FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of foreign Private Issuer

Pursuant to Rule 13a – 16 or 15d – 16 of

the Securities Exchange Act of 1934

For the month of March, 2007

Commission File Number : 1-15232

16, rue de la Ville l’Evêque,

75008 Paris-France

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (1):

Note: Regulation S-T Rule 101 (b) (1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (7):

Note: Regulation S-T Rule 101 (b) (7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rule of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

If « yes » is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

| | |

PRESS RELEASE March 8, 2007 Press Service 16 rue de la Ville l'Evêque 75008 Paris, France | |  |

2006 RESULTS

Strong growth in results

Promising outlook and accelerated industrial development

The Board of Directors meeting March 7, 2007, chaired by Gérard Mestrallet, approved the results for the financial year 2006. The accounts will be submitted for approval to the Annual General Shareholders’ Meeting, May 4, 2007.

|

Record results in 2006 : dividend +20 % |

l EBITDA: EUR 7.1 billion (+ 11.2% organic growth)

l Current operating income: EUR 4.5 billion (+ 15.9% organic growth)

l Net income group share: EUR 3.6 billion (+ 43.5%), a record high

l ROCE: 13% (10.7% at year-end 2005)

l Net debt: EUR 10.4 billion (EUR 13.8 billion in 2005)

| | - | All 2004-2006 performance targets exceeded. |

| | - | Dynamic contribution of all business lines to excellent results. |

| | - | Acceleration of organic growth in operating performance indicators. |

|

Streamlining and optimization of Group structure |

| | - | Buy out of remaining Electrabel shares (1.38%), for a total of EUR 445 million |

| | - | Planned sale to Electrabel of 100% of SUEZ-Tractebel |

|

Strong development prospect and value creation potential |

| | - | Accelerated industrial development: EUR 15 billion in investments, 2007-2009 |

| | o | 75,000 MW installed capacity in 2012 (52,000 MW in 2006), developments in nuclear, natural gas, and LNG |

| | o | Accelerated growth in environment activities (+ 6% to + 10% per year) |

| | - | Further improvements in operational and financial performance |

| | - | Shareholder return improvements |

| | o | Proposed ordinary dividend increase: + 20% (EUR 1.20/share) |

| | o | Dividend payout greater than 50% of recurring net income1 starting in 2007. |

| | - | Strengthened prospects with the planned merger with Gaz de France, a major opportunity |

Gérard Mestrallet, SUEZ Chairman and CEO, commented:“Our record-high 2006 results prove the strength of the SUEZ business model and the effectiveness of the strategy. All energy division activities recorded current operating income growth near or above 10%. The environment division reported current operating income in excess of EUR 1 billion, a sign of exceptional dynamism. On the basis of these record results, our unique positions in these two sectors, and the strong promising opportunities provided by our business environment, we have announced ambitious new objectives. SUEZ is accelerating its industrial development and responding to the world’s considerable requirements for clean and secure energy, as well as its needs in water and waste services. Together, they are among the world’s most pressing challenges. SUEZ strong prospects will be reinforced by the merger project with Gaz de France, a major project for the Group.”

1 Excluding capital gains in particular.

Page 1 sur 8

Record results in all businesses, backed by strong growth

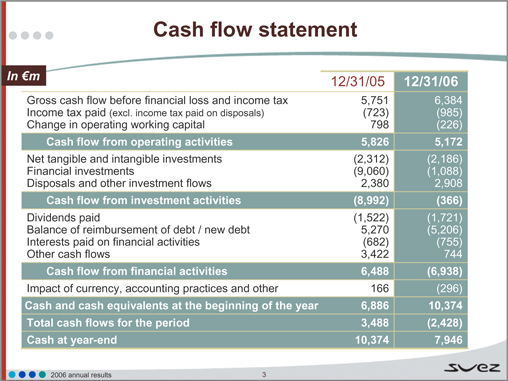

2006 was characterized by accelerated growth in Group results, with net income group share breaking records at EUR 3.6 billion; organic growth in EBITDA (+ 11.2%) outpaced organic growth in revenues (+ 8.2%), reflecting a further increase in profitability.

The rates of organic growth in revenues as well as EBITDA exceeded the Group’s (2004-2006) medium-term targets.

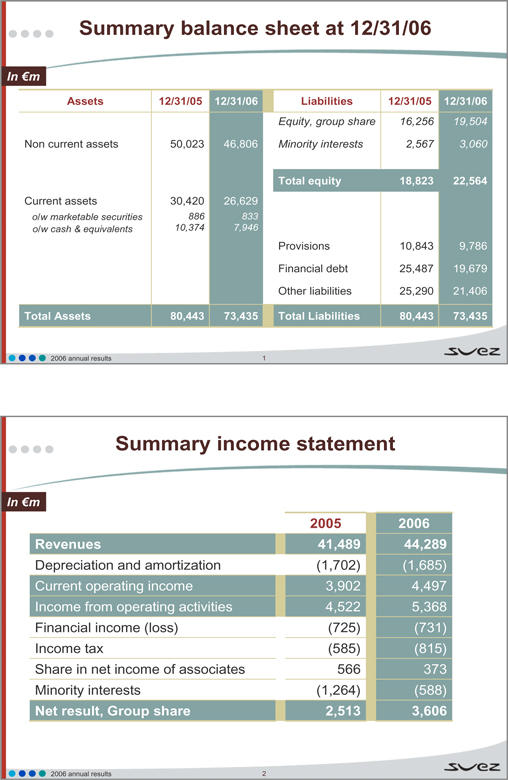

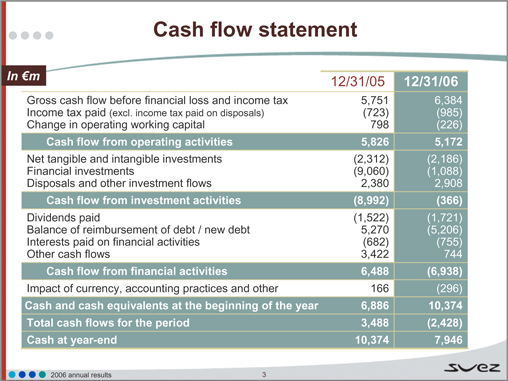

At December 31, 2006, net debt was EUR 10.4 billion, compared with EUR 13.8 billion at the end of 2005, representing 46.3% of shareholders’ equity at year-end 2006 (72% at December 31, 2005).

Revenues: acceleration in internal growth, + 11.3%

At December 31, 2006,after - EUR 1.7 billion in net impact of acquisitions and disposals, SUEZrevenueswere EUR 44.3 billion (versus EUR 41.5 billion at December 31, 2005), reflecting a high organic growth (excluding the positive impact of natural gas prices) rate of +8.2%, exceeding the announced objective of +7%, and recorded a net increase compared to last year. On a comparable structural and exchange rate basis, internal growth was +11.3%. This excellent performance reflects the Group’s commercial vitality.

EBITDA: further profitability improvement

Total EBITDAprogressed + 8.8% to EUR 7,083 million. In organic terms, on a comparable scope and exchange rate basis, EBITDA growth was + 11.2%. Along with continued cost reduction measures, the EBITDA improvement reflects a constant and sustained increase in Group profitability. EBITDA components break down as follows:

| | - | SUEZ Energy Europe (SEE): EUR 3,060 million, with organic growth of 9.2%. SEE’s growth contributions include fine operating results in electricity (good availability of power plants in the Netherlands and plant startups and repowering in Italy and Spain), in natural gas (commercial successes), and favorable market conditions despite regulatory taxes in Belgium. |

| | - | SUEZ Energy International (SEI): EUR 1,566 million, with sustained organic growth of + 17.1%. These very fine results are mainly due to strong growth in LNG activities, improvement in merchant plant activity, and commercial successes with commercial and industrial customers in the United States; advances in sales in Thailand; and new projects in the Middle East. |

| | - | SUEZ Energy Services (SES): EUR 591 million, with an organic growth rate of + 7.3%. The increase over 2005 is accounted for by commercial dynamism (installations and services in France, HVAC in Europe, and project engineering) and improved operating performance. |

| | - | SUEZ Environment (SE): EUR 1,983 million, with an organic growth rate of + 7.8%. This strong progression is explained mainly by new waste services contracts (including Zorbau, Spolana, Sleco, and SCIP) and water contracts (Vallauris, Briançon, and Dunkirk). These strong positions are bolstered by value-creating acquisitions and selective developments in low-capital intensive activities (services provided in Water in France, PFI UK, Water in China, and the Algiers contract). |

Current operating income: strong, balanced growth contributed by each business line

Current operating incomecame to EUR 4,497 million, reflecting strength in both total growth (+ 15.2%) as well as organic growth (+ 15.9%). Growth in current operating income outpaced growth in EBITDA, benefiting mainly from the Group’s operational developments and the strong advance of EBITDA in all business lines:

| | - | SEE: EUR 2,141 million, organic growth of + 9.5%. |

| | - | SEI: EUR 1,099 million, organic growth of + 45.7%. |

| | - | SES: EUR 392 million, organic growth of + 10.9%, twice as fast as revenues. |

| | - | SE: EUR 1,044 million, organic growth of + 7.3%. |

Page 2 sur 8

Net income group share achieved an historic high, at EUR 3.6 billion

Net income group share benefited from a sharp improvement inincome from operating activities, which rose 18.7% to EUR 5,368 million.

This figure includes capital gains from disposals for EUR 1,093 million (compared with EUR 1,530 million in 2005), and draws advantage from a strong improvement in the change in fair value of commodity derivatives, asset impairments, and restructuring costs. In addition, minority interests decreased by EUR 676 million, as a result of the combined public offer for Electrabel that closed December 6, 2005, and the 98.6% interest in Electrabel held throughout 2006. For 2006, this transaction had an accretive effect of + 4.6%, one year ahead of its initial target.

Further increase in Group profitability

Return on capital employed (ROCE) increased to + 13% versus + 10.7% at year-end 2005, to be compared with the weighted average cost of capital: 6.8%. ROCE of all business lines is on the rise.

Very sound financial profile

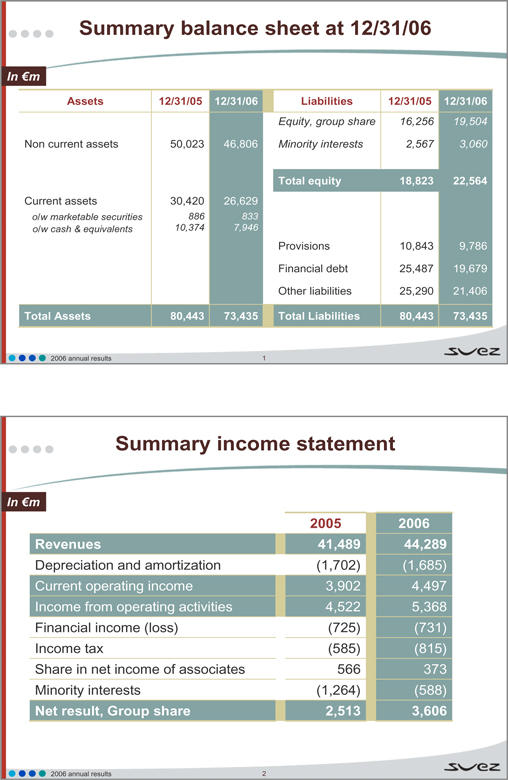

The Group’s cash flow generation finances dividends and industrial growth

The Group’s excellent operating results generated EUR 5.4 billion in cash flows, funding the Group’s dividend (EUR 1.7 billion) and its industrial expansion in 2006. Investments amounted to EUR 3.8 billion, including the buyout of remaining capital in SHEM (France), the Bristol Water acquisition (United Kingdom), completion of the heating and cooling system in Zaragoza (Spain), and power plant developments, mainly in Italy and Spain.

25% net debt reduction to EUR 10.4 billion

Net debt at December 31, 2006 declined to EUR 10.4 billion, 99% of which is hedged against interest rate increases. Taking into account the simultaneous strengthening of shareholders’ equity (EUR 22.4 billion, up EUR 3.7 billion over year-end 2005), gearing is down to 46.3%, versus 72% at December 31, 2005. The coverage ratio (net debt/EBITDA) is 1.5 versus 2.1 at year-end 2005.

|

STREAMLINING AND OPTIMIZATION OF GROUP STRUCTURE |

The SUEZ Board of Directors has announced the company’s intention to launch a buy out for all Electrabel shares not yet held, either directly or indirectly, i.e. 1.38% of Electrabel’s capital. The offering price will be EUR 590/share, amounting to a total investment of EUR 445 million, attached coupons nº 19 and following attached, subject to the conclusions of an independent expert and the opinion of the Electrabel Board of Directors. On March 20, 2007, SUEZ will file a prospectus with Belgium’s Commission bancaire, financière et des assurances (CBFA).

On the other hand, the SUEZ Board of Directors announces the company’s intention to sell SUEZ-Tractebel to Electrabel. This project will be submitted at a later date for decision to the Boards of Directors of Electrabel and SUEZ. The main SUEZ-Tractebel operational assets are: SUEZ Energy International, the consulting engineers Tractebel Engineering, and equity holdings in Distrigas and Fluxys.

Page 3 sur 8

Acceleration of industrial investments, 2007-2009: EUR 15 billion

The Group enjoys excellent industrial prospects related to a favorable business environment in the energy and environment sectors and to the Group proven commercial dynamism. The competitive position of SUEZ businesses, its experience, and its technological leadership constitute strong growth drivers in markets undergoing substantial change (such as consolidation among major players, energy market regulatory developments, and new water treatment technologies).

In this context, the Group is accelerating its industrial development. Excluding major acquisitions, its investments will increase to EUR 15 billion during the period 2007-2009, compared with EUR 10.2 billion for 2004-2006, excluding the combined public offer for Electrabel. These investments will be realized while observing the Group’s financial discipline (maintenance of a “A” credit rating and respecting internal investment criteria).

Within this framework, one of the Group’s objectives is to increase its installed capacity to 75,000 MW in 2012 (compared with approximately 52,000 MW today, a 50% increase). SUEZ has the firm intention of increasing its nuclear power generation capacities through the construction of new power plants in Europe in line with national public policies. The objective for 2015-2020 is to own and operate new 3rd generation nuclear plants.

Ambitious objectives

For 2007, the Group’s targets for operational performance are:

| | - | EBITDA growth above + 10% |

| | - | Current operating income growth above + 15% |

| | - | ROCE in 2007 greater than ROCE in 2006. |

In particular, for the period 2007-2009, SUEZ Environment performance objectives are:

| | - | Average annual growth in revenues between + 6% and + 10% |

| | - | Growth in EBITDA greater than growth in revenues |

| | - | Between EUR 4.0 billion and EUR 4.5 billion in industrial investments, entirely self-funded. |

SUEZ will continue its efforts to increase operational profitability and generate liquidity in all its businesses. It will also benefit from operational synergies generated from the full integration of Electrabel (the EUR 250 million target between 2006 and 2008, announced at the time of the combined public offer, will be exceeded), and should benefit from enhanced financial synergies (EUR 190 million on a full-year basis, instead of the announced EUR 100 million).

The performance improvement programs (Optimax) have over delivered. Thus, the cost savings program which objective was EUR 550 million for the period 2005-2006 ultimately produced savings of EUR 591 million. The Group will continue its efforts with a new cycle of continuous operational processes performance improvement OPERANDI program.

Shareholder return improvements

Confident in the Group’s outlook in each of its businesses, at its March 7, 2007 meeting the Board of Directors confirmed its intention to continue a dynamic and competitive dividend payout policy:

| | - | for 2006, an ordinary dividend of EUR 1.20 per share will be proposed to the Shareholders’ General Meeting, representing an increase of 20% over the dividend paid for 2005; |

| | - | for the following years, a dividend payout greater than 50% of recurring net income (excluding capital gains, in particular). |

In addition, the Group will implement a share buyback program.

Planned merger with Gaz de France: a major opportunity

The merger with Gaz de France will further strengthen the Group’s prospects.

In 2007, SUEZ teams will keep on working towards the merger with Gaz de France. The project responds to an undisputed industrial logic and is value creating for all stakeholders of the two groups’: shareholders, employees, and customers.

Page 4 sur 8

The recent geopolitics and sectors evolutions (ongoing sector consolidation, fossil fuel prices fluctuations, debate around the european energy policy and supply security) also validate the strategic interest of such a merger.

SUEZ, an international industrial and services Group, designs sustainable and innovative solutions in the management of public utilities as a partner of public authorities, businesses and individuals. The Group aims to answer essential needs in electricity, natural gas, energy services, water and waste management. SUEZ is listed on the Brussels, Luxembourg, Paris, New York and Zurich stock exchanges and is represented in the main international indices: CAC 40, BEL 20, DJ STOXX 50, DJ EURO STOXX 50, Euronext 100, FTSE Eurotop 100, MSCI Europe and ASPI Eurozone.

Important Information

This communication does not constitute an offer to purchase or exchange or the solicitation of an offer to sell or exchange any securities of Suez or an offer to sell or exchange or the solicitation of an offer to buy or exchange any securities Electrabel or Gaz de France, nor shall there be any sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares to be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration.

In connection with the proposed business combination, the required information document will be filed with theAutorité des marchés financiers(“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus.Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information.If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site atwww.sec.gov and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website atwww.amf-france.org or directly from Gaz de France on its web site at:www.gazdefrance.com or directly from Suez on its website at:www.suez.com, as the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about Gaz de France, Suez and their combined businesses after completion of the proposed business combination. Forward-looking statements are statements that are not historical facts. These statements include financial projections, synergies, cost-savings and estimates and their underlying assumptions, statements regarding plans, objectives, savings, expectations and benefits from the transaction and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results, developments, synergies, savings and benefits from the transaction to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with theAutorité des marchés financiers(“AMF”) made by Gaz de France and Suez, including those listed under “Facteurs de Risques” in theDocument de Référencefiled by Gaz de France with the AMF on May 5, 2006 (under no: R.06-050) and in theDocument de Référenceand its update filed by Suez on April 11, 2006 (under no: D.06-0248), as well as documents filed by Suez with the SEC, including those listed under “Risk Factors” in the Annual Report on Form 20-F for 2006 that Suez filed with the SEC on June 26, 2006, and in the Amended Annual Report on Form 20-F/A filed with the SEC on February 1, 2007. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements.

| | | | | | |

Press Contacts: | | +33 1 40 06 66 51/ 66 68 | | Analyst Contacts: | | 33 1 40 06 65 31/66 29 |

Belgium | | +32 2 510 76 70 | | | | |

This release is also available on the Internet:http://www.suez.com

Page 5 sur 8

SUEZ Energy Europe: Strengthened positions in several European countries

| | - | Acquisition in the Netherlands of electricity and natural gas supply and distribution companies (Rendo and Cogas). |

| | - | Acquisition of the remaining shares of Société Hydro Electrique du Midi (SHEM) in France. |

| | - | Extension of generating facilities in Italy (Rosignano), Poland, and Spain (Castelnou). |

| | - | Natural gas pipeline startup between Balgzand (Netherlands) and Bacton (United Kingdom). |

| | - | Increased renewable energy generation capacity. |

SUEZ Energy International: Leader in its key electricity and LNG markets

| | - | Middle East: leader in electricity generation (8,200 MW) and seawater desalination (2 million m3/jday), nº 1 private investor in these activities. Startup of 2 power plants, in Oman and Bahrain. Acquisition of a power plant in Bahrain. Contract awards for 2 major electricity generation and desalination plants: in Oman and Saudi Arabia. |

| | - | Brazil: sustained commercial development by Tractebel Energia. Electricity auction success (EUR 8 billion in cash flow guaranteed over 30 years, beginning 2009 and 2011). |

Two new projects : São Salvador and Estreito.

| | - | United States: 3rd largest electricity supplier to commercial and industrial customers. |

| | - | Liquefied natural gas (LNG): |

| | o | United States: construction permit awarded for 2 LNG regasification terminals: Neptune, at the latest 2009 (offshore from Boston) and Calypso (Florida), beginning in 2010. |

| | o | Chile: master agreement with GasAtacama to develop an LNG regasification terminal, between now and the end of 2008. |

| | o | Nigeria: preliminary LNG supply agreement with Brass LNG for 20 years. |

SUEZ Energy Services: Strong sales activity

| | - | Construction and operation of a heating and cooling system by Elyo Ibérica (in consortium) for the International Exposition “Expo Agua Zaragoza 2008” (35 years, EUR 300 million). |

| | - | Renewal of an Elyo facilities management contract at PSA Peugeot Citroën sites in the Paris region (5 years, EUR 143 million). |

| | - | GTI (in consortium) industrial maintenance contract for the Shell site at Pernis (Netherlands), (5 years, EUR 100 million). |

| | - | Renewal of a multi-technical Endel maintenance contract for the CNES Space Center installations at Kourou in Guyana (5 years, EUR 90 million). |

| | - | Completion by Axima of air conditioning for 2 cruise ships for the account of Aker Yards (€ 58,3 million). |

| | - | Ineo global multi-technical maintenance contract for the Total installations at Lacq and Champs du Sud Ouest (12 years, EUR 12 million). |

| | - | Three contracts for Tractebel Engineering: design and planning for LNG terminals in Sicily and Morocco (€ 12 millions). |

| | - | Operation and maintenance contract with performance guarantee by Axima Services for two prestige buildings in Brussels: Juste Lipse and Tour Dexia (10 years, EUR 30 million). |

SUEZ Environment: bountiful contracts in 2006

| | - | Two contracts in the United Kingdom for universal waste management: Cornwall region (30 years, EUR 1.5 billion) and Northumberland (28 years, EUR 1 billion). |

| | - | Water services management at Changshu, near Shanghai (30 years, EUR 1 billion). |

| | - | Operation over 30 years of a wastewater treatment plant at Tangjiatuo (China) and a 30-year management contract for wastewater services north of Chongqing. |

| | - | Design, construction and operation over a 2-year period of Europe’s largest reverse osmosis water desalination plant, at Barcelona (EUR 159 million). |

| | - | Acquisition by Agbar of Bristol Water (annual revenues: EUR 130 million). |

| | - | Renewal of a public/private service contracts with the town of Créteil for water (15 years, EUR 124 million), and the town of Sénart for water and wastewater treatment (15 years, EUR 118 million). |

| | - | Design, construction and operation by Degrémont of the Lusail wastewater treatment plant at Qatar (10 years, USD 188 million). |

| | - | Contract with the City of Algiers: modernization of the water and wastewater treatment service (5 years, EUR 120 million). |

| | - | Wastewater contract with localities in the Briançonnais region of France (25 years, EUR 115 million). |

| | - | Decontamination of the Spolana chemical complex (Prague), EUR 90 million. |

Page 6 sur 8

Page 7 sur 8

Page 8 sur 8

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

Date: March 13, 2007 | | Company NameSUEZ |

| | |

| | By: | | /s/ Yves de GAULLE |

| | | | Name: Yves de GAULLE |

| | | | Title: General Secretary |