Filed by: Gaz de France

pursuant to Rule 165 and Rule 425(a)

under the Securities Act of 1933, as amended

Subject Company: SUEZ

Exchange Act File Number: 001-15232

Date: February 28, 2008

On February 27, 2008, Gaz de France made the following slide presentation available on its website and at a presentation of its 2007 annual results in Paris, France.

Important Information

This communication does not constitute an offer to purchase, sell, or exchange or the solicitation of an offer to sell, purchase, or exchange any securities of Suez, Suez Environment (or any company holding the Suez Environment Shares) or Gaz de France, nor shall there be any offer, solicitation, purchase, sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation, purchase, sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares which would be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration.

In connection with the proposed transactions, the required information document will be filed with theAutorité des marchés financiers(“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus.Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information.If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site atwww.sec.gov and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website atwww.amf-france.org or directly from Gaz de France on its web site atwww.gazdefrance.com or directly from Suez on its website atwww.suez.com, as the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about Gaz de France, Suez, Suez Environment and their combined businesses after completion of the proposed transactions. Forward-looking statements are statements that are not historical facts. These statements include financial projections, synergies, cost-savings and estimates and their underlying assumptions, statements regarding plans, objectives, savings, expectations and benefits from the transaction and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results, developments, synergies, savings and benefits from the proposed transactions to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with theAutorité des marchés financiers(“AMF”) made by Gaz de France and Suez, including those listed under “Facteurs de Risques” in theDocument de Référencefiled by Gaz de France with the AMF on April 27, 2007 (under no: R.07-046) and in theDocument de Référenceand its update filed by Suez on April 4, 2007 (under no: D.07-0272), as well as documents filed by Suez with the SEC, including those listed under “Risk Factors” in the Annual Report on Form 20-F for 2006 that Suez filed with the SEC on June 29, 2007. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements.

* * * *

Gaz de France 2007 Annual Results 27 February 2008 2007 Annual Results 27 February 2008 |

Gaz de France 2007 Annual Results 27 February 2008 2007 Annual Results Jean-François CIRELLI Chairman and Chief Executive Officer 27 February 2008 |

3 Gaz de France 2007 Annual Results 27 February 2008 Disclaimer Important Information This document does not constitute an offer to purchase or exchange nor a solicitation to sell or exchange Suez, Suez Environnement (or any company owning Suez Environnement shares) or Gaz de France shares. Nor is it an offer to sell or trade shares in a country (including the United States of America, Germany, Italy and Japan) in which such an offer, solicitation, sale or exchange would be illegal or which would be subject to registration according to the applicable law in the country in question. Distribution of this document may, in certain countries, be subject to legal or regulatory restrictions. As a result, anyone who is in possession of this document must find out if any such restrictions apply and conform to them. As far as possible given the applicable regulations, Gaz de France et Suez decline all responsibility in the event of violation of these restrictions by anyone. Any Gaz de France shares issued in the framework of the merger operation to the profit of Suez shareholders (including those who hold shares represented by the ADS (American Depositary Shares) of Suez) may not be offered or sold in the United States of America without being registered or without having benefited from an exemption from the obligation to register in accordance with the 1933 US Securities Act, as modified. Suez Environnement shares (or those of any company holding shares in Suez Environnement) are not and shall not be registered in the United States of America, in line with the US Securities Act of 1933 and shall be neither offered nor sold in the United States of America, without being registered or without having benefited from an exemption from the obligation to register. For the purposes of the planned operations, the necessary documentation will be deposited with the AMF. Insofar as Gaz de France would be obliged to or may decide to register Gaz de France shares issued in the merger operation in the United States of America, it would submit an American registration document (registration statement on Form F-4), including a prospectus, to the SEC (United States Securities and Exchange Commission). It is strongly recommended that investors read the information that is submitted to the AMF, the American registration statement and the prospectus when they are available, if necessary, as well as any other document that may be submitted to the SEC and/or the AMF, along with any amendment or complementary information to these documents, because these may contain important information. In the event of registration in the United States of America, copies of the American registration statement, the prospectus, as well as any other necessary documents submitted to the SEC, will be available, free of charge, on the SEC website (www.sec.gov). At an appropriate time, investors will receive information concerning the way to obtain, free of charge, documents relating to the Gaz de France operation or via a duly designated representative. Investors and holders of Suez shares may obtain, free of charge, copies of documents submitted to the AMF on the AMF website (www.amf- france.org) or directly from the Gaz de France website (www.gazdefrance.com) or the Suez website (www.suez.com). Forward-Looking Statements This communication contains forward-looking information and statements about Gaz de France, Suez, Suez Environment and their combined businesses after completion of the proposed transactions. Forward-looking statements are statements that are not historical facts. These statements include financial projections, synergies, cost-savings and estimates and their underlying assumptions, statements regarding plans, objectives, savings, expectations and benefits from the transaction and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expects,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the Management Teams of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares and Suez ADRs are cautioned that forward-looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results, developments, synergies, savings and benefits from the proposed transactions to differ materially from those expressed in, or implied or projected by, the forward- looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the Autorité des marchés financiers (“AMF”) made by Gaz de France and Suez, including under “Facteurs de Risques” in the Document de Référence filed by Gaz de France with the AMF on April 27, 2007 (under no: R.07-046) and in the Document de Référence and its update filed by Suez on April 4, 2007 (under no: D.07-0272), as well as documents filed with the SEC, including under “Risk Factors” in the Annual Report on Form 20-F for 2006 filed by Suez on June 29, 2007. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements. |

4 Gaz de France 2007 Annual Results 27 February 2008 Contents Business trends and highlights Results as at 31 December 2007 Main achievements in 2007 and outlook Appendices |

Gaz de France 2007 Annual Results 27 February 2008 Business trends and highlights Jean-François CIRELLI |

6 Gaz de France 2007 Annual Results 27 February 2008 2007: record-high results 1 Before replacement costs and employee shareholding schemes 2 Before tax, change in WCR and replacement costs 3 Number of shares outstanding (in thousands): 983,115 in 2007 and 983,719 in 2006 * To be proposed to 19 May 2008 Annual General Meeting Average climate conditions +1.6% Change 2006 2007 In million euros 27,642 27,427 Sales Operating income Net income Group share 3,608 3,874 +7.6% 2,298 2,472 +15% 5,118 5,904 Net income per share 3 (in €) +7.6% 2.34 2.51 Operating cash flow 2 +7.4% Adjusted operating income 1 5,149 5,666 +10% -0.8% Dividend per share (in €) +15% 1.10 1.26* |

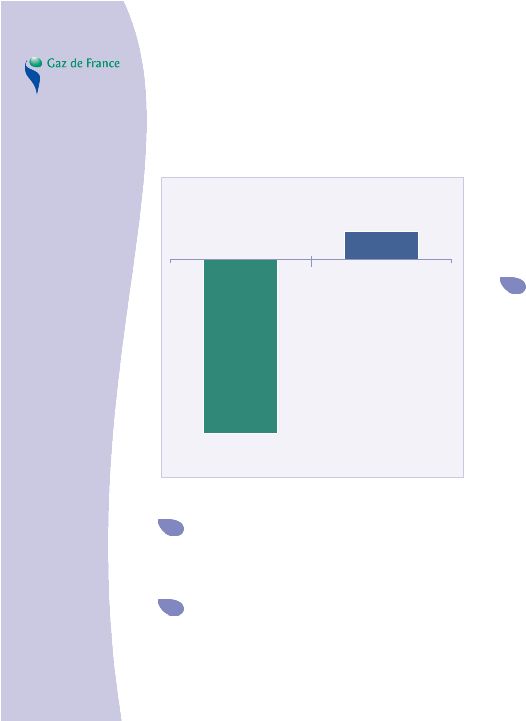

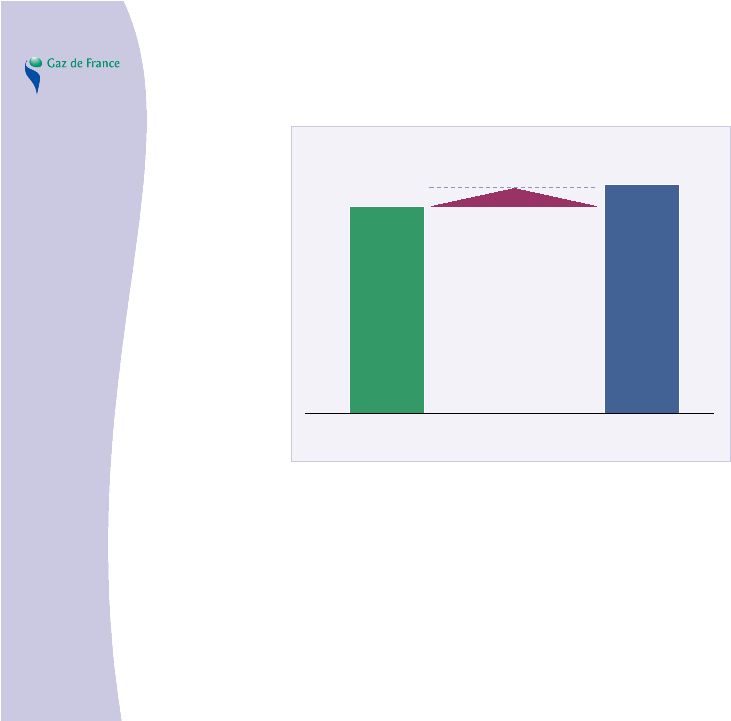

7 Gaz de France 2007 Annual Results 27 February 2008 2006 2007 5,149 5,666 Adjusted operating income 1 2007 performance exceeded objectives The return to breakeven of gas sales at regulated tariffs and good commercial results Year-end market conditions allowed the Group to fully leverage the LNG portfolio Operating costs under increased control Favourable climat conditions in the last quarter In million euros 1 Before replacement costs and employee shareholding schemes h |

8 Gaz de France 2007 Annual Results 27 February 2008 Regulated natural gas tariffs in line with costs regulated tariffs covering supply costs Losses - gains on regulated-tariff sales Clarification of legal framework applicable to natural gas tariffs in France by Council of State ruling Finalisation of 2008-2010 Public Service Contract with State, as soon as possible In million euros - 511 84 2006 2007 |

9 Gaz de France 2007 Annual Results 27 February 2008 Source CERA Buoyant market conditions at year-end Increase in arbitrage operations, particularly in LNG • 12 cargoes in Q4 covering approximately 9 TWh Gas Oil 40 45 50 55 60 65 70 75 80 85 90 95 0,80 1,30 1,80 2,30 2,80 3,30 3,80 4,30 NBP (c€/kWh) Border contract tracker (c€/kWh) Brent ($/bl) Brent (€/bl) |

10 Gaz de France 2007 Annual Results 27 February 2008 Operating costs under increased control 16.0 15.6 15.1 2005 2006 2007 -2.0% -3.1% Headcount reduction in regulated business activities on a comparable basis (in thousands) Actual 2007 Objective 2009 Decreasing purchasing costs 2007 actuals exceeded target In thousands of employees In million euros 132 OPEX CAPEX 290 |

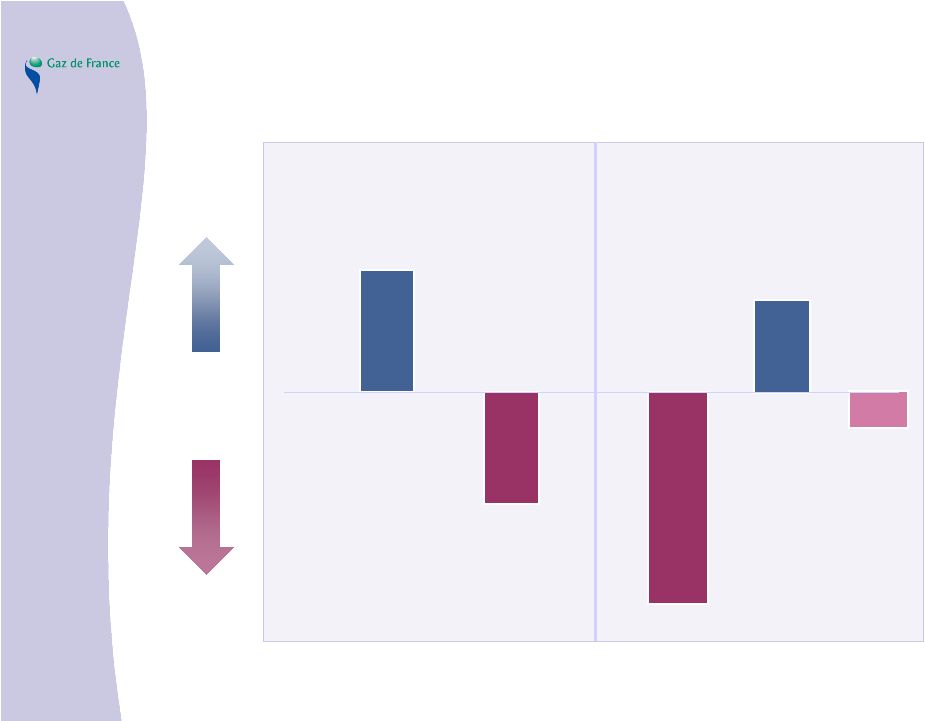

11 Gaz de France 2007 Annual Results 27 February 2008 Return to favourable climate conditions in second half COOLER WARMER AVERAGE CLIMATE 14.5 -13.4 -25.3 H1 2006 H2 2006 H1 2007 in TWh Climate adjustment* - France 10.7 H2 2007 * Distribution France scope Climate adjustments – See Presentation of Half-Year Results 2007 ** February estimate Jan-Feb 2008** -6.4 |

12 Gaz de France 2007 Annual Results 27 February 2008 Operational indicators Natural gas sales (in TWh) -4% * Electricity sales (in TWh) +7.2% -3% Hydrocarbon production * (in Mboe) Number of gas customers (in millions) 730 762 2006 2007 43.1* 41.8 2006 2007 20.6 22.1 2006 2007 14.7 13.9 2006 2007 +6%* * -1.6% based on average climate * Stable on a comparable basis *On a comparable basis |

13 Gaz de France 2007 Annual Results 27 February 2008 A balanced business mix 2007 Adjusted Operating Income breakdown 58% 42% Infrastructures Energy Supply and Services + 2 points International sales 39% 41% 2006 2007 €10,840 M €11,361 M €5,666 M |

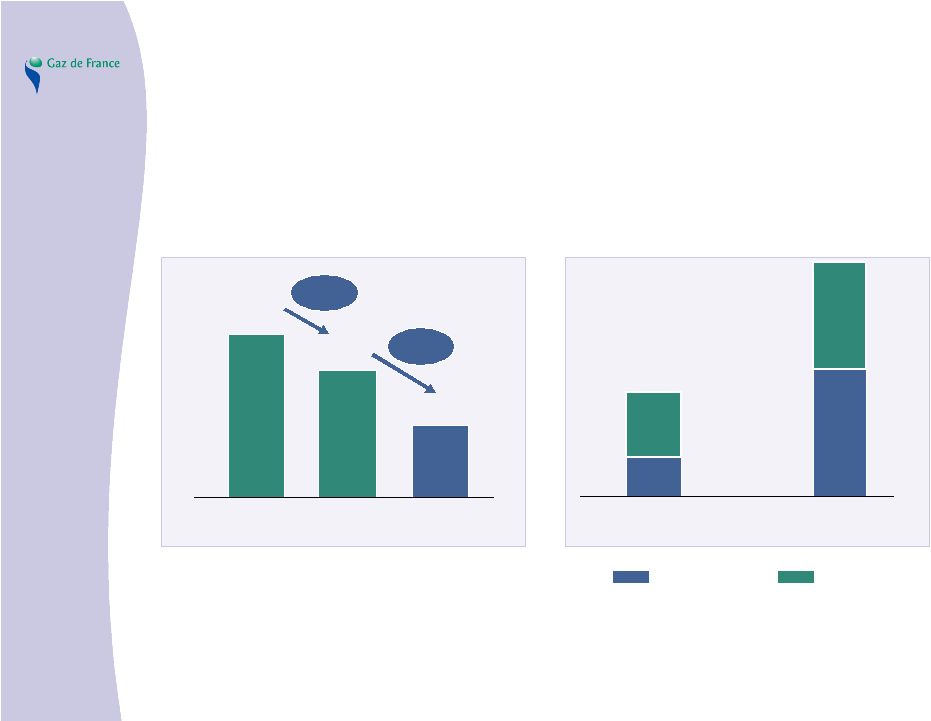

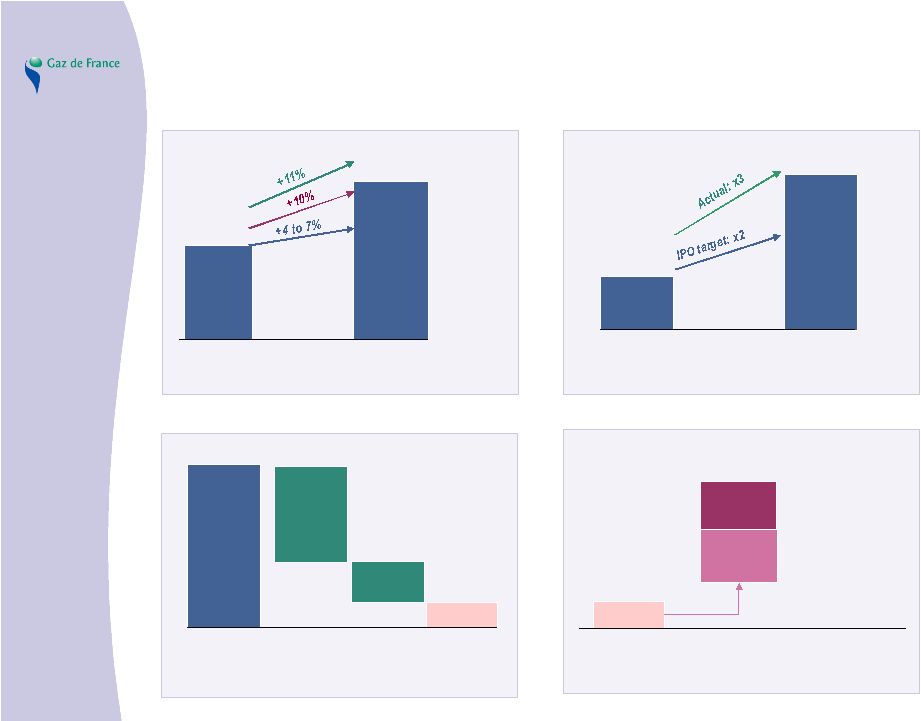

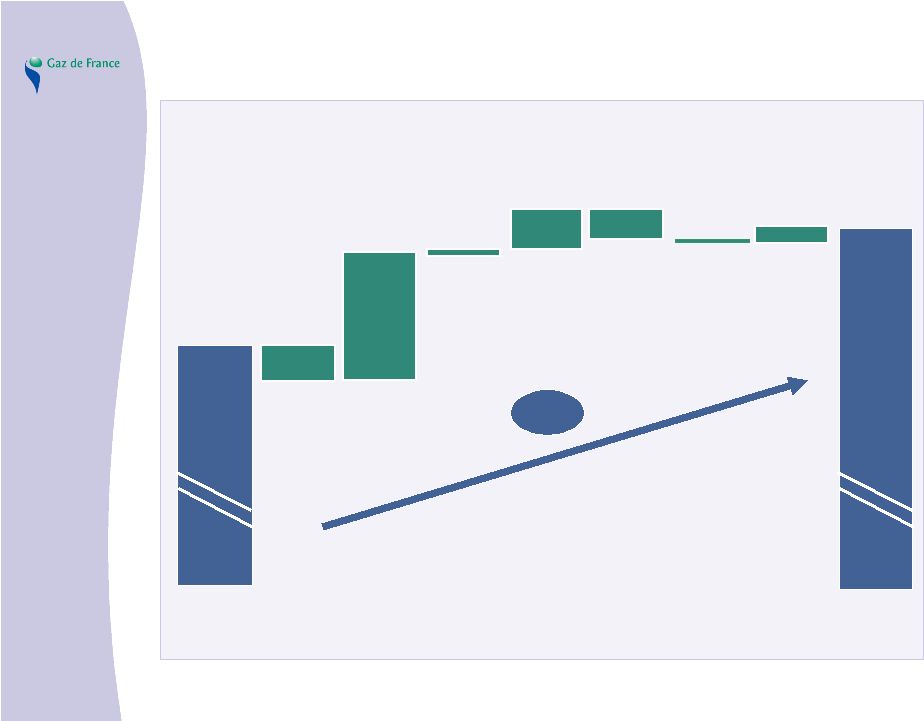

14 Gaz de France 2007 Annual Results 27 February 2008 Commitments met Growth in Adjusted Operating Income – Shareholder returns In million euros 2004 2007 4,173 5,666 Actual Revised target IPO target Growth in Adjusted Operating Income Growth in dividend In million euros 2004 2007 419 1,240* * Based on the number of shares outstanding as at 31 December 2007 and a Dividend per share of €1.26 Investments Additional shareholder returns In billion euros 2005-2008 Target 2005-2007 Actual 10.2 4.0 17.5 2008 Target In billion euros Shareholder returns Share buy-back Additional dividend pay-out over 2006-2008 1.0 * 0.9 * Estimated 3.3 3.3 |

15 Gaz de France 2007 Annual Results 27 February 2008 Adjusted Operating Income target Planned investments for 2008: €4 billion, +20% compared to 2007 Objective is to increase dividend 10 to 15% between the dividend paid in 2008 and the dividend paid in 2009 2 2008 target: continuing development and profitable growth 1 Assuming that regulated natural gas tariffs in France fully cover the relevant supply costs Target based on average climate conditions 4,173 6,100 2004 2008 Target 1 2 Subject to approval of the Annual General Meeting |

Gaz de France 2007 Annual Results 27 February 2008 Results as at 31 December 2007 Stéphane BRIMONT Chief Financial Officer |

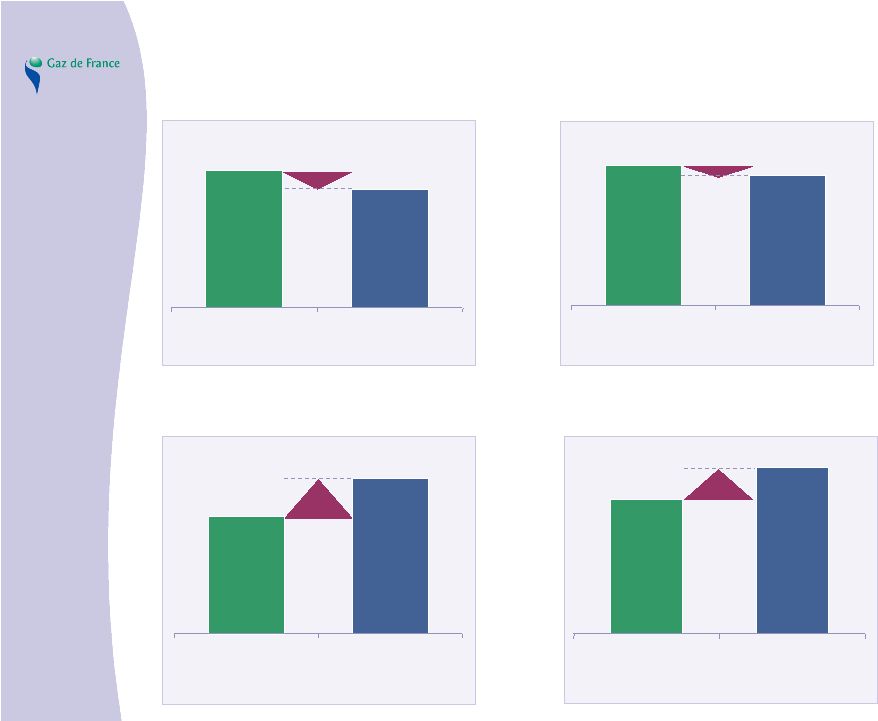

17 Gaz de France 2007 Annual Results 27 February 2008 Sales significantly impacted by the climate 27,642 27,427 -369* +464 2006 sales 2007 sales +817 Price Other Scope In million euros * Including -98 IFRIC 12 Climate Volumes -666 -460 28,093 2007 sales Excl. climate effect +1.6% |

18 Gaz de France 2007 Annual Results 27 February 2008 In million euros Differing impacts on segments from business conditions 5,149 5,666 - 143 + 546 + 12 + 177 -121 - 7 + 53 Adjusted Operating Income 2006 Adjusted Operating Income 2007 Exploration Production Energy Purchase & Sales Services Transmission Storage Distribution France Transmission Distribution International Other +10% |

19 Gaz de France 2007 Annual Results 27 February 2008 1,127 Adjusted Operating Income 1,717 Sales 2007 Operating income Exploration-Production A major contributor to Group results 755 1,270 1,659 2006 935 - 11% +3.5% Change - 19% Contribution to Group Adjusted Operating Income 1,270 1,127 +158 -53 - 24 -180 +41 2006 Adjusted Operating Income Prices Volumes Other Scope Non- recurring 2007** 2007 Adjusted Operating Income ** Incl. sale of Cavendish +31 MEUR Non- recurring 2006* -85 * Primarily capital gains from KGM sale 20% In million euros |

20 Gaz de France 2007 Annual Results 27 February 2008 Energy Purchase & Sales Good sales performance 1,075 20,041 940 529 20,455 443 Adjusted Operating Income Sales 2007 Operating income 2006 In million euros +103% -2% Change +112% 1,075 529 +26 +511 -154 +38 2006 Adjusted Operating Income Current effects Climate 2007 Adjusted Operating Income Reg. tariffs* Losses 2006 Non- recurring 2007 +41 Non- recurring 2006 19% +84 Reg. tariffs* Sales margin 2007 * regulated tariffs Contribution to Group Adjusted Operating Income |

21 Gaz de France 2007 Annual Results 27 February 2008 Services Continuing increase in operating profitability 129 1,807 82 117 1,801 71 Adjusted Operating Income Sales 2007 Operating income 2006 In million euros +10% +0.3% Change +15% 117 129 +5 2006 Adjusted Operating Income Scope 2007 Adjusted Operating Income +7 2% Contribution to Group Adjusted Operating Income Current effects |

22 Gaz de France 2007 Annual Results 27 February 2008 1,534 2,494 1,185 Transmission-Storage Outstanding performance driven by Storage 1,357 2,355 1,013 Adjusted Operating Income Sales 2007 Operating income 2006 In million euros +13%* +5.9% Change +17% 1,357 1,534 +88 2006 Adjusted Operating Income Non- recurring 2007 +52 Current effects 2007 Adjusted Operating Income * Excluding non-recurring items, increase of 4% Non- recurring 2006 +37 27% Contribution to Group Adjusted Operating Income |

23 Gaz de France 2007 Annual Results 27 February 2008 Distribution France A difficult year, due in particular to climate conditions 3,076 3,289 Sales 2007 2006 -6.5% Change 1,291 552 1,412 726 Adjusted Operating Income Operating income -8.6% -24% 1,412 1,291 Climate Current effects -41 -80 23% 2006 Adjusted Operating Income 2007 Adjusted Operating Income In million euros Contribution to Group Adjusted Operating Income |

24 Gaz de France 2007 Annual Results 27 February 2008 Transmission - Distribution International Another year of good results 491 5,202 381 498 5,178 348 Adjusted Operating Income Sales 2007 Operating income 2006 -1.4% +0.5% Change +9.5% Scope -8 Climate -36 Current effects +37 498 491 9% 2006 Adjusted Operating Income 2007 Adjusted Operating Income In million euros Contribution to Group Adjusted Operating Income |

25 Gaz de France 2007 Annual Results 27 February 2008 From Adjusted Operating Income to net income 2006 2007 Adjusted Operating Income Operating income Replacement costs 5,666 3,874 -247 Change +10% +7.4% Financial income Taxes Share of income in equity-accounted companies Minority interests Net income – Group share -310 -1,153 99 -38 2,472 +7.6% Net provision for depreciations -1,514 -18 Net provision for reserves 5,149 3,608 -357 -1,104 176 - 25 -1,430 183 -294 2,298 -13 Share-based payment 0 In million euros |

26 Gaz de France 2007 Annual Results 27 February 2008 Investments backed by an increasing CAPEX programme 622 689 1,416 1,520 391 434 383 745 2006 2007 Other * Energy Purchase & Sales Infrastructures Exploration Production * Services, Transmission Distribution International and other 3,166 1 3,034 2 In million euros External growth 2006 2007 816 275 1 Including €2,647 M in CAPEX 2 Including €2,869 M in CAPEX In million euros Other * Energy Purchase & Sales Infrastructures Exploration Production |

27 Gaz de France 2007 Annual Results 27 February 2008 Change in net debt as at 31 December 2007 In million euros * Including replacement costs 5,904 5,025 738 + 232 - 1,111 - 3,309 - 1,095 + 117 Operating cash flow Investments* Decrease in WCR Decrease in net debt Other Tax Operating cash flow including change in WCR and tax Dividend pay-out |

28 Gaz de France 2007 Annual Results 27 February 2008 A sound financial structure < 1 yr 1 to 5 yrs > 5 yrs 31/12/2006 1,355 970 3,620 3,472 2,734 Net financial debt 21% 15% Maturity of debt as at 31/12/2007* by currency Euro 94% US $ Other Structure of net debt* as at 31/12/2007 Including hedging * Based on gross debt Net financial debt/ shareholders’ equity 31/12/2006 31/12/2007 31/12/2007 In million euros In million euros by type of rate Variable 30% Fixed 70% |

29 Gaz de France 2007 Annual Results 27 February 2008 Profitability progressing thanks to significant improvement in Energy Purchase & Sales division * [1] Calculated as the ratio between net operating income after tax and capital employed. Net operating income after tax is equal to the operating income after deduction of capital gains and losses from intangible and financial assets, impairments, latent gains and losses on mark-to-market on financial instruments, restructuring costs, to which are added income and expenses from employed capital (dividends and income from companies accounted for by the equity method, other items from financial result) after taxes applicable to all of the above. 11.2% 12.1% 2006 2007 ROCE* + 0.9 point |

Gaz de France 2007 Annual Results 27 February 2008 Main highlights in 2007 and outlook 2008 Jean-François CIRELLI |

31 Gaz de France 2007 Annual Results 27 February 2008 2007 highlights Algerian contracts extended (55 bcm concluded up to 2019) Holdings in 10 offshore licenses in the North Sea Production launch of Minke, Njord, Fram and Snohvit gas fields Exploration campaigns finalised in Touat 45% stake in Alam El Shawish West license in Egypt 2008 outlook Ongoing contractual talks with our partners Discussions regarding new LNG supply E&P: increase production to 50 Mboe Marketability decision on Touat Acquisition opportunities reviewed on a case-by-case basis Securing gas supply |

32 Gaz de France 2007 Annual Results 27 February 2008 2007 highlights Construction on Cycofos CCGT continues Launch of Montoir CCGT Leading wind energy operator in France: nearly 145 MW installed in early 2008 Leading position amongst electricity generators in Italy 2008 outlook GDF Futures Energies subsidiary created Group wind energy capacity to nearly double in 2008 Cycofos: construction completed, commissioning in early 2009 Montoir: commissioning in early-2010 St-Brieuc: commissioning in late-2010 Development in electricity production |

33 Gaz de France 2007 Annual Results 27 February 2008 A new marketing strategy 2007 highlights Retail customer market liberalisation • Organisation • Information system specific to Gaz de France • New offers: 77,000 gas customers, 46,500 electricity customers New marketing channels • Partnership with French LCL bank 2008 outlook Integrating the Grenelle Environmental Plan dynamic into new offers • Natural gas + renewables • Zero-carbon offers Continuing the development of dual offers The Internet surge Continuing the diversification of marketing channels Stepping up the development of natural gas |

34 Gaz de France 2007 Annual Results 27 February 2008 2007 highlights Development gaining speed in Storage across Europe: United Kingdom, Germany and Romania, etc. Research & Development in the field of CO 2 Capture and Sequestration (CCS) Investments doubled in Transmission in France between 2005 and 2007 Fos Cavaou terminal 2008 outlook Transmission: growth in the investment programme (> €550 M) Storage UK: €80 M in investments planned on Stublach. Third-party access exemption request Storage Germany: construction continues on two caverns, call for tenders for the construction of two additional caverns. Three new projects under consideration Romania: growth in Amgaz capacity, preliminary work to increase Depomures capacity Development in Infrastructure businesses in France and Europe |

35 Gaz de France 2007 Annual Results 27 February 2008 2008: creation of GDF SUEZ A world leader in energy, a key utility stock Sustained development in all businesses of the new Group Strong 2007 performance, demonstrating the robustness and profitability of all businesses of both companies A unique opportunity to boost both companies’ development by leveraging their strong industrial complementarities Merger project rationale enhanced by recent trends in the energy sector and acceleration of the consolidation in Europe A value-creative transaction for all stakeholders |

36 Gaz de France 2007 Annual Results 27 February 2008 Merger in First Half 2008 Main steps already completed Next steps before merger completion Opinion of Gaz de France employee representative bodies Registration of stock market documentation (GDF SUEZ and Suez Environnement) Opinion of the "Commission des Participations et Transferts" EGMs to approve merger and distribution of 65% of Suez Environnement) Merger completion and simultaneous listing of Suez Environnement Privatisation law of Gaz de France European Commission authorisation Merger project approved by the Boards of Directors Opinion of Suez employee representative bodies Tax ruling on the distribution of the shares of Suez Environnement Privatisation law implementation decree |

37 Gaz de France 2007 Annual Results 27 February 2008 Joint integration team Three teams in charge of integration process Integration process involving Human Resources and Communication Departments Potential for operational synergies of approximately €1bn per year, by 2013 46 workshops launched Co-leaders from both Groups Integration process GDF SUEZ will be operational as soon as the merger is completed Process management committee Synergy management committee Change management Steering committee |

38 Gaz de France 2007 Annual Results 27 February 2008 Strong prospects for profitable growth 1 GDF SUEZ pro forma EBITDA as defined in appendix 2 Industrial investments (maintenance and development) derived mainly from organic growth 3 Based on the Gaz de France dividend paid in 2007 for fiscal year 2006 (€1.10 per share). Suez shareholders will also be able to benefit from the dividend paid by Suez Environnement, as of 2009. GDF SUEZ medium-term targets EBITDA growth of approximately 10% 1 in 2008 EBITDA target of €17 Bn 1 by 2010 CAPEX of €10 Bn 2 per year, on average, between 2008 and 2010 Ratings target: Strong A Dynamic dividend policy targeting an attractive yield compared to sector average • Target payout ratio: above 50% of recurring Group net income • Average annual growth in dividend per share of 10 to 15% between dividend paid in 2007 3 and dividend paid in 2010 • Additional shareholder returns through exceptional dividends and share buy-backs 2008 targets for Gaz de France Adjusted Operating Income of €6.1 billion in 2008 Step-up in development: investments for 2008: €4 billion, up by 20% compared to 2007 An additional increase in dividends per share for fiscal year 2008 of 10% to 15% |

Gaz de France 2007 Annual Results 27 February 2008 Conclusion |