The Next Chapter Begins: Creating Value through Growth Corporate Overview January 13, 2015 Helen Torley, M.B. Ch. B., M.R.C.P. President and Chief Executive Officer 1 EXHIBIT 99.2

Forward-Looking Statements All of the statements in this presentation that are not statements of historical facts constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of such statements include future product development and regulatory events and goals, anticipated clinical trial results and strategies, product collaborations, our business intentions and financial estimates and results. These statements are based upon management’s current plans and expectations and are subject to a number of risks and uncertainties which could cause actual results to differ materially from such statements. A discussion of the risks and uncertainties that can affect these statements is set forth in the Company’s annual and quarterly reports filed from time to time with the Securities and Exchange Commission under the heading “Risk Factors.” The Company disclaims any intention or obligation to revise or update any forward-looking statements, whether as a result of new information, future events, or otherwise. 2

Halozyme: Two Potential Drivers of Future Growth and Value 3 ENHANZE™ (rHuPH20) n CH2 CH2 OCH2 O CH3 N H O CH2 CH2 OO CH2 CH3 N H O n CH2 CH2 OO CH2 CH3 N O H n n CH2 CH2 OCH2 O CH3 N H O CH2 CH2 OO CH2 CH3 N O H n PEGylated form of rHuPH20 Investigational new drug in phase 2 development PEGPH20

UUUSS US US Regulatory Validation – Baxter’s HYQVIA [(Immune Globulin Infusion 10% (Human) with Recombinant Human Hyaluronidase)] approval by FDA in September 2014 Commercial Validation – Rapid adoption and market conversion to Herceptin SC (trastuzumab) – Janssen Global License agreement within 100 days of HYQVIA approval 4 PEGPH20 ENHANZE (rHuPH20) Significant Value Creating Progress in 2014 Encouraging Study 202 Pancreatic Cancer data – Information on risk:benefit – Early data on efficacy (ORR and PFS) in patients with tumors that accumulate high levels of hyaluronan Initiation of PRIMAL study in Non-Small Cell Lung Cancer

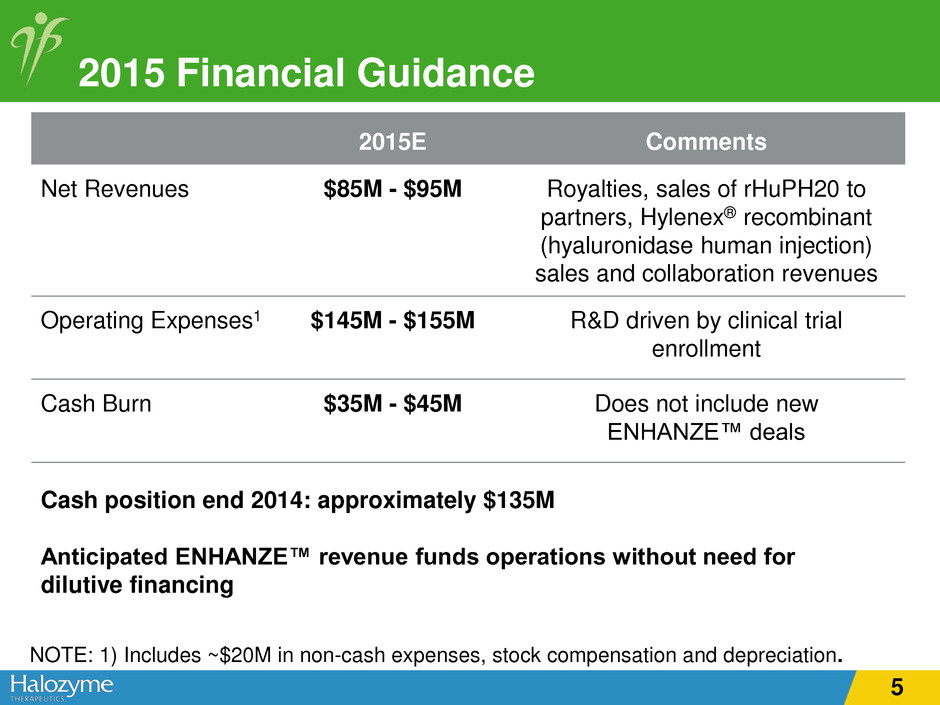

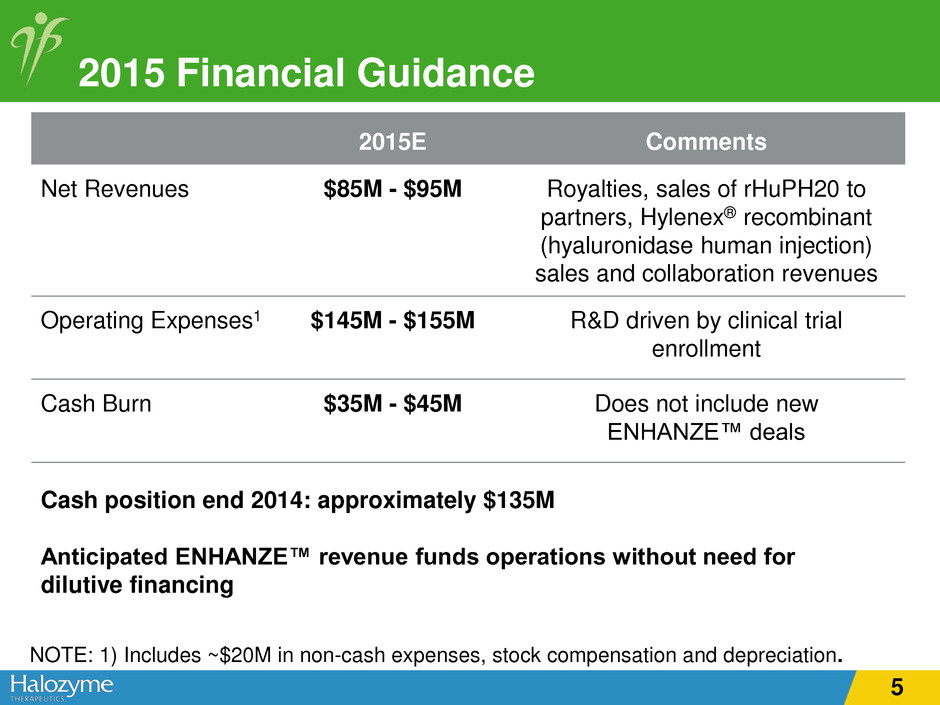

2015 Financial Guidance 5 2015E Comments Net Revenues $85M - $95M Royalties, sales of rHuPH20 to partners, Hylenex® recombinant (hyaluronidase human injection) sales and collaboration revenues Operating Expenses1 $145M - $155M R&D driven by clinical trial enrollment Cash Burn $35M - $45M Does not include new ENHANZE™ deals NOTE: 1) Includes ~$20M in non-cash expenses, stock compensation and depreciation. Cash position end 2014: approximately $135M Anticipated ENHANZE™ revenue funds operations without need for dilutive financing

PEGPH20 (PEGylated form of rHuPH20) 6

PEGPH20 – Investigational new drug – Intended to target hyaluronan (HA), a key component of the tumor microenvironment (TME) – Potential to increase tumor-selective access of co-administered anticancer therapy into tumors that accumulate high levels of hyaluronan (HAhigh) Encouraging early clinical efficacy data in Phase 1b and 2 trials of Stage IV pancreatic ductal adenocarcinoma when co-administered with – Gemcitabine – Gemcitabine and Abraxane® (nab-paclitaxel) Initial Tumor Focus Areas – Pancreatic, NSCLC, Gastric PEGPH20 Goal: Improving Targeting of Co-Administered Cancer Drugs 7

1L Stage IV Pancreatic Cancer 2L Stage IIIB/IV Non Small Cell Lung Cancer Annual Incidence (US and EU 5) ~100,000 ~80,000 Estimated % with HAhigh 40-60% 35-45% 5 Year Survival 5% 16.8% Overall Survival with Current Standard of Care 8.5 months (Abraxane® plus gemcitabine) 7-8 months (docetaxel, Alimta®, Tarceva®) Targeting Large Markets With Poor Survival Rates GLOBOCAN 2012, SEER 18, 2004-2010. Halozyme analysis. 8

Study 202: Ongoing Trial of PEGPH20 with Abraxane® and Gemcitabine PEGPH20 + Abraxane® + gemcitabine Abraxane® + gemcitabine Stage IV Metastatic PDA N=260 KPS 70-100 Biopsy Tissue Primary endpoints: PFS Rate of TE events Secondary endpoints: PFS by HA level ORR OS H A L O -2 0 2 Total Sites 44 (US only) First patient enrolled March 2013 Expected last patient enrolled 2H 2015 Expected top line data Event driven, estimate Q4 2015-Q1 2016 HA status Retrospective assessment at central lab of tissue biopsy with HTI601/StainMap™ 9

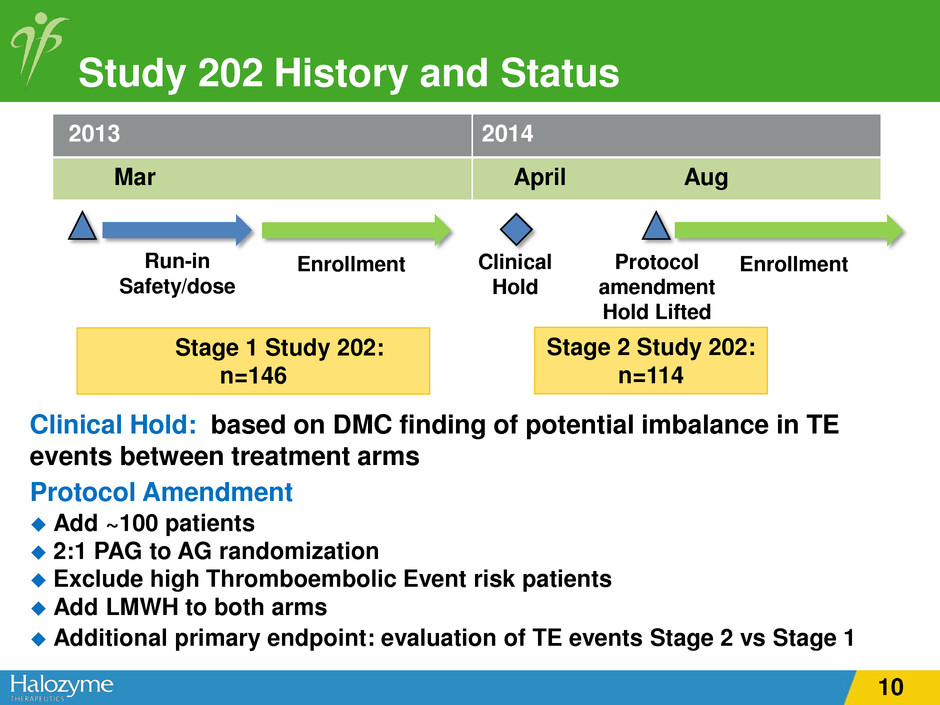

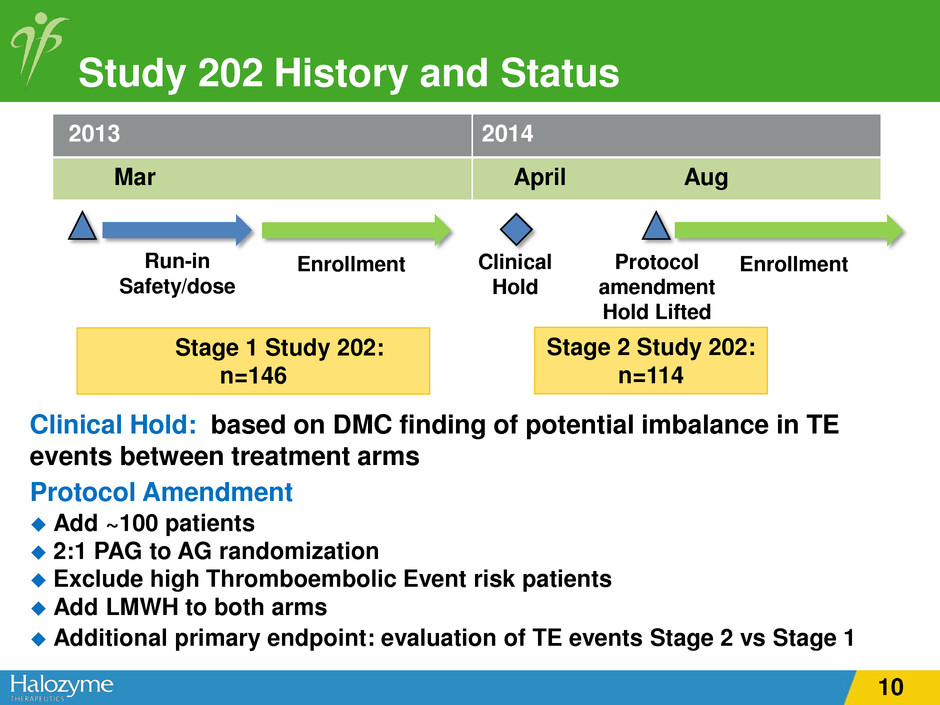

Study 202 History and Status Clinical Hold: based on DMC finding of potential imbalance in TE events between treatment arms Protocol Amendment Add ~100 patients 2:1 PAG to AG randomization Exclude high Thromboembolic Event risk patients Add LMWH to both arms Additional primary endpoint: evaluation of TE events Stage 2 vs Stage 1 2013 2014 Mar April Aug Stage 1 Study 202: n=146 Run-in Safety/dose Enrollment Clinical Hold Protocol amendment Hold Lifted Stage 2 Study 202: n=114 Enrollment 10

Results: Early Data Suggest Higher ORR with PEGPH20 Particularly in HAhigh ORR based on independent, blinded central review Safety data presented on slides 14 and 15 MPACT Study ORR Results: Von Hoff D. NEJM. 2013,369:1691 – Abraxane® plus gemcitabine, 23% vs gemcitabine, 7% Study 202 Interim Analysis: ORR (RECIST 1.1 for controlled trial) Analysis Population PAG Arm Responders/ total patients (%) AG Arm Responders/ total patients (%) Rate Ratio P-value PAG vs AG Safety 25/74 (34) 14/61 (23) 1.5 0.17 HA Overall Response Rate 21/35 (60) 10/27 (37) 1.6 0.090 HA High 12/17 (71) 5/17 (29) 2.4 0.016 HA Low 9/18 (50) 5/10 (50) 1.0 0.94 11

Progression Free Survival Study 202 Interim Results: Analysis Population No. with events / total evaluated patients; median PFS in months HR P-value PAG vs AG PAG arm n=61 AG arm n=45 Safety w/HA 34/61; 5.5 30/45; 4.8 0.64 0.086 HA High 12/25; 9.2 15/23; 4.3 0.38 0.031 HA Low 22/36; 4.8 15/22; 5.6 0.92 0.81 Results: Early Data Suggests Increased PFS In HAhigh Patients Treated with PEGPH20 MPACT Study PFS Results: Von Hoff D. NEJM. 2013,369:1691 – Abraxane® plus gemcitabine 5.5 months vs gemcitabine 3.7 months 12

ORR: 71% PFS: 9.2 months ORR: 29% PFS: 4.3 month ORR: 50% PFS: 4.8 months ORR: 50% PFS: 5.6 months Study 202: Interim ORR and PFS Data Summary PAG AG High HA Low HA ORR data through April 9th, 2014 and reflects PAG or AG treatment PFS data through December 5th, 2014 and reflects PAG AG treatment in PAG arm 13

Overall Safety Profile Treatment Related AEs >25% Patients PAG N=74 Patients, n (%) AG N=61 Patients, n (%) Preferred Term Grade 3+ Any Grade Grade 3+ Any Grade Any AE 61 (82.4) 73 (98.6) 45 (73.8) 57 (93.4) Fatigue 13 (17.6) 50 (67.6) 11 (18.0) 39 (63.9) Nausea 5 (6.8) 41 (55.4) 2 (3.3) 27 (44.3) Anemia 14 (18.9) 30 (40.5) 10 (16.4) 32 (52.5) Edema peripheral 2 (2.7) 43 (58.1) 3 (4.9) 17 (27.9) Diarrhea 5 (6.8) 31 (41.9) 2 (3.3) 22 (36.1) Alopecia 0 24 (32.4) 0 25 (41.0) Decreased appetite 4 (5.4) 26 (35.1) 2 (3.3) 15 (24.6) Muscle spasms 6 (8.1) 40 (54.1) 0 1 (1.6) Platelet count decreased 5 (6.8) 21 (28.4) 4 (6.6) 18 (29.5) Vomiting 4 (5.4) 23 (31.1) 0 16 (26.2) Neutropenia 18 (24.3) 24 (32.4) 9 (14.8) 11 (18.0) 14

Parameters PAG AG Patients, N 74 61 Patients with TEs, n (%) 31 (41.9) 15 (24.6) Patients with PE, n (%) 16 (21.6) 6 (9.8) Patients with DVT, n (%) 16 (21.6) 9 (14.7) Patients with Arterial TE, n (%) 7 (9.4) 0 Grade 1 and 2 events, (% of N) 21 15 Grade ≥3 events (% of N) 23 5 Study 202: Stage 1 Interim Results Thromboembolic Events Through 12/1/14 TE events in Stage 1 managed through dose interruption, with majority of patient reinitiating PAG/AG post anticoagulation. Patients may have had more than one event 15

Pancreatic Cancer: Planned Next Steps Complete enrollment – Study 202 in 2H 2015 – SWOG Study S1313: PEGPH20 in combination with mFOLFIRINOX Meet with FDA (end Q1 target) – Discuss potential registration-seeking trial in HAhigh Stage 4 Pancreatic Ductal Adenocarcinoma patients Gain EMA scientific advice on proposed protocol 16

Non Small Cell Lung Cancer: Significant Unmet Medical Need Over 160K newly diagnosed 1L and 84K 2L patients annually (US & 5EU) Survival times remain low with no curative therapy Immunotherapy may offer hope for some but opportunity remains to do more 2L Chemo [84,000] NSCLC [375,000] <Stage IIIB (50%) Stage IIIB/IV (50%) EGFR/ALK (20%) 1L Chemo [160,000] References: GLOBOCAN 2012 (IARC) - 3.7.2014; “Lung Cancer”, American Cancer Society, 2014. 2 Scagliotti, et al. J Clin Oncol. 2008; 26:3543-51, Halozyme analysis. 17

Non Small Cell Lung Cancer: Two PEGPH20 Trials Planned Over 160K newly diagnosed 1L and 84K 2L patients annually (US & 5EU) Survival times remain low with no curative therapy Immunotherapy may offer hope for some but opportunity remains to do more 2L Chemo [84,000] NSCLC [375,000] <Stage IIIB (50%) Stage IIIB/IV (50%) EGFR/ALK (20%) 1L Chemo [160,000] References: GLOBOCAN 2012 (IARC) - 3.7.2014; “Lung Cancer”, American Cancer Society, 2014. 2 Scagliotti, et al. J Clin Oncol. 2008; 26:3543-51, Halozyme analysis. PD1-Combo (PEGPH20 + PD1) PRIMAL (PEGPH20 + docetaxel) 18

Phase 1b/2 PRIMAL Study in NSCLC Initiated Dose escalation PEGPH20 + docetaxel 75mg/m2 N=Up to 240 Schedule A PEGPH20 Q21d Schedule B PEGPH20 2/W Q21d PEGPH20 + docetaxel docetaxel N = 170 HAhigh 1:1R Phase 1b Phase 2 PEGPH20 + docetaxel in HAhigh Platinum Failed NSCLC Patients Total Sites Phase 1b ~10, Phase 2 50-75; Global Study Status Sites opening: patient screening underway Study Objectives Phase 1b: Dose finding: schedule options Phase 2: Efficacy in HAhigh patients Primary Endpoint PFS Secondary Endpoints ORR, DOR, DCR, OS HA Screen 19

Dose Escalation Endpoints: DLT, MTD, RP2D, PK of PEGPH20 and safety profile Dose Expansion Phase 1b expansion end points: ORR, DCR, DOR, PFS Plan to initiate study Q3 2015 Exploring Combination of PEGPH20 with an Anti- PD1 Antibody in HAhigh Tumors—HALO 107-101 Dose escalation PEGPH20 + PD1 Inhibitor 2L NSCLC Gastric Phase 1b Study in Multiple Tumors: 20 HAhigh Subjects Each HA SCREEN 20

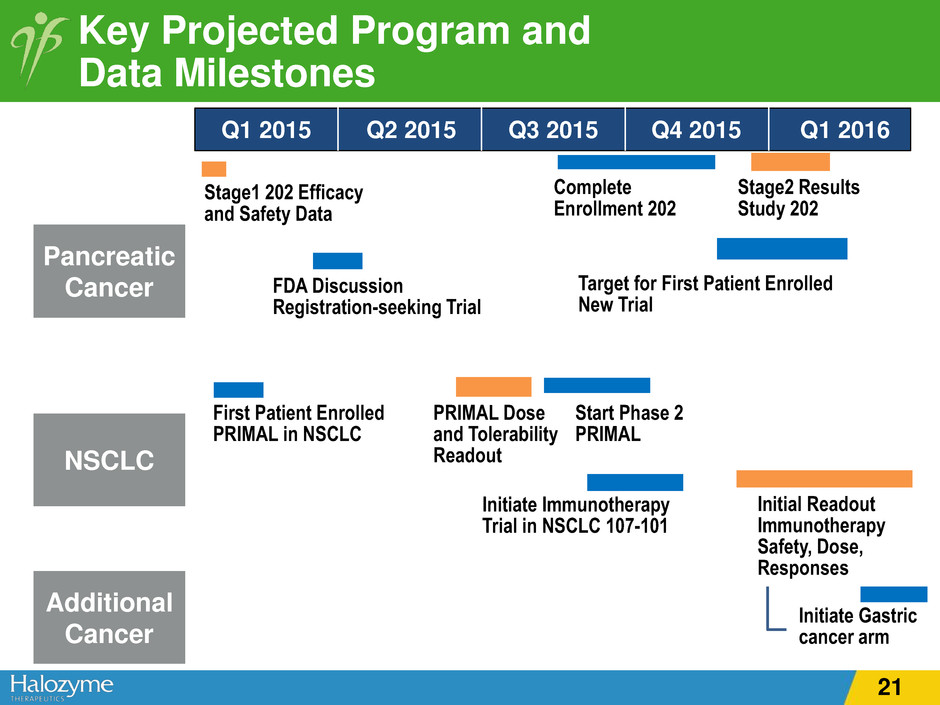

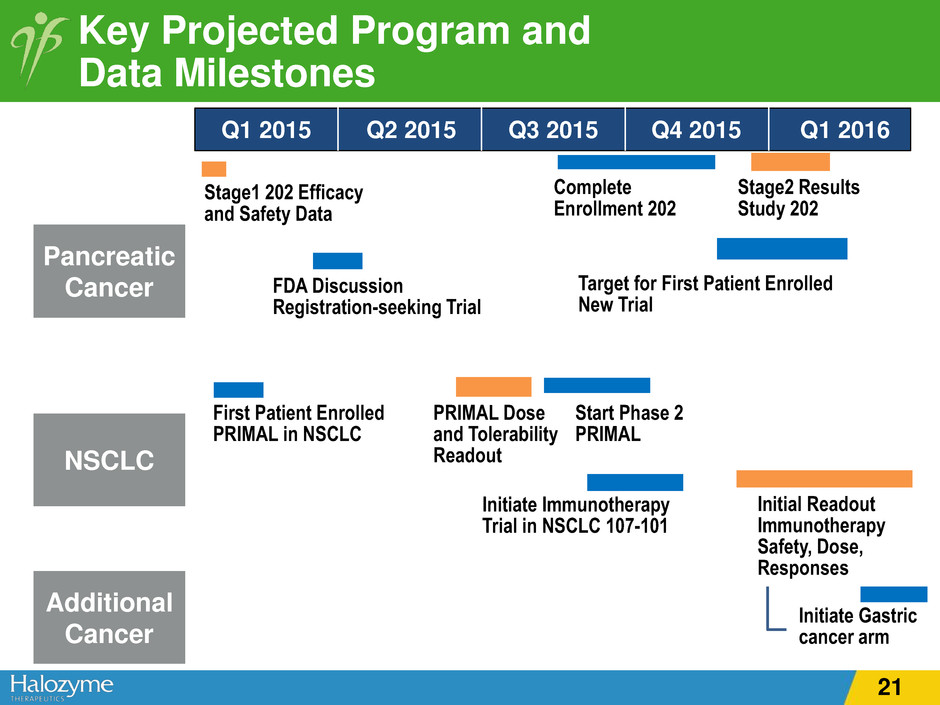

Key Projected Program and Data Milestones FDA Discussion Registration-seeking Trial Stage1 202 Efficacy and Safety Data Q1 2016 Pancreatic Cancer NSCLC Additional Cancer Q4 2015 Q3 2015 Q2 2015 Q1 2015 Complete Enrollment 202 Stage2 Results Study 202 Target for First Patient Enrolled New Trial First Patient Enrolled PRIMAL in NSCLC PRIMAL Dose and Tolerability Readout Start Phase 2 PRIMAL Initiate Immunotherapy Trial in NSCLC 107-101 Initial Readout Immunotherapy Safety, Dose, Responses Initiate Gastric cancer arm 21

ENHANZE™ Technology 22

HYQVIA [(Immune Globulin Infusion 10% (Human) with Recombinant Human Hyaluronidase)] Approved September 2014 following 15-1 vote by Advisory Committee on positive risk:benefit Differentiated subcutaneous therapy for Primary Immunodeficiency Disease (PID) in Adults rHUPH20 pre-administration facilitates administration of increased fluid volumes Generally once a month dosing through one injection site Opportunity1 ~$2.0BN Global market opportunity in PID ~35% of patients receiving subcutaneous administration today Evaluating additional formulations/indications NOTE: 1) Information obtained from Baxter investor update (October 16, 2014). Prior to HYQVIA infusion After 500 mL HYQVIA infused Baxter’s HYQVIA: First U.S. Approved Biologics License Application Which Utilizes ENHANZE™ 22

+ UP TO 6 ADDITIONAL TARGETS PCSK-9 Rivipansel + UP TO 2 ADDITIONAL TARGETS Royalties from Top-line Sales plus Milestones UP TO 5 EXCLUSIVE TARGETS Revenue-Driving ENHANZE™ Platform Recognized By 3 of Top 5 Pharma/Biotech Companies 23

NOTE: 1) Financial information obtained from Roche investor update (January 30, 2014). Amounts presented in $US Dollars (1 CHF = 1.0794 $USD). Rounded. 2) Revenues as a percentage of sales for Herceptin and Mabthera/Rituxan were obtained from Roche investor update (January 30, 2014). 3) Information obtained from Roche investor presentation (July 25, 2013). 4) Halozyme receives a mid-single digit royalty payment on net product sales of Herceptin SC and MabThera SC from Roche; royalties subject to IV to SC conversion rate, countries where launched, approvals, reimbursements, timelines, pricing and other commercial factors. 5) Herceptin SC launched in EU (September 2013). 6) MabThera SC launched in EU (June 2014). Herceptin MabThera/Rituximab IV Formulation WW Revenues (2013)1: $6.6BN $7.5BN IV Implied Revenues (x-US, x-Japan): $4.3BN (or ~66% WW Sales)2 $3.6BN (or ~49% WW Sales)2 SC Addressable Indication(s)3: ~70% ~83% Adjusted rHuPH20 Potential Market Opportunity4: ~$3.0BN5 ~$3.0BN6 *This information presented below is not intended to be a sales projection and is for illustrative purposes only. Roche has not provided any guidance on the commercial potential for these products* Roche Partnered Programs Represent Significant Opportunity 24

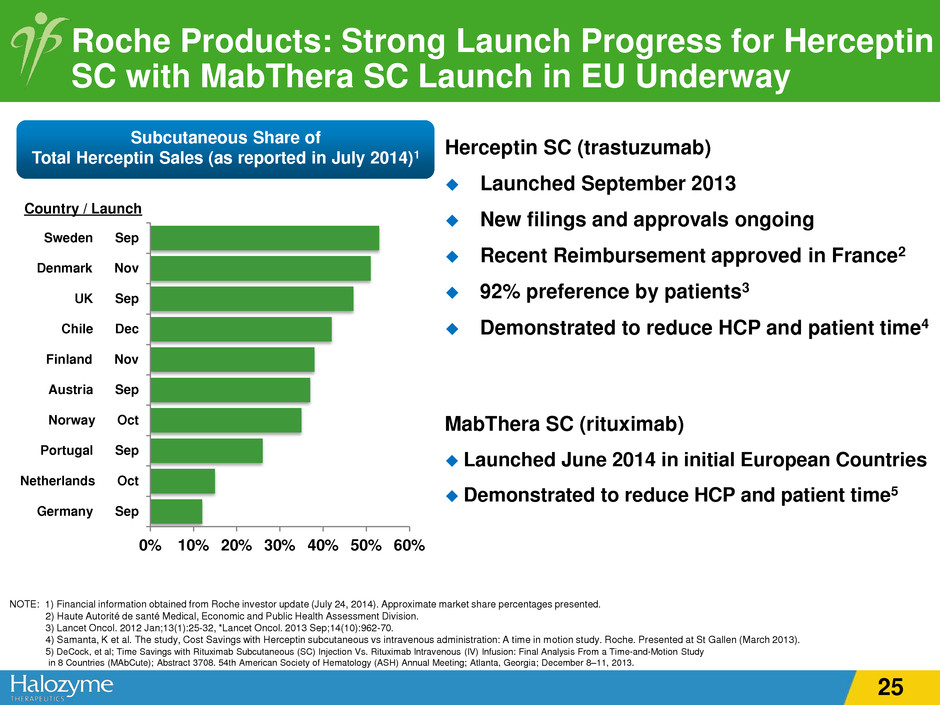

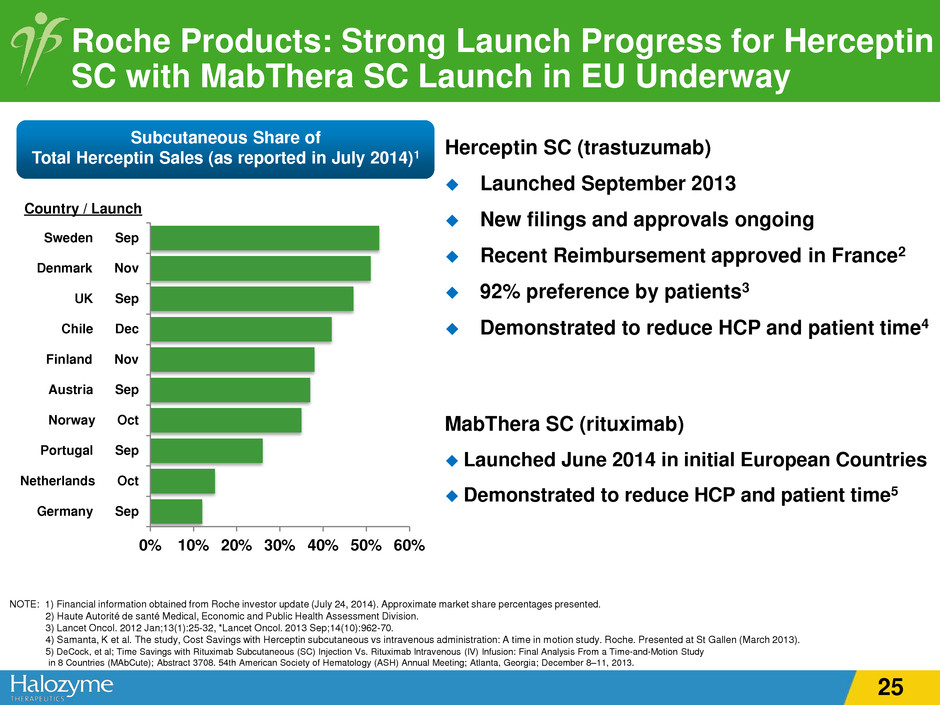

Herceptin SC (trastuzumab) Launched September 2013 New filings and approvals ongoing Recent Reimbursement approved in France2 92% preference by patients3 Demonstrated to reduce HCP and patient time4 MabThera SC (rituximab) Launched June 2014 in initial European Countries Demonstrated to reduce HCP and patient time5 0% 10% 20% 30% 40% 50% 60% Germany Sep Netherlands Oct Portugal Sep Norway Oct Austria Sep Finland Nov Chile Dec UK Sep Denmark Nov Sweden Sep Subcutaneous Share of Total Herceptin Sales (as reported in July 2014)1 Country / Launch NOTE: 1) Financial information obtained from Roche investor update (July 24, 2014). Approximate market share percentages presented. 2) Haute Autorité de santé Medical, Economic and Public Health Assessment Division. 3) Lancet Oncol. 2012 Jan;13(1):25-32, *Lancet Oncol. 2013 Sep;14(10):962-70. 4) Samanta, K et al. The study, Cost Savings with Herceptin subcutaneous vs intravenous administration: A time in motion study. Roche. Presented at St Gallen (March 2013). 5) DeCock, et al; Time Savings with Rituximab Subcutaneous (SC) Injection Vs. Rituximab Intravenous (IV) Infusion: Final Analysis From a Time-and-Motion Study in 8 Countries (MAbCute); Abstract 3708. 54th American Society of Hematology (ASH) Annual Meeting; Atlanta, Georgia; December 8–11, 2013. Roche Products: Strong Launch Progress for Herceptin SC with MabThera SC Launch in EU Underway 25

$799 $1,700 $2,900 $0 $1,000 $2,000 $3,000 $4,000 1Q14 Royalties (Reflects Oct-Dec 2013 Sales) 2Q14 Royalties (Reflects Jan-Mar 2014 Sales) 3Q14 Royalties (Reflects April-June 2014 Sales) Royalties (As Reported by HALO) Royalty Revenues (in $000)1,2,3 Sept 2013 Oct 2013 Nov 2013 Dec 2013 Jan 2014 Feb 2014 Mar 2014 April 2014 May 2014 June 2014 July 2014 Aug 2014 Sept 2014 Oct 2014 Herceptin SC (trastuzumab) EU launch HYQVIA [(Immune Globulin Infusion 10% (Human) with Recombinant Human Hyaluronidase)] US launch NOTE: 1) Under the contracts with our collaborators, Halozyme receives royalty information and payments 60 days post the close of each quarter. 2) Launch Markets for Herceptin SC as reported in Roche investor update (18 countries: April 15, 2014; 29 countries: October 16, 2014). 3) HYQVIA launched in the EU in 3Q2013. MabThera SC (rituximab) EU launch Just At The Start of The Royalty Ramp 26

PEGPH20 Pancreatic Cancer Present Study 201 (Phase 1b) final results - ASCO-GI FDA Discussion (Regarding registration-seeking trial) Complete Study 202 (Phase 2) Enrollment Initiate Registration-Seeking Clinical Trial January 2015 1H 2015 2H 2015 4Q2015-1Q2016 PEGPH20 Non-Small Cell Lung Cancer (PRIMAL) Complete Phase 1b Enrollment Initiate Phase 2 Enrollment 3Q20151 4Q20152 PEGPH20 Immunotherapy Initiate Phase 1b Enrollment 2H 2015 ENHANZE Goals Increase number of products seeking registration Increase number of partnerships Key 2015 PEGPH20 Milestones and ENHANZE Goals 27 NOTE: 1) Pending the number of dose escalation cohorts of PEGPH20. 2) The Phase 2 randomized portion of the study will follow evaluation of the Phase 1b data.