Exhibit 99.1

Public Service Enterprise Group

PSEG Earnings Conference Call

2nd Quarter 2009

July 31, 2009

Forward-Looking Statement

Readers are cautioned that statements contained in this presentation about our and our subsidiaries’ future performance, including future

revenues, earnings, strategies, prospects and all other statements that are not purely historical, are forward-looking statements for purposes of

the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Although we believe that our expectations are based on

reasonable assumptions, we can give no assurance they will be achieved. The results or events predicted in these statements may differ

materially from actual results or events. Factors which could cause results or events to differ from current expectations include, but are not

limited to:

Adverse changes in energy industry, law, policies and regulation, including market structures and rules, and reliability standards.

Any inability of our energy transmission and distribution businesses to obtain adequate and timely rate relief and regulatory approvals from

federal and state regulators.

Changes in federal and state environmental regulations that could increase our costs or limit operations of our generating units.

Changes in nuclear regulation and/or developments in the nuclear power industry generally, that could limit operations of our nuclear generating

units.

Actions or activities at one of our nuclear units that might adversely affect our ability to continue to operate that unit or other units at the same

site.

Any inability to balance our energy obligations, available supply and trading risks.

Any deterioration in our credit quality.

Availability of capital and credit at reasonable pricing terms and our ability to meet cash needs.

Any inability to realize anticipated tax benefits or retain tax credits.

Increases in the cost of or interruption in the supply of fuel and other commodities necessary to the operation of our generating units.

Delays or cost escalations in our construction and development activities.

Adverse investment performance of our decommissioning and defined benefit plan trust funds, and changes in discount rates and funding

requirements.

Changes in technology and increased customer conservation.

For further information, please refer to our Annual Report on Form 10-K, including Item 1A. Risk Factors, and subsequent reports on Form 10-Q

and Form 8-K filed with the Securities and Exchange Commission. These documents address in further detail our business, industry issues and

other factors that could cause actual results to differ materially from those indicated in this presentation. In addition, any forward-looking

statements included herein represent our estimates only as of today and should not be relied upon as representing our estimates as of any

subsequent date. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so,

even if our internal estimates change, unless otherwise required by applicable securities laws.

1

GAAP Disclaimer

PSEG presents Operating Earnings in addition to its Net Income reported

in accordance with accounting principles generally accepted in the United

States (GAAP). Operating Earnings is a non-GAAP financial measure that

differs from Net Income because it excludes gains or losses associated

with Nuclear Decommissioning Trust (NDT) and Mark-to-Market (MTM)

accounting, the impact of the sale of certain non-core domestic and

international assets and material impairments and lease-transaction-

related charges. PSEG presents Operating Earnings because

management believes that it is appropriate for investors to consider

results excluding these items in addition to the results reported in

accordance with GAAP. PSEG believes that the non-GAAP financial

measure of Operating Earnings provides a consistent and comparable

measure of performance of its businesses to help shareholders

understand performance trends. This information is not intended to be

viewed as an alternative to GAAP information. The last slide in this

presentation includes a list of items excluded from Income from

Continuing Operations to reconcile to Operating Earnings, with a

reference to that slide included on each of the slides where the non-GAAP

information appears.

2

PSEG

2009 Q2 Review

Ralph Izzo

Chairman, President and Chief Executive Officer

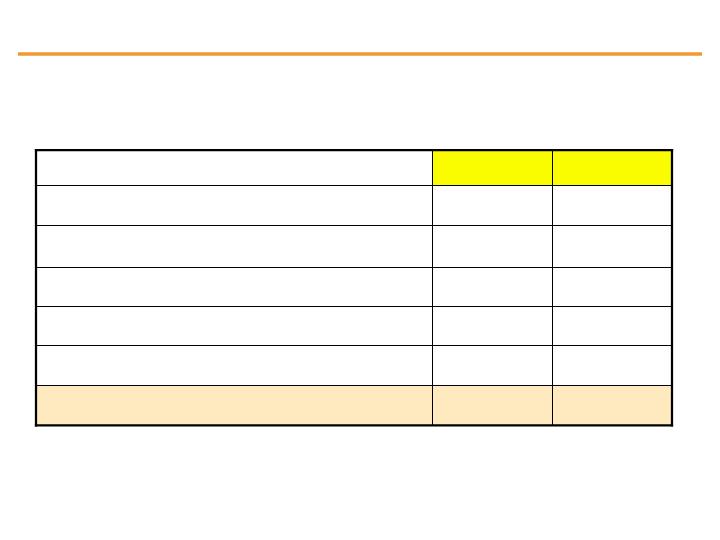

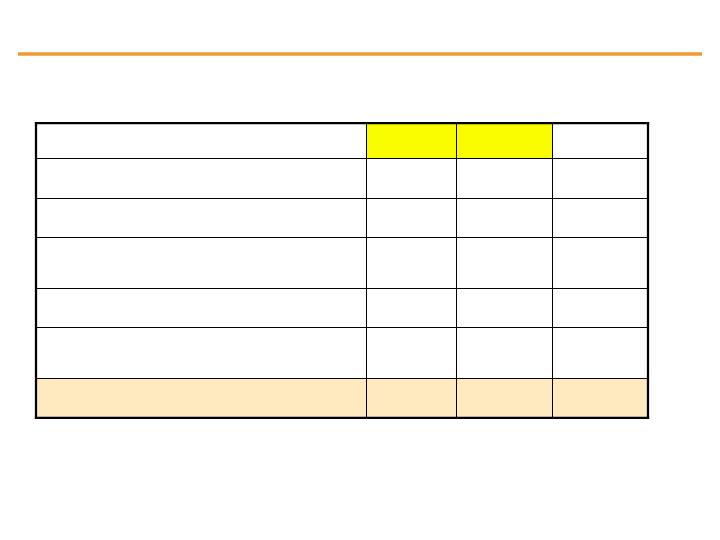

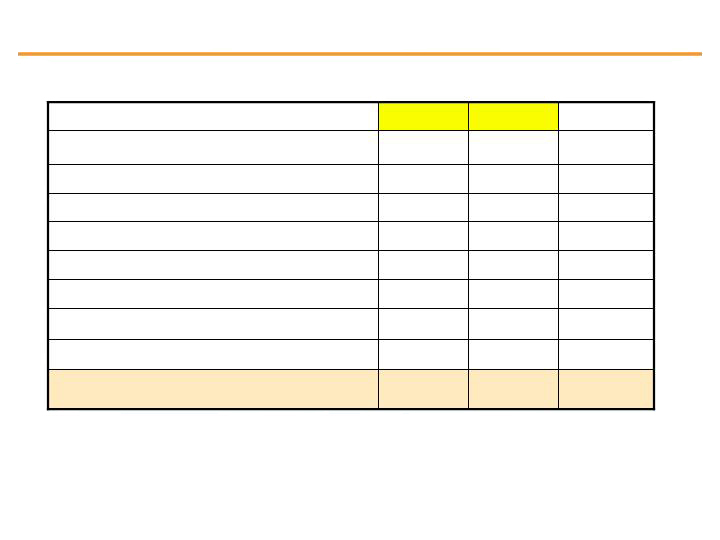

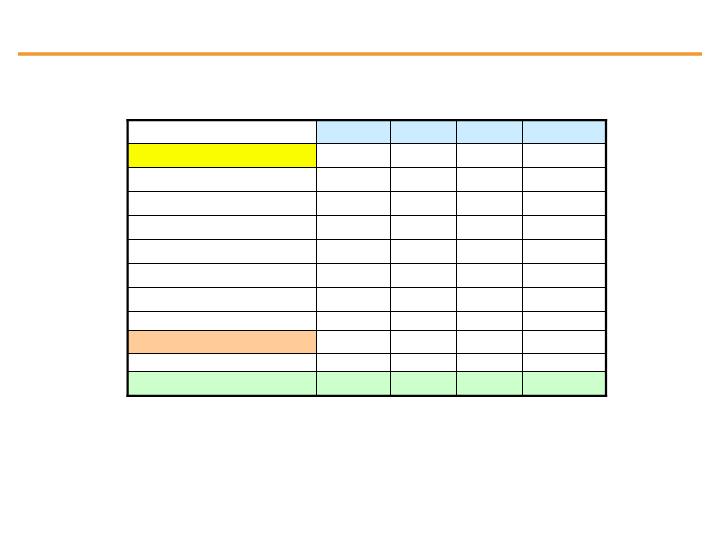

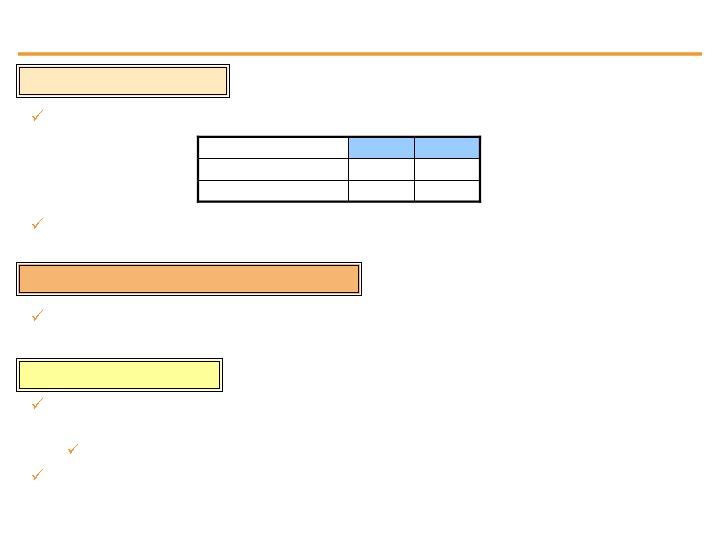

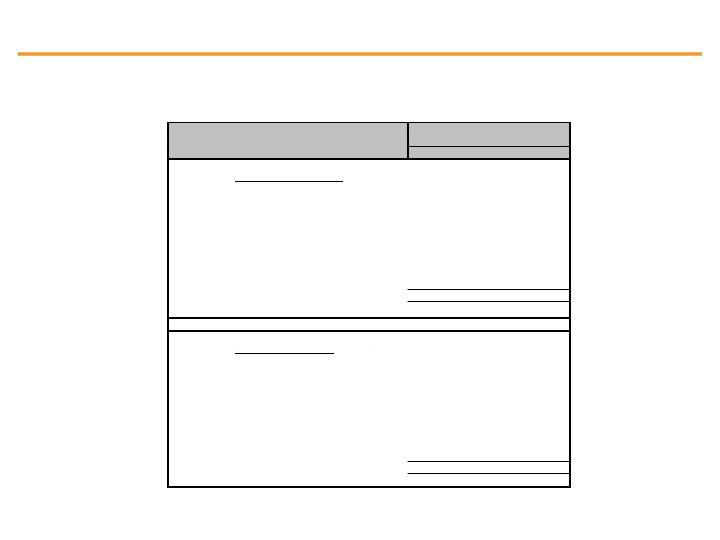

Q2 2009 Earnings Summary

16

-

Discontinued Operations, Net of Tax

$ 0.61

$ 0.63

EPS from Operating Earnings*

(150)

311

Net Income (Loss)

(166)

311

Income (Loss) from Continuing Operations

(479)

(7)

Reconciling Items, Net of Tax

$ 313

$ 318

Operating Earnings

2008

2009

$ millions (except EPS)

Quarter ended June 30,

* See page 33 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings.

4

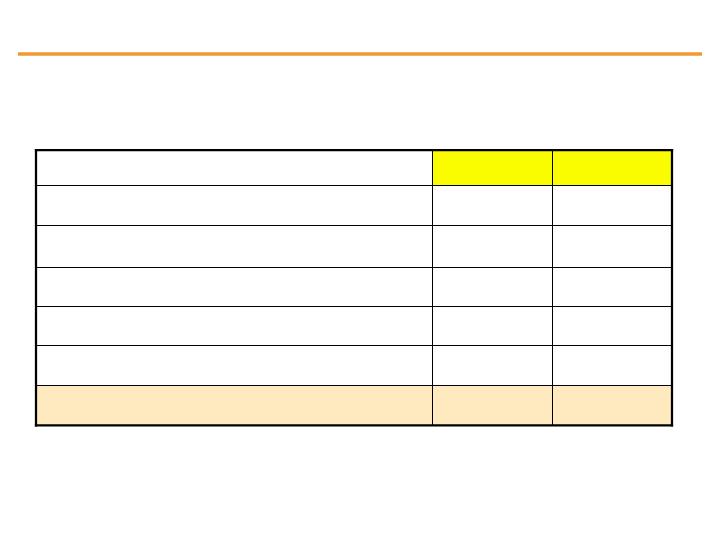

YTD Earnings Summary

29

-

Discontinued Operations, Net of Tax

$ 1.47

$ 1.58

EPS from Operating Earnings*

298

755

Net Income

269

755

Income from Continuing Operations

(482)

(45)

Reconciling Items, Net of Tax

$ 751

$ 800

Operating Earnings

2008

2009

$ millions (except EPS)

Six months ended June 30,

* See page 33 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings.

5

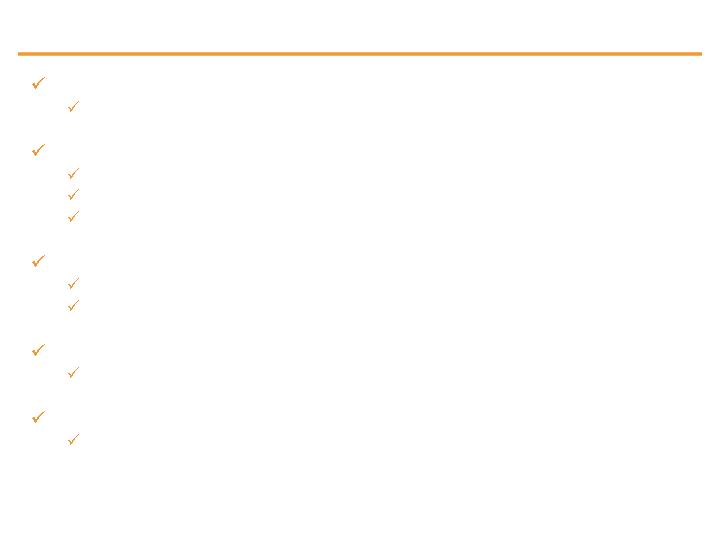

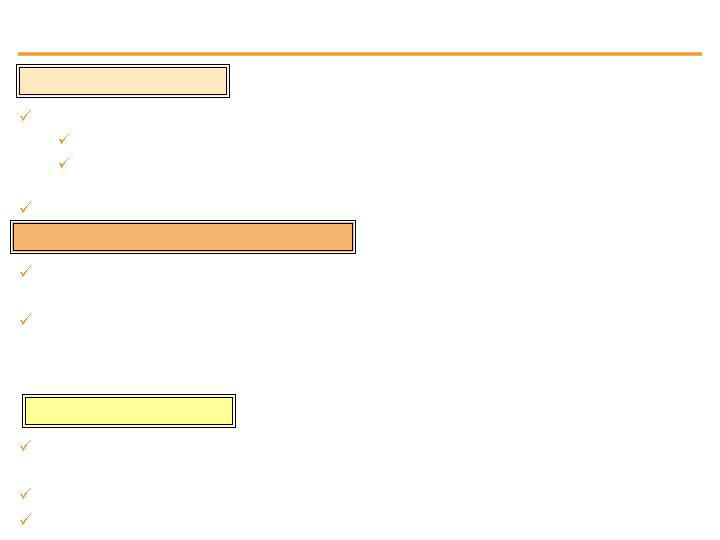

PSEG – Q2 2009: Securing long-term objectives

Q2 2009 results in line with expectations

Demonstrates strength and flexibility of asset base

Regulatory approvals for major PSE&G initiatives

Advances State’s clean energy agenda

Supports job creation

Maintains financial health and stability

Lease terminations

Improves net cash position

Economic decision that improves risk profile

Markets remain challenging

2nd coolest June on record since 1970

2009 earnings guidance of $3.00 - $3.25 remains unchanged

Upper-end of earnings guidance challenged

6

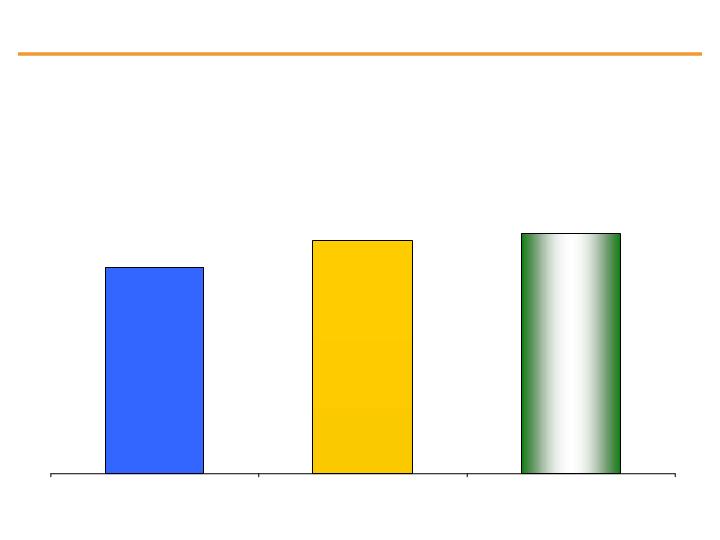

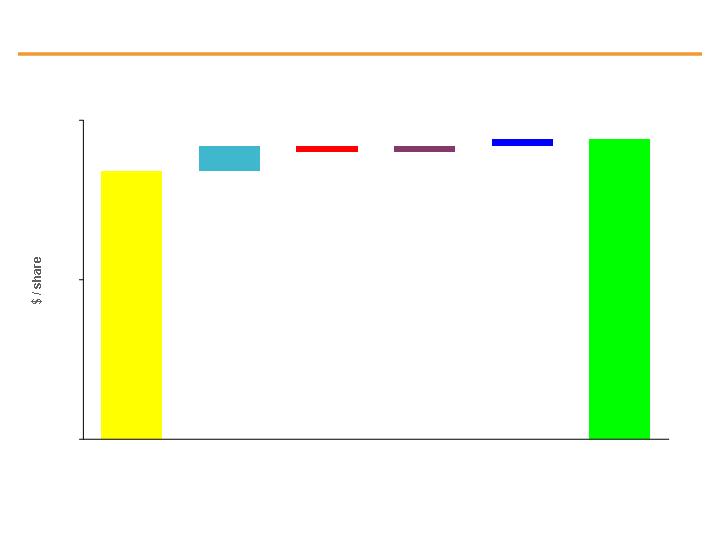

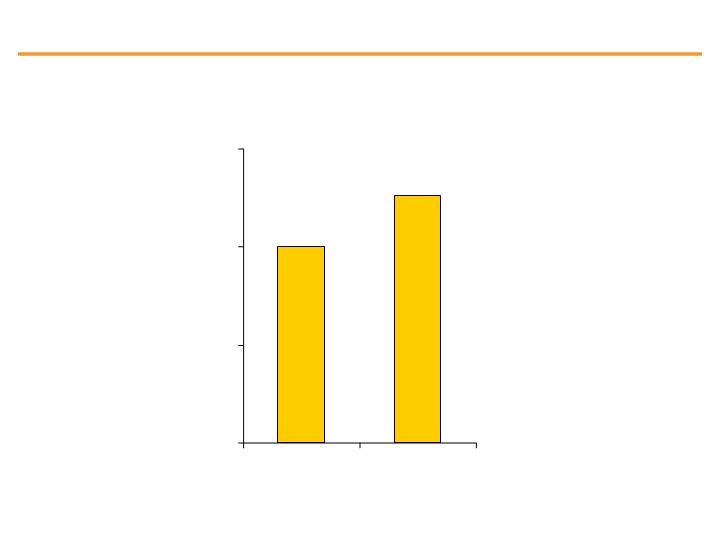

$2.68

$3.00 - $3.25

PSEG Earnings

$3.03

* See page 34 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings.

2007 Operating Earnings*

2008 Operating Earnings*

2009 Guidance

7

PSEG – Meeting Challenges

Greenhouse gas reduction goals exceeded

Focused on maintaining strong operations; lower expenses

Investing in areas with good risk-adjusted returns

Reducing financial risk

Common stock dividend provides above average returns

8

PSEG

2009 Q2 Operating Company Review

Caroline Dorsa

Executive Vice President and Chief Financial Officer

Q2 Operating Earnings by Subsidiary

$ 313

(4)

50

51

$ 216

2008

$ 318

1

36

43

$ 238

2009

Operating Earnings

Earnings per Share

(0.01)

-

Enterprise

$ 0.61

$ 0.63

Operating Earnings*

0.10

0.07

PSEG Energy Holdings

0.10

0.09

PSE&G

$ 0.42

$ 0.47

PSEG Power

2008

2009

$ millions (except EPS)

Quarter ended June 30,

* See page 33 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings.

10

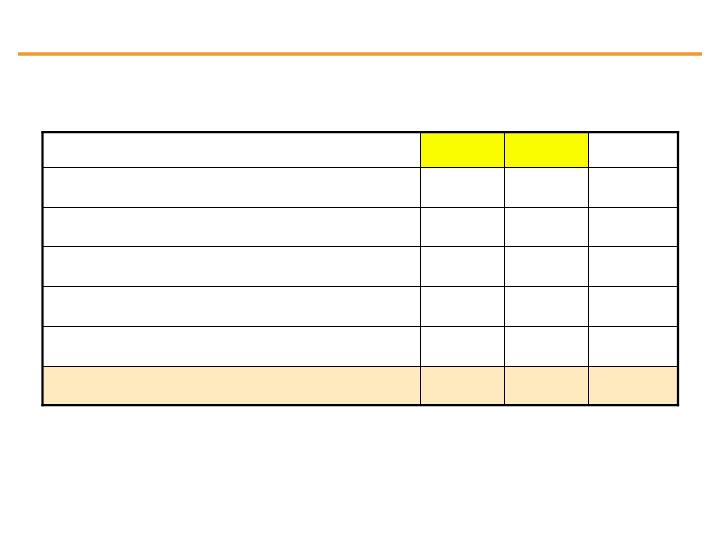

YTD Operating Earnings by Subsidiary

$ 751

(9)

78

187

$ 495

2008

$ 800

(3)

40

166

$ 597

2009

Operating Earnings

Earnings per Share

(0.02)

(0.01)

Enterprise

$ 1.47

$ 1.58

Operating Earnings*

0.15

0.08

PSEG Energy Holdings

0.37

0.33

PSE&G

$ 0.97

$ 1.18

PSEG Power

2008

2009

$ millions (except EPS)

Six months ended June 30,

* See page 33 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings.

11

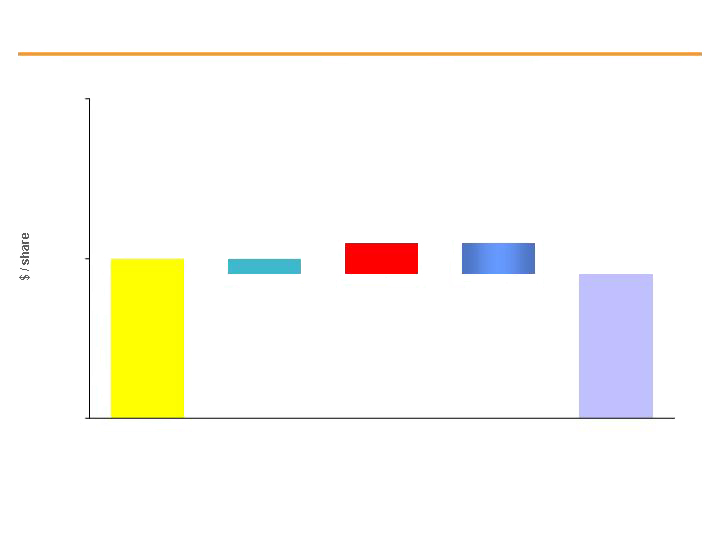

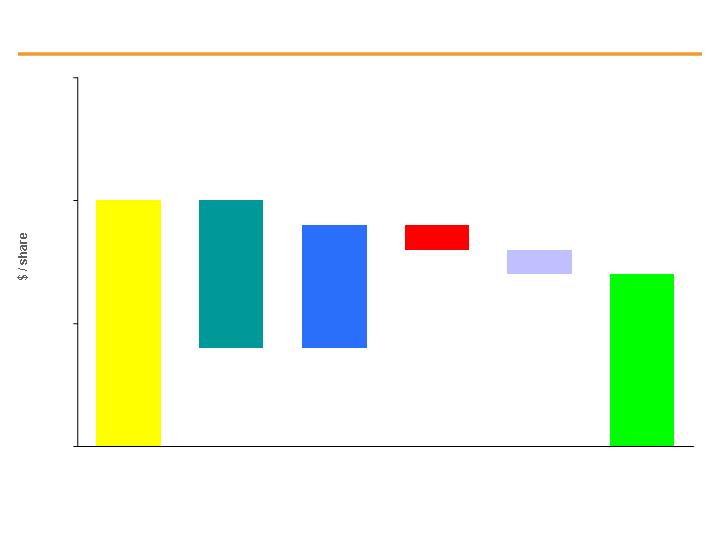

PSEG EPS Reconciliation – Q2 2009 versus Q2 2008

Q2 2009

operating

earnings*

Q2 2008

operating

earnings*

Recontracting

and Lower Fuel

Expense .04

BGSS (.01)

O&M .01

Depreciation,

Interest and Other

.01

PSEG

Power

Weather (.01)

Transmission

Margin .01

Gas Margin .01

Depreciation

and O&M (.02)

PSE&G

PSEG Energy

Holdings

Texas Generation

Facilities (.06)

2009 Lease Sales

.05

Lease Income (.01)

Effective Tax Rate

and Other (.01)

* See page 33 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings.

Enterprise

Interest

$.61

.05

(.01)

(.03)

.01

$.63

0.00

0.25

0.50

0.75

12

PSEG Power

2009 Q2 Review

PSEG Power – Q2 2009 EPS Summary

(25)

27

2

Mark-to-Market, Net of Tax

20

(3)

17

NDT Funds Related Activity,

Net of Tax

($ 322)

$ 1,623

$ 1,301

Operating Revenues

$ 0.05

$ 0.42

$ 0.47

EPS from Operating Earnings*

17

240

257

Income from Continuing Operations/

Net Income

22

216

238

Operating Earnings

Variance

Q2 2008

Q2 2009

$ millions (except EPS)

* See page 33 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings.

14

Recontracting

and Lower Fuel

Expense

PSEG Power EPS Reconciliation – Q2 2009 versus Q2 2008

Q2 2009

operating

earnings*

Q2 2008

operating

earnings*

BGSS

O&M

* See page 33 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings.

Depreciation,

Interest and

Other

$.47

.01

.01

(.01)

.04

$.42

0.00

0.25

0.50

15

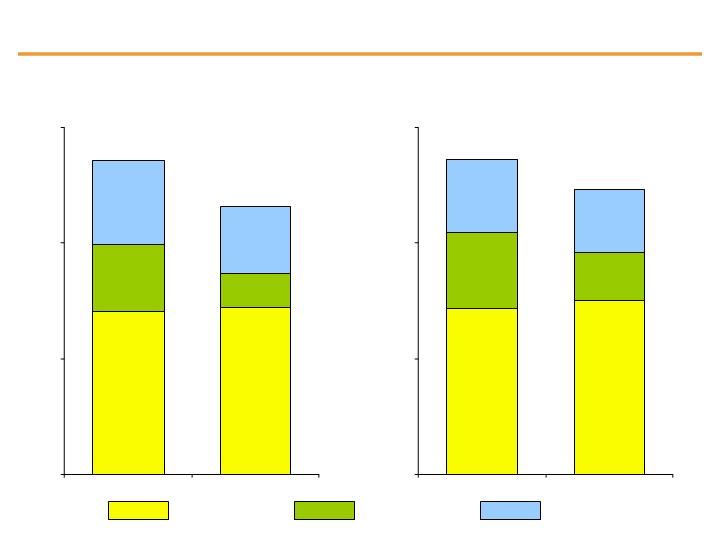

PSEG Power – Generation Measures

Quarter ended June 30,

Total Nuclear

Total Coal*

Total Oil &

Natural Gas

* Includes figures for Pumped Storage

PSEG Power – Generation (GWh)

13,569

11,553

Six months ended June 30,

27,268

24,673

7,032

7,196

2,889

1,470

3,648

2,887

0

5,000

10,000

15,000

2008

2009

14,296

15,014

6,546

4,149

6,426

5,510

0

10,000

20,000

30,000

2008

2009

16

PSEG Power – Fuel Costs

117

379

Oil & Gas

47

86

Coal

$17.20

$36.50

$ / MWh

11,600

13,600

Total Generation

(GWh)

199

496

Total Fuel Cost

35

31

Nuclear

Total Fossil

($ millions)

164

465

2009

2008

Quarter ended June 30,

PSEG Power – Fuel Costs

291

621

Oil & Gas

141

201

Coal

$20.40

$32.40

$ / MWh

24,700

27,300

Total Generation

(GWh)

503

884

Total Fuel Cost

71

62

Nuclear

Total Fossil

($ millions)

432

822

2009

2008

Six months ended June 30,

17

Market forces supported margins in Q2 2009…

PSEG Power Gross Margin ($/MWh)

$50

$63

Quarter ended June 30

… and will support stronger than forecast improvement for full-year.

$0

$25

$50

$75

2008

2009

18

PSEG Power – Q2 Operating Highlights

15% decline in total output is a reflection of market conditions.

Weighted average combined cycle capacity factor of 40.5% vs 48.2% in Q2 2008.

Weighted average coal capacity factor of 29.0% vs 56.0% in Q2 2008.

Nuclear fleet capacity factor of 89.1%.

Low cost nuclear fleet met 62% of load requirements in the quarter.

Operations

Regulatory and Market Environment

Financial

Power markets affected by abnormally cool weather, contraction in economic

growth and excess supply of gas.

PSEG Power bid for 178MW of new peaking capacity accepted by PJM in 2012-

2013 RPM capacity auction at $185MW/day.

Power entered into a new $350 million credit facility that expires July 2011.

This facility replaces two expired credit facilities and one termination.

19

PSE&G

2009 Q2 Review

PSE&G – Q2 2009 Earnings Summary

(206)

1,699

1,493

Total Operating Expenses

(1)

27

26

Taxes Other than Income Taxes

Operating Expenses

(234)

1,213

979

Energy Costs

24

320

344

Operation & Maintenance

5

139

144

Depreciation & Amortization

($ 0.01)

$ 0.10

$ 0.09

EPS from Operating Earnings*

(8)

51

43

Operating Earnings / Net Income

($ 215)

$ 1,858

$ 1,643

Operating Revenues

Variance

Q2 2008

Q2 2009

$ millions (except EPS)

* See page 33 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings.

21

PSE&G EPS Reconciliation – Q2 2009 versus Q2 2008

Q2 2009

operating

earnings*

Q2 2008

operating

earnings*

Weather -

Electric

Depreciation and

O&M

* See page 33 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings.

Margin:

Transmission .01

Gas .01

$.10

(.01)

.02

(.02)

$.09

0.00

0.10

0.20

22

PSE&G’s Margins are affected by Residential Sales and C&I

Demand and Customer charges.

Electric

Gas

2009 Forecast

Total electric sales expected to decline by 1.5% – 2.0% vs. 2008.

Residential electric sales are expected to be flat versus last year.

Gas sales, on a weather normalized basis, are forecasted to

decline ~ 0.5%.

Residential

Service

Charge, 5%

C&I Non-

Volume

Customer

and Demand

Charges, 45%

Street

Lighting, 10%

Residential

Sales, 40%

C&I Non-

Volume

Customer

and Demand

Charges, 15%

Residential

Sales, 60%

Residential

Service

Charge, 15%

C&I Sales,

10%

23

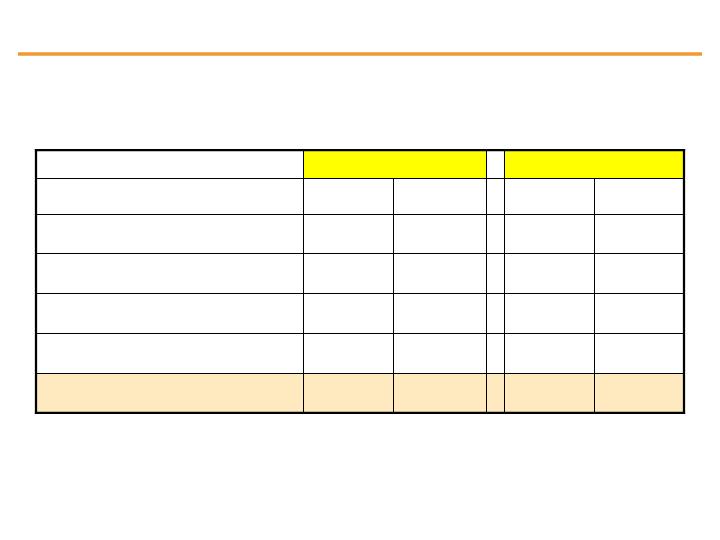

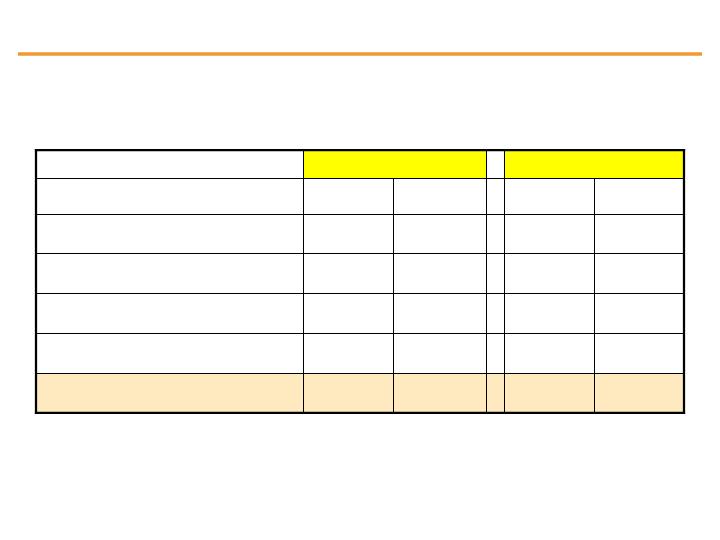

PSE&G: Capital spending

Capital Spending Update

418

183

228

7

Solar 4 All

$4,470

$1,521

$1,901

$1,048

Revised Capital Spending

$3,190

$1,237

$1,111

$842

2008 10-K Projections

$1,280

$284

$790

$206

TOTAL

166

52

106

8

Energy Efficiency

5

44

2011

274

177

92

Gas

422

279

99

Electric

NJ Stimulus

TOTAL

2010

2009

24

PSE&G – Q2 Operating Highlights

PSE&G received BPU approval of proposals on energy efficiency ($166M) and

Solar 4 All ($515M).

PSE&G filed for an increase in electric ($134M) and gas ($97M) revenues on May

29, 2009; request based on 2009 test year and supports 11.5% ROE and 51%

equity ratio.

2009-2011 capital expenditures increased by $1.3 billion for new capital

programs.

Some deterioration in aging of accounts receivable; reserve levels adequate.

Average return on equity for 12 months ended June 30, 2009 of 9.2%.

Operations

Regulatory and Market Environment

Financial

Electric sales affected by abnormally cool weather.

June 2009 is 2nd coldest on record since 1970.

Maintaining forecast for weather adjusted decline in electric sales of 1.5% – 2.0% for full-

year.

Controllable O&M expenses down slightly from year ago levels.

25

PSEG Energy Holdings

2009 Q2 Review

PSEG Energy Holdings – Q2 2009 Earnings Summary

490

(490)

--

Lease Transaction Reserves

(16)

16

--

Discontinued Operations, Net of Tax

(13)

(13)

(26)

Mark-to-Market, Net of Tax

($0.03)

$ 0.10

$ 0.07

EPS from Operating Earnings*

($ 447)

($ 437)

$ 10

Net Income (Loss)

($ 14)

$ 50

$ 36

Operating Earnings

Variance

Q2 2008

Q2 2009

$ millions (except EPS)

* See page 33 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings.

27

PSEG Energy Holdings EPS Reconciliation – Q2 2009 versus

Q2 2008

Q2 2009

operating

earnings*

Q2 2008

operating

earnings*

Texas Generation

Facilities

2009 Lease

Sales

Lease

Income

* See page 33 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings.

Effective Tax Rate

and Other

.07

(.01)

(.01)

.05

(.06)

$.10

0.00

0.05

0.10

0.15

28

PSEG Energy Holdings – Q2 Operating Highlights

Texas market hurt by decline in demand and availability of wind resources.

Reached agreement on termination of five cross-border leveraged leases in 2Q

2009.

Terminated eight of these types of leases since December 2008 for a total for $450M.

Cross-border leveraged lease tax liability reduced by $350M; increased reserve

on deposit with IRS by $140M to $320M.

Operations

Regulatory and Market Environment

Financial

Texas – 2,000 MW gas-fired combined cycle capacity.

$16.99

1,937

Q2 2009

$41.21

2,157

Q2 2008

Gross Margin ($/MWh)

Production (GWh)

Lower margin a reflection of decline in energy prices.

29

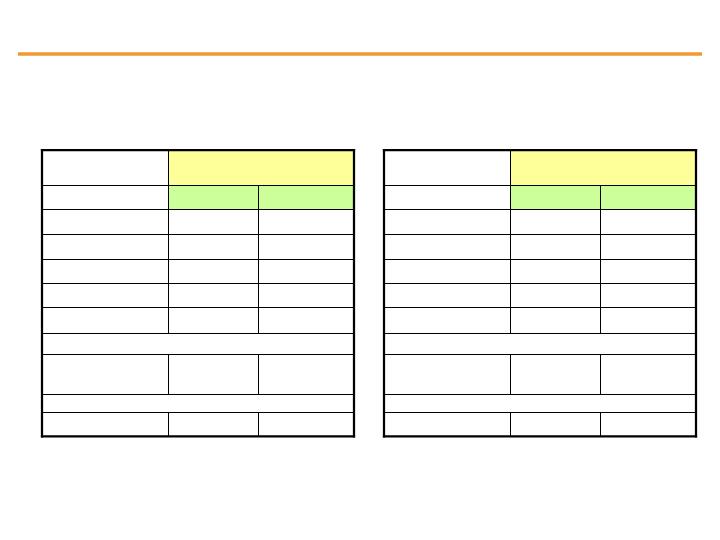

PSEG

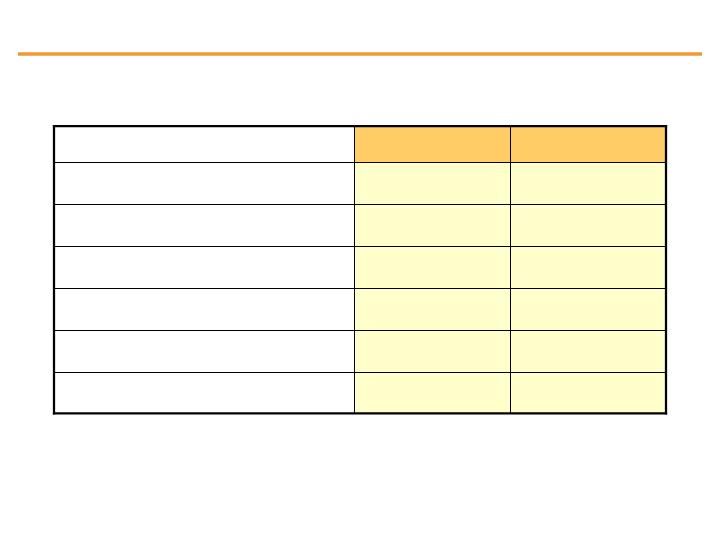

2009 Operating Earnings Guidance

$ 3.03

$ 1,542

($ 24)

$ 99

$ 360

$ 1,107

2008A*

$ 3.00 – $ 3.25

$ 1,520 – $ 1,640

($ 5)

$ 40 – $ 65

$ 315 – $ 335

$ 1,170 – $ 1,245

2009E

Enterprise

Earnings per Share

Operating Earnings

PSEG Energy Holdings

PSE&G

PSEG Power

$ millions (except EPS)

* See page 34 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings.

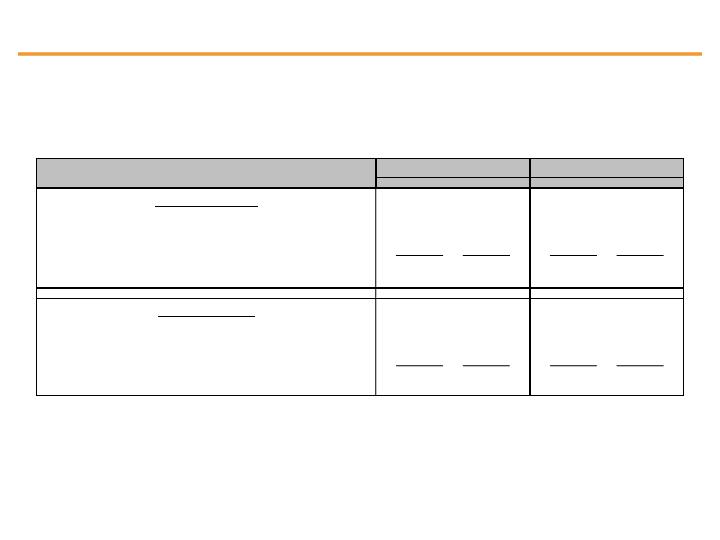

31

Expiration

Total

Primary

Usage at

Available

Company

Facility

Date

Facility

Purpose

7/24/2009

7/24/2009

PSEG

5-year Credit Facility

Dec-12

$1,000

1

CP Support/Funding/LCs

$16

$984

Uncommitted Bilateral

Agreement

N/A

N/A

Funding

0

N/A

Power

5-Year Credit Facility

Dec-12

1,600

3

Funding/LCs

187

1,413

2-Year Credit Facility

Jul-11

350

Funding

0

350

Bilateral Credit Facility

Sep-09

150

Funding/LCs

0

150

Bilateral Credit Facility

Sep-09

50

Funding

0

50

Bilateral Credit Facility

Mar-10

100

Funding/LCs

44

56

PSE&G

5-year Credit Facility

Jun-12

600

2

CP Support/Funding/LCs

373

227

Uncommitted Bilateral

N/A

N/A

Funding

0

N/A

Total

$3,850

$3,230

1

PSEG Facility reduces by $47 million in 12/2011

2

PSE&G Facility reduces by $28 million in 12/2011

3

Power Facility reduces by $75 million in 12/2011

PSEG Liquidity as of July 24, 2009

32

Items Excluded from Income from Continuing Operations to

Reconcile to Operating Earnings

Please see Page 2 for an explanation of PSEG’s use of Operating Earnings as a non-GAAP financial measure and how

it differs from Net Income.

Pro-forma Adjustments, net of tax

2009

2008

2009

2008

Earnings Impact ($ Millions)

Gain (Loss) on Nuclear Decommissioning Trust (NDT) Fund Related Activity

17

$

(3)

$

(6)

$

(10)

$

Gain (Loss) on Mark-to-Market (MTM)

(24)

14

(39)

19

Lease Reserves

-

(490)

-

(490)

Premium on Bond Redemption

-

-

-

(1)

Total Pro-forma adjustments

(7)

$

(479)

$

(45)

$

(482)

$

Fully Diluted Average Shares Outstanding (in Millions)

507

509

507

509

Per Share Impact (Diluted)

Gain (Loss) on Nuclear Decommissioning Trust (NDT) Fund Related Activity

0.03

$

-

$

(0.01)

$

(0.02)

$

Gain (Loss) on Mark-to-Market (MTM)

(0.05)

0.03

(0.08)

0.04

Lease Reserves

-

(0.96)

-

(0.96)

Premium on Bond Redemption

-

-

-

-

Total Pro-forma adjustments

(0.02)

$

(0.93)

$

(0.09)

$

(0.94)

$

For the Quarters Ended

For the Six Months Ended

June 30,

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Reconciling Items Excluded from Continuing Operations to Compute Operating Earnings

(Unaudited)

June 30,

33

Please see Page 2 for an explanation of PSEG’s use of Operating Earnings as a non-GAAP financial measure

and how it differs from Net Income.

Items Excluded from Income from Continuing Operations to

Reconcile to Operating Earnings

Pro-forma Adjustments, net of tax

2008

2007

Earnings Impact (in Millions)

Impairment of PPN

(9)

$

(2)

$

Impairment of Turboven

(4)

(7)

Loss on Sale of Chilquinta and Luz del Sur

-

(23)

Nuclear Decommissioning Trust (NDT) Fund Related Activity

(71)

12

Mark-to-Market (MTM)

16

10

Premium on Bond Redemption

(1)

(28)

Lease Reserves

(490)

-

Total Pro-forma to Operating Earnings

(559)

$

(38)

$

Fully Diluted Average Shares Outstanding (in Millions)

508

509

Per Share Impact (Diluted)

Impairment of PPN

(0.02)

$

-

$

Impairment of Turboven

(0.01)

(0.01)

Loss on Sale of Chilquinta and Luz del Sur

-

(0.05)

Nuclear Decommissioning Trust (NDT) Fund Related Activity

(0.14)

0.02

Mark-to-Market (MTM)

0.03

0.02

Premium on Bond Redemption

-

(0.06)

Lease Reserves

(0.96)

-

Total Pro-forma to Operating Earnings

(1.10)

$

(0.08)

$

December 31,

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Reconciling Items Excluded from Continuing Operations to Compute Operating Earnings

(Unaudited)

For the Twelve Months Ended

34