TRIBUTE PHARMACEUTICALS CANADA INC.

(formerly Stellar Pharmaceuticals Inc.)

AMENDED AND RESTATED NOTICE OF ANNUAL AND SPECIAL MEETING AND MANAGEMENT INFORMATION CIRCULAR

June 5, 2013

TRIBUTE PHARMACEUTICALS CANADA INC.

151 Steeles Ave E,

Milton, Ontario, L9T 1Y1

Canada

June 5, 2013

Dear Stockholder:

You are cordially invited to attend the 2013 Annual and Special Meeting of Stockholders of Tribute Pharmaceuticals Canada Inc. to be held at the Company’s offices located at 151 Steeles Ave E, Milton, Ontario, L9T 1Y1 Canada, at 11:00 A.M., Toronto time, on Thursday, June 20, 2013.

The notice of annual and special meeting and the proxy statement on the following pages cover the formal business of the Meeting. At the Meeting, management also will report on our current business and operations and will be available to respond to questions from stockholders.

Whether or not you plan to attend, it is important that your shares be represented and voted at the meeting. I urge you, therefore, to return a signed proxy card or vote by telephone or over the internet, so that you can be sure your votes are properly counted, even if you plan to attend the meeting. Information about voting procedures can be found in the proxy statement.

I hope you will join us.

| | | Sincerely, | |

| | | | |

| | |  | |

| | | | |

| | | Robert Harris | |

| | | Chief Executive Officer | |

TRIBUTE PHARMACEUTICALS CANADA INC.

(formerly Stellar Pharmaceuticals Inc.)

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual and special meeting (the "Meeting") of the shareholders of TRIBUTE PHARMACEUTICALS CANADA INC. (the "Company") will be held at the offices of Company, 151 Steeles Ave E, Milton, Ontario, L9T 1Y1 on Thursday, the 20th day of June, 2013 at the hour of 11:00 a.m. (Toronto time) for the following purposes:

| 1. | TO RECEIVE the financial statements of the Company for the year ended December 31, 2012, together with the report of the auditors thereon; |

| 2. | TO RE-APPOINT auditors of the Company for the ensuing year and authorize the directors to fix their remuneration; |

| 3. | TO ELECT directors for the ensuing year; |

| 4. | TO APPROVE a non-binding advisory vote on the Company’s executive compensation; |

| 5. | TO APPROVE a non-binding advisory vote on the frequency of future executive compensation advisory votes; and |

| 6. | TO TRANSACT such other business as may properly come before the Meeting. |

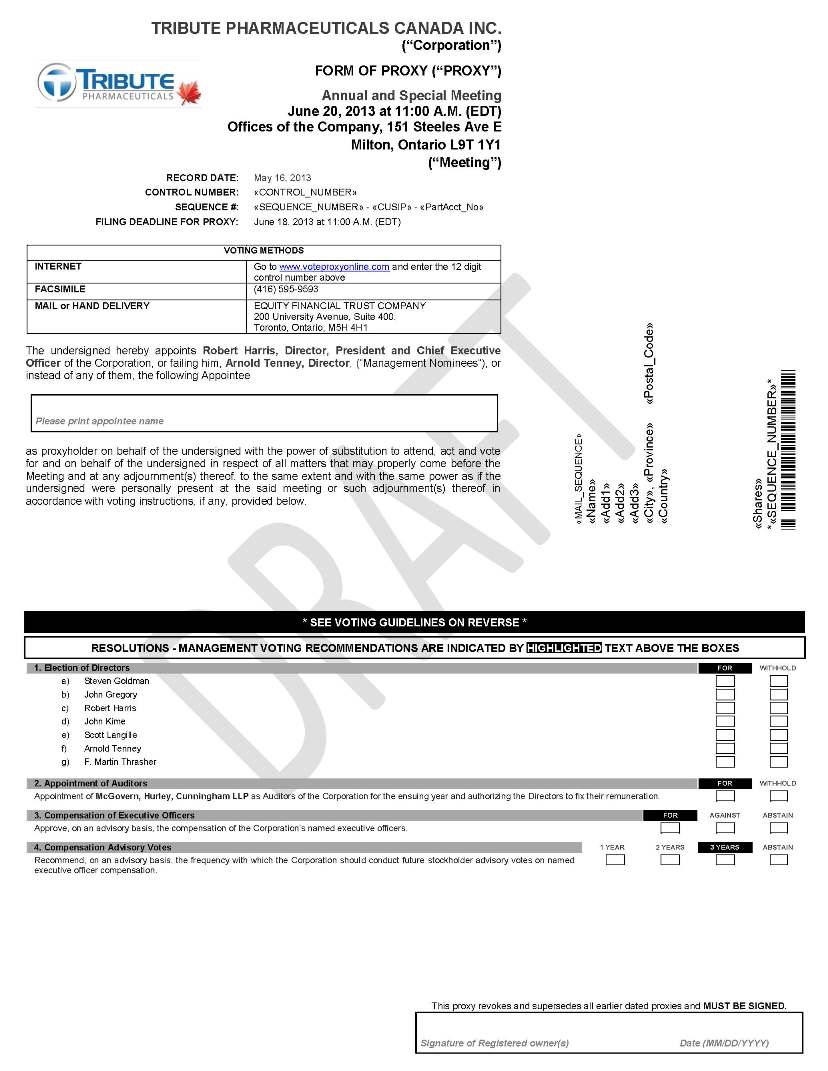

A shareholder wishing to be represented by proxy at the Meeting or any adjournment thereof must have deposited his duly executed form of proxy not later than 11:00 a.m. (Toronto time) on Tuesday, June 18, 2013 or, if the Meeting is adjourned, not later than 48 hours, excluding Saturdays, Sundays and holidays, preceding the time of such adjourned Meeting, at the offices of Equity Financial Trust Company, 200 University Avenue, Suite 400, Toronto, Ontario M5H 4H1.

A form of proxy solicited by management in respect of the Meeting is enclosed herewith. Shareholders who are unable to be personally present at the Meeting are requested to date, sign and return in the envelope provided for that purpose the enclosed form of proxy for use at the Meeting.

DATED at Milton, Ontario this 5th day of June, 2013

| | | BY ORDER OF THE BOARD | |

| | | | |

| | |  | |

| | | | |

| | | ROBERT HARRIS | |

| | | President and Chief Executive Officer | |

TRIBUTE PHARMACEUTICALS CANADA INC.

(formerly Stellar Pharmaceuticals Inc.)

MANAGEMENT INFORMATION CIRCULAR

GENERAL INFORMATION

Why am I receiving these materials?

Tribute Pharmaceuticals Canada Inc. (the “Company”) has delivered printed versions of these materials to you by mail, in connection with the Company’s solicitation of proxies for use at the 2013 annual and special meeting of shareholders (the “Meeting”) to be held on Thursday, June 20, 2013 at 11:00 a.m. Toronto time, and at any postponement(s) or adjournment(s) thereof. You are invited to attend the Meeting and are requested to vote on the proposals described in this proxy statement (the “Proxy Statement”). The Meeting will be held at the Company’s principal executive offices located at the address shown in the notice above.

What is included in these materials?

These materials include:

| | ● | | This Proxy Statement for the Meeting; and |

| | ● | | The Company’s Annual Report on Form 10-K for the year ended December 31, 2012, as filed with the Securities and Exchange Commission (the “SEC”) on March 22, 2013 (the “Annual Report”); and |

| | ● | | The proxy card or vote instruction form for the Meeting. |

What items will be voted on at the Meeting?

Shareholders will vote on four items at the Meeting:

| | ● | | The election to the Company’s Board of Directors (the “Board”) of the seven nominees named in this Circular; |

| | ● | | Ratification of the appointment of McGovern, Hurley, Cunningham LLP as the Company’s independent registered public accounting firm for 2013; |

| | ● | | A non-binding advisory vote to approve executive compensation; and |

| | ● | | A non-binding advisory vote on the frequency of future executive compensation advisory votes. |

What are the Board’s voting recommendations?

The Board recommends that you vote your shares:

| | ● | | “FOR” each of the nominees to the Board; |

| | ● | | “FOR” ratification of the appointment of McGovern, Hurley, Cunningham LLP as the Company’s independent registered public accounting firm for 2013; |

| | ● | | “FOR” the approval of the non-binding advisory resolution approving the Company’s executive compensation; and |

| | ● | | “EVERY THREE YEARS” for the frequency of future executive compensation advisory votes. |

Who may vote at the Meeting?

Each share of the Company’s common stock has one vote on each matter. Only shareholders of record as of the close of business on May 16, 2013 (the “Record Date”) are entitled to receive notice of, to attend, and to vote at the Meeting. As of the Record Date, there were 50,972,542 shares of the Company’s common stock issued and outstanding.

What is the difference between a shareholder of record and a beneficial owner of shares held in street name?

Shareholder of Record. If your shares are registered directly in your name with the Company’s transfer agent, Equity Financial Trust Company, you are considered the shareholder of record with respect to those shares, and the Notice was sent directly to you by the Company.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and a Notice was forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. Those instructions are contained in a “vote instruction form.” which should have been sent to you by such organization.

If I am a shareholder of record of the Company’s shares, how do I vote?

If you are a shareholder of record, there are four ways to vote:

| | ● | | In person. You may vote in person at the Meeting. The Company will give you a ballot when you arrive. |

| | ● | | Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the proxy card. |

| | ● | | By Telephone. You may vote by proxy by calling the toll free number found on the proxy card. |

| | ● | | By Mail. You may vote by proxy by filling out the proxy card and returning it in the envelope provided. |

If I am a beneficial owner of shares held in street name, how do I vote?

If you are a beneficial owner of shares held in street name, there are four ways to vote:

| | ● | | In person. If you wish to vote in person at the Meeting, you must obtain a legal proxy from the organization that holds your shares. Please contact that organization for instructions regarding obtaining a legal proxy. |

| | ● | | Via the Internet. You may vote by proxy via the Internet by visiting www.voteproxyonline.com and entering the control number found in your Notice. |

| | ● | | By Telephone. You may vote by proxy by calling the toll free number found on the vote instruction form. |

| | ● | | By Mail. You may vote by proxy by filling out the vote instruction form and returning it in the envelope provided. |

What is the quorum requirement for the Meeting?

The holders of 15% of the shares entitled to vote at the Meeting must be present at the Meeting in person or by proxy for the transaction of business. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum if you:

| | ● | | Are entitled to vote and you are present in person at the Meeting; or |

| | ● | | Have properly voted on the Internet, by telephone or by submitting a proxy card or vote instruction form by mail. |

If a quorum is not present, the Meeting will be adjourned until a quorum is obtained.

Which ballot measures are considered “routine” or “non-routine”?

The ratification of the appointment of McGovern, Hurley, Cunningham LLP as the Company’s independent registered public accounting firm for 2013 is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with this proposal.

The election of directors, the non-binding advisory resolution approving the Company’s executive compensation and the non-binding advisory resolution approving the frequency of future executive compensation advisory votes, are matters considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore broker non-votes may exist in connection with these proposals.

What is the voting requirement to approve each of the proposals?

For the election of directors, the seven nominees receiving the highest number of affirmative votes will be elected as directors to serve until the next annual meeting of shareholders and until their successors are duly elected and qualified. Approval for the remaining proposals requires the affirmative vote of a majority of the shares present or represented by proxy and voting at the Meeting and (ii) a majority of the shares required to constitute the quorum.

How are broker non-votes and abstentions treated?

Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present. Only “FOR” and “AGAINST” votes are counted for purposes of determining the votes received in connection with each proposal.

For all matters, broker non-votes and abstentions will have no effect on determining whether the affirmative vote constitutes a majority of the shares present or represented by proxy and voting at the Meeting. However, approval of these other proposals also requires the affirmative vote of a majority of the shares necessary to constitute a quorum, and therefore broker non-votes and abstentions could prevent the approval of these proposals because they do not count as affirmative votes.

In order to minimize the number of broker non-votes, the Company encourages you to vote or to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the Notice.

Where can I find the voting results of the Meeting?

The preliminary voting results will be announced at the Meeting. The final voting results will be tallied by the inspector of election and published in the Company’s Current Report on Form 8-K, which the Company is required to file with the SEC within four business days following the Meeting.

SOLICITATION OF PROXIES

This Management Information Circular is furnished in connection with the solicitation of proxies by or on behalf of management of Tribute Pharmaceuticals Canada Inc. (the "Company") for use at the annual and special meeting of the shareholders of the Company (the "Meeting") to be held at the offices of the Company, 151 Steeles Ave E, Milton, Ontario, L9T 1Y1, on Thursday, the 20th day of June, 2013, at the hour of 11:00 a.m. (Toronto time) for the purposes set forth in the annexed notice of the Meeting. Unless otherwise noted, all information set forth herein is given as at May 16, 2013. The cost of solicitation by or on behalf of management will be borne by the Company. The Company may reimburse brokers, custodians, nominees and other fiduciaries for their reasonable charges and expenses incurred in forwarding the proxy material to beneficial owners of common shares. It is expected that such solicitation will be primarily by mail. In addition to solicitation by mail, certain officers, directors and employees of the Company may solicit proxies by telephone or personally. These persons will receive no compensation for such solicitation other than their regular salaries.

MANNER IN WHICH PROXIES WILL BE VOTED

The common shares represented by the accompanying form of proxy, if the same is properly executed in favour of Mr. Harris or Mr. Tenney, the management nominees, and is received at the offices of Equity Financial Trust Company, 200 University Avenue, Suite 400, Toronto, Ontario M5H 4H1 or, by facsimile at (416) 595-9593 not later than 11:00 a.m. (Toronto time) on Tuesday, June 18, 2013, or, if the Meeting is adjourned, not later than 48 hours, excluding Saturdays, Sundays and holidays, preceding the time of such adjourned Meeting, will be voted at the Meeting, and where a choice is specified in respect of any matter to be acted upon, will be voted in accordance with the specifications made. In the absence of such a specification, such shares will be voted in favour of such matter.

The accompanying form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the annexed notice of Meeting, and with respect to other matters which may properly come before the Meeting. At the date hereof, management of the Company knows of no such amendments, variations or other matters.

ALTERNATE PROXY

Each shareholder has the right to appoint a person other than the persons named in the accompanying form of proxy, who need not be a shareholder, to attend and act for him and on his behalf at the Meeting. Any shareholder wishing to exercise such right may do so by inserting in the blank space provided in the accompanying form of proxy the name of the person whom such shareholder wishes to appoint as proxy and by duly depositing such proxy, or by duly completing and depositing another proper form of proxy.

REVOCABILITY OF PROXY

A shareholder giving a proxy has the power to revoke it. Such revocation may be made by the shareholder attending the Meeting, duly executing another form of proxy bearing a later date and depositing the same before the specified time, or may be made by written instrument revoking such proxy executed by the shareholder or by his or her attorney authorized in writing and deposited with the Company c/o Equity Financial Trust Company, 200 University Avenue, Suite 400, Toronto, Ontario M5H 4H1 or, by facsimile at (416) 595-9593 at any time up to and including the close of business on the last business day preceding the day of the Meeting or any adjournment thereof, or with the Chairman of the Meeting on the day of the Meeting or any adjournment thereof or in any other manner permitted by law. If such written instrument is deposited with the Chairman of the Meeting on the day of the Meeting or any adjournment thereof, such instrument will not be effective with respect to any matter on which a vote has already been cast pursuant to such proxy.

VOTING BY PROXY AT THE MEETING

If a registered shareholder cannot attend the Meeting but wishes to vote on the resolutions, the registered shareholder should sign, date and deliver the enclosed form of proxy to the Company’s registrar and transfer agent, Equity Financial Trust Company, 200 University Avenue, Suite 400, Toronto, Ontario M5H 4H1 or, by facsimile at (416) 595-9593 so it is received at least 48 hours (excluding Saturdays, Sundays and holidays) before the time of the Meeting or any adjournment thereof. The persons named in the enclosed form of proxy are directors and/or officers of the Company. A shareholder giving a proxy can strike out the names of the nominees printed in the accompanying form of proxy and insert the name of another nominee in the space provided, or the shareholder may complete another form of proxy. A proxy nominee need not be a shareholder of the Company. A registered shareholder giving a proxy has the right to attend the Meeting, or appoint someone else to attend as his or her proxy at the Meeting and the proxy submitted earlier can be revoked in the manner described under “Revocability of Proxy”.

ADVICE TO BENEFICIAL HOLDERS OF SECURITIES

The information set forth in this section is of significant importance to many public shareholders of the Company, as a substantial number of the public shareholders of the Company do not hold common shares in their own names. Shareholders who do not hold their common shares in their own names (referred to in this Management Information Circular as "Beneficial Shareholders") should note that only proxies deposited by shareholders whose names appear on the records of the Company as the registered holders of the common shares can be recognized and acted upon at the Meeting. If common shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases those common shares will not be registered in the shareholder's name on the records of the Company. Such common shares will more likely be registered under the name of the shareholder's broker or an agent of that broker. In Canada, the vast majority of such common shares are registered under the name of CDS & Co. (the registration name for CDS Clearing and Depository Services Inc., which acts as nominee for many Canadian brokerage firms). Common shares held by brokers or their nominees can only be voted (for or against resolutions) upon the instructions of the Beneficial Shareholder. Without specific instructions, brokers/nominees are prohibited from voting common shares for their clients. The directors and officers of the Company do not know for whose benefit the common shares registered in the name of CDS & Co. are held.

Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from Beneficial Shareholders in advance of shareholders' meetings. Every intermediary/broker has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Shareholders in order to ensure that their common shares are voted at the Meeting. Often, the form of proxy supplied to a Beneficial Shareholder by its broker is identical to the form of proxy provided to registered shareholders. However, its purpose is limited to instructing the registered shareholders how to vote on behalf of the Beneficial Shareholder. The majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. ("Broadridge"). Broadridge typically applies a decal to the proxy forms, mails those forms to the Beneficial Shareholders and asks Beneficial Shareholders to return the proxy forms to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of common shares to be represented at the Meeting. A Beneficial Shareholder receiving a proxy with a Broadridge decal on it cannot use that proxy to vote common shares directly at the Meeting. The proxy must be returned to Broadridge well in advance of the Meeting in order to have the common shares voted.

Since the Company does not have access to the names of its non-registered shareholders, if a Beneficial Shareholder attends the Meeting, the Company will have no record of the Beneficial Shareholder's shareholdings or of its entitlement to vote unless the Beneficial Shareholder's nominee has appointed the Beneficial Shareholder as proxyholder. Therefore, a Beneficial Shareholder who wishes to vote in person at the Meeting must insert its own name in the space provided on the voting instruction form sent to the Beneficial Shareholder by its nominee, and sign and return the voting instruction form by following the signing and returning instructions provided by its nominee. By doing so, the Beneficial Shareholder will be instructing its nominee to appoint the Beneficial Shareholder as proxyholder. The Beneficial Shareholder should not otherwise complete the voting instruction form as its vote will be taken at the Meeting.

INTEREST OF CERTAIN PERSONS AND CORPORATIONS

IN MATTERS TO BE ACTED UPON

No person who has been a director or executive officer of the Company since the beginning of the last financial year and no associate or affiliate of any such director or executive officer has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

As at May 16, 2013, the Company had outstanding 50,972,542 common shares, each carrying the right to one vote. The record date for the determination of shareholders entitled to receive notice of the Meeting has been fixed as the close of business on May 16, 2013. In accordance with the provisions of the Business Corporations Act (Ontario), the Company will arrange for a list of holders of common shares to be prepared on such record date. Each holder of common shares named in the list will be entitled to vote the common shares shown opposite his name on the list at the Meeting.

As of the date hereof, to the knowledge of the directors and senior officers of the Company, the following are the only persons beneficially owning, directly or indirectly, or exercising control or direction over, voting securities of the Company carrying more than 10% of the voting rights attached to all voting securities of the Company:

| Name and Municipality of Residence | Type of Ownership | Number of Common Shares | Percentage of Class |

Robert Harris(1) Milton, Ontario | Beneficial | 8,875,000 | 17.4% |

Scott Langille(2) Elora, Ontario | Beneficial | 6,812,500 | 13.4% |

John Gregory(3) Tennessee, U.S.A. | Beneficial | 8,088,794 | 15.9% |

Notes:

| (1) | Includes 4,125,000 common shares owned by Mr. Harris’s spouse. |

| (2) | The 6,812,500 common shares are owned by Elora Financial Management Inc, a company beneficially owned by Mr. Langille. |

| (3) | Includes (i) 625,000 common shares held by Mr. Gregory, (ii) 6,438,794 common shares held by SJ Strategic Investments, LLC, (iii) 1,025,000 common shares held by Kingsway Charities Inc. Mr. Gregory has sole voting and dispositive power over the shares held by SJ Strategic Investments, LLC and Kingsway Charities Inc. |

PARTICULARS OF MATTERS TO BE ACTED UPON

(1) Financial Statements

The shareholders will receive and consider the audited financial statements of the Company for the fiscal year ended December 31, 2012 together with the auditor's report thereon.

(2) Re-Appointment of Auditors

Shareholders of the Company will be asked to vote for the re-appointment of McGovern, Hurley, Cunningham LLP, as the Company's auditors, to hold office until the next annual meeting of the Shareholders, or until their successors have been appointed, at a remuneration to be fixed by the Directors.

The management of the Company recommends the re-appointment of McGovern, Hurley, Cunningham LLP, as auditors of the Company. McGovern, Hurley, Cunningham LLP was originally appointed as the auditors for the Company on May 20, 2009.

This resolution requires the approval of a simple majority of the votes cast at the Meeting, in person or by proxy, in order to be approved.

In the absence of instructions to the contrary, the common shares represented by a properly executed form of proxy in favour of the persons designated by management of the Company will be voted FOR the re-appointment of McGovern, Hurley, Cunningham LLP as auditors of the Company.

(3) Election of Directors

The articles of the Company provide that the number of directors shall be a minimum of one and a maximum of ten and there are currently seven directors. Unless the authority to do so is withheld, the persons named in the accompanying form of proxy (if the same is duly executed in their favour and is duly deposited) will vote the common shares represented thereby in favour of the election as directors of the persons named below. If prior to the Meeting any vacancies occur in the slate of nominees listed below, unless the authority to do so is withheld, it is intended that discretionary authority shall be exercised to vote the common shares represented by the proxies solicited in respect of the Meeting for the election of such other person or persons as directors in accordance with the best judgment of management. Management is not aware that any of such nominees would be unwilling or unable to serve as a director if elected.

The Board has adopted a policy that entitles each Shareholder to vote for each nominee on an individual basis. Each director should be elected by the vote of a majority of the common shares represented in person or by proxy at the Meeting that are voted in respect of that nominee. If any nominee for election as a director receives, from the common shares voted at the Meeting in person or by proxy, a greater number of votes "withheld" than votes "for" his election, the nominee will be expected to promptly offer his resignation to the Chairman of the Board following the Meeting, to take effect upon acceptance by the Board.

In such circumstances, the remaining Board members will expeditiously consider such director's offer to resign. Within 90 days of the Meeting, the Board will make a final decision concerning the acceptance of such director's resignation and announce that decision by way of news release. Any director who offers his resignation will not participate in the deliberations of the Board or any of its committees pertaining to the resignation.

The process only applies in circumstances involving an "uncontested" election of directors – where the number of nominees does not exceed the number of directors to be elected and where no proxy materials are circulated in support of one or more nominees who are not a part of the slate supported by the Board for election at the Meeting. Subject to the applicable corporate law, where the Board accepts the offer of resignation of a director and that director resigns, the Board may exercise its discretion with respect to the resulting vacancy and may, without limitation, leave the resultant vacancy unfilled until the next annual meeting of Shareholders, fill the vacancy through the appointment of a new director whom the Board considers to merit the confidence of the Shareholders, or call a special meeting of Shareholders to elect a new nominee to fill the vacant position.

The information below as to the number of common shares of the Company beneficially owned by the proposed nominees, not being within the knowledge of the Company, has been furnished by the respective persons individually.

| Name, Municipality of Residence and Position and/or Office with the Company | Principal Occupation | Period Served as a Director | Common Shares Beneficially Owned, Directly or Indirectly, or Over Which Control or Direction is Exercised* |

Steven Goldman(2) Toronto, Ontario Director | Lawyer, Partner at Goldman Hine LLP. | Since April 9,2010 | 2,483,346(3) |

John Gregory Tennessee, U.S.A. Director | Managing partner of SJ Strategic Investments LLC | Since February 26, 2007 | 8,088,794(4) |

Robert Harris Milton, Ontario President, Chief Executive Officer and Director | President and Chief Executive Officer | Since December 1, 2011 | 8,875,000(5) |

John Kime(1)(2) London, Ontario Director | President, iBD Advisors Inc. | Since November 28, 2000 | 125,000 |

Scott Langille Elora, Ontario Proposed Director, Chief Financial Officer | Chief Financial Officer | June 22, 2012 | 6,812,500(6) |

Arnold Tenney(1) Toronto, Ontario Chairman | President of LMT Consulting | Since April 29, 2004 | 1,154,200(7) |

F. Martin Thrasher(2) London, Ontario Director | President of FMT Consulting | Since April 22, 2009 | 1,250,000(8) |

Notes:

* Does not include options or other convertible securities.

(1) Member of the Compensation Committee.

(2) Member of the Audit Committee.

| (3) | Includes (i) 100,000 common shares held by Mr. Goldman, (ii) 615,540 common shares held by Mr. Goldman by RBC Securities in Mr. Goldman’s RRSP, (iii) 958,206 common shares held by Lambent Consulting Corp., (iv) 809,600 common shares of held by Mr. Goldman’s spouse. |

| (4) | Includes (i) 625,000 common shares held by Mr. Gregory, (ii) 6,438,794 common shares held by SJ Strategic Investments, LLC, (iii) 1,025,000 common shares held by Kingsway Charities Inc. |

| (5) | Includes 4,125,000 common shares owned by Mr. Harris’s spouse. Mr. Gregory has sole voting and dispositive power over the shares held by SJ Strategic Investments, LLC and Kingsway Charities Inc. |

| (6) | The 6,812,500 common shares are owned by Elora Financial Management Inc. Mr. Langille has sole voting and dispositive power over the shares held by Elora Financial Inc. |

| (7) | Includes (i) 942,700 common shares held by LMT Financial Inc., (ii) 126,500 common shares held by Arnmat Investments Limited, (iii) 85,000 common shares held by Mr. Tenney’s spouse. Mr. Tenney has sole voting and dispositive power over the shares held by LMT Financial, Inc. and Arnmat Investments Limited. |

| (8) | Includes (i) 1,250,000 common shares held by 2089636 Ontario Ltd. Mr. Thrasher has sole voting and dispositive power over the shares held by 2089636 Ontario Ltd. |

The biographical information for each of the directors is contained in prior management information circulars of the Company.

UNLESS OTHERWISE INSTRUCTED, THE PERSONS NAMED IN THE ACCOMPANYING FORM OF PROXY INTEND TO VOTE FOR THE ELECTION TO THE BOARD OF DIRECTORS OF THE 7 NOMINEES WHO ARE IDENTIFIED ABOVE. DIRECTORS ARE ELECTED BY A PLURALITY OF VOTES CAST.

Cease Trade Orders and Sanctions

To the best of the Company's knowledge, no proposed director of the Company is at the date hereof, or within the ten years prior to the date hereof has been, a director, chief executive officer or chief financial officer of any company (including the Company) that, while that person was acting in that capacity:

| (a) | was the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days; or |

| (b) | was subject to a cease trade order or similar order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer. |

Other than as set forth below, to the best of the Company's knowledge, no proposed director of the Company is at the date hereof, or within the ten years prior to the date hereof has been, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets. Mr. Thrasher was a director of a private company name which filed for bankruptcy in January 2012. Mr. Thrasher resigned from the board of the private company in February 2012.

To the best of the Company’s knowledge, no proposed director has, within the ten years before the date hereof, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of that person.

No proposed director has been subject to:

| | (a) | any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| | (b) | any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed director. |

(4) Advisory Vote on Executive Compensation

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) entitle the Company's shareholders to vote to approve, on a non-binding advisory basis, the compensation of the Company's Named Executive Officers as disclosed herein in accordance with the compensation disclosure rules of the Securities and Excahnge Commission.

As described in detail in this Circular under the heading "Statement of Executive Compensation", the Company's executive compensation programs are designed to (1) motivate and retain executive officers, (2) reward the achievement the Company's short-term and long-term performance goals, (3) establish an appropriate relationship between executive pay and short-term and long-term performance and (4) align executive officers' interests with those of the Company's shareholders. Under these programs, the Company's executive officers are rewarded for the achievement of specific financial operating goals established by the Compensation Committee and the realization of increased shareholder value. Please read the referenced sections for additional details about the Company's executive compensation programs, including information about the fiscal year 2012 compensation of the Company's Named Executive Officers set forth under the heading "Statement of Executive Compensation" in this proxy statement.

The Compensation Committee continually reviews the compensation programs for the Company's executive officers to ensure they achieve the desired goals of aligning the Company's executive compensation structure with the Company's shareholders' interests and current market practices.

This vote is advisory, which means that the vote on executive compensation is not binding on the Company, the Compensation Committee or the Company's Board. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Company's Named Executive Officers and the philosophy, policies and practices described in this proxy statement in accordance with the compensation disclosure rules of the Securities nd Exchange Commission. The Company's Board and the Compensation Committee value the opinions of the Company's shareholders and to the extent there is any significant vote against the Named Executive Officer compensation as disclosed in this proxy statement, the Company will consider the Company's shareholders' concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

The Company is asking the Company's shareholders to indicate their support for the Company's Named Executive Officers compensation as disclosed in this Circular. This proposal, commonly known as a "say-on-pay" proposal, gives the Company's shareholders the opportunity to express their views on the Company's executive compensation. Accordingly, the Company will ask its shareholders to vote "FOR" the following resolution at the Meeting:

"RESOLVED, that the compensation paid to the Company's Named Executive Officers, as disclosed in The Company's Proxy Statement for the 2013 Annual and Special Meeting of Shareholders pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED."

Recommendation

THE COMPANY BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE PROPOSAL TO APPROVE THE COMPENSATION OF THE COMPANY'S NAMED EXECUTIVE OFFICERS AS DESCRIBED UNDER THE HEADING "STATEMENT OF EXECUTIVE COMPENSATION," AND THE RELATED DISCLOSURES CONTAINED IN THIS PROXY STATEMENT.

In the absence of instructions to the contrary, the common shares represented by a properly executed form of proxy in favour of the persons designated by management of the Company will be voted FOR the foregoing resolution.

(5) Advisory Vote on the Frequency of Holding an Advisory Vote on Executive Compensation

In addition to the advisory approval of the Company's executive compensation program, the Company is also holding a non-binding advisory vote by shareholders on the frequency with which shareholders would have an opportunity to hold an advisory vote on the Company's executive compensation program. The Company has included this proposal among the items to be considered at the Meeting pursuant to the requirements of Section 14A of the Exchange Act. The Company is providing shareholders the option of selecting a frequency of one, two or three years, or abstaining. For the reasons described below, the Company recommends that the Company shareholders select a frequency of three years.

The Company's executive compensation program is designed to support long-term value creation, and a vote every three years vote will allow shareholders to better judge our executive compensation program in relation to the Company's long-term performance. As described in the Compensation Discussion and Analysis in this Circular, one of the core principles of the Company's executive compensation program is to ensure management’s interests are aligned with shareholders’ interests.

A vote every three years will provide the Company with the time to thoughtfully respond to shareholders’ sentiments and implement any necessary changes. The Company carefully monitors its compensation program to maintain the consistency and credibility of the program, which is important in motivating and retaining employees. Accordingly, a vote every three years will coincide with this more detailed review and an every three-year vote will allow for the highest level of accountability and direct communication between the Company and its shareholders. The Company therefore recommends that the Company shareholders select "Three Years" when voting on the frequency of advisory votes on executive compensation. Although the advisory vote is non-binding, the Company's Board will review the results of the vote and take them into account in making a determination concerning the frequency of future advisory votes on executive compensation.

The Company will continue to engage with shareholders regarding the Company's executive compensation program during the period between shareowner votes. Engagement with the Company's shareowners is a key component of the Company's corporate governance. The Company seeks and is open to input from shareholders regarding board and governance matters, as well as the executive compensation program, and believe it has been appropriately responsive to our shareholders. The Company believes that this outreach to shareholders, and our shareholders’ ability to contact the Company at any time to express specific views on executive compensation, serve to hold it accountable to shareholders and reduce the need for and value of more frequent advisory votes on executive compensation.

The option of one year, two years or three years that receives the highest number of votes cast by shareholders will be the frequency of the advisory note on executive compensation that has been selected by shareholders. However, because this vote is advisory and not binding on the Board of Directors or the Company, the Board may decide that it is in the best interests of the Company's shareholders and the Company to hold an advisory vote on executive compensation more or less frequently than the option approved by the Company's shareholders.

Shareholders may cast a vote on the preferred voting frequency by selecting the option of one year, two years, or three years (or abstain) when voting in response to the resolution set foth below:

"RESOLVED, that the shareholders determine, on an advisory basis, whether the preferred frequency of an advisory vote on the executive compensation of the Company’s named executive officers as set forth in the Company’s proxy statement should be every year, every two years, or every three years."

Recommendation

THE COMPANY BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE THREE-YEAR FREQUENCY AS THE PRFERRED FREQUENCY FOR HOLDING AN ADVISORY VOTE ON EXECUTIVE COMPENSATION.

In the absence of instructions to the contrary, the common shares represented by a properly executed form of proxy in favour of the persons designated by management of the Company will be voted FOR a three-year frequency for holding an advisory vote on executive compensation.

STATEMENT OF CORPORATE GOVERNANCE MATTERS

Corporate governance relates to the activities of the Board, the members of which are elected by and accountable to the shareholders, and accounts for the role of management who are appointed by the Board and charged with the day to day management of the Company. The Board and senior management consider good corporate governance to be central to the effective and efficient operation of the Company. National Policy 58-201 of the Canadian Securities Administrators has set out a series of guidelines for effective corporate governance (the "Guidelines"). The Guidelines address matters such as the constitution and independence of corporate boards and the effectiveness and education of board members. National Instrument 58-101 Disclosure of Corporate Governance Practices ("NI 58-101") requires the Company to disclose annually in its Management Information Circular certain information concerning its corporate governance practices.

Set out below is a description of the Company's approach to corporate governance in relation to the Guidelines.

Board of Directors

NI 58-101 defines an "independent director" as a director who has no direct or indirect material relationship with the Company. A "material relationship" is in turn defined as a relationship which could, in the view of the Board, be reasonably expected to interfere with such member's independent judgment. The Board is currently comprised of seven members; the Board has determined that three members are not "independent" directors within the meaning of NI 58-101 and the remaining three directors are considered to be independent.

Mr. Harris, Mr. Langille and Mr. Tenney are not considered "independent". Mr. Harris and Mr. Langille are not considered "independent" as the result of their positions as the President and Chief Executive Officer and Chief Financial Officer, respectively, of the Company. Mr. Tenney is not considered "independent" as the result of consulting fees received by LMT, a company beneficially owned by Mr. Tenney and his spouse and the fact that he was the previous interim President and Chief Executive Officer of the Company. The remaining four directors are considered to be independent directors since they are all independent of management and free from any material relationship with the Company. The basis for this determination is that, since the beginning of the fiscal year ended December 31, 2012, none of the independent directors have worked for the Company, received remuneration from the Company or had material contracts with or material interests in the Company which could interfere with their ability to act with a view to the best interests of the Company.

The Board believes that it functions independently of management. To enhance its ability to act independent of management, the Board may meet in the absence of members of management and the non-independent directors or may excuse such persons from all or a portion of any meeting where a potential conflict of interest arises or where otherwise appropriate. The Board held twelve (12) meetings of the independent directors during the fiscal year ended December 31, 2012.

Board Mandate

The Board is responsible for reviewing and approving the Company's operating plans and budgets as presented by management. The Board is responsible for identifying the principal risks of the Company's business and for ensuring these risks are effectively monitored and mitigated to the extent practicable. Succession planning, including the recruitment, supervision, compensation and performance assessment of the Company's executive officers also falls within the ambit of the Board's responsibilities. The Board is responsible for ensuring effective communications by the Company with its stockholders and the public and for ensuring that the Company adheres to all regulatory requirements with respect to the timeliness and content of its disclosure. In keeping with its overall responsibility for the stewardship of the financial affairs of the Company, the Board created an Audit Committee (as hereinafter defined) which is responsible for the integrity of the Company's internal control and management information systems.

The Board is responsible for approving annual operating plans recommended by management. Board consideration and approval is also required for all material contracts and business transactions and all debt and equity financing proposals.

The Board delegates to management responsibility for meeting defined corporate objectives, implementing approved strategic and operating plans, carrying on the Company's business in the ordinary course, managing the Company's cash flow, evaluating new business opportunities, recruiting staff and complying with applicable regulatory requirements.

The Board believes the Company is well served and the independence of the Board from management is not compromised. The Board does not have, and does not consider it necessary under the circumstances to have, any formal structures or procedures in place to ensure that the Board can function independently of management. The Board believes that its current composition is sufficient to ensure that the Board can function independently of management.

Directorships

None of the directors of the Company are directors of other reporting issuers (or the equivalent) other than Mr. Gregory who is a director of Adams Golf, Inc, (NASDAQ) and Mr. Thrasher who is a director of Legumex Walker Inc. (TSX).

Orientation and Continuing Education

While the Company currently has no formal orientation and education program for new Board members, sufficient information (such as recent annual reports, proxy solicitation materials, various other operating and budget reports and board and committee mandates) is provided to new Board members to ensure that they are familiar with the Company's business and the procedures of the Board. In addition, directors are encouraged to visit and meet with management on a regular basis. The Company also encourages continuing education of its directors and officers where appropriate in order to ensure that they have the necessary skills and knowledge to meet their respective obligations to the Company.

Ethical Business Conduct

Ethical business behaviour is of great importance to the Board and the management of the Company. The Company has instituted policies on disclosure, insider trading as well as a whistleblower policy for all staff and personnel to report any fraudulent or illegal acts on an anonymous basis directly to the Audit Committee chair. The Company has adopted a written Disclosure Policy in order to ensure that communications to the investing public about the Company are timely, factual, accurate and broadly disseminated in accordance with applicable securities laws. The goal of this Disclosure Policy is to provide a consistent understanding of the Company's approach to disclosure among the Board of Directors, and all employees of the Company. The Company has also adopted a written Whistle Blower Policy in order to assist in achieving the highest business and personal ethical standards as well as to comply with all laws and regulations that apply to our business. Adherence to these standards will help to ensure decisions reflect care and consideration for all our stakeholders. Both the Disclosure Policy and the Whistle Blower Policy are available from the Company upon request.

In addition, if a director of the Company also serves as a director and/or officer of another company engaged in similar activities, the Board must comply with the conflict of interest provisions of the Business Corporations Act (Ontario), as well as the relevant securities regulatory instruments, in order to ensure that directors exercise independent judgment in considering transactions and agreements in respect of which a director or officer has a material interest. Each director is required to declare the nature and extent of his interest and is not entitled to vote at meetings which involve such conflict.

Nomination of Directors

The Board performs the functions of a nominating committee with the responsibility for the appointment and assessment of directors. The Board believes that this is a practical approach at this stage of the Company's development.

While there are no specific criteria for Board membership, the Company attempts to attract and retain directors with business knowledge, such as accounting and finance, which provide knowledge which assists in guiding management of the Company. As such, nominations tend to be the result of recruitment efforts by management of the Company and discussions among the directors prior to the consideration of the Board as a whole.

Compensation

Please see "Statement of Executive Compensation" for further discussion.

Assessments

The Board does not formally review the contribution and effectiveness of the Board, its committees or its members. The Board believes that its size facilitates an informal process of discussion and evaluation.

Director Independence

Our board of directors has determined that a majority of the board consists of members are currently "independent" as that term is defined under current listing standards of NASDAQ.

Committees

In addition to the Compensation Committee, the Board also has an Audit Committee. The Audit Committee is currently composed of the following three members: John Kime, Martin Thrasher and Steven Goldman, each of whom are independent directors for the purposes of National Instrument 52-110 – "Audit Committees" (other than Mr. Goldman who is a partner in the law firm of Goldman Hine LLP which has previously provided certain legal services to the Company), and each of whom are financially literate. In addition to other duties, the Audit Committee reviews all financial statements, annual and interim, intended for circulation among shareholders and reports upon these to the Board. In addition, the Board may refer to the Audit Committee other matters and questions relating to the financial position of the Company and its affiliates. There were five meetings of the Audit Committee during the fiscal year ending December 31, 2012. The full text of the Audit Committee's charter is attached as Schedule "A".

Audit Committee Member Information

John J. Kime, Director. Mr. Kime has been a Director since November 2000. Mr. Kime is the President and CEO of iBD Advisors Inc., a privately-owned Canadian company providing guidance to Canadian and international companies on site location needs and business considerations connected with their plans to locate and expand in North America. Prior to assuming his responsibilities at iBD Advisors, Mr. Kime was the President and CEO of the London Economic Development Corporation, a public/private partnership with responsibility for providing economic development services to the city of London, Ontario, Canada. From 1991 to 1998, Mr. Kime served as Director of International Development for Big ‘O’ Inc., a company engaged in the development of manufacturing technologies used in the control and containment of water, chemicals and other substances. Mr. Kime has a BA from The University of Western, and qualified as a Chartered Accountant in 1968. Mr. Kime has been chosen to be a Director in light of his significant business operating, accounting and financial experience.

F. Martin Thrasher, Director. Mr. Thrasher is a seasoned international executive. After graduating from the Richard Ivey School of Business in Toronto, Mr. Thrasher spent over 30 years working around the globe for companies such as General Foods, McCormick & Co, Campbell Soup Co. and ConAgra Foods Inc. Mr. Thrasher lived and worked in Canada, Australia, Belgium and the U.S.. His responsibilities with Campbell Soup Co. included positions as President, International Grocery and President, North America Grocery. At ConAgra Foods Inc., he was President of the Retail Products Co, a $9 billion business with over 30,000 employees. Currently, Mr. Thrasher is President of FMT Consulting, a boutique advisory and consulting firm. Mr. Thrasher was chosen as a Director in light of his significant international business experience with Fortune 500 companies.

Steven H. Goldman, Director. Mr. Goldman is an accomplished lawyer and business leader who became a Director in April 2010. He is currently a partner in the Toronto law firm of Goldman Hine LLP. Before joining that firm, he successfully led the restructuring and turnaround of the Speedy Auto Service and Minute Muffler franchise systems as their President and CEO from December 2007 until December 2009. Mr. Goldman graduated from Carleton University in 1976 (BA, President’s Medal) and from Queen’s University in 1980 (JD). Mr. Goldman was called to the Bar in Ontario in 1982. He is a member of the Law Society of Upper Canada, the American Bar Association Forum on Franchising, a member of the Executive of the Ontario Bar Association (Franchise section), the Institute of Corporate Directors and the Turnaround Management Association. Mr. Goldman was a Director and member of the Company’s audit committee from December 2000 until June 2005, and is a former director of Alegro Health Corp., now known as Centric Health Corp. (TSX). Mr. Goldman was chosen as a Director in light of his practical business and legal experience.

Reliance on Exemptions

During the fiscal year ended December 31, 2012, the Company relied on the exemption provided by section 6.1 of National Instrument 52-110 – Audit Committees, which provides that the Company, as a venture issuer, is not required to comply with Part 3 (Composition of Audit Committee) and Part 5 (Reporting Obligations) of NI 52-110.

Engagement of the Independent Auditor

The Audit Committee is responsible for approving every engagement of the Company's external auditor to perform audit or non-audit services for the Company before the external auditor is engaged to provide those services. Under applicable Securities & Exchange Commission rules, the Audit Committee is required to pre-approve the audit and non-audit services performed by the independent auditors in order to ensure that they do not impair the auditors’ independence. The Securities & Exchange Commission’s rules specify the types of non-audit services that an independent auditor may not provide to its audit client and establishes the Audit Committee’s responsibility for administration of the engagement of the independent auditors

Consistent with the Securities & Exchange Commission’s rules, the Audit Committee charter requires that the Audit Committee review and pre-approve all audit services and permitted non-audit services provided by the independent auditors to the Company or any of the Company's subsidiaries. The Audit Committee may delegate pre-approval authority to a member of the Audit Committee and if it does, the decisions of that member must be presented to the full Audit Committee at its next scheduled meeting.

The Audit Committee’s pre-approval policy provides as follows:

| | ● | First, once a year when the base audit engagement is reviewed and approved, management will identify all other services (including fee ranges) for which management knows it will engage its external auditor for the next 12 months. Those services typically include quarterly reviews, certifications to lenders as required by financing documents, consultations on new accounting and disclosure standards and reporting on management’s internal controls assessment. |

| | ● | Second, if any new “unlisted” proposed engagement arises during the year, the engagement will require approval of the Audit Committee. |

External Auditor Service Fees

The shareholders have appointed McGovern, Hurley, Cunningham LLP as the Company’s independent auditors for the fiscal years ended December 31, 2012 and 2011.

As defined by applicable securities laws, (i) "audit fees" are fees for professional services rendered by the Company’s principal accountant for the audit of our annual financial statements and review of financial statements included in the Company’s Form 10-Q filings, or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years; (ii) "audit-related fees" are fees for assurance and related services by the Company’s principal accountant that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under "audit fees"; (iii) "tax fees" are fees for professional services rendered by the Company’s principal accountant for tax compliance, tax advice, and tax planning; and (iv) "all other fees" are fees for products and services provided by the Company’s principal accountant, other than the services reported under "audit fees" , "audit-related fees", and "tax fees".

Audit Fees

Audit fees consist of fees recorded for professional services rendered for the audit of the Company’s financial statements and services that are normally provided in connection with statutory and regulatory filings. The aggregate fees recorded by the Company for the 2012 and 2011 audit were $209,000 and $119,000, respectively.

Audit-Related Fees

Audit related fees are fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements and are not under "Audit Fees". There were no audit-related fees in 2012 (2011 - $Nil).

All Other Fees

Fees related to the review of the interim financial statements included in quarterly reports and services that are normally provided in connection with statutory and regulatory filings. No amounts were paid in respect of “All Other Fees” during 2012 or 2011.

Tax Fees

We do not engage our principal accountant to assist with the preparation or review of our annual tax filings. We do, however, engage an outside tax consultant to provide this service. The Company recorded expense of $3,800 in 2012 (2011 - $2,000).

The Board’s Role in Risk Oversight

It is management’s responsibility to manage risk and bring to the Board’s attention the most material risks to the Company. The Board has oversight responsibility of the processes established to report and monitor systems for material risks applicable to the Company. The Audit Committee provides oversight of management with respect to enterprise-wide risk management, which focuses primarily on financial and accounting risks and legal and compliance risks, including oversight of internal controls over financial reporting. In addition, the Compensation Committee considers risks related to the attraction and retention of talent and risks relating to the design of compensation programs and arrangements. The Compensation Committee also reviews compensation and benefits plans affecting employees in addition to those applicable to the executive officers. The Company has determined that it is not reasonably likely that compensation and benefit plans create risks that would have a material adverse effect on the Company. The full Board considers strategic risks and opportunities and regularly receives detailed reports from management and the committees, with respect to their areas of responsibility for risk oversight.

Board Leadership Structure

The Board is led by the Company’s Chairman of the Board, Arnold Tenney. The Chairman of the Board chairs all Board meetings (including executive sessions), approves Board agendas and schedules, and oversees Board materials. The Chairman of the Board also acts as liaison between the independent directors and management, is available to the Company’s outside corporate counsel to discuss and, as necessary, respond to shareholder communications to the Board, and calls meetings of the independent directors. The Company believes that having different people serving in the roles of chairman of the board and chief executive officer is an appropriate and effective organizational structure for the Company.

Compliance with Section 16(a) of the Securities Exchange Act of 1934

Section 16(a) of the Securities Exchange Act of 1934, requires the Company’s executive officers, directors and persons who beneficially own more than 10% of the common shares (“reporting persons”) to file initial reports of ownership and reports of changes of ownership with the SEC. Executive officers, directors and greater than 10% beneficial owners are required to furnish Tribute with copies of all Section 16(a) forms they file. The Company believes that all of its officers and directors have filed reports required by Section 16(a) of the Securities Exchange Act of 1934 during the year ended December 31, 2012.

Code of Ethics

We have adopted a formal Code of Ethics applicable to all employees, officers, directors and consultants. A copy of the Code of Ethics is available on the Company’s website at www.tributepharma.com/investors. The Company intends to disclose any changes in or waivers from its code of ethics by posting such information on its website or by filing a Form 8-K.

STATEMENT OF EXECUTIVE COMPENSATION

Securities law requires that a "Statement of Executive Compensation" in accordance with Form 51-102F6 be included in this Management Information Circular. Form 51-102F6 prescribes the disclosure requirements in respect of the compensation of the executive officers and directors of reporting issuers. Form 51-102F6 provides that compensation disclosure must be provided for the Chief Executive Officer and Chief Financial Officer of an issuer and each of the issuer’s three most highly compensated executive officers, other than the Chief Executive Officer and Chief Financial Officer and other than an executive officer whose total salary and bonus does not exceed $150,000. Based on these requirements, the executive officers of the Company for whom disclosure is required under Form 51-102F6 are Mr. Robert Harris (President and Chief Executive Officer), Mr. Scott Langille (Chief Financial Officer) and Ms. Janice M. Clarke (VP of Finance and Administration). For the purposes of this section of this Management Information Circular, Mr. Harris, Mr. Langille and Ms. Clarke shall be referred to as the "Named Executive Officers".

Compensation Discussion and Analysis

Compensation Philosophy and Objectives

The compensation philosophy of the Company is to provide market competitive pay to employees and reward them for their contribution to the operating and financial performance of the Company and the success in implementing the Company's short-term and long-term strategies.

The objectives of the compensation program are: (i) to attract and retain individuals critical to the success of the Company; (ii) to reward performance of individuals by recognizing their contribution to the Company; (iii) to align the interests of the Named Executive Officers and the broader management group, with shareholders' interest and the execution of the Company's strategic plan; and (iv) to compensate individuals based on their performance and, to the extent applicable, on similar compensation for companies at a comparable stage of development.

Compensation Committee

The Company has established a Compensation Committee which is composed of two directors, Arnold Tenney and John Kime, one of whom (Mr. Kime) is independent of management. The Compensation Committee meets no less than once each year and is responsible for making recommendations to the Board regarding:

| ● | reviewing and approving the compensation and other terms of employment of the Company's Chief Executive Officer; |

| ● | reviewing and approving corporate performance goals and objectives of the Company's executive officers and other senior management; and |

| ● | administration of the Company's stock option plan and other benefit plans and programs. |

The Compensation Committee makes recommendations to the Board regarding various other matters, and the Board then determines whether to adopt such recommendations as submitted or otherwise.

The Compensation Committee provides guidance with respect to, and the purpose and principles behind, the Company’s compensation decisions and overall compensation philosophy and objectives; oversees the Company’s compensation policies, plans and programs; and reviews and determines executive officer compensation. The Compensation Committee annually evaluates the performance and determines the compensation of the Chief Executive Officer, the Chief Financial Officer and the VP of Finance and Administration of the Company based upon a mix of factors including the achievement of corporate goals, achievement of individual goals, overall individual performance, and comparisons with other companies selected based on size and similar business.

The Compensation Committee did not formally consider the implications of the risks associated with the Company's compensation policies and practices. The Committee did not feel that a formal review was necessary given the size of the Company's business, the composition of the compensation and the size of the management group.

The Company has no policy that precludes an officer or director from purchasing financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held directly or indirectly, by the officer or director.

The Company does not currently anticipate that it will make any significant changes to its compensation policies and practices in the next financial year.

Total Compensation

Total compensation for the Named Executive Officers listed in the summary Compensation Table below is based on the following components: (i) fixed compensation, which includes base salary and benefits; (ii) performance based compensation, which includes annual and long-term incentives; and (iii) other compensation.

Fixed Compensation

Fixed Compensation includes:

1. Base Salary

Base salary is determined through formal job evaluation, salary survey data and market comparators. Salary ranges are reviewed annually. Base salaries for all employees are typically increased at contract renewal based on a cost of living factor, such factor being sourced from publicly available salary survey data.

2. Benefits

Each of the Named Executive Officers and other members of the Company’s senior management are enrolled in a benefits plan offering medical, dental, life and long-term disability benefits.

Performance Based Compensation

Performance based compensation includes annual and long-term incentives.

1. Annual Incentives

The annual incentive of the Chief Executive Officer, Chief Financial Officer and VP of Finance and Administration are approved by the Board and is dependent upon corporate and individual performance, measured against the strategic plan approved by the Board. The annual incentive pay for other senior management is recommended to the Compensation Committee by the Chief Executive Officer based on corporate, divisional and individual performance measured against the strategic plan.

2. Long-Term Incentives – Stock Option Plan

The Company’s stock option plan (the "Stock Option Plan") was adopted to provide the Company with a share ownership incentive program to attract, retain and motivate qualified directors, officers, full-time employees and consultants of the Company (collectively, "Service Providers"). The Stock Option Plan rewards those Service Providers for their contributions toward the long-term goals of the Company. The Stock Option Plan is designed to have common shares acquired as long-term investments.

The Stock Option Plan is administered by the Board, and at its option, the Compensation Committee of the Board. Subject to the provisions of the Stock Option Plan, the Board is authorized in its sole discretion to make decisions regarding the administration of the Stock Option Plan. Recommendations for stock options are prepared by management and presented to the Board for approval. The Board reviews the proposal, the individual or individuals involved and the terms and conditions proposed before approving the recommendations.

Summary Compensation Table

| Name and principal position | Year | Salary ($) | Option-based awards(1) ($) | Non-equity incentive plan compensation | Pension value ($) | All other compensation ($) | Total compensation ($) |

| Annual incentive plans | Long-term incentive plans |

Robert Harris President and Chief Executive Officer | 2012 | 258,661 | 62,084 | Nil | Nil | Nil | 14,400(3) | 335,145 |

2011(2) | 22,533 | Nil | Nil | Nil | Nil | Nil | 22,533 |

Scott Langille Chief Financial Officer | 2012 | 203,633 | 50,773 | Nil | Nil | Nil | 14,400(3) | 268,806 |

2011(2) | 17,867 | Nil | Nil | Nil | Nil | Nil | 17,867 |

Janice Clarke VP of Finance and Administration | 2012 | 161,804 | 26,550 | Nil | Nil | Nil | Nil | 188.354 |

| 2011 | 179,714 | 17,650 | Nil | Nil | Nil | Nil | 197,364 |

| 2010 | 120,400 | 15,002 | Nil | Nil | Nil | Nil | 135,402 |

Notes:

(1) Calculated based on the Black-Scholes valuation model at the date of grant. The computation of expected volatility is based on the common share market closing price over the period equal to the expected life of the options. The computation of expected life is calculated using the simplified method. The dividend yield is 0.0%, since there is no history of paying dividends and there are no plans to pay dividends. The risk-free interest rate is the Canadian Treasury Bond rate for the period equal to the expected term.

(2) Compensation amounts are from December 1, 2011.

(3) Auto allowance of $14,400.

Incentive Plan Awards

Outstanding Option-Based Awards at the end of the Most Recently Completed Financial Year

The below table sets forth information regarding the options held by the Named Executive Officers as at December 31, 2012.

| | Option-based Awards |

| Name | Number of securities underlying unexercised options (#) | Option exercise price (Cdn$) | Option expiration date | Value of unexercised in-the-money options (Cdn$) (1) |

Robert Harris President and Chief Executive Officer | 1,034,276 | 0.57 | December 1, 2016 | Nil |

Scott Langille Chief Financial Officer | 846,226 | 0.57 | December 1, 2016 | Nil |

Janice M. Clarke VP of Finance and Administration | 20,000 25,000 30,000 10,000(2) 45,000 15,000 10,000(2) | 0.57 0.57 0.41 0.68 0.95 1.00 0.84 | March 29, 2017 December 1, 2016 June 22, 2016 April 14, 2016 June 30, 2015 December 9, 2014 December 9, 2014 | Nil Nil 10,200 Nil Nil Nil Nil |

Notes:

(1) Calculated as the aggregate dollar value of options vested during the year that would have been realized if the options under the option-based award had been exercised on the vesting date.

(2) Original grant was 20,000 common shares, however only certain performance criteria were met in 2011 and 2010 as a result a grant covering only 10,000 common shares remains.

Incentive Plan Awards – Value Vested or Earned during the Most Recently Completed Financial Year

The incentive plan awards for each of the Named Executive Officers during 2012 are shown in the table below and are comprised of vested stock options.

| Name | Option-based awards – Value vested during 2012 (Cdn$) (1) | Non-equity incentive plan compensation – Value earned during 2012 (Cdn$) |

Robert Harris President and Chief Executive Officer | 82,779 | 125,000 |

Scott Langille Chief Financial Officer | 67,697 | 80,000 |

Janice M. Clarke VP of Finance and Administration | 21,450 | 48,000 |

Notes:

| | (1) | Calculated as the aggregate dollar value of options vested during the year that would have been realized if the options under the option-based award had been exercised on the vesting date. All options which vested in the year were out-of-money at the time the options vested. |

RH Executive Employment Agreement

In connection with his appointment as a director, President and Chief Executive Officer, Rob Harris (“RH” and the Company entered into an Executive Employment Agreement, the term of which commenced on December 1, 2011 and ends on December 31, 2014, with automatic three year renewal periods unless written notice of non-renewal is provided by RH upon no less than 90 days prior to the end of that term or by the Company upon no less than 180 days prior to the end of that term. For the first three year term, RH shall be paid an annual base salary of CND$250,000 for his services. RH’s annual salary for future terms shall be reviewed by the Company’s Board of Directors. The Company also has agreed to provide RH with a monthly automobile allowance of $1,200 during the term of the Agreement. RH shall be entitled to an initial grant of options governed by the terms of the Company’s stock option plan to purchase an aggregate of 1,034,276 common shares of the Company, which shall vest as follows:

(i) 50% of the options will be subject to a time vesting schedule beginning on April 1, 2012 and irrespective of RH’s continued employment with the Company as follows:

| Date of Vesting | Number of Options Vested |

| April 1, 2012 | 8 1/3rds % of total options granted in (i) |

| July 1, 2012 | 8 1/3rds % of total options granted in (i) |

| October 1, 2012 | 8 1/3rds % of total options granted in (i) |

| January 1, 2013 | 8 1/3rds % of total options granted in (i) |

| April 1, 2013 | 8 1/3rds % of total options granted in (i) |

| July 1, 2013 | 8 1/3rds % of total options granted in (i) |

| October 1, 2013 | 8 1/3rds % of total options granted in (i) |

| January 1, 2014 | 8 1/3rds % of total options granted in (i) |

| April 1, 2014 | 8 1/3rds % of total options granted in (i) |

| July 1, 2014 | 8 1/3rds % of total options granted in (i) |

| October 1, 2014 | 8 1/3rds % of total options granted in (i) |

| January 1, 2015 | 8 1/3rds % of total options granted in (i) |

The options in (i) above shall have an exercise price (converted to Canadian dollar using the Bank of Canada noon rate) equivalent to the closing price of the Company’s common shares on the day immediately preceding December 1, 2011 and an expiry date five years from the date of grant.

(ii) 25% of the options will be granted upon the quarterly achievement of either of the Gross Revenue or EBITDA targets, each as defined below, with a total of 50% of the options granted if both targets are achieved, during the three year term of the Executive Employment Agreement which shall vest as follows:

| Date of Grant / Vesting | Number of Options Granted | Number of Options Vested |

| March 31, 2013 | (a) 33 1/3rd % of total performance based options granted in (ii) above | 25% of (a) |

| June 30, 2013 | | 25% of (a) |

| September 30, 2013 | | 25% of (a) |

| December 31, 2013 | | 25% of (a) |

| March 31, 2014 | (b) 33 1/3rd % of total performance based options granted in (ii) above | 25% of (b) |

| June 30, 2014 | | 25% of (b) |

| September 30, 2014 | | 25% of (b) |

| December 31, 2014 | | 25% of (b) |

| March 31, 2015 | (c) 33 1/3rd % of total performance based options granted in (ii) above | 25% of (c) |

| June 30, 2015 | | 25% of (c) |

| September, 2015 | | 25% of (c) |

| December 31, 2015 | | 25% of (c) |

| ● | Gross revenue and EBITDA targets for calendar 2012 to 2014 are to be contained in the budgets for 2012, 2013 and 2014 as approved by the Board of Directors of the Company. |

The options referred to in clause (ii) above shall have an exercise price (converted to Canadian dollar using the Bank of Canada noon rate) equivalent to the closing price of the Company’s common shares on the day immediately preceding the date of grant and an expiry date five years from the date of grant.