Filed by: Gaz de France

pursuant to Rule 165 and Rule 425(a)

under the Securities Act of 1933, as amended

Subject Company: SUEZ

Exchange Act File Number: 001-15232

Date: April 21, 2008

On April 16, 2008, Gaz de France presented the following information at its Investor Day held in Paris, France.

Important Information

This communication does not constitute an offer to purchase, sell, or exchange or the solicitation of an offer to sell, purchase, or exchange any securities of Suez, Suez Environment (or any company holding the Suez Environment Shares) or Gaz de France, nor shall there be any offer, solicitation, purchase, sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation, purchase, sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares which would be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration.

In connection with the proposed transactions, the required information document will be filed with theAutorité des marchés financiers(“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus.Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information.If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site atwww.sec.gov and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website atwww.amf-france.org or directly from Gaz de France on its web site atwww.gazdefrance.com or directly from Suez on its website atwww.suez.com, as the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about Gaz de France, Suez, Suez Environment and their combined businesses after completion of the proposed transactions. Forward-looking statements are statements that are not historical facts. These statements include financial projections, synergies, cost-savings and estimates and their underlying assumptions, statements regarding plans, objectives, savings, expectations and benefits from the transaction and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results, developments, synergies, savings and benefits from the proposed transactions to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with theAutorité des marchés financiers(“AMF”) made by Gaz de France and Suez, including those listed under “Facteurs de Risques” in theDocument de Référencefiled by Gaz de France with the AMF on April 27, 2007 (under no: R.07-046) and any update thereto and in theDocument de Référencefiled by Suez on March 18, 2008 and any update thereto, as well as documents filed by Suez with the SEC, including those listed under “Risk

Factors” in the Annual Report on Form 20-F for 2006 that Suez filed with the SEC on June 29, 2007. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements.

* * * *

2

Gaz de France

Purchase & Sale of Natural Gas

A global player with key competitive advantages in changing energy markets

Gaz de France Investor Day

Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Disclaimer

The objectives summarised above are based on data, assumptions and estimates deemed reasonable by Gaz de France. The said data, assumptions and estimates may evolve or be changed as a result of uncertainties due in particular to the economic, financial, competitive, regulatory or weather conditions. In addition, the materialisation of certain risks factors described in Chapter 4 of the Document de Référence filed with the Autorité des marchés financiers (“AMF”) under Number R07-046 on 27 April 2007 (hereinafter referred to as the “Document de Référence”) could have an impact on the group’s operations and its ability to achieve its objectives. In addition, achieving those objectives is dependent on the success of the commercial strategy described in Chapter 6.1.2 of the Document de Référence. Gaz de France consequently disclaims any undertaking and gives no representation as to the fact that it will achieve its objectives and does not undertake to publish or issue possible revisions or updates of such forward-looking statements or information, beyond what is required by the laws and regulations with which it must comply.

This communication does not constitute an offer to purchase or exchange or the solicitation of an offer to sell or exchange any securities of Suez or an offer to sell or exchange or the solicitation of an offer to buy or exchange any securities of Gaz de France, nor shall there be any sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares to be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration.

In connection with the proposed business combination, the required information document will be filed with the AMF and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus. Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information. If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s website at www.sec.gov and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Gaz de France and Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website at www.amf-france.org or directly from Gaz de France on its website at: www.gazdefrance.com or directly from Suez on its website at: www.suez.com, as the case may be.

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

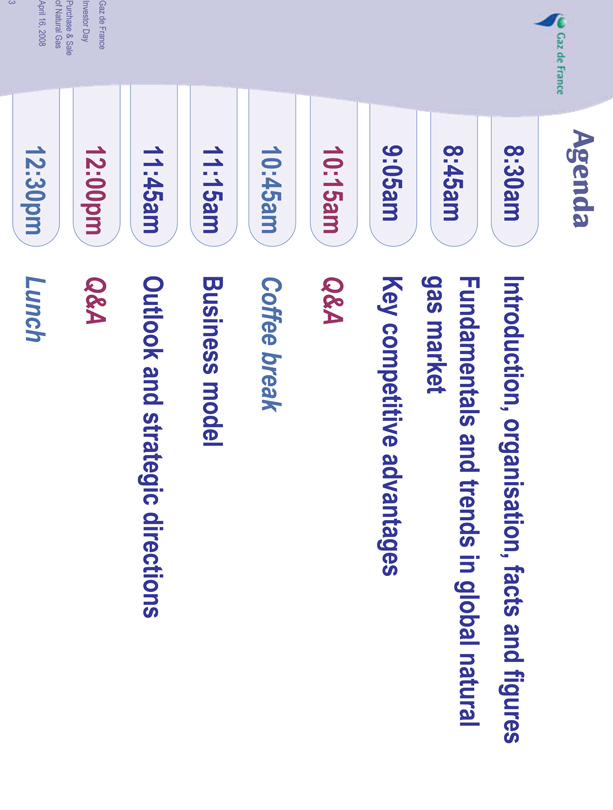

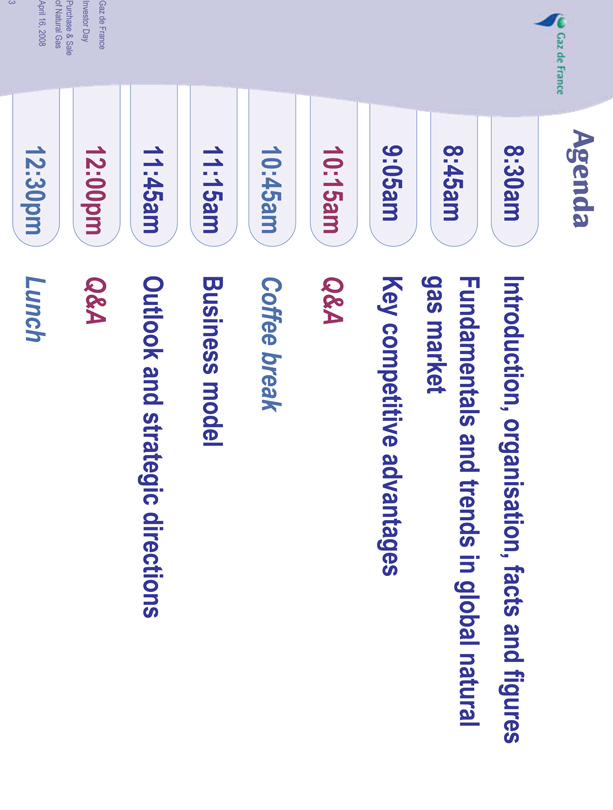

Agenda

8:30am Introduction, organisation, facts and figures

8:45am Fundamentals and trends in global natural gas market

9:05am Key competitive advantages

10:15am Q&A

10:45am Coffee break

11:15am Business model

11:45am Outlook and strategic directions

12:00pm Q&A

12:30pm Lunch

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

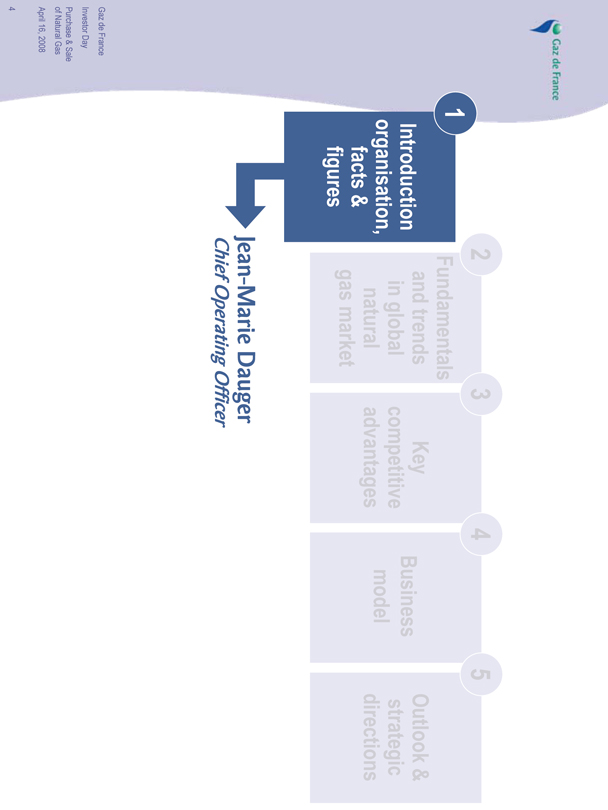

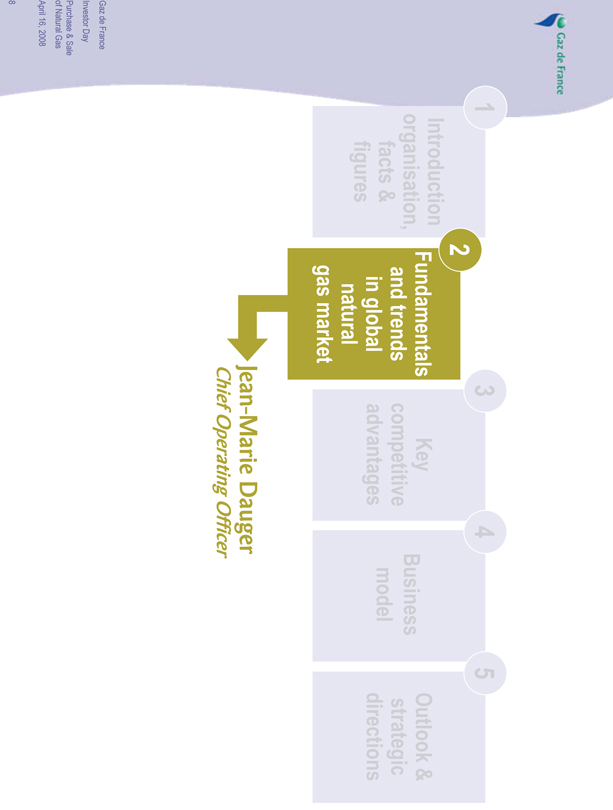

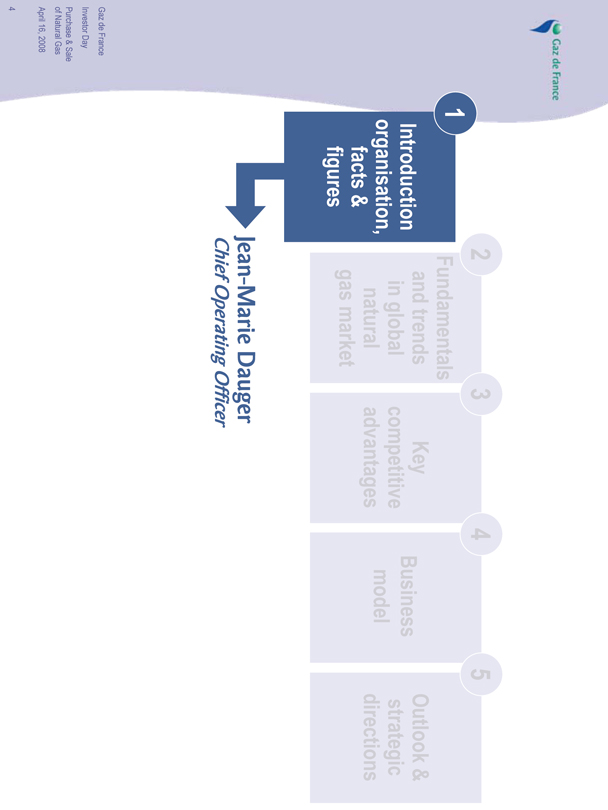

1 Introduction organisation, facts & figures

2 Fundamentals and trends in global natural gas market

3 Key competitive advantages

4 Business Model

5 Outlook & strategic directions

Jean-Marie Dauger

Chief Operating Officer

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

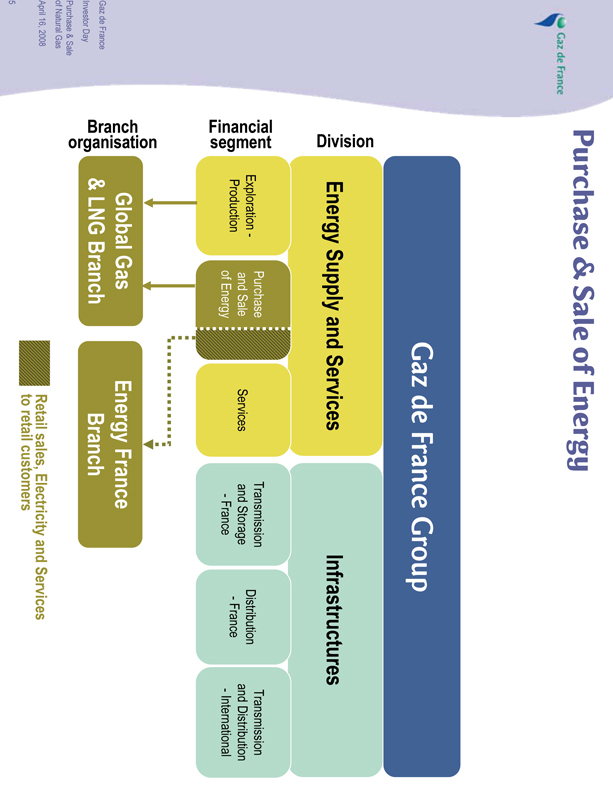

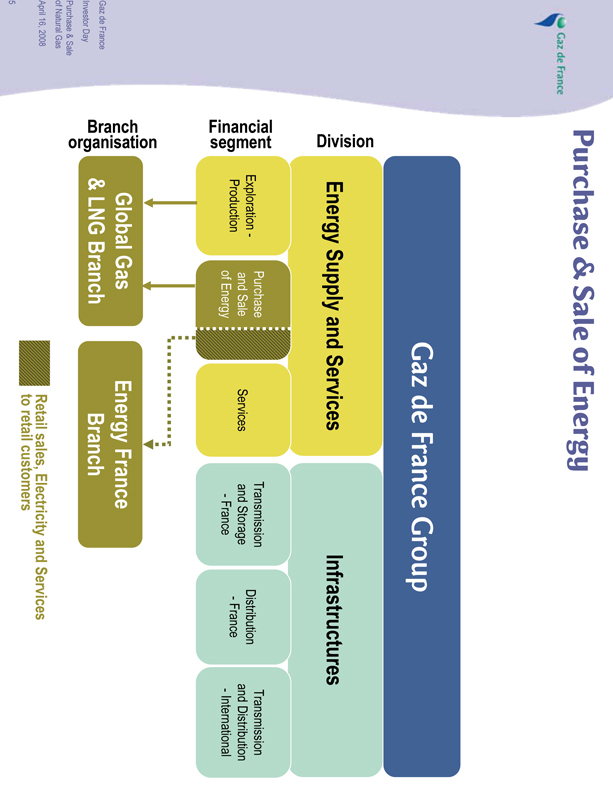

Purchase & Sale of Energy

Gaz de France Group

Division

Energy Supply and Services

Infrastructures

Financial segment

Exploration - Production

Purchase and Sale of Energy

Services

Transmission and Storage - France

Distribution - France

Transmission and Distribution - International

Branch Organisation

\Global Gas & LNG Branch

Energy France Branch

Retail sales, Electricity and Services to retail customers

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

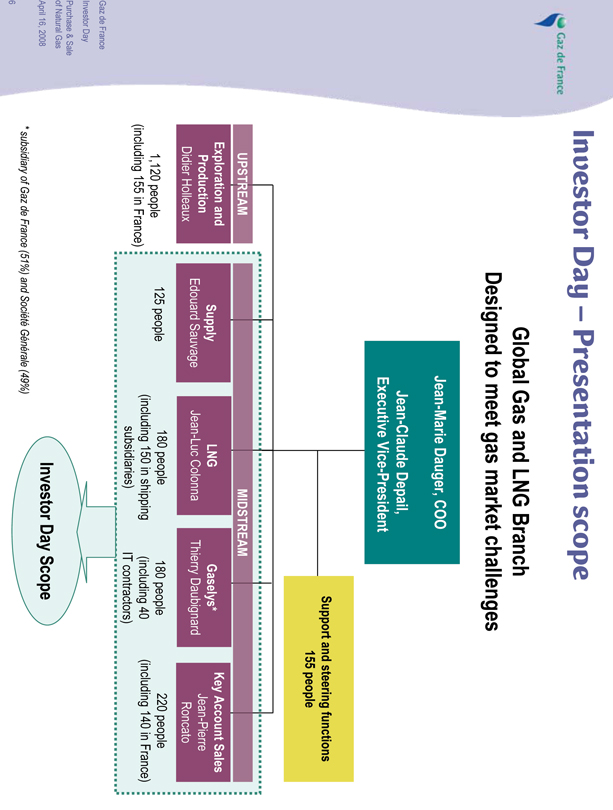

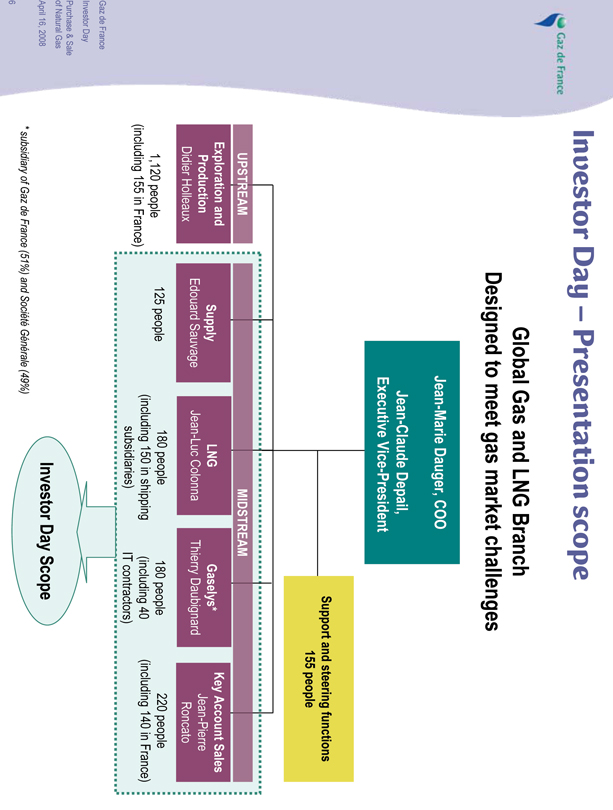

Investor Day – Presentation scope

Global Gas and LNG Branch

Designed to meet gas market challenges

Jean-Marie Dauger, COO

Jean-Claude Depail, Executive Vice-President

Support and steering functions 155 people

UPSTREAM

Exploration and Production Didier Holleaux

1,120 people (including 155 in France)

MIDSTREAM

Supply Edouard Sauvage

125 people

LNG Jean-Luc Colonna

180 people (including 150 in shipping subsidiaries)

Gaselys* Thierry Daubignard

180 people (including 40 IT contractors)

Key Account Sales Jean-Pierre Roncato

220 people (including 140 in France)

Investor Day Scope

* subsidiary of Gaz de France (51%) and Société Générale (49%)

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

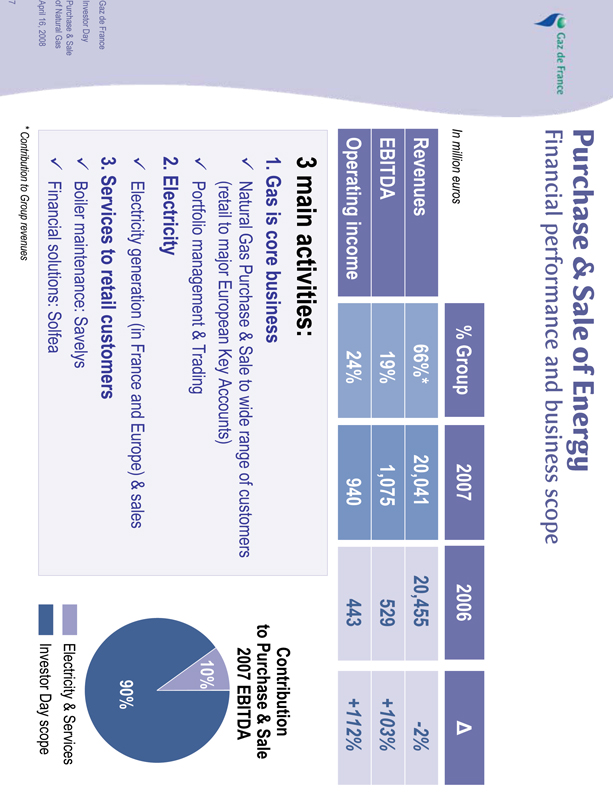

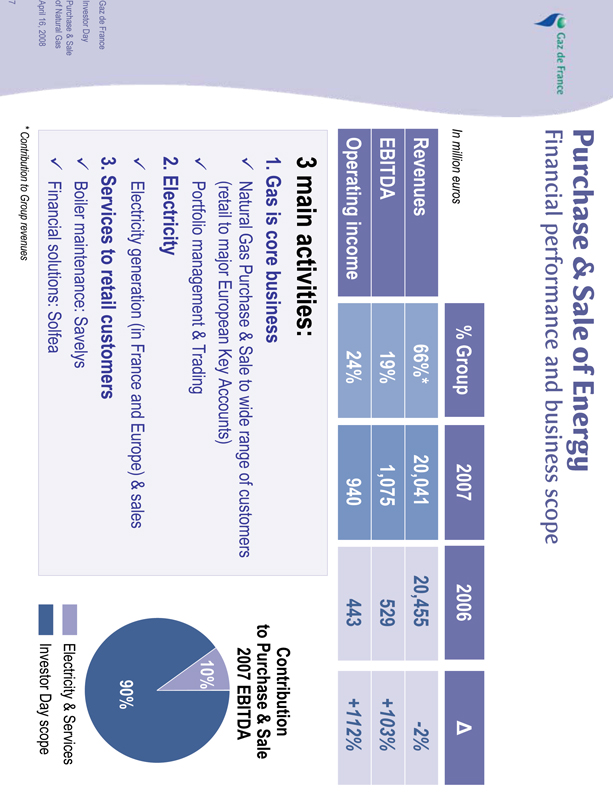

Purchase & Sale of Energy

Financial performance and business scope

In million euros % Group 2007 2006

Revenues 66%* 20,041 20,455 -2%

EBITDA 19% 1,075 529 +103%

Operating income 24% 940 443 +112%

3 main activities:

1. Gas is core business

Natural Gas Purchase & Sale to wide range of customers (retail to major European Key Accounts)

Portfolio management & Trading

2. Electricity

Electricity generation (in France and Europe) & sales

3. Services to retail customers

Boiler maintenance: Savelys

Financial solutions: Solfea

Contribution to Purchase & Sale 2007 EBITDA

10%

90%

Electricity & Services

Investor Day scope

* Contribution to Group revenues

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

1 Introduction organisation, facts & figures

2 Fundamentals and trends in global natural gas market

3 Key competitive advantages

4 Business model

5 Outlook & strategic directions

Jean-Marie Dauger

Chief Operating Officer

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

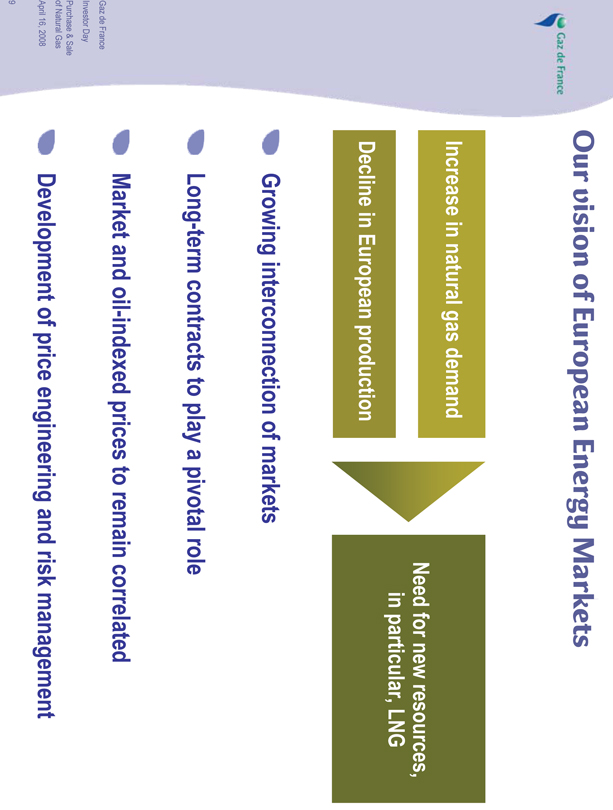

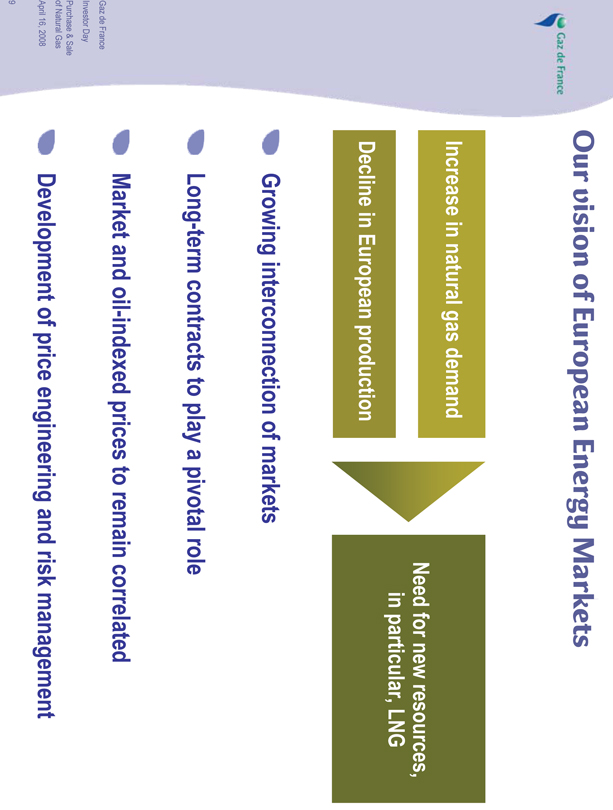

Our vision of European Energy Markets

Increase in natural gas demand

Decline in European production

Need for new resources, in particular, LNG

Growing interconnection of markets

Long-term contracts to play a pivotal role

Market and oil-indexed prices to remain correlated

Development of price engineering and risk management

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Our vision of European Energy Markets

Increase in natural gas demand

Total World primary energy demand

In Mtoe

+ 1.8%

11,429

13%

6%

21%

35%

25%

2005

-14,361

12%

6%

21%

33%

28%

2015

17,721

13%

5%

22%

32%

28%

2030

Hydro and renewables

Nuclear

Natural gas

Oil

Coal

+ 2.1%

Source: World Energy Outlook 2007, Reference Scenario, International Energy Agency

Total E.U primary energy demand

In Mtoe

+ 0.4%

1,814

8%

14%

24%

37%

17%

2005

1,910

10%

13%

27%

35%

15%

2015

2,006

15%

8%

30%

33%

14%

2030

Hydro and renewables

Nuclear

Natural gas

Oil

Coal

+ 1.3%

Mid-term growth expected for global gas demand

Uncertain growth pace

Increased competition for new resources

Mid-term growth expected for gas share of European energy demand

To be primarily driven by gas-fired power generation

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

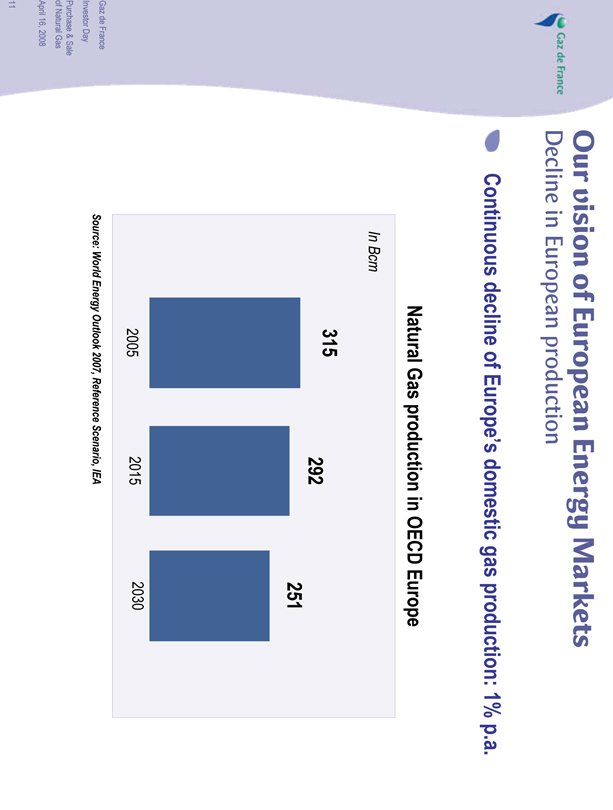

Our vision of European Energy Markets

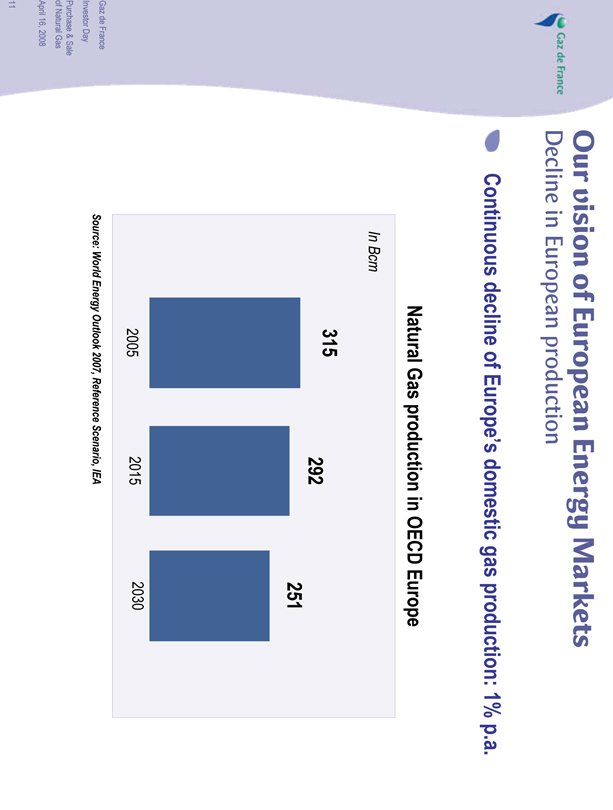

Decline in European production

Continuous decline of Europe’s domestic gas production: 1% p.a.

Natural Gas production in OECD Europe

In Bcm

315

292

251

2005 2015 2030

Source: World Energy Outlook 2007, Reference Scenario, IEA

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

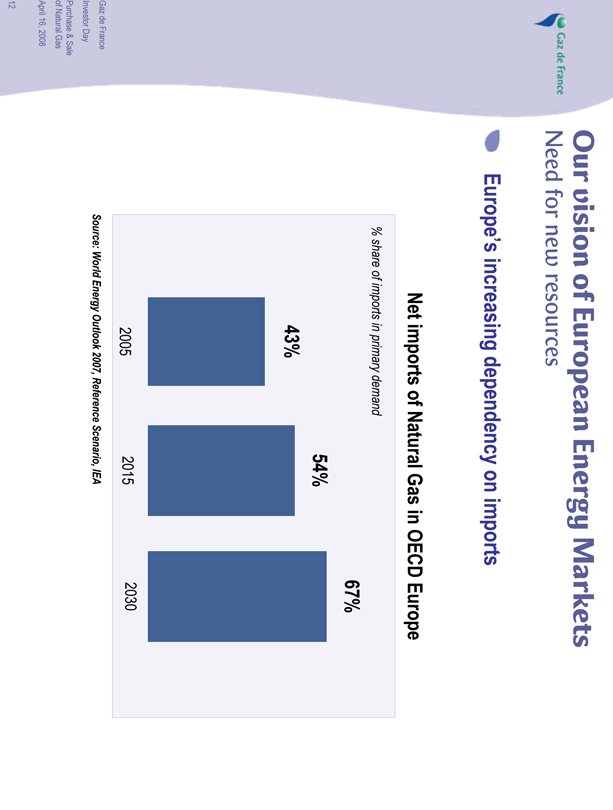

Our vision of European Energy Markets

Need for new resources

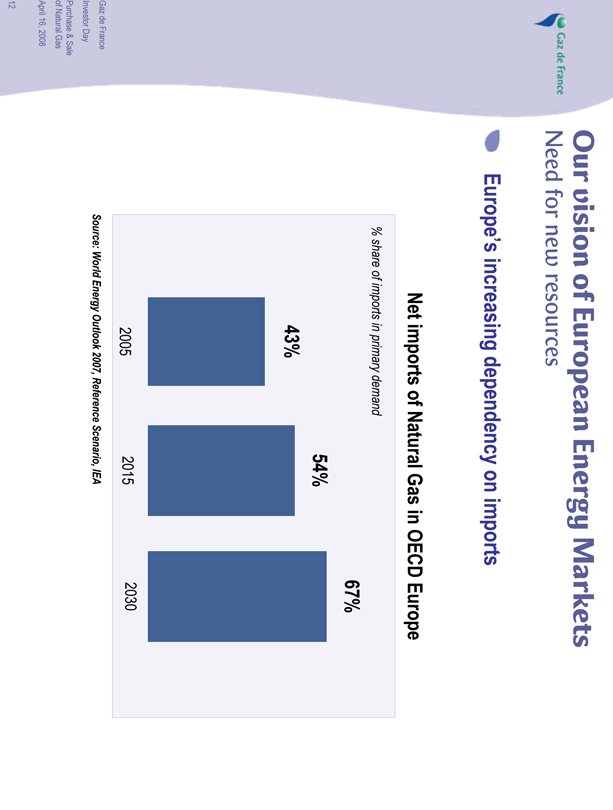

Europe’s increasing dependency on imports

Net imports of Natural Gas in OECD Europe

% share of imports in primary demand

43%

54%

67%

2005 2015 2030

Source: World Energy Outlook 2007, Reference Scenario, IEA

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

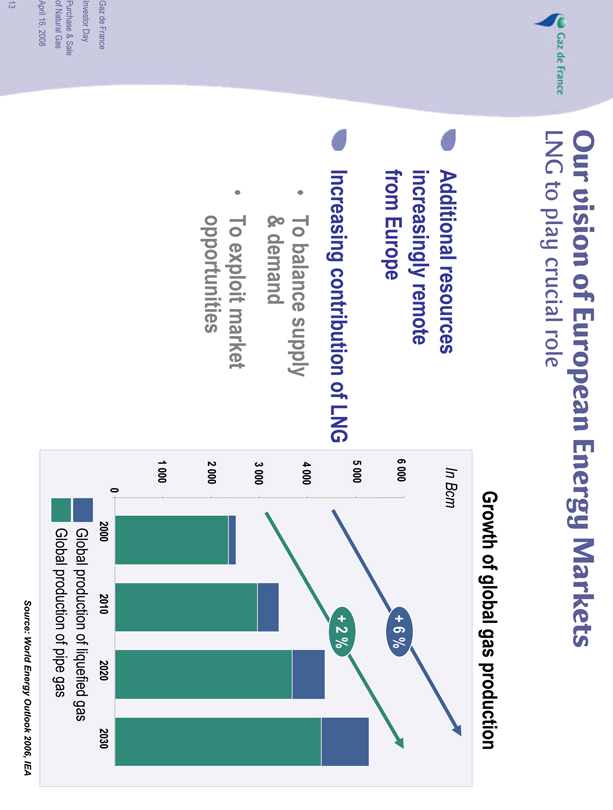

Our vision of European Energy Markets

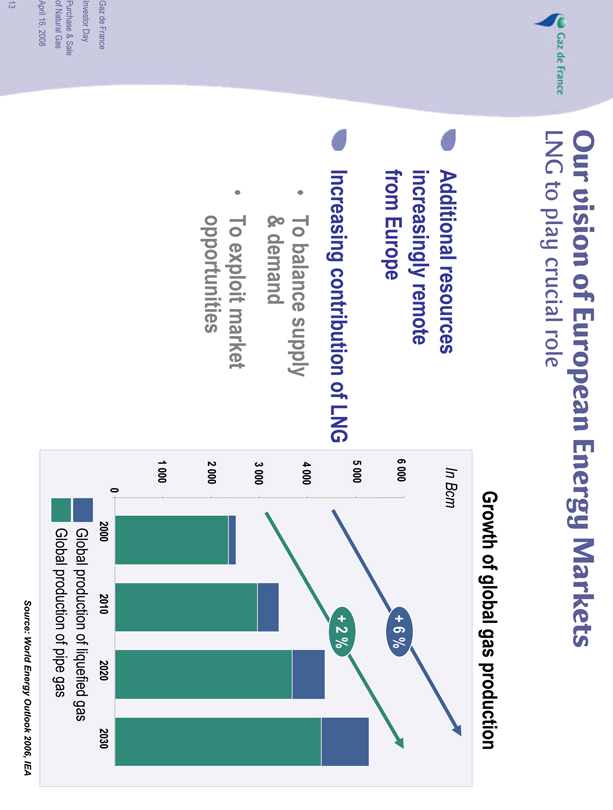

LNG to play crucial role

Additional resources increasingly remote from Europe

Increasing contribution of LNG

To balance supply & demand

To exploit market opportunities

Growth of global gas production

In Bcm

6 000

5 000

4 000

3 000

2 000

1 000

0

+ 6 %

+ 2 %

2000 2010 2020 2030

Global production of liquefied gas

Global production of pipe gas

Source: World Energy Outlook 2006, IEA

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

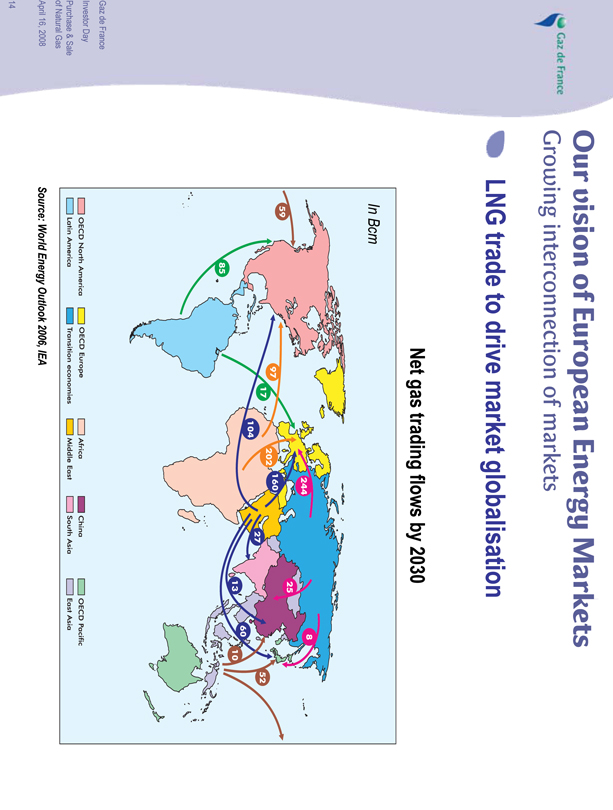

Our vision of European Energy Markets

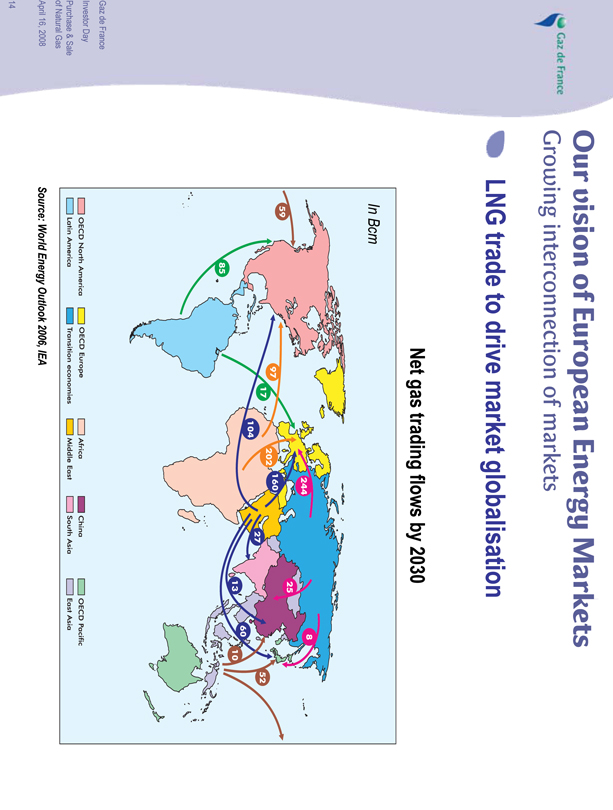

Growing interconnection of markets

LNG trade to drive market globalisation

Net gas trading flows by 2030

In Bcm

59

85

97

17

104

202

160

244

27

25

13

8

60

10

52

OECD North America

Latin America

OECD Europe

Transition economies

Africa

Middle East

China

South Asia

OECD Pacific

East Asia

Source: World Energy Outlook 2006, IEA

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Our vision of European Energy Markets

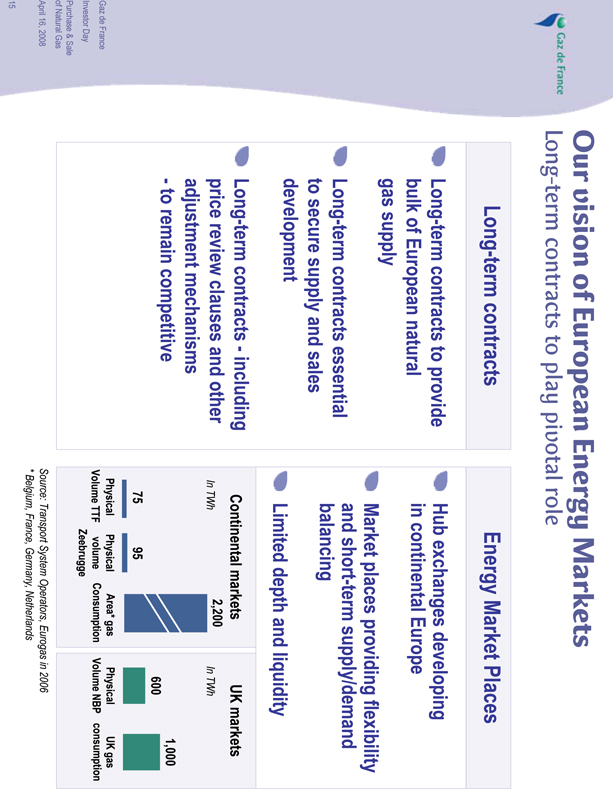

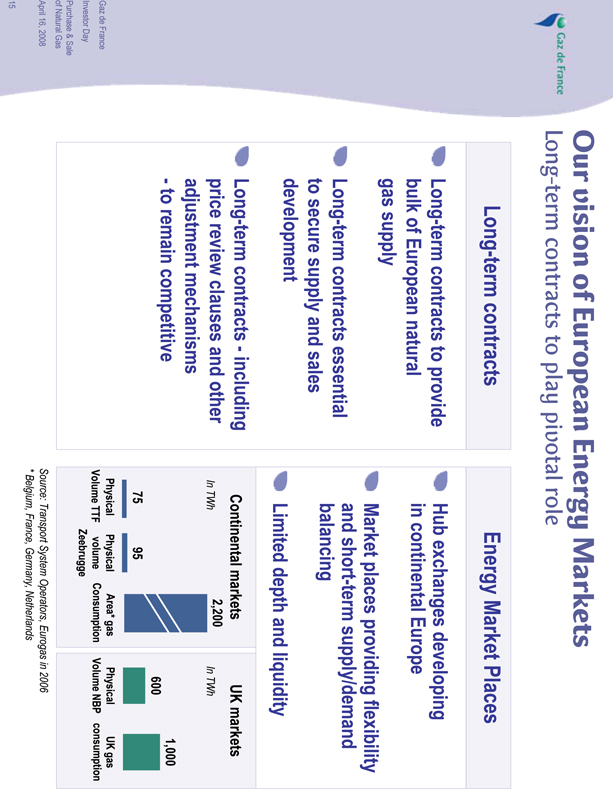

Long-term contracts to play pivotal role

Long-term contracts

Long-term contracts to provide bulk of European natural gas supply

Long-term contracts essential to secure supply and sales development

Long-term contracts - including price review clauses and other adjustment mechanisms - to remain competitive

Energy Market Places

Hub exchanges developing in continental Europe

Market places providing flexibility and short-term supply/demand balancing

Limited depth and liquidity

Continental markets

In TWh

75

Physical Volume TTF

95

Physical volume Zeebrugge

2,200

Area* gas Consumption

UK markets

In TWh

600

Physical Volume NBP

1,000

UK gas consumption

Source: Transport System Operators, Eurogas in 2006

* Belgium, France, Germany, Netherlands

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Our vision of European Energy Markets

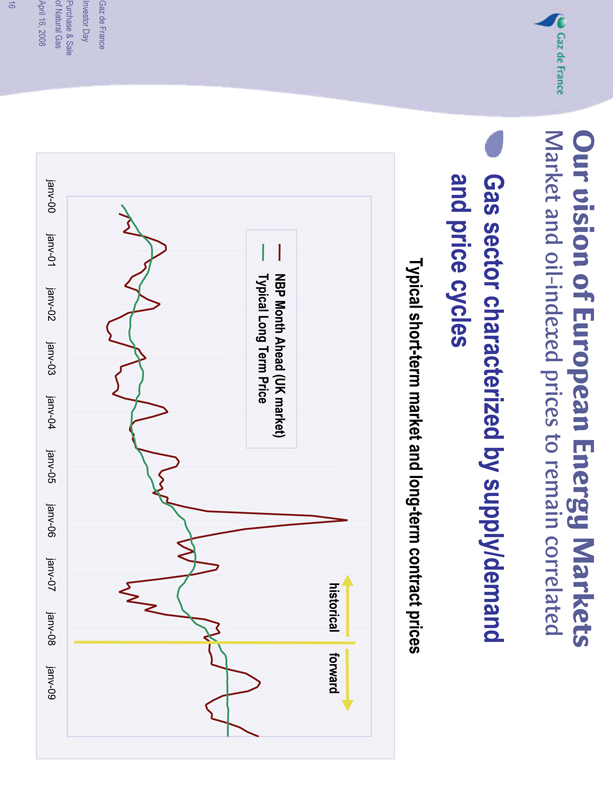

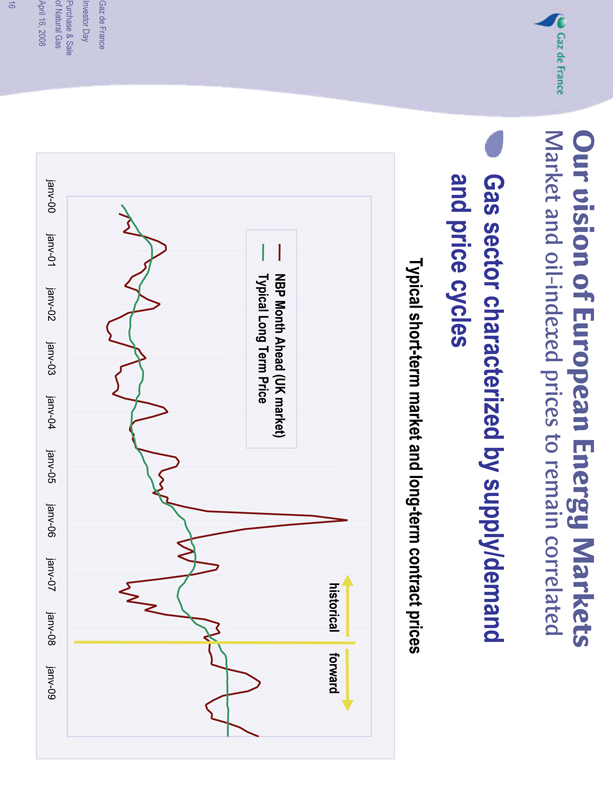

Market and oil-indexed prices to remain correlated

Gas sector characterized by supply/demand and price cycles

Typical short-term market and long-term contract prices

NBP Month Ahead (UK market)

Typical Long Term Price

historical forward

janv-00 janv-01 janv-02 janv-03 janv-04 janv-05 janv-06 janv-07 janv-08 janv-09

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Our vision of European Energy Markets

Development of price engineering and risk management

To meet large customers’ requirements

To hedge margins and secure profits in a volatile market

To extract value from supply portfolio

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

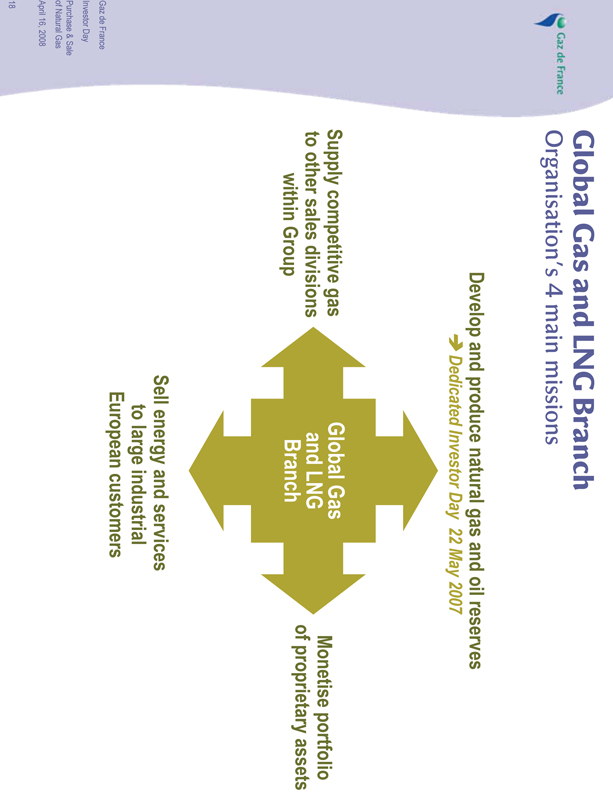

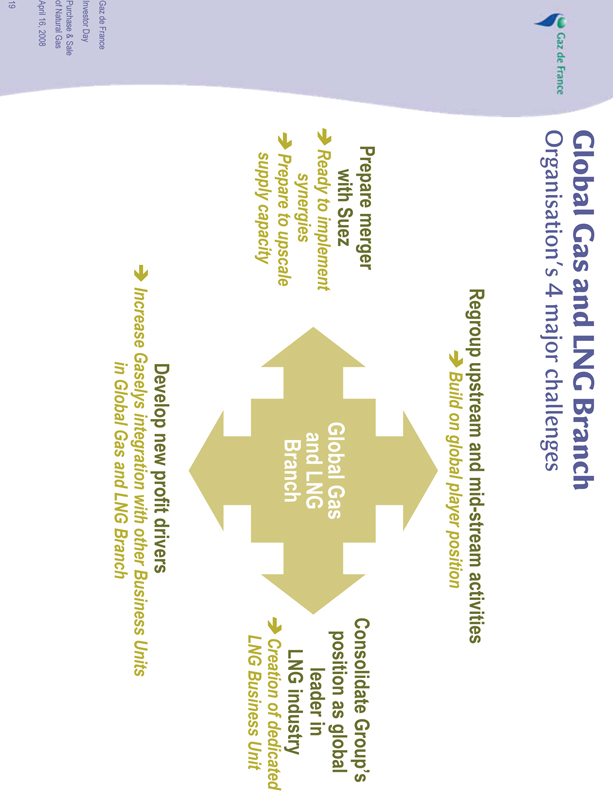

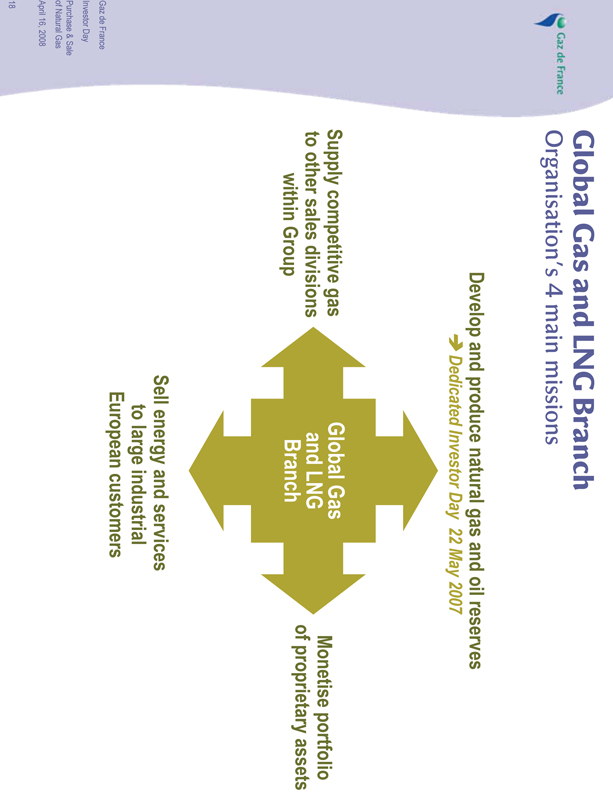

Global Gas and LNG Branch

Organisation’s 4 main missions

Develop and produce natural gas and oil reserves

Dedicated Investor Day 22 May 2007

Supply competitive gas to other sales divisions within Group

Global Gas and LNG Branch

Monetise portfolio of proprietary assets

Sell energy and services to large industrial European customers

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

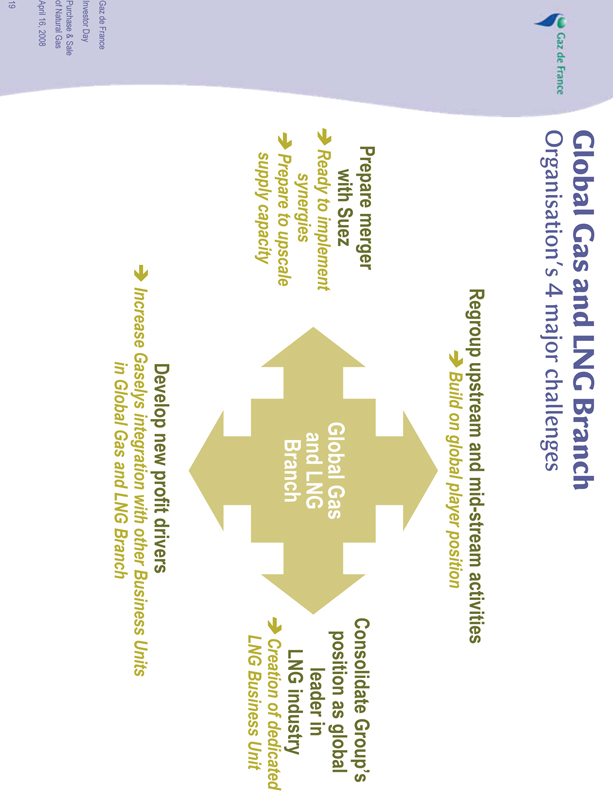

Global Gas and LNG Branch

Organisation’s 4 major challenges

Regroup upstream and mid-stream activities

Build on global player position

Prepare merger with Suez

Ready to implement synergies

Prepare to upscale supply capacity

Global Gas and LNG Branch

Consolidate Group’s position as global leader in LNG industry

Creation of dedicated LNG Business Unit

Develop new profit drivers

Increase Gaselys integration with other Business Units in Global Gas and LNG Branch

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

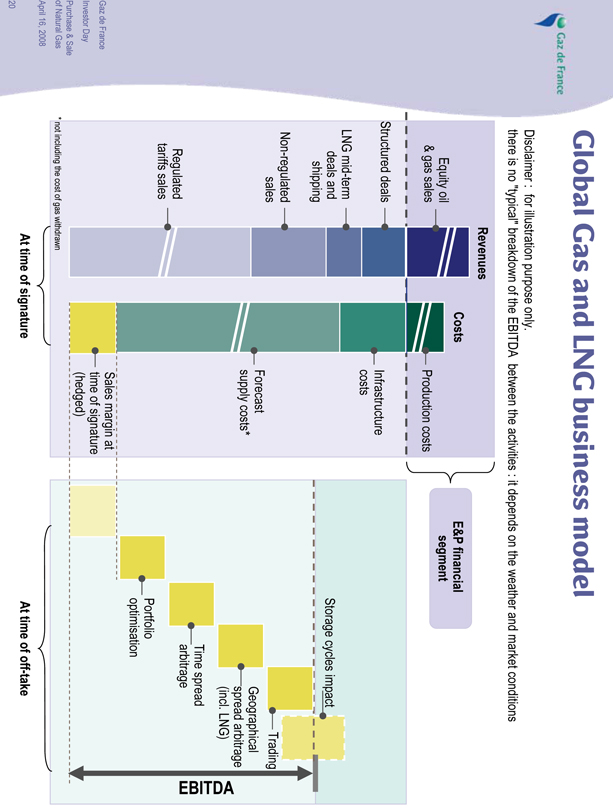

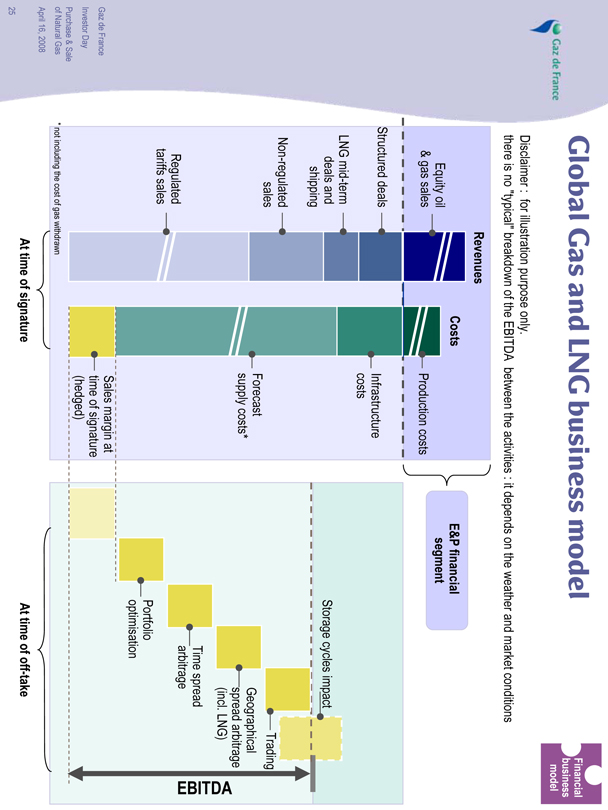

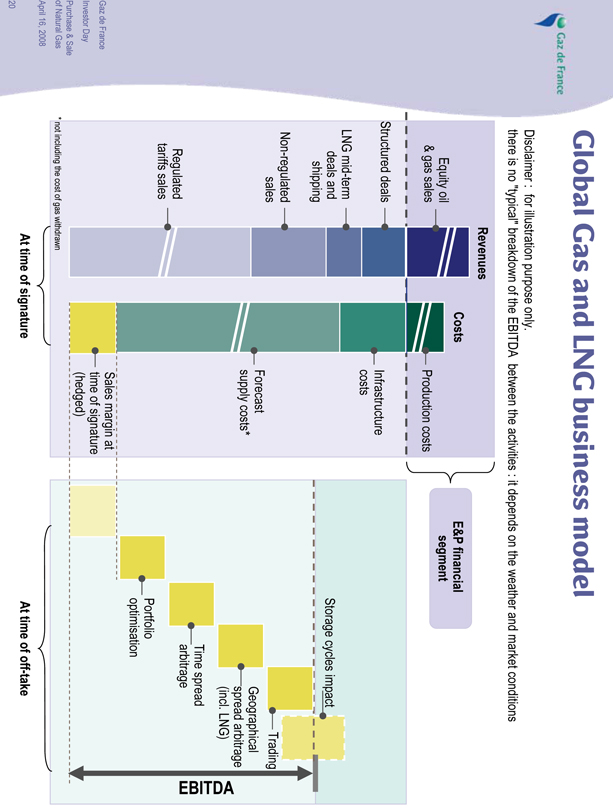

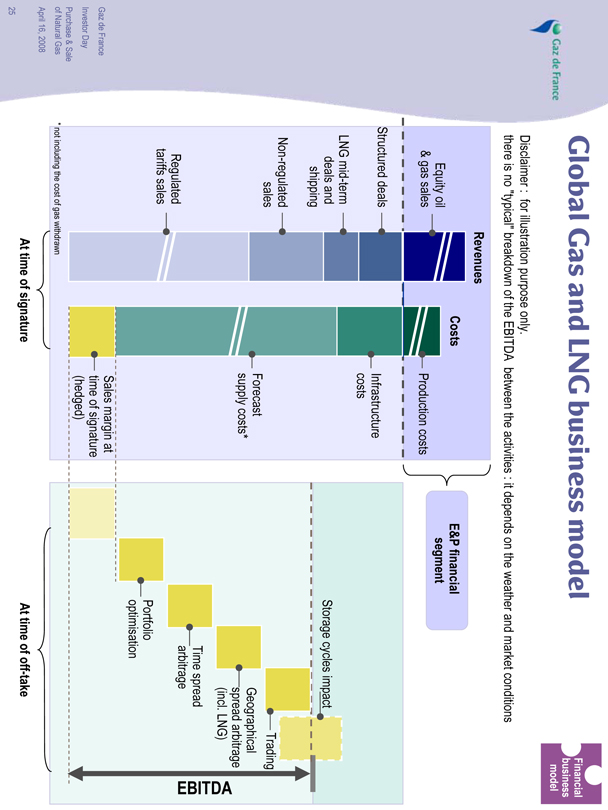

Global Gas and LNG business model

Disclaimer : for illustration purpose only. there is no “typical” breakdown of the EBITDA between the activities : it depends on the weather and market conditions

Revenues

Equity oil & gas sales

Structured deals

LNG mid-term deals and shipping

Non-regulated sales

Regulated tariffs sales

Costs

Production costs

Infrastructure costs

Forecast supply costs*

Sales margin at time of signature (hedged)

* not including the cost of gas withdrawn

At time of signature

E&P financial segment

Storage cycles impact

Trading

Geographical spread arbitrage (incl. LNG)

Time spread arbitrage

Portfolio optimisation

EBITDA

At time of off-take

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Video presentation

Supply

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

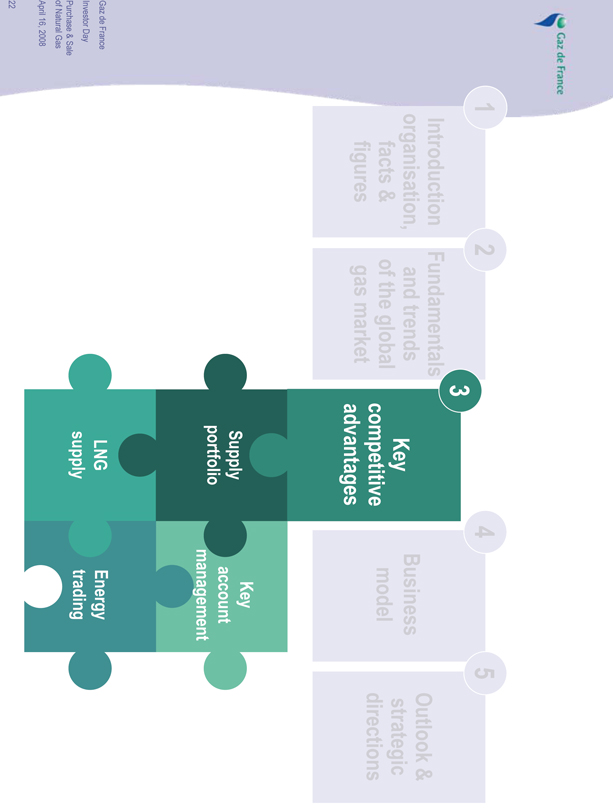

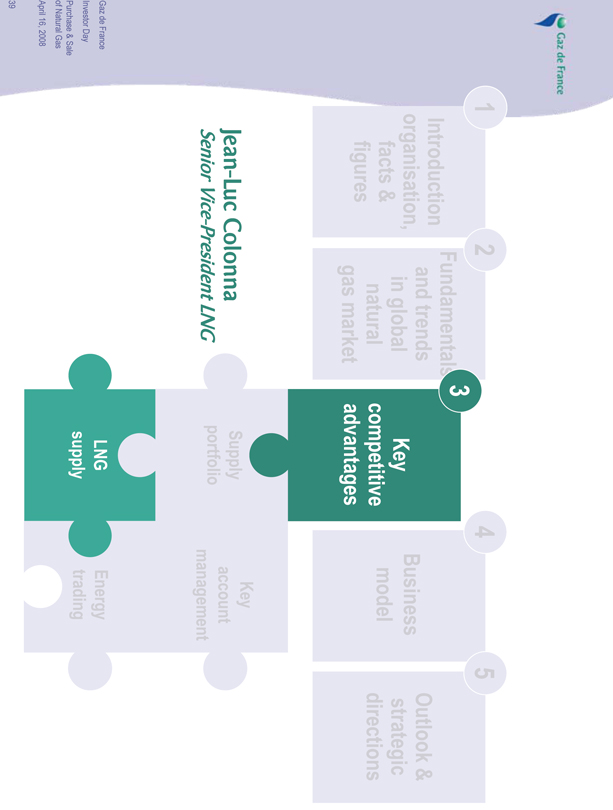

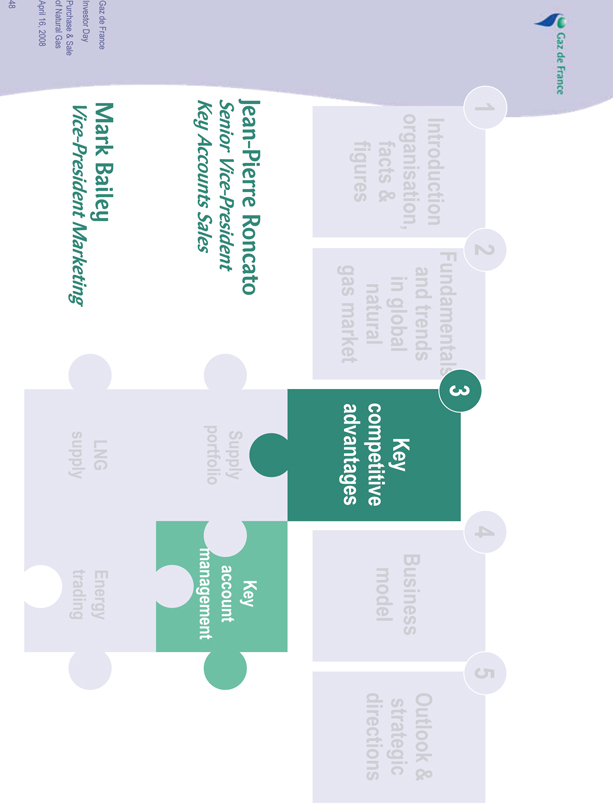

1 Introduction organisation, facts & figures

2 Fundamentals and trends of the global gas market

3 Key competitive advantages

Supply portfolio

LNG supply

4 Business model

Key account management

Energy trading

5 Outlook & strategic directions

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

1 Introduction organisation, facts & figures

2 Fundamentals and trends of the global gas market

3 Key competitive advantages

Supply portfolio

LNG supply

4 Business model

Key account management

Energy trading

5 Outlook & strategic directions

Édouard Sauvage

Senior Vice-President Gas Supply

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

One of Europe’s most valuable portfolio

Competitive gas supply contracts

Access to market places

Supply portfolio

Committed capacity in infrastructure

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

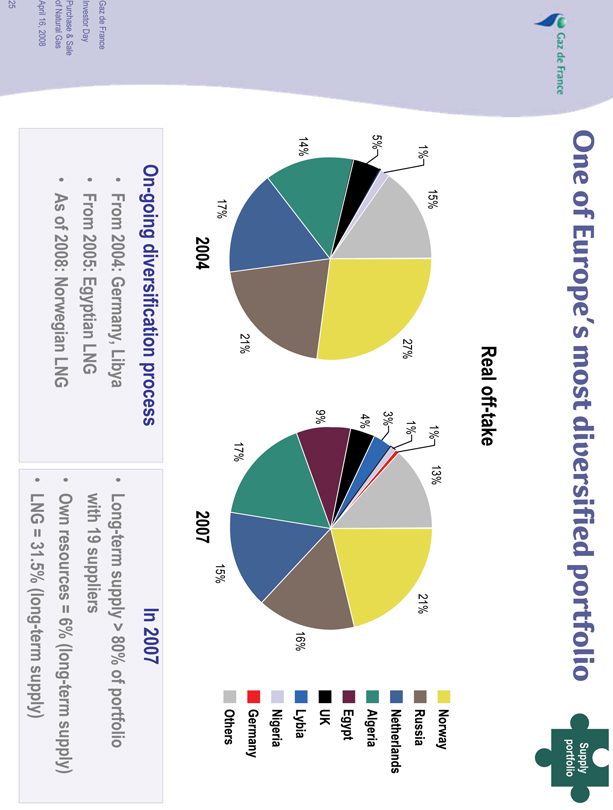

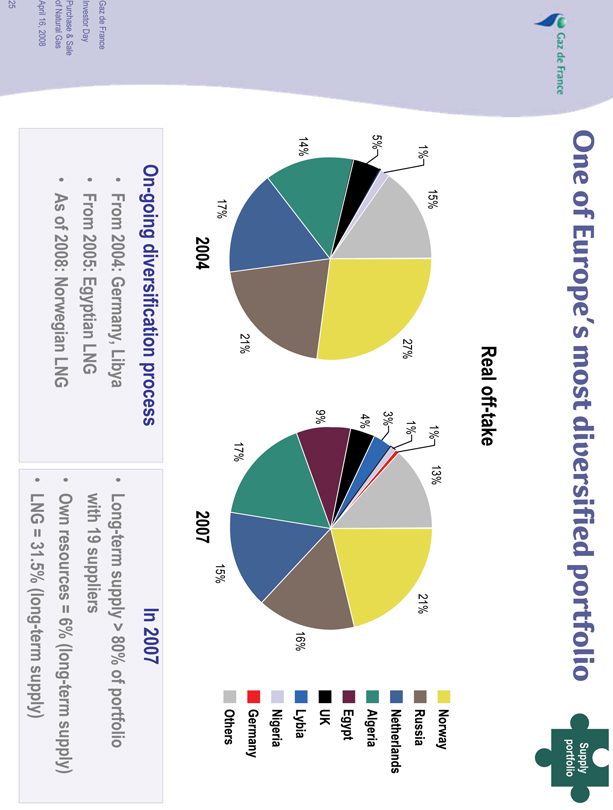

One of Europe’s most diversified portfolio

Supply portfolio

Real off-take

2004

15% 1% 5% 14% 17% 21% 27%

2007 13% 1% 1% 3% 4% 9% 17% 15% 16% 21%

Norway

Russia

Netherlands

Algeria

Egypt

UK

Lybia

Nigeria

Germany

Others

On-going diversification process

Form 2004: Germany, Libya

From 2005: Egyptian LNG

As of 2008: Norwegian LNG

In 2007

Long-term supply > 80% of portfolio with 19 suppliers

Own resources = 6% (long-term supply)

LNG = 31.5% (long-term supply)

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

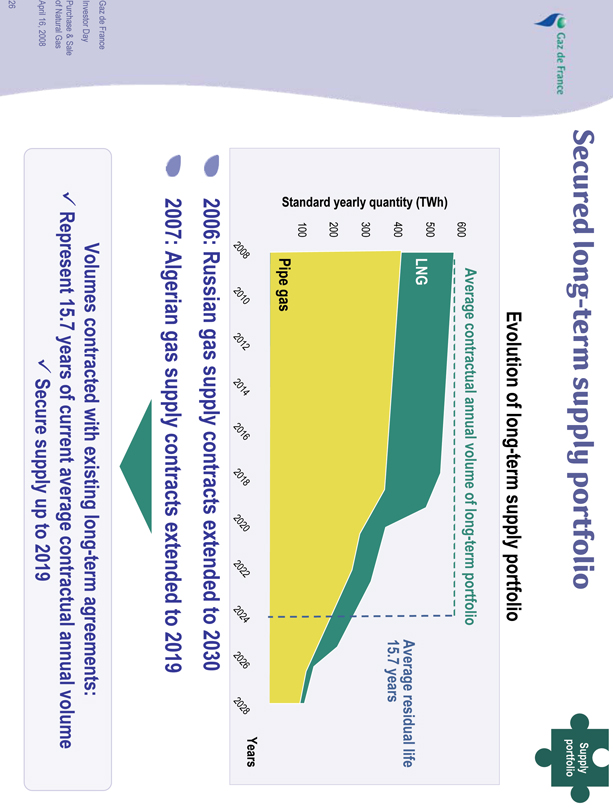

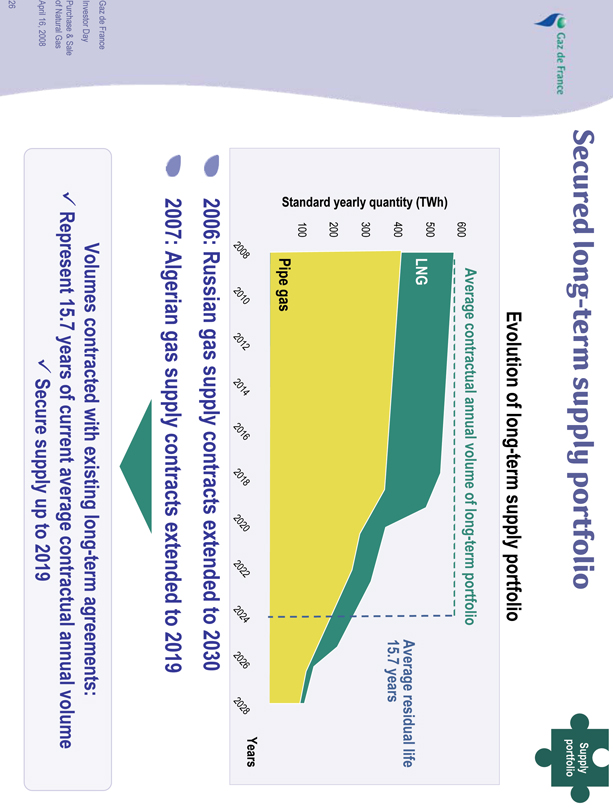

Secured long-term supply portfolio

Supply portfolio

Evolution of long-term supply portfolio

Average contractual annual volume of long-term portfolio

Standard yearly quantity (TWh)

600

500

400

300

200

100

LNG

Pipe gas

Years 2008 2010 2012 2014 2016 2018 2020 2022 2024 2026 2028

Average residual life 15.7 years

2006: Russian gas supply contracts extended to 2030

2007: Algerian gas supply contracts extended to 2019

Volumes contracted with existing long-term agreements:

Represent 15.7 years of current average contractual annual volume

Secure supply up to 2019

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

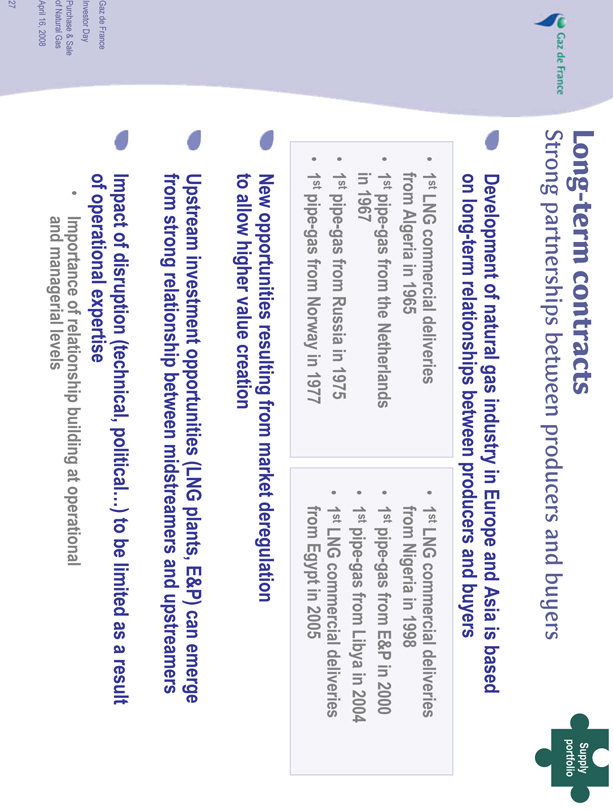

Long-term contracts

Strong partnerships between producers and buyers

Supply portfolio

Development of natural gas industry in Europe and Asia is based on long-term relationships between producers and buyers

1st LNG commercial deliveries from Algeria in 1965

1st pipe-gas from the Netherlands in 1967

1st pipe-gas from Russia in 1975

1st pipe-gas from Norway in 1977

1st LNG commercial deliveries from Nigeria in 1998

1st pipe-gas from E&P in 2000

1st pipe-gas from Libya in 2004

1st LNG commercial deliveries from Egypt in 2005

New opportunities resulting from market deregulation to allow higher value creation

Upstream investment opportunities (LNG plants, E&P) can emerge from strong relationship between midstreamers and upstreamers

Impact of disruption (technical, political…) to be limited as a result of operational expertise

Importance of relationship building at operational and managerial levels

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Video presentation

30-year anniversary of Gaz de France-Gazprom Partnership

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

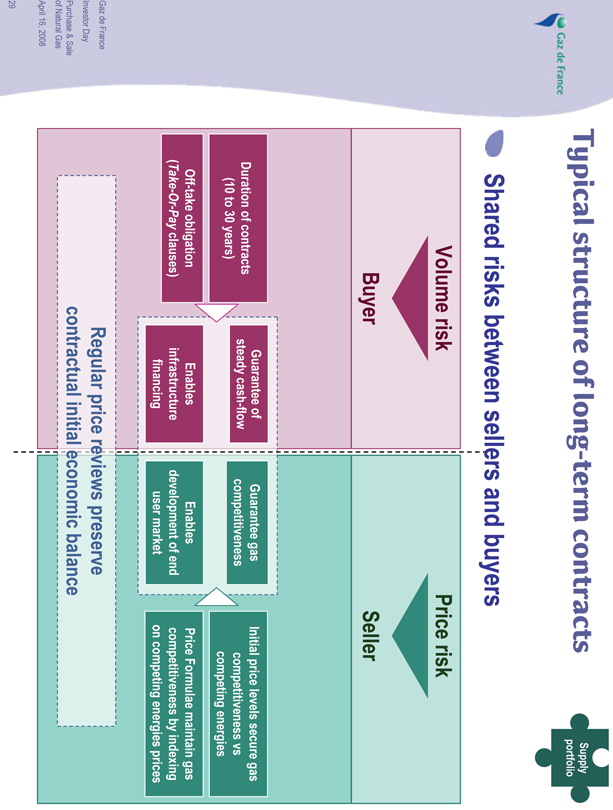

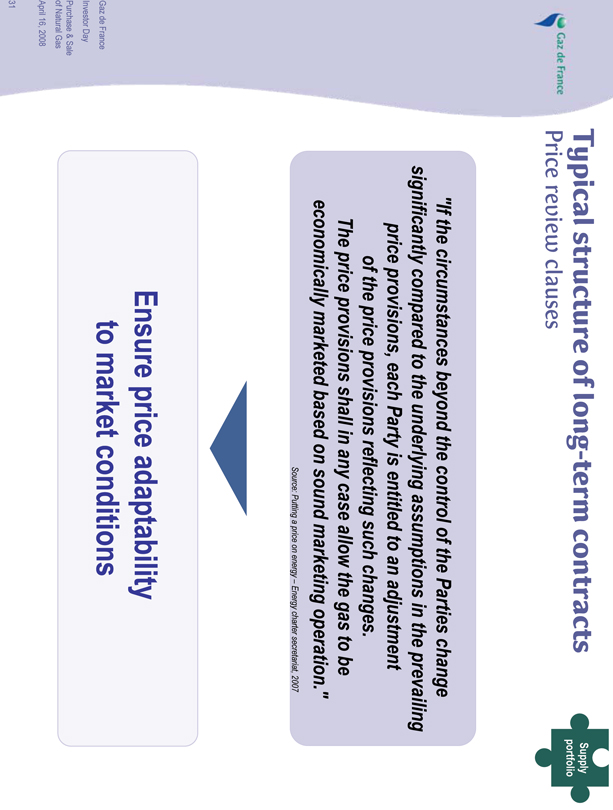

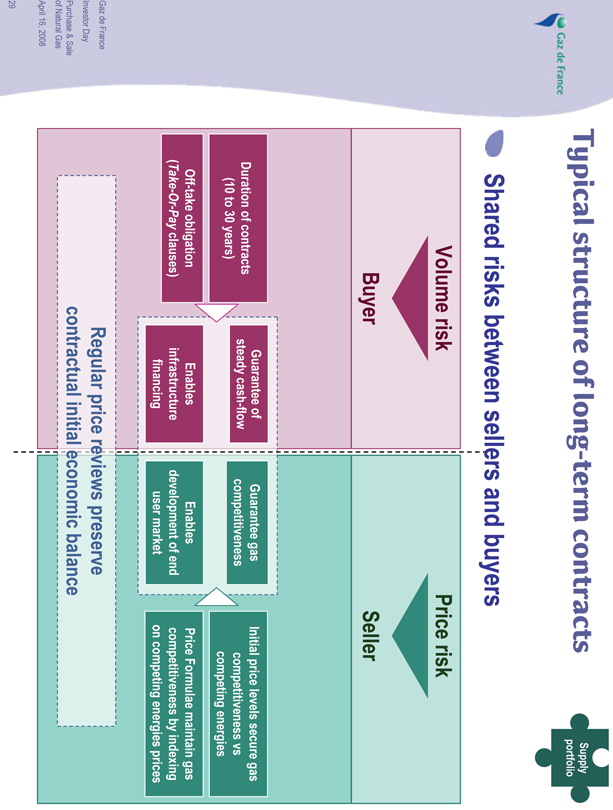

Typical structure of long-term contracts

Supply portfolio

Shared risks between sellers and buyers

Volume risk

Buyer

Duration of contracts (10 to 30 years)

Off-take obligation (Take-Or-Pay clause)

Guarantee of steady cash-flow

Enables infrastructure financing

Price risk

Seller

Guarantee gas competitiveness

Enables development of end user market

Initial price levels secure gas competitiveness vs competing energies

Price Formulae maintain gas competitiveness by indexing on competing energies prices

Regular price reviews preserve contractual initial economic balance

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

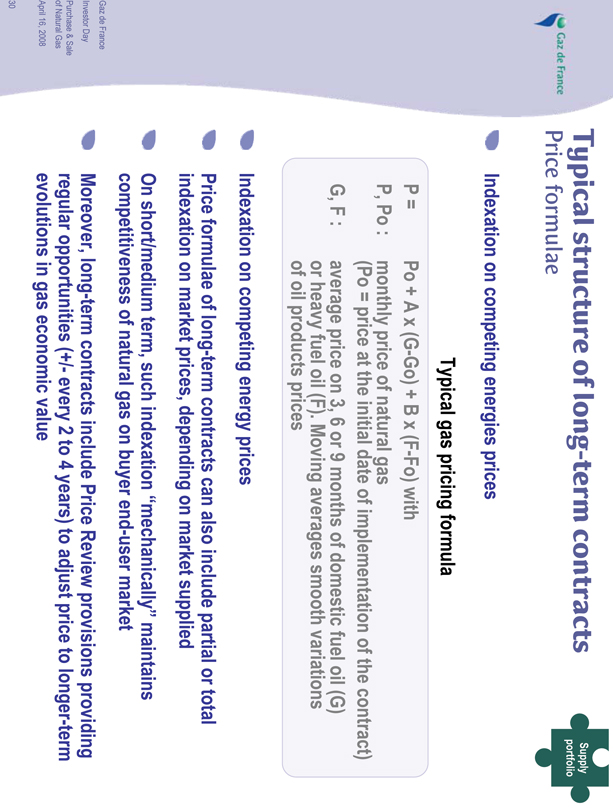

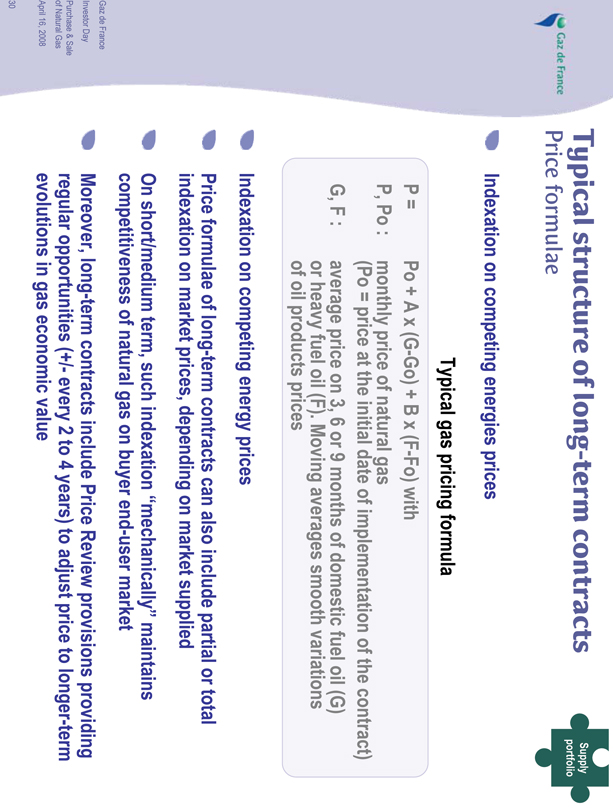

Typical structure of long-term contracts

Price formulae

Supply portfolio

Indexation on competing energies prices

Typical gas pricing formula

P = Po + A x (G-Go) + B x (F-Fo) with

P, Po : monthly price of natural gas (Po = price at the initial date of implementation of the contract)

G, F : average price on 3, 6 or 9 months of domestic fuel oil (G) or heavy fuel oil (F). Moving averages smooth variations of oil products prices

Indexation on competing energy prices

Price formulae of long-term contracts can also include partial or total indexation on market prices, depending on market supplied

On short/medium term, such indexation “mechanically” maintains competitiveness of natural gas on buyer end-user market

Moreover, long-term contracts include Price Review provisions providing regular opportunities (+/- every 2 to 4 years) to adjust price to longer-term evolutions in gas economic value

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Typical structure of long-term contracts

Price review clauses

Supply portfolio

“If the circumstances beyond the control of the Parties change significantly compared to the underlying assumptions in the prevailing price provisions, each Party is entitled to an adjustment of the price provisions reflecting such changes. The price provisions shall in any case allow the gas to be economically marketed based on sound marketing operation.”

Source: Putting a price on energy - Energy charter secretariat, 2007

Ensure price adaptability to market conditions

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

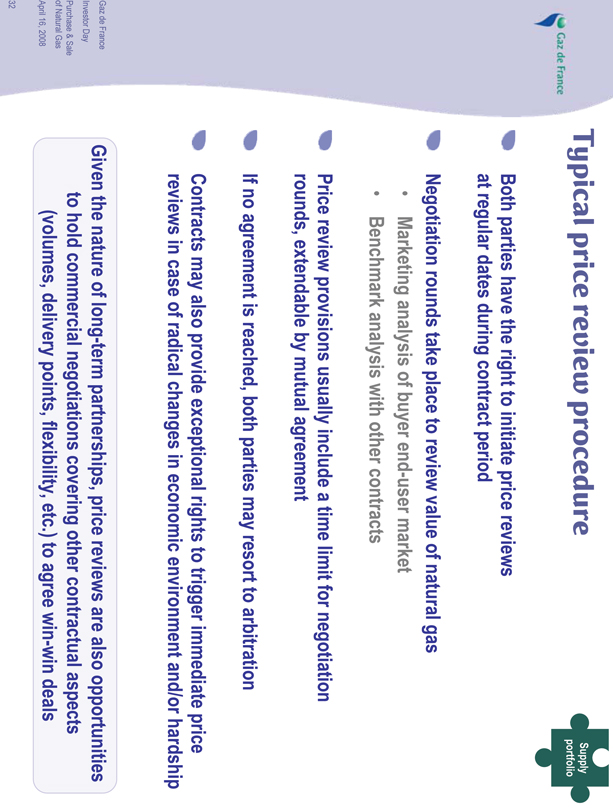

Typical price review procedure

Supply portfolio

Both parties have the right to initiate price reviews at regular dates during contract period

Negotiation rounds take place to review value of natural gas

Marketing analysis of buyer end-user market

Benchmark analysis with other contracts

Price review provisions usually include a time limit for negotiation rounds, extendable by mutual agreement

If no agreement is reached, both parties may resort to arbitration

Contracts may also provide exceptional rights to trigger immediate price reviews in case of radical changes in economic environment and/or hardship

Given the nature of long-term partnerships, price reviews are also opportunities to hold commercial negotiations covering other contractual aspects (volumes, delivery points, flexibility, etc.) to agree win-win deals

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

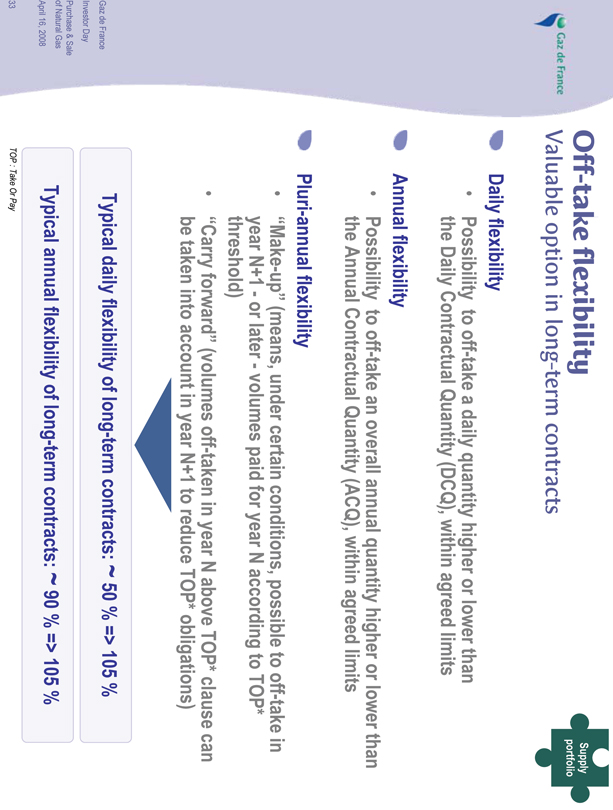

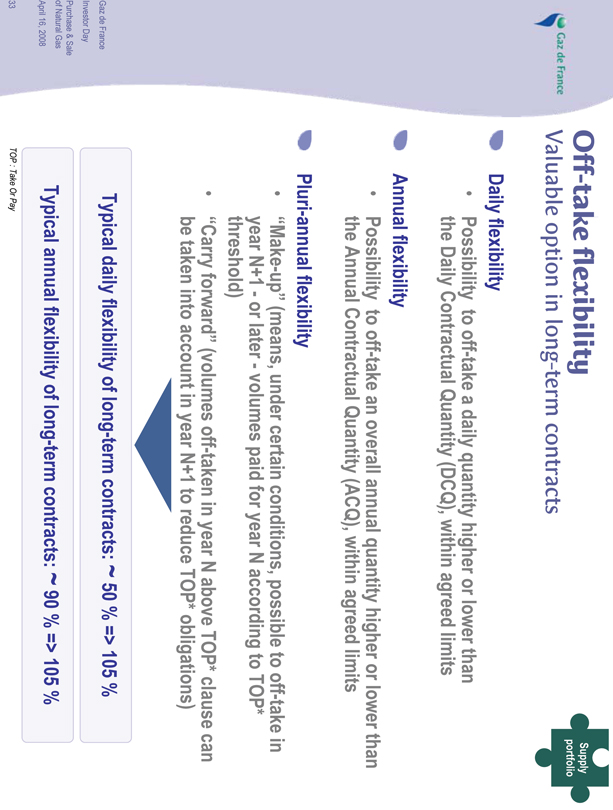

Off-take flexibility

Valuable option in long-term contracts

Supply portfolio

Daily flexibility

Possibility to off-take a daily quantity higher or lower than the Daily Contractual Quantity (DCQ), within agreed limits

Annual flexibility

Possibility to off-take an overall annual quantity higher or lower than the Annual Contractual Quantity (ACQ), within agreed limits

Pluri-annual flexibility

“Make-up” (means, under certain conditions, possible to off-take in year N+1 - or later - volumes paid for year N according to TOP* threshold)

“Carry forward” (volumes off-taken in year N above TOP* clause can be taken into account in year N+1 to reduce TOP* obligations)

Typical daily flexibility of long-term contracts: ~ 50 % => 105 %

Typical annual flexibility of long-term contracts: ~ 90 % => 105 %

TOP : Take Or Pay

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

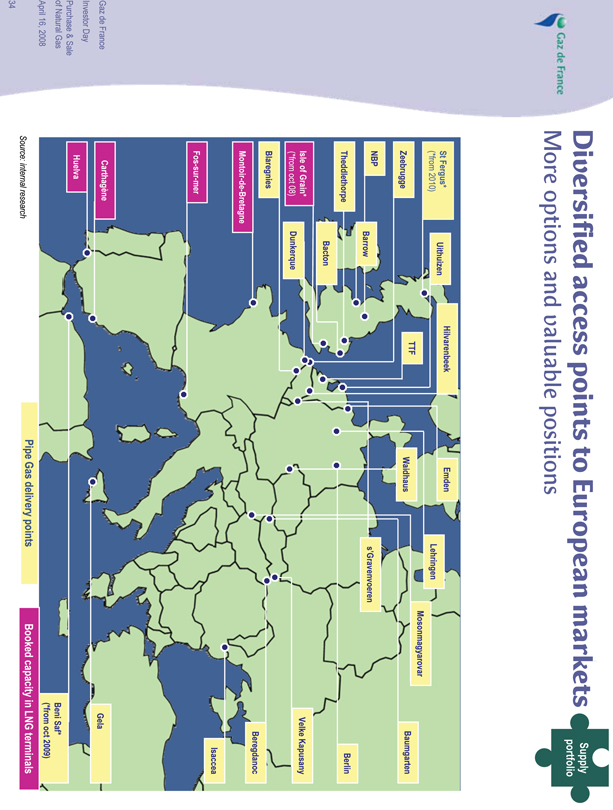

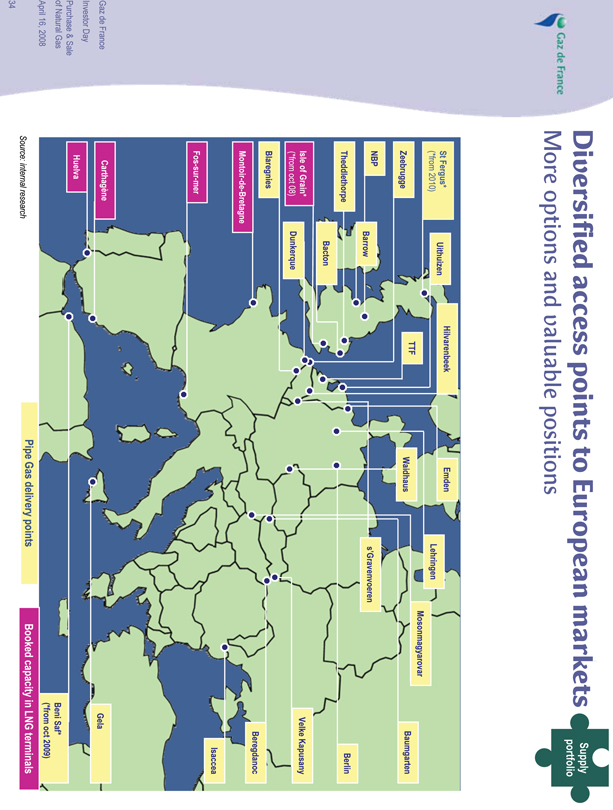

Diversified access points to European markets

More options and valuable positions

Supply portfolio

St Fergus* (*from 2010)

Ulthuizen

Hilvarenbeek

Emden

Lehringen

Mosonmagyarovar

Baumgarten

Zeebrugge

TTF

Waidhaus

s’Gravenvoeren

Berlin

NBP

Barrow

Theddlethorphe

Bacton

Velke Kapusamy

Isle of Grain* (*frome oct 08)

Dunkerque

Blaregnies

Beregdanoc

Montoir-de-Bretagne

Fos-sur-mer

Isaccea

Carthagene

Gela

Huelva

Beni-Saf* (*from oct 2009)

Pipe Gas delivery points Booked capacity in LNG terminals

Source: internal research

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

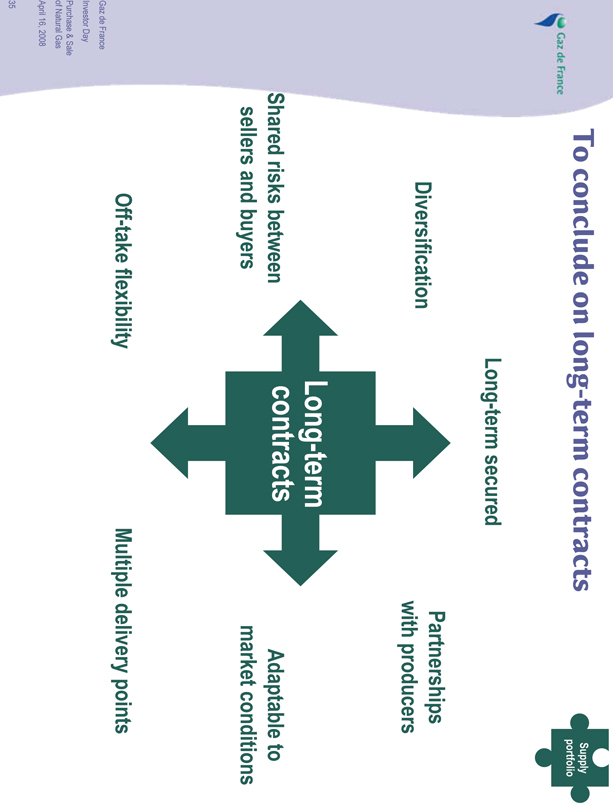

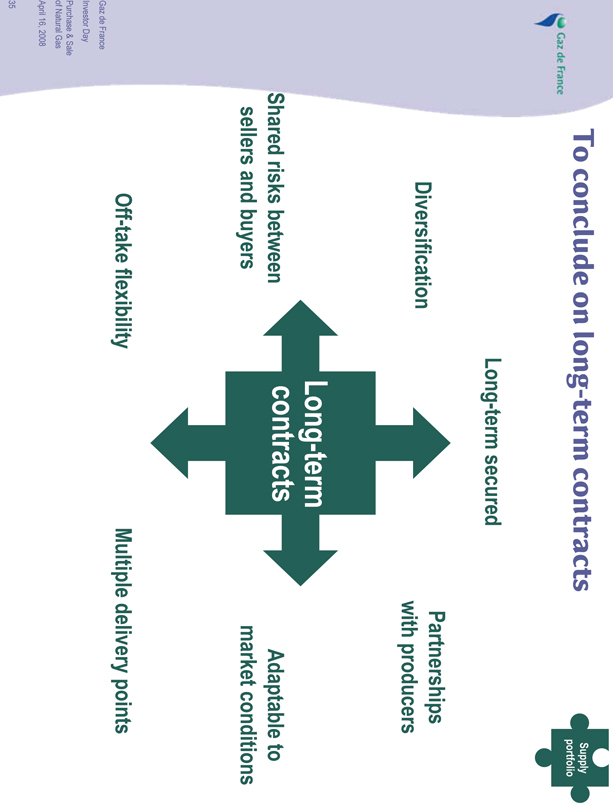

To conclude on long-term contracts

Supply portfolio

Long-term secured

Diversification

Partnerships with producers

Shared risks between sellers and buyers

Long-term contracts

Adaptable to market conditions

Off-take flexibility

Multiple delivery points

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

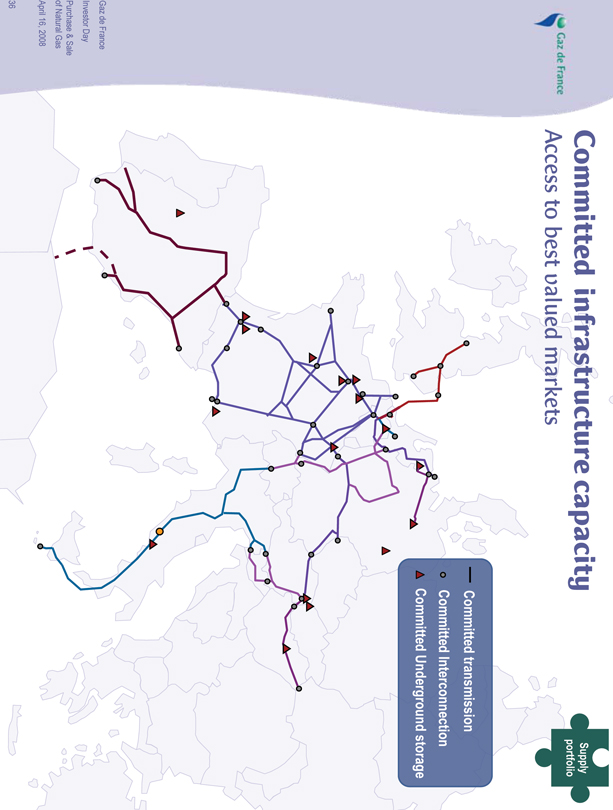

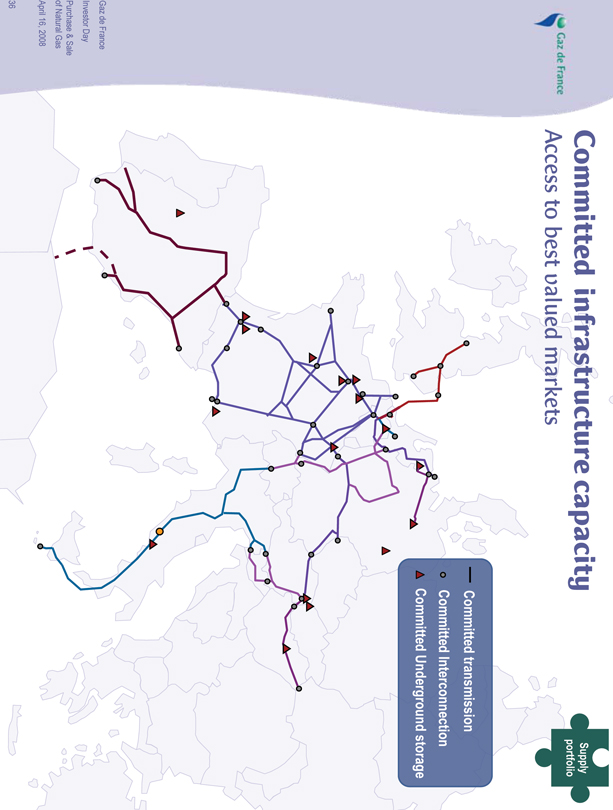

Committed infrastructure capacity

Access to best valued markets

Supply portfolio

Committed transmission

Committed Interconnection

Committed Underground storage

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

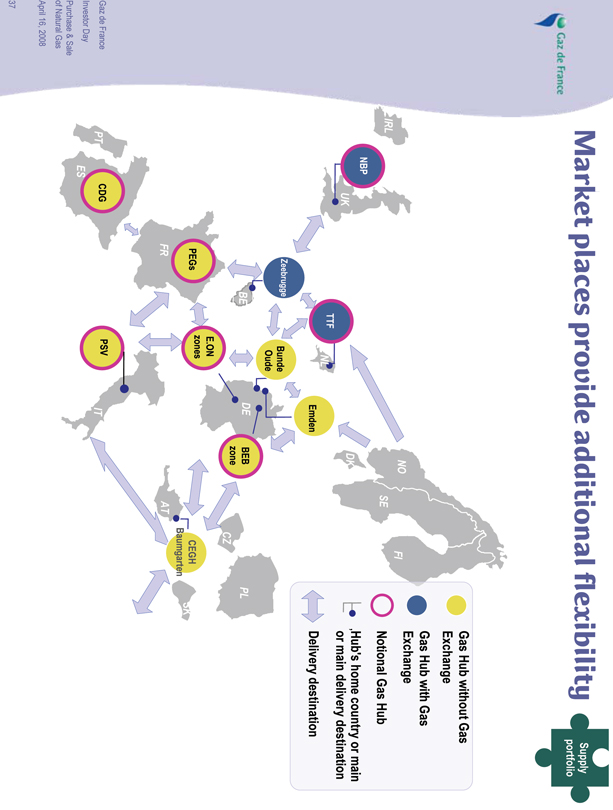

Gaz de France

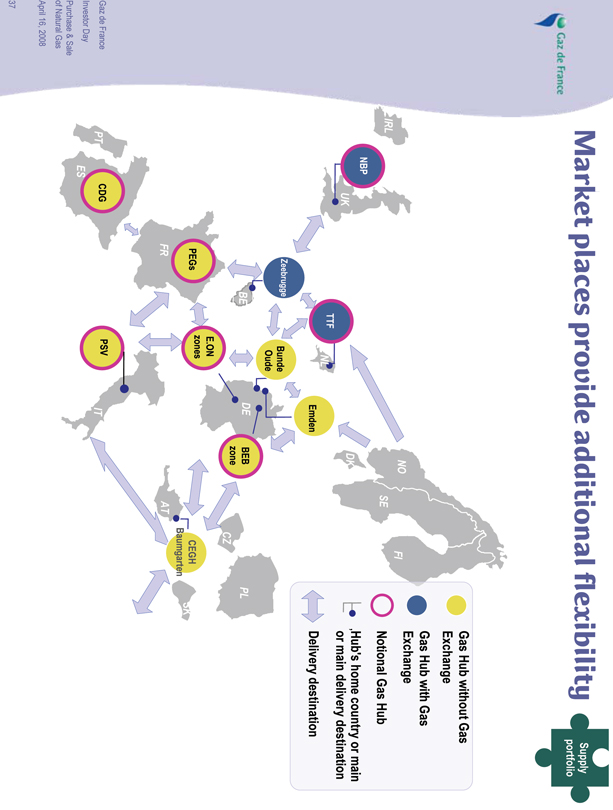

Market places provide additional flexibility

Supply portfolio

IRL

NBP

UK

PT

ES

CDG

FR

PEGs

Zeebrugge

BE

TTF

NL

Bunde Oude

E.ON zones

PSV

IT

DE

BEB zone

Emden

DK

NO

SE

FI

CZ

PL

CEGH Baumgarten

AT

SK

Gas Hub without Gas Exchange

Gas Hub with Gas Exchange

Notional Gas Hub

Hub’s home country or main or main delivery destination

Delivery destination

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Video presentation

LNG

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

1 Introduction organisation, facts & figures

2 Fundamentals and trends in global natural gas market

3 Key competitive advantages

Supply portfolio

LNG supply

4 Business model

Key account management

Energy trading

5 Outlook & strategic directions

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

LNG flexibility to increase supply portfolio value

Gaz de France LNG strategy and leadership

Strong global positions

LNG supply

LNG Large and diversified LNG supply portfolio

Large renewed LNG fleet

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Gaz de France LNG development strategy

LNG supply

A clear positioning as integrated mid-streamer with an LNG business

Based on long-term relationship with producers

Focused on supplying our 14.5 million European customers

Able to seize global arbitrage opportunities thanks to a large and diversified portfolio

Balanced between:

Supply/trading activities

Investments in infrastructures all along the LNG chain

A track record of technical and commercial innovations

Liquefaction process, safety models, floating facilities (flexible hoses)

Partnerships with suppliers and banks, LNG/pipe gas swaps, regasification capacity swaps

LNG: 31.5% of Gaz de France long-term supply portfolio

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

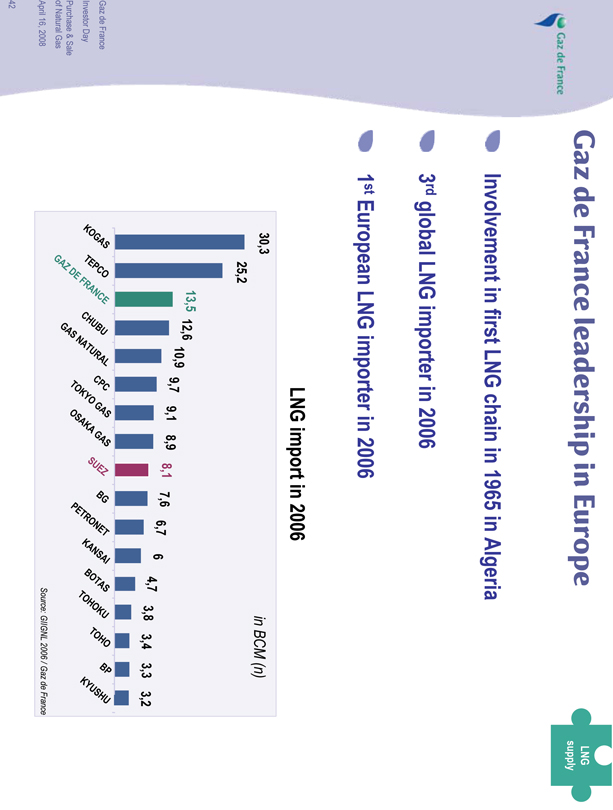

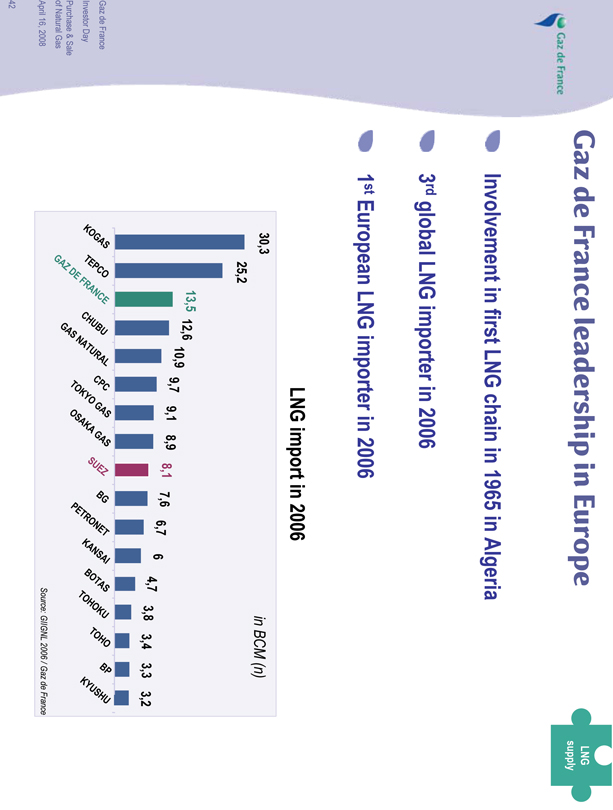

Gaz de France leadership in Europe

LNG supply

Involvement in first LNG chain in 1965 in Algeria

3rd global LNG importer in 2006

1st European LNG importer in 2006

LNG import in 2006

30,3 KOGAS

25.2 TEPCO

13,5 GAZ DE FRANCE

12,6 CHUBU

10,9 GAS NATURAL

9,7 CPC

9,1 TOKYO GAS

8,9 OSAKA GAS

8,1 SUEZ

7,6 BG

6,7 PETRONET

6 KANSAI

4,7 BOTAS

3,8 TOHOKU

3,4 TOHO

3,3 BP

3,2 KYUSHU

Source: GIIGNL 2006/Gaz de France

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

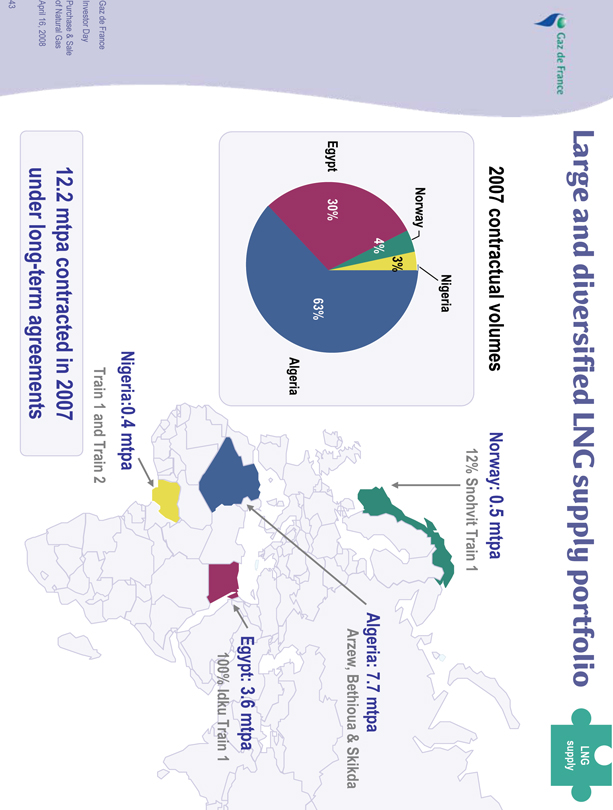

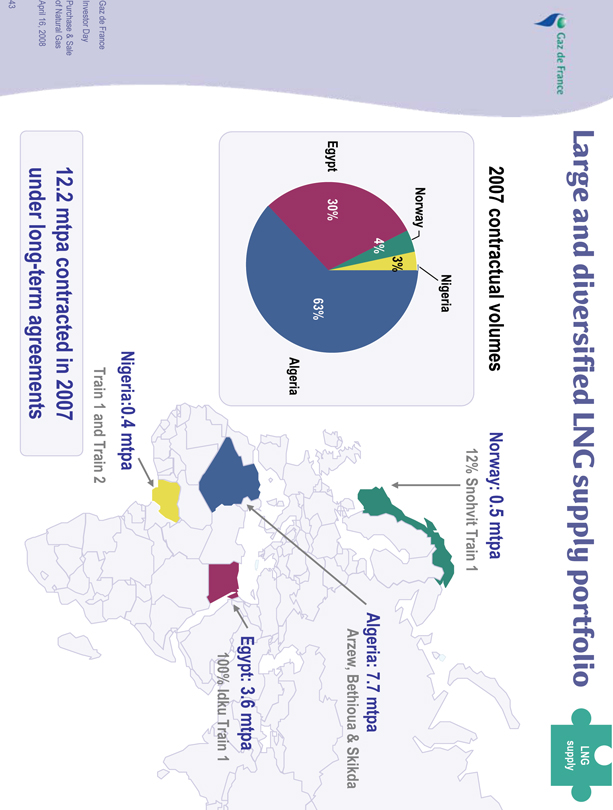

Large and diversified LNG supply portfolio

LNG supply

2007 contractual volumes

Norway: 0.5 mtpa 12% Snohvit Train 1

Nigeria 3%

Norway 4%

Egypt 30%

Algeria: 63%

Algeria: 7.7 mtpa Arzew, Bethioua & Skikda

Egypt: 3.6 mtpa

100% Idku Train 1

Nigeria:0.4 mtpa

Train 1 and Train 2

12.2 mtpa contracted in 2007 under long-term agreements

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

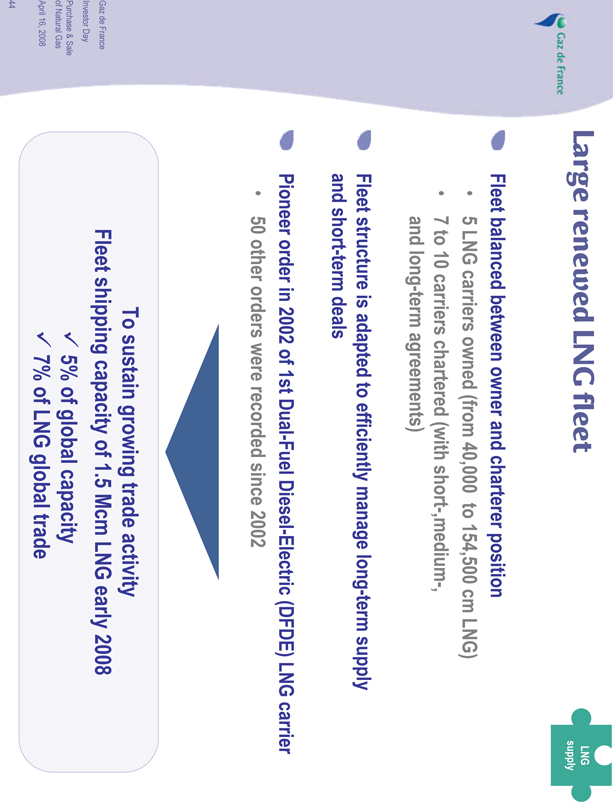

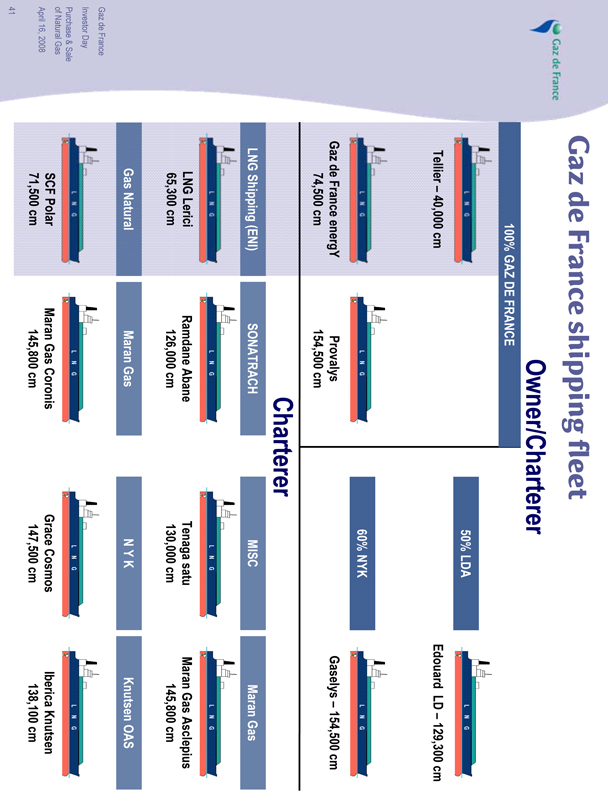

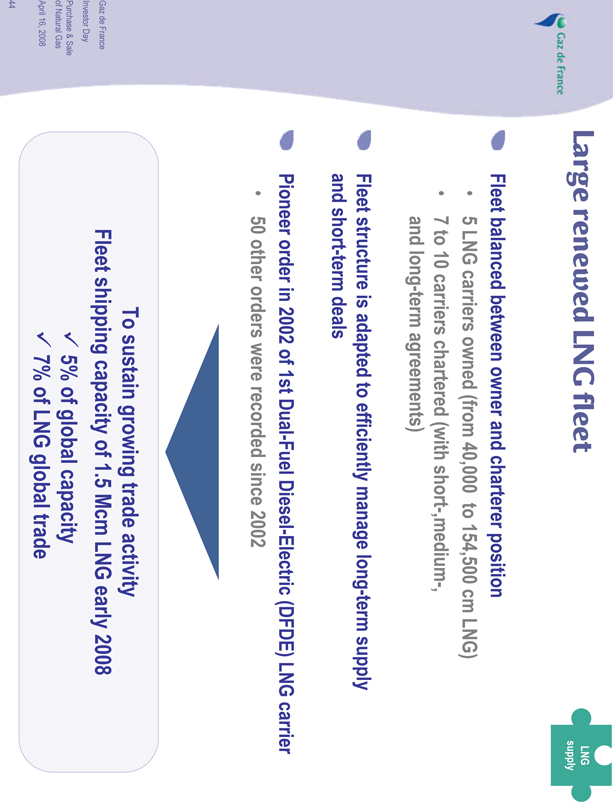

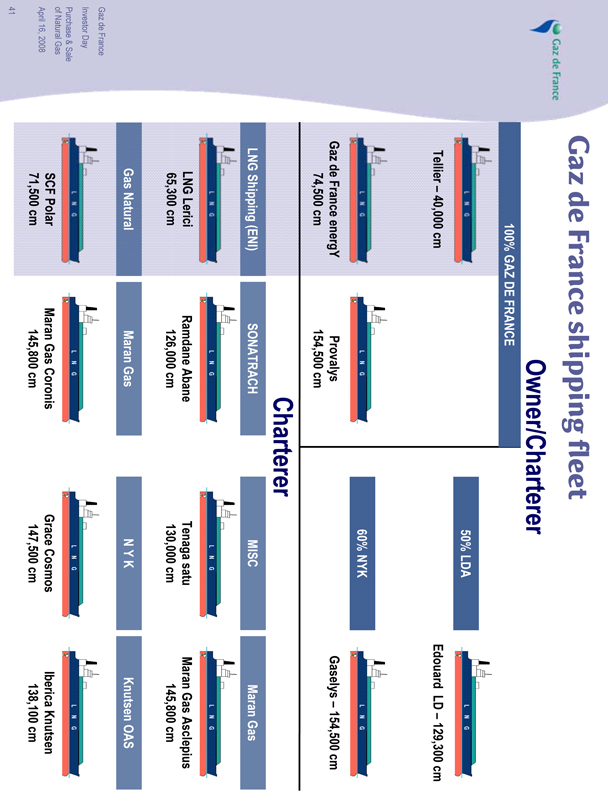

Large renewed LNG fleet

LNG supply

Fleet balanced between owner and charterer position

5 LNG carriers owned (from 40,000 to 154,500 cm LNG)

7 to 10 carriers chartered (with short-,medium-, and long-term agreements)

Fleet structure is adapted to efficiently manage long-term supply and short-term deals

Pioneer order in 2002 of 1st Dual-Fuel Diesel-Electric (DFDE) LNG carrier

50 other orders were recorded since 2002

To sustain growing trade activity

Fleet shipping capacity of 1.5 Mcm LNG early 2008

5% of global capacity

7% of LNG global trade

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

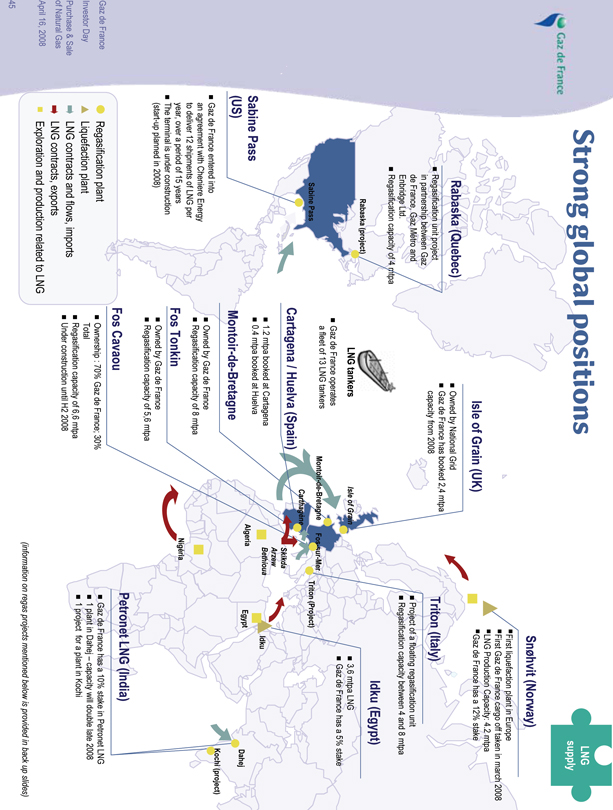

Strong global positions

LNG supply

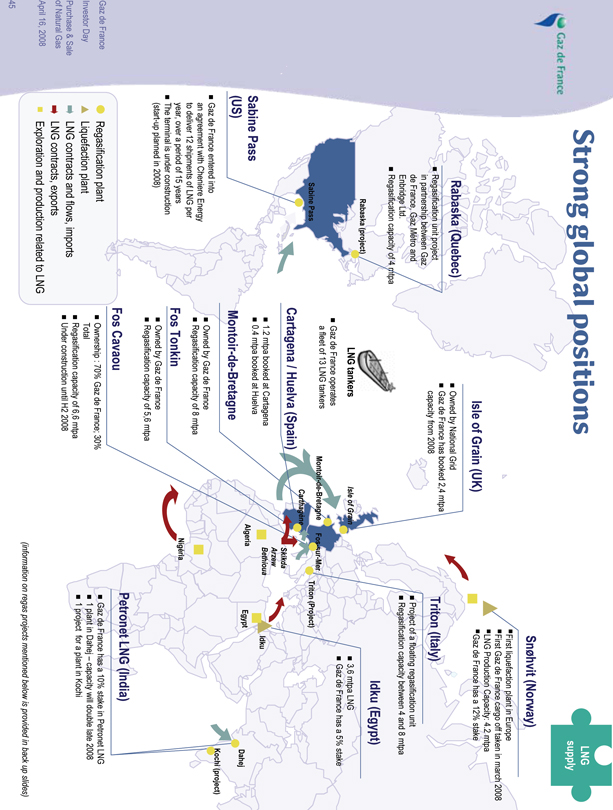

Snøhvit (Norway)

First liquefaction plant in Europe

First Gaz de France cargo off taken in march 2008

LNG Production Capacity: 4.2 mtpa

Gaz de France has a 12% stake

Rabaska (Quebec)

Regasification unit project in partnership between Gaz de France, Gaz Metro and Enbridge Ltd.

Regasification capacity of 4 mtpa

Isle of Grain (UK)

Owned by National Grid

Gaz de France has booked 2,4 mtpa capacity from 2008

Triton (Italy)

Project of a floating regasification unit

Regasification capacity between 4 and 8 mtpa

Rabaska (project)

LNG tankers

Gaz de France operates a fleet of 13 LNG tankers

Isle of Grain

Montoir-de-Bretagne

Carthagène

Fos-sur-Mer

Triton (Project)

Skikda

Arzew

Bethioua

Algeria

Egypt

Idku

Nigeria

Dahej

Kochi (project)

Idku (Egypt)

3.6 mtpa LNG

Gaz de France has a 5% stake

Sabine Pass (US)

Gaz de France entered into an agreement with Cheniere Energy to deliver 12 shipments of LNG per year, over a period of 15 years

The terminal is under construction (start-up planned in 2008)

Cartagena / Huelva (Spain)

1.2 mtpa booked at Cartagena

0.4 mtpa booked at Hueva

Montoir-de-Bretagne

Owned by Gaz de France

Regasification capacity of 8 mtpa

Fos Tonkin

Owned by Gaz de France

Regasification capacity of 5,6 mtpa

Fos Cavaou

Ownership: 70% Gaz de France; 30% Total

Regasification capacity of 6,6 mtpa

Under construction until H2 2008

Petronet LNG (India)

Gaz de France has a 10% stake in Petronet LNG

1 plant in Dahej – capacity will double late 2008

1 project for a plant in Kochi

Regasification plant

Liquefaction plant

LNG contracts and flows, imports

LNG contracts, export Exploration and production related to LNG

(information on regas projects mentioned below is provided in back up slides)

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Why is being an LNG world leader a key asset for Gaz de France?

LNG supply

LNG is necessary for accessing new reserves, supplying our customers and supporting our sales development

LNG provides diversification and security of supply

LNG provides flexibility, helps balancing supply & demand, and adds value through arbitrage opportunities

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Video presentation

Key Accounts

Gaz de France Investor Day

Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

1 Introduction organisation, facts & figures

2 Fundamentals and trends in global natural gas market

3 Key competitive advantages

Supply portfolio

LNG supply

4 Business Model

Key account management

Energy Trading

5 Outlook & strategic directions

Jean-Pierre Roncato

Senior Vice-President

Key Accounts Sales

Key account management

Mark Bailey

Vice-President Marketing

Energy trading

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

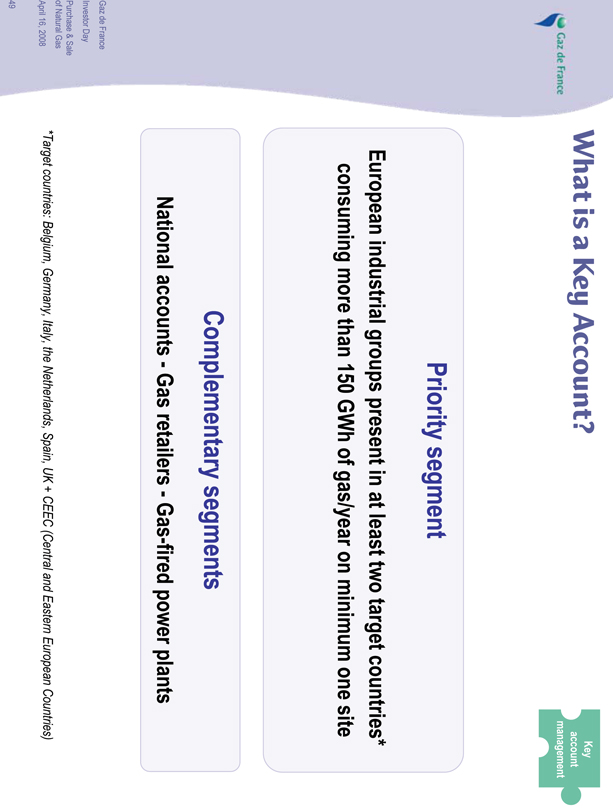

What is a Key Account?

Key account management

Priority segment

European industrial groups present in at least two target countries* consuming more than 150 GWh of gas/year on minimum one site

Complementary segments

National accounts - Gas retailers - Gas-fired power plants

*Target countries: Belgium, Germany, Italy, the Netherlands, Spain, UK + CEEC (Central and Eastern European Countries)

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

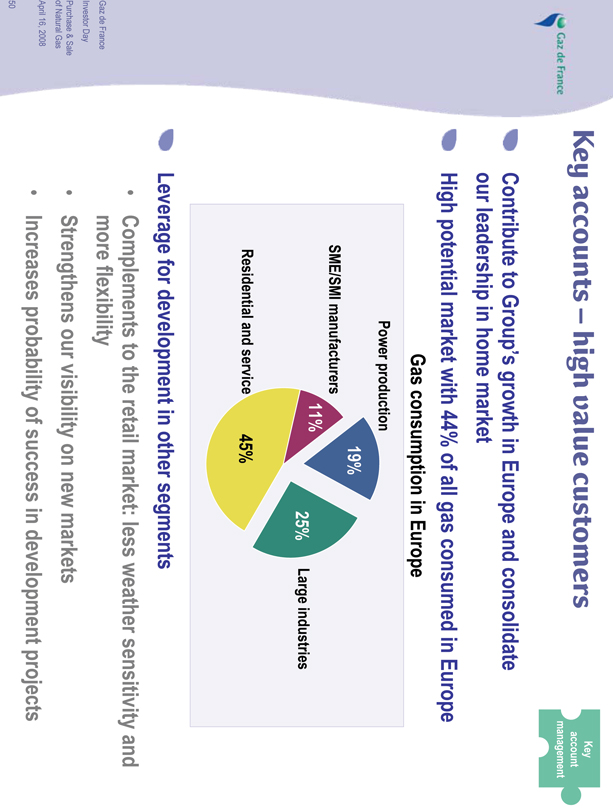

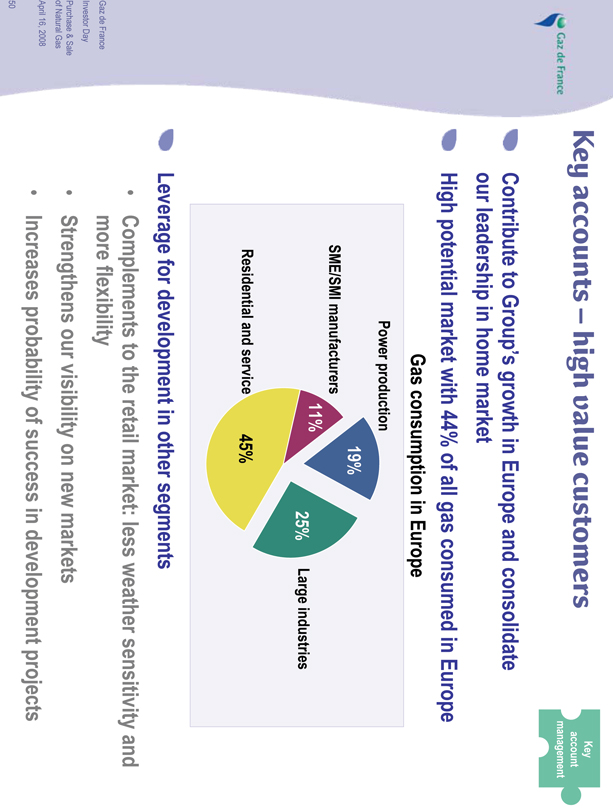

Key accounts – high value customers

Key account management

Contribute to Group’s growth in Europe and consolidate our leadership in home market

High potential market with 44% of all gas consumed in Europe

Gas consumption in Europe

Power production 19%

SME/SMI manufacturers 11%

Large industries 25%

Residential and service 45%

Leverage for development in other segments

Complements to the retail market: less weather sensitivity and more flexibility

Strengthens our visibility on new markets

Increases probability of success in development projects

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

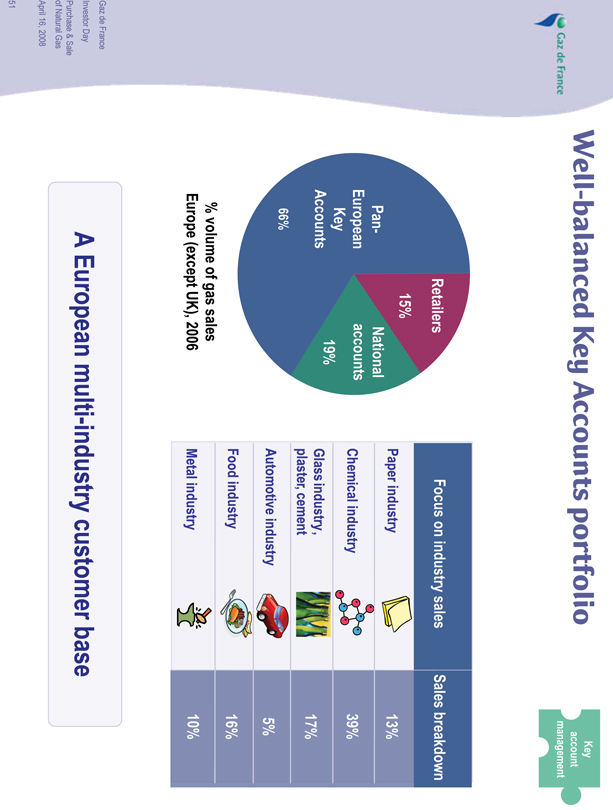

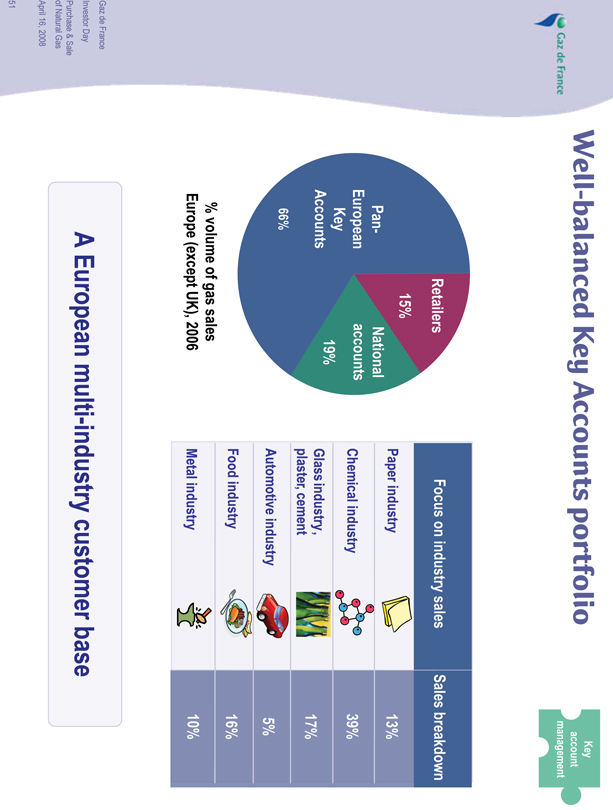

Well-balanced Key Accounts portfolio

Key account management

Retailers 15%

Pan-European Key Accounts 66%

National accounts 19%

% volume of gas sales

Europe (except UK), 2006

Focus on industry sales Sales breakdown

Paper industry 13%

Chemical industry 39%

Glass industry, plaster, cement 17%

Automotive industry 5%

Food industry 16%

Metal industry 10%

A European multi-industry customer base

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

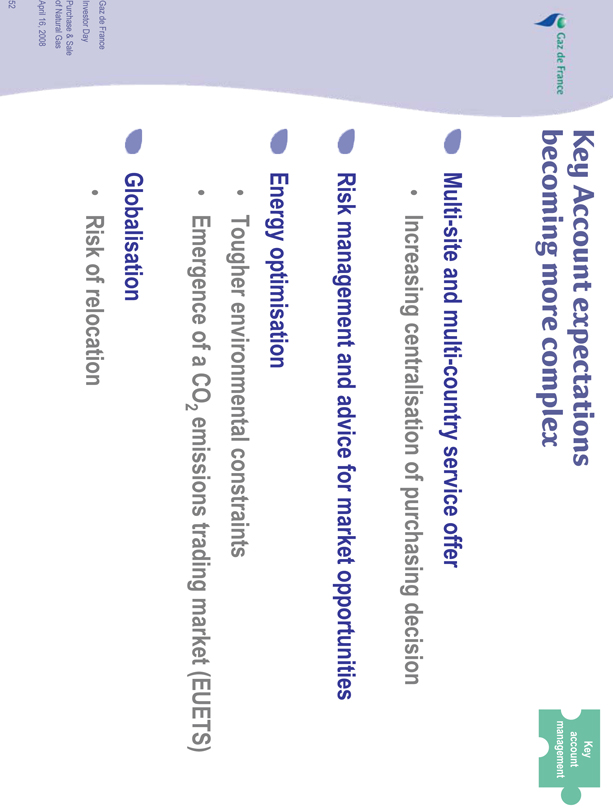

Key Account expectations becoming more complex

Key account management

Multi-site and multi-country service offer

Increasing centralisation of purchasing decision

Risk management and advice for market opportunities

Energy optimisation

Tougher environmental constraints

Emergence of a CO2 emissions trading market (EUETS)

Globalisation

Risk of relocation

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

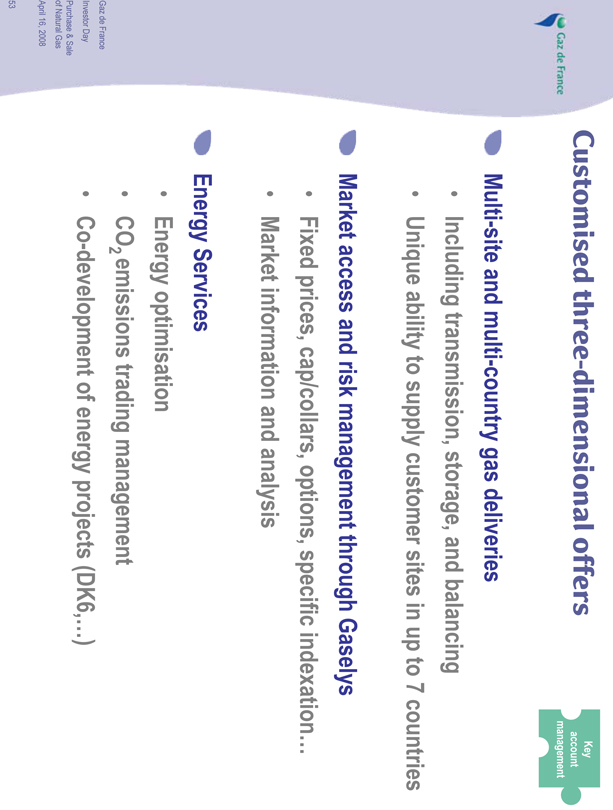

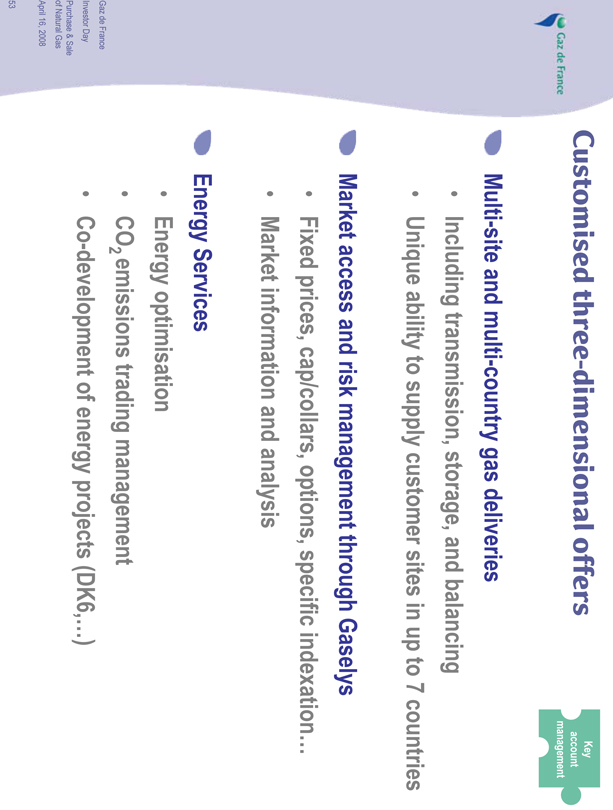

Customised three-dimensional offers

Key account management

Multi-site and multi-country gas deliveries

Including transmission, storage, and balancing

Unique ability to supply customer sites in up to 7 countries

Market access and risk management through Gaselys

Fixed prices, cap/collars, options, specific indexation…

Market information and analysis

Energy Services

Energy optimisation

CO2 emissions trading management

Co-development of energy projects (DK6,…)

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

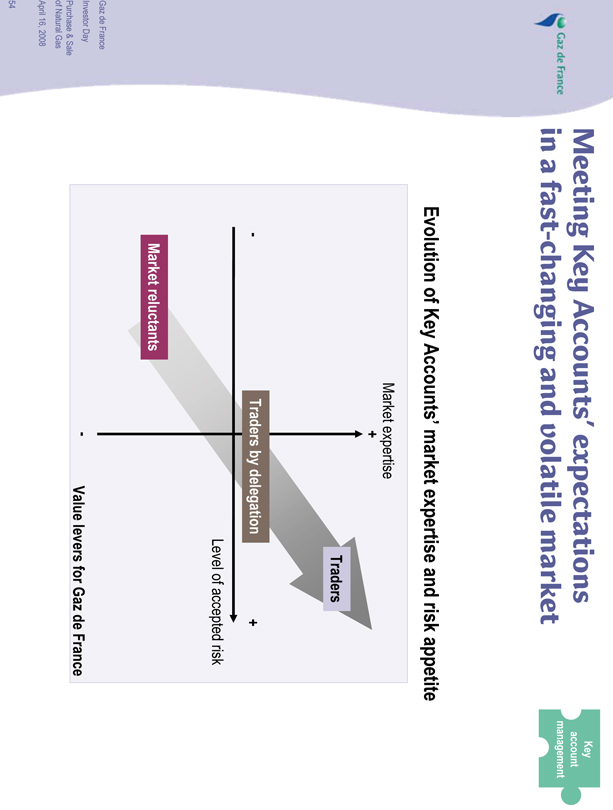

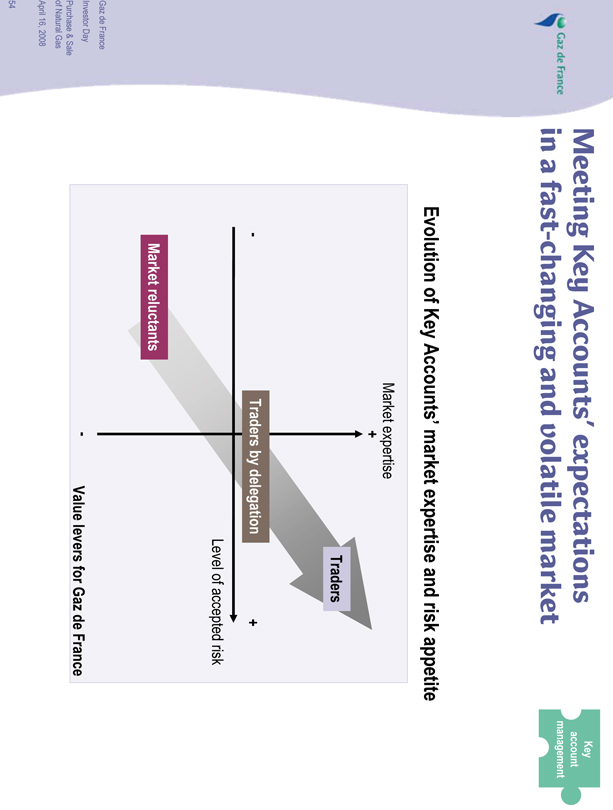

Meeting Key Accounts’ expectations in a fast-changing and volatile market

Key account management

Evolution of Key Accounts’ market expertise and risk appetite

+ Market expertise

Traders

- Traders by delegation +

Level of accepted risk

Market reluctants

- Value levers for Gaz de France

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

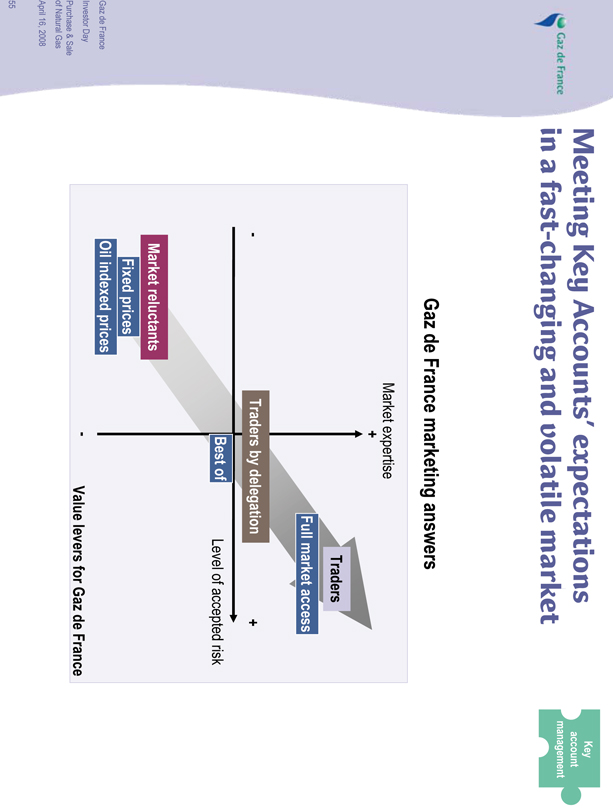

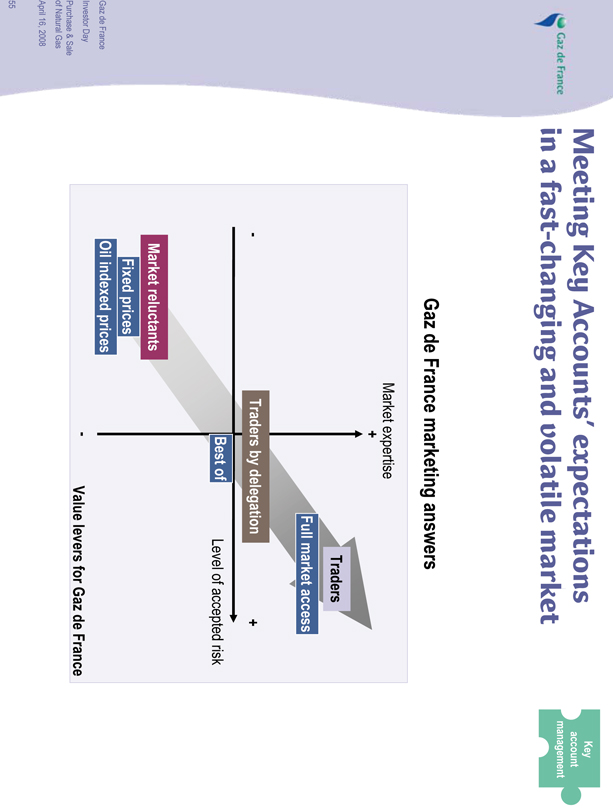

Meeting Key Accounts’ expectations in a fast-changing and volatile market

Key account management

Gaz de France marketing answers

+ Market expertise

Traders

Full market access

- Traders by delegation +

Best of

Level of accepted risk

Market reluctants

Fixed prices

Oil indexed prices

- Value levers for Gaz de France

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Video presentation

Customer testimonial

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

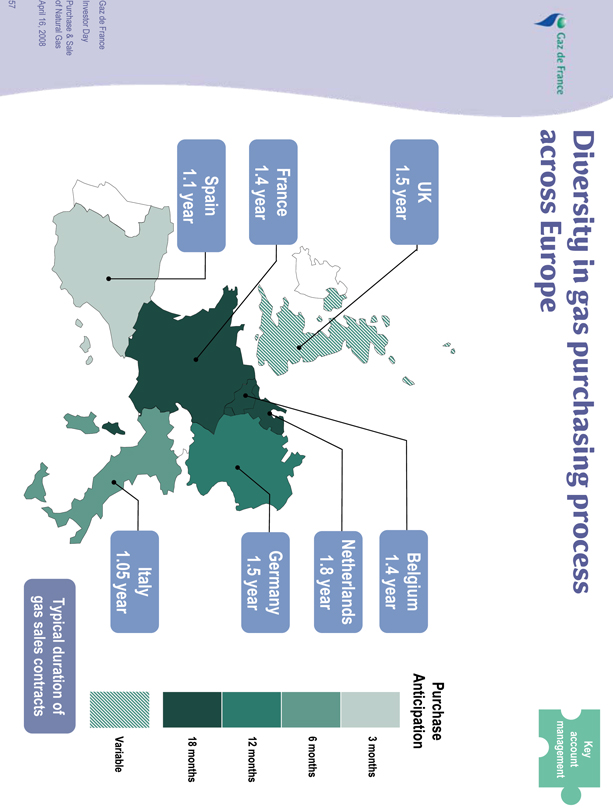

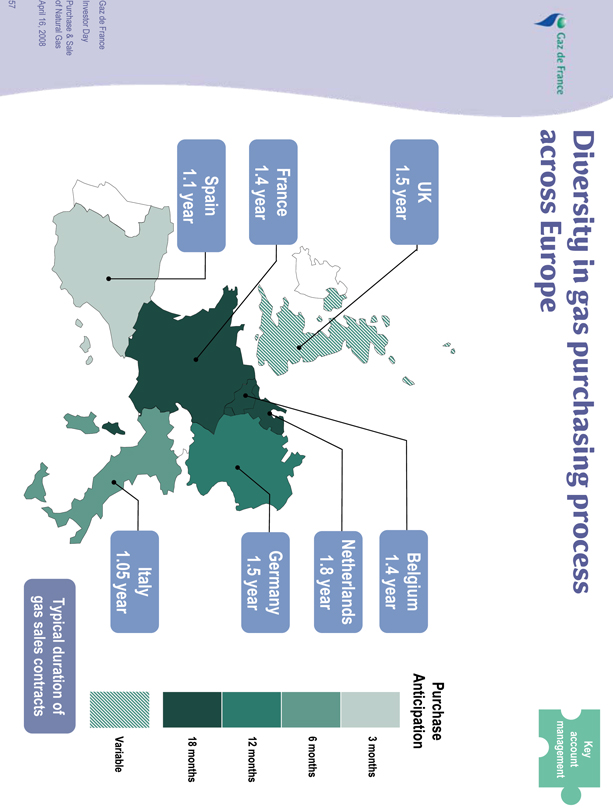

Diversity in gas purchasing process across Europe

Key account management

UK 1.5 year

Belgium 1.4 year

Netherlands 1.8 year

France 1.4 year

Germany 1.5 year

Spain 1.1 year

Italy 1.05 year

Purchase Anticipation

3 months

6 months

12 months

18 months

Variable

Typical duration of gas sales contracts

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Gas buying process of Key Accounts

Key account management

Duration of sales contracts from 12 to 24 months

Gas sales contracted up to 18 months in advance

Prices for sales of year n reflect forward vision of year n-1 (or even n-2) for n vs effective prices of year n

We thus hedge our sales contracts at the date of the deal

Illustration for year 2007

For illustration purpose only

Typical short-term market and long-term contract prices

historical forward

– NBP Month Ahead / forward

– Typical Long-Term Price

EUR/MWh

60,00

50,00

40,00

30,00

20,00

10,00

0,00

Janv-06 Janv-07 Janv-08

Forward prices as of March 2006

Typical short-term market and long-term contract prices

– NBP Month Ahead / forward

– Typical Long-Term Price

historical forward

EUR/MWh

50

45

40

35

30

25

20

15

10

5

0

Janv-06 Janv-07 Janv-08

Ex post vision (prices as of March 2008)

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Sales & marketing designed for success

Key account management

Sales & marketing structure “mirroring” that of the customer

Local professional and experienced teams in each country

Pan-European Key Account Managers negotiating with customers’ decision makers

Central marketing team designing service offers for all of Europe, with dedicated experts per country

Creating proximity with customers

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

A unique brand dedicated to Key Accounts across Europe

Key account management

Gaz de France EnergY®

La marca de las Grandes

Cuentas Europeas

Bienvenido

al mundo de

adaptive energY

Gaz de France energy

Gaz de France energy

Global communication, adapted to local markets

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Video presentation

Adaptative energy

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

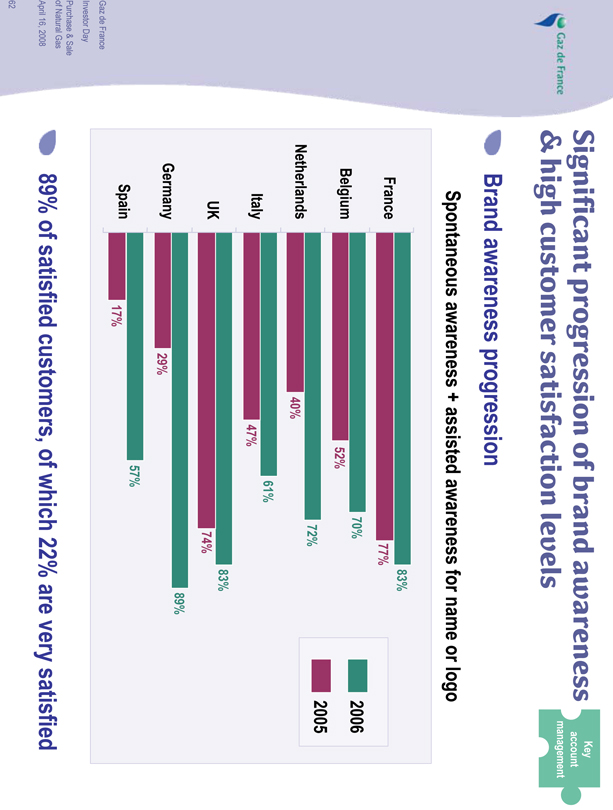

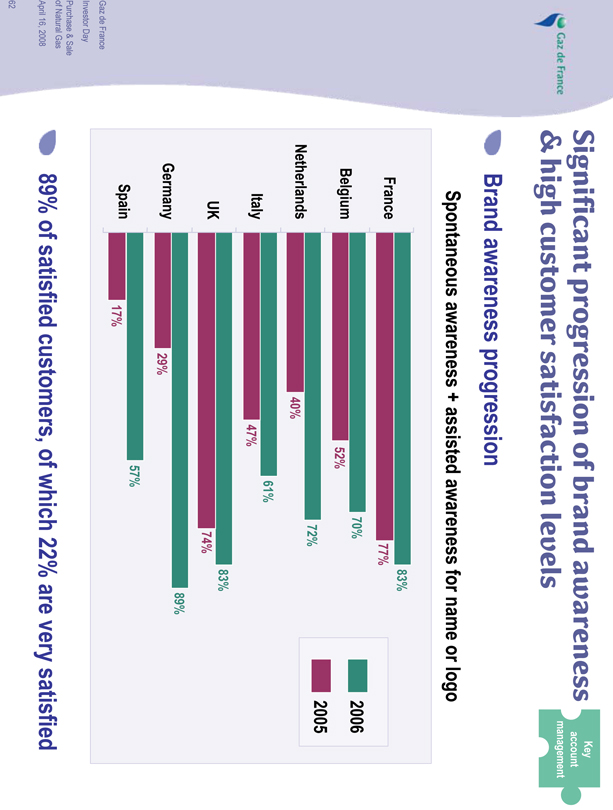

Significant progression of brand awareness

Key account management

& high customer satisfaction levels

Brand awareness progression

Spontaneous awareness + assisted awareness for name or logo

83%

France 77%

70% 2006

Belgium 52%

2005

72%

Netherlands 40%

61%

Italy 47%

83% UK 74% 89%

Germany 29%

57%

Spain 17%

89% of satisfied customers, of which 22% are very satisfied

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

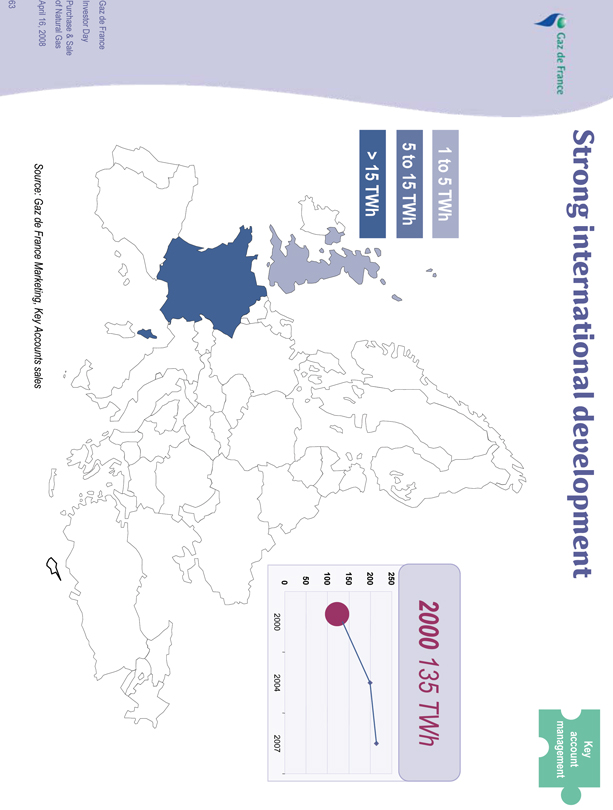

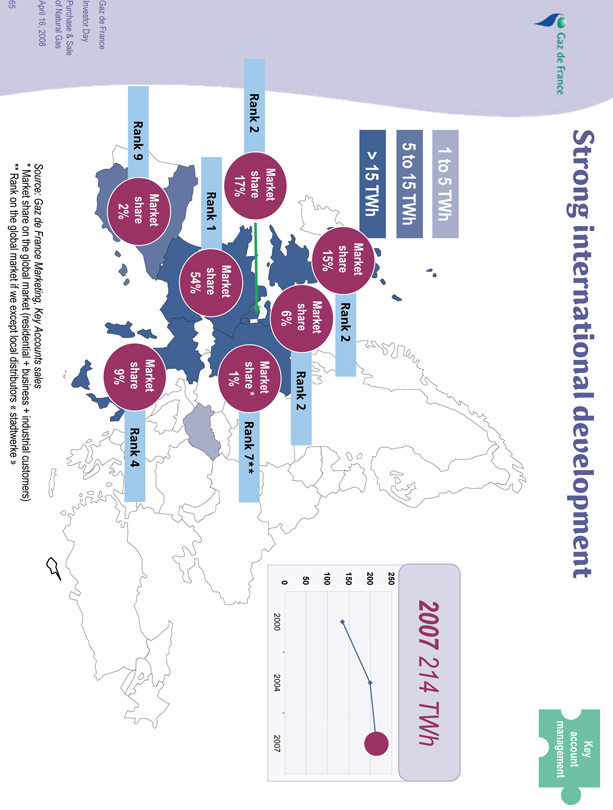

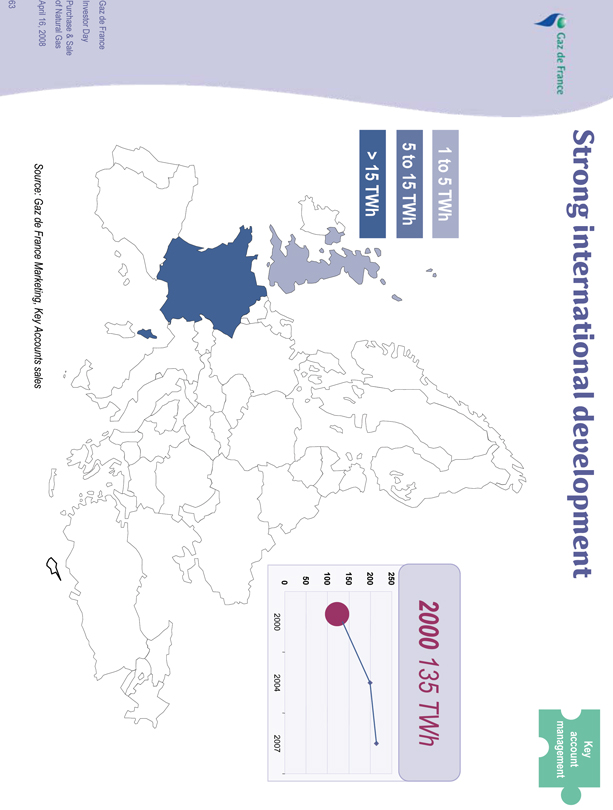

Strong international development

Key account management

1 to 5 TWh

5 to 15 TWh

> 15 TWh

2000 135 TWh

250

200

150

100 50

0 2000 2004 2007

Source: Gaz de France Marketing, Key Accounts sales

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

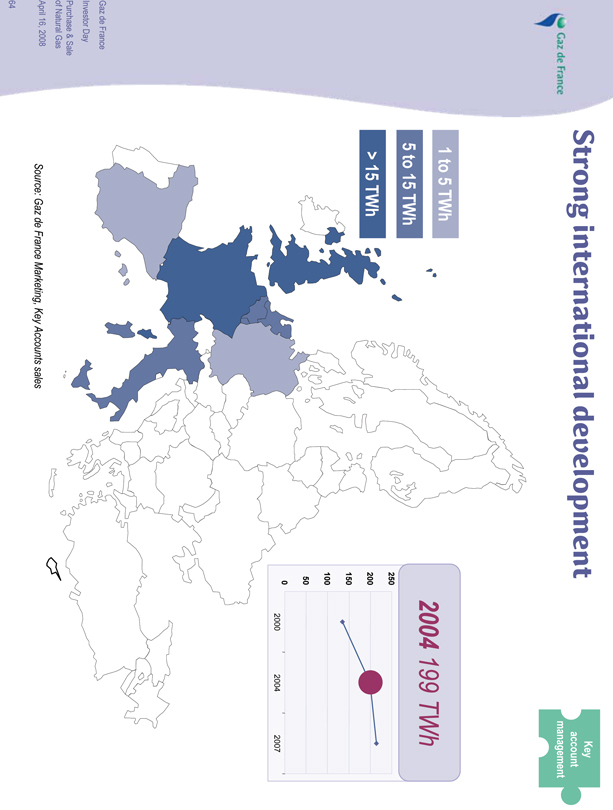

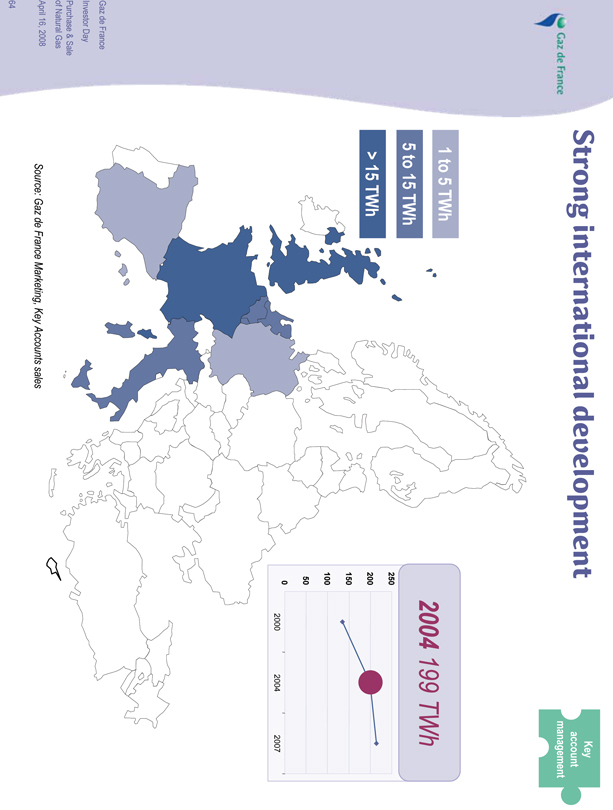

Strong international development

Key account management

1 to 5 TWh

5 to 15 TWh

> 15 TWh

2004 199 TWh

250

200

150

100

50

0 2000 2004 2007

Source: Gaz de France Marketing, Key Accounts sales

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

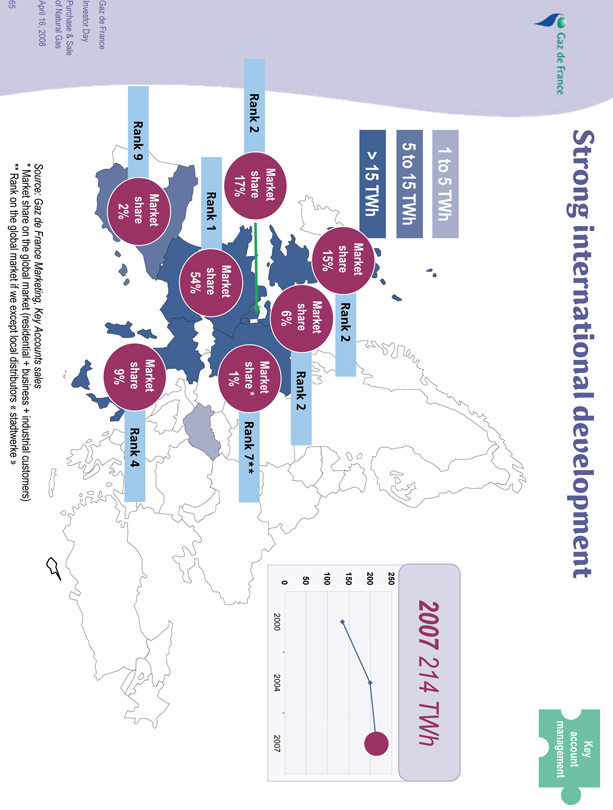

Strong international development

Key account management

1 to 5 TWh

5 to 15 TWh

> 15 TWh

2007 214 TWh

250

200

150

100

50

0 2000 2004 2007

Market share 15% Rank 2

Market share 6% Rank

Market 2000 2004 2007

Market share * 1% Rank 7**

Market share 17% Rank 2

Market share 54% Rank 1

Market share 2% Rank 9

Market share 9% Rank 4

Source: Gaz de France Marketing, Key Accounts sales

* Market share on the global market (residential + business + industrial customers)

** Rank on the global market if we except local distributors « stadtwerke »

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

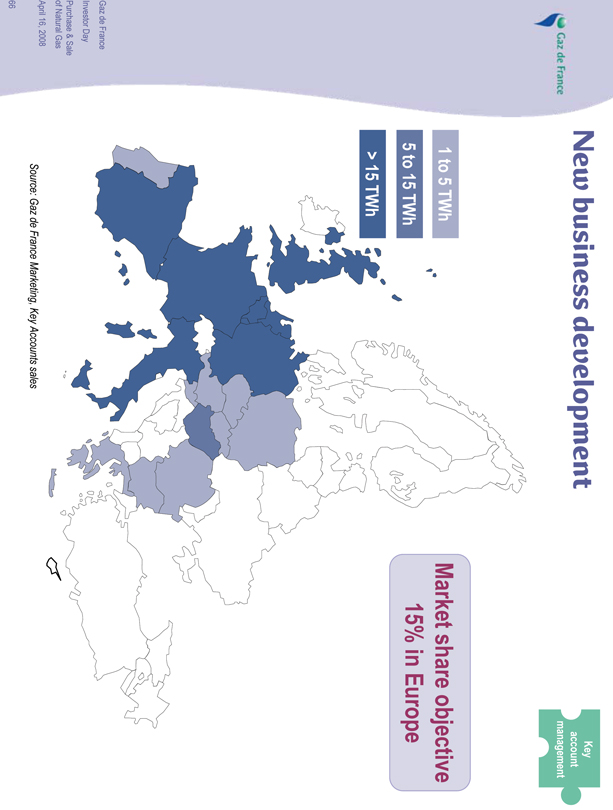

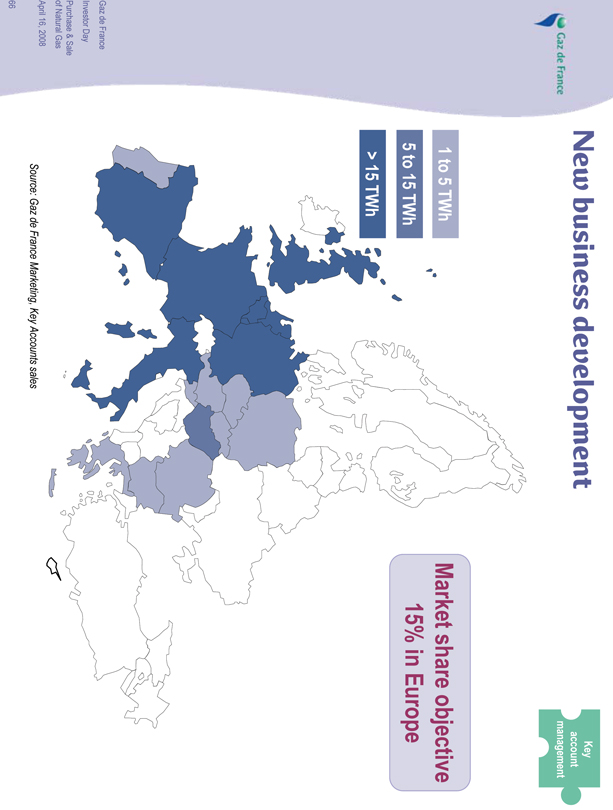

New business development

Key account management

1 to 5 TWh

5 to 15 TWh

> 15 TWh

Market share objective 15% in Europe

Source: Gaz de France Marketing, Key Accounts sales

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

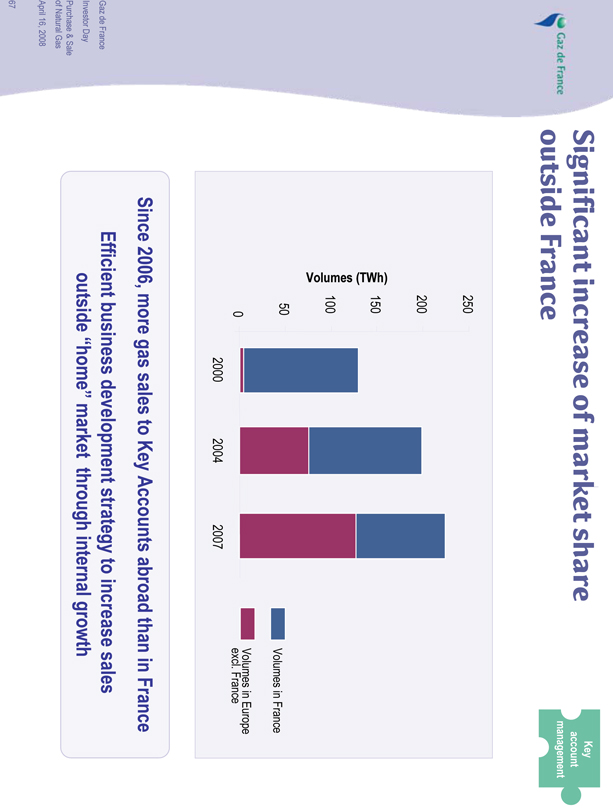

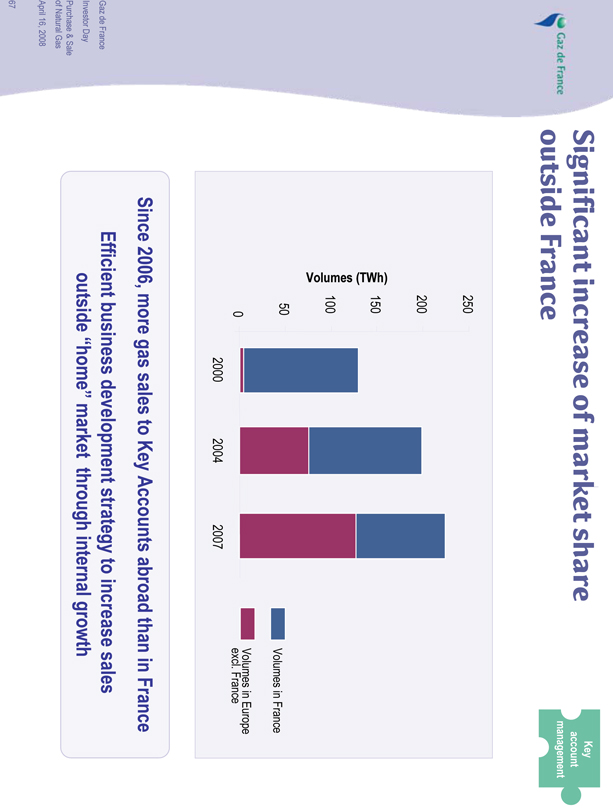

Significant increase of market share outside France

Key account management

Volumes (TWh)

250

200

150

100

50

0 2000 2004 2007

Volumes in France

Volumes in Europe excl. France

Since 2006, more gas sales to Key Accounts abroad than in France

Efficient business development strategy to increase sales outside “home” market through internal growth

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

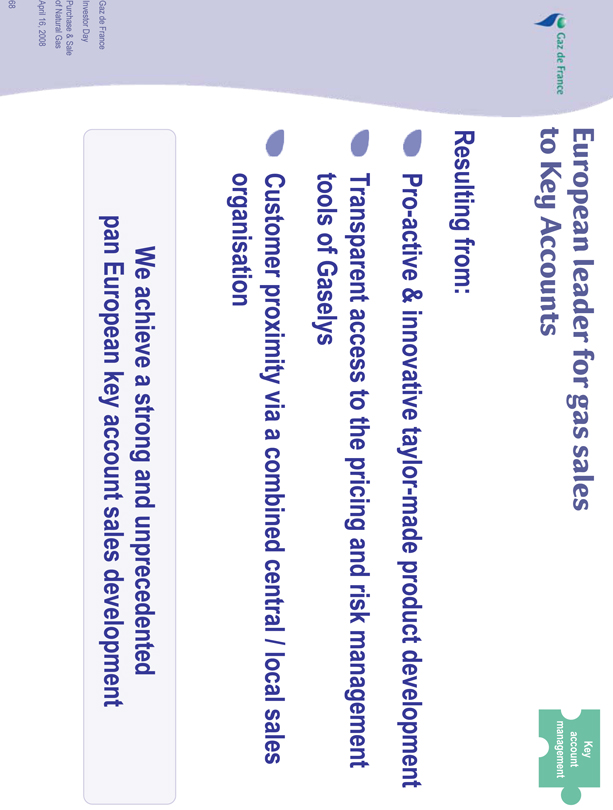

Gaz de France

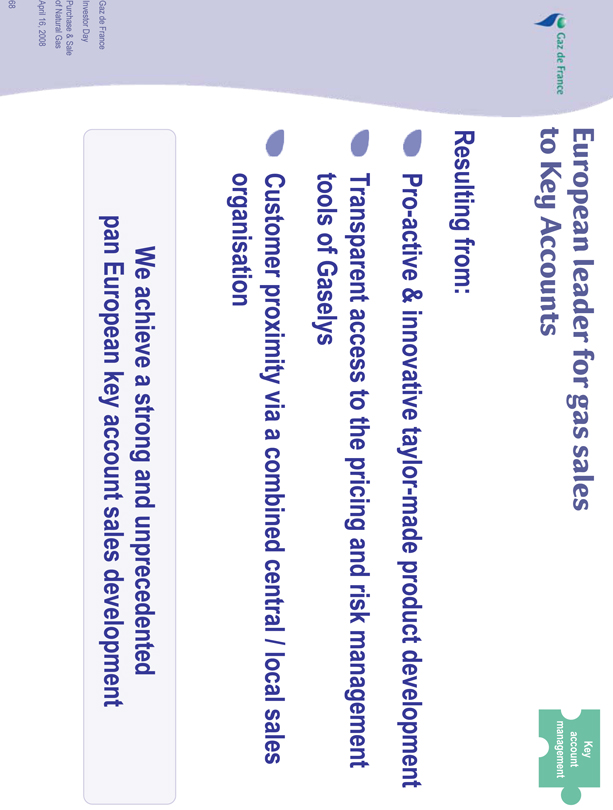

European leader for gas sales to Key Accounts

Key account management

Resulting from:

Pro-active & innovative taylor-made product development

Transparent access to the pricing and risk management tools of Gaselys

Customer proximity via a combined central / local sales organisation

We achieve a strong and unprecedented pan European key account sales development

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Video presentation

Gaselys

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

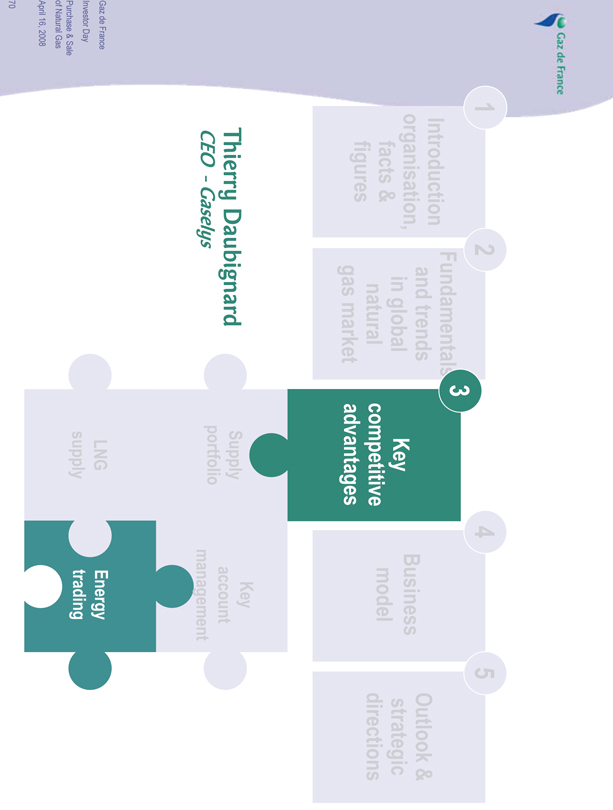

1 Introduction organisation, facts & figures

2 Fundamentals and trends in global natural gas market

3 Key competitive advantages

Supply portfolio

LNG supply

4 Business model

Key account management

Energy trading

5 Outlook & strategic directions

Thierry Daubignard

CEO - Gaselys

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

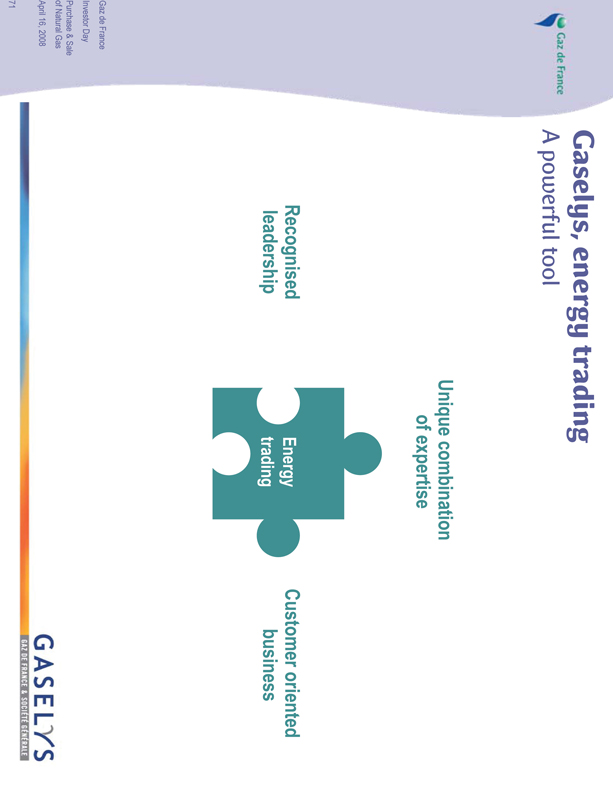

Gaselys, energy trading

A powerful tool

Unique combination of expertise

Recognised leadership

Energy trading

Customer oriented business

GASELYS

GAZ DE FRANCE & SOCIETE GENERALE

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

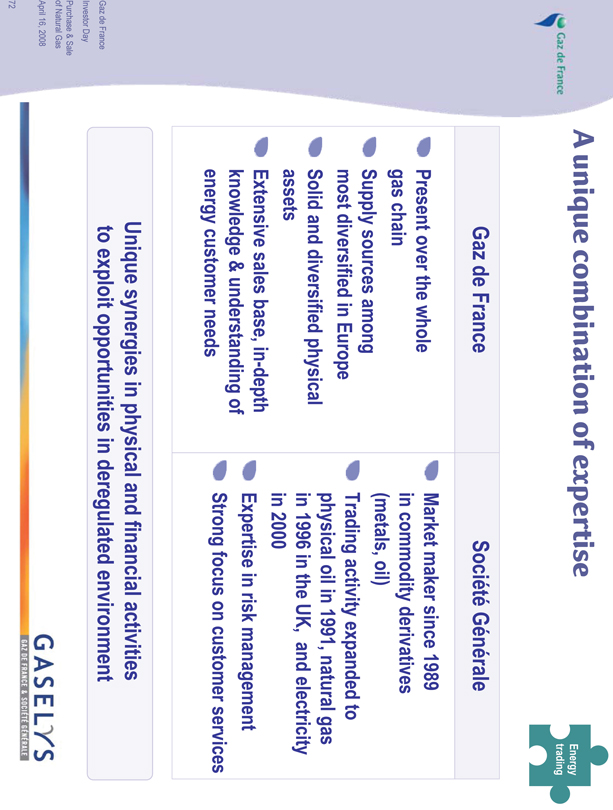

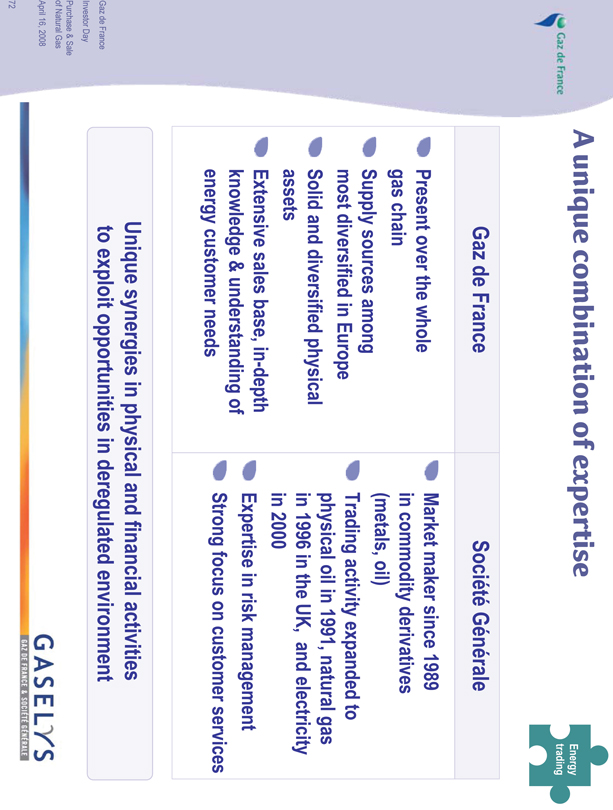

A unique combination of expertise

Energy trading

Gaz de France

Present over the whole gas chain

Supply sources among most diversified in Europe

Solid and diversified physical assets

Extensive sales base, in-depth knowledge & understanding of energy customer needs

Société Générale

Market maker since 1989 in commodity derivatives (metals, oil)

Trading activity expanded to physical oil in 1991, natural gas in 1996 in the UK, and electricity in 2000

Expertise in risk management

Strong focus on customer services

Unique synergies in physical and financial activities to exploit opportunities in deregulated environment

GASELYS

GAZ DE FRANCE & SOCIETE GENERALE

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

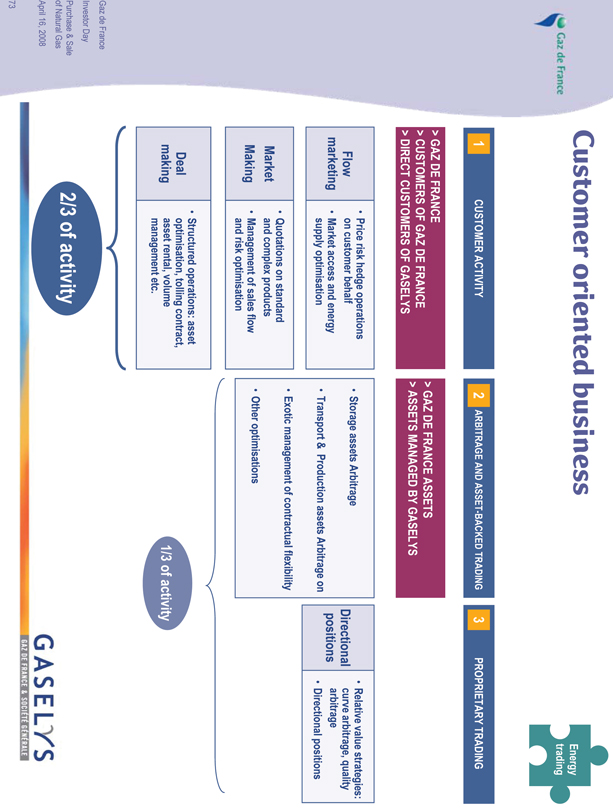

Customer oriented business

Energy trading

1 CUSTOMER ACTIVITY

> GAZ DE FRANCE

> CUSTOMERS OF GAZ DE FRANCE

> DIRECT CUSTOMERS OF GASELYS

Flow marketing

Price risk hedge operations on customer behalf

Market access and energy supply optimisation

Market Making

Quotations on standard and complex products

Management of sales flow and risk optimisation

Deal Making

Structured operations; asset optimisation, tolling contract, asset rental, volume management etc.

2/3 of activity

2 ARBITRAGE AND ASSET-BACKED TRADING

> GAZ DE FRANCE ASSETS

> ASSETS MANAGED BY GASELYS

Storage assets Arbitrage

Transport & Production assets Arbitrage on

Exotic management of contractual flexibility

Other optimisations

3 PROPRIETARY TRADING

Directional positions

Relative value strategies: curve arbitrage, quality arbitrage

Directional positions

1/3 of activity

GASELYS

GAZ DE FRANCE & SOCIETE GENERALE

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

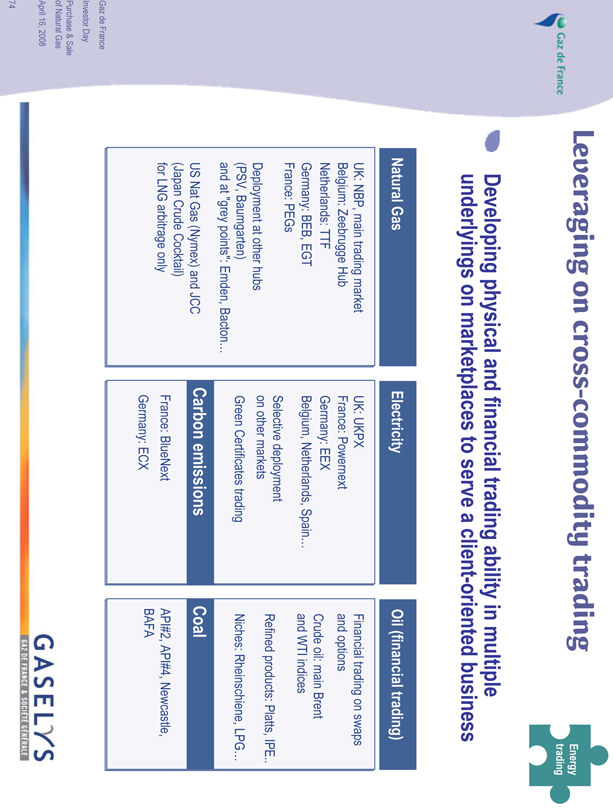

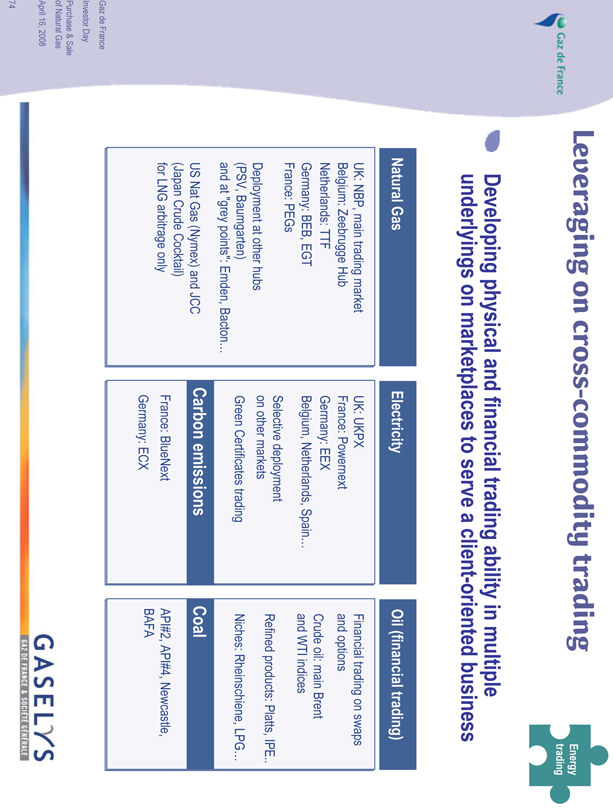

Leveraging on cross-commodity trading

Energy trading

Developing physical and financial trading ability in multiple underlyings on marketplaces to serve a client-oriented business

Natural Gas

UK: NBP, main trading market

Belgium: Zeebrugge Hub

Netherlands: TTF

Germany: BEB, EGT

France: PEGs

Deployment at other hubs (PSV, Baumgarten) and at “grey points”: Emden, Bacton…

US Nat Gas (Nymex) and JCC (Japan Crude Cocktail) for LNG arbitrage only

Electricity

UK: UKPX

France: Powernext

Germany: EEX

Belgium, Netherlands, Spain…

Selective deployment on other markets

Green Certificates trading

Carbon emissions

France: BlueNext

Germany: ECX

Oil (financial trading)

Financial trading on swaps and options

Crude oil: main Brent and WTI indices

Refined products: Platts, IPE..

Niches: Rheinschiene, LPG…

Coal

API#2, API#4, Newcastle, BAFA

GASELYS

GAZ DE FRANCE & SOCIETE GENERALE

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

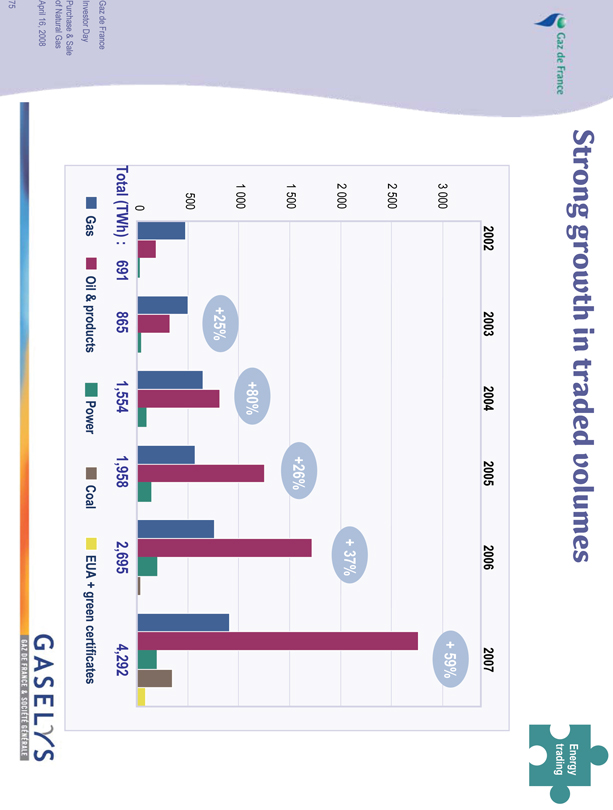

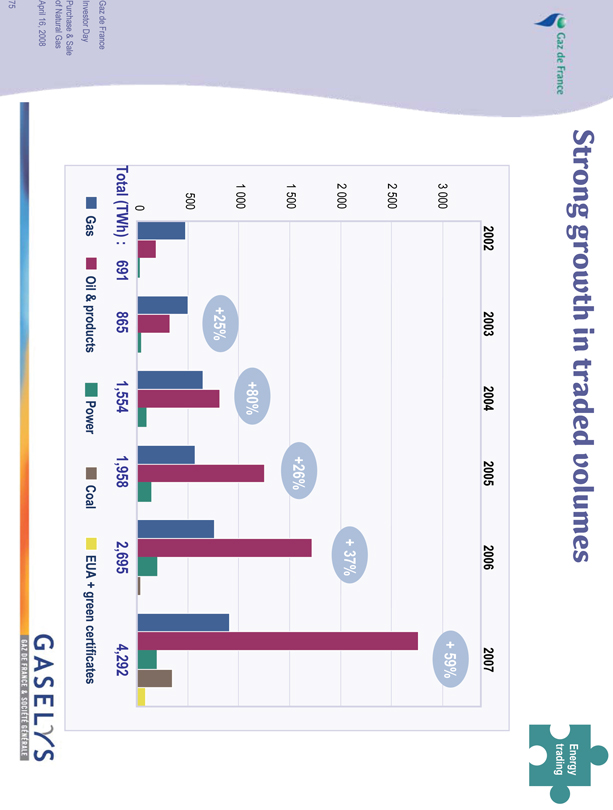

Strong growth in traded volumes

Energy trading

2002 2003 2004 2005 2006 2007

3 000

2 500

2 000

1 500

1 000

500

0

+ 59%

+ 37%

+26%

+80%

+25%

Total (TWh) : 691 865 1,554 1,958 2,695 4,292

Gas Oil & products Power Coal EUA + green certificates

GAZELYS

GAZ DE FRANCE & SOCIETE GENERALE

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

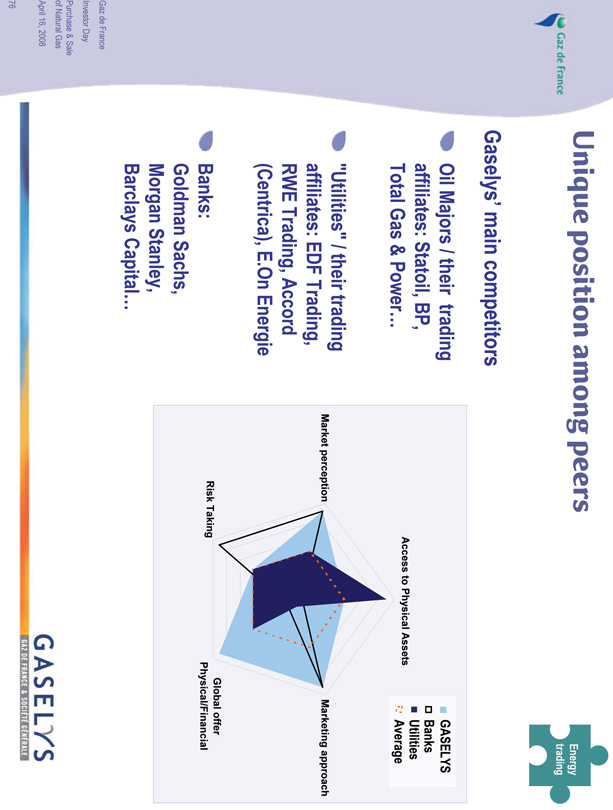

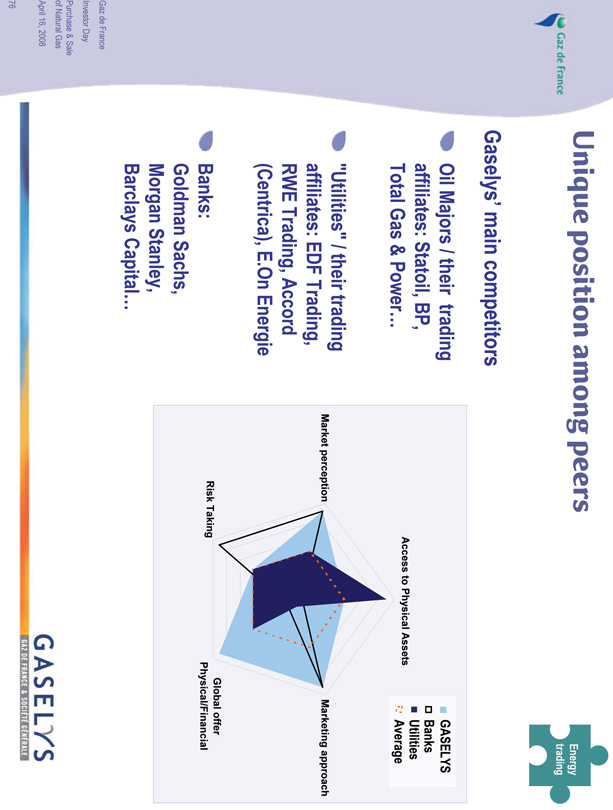

Unique position among peers

Energy trading

Gaselys’ main competitors

Oil Majors / their trading affiliates: Statoil, BP, Total Gas & Power…

“Utilities” / their trading affiliates: EDF Trading, RWE Trading, Accord (Centrica), E.On Energie

Banks: Goldman Sachs, Morgan Stanley, Barclays Capital…

Market perception

Risk Taking

Access to Physical Assets

Marketing approach

Global offer Physical/Financial

GASELYS

Banks

Utilities

Average

GAZELYS

GAZ DE FRANCE & SOCIETE GENERALE

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

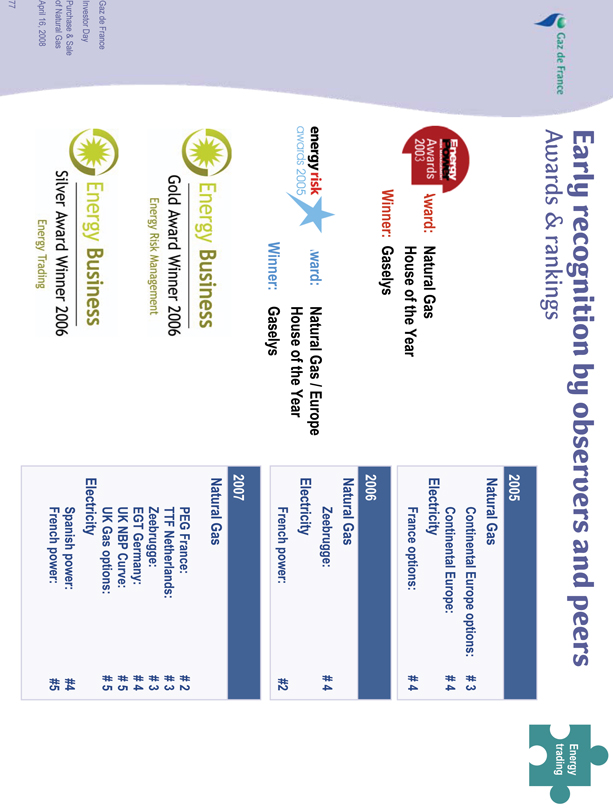

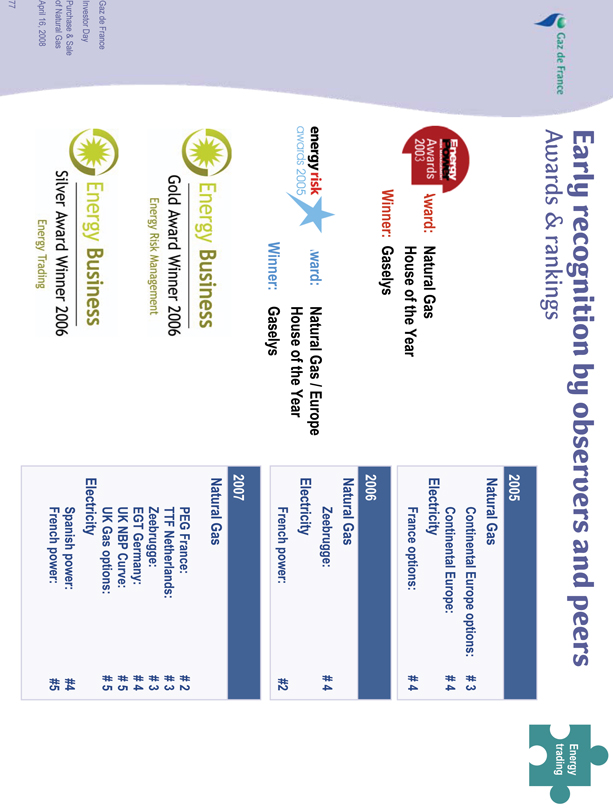

Early recognition by observers and peers

Awards & rankings

Energy trading

Energy Power Awards 2003

Award: Natural Gas House of the Year

Winner: Gaselys

energy risk awards 2005

Award: Natural Gas / Europe House of the Year

Winner: Gaselys

Energy Business

Gold Award Winner 2006

Energy Risk Management

Energy Business

Silver Award Winner 2006

Energy Trading

2005

Natural Gas

Continental Europe options: # 3

Continental Europe: # 4

Electricity

France options: # 4

2006

Natural Gas

Zeebrugge: # 4

Electricity

French power: #2

2007

Natural Gas

PEG France: # 2

TTF Netherlands: # 3

Zeebrugge: # 3

EGT Germany: # 4

UK NBP Curve: # 5

UK Gas options: # 5

Electricity

Spanish power: #4

French power: #5

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Purchase & Sale of Natural Gas

A global player with key competitive advantages in changing energy markets

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

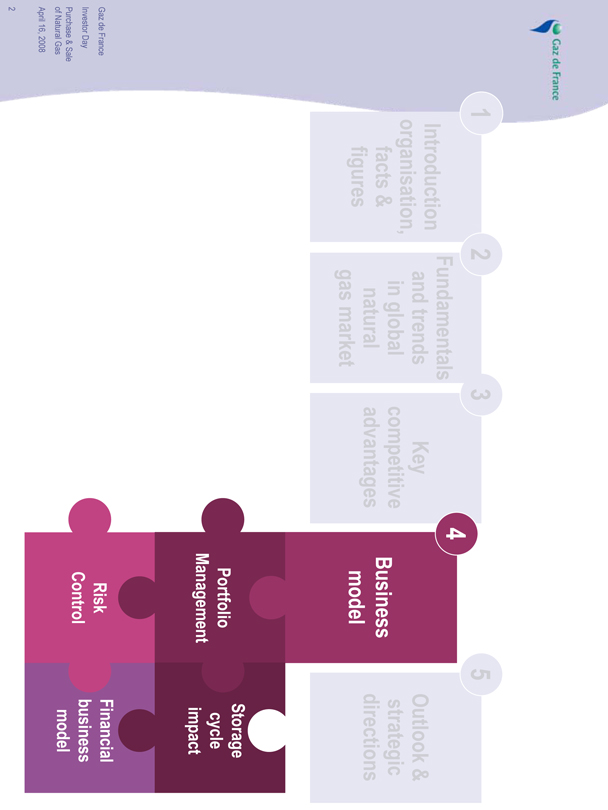

1 Introduction organisation, facts & figures

2 Fundamentals and trends in global natural gas market

3 Key competitive advantages

4 Business model

Portfolio Management

Risk Control

5 Outlook & strategic directions

Storage cycle impact

Financial business model

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

1 Introduction organisation, facts & figures

2 Fundamentals and trends in global natural gas market

3 Key competitive advantages

4 Business model

Portfolio Management

Risk Control

5 Outlook & strategic directions

Storage cycle impact

Financial business model

Bertrand Fauchet

Vice-President - Optimisation

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

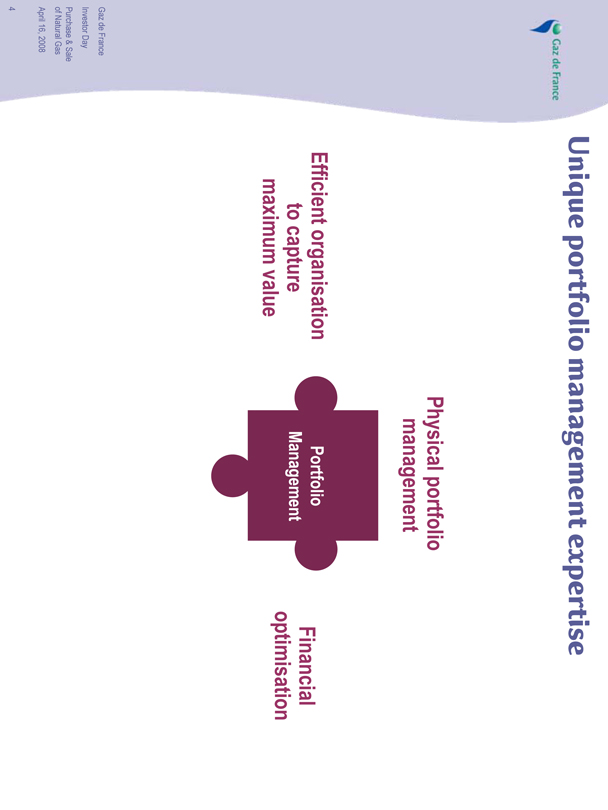

Unique portfolio management expertise

Physical portfolio management

Efficient organisation to capture maximum value

Portfolio Management

Financial optimisation

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

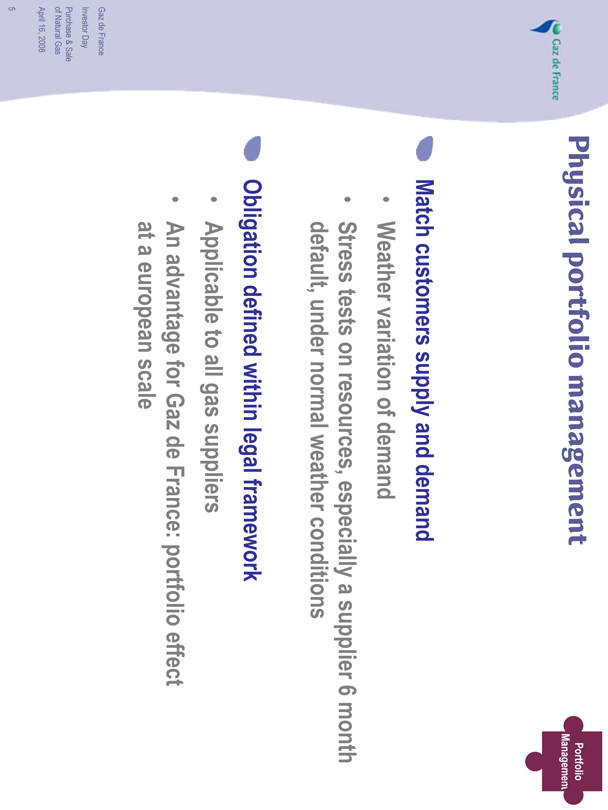

Physical portfolio management

Portfolio Management

Match customers supply and demand

Weather variation of demand

Stress tests on resources, especially a supplier 6 month default, under normal weather conditions

Obligation defined within legal framework

Applicable to all gas suppliers

An advantage for Gaz de France: portfolio effect at a european scale

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

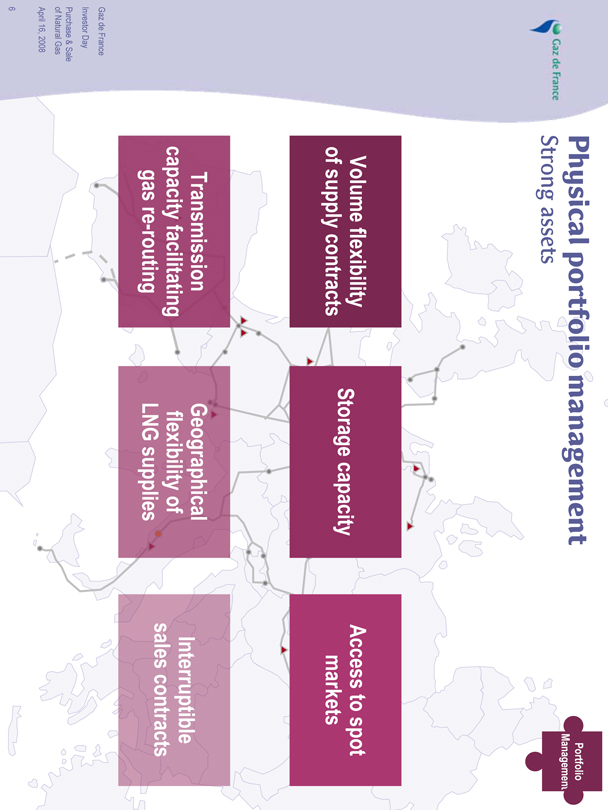

Physical portfolio management

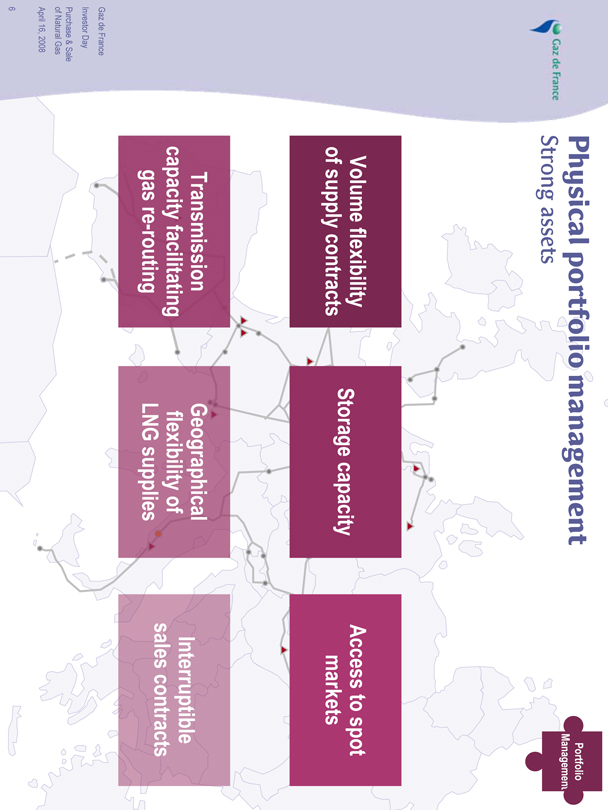

Strong assets

Portfolio Management

Volume flexibility of supply contracts

Transmission capacity facilitating gas re-routing

Storage capacity

Geographical flexibility of LNG supplies

Access to spot markets

Interruptible sales contracts

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

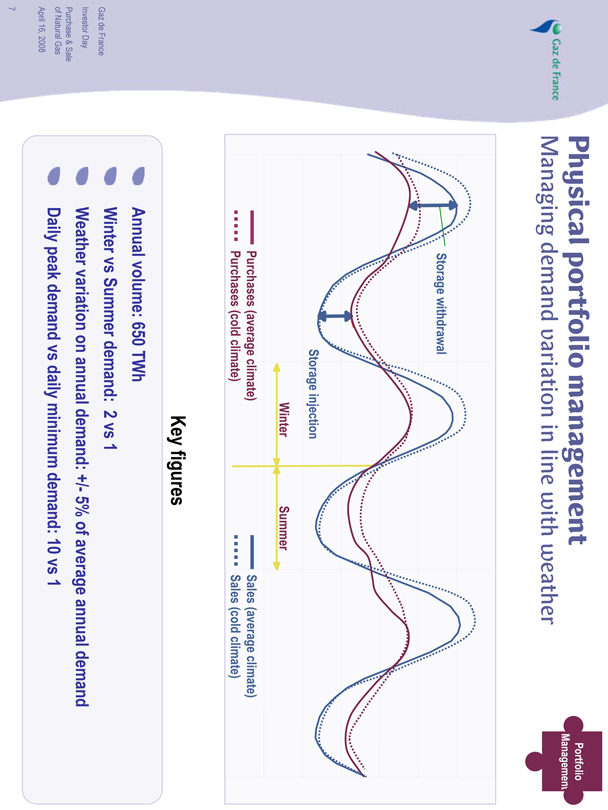

Physical portfolio management

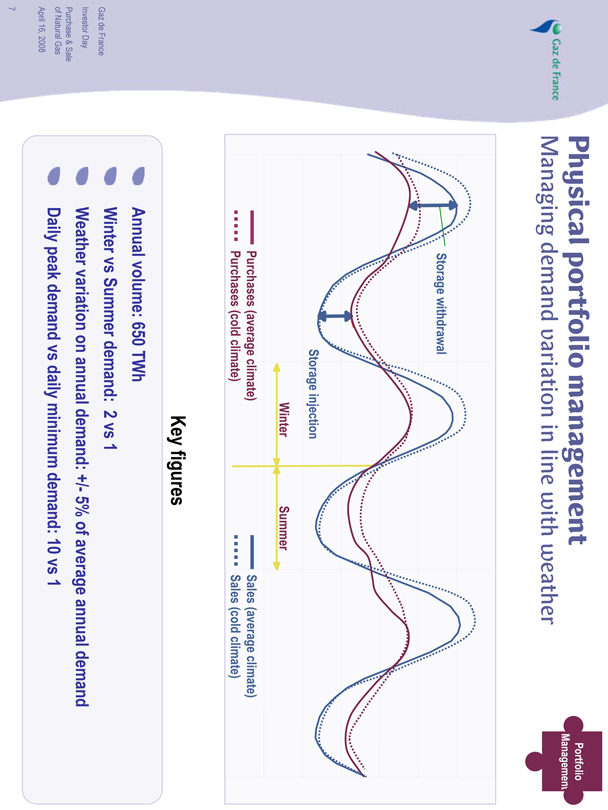

Managing demand variation in line with weather

Portfolio Management

Storage withdrawal

Storage injection

Winter Summer

Purchases (average climate) Sales (average climate)

Purchases (cold climate) Sales (cold climate)

Key figures

Annual volume: 650 TWh

Winter vs Summer demand: 2 vs 1

Weather variation on annual demand: +/- 5% of average annual demand

Daily peak demand vs daily minimum demand: 10 vs 1

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

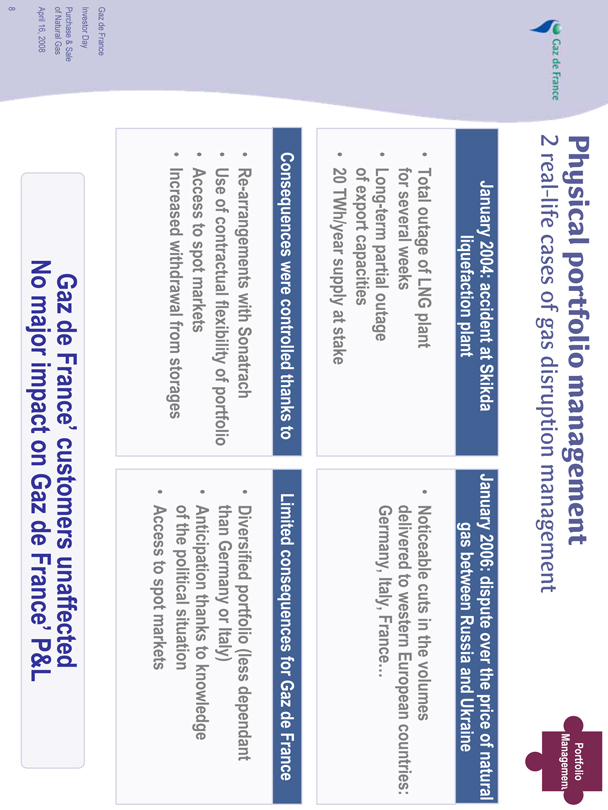

Physical portfolio management

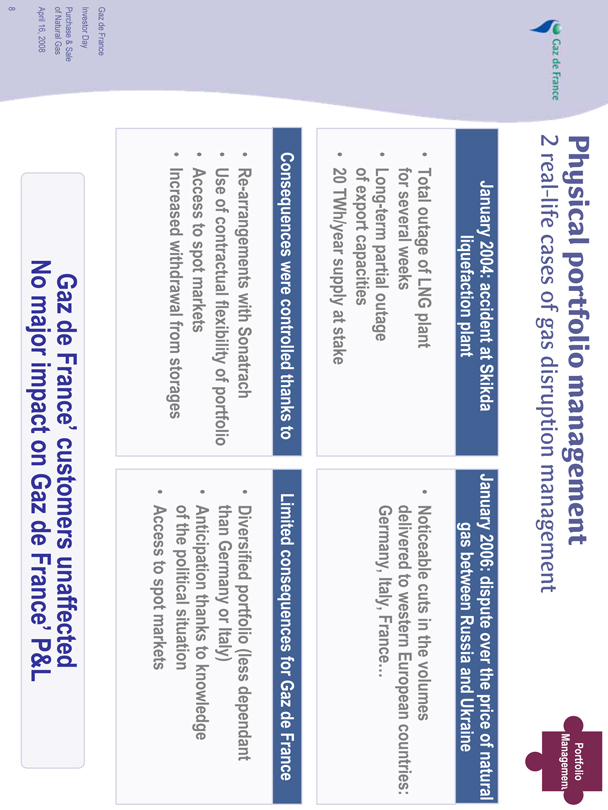

2 real-life cases of gas disruption management

Portfolio Management

January 2004: accident at Skikda liquefaction plant

Total outage of LNG plant for several weeks

Long-term partial outage of export capacities

20 TWh/year supply at stake

Consequences were controlled thanks to

Re-arrangements with Sonatrach

Use of contractual flexibility of portfolio

Access to spot markets

Increased withdrawal from storages

January 2006: dispute over the price of natural gas between Russia and Ukraine

Noticeable cuts in the volumes delivered to western European countries: Germany, Italy, France…

Limited consequences for Gaz de France

Diversified portfolio (less dependant than Germany or Italy)

Anticipation thanks to knowledge of the political situation

Access to spot markets

Gaz de France’ customers unaffected No major impact on Gaz de France’ P&L

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

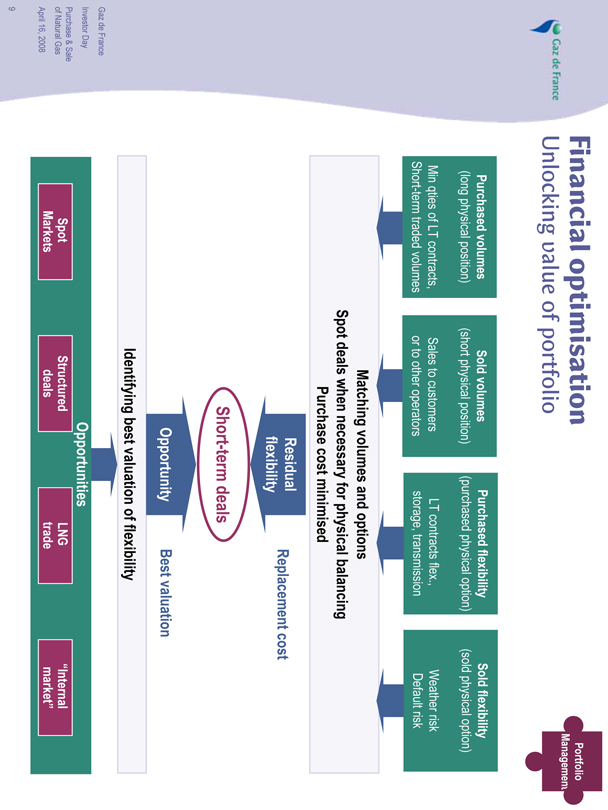

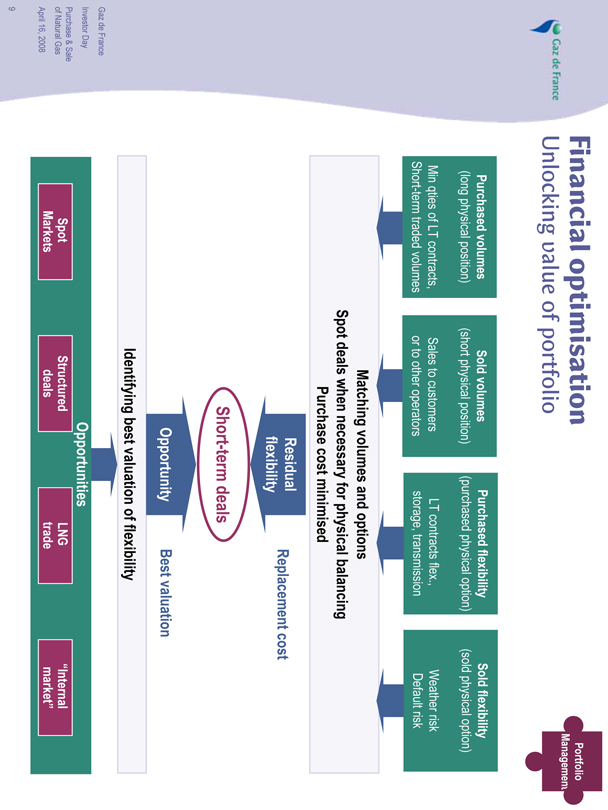

Financial optimisation

Unlocking value of portfolio

Portfolio Management

Purchased volumes (long physical position)

Min qties of LT contracts Short-term traded volumes

Sold volumes (short physical position)

Sales to customers or to other operators

Purchased flexibility (purchased physical option)

LT contracts flex., storage, transmission

Sold flexibility (sold physical option)

Weather risk Default risk

Matching volumes and options

Spot deals when necessary for physical balancing

Purchase cost minimised

Residual flexibility Replacement cost

Short-term deals

Opportunity Best valuation

Identifying best valuation of flexibility

Opportunities

Spot Markets

Structured deals

LNG trade

“Internal market”

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

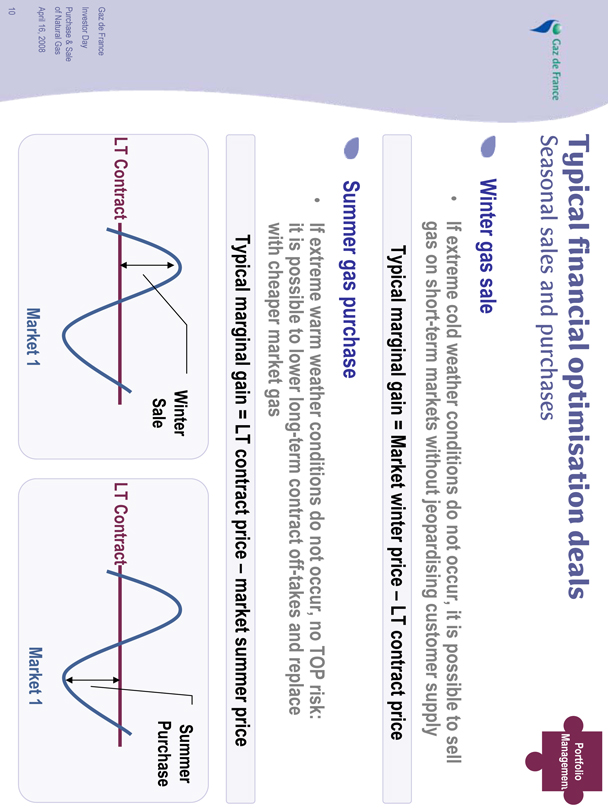

Gaz de France

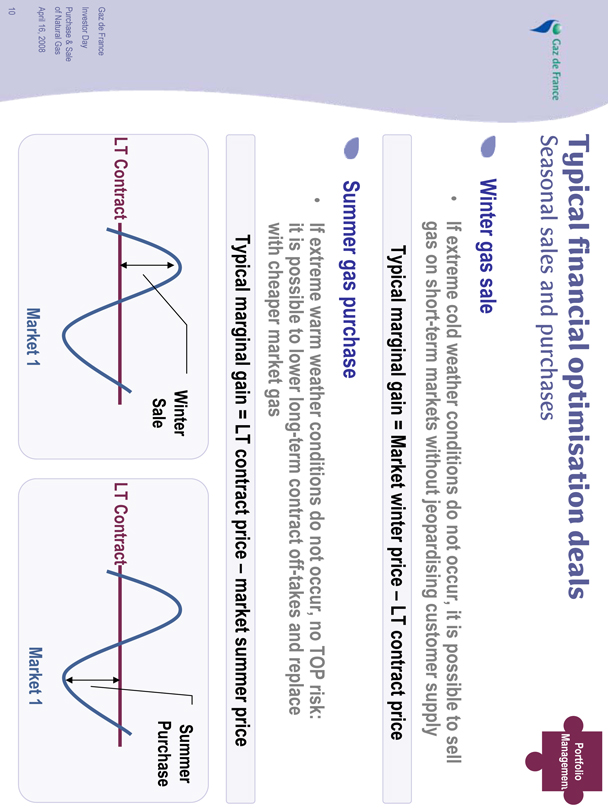

Typical financial optimisation deals

Seasonal sales and purchases

Portfolio Management

Winter gas sale

If extreme cold weather conditions do not occur, it is possible to sell gas on short-term markets without jeopardising customer supply

Typical marginal gain = Market winter price – LT contract price

Summer gas purchase

If extreme warm weather conditions do not occur, no TOP risk: it is possible to lower long-term contract off-takes and replace with cheaper market gas

Typical marginal gain = LT contract price – market summer price

LT Contract

Winter Sale

Market 1

LT Contract

Summer Purchase

Market 1

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

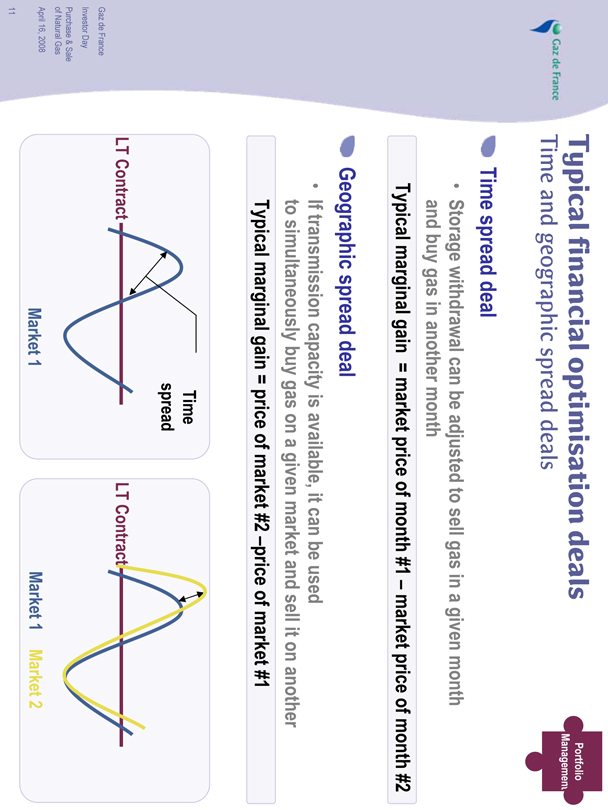

Typical financial optimisation deals

Time and geographic spread deals

Portfolio Management

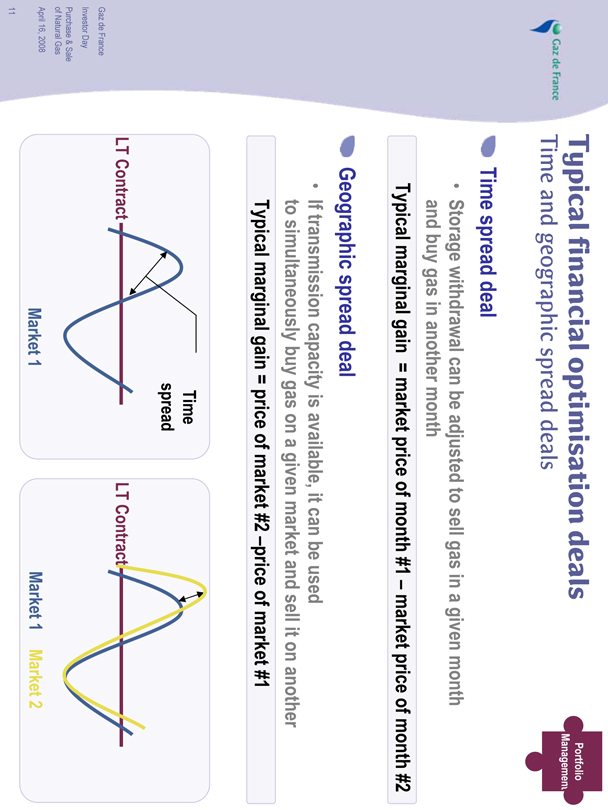

Time spread deal

Storage withdrawal can be adjusted to sell gas in a given month and buy gas in another month

Typical marginal gain = market price of month #1 – market price of month #2

Geographic spread deal

If transmission capacity is available, it can be used to simultaneously buy gas on a given market and sell it on another

Typical marginal gain = price of market #2 –price of market #1

LT Contract

Time spread

Market 1

LT Contract

Market 1

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

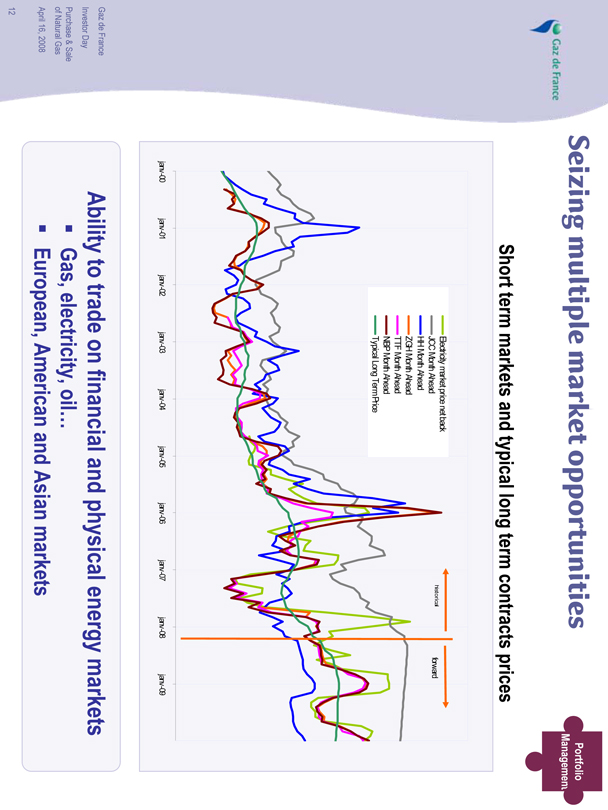

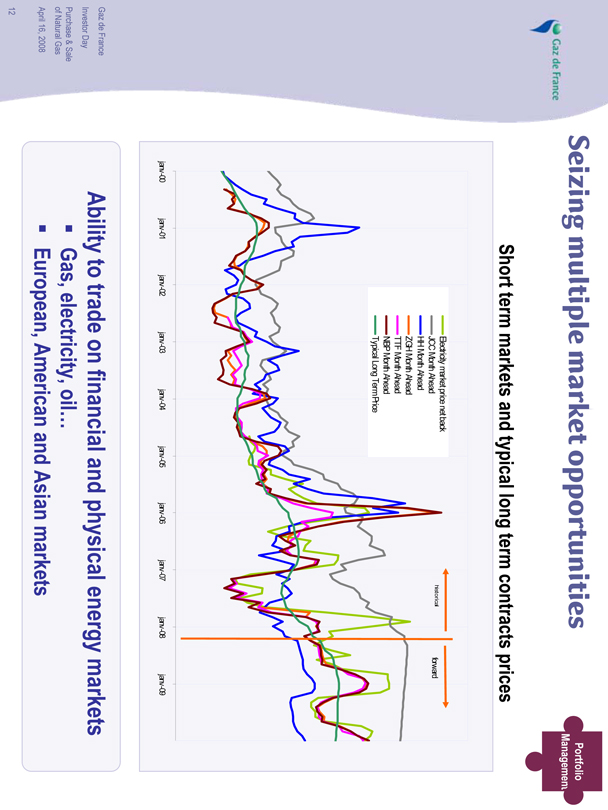

Seizing multiple market opportunities

Portfolio Management

Short term markets and typical long term contracts prices

Electricity market price net back

JCC Month Ahead

HH Month Ahead

ZGH Month Ahead

TTF Month Ahead

NBP Month Ahead

Typical Long Term Price

Historical forward

janv-00 janv-01 janv-02 janv-03 janv-04 janv-05 janv-06 janv-07 janv-08 janv-09

Ability to trade on financial and physical energy markets

Gas, electricity, oil…

European, American and Asian markets

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

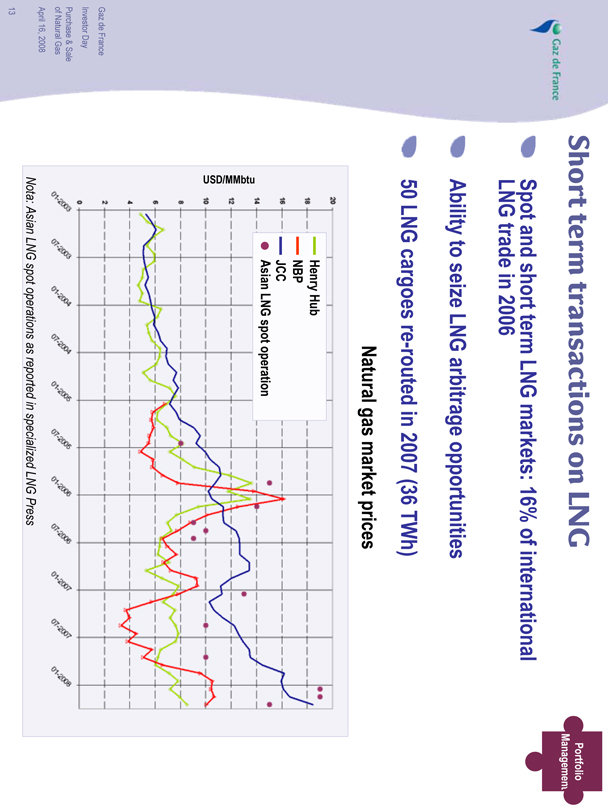

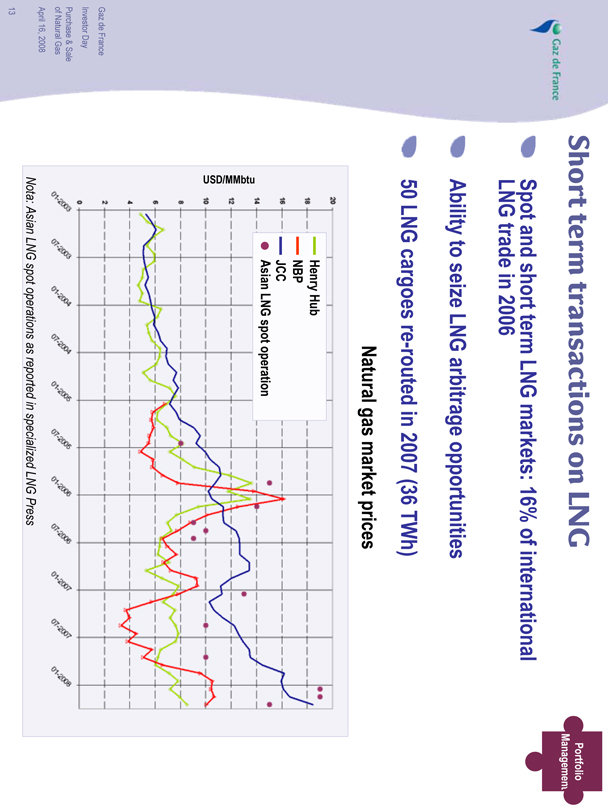

Short term transactions on LNG

Portfolio Management

Spot and short term LNG markets: 16% of international LNG trade in 2006

Ability to seize LNG arbitrage opportunities

50 LNG cargoes re-routed in 2007 (36 TWh)

Natural gas market prices

Henry Hub

NBP

JCC

Asian LNG spot operation

USD/MMbtu

01-2003 07-2003 01-2004 07-2004 01-2005 07-2005 01-2006 07-2006 01-2007 07-2007 01-2008

Nota: Asian LNG spot operations as reported in specialized LNG Press

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

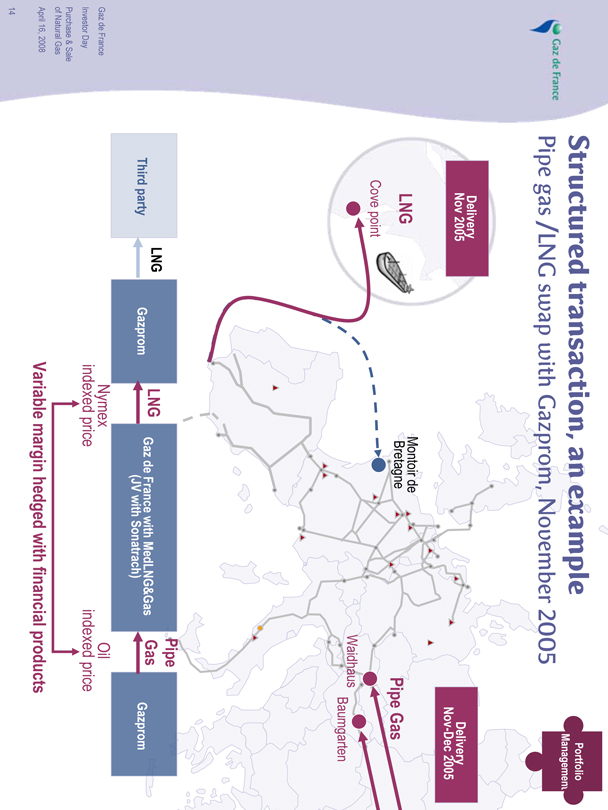

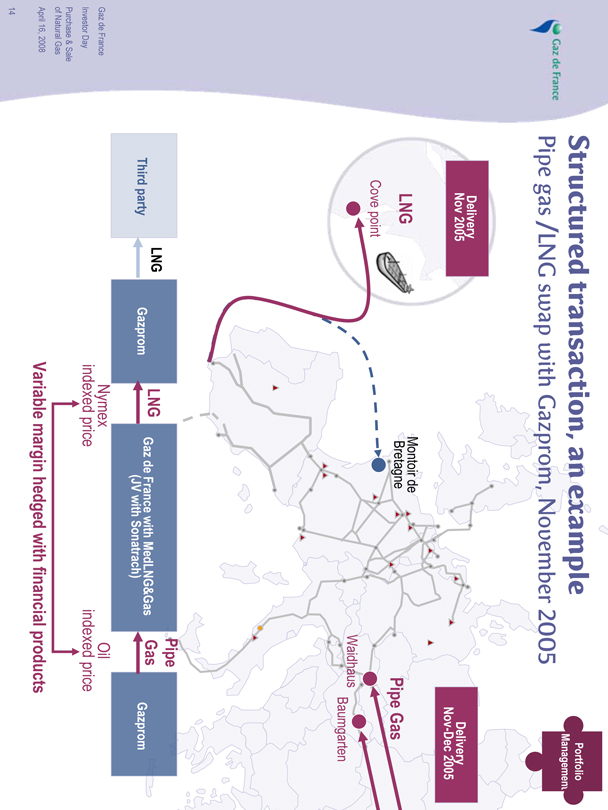

Structured transaction, an example

Pipe gas /LNG swap with Gazprom, November 2005

Portfolio Management

Delivery Nov 2005

LNG Cove point

Montoir de Bretagne

Delivery Nov-Dec 2005

Pipe Gas

Waidhaus

Baumgarten

Third party

LNG

Gazprom

LNG

Gaz de France with MedLNG&Gas (JV with Sonatrach)

Pipe Gas

Gazprom

Nymex indexed price

Oil indexed price

Variable margin hedged with financial products

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Efficient organisation to generate maximum value

Portfolio Management

3-year position continuously updated by portfolio manager of Supply Division

Continuous process of data collection and update

Use of proprietary mathematical models and software for optimisation

Close dialogue between Portfolio Management and Negotiators

To identify market opportunities as early as possible

To flag up portfolio manager’s interest in proposing potential deals

Efficient and reactive operational teams

Quick implementation of new contracts / delivery points

Proximity between Gaselys and Supply & LNG Divisions adds value

On-going tracking of market opportunities

On-going advice on optimising value of flexibility across portfolio

Designing dynamic financial hedges

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaze de France

Portfolio Management

1 Introduction organisation, facts & figures

2 Fundamentals and trends in global natural gas market

3 Key competitive advantages

4 Business model

Portfolio Management

Risk Control

5 Outlook & strategic directions

Storage cycle impact

Financial business model

Jean-Claude Depail

Executive Vice-President

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaze de France

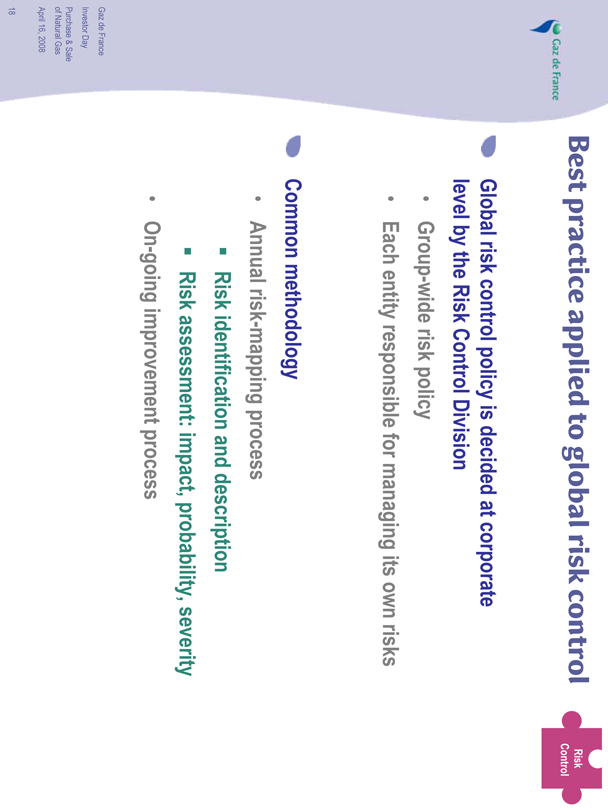

Best practice applied to global risk control

Risk Control

Dedicated risk control organisation

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaze de France

Best practice applied to global risk control

Risk Control

Global risk control policy is decided at corporate level by the Risk Control Division

Group-wide risk policy

Each entity responsible for managing its own risks

Common methodology

Annual risk-mapping process

Risk identification and description

Risk assessment: impact, probability, severity

On-going improvement process

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaze de France

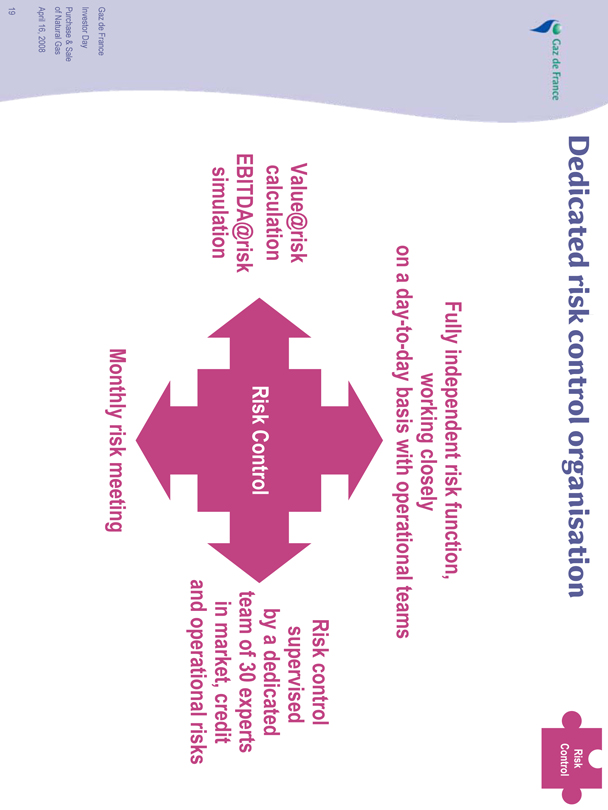

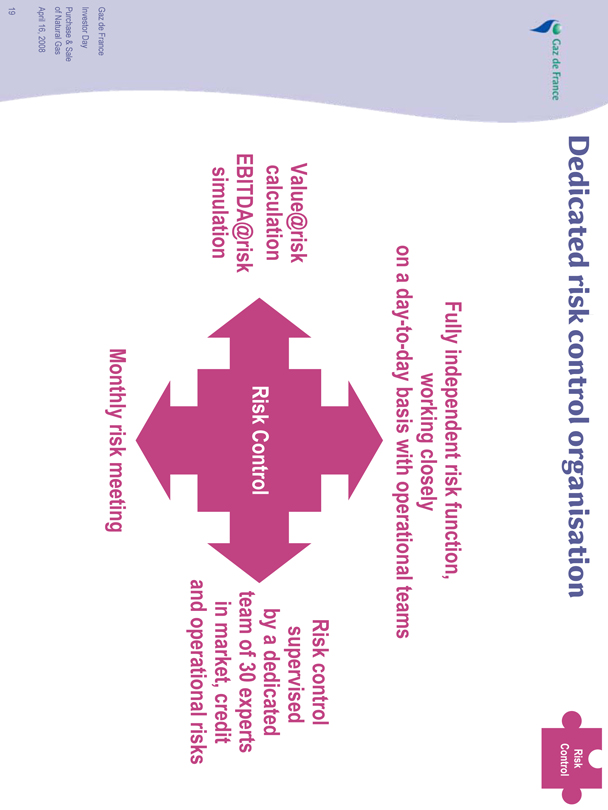

Dedicated risk control organisation

Risk Control

Fully independent risk function, working closely on a day-to-day basis with operational teams

Value@risk calculation

EBITDA@risk simulation

Risk Control

Risk control supervised by a dedicated team of 30 experts in market, credit and operational risks

Monthly risk meeting

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

1 Introduction organisation, facts & figures

2 Fundamentals and trends in global natural gas market

3 Key competitive advantages

4 Business model

Portfolio Management

Risk Control

5 Outlook & strategic directions

Storage cycle impact

Financial business model

Jean-Claude Depail

Executive Vice-President

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

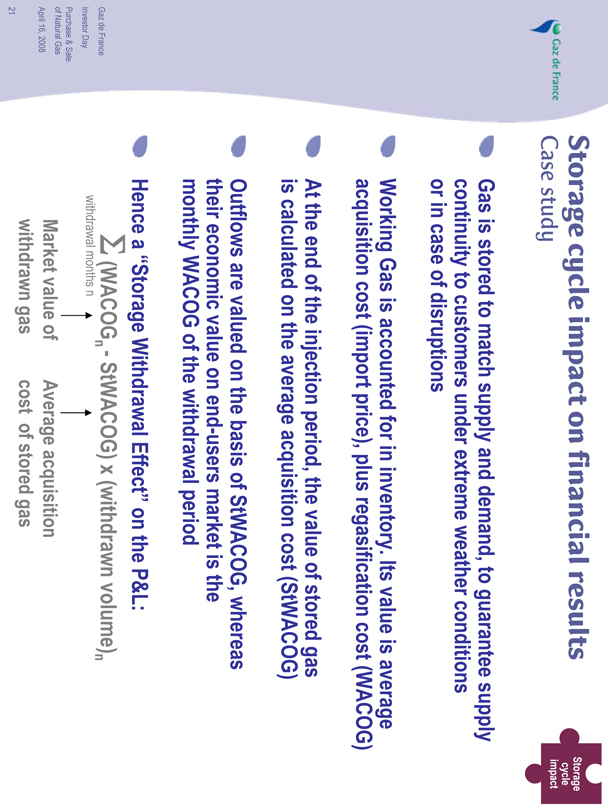

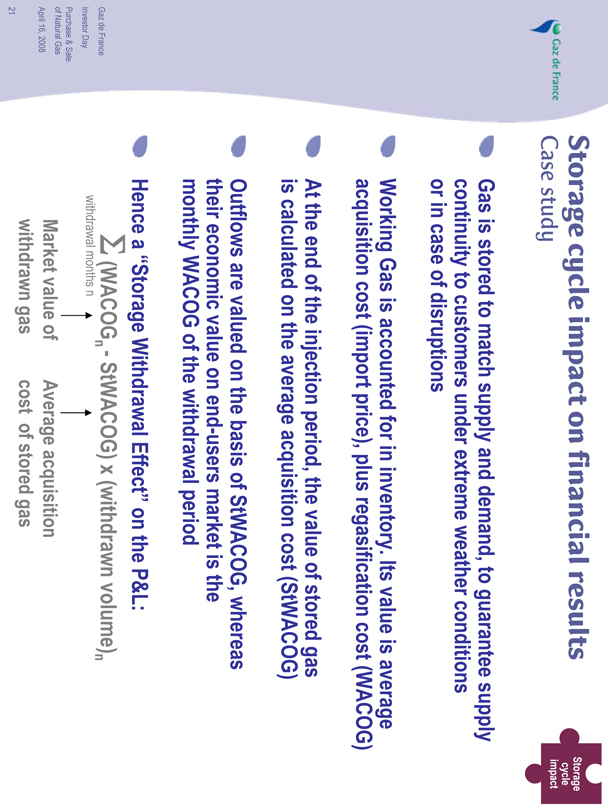

Storage cycle impact on financial results

Case study

Storage cycle impact

Gas is stored to match supply and demand, to guarantee supply continuity to customers under extreme weather conditions or in case of disruptions

Working Gas is accounted for in inventory. Its value is average acquisition cost (import price), plus regasification cost (WACOG)

At the end of the injection period, the value of stored gas is calculated on the average acquisition cost (StWACOG)

Outflows are valued on the basis of StWACOG, whereas their economic value on end-users market is the monthly WACOG of the withdrawal period

Hence a “Storage Withdrawal Effect” on the P&L:

S(WACOGn - StWACOG) x (withdrawn volume)n

withdrawal months n

Market value of withdrawn gas

Average acquisition cost of stored gas

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaze de France

Storage cycle impact on financial results

Case study

Storage cycle impact

Steep increase in oil prices over 2004-2006 period

As oil prices fluctuate, injection/withdrawal cycles cause important spread between StWACOG and monthly WACOG (especially during Winter 05/06)

Heavy withdrawal in Winter 05/06 had significant positive impact on EBITDA. Spread decreased with Summer injection in 06

j-04 m-04 m-04 j-04 s-04 n-04 j-05 m-05 m-05 j-05 s-05 n-05 j-06 m-06 m-06 j-06 s-06 n-06

- Brent $ - WACOG EUR/MWh

m-04 m-04 j-04 s-04 n-04 j-05 m-05 m-05 j-05 s-05 n-05 j-06 m-06 m-06 j-06 s-06 n-06

- WACOG - StWACOG - Storage level

Injection in storage Withdrawal in storage

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaze de France

1 Introduction organisation, facts & figures

2 Fundamentals and trends in global natural gas market

3 Key competitive advantages

4 Business model

Portfolio Management

Risk Control

5 Outlook & strategic directions

Storage cycle impact

Financial business model

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaze de France

Global Gas and LNG business model

Consistent Positive returns

Financial business model

Ability to operate under unfavourable market conditions

Proven and profitable business model

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaze de France

Global Gas and LNG business model

Financial business model

Disclaimer : for illustration purpose only. there is no “typical” breakdown of the EBITDA between the activities : it depends on the weather and market conditions

Revenues

Equity oil & gas sales

Structured deals

LNG mid-term deals and shipping

Non-regulated sales

Regulated tariffs sales

Costs

Production costs

Infrastructure costs

Forecast supply costs*

Sales margin at time of signature (hedged)

E&P financial segment

Storage cycles impact

Trading

Geographical spread arbitrage (incl. LNG)

Time spread arbitrage

Portfolio optimisation

* not including the cost of gas withdrawn

At time of signature

At time of off-take

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

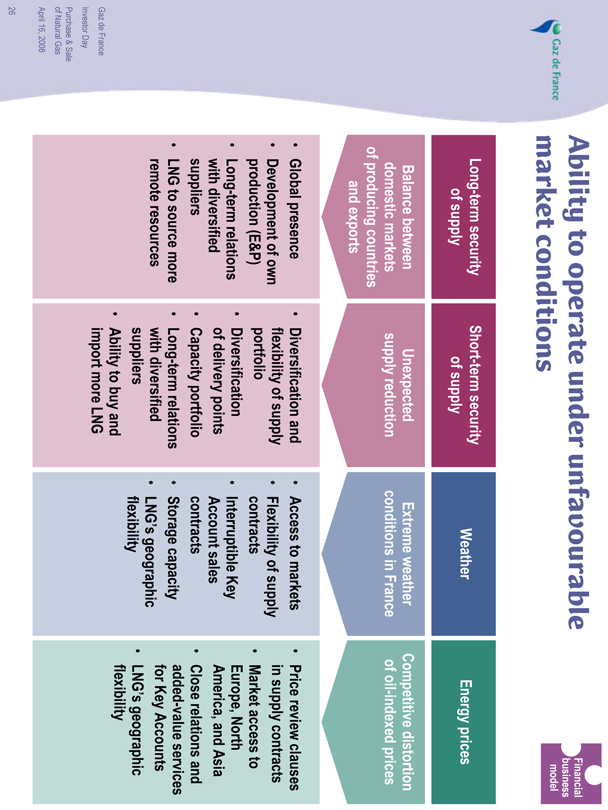

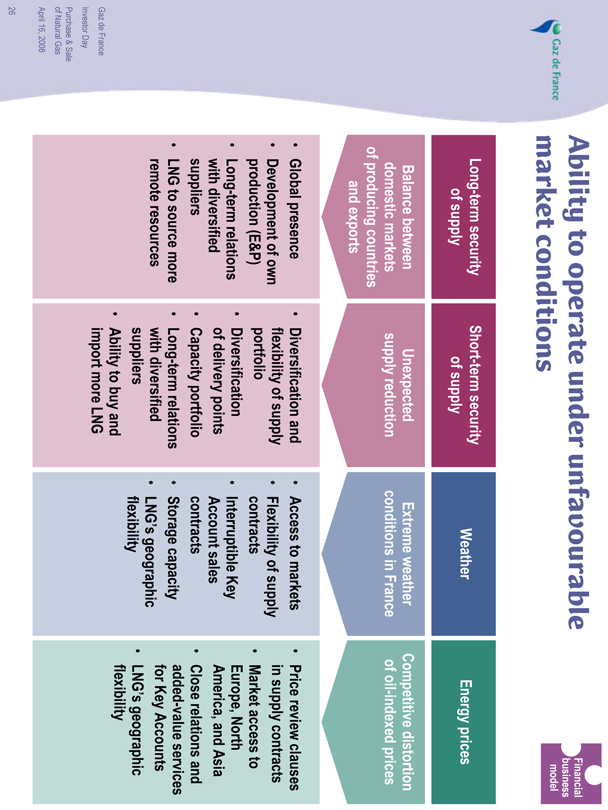

Ability to operate under unfavourable market conditions

Financial business model

Long-term security of supply

Balance between domestic markets of producing countries and exports

Global presence

Development of own production (E&P)

Long-term relations with diversified suppliers

LNG to source more remote resources

Short-term security of supply

Unexpected supply reduction

Diversification and flexibility of supply portfolio

Diversification of delivery points

Capacity portfolio

Long-term relations with diversified suppliers

Ability to buy and import more LNG

Weather

Extreme weather conditions in France

Access to markets

Flexibility of supply contracts

Interruptible Key Account sales contracts

Storage capacity

LNG’s geographic flexibility

Energy prices

Competitive distortion of oil-indexed prices

Price review clauses in supply contracts

Markets access to Europe, North America, and Asia

Close relations and added-value services for Key Accounts

LNG’s geographic flexibility

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

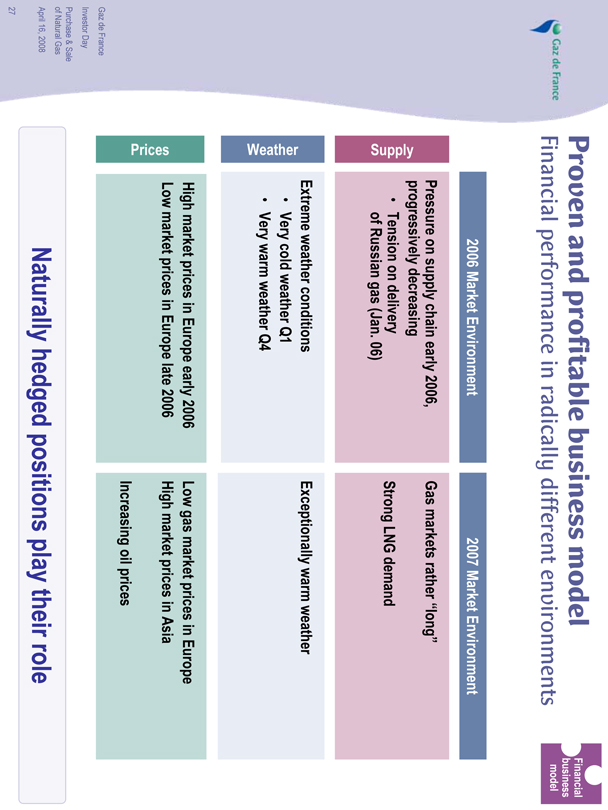

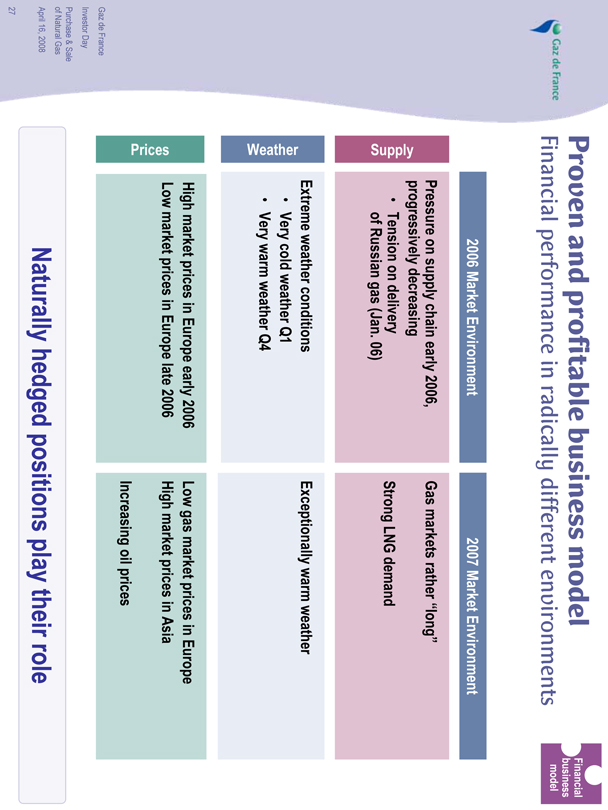

Proven and profitable business model

Financial performance in radically different environments

Financial business model

2006 Market Environment 2007 Market Environment

Supply

Pressure on supply chain early 2006, progressively decreasing

Tension on delivery of Russian gas (Jan. 06)

Gas markets rather “long”

Strong LNG demand

Weather

Extreme weather conditions

Very cold weather Q1

Very warm weather Q4

Exceptionally warm weather

Prices

High market prices in Europe early 2006

Low market prices in Europe late 2006

Low gas market prices in Europe

High market prices in Asia

Increasing oil prices

Naturally hedged positions play their role

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

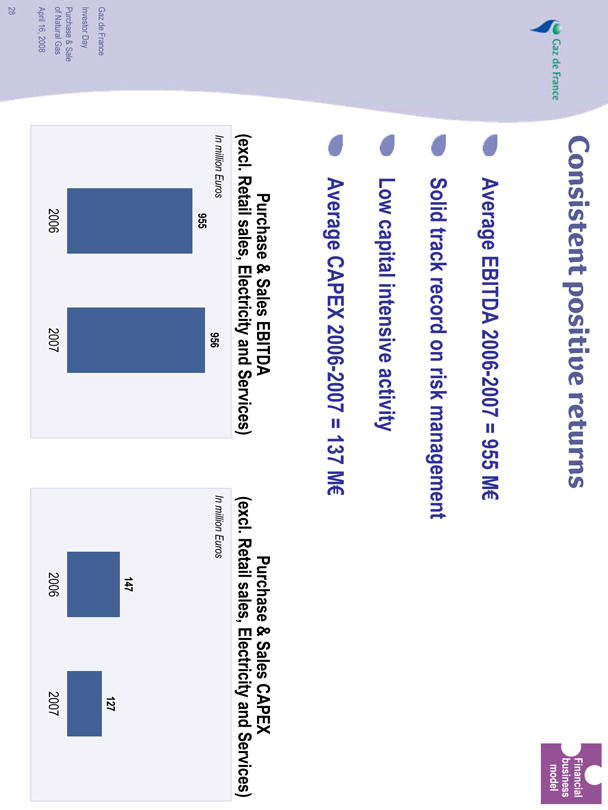

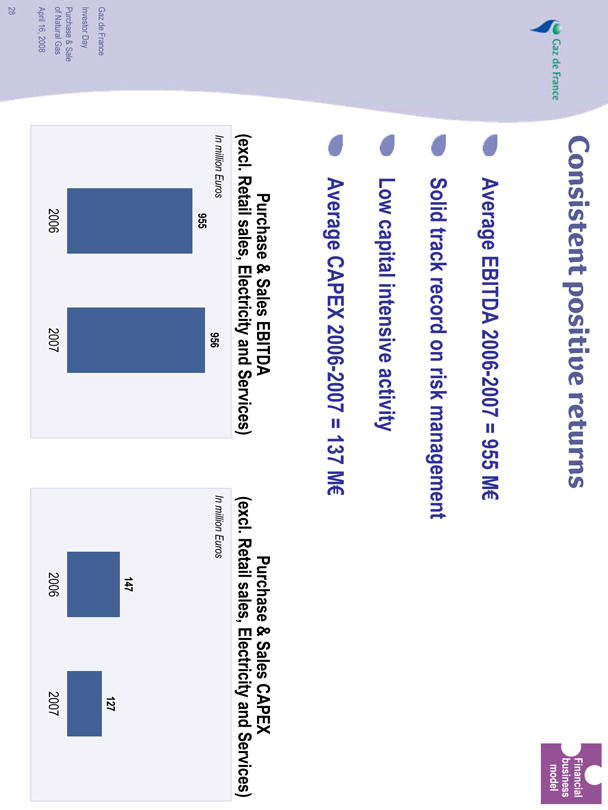

Consistent positive returns

Financial business model

Average EBITDA 2006-2007 = 955 M€

Solid track record on risk management

Low capital intensive activity

Average CAPEX 2006-2007 = 137 M€

Purchase & Sales EBITDA

(excl. Retail sales, Electricity and Services)

In million Euros

955

2006

956

2007

Purchase & Sales CAPEX

(excl. Retail sales, Electricity and Services)

In million Euros

147

2006

127

2007

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

5 Outlook & strategic directions

Jean-Marie Dauger

Chief Operating Officer

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Wrap up

A global player with key competitive advantages in changing gas market

A top tier player, integrated all along gas chain

Strong competitive advantage in supplies

Expanding global leadership in LNG

Robust base of key account customers

Strong expertise in price engineering

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Strategic directions

Sustaining profitable development

Achieve strong development for natural gas and oil reserves

Continue to adapt our competitive supply portfolio to fast-changing market conditions

Expand LNG sourcing, leveraging on E&P activities

Further develop profitable Key Account business in Europe

Maintain commitment to European infrastructure projects

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

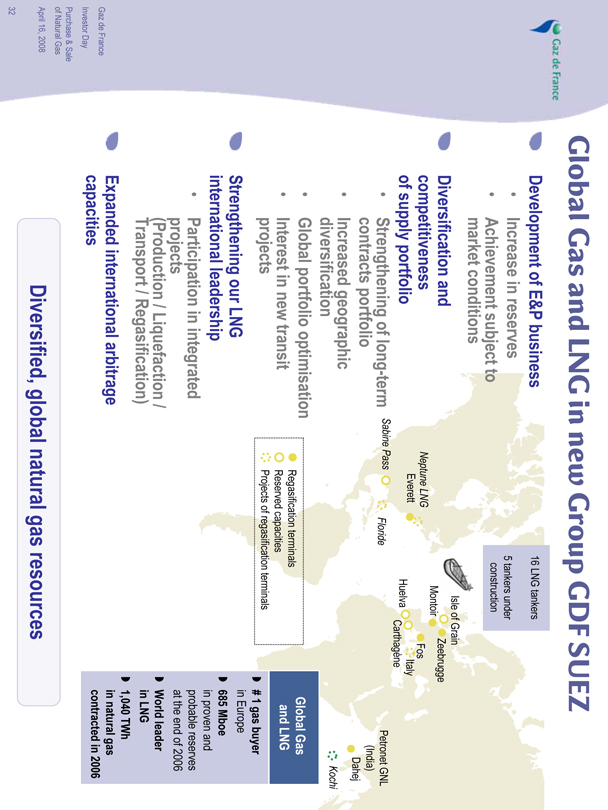

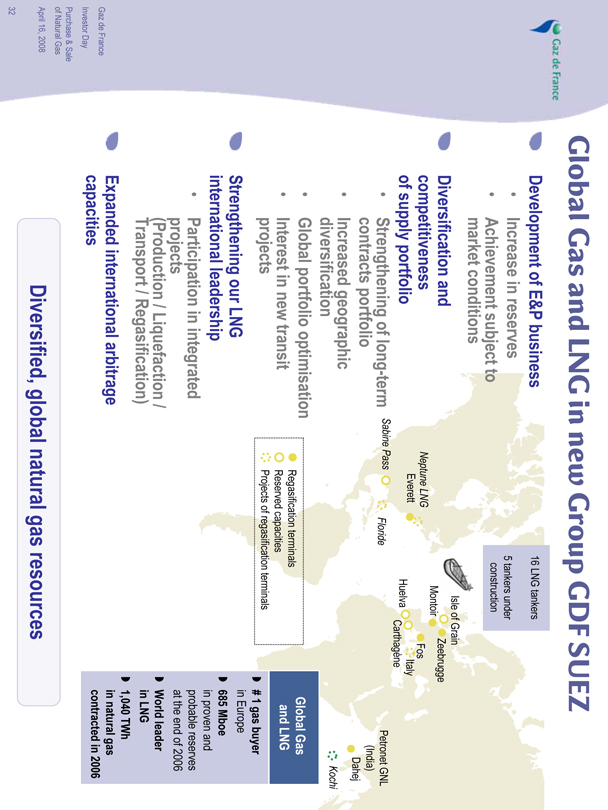

Gaz de France

Global Gas and LNG in new Group GDF SUEZ

Development of E&P business

Increase in reserves

Achievement subject to market conditions

Diversification and competitiveness of supply portfolio

Strengthening of long-term contracts portfolio

Increased geographic diversification

Global portfolio optimisation

Interests in new transit projects

Strengthening our LNG international leadership

Participation in integrated projects

(Production/Liquefaction) / Transport/ Regasification)

Expanded international arbitrage capacities

16 LNG tankers

5 tankers under construction

Isle of Grain Zeebrugge

Neptune LNG Everett

Montoir

Sabine Pass

Floride

Huelba

Fos

Italy

Carthagene

Petronet GNL (India) Dahej Kochi

Regasfication terminals

Reserved capacities

Projects of regasification terminals

Global Gas and LNG

# 1 gas buyer in Europe

685 Mboe in proven and probable reserves at the end of 2006

World leader in LNG

1,040 TWh in natural gas contracted in 2006

Diversified, global natural gas resources

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Conclusion

European leader on mid-stream and down-stream gas market

Strong competitive advantages in Supply, LNG, Key Accounts, Trading and Portfolio Management

Capitalising on over 40 years’ experience

Long-term relationships with producers and customers

Highly qualified staff with strong technical expertise

Diversified and flexible supply & capacity portfolio

Proven low capital-intensive business model

Delivering high profitability

Managing risk and volatility

Merger with Suez will boost size and open new opportunities

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Purchase & Sale of Natural Gas

A global player with key competitive advantages in changing energy markets

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

Appendices

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

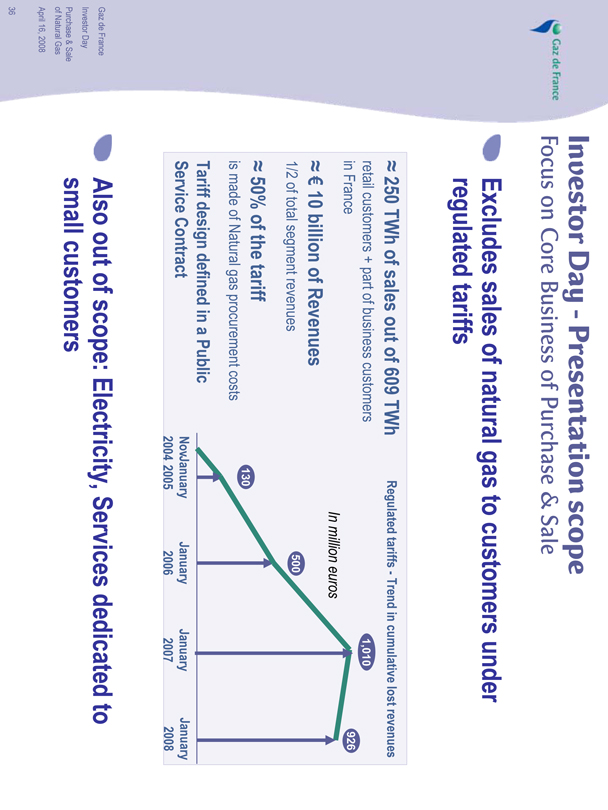

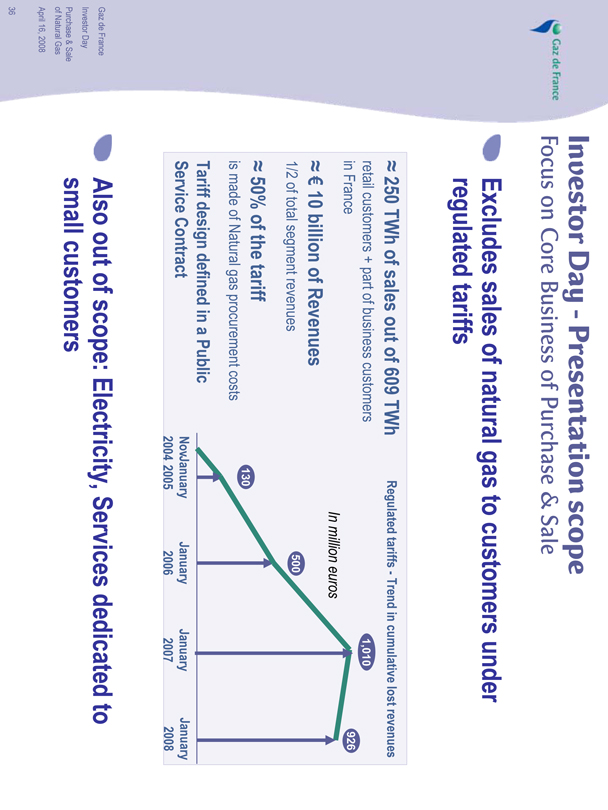

Gaz de France

Investor Day - Presentation scope

Focus on Core Business of Purchase & Sale

Excludes sales of natural gas to customers under regulated tariffs

= 250 TWh of sales out of 609 TWh

retail customers + part of business customers in France

= € 10 billion of Revenues

1/2 of total segment revenues

= 50% of the tariff

is made of Natural gas procurement costs

Tariff design defined in a Public Service Contract

Regulated tariffs - Trend in cumulative lost revenues

In million euros

1,010

926

500

130

NovJanuary 2004 2005

January 2006

January 2007

January 2008

Also out of scope: Electricity, Services dedicated to small customers

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

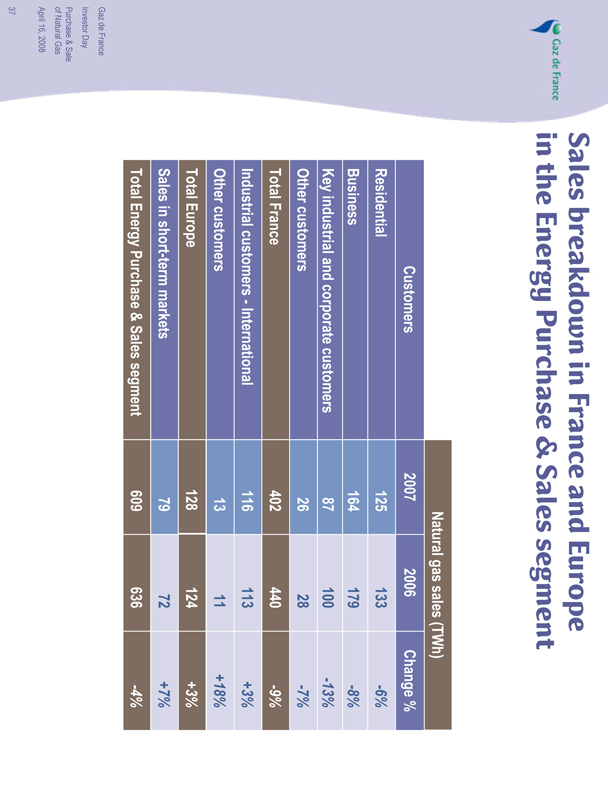

Gaz de France

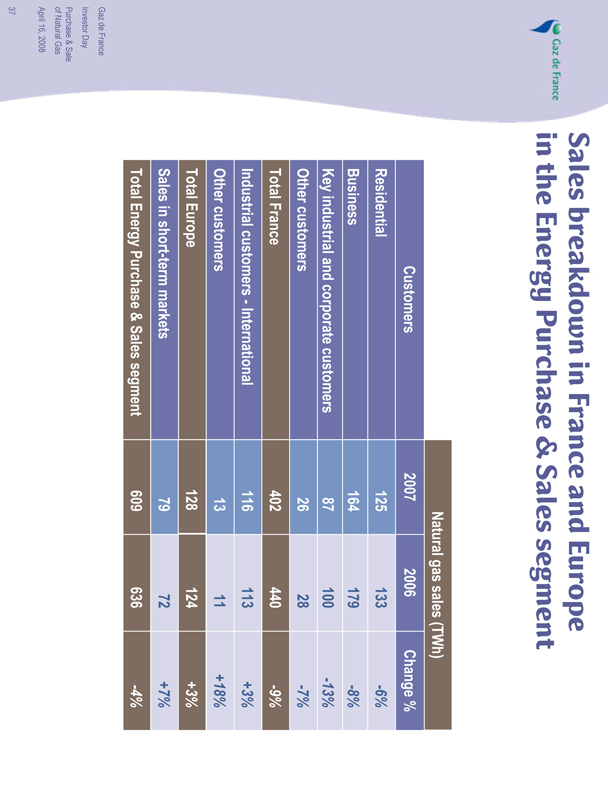

Sales breakdown in France and Europe in the Energy Purchase & Sales segment

Natural gas sales (TWh)

Customers 2007 2006 Change %

Residential 125 133 -6%

Business 164 179 -8%

Key industrial and corporate customers 87 100 -13%

Other customers 26 28 -7%

Total France 402 440 -9%

Industrial customers - International 116 113 +3%

Other customers 13 11 +18%

Total Europe 128 124 +3%

Sales in short-term markets 79 72 +7%

Total Energy Purchase & Sales segment 609 636 -4%

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gaz de France

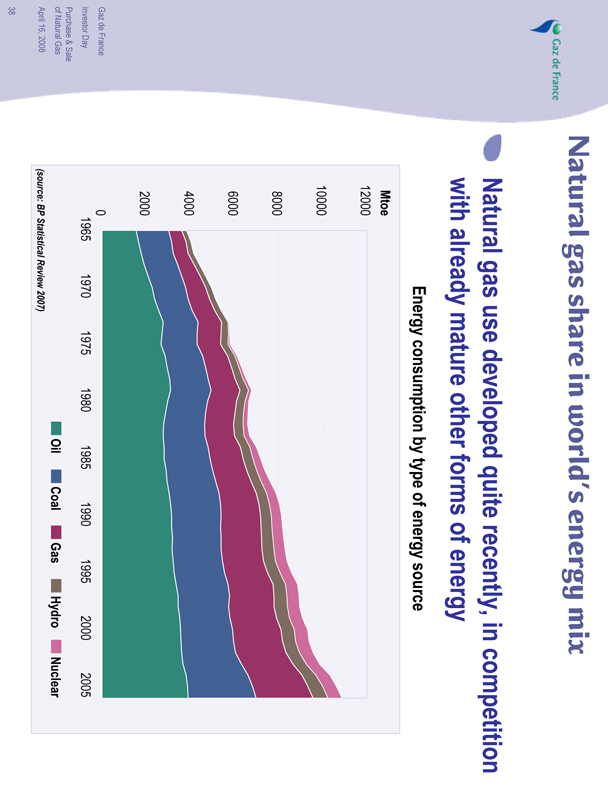

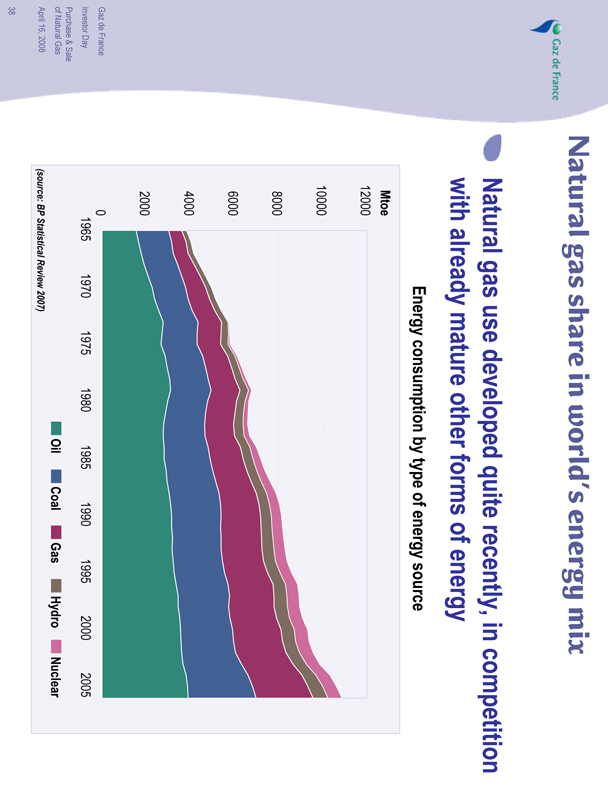

Natural gas share in world’s energy mix

Natural gas use developed quite recently, in competition with already mature other forms of energy

Energy consumption by type of energy source

Mtoe

12000

10000

8000

6000

4000

2000

0

1965 1970 1975 1980 1985 1990 1995 2000 2005

Oil Coal Gas Hydro Nuclear

(source: BP Statistical Review 2007)

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

Gas de France

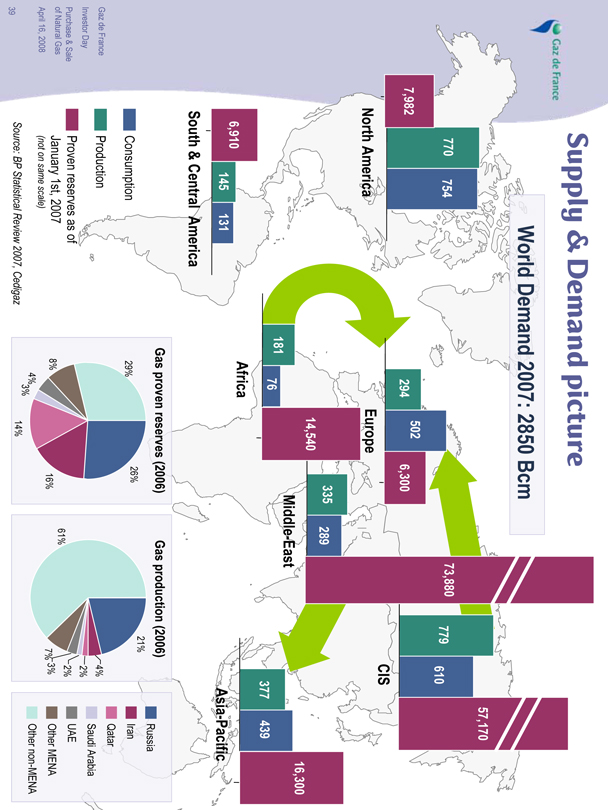

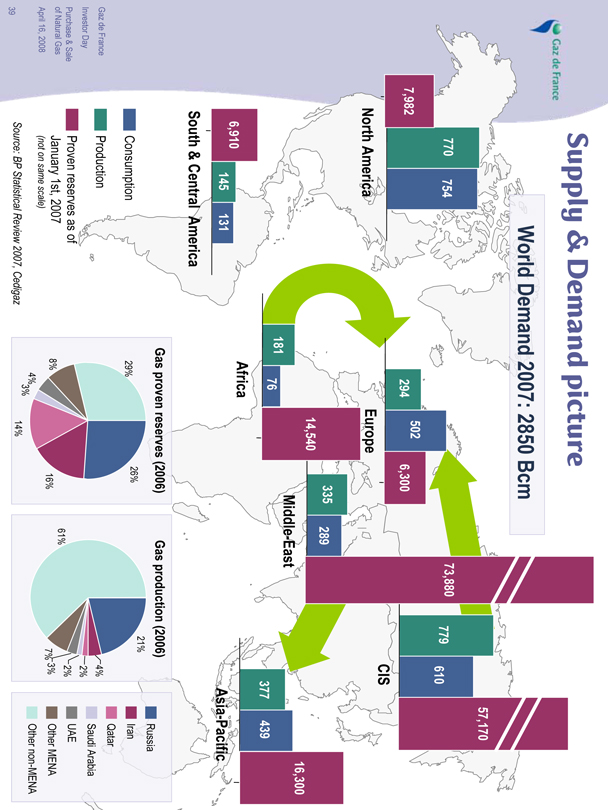

Supply & Demand picture

World Demand 2007: 2850 Bcm

7,982 770 754 North America

294 502 6,300 Europe

779 610 57,170 CIS

6,910 145 131 South & Central America

181 76 14,540 Africa

335 289 73,880 Middle-East

377 439 16,300 Asia-Pacific

Consumption

Production

Proven Reserves as of January 1st, 2007 (not on same scale)

Gas proven reserves (2006)

29% 26% 8% 4% 3% 14% 16%

Gas production (2006)

61% 21% 4% 2% 2% 3% 7%

Russia

Iran

Qatar

Saudi Arabia

UAE

Other MENA

Other non-MENA

Source: BP Statistical Review 2007, Cedigaz

Gaz de France Investor Day Purchase & Sale of Natural Gas April 16, 2008

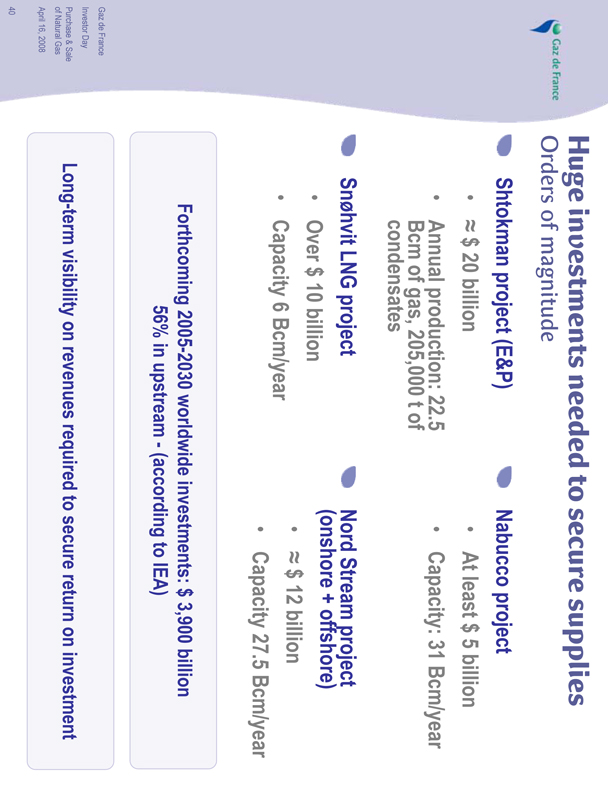

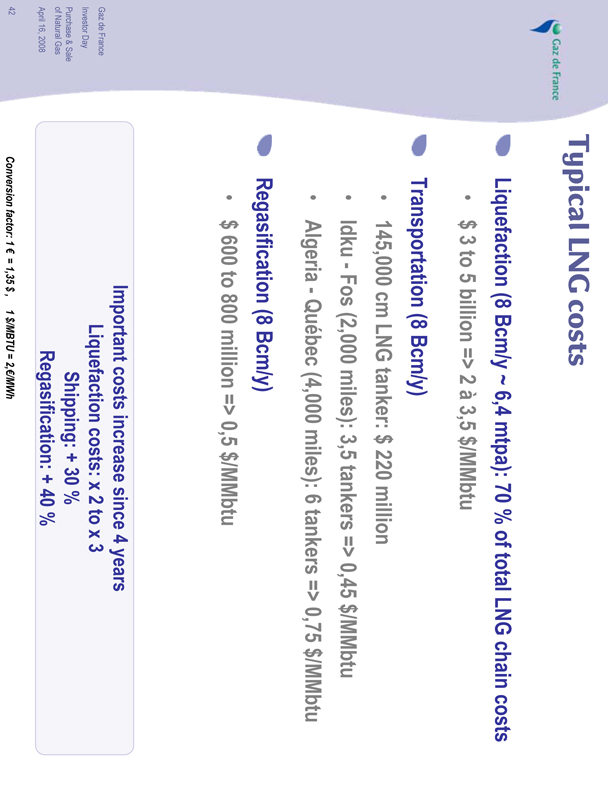

Gas de France