- PLUR Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Pluri (PLUR) DEF 14ADefinitive proxy

Filed: 27 Apr 22, 4:01pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement. |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| ☒ | Definitive Proxy Statement. |

| ☐ | Definitive Additional Materials. |

| ☐ | Soliciting Material Pursuant to §240.14a-12. |

| Pluristem Therapeutics Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PLURISTEM THERAPEUTICS INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On June 21, 2022

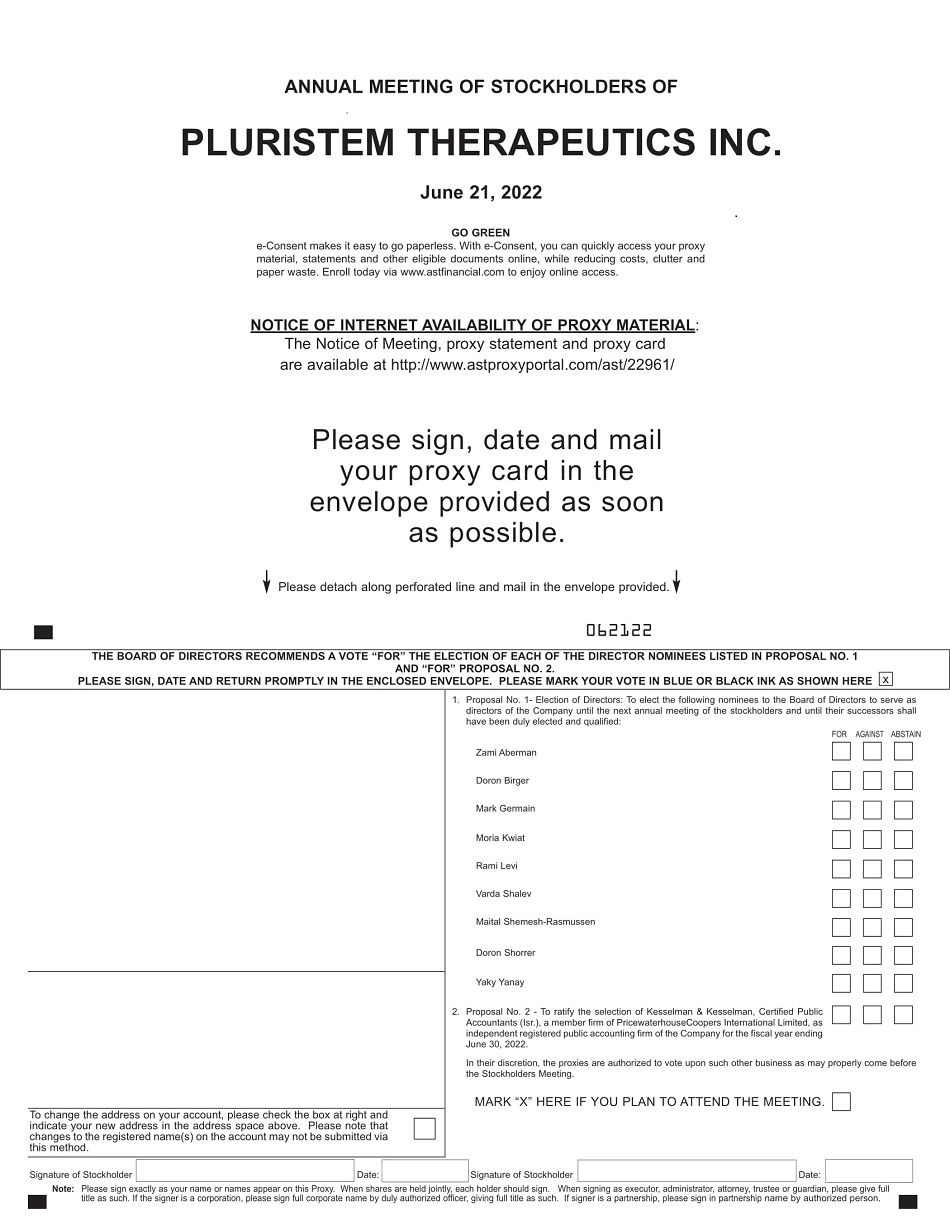

You are hereby notified that the annual meeting of shareholders of Pluristem Therapeutics Inc., or the Company, will be held on the 21st day of June, 2022 at 5:00 p.m., local time, at our offices, Matam Advanced Technology Park Building No. 5, Haifa, Israel, 3508409. However, we are actively monitoring developments with regard to the coronavirus, or COVID-19, and it is possible that the annual meeting may be held solely by means of remote communication. In the event it is not possible or advisable to hold our annual meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable. We intend to hold the annual meeting for the following purposes:

1. To elect nine directors to serve until the next annual meeting of shareholders and until their respective successors shall have been duly elected and qualified;

2. To ratify the selection of Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm of PricewaterhouseCoopers International Limited, as independent registered public accounting firm of the Company for the fiscal year ending June 30, 2022; and

3. To consider and act upon such other business as may properly come before the meeting or any adjournment or postponement thereof.

All shareholders are cordially invited to attend the annual meeting. If your shares are registered in your name, please bring the admission ticket attached to your proxy card. If your shares are registered in the name of a broker, trust, bank or other nominee, you will need to bring a proxy or a letter from that broker, trust, bank or other nominee or your most recent brokerage account statement, that confirms that you are the beneficial owner of those shares. If you do not have either an admission ticket or proof that you own shares of the Company, you will not be admitted to the meeting.

The Board of Directors has fixed the close of business on April 27, 2022 as the record date for the meeting. Only shareholders on the record date are entitled to notice of and to vote at the meeting and at any adjournment or postponement thereof.

Your vote is important regardless of the number of shares you own. The Company requests that you vote by internet or telephone, or complete, sign and date a proxy card, which you may obtain upon request, without delay, even if you now plan to attend the annual meeting. You may revoke your proxy at any time prior to its exercise by delivering written notice or another duly executed proxy bearing a later date to the Secretary of the Company, or by attending the annual meeting and voting in person.

INTERNET AVAILABILITY OF PROXY MATERIALS

Securities and Exchange Commission rules allow us to furnish proxy materials to our shareholders over the internet. You can access proxy materials and authorize a proxy to vote your shares at http://www.astproxyportal.com/ast/22961/

You may vote via the internet at www.voteproxy.com with American Stock Transfer and you may vote via the telephone at 1-800-PROXIES (1-800-776-9437) in the United States or 1-718-921-8500 from foreign countries and follow the instructions. You may also authorize a proxy to vote your shares over the internet. In order to vote over the internet or by telephone you must have your shareholder identification number, which is set forth in the Notice of Internet Availability of Proxy Materials mailed to you. You may also request a paper proxy card to submit your vote by mail.

| By order of the Board of Directors, | |

| /s/ Yaky Yanay | |

| Yaky Yanay, Chief Executive Officer and President |

April 27, 2022

IMPORTANT: In order to secure a quorum and to avoid the expense of additional proxy solicitation, please either vote by internet or sign, date and return your proxy promptly in the enclosed envelope even if you plan to attend the meeting personally. Your cooperation is greatly appreciated.

PLURISTEM THERAPEUTICS INC.

Matam Advanced Technology Park

Building No. 5

Haifa, Israel, 3508409

PROXY STATEMENT

INTRODUCTION

This proxy statement and the accompanying proxy are made available by Pluristem Therapeutics Inc., or the Company, to the holders of record of the Company’s outstanding common shares, $0.00001 par value per share, or the Common Shares, commencing on or about April 27, 2022. The accompanying proxy is being solicited by the Board of Directors of the Company, or the Board, for use at the annual meeting of shareholders of the Company, or the Meeting, to be held on the 21st day of June, 2022 at 5:00 p.m. local time, at our offices, Matam Advanced Technology Park Building No. 5, Haifa, Israel, 3508409 and at any adjournment or postponement thereof. However, we are actively monitoring developments with regard to the coronavirus or COVID-19, and it is possible that the Meeting may be held solely by means of remote communication. In the event it is not possible or advisable to hold our Meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable. The cost of solicitation of proxies will be borne by the Company. Directors, officers and employees of the Company may assist in the solicitation of proxies by mail, telephone, telefax, in person or otherwise, without additional compensation. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting materials to the owners of share held in their names and the Company will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of such proxy materials.

The Board has fixed April 27, 2022 as the record date for the Meeting. Only shareholders of record on April 27, 2022, or the Record Date, are entitled to notice of and to vote at the Meeting or any adjournment or postponement thereof. On April 27, 2022, there were 32,347,584 issued and outstanding Common Shares. Each Common Share is entitled to one vote per share.

The Company’s Bylaws provide that a quorum shall consist of the holders of at least thirty three and one third percent (33 1/3%) of the stock issued and outstanding and entitled to vote thereat, present in person or represented by proxy at the Meeting. If such quorum shall not be present or represented, the shareholders entitled to vote thereat, present in person or represented by proxy, shall have the power to adjourn the Meeting, without notice other than announcement at the Meeting, until a quorum shall be present or represented. Abstentions may be specified on all proposals. Abstentions will be counted as present for purposes of determining a quorum and will be counted as not voting on the proposal in question. Submitted proxies which are left blank will also be counted as present for purposes of determining a quorum, but are not counted for purposes of determining whether a proposal has been approved in matters where the proxy does not confer the authority to vote on such proposal, and thus have no effect on its outcome.

The affirmative vote of the holders of a majority of the Common Shares having voting power present in person or represented by proxy shall be sufficient for the election of each of the director nominees and for the ratification of the selection of Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm of PricewaterhouseCoopers International Limited, as independent registered public accounting firm of the Company for the fiscal year ending June 30, 2022.

All Common Shares represented in person or by valid proxies received by the Company prior to the date of, or at, the Meeting, and not revoked, will be voted as specified in the proxies or voting instructions.

1

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares.

If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine”, but not with respect to “non-routine” matters. In the event that a broker, bank, or other agent indicates on a proxy that it does not have discretionary authority to vote certain shares on a non-routine proposal, then those shares will be treated as broker non-votes. Proposal No. 1 is a non-routine proposal; therefore, your broker, bank or other agent is not entitled to vote your shares on Proposal No. 1 without your instructions. Broker non-votes will be counted as present for purposes of determining a quorum and will be counted as not voting on the non-routine proposals in question. Other than for the purpose of establishing a quorum, broker non-votes will not be counted as entitled to be voted and will therefore not affect the outcome of Proposal No. 1 (as noted above, because Proposal No. 2 is considered routine, there will not be broker non-votes with respect to that proposal).

Any shareholder who has submitted a proxy may revoke it at any time before it is voted, by written notice addressed to and received by our Secretary, by submitting a duly executed proxy bearing a later date or by electing to vote in person at the Meeting. The mere presence at the Meeting of the shareholder appointing a proxy does not, however, revoke the appointment.

Notice of Internet Availability of Proxy Materials

In accordance with rules and regulations of the Securities and Exchange Commission, or the SEC, instead of mailing a printed copy of our proxy materials, which consist of this proxy statement, proxy card, notice of annual meeting, and our annual report to shareholders for the fiscal year ended June 30, 2021, or Fiscal Year 2021, respectively, to each shareholder of record, we may furnish proxy materials via the internet. Accordingly, all of our shareholders of record as of the Record Date will receive a notice of internet availability of proxy materials. The notice of internet availability of proxy materials will be mailed on or about May 4, 2022.

On the date of mailing the Notice of Internet Availability of Proxy Materials, shareholders will be able to access all of the proxy materials at http://www.astproxyportal.com/ast/22961/. The proxy materials will be available free of charge. The Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review all of the important information contained in the proxy materials over the internet. The Notice of Internet Availability of Proxy Materials contains instructions as to how to vote by internet or by telephone. The Notice of Internet Availability of Proxy Materials also instructs you as to how you may request a paper or email copy of the proxy card. If you received a Notice of Internet Availability of Proxy Materials and would like to receive printed copies of the proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials.

IMPORTANT: If your shares are held in the name of a brokerage firm, bank, nominee or other institution, you should provide instructions to your broker, bank, nominee or other institution on how to vote your shares. Please contact the person responsible for your account and give instructions for a proxy to be completed for your shares.

Our website address is included several times in this proxy statement as a textual reference only and the information presented on our website is not incorporated by reference into this proxy statement.

2

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

At the Meeting, nine directors are to be elected, which number shall constitute our entire Board, to hold office until the next annual meeting of shareholders and until their successors shall have been duly elected and qualified. Unless otherwise specified in the proxy, it is the intention of the persons named in the enclosed form of proxy to vote the share represented thereby for the election as directors, each of the nominees whose names and biographies appear below. All of the nominees whose names and biographies appear below are presently our directors. In the event any of the nominees should become unavailable or unable to serve as a director, it is intended that votes will be cast for a substitute nominee designated by the Board. The Board has no reason to believe that the nominees named will be unable to serve if elected. Each nominee has consented to being named in this proxy statement and to serve if elected.

Principal Employment and Experience of Director Nominees and Executive Officers

The following information is furnished with respect to our executive officers and the persons nominated for election as directors. All of the director nominees are current members of our Board.

| Name | Age | Present Principal Employer and Prior Business Experience | ||

| Zami Aberman | 68 | Mr. Aberman joined the Company in September 2005 and has served as our Chairman since January 2022, as Executive Chairman since June 2019, as our Co-Chief Executive Officer from March 2017 until June 2019, as our CEO from November 2005 until March 2017, and as President of the Company from September 2005 until February 2014. He changed the Company’s strategy towards cellular therapeutics. Mr. Aberman’s vision to use the maternal section of the Placenta (Decidua) as a source for cell therapy, combined with the Company’s 3D culturing technology, led to the development of our products. Since November 2005, Mr. Aberman has served as a director of the Company, and since April 2006, as Chairman of the Board. He has 40 years of experience in marketing and management in the high technology industry. Mr. Aberman has held the CEO and Chairman positions of various companies located in Israel, the United States, Europe, Japan and Korea.

Mr. Aberman has operated within high-tech global companies in the fields of automatic optical inspection, network security, video over IP, software, chip design and robotics. He serves as the chairman of Rose Hitech Ltd., a private investment company. He previously served as the chairman of VLScom Ltd., a private company specializing in video compression for HDTV and video over IP and as a director of Ori Software Ltd., a company involved in data management. Prior to holding those positions, Mr. Aberman served as the President and CEO of Elbit Vision System Ltd. (EVSNF.OB), a company engaged in automatic optical inspection. Before joining the Company, Mr. Aberman served as President and CEO of Netect Ltd., a company specializing in the field of internet security software and was the co-founder, President and CEO of Associative Computing Ltd., which developed an associative parallel processor for real-time video processing. He also served as Chairman of Display Inspection Systems Inc., specializing in laser based inspection machines and as President and CEO of Robomatix Technologies Ltd.

In 1992, Mr. Aberman was awarded the Rothschild Prize for excellence in his field from the President of the State of Israel. Mr. Aberman holds a B.Sc. in Mechanical Engineering from Ben Gurion University in Israel.

We believe that Mr. Aberman’s qualifications to sit on our Board include his unique multidisciplinary innovative approach, years of experience in the financial markets in Israel and globally, as well as his experience in serving as the CEO of publicly traded entities. |

| Yaky Yanay | 50 | Mr. Yanay became a director of the Company in February 2015. He has served as our President from February 2014 and as our CEO from June 2019, previously serving as Co-CEO from March 2017. Mr. Yanay has served in variety of executive positions in Pluristem since 2006 including as our CFO from November 2006 until February 2014 and from February 2015 until March 2017. He also served as our Chief Operating Officer from February 2014 until March 2017. From November 2006 to February 2014, he served as our Secretary and served as our Executive Vice President from March 2013 until February 2014. From 2015 to 2018, Mr. Yanay served as the Co-Chairman of Israel Advanced Technology Industries (IATI), the largest umbrella organization representing Israel’s high tech and life science industries and since August 2012 has continually served as a Director of IATI, representing Israel’s life sciences industry. Prior to joining the Company, Mr. Yanay founded and served as Chairman of “The Israeli Life Science Forum” and also served as the CFO of Elbit Vision Systems Ltd., a public company. In addition, from July 2010 to April 2018, he served on the Board of Directors of Elbit Vision Systems Ltd. Prior to these positions, Mr. Yanay served as manager of audit groups of the technology sector at Ernst & Young Israel.

Mr. Yanay holds a bachelor’s degree with honors in business administration and accounting from the College of Management Academic Studies of Rishon LeZion and is a Certified Public Accountant in Israel.

We believe that Mr. Yanay’s qualifications to sit on our Board include his years of experience in the medical technology industry, his vast skill and expertise in accounting and economics, as well as his knowledge and familiarity with corporate finance. |

3

| Chen Franco-Yehuda | 38 | Mrs. Franco-Yehuda was appointed as CFO, Treasurer, and Secretary of Pluristem Therapeutics, effective as of March 17, 2019. She is responsible for managing financial and corporate strategy, and is also in charge of the finance, IT, investor relations, PR and legal departments. Prior to being appointed as our CFO, Mrs. Franco-Yehuda served as the Company’s Head of Accounting and Financial Reporting since July 2016 and, prior to that, the Company’s Controller since May 2013. Before joining the Company, from October 2008 to April 2013, Mrs. Franco-Yehuda served as a manager of audit groups relating to public and private companies in various industries at PricewaterhouseCoopers (PwC) and also as a lecturer of accounting classes at the Open University of Israel from 2009 to 2014.

Mrs. Franco-Yehuda holds a bachelor’s degree in economics and accounting from Haifa University and is a certified public accountant in Israel.

| ||

| Doron Birger* | 70 | Mr. Birger became a director of the Company in July 2021. Mr. Doron Birger has been serving as the chairman of the board of directors of Sight Diagnostic Ltd. since June 2014, as chairman of the board of directors of Nurami Medical Ltd. from April 2016 to March 2022, and is currently a director of Nurami, Ultrasight Medical Imaging Ltd. from June 2019, Intelicanna Ltd. (TASE: INTL) from April 2021 and Matricelf Ltd. (TASE:MTLF ) from December 2020, Galooli from September 21 and and as a director of IceCure Medical Ltd. (TASE: ICCM) since August 2012, Vibrant Ltd. since December 2014, Hera Med Ltd. (ASX: HMD) since November 2019, Citrine Global (OTC: CTGL) since March 2020, Kadimastem Ltd. (TASE: KDST) since December 2020 and Netiv Ha’or, a subsidiary of the Israel Electric Corporation Ltd., since March 2020 and as chairman and director in a variety of non-profit organizations. Prior to that, Mr. Birger has served as member of the board of directors of MCS Medical Compression Systems (DBN) Ltd. (TASE:MDCL) from March 2015 to May 2018, Mekorot National Water Company Ltd. from November 2015 to November 2018, and chairman of the board of directors of Insulin Medical Ltd. (TASE: INSL) from March 2016 to August 2017, IOPtima Ltd. from June 2012 to June 2019, MST Medical Surgical Technologies Ltd. from August 2009 to June 2019, Highcon Ltd. from November 2014 to January 2018, Magisto Ltd. from September 2009 to July 2019, Real Imaging Ltd. from November 2018 to April 2019 and Medigus Ltd. (Nasdaq and TASE: MDGS) from May 2015 to September 2018. Mr. Birger holds a BA and MA in economics from the Hebrew University, Israel.

We believe that Mr. Birger’s qualifications to sit on our Board include his extensive experience in the high-tech sector and life-science industry, his experience serving as a director of public companies, his vast skill and expertise in accounting and economics as well as his knowledge and familiarity with corporate finance. |

| Mark Germain* | 70 | Mr. Germain became a director of the Company in May 2007. Between May 2007 and February 2009, Mr. Germain served as Co-Chairman of our Board. Mr. Germain has been a merchant banker serving primarily the biotech and life sciences industries for over five years. He has been involved as a founder, director, chairman of the board of, and/or investor in, over twenty companies in the biotech field and assisted many of them in arranging corporate partnerships, acquiring technology, entering into mergers and acquisitions, and executing financings and going public transactions. He graduated from New York University School of Law in 1975, Order of the Coif, and was a partner in a New York law firm practicing corporate and securities law before leaving in 1986. Since then, and until he entered the biotech field in 1991, he served in senior executive capacities, including as president of a public company that was sold in 1991. In addition to being a director of the Company, Mr. Germain is a Managing Director at The ÆNTIB Group, a boutique merchant bank. From June 2018 through September 30, 2019, Mr. Germain also served as Vice Chairman of the board of BiondVax Pharmaceuticals Ltd., a company based in Israel engaging in a Phase III clinical trials for a universal flu vaccine, and, effective September 30, 2019 has served as the chairman of the board of BiondVax Pharmaceuticals Ltd.

Mr. Germain also serves or served as a director of the following companies that were reporting companies in the past: ChromaDex Inc., Stem Cell Innovations, Inc., Omnimmune Corp. and Collexis Holdings, Inc. He is also a co-founder and director of a number of private companies in and outside the biotech field.

We believe that Mr. Germain’s qualifications to sit on our Board include his years of experience in the biotech industry, his experience serving as a director of public companies, as well as his knowledge and familiarity with corporate finance. |

4

| Moria Kwiat* | 41 | Dr. Kwiat became a director of the Company in May 2012. Dr. Kwiat is Product Manager at AquaPass, a medical device company that develops a treatment for heart failure. Between 2018 to 2022, she served as an analyst at aMoon, a leading Israeli life sciences venture fund. Between 2016 to 2017, she was a consultant and analyst at Frost & Sullivan, producing equity research for public companies in the healthcare domain. Dr. Kwiat has a broad academic background and scientific experience in inter-disciplinary fields, with specific expertise at the interface between biology and materials field. She is the co-author of multiple scientific papers. Dr. Kwiat holds a Post-Doctoral degree in nanotechnology and material sciences, a Ph.D. in Chemistry and a M.Sc. and B.Sc. in Biotechnology, from Tel Aviv University. | ||

| We believe that Dr. Kwiat’s qualifications to sit on our Board include her knowledge and experience as a scientist and a researcher in the fields of biotechnology and nanotechnology. | ||||

| Rami Levi* | 60 | Mr. Levi is the Founder and President of Catalyst Group International, LLC where, since 2009, he has provided consulting services relating to strategic planning to notable clients in the private and public sectors. From 2004 to 2006, he served as Senior Deputy General and Head of Marketing Administration at Israel's Ministry of Tourism. He holds an MA with Honors in Political Science from The Hebrew University of Jerusalem.

We believe that Mr. Levi’s qualifications to sit on our Board include his experience in strategic planning, business development and activities in the government sector. |

| Varda Shalev* | 62 | Professor Shalev became a director of the Company in July 2021. Professor Shalev has been serving as a professor at the department of epidemiology at the medical school of Tel Aviv University, Israel since 2019. She has also been serving as a member of the board of directors of BATM Advanced Communications Ltd. since November 2018. She is the Chief Medical Officer of Alike Ltd. from May 2020. Professor Shalev established the Department of Medical Informatics at Maccabi Health Care and was responsible for planning and developing its computerized medical systems. She has pioneered the development of multiple disease registries to support chronic disease management. She also served as the director of primary care division at Maccabi Health Care from October 2013 to June 2015 and as the Founder and Chief Executive Officer of the research and innovation center (KSM Institute and Maccabitech the epidemiological and clinical research arm of Israel’s Maccabi Healthcare Services) at Maccabi Health Care from July 2015 to May 2020. Professor Shalev holds an MD from Ben Gurion University, Israel, and an MPH in Public Health Administration from Clark University, Massachusetts and her Doctoral Fellowship in Medical Informatics from Johns Hopkins University.

We believe that Prof. Shalev’s qualifications to sit on our Board include her experience working in clinical environments and research settings at the intersection of health and technology. | ||

| Maital Shemesh-Rasmussen* | 51 | Ms. Shemesh-Rasmussen has served as the Chief Commercial Officer of Octave Bioscience since February 2021. Prior to this role, Ms. Shemesh-Rasmussen served as the Global Head of Marketing at Roche Diagnostics Information Solutions between 2018 and 2020. Between 2016 and 2018, she worked at Fitango Health, Inc. where she focused on marketing and business development. Between 2013 and 2016, she led Product Marketing at the Oracle Health Sciences Global Business Unit, as well as Marketing and Business Development in the Oracle Digital Health Innovation Unit. Prior to these positions, Ms. Shemesh-Rasmussen served as Vice President at JPMorgan Chase Bank from 2002 until 2007. Ms. Shemesh-Rasmussen holds a BA in Behavioral Sciences from Ben Gurion University.

We believe that Ms. Shemesh-Rasmussen’s qualifications to sit on our Board include her experience in marketing for pharmaceutical companies, science, business development and investment banking. |

5

| Doron Shorrer* | 68 | Mr. Shorrer became a director of the Company in October 2003. Mr. Shorrer was one of the Company’s founders and served as its first Chairman until 2006. Since 1998, Mr. Shorrer has served as the Chairman and CEO of Shorrer International Ltd., an investment and financial consulting company. Mr. Shorrer also serves as a director at each of Meitav-Dash Pension Funds., Oxs Wellbeing Systems. and Baroz Insurance Agency.

Mr. Shorrer has served as a director of Provident Fund for employees of the Israel Electric Company Ltd. and between 1999 and 2004 he was Chairman of the board of directors of Phoenix Insurance Company, one of the largest insurance companies in Israel, and of Mivtachim Pension Funds Group, the largest pension fund in Israel. Prior to serving in these positions, Mr. Shorrer held senior positions that included Arbitrator at the Claims Resolution Tribunal for Dormant Accounts in Switzerland; Economic and Financial Advisor, Commissioner of Insurance and Capital Markets for the State of Israel; Member of the board of directors of “Nechasim” of the State of Israel; Member Committee for the Examination of Structural Changes in the Capital Market (The Brodet Committee); General Director of the Ministry of Transport; founder and managing partner of an accounting firm with offices in Jerusalem, Tel-Aviv and Haifa; Member of the Lecture Staff of the Hebrew University Business Administration School; Chairman of Amal School Chain; Chairman of a Public Committee for Telecommunications; and Economic Consultant to the Ministry of Energy. In addition, Mr. Shorrer served as a director of Hebrew University employees and Massad Bank from the International Bank group from 2009 to 2018.

Among his many areas of expertise, Mr. Shorrer formulates, implements and administers business planning in the private and institutional sector, in addition to consulting on economic, accounting and taxation issues to a diverse audience ranging from private concerns to government ministries.

| ||

| Mr. Shorrer holds a B.A. in Economics and Accounting and an M.B.A. in Business Administration (specialization in finance and banking) from the Hebrew University of Jerusalem and is a Certified Public Accountant in Israel. | ||||

| We believe that Mr. Shorrer’s qualifications to sit on our Board include his years of experience in the high-tech industry, his vast skill and expertise in accounting and economics, as well as his knowledge and familiarity with corporate finance. |

| * | The Board determined that this director or nominee is “independent” as defined by the rules of the SEC and Nasdaq rules and regulations. None of the independent directors has any relationship with us besides serving on our Board. |

There are no family relationships between any of the director nominees or executive officers named in this proxy statement.

Required Vote

The affirmative vote of the holders of a majority of the Common Shares having voting power present in person or represented by proxy shall be sufficient for the election of each of the director nominees.

| The Board recommends a vote “FOR” the election of each of the director nominees named above. |

6

PROPOSAL NO. 2 — RATIFICATION OF THE SELECTION OF Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm of PricewaterhouseCoopers International Limited, AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE FISCAL YEAR ENDING JUNE 30, 2022.

Our Audit Committee has selected Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm of PricewaterhouseCoopers International Limited, as our independent registered public accounting firm, or the Independent Auditors, for the current fiscal year, subject to ratification by our stockholders at the Meeting. We do not expect to have a representative of the Independent Auditors attend the Meeting.

Neither our by-laws, our other governing documents, nor other law requires shareholder ratification of the selection of the Independent Auditors as our independent registered public accounting firm. However, the Audit Committee is submitting the selection of the Independent Auditors to the shareholders for ratification as a matter of good corporate practice. If the shareholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain the Independent Auditors. Even if the selection is ratified, the Audit Committee in its discretion may decide to appoint a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its shareholders.

Required Vote

The affirmative vote of the holders of a majority of the Common Stock having voting power present in person or represented by proxy shall be sufficient for the ratification of the selection of Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm of PricewaterhouseCoopers International Limited, as independent registered public accounting firm of the Company for the fiscal year ending June 30, 2022.

| The Board recommends a vote “FOR” the ratification of the selection of Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm of PricewaterhouseCoopers International Limited, as independent registered public accounting firm of the Company for the fiscal year ending June 30, 2022. |

7

CORPORATE GOVERNANCE

Committees and Meetings of Our Board

The Board held 12 meetings during Fiscal Year 2021. Throughout this period, each member of our Board who was a director in Fiscal Year 2021 attended or participated in at least 75% of the aggregate of the total number of meetings of our Board held and the total number of meetings held by all committees of our Board on which each the director served during the periods such director served. Our Board has three standing committees: the Compensation Committee, the Audit Committee and the Nominating Committee.

Audit Committee. The members of our Audit Committee are Mr. Birger, Mr. Shorrer and Ms. Shemesh -Rasmussen. Mr. Shorrer is the Chairman of the Audit Committee, and our Board has determined that all members of the Audit Committee are “independent” as defined by the rules of the SEC and the Nasdaq rules and regulations. The Board also determined that Mr. Shorrer and Mr. Doron Birger are an Audit Committee financial experts. The Audit Committee operates under a written charter that is posted on our website at www.pluristem.com. The information on our website is not incorporated by reference into this Proxy Statement. The primary responsibilities of our Audit Committee include:

| ● | appointing, compensating and retaining our registered independent public accounting firm; |

| ● | overseeing the work performed by any outside accounting firm; |

| ● | assisting the Board in fulfilling its responsibilities by reviewing: (i) the financial reports provided by us to the SEC, our shareholders or to the general public, and (ii) our internal financial and accounting controls; and |

| ● | recommending, establishing and monitoring procedures designed to improve the quality and reliability of the disclosure of our financial condition and results of operations. |

Our Audit Committee held 6 meetings during Fiscal Year 2021.

Compensation Committee. The members of our Compensation Committee are Mr. Shorrer and Ms. Kwiat. Mr. Shorrer is the Chairman of the Compensation Committee and the Board has determined that all of the members of the Compensation Committee are “independent” as defined by the rules of the SEC and Nasdaq rules and regulations. The Compensation Committee operates under a written charter that is posted on our website at www.pluristem.com. The information on our website is not incorporated by reference into this Proxy Statement. The primary responsibilities of our Compensation Committee include:

| ● | reviewing and recommending to our Board the annual base compensation, the annual incentive bonus, equity compensation, employment agreements and any other benefits of our executive officers; |

| ● | administering our equity based plans and making recommendations to our Board with respect to our incentive–compensation plans and equity–based plans; and |

| ● | annually reviewing and making recommendations to our Board with respect to the compensation policy for such other officers as directed by our Board. |

Our Compensation Committee held 8 meetings during Fiscal Year 2021. During Fiscal Year 2021 the Compensation Committee engaged Deloitte Israel to review the Company’s existing compensation structure for its executive officers and non-executive directors. Such review included a benchmark analysis that evaluated the compensation that we pay our CEO, CFO, Executive Chairman and non-executive directors in comparison to our peer group. On September 10, 2020, our Board, upon recommendation from our Compensation Committee, approved new compensation arrangements for our CEO, CFO and Executive Chairman as well as an updated compensation policy for our non-executive directors.

Nominating Committee. The members of our Nominating Committee are Mark Germain and Doron Shorrer. Mr. Germain is the Chairman of the Nominating Committee. The Board has determined that all of the members of the Nominating Committee are “independent” as defined by the rules of the SEC and Nasdaq rules and regulations. The Nominating Committee operates under a written charter that is posted on the “Investors” section of our website, www.pluristem.com. The primary responsibilities of our Nominating Committee include:

| ● | Overseeing the composition and size of the Board, developing qualification criteria for Board members and actively seeking, interviewing and screening individuals qualified to become Board members for recommendation to the Board; |

8

| ● | Recommending the composition of the Board for each annual meeting of shareholders; and |

| ● | Reviewing periodically with the Chairman of the Board and the Chief Executive Officer the succession plans relating to positions held by directors, and making recommendations to the Board with respect to the selection and development of individuals to occupy those positions. |

Our Nominating Committee held 4 meetings during Fiscal Year 2021. The Nominating Committee did not receive advice from or retain any consultants during Fiscal Year 2021.

Director Nominations

The Nominating Committee is responsible for developing and approving criteria, with Board approval, for candidates for Board membership. The Nominating Committee is responsible for overseeing the composition and size of the Board, developing qualification criteria for Board members and actively seeking, interviewing and screening individuals qualified to become Board members for recommendation to the Board and for recommending the composition of the Board for each of the Company’s annual meetings. The Board as a whole is responsible for nominating individuals for election to the Board by the shareholders and for filling vacancies on the Board that may occur between annual meetings of the shareholders.

Nominees for director will be selected on the basis of their integrity, business acumen, knowledge of our business and industry, age, experience, diligence, conflicts of interest and the ability to act in the interests of all shareholders. No particular criteria will be a prerequisite or will be assigned a specific weight, nor does the Company have a diversity policy. The Company believes that the backgrounds and qualifications of its directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities.

We have never received communications from shareholders recommending individuals to any of our independent directors. Therefore we do not yet have a policy with regard to the consideration of any director candidates recommended by shareholders. In Fiscal Year 2021, we did not pay a fee to any third party to identify or evaluate, or assist in identifying or evaluating, potential nominees for our Board. We have not received any recommendations from shareholders for Board nominees. All of the nominees for election at the Meeting are current members of our Board.

Board Leadership Structure.

Commencing on January 1, 2022, Mr. Aberman transitioned from his position as Executive Chairman to Chairman of the Board. In his position as Chairman of the Board, Mr. Aberman is responsible for setting the agenda and priorities of the Board.

As CEO, Mr. Yanay, leads our day-to-day business operations and is directly accountable to the full Board, and, in addition, is responsible for our management operations and for general oversight of our business and the various management teams that are responsible for our day-to-day operations. We believe that this structure provides an efficient and effective leadership model for the Company to enable us to deliver better results and explore opportunities for the company and its investors.

The Board has designated an independent director to serve as the lead independent director to enhance the Board’s ability to fulfill its responsibilities independently. The Board has appointed Mark Germain as lead independent director. The lead independent director serves as the liaison between the Chairman and the independent directors.

We believe that having different persons serving as Chairman and CEO, together with an empowered lead independent director is the optimal Board structure to provide independent oversight and management accountability while ensuring that our strategic plans are pursued to optimize long-term shareholder value.

Risk Oversight. The Board, including the Audit Committee, Investment Committee, and Compensation Committee, periodically reviews and assesses the significant risks to the Company. Our management is responsible for our risk management process and the day-to-day supervision and mitigation of risks. These risks include strategic, operational, competitive, financial, legal and regulatory risks. Our Board leadership structure, together with the frequent interaction between our directors and management, assists in this effort. Communication between our Board and management regarding long-term strategic planning and short-term operational practices include matters of material risk inherent in our business.

9

The Board plays an active role, as a whole and at the committee level, in overseeing management of the Company’s risks. Each of our Board committees is focused on specific risks within their areas of responsibility, but the Board believes that the overall enterprise risk management process is more properly overseen by all of the members of the Board. The Audit Committee is responsible for overseeing the management of financial and accounting risks. The Compensation Committee is responsible for overseeing the management of risks relating to executive compensation plans and arrangements.

While each committee is responsible for the evaluation and management of such risks, the entire Board is regularly informed of such risks through committee reports. The Board incorporates the insight provided by these reports into its overall risk management analysis.

The Board administers its risk oversight responsibilities through the CEO and the CFO, who, together with management representatives of the relevant functional areas, review and assess our operations as well as operating management’s identification, assessment and mitigation of the material risks affecting our operations.

Our Board has adopted a Code of Business Conduct and Ethics that applies to, among other persons, members of our Board, our officers including our CEO (being our principal executive officer) and our CFO (being our principal financial and accounting officer) and our employees. Our Code of Business Conduct and Ethics is posted on our website at www.pluristem.com. The information on our website is not incorporated by reference into this Definitive Proxy.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who own more than 10% of our Common Shares, to file reports regarding ownership of, and transactions in, our securities with the SEC and to provide us with copies of those filings.

We have reviewed all forms provided to us or filed with the SEC. Based on that review and on written information given to us by our executive officers and directors, we believe that all Section 16(a) filings during the past fiscal year were filed on a timely basis and that all directors, executive officers and 10% beneficial owners have fully complied with such requirements during the past fiscal year, other than three reports on Form 4, filed on July 7, 2020, May 26, 2021 and June 1, 2021, which were filed late by Clover Wolf Capital – Limited Partnership, resulting in 4 transactions, 3 transactions and 6 transactions, respectively, not being reported on a timely basis.

Anti-Hedging Policy

Under our insider trading policy, our directors and officers are prohibited from engaging in short sales of our securities, purchases of our securities on margin, hedging or monetization transactions through the use of financial instruments, and options and derivatives trading on any of the stock exchanges or futures exchanges, without prior written pre-clearance.

COMMUNICATING WITH OUR BOARD

Our Board will give appropriate attention to written communications that are submitted by shareholders, and will respond if and as appropriate. Mr. Shorrer, one of our independent directors, and the Chairman of our Audit Committee, with the assistance of our outside counsel, is primarily responsible for monitoring communications from our shareholders and for providing copies or summaries to the other directors as he considers appropriate. Communications are forwarded to all directors if they relate to substantive matters and include suggestions or comments that Mr. Shorrer considers to be important for the directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we tend to receive repetitive or duplicative communications.

Shareholders who wish to send communications on any topic to our Board should address such communications to: Pluristem Therapeutics, Inc., c/o Doron Shorrer, Matam Advanced Technology Park Building No. 5, Haifa, Israel, 3508409.

ATTENDANCE AT SPECIAL AND ANNUAL SHAREHOLDER MEETINGS

We encourage our directors to attend our special and annual shareholders meetings. Mr. Aberman, our Chairman, and Mr. Yanay, our CEO, president and director, attended our last annual shareholder meeting.

10

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Compensation Committee of our Board is comprised solely of independent directors as defined by Nasdaq and non-employee directors as defined by Rule 16b-3 under the Securities Exchange Act of 1934, as amended. The Compensation Committee has the authority and responsibility to review and make recommendations to the Board regarding the compensation of our CEO, Chairman and CFO. Our named executive officers for Fiscal Year 2021 are those three individuals listed in the “Summary Compensation Table” below. Other information concerning the structure, roles and responsibilities of our Compensation Committee is set forth in “Board Meetings and Committees—Compensation Committee” section above.

At our 2021 annual meeting of shareholders, we provided our shareholders with the opportunity to cast an advisory vote on our then named executive officers’ compensation. Over 88% of the votes cast on this “2021 say-on-pay vote” were voted in favor of the proposal. We have considered the 2021 say-on-pay vote and we believe that the support from our shareholders for the 2021 say-on-pay vote proposal indicates that our shareholders are supportive of our approach to executive compensation. At our 2019 annual meeting of shareholders, our shareholders voted in favor of the proposal to hold say-on-pay votes every two years. We will continue to consider the outcome of our say-on-pay votes when making compensation decisions regarding our named executive officers.

A discussion of the policies and decisions that shape our executive compensation program, including the specific objectives and elements, is set forth below.

Executive Compensation Objectives and Philosophy

The objective of our executive compensation program is to attract, retain and motivate talented executives who are critical for our continued growth and success and to align the interests of these executives with those of our shareholders. To this end, our compensation programs for executive officers are designed to achieve the following objectives:

| ● | attract, hire, and retain talented and experienced executives; |

| ● | motivate, reward and retain executives whose knowledge, skills and performance are critical to our success; |

| ● | ensure fairness among the executive management team by recognizing the contributions each executive makes to our success and the tenure of each team member as a factor in achieving such success; |

| ● | focus executive behavior on achievement of our corporate objectives and strategy; |

| ● | build a mechanism of “pay for performance”; and |

| ● | align the interests of management and shareholders by providing management with longer-term incentives through equity ownership. |

The Compensation Committee reviews the allocation of compensation components regularly to ensure alignment with strategic and operating goals, competitive market practices and legislative changes. The Compensation Committee does not apply a specific formula to determine the allocation between cash and non-cash forms of compensation. Certain compensation components, such as base salaries, benefits and perquisites, are intended primarily to attract, hire, and retain well-qualified executives. Other compensation elements, such as long-term incentive opportunities, are designed to motivate and reward performance. Long-term incentives are intended to reward our long-term performance and executing our business strategy, and to strongly align named executive officers’ interests with those of shareholders. As such, from time to time, the Compensation Committee, and/or the Board, may engage external consultants to provide the Company with data that the Compensation Committee and/or Board may deem to be appropriate in determining the compensation of our executive officers, and the compensation, if any, paid to the members of the Board.

11

With respect to equity compensation, the Compensation Committee makes awards to executives under our equity compensation plans as approved by the Board. Executive compensation is paid or granted based on such matters as the Compensation Committee deems appropriate, including our financial and operating performance, the alignment of the interests of the executive officers and our shareholders, the performance of our Common Shares and our ability to attract and retain qualified individuals.

Elements of Executive Officer Compensation

Our executive officer compensation program is comprised of: (i) base salary or monthly compensation; (ii) performance based bonuses; (iii) long-term equity incentive compensation in the form of Restricted Stock Unit, or RSU, grants; and (iv) benefits and perquisites.

In establishing overall executive compensation levels and making specific compensation decisions for our executive officers in Fiscal Year 2021, the Compensation Committee considered a number of criteria, including the executive’s position, scope of responsibilities, prior base salary and annual incentive awards and expected contribution.

Generally, our Compensation Committee reviews and, as appropriate, approves compensation arrangements for our named executive officers, from time to time but not less than once a year. The Compensation Committee also takes into consideration our CEO recommendations for the compensation of our CFO. Our CEO generally presents these recommendations at the time of our Compensation Committee’s review of executive compensation arrangements.

On September 10, 2020, our Board, upon recommendation from our Compensation Committee, approved compensation arrangements for our CEO, CFO and Chairman as well as our non-executive directors. In that regard, the Compensation Committee engaged Deloitte Israel to review the Company’s existing compensation structure for its executive officers and non-executive directors. Such review included a benchmark analysis that evaluated the compensation that we pay our CEO, CFO, Chairman and non-executive directors in comparison to our peer group. When evaluating the appropriateness of our compensation peer group, the Compensation Committee seeks to construct and approve a peer group of companies in similar industries of similar size to that of our Company. As a result, the Company has revised its compensation structure for its executive officers, Chairman and non-executive directors as further described herein, which went into effect during fiscal year 2021.

Base Salary

The Compensation Committee performs a review of base salaries / monthly compensation for our named executive officers from time to time as appropriate. In determining salaries, the Compensation Committee members also take into consideration their understanding of the compensation practices of comparable companies (based on size and stage of development), independent third party market data such as compensation benchmark surveys to industry, including information relating to peer companies; individual experience and performance adjusted to reflect individual roles; and contribution to our clinical, regulatory, commercial, financial and operational performance. None of the factors above has a dominant weight in determining the compensation of our executive officers, and our Compensation Committee considers the factors as a whole when considering such compensation. In addition, our Compensation Committee may, from time to time, use comparative data regarding compensation paid by peer companies, for example, as it conducted during Fiscal Year 2021, in order to obtain a general understanding of current trends in compensation practices and ranges of amounts being awarded by other public companies, and not as part of an analysis or a formula. We may also change the base salary / monthly compensation of an executive officer at other times due to market conditions. We believe that a competitive base salary / monthly compensation is a necessary element of any compensation program that is designed to attract and retain talented and experienced executives. We also believe that attractive base salaries can motivate and reward executives for their overall performance.

12

Base salaries and/or monthly compensation are established in part based on the individual experience, skills and expected contributions of our executives and our executives’ performance during the prior year. Compensation adjustments are made occasionally based on changes in an executive’s level of responsibility, Company progress or on changed local and specific executive employment market conditions.

On September 10, 2020, at the recommendation of our Compensation Committee, following the benchmarking review conducted, our Board approved, effective as of January 1, 2021, on the one hand, an increase to the base monthly salary of our CEO and CFO such that the respective salaries will increase to 99,000 NIS and 65,000 NIS, and on the other hand, a decrease to the monthly consulting fee of our then Executive Chairman to 142,250 NIS per month starting January 1, 2021 and effective through the earlier of December 31, 2021 or the filing of a BLA. Effective January 1, 2022, we entered into a new consulting agreement with our Chairman whereby we agreed to pay him 30,500 NIS per month and reimburse him up to 4,000 NIS per month for a company car. In addition, our Chairman is eligible for a bonus, at the Board’s discretion of up to $75,000 for extraordinary performance, as well as eligible for a special bonus equal to 1.5% of amounts received by us from non-dilutive funding received, among other things, from corporate partnering and strategic deals that closed by December 31, 2022. As a result of these changes, we entered into new employment and service agreements, as the case may be, with of each of our CEO, CFO and Chairman. In addition, Mr. Aberman and Mr. Yanay are no longer eligible for annual director fees.

Performance Based Bonus

Given the nature of our business, the determination of incentives for our executives is generally tied to success in promoting our Company’s development. We are continually seeking non-dilutive sources of funding. In addition, a key component of our strategy is to develop and manufacture cell therapy products for the treatment of multiple disorders through collaboration with other companies and entering into licensing agreements with such companies, such as our agreement with CHA. Therefore, to reward our executive officers, each of Mr. Yanay and Mr. Aberman will be entitled to a bonus equal to 1.5%, and Ms. Franco–Yehuda will be entitled to a bonus equal to 0.5%, of amounts received by us from non-dilutive funding received, among other things, from corporate partnering and strategic deals.

Our Board approved a target bonus to our CEO, equal to up to seven times his monthly salary and to our CFO, of up to five and a half times her monthly salary, subject to milestones and performance targets that was set by our Compensation Committee. In addition, according to their employment agreements, Ms. Franco-Yehuda and Mr. Yanay are also entitled to a special bonus of up to three times of their monthly salary at the discretion of the Board.

During Fiscal Year 2021, we accrued bonuses of $126,000 and $64,000 to our CEO and CFO, respectively, for certain target bonuses as a result of the achievement of certain milestones that were defined by the Compensation Committee. We paid such bonuses in October 2021.

Long-Term Equity Incentive Compensation

Long-term incentive compensation allows the executive officers to share in any appreciation in the value of our Common Shares. The Compensation Committee believes that share participation aligns executive officers’ interests with those of our shareholders. The amounts of the awards are designed to reward past performance and create incentives to meet long-term objectives. Awards are made at a level expected to be competitive within the biotechnology industry. We do not have a formula relating to the level of awards that is competitive within the biotechnology industry. In determining the amount of each grant, the Compensation Committee also takes into account the number of shares held by the executive prior to the grant. For our executive management team, awards are made on a discretionary basis and not pursuant to specific criteria set out in advance.

RSU awards provide our executive officers with the right to purchase shares of our Common Shares at a par value of $0.00001, subject to continued employment with our Company or the achievement of certain business or market milestones. In recent years, we granted our executive officers RSU awards.

13

We chose to grant RSU awards and not options because RSU awards, once vested, always have an immediate financial value to the holder thereof, unlike options where the exercise price might be below the current market price of the shares and therefore not have any intrinsic value to the holder thereof. Our Chairman, CEO and CFO are entitled to acceleration of the vesting of their awards in the following circumstances: (1) if we terminate their employment or consulting arrangement with us or any of our subsidiaries for a reason other than “Justifiable Cause” (as defined in their employment or consulting arrangement contract), they will be entitled to acceleration of 100% of any unvested award and (2) if they resign, they will be entitled to acceleration of up to 50% of any unvested award subject to the approval of the Board and (3) in the event of a change in control as defined in their consulting or employment agreement, as long as they continue to provide services to the Company or its subsidiaries, they will be entitled to an acceleration of 100% of any unvested RSUs. All grants are approved, upon receipt of recommendation by our Compensation Committee, by our Board.

In September 2020, following a benchmark analysis conducted by our compensation committee, we decided to grant our CEO and Chairman 1,000,000 RSUs each. Of this award, 500,000 RSUs that were granted to each of them were linked to achievement of a market condition – our reaching $550 million of market capitalization during the three year period from the date of the grant. We believe that such compensation aligns executive officers’ interests with those of our shareholders.

For clarification purposes, the acceleration mechanism detailed above does not apply to the 500,000 RSUs granted to each of our CEO and Chairman in September 2020, that were linked to the achievement of our market capitalization reaching of $550 million during the three year period from the date of the grant.

Benefits and Perquisites

Generally, benefits available to Mr. Yanay and Ms. Franco-Yehuda are available to all employees on similar terms and include welfare benefits, paid time-off, life and disability insurance and other customary or mandatory social benefits in Israel. We provide our named executive officers with a phone and a Company car, or reimbursement for car or phone expenses, which are customary benefits in Israel to managers and officers.

Mr. Yanay is entitled to a severance payment that equals a month’s compensation for each twelve-month period of employment or otherwise providing services to the Company, and an additional adjustment fee that equals the monthly salary amount multiplied by 6, plus the number of years the employment agreement remains in force from September 12, 2018, but in any event no more than 9 years in the aggregate.

In conjunction with the adjustments made to the base salaries during Fiscal Year 2021, the employment agreement of our CFO was amended to also provide for an adjustment fee that equals her monthly salary amount multiplied by three, plus the number of years the employment agreement remained in force from June 30, 2020, but in any event no more than six months of adjustment fees in the aggregate.

Ms. Chen Franco-Yehuda is also entitled to severance pay upon termination of employment for any reason, including retirement, based on 8.333% of her monthly base salary, according to section 14 of the Severance Pay Law, 1963.

We do not believe that the benefits and perquisites described above deviate materially from the customary practice for compensation of executive officers by other companies similar in size and stage of development.

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed the foregoing Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with our management and, based on such review and discussions, the Compensation Committee recommended to our Board that the Compensation Discussion and Analysis be included in this proxy statement and our annual report on Form 10-K for Fiscal Year 2021.

Compensation Committee Members:

Doron Shorrer, Chairman Moria Kwiat |

14

Summary Compensation Table

The following table shows the particulars of compensation paid to our named executive officers for the fiscal years ended June 30, 2021 and 2020. We do not currently have any other executive officers.

| Name and Principal Position | Fiscal Year (1) | Salary ($)(2) | Non-Equity ($)(3) | Bonus ($)(4) | Share-based Awards ($)(5) | All Other Compensation ($)(6) | Total ($) | |||||||||||||||||||||

| Zami Aberman(9) | 2021 | 556,475 | (7) | - | - | 8,741,402 | 508,074 | 9,805,951 | ||||||||||||||||||||

| Executive Chairman | 2020 | 439,704 | (7) | - | - | - | 61,540 | 501,244 | ||||||||||||||||||||

| Yaky Yanay | 2021 | 459,016 | (8) | 126,000 | - | 8,741,402 | 27,588 | 9,354,006 | ||||||||||||||||||||

| CEO | 2020 | 320,911 | (8) | - | - | - | 29,466 | 350,377 | ||||||||||||||||||||

| Chen Franco-Yehuda | 2021 | 251,642 | 64,000 | 1,020,000 | 14,653 | 1,350,295 | ||||||||||||||||||||||

| CFO | 2020 | 179,229 | - | 14,426 | - | 14,035 | 207,690 | |||||||||||||||||||||

| (1) | The information is provided for each fiscal year, which begins on July 1 and ends on June 30. |

| (2) | Amounts paid for Salary which were originally denominated in NIS, were translated into U.S. dollars at the then current exchange rate for each payment. The salaries of Mr. Yanay and Ms. Franco-Yehuda are comprised of base salaries and additional payments and provisions such as welfare benefits, paid time-off, life and disability insurance and other customary or mandatory social benefits to employees in Israel. |

For Mr. Yanay and Mr. Aberman, their salaries also include additional amounts equal to one monthly salary of NIS 80,000, or approximately $25,000 and NIS 149,500, or approximately $44,000, respectfully.

| (3) | For Mr. Yanay and Ms. Franco-Yehuda, we have accrued bonuses during Fiscal Year 2021 of $126,000 and $64,000 respectively, for certain target bonuses as a result of the achievement of certain milestones that were defined by the Compensation Committee. We paid such bonuses during October 2021. |

| (4) | In fiscal year 2020, we paid to Ms. Franco-Yehuda a onetime bonus of NIS 50,000, or approximately $14,000. |

| (5) | The fair value recognized for the share-based awards was determined as of the grant date in accordance with Accounting Standard Codification, or ASC, Topic 718. The assumptions used in the calculations for these amounts are included in Note 9 to our audited consolidated financial statements for Fiscal Year 2021 included in our annual report on Form 10-K for the fiscal year ended June 30, 2021. |

| (6) | Mr. Aberman is entitled to adjustment fees of NIS 1,515,600, or approximately $443,000, out of which we paid NIS 38,250, or approximately $11,000, during Fiscal Year 2021, and we paid the rest of the adjustment fees in January 2022. Additionally, this column includes costs in connection with car or car expenses reimbursement and mobile phone expenses for Mr. Aberman. We have also paid Mr. Yanay the tax associated with the company car benefit included in this column, which is grossed-up. For Mr. Yanay the gross-up is part of the amount in the “Salary” column. |

| (7) | Includes $6,201 and $18,486 paid in cash to Mr. Aberman as compensation for services as a director in fiscal year 2021 and 2020 respectively. Since October 2020, Mr. Aberman was not entitled to compensation for services as a director. |

| (8) | Includes $6,194 and $18,400 paid in cash to Mr. Yanay as compensation for services as a director in Fiscal Year 2021 and 2020, respectively. Staring in 2021, Mr. Yanay is not entitled to compensation for services as a director. |

| (9) | On January 1, 2022, we entered into a new consulting agreement, or the Consulting Agreement, with Mr. Zami Aberman, pursuant to which Mr. Aberman shall serve as the Chairman of the Board of Directors. |

15

During the fiscal year ended June 30, 2021, we had the following written agreements and other arrangements concerning compensation with our named executive officers:

| (a) | Mr. Aberman is engaged with us as a consultant and currently receives a monthly consulting fee of NIS 30,500 (approximately $9,500 per month). On September 10, 2020, at the recommendation of our Compensation Committee, our Board approved, effective as of January 1, 2021 a decrease to the monthly consulting fee of our Executive Chairman from 149,500 to NIS 142,250 per month. In addition, Mr. Aberman was entitled once a year to receive an additional amount that equals the monthly consulting fee. All amounts that were paid, were paid plus value added tax. Effective January 1, 2022, we entered into a new consulting agreement with Mr. Aberman, whereby he shall serve as the Company’s Chairman and we agreed to pay him 30,500 NIS per month and reimburse him up to 4,000 NIS per month for a company car. In addition, our Chairman is eligible for a bonus, at the Board’s discretion of up to $75,000 for extraordinary performance, as well as eligible for a special bonus equal to 1.5% of amounts received by us from non-dilutive funding received, among other things, from corporate partnering and strategic deals closed by December 31, 2022. | |

| (b) | Starting January 1, 2021, Mr. Yanay’s monthly salary is NIS 99,000, approximately $30,000 per month. On September 10, 2020, at the recommendation of our Compensation Committee, our Board approved, effective as of January 1, 2021, an increase to the base salary of our CEO such that the salary will increase to NIS 99,000 from NIS 80,000. Mr. Yanay is provided with a cellular phone and a Company car pursuant to the terms of his agreement. Furthermore, Mr. Yanay is entitled to a performance based bonus of 1.5% from amounts received by us from non-diluting funding and strategic deals and a target bonus equal to up to seven times his monthly salary subject to milestones and performance targets that was set by our Compensation Committee. The Board may also grant Mr. Yanay a discretionary bonus of up to 3 months of his monthly salary. |

| (c) | Starting January 1, 2021 Ms. Franco-Yehuda’s monthly salary is NIS 65,000. On September 10, 2020, at the recommendation of our Compensation Committee, our Board approved, effective as of January 1, 2021, an increase to the base salary of our CFO such that the salary will increase to NIS 65,000 from NIS 42,000. Ms. Franco-Yehuda receives car and cellular phone expense reimbursements pursuant to the terms of her agreement. Furthermore, Ms. Franco-Yehuda is entitled to a performance based bonus of 0.5% from amounts received by us from non-diluting funding and strategic deals and a target bonus equal to up to five and a half times her monthly salary, subject to milestones and performance targets that was set by our Compensation Committee. The Board may also grant Ms. Franco-Yehuda a discretionary bonus of up to 3 months of her monthly salary. |

Potential Payments Upon Termination or Change-in-Control

We have no plans or arrangements in respect of remuneration received or that may be received by our executive officers to compensate such officers in the event of termination of employment (as a result of resignation, retirement, change-in-control) or a change of responsibilities following a change-in-control, except for the following: (i) in the event of termination of Mr. Aberman’s Consulting Agreement, a thirty (30) day written notice period (the “Notice Period”) will be applied and Mr. Aberman shall continue to provide the services during the Notice Period and shall be entitled to receive the consideration for such services (the notice period will not apply in the event Mr. Aberman is not elected by the shareholders to serve as a Board member at an annual general meeting); (ii) in the event of termination of Mr. Yanay employment, he is entitled to a severance payment, under Israeli law, that equals a month’s compensation for each twelve-month period of employment or otherwise providing services to the Company, and an additional adjustment fee that equals the monthly base salary multiplied by six, plus the number of years the employment agreement is in force from September 12, 2018, but in any event no more than nine months in the aggregate; and (iii) in the event of termination of Mrs. Franco-Yehuda’s employment, she is entitled to a severance payment, under Israeli law, that equals a month’s compensation for each twelve-month period of employment or otherwise providing services to the Company, and in addition, effective as September 10, 2020, she will be entitled to receive an adjustment fee that equals her monthly salary amount multiplied by three, plus the number of years the employment agreement remains in force from June 30, 2020, but in any event no more than six years in the aggregate.

16

In addition, Mr. Aberman, Mr. Yanay and Ms. Franco-Yehuda are entitled to acceleration of the vesting of their share options and restricted share in the following circumstances: (1) if we terminate their employment for a reason other than cause (as may be defined in each respective agreement), they will be entitled to acceleration of 100% of any unvested awards and (2) if they resign, they will be entitled to acceleration of 50% of any unvested award, subject to the approval of the Board. In addition, Mr. Aberman, Mr. Yanay and Ms. Franco-Yehuda are also entitled to acceleration of 100% of any unvested award in case of our change in control as defined in their respective consulting and employment agreements.

For clarification purposes, the acceleration mechanism detailed above does not apply to the 500,000 RSUs granted to each of our CEO and Executive Chairman in September 2020, that were linked to the achievement of our market capitalization reaching of $550 million during the three year period from the date of the grant.

The following table displays the value of what our CEO, Executive Chairman and CFO would have received from us had their employment been terminated, or a change in control of us happened on June 30, 2021.

| Officer | Salary | Accelerated Vesting of RSUs(1) | Total | |||||||||

| Zami Aberman (6) | ||||||||||||

| Terminated due to officer resignation | $ | 453,792 | $ | 841,500 | (2) | $ | 1,295,292 | |||||

| Terminated due to discharge of officer | $ | 453,792 | $ | 1,683,000 | (3) | $ | 2,136,792 | |||||

| Change in control | - | $ | 1,683,000 | (4) | $ | 1,683,000 | ||||||

| Yaky Yanay | ||||||||||||

| Terminated due to officer resignation | $ | 565,689 | (5) | $ | 841,500 | (2) | $ | 1,407,189 | ||||

| Terminated due to discharge of officer | $ | 565,689 | (5) | $ | 1,683,000 | (3) | $ | 2,248,689 | ||||

| Change in control | - | $ | 1,683,000 | (4) | $ | 1,683,000 | ||||||

| Chen Franco Yehuda | ||||||||||||

| Terminated due to officer resignation | $ | 79,755 | $ | 169,290 | (2) | $ | 249,045 | |||||

| Terminated due to discharge of officer | $ | 79,755 | $ | 338,580 | (3) | $ | 418,335 | |||||

| Change in control | - | $ | 338,580 | (4) | $ | 338,580 | ||||||

| (1) | Value shown represents the difference between the closing market price of our Common Shares on June 30, 2021 of $3.96 per share and the applicable exercise price of each grant. |

| (2) | Up to 50% of all unvested RSUs issued under the applicable equity incentive plans vest upon resignation under the terms of those plans, subject to the approval of the Board at its sole discretion. |

| (3) | All unvested RSUs issued under the applicable equity incentive plans vest upon an involuntary termination due to discharge, except for cause, excluding 500,000 RSUs that will vest upon achievement of increasing market capitalization of our Common Shares on the Nasdaq Global Market to $550 million within no more than 3 years from the date of grant. |

| (4) | All unvested RSUs issued under the applicable equity incentive plans vest upon a change in control under the terms of those plans excluding 500,000 RSUs that will vest upon achievement of increasing market capitalization of our Common Shares on the Nasdaq Global Market to $550 million within no more than 3 years from the date of grant. |

17

| (5) | As of June 30, 2021, the value of the severance fund net of Mr. Yanay is $220,000. For severance payments, we will need to pay the difference between Mr. Yanay’s eligibility to receive severance payment and the value of the fund, which as of June 30, 2021, amounted to $345,000. |

| (6) | As a result of Mr. Aberman’s consulting agreement, effective of January 1, 2022, he is no longer eligible to receive a payment in the event of a change in control and is limited to an adjustment fee that equals one month of consulting fees. |

Pension, Retirement or Similar Benefit Plans

We have no arrangements or plans, except for those we are obligated to maintain pursuant to the Israeli law, under which we provide pension, retirement or similar benefits for directors or executive officers. Our directors and executive officers may receive stock options, RSUs or restricted shares at the discretion of our Board in the future.

Outstanding Equity Awards at the End of Fiscal Year 2021

The following table presents the outstanding equity awards held as of June 30, 2021 by our named executive officers, all of which have been issued pursuant to our 2019 Equity Compensation Plan, or the 2019 Plan, and 2016 Equity Compensation Plan, or the 2016 Plan:

| Name | Number of shares that have not vested (#) | Market value of shares that have not vested ($) | Equity incentive plan awards: Number of shares that have not vested (#) | Equity incentive plan awards: Market value of shares that have not vested ($) | ||||||||||||

| Zami Aberman | - | - | 500,000 | (1) | 1,980,000 | |||||||||||

| 406,250 | (2) | 1,608,750 | - | - | ||||||||||||

| 18,750 | (3) | 74,250 | - | - | ||||||||||||

| Yaky Yanay | - | -- | 500,000 | (1) | 1,980,000 | |||||||||||

| 406,250 | (2) | 1,608,750 | - | - | ||||||||||||

| 18,750 | (3) | 74,250 | - | - | ||||||||||||

| Chen Franco-Yehuda | 750 | (4) | 2,970 | - | - | |||||||||||

| 3,500 | (5) | 13,860 | - | - | ||||||||||||

| 81,250 | (6) | 321,750 | - | - | ||||||||||||

| (1) | 500,000 RSUs vest in full upon milestone achievement of increasing our market capitalization on the Nasdaq Global Markets to $550 million within no more than three years from the date of grant. |

| (2) | 406,250 RSUs vest in 13 equal installments of 31,250 on September 10, 2021 and every three months thereafter. |

| (3) | 18,750 RSUs vest in six equal installments of 3,125 on September 19, 2021 and every three months thereafter. |

| (4) | 750 RSUs vest in six equal installments of 125 on September 19, 2021 and every three months thereafter. |

| (5) | 3,500 RSUs vest in seven equal installments of 500 on September 28, 2021 and every three months thereafter. |

| (6) | 81,250 RSUs vest in 13 equal installments of 6,250 on September 11, 2021 and every three months thereafter. |

18

Option Exercises and Stock Vested Table