Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on November 20, 2002

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the period ended September 30, 2002

MESSER GRIESHEIM HOLDING AG

(Exact name of Registrant as specified in its Charter)

Koogstraat 10

25870 Norderfriedrichskoog

Germany

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-Fý Form 40-Fo

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yeso Noý

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

N/A.

TABLE OF CONTENTS

In this document:

- •

- "Messer Holding", "the Company", "we", "us" and "our" refers to Messer Griesheim Holding AG and, unless the context otherwise requires, its consolidated subsidiaries;

- •

- "Messer Griesheim" refers to the Messer Griesheim Holding AG's subsidiary, Messer Griesheim GmbH, which is the operating company whose business and results of operations are described in this Form 6-K, including, unless the context otherwise requires, its consolidated subsidiaries;

- •

- "Messer Griesheim Group" refers to the parent of Messer Griesheim Holding AG, Messer Griesheim Group GmbH & Co. KGaA, a German Partnership limited by shares, or Messer Griesheim Group GmbH prior to its conversion on November 1, 2001 to Messer Griesheim Group GmbH & Co. KGaA;

- •

- "Messer Employee GmbH" refers to Messer Employee GmbH & Co. KG, a company through which employees participating on our share purchase and option plan are to hold shares in Messer Griesheim Group.

- •

- "Messer Industrie" and "MIG" refers to Messer Industrie GmbH, a holding company for the Messer family's minority interest in Messer Griesheim Group.

REPORT FOR THE NINE MONTH PERIOD ENDED SEPTEMBER 30, 2002

The accounts being reported on are the consolidated results of Messer Griesheim Holding AG. Our obligation to provide this report with The Bank of New York (the "Trustee"), for the benefit of our noteholders, and the U.S. Securities and Exchange Commission arises under the indenture, dated as of May 16, 2001, between the Company and the Trustee, pursuant to which the Company has issued its 10.375% Senior Notes due 2011.

This Form document includes forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. Although we believe that our expectations are based on reasonable assumptions, we cannot assure you that actual results will not be materially different from our expectations. Factors that could cause our actual results to differ materially from our expectations include, among other things:

- •

- the amount of proceeds that we realize from our divestiture program;

- •

- the timing of the receipt of proceeds that we realize from our divestiture program;

- •

- the amount of savings in operational costs that Messer Holding is able to achieve as a result of its cost-savings program;

- •

- the costs of implementing Messer Holding's cost-savings program;

2

- •

- the timing to achieve the benefits of our cost-savings program;

- •

- anticipated trends and conditions in our industry, including regulatory developments;

- •

- our capital needs; and

- •

- our ability to compete.

We are under no obligation to update or revise publicly any forward-looking statement. The forward-looking events discussed in this document might not happen. In addition, you should not interpret statements regarding past trends or activities as promises that those trends or activities will continue in the future. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement and the more detailed discussion of risks in the section entitled "Risk Factors" of the Company's Post-Effective Amendment No. 1 to its Registration Statement on Form F-4 filed with the Securities and Exchange Commission on April 30, 2002. Some numbers that appear in this Form 6-K (including percentage amounts) have been rounded. Numbers in tables may not sum precisely to the totals shown due to rounding.

Investors are cautioned that forward-looking statements contained in this section involve both risk and uncertainty. Several important factors could cause actual results to differ materially from those anticipated by these statements. Many of these statements are macroeconomic in nature and are, therefore, beyond the control of management.

BUSINESS

We are a producer and distributor of industrial gases, including oxygen, nitrogen, argon, helium, carbon dioxide, hydrogen, helium, specialty gases and acetylene. The industrial gases we produce are used in a broad range of industries, such as the industrial, chemical and pharmaceutical manufacturers, and the food processing and waste treatment industries.

3

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion in conjunction with the Company's unaudited interim condensed consolidated financial statements included elsewhere herein. The Company's financial statements are prepared in accordance with the International Financial Reporting Standards of the International Accounting Standards Board, or IAS, which differ in certain significant respects from U.S. GAAP. You can find reconciliations of net income, and shareholders' equity and disclosures regarding differences between IAS and U.S. GAAP in note 19 to the Company's unaudited interim condensed consolidated financial statements.

The Company calculates normalized EBITDA as operating profit before depreciation and amortization, after adding back charges for impairment of intangible assets and property, plant and equipment, restructuring and reorganization charges and dividends from non-consolidated subsidiaries.

Normalized EBITDA is not a measure recognized by IAS or U.S. GAAP. This and similar measures are used by different companies for differing purposes and are often calculated in ways that reflect the unique situations of those companies. We urge you to be very cautious in comparing our normalized EBITDA data to the EBITDA data of other companies. Normalized EBITDA is not a substitute for operating profit as a measure of operating results. Likewise, normalized EBITDA is not a substitute for cash flow as a measure of liquidity.

Overview

We operate in 47 countries through more than 417 facilities, including production plants, distribution and filling stations and research centers. We have an estimated global market share of approximately 5% of the total industrial gases market, making us the seventh largest industrial gas producer worldwide, and leading market shares in Germany and certain other countries in central and eastern Europe. We also have strong businesses in selected industrial areas of the United States and in selected niche markets in other Western European countries. In the third quarter 2002, we generated net sales of €380.4 million and normalized EBITDA of €99.3 million.

Our primary or core markets are Europe and North America. Our two largest markets, Germany and North America, collectively accounted for 65.4% of our net sales and 71.5% of our normalized EBITDA for the third quarter 2002. Within each of our geographic markets, we generally organize our business based upon how we deliver industrial gases to our customers: delivery of large volumes from on-site production facilities or by pipeline, delivery in bulk tanks transported by truck or rail and delivery in gas cylinders. In addition to our core markets of Europe and North America, we also operate in Asia, Africa and Latin America. We have been in the process of divesting substantially all of the assets outside our core markets, along with certain non-strategic assets in our core markets. Other than our joint ventures in Central America and China, we anticipate completing these divestitures by year end 2002.

The following is an overview of a number of significant factors that affect our results of operations or that may affect our future results of operations.

Acquisition Transactions, Refinancing and Divestiture Program

As discussed elsewhere in this document, the acquisition transactions have been accounted for at fair value and, accordingly, our assets and liabilities have been recorded at their estimated fair values as of April 30, 2001, the date of the acquisition transactions. As a result, the financial statements of Messer Griesheim for periods prior to the acquisition transactions are not comparable to our financial statements for periods subsequent to the acquisition transactions. To highlight this lack of comparability, a solid vertical line has been inserted, where applicable, between columns in the tables

4

and schedules of this document, and in our unaudited interim condensed consolidated financial statements to distinguish information pertaining to the pre-acquisition and post-acquisition periods.

The Acquisition of Messer Griesheim

Prior to the completion of the acquisition transactions described below, Messer Griesheim was owned:

- •

- 331/3% by the Messer family through a holding company, Messer Industrie GmbH, and

- •

- 662/3% by Hoechst AG, a subsidiary of Aventis S.A. Aventis was formed in December 1999 as the result of the merger of Hoechst AG and Rhône-Poulenc S.A., two of Europe's largest chemical companies.

On December 31, 2000, Messer Industrie, Hoechst and our parent company Messer Griesheim Group GmbH (formerly named Cornelia Verwaltungsgesellschaft mbH), entered into certain acquisition transactions.

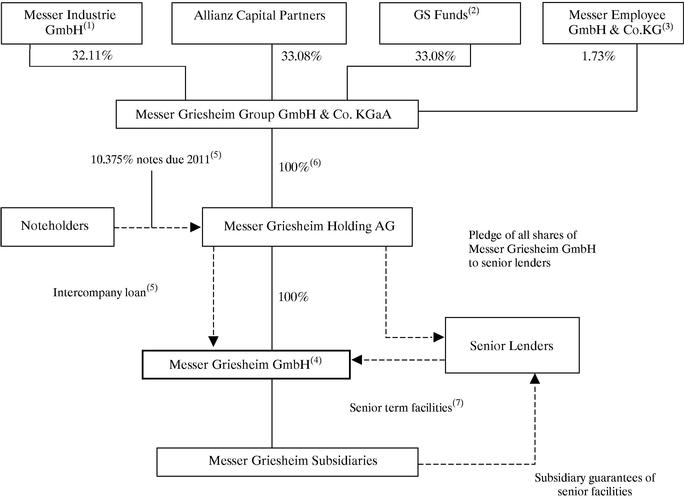

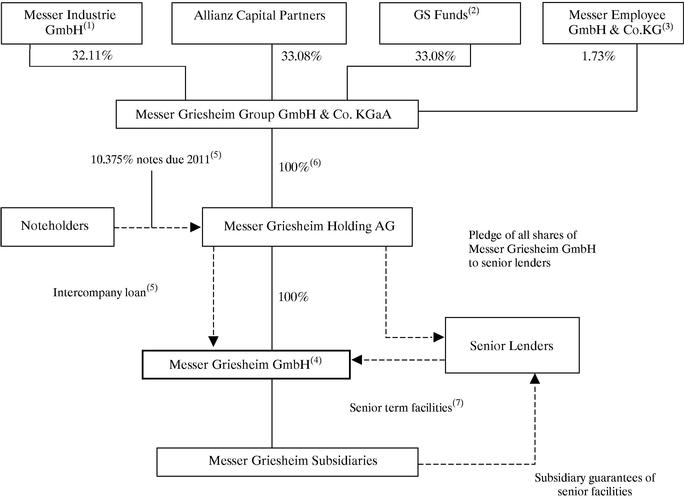

�� As a result of the acquisition transactions, Messer Holding owns 100% of Messer Griesheim and the issuer is directly or indirectly wholly owned by Messer Griesheim Group. Messer Holding and Messer Griesheim Group are both holding companies with no material assets other than their direct or indirect interests in Messer Griesheim (and, in Messer Holding's case, the payments under the intercompany loan to Messer Griesheim). During the nine month period ended September 30, 2002, our employees and members of the shareholders' committee purchased shares through the share purchase and option plan. The plan participants hold their shares through Messer Employee GmbH & Co. KG. Consequently, Messer Griesheim Group is owned as of September 30, 2002:

- •

- 32.11% by the Messer family, through Messer Industrie;

- •

- 33.08% by Allianz Capital Partners;

- •

- 33.08% by six private equity funds managed by affiliates of The Goldman Sachs Group, Inc. (GS Funds); and

- •

- 1.73% by Messer Employee GmbH & Co. KG reflecting ownership interests of our employee and shareholder committee participants in the share purchase and option plan.

In connection with these acquisition transactions, the main shareholders of Messer Griesheim Group entered into a shareholders' agreement governing their respective voting control and other ownership rights with respect to the issuer and Messer Griesheim.

Due to certain antitrust related considerations relating to the equity interest of Allianz AG in a competitor of Messer Griesheim, the agreement generally allocates the rights of the financial sponsors relating to corporate governance and management to the GS Funds until such time as the antitrust related considerations are no longer relevant. Accordingly, until then, members of the shareholders' committee appointed by the GS Funds will represent all votes of the financial sponsors constituting 66.16% of all votes in the shareholders' committee. Thereafter, the rights will be shared by Allianz Capital Partners and the GS Funds, with Allianz Capital Partners having a deciding vote in the event of a lack of consensus between Allianz Capital Partners and the GS Funds, subject to certain exceptions.

Transaction Structure

The following diagram shows our ownership structure and the structure of our principal indebtedness as of September 30, 2002 following completion of the acquisition transactions in April 2001, reflecting the issuance of the senior notes and the refinancing or repayment of our indebtedness to the extent completed, including repayment in full of the €400 million mezzanine bridge facility and repayment of €115 million of our senior term facilities and subsequent share purchases by

5

our employees and shareholder committee members through the share purchase and option plan mentioned above.

- (1)

- The holding company for the Messer family's interests in Messer Griesheim.

- (2)

- Certain private equity funds managed by affiliates of The Goldman Sachs Group, Inc.

- (3)

- The employees and shareholder committee members participating in the share purchase and option plan hold their shares through Messer Employee GmbH & Co. KG. The participant's voting rights are exercised by the managing partner of this company, Messer Employee Beteiligungsverwaltungs GmbH.

- (4)

- Principal operating company in Germany and holding company for the remainder of our operations.

- (5)

- €550.0 million aggregate principal amount. As of September 30, 2002, €532.9 million remained outstanding.

- (6)

- Messer Griesheim Group owns 100% of Messer Holding, 33.33% of which is owned directly and 66.67% of which is owned through its wholly owned subsidiary, DIOGENES 20. Vermögensverwaltung GmbH.

- (7)

- €1,340 million was the initial aggregate amount of senior term loan facilities. Messer Griesheim GmbH repaid €115 million principal amount of senior term facilities in May 2001 with a portion of the proceeds from the sale of the senior notes. As of September 30, 2002 €762.4 million aggregate principal amount remained outstanding under the senior term facilities. The senior term facilities also include committed but undrawn funds totaling €286 million under revolving facilities. Certain of Messer Griesheim's subsidiaries are also direct borrowers under the senior term facilities.

6

Refinancing Program

In connection with the acquisition transactions described above, substantially all of Messer Griesheim's existing indebtedness was refinanced through the senior term facilities and the senior notes. Upon the initial closing of the acquisitions, Messer Griesheim entered into a senior term facilities agreement with aggregate available funds of €1,650 million (€1,340 million of term loan facilities and €310 million of revolving facilities) and a mezzanine bridge facility agreement in the aggregate amount of €400 million. In May 2001, the Company issued €550 million principal amount of 10.375% senior notes maturing on June 1, 2011. Upon the closing of the sales of the senior notes, Messer Holding made an intercompany loan to Messer Griesheim with the gross proceeds from the senior notes, and Messer Griesheim used the intercompany loan to repay the mezzanine bridge facility in full and repay €115 million principal amount of the outstanding term borrowings under the facilities.

Business Practices

We believe the following selected business practices are important for a proper understanding of financial reporting risks.

Net Sales

We primarily earn revenues from

- •

- sales of industrial gases and, to a lesser extent,

- •

- sales of hardware related to industrial gas usage.

Our sales of industrial gases, which amount to greater than 90% of our total revenue, are divided into three business units corresponding to their mode of delivery: on-site and pipeline sales, bulk delivery sales and cylinder delivery sales. Contracts in our on-site production and pipeline supply businesses in Europe and the United States typically have terms of 10 to 15 years and usually have "take-or-pay" minimum purchase provisions. In each of the last three years, the "take-or-pay" minimum purchase requirements in our on-site and pipeline supply contracts accounted for approximately 60% to 70% in Germany and 40% to 45% in the United States of the total amount of net sales that we generated under these contracts.

Contracts in our bulk business generally have terms of two to three years in Europe and five to seven years in the United States. Customers in our on-site and pipeline and bulk businesses have historically exhibited high renewal rates, with over 90% of customers whose contracts expired in the past five years renewing their contracts with us. Our on-site, pipeline and bulk businesses in Germany and the United States accounted for approximately 44% of our total net sales and approximately 60% of our normalized EBITDA in the third quarter 2002. We generally sell our cylinder gases by purchase orders or by contracts with terms ranging between one to two years in Europe and three to five years in the United States.

Our net sales are dependent on the economic conditions in the markets in which we operate. However, we believe that we have limited exposure to the cyclical nature in demand of any particular industry because of the wide diversity of industries represented by our customer base.

Although industrial gas prices appear to have stabilized in many of the markets in which we operate, prices have consistently decreased for at least the last 10 years, especially in the bulk and commodity gas cylinder segments, due to aggressive efforts by most producers to increase market share. The profit margin impact of this price erosion has been partially offset by efficiency improvements throughout the supply chain and regional consolidation among large participants in the industry, permitting economies of scale. In addition, new applications for industrial gases have provided opportunities for increased sales volumes and profit margins.

7

Cost of Sales

Our principal raw material is air, which is free and which we separate into its component gases. Cost of sales principally consists of:

- •

- capital costs of plants;

- •

- costs of energy required for production; and

- •

- labor costs relating to production.

Energy costs consist principally of electrical power costs. Electricity represents approximately 29% of cost of sales in the third quarter of 2002. We are able to pass on a portion of increases in energy costs to many, but not all, of our on-site and pipeline customers with long-term supply contracts, although these adjustments in cost often occur only on an annual basis. The amount and other terms of these energy cost pass-through provisions vary by contract.

Labor costs relating to production consist principally of wages and salaries, social security contributions and other expenses related to employee benefits. Social security contributions include our portion of social security payments as well as our contributions to workers' insurance associations.

We depreciate fixed assets on a straight-line basis. Our depreciation rates assume useful lives ranging from 10 to 50 years for buildings, 10 to 20 years for plant and machinery and 3 to 20 years for other plant, factory and office equipment.

Divestiture Program

Our core markets are Europe and North America. In May 2001, immediately following our change of ownership resulting from the acquisition transactions described elsewhere in this Form 6-K, we adopted a divestiture program. Pursuant to the divestiture program, we intended to sell substantially all of our assets and operations in our non-core markets in Asia, Africa and Latin America, as well as certain non-strategic assets and operations in our core markets. The proceeds from this divestiture program will be used to reduce our consolidated debt.

Pursuant to the divestiture program, as of September 30, 2002, we have completed disposals of our home care business in Germany, our health care business in Canada and our non-cryogenic plant production operations in Germany, the United States, Italy and China. We also have completed disposals of our operations in Argentina, Brazil, Canada, Egypt, Mexico, South Africa, South Korea, Trinidad & Tobago and Venezuela, our nitric oxide business in Austria, substantially all our carbon dioxide business in the United States and our nitrogen services business in the United Kingdom. As of September 30, 2002 we have substantially completed the disposal of our investments included in subsidiaries available for sale. As a result, we completed repayment of our senior term disposal facility in the second quarter of 2002.

The remaining divestiture of certain of our assets and operations may require additional expenditures prior to their disposal and may not be completed by December 31, 2002.

Cost-Savings Plan

We are implementing a plan to reduce our operating costs, principally in Europe. This plan involves eliminating duplication in support positions for certain process functions, reducing energy costs, centralizing key process functions and simplifying our management structure. We have identified most of the specific cost savings measures that we anticipate to achieve by year-end 2003. We expect that these measures will reduce the cost base of our operations in our core markets relative to its level for the year 2000 by approximately €100 million by year-end 2003. To implement these measures, we

8

expect to spend approximately €84 million in total between April 30, 2001 and year end 2003, principally to be applied towards severance payments and efficiency improvements.

For the eight month period ending December 31, 2001, we have reduced the cost base of our operations in our core markets relative to its level for the year 2000 by €27.0 million. As a result of implementation of these measures, we incurred one time costs of approximately €32.4 million (excluding €12.5 million of costs that were included as part of the purchase price accounting adjustments) for the seventeen month period from May 1, 2001 to September 30, 2002, of which €3.0 million was recorded in the third quarter 2002. We expect to incur an additional €39.1 million of one-time costs by the end of 2003. These one-time costs relate to divestitures (€14.0 million) reduction in work force (€7.0 million) and various other reductions of operating costs (€18.1 million).

Critical Accounting Policies

The results of our operations and financial condition are dependent upon the utilization of accounting methods, assumptions and estimates that are used as a basis for the preparation of the unaudited interim condensed consolidated financial statements. We have identified the following critical accounting policies and related assumptions, estimates and uncertainties, which management believes are essential to understanding the underlying financial reporting risks and the impact that these accounting methods, assumptions, estimates and uncertainties have on our reported financial results. This information should be read in conjunction with the unaudited interim condensed consolidated financial statements.

Purchase Accounting

We accounted for the acquisition transactions similar to that of an acquisition of Messer Griesheim by Messer Holding. The accounting for this acquisition resulted in significant amounts of long-lived intangible assets. Our accounting policy relating to purchase business combinations requires the use of the purchase method whereby the purchase price is allocated to identifiable tangible and intangible assets based upon their fair value. The allocation of purchase price is judgmental and requires the extensive use of estimates and fair value assumptions, which can have a significant impact on operating results. Changes in the industry conditions, technological advances and other economic factors could result in revisions to the judgments, estimates and valuation techniques utilized in the application of purchase accounting. Such differing allocations could impact future operating results.

Recoverability of Long-Lived Assets

Our business is capital intensive and, historically, required a significant investment in property, plant and equipment. At September 30, 2002, the carrying value of our property, plant and equipment was €1,518 million. At September 30, 2002 long-lived intangible assets amounted to €811 million. We review long-lived assets, including intangible assets, for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying value of an asset to the higher of net selling price and value in use. Net selling price is the amount obtainable from the sale of an asset in an arm's length transaction between knowledgeable, willing parties, after deducting any direct incremental disposal costs. Value in use is the present value of estimated future cash flows expected to arise from continuing use of an asset and from its disposal at the end of its useful life.

A continuation of the currently competitive economic conditions in the industrial gas industry could result in an increasingly adverse pricing environment due to significant industry over-capacity. This could result in decreased production and reduced capacity utilization. Such events could result in reductions of future net cash flows expected to be generated to the extent that both long-lived tangible and intangible assets could be considered impaired, negatively impacting future operating results.

9

Recoverability of Investments in Subsidiaries Available for Sale

We have made a series of investments in, and advances to, companies that are principally engaged in the manufacture, sale and distribution of industrial gases which are located in regional markets which we no longer consider part of our core markets. At September 30, 2002, the carrying amounts of investments in subsidiaries available for sale aggregate approximately €17.5 million. Our accounting policy is to value such investments at estimated net realizable value. In determining estimated net realizable value, we consider the forecasted results of the investee, the economic environment in the regional market and our ability and intent to hold the investment until the estimated sale date.

A slump in demand for industrial gases could adversely impact the operations of these investments and their capability to generate future net cash flows. Furthermore, since these investments are not publicly traded, further judgments and estimates are required to determine their fair value. As a result, potential impairment charges to write-down such investments to net realizable value could adversely affect future operating results.

Realization of Deferred Tax Assets

At September 30, 2002, we had total deferred tax assets of approximately €179.7 million. Included in this total are the benefit of net operating loss and tax credit carry forwards of approximately €118.9 million. Such tax loss and credit carry forwards generally do not expire under current law, except certain amounts attributable to operations in the United States that expire in 20 years. Realization of these amounts are dependent upon the generation of future taxable income at a level sufficient to absorb the loss and credit carry forwards. These deferred tax assets were recognized to the extent that it is probable that future taxable profit will be available. The amount of total deferred tax assets considered realizable prospectively could be reduced if our estimates of projected future taxable income are lowered from present levels or changes in current tax regulations are revised which could impose restrictions on the time or extent of our ability to utilize tax loss and credit carry forwards in the future.

Currently, the German Government is contemplating future new tax legislation which could limit the NOL carry forward to 7 years and which could limit the use of the NOL carry forward to only 50% of the taxable income in any given year. This contemplated new tax legislation could affect the Group's ability to use its NOL. This future new tax legislation might also contain other features which could affect the Group. These changes still have to be properly defined and have to pass through the legislation procedures. Hence, they were not considered in the current interim condensed consolidated financial statements.

Restructuring Charges

Subsequent to the acquisition transactions, the management approved plans to restructure the Group and reduce costs. These changes were intended to, among other things, improve operational efficiencies and improve profitability. While the management approved a detailed restructuring plan, the calculation of the provision requires the use of estimates and management judgment. Additionally, if industry conditions continue to deteriorate or an economic downturn is experienced in the future, further restructuring charges may be incurred. Resulting variances from estimates previously utilized may adversely impact future financial results.

Reclassifications

Certain reclassifications have been made to the financial statement presentation of the prior period to conform such presentation to the current period presentation.

10

Results of Operations

When comparing the three months ended September 30, 2002, with the three months ended September 30, 2001 as well as when comparing the nine months ended September 30, 2002 with the five months ended September 30, 2001, and the four months ended April 30, 2001, consideration should be given to the impact on comparability arising from the acquisition transaction, the refinancing program, the divestiture program and the other developments described above. As a result of these events, comparability is impacted by a number of factors, the most significant of which are (i) the new cost base of the Company's assets and liabilities as a result of the acquisition transactions, (ii) the refinancing program and the resulting impact on financing costs and (iii) the divestiture program. All of these factors impacted the comparability of the results presented for the nine and the three months ended September 30, 2002, to the respective prior year periods.

To highlight this lack of comparability, a solid vertical line has been inserted, where applicable, between columns in the tables below, in our interim condensed consolidated financial statements and elsewhere in this document in order to distinguish information pertaining to the pre-acquisition and post-acquisition periods.

Nine Months Ended September 30, 2002 Compared with Five Months Ended September 30, 2001 and Four Months Ended April 30, 2001

The following table sets forth a summary of the results of operations for the nine months ended September 30, 2002, five months ended September 30, 2001 and four months ended April 30, 2001, in terms of amounts as well as percentages of net sales. Financial information for periods prior to and subsequent to the acquisition transactions have been separated in the following table by inserting a solid vertical line between the columns for such periods.

| |

| |

| |

| |

| | Predecessor

| |

|---|

| | Successor

| |

|---|

| | Messer Griesheim GmbH

| |

|---|

| | Messer Griesheim Holding AG

| |

|---|

| | Nine Months Ended

September 30, 2002

| | Five Months Ended

September 30, 2001

| | Four Months Ended

April 30, 2001

| |

|---|

| | € (in millions)

| | %

| | € (in millions)

| | %

| | € (in millions)

| | %

| |

|---|

| Net sales | | 1,143.9 | | 100.0 | | 659.5 | | 100.0 | | 574.5 | | 100.0 | |

| Cost of sales | | (567.1 | ) | (49.6 | ) | (336.2 | ) | (51.0 | ) | (293.4 | ) | (51.1 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Gross profit | | 576.8 | | 50.4 | | 323.3 | | 49.0 | | 281.1 | | 48.9 | |

| Distribution and selling costs | | (355.4 | ) | (31.1 | ) | (192.0 | ) | (29.1 | ) | (177.2 | ) | (30.8 | ) |

| General and administrative costs | | (95.9 | ) | (8.4 | ) | (47.5 | ) | (7.2 | ) | (45.0 | ) | (7.8 | ) |

| Other, net(1) | | (32.4 | ) | (2.8 | ) | (33.0 | ) | (5.0 | ) | (12.4 | ) | (2.2 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Operating profit | | 93.1 | | 8.1 | | 50.8 | | 7.7 | | 46.5 | | 8.1 | |

| | |

| |

| |

| |

| |

| |

| |

| Interest expense, net | | (108.8 | ) | (9.5 | ) | (64.3 | ) | (9.7 | ) | (36.4 | ) | (6.3 | ) |

| Loss before income taxes and minority interests | | (28.6 | ) | (2.5 | ) | (29.9 | ) | (4.5 | ) | (6.6 | ) | (1.1 | ) |

| Income taxes | | (21.7 | ) | (1.9 | ) | (21.8 | ) | (3.3 | ) | (4.8 | ) | (0.8 | ) |

| Net loss | | (58.0 | ) | (5.1 | ) | (56.2 | ) | (8.5 | ) | (13.5 | ) | (2.3 | ) |

| Normalized EBITDA | | 297.0 | | 26.0 | | 171.0 | | 25.9 | | 125.9 | | 21.9 | |

- (1)

- Amounts include total net of research and development costs, other operating income, other operating expense and restructuring and reorganization charges and impairment of intangible assets and property, plant and equipment.

11

As a result of the acquisition transactions, the refinancing program and the divestiture program, as described above, a comparison of the nine months ended September 2002 with the four months ended April 30, 2001 and the five months ended September 30, 2001 is not meaningful. The acquisition transactions were accounted for in a manner similar to a "purchase" business combination and, accordingly, the cost of the acquisition has been allocated to the assets acquired and the liabilities assumed based on their fair values. The accounting treatment impacts our results of operations for post acquisition periods primarily by increasing amortization of goodwill, increasing depreciation of property, plant and equipment, reducing losses of disposals of subsidiaries and other assets included in the divestiture program and correspondingly decreasing our operating profit compared to all periods prior to April 30, 2001. The refinancing program increased our interest expense compared to all periods prior to April 30, 2001. In addition, certain subsidiaries to be sold as part of our divestiture program have been deconsolidated and thus excluded from the results of operations for all periods after April 30, 2001.

Three Months Ended September 30, 2002 Compared with Three Months Ended September 30, 2001

Except for the effect of the final purchase price allocation subsequent to the acquisition transaction, management believes that comparison of the three month period ended September 30, 2002 and the three month period ended September 30, 2001 is meaningful as presented below.

The following table sets forth a summary of the results of operations for the three months ended September 30, 2002, three months ended September 30, 2001, in terms of amounts as well as percentages of net sales.

| | Successor

| |

|---|

| | Messer Griesheim Holding AG

| |

|---|

| | Three Months Ended September 30, 2002

| | Three Months Ended September 30, 2001

| |

|---|

| | € (in millions)

| | %

| | € (in millions)

| | %

| |

|---|

| Net sales | | 380.4 | | 100.0 | | 393.6 | | 100.0 | |

| Cost of sales | | (186.7 | ) | (49.1 | ) | (206.1 | ) | (52.4 | ) |

| | |

| |

| |

| |

| |

| Gross profit | | 193.7 | | 50.9 | | 187.5 | | 47.6 | |

Distribution and selling costs |

|

(116.9 |

) |

(30.7 |

) |

(112.4 |

) |

(28.6 |

) |

| General and administrative costs | | (28.1 | ) | (7.4 | ) | (28.7 | ) | (7.3 | ) |

| Other, net(1) | | (15.7 | ) | (4.1 | ) | (21.4 | ) | (5.4 | ) |

| | |

| |

| |

| |

| |

| Operating profit | | 33.0 | | 8.7 | | 25.0 | | 6.3 | |

| | |

| |

| |

| |

| |

| Interest expense, net | | (32.5 | ) | (8.5 | ) | (40.1 | ) | (10.2 | ) |

| Loss before income taxes and minority interests | | (12.6 | ) | (3.3 | ) | (17.5 | ) | (4.4 | ) |

| Income taxes | | (10.5 | ) | (2.8 | ) | (20.9 | ) | (5.3 | ) |

| Net loss | | (25.8 | ) | (6.8 | ) | (41.3 | ) | (10.5 | ) |

| Normalized EBITDA | | 99.3 | | 26.1 | | 98.1 | | 24.9 | |

- (1)

- Amounts include total net of research and development costs, other operating income, other operating expense and restructuring and reorganization charges and impairment of intangible assets and property, plant and equipment.

12

Net sales. Net sales decreased 3.4% to €380.4 million in the third quarter 2002 from €393.6 million in the third quarter 2001 based essentially on the factors described below.

| | Messer Griesheim Holding AG

|

|---|

| | Three Months Ended September 30, 2002

| | Three Months Ended September 30, 2001

|

|---|

| | €

(in millions)

| | €

(in millions)

|

|---|

| Net sales (Business Areas) | | | | |

| Germany | | 168.8 | | 163.9 |

| Western Europe, excluding Germany | | 63.6 | | 64.7 |

| Eastern Europe | | 54.3 | | 54.2 |

| North America | | 80.0 | | 95.9 |

| Others | | 13.8 | | 14.7 |

| Reconciliation/Corporate | | (0.1 | ) | 0.2 |

| | |

| |

|

| Total | | 380.4 | | 393.6 |

| | |

| |

|

- •

- Net sales in Germany increased by 3.0% to €168.8 million in the third quarter 2002 from €163.9 million in the third quarter 2001. This increase is caused by higher pipeline sales due to new capacity brought on stream by the Dormagen plant and the sale of technical equipment. Without these items net sales in the third quarter 2002 are flat compared to net sale in the third quarter 2001 as a result of the continuing weak business climate in Germany.

- •

- Net sales in Western Europe (excluding Germany) decreased by 1.7% to €63.6 million in the third quarter 2002 from €64.7 million in the third quarter 2001. This decrease results from lower sales in the United Kingdom due to an ongoing decline in the beverage business. The remaining European countries show an increase in sales particularly the pipeline business in Spain.

- •

- Net sales in Eastern Europe increased slightly by 0.2% to €54.3 million in the third quarter 2002 from €54.2 million in the third quarter 2001. Net sales in Central Europe and South Eastern Europe show a stable performance with only slight variations within these regions.

- •

- Net sales in North America decreased by 16.6% to €80.0 million in the third quarter 2002 from €95.9 million to the third quarter 2001. Despite sales price increase and surcharges, this decrease results primarily from the €12.1 million reduction in net sales as a result of the disposals of our operations in Canada and our carbon dioxide business in the U.S. pursuant to the divestiture program. Additional reduction of approximately €3.5 million is caused by the negative currency impact due to the ongoing decline in the value of the US$ against the Euro in the third quarter 2002. Excluding the effects of the business disposals and declining exchange rates, sales in the third quarter 2002 were flat compared to the third quarter 2001. This reflects the slowing down of the business in the U.S. While bulk and pipeline sales are above third quarter 2001, our cylinder business sales are still below.

- •

- Others represents the non core operations in Latin America, Africa and Asia.

Cost of sales. Cost of sales decreased by 9.4% to €186.7 million in the third quarter 2002 from €206.1 million in the third quarter 2001. Cost of sales consist primarily of raw material costs (principally energy costs), purchased parts and direct labor, as well as manufacturing overheads and depreciation.

The change in cost of sales was impacted by an amount of €2.4 million representing additional depreciation due to step ups related to the purchase method of accounting which was not finalized

13

until after the third quarter 2001. Excluding this effect, cost of sales decreased by 10.4% for the third quarter 2002 compared to the third quarter 2001.

The absolute decrease is caused by lower sales as compared to the third quarter 2001. However, the relative decrease in cost of sales resulted from our successful cost savings initiatives and sales price increases and surcharges primarily in the U.S.

Distribution and selling costs. Distribution and selling costs increased by 4.0% to €116.9 million in the third quarter 2002 from €112.4 million in the third quarter 2001. Distribution and selling costs consist primarily of sales organization costs, transport of gases and cylinders from the production site or filling station to the customer, depreciation of the cylinders and tanks at the customer site, advertising and sales promotions, commissions and freight.

The change in distribution and selling costs was impacted by an amount of €9.8 million representing additional depreciation due to step ups related to the purchase method of accounting which was not finalized until after the third quarter 2001. Excluding this effect, distribution and selling costs decreased by 4.3% for the third quarter 2002 compared to the third quarter 2001 due to the ongoing decline in the value of the US$ against the Euro in the third quarter 2002. This absolute decrease is caused by lower sales as compared to the third quarter 2001.

General and administrative costs. General and administrative expenses decreased slightly by 2.1% to €28.1 million in the third quarter 2002 from €28.7 million to the third quarter 2001. General and administrative costs consist primarily of personnel costs attributable to general management, finance and human resources functions, as well as other corporate overhead charges. These decreases in general and administrative costs resulted from our successful cost saving initiatives.

Operating profit. Operating profit increased 32.0% to €33.0 million in the third quarter 2002 from €25.0 million in the third quarter 2001 based essentially on the factors described below.

| | Messer Griesheim Holding AG

| |

|---|

| | Three Months Ended September 30, 2002

| | Three Months Ended September 30, 2001

| |

|---|

| | €

(in millions)

| | €

(in millions)

| |

|---|

| Operating profit (loss) (Business Areas) | | | | | |

| Germany | | 30.8 | | 44.8 | |

| Western Europe, excluding Germany | | (0.2 | ) | 5.8 | |

| Eastern Europe | | 9.7 | | 9.9 | |

| North America | | 2.0 | | 1.0 | |

| Others | | 2.1 | | 0.9 | |

| Reconciliation/Corporate | | (11.4 | ) | (37.4 | ) |

| | |

| |

| |

| Total | | 33.0 | | 25.0 | |

| | |

| |

| |

- •

- In Germany, the operating profit decreased 31.3% to €30.8 million in the third quarter 2002 as compared to an operating profit of €44.8 million in the third quarter 2001. The operating profit in the third quarter 2001 does not include additional depreciation and amortization of €11.5 million related to the purchase price accounting as in the third quarter 2002. Excluding this effect, operating profit in the third quarter 2001 was €33.3 million resulting in a decrease of 7.5% for the third quarter 2002 compared to the third quarter 2001 following a higher share of low margin products.

14

- •

- In Western Europe, excluding Germany, the operating profit decreased significantly to €(0.2) million in the third quarter 2002 compared to an operating profit of €5.8 million in the third quarter 2001. The operating profit in the third quarter 2001 does not include additional depreciation and amortization of €2.4 million related to the purchase price accounting as in the third quarter 2002. Excluding this effect, operating profit in the third quarter 2001 was €3.4 million resulting in a decrease of €3.6 million for the third quarter 2002 compared to the third quarter 2001. This decrease is mainly caused by the impairment of a carbon dioxide plant in Spain (€1.3 million) as well as a combination of the weak operational performance and a higher level of low margin engineering business in the U.K.

- •

- In Eastern Europe, the operating profit decreased 2.0% to €9.7 million in the third quarter 2002 compared to an operating profit of €9.9 million in the third quarter 2001. The operating profit in the third quarter 2001 does not include additional depreciation and amortization of €1.6 million related to the purchase price accounting as in the third quarter 2002. Excluding this effect, operating profit in the third quarter 2001 was €8.3 million resulting in an increase of 16.9% for the third quarter 2002 compared to the third quarter 2001. This increase is primarily due to a higher share of bulk business in the Czech Republic and of carbon dioxide business in Poland.

- •

- In North America, the operating profit increased 100% to €2.0 million in the third quarter 2002 as compared to €1.0 million in the third quarter 2001. The operating profit in the third quarter 2001 does not include additional depreciation and amortization of €4.4 million related to the purchase price accounting as in the third quarter 2002 resulting in an increase of €5.4 million for the third quarter 2002 compared to the third quarter 2001. The results of the third quarter 2001 include a negative contribution from the disposals of our operations in Canada and our carbon dioxide business in the U.S. of €2.2 million and restructuring expenses of €0.3 million. Excluding these effects, the operating loss of the third quarter 2001 was €(0.9) million resulting in an increase of €2.9 million for the third quarter 2002 compared to the third quarter 2001. This increase is primarily due to sales price increases and surcharges within the bulk and pipeline business.

- •

- Operating loss for Reconciliation/Corporate decreased to €11.4 million in the third quarter 2002 from an operating loss of €37.4 million in the third quarter 2001. Reconciliation/corporate represents the administrative function of the Group (including goodwill amortization in the third quarter 2001). The decrease is due to reorganization and restructuring charges of €3.0 million and additional goodwill amortization of €11.3 million arising from purchase price allocation in the third quarter 2001. Additionally, costs in connection with the refinancing and additional indirect costs relating to the change in ownership were expensed in the third quarter 2001.

Interest expense, net. Net interest expense decreased 19.0% to €32.5 million in the third quarter 2002 from €40.1 million in the third quarter 2001. This decrease is due to our successful debt reduction including scheduled and voluntary early repayments of the senior facility agreement.

Income taxes. In the third quarter 2002 the Company recorded income tax expense of €10.5 million, compared to an income tax expense of €20.9 million in the third quarter 2001. Despite our operating loss, income tax expenses are incurred mainly due to non-deductible interest expense and goodwill amortization as well as withholding taxes of approximately €5.5 million on dividends received.

Net loss. In addition to the factors discussed above, net loss is also impacted by a release of cumulative translation adjustment resulting from dividend payment and repurchase of a portion of the Senior Notes during September 2002.

15

Liquidity and Capital Resources

Cash Flows for the Three Months Ended September 30, 2002 and the Three Months Ended September 30, 2001

The following table summarizes our cash-flow activity during the three months ended September 30, 2002 and the three months ended September 30, 2001.

| | Messer Griesheim Holding AG

|

|---|

| | Three Months Ended

September 30, 2002

| | Three Months Ended

September 30, 2001

|

|---|

| | €

(in millions)

| | €

(in millions)

|

|---|

| Cash flow from operating activities | | 100.6 | | 112.8 |

| Cash flow from (used in) investing activities | | (9.3 | ) | 3.5 |

| Cash flow (used in) from financing activities | | (58.2 | ) | 36.0 |

| Cash and cash equivalents, end of period | | 159.2 | | 258.3 |

Cash flow from operating activities. The cash flow from operating activities for the three months ended September 30, 2002 decreased to €100.6 million from €112.8 million for the three months ended September 30, 2001. The decrease is mainly due to higher tax payments resulting from withholding taxes of €5.5 million in connection with dividends received. Operating cash flows in the three months period ended September 30, 2002 reflect a net loss of €25.8 million, consisting of EBIT (earnings before interest and taxes) of €17.2, net of interest and taxes of €32.5 and €10.5, respectively. Operating cash flow in the third quarter of 2001 reflects a net loss of €41.3 million, consisting of EBIT (earnings before interest and taxes) of €19.7 million, net of interest and taxes of €40.1 million and €20.9 million, respectively.

Cash flow from (used in) investing activities. The cash flow used in investing activities for the three months ended September 30, 2002 decreased to €9.3 million from a cash inflow of €3.5 million in the third quarter 2001. The decrease mainly resulted from decreased proceeds from the sale of investments to €1.5 million from €19.6 million, partly offset by higher capital expenditures in the third quarter 2001.

Cash flow (used in) from financing activities. The company used €58.2 million in cash for financing activities during the three months ended September 30, 2002. Cash flows for financing activities during the third quarter of 2002 were applied to pay principal and interest related to our corporate debt of €23.1 million, thereof repurchase of Senior Notes (€17.1 million) and €19.4 million, respectively. Cash flows for financing activities during the third quarter of 2001 included interest paid of €21.9 million and €57.9 million proceeds from the addition to corporate debt, net of the increase in cash collateral.

16

Contractual Obligations

The following table summarizes our contractual obligations as of September 30, 2002:

| | Less than

1 year

| | 1-3 years

| | 4-5 years

| | After

5 years

| | Total

|

|---|

| | €

(in millions)

| | €

(in millions)

| | €

(in millions)

| | €

(in millions)

| | €

(in millions)

|

|---|

| Contractual Obligations | | | | | | | | | | |

| Long-Term Debt | | 32.6 | | 88.3 | | 117.2 | | 1,095.9 | | 1,334.0 |

| Capital Lease Obligations(1) | | 16.9 | | 53.6 | | 59.0 | | 33.0 | | 162.5 |

| Operating Lease Obligations | | 8.9 | | 17.5 | | 15.2 | | 50.5 | | 92.1 |

| Commitments | | | | | | | | | | |

| Other Long-Term Obligations(2) | | | | | | | | | | 24.5 |

| ACIC Joint Ventures(3) | | | | | | | | | | 32.0 |

| Financial Guarantees(4) | | | | | | | | | | 127.8 |

| Long-Term Purchase Agreements | | | | | | | | | | 60.8 |

| Commitments for capital to be funded to equity and cost method investees | | | | | | | | | | 15.9 |

- (1)

- The capital lease obligations include an interest portion of €28.3 Mio.

- (2)

- Other financial obligations not included in the consolidated balance sheet relate to long-term commitments for capital expenditures.

- (3)

- Commitments to acquire joint venture interests currently owned by Aventis.

- (4)

- Financial guarantees mainly include guarantees for leased machinery and equipment at various subsidiaries of €72.5 million, guarantees for at equity consolidated subsidiaries of €27.5 million, and guarantees for third party debt of deconsolidated subsidiaries formerly included in assets available for sale from the divestiture program of €7.8 million.

Anticipated Uses/Expenditures and Sources of Funds

Capital expenditures in our core markets as a percentage of net sales were 6.5% in the nine-months period ended September 30, 2002. A core component of our strategy is to reduce Messer Griesheim's historically high levels of capital expenditures.

We will require funds to meet scheduled debt repayments and to fund the planned acquisition of the ACIC joint ventures from Aventis as elsewhere stated in this Form 6-K, with a purchase price of €32.0 million plus interest and the assumption of existing debt (approximately 14.1 million at September 30, 2002).

We had total indebtedness (including finance leases) of €1,468.2 million at September 30, 2002, of which €1,426.3 million was long-term indebtedness. The indebtedness was primarily due to banks and our bondholders and had an average rate of interest of approximately 8.1% as of September 30, 2002.

Messer Griesheim's principal sources of funds have been cash flow from operations and borrowings from banks. We expect that, going forward, we will finance on-going operations and finalize our implementation of our cost-savings measures and information-technology improvements with a combination of existing cash balances and operating cash flows, and available funds from our credit lines. We expect that our other cash requirements will be met through operating cash flows.

As of September 30, 2002, we had in place unused revolving credit lines totaling €286.0 million. In addition, certain of our subsidiaries have unused available credit lines under local facilities.

From October 1, 2002 until October 8, 2002 Messer Griesheim has repurchased additional Senior Notes amounting to €39.2 for an average price of 102.9%. In connection with the repurchase, unamortized finance cost of €3.3 million, fees and tender premium of €1.5 million were incurred.

17

Goldman and Sachs was our agent in repurchasing the senior notes and the fees paid for this were €0.4 million.

In October 2002, Messer Griesheim has received a loan from its shareholder Messer Griesheim Group amounting to €33.0 million. The loan bears a fixed interest rate of 5.0% per annum and has a maturity of five years.

Interest Rate Risk Management

We are exposed to interest rate risk mainly through our debt instruments. We manage interest rate risk on a group-wide basis with a combination of fixed and floating rate instruments designed to balance the fixed and floating interest rates. We have entered into interest rate swap agreements that effectively convert a major portion of our floating rate indebtedness to a fixed rate basis for the next two and one half years, thus reducing the impact of interest rate changes on future interest expense.

As of September 30, 2002, approximately 87% of our debt facilities were hedged to comply with the terms of our senior facilities agreement. The remaining 13% of our multicurrency debt facilities have floating rates. With respect to such portion of the debt facilities for each fluctuation in market interest rates of 1%, the interest expense related to such portion of the debt facilities would fluctuate by approximately €1.9 million annually.

Foreign Exchange Risk Management

We also are exposed to foreign currency exchange risk related to foreign currency denominated assets and liabilities and debt service payments denominated in foreign currencies. We manage foreign currency exchange risk on a group-wide basis using exchange forward contracts. Our current policy with respect to limiting foreign currency exposure is to hedge foreign currency exposures.

For the majority of our operations, we have local production facilities which generate cash flows in local currencies. These cash flows generally match local expenditures and debt service of these operations, resulting in a 95% or greater "natural hedge" as of September 30, 2002.

The most significant foreign exchange rate risks exist in Central America, Eastern Europe and China where we produce locally. A portion of our debt serviced by these facilities is denominated in Euros and U.S. dollars. Accordingly, we depend on the stability of currencies in these countries in order to service these debts. The total Euro and US dollar denominated debt in these countries is €25.7 million. The single largest debt is approximately €7.9 million in Poland. An increase or decrease of 10% of the Zloty against the Euro would result in a pretax impact of approximately €0.8 million on our annual results of operations. If all the currencies in these countries depreciate against the Euro and the U.S. Dollar, a 10% change would impact our consolidated net results by approximately €2.6 million annually on a pretax basis.

Our reporting currency is the Euro. The net assets outside the "Euro zone" are subject to currency fluctuations against the Euro. The most volatile currencies are those of Eastern Europe, China, and Central America. Normally, we do not hedge the net assets of foreign subsidiaries. Except for our subsidiary located in Yugoslavia, a hyperinflationary economy, in the event the Euro significantly increases in value relative to other currencies, the accounting treatment would result in a charge against our equity without any effect on net income.

Derivative Financial Instruments

The table below provides information about our significant derivative financial instruments that are sensitive to changes in interest and foreign currency exchange rates as of September 30, 2002. The table presents the notional amounts and the weighted average contractual foreign exchange rates. The terms

18

of our cross-currency exchange forward contracts generally do not exceed one year. At September 30, 2002, our interest rate swaps had remaining terms of two and one half years.

| | Contract

Notional

Amount

| | Contractual

Rates

| | Fair value

September 30,

2002

| |

|---|

| | (€ equivalent in thousands, except for contractual rates)

| |

|---|

| | €'000

| | %

| | €'000

| |

|---|

| Interest rate cap contracts(1) | | | | | | | |

| | Euro | | 25,565 | | 5.50000 | | 13 | |

| Interest rate swap contracts | | | | | | | |

| | Euro | | 86,573 | | 4.45500 | | (2,046 | ) |

| | Euro | | 220,000 | | 4.69500 | | (6,094 | ) |

| | Euro | | 53,350 | | 4.73000 | | (1,528 | ) |

| | U.S. dollar(2) | | 252,632 | | 5.00000 | | (13,798 | ) |

| | Euro | | 43,650 | | 4.65250 | | (1,201 | ) |

| Forward interest rate swap contracts | | | | | | | |

| | Euro | | 170,000 | | 4.84500 | | (874 | ) |

| | U.S. dollar(2) | | 228,426 | | 5.18500 | | (2,192 | ) |

|

|

Forward exchange rate |

|

| Foreign currency forward contracts(1)(2) | | | | | | | |

| | Euro/U.S. dollar | | 25,380 | | 0.87590 | | (3,087 | ) |

| | British pounds sterling/U.S. dollar | | 1,276 | | 1.55896 | | 6 | |

| | Euro/U.S. dollar | | 12,690 | | 0.96130 | | 282 | |

- (1)

- Free standing derivatives, which are market-to-market through earnings.

- (2)

- U.S. Dollar (US$) amounts under the facility have been converted into EURO at the rate of €1 = US$ 0.9850, British Pound (GBP) amounts at the rate of €1 = GBP 0.6297, the exchange rates at September 30, 2002.

Commodity Price Risk

We are exposed to commodity price risks through our dependence on various raw materials, such as chemical and energy prices. We seek to minimize these risks through our sourcing policies, operating procedures and pass through clauses in our product pricing agreements. We currently do not utilize derivative financial instruments to manage any remaining exposure to fluctuations in commodity prices.

Risk Identification and Analysis

The identification and analysis of risks relating to our operations is conducted through the application of an enterprise-wide risk management system, encompassing all of our activities worldwide. The goal of this risk management system is to foster a group-wide culture of risk management using a common set of objectives and standards in the measurement and treatment of risk. As with any risk management system, the results are based on individual assessments that may be subject to error. There is no guarantee that this system will consistently identify all of the important risks or provide an adequate assessment of their potential impact.

We are exposed to market risk through our commercial and financial operations as described above. We are implementing a hedging policy to reduce some of these exposures, but we may still incur losses as a result of changes in currency exchange rates, interest rates and commodity risk. We do not purchase or sell derivative financial instruments for trading purposes.

19

Reconciliation to U.S. GAAP

Initial Adoption of Accounting Policies

Effective July 1, 2001, the Company adopted Statement 141 "Business Combinations" and certain provisions of SFAS 142 "Goodwill and Other Intangible Assets". The Company adopted SFAS 142 in its entirety on January 1, 2002. SFAS 141 requires that the purchase method of accounting be used for all business combinations initiated after June 30, 2001, as well as all purchase method business combinations completed after June 30, 2001. SFAS 141 also specifies criteria intangible assets acquired in a purchase method business combination must meet to be recognized and reported separately from goodwill, and also indicates that any purchase price allocable to an assembled workforce may not be accounted for separately. Additionally, SFAS 141 required, upon adoption of SFAS 142 in its entirety, that the Company evaluate its existing intangible assets and goodwill that were acquired in a prior purchase business combination, and to make any necessary reclassifications in order to conform with the new criteria in SFAS 141 for recognition apart from goodwill. SFAS 142 requires that goodwill and intangible assets with indefinite useful lives no longer be amortized, but instead will be tested for impairment annually (or more frequently if impairment indicators arise) in accordance with the provisions of SFAS 142. Intangible assets with definite useful lives will be amortized over their respective estimated useful lives to their estimated residual values, and reviewed for impairment in accordance with SFAS 144 "Accounting for the Impairment or Disposal of Long-Lived Assets". By June 30, 2002 the Company had completed the first step of the transitional impairment test. As the result, an indication of impairment exists in reporting units located in North America and Eastern Europe. The second step of the impairment test will be completed by the end of the current fiscal year. Any transitional impairment loss will be recognized as a cumulative effect of a change in accounting principle.

In August 2001, the FASB approved for issuance SFAS 144. This Statement addresses financial accounting and reporting for the impairment or disposal of long-lived assets. This Statement supersedes SFAS 121 and the accounting and reporting provisions of APB Opinion No. 30 "Reporting the Results of Operations—Reporting the Effects of Disposal of a Segment of a Business, and Extraordinary, Unusual and Infrequently Occurring Events and Transactions", for the disposal of a segment of a business (as previously defined in that Opinion). This Statement also amends ARB No. 51 "Consolidated Financial Statements" to eliminate the exception to consolidation for a subsidiary for which control is likely to be temporary. The Company adopted the provisions of this Statement on January 1, 2002. The adoption of the new pronouncement did not have a material effect on the unaudited interim condensed consolidated financial statements. However, the Company has noted that certain provisions of SFAS 144 will potentially impact its accounting and reporting for the remaining subsidiaries to be sold under its divestiture program. The Company has also noted that the provisions of SFAS 144 would supersede certain provisions of EITF 87-11 and EITF 90-6 as they relate to allocation of purchase price in a business combination where the acquirer intends to sell a portion of the operations of the acquired enterprise and, as a result, had SFAS 144 been applied in accounting for the acquisition transactions, certain of the differences between U.S. GAAP and IAS relating to operations and entities included in the divestiture program would not have occurred.

Main Differences

Our results as reported under IAS differ from our results as reconciled to U.S. GAAP, principally as a result of the different treatment under U.S. GAAP of:

- •

- allocation of purchase price to assets to be sold,

- •

- amortization of goodwill for periods after December 31, 2001

- •

- restructuring costs,

20

- •

- transaction costs incurred by our parent on our behalf,

- •

- impairment of long lived assets,

- •

- assembled workforce (intangible asset),

- •

- foreign currency gains and losses on borrowing costs directly attributable to construction,

- •

- provisions for pensions and similar obligations, and

- •

- gains and losses related to financial instruments.

The significant differences between IAS and U.S. GAAP applicable to the financial statements presented herein are summarized below and further discussed elsewhere in this document.

Three Months Ended September 30, 2002 and Three Months Ended September 30, 2001

Net loss as reported under IAS was €(25.8) million in the three month period ended September 30, 2002 and €(18.6) million as reconciled to U.S. GAAP. The main difference between net loss reported under IAS and net loss reported under U.S. GAAP is due to the discontinuation of goodwill amortization under U.S. GAAP upon adoption of SFAS 142.

In the three month period ended September 30, 2001 the net loss reported under IAS was €(41.3) million, respectively and €(36.8) million as reconciled to U.S. GAAP. The difference between net loss reported under IAS and net loss reported under U.S. GAAP is primarily due to amortization expense on intangible assets and assets to be sold within one year of the date of the acquisition transaction and to the tax effect under U.S. GAAP associated with these adjustments.

Nine Months Ended September 30, 2002, Five Months Ended September 30, 2001 and Four Months Ended April 30, 2001

Net loss as reported under IAS was €(58.0) million in the first nine months ended September 30, 2002 and €(35.2) million as reconciled to U.S. GAAP. There were reconciling adjustments of €0.6 million in first nine months ended September 30, 2002 between IAS and U.S. GAAP relating to assets to be sold within one year of the date of the acquisition transaction. The remaining difference between net loss reported under IAS and net loss reported under U.S. GAAP is primarily due to the discontinuation of goodwill amortization under U.S. GAAP upon adoption of SFAS 142, provisions for pension and similar obligations and the tax effect under U.S. GAAP associated with these adjustments.

In the five month period ended September 30, 2001 and the four month period ended April 30, 2001 the net loss reported under IAS was €(56.2) million and €(13.5) million, respectively and €(52.9) million and €(13.4) million as reconciled to U.S. GAAP. The difference between net loss reported under IAS and net loss reported under U.S. GAAP is primarily due to amortization expense and assets to be sold within one year of the date of the acquisition transaction and to the tax effect under U.S. GAAP associated with these adjustments.

21

MESSER GRIESHEIM HOLDING AG

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in € thousands, unless otherwise stated)

| |

| | Successor

| |

|---|

| |

| | Messer Griesheim Holding AG

| |

|---|

| | Note

| | Three Months Ended September 30, 2002

| | Three Months Ended September 30, 2001

| |

|---|

| Net sales | | | | 380,397 | | 393,565 | |

Cost of sales |

|

|

|

(186,703 |

) |

(206,074 |

) |

| | | | |

| |

| |

| Gross profit | | | | 193,694 | | 187,491 | |

Distribution and selling costs |

|

|

|

(116,913 |

) |

(112,395 |

) |

| Research and development costs | | | | (2,753 | ) | (4,577 | ) |

General and administrative costs |

|

|

|

(28,117 |

) |

(28,669 |

) |

| Other operating income | | | | 5,384 | | 8,685 | |

| Other operating expense | | | | (13,966 | ) | (20,505 | ) |

| Impairment of intangible assets and property, plant and equipment | | | | (1,251 | ) | — | |

| Restructuring and reorganization charges | | 8 | | (3,036 | ) | (4,997 | ) |

| | | | |

| |

| |

| Operating profit | | | | 33,042 | | 25,033 | |

| | | | |

| |

| |

| Equity method investments income, net | | | | 1,744 | | 2,676 | |

| Other investment (expense) income, net | | | | (420 | ) | 3,088 | |

| Interest expense, net | | 4 | | (32,530 | ) | (40,127 | ) |

| Changes in fair value of investments in subsidiaries available for sale | | 9 | | (242 | ) | (9,426 | ) |

| Other financial income (expense), net | | | | (14,234 | ) | 1,232 | |

| | | | |

| |

| |

| Non-operating expense | | | | (45,682 | ) | (42,557 | ) |

| | | | |

| |

| |

| Loss before income taxes and minority interests | | | | (12,640 | ) | (17,524 | ) |

| Income tax expense, net | | 10 | | (10,469 | ) | (20,914 | ) |

| | | | |

| |

| |

| Loss before minority interests | | | | (23,109 | ) | (38,438 | ) |

| Minority interests, net of income taxes | | | | (2,670 | ) | (2,868 | ) |

| | | | |

| |

| |

| Net loss | | | | (25,779 | ) | (41,306 | ) |

| | | | |

| |

| |

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

22

MESSER GRIESHEIM HOLDING AG

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in € thousands, unless otherwise stated)

| |

| | Successor

| | Predecessor

| |

|---|

| |

| | Messer Griesheim Holding AG

| | Messer Griesheim GmbH

| |

|---|

| | Note

| | Nine Months Ended September 30,

2002

| | Five Months Ended September 30,

2001

| | Four Months Ended April 30, 2001

| |

|---|

| Net sales | | | | 1,143,850 | | 659,538 | | 574,463 | |

Cost of sales |

|

|

|

(567,127 |

) |

(336,171 |

) |

(293,414 |

) |

| | | | |

| |

| |

| |

| Gross profit | | | | 576,723 | | 323,367 | | 281,049 | |

Distribution and selling costs |

|

|

|

(355,436 |

) |

(191,962 |

) |

(177,182 |

) |

| Research and development costs | | | | (9,238 | ) | (6,748 | ) | (6,599 | ) |

| General and administrative costs | | | | (95,895 | ) | (47,514 | ) | (45,027 | ) |

| Other operating income | | | | 20,821 | | 9,498 | | 10,242 | |

| Other operating expense | | | | (35,463 | ) | (26,623 | ) | (11,133 | ) |

| Impairment of intangible assets and property, plant and equipment | | | | (1,251 | ) | — | | (2,356 | ) |

| Restructuring and reorganization charges | | 8 | | (7,162 | ) | (9,255 | ) | (2,540 | ) |

| | | | |

| |

| |

| |

| Operating profit | | | | 93,099 | | 50,763 | | 46,454 | |

| | | | |

| |

| |

| |

| Equity method investments income (expense), net | | | | 1,530 | | (5,302 | ) | (5,106 | ) |

| Other investment expense, net | | | | (1,114 | ) | (2,199 | ) | (4,544 | ) |

| Interest expense, net | | 4 | | (108,776 | ) | (64,270 | ) | (36,364 | ) |

| Changes in fair value of investments in subsidiaries available for sale | | 9 | | (748 | ) | (8,192 | ) | — | |

| Other financial expense, net | | | | (12,595 | ) | (656 | ) | (6,990 | ) |

| | | | |

| |

| |

| |

| Non-operating expense | | | | (121,703 | ) | (80,619 | ) | (53,004 | ) |

| | | | |

| |

| |

| |

| Loss before income taxes and minority interests | | | | (28,604 | ) | (29,856 | ) | (6,550 | ) |

| Income tax expense, net | | 10 | | (21,693 | ) | (21,772 | ) | (4,813 | ) |

| | | | |

| |

| |

| |

| Loss before minority interests | | | | (50,297 | ) | (51,628 | ) | (11,363 | ) |

| Minority interests, net of income taxes | | | | (7,733 | ) | (4,580 | ) | (2,135 | ) |

| | | | |

| |

| |

| |

| Net loss | | | | (58,030 | ) | (56,208 | ) | (13,498 | ) |

| | | | |

| |

| |

| |

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

23

MESSER GRIESHEIM HOLDING AG

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in € thousands, unless otherwise stated)

| | Note

| | As of

September 30,

2002

| | As of

December 31,

2001

| |

|---|

| Assets | | | | | | | |

| Intangible assets | | | | 810,786 | | 852,809 | |

| Property, plant and equipment | | | | 1,517,810 | | 1,697,679 | |

| Equity method investments | | | | 17,882 | | 19,186 | |

| Cost method and other investments | | | | 50,824 | | 59,347 | |

| Deferred tax assets | | | | 6,309 | | 4,546 | |

| Other long-term receivables, net and other assets | | 11 | | 18,739 | | 43,081 | |

| | | | |

| |

| |

| Non-current assets | | | | 2,422,350 | | 2,676,648 | |

| | | | |

| |

| |

| Inventories | | 12 | | 81,894 | | 80,098 | |

| Trade accounts receivable, net | | | | 289,269 | | 290,743 | |

| Investments in subsidiaries available for sale | | 9 | | 17,529 | | 42,183 | |

| Other receivables and other assets | | | | 61,787 | | 71,796 | |

| Cash and cash equivalents | | 13 | | 159,164 | | 188,018 | |

| | | | |

| |

| |

| Current assets | | | | 609,643 | | 672,838 | |

| | | | |

| |

| |

| Total assets | | | | 3,031,993 | | 3,349,486 | |

| | | | |

| |

| |

| Stockholders' equity and liabilities | | | | | | | |

| Issued capital and reserves | | | | 967,180 | | 967,180 | |

| Accumulated deficit | | | | (127,561 | ) | (69,531 | ) |

| Cumulative other comprehensive income (loss) | | | | (50,213 | ) | 5,740 | |

| | | | |

| |

| |

| Stockholders' equity | | | | 789,406 | | 903,389 | |

| Minority interests | | | | 84,564 | | 88,138 | |

| Provisions for pensions and similar obligations | | | | 169,008 | | 166,356 | |

| Other provisions | | | | 65,297 | | 53,344 | |

| Corporate debt, less current portion | | 4 | | 1,368,374 | | 1,540,312 | |

| Deferred tax liabilities | | | | 127,147 | | 135,933 | |

| Other liabilities | | | | 28,967 | | 25,353 | |

| | | | |

| |

| |

| Non-current liabilities | | | | 1,758,793 | | 1,921,298 | |

| Other provisions | | | | 136,972 | | 159,215 | |

| Corporate debt | | 4 | | 31,845 | | 40,927 | |

| Trade accounts payable | | | | 102,560 | | 118,344 | |

| Miscellaneous liabilities | | | | 127,853 | | 118,175 | |

| Current liabilities | | | | 399,230 | | 436,661 | |

| | | | |

| |

| |

| Total stockholders' equity and liabilities | | | | 3,031,993 | | 3,349,486 | |

| | | | |

| |

| |

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

24

MESSER GRIESHEIM HOLDING AG

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(Amounts in € thousands, unless otherwise stated)

Predecessor

| |

| |

| |

| | Other comprehensive income

| |

| |

| |

|---|

| |

| |

| |

| | Cumulative

other

comprehensive

income

| |

| |

|---|

| | Subscribed

capital

| | Additional

paid-in

capital

| | Accumulated

deficit

| | Hedging

reserve

| | Translation

reserve

| | Total Stockholders' Equity

| |

|---|

| Balance as of December 31, 2000 | | 276,098 | | 158,386 | | (80,164 | ) | — | | 84,204 | | 84,204 | | 438,524 | |

| IAS 39 transition adjustment | | — | | — | | 335 | | — | | — | | — | | 335 | |

| Net loss | | — | | — | | (13,498 | ) | — | | — | | — | | (13,498 | ) |

| Translation adjustment | | — | | — | | — | | — | | 3,522 | | 3,522 | | 3,522 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Balance as of April 30, 2001 | | 276,098 | | 158,386 | | (93,327 | ) | — | | 87,726 | | 87,726 | | 428,883 | |

| | |

| |

| |

| |

| |

| |

| |

| |

Successor

| |

| |

| |

| | Other comprehensive income

| |

| |

| |

|---|

| |

| |

| |

| | Cumulative

other

comprehensive

income

| |

| |

|---|

| | Subscribed

capital

| | Additional

paid-in

capital

| | Accumulated

deficit

| | Hedging

reserve

| | Translation

reserve

| | Total Stockholders' Equity

| |