Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

INDEX TO THE FINANCIAL STATEMENTS MESSER GRIESHEIM HOLDING AG

INDEX TO UNAUDITED FINANCIAL STATEMENTS SINGAPORE SYNGAS PTE LTD.

INDEX TO FINANCIAL STATEMENTS SINGAPORE SYNGAS PTE LTD.

As filed with the Securities and Exchange Commission on April 30, 2002

Registration No. 333-73020

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE

AMENDMENT No. 1

TO

FORM F-4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MESSER GRIESHEIM HOLDING AG

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of registrant name into English)

| Federal Republic of Germany | | 2810 | | Not Applicable |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification No.) |

Koogstraat 10

25870-Norderfriedrichskoog, Germany

+49-4864-1401

(Address, including zip code, and telephone number, including area code,

of registrant's principal executive offices)

CT Corporation System

1633 Broadway

New York, New York 10019

212-245-4107

(Name, address, including zip code, and telephone number, including area code, of agent for service)

WITH A COPY TO:

Thomas B. Siebens, Esq.

Milbank, Tweed, Hadley & McCloy LLP

Dashwood House

69 Old Broad Street

London, England EC2M 1QS

+44-20-7448-3034

Approximate date of commencement of proposed sale to the public:As soon as practicable after this registration statement becomes effective.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended or until the registration statement shall become effective on such date as the commission, acting pursuant to said Section 8(a), may determine.

EURO550,000,000

Messer Griesheim Holding AG

10.375% Senior Notes due 2011

The 10.375% Senior Notes due 2011 offered hereby were issued on December 15, 2001 in exchange for the 10.375% Senior Notes due 2011 originally issued on May 16, 2001. We refer to the exchanged notes and the original notes collectively as the notes.

The issuer will pay interest on the notes on June 1 and December 1 of each year. The first payment was made on December 1, 2001. Prior to June 1, 2006, the issuer may redeem all but not part of the notes by paying a "make-whole" premium as set forth in this prospectus. The issuer has the option to redeem all or a portion of the notes at any time on or after June 1, 2006 at the redemption prices set forth in this prospectus. In addition, prior to June 1, 2004, the issuer has the option to redeem up to 35% of the aggregate principal amount of the notes with the net proceeds of certain public equity offerings at a redemption price equal to 110.375% of the principal amount of the notes being redeemed. The notes will be issued only in registered book-entry form, in integral multiples of EURO1,000.

The issuer is the holding company for Messer Griesheim GmbH. The issuer has loaned the proceeds of the offering of the original notes pursuant to a subordinated intercompany loan to Messer Griesheim. The intercompany loan is subordinated to all existing and future debt of Messer Griesheim under its senior credit facilities and is subject to restrictions on enforcement. The intercompany loan also is effectively subordinated to all other existing and future debt of Messer Griesheim and its subsidiaries. The shares of Messer Griesheim have been pledged as security to the lenders under Messer Griesheim's senior credit facilities.

Application has been made to list the notes on the Luxembourg Stock Exchange.

Certain private equity funds managed by affiliates of The Goldman Sachs Group, Inc. indirectly own 33.665% of the issuer. Goldman Sachs International is also an affiliate of The Goldman Sachs Group, Inc.

See "Risk Factors" beginning on page 14 for a discussion of certain factors you should consider before buying the notes.

This prospectus has been prepared for and is to be used by Goldman, Sachs & Co., Goldman Sachs International and other affiliates of The Goldman Sachs Group, Inc. in connection with offers and sales of notes related to market-making transactions. The issuer will not receive any of the proceeds of such sales. Goldman, Sachs & Co., Goldman Sachs International or other affiliates of The Goldman Sachs Group, Inc. may act as principal or agent in such transactions. The notes may be offered in negotiated transactions or otherwise.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Goldman, Sachs & Co. | | Goldman Sachs International |

Prospectus dated April , 2002.

EXPLANATORY NOTE

THE ORIGINAL REGISTRATION STATEMENT AS DECLARED EFFECTIVE ON NOVEMBER 14, 2001 COVERED THE REGISTRATION OF AN AGGREGATE PRINCIPAL AMOUNT OF EURO550,000,000 OF 10.375% SENIOR NOTES DUE 2011 OF MESSER GRIESHEIM HOLDING AG, WHICH WE HEREINAFTER REFER TO AS THE EXCHANGE NOTES, THAT WAS EXCHANGED FOR AN EQUAL PRINCIPAL AMOUNT OF OUR OUTSTANDING 10.375% SENIOR NOTES DUE 2011. THIS REGISTRATION STATEMENT ALSO COVERED THE REGISTRATION OF THE EXCHANGE NOTES FOR RESALE BY GOLDMAN SACHS & CO., GOLDMAN SACHS INTERNATIONAL AND OTHER AFFILIATES OF THE GOLDMAN SACHS GROUP, INC. IN MARKET-MAKING TRANSACTIONS. THIS POST-EFFECTIVE AMENDMENT NO. 1 IS FILED PURSUANT TO ITEM 512 OF REGULATION S-K AND WILL COVER THE REGISTRATION OF THE EXCHANGE NOTES FOR RESALE BY GOLDMAN SACHS & CO., GOLDMAN SACHS INTERNATIONAL AND OTHER AFFILIATES OF THE GOLDMAN SACHS GROUP INC. IN MARKET-MAKING TRANSACTIONS.

TABLE OF CONTENTS

In this prospectus:

"Messer Holding" and "the issuer" refer to Messer Griesheim Holding AG, the issuer of the notes, without its consolidated subsidiaries;

"Messer Griesheim" refers to the issuer's subsidiary, Messer Griesheim GmbH, which is the operating company whose business and results of operations are described in this prospectus, including, unless the context otherwise requires, its consolidated subsidiaries;

"we", "us" and "our" refers to the issuer and its consolidated subsidiaries, including Messer Griesheim.

"Messer Griesheim Group" and "the Group" refer to the parent of the issuer, Messer Griesheim Group GmbH & Co. KGaA, a German partnership limited by shares, or Messer Griesheim Group GmbH prior to its conversion on November 1, 2001 to Messer Griesheim Group GmbH Co. KGaA;

"Messer Industrie" refers to Messer Industrie GmbH, a holding company for the Messer family's minority interest in Messer Griesheim Group; and

"MGB" refers to Messer Griesheim Beteiligungsverwaltungs GmbH, which is the general partner of Messer Griesheim Group.

"Messer Employee GmbH" refers to Messer Employee GmbH & Co. KG, a company through which employees participating in our share purchase and option plan are to hold shares in Messer Griesheim Group.

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. The information contained in this prospectus is set forth as of the date hereof and is subject to change, completion or amendment without notice. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the cover page of this prospectus.

The distribution of this prospectus and the offer and sale of the notes may be restricted by law in certain jurisdictions. Person into whose possession this prospectus or any of the notes come must inform themselves about, and observe, such restrictions. In particular, except for (i) our filing of registration statement with the SEC on Form F-4 (No. 333-73020) under the Securities Act of 1933 with respect to the exchange notes; (ii) listing of the original notes on the Luxembourg Stock Exchange; and (iii) our application to list the exchange notes on the Luxembourg Stock Exchange, we have taken no action which would permit a public offering of the notes or distribution of this prospectus or any other offering material in any jurisdiction where action for that purpose is required. Accordingly, the notes may not be offered or sold, directly or indirectly, and neither this prospectus nor any other offering material may be distributed or published in any jurisdiction, except under circumstances that will result in compliance with any applicable laws and regulations. Each purchaser of the notes must comply with all applicable laws and regulations in force in any jurisdiction in which it purchases, offers or sells the notes or possesses or distributes this prospectus and must obtain any consent, approval or permission required of it for the purchase, offer or sale by it of the notes under the laws and regulations in force in any jurisdiction to which it is subject or in which it makes such purchases, offers or sales and we shall have no responsibility therefor.

The information contained in sections of this prospectus describing clearing arrangements has been provided by publicly available sources which the issuer believes are reliable. The issuer has not independently verified such information and takes no responsibility for the accuracy of those sections; however, the issuer has taken reasonable care to ensure that the information from these sources has been reproduced correctly. The issuer accepts responsibility accordingly. In addition, that information is subject to any change in or reinterpretation of the rules, regulations and procedures of Euroclear and Clearstream. The issuer advises investors who wish to use the facilities of any of those clearing systems to confirm the rules, regulations and procedures of the relevant clearing system. The issuer will have no responsibility or liability for any aspect of the records relating to, or payments made on account of, book-entry interests held through any clearing system. Finally, the issuer will have no responsibility or liability for maintaining, supervising or reviewing any records relating to those book-entry interests.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement we filed with the SEC on Form F-4 (No. 333-73020) under the Securities Act with respect to the exchange notes. As permitted by the rules and regulations of the SEC, this prospectus omits some of the information, exhibits and undertakings contained in the registration statement. For further information with respect to us and the exchange notes, see the registration statement, including its exhibits.

You may read and copy any document we file at the following SEC public reference rooms:

Judiciary Plaza

450 Fifth Street, N.W.

Room 1024

Washington D.C. 20549 | | 500 West Madison Street

14th Floor

Chicago

Illinois 60661 | | Woolworth Building

233 Broadway

New York

New York 10007-2517 |

Statements contained in this prospectus relating to the contents of any contract or other document are for informational purposes and should not substitute for your review of the copy of the contract or document filed as an exhibit to the registration statement. Any such statements in the prospectus are qualified in all respects by reference to the corresponding exhibit.

We file reports and other information with the Securities and Exchange Commission pursuant to the information requirements of the Securities and Exchange Act of 1934. Our filings with the Securities and Exchange Commission may be inspected without charge at the public reference room of the Securities and Exchange Commission at 450 Fifth Street, N.W., Washington, D. C. 20549. You may obtain information regarding the operation of the public reference room by calling the Securities and Exchange Commission at 1-800-SEC-0330. In addition, registration statements and certain other filings made with the Securities and Exchange Commission through its Electronic Data Gathering, Analysis and Retrieval system are publicly available through the Securities and Exchange Commission's website located at http://www.sec.gov. Additionally, under the indenture for the notes, the issuer has agreed to distribute to noteholders, and to file with the U.S. Securities and Exchange Commission if it will accept such filing, the issuer's audited year-end financial statements within 120 days of each year end, the issuer's unaudited quarterly financial statements within 60 days of the end of each quarter and all current reports that would be required to be furnished to the Commission on form 6-K if it were required to file reports on that form.

For a period of 180 days after the consummation of the exchange offer, we will promptly send additional copies of this prospectus and any amendment or supplement to it to any broker-dealer that requests such documents.

You can obtain, free of charge, copies of this prospectus (and copies of the documents referred to in this prospectus) from us, and, as long as the notes are listed on the Luxembourg Stock Exchange, from the offices of the paying agent in Luxembourg.

ENFORCEABILITY OF CIVIL LIABILITIES

We are stock corporation organized under the laws of the Federal Republic of Germany. Most of our management board and supervisory board members and executive officers reside outside the United States. All or a substantial portion of our assets and most of our management board and supervisory board members also are located outside the United States. As a result, it may not be possible for investors to effect service of process within the United States upon us or such persons with respect to matters arising under the United States federal securities laws or to enforce against us or such persons located outside the United States judgments of United States courts predicated upon the civil liability provisions of the United States federal securities laws.

CURRENCY PRESENTATION

In this prospectus:

- •

- "DM" means Deutsche Mark;

- •

- " EURO" and "euros" mean the single currency of the participating Member States in the Third Stage of European Economic and Monetary Union of the Treaty Establishing the European Community, as amended from time to time; and

- •

- "$" and "dollars" mean U.S. dollars.

For information regarding recent rates of exchange between the euro and dollars, see the section "Exchange Rates".

FINANCIAL STATEMENT PRESENTATION

The issuer was a dormant company which was activated to become a holding company for Messer Griesheim's shares in connection with the acquisition transactions described in this prospectus. The issuer has no material assets or sources of revenue other than its shares in Messer Griesheim, which have been pledged to Messer Griesheim's senior lenders as security, and an intercompany loan to Messer Griesheim.

Accordingly, this prospectus includes:

- •

- audited consolidated financial statements of Messer Griesheim as of December 31, 1999 and 2000 and for the years ended December 31, 1999 and 2000 and as of April 30, 2001 and for the four months ended April 30, 2001;

- •

- audited consolidated financial statements of the issuer as of and for the eight months ended December 31, 2001;

- •

- audited financial statements of Singapore Syngas Pte Ltd as of December 31, 2000 and for the year ended December 31, 2000 and unaudited financial statements of Singapore Syngas Pte Ltd as of December 31, 2001 and 1999 and for the year ended December 31, 2001 and the two years ended December 31, 1999; and

- •

- unaudited pro forma financial data relating to the issuer and Messer Griesheim on a consolidated basis for the year ended December 31, 2001 adjusted to reflect the issuance of the notes and the acquisition and refinancing transactions described below.

Both Messer Griesheim's and the issuer's financial statements are prepared in accordance with International Accounting Standards as adopted by the International Accounting Standards Board (formerly known as the International Accounting Standards Committee), or IAS. IAS differ in certain respects from generally accepted accounting principles in the United States and certain other countries. Material differences between IAS and generally accepted accounting principles in the United States, or U.S. GAAP, that affect our financial statements, are discussed in note 40 to our audited consolidated financial statements contained in this prospectus.

Singapore Syngas Pte Ltd's financial statements are prepared in accordance with Singapore generally accepting accounting principles, or SGAAP. SGAAP differ in certain respects from International Accounting Standards of the International Accounting Standards Committee. Material differences between SGAAP and IAS that affect the financial statements of Singapore Syngas Pte Ltd are discussed in Note 18 to the Singapore Syngas Pte Ltd financial statements contained in this prospectus. IAS differ in certain respects from generally accepted accounting principles in the United States. Material differences between IAS and U.S. GAAP that affect the financial statements of Singapore Syngas Pte Ltd are discussed in Note 19 to the Singapore Syngas Pte Ltd financial statements contained in this prospectus.

MARKET AND INDUSTRY DATA

Information or other statements presented in this prospectus regarding market share and industry data relating to our business were obtained from industry publications and other publicly available publications. Although the issuer believes that this information is reliable, the issuer cannot guarantee the accuracy or completeness of the information neither has the issuer independently verified it. Unless the context indicates otherwise, all market and industry data is for the calendar year 2001.

FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. Although we believe that our expectations are based on reasonable assumptions, we cannot assure you that actual results will not be materially different from our expectations. Factors that could cause our actual results to differ materially from our expectations include, among other things:

- •

- the amount of proceeds that we realize from our divestiture program;

- •

- the timing of the receipt of proceeds that we realize from our divestiture program;

- •

- the amount of savings in operational costs that Messer Griesheim is able to achieve as a result of its cost-savings program;

- •

- the costs of implementing Messer Griesheim's cost-savings program;

- •

- the timing to achieve benefits of our cost-savings program;

- •

- anticipated trends and conditions in our industry, including regulatory developments;

- •

- our capital needs; and

- •

- our ability to compete.

We are under no obligation to update or revise publicly any forward-looking statement. The forward-looking events discussed in this prospectus might not happen. In addition, you should not interpret statements regarding past trends or activities as promises that those trends or activities will continue in the future. All written, oral and electronic forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

Some numbers that appear in this prospectus (including percentage amounts) have been rounded. Numbers in tables may not sum precisely to the totals shown due to rounding.

SUMMARY

This summary does not contain all of the information that may be important to you. You should carefully read this prospectus in its entirety to understand the structure of our offering, our business, the risks associated with investing in the notes, the terms of the notes and the tax and other considerations that are important to your decision to invest in the notes.

In this prospectus:

"Messer Holding" and "the issuer" refer to Messer Griesheim Holding AG, the issuer of the notes, without its consolidated subsidiaries;

"Messer Griesheim" refers to the issuer's subsidiary, Messer Griesheim GmbH, which is the operating company whose business and results of operations are described in this prospectus, including, unless the context otherwise requires, its consolidated subsidiaries;

"we", "us" and "our" refers to the issuer and its consolidated subsidiaries, including Messer Griesheim;

"Messer Griesheim Group" and "the Group" refer to the parent of the issuer, Messer Griesheim Group GmbH & Co. KGaA, a German partnership limited by shares, or Messer Griesheim Group GmbH prior to its conversion on November 1, 2001 to Messer Griesheim Group GmbH & Co. KGaA;

"Messer Industrie" refers to Messer Industrie GmbH, a holding company for the Messer family's minority interest in Messer Griesheim Group; and

"MGB" refers to Messer Griesheim Beteiligungsverwaltungs GmbH, which is the general partner of Messer Griesheim Group.

We frequently use net sales and "normalized EBITDA" to evaluate our results of operations. We calculate "normalized EBITDA" as operating profit before depreciation and amortization, after adding back charges for impairment of intangible assets and property, plant and equipment, restructuring and reorganization charges. Normalized EBITDA is not a measure recognized by U.S. GAAP or IAS and may not be comparable to similar measures presented by our competitors. For a fuller explanation of our normalized EBITDA calculations, see the section captioned "Normalized EBITDA" below in this summary.

The Issuer

The issuer is a holding company that holds all of the shares of Messer Griesheim. The issuer issued the notes to obtain funding for refinancing a portion of Messer Griesheim's long-term indebtedness. Upon issuance of the notes, the issuer forwarded the proceeds to Messer Griesheim under an intercompany loan. The issuer plans to repay the notes out of repayments it receives from Messer Griesheim under the intercompany loan. The issuer will have no material assets or sources of revenue other than its shares in Messer Griesheim, which have been pledged to Messer Griesheim's senior lenders as security, and the intercompany loan to Messer Griesheim.

Our Business

Overview

We are a producer and distributor of industrial gases, including oxygen, nitrogen, argon, carbon dioxide, hydrogen, helium, specialty gases and acetylene. The industrial gases we produce are used in a broad range of industries, such as the steel, chemicals, electronics, pulp and paper, healthcare, food and beverages, automotive, lighting and glass industries. We market these products primarily in our core markets, which are Germany, the United States and the rest of Europe. In 2001, we had an estimated global market share of approximately 5%, making us the seventh largest industrial gas producer worldwide, and an estimated market share in Germany of approximately 31%. In the eight months ended December 31, 2001, we generated net sales of EURO1,047 million and normalized EBITDA of EURO245 million and in the four months ended April 30, 2001 our predecessor generated net sales of EURO574 million and normalized EBITDA of EURO126 million.

Substantially all of the net sales of our on-site, pipeline and bulk businesses are generated under medium to long-term contracts, which provides us with a steady source of revenues. We estimate that approximately 34% of our total net sales and approximately 45% of our normalized EBITDA in 2001 were generated by our on-site, pipeline and bulk businesses in Germany and the United States. In the eight months ended December 31, 2001, we generated net sales of EURO1.0 billion and in the four months ended April 30, 2001 our predecessor generated net sales of EURO0.6 billion, compared with net sales of EURO1.7 billion in 2000 and EURO1.5 billion in 1999.

Our principal customers are located in Europe and North America. Our diversified customer portfolio includes a wide range of international companies such as ThyssenKrupp, NUCOR, Bayer, Veba, Celanese, Clariant, BASF, Volkswagen, Bosch, DaimlerChrysler, Textron-Kautex, DuPont, General Electric, Caterpillar, Nestlé and Shell.

In May 2001, immediately following our change in ownership through the acquisition transactions described elsewhere in this prospectus, we adopted a divestiture program under which we intend to divest substantially all of our assets and operations located outside of our core regions as well as certain non-strategic assets and operations in our core regions. Other than the joint ventures in China described under "The Acquisition Transactions, The Refinancing and the Divestiture Program", we intend to complete these divestitures by year-end 2002. We estimate that these assets and operations accounted for approximately 24% of net property, plant and equipment, 17% of net sales and 7% of normalized EBITDA of our predecessor, Messer Griesheim, as of and for the year ended December 31, 2000. Pursuant to the divestiture program, as of December 31, 2001, the consummated dispositions resulted in debt relief (including deconsolidated debt as a result of the divestiture program) of approximately EURO234.0 million. Agreements for additional dispositions provide for an additional EURO73 million of debt relief, resulting, upon consummation, in aggregate debt consolidated relief as of December 31, 2000 of EURO307.0 million.

We believe the industrial gas industry benefits from:

- •

- stable earnings from long-term supply contracts;

- •

- limited cyclicality due to a highly diversified range of customers;

- •

- high barriers to entry due to significant required start-up investments; and

- •

- favorable growth prospects driven largely by new applications.

We believe that the worldwide industrial gas industry is relatively concentrated with competition taking place at the regional or local level. In most geographic markets, the two or three largest producers have a significant combined market share. The seven largest producers are estimated to have accounted for approximately 75% of the worldwide market in 2001. Except for the impact of Linde's acquisition of AGA in 2000, the relative market shares of the leading industrial gas producers have remained essentially unchanged over the past decade, which we believe illustrates the industry's stability. We also believe that there is a recent trend among industry participants towards a focus on return on capital as opposed to growing market share.

Our Key Strengths

We believe that our key strengths include:

- •

- A leading market position in Germany and strong positions in certain other core markets. We have an estimated market share of approximately 31% in Germany and strong

businesses in selected industrial areas of the United States and in selected niche markets in other western European countries. In addition, we have estimated market shares in excess of 45% in seven central eastern European countries that we believe offer attractive growth prospects.

- •

- Stable cash flows from long-term contracts. Our contracts for on-site and pipeline services in Germany and the United States typically range between 10 and 15 years and generated approximately 12% of our total net sales in the year ended 2001. These contracts typically have "take or pay" minimum purchase requirements. In each of the last three years, these minimum purchase requirements represented approximately 60% to 70% of net sales generated under these supply contracts in Germany and 40% to 45% in the United States. Contracts in both our on-site and pipeline and bulk businesses have historically exhibited high renewal rates, with over 90% of customers whose contracts expired in the past five years renewing their contracts with us. Our contracts for bulk deliveries, which generated approximately 22% of our total net sales in Germany and the United States in 2001, typically have terms of two to three years in Europe and five to seven years in the United States.

- •

- A diversified customer base. We believe that our diverse customer base helps protect our operating results against macroeconomic fluctuations. Our customers include companies in a wide variety of industries such as the steel, chemicals, food and beverages, oil refining, waste processing, electronics, pulp and paper, automotive, healthcare and glass industries. We are not dependent on any customer or set of customers, and no single customer accounted for more than 4% of our net sales in any of the last three years.

- •

- Strong applications technology capability. In addition to producing and distributing industrial gases, we also have an applications technology business. Our applications technology division develops and markets a wide range of industrial gas applications and technologies both as a service to our customers and a means of expanding the uses of and demand for our products. We believe that we have particularly strong applications technology capability in the steel, metals, oil refining, chemicals and food industries. A significant portion of our bulk business in particular results from applications developed internally in cooperation with our customers or invented by us for use by our customers.

- •

- Experienced senior management team backed by strong shareholder expertise. Our senior management team combines professionals with long-term experience within our company and recent hires with significant experience at our competitors and in other industries. In addition to the Messer family, which founded our principal predecessor company in 1898, our shareholders include Allianz Capital Partners, a subsidiary of Allianz Group, a leading global financial services company and one of the largest insurance companies worldwide, and certain private equity funds managed by affiliates of The Goldman Sachs Group, Inc.

Our Strategy

We intend to maximize value by focusing on existing operations in our core markets. This contrasts with our former emphasis on volume growth and global expansion. We believe that this strategy will increase our return on assets and cash flow and reduce our leverage going forward. The key elements of this strategy are to:

- •

- Reduce our debt, primarily through implementation of our divestiture program adopted in May 2001, under which we intend to divest substantially all of our assets and operations in our non-core markets in Asia, Africa and Latin America as well as certain non-strategic assets and operations in our core markets. Other than the joint ventures in China described under "The Acquisition Transactions, The Refinancing and the Divestiture Program", we intend to complete these divestitures by year-end 2002. We estimated that the assets and operations

to be divested accounted for approximately 24% of net property, plant and equipment, 17% of total net sales and 7% of normalized EBITDA of our predecessor, Messer Griesheim, as of and for the year ended December 31, 2000. Upon completion of the entire divestiture program we expect the total proceeds from our divestitures will permit us to reduce our consolidated debt reflected on the December 31, 2000 balance sheet by at least EURO400 million. In addition to our divestiture program, we also intend to reduce our need for debt financing and achieve further deleveraging by reducing our capital expenditures going forward and implementing a cost-savings plan. For the eight month period ending December 31, 2001, we have divested a significant portion of our assets and operations in our non-core markets in Asia, Africa and Latin America as well as certain non-strategic assets and operations in our core markets. Pursuant to our divestiture program, as of December 31, 2001, the consummated dispositions resulted in debt relief (including deconsolidated debt as a result of the divestiture program) of approximately EURO234 million. Agreements for additional dispositions provide for an additional EURO73 million of debt relief, resulting, upon consummation, in aggregate consolidated debt relief as of December 31, 2000 of EURO307 million.

- •

- Exploit recent investments and reduce capital expenditures, principally by focusing on our existing higher-yielding assets in the United States and Europe. Over the last five years, we have invested more than EURO2 billion in new assets, of which 36% was invested in Germany and 16% in the United States to add production capacity and increase production efficiencies. As a result, we currently have additional production capacity in these markets, which we believe we can exploit with limited additional investment. Reflecting our former rapid global expansion strategy, our capital expenditures in each of the last five years averaged more than 25% of our total net sales. In the year ended 2001, we reduced our capital expenditures to no more than 10% of our total net sales and intend to maintain that reduced level of capital expenditures for the foreseeable future. Our capital expenditures in the future will be focused on making modest additions to our existing operations in our core markets that will allow us to exploit the full potential of earlier investments.

- •

- Profitably grow with the market in our core regions, principally by maximizing utilization of our existing production capacity, much of which has been recently constructed and is only now beginning to commence operations (including, for example, two new large air separation units and a carbon monoxide plant in Germany). We also intend to continue drawing on our strong applications technology capability to service customers and develop new value-added products and applications, focusing in particular on faster growing industry segments such as petrochemicals, refining, electronics and food.

- •

- Implement our cost-savings plan, principally in Europe and particularly in Germany, by eliminating duplication in certain support positions, reducing energy costs and centralizing key business processes relating to supply chain management and applications technology development. This cost-savings plan will include, among other things, implementing improved information technology systems and simplifying our management structure. In May 2001, we announced plans to eliminate by year-end 2003 approximately 850 out of more than 5,600 positions in Europe, principally in Germany. We have already begun centralizing key business processes by combining previously distinct business units in Germany and Europe where we have consolidated some of our sales and marketing activities on a regional basis. We have identified most of the specific cost-saving measures that we expect to achieve by year-end 2003. We expect these will reduce the cost base of our operations in our core markets relative to its level for the year 2000 by EURO100 million by year- end 2003. To implement these measures, we expect to incur total one-time costs of approximately EURO84 million between April 30, 2001 and year-end 2003. For the eight month period ending December 31, 2001 we have reduced the cost base of our operations in our core markets

relative to its level for the year 2000 by EURO27.0 million. As a result of implementation of these measures we incurred total one-time costs of approximately EURO25.3 million (excluding EURO12.5 million of costs that were included as part of the purchase price accounting adjustments) for the eight month period ended December 31, 2001. We expect to incur an additional EURO46.6 million of one-time costs within the next two years.

The Acquisition Transactions, the Refinancing and the Divestiture Program

As discussed in note 3 to our consolidated financial statements contained in this prospectus, the acquisition transactions have been accounted for at fair value and, accordingly, our assets and liabilities have been recorded at their estimated fair values as of April 30, 2001, the date of the acquisition transactions. As a result, the consolidated financial statements of Messer Griesheim for periods prior to the acquisition transactions are not comparable to our consolidated financial statements for periods subsequent to the acquisition transactions. To highlight this lack of comparability, a solid vertical line has been inserted, where applicable, between columns in the tables of selected and summary financial data, in our financial statements and elsewhere in this prospectus to distinguish information pertaining to the pre-acquisition and post-acquisition periods.

The Acquisition of Messer Griesheim

Prior to the completion of the acquisition transactions described below, Messer Griesheim was owned:

- •

- 331/3% by the Messer family through a holding company, Messer Industrie GmbH, and

- •

- 662/3% by Hoechst AG, a subsidiary of Aventis S.A. Aventis was formed in December 1999 as the result of the merger of Hoechst AG and Rhône-Poulenc S.A., two of Europe's largest chemical companies.

On December 31, 2000, Messer Industrie, Hoechst and our parent company Messer Griesheim Group GmbH (formerly named Cornelia Verwaltungsgesellschaft GmbH and, since November 1, 2001 converted into Messer Griesheim Group GmbH & Co. KGaA), entered into certain acquisition transactions. A detailed description of these acquisition transactions is included under "The Acquisition Transaction, the Refinancing and the Divestiture Program".

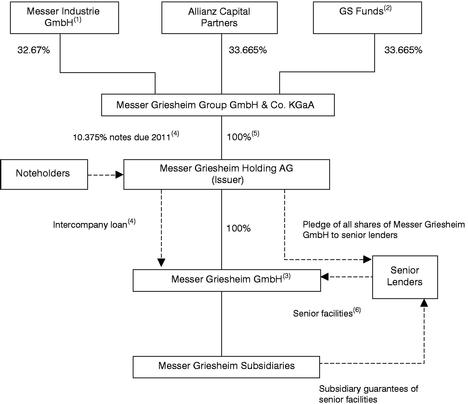

As a result of the acquisition transactions described below, the issuer owns 100% of Messer Griesheim and the issuer is wholly owned by Messer Griesheim Group. The issuer and Messer Griesheim Group are both holding companies with no material assets other than their direct or indirect interests in Messer Griesheim (and, in the issuer's case, the payments under the intercompany loan to Messer Griesheim). As a result of the completion of the acquisition transactions, Messer Griesheim Group is owned:

- •

- 32.67% by the Messer family, through Messer Industrie;

- •

- 33.665% by Allianz Capital Partners; and

- •

- 33.665% by six private equity funds managed by affiliates of The Goldman Sachs Group, Inc.

In connection with these acquisition transactions, the shareholders of Messer Griesheim Group entered into a shareholders' agreement governing their respective voting control and other ownership rights with respect to the issuer and Messer Griesheim. A more detailed description of the shareholders' agreement appears under "Principal Shareholders—Shareholders' Agreement".

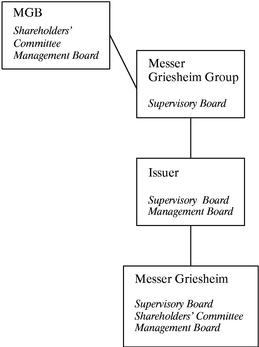

The following diagram shows our ownership structure and the structure of our principal indebtedness as of December 31, 2001, following completion of the acquisition transactions on or about April 30, 2001 reflecting the issuance of the notes and the refinancing of our indebtedness to the extent completed, including repayment in full of the EURO400 million mezzanine bridge facility and repayment of EURO115 million of our senior term facilities:

- (1)

- The holding company for the Messer family's interests in Messer Griesheim.

- (2)

- Certain private equity funds managed by affiliates of The Goldman Sachs Group, Inc.

- (3)

- Principal operating company in Germany and holding company for the remainder of our operations.

- (4)

- EURO550.0 million aggregate principal amount.

- (5)

- Messer Group owns 100% of Messer Holding, 331/3% of which is owned directly and 662/3% of which is owned through a wholly-owned holding company.

- (6)

- EURO1,340 million is the initial aggregate amount of term loan facilities. Messer Griesheim repaid EURO115 million principal amount of senior term facilities with a portion of the proceeds from the sale of the notes. As of December 31, 2001, EURO925.7 million aggregate principal amount remained outstanding under the senior term facilities. The senior facilities also include committed but not fully drawn funds totalling EURO310 million under revolving facilities. Certain of Messer Griesheim's subsidiaries are also direct borrowers under the senior facilities.

Refinancing Program

In connection with the acquisition transactions described above, substantially all of Messer Griesheim's existing indebtedness was refinanced through the notes and the senior facilities described below. Upon the initial closing of the acquisition Messer Griesheim entered into a senior facilities agreement with aggregate available funds of EURO1,650 million ( EURO1,340 million of term loan facilities and EURO310 million of revolving facilities) and a mezzanine bridge facility agreement in the aggregate amount of EURO400 million. Since that time Messer Griesheim has borrowed a portion of the term loans under the senior facilities and the entire mezzanine bridge facility. Upon the closing of the sale of the notes, the issuer made an intercompany loan to Messer Griesheim with the gross proceeds from the notes, and Messer Griesheim used the intercompany loan to repay the mezzanine bridge facility in full and repay EURO115 million principal amount of outstanding term borrowings under the senior facilities. As of December 31, 2001, the senior facilities consist of the following facilities:

| | Amounts

EURO (in millions)

| | Maturity Date

|

|---|

| $198 million Senior Term Disposal Facility(2) | | 21.5 | (1) | April 30, 2003 |

| EURO300 million Senior Term A Facility(2),(3),(4) | | 294.9 | | April 20, 2008 |

| EURO170 million Senior Term B Euro Facility(2) | | 170.0 | | April 30, 2009 |

| $124 million Senior Term B Dollar Facility(2) | | 140.6 | (1) | April 30, 2009 |

| EURO115 million Senior Term C Euro Facility(2) | | 115.0 | | April 30, 2010 |

| $162 million Senior Term C Dollar Facility(2),(4) | | 183.7 | (1) | April 30, 2010 |

| EURO260 million Senior Revolving Facility I | | — | | March 31, 2008 |

| EURO50 million Senior Revolving Facility II | | — | | March 31, 2008 |

| | |

| | |

- (1)

- Dollar amounts under the facility have been converted into euros at the rate of EURO1=$0.882.

- (2)

- The commitments with respect to the term loans of the senior facilities which comprise all of the loans of the senior facilities other than revolving loans, are reduced by the amount of repayments (i.e., the available facilities are reduced by the amounts of repayments).

- (3)

- Tranche A is a multicurrency facility. Interest rate is a weighted rate.

- (4)

- Interest rate is a weighted rate.

- (5)

- Principal repayments are due earlier upon the sale of certain assets, including subsidiaries identified as part of the disposal program. As of December 31, 2001, $179.6 million of the $198.6 million senior term disposal facility had been repaid. As of April 29, 2002, the senior term disposal facility has been repaid in full.

The issuer will rely on payments it receives under the intercompany loan to make payments to you on the notes. The issuer's claims under the intercompany loan are subordinated to the claims of the lenders under the senior facilities. Payments on the intercompany loan also are not permitted in certain cases involving payment and non-payment defaults under the senior facilities. In addition, the issuer has pledged all of its shares in Messer Griesheim to the senior lenders as security for the senior facilities. Moreover, the issuer has agreed that if the senior lenders foreclose on that share pledge following an event of default and seek to sell the issuer's shares of Messer Griesheim, the issuer will release its claims against Messer Griesheim for payment of the intercompany loan. If the issuer is ever required to release its claims for repayment of the intercompany loan, its only source of repayment for the notes will be the net proceeds, if any, from a foreclosure sale of the Messer Griesheim shares after the senior lenders have been repaid in full. In addition, the intercompany loan is effectively subordinated to all existing and future debt of Messer Griesheim's subsidiaries.

Divestiture Program

In May 2001, immediately following our change in ownership through the acquisition transactions described elsewhere in this prospectus, we adopted a divestiture program under which we intend to divest substantially all of our assets and operations outside of our core regions as well as certain non-strategic operations in our core regions. We estimate that the assets and operations to be divested accounted for approximately 24% of net property, plant and equipment, 17% of the net sales and 7% of the normalized EBITDA of our predecessor, Messer Griesheim, as of, and for the year ended December 31, 2000. By divesting these operations, our management believes that we can reduce our consolidated debt and focus on our most profitable geographic markets.

We intend to complete all planned divestitures other than our joint ventures in China by year-end 2002. We are required under Messer Griesheim's senior facilities agreement to use the proceeds of these divestitures to repay borrowings under the senior facilities agreement, and the senior facilities agreement requires us to repay at least $198.6 million of borrowings (the entire senior term disposal facility) by April 2003. As of April 29, 2002, the senior term disposal facility has been repaid in full. Separately, Messer Griesheim is required to ensure that the combination of the repayment of the senior term disposal facility and the assumption of indebtedness by third parties in connection with divestments of assets will result in the reduction of the aggregate indebtedness of Messer Griesheim and its consolidated subsidiaries by at least EURO255 million by April 30, 2003. Upon completion of the entire divestiture program, we expect that our divestitures will permit us to reduce our consolidated debt, reflected on the December 31, 2000 balance sheet, by at least EURO400 million.

During the eight month period ended December 31, 2001, pursuant to the divestiture program, we completed disposals of our home care business in Germany, our health care business in Canada and our non-cryogenic plant production operations in Germany, the United States, Italy and China. We have also completed disposals of our operations in Argentina, Brazil, Mexico, South Africa and South Korea and our carbon dioxide business in the United States. For an update on the status of our divestiture program, see "Recent Developments" herein.

Singapore Transactions

In anticipation of the acquisition transactions and prior to adoption of the divestiture program, Messer Griesheim reduced its ownership interest in and exposure to operations in Singapore, as described under "Singapore Transactions" elsewhere in this prospectus.

Recent Events

During February 2002, Messer Griesheim entered into an agreement with a private investor to divest its activities in Venezuela in connection with Messer Griesheim's divestiture program. During March 2002, Messer Griesheim sold its Messer UK Nitrogen services business. The sale is composed of the sale of the assets owned by Messer UK as well as the sale of existing customer contracts and contacts. During April 2002, Messer Griesheim completed the sale of its activities in Egypt to Air Liquide in connection with our divestiture program. The impact of each of these transactions on the consolidated statements of operations is not significant. The proceeds, however, from the sale of our operations in Egypt have enabled Messer Griesheim to repay in full the senior term disposal facility.

Summary of Key Terms of the Notes

| | | |

| Notes Offered | | EURO550 million principal amount of 10.375% senior notes due 2011. |

Issuer |

|

Messer Griesheim Holding AG, a German stock corporation. |

Issue Price |

|

100.0%, plus accrued interest, if any, from May 16, 2001. |

Maturity Date |

|

June 1, 2011. |

Sinking Fund |

|

None. |

Interest |

|

Annual rate of 10.375%.

Payment frequency: every six months on June 1 and December 1.

First payment: December 1, 2001. |

Ranking |

|

The notes are senior debt of the issuer. |

|

|

The issuer loaned the proceeds of the offering pursuant to a subordinated intercompany loan to Messer Griesheim. The intercompany loan is subordinated to Messer Griesheim's senior facilities and is subject to restrictions on enforcement. The intercompany loan also is effectively subordinated to all other existing and future debt of Messer Griesheim and its subsidiaries. The shares of Messer Griesheim have been pledged as security under Messer Griesheim's senior credit facilities. |

Optional Redemption |

|

Prior to June 1, 2006, the issuer may redeem all but not part of the notes by paying a make-whole premium based on the German Bund rate. |

|

|

On and after June 1, 2006, the issuer may redeem some or all of the notes at any time at the redemption prices listed in the section "Description of the Notes" under the heading "Optional Redemption". |

|

|

In addition, prior to June 1, 2004, the issuer may redeem up to 35% of the notes with the proceeds of one or more public equity offerings of its or its parent company's equity at a redemption price equal to 110.375% of the principal amount of the notes redeemed. |

Mandatory Offer to Repurchase |

|

If the issuer experiences specific kinds of changes of control or if it sells assets without having met certain conditions, it must offer to repurchase the notes at the prices listed in the section "Description of the Notes" under the headings "Change of Control; Repurchase at the Option of Holders" and "Asset Sales; Repurchase at the Option of Holders with Excess Proceeds". |

|

|

|

Use of Proceeds |

|

The gross proceeds of EURO550 million from the offering of the original notes was used by the issuer to make a subordinated intercompany loan to Messer Griesheim of EURO550 million. The intercompany loan was used to repay the entire EURO400 million principal amount outstanding under the mezzanine bridge facility and EURO115 million principal amount of outstanding indebtedness under the senior term facilities. The balance of the intercompany loan is being used for general corporate purposes of Messer Griesheim. |

Basic Covenants of Indenture |

|

The issuer has issued the notes under an indenture with The Bank of New York as trustee. The indenture, among other things, restricts our ability to: incur additional debt; pay or repurchase shares or subordinate debt; make investments; use assets as security in other transactions; enter into transactions with affiliates; issue or sell shares in Messer Griesheim; dispose of assets; merge or consolidate with or into other companies; or pay or modify our intercompany loan to Messer Griesheim. For a more detailed description of these covenants, see the section "Description of the Notes" under the headings "Asset Sales" and "Certain Covenants". |

Listing |

|

The notes are listed on the Luxembourg Stock Exchange. |

Trustee, Registrar, Prinicipal Paying and Transfer Agent |

|

The Bank of New York |

Security Numbers |

|

|

|

ISIN

|

|

Common Code

|

| | | Original Notes: | | | | |

| | | Rule 144A | | XS0129587142 | | 012958714 |

| | | Regulation S | | XS0129586763 | | 012958676 |

| | | Exchange Notes | | XS0136262275 | | 013626327 |

| | | |

| Governing Law | | The notes and the indenture governing the notes will be governed by the laws of the State of New York. |

Exchange Offer |

|

On December 15, 2001, the exchange offer was consummated resulting in the exchange of all of the Rule 144A notes and all of the Regulation S notes (other than approximately EURO2.2 million in aggregate principal amount) for equivalent registered notes. The exchange notes have been accepted for clearance through Euroclear and Clearstream. |

Risk Factors

Noteholders who are considering buying the notes should consider carefully all the information set forth in this prospectus and, in particular, should evaluate the specific factors under the section "Risk Factors" beginning on page 14 for considerations relevant to an investment in the notes.

Our principal executive offices are located at Fütingsweg 34, 47805 Krefeld, Germany, and our telephone number is (+49) 2151 379 0.

Normalized EBITDA

We frequently use net sales and "normalized EBITDA" as measures for:

- •

- comparing our year-to-year and interim results, and

- •

- comparing the relative contributions of our regional operations to our consolidated results of operations.

Our results of operations reflect restructuring and reorganization charges and charges for impairment of assets in 2000 and 2001 following a change of strategy for our operations in our non-core markets. We believe it is appropriate to adjust our EBITDA measure to remove the effects of these charges because of their unusual nature. Accordingly, we calculate "normalized EBITDA" as operating profit before depreciation and amortization, after adding back charges for impairment of intangible assets and property, plant and equipment and restructuring and reorganization charges.

The issuer calculates normalized EBITDA as operating profit before depreciation and amortization, after adding back charges for impairment of intangible assets and property, plant and equipment, restructuring and reorganization charges.

Normalized EBITDA is not a measure recognized by IAS or U.S. GAAP. This and similar measures are used by different companies for differing purposes and are often calculated in ways that reflect the unique situations of those companies. We urge you to be very cautious in comparing our normalized EBITDA data to the EBITDA data of other companies. Normalized EBITDA is not a substitute for operating profit as a measure of operating results. Likewise, normalized EBITDA is not a substitute for cash flow as a measure of liquidity.

Summary Financial Data

The following summary financial data for the eight month period ended December 31, 2001

has been derived from our audited consolidated financial statements. The summary financial

data as of and for the year ended December 31, 2000 and as of and for the four month period ended April 30, 2001 is derived from Messer Griesheim's revised consolidated financial

statements that were audited by KPMG Deutsche Treuhand – Gesellschaft Aktiengesellschaft Wirtschaftsprüfungsgesellschaft, independent accountants, whose report thereon is based in part upon the report of other auditors. The summary financial data for the years ended December 31, 1999 and 1998 is derived from Messer Griesheim's revised consolidated financial statements, which were audited by PwC Deutsche Revision Aktiengesellschaft Wirtschaftsprüfungsgesellschaft, independent accountants. Consolidated balance sheets as of December 31, 2001, April 30, 2001 and December 31, 2000 and the related consolidated statements of operations and of cash flows for the eight months ended December 31, 2001, four months ended April 30, 2001 and the two years ended December 31, 2000 and notes thereto appear elsewhere in this prospectus. The summary financial data as of and for the year ended December 31, 1997 have been revised to reflect the accounting principles that we applied for 2000, 1999 and 1998.

Pro forma summary financial data of the issuer and Messer Griesheim, calculated on a consolidated basis as though the acquisition transactions, the refinancing program, and the divestiture program had occurred on January 1, 2001, is included in this table, as set forth in more detail under "Unaudited Pro Forma Consolidated Financial Data".

On April 30, 2001, a series of acquisition transactions were consummated as described elsewhere in this prospectus which resulted in a change in the ownership of Messer Griesheim and the issuer. The acquisition transactions have been accounted for in a manner similar to a "purchase" business combination and, accordingly, the cost of the acquisition has been allocated to the assets acquired and liabilities assumed, including those to be disposed of under our divestiture program described elsewhere in this prospectus, based on their estimated fair values as of April 30, 2001, the acquisition date. The resulting excess of such cost over the fair value of the net assets acquired is accounted for as goodwill. In connection with the acquisition transactions, substantially all of Messer Griesheim's existing indebtedness was refinanced (the "refinancing program"). Additionally, following the acquisition transactions, Messer Griesheim adopted in May 2001 a divestiture program pursuant to which it intends to sell substantially all of the assets and operations in its non-core markets, located in Asia, Africa and Latin America, as well as certain non-strategic assets and operations in its core markets. Other than our joint ventures in China, we intend to complete these divestitures by the end of calendar year 2002.

Consideration should be given to the effects of the acquisition transactions, the refinancing program, and the divestiture program when comparing historical financial information, including the summary financial data, for periods prior to April 30, 2001 to periods thereafter. To make this clear, financial information for periods prior to and subsequent to the acquisition transactions have been separated in the following table by inserting a solid vertical line between the columns for such periods.

Both Messer Griesheim and the issuer prepare their financial statements in accordance with IAS, which differs in certain significant respects from U.S. GAAP. The principal differences between IAS and U.S. GAAP applicable to the historical financial statements are summarized in note 40 of the issuer's audited consolidated financial statements. This data should be read together with the financial statements and related notes and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this prospectus.

The issuer has no material assets or sources of revenue other than its shares in Messer Griesheim, which have been pledged to Messer Griesheim's senior lenders as security, and an intercompany loan of EURO550 million to Messer Griesheim. Historical consolidated financial statements relating to the issuer are included elsewhere in this prospectus. Pro forma consolidated financial data presenting pro forma consolidated results of the issuer and Messer Griesheim for the year ended December 31, 2001 is included in this table and in the section titled "Unaudited Pro Forma Consolidated Financial Data".

| | Periods Prior to the Acquisition Transactions

| |

| |

| |

|---|

| | Messer Griesheim Holding AG

| |

| |

|---|

| | Messer Griesheim GmbH

| |

| |

|---|

| | Pro forma(1)

| |

|---|

| |

| |

| |

| |

| | Four Months Ended April 30, 2001

| | Eight Months Ended December 31, 2001

| |

|---|

| | Year ended December 31,

| |

|---|

| | Fiscal

Year

2001

| |

|---|

| | 1997(2)

| | 1998(2)

| | 1999(2)

| | 2000

| |

|---|

| | (amounts in EURO millions, except ratios)

| |

|---|

| SUMMARY FINANCIAL DATA(3) | | | | | | | | | | | | | | | |

| Income statement data | | | | | | | | | | | | | | | |

| Net sales | | 1,269 | | 1,477 | | 1,492 | | 1,696 | | 574 | | 1,047 | | 1,512 | |

| Gross profit | | 709 | | 781 | | 791 | | 851 | | 281 | | 482 | | 708 | |

| Distribution and selling costs | | (451 | ) | (501 | ) | (531 | ) | (569 | ) | (177 | ) | (314 | ) | n/a | |

| General and administrative costs | | (78 | ) | (102 | ) | (130 | ) | (128 | ) | (45 | ) | (83 | ) | n/a | |

| Impairment of intangible assets and property, plant and equipment | | — | | — | | (4 | ) | (129 | ) | (2 | ) | — | | — | |

| Restructuring charges | | — | | — | | — | | (20 | ) | (3 | ) | (25 | ) | (30 | ) |

| Operating profit (loss) | | 175 | | 189 | | 112 | | (3 | ) | 46 | | 37 | | 57 | |

| Income (loss) from continuing operations | | 135 | | 140 | | 32 | | (319 | ) | (7 | ) | (91 | ) | (86 | ) |

| Net income (loss) | | 74 | | 84 | | (21 | ) | (206 | ) | (13 | ) | (70 | ) | (86 | ) |

Cash flow information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash from (used in) operating activities(4) | | 242 | | 176 | | 357 | | 261 | | (9 | ) | 138 | | n/a | |

| Net cash used in investing activities(4) | | (329 | ) | (541 | ) | (473 | ) | (335 | ) | (66 | ) | (87 | ) | n/a | |

| Net cash (used in) from financing activities(4) | | 132 | | 361 | | 108 | | 86 | | 248 | | (75 | ) | n/a | |

| Depreciation and amortization | | 132 | | 147 | | 196 | | 342 | | 77 | | 183 | | n/a | |

| Investments(5) | | 425 | | 634 | | 557 | | 403 | | 85 | | 85 | | n/a | |

Balance sheet information at period end |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents | | 69 | | 61 | | 57 | | 50 | | 227 | | 188 | | n/a | |

| Total assets | | 2,095 | | 2,565 | | 3,053 | | 2,976 | | 3,190 | | 3,349 | | n/a | |

| Total corporate debt | | 657 | | 1,138 | | 1,470 | | 1,699 | | 1,951 | | 1,581 | | n/a | |

OTHER INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Normalized EBITDA(6) | | 307 | | 336 | | 308 | | 359 | | 126 | | 245 | | n/a | |

| Ratio of earnings to fixed charges(7) | | 3.8 | | 3.1 | | 1.7 | | — | | n/a | | n/a | | n/a | |

- (1)

- Calculated on a pro forma basis to present financial information of the issuer and Messer Griesheim on a consolidated basis as though the acquisition transactions, the refinancing program, and the divestiture program had occured on January 1, 2001, as set forth in more detail under "Unaudited Pro Forma Consolidated Financial Data".

- (2)

- For periods prior to January 1, 2000, translated from Deutsche Mark, or DM, to euros at the fixed exchange rate of EURO1.00 = DM 1.95583.

- (3)

- Summary financial data for all historical periods is derived from the historical financial statements, which were audited or unaudited as indicated in the introduction preceding this information.

- (4)

- Cash flow information for 1997 was not reclassified for the discontinued cutting and welding operations. See note 10 to Messer Griesheim's audited financial statements for additional information relating to 1998 and 1999 cash flows of discontinuing operations.

- (5)

- Includes cash outlays for property, plant and equipment and intangible assets and purchases of investments and loans to related parties. The investments and loans to related parties in 1997 include the cutting and welding business, as the financial data for 1997 do not reflect the full effect of this business as discontinued operations. We believe that investments in the cutting and welding business accounted for no more than EURO1 million in 1997.

- (6)

- Calculated as operating profit before depreciation and amortization, after adding back charges for impairment of intangible assets and property, plant and equipment, restructuring and reorganization charges. Normalized EBITDA is not a measure recognized by IAS or U.S. GAAP and may not be comparable to similar measures presented by our competitors. Please consider the more detailed explanation of normalized EBITDA contained above under "Summary—Normalized EBITDA".

- (7)

- An explanation of the discussion of the methodology used to calculate the ratio of earnings to fixed charges is set out in footnote 9 to "Selected Historical Financial Data".

RISK FACTORS

Before making an investment decision with respect to the notes, you should carefully consider the risks relating to our business and the legal structures underlying this offering described below, in addition to the other information in this prospectus. These risks are not the only ones we face; additional risks and uncertainties not presently known to us, or that we now believe are immaterial, could also impair our business or the issuer's ability to make payment on the notes.

Risks Relating to Our Business and the Industrial Gas Industry

To service our debt, we will require a significant amount of cash, which we may not be able to raise or generate. Our ability to generate cash depends on economic factors beyond our control.

Our ability to generate cash from operations depends largely on the health of the economy in Europe and the United States, as well as on the competitive environment for industrial gases in these markets. In addition, our cash flows from operations outside of western Europe and the United States are subject to devaluation and repatriation risk. If our operating cash flows are not sufficient to meet our operating expenses and debt payment obligations, we may be forced to do one or more of the following:

- •

- delay or reduce capital expenditures or the introduction of new products and applications;

- •

- sell additional assets beyond those we currently plan to divest; and

- •

- forego business opportunities, including acquisitions and key research and development activities.

If we are unable to meet our debt service obligations, we may attempt to restructure or refinance our existing debt or to seek additional funding. However, we may not be able to do so on satisfactory terms, if at all. Any such failure could result in an event of default under Messer Griesheim's senior facilities, and the issuer could lose its rights under the intercompany loan. In that event, the issuer would have no funds to make payments to you.

Our high levels of indebtedness could adversely affect our ability to run our business.

As of December 31, 2001, we had EURO1,581.2 million of indebtedness and EURO300.5 million of additional availability under undrawn committed credit facilities within our senior facilities. Our high level of debt could have important consequences to you, including the following:

- •

- we may have difficulty borrowing money in the future for working capital, capital expenditures, research and development or other purposes;

- •

- we will need to use a large portion of our cash flow from operations to pay principal and interest on Messer Griesheim's senior facilities and on the intercompany loan, which will reduce the amount of cash available to Messer Griesheim to finance its operations and other business activities;

- •

- we may be more vulnerable to economic downturns and adverse business developments; and

- •

- we may have a much higher level of debt than certain of our competitors, which may put us at a competitive disadvantage and may make it difficult for us to pursue our business strategy.

The terms of the indenture governing the notes and Messer Griesheim's senior facilities restrict our ability to incur additional debt, but they do not fully prohibit us from doing so. Accordingly, we may be able to incur substantial additional debt in the future. If we do incur additional debt, the risks outlined above could intensify.

We are subject to restrictive debt covenants.

Messer Griesheim's senior facilities and the indenture governing the notes restrict our ability to do, among other things, any of the following:

- •

- incur additional debt;

- •

- pay dividends or distributions on, or redeem or repurchase, the shares we hold in Messer Griesheim;

- •

- make investments or capital expenditures;

- •

- create liens;

- •

- enter into transactions with affiliates; or

- •

- sell assets or consolidate or merge with or into other companies.

All of these limitations will be subject to exceptions and qualifications that may be important.

If Messer Griesheim is not able to comply with any of the covenants set out in the senior facilities agreement, an event of default would occur, and the issuer could lose its rights under the intercompany loan. In that event, the issuer would have no funds available to make payments to you. We encourage you to read "Description of the Notes—Certain Covenants" and "Description of Messer Griesheim's Senior Indebtedness" in detail.

In addition, a central part of our strategy is to realize the potential of capital investments we have made in the United States and Europe over the past five years. Achieving significant returns from those investments may require spending additional capital. However, the restrictive nature of the covenants contained in the notes and in Messer Griesheim's senior facilities agreement may limit our ability to invest any additional capital, even where required to realize the benefits of prior investments.

Our divestiture program adopted in May 2001 may not proceed as quickly as we plan or achieve the economic benefits we anticipate. Our divestiture program may not produce the significant amounts of cash necessary to repay our senior facilities.

A major component of our business strategy is the divestiture of substantially all of the assets and operations located outside of our core markets along with certain non-strategic assets and operations within our core markets. We intend to complete all planned divestures other than the joint ventures in China by year-end 2002. Pursuant to the divestiture program, as of December 31, 2001, the consummated dispositions resulted in debt relief (including deconsolidated debt as a result of the divestiture program) of approximately EURO234 million. Agreements for additional dispositions provided an additional EURO73 million of debt relief, resulting, upon consummation, in aggregate consolidated debt relief as of December 31, 2000 of EURO307 million. While we have divested a significant portion of the assets and operations located outside of our core markets, we cannot predict with any certainty how quickly the remaining divestitures can be negotiated and completed or the amount of proceeds we will realize from the remaining divestitures. We estimate that these assets and operations to be divested accounted for approximately 24% of the net property, plant and equipment, 17% of the net sales and 7% of the normalized EBITDA of our predecessor, Messer Griesheim, as of and for the year ended December 31, 2000. The remaining divestiture of certain of our assets and operations may require additional expenditures prior to their disposals. In most cases, we are attempting to sell these assets through auction processes, although we cannot guarantee that there will be sufficient competition in each case. For assets in some countries, there are only one or two potential acquirors with whom we can realistically negotiate. There is no assurance that we can realize prices for these assets that correspond to their value in other markets or to the cost we incurred in purchasing and installing these assets. In addition, economic and market conditions that generally affect the pace and amount of corporate acquisition activity may also negatively affect the amount of proceeds we receive from, and the timing of, our divestiture program.

If we are unable to repatriate sale proceeds to Germany, Messer Griesheim may not be able to use these proceeds for debt repayment and an event of default may occur under Messer Griesheim's senior facilities as a result. If there is an event of default under the terms of the senior facilities, the issuer could lose its rights to the intercompany loan and thus its source of funds to make payments on the notes.

To implement our cost-savings plan, we will incur significant expenditures of capital. There is no assurance that we will achieve our desired level of savings pursuant to this plan.

A major component of our business strategy is the realization of cost savings in our core operations, particularly in Europe. In order to implement our cost savings plan, we expect to incur total one-time costs of approximately EURO84 million between April 30, 2001 and year-end 2003. During the implementation phase of our cost savings plan, we expect our implementation costs to exceed realized savings. Moreover, our restructuring costs may be higher than we anticipate, particularly if implementation is delayed, and our information technology improvements may not yield the cost savings benefits that we anticipate. Accordingly, we cannot assure you that our cost savings will be at the levels we expect or that the actual savings will be greater than the costs we incurred in implementing our plan. In addition we also cannot assure you that we will have the necessary cash to implement our cost-saving measures on a timely basis.

We operate in a highly competitive environment, which has tended to reduce industrial gas prices over most of the past five years. Falling prices could reduce our revenues or cash flows.

The worldwide industrial gas industry is dominated by seven major producers, four of which have large operations in Europe. Additionally, there are also thousands of smaller, local producers, some of whom operate on a low-cost basis, primarily in the cylinder segment. Some of our competitors may have greater financial resources than we do. The past five years have witnessed consolidation among the biggest producers and an aggressive effort by most large producers to increase market share. The resulting price reductions combined with increasing energy prices have required us and other major producers to reduce costs to maintain profit levels. Although prices appear to have stabilized in many of our markets recently, we cannot assure you that the prices of our products will not continue to fall, which could adversely effect our revenues and cash flows, or that we will be able to maintain current levels of profitability.

We are exposed to local business risks in many different countries.

We manufacture and distribute our products in many countries around the world, with particular focus on 28 countries in Europe and in North America. Some of these countries, particularly those in eastern Europe have suffered from instability in their political and legal systems over the past ten years. Accordingly, our business is subject to risks related to the differing political, social and economic conditions of these various countries. These risks include, among other things:

- •

- political and economic conditions that could result in our operations being disrupted;

- •

- differences and unexpected changes in regulatory environments;

- •

- varying tax regimes, including the risk that individual countries in which we operate will impose withholding taxes on our intercompany transfers;

- •

- restrictions on the repatriation of capital;

- •

- exposure to different legal standards and enforcement mechanisms, including differing insolvency regimes; and

- •

- difficulties in staffing and managing operations.

Our overall success depends, in part, upon our ability to deal with those risks. We cannot assure you that we will continue to succeed in implementing policies and practices that are both effective and realistic in each location where we do business. It is possible that, in light of these and similar considerations, we may divest or discontinue operations in certain countries, including those that would otherwise be considered to be strategic assets within our core markets.

Increases in energy costs could reduce our profitability.

Energy costs consist principally of electrical power costs. Electricity represented approximately 27% of our cost of sales in 2001. Our air separation and other production processes require significant amounts of electric energy. Electricity represented approximately 27% of our cost of sales in 2001. Though we pass a portion of these energy costs through to our customers under some of our long-term contracts, increases in energy costs can reduce our profitability significantly. A significant portion of our total energy costs are not passed through to customers. It is difficult to predict general trends in electricity prices for our various production facilities. We cannot assure you that energy prices will not continue to rise or remain volatile. Any such increases or volatility could have a direct impact on our operating costs and profitability.

We will have ongoing environmental costs. If environmental laws in Europe become more stringent, we could be exposed to further clean-up costs on some of our properties.