegaray.

Printed by Mercure Graphic.

Print run

135,000 copies (French, English, Spanish, Portuguese, Dutch, German).

“The articles in this issue of Terre Bleue were written between March 1 and 30, 2006. The information published herein is presented as known at the time at which it was received (and not necessarily at the date of publication) and the Group gives no undertaking to update or revise it in light of new information received, future events or for any other reason whatever. The financial data concerning the Group is drawn from the documents registered by SUEZ with the French Financial Markets Authority (AMF).”

THE MAIN EVENT

On January 10, 2006, through its subsidiary Electrabel France,

SUEZ agreed with Gaz de France to form an industrial partnership aimed at developing and diversifying their respective electricity production and supply businesses. Electrabel France and Gaz de France agreed to coordinate the development of the two combined cycle natural gas power plants (approximately 420 MW each) they were planning to build separately at Fos-sur-Mer, on the Mediterranean coast in France: - on the Sollac Méditerranée site for Gaz de France (scheduled startup 2008); - on a site rented from the Marseille Port Authority for SUEZ

(scheduled startup 2009).

4 | | TERRE BLEUE - SPECIAL EDITION - APRIL 2006 |

“This is a concerted merger, one both companies wanted.

We share a great many values, and for both of us our identity is bound up with sustainable development.”

GÉRARD MESTRALLET

CHAIRMAN AND CHIEF

EXECUTIVE OFFICER

SUEZ had been exploring the feasibility of a strategic alliance with Gaz de France for months. The aim: to create a front-rank European player in Energy and the Environment. Today this vision is on the point to coming into being. Gérard Mestrallet, Chairman and Chief Executive Officer of SUEZ, explains.

TERRE BLEUE: HOW DID THIS PROPOSED MERGER BETWEEN GAZ DE FRANCE AND SUEZ COME ABOUT? GÉRARD MESTRALLET: The pace of change on the European energy scene has accelerated recently. We have been keeping a close watch on events, obviously. But we didn’t wait on them to frame and implement our own strategy for the European energy market. Over several months, the Board of Directors has been encouraging me to explore the possibility of a strategic tie-up with Gaz de France, combining the two Groups’ assets to create a European leader and a global player in energy and the environment. On December 6, 2005, SUEZ closed its combined public tender offer for Electrabel, launched in August. Then, on January 26 of this year, SUEZ and Gaz de France announced their agreement to form an industrial partnership to develop two combined cycle natural gas power plants with a capacity of around 420 MW each, to be built at Fos-sur-Mer near Marseille, in southern France. These are scheduled for startup in 2008 (for the Gaz de France project) and 2009 (for SUEZ). The announcement confirmed SUEZ’s French electricity market ambitions and showed clearly that our two companies were already working together. SUEZ had also clearly signaled its intention to figure among the European leaders in Energy and the Environment. This intention was restated forcefully on February 26 of this year, when the Boards of SUEZ and Gaz de France approved the plan for a friendly merger between the two firms. The result is an industrial operation with major consequences for the Energy and Environment scene in Europe.

TERRE BLEUE: WHAT ARE THE AIMS OF THE PROPOSED MERGER OF THE TWO FIRMS?

GÉRARD MESTRALLET: The merger is a logical extension of our development strategy and our vision of the industry, and the same applies to Gaz de France. This operation is entirely in line with the strategic ambitions of both Groups and will help drive forward those ambitions. It represents an unparalleled strategic fit in terms of our respective employees’ know-how and skills as well as our assets, establishing the new entity as one of the world leaders in Energy and the Environment, with a strong Franco-Belgian identity.

THE PROPOSED SUEZ – GAZ DE FRANCE MERGER

A European champion and a world player

in Energy and the Environment

THE MAIN EVENT

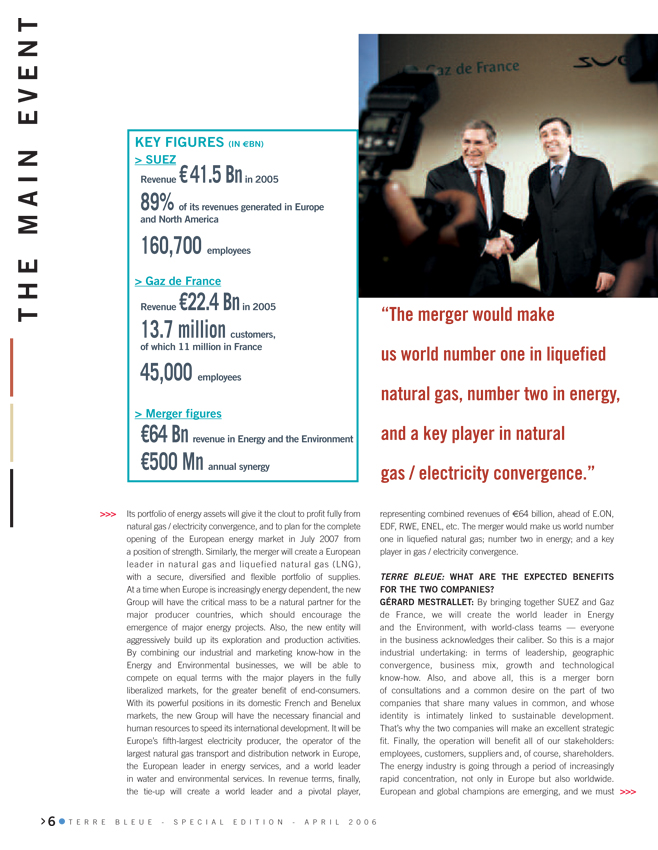

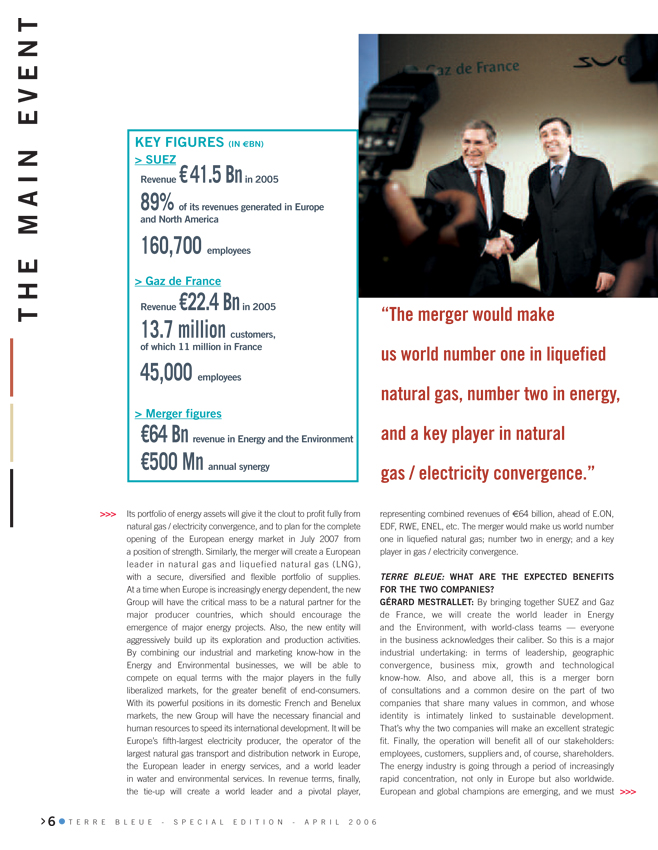

KEY FIGURES (IN €BN)

SUEZ

Revenue €41.5 Bn in 2005

89% of its revenues generated in Europe and North America

160,700 employees

Gaz de France

Revenue €22.4 Bn in 2005

13.7 million customers,

of which 11 million in France

45,000 employees

Merger figures

€64 Bn revenue in Energy and the Environment €500 Mn annual synergy

Its portfolio of energy assets will give it the clout to profit fully from natural gas / electricity convergence, and to plan for the complete opening of the European energy market in July 2007 from a position of strength. Similarly, the merger will create a European leader in natural gas and liquefied natural gas (LNG), with a secure, diversified and flexible portfolio of supplies. At a time when Europe is increasingly energy dependent, the new Group will have the critical mass to be a natural partner for the major producer countries, which should encourage the emergence of major energy projects. Also, the new entity will aggressively build up its exploration and production activities. By combining our industrial and marketing know-how in the Energy and Environmental businesses, we will be able to compete on equal terms with the major players in the fully liberalized markets, for the greater benefit of end-consumers. With its powerful positions in its domestic French and Benelux markets, the new Group will have the necessary financial and human resources to speed its international development. It will be Europe’s fifth-largest electricity producer, the operator of the largest natural gas transport and distribution network in Europe, the European leader in energy services, and a world leader in water and environmental services. In revenue terms, finally, the tie-up will create a world leader and a pivotal player,

“The merger would make us world number one in liquefied natural gas, number two in energy, and a key player in natural gas / electricity convergence.”

representing combined revenues of €64 billion, ahead of E.ON, EDF, RWE, ENEL, etc. The merger would make us world number one in liquefied natural gas; number two in energy; and a key player in gas / electricity convergence.

TERRE BLEUE: WHAT ARE THE EXPECTED BENEFITS FOR THE TWO COMPANIES?

GÉRARD MESTRALLET: By bringing together SUEZ and Gaz de France, we will create the world leader in Energy and the Environment, with world-class teams - everyone in the business acknowledges their caliber. So this is a major industrial undertaking: in terms of leadership, geographic convergence, business mix, growth and technological know-how. Also, and above all, this is a merger born of consultations and a common desire on the part of two companies that share many values in common, and whose identity is intimately linked to sustainable development. That’s why the two companies will make an excellent strategic fit. Finally, the operation will benefit all of our stakeholders: employees, customers, suppliers and, of course, shareholders. The energy industry is going through a period of increasingly rapid concentration, not only in Europe but also worldwide. European and global champions are emerging, and we must

6 | | TERRE BLEUE - SPECIAL EDITION - APRIL 2006 |

Gérard Mestrallet, Chairman and CEO of SUEZ, and Jean-François Cirelli, Chairman of Gaz de France, at the press conference announcing the plan to merge the two Groups.

The portfolio of energy assets, situated mainly in France and Belgium, will allow us to profit fully from natural gas / electricity convergence in terms of supplying gas for electricity generation and developing a combined gas and electricity offering for customers.

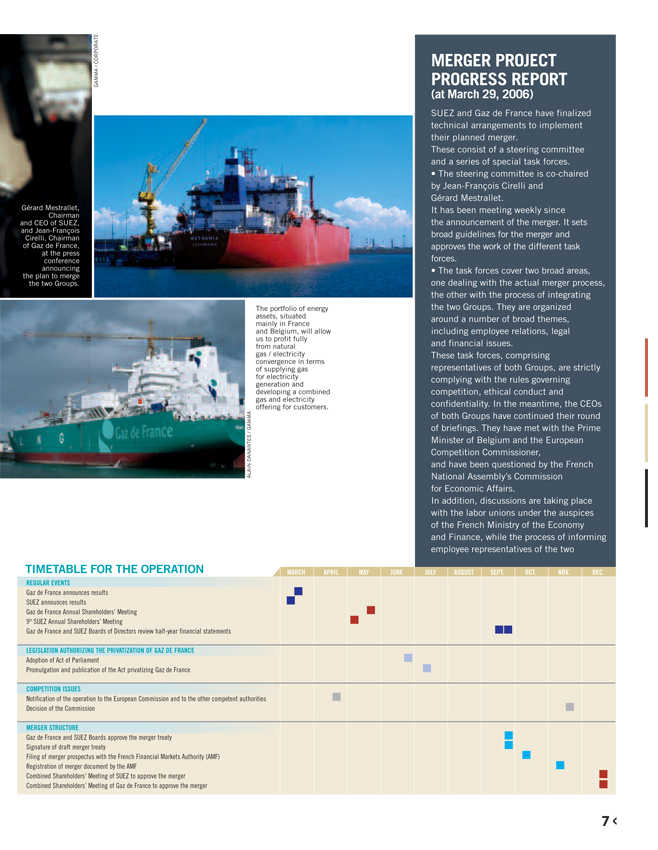

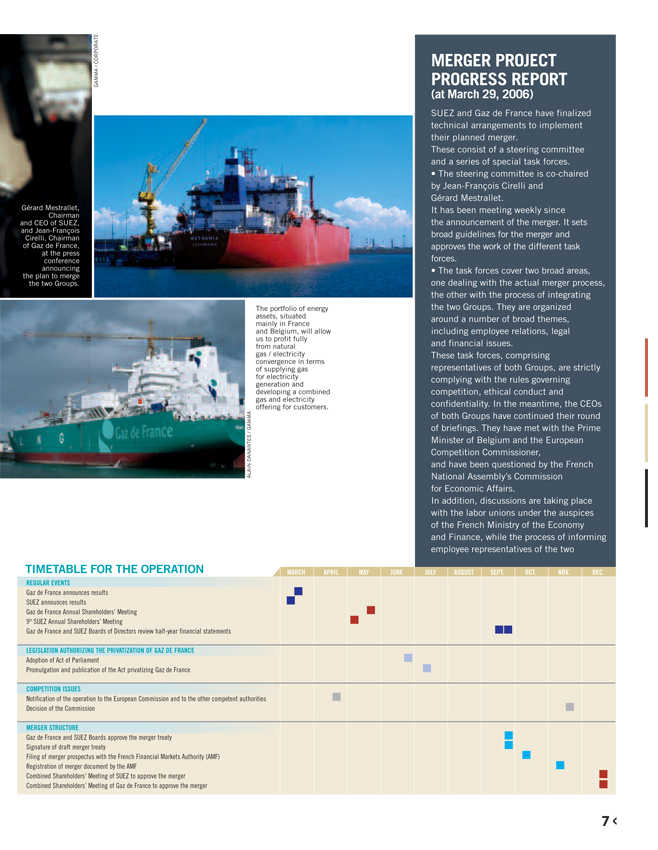

MERGER PROJECT PROGRESS REPORT

(at March 29, 2006)

SUEZ and Gaz de France have finalized technical arrangements to implement their planned merger.

These consist of a steering committee and a series of special task forces. The steering committee is co-chaired by Jean-François Cirelli and Gérard Mestrallet.

It has been meeting weekly since the announcement of the merger. It sets broad guidelines for the merger and approves the work of the different task forces.

The task forces cover two broad areas, one dealing with the actual merger process, the other with the process of integrating the two Groups. They are organized around a number of broad themes, including employee relations, legal and financial issues.

These task forces, comprising representatives of both Groups, are strictly complying with the rules governing competition, ethical conduct and confidentiality. In the meantime, the CEOs of both Groups have continued their round of briefings. They have met with the Prime Minister of Belgium and the European Competition Commissioner, and have been questioned by the French National Assembly’s Commission for Economic Affairs.

In addition, discussions are taking place with the labor unions under the auspices of the French Ministry of the Economy and Finance, while the process of informing employee representatives of the two

TIMETABLE | | FOR THE OPERATION MARCH APRIL MAY JUNE JULY AUGUST SEPT. OCT. NOV. DEC. |

Gaz | | de France announces results |

Gaz | | de France Annual Shareholders’ Meeting |

9th | | SUEZ Annual Shareholders’ Meeting |

Gaz | | de France and SUEZ Boards of Directors review half-year financial statements |

LEGISLATION | | AUTHORIZING THE PRIVATIZATION OF GAZ DE FRANCE |

Adoption | | of Act of Parliament |

Promulgation | | and publication of the Act privatizing Gaz de France |

Notification | | of the operation to the European Commission and to the other competent authorities |

Decision | | of the Commission |

Gaz | | de France and SUEZ Boards approve the merger treaty |

Signature | | of draft merger treaty |

Filing | | of merger prospectus with the French Financial Markets Authority (AMF) |

Registration | | of merger document by the AMF |

Combined | | Shareholders’ Meeting of SUEZ to approve the merger |

Combined | | Shareholders’ Meeting of Gaz de France to approve the merger |

THE MAIN EVENT

The merger is a major industrial undertaking in terms of geographic convergence, leadership, business mix, growth and technological know-how.

PRESERVING JOBS, A MAJOR PRIORITY

The merger will benefit shareholders and customers, to be sure, but it will benefit all employees of both companies as well. In fact, it will even create jobs. That is because the new Group will have the resources and scale needed to pursue very ambitious growth goals, creating jobs without jeopardizing existing ones. Gaz de France will thus be able to fulfill its public service obligations, and the terms of employment of personnel at either Gaz de France or SUEZ will be utterly unaffected. Similarly, while the process now underway will strengthen the new entity in the energy sector, it will also create exciting growth opportunities in the environmental business. All these factors help explain why this is a friendly merger sought by both SUEZ and Gaz de France, two companies that share many common values and whose identity is closely linked to sustainable development.

Every day, Elyo designs energy services and manages them for the long term, with guaranteed performance. Elyo develops optimized solutions at its customers’ sites (businesses, local governments, and managers of institutional and residential sites), contributing to the preservation of the environment.

Collecting household waste in the Czech Republic.

8 | | TERRE BLEUE - SPECIAL EDITION - APRIL 2006 |

THE ENVIRONMENT, LYNCHPIN OF THE NEW GROUP

Sustainable, profitable growth in the Energy and Environmental businesses has been SUEZ’s strategic priority ever since its origin.

The same goes for Gaz de France.

Moreover, SUEZ full realizes the need to stay true to its growth model based on solid sales networks in the field, deep local roots, and a strong corporate culture.

While the process now set in motion will greatly bolster the role of Energy, the Environmental businesses will remain central to the activities of the new entity.

respond appropriately. That is what our company did when it took a 100% stake in Electrabel. We showed the way, ideally placing ourselves to become a world leader at the first opportunity. Now the opportunity has arisen, and the new Group in the making will position France and Belgium strongly in the energy market. I have long urged the pursuit of this vision, and now it is poised to come into being. ENEL’s hostile bid for SUEZ would have led to the break up of the Group, particularly the split up of its Energy and Environmental divisions. The French Government, with the full backing of the Belgian Government, has opted to accelerate the merger process, and the Board of Directors together with the main shareholders have given the go-ahead too. Needless to say, we will honor in full the commitments we made to the Belgian Government at the time of the Electrabel bid, and we will push ahead with the plan to develop the Zeebrugge terminal. Similarly, we will maintain SUEZ’s activities in Belgium and uphold the Franco-Belgian spirit embodied in SUEZ–Electrabel.

TERRE BLEUE: THE MERGER WILL PUT ENERGY AT THE CENTER OF THE GROUP’S STRATEGY. WILL THE ENVIRONMENT REMAIN A PRIORITY ALL THE SAME? GÉRARD MESTRALLET: Our strategy has always strived for sustainable and profitable development in both Energy and the Environment. That has been our guiding vision ever since the Group’s origins, and we have never wavered in that. This is our goal and our strength. Our businesses are the businesses of tomorrow, and we are proud of that. Obviously the process in hand will greatly strengthen us in the Energy sector. Nevertheless, the creation of this new Group opens up exciting growth prospects for our Environmental businesses as well. And I must point out, too, that Gaz de France has never once questioned the place of the Environmental sector within the new Group - for the simple reason that it has always been part of our plan. Having formulated our project in full consultation with the labor unions, we are now entering a phase where we will all have to work hard to make it a success. The world is changing fast, and only by working together can we successfully build a position of strength from which to deliver an ambitious energy policy. Labor and employee representatives have consistently shown their deep commitment to that approach. Today our focus is firmly on the future, with two companies forming a strong strategic fit, with shared values and a plan that will create new jobs. At the same time, we remain faithful to our growth model, leveraging our strengths in the shape of our well-established sales forces in the field, our local roots, and a strong corporate culture. The coming weeks are going to be exciting and demanding. I am counting on all of you for your support and commitment.

9

THE MAIN EVENT

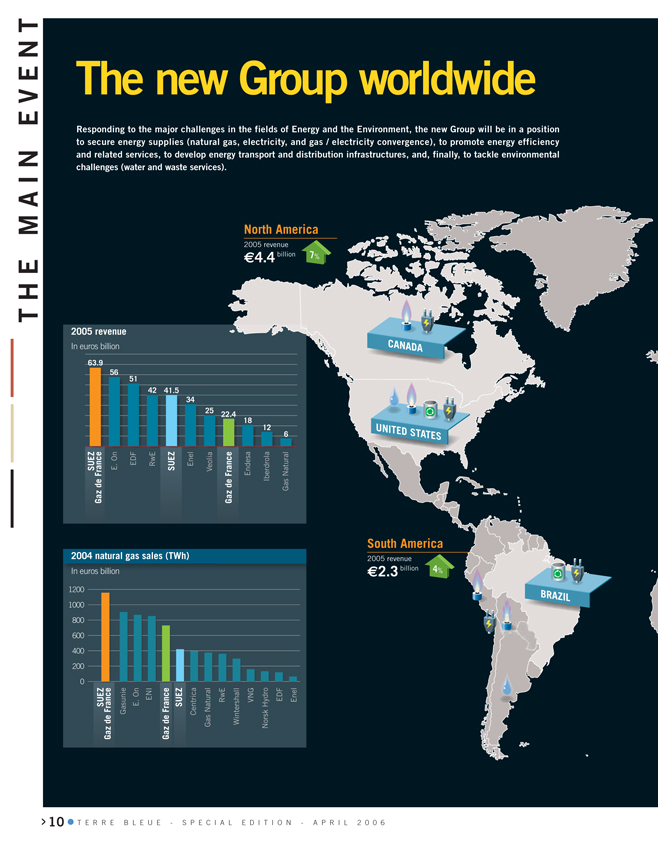

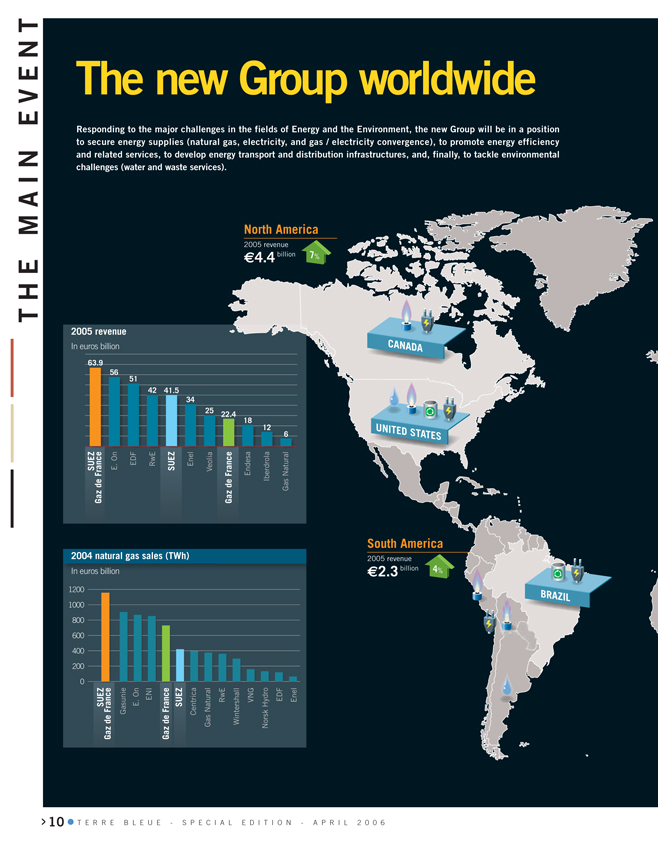

The new Group worldwide

Responding to the major challenges in the fields of Energy and the Environment, the new Group will be in a position to secure energy supplies (natural gas, electricity, and gas / electricity convergence), to promote energy efficiency and related services, to develop energy transport and distribution infrastructures, and, finally, to tackle environmental challenges (water and waste services).

North America

2005 revenue

€ 4.4 billion 7%

2005 revenue

In euros billion

63.9 56 51

42 41.5 34 25

22.4 18 12 6

On EDF RwE Enel Natural

SUEZ E. SUEZ Veolia

France France Endesa Iberdrola de de Gas Gaz Gaz

CANADA

UNITED S

TATES

0 200 400 600 800 1000 1200

SUEZ

Gaz de France In euros billion

Gasunie E. On ENI

Gaz de France

SUEZ 2004 natural gas sales (TWh)

Centrica Gas Natural RwE Wintershall VNG Norsk Hydro EDF

Enel

South America

2005 revenue

€2.3 billion 4%

BRAZIL

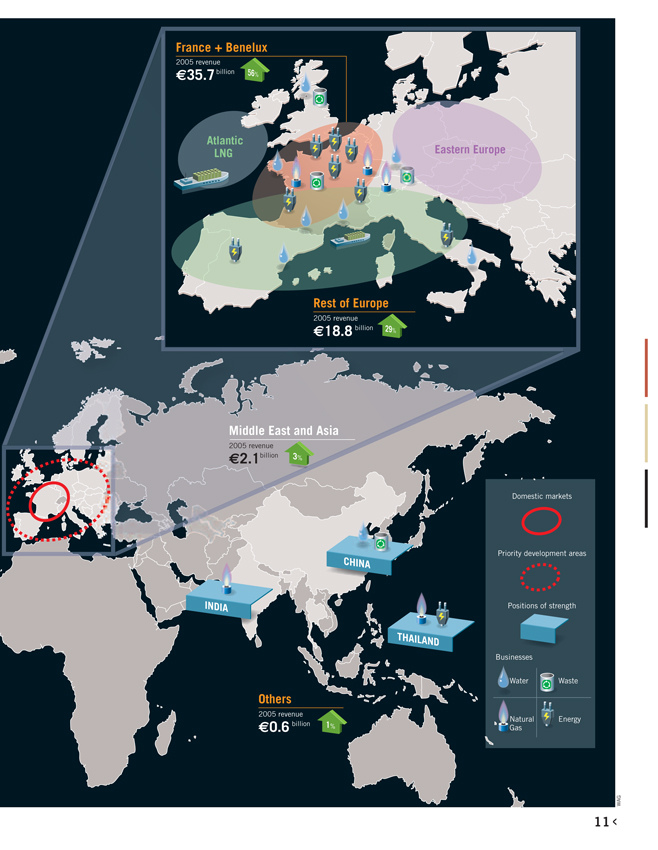

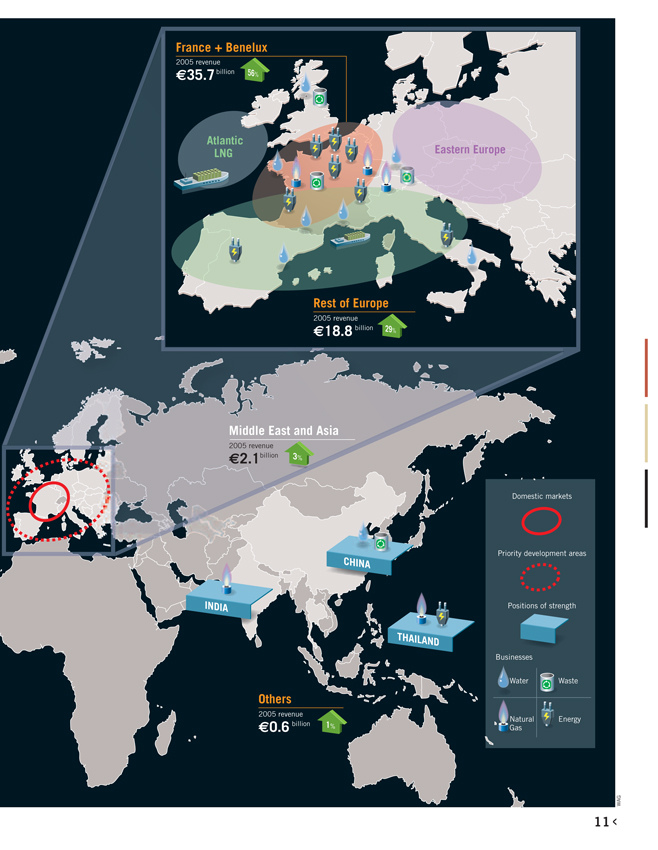

France + Benelux

2005 revenue

€35.7billion 56%

Atlantic LNG

Eastern Europe

Rest of Europe

2005 revenue

€18.8 billion 29%

Middle East and Asia

2005 revenue

€2.1billion 3%

CHINA

INDIA

Others

2005 revenue

€0.6 billion 1%

Domestic markets

Priority development areas

Positions of strength

Businesses

Water

Waste

Natural Gas

Energy

10 TERRE BLEUE - SPECIAL EDITION - APRIL 2006

THE MAIN EVENT

10 good reasons for the SUEZ-Gaz de France merger

The energy sector is in the process of extremely rapid consolidation, and the main challenges are to achieve secure, plentiful supplies of both gas and electricity. Another major challenge is the process of gas / electricity convergence, which SUEZ has been addressing for the past ten years with a view to promoting energy efficiency.

A COMMON STRATEGIC VISION

The SUEZ-Gaz de France merger is born of a joint determination to achieve the status of a major player of this market consolidation. The merger brings into being an actor with a leading competitive position in its markets, able to respond to the challenges it faces, an actor delivering service its customers. This project relies on a common strategic vision, building coherence for both Groups, continuing the rationale of the partnerships already in place. The planned merger is also part of the gas / electricity convergence pursued by both Groups, responding to customer expectations for combined gas/electricity offers, in fully liberalized markets. This merger is meaningful and leverages the good match between the two companies: the same culture of public and customer service, the same values rooted in sustainable development. This merger has been approved by the Boards of SUEZ and Gaz de France, and has the support of the major shareholders of the two Groups.

1 | | AND ENVIRONMENTAL BIRTH OF WORLD LEADER IN ENERGY |

As Europe’s leading gas purchaser, the new Group will be in a position of strength to negotiate with producer countries.

It will also be Europe’s leading gas supplier and industry player, as well as global leader in liquefied natural gas.

As Europe’s fifth ranked electricity producer, its production mix is highly diversified: hydro power, renewables, gas and nuclear – the new Group will have perfectly balanced resources at its disposal, making it the closest-tailored of all the major European players to market needs.

The new Group will also be Europe’s largest operator of CCGT power plants, a considerable advantage for a Group on the way to becoming Europe’s leading player in the gas industry.

It will be European leader in energy services of critical importance in this period of cost savings and high energy prices. The Group will provide its customers an active advisory service in the field of the rational use of energy.

The Group will also operate Europe’s largest gas transportation and distribution network.

Finally, the Group will be the global leader in water and waste services.

The new Group will be unchallenged as the European leader in its field 86% of its revenue being generated in Europe, 56% in France and Benelux.

Its roots in both markets are reinforced by extensive European and international market share. 29% of total revenues are generated in the rest of Europe. The Group is also present in North America (7% of revenues), in South America (where it is the leading private producer of electricity in Brazil), as well as in the Middle East, India, Thailand and China.

The new Group will be a European leader in services to local authorities, not only by revenue (No. 1), but also by stock market capitalization (No. 2).

3 | | AN AMBITIOUS INDUSTRIAL PROJECT |

This projected merger is the result of a common strategic vision, shared by both companies.

- Leadership ambition. To propel the new Group to European leadership in the fields of gas, electricity, services and the environment.

- Marketplace ambition. Territorial roots in the French-Belgian markets, supported by selective involvement in the global markets.

- Business development ambition. Balanced portfolio of activities to provide a highly attractive match between business lines, and a leading position at the heart of Europe in gas / electricity convergence. Control over resources, both in electricity thanks to nuclear, and in gas, where the new Group has the most diversified sources of procurement in Europe.

- Growth ambition. Substantial potential to build on existing market share in Europe, and in a limited number of significant global markets.

- Ambitious know-how. Common values, complementary know-how and technological leadership.

4 | | A BALANCED PORTFOLIO OF ACTIVITIES |

The new Group’s businesses will be highly coherent: balance between regulated and unregulated activities; upstream and downstream; gas and electricity.

12 TERREBLEUE - SPECIALEDITION - APRIL 2006

In environmental terms, the business portfolio is a low emitter of greenhouse gases.

Finally, the new Group will have real expertise in the nuclear field.

5 | | SUBSTANTIAL POTENTIAL FOR GROWTH AND DEVELOPMENT |

The strength of the SUEZ-Gaz de France merger is its potential for growth and development in all its businesses.

- On-going projects in energy include:

Gaz de France exploration-production projects

LNG, including projects for liquefaction plant and for additional terminals, serviced by its fleet of methane tankers…

Participation in the development of European infrastructures (Medagas pipeline between Algeria and Spain and the Baltic pipeline connecting Russia to Germany)…

Projects for electricity production, notably involving renewable energies…

- On-going projects in environmental services (water and waste) include:

Combined desalination and power projects in the Middle-East Determined development in Europe, whilst building on strong market share in North America, China and Australia Development of delegated management contracts and consultancy services on major international development projects

6 | | REINFORCED COMMERCIAL POSITIONS |

The new Group will be stronger in market terms, both in energy and water distribution, and in its other services to local authorities.

Servicing 80 million in drinking water, 65 million customers in waste, €20.2 million in gas and electricity, enjoying high profile brand names (SUEZ, Gaz de France, Gaz de France Dolcevita, Gaz de France Provalys, Electrabel, Sita, Lyonnaise des Eaux, Degrémont, Elyo, Cofathec, Savelys…), the new Group has the resources to develop an even more ambitious sales and marketing policy in response to customer expectations.

The Group is ready for the comprehensive liberalisation of the European energy markets in 2007.

7 | | A SOLID FINANCIAL STRUCTURE |

Financial profile of the combined entity

With combined revenues of €63.9 billion (SUEZ €41.5 billion; Gaz de France €22.4 billion), an EBITDA of €10.7 billion (SUEZ €6.5 billion and Gaz de France €4.2 billion), the new entity will rank among the very foremost European players in the Energy and Environment sectors. It will have a combined market capitalization of €72.9 billion (SUEZ €43.2 billion and Gaz de France €29.7 billion, based on spot share prices at 24/02/2006) and, finally, a Standard & Poor’s rating of A for SUEZ-Gaz de France (SUEZ: A- and Gaz de France AA - ).

8 | | A VALUE-CREATING MERGER AND JOBS |

The merger between the two Groups generates significant operational synergies, including in the short term:

€500 million expected in the first three years.

In the longer term, the merger will also generate other synergies notably tied to the new Group’s development opportunities wich are estimated at €500 million.

The new Group will put on all the more value as it is set to become the leading player in services to local authorities, and will be better diversified in terms of regulatory and geographical risks. The stock’s liquidity will also be enhanced.

The new Group will be ideally positioned as a major actor in the European job market.

9 FAIR PARITY

The merger parity is one Gaz de France share for one SUEZ share after payment of an extraordinary dividend of €1.

Parities have been set on the basis of classic multi-criteria analysis. This parity is within the range of average stock market ratios, over one month, three months and six months.

Share ownership in the new group will break down as 57% former SUEZ shareholders and 43% former Gaz de France shareholders.

The leading shareholder will be the French State, owning a stake of approximately 34%.

The merger will have have an accretive effect on earnings per share, recurrent and before depreciation of goodwill for the shareholders, both Gaz de France and SUEZ. The transaction will create value for the shareholders of both companies.

10 A STRONG COMMITMENT TO DIVIDENDS

The new Group’s financial management will be rigorous and dynamic. The new Group will benefit from considerable ability to generate free cash flow, and will serve to finance its growth-oriented investment policy and dynamic dividend distribution. The distribution policy will focus on offering competitive yields (dividends, share repurchase).

13

RESULTS

Further strong growth in Group earnings, with record net income Group share of €2.5 billion, a sound financial condition following the buyout of Electrabel’s minority interests, a host of commercial successes, and these trends are likely to continue in 2006… altogether a proud record for the past year, and bright prospects for the coming year.

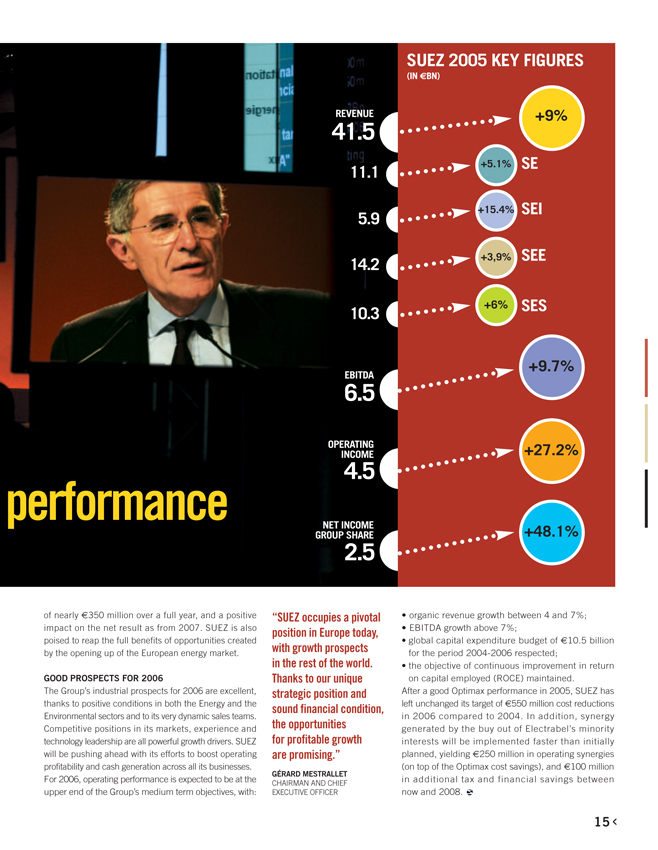

SUEZ reported sustained business growth in 2005, with revenues rising 9% (gross) to €41.5 billion. The Group also continued to improve its profitability and expand, while strengthening its balance sheet.

MEDIUM TERM OBJECTIVES EXCEEDED

All Group businesses contributed to the 6.3% organic growth in revenues, at the upper end of the Group’s medium term objectives.

With organic growth close to 4%, SUEZ Energy Europe (SEE) benefited from sharply increased market prices for electricity in Europe. Also, the growth in its activities outside the Benelux countries, especially in France, Germany and Italy, more than offset market share losses in Belgium. The conspicuous rise in SUEZ Energy International’s revenues (organic revenues up 15.4%) stemmed from surging growth in its main markets, higher electricity prices in Brazil, stronger demand in Thailand, and new opportunities in LNG.

The Installation and Maintenance businesses, in France especially, supported growth at SUEZ Energy Services (SES), with a 6% organic increase.

The Group’s Environment business registered highly encouraging trends in terms of activity levels (organic revenues advanced 5.1%), with Waste Services bouncing back in the fourth quarter.

Meanwhile, all Group business continued their drive to boost profitability, with a 9% organic rise in EBIDTA, far outpacing the organic growth in revenue. All sectors contributed to this strong performance, yielding an estimated €329 million in Optimax savings, well on the way to the Group’s 2-year (2005-2006) target of €550 million.

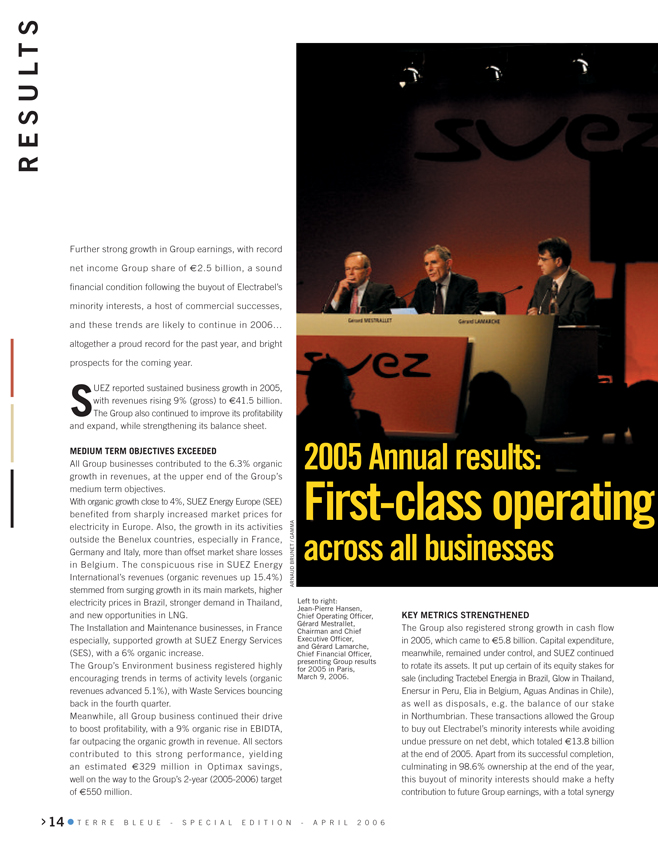

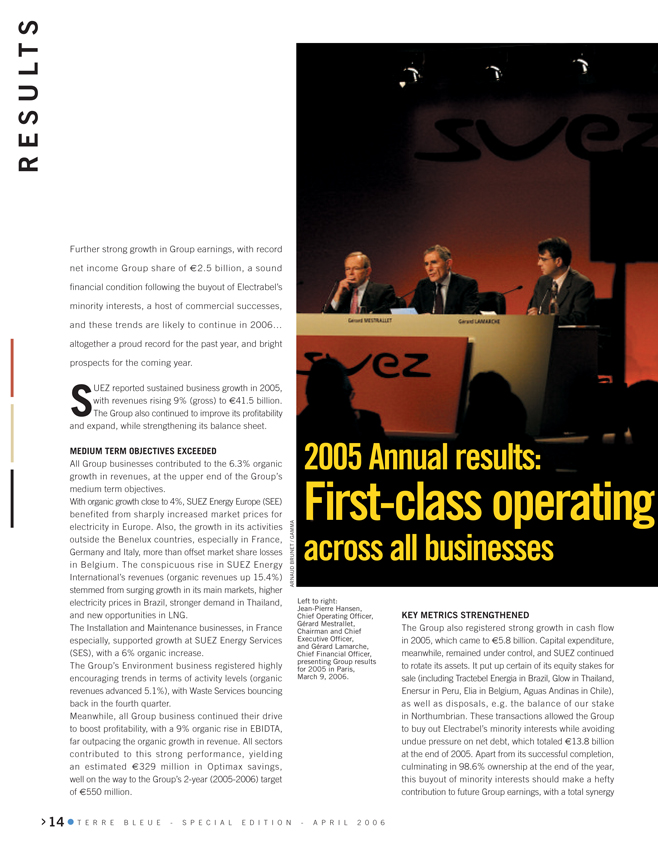

Left to right: Jean-Pierre Hansen, Chief Operating Officer, Gérard Mestrallet, Chairman and Chief Executive Officer, and Gérard Lamarche, Chief Financial Officer, presenting Group results for 2005 in Paris, March 9, 2006.

KEY METRICS STRENGTHENED

The Group also registered strong growth in cash flow in 2005, which came to €5.8 billion. Capital expenditure, meanwhile, remained under control, and SUEZ continued to rotate its assets. It put up certain of its equity stakes for sale (including Tractebel Energia in Brazil, Glow in Thailand, Enersur in Peru, Elia in Belgium, Aguas Andinas in Chile), as well as disposals, e.g. the balance of our stake in Northumbrian. These transactions allowed the Group to buy out Electrabel’s minority interests while avoiding undue pressure on net debt, which totaled €13.8 billion at the end of 2005. Apart from its successful completion, culminating in 98.6% ownership at the end of the year, this buyout of minority interests should make a hefty contribution to future Group earnings, with a total synergy

of nearly €350 million over a full year, and a positive impact on the net result as from 2007. SUEZ is also poised to reap the full benefits of opportunities created by the opening up of the European energy market.

GOOD PROSPECTS FOR 2006

The Group’s industrial prospects for 2006 are excellent, thanks to positive conditions in both the Energy and the Environmental sectors and to its very dynamic sales teams. Competitive positions in its markets, experience and technology leadership are all powerful growth drivers. SUEZ will be pushing ahead with its efforts to boost operating profitability and cash generation across all its businesses. For 2006, operating performance is expected to be at the upper end of the Group’s medium term objectives, with:

“SUEZ occupies a pivotal position in Europe today, with growth prospects in the rest of the world. Thanks to our unique strategic position and sound financial condition, the opportunities for profitable growth are promising.”

GÉRARD MESTRALLET

CHAIRMAN AND CHIEF EXECUTIVE OFFICER

organic revenue growth between 4 and 7%;

EBITDA growth above 7%;

global capital expenditure budget of €10.5 billion for the period 2004-2006 respected; the objective of continuous improvement in return on capital employed (ROCE) maintained.

After a good Optimax performance in 2005, SUEZ has left unchanged its target of €550 million cost reductions in 2006 compared to 2004. In addition, synergy generated by the buy out of Electrabel’s minority interests will be implemented faster than initially planned, yielding €250 million in operating synergies (on top of the Optimax cost savings), and €100 million in additional tax and financial savings between now and 2008.

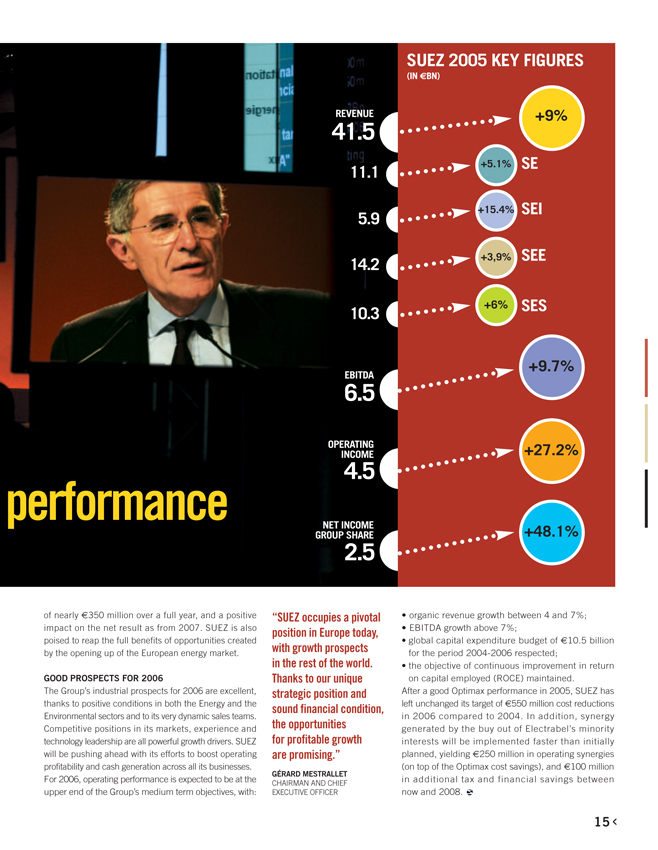

SUEZ 2005 KEY FIGURES

(IN €BN)

+9%

+5.1% SE

+15.4% SEI

+3,9% SEE

+6% SES

+9.7%

+27.2%

+48.1%

REVENUE

41.5

11.1 5.9 14.2 10.3

EBITDA

6.5

OPERATING

INCOME

4.5

NET INCOME GROUP SHARE

2.5

14 TERRE BLEUE - SPECIAL EDITION - APRIL 2006

15