PSEG Public Service Enterprise Group 2010 AGA Financial Forum Palm Beach, Florida May 17-19, 2010 Exhibit 99 |

2 Forward-Looking Statement Readers are cautioned that statements contained in this presentation about our and our subsidiaries' future performance, including future revenues, earnings, strategies, prospects and all other statements that are not purely historical, are forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance they will be achieved. The results or events predicted in these statements may differ materially from actual results or events. Factors which could cause results or events to differ from current expectations include, but are not limited to: • Adverse changes in energy industry, law, policies and regulation, including market structures and rules, and reliability standards. • Any inability of our transmission and distribution businesses to obtain adequate and timely rate relief and regulatory approvals from federal and state regulators. • Changes in federal and state environmental regulations that could increase our costs or limit operations of our generating units. • Changes in nuclear regulation and/or developments in the nuclear power industry generally, that could limit operations of our nuclear generating units. • Actions or activities at one of our nuclear units located on a multi-unit site that might adversely affect our ability to continue to operate that unit or other units at the same site. • Any inability to balance our energy obligations, available supply and trading risks. • Any deterioration in our credit quality. • Availability of capital and credit at commercially reasonable terms and our ability to meet cash needs. • Any inability to realize anticipated tax benefits or retain tax credits. • Changes in the cost of or interruption in the supply of fuel and other commodities necessary to the operation of our generating units. • Delays or unforeseen cost escalations in our construction and development activities. • Increase in competition in energy markets in which we compete. • Adverse performance of our decommissioning and defined benefit plan trust fund investments, and changes in discount rates and funding requirements. • Changes in technology and increased customer conservation. For further information, please refer to our Annual Report on Form 10-K, including Item 1A. Risk Factors, and subsequent reports on Form 10-Q and Form 8-K filed with the Securities and Exchange Commission. These documents address in further detail our business, industry issues and other factors that could cause actual results to differ materially from those indicated in this presentation. In addition, any forward-looking statements included herein represent our estimates only as of today and should not be relied upon as representing our estimates as of any subsequent date. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if our internal estimates change, unless otherwise required by applicable securities laws. |

3 GAAP Disclaimer PSEG presents Operating Earnings in addition to its Net Income reported in accordance with accounting principles generally accepted in the United States (GAAP). Operating Earnings is a non-GAAP financial measure that differs from Net Income because it excludes the impact of the sale of certain non-core domestic and international assets and material impairments and lease-transaction-related charges. PSEG presents Operating Earnings because management believes that it is appropriate for investors to consider results excluding these items in addition to the results reported in accordance with GAAP. PSEG believes that the non-GAAP financial measure of Operating Earnings provides a consistent and comparable measure of performance of its businesses to help shareholders understand performance trends. This information is not intended to be viewed as an alternative to GAAP information. The last two slides in this presentation include a list of items excluded from Net Income to reconcile to Operating Earnings, with a reference to that slide included on each of the slides where the non-GAAP information appears. |

PSEG – Defining the Future Caroline Dorsa Executive Vice President and Chief Financial Officer |

5 PSEG: the right mix for the opportunities of today and tomorrow PSE&G positioned to meet NJ’s energy policy and economic growth objectives with $5.3 billion investment program. Electric & Gas Delivery and Transmission PSEG Power’s low-cost baseload nuclear and coal fleet is geographically well positioned and environmentally responsible. Regional Wholesale Energy PSEG Energy Holdings positioned to pursue attractive renewable generation opportunities: • Solar • Offshore wind • Compressed Air Energy Storage (CAES) Renewable Investments |

6 A successful track record… … provides the confidence to capitalize on the opportunities of tomorrow. PSEG Power resumed independent control of nuclear fleet, produced record levels of generation and achieved top quartile performance; fossil fleet retrofitted to meet more stringent environmental requirements. PSE&G consistently recognized for reliability; investment programs expanded to meet NJ’s goals for economic growth and clean energy. Business focus improved; balance sheet strengthened; Holdings’ financial risk lessened with sale of international investments, termination of offshore leases Operational and financial focus has allowed PSEG to meet/exceed earnings objectives in each of the past three years. History of returning cash to shareholders through common dividend. 2007 2008 2009 |

7 Earnings growth achieved… … through higher energy market pricing, increased production and lower costs. $2.68 $3.03 $3.12 2007 Operating Earnings* 2008 Operating Earnings* 2009 Operating Earnings* * See page 64 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings. |

8 Tomorrow’s energy market will reward… …an operationally efficient, environmentally responsible, integrated generation, transmission and distribution business. Higher margins driven by environmentally responsible & operationally flexible energy supply Superior operations = customer satisfaction + higher value Business driven by the need to address environmental issues and stable pricing Infrastructure investment to support reliability + improve performance |

9 Investment programs, hedge profile and cost control support 2010 outlook $3.12 $3.00 - $3.25 2009 Operating Earnings* 2010 Guidance * See page 64 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings. Reaffirming 2010 guidance of $3.00 – $3.25. |

10 $0.84 0.01 (0.01) (0.01) (0.10) $0.95 0.00 0.25 0.50 0.75 1.00 PSEG EPS Reconciliation – Q1 2010 versus Q1 2009 Q1 2010 operating earnings* Q1 2009 operating earnings* Interest Higher volume offset by lower prices (0.05) BGSS and trading (0.04) O&M (0.02) Increase in effective tax rate related to new healthcare legislation (0.02) Depreciation, interest and other 0.03 PSEG Power Weather (0.02) O&M (0.02) Electric margin 0.01 Transmission margin 0.01 Other 0.01 PSE&G PSEG Energy Holdings Enterprise Lower project earnings and lower gains on lease sales * See page 65 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings. |

11 PSE&G is the largest utility in New Jersey providing electric, gas and transmission services,… …and delivering renewable and energy efficiency solutions for customers. * Actual ** Weather normalized = estimated annual growth per year over forecast period *** Lifetime GWh + Lifetime Dtherms converted to GWh 60% 31% Residential 36% 58% Commercial 0.4%** 0.4% - 1.3%** Projected Annual Load Growth (2009 – 2012) Sales Mix 3,500 M Therms 41,961 GWh Electric Sales and Gas Sold and Transported (0.4%)* (0.6%)* Historical Annual Load Growth (2005 - 2009) 4% 11% Industrial 1.7 Million 3.2% Gas 2.1 Million 3.0% Customers Growth (2004 – 2009) Electric 0.5%* Historical Annual Peak Load Growth 2005-2009 1,442 Network Circuit Miles Key Statistics Transmission 2.1%** Projected PJM Peak Load Growth 2009-2012 13,512 GWh 230 GWh Energy Efficiency Initiative (lifetime equivalent)*** 80 MW 1 MW Solar 4 All 11.6 MW 2009 Renewables and Energy Efficiency Solar Loan 81 MW Total |

12 PSE&G’s investment program provides opportunity for 14% annualized growth in rate base PSE&G Rate Base 0 2,000 4,000 6,000 8,000 10,000 12,000 2009 2010 2011 2012 Gas Distribution Electric Distribution Electric Transmission EMP |

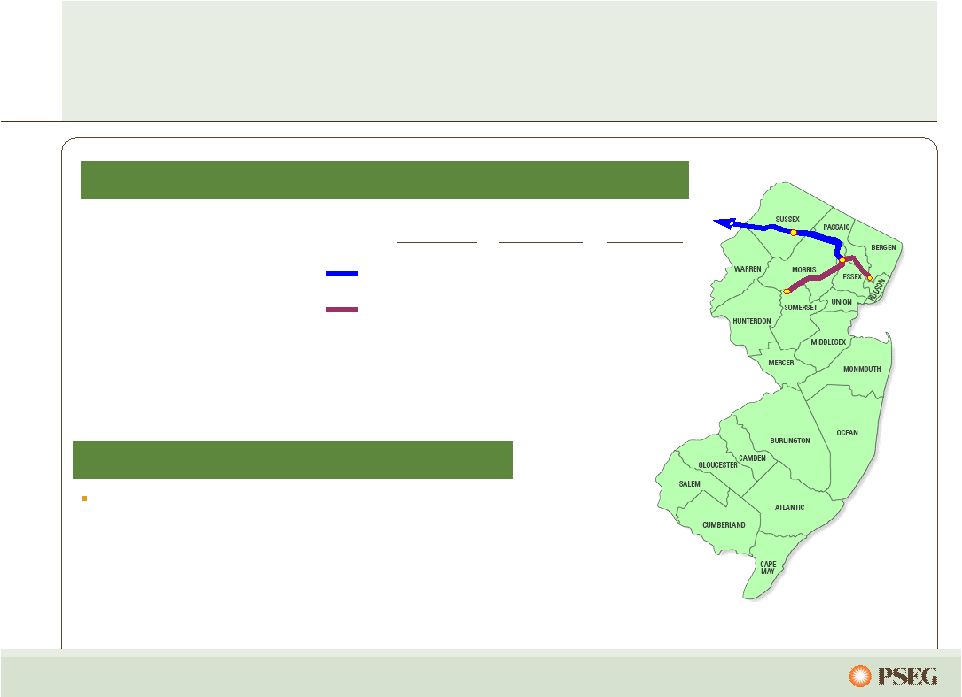

13 Projects to NY Neptune HVDC project (685 MW) Sayreville to Long Island Linden VFT project (330 MW) Linden to Staten Island Bergen O66 project (670 MW*) Bergen to ConEd's West 49th St Bergen U2-100 project (800 MW**) connecting Bergen to NY Projects to NJ PSE&G’s evaluation of the proposed backbone Transmission projects: Susquehanna - Roseland Branchburg- Roseland-Hudson As a result NJ will need new generation, DSM or additional transmission imports. Total Import Capability ~ 2,000 MW Total Export Capability ~ 2,500 MW 2010-2020 NJ Summer Peak Growth Rate = 1.6% Sources: Imports: PSE&G Estimates; Exports: PJM 2009 RTEP; Load Growth: PJM 2010 Load Forecast Report NJ’s load is expected to grow 3,450MW by 2020, with net imports decreasing ~500MW. * Project has firm contract for 320MW ** Project in queue – no firm contracts |

14 Low-cost portfolio Regional focus in competitive, liquid markets Assets favorably located near customers/load centers Many units east of PJM constraints Southern NEPOOL/ Connecticut Texas assets – low cost combined cycle Market knowledge and experience to maximize the value of our assets … with low cost plants, in good locations, within solid markets. Power’s assets drive value in a dynamic environment… 15% 52% 8% Fuel Diversity Coal Gas Oil Nuclear Pumped Storage 1% Energy Produced (Twelve months ended December 31, 2009) Total GWh: 59,808 51% 15% 34% Pumped Storage & Oil <1% Nuclear Coal Gas Total MW: 15,548 24% 8% |

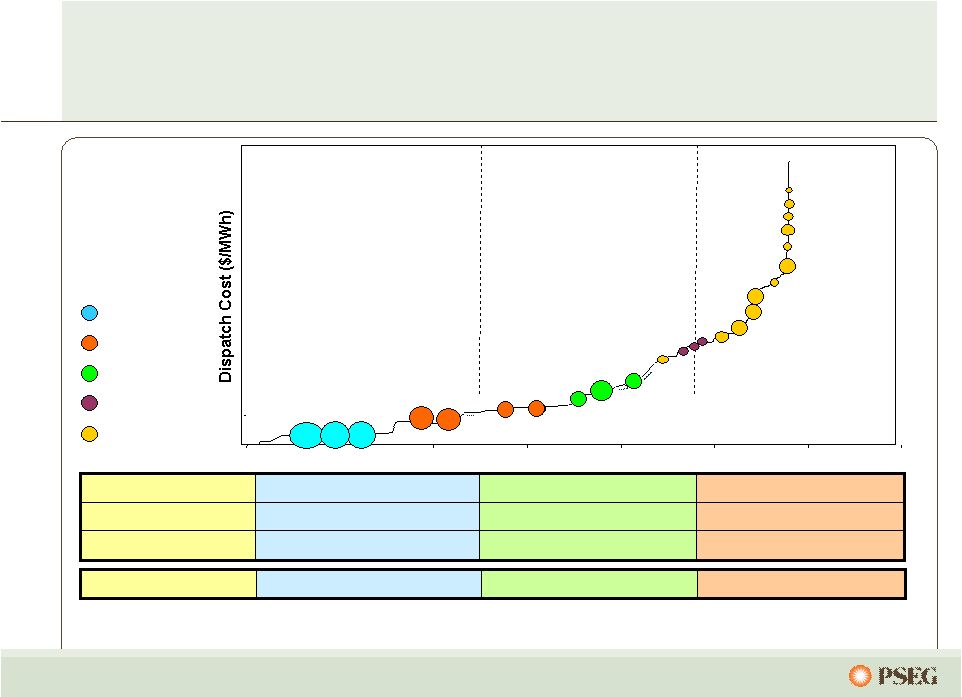

15 … while maintaining optionality under a variety of conditions. Power’s PJM assets along the dispatch curve enables us to optimize profitability… X X Ancillary Revenue X X X X Capacity Revenue X X Energy Revenue X X Dual Fuel Peaking units Baseload units Load following units Illustrative Salem Hope Creek Keystone Conemaugh Hudson 2 Linden 1,2 Burlington 8-9-11 Edison 1-2-3 Essex 10-11-12 Bergen 1 Sewaren 1-4 Hudson 1 Mercer1, 2 Bergen 2 Sewaren 6 Mercer 3 Kearny 10-11 Linden 5-8 / Essex 9 Burlington 12 / Kearny 12 Peach Bottom Nuclear Coal Combined Cycle Steam Peaking Yards Creek National Park Salem 3 Bergen 3 |

16 0 50 100 150 200 250 Source: EPA, EIA (2006 and 2007) and PSEG Projection Power’s coal assets will have completed many environmental upgrades by 2010… …resulting in dramatically lower emissions. 0 2 4 6 8 10 12 14 0 10 20 30 40 50 60 PSEG Projected NOX Emission Rate for 2011 versus 2008 400 U.S. Coal Plants Conemaugh Hudson Bridgeport Mercer Keystone NOx Keystone Bridgeport Conemaugh Hudson Mercer SO 2 PSEG Projected SO2 Emission Rate for 2011 versus 2008 400 U.S. Coal Plants Keystone Conemaugh Bridgeport Mercer Mercury PSEG Projected HG Emission Rate for 2011 versus 2008 400 U.S. Coal Plants Hudson |

… for new investment. PJM’s capacity construct – an important pricing signal… With nearly 1/3 of its capacity in PS North and nearly 2/3 of its capacity in MAAC and EMAAC, Power’s assets in congested locations received higher pricing in the 2013/2014 RPM Auction. PJM Capacity Available to Receive Auction Pricing 0 2,000 4,000 6,000 8,000 10,000 12,000 09/10 10/11 11/12 12/13 13/14 • Locational value of Power’s fleet recognized • Bid for 90MW of new capacity accepted for 2013/2014 • On schedule to complete 178MW of peaking capacity for June 2012 $27.73 $16.46 $110.00 $174.29 $102.04 Rest of Pool $245.00 $185.00 PSEG North Zone $245.00 PSEG $133.37 $139.73 2012 / 2013 $226.15 $245.00 2013/2014 $110.00 $174.29 $191.32 MAAC $110.00 $174.29 $191.32 Eastern MAAC 2011 / 2012 2010 / 2011 2009 / 2010 $/MW-day PJM Zones |

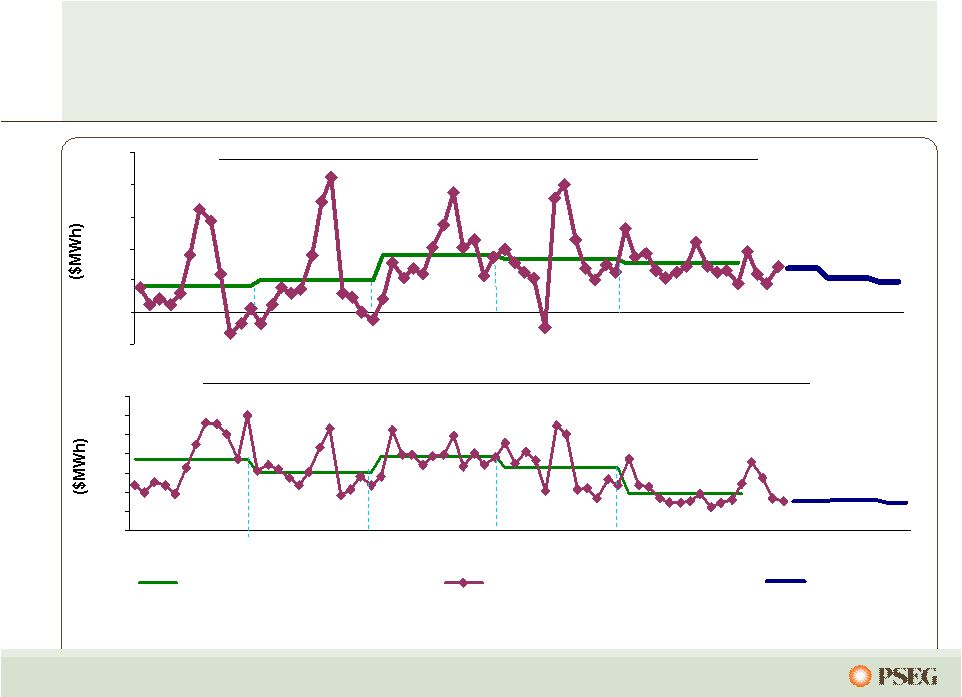

18 0% 25% 50% 75% 100% 2010 2011 2012 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 0% 25% 50% 75% 100% 2010 2011 2012 $0 $50 $100 $150 Power’s hedging program provides near- term stability from market volatility… … while remaining open to long-term market forces. Estimated EPS impact of $10/MWh PJM West around the clock price change* (~$2/mmbtu gas change) Contracted Capacity Price (right scale) * As of March 31, 2010 Assuming normal market commodity correlation and demand ** Excludes Texas – No capacity market Power has contracted for a considerable percentage of its future output over the next two years at attractive prices. The pricing for most of Power’s capacity has been fixed through May 2013, with the completion of auctions in PJM and NE. % sold (left scale) $0.30 - $0.60 $0.10 - $0.30 $0.05 - $0.10 Contracted Energy Price (right scale) % sold (left scale) ** * |

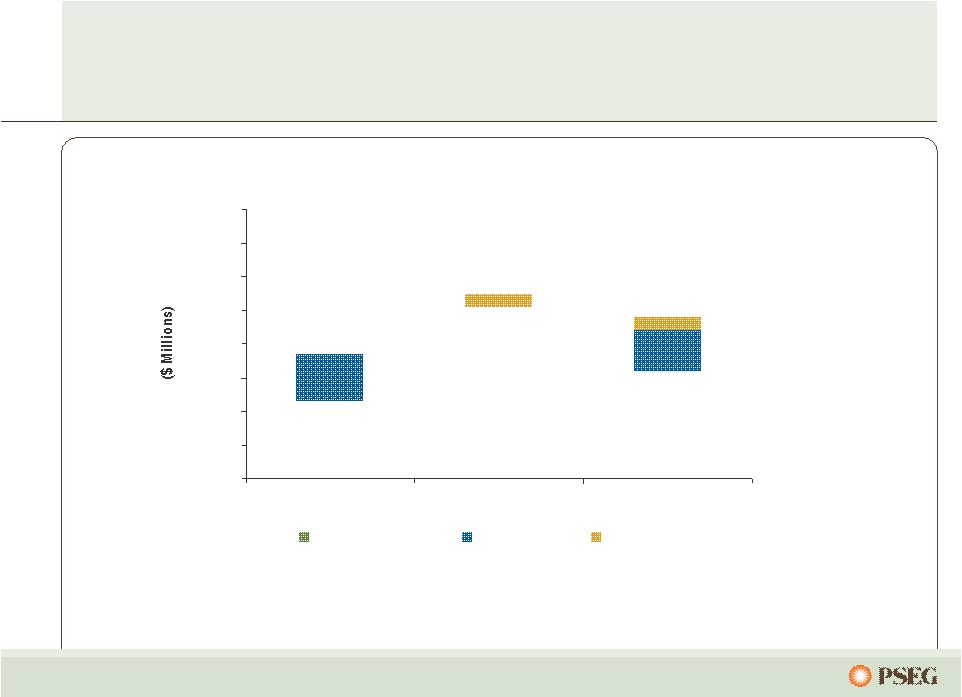

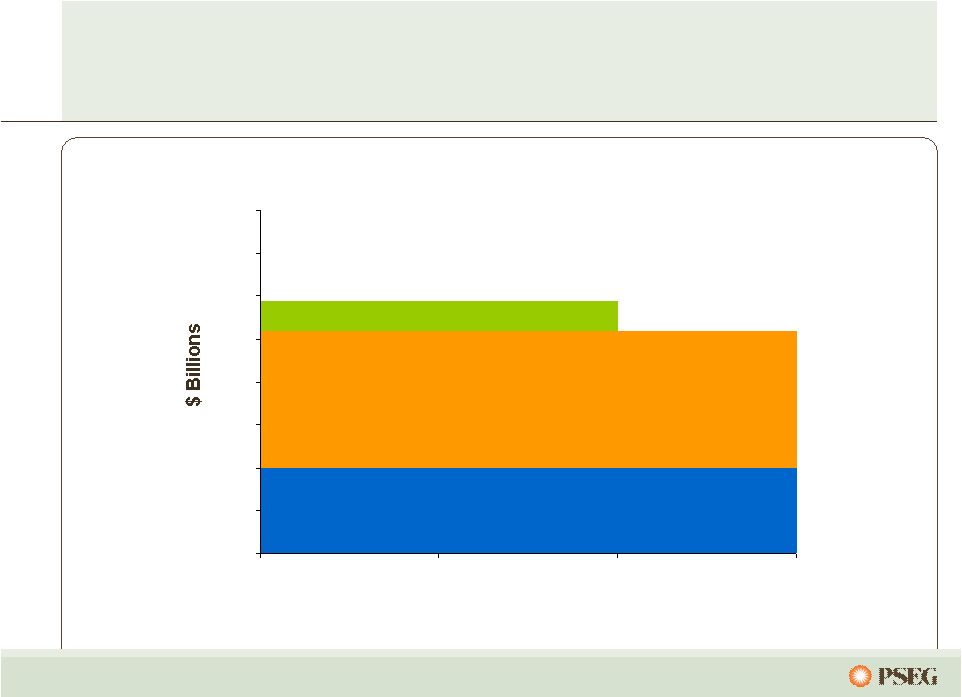

19 Sources Uses PSEG’s internally generated cash flow enables Power… … to strengthen its long term balance sheet; support the shareholder dividend; and, allows PSE&G to retain earnings for growth. Sources Uses Cash from Ops Net Debt Redemption Investment Dividends to Parent for payment to shareholders Power 2009–2012 Sources and Uses Cash from Ops* Net Debt Issuance Intercompany Capital Contribution Investment PSE&G 2009-2012 Sources and Uses * Cash from Operations adjusts for securitization principal repayments ~ $0.8B |

20 PSEG is advantaged… … with a strong balance sheet and cash flow to pursue an investment program that seizes the opportunities of tomorrow. Right Assets, Right Markets Operational Flexibility Environmental Infrastructure Improvements 2010 Integrated business model with assets located close to load centers Dispatch flexibility of operating assets and trading capability supports margins in full-requirements markets Environmentally responsible; pursuing investments in renewables; nuclear uprates Investments to improve reliability and functionality of grid |

21 PSEG value proposition PSEG provides investors with a balanced portfolio of assets within a shifting landscape for energy. PSEG’s focus on operational excellence and O&M control will yield benefits now, and over the long-term. PSEG’s capital commitments are focused on improving reliability and service quality at attractive risk-adjusted returns. PSEG’s strong balance sheet and cash flow support a capital program that will benefit shareholders through ongoing support of dividends and opportunity for future growth. |

Appendix |

23 Q1 Operating Earnings by Subsidiary $ 482 (4) 11 123 $ 352 2009 $ 425 3 7 117 $ 298 2010 Operating Earnings Earnings per Share -- 0.01 Enterprise $ 0.95 $ 0.84 Operating Earnings* 0.02 0.01 PSEG Energy Holdings 0.24 0.23 PSE&G $ 0.69 $ 0.59 PSEG Power 2009 2010 $ millions (except EPS) Quarter ended March 31 * See page 65 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings. |

24 PSEG Power – Gross Margin Performance $0 $25 $50 $75 2010 2009 $63 $55 Quarter ended March 31 Power’s gross margin affected by lower pricing and customer migration which offset 7% increase in production. Combined cycle gas units maintained strong contribution to operations. No change versus year ago; higher prices offset decline in generation. $18 Texas Regional Performance $12 $27 $748 Q1 Gross Margin ($M) Q1 Performance Region Increase in generation supported margin. New York Contribution to margin hurt by lower prices. New England Q1 contribution to gross margin ($M) declined 5.0% versus year ago; decline in price and migration offset increase in production. PJM PSEG Power Gross Margin ($/MWh)* * Excludes Texas Increase in generation was predominantly from combined cycle and coal with continued strong nuclear. |

PSEG Power |

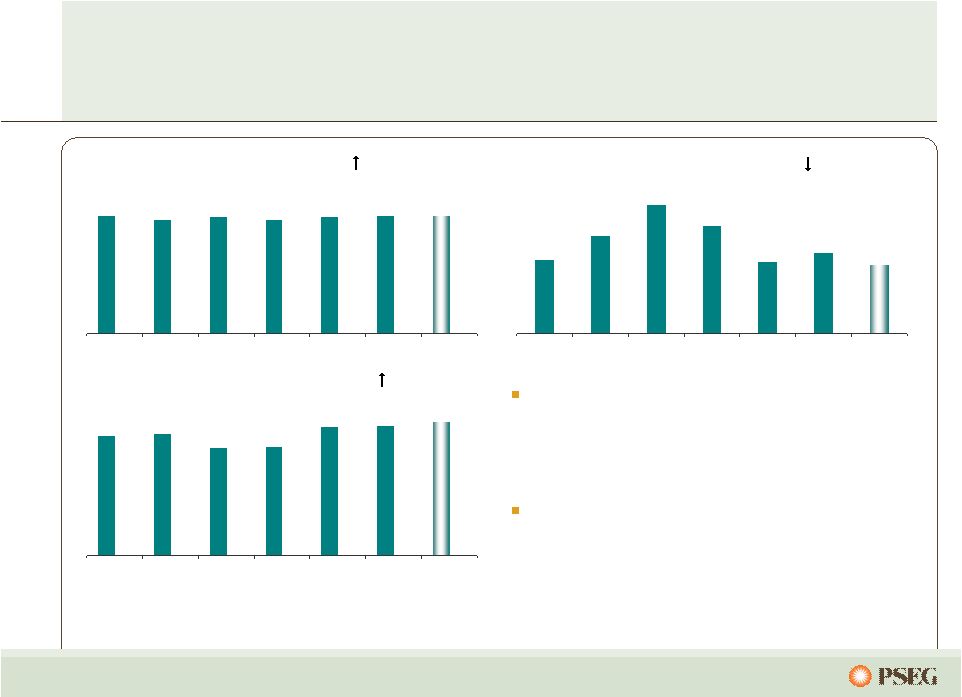

26 Our nuclear performance has improved… 11.1 3.1 0.6 2.1 1.0 0.9 0.4 0.7 0.6 0.7 0.6 0.6 0.6 2004 2005 2006 2007 2008 2009 2010 Target 25 27 29 28 29 30 30 2004 2005 2006 2007 2008 2009 2010 Target 79.0 85.0 97.0 94.0 91.7 99.0 98.0 96 96 97 96 97 98 2004 2005 2006 2007 2008 2009 2010 Target Salem station set a new generation record. Highest combined Salem and Hope Creek Nuclear site output in Power’s history Top quartile INPO Index … as we maintain our drive for excellence. Nuclear Generation Output* (000’s GWh) Forced Loss Rate ( ) (%) INPO Index ( ) NJ Units 1st Quartile NJ Units 1st Quartile * Total PS share nuclear generation |

27 Power’s coal fleet has shown improvement… 14 15 15 13 13 9 13 2004 2005 2006 2007 2008 2009 2010 Target 10.3 11.1 11.3 7.9 8.4 4.8 3.8 2004 2005 2006 2007 2008 2009 2010 Target 1.11 1.12 1.01 0.91 0.96 0.83 0.47 0.34 0.34 0.29 0.20 0.21 0.19 0.16 2004 2005 2006 2007 2008 2009 2010 Target Market conditions reduced output in 2009 Operational results greatly improved Environmental footprint improved … and back-end technology investments will prepare us for the future. Output (000’s GWh) Forced Outage Rate ( ) (% EFORD) SO 2 and NOx Rates ( ) (lb/mmbtu) SO2 NOx |

28 Power’s combined cycle fleet is creating value… 5 4 8 10 20 20 18 2004 2005 2006 2007 2008* 2009* 2010 Target* 3.4 7 3.4 2.5 1.8 1.5 0.8 2004 2005 2006 2007 2008* 2009* 2010 Target* 8079 7847 7928 7768 7587 7507 7452 2004 2005 2006 2007 2008* 2009* 2010 Target* Output (000’s GWh) Forced Outage Rate ( ) (% EFORD) Period Heat Rate ( ) (mmbtu/KWh) Highest output ever in 2009 Approaching top quartile forced outage rate Benefiting from heat rate improvement program … benefiting from operating enhancements and market dynamics. * Includes Texas |

29 Our peaking fleet rounds out a diverse generation portfolio… 13 17 23 19 13 14 12 2004 2005 2006 2007 2008 2009 2010 Target 85 86 76 77 91 92 94 2004 2005 2006 2007 2008 2009 2010 Target Peaking start success provides opportunities in ancillary and real time markets Peaking adds flexibility in serving load and managing needs of a diverse market environment … and provides ability to follow load during periods of high demand. % Start Success ( ) Forced Outage Rate ( ) (% EFORD) Equivalent Availability ( ) (%) 99.7 96.5 98.6 97.0 98.9 99.3 99.7 2004 2005 2006 2007 2008 2009 2010 Target |

30 Stringent environmental challenges are on the horizon, with potentially broad industry impacts… High High Regional High High Industry Impact Emission restrictions net favorable to Power Carbon Controls on coal units done or under way Power’s relative position very strong NOx, SO 2 , Hg (CAIR) Peaking fleet replacement strategy Upwind states anticipated to increase NOx stringency Ozone air quality standards (HEDD) EPA required to perform cost-benefit analysis Issue widely shared across industry Potential capital spend exposure Once-through cooling water (316(b)) Power uses dry fly ash systems Ash has been tested as non-hazardous Coal ash regulation Power’s Positioning Issue …but Power’s clean fleet is very competitively positioned for success. |

31 Power’s portfolio is well positioned… Baghouse* Scrubber 2010 SCR Mercer (NJ) Baghouse 2010* Scrubber 2010 SCR 2010 Hudson (NJ) Mercury/ Particulate SO 2 NOx Description Current Regulations and Compliance Measures Baghouse* Ultra-low Sulfur Coal Low Nox Burners Bridgeport (CT) Scrubber (Hg MACT Compliant) Scrubber (Hg MACT Compliant) Scrubber Scrubber SCR 2014 SCR Conemaugh (PA) Keystone (PA) …to meet current regulatory requirements. Capital Spend Planned No Additional Capital Spend Planned * Hg MACT compliant with baghouse |

32 $0 $100 $200 $300 $400 $500 $600 $700 $800 2010 2011 2012 Maintenance Growth Environmental Power’s projected capital spending will decline considerably… …as we complete significant environmental back-end technology projects in 2010. PSEG Power Capital Spending |

33 Nuclear’s operational excellence program will create value for years to come… RGGI 18 30 40 to 60 3,662 2009 None 21 25 40 3,484 2004 Progress toward National Program CO2 Program 19 O&M (non-fuel) $/MWh 30 Output (000 GWh) 60 License Life 3,694 Capacity (MW) 2012E Description …as our efforts continue to pursue a potential new unit. |

34 Fossil’s operational excellence program… 12,125 11,211 26,789 Emissions NOx Tons 37,863 15 447 30 11,886 2009* 80,287 16 349 21 11,123 2004 12,137 Emissions SO2 Tons 14 O&M (non-fuel) $/MWh 211 Capital ($ Millions) 32 Output (000 GWh) 11,589 Capacity (MW) 2012E* Description …is expected to result in higher output at a lower cost. * Includes Texas |

35 $0 $100 $200 $300 $400 $500 $600 $700 $0 $10 $20 $30 $40 CO2 Price ($/ton) While the prospects for a cap and trade program may be delayed… …Power remains well positioned to capture value if implemented. CO 2 $/Ton Impact on PJM Prices and Power’s EBITDA The impact on electric prices moderates at higher CO2 prices as: • the fleet dispatch changes, and • the CO2 intensity of the grid goes down. Illustration at $20 CO 2 : (2008 Data) 62 TWh x ~ $11 to $14/MWh ~ $680 – $870 M revenue 23M tons x $20/ton ~ $460 M expense |

36 Full Requirements Component Increase in Capacity Markets/RPM Growing Renewable Energy Requirements Component for Market Risk Through Power’s participation in each of the BGS auctions… Market Perspective – BGS Auction Results … we have developed an expertise in serving full-requirements contracts. 2003 2004 2005 2006 2007 2008 2009 2010 3 Year Average Round the Clock PJM West Forward Energy Price $55.59 Capacity Load shape Transmission Congestion Ancillary services Risk premium Green $33 - $34 $36 - $37 $44 - $46 $67 - $70 $58 - $60 $68 - $71 $56 - $58 $48 - $50 ~ $21 $55.05 ~ $18 $65.41 ~ $21 $102.51 ~ $32 $98.88 ~ $41 $111.50 ~ $43 $103.72 ~ $47 $95.77 ~ $47 Note: BGS prices reflect PSE&G Zone |

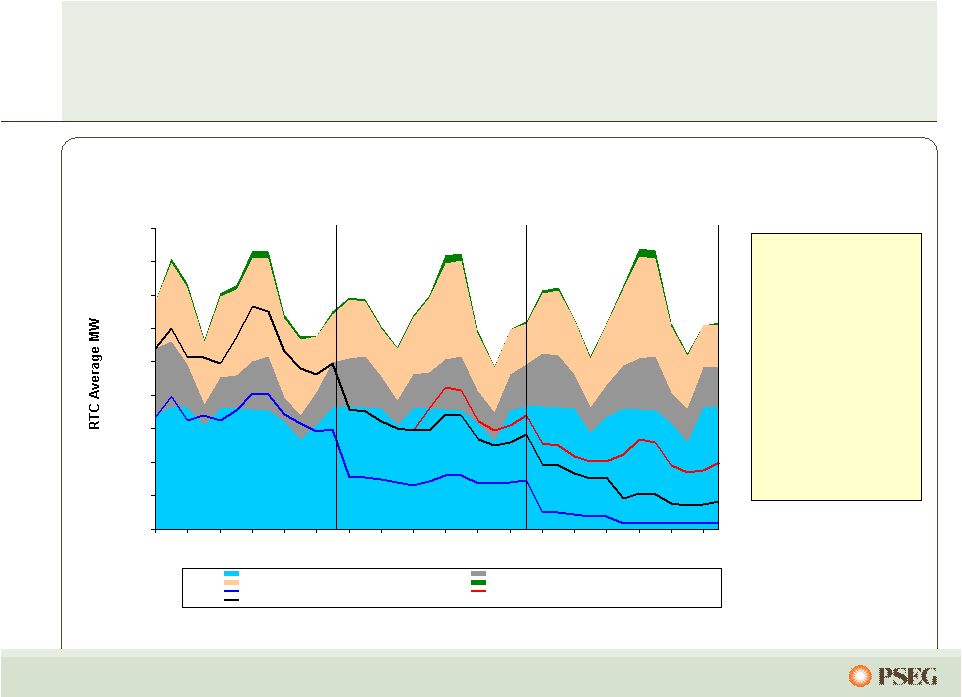

37 The result of Power’s hedging strategy is a portfolio of contracted output… … which dampens the impact of market volatility on earnings in the near term. Power’s anticipated nuclear and coal output is contracted over the next few years: 2010: 100% 2011: 66% 2012: 26% As of March 31, 2010 Total Fleet RTC Average MW - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 Nuclear / Pumped Storage Coal Combined Cycle (CC) Steam and Peakers Other Load Contracts + Hedges Existing BGS, Other Load Contracts, Hedges + Future BGS Existing BGS, Other Load Contracts, and Hedges 2010 2011 2012 |

38 $0 $20 $40 $60 $80 $100 2004 2005 2006 2007 2008 2009 2010 Fwd 2011 Fwd 2012 Fwd 2013 Fwd The effect of our multi-year hedging/forward sales strategy… …creates a realized price that is a blend of prior and future pricing. PJM West PS Zone vs PJM West Basis 2010 Realized Price *Forward prices as of April 2010 * Power’s hedging strategy enables current year prices to be derived from contracts secured over the prior 2 - 3 years. The fixed pricing of the BGS Auction has the effect of realizing forward prices up to three years ahead in the current year. |

39 Power’s coal hedging reflects 2010 supply matched with 2010 sales… … while maintaining flexibility on supply post BET installation. 0% 20% 40% 60% 80% 100% 2010 2011 2012 $0 $10 $20 $30 $40 $50 Contracted Coal Mid $20’s To High $20’s Mid $20’s To High $20’s Mid $40’s To Low $40’s Mid $40’s To Low $40’s High $40’s To Mid $40’s Indicative Pricing ($/MWh) Prices lower, moderating Northern Appalachian Conemaugh Prices lower, moderating Northern Appalachian Keystone More limited segment of coal market Metallurgical CAPP/NAPP Mercer Flexibility after BET in 2010 Adaro (2010) CAPP/NAPP (2011+) Hudson Higher price, lower BTU, enviro coal Adaro Bridgeport Harbor Comments Coal Type Station % Hedged (left scale) $/MWh (right scale) |

40 $0 $5 $10 2010 2011 2012 Anticipated Nuclear Fuel Cost Power has hedged its nuclear fuel needs through 2012… … with increased costs over that time horizon. Hedged |

41 $0 $20 $40 $60 $80 $100 2004 2005 2006 2007 2008 2009 2010 Fwd * 2011 Fwd 2012 Fwd $0 $20 $40 $60 $80 $100 2004 2005 2006 2007 2008 2009 2010 Fwd * 2011 Fwd 2012 Fwd $0 $20 $40 $60 $80 $100 2004 2005 2006 2007 2008 2009 2010 Fwd * 2011 Fwd 2012 Fwd Commodity prices have been volatile… Henry Hub NYMEX ($/MMBTU) West Hub On Peak ($/MWh) Central Appalachian Coal ($/Ton) $0 $2 $4 $6 $8 $10 2004 2005 2006 2007 2008 2009 2010 Fwd * 2011 Fwd 2012 Fwd *Forward prices as of April 2010 Western Hub RTC ($/MWh) |

42 *See page 64 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings Commodity prices have been volatile… … but Power’s diverse asset portfolio and hedging strategy has mitigated the effects, providing strong results. |

43 -$10 $0 $10 $20 $30 $40 $50 2005 2006 2007 2008 2009 2010 2011 2012 $0 $10 $20 $30 $40 $50 $60 $70 2005 2006 2007 2008 2009 2010 2011 2012 Annual Average Historical Monthly Forecast Note: Forward prices as of April 2010 Forward spark spreads and dark spreads are showing some moderation… PJM Western Hub Spark Spread (On-Peak – Henry Hub x 7.5 Heat Rate) PJM Western Hub Dark Spread (RTC – Central Appalachian Coal x 10 Heat Rate) … and are expected to remain highly influenced by gas prices. |

PSE&G |

45 Filed: May 29, 2009 12/09 Update: January 29, 2010 Test Year: 2009 * Modified in February for 11.25% ROE from 11.5% ROE New Jersey Electric & Gas Rate Case 51.2% Equity Ratio Includes tracking mechanisms for capital expenditures and pension costs 11.25%* Return on Equity $64.4 million $139.8 million Increase $2.3 billion $3.8 billion Rate Base Request as of the 03/10 update Electric Request Gas |

46 2009: Success in meeting State’s energy and economic development goals… …with reasonable contemporaneous returns. 514 180 694 April 2009 NJ Capital Infrastructure Stimulus 30 17 47 December 2008 Carbon Abatement 64 1 65 July 2009 Demand Response 143 - 143 November 2009 Solar Loan II $62 $43 $105 April 2008 Solar Loan I $1,501 $258 $1,759 Total 185 5 190 July 2009 Economic Energy Efficiency Stimulus 503 12 515 July 2009 Solar 4 All Remaining Spending Thru 2009 Total Amount Approval Date ($ Millions) |

47 Branchburg Branchburg Roseland Roseland Hopatcong Hopatcong Hudson Hudson Transmission investment recovery… Future Transmission project spending will be influenced by PJM evaluation, potentially adding $1.5B in additional projects over 2010 – 2015. Various $300 14 69kV Reliability projects thru 2012 Various $200 20 Approved RTEP projects thru 2012 125 bps 2013** $1,100 Branchburg-Roseland-Hudson 125 bps 2012-2013 $750 Susquehanna-Roseland Incentive In-Service Spending ($ Millions) …is supported by formula rate treatment and CWIP in rate base*. * Approval of CWIP for 500kV backbone projects. **PJM has specified a June 2013 in-service date for this project, though PJM has publicly indicated that the in-service date may be delayed and that alternatives to the project are being considered. Transmission Projects Future Projects |

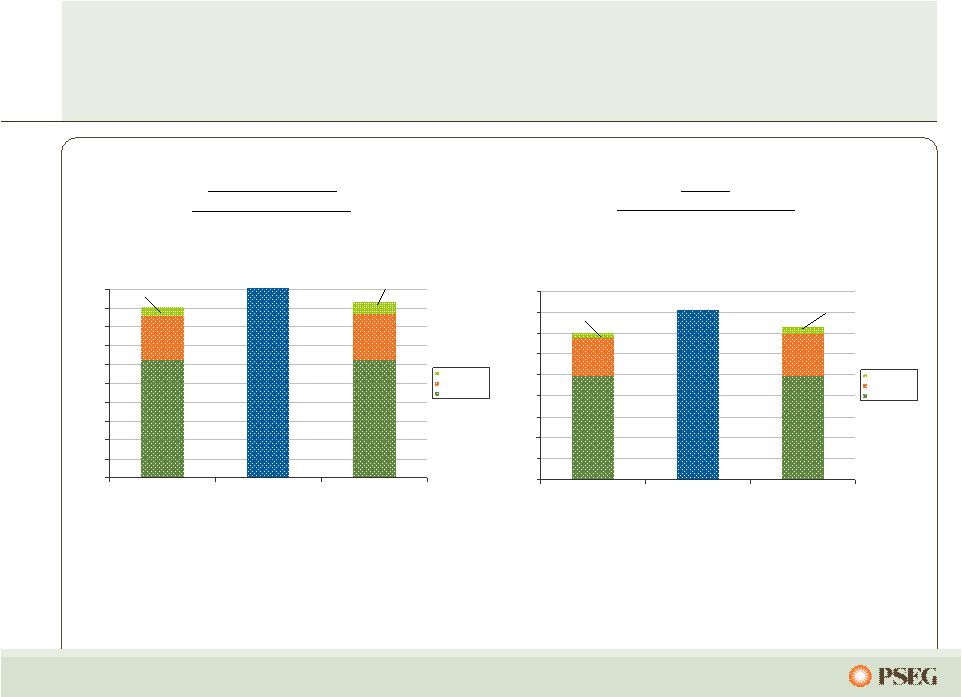

48 The national average ratio for electric bills to disposable income is 3.4%*, … 0 2 4 6 8 10 12 14 16 18 20 PSE&G 2009 Regional Average PSE&G 2012E Clauses and Other Delivery BGS Based on tariff rates in effect in June 2009 …while PSE&G’s typical electric bill is 2.6% of disposable income in New Jersey. Electricity (500kWh/month bill) BGS Delivery Clauses and Other 18.1 Gas (100 therm/month bill) 1.45 BGS**** Delivery ** 20.1 * Source Moody’s Industry Outlook – July 2009 ** Includes base rate increases *** Other includes NJ stimulus filing ,Solar 4 All and Solar I & II, EEE, and Demand Response **** Assumes BGS/BGSS pricing remains constant 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 PSE&G 2009 Regional Average PSE&G 2012E Clauses and Other Delivery BGSS Delivery BGSS BGSS**** Delivery ** Clauses and Other*** 1.62 1.40 18.7 Clauses and Other*** Clauses and Other |

PSEG Energy Holdings |

50 PSEG Energy Holdings… PSEG Global International assets sold* Texas generating assets (2 – 1,000MW CCGTs) transferred to PSEG Power Small remaining investment in domestic traditional generation joint venture assets PSEG Resources Tax exposure reduced by $740 million through fourteen LILO/SILO lease terminations, including Nuon termination in January 2010 Maximizing value and minimizing risk for traditional leases and real estate Long-term debt reduced by $1 billion over 2008 and 2009 Redemption of $642 million of Energy Holdings recourse debt $368 million eliminated through bond exchange $127 million of debt remaining … has streamlined its businesses and reduced its risk. * Nominal investment in Venezuela remaining |

51 Ongoing portfolio management continues… Global - International Asset Investment 0.0 0.5 1.0 1.5 2.0 2.5 2004 2005 2006 2007 2008 2009 2010 Est Resources - Traditional Leases, Real Estate and Other Investments 0.0 0.5 1.0 1.5 2.0 2.5 2006 2007 2008 2009 2010 Est … with opportunistic asset monetization as appropriate. Global- Domestic Generation Investment 0.0 0.5 1.0 1.5 2.0 2.5 2004 2005 2006 2007 2008 2009 2010 Est Resources - LILO/SILO Exposure * 0.0 0.5 1.0 1.5 2.0 2.5 2006 2007 2008 2009 Mar-10 * Does not include IRS deposits of $ 320M |

52 PSEG Energy Holdings is focused on renewable energy opportunities Complementing PSEG portfolio by increasing earnings base with structured, low risk investments Disciplined evaluation of favorable markets for renewables Transaction structure and partnerships designed to mitigate risk Expand geographic and regulatory diversity Attractive and predictable returns Pursuing renewable strategy through three primary vehicles Solar Source LLC Energy Storage and Power LLC Garden State Offshore Energy LLC |

PSEG |

54 $(0.12) $0.14 $0.74 $1.92 $0.02 $(0.05) $0.09 $0.07 $0.63 $0.71 $2.38 $2.30 2007 2008 2009 $3.12* We have met or exceeded our earnings objectives … … and expect 2010 earnings to remain strong. Holdings PSE&G Power Parent Earnings per Share by Subsidiary $2.68* *See page 64 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings $3.00 - $3.25 $2.80 - $3.05 $2.30 - $2.50 Guidance Range $3.03* |

55 $2,091 $1,993 $163 $30 2008 2009 Sustainability Plan Non-pension O&M Expense (1) Pension Expense Manage Staffing Levels Control General and Administrative Expenses Capture Productivity Gains (1) Excludes O&M related to PSE&G clauses We have successfully managed our O&M … … through benchmarking efforts and operational excellence. $2,121M $2,156M |

56 Earnings were strong in 2009… …benefiting from pricing, cost control and risk mitigation. $3.12 $3.03 2008* PSE&G Power Holdings / Enterprise 2009* ($0.08) $0.08 $0.09 Interest 0.03 Debt Exchange Premium Eliminated in Consolidation 0.04 Recontracting and Lower Fuel Expense 0.04 BGSS and Wholesale Power Trading 0.01 O&M 0.02 Interest 0.03 Depreciation and Other (0.02) Margin – Gas, Electric, Transmission and Appliance Service 0.04 Weather (0.01) O&M (0.06) Depreciation (0.03) Taxes (0.03) Interest 0.01 2009 Lease Sales 0.13 Lease Income (0.04) Effective Tax Rate and Other (0.03) Debt Exchange Premium Eliminated in Consolidation (0.04) Holdings: Enterprise: *See page 64 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings |

57 Cash Exposure Net of $320M of IRS Deposits 12/31/08 12/31/09 3/31/10 4 5 17 # of LILO/SILO Leases 2009 Activities Terminated 12 LILO / SILO leases 2010 Activities Terminated 1 lease in January Pursue additional lease termination opportunities 2008 Activities Terminated 1 LILO / SILO lease Exposure to our potential lease tax liability… …was reduced with aggressive asset management. $660 ~$1,200 ~$280 ~$600 $- $500 $1,000 $1,500 |

58 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 2009 2010 2011 2012 PSEG Consolidated O&M (1) C.A.G.R. (’09 –’12) = 0.7% (1) Excludes O&M related to PSE&G clauses Aggressive employee management of our O&M, including 2010 wage freeze … …and improving pension expense, will result in modest O&M growth. |

59 2009 Operating Earnings* 2010 Guidance Rigorous cost controls, hedging strategy and improved utility capital recovery… …help mitigate the risk of weak prices in 2010. $3.12 $3.00 - $3.25 PSE&G: Network Transmission Service (NTS) revenue increase for 2010 from 2009 ~ $0.03 EPS 2009 earned ROE = 8.3% 1% change in Distribution earned ROE in 2010 ~ $0.07 EPS 1% change in load in 2010 ~ $0.02 EPS PSEG Power: Revenue/Margin Nuclear output fully contracted Dark Spread change of $5/MWh at market – impact of $0.02-$0.04/share Spark Spread change of $5/MWh at market – impact of $0.04-$0.08/share Operations 1% change in nuclear capacity factor – impact of $0.01-$0.02/share O&M 1% change – impact of ~$0.01/share Drivers *See page 64 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings |

60 PSEG is shifting emphasis to growth investments… …to meet the requirements of the evolving energy markets. Maintenance / Regulatory Investments $2.5B Growth Investments $5.2B Capital Spending by Category Total 2010-2012 Capital: $7.7 Billion Wind (Holdings), $0.02B, 0% New Nuclear, $0.05B, 1% Transmission, $2.14B, 27% Core Investment, $2.18B, 28% |

61 PSE&G’s capital spending is focused on growth… …with a substantial portion allowed to earn reasonable contemporaneous returns. PSE&G Capital Spending by Category Total 2010-2012 Capital: $5.3 Billion New Business, $0.43B, 8% Renewables, $0.93B, 18% Transmission, $2.14B, 40% Core Investment, $1.26B, 24% |

62 $0 $1,000 $2,000 $3,000 $4,000 $5,000 Sources Uses In 2009, we had substantial cash generation … PSEG Consolidated 2009 Sources and Uses Power Cash from Ops Shareholder Dividend Gross Lease Proceeds PSE&G Investment …which was applied toward improving our financial profile. Debt Redemptions Lease Termination Taxes & IRS Deposit Debt Issuances PSE&G Cash from Ops(1) Power Investment (1) PSE&G Cash from Operations adjusts for securitization principal repayments of ~ $190M Regulated investment Eliminated Parent Long-term debt and minimized Holdings’ debt Reduced Tax Risk |

63 With our current facilities, PSEG/Power will have at least $2.6 billion of credit capacity through 2012 ... Non-PSE&G Credit Capacity ...and we will continue to ensure adequate liquidity. $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 2010 2011 2012 Power Syndicated Facility - 1.60B Expires 12/2012 Power 2-Year Facility - 0.35B Expires 7/2011 PSEG Syndicated Facility - 1.00B Expires 12/2012 |

64 Items Excluded from Income from Continuing Operations to Reconcile to Operating Earnings Please see Page 3 for an explanation of PSEG’s use of Operating Earnings as a non-GAAP financial measure and how it differs from Net Income. Pro-forma Adjustments, net of tax 2009 2008 2007 2006 2005 Earnings Impact ($ Millions) Gain (Loss) on Nuclear Decommissioning Trust (NDT) Fund Related Activity 9 $ (71) $ 12 $ 11 40 Gain (Loss) on Mark-to-Market (MTM) (25) 16 10 28 (9) Lease Transaction Reserves - (490) - - - Net Reversal of Lease Transaction Reserves 29 - - - - Asset Sales and Impairments - (13) (32) (178) - Premium on Bond Redemption - (1) (28) (7) (6) Merger-related Costs - - - (8) (32) Total Pro-forma adjustments 13 $ (559) $ (38) $ (154) $ (7) $ Fully Diluted Average Shares Outstanding (in Millions) 507 508 509 505 489 Per Share Impact (Diluted) Gain (Loss) on Nuclear Decommissioning Trust (NDT) Fund Related Activity 0.02 $ (0.14) $ 0.02 $ 0.02 $ 0.08 $ Gain (Loss) on Mark-to-Market (MTM) (0.05) 0.03 0.02 0.06 (0.02) Lease Transaction Reserves - (0.96) - - - Net Reversal of Lease Transaction Reserves 0.05 - - - - Asset Impairments - (0.03) (0.06) (0.35) - Premium on Bond Redemption - - (0.06) (0.01) (0.01) Merger-related Costs - - - (0.02) (0.07) Total Pro-forma adjustments 0.02 $ (1.10) $ (0.08) $ (0.30) $ (0.02) $ PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED For the Twelve Months Ended December 31, Reconciling Items Excluded from Continuing Operations to Compute Operating Earnings (Unaudited) |

65 Items Excluded from Income from Continuing Operations to Reconcile to Operating Earnings Pro-forma Adjustments, net of tax 2010 2009 Earnings Impact ($ Millions) Gain (Loss) on Nuclear Decommissioning Trust (NDT) Fund Related Activity 10 $ (23) $ Gain (Loss) on Mark-to-Market (MTM) 56 (15) Total Pro-forma adjustments 66 $ (38) $ Fully Diluted Average Shares Outstanding (in Millions) 507 507 Per Share Impact (Diluted) Gain (Loss) on NDT Fund Related Activity 0.02 $ (0.04) $ Gain (Loss) on MTM 0.11 (0.03) Total Pro-forma adjustments 0.13 $ (0.07) $ (a) Income from Continuing Operations for the three months ended March 31, 2010 and 2009 is equal to Net Income. For the Three Months Ended March 31, PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED Reconciling Items Excluded from Continuing Operations (a) to Compute Operating Earnings (Unaudited) Please see Page 3 for an explanation of PSEG’s use of Operating Earnings as a non-GAAP financial measure and how it differs from Net Income. |