Table of Contents

CALCULATION OF REGISTRATION FEE

| ||||||||

Title of each class of securities to be registered(1) | Amount to be registered(1) | Proposed maximum offering price per unit | Proposed maximum aggregate offering price | Amount of registration fee(2) | ||||

Common Stock, par value $0.001 per share | 8,846,153 | $13.00 | $114,999,989 | $14,812 | ||||

| ||||||||

| ||||||||

| (1) | Includes shares of common stock that may be purchased by the underwriters pursuant to the underwriters’ option to purchase additional shares. |

| (2) | Calculated pursuant to Rule 457(r) under the Securities Act of 1933, as amended, or the Securities Act. The fee payable in connection with the offering of common stock pursuant to this prospectus supplement has been paid in accordance with Rule 456(b) under the Securities Act. |

Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-179444

Prospectus Supplement

(To Prospectus dated February 9, 2012)

7,692,307 shares

Common stock

This is an offering of 7,692,307 shares of our common stock.

Our common stock is listed on The NASDAQ Global Select Market under the symbol “HALO.” The last reported sale price of our common stock on The NASDAQ Global Select Market on February 4, 2014 was $13.78 per share.

Per Share | Total | |||||||

Public offering price | $ | 13.00 | $ | 99,999,991.00 | ||||

Underwriting discounts and commissions | $ | 0.78 | $ | 5,999,999.46 | ||||

Proceeds to us, before expenses | $ | 12.22 | $ | 93,999,991.54 | ||||

We have granted the underwriters a 30-day option to purchase up to 1,153,846 additional shares of common stock at the public offering price less the underwriting discounts and commissions.

Investing in our common stock involves significant risks. See “Risk Factors” beginning on pageS-12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about February 10, 2014.

Joint book-running managers

| J.P. Morgan | Citigroup |

Co-managers

| Piper Jaffray | BMO Capital Markets |

February 4, 2014

Table of Contents

Prospectus Supplement

| Page | ||||

| S-ii | ||||

| S-1 | ||||

| S-12 | ||||

| S-29 | ||||

| S-30 | ||||

| S-30 | ||||

| S-30 | ||||

| S-31 | ||||

Material U.S. Federal Income Tax Consequences to Non-U.S. Holders | S-32 | |||

| S-36 | ||||

| S-40 | ||||

| S-40 | ||||

| S-40 | ||||

Prospectus

| Page | ||||

| 1 | ||||

| 2 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 13 | ||||

| 20 | ||||

| 22 | ||||

| 23 | ||||

| 26 | ||||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus supplement or the accompanying prospectus. If you rely on any unauthorized information or representations, you will do so at your own risk. This prospectus supplement and the accompanying prospectus are an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus supplement and the accompanying prospectus is current only as of their respective dates.

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of the offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus dated February 9, 2012, including the documents incorporated by reference, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or in any document incorporated by reference that was filed with the Securities and Exchange Commission (“SEC”) before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement. You should read this prospectus supplement and the accompanying prospectus, including the information incorporated by reference and any free writing prospectus that we have authorized for use in connection with this offering, in their entirety before making an investment decision.

Neither we nor the underwriters authorized anyone to provide you with information that is different from or in addition to the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus, along with the information contained in any free writing prospectus that we have authorized for use in connection with this offering. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering is accurate only as of the respective dates of those documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

S-ii

Table of Contents

This summary highlights selected information appearing elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus, and may not contain all of the information that is important to you. This prospectus supplement and the accompanying prospectus include information about the offering as well as information regarding our business. You should read this prospectus supplement and the accompanying prospectus, including the information incorporated by reference and any free writing prospectus that we have authorized for use in connection with this offering, in their entirety. If you invest in our common stock, you are assuming a high degree of risk. See “Risk Factors” beginning on page S-12.

Unless the context indicates otherwise or we expressly state to the contrary, as used in this prospectus supplement and the accompanying prospectus, the terms the “Company,” “Halozyme,” “Halozyme Therapeutics,” “we,” “us” and “our” refer to Halozyme Therapeutics, Inc., a Delaware corporation, and our operating subsidiary, Halozyme, Inc.

Overview

Halozyme is a science-driven, biopharmaceutical company committed to making molecules into medicines for patients in need. Our research focuses primarily on human enzymes that alter the extracellular matrix. The extracellular matrix is a complex matrix of proteins and carbohydrates surrounding the cell that provides structural support in tissues and orchestrates many important biological activities, including cell migration, signaling and survival. Over many years, we have developed unique technology and scientific expertise enabling us to pursue this target-rich environment for the development of therapies.

Our proprietary enzymes can be used to facilitate the delivery of injected drugs and fluids, thus enhancing the efficacy and the convenience of other drugs or can be used to alter abnormal tissue structures for clinical benefit. We have chosen to exploit our technology and expertise in a balanced way to modulate both risk and spend by: (1) developing our own proprietary products in therapeutic areas with significant unmet medical needs, such as diabetes, oncology and dermatology, and (2) licensing our technology to biopharmaceutical companies to collaboratively develop products which combine our technology with the collaborators’ proprietary compounds.

The majority of our approved product and product candidates are based on rHuPH20, a patented human recombinant hyaluronidase enzyme. rHuPH20 temporarily breaks down hyaluronic acid (“HA”)—a naturally occurring substance that is a major component of the extracellular matrix in tissues throughout the body such as skin and cartilage. We believe this temporary degradation creates an opportunistic window for the improved subcutaneous delivery of injectable biologics, such as monoclonal antibodies and other large therapeutic molecules, as well as small molecules and fluids. The HA reconstitutes its normal density within several days and, therefore, we anticipate that any effect of rHuPH20 on the architecture of the subcutaneous space is temporary. rHuPH20 can thus be applied as a drug delivery platform to increase dispersion and absorption of other injected drugs and fluids that are injected under the skin or in the muscle thereby enhancing efficacy or convenience. For example, rHuPH20 can be used to convert drugs that must be delivered intravenously into subcutaneous injections or to reduce the number of subcutaneous injections needed for effective therapy. We refer to the application of rHuPH20 to facilitate the delivery of other drugs or fluids as Enhanze™ technology. rHuPH20 is also the active ingredient in our first commercially approved product,Hylenex® recombinant (hyaluronidase human injection). Additionally, we are expanding our scientific work in the extracellular matrix by developing other enzymes and agents that target its unique aspects, giving rise to potentially new molecular entities that can be indicated in endocrinology, oncology and dermatology.

Our proprietary pipeline consists of multiple clinical stage products in diabetes, oncology and dermatology. We currently have collaborations with F. Hoffmann-La Roche, Ltd. and Hoffmann-La Roche, Inc. (“Roche”), Pfizer Inc. (“Pfizer”), Baxter Healthcare Corporation (“Baxter”), ViroPharma Incorporated (“ViroPharma”) and Intrexon Corporation (“Intrexon”), with two products approved for marketing in Europe, one product candidate

S-1

Table of Contents

which has been submitted for regulatory approval in the U.S., one product candidate which has been submitted for regulatory approval in Europe and has received a positive opinion from the EU Committee for Medicinal Products for Human Use (“CHMP”), as well as several others at various stages of development.

Our operations to date have involved: (i) building infrastructure for and staffing our operations; (ii) acquiring, developing and securing proprietary protection for our technology; (iii) developing our proprietary product pipeline; (iv) entering into and supporting our collaborations with other companies to advance licensed product candidates; and (v) selling our own approved commercial product,Hylenex recombinant. Currently, we have received only limited revenue from the sales ofHylenex recombinant, in addition to other revenues from our collaborations.

Future revenues from the sales and/or royalties of our product candidates which have not been approved or have recently been approved will depend on the ability of Halozyme and our collaborators to develop, manufacture, secure regulatory approvals for and commercialize the product candidates. We have incurred net operating losses each year since inception, with an accumulated deficit of approximately $360.1 million as of September 30, 2013.

The following are the anticipated milestones for our product development programs in 2014:

Proprietary Products

PEGPH20

| • | Complete enrollment in the on-going Phase 2 multicenter, randomized clinical trial (Study 202) evaluating PEGPH20 as a first-line therapy for patients with stage IV metastatic pancreatic cancer, in the second half of 2014. |

| • | Initiate patient enrollment in an additional solid tumor setting in the fourth quarter 2014. |

Hylenex Diabetes Program

| • | Announce top-line data from the 400 patient CONSISTENT 1 clinical trial evaluating the use ofHylenex in conjunction with rapid analog insulin in people with Type 1 diabetes using insulin pumps in the first quarter of 2014. |

| • | Submit clinical data from CONSISTENT 1 for publication at a major medical meeting in 2014. |

| • | Gain input from the U.S. Food and Drug Administration (“FDA”) on the path to secure an update to theHylenex label to include key efficacy and safety data when used as a pre-treatment in patients with diabetes using insulin pumps. |

HTI-501

| • | Announce top-line data for HTI-501 from the 36 subject Phase 2 clinical trial in cellulite in the first quarter of 2014. |

Collaboration Products

| • | Roche expects to receive approval of the marketing authorization in the EU for MabThera SC during 2014. |

| • | Baxter expects to receive a response to its amended Biologic License Application (“BLA”) for HyQvia from the FDA in mid-2014. |

S-2

Table of Contents

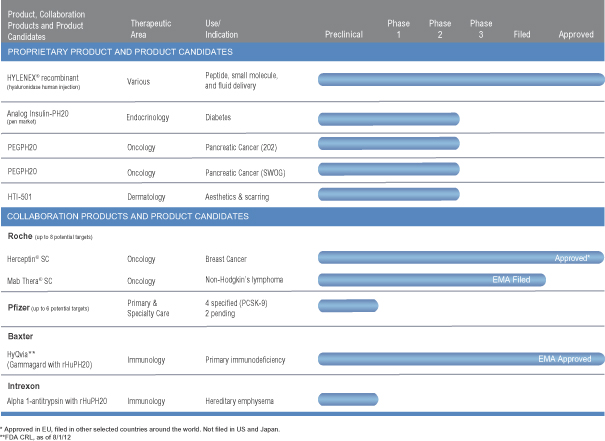

Product and Product Candidates

We have one marketed product and multiple product candidates targeting several indications in various stages of development. The following table summarizes our proprietary product and product candidates as well as two approved products and product candidates under development with our collaborators:

Proprietary Pipeline

Hylenex recombinant (hyaluronidase human injection)

Hylenex recombinant is a formulation of rHuPH20 that has received FDA approval to facilitate subcutaneous fluid administration for achieving hydration, to increase the dispersion and absorption of other injected drugs and, in subcutaneous urography, to improve resorption of radiopaque agents. We reintroducedHylenex recombinant to the market in December 2011 after resolution of Baxter’s voluntary recall and the return by Baxter of marketing rights to us. Upon its return to the market, our focus was to take advantage of the initial markets previously developed by Baxter. From May 2013 to September 2013,Hylenex was established as the number one prescribed HA. We are continuing to assess our commercial and strategic options for the product to address additional uses such as in connection with insulin pumps as described further below under “More Physiologic (Ultrafast) Insulin Program.”

S-3

Table of Contents

More Physiologic (Ultrafast) Insulin Program

Our most advanced proprietary program combines rHuPH20 with prandial (mealtime) insulin intended for the diabetes market. Diabetes mellitus is an increasingly prevalent, costly condition associated with substantial morbidity and mortality. Attaining and maintaining target blood sugar levels to minimize the long-term clinical risks is a key treatment goal for people living with diabetes.

The primary goal of our ultrafast insulin program is to enable a best-in-class prandial insulin product, with demonstrated clinical benefits for diabetes mellitus patients, in comparison to the current standard of care analog insulin products. Towards that goal, we pair rHuPH20 with prandial insulin to facilitate faster insulin dispersion in, and absorption from, the subcutaneous space into the vascular compartment, intended to lead to a faster insulin response and a shorter duration of action thereby potentially yielding a more physiologic insulin effect, similar to that found in non-diabetic people. A number of clinical trials investigating the various attributes of our product candidates have been completed.

We currently view two distinct opportunities to enter the prandial insulin market:

The first opportunity (what we refer to as the Continuous Subcutaneous Insulin Injection (“CSII”) market) is to pre-treat the insulin infusion site withHylenex recombinant at the time of infusion site change (once every 3 days). Pump therapy is growing in the U.S. among patients with Type 1 and Type 2 diabetes. We believe that the pre-treatment of the infusion site withHylenex recombinant could provide faster onset and shorter duration of insulin action. We currently intend to commercializeHylenex recombinant in CSII ourselves, with an initial focus on adults with Type 1 diabetes.

For the CSII market, we have published interim data from a study evaluating the use ofHylenex recombinant in analog insulin pump therapy that showed pre-administration ofHylenex recombinant provided a more physiologic profile, with what appeared to be “faster-on” and “faster-off” effects than current rapid insulin analogs. Copies of these publications can be found at http://www.halozyme.com/Technology/Journals-Abstracts-And-Posters/default.aspx. Data from the double-blind cross-over study showed that pre-treatment of the infusion site withHylenex recombinant, at the time of infusion set change, accelerated the absorption and shortened the action of mealtime insulin, provided a more consistent insulin action profile and improved post-prandial glucose control.

In preparation for commercializingHylenex recombinant in the CSII market in Type 1 diabetes for pre-administration with analog insulin, we are conducting supportive clinical studies, developing our regulatory and commercial strategy, manufacturing product and developing the administration convenience kit. In the first quarter of 2013, we initiated CONSISTENT 1, the largest of several planned studies for the CSII market. The CONSISTENT 1 study is evaluating the safety and efficacy ofHylenex recombinant in a 24 month trial conducted in over 400 Type 1 diabetic patients who were randomized 3:1 to either rapid acting analog insulin (“RAI”) delivered by CSII with Hylenex or standard CSII using RAI alone. Subjects randomized to the Hylenex group administer 150 units of Hylenex once every three days through each new infusion cannula, immediately prior to initiation of insulin delivery. The primary efficacy endpoint is comparison of change from baseline of A1C levels (A1C is a measure of average blood sugar over three months) using an industry standard non inferiority margin of 0.4%. The time point for assessment of the primary endpoint for the study was recently changed from four months to six months based on feedback we received from the FDA. Secondary endpoints for the study are hypoglycemia rates, hyperglycemia comparisons, glucose variability and safety endpoints (adverse events, local tolerability and immunogenicity). Enrollment for this trial was completed in the third quarter of 2013. We plan to communicate top line results from the CONSISTENT 1 study in the first quarter of 2014. We are currently in dialog with the FDA regarding the path for a labeling update to include key efficacy and safety data prior to initiating promotion ofHylenex recombinant for this use.

The second opportunity (what we refer to as the Multiple Daily Injection (“MDI”) market) is to combine rHuPH20 with an FDA approved RAI, e.g., insulin lispro (Humalog®) (Lispro-PH20), insulin aspart (Novolog®) (Aspart-PH20) and insulin glulisine (Apidra®) (Glulisine-PH20), (each such combination, analog-PH20), to accelerate their action. Based on the need for broad commercial reach to successfully introduce a new prandial

S-4

Table of Contents

insulin to the injection market, we believe that to maximize value, partnering with a large biotechnology or pharmaceutical company with global access to both the primary care and endocrinology markets may be required.

With regard to the MDI opportunity, we published data from two treatment studies—one in Type 1 diabetes patients and one in Type 2 diabetes patients. Copies of these publications can be found at http://www.halozyme.com/Technology/Journals-Abstracts-And-Posters/default.aspx. Both studies met their primary endpoints of A1C non-inferiority and improved post-prandial glucose control compared to patients who were treated with RAI alone. Additionally, data from the Type 1 diabetes treatment study indicated that Analog-PH20 formulations reduced hypoglycemia compared to RAI alone.

PEGPH20

We are developing PEGPH20, a new molecular entity, as a candidate for the systemic treatment of tumors that accumulate HA. PEGylation refers to the attachment of polyethylene glycol to rHuPH20, thereby creating PEGPH20. One of the novel properties of PEGPH20 is that it lasts for an extended duration in the bloodstream and, therefore, can be used to maintain therapeutic effect to treat systemic disease.

Solid malignancies often accumulate high levels of HA, including pancreatic, lung, breast, colon and prostate cancers, and therefore we believe that PEGPH20 has the potential to help patients with these types of cancer. Among solid tumors, pancreatic ductal adenocarcinoma is associated with the highest frequency of HA overexpression.

Over 100,000 patients are diagnosed with pancreatic cancer annually and are frequently not diagnosed until late stages. The pathologic accumulation of HA, along with other matrix components, creates a unique microenvironment for the growth of tumor cells compared to normal cells. We believe that depleting the HA component of the tumor architecture with PEGPH20 disrupts the tumor microenvironment, resulting in tumor growth inhibition. In addition, removal of HA rich matrix results in opening previously constricted vessels to allow anti-cancer therapies to have greater access to the tumor, which may enhance the treatment effect of complementary therapeutic modalities. Increased blood flow may also enable increased efficacy of radiotherapy treatment.

In June 2013, we presented the results from a Phase 1b clinical study of PEGPH20 in combination with gemcitabine for the treatment of patients with stage IV metastatic pancreatic cancer (Phase 1b PEGPH20 Clinical Study) at the 2013 American Society of Clinical Oncology (“ASCO”) Annual meeting. This study enrolled 28 patients with previously untreated stage IV pancreatic ductal adenocarcinoma. Patients were treated with one of three doses of PEGPH20 (1.0, 1.6 and 3.0 µg/kg twice weekly for four weeks, then weekly thereafter) in combination with gemcitabine 1000 mg/m2 administered intravenously. In this study, the overall response rate (complete response + partial response) by RECIST 1.1 criteria was 42 percent (10 of 24 patients, 95 percent CI 22 – 62 percent) for those treated at therapeutic dose levels of PEGPH20 (1.6 and 3.0 µg/kg) as assessed by an independent radiology review.

In September 2013, at the European Cancer Congress 2013, we presented exploratory post-hoc analysis of progression free survival and overall survival of a small subset of patients treated with PEGPH20 with available biopsy samples and HA scores in the Phase 1b study. Both progression free survival and overall survival were longer in patients with high levels of tumor HA compared to patients with low levels of tumor HA. The observation that patients with tumors characterized by high levels of HA may respond best to PEGPH20 has resulted in our effort to develop a companion diagnostic to enable pre-selection of these patients.

In the second quarter of 2013, we initiated a Phase 2 multicenter, randomized clinical trial evaluating PEGPH20 as a first-line therapy for patients with stage IV metastatic pancreatic cancer. Approximately 124 patients are expected to participate in the study and receive gemcitabine and nab-paclitaxel (“ABRAXANE™”)

S-5

Table of Contents

either with or without PEGPH20. The primary outcome will be to measure progression-free survival between patients administered with PEGPH20 and those who are not. We expect to complete enrollment in this study in the second half of 2014. In addition, in October 2013, SWOG, a cancer research cooperative group of more than 4,000 researchers in over 500 institutions around the world, initiated a 144 patient Phase 1b/2 randomized clinical trial of PEGPH20 in combination with modified FOLFIRINOX chemotherapy (“mFOLFIRINOX”) compared to mFOLFIRINOX treatment alone in patients with metastatic pancreatic adenocarcinoma.

HTI-501

HTI-501, an engineered drug formulation variant of cathepsin L (a lysosomal proteinase), that acts by degrading collagen, is our first conditionally-active biologic. Collagen is an abundant protein in the body, particularly in connective tissue, and is present in high amounts in the extracellular matrix in the form of collagen fibers. Collagens are a class of helical proteins that are assembled into macromolecular fibrils and fibers. The collagen fiber network provides a structural scaffolding framework in the extracellular matrix. In the skin, these collagen fibers connect the superficial epithelial tissues to the underlying connective tissues. Collagen abnormalities contribute to a number of conditions, including frozen shoulder, Dupuytren’s contracture, Peyronie’s disease and cellulite.

A conditionally active biologic is a molecule that is only active under certain physiological conditions. HTI-501 is active under mildly acidic conditions and inactive at the neutral pH normally found in the tissue. The enzyme is combined with a mildly acidic buffer and injected in its active state. The enzyme is only active locally and for a short period of time. Once the mildly acidic conditions of the HTI-501 administration have been neutralized by the body, the enzyme becomes inactive. We intend to harness this conditional activity to exert control over the duration and location of the enzyme’s therapeutic activity, potentially improving the efficacy or safety of this product candidate for both medical and aesthetic conditions.

We are exploring HTI-501 as an approach to the treatment of edematous fibrosclerotic panniculopathy, also known as cellulite. The condition affects the great majority of post-adolescent women and is prevalent in all races. We believe that the collagen fibers (“fibrous septa”) anchor the epidermis against the swelling of subcutaneous fat, which creates the dimpled appearance associated with the condition. We believe that HTI-501 deposited under the skin can release the tension in the collagenous fibrous septa and thereby smoothing the dimpled appearance of the skin. HTI-501 may also be potentially utilized as a treatment for other conditions involving collagen, such as frozen shoulder, Dupuytren’s contracture, Peyronie’s disease, keloids and hypertrophic scarring.

In September 2011, we initiated a Phase 1/2 clinical trial for HTI-501 outside the U.S. in women with moderate to severe cellulite. The Phase 1 dose-escalation portion of the trial was completed in 2012 while the ongoing Phase 2 portion of the trial is designed to assess the pharmacologic activity of HTI-501 and extend the safety assessment to multiple injections in a treatment area. In the third quarter of 2013, we completed the enrollment for the Phase 2 portion and the independent panel review of one month data.

Interim results from this trial were presented June 29, 2013 at the 9th Annual World Congress of Cosmetic Dermatology in Athens, Greece. The primary endpoint is physician assessment at Day 28, supported by secondary endpoints of subject self-evaluations and objective measurements of changes to the skin topography. The interim results from 12 of the planned 34 evaluable patients from this Phase 1/2 trial indicates pharmacologic activity at the primary 28 day observation point, with 83 percent of subjects (10 of 12) showing improvement from the pretreatment assessment, with a median improvement of 53 percent (p=.006) by the primary physician assessment. In comparison, 75 percent of subjects (9 of 12) showed improvement with a median improvement of 22 percent (p=.009) for the vehicle injection control at the same observation point. The objective measure (skin topography) for the treated area showed modest improvement in 80 percent of evaluable subjects (8 of 10) treated with HTI-501 (p=.042), but was not significantly changed for the vehicle control (p=.84) or a post-hoc evaluation of non-injected areas. To query the robustness of any study conclusions, an

S-6

Table of Contents

independent blinded panel evaluation of images will be performed on the evaluable subjects at one and six months following treatment. The HTI-501 enzyme and its formulation have been well tolerated so far in this trial at all doses and formulations tested, with no serious or severe adverse events. The most common side effects have been mild to moderate transient injection site discomfort and mild to moderate injection site bruising, resolving within about two weeks without intervention. We expect to report top line data at the three month and six month endpoints in the first quarter of 2014.

We currently do not have an investigational new drug application (“IND”) in the U.S., which would be required for us to conduct clinical trials in the U.S. for HTI-501. In order for us to file an IND, we will need to conduct significant development work including preclinical studies and manufacturing development.

Collaborations

Roche Collaboration

In December 2006, we and Roche entered into an agreement under which Roche obtained a worldwide, exclusive license to develop and commercialize product combinations of rHuPH20 with up to thirteen Roche target compounds (the “Roche Collaboration”). Roche initially had the exclusive right to apply rHuPH20 to only three pre-defined Roche biologic targets with the option to exclusively develop and commercialize rHuPH20 with ten additional targets. As of September 30, 2013, Roche has elected a total of five exclusive targets and retains the option to develop and commercialize rHuPH20 with three additional targets through the payment of annual license maintenance fees.

In September 2013, Roche launched a subcutaneous (SC) formulation of Herceptin® (trastuzumab) (Herceptin SC) in Europe for the treatment of patients with HER2-positive breast cancer. This formulation utilizes our recombinant human hyaluronidase (rHuPH20) and is administered in two to five minutes, rather than 30 to 90 minutes with the standard intravenous form. Roche received European marketing approval for Herceptin SC in August 2013. The European Commission’s approval was based on data from Roche’s Phase 3 HannaH study which showed that the subcutaneous formulation of Herceptin was associated with comparable efficacy (pathological complete response, pCR) to Herceptin administered intravenously in women with HER2-positive early breast cancer and resulted in non-inferior trastuzumab plasma levels. Overall, the safety profile in both arms of the HannaH study was consistent with that expected from standard treatment with Herceptin and chemotherapy in this setting. No new safety signals were identified. Breast cancer is the most common cancer among women worldwide. Each year, about 1.4 million new cases of breast cancer are diagnosed worldwide, and over 450,000 women will die of the disease annually. In HER2-positive breast cancer, increased quantities of the human epidermal growth factor receptor 2 (HER2) are present on the surface of the tumor cells. This is known as “HER2 positivity” and affects approximately 15% to 20% of women with breast cancer. HER2-positive cancer is a particularly aggressive form of breast cancer.

In December 2012, Roche submitted Line Extension Applications to the European Medicines Agency (EMA) for MabThera SC, Roche’s subcutaneous (SC) formulation of MabThera® (rituximab) using Halozyme’s recombinant human hyaluronidase (rHuPH20). In January 2014, the CHMP recommended that the European Commission approve MabThera SC for the treatment of patients with common forms of non-Hodgkin lymphoma (NHL). NHL is a type of cancer that affects lymphocytes (white blood cells). An estimated 66,000 new cases of NHL were diagnosed in the U.S. in 2009 with approximately 125,000 new cases reported worldwide. In December 2012, at the annual meeting of the American Society of Hematology, Roche presented positive data from the first stage of its two-stage Phase 3 clinical study investigating pharmacokinetics, efficacy and safety of MabThera SC. The primary endpoint in the first stage of the study was met, showing the MabThera SC injection resulted in non-inferior MabThera concentrations in the blood compared with IV-infused MabThera (MabThera IV).

S-7

Table of Contents

Baxter Gammagard Collaboration

GAMMAGARD LIQUID is a current Baxter product that is indicated for the treatment of primary immunodeficiency disorders associated with defects in the immune system. In September 2007, we and Baxter entered into an agreement under which Baxter obtained a worldwide, exclusive license to develop and commercialize product combinations of rHuPH20 with GAMMAGARD LIQUID (HyQvia) (the “Gammagard Collaboration”).

Baxter filed a BLA for HyQvia in the U.S. in the second quarter of 2011. On August 1, 2012, we announced that the FDA had issued a complete response letter (“CRL”) for Baxter’s HyQvia BLA. The CRL requested additional preclinical data to support the BLA. The primary issues raised in the CRL focused on non-neutralizing antibodies generated against rHuPH20 and the possible effects of these antibodies on reproduction, development and fertility. Elevated anti-rHuPH20 antibody titers were detected in the registration trial, but have not been associated with any adverse events. Pending Baxter and us providing additional preclinical data sufficient to address the regulatory questions, the FDA has requested that patients should no longer be dosed with rHuPH20 in the Baxter HyQvia program. In December 2013, we and Baxter announced that Baxter has completed submission of the amended BLA to the FDA to initiate the review process for approval of HyQvia. Baxter submitted additional preclinical data that was requested from the FDA in 2012 and expects a six-month review.

In May 2013, the European Commission granted Baxter marketing authorization in all EU Member States for the use of HyQvia (solution for subcutaneous use) as replacement therapy for adult patients with primary and secondary immunodeficiencies. This therapy offers patients the option to administer their therapy at home, in a single subcutaneous site every three to four weeks. Baxter has launched HyQvia into the first EU country in July 2013 and a number of EU countries in the second half of 2013. Baxter plans to expand the launch to other EU markets in 2014.

Pfizer Collaboration

In December 2012, we and Pfizer entered into a collaboration and license agreement, under which Pfizer has the worldwide license to develop and commercialize products combining rHuPH20 enzyme with Pfizer proprietary biologics directed to up to six targets in primary care and specialty care indications (the “Pfizer Collaboration”). Targets may be selected on an exclusive or non-exclusive basis. In September 2013, Pfizer elected the fourth therapeutic target on an exclusive basis. In December Pfizer announced that one of the targets is PCSK9

ViroPharma Collaboration

In May 2011, we and ViroPharma entered into a collaboration and license agreement under which ViroPharma obtained a worldwide exclusive license for the use of rHuPH20 enzyme in the development and commercialization of a subcutaneous injectable formulation of ViroPharma’s commercialized product, Cinryze (C1 esterase inhibitor [human]) (the “ViroPharma Collaboration”). In addition, the license provides ViroPharma with exclusivity to C1 esterase inhibitor and to hereditary angioedema, a rare, debilitating and potentially fatal genetic disease, along with three additional orphan indications.

In December 2012, ViroPharma initiated a Phase 2 double blind, multicenter, dose ranging study to evaluate the safety and efficacy of subcutaneous administration of Cinryze in combination with rHuPH20 in adolescents and adults with hereditary angioedema attacks. On August 1, 2013, ViroPharma announced that it was discontinuing the study following discussions with the Center for Biologics Evaluation and Research (“CBER”) division of the FDA as a precaution related to the emergence of an unexpected incidence and titer of non-neutralizing anti-rHuPH20 antibodies in a number of patients with the formulation being used in this study. These antibodies have not been associated with any adverse clinical effects.

S-8

Table of Contents

Intrexon Collaboration

In June 2011, we and Intrexon entered into a collaboration and license agreement under which Intrexon obtained a worldwide exclusive license for the use of rHuPH20 enzyme in the development and commercialization of a subcutaneous injectable formulation of Intrexon’s recombinant human alpha 1-antitrypsin (rHuA1AT) (the “Intrexon Collaboration”). In addition, the license provides Intrexon with exclusivity for a defined indication.

For a further discussion of the material terms of our collaboration agreements, refer to Note 4 to our consolidated financial statements in our Quarterly Report on Form 10-Q for the three and nine months ended September 30, 2013 incorporated by reference herein.

Recent Developments

Amendment to Certificate of Incorporation

In May 2013, our stockholders approved an amendment to our Certificate of Incorporation to increase our authorized number of shares of common stock from 150 million shares to 200 million shares.

Amended and Restated Loan and Security Agreement

On December 27, 2013, we entered into an Amended and Restated Loan and Security Agreement (the “Loan Agreement”) with Oxford Finance LLC, a Delaware limited liability company, and Silicon Valley Bank, a California corporation, amending and restating in its entirety the Loan and Security Agreement dated as of December 28, 2012 (the “Original Loan Agreement”). The Original Loan Agreement provided for a $30 million secured single-draw term loan facility with a maturity date of January 1, 2017. The original term loan was fully drawn at close. The Loan Agreement extends the original $30 million term loans and provides for an additional $20 million in new term loans, bringing the total term loan balance to $50 million. Upon closing of the Loan Agreement, we received approximately $19 million, net of accrued interest. The proceeds are to be used for working capital and general business requirements. The amended and restated term loan facility matures on January 1, 2018. The amended and restated term loan facility is secured by substantially all of our assets, except that the collateral does not include any equity interests in our subsidiary, Halozyme, Inc., any intellectual property (including all licensing, collaboration and similar agreements relating thereto), and certain other excluded assets. The amended and restated term loan repayment schedule provides for interest only payments for the first year, followed by consecutive equal monthly payments of principal and interest in arrears starting in February 2015 and continuing through the maturity date. The Loan Agreement provides for a 7.55% interest rate on the term loans and a final payment equal to 8.5% of the initial principal amount of the term loans, which is due when the term loans become due or upon the prepayment of the facility. Based upon preliminary estimates, as of December 31, 2013, we had approximately $71 million in cash and cash equivalents and marketable securities. This financial information is subject to completion of our year-end financial closing procedures, the preparation of our financial statements, and the completion of the audit of our financial statements as of and for the year ended December 31, 2013, and our actual results may differ from these estimates.

MabTheraSC Receives Positive CHMP Opinion

In January 2014, the CHMP recommended that the European Commission approve MabThera SC for the treatment of patients with common forms of non-Hodgkin lymphoma.

CONSISTENT 1 Clinical Trial Update

The time point for assessment of the primary endpoint for the CONSISTENT 1 clinical study evaluating the use ofHylenex recombinant in conjunction with rapid analog insulin in people with Type 1 diabetes using insulin

S-9

Table of Contents

pumps was recently changed from 4 months to 6 months basedon feedback we received from the FDA. We plan to communicate top line results from the CONSISTENT 1 study in the first quarter of 2014.

Corporate Information

We reincorporated from the State of Nevada to the State of Delaware in November 2007. Our principal offices and research facilities are located at 11388 Sorrento Valley Road, San Diego, California 92121. Our telephone number is (858) 794-8889 and our e-mail address is info@halozyme.com. Additional information about us can be found on our website at www.halozyme.com. The information on our website is not part of this prospectus supplement.

S-10

Table of Contents

Common stock offered by us in this offering | 7,692,307 shares of our common stock |

Option to purchase additional shares | We have granted the underwriters an option for a period of up to 30 days from the date of this prospectus supplement to purchase up to 1,153,846 additional shares of common stock at the public offering price less the underwriting discounts and commissions |

Common stock to be outstanding immediately after this offering | 121,679,046 shares (or 122,832,892 shares if the underwriters exercise in full their option to purchase additional shares) |

Risk factors | Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-12 |

Use of proceeds | We intend to use the net proceeds from this offering to fund research and development of proprietary programs, including the potential acceleration of the PEGPH20 program, and for other general corporate purposes. See “Use of Proceeds” on page S-30 |

NASDAQ Global Select Market symbol | HALO |

The number of shares of common stock to be outstanding immediately after this offering as shown above is based on 113,986,739 shares of common stock outstanding as of September 30, 2013. This number of shares excludes, as of September 30, 2013:

| • | 7,178,512 shares of common stock issuable upon the exercise of outstanding stock options, having a weighted average exercise price of $6.92 per share; |

| • | 746,636 shares of common stock issuable upon settlement of restricted stock units; and |

| • | an aggregate of up to 7,010,395 shares of common stock reserved for future issuance under our equity incentive plans. |

Unless otherwise indicated, all information in this prospectus supplement assumes:

| • | that the underwriters do not exercise their option to purchase up to 1,153,846 additional shares of our common stock; and |

| • | no options or shares of common stock were issued after September 30, 2013, and no outstanding equity awards were exercised or vested after September 30, 2013. |

S-11

Table of Contents

An investment in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks described below, together with other information in this prospectus supplement, the accompanying prospectus, the information and documents incorporated by reference, and in any free writing prospectus that we have authorized for use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us, or that we currently see as immaterial, may also harm our business.

Risks Related to this Offering and Our Common Stock

Our stock price is subject to significant volatility.

We participate in a highly dynamic industry which often results in significant volatility in the market price of common stock irrespective of company performance. As a result, our high and low sales prices of our common stock during the twelve months ended January 31, 2014 were $18.18 and $5.03, respectively. We expect our stock price to continue to be subject to significant volatility and, in addition to the other risks and uncertainties described elsewhere in this prospectus supplement and all other risks and uncertainties that are either not known to us at this time or which we deem to be immaterial, any of the following factors may lead to a significant drop in our stock price:

| • | the presence of competitive products to those being developed by us; |

| • | failure (actual or perceived) of our collaborators to devote attention or resources to the development or commercialization of product candidates licensed to such collaborator; |

| • | a dispute regarding our failure, or the failure of one of our third party collaborators, to comply with the terms of a collaboration agreement; |

| • | the termination, for any reason, of any of our collaboration agreements; |

| • | the sale of common stock by any significant stockholder, including, but not limited to, direct or indirect sales by members of management or our Board of Directors; |

| • | the resignation, or other departure, of members of management or our Board of Directors; |

| • | general negative conditions in the healthcare industry; |

| • | general negative conditions in the financial markets; |

| • | the failure, for any reason, to obtain regulatory approval for any of our proprietary or collaboration product candidates; |

| • | the failure, for any reason, to secure or defend our intellectual property position; |

| • | for those products that are not yet approved for commercial sale, the failure or delay of applicable regulatory bodies to approve such products; |

| • | identification of safety or patient tolerability issues; |

| • | failure of clinical trials to meet efficacy endpoints; |

| • | suspensions or delays in the conduct of clinical trials or securing of regulatory approvals; |

| • | adverse regulatory action with respect to our and our collaborators’ products and product candidates such as clinical holds, imposition of onerous requirements for approval or product recalls; |

| • | our failure, or the failure of our third party collaborators, to successfully commercialize products approved by applicable regulatory bodies such as the FDA; |

S-12

Table of Contents

| • | our failure, or the failure of our third party collaborators, to generate product revenues anticipated by investors; |

| • | problems with a bulk rHuPH20 contract manufacturer or a fill and finish manufacturer for any product or product candidate; |

| • | the sale of additional debt and/or equity securities by us; |

| • | our failure to obtain financing on acceptable terms; or |

| • | a restructuring of our operations. |

Future transactions where we raise capital may negatively affect our stock price.

We are currently a “Well-Known Seasoned Issuer” and may file automatic shelf registration statements at any time with the SEC. In addition, we currently have the ability to offer and sell additional equity, debt securities and warrants to purchase such securities, either individually or in units, under an effective automatic shelf registration statement. Sales of substantial amounts of shares of our common stock or other securities under our shelf registration statements could lower the market price of our common stock and impair our ability to raise capital through the sale of equity securities. In the future, we may issue additional options, warrants or other derivative securities convertible into our common stock.

Trading in our stock has historically been limited, so investors may not be able to sell as much stock as they want to at prevailing market prices.

Our stock has historically traded at a low daily trading volume. If low trading volume continues, it may be difficult for stockholders to sell their shares in the public market at any given time at prevailing prices.

Our rights agreement and anti-takeover provisions in our charter documents and Delaware law may make an acquisition of us more difficult.

We are party to a Rights Agreement designed to deter abusive takeover tactics and to encourage prospective acquirors to negotiate with our board of directors rather than attempt to acquire us in a manner or on terms that our board deems unacceptable, which could delay or discourage takeover attempts that stockholders may consider favorable.

In addition, anti-takeover provisions in our charter documents and Delaware law may make an acquisition of us more difficult. First, our board of directors is classified into three classes of directors. Under Delaware law, directors of a corporation with a classified board may be removed only for cause unless the corporation’s certificate of incorporation provides otherwise. Our amended and restated certificate of incorporation, as amended, does not provide otherwise. In addition, our bylaws limit who may call special meetings of stockholders, permitting only stockholders holding at least 50% of our outstanding shares to call a special meeting of stockholders. Our amended and restated certificate of incorporation, as amended, does not include a provision for cumulative voting for directors. Under cumulative voting, a minority stockholder holding a sufficient percentage of a class of shares may be able to ensure the election of one or more directors. Finally, our bylaws establish procedures, including advance notice procedures, with regard to the nomination of candidates for election as directors and stockholder proposals.

These provisions may discourage potential takeover attempts, discourage bids for our common stock at a premium over market price or adversely affect the market price of, and the voting and other rights of the holders of, our common stock. These provisions could also discourage proxy contests and make it more difficult for stockholders to elect directors other than the candidates nominated by our board of directors.

In addition, because we are incorporated in Delaware, we are governed by the provisions of Section 203 of the Delaware General Corporation Law, which may prohibit large stockholders from consummating a merger with, or acquisition of, us.

These provisions may deter an acquisition of us that might otherwise be attractive to stockholders.

S-13

Table of Contents

Management will have broad discretion as to the use of the net proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion as to the application of the net proceeds and could use them for purposes other than those contemplated at the time of this offering. Our stockholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase our profitability or our market value.

Investors in this offering will pay a higher price than the book value of our common stock.

You will suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering because the price per share being offered hereby is substantially higher than the book value per share of our common stock. Based on the public offering price of $13.00 per share in this offering, if you purchase shares in this offering, after giving effect to the sale of 7,692,307 shares in this offering, you will suffer immediate and substantial dilution of $12.26 per share in the net tangible book value of the common stock. See “Dilution” beginning on page S-31 of this prospectus supplement for a more detailed discussion of the dilution you will incur in this offering.

Risks Related to Our Business

We have generated only minimal revenue from product sales to date; we have a history of net losses and negative cash flow, and we may never achieve or maintain profitability.

Relative to expenses incurred in our operations, we have generated only minimal revenues from product sales, licensing fees, milestone payments, bulk rHuPH20 supply payments and research reimbursements to date and we may never generate sufficient revenues from future product sales, licensing fees and milestone payments to offset expenses. Even if we ultimately do achieve significant revenues from product sales, licensing fees, research reimbursements, bulk rHuPH20 supply payments and/or milestone payments, we expect to incur significant operating losses over the next few years. We have never been profitable, and we may never become profitable. Through September 30, 2013, we have incurred aggregate net losses of approximately $360.1 million.

If our product candidates do not receive and maintain regulatory approvals, or if approvals are not obtained in a timely manner, such failure or delay would substantially impair our ability to generate revenues.

Approval from the FDA or equivalent health authorities is necessary to manufacture and market pharmaceutical products in the United States and the other countries in which we anticipate doing business have similar requirements. The process for obtaining FDA and other regulatory approvals is extensive, time-consuming, risky and costly, and there is no guarantee that the FDA or other regulatory bodies will approve any applications that may be filed with respect to any of our product candidates, or that the timing of any such approval will be appropriate for the desired product launch schedule for a product candidate. We and our collaborators attempt to provide guidance as to the timing for the filing and acceptance of such regulatory approvals, but such filings and approvals may not occur when we or our collaborators expect or at all. The FDA or other foreign regulatory agency may refuse or delay approval of our product candidates for failure to collect sufficient clinical or animal safety data and require us or our collaborators to conduct additional clinical or animal safety studies which may cause lengthy delays and increased costs to our programs. For example, we announced on August 1, 2012 that the FDA had issued a CRL for Baxter’s HyQvia BLA. The CRL requested additional preclinical data to support the BLA. The primary issues raised in the letter focused on non-neutralizing antibodies generated against rHuPH20 and the possible effects of these antibodies on reproduction, development and fertility. Elevated anti-rHuPH20 antibody titers were detected in the registration trial, but have not been associated with any adverse events. Pending Baxter and us providing additional preclinical data sufficient to address the regulatory questions, the FDA has requested that patients should no longer be dosed with rHuPH20 in the Baxter clinical studies. In view of the issues raised in the HyQvia CRL, we contacted the FDA regarding the

S-14

Table of Contents

impact on Hylenex recombinant. After reviewing the applicable data submitted by us, FDA confirmed that there was no need for actions against Hylenex recombinant or clinical programs under the Hylenex recombinant IND application(s). Subsequent to this, in August 2013, our collaborator ViroPharma announced that it was discontinuing its study of subcutaneous administration of Cinryze in combination with rHuPH20 in adolescents and adults with hereditary angioedema attacks, following discussion with FDA regarding the emergence of an unexpected incidence and titer of non-neutralizing anti-rHuPH20 antibodies in a number of patients with the formulation being used in this study. Although these antibodies have not been associated with any adverse clinical effects, we cannot assure you that they will not arise and have adverse impact on future development of rHuPH20 or future sales of Hylenex recombinant.

There can be no assurance that Baxter and we will be able to resolve the issues raised by the FDA in a timely manner which could result in a delay or failure to gain regulatory approval for the HyQvia product candidate. Furthermore, although we do not believe at this time that the issues raised by the FDA with respect to the HyQvia BLA or the ViroPharma Phase 2 study will have a significant impact on our proprietary and other collaboration product candidates, there can be no assurance that these concerns will not also be raised by the FDA or other health authorities in the future.

Only two of our collaboration product candidates has been approved for commercialization and two of our collaboration product candidates are currently in the regulatory approval process. Only one of our proprietary products has been approved for commercialization, and we have no proprietary product candidates currently in the regulatory approval process. We and our collaborators may not be successful in obtaining such approvals for any potential products in a timely manner, or at all. Refer to the risk factor titled “Our proprietary and collaboration product candidates may not receive regulatory approvals or their development may be delayed for a variety of reasons, including unsuccessful clinical trials, regulatory requirements or safety concerns” for additional information relating to the approval of product candidates.

Additionally, even with respect to products which have been approved for commercialization, in order to continue to manufacture and market pharmaceutical products, we or our collaborators must maintain our regulatory approvals. If we or any of our collaborators are unsuccessful in maintaining our regulatory approvals, our ability to generate revenues would be adversely affected.

Use of our product candidates or those of our collaborators could be associated with side effects or adverse events.

As with most pharmaceutical products, use of our product candidates or those of our collaborators could be associated with side effects or adverse events which can vary in severity (from minor reactions to death) and frequency (infrequent or prevalent). Side effects or adverse events associated with the use of our product candidates or those of our collaborators may be observed at anytime, including in clinical trials or when a product is commercialized, and any such side effects or adverse events may negatively affect our or our collaborators’ ability to obtain regulatory approval or market our product candidates. Side effects such as toxicity or other safety issues associated with the use of our product candidates or those of our collaborators could require us or our collaborators to perform additional studies or halt development or sale of these product candidates or expose us to product liability lawsuits which will harm our business. We or our collaborators may be required by regulatory agencies to conduct additional animal or human studies regarding the safety and efficacy of our pharmaceutical product candidates which we have not planned or anticipated. Furthermore, there can be no assurance that we or our collaborators will resolve any issues related to any product related adverse events to the satisfaction of the FDA or any regulatory agency in a timely manner or ever, which could harm our business, prospects and financial condition.

S-15

Table of Contents

If our contract manufacturers are unable to manufacture and supply to us bulk rHuPH20 in the quantity and quality required by us or our collaborators for use in our products and product candidates, our product development and commercialization efforts could be delayed or stopped and our collaborations could be damaged.

We have existing supply agreements with contract manufacturing organizations Avid and Cook to produce bulk rHuPH20. These manufacturers each produce bulk rHuPH20 under current cGMP for clinical uses. In addition, Avid currently produces bulk rHuPH20 forHylenex recombinant. In addition to supply obligations, Avid and Cook will also provide support for the chemistry, manufacturing and controls sections for FDA and other regulatory filings. We rely on their ability to successfully manufacture these batches according to product specifications, and Cook has relatively limited experience manufacturing bulk rHuPH20. In addition, as a result of our contractual obligations to Roche, we have been required to significantly scale up our bulk rHuPH20 production at Cook during the last three years. If Cook is unable to obtain status as an approved manufacturing facility, or if either Avid or Cook: (i) is unable to retain status as an approved manufacturing facilities; (ii) is unable to otherwise successfully scale up bulk rHuPH20 production; or (iii) fails to manufacture and supply bulk rHuPH20 in the quantity and quality required by us or our collaborators for use in our proprietary and collaboration products and product candidates for any other reason, our business will be adversely affected. In addition, a significant change in such parties’ business or financial condition could adversely affect their abilities to fulfill their contractual obligations to us. We have not established, and may not be able to establish, favorable arrangements with additional bulk rHuPH20 manufacturers and suppliers of the ingredients necessary to manufacture bulk rHuPH20 should the existing manufacturers and suppliers become unavailable or in the event that our existing manufacturers and suppliers are unable to adequately perform their responsibilities. We have attempted to mitigate the impact of supply interruption through the establishment of excess bulk rHuPH20 inventory, but there can be no assurances that this safety stock will be maintained or that it will be sufficient to address any delays, interruptions or other problems experienced by Avid and/or Cook. Any delays, interruptions or other problems regarding the ability of Avid and/or Cook to bulk rHuPH20 on a timely basis could: (i) cause the delay of clinical trials or otherwise delay or prevent the regulatory approval of proprietary or collaboration product candidates; (ii) delay or prevent the effective commercialization of proprietary or collaboration products; and/or (iii) cause us to breach contractual obligations to deliver bulk rHuPH20 to our collaborators. Such delays would likely damage our relationship with our collaborators under our key collaboration agreements, and they would have a material adverse effect on our business and financial condition.

If any party to a key collaboration agreement, including us, fails to perform material obligations under such agreement, or if a key collaboration agreement, or any other collaboration agreement, is terminated for any reason, our business could significantly suffer.

We have entered into multiple collaboration agreements under which we may receive significant future payments in the form of milestone payments, target designation fees, maintenance fees and royalties. We are dependent on our collaborators to develop and commercialize product candidates subject to our collaborations in order for us to realize any financial benefits from these collaborations. Our collaborators may not devote the attention and resources to such efforts that we would to such efforts ourselves or simultaneously develop and commercialize products in competition to those products we have licensed to them. In addition, in the event that a party fails to perform under a key collaboration agreement, or if a key collaboration agreement is terminated, the reduction in anticipated revenues could delay or suspend our product development activities for some of our product candidates, as well as our commercialization efforts for some or all of our products. Specifically, the termination of a key collaboration agreement by one of our collaborators could materially impact our ability to enter into additional collaboration agreements with new collaborators on favorable terms, if at all. In certain circumstances, the termination of a key collaboration agreement would require us to revise our corporate strategy going forward and reevaluate the applications and value of our technology.

S-16

Table of Contents

Most of our current proprietary and collaboration products and product candidates rely on the rHuPH20 enzyme, and any adverse development regarding rHuPH20 could substantially impact multiple areas of our business, including current and potential collaborations, as well as proprietary programs.

rHuPH20 is a key technological component of Enhanze technology and our most advanced proprietary and collaboration products and product candidates, including the product candidates under our Roche, Pfizer, Baxter, ViroPharma and Intrexon collaborations, our more physiologic insulin program, our PEGPH20 program and Hylenex recombinant. An adverse development for rHuPH20 (e.g., an adverse regulatory determination relating to rHuPH20, if we are unable to obtain sufficient quantities of rHuPH20, if we are unable to obtain or maintain material proprietary rights to rHuPH20 or if we discover negative characteristics of rHuPH20) would substantially impact multiple areas of our business, including current and potential collaborations, as well as proprietary programs. For example, elevated anti-rHuPH20 antibody titers have been detected in the registration trial for Baxter’s HyQvia product candidate as well as in ViroPharma’s Phase 2 clinical trial with subcutaneous Cinryze with rHuPH20, but have not been associated, in either case, with any adverse events. Baxter has submitted preclinical data to the FDA regarding the antibodies in its BLA resubmission in response to the CRL Letter received for the HyQvia BLA and is awaiting response from the FDA. ViroPharma has chosen to discontinue the Phase 2 clinical trial with subcutaneous Cinryze with rHuPH20 due to the unexpected incidence and titer of antibodies in a number of patients with the formulation being used in this study. We monitor for antibodies to rHuPH20 in our collaboration and proprietary programs, and although we do not believe at this time that the incidence of non-neutralizing anti-rHuPH20 antibodies in either the HyQvia program or the ViroPharma program will have a significant impact on our other proprietary and other collaboration product candidates, there can be no assurance that there will not be other such occurrences in our other programs or that concerns regarding these antibodies will not also be raised by the FDA or other health authorities in the future, which could result in delays or discontinuations of our development or commercialization activities or deter entry into additional collaborations with third parties.

Our proprietary and collaboration product candidates may not receive regulatory approvals or their development may be delayed for a variety of reasons, including unsuccessful clinical trials, regulatory requirements or safety concerns.

Clinical testing of pharmaceutical products is a long, expensive and uncertain process, and the failure or delay of a clinical trial can occur at any stage. Even if initial results of preclinical and nonclinical studies or clinical trial results are promising, we or our collaborators may obtain different results in subsequent trials or studies that fail to show the desired levels of safety and efficacy, or we may not, or our collaborators may not, obtain applicable regulatory approval for a variety of other reasons. Preclinical, nonclinical, and clinical trials for any of our proprietary or collaboration product candidates could be unsuccessful, which would delay or prohibit regulatory approval and commercialization of the product candidates. In the United States and other jurisdictions, regulatory approval can be delayed, limited or not granted for many reasons, including, among others:

| • | clinical results may not meet prescribed endpoints for the studies or otherwise provide sufficient data to support the efficacy of our product candidates; |

| • | clinical and nonclinical test results may reveal side effects, adverse events or unexpected safety issues associated with the use of our product candidates; |

| • | regulatory review may not find a product candidate safe or effective enough to merit either continued testing or final approval; |

| • | regulatory review may not find that the data from preclinical testing and clinical trials justifies approval; |

| • | regulatory authorities may require that we change our studies or conduct additional studies which may significantly delay or make continued pursuit of approval commercially unattractive; for example, based on FDA feedback, we recently changed the time point for assessment of the primary endpoint of non-inferiority of A1C from four months to six months in our CONSISTENT 1 trial for Hylenex recombinant for use in CSII; |

S-17

Table of Contents

| • | a regulatory agency may reject our trial data or disagree with our interpretations of either clinical trial data or applicable regulations; |

| • | the cost of clinical trials required for product approval may be greater than what we originally anticipate, and we may decide to not pursue regulatory approval for such a product; |

| • | a regulatory agency may not approve our manufacturing processes or facilities, or the processes or facilities of our collaborators, our contract manufacturers or our raw material suppliers; |

| • | a regulatory agency may identify problems or other deficiencies in our existing manufacturing processes or facilities, or the existing processes or facilities of our collaborators, our contract manufacturers or our raw material suppliers; |

| • | a regulatory agency may change its formal or informal approval requirements and policies, act contrary to previous guidance, adopt new regulations or raise new issues or concerns late in the approval process; or |

| • | a product candidate may be approved only for indications that are narrow or under conditions that place the product at a competitive disadvantage, which may limit the sales and marketing activities for such product candidate or otherwise adversely impact the commercial potential of a product. |

If a proprietary or collaboration product candidate is not approved in a timely fashion on commercially viable terms, or if development of any product candidate is terminated due to difficulties or delays encountered in the regulatory approval process, it could have a material adverse impact on our business, and we will become more dependent on the development of other proprietary or collaboration product candidates and/or our ability to successfully acquire other products and technologies. There can be no assurances that any proprietary or collaboration product candidate will receive regulatory approval in a timely manner, or at all. For example, we are currently in dialog with the FDA regarding the path for a labeling update to include key efficacy and safety data prior to initiatingHylenex recombinant for use in CSII. There can be no assurance that we will be able to gain clarity as to the FDA’s requirements or that the requirements may be satisfied by us in a commercially feasible way. If we are not successful in updating data into the Hylenex recombinant labeling, our ability to promote this use will be limited and may adversely impact our projected market for the CSII use.

We anticipate that certain proprietary and collaboration products will be marketed, and perhaps manufactured, in foreign countries. The process of obtaining regulatory approvals in foreign countries is subject to delay and failure for the reasons set forth above, as well as for reasons that vary from jurisdiction to jurisdiction. The approval process varies among countries and jurisdictions and can involve additional testing. The time required to obtain approval may differ from that required to obtain FDA approval. Foreign regulatory agencies may not provide approvals on a timely basis, if at all. Approval by the FDA does not ensure approval by regulatory authorities in other countries or jurisdictions, and approval by one foreign regulatory authority does not ensure approval by regulatory authorities in other foreign countries or jurisdictions or by the FDA.

Our third party collaborators are responsible for providing certain proprietary materials that are essential components of our collaboration product candidates, and any failure to supply these materials could delay the development and commercialization efforts for these collaboration product candidates and/or damage our collaborations.

Our development and commercialization collaborators are responsible for providing certain proprietary materials that are essential components of our collaboration product candidates. For example, Roche is responsible for producing the Herceptin and MabThera required for its subcutaneous product candidates and Baxter is responsible for producing the GAMMAGARD LIQUID for its product candidate HyQvia. If a collaborator, or any applicable third party service provider of a collaborator, encounters difficulties in the manufacture, storage, delivery, fill, finish or packaging of the collaboration product candidate or component of such product candidate, such difficulties could (i) cause the delay of clinical trials or otherwise delay or prevent the regulatory approval of collaboration product candidates; and/or (ii) delay or prevent the effective

S-18

Table of Contents

commercialization of collaboration products. Such delays could have a material adverse effect on our business and financial condition. For example, Baxter received a Warning Letter from the FDA in January 2010 regarding Baxter’s GAMMAGARD LIQUID manufacturing facility in Lessines, Belgium. The FDA indicated in March 2010 that the issues raised in the Warning Letter had been addressed by Baxter, and we do not expect these issues to impact the development of the HyQvia product candidate.

We rely on third parties to prepare, fill, finish and package our products and product candidates, and if such third parties should fail to perform, our commercialization and development efforts for our products and product candidates could be delayed or stopped.

We rely on third parties to store and ship bulk rHuPH20 on our behalf and to also prepare, fill, finish and package our products and product candidates prior to their distribution. If we are unable to locate third parties to perform these functions on terms that are acceptable to us, or if the third parties we identify fail to perform their obligations, the progress of clinical trials could be delayed or even suspended and the commercialization of approved product candidates could be delayed or prevented. For example,Hylenex recombinant was voluntarily recalled in May 2010 because a portion of theHylenex recombinant manufactured by Baxter was not in compliance with the requirements of the underlyingHylenex recombinant agreements. During the second quarter of 2011, we submitted the data that the FDA had requested to support the reintroduction ofHylenex recombinant. The FDA approved the submitted data and granted the reintroduction ofHylenex recombinant, and we reintroducedHylenex recombinant to the market in December 2011. In June 2011, we entered into a commercial manufacturing and supply agreement with Baxter, under which Baxter will fill, finish and packageHylenex recombinant product for us. Under our commercial manufacturing and supply agreement with Baxter, Baxter has agreed to fill and finishHylenex recombinant product for us for a limited period of time. The term of the commercial manufacturing and supply agreement with Baxter expires on December 31, 2015, subject to further extensions in accordance with the terms and conditions of the agreement. In June 2011, we entered into a services agreement with a third party manufacturer for the technology transfer and manufacture ofHylenex recombinant. If we are unable to receive regulatory approval for the third party manufacturer prior to the expiration of the commercial manufacturing and supply agreement with Baxter or if the new manufacturer encounters difficulties in the manufacture, fill, finish or packaging ofHylenex recombinant, our business and financial condition could be adversely effected.

If we are unable to sufficiently develop our sales, marketing and distribution capabilities or enter into successful agreements with third parties to perform these functions, we will not be able to fully commercialize our products.

We may not be successful in marketing and promoting our approved product,Hylenex recombinant or any other products we develop or acquire in the future. Our sales, marketing and distribution capabilities are very limited. In order to commercialize any products successfully, we must internally develop substantial sales, marketing and distribution capabilities or establish collaborations or other arrangements with third parties to perform these services. We do not have extensive experience in these areas, and we may not be able to establish adequate in-house sales, marketing and distribution capabilities or engage and effectively manage relationships with third parties to perform any or all of such services. To the extent that we enter into co-promotion or other licensing arrangements, our product revenues are likely to be lower than if we directly marketed and sold our products, and any revenues we receive will depend upon the efforts of third parties, whose efforts may not meet our expectations or be successful. These third parties would be largely responsible for the speed and scope of sales and marketing efforts, and may not dedicate the resources necessary to maximize product opportunities. Our ability to cause these third parties to increase the speed and scope of their efforts may also be limited. In addition, sales and marketing efforts could be negatively impacted by the delay or failure to obtain additional supportive clinical trial data for our products. In some cases, third party collaborators are responsible for conducting these additional clinical trials, and our ability to increase the efforts and resources allocated to these trials may be limited. For example, in January 2011, we and Baxter mutually agreed to terminate theHylenex Collaboration and the associated agreements.

S-19

Table of Contents