Life Sciences Research

Raymond James

Investor Conference

March 2008

Safe Harbor Disclaimer

This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements include statements relating to LSR’s anticipated financial performance, business prospects, new

developments and similar matters, and/or statements preceded by, followed by or that include the words "believes," "could,"

"expects," "anticipates," "estimates," "intends," "plans," or similar expressions. These forward-looking statements are based on

management's current expectations and assumptions, which are inherently subject to uncertainties, risks and changes in

circumstances that are difficult to predict and which may be beyond LSR’s control, as more fully described in the Company’s SEC

filings, including its Form 10K, as filed with the US Securities and Exchange Commission. Actual results may differ materially from

those suggested by the forward-looking statements due to a variety of factors, including changes in business, political, and

economic conditions, and actions and initiatives by current and potential competitors. Other unknown or unpredictable factors also

could have material adverse effects on LSR’s future results, performance or achievements. In light of these risks, uncertainties,

assumptions and factors, the forward-looking events discussed in this presentation may not occur. You are cautioned not to place

undue reliance on these forward-looking statements, which speak only as of the date stated, or if no date is stated, as of the date

of this presentation. LSR is not under any obligation and does not intend to make publicly available any update or other revisions

to any of the forward-looking statements contained in this presentation. to reflect circumstances existing after the date of this press

release or to reflect the occurrence of future events even if experience or future events make it clear that any expected results

expressed or implied by those forward-looking statements will not be realized.

Attractive investment opportunity

Leading player in rapidly growing CRO market

High barriers to entry

Proven strategy for growth

Strong revenue visibility

Opportunity for margin and earnings expansion

Experienced management team

Attractively valued below peers

Contract research

We are in the business of helping our customers get

new medicines to market

As quickly, safely and efficiently as possible

To help patients with unmet medical need

Safety testing of novel medicines is mandated by

governments worldwide

Must be performed in animal models prior to testing in

humans

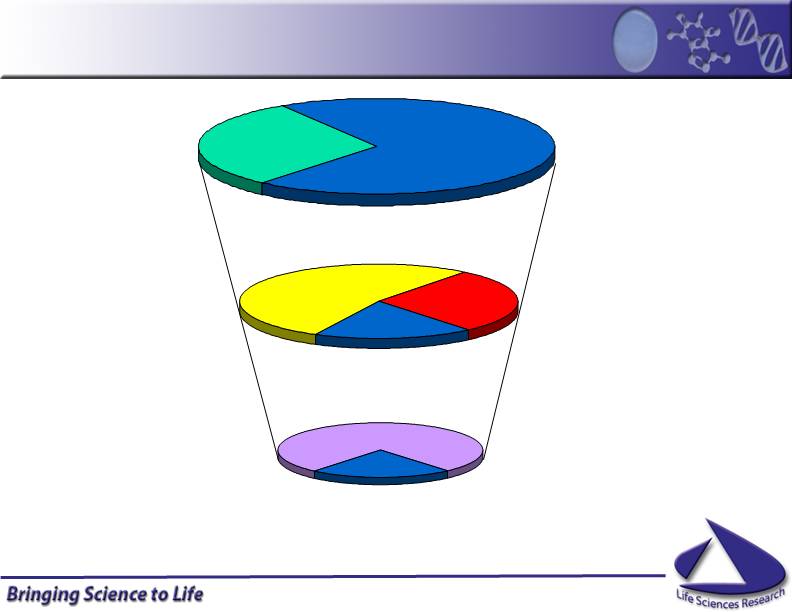

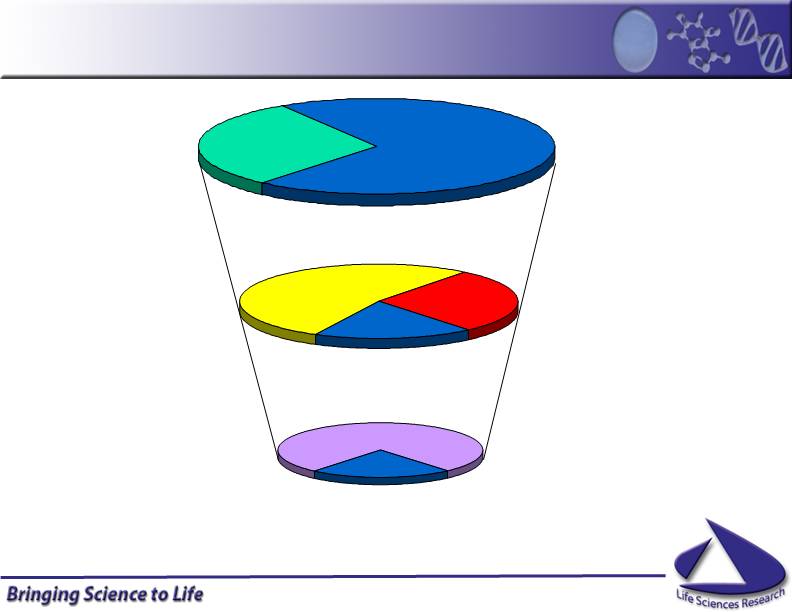

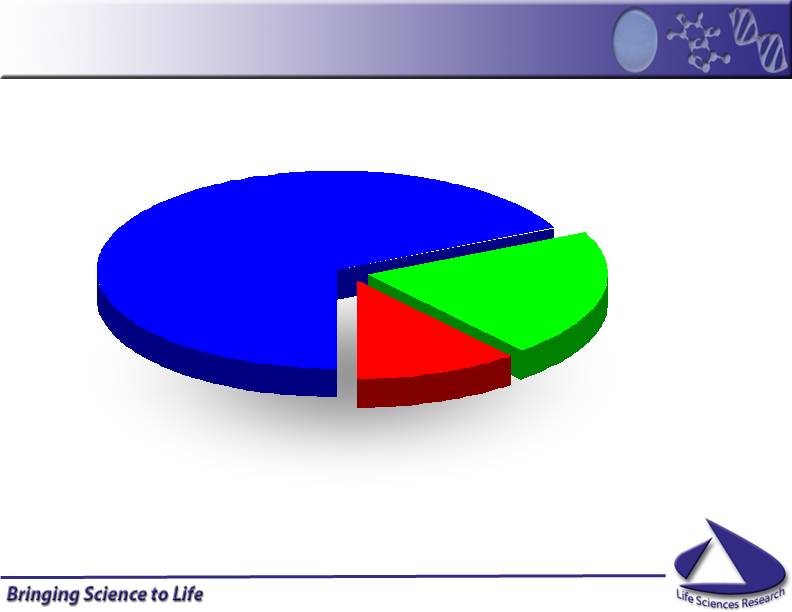

R&D outsourcing

Development

$83bn

Research

$37bn

Source: Goldman Sachs

Other

$23bn

Clinical

$44bn

Preclinical

$16bn

Outsourced

$3.5bn

…and some

suggest it could

double within 5

years

Drivers of outsourcing

Big pharma

Under pressure to increase outputs of innovation

whilst cutting costs per compound

Pharma don’t want to invest in expensive, fixed-

cost assets

Biotech

Little or no internal infrastructure

Need access to development expertise

Market dynamics

Non-clinical market of $3.5 billion

Estimated growing at 11-15% per annum

High barriers to entry

Heritage and staffing

Capacity constrained

Additions complex and expensive

Controlled introduction of new capacity

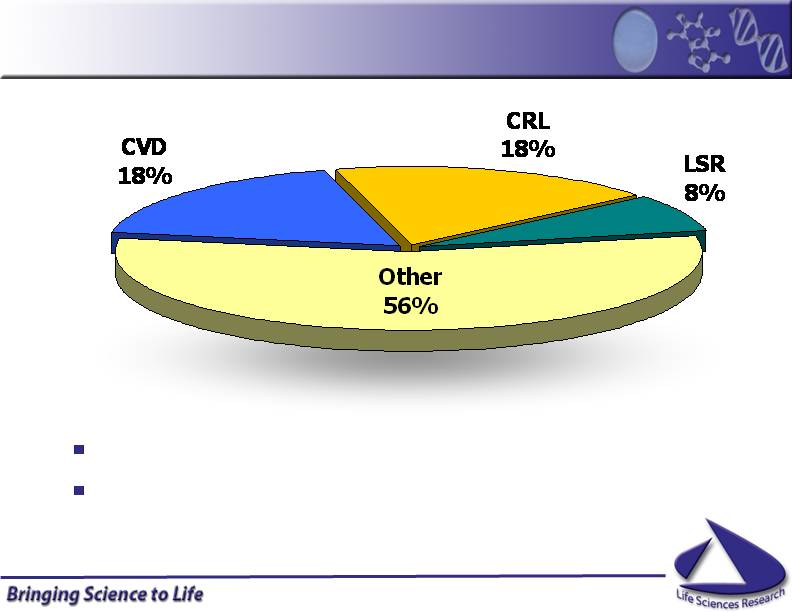

Competitive landscape

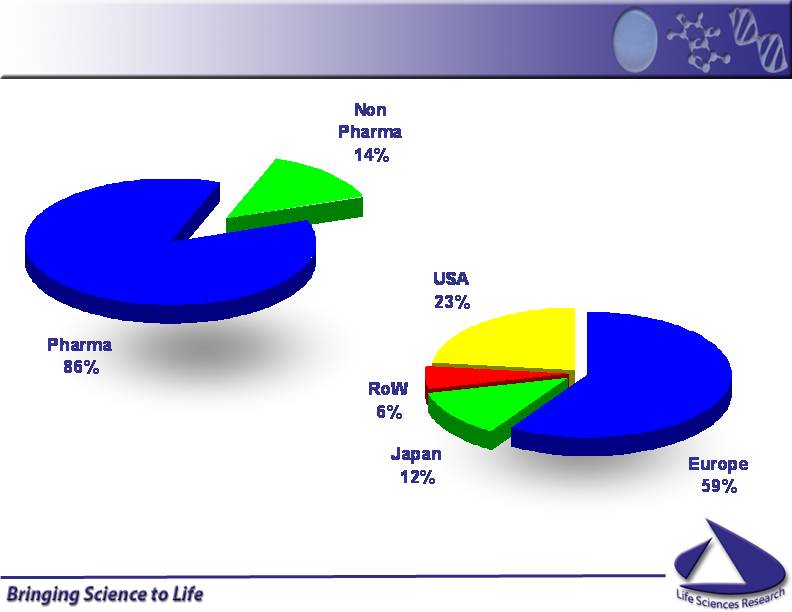

Three public, global, full service providers

Differentiated by size and focus on big pharma

Life Sciences Research, Inc.

A leading non-clinical CRO

More than 50% of sales from big pharma

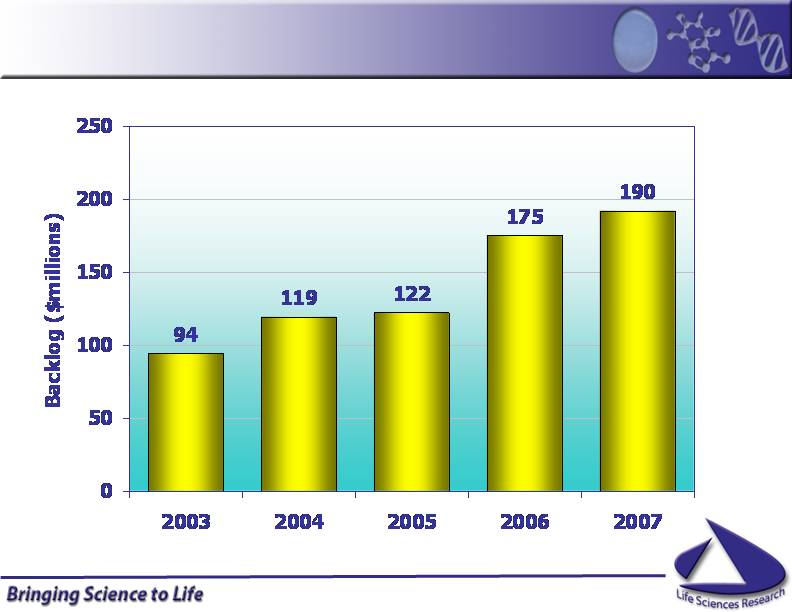

Studies last up to 3 years, so we build

significant backlog

Around 75% of backlog will convert to

revenues in next 12 months

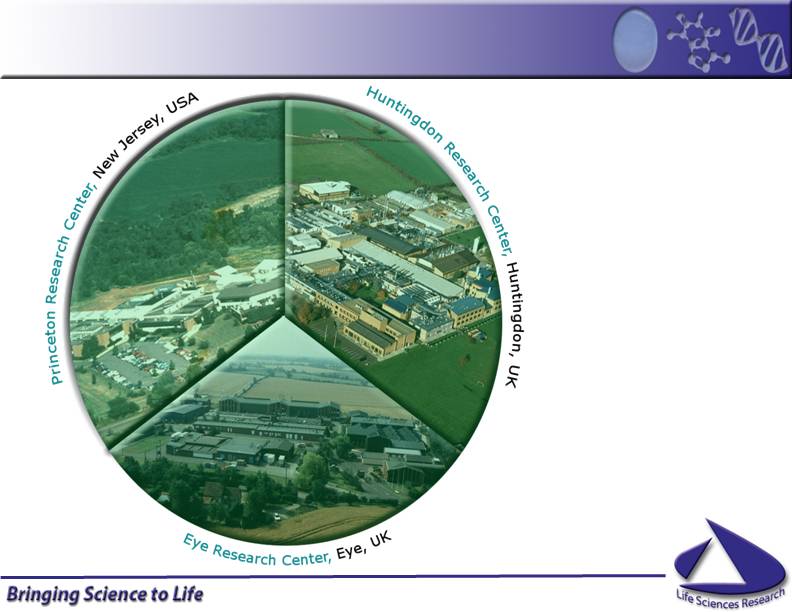

A global CRO

…with around 1,600 employees

…and ~$240 million revenue

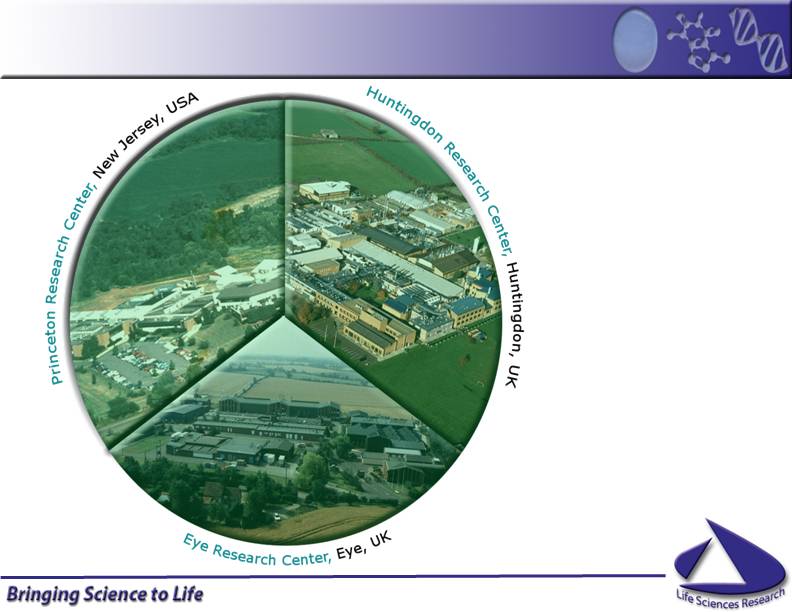

Research locations

Princeton, US

300 staff

180,000 sq ft

Huntingdon, UK

900 staff

450,000 sq ft

Eye, UK

400 staff

200,000 sq ft

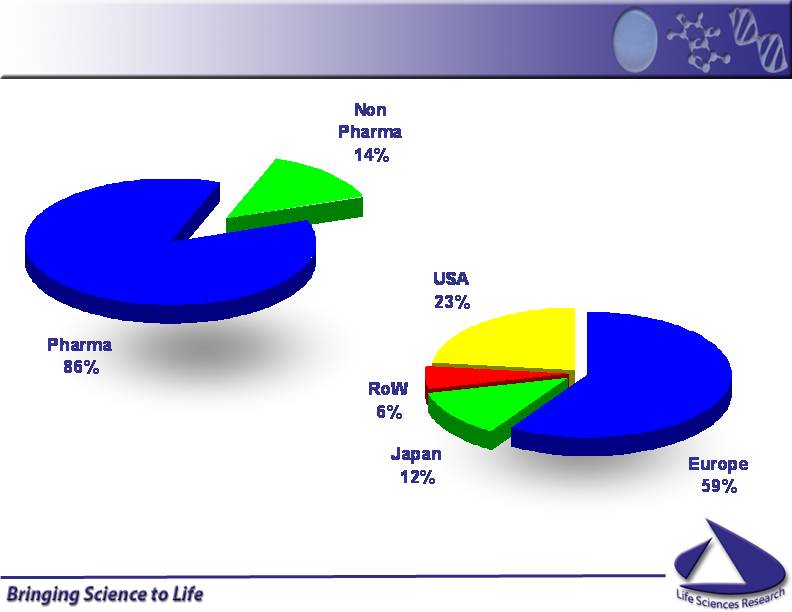

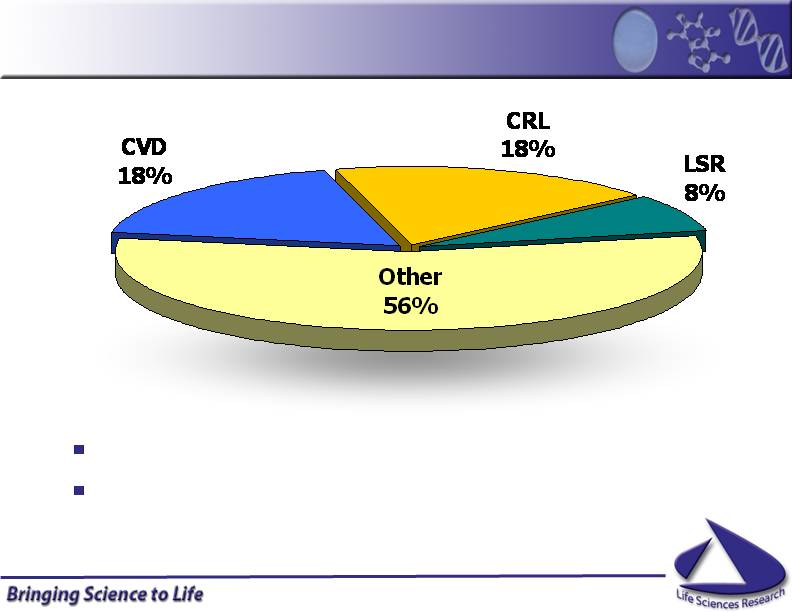

Business mix

Sales by division

Toxicology

68%

Chemistry

21%

Environmental

11%

Core strategy

Customer Service

Scientific Quality

Operational Excellence

Customer service

Everyone says it, but we’re the only company with a

dedicated Customer Service Director

…and training for every member of staff

Big enough…but not too big

Small enough so customers still feel they’re valued and

treated as individuals

Innovative and flexible partnerships

We built the first dedicated space deal

Recent feedback from top pharma tell us we think out of the

box more than other full service CROs to meet their needs

Scientific quality

Recruitment and training

Attract and retain scientific leaders

CPD for scientific staff

Structured training programs

Specialty tox

World leaders in inhalation

Recognised strength in reproductive toxicology and

infusion…with continued focus and investment

Biologics

Focused on, and hugely experienced in, safety assessment

for biologics

Adding expertise and facilities in key areas to become a

global leader

Operational excellence

Focus on delivery

On time…every time is our goal

Continually measure and improve

Drive efficiency

Process improvement teams focus across the company

Company-wide metrics on performance

Investment in IT infrastructure

Liberate – automated report production

Primavera – smart, flexible scheduling system

Extranet – customer access data in near real-time

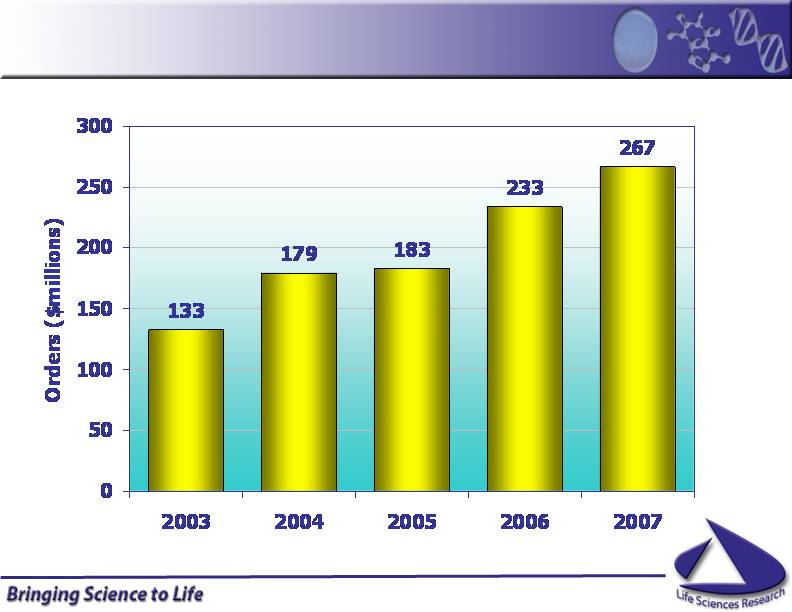

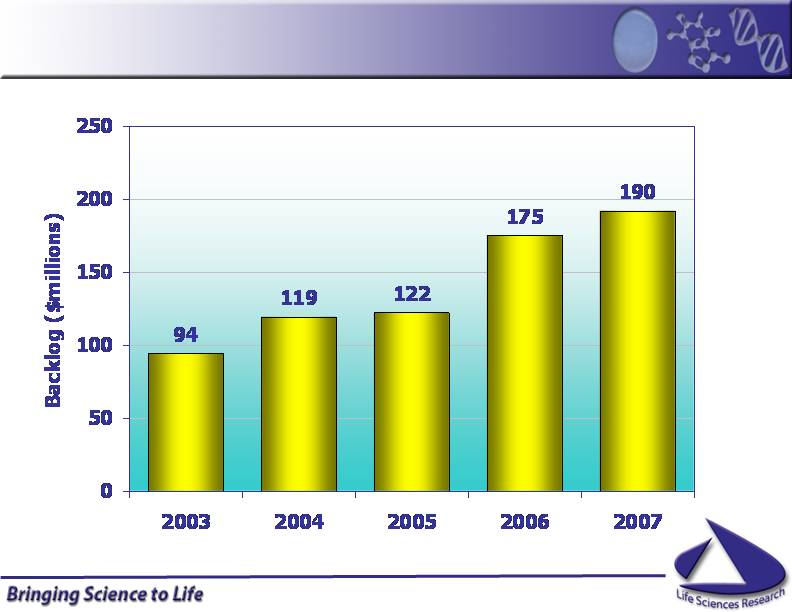

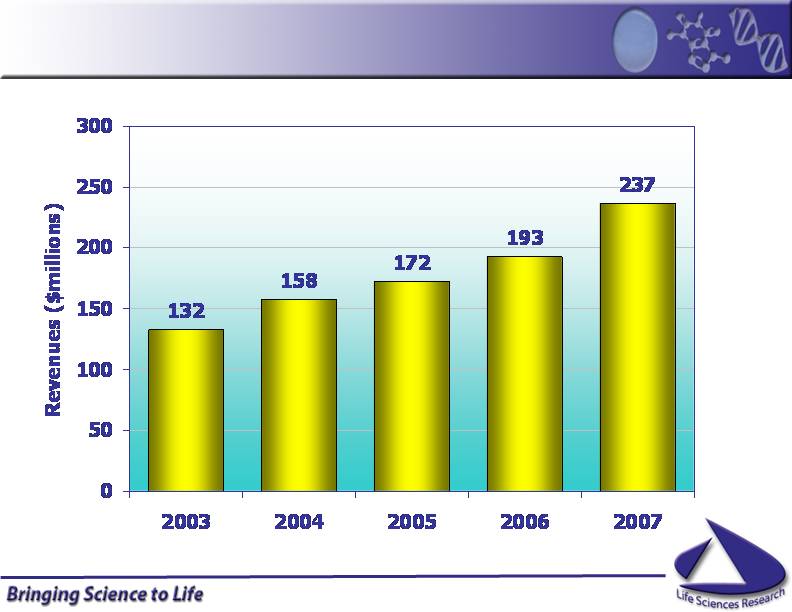

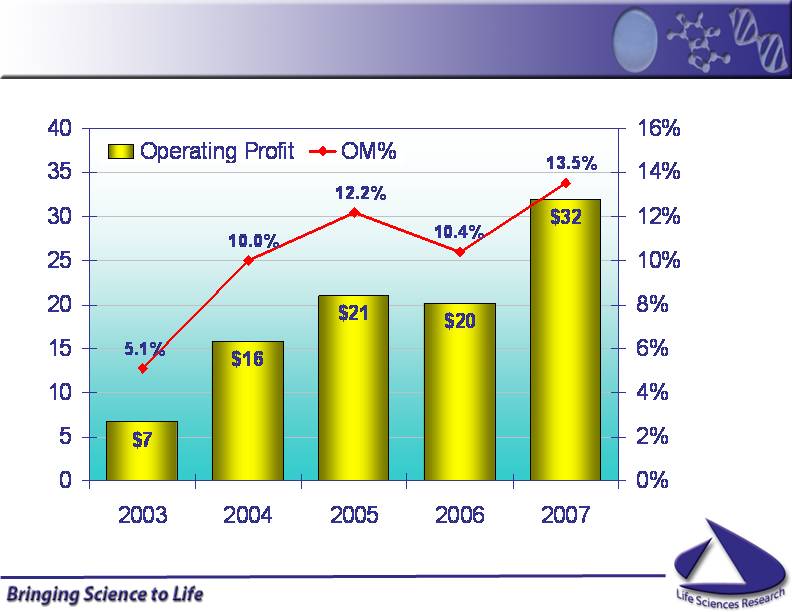

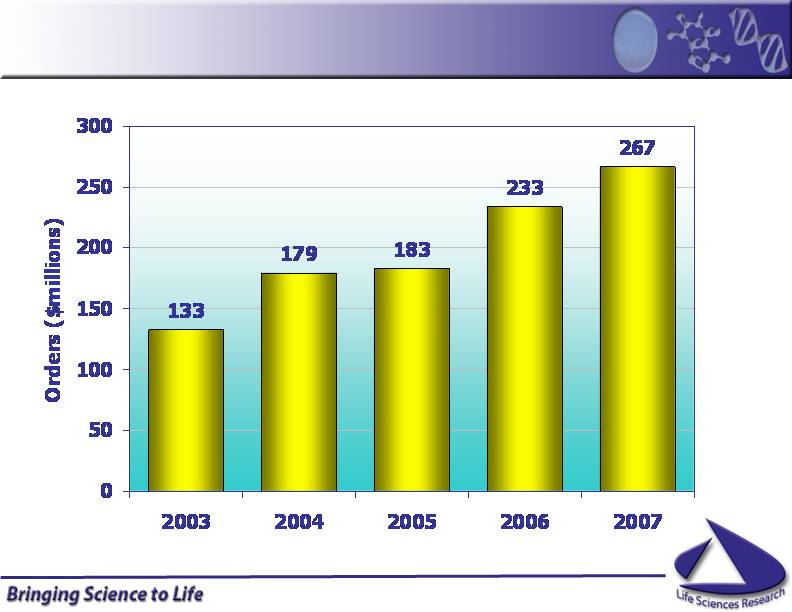

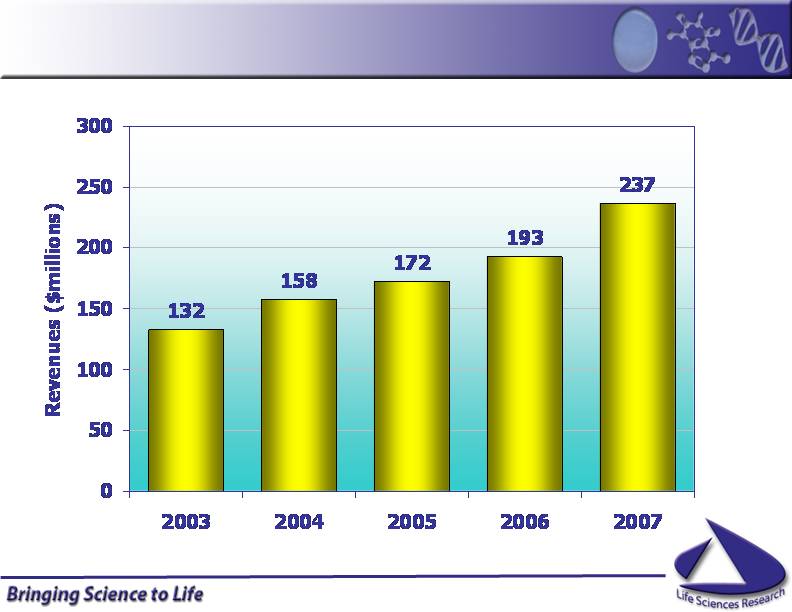

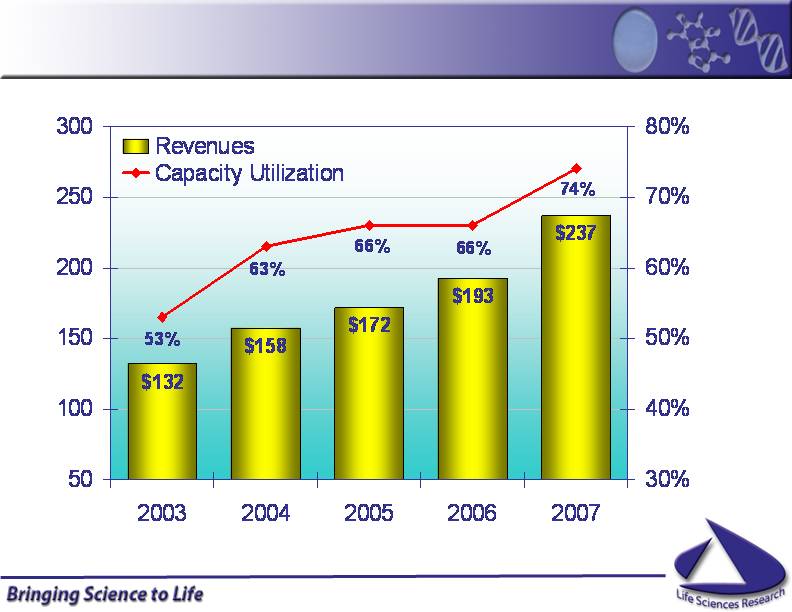

Historic performance

Backlog growth

Revenue growth

7%

9%

10%

11%

16%

Note: % growth is at constant currency

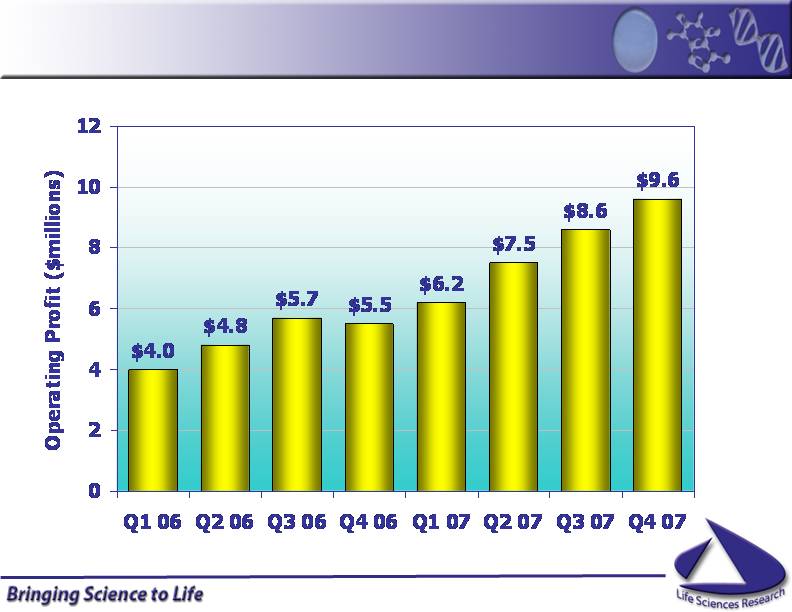

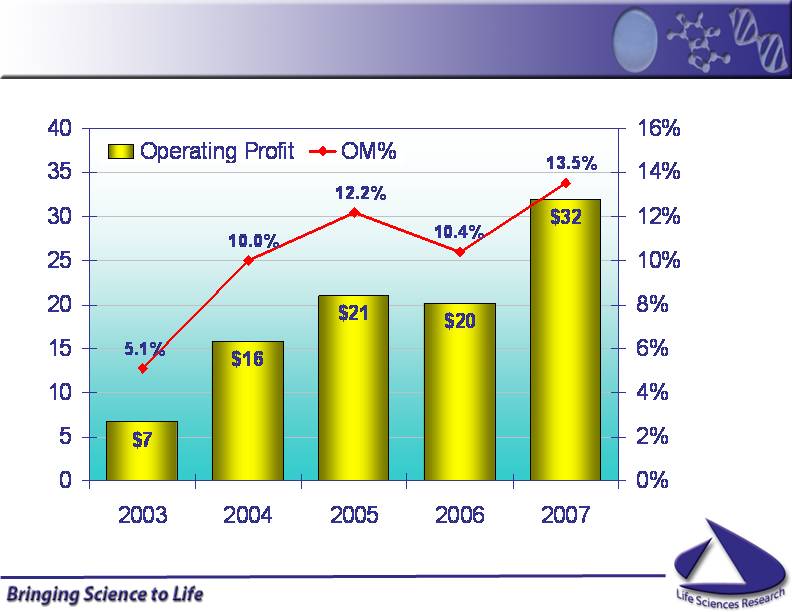

Operating margin growth

9.4%

10.1%

11.6%

10.4%

11.5%

12.9%

14.1%

15.1%

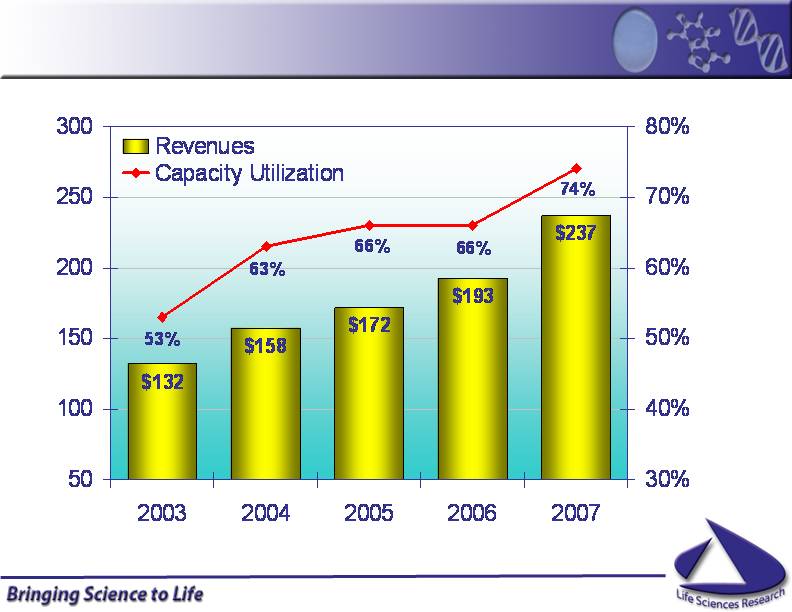

Increasing capacity utilization…

…gives operating margin leverage

Excellent cash flow “boosters”

Low capital intensity

Cap ex/sales ~8-9%

$16M in 2007, $20-25M anticipated in 2008

Modest working capital demands

DSO of 13

Stable low tax rate

Benefit from long term UK R&D tax incentives

>$85M, primarily UK, should they ever be needed

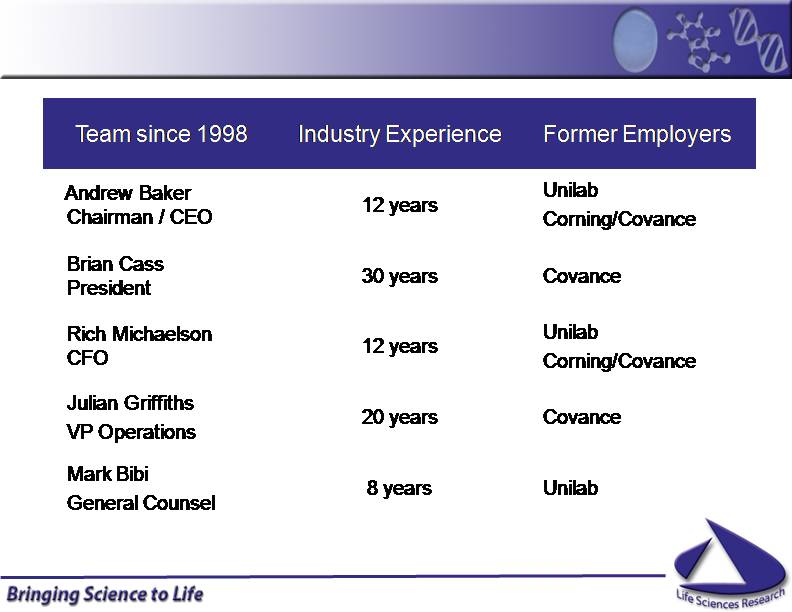

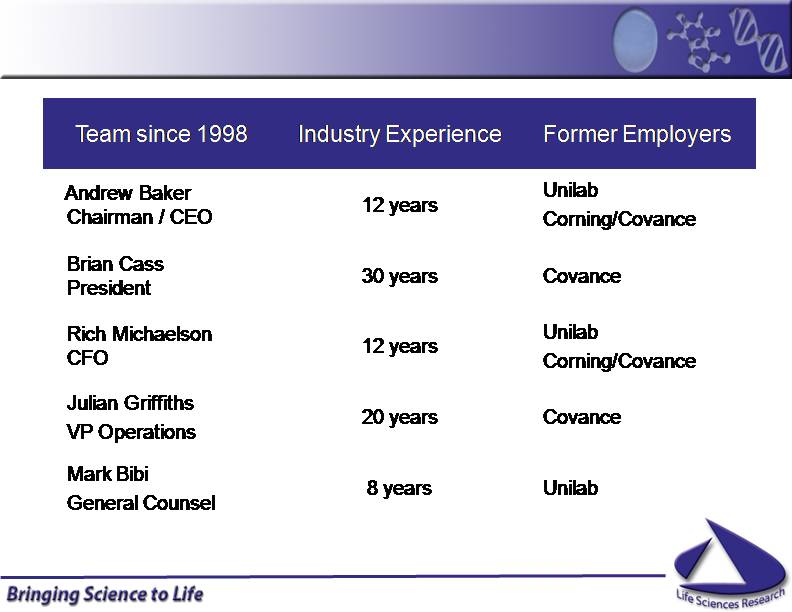

Management

Combined 21% equity ownership in LSR

2007 Financial Results

2007 financial results ($ millions, except EPS)

Revenue $236.8 up 15.6%

Op Profit $ 31.9 up 59% excl 2006 one time charges

OM % 13.5% up 300 b.p. excl 2006 one time charges

Net Income $ (14.0 )

Adjustments:

NOL & Pension Tax Valuation Expense 37.4

non-cash fx (gain)/ loss (0.9)

Tax Benefit (4.2 )

Adj Net Income $ 18.3

Weighted shares outstanding (millions)

- basic 12.7

- fully diluted 15.0

Adj EPS

- basic $ 1.44

- fully diluted $ 1.22

2007 financial results ($ millions, except EPS)

Revenue $236.8 up 15.6%

Op Profit $ 31.9 up 59% excl 2006 one time charges

OM % 13.5% up 300 b.p. excl 2006 one time charges

Adj Net Income $ 18.3

Adj EPS (diluted) $ 1.22

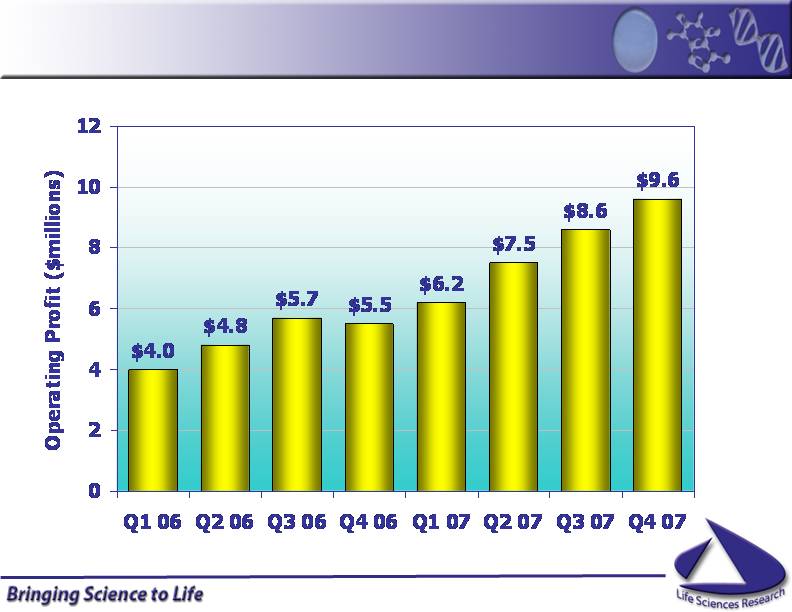

Q1 ��Q2 Q3 Q4

Revenue $ 54.3 $ 58.2 $ 60.9 $ 63.4

OM% 11.5% 12.9% 14.1% 15.1%

Net Income 3.5 5.5 5.9 (28.8 )

Adjustments:

non-cash fx (gain)/loss (0.1) (1.3) (0.6 ) 1.1

Tax Valuation Expense 37.4

Tax (Benefit)/ charge (.8 ) .0 .2 (3.7 )

Adjusted Net Income $ 2.6 $ 4.5 $ 5.6 $ 6.0

Adjusted EPS $.17 $.29 $.36 $.39

2007 financials

Cash $36.2

Long Term Debt

Term Loan $59.2

Capitalized Lease $23.3

Free Cash Flow $22.3

(cash from operations less investing activities)

2007 Cap Ex$16

2008 estimated Cap Ex $20-25

DSO 13

August 2007: Company amended financing agreement

to lower rates and debt level by $10 million

~$10 million used to repurchase equity in H2 07

Summary

Leading player in rapidly growing CRO market

High barriers to entry

Proven strategy for growth

Strong revenue visibility

Opportunity for margin and earnings expansion

Experienced management team

Attractively valued below peers

Life Sciences Research

Raymond James

Investor Conference

March 2008