Lehman Brothers CEO Energy/Power Conference

September 9, 2004

Safe Harbor Statement

Statements contained in this presentation that state the company’s or its management’s expectations or predictions of the future are forward-looking statements intended to be covered by the safe harbor provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934. The words “believe,” “expect,” “should,” “estimates,” and other similar expressions identify forward-looking statements. It is important to note that the company’s actual results could differ materially from those projected in its forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecast, see the company’s annual reports on Form 10-K and its quarterly reports on Form 10-Q filed with the Securities and Exchange Commission.

Thomas D. O’Malley

Chairman and Chief Executive Officer

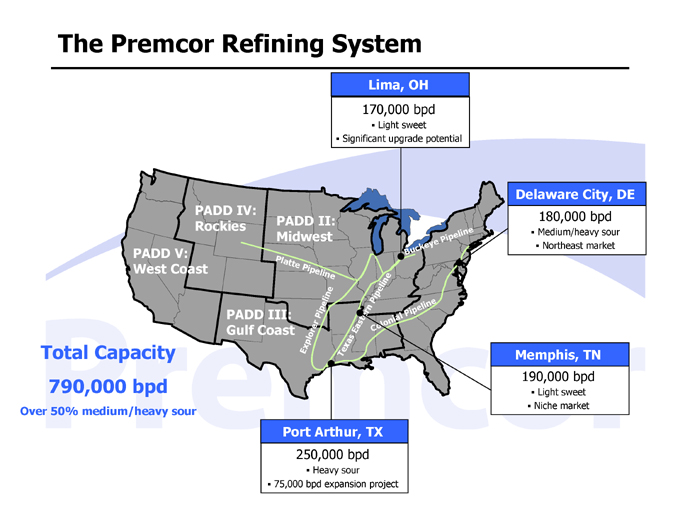

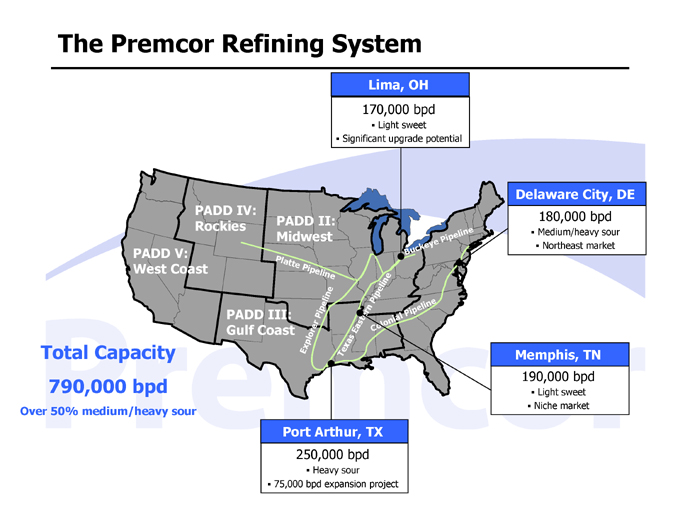

The Premcor Refining System

Lima, OH

170,000 bpd

Light sweet

Significant upgrade potential

Total Capacity 790,000 bpd

Over 50% medium/heavy sour

Port Arthur, TX

250,000 bpd

Heavy sour

75,000 bpd expansion project

Delaware City, DE

180,000 bpd

Medium/heavy sour

Northeast market

Memphis, TN

190,000 bpd

Light sweet

Niche market

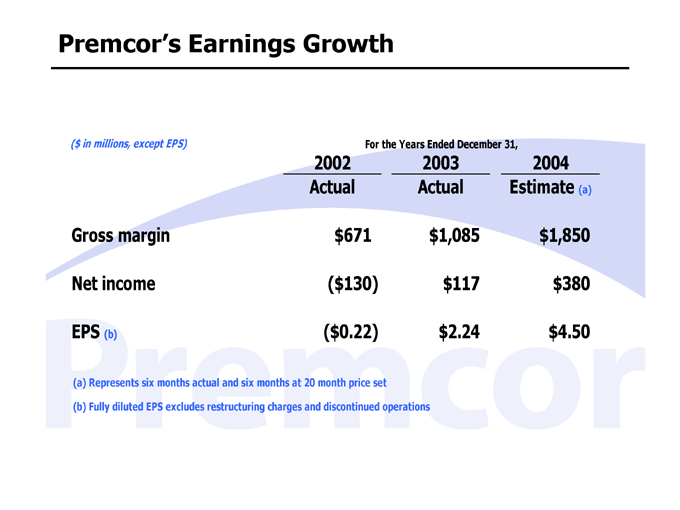

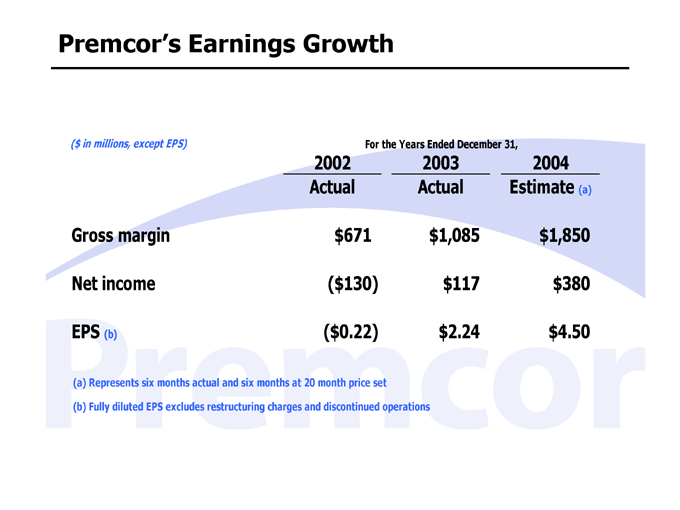

Premcor’s Earnings Growth

($ in millions, except EPS) For the Years Ended December 31,

2002 2003 2004

Actual Actual Estimate (a)

Gross margin $671 $1,085 $1,850

Net income ($130) $117 $380

EPS (b) ($0.22) $2.24 $4.50

(a) Represents six months actual and six months at 20 month price set

(b) Fully diluted EPS excludes restructuring charges and discontinued operations

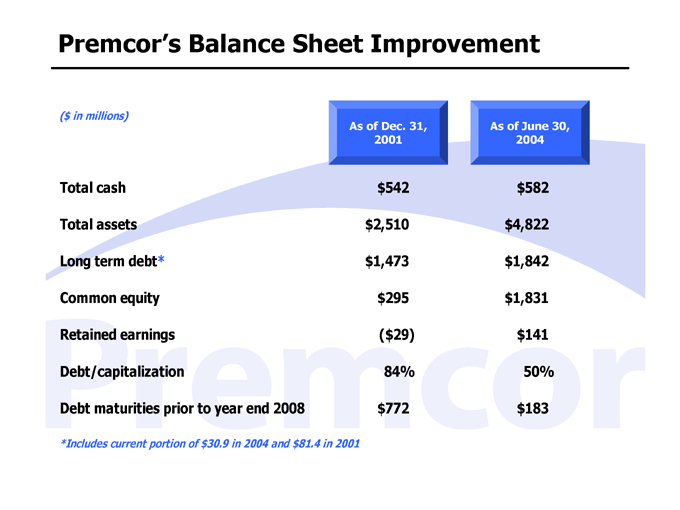

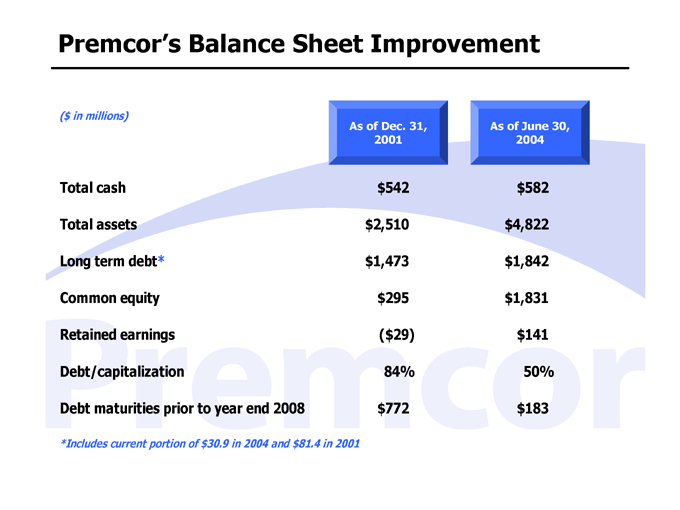

Premcor’s Balance Sheet Improvement

($ in millions)

As of Dec. 31, 2001 As of June 30, 2004

Total cash $542 $582

Total assets $2,510 $4,822

Long term debt* $1,473 $1,842

Common equity $295 $1,831

Retained earnings ($29) $141

Debt/capitalization 84% 50%

Debt maturities prior to year end 2008 $772 $183

*Includes current portion of $30.9 in 2004 and $81.4 in 2001

Premcor’s Growth Trajectory

Millions of Barrels

300 250 200 150 100

2002 2003 2004 2005 2006

135 180 240 270 295

Annual Production

2003: Memphis Refinery acquisition (10 months)

2004: Delaware City Refinery acquisition (8 months)

2005: Delaware City (12 months)

2006: Port Arthur Refinery expansion (Q1 startup)

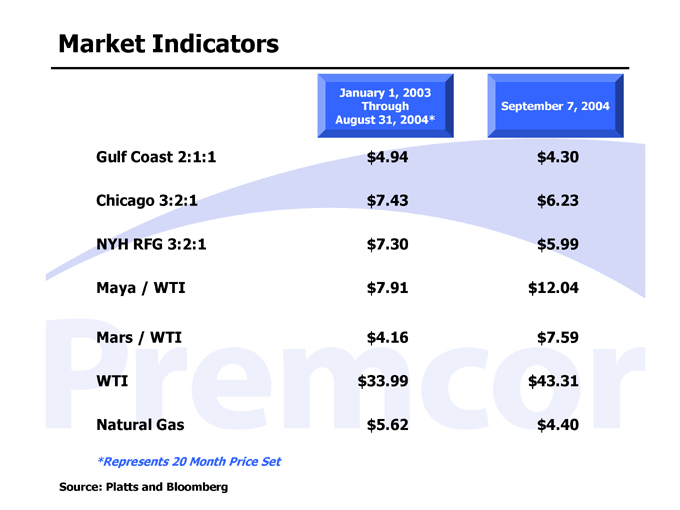

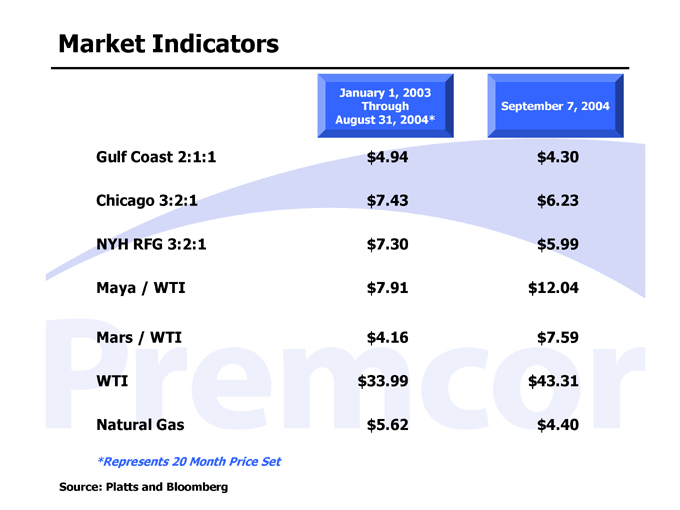

Market Indicators

January 1, 2003 Through August 31, 2004* September 7, 2004

Gulf Coast 2:1:1 $4.94 $4.30

Chicago 3:2:1 $7.43 $6.23

NYH RFG 3:2:1 $7.30 $5.99

Maya / WTI $7.91 $12.04

Mars / WTI $4.16 $7.59

WTI $33.99 $43.31

Natural Gas $5.62 $4.40

*Represents 20 Month Price Set

Source: Platts and Bloomberg

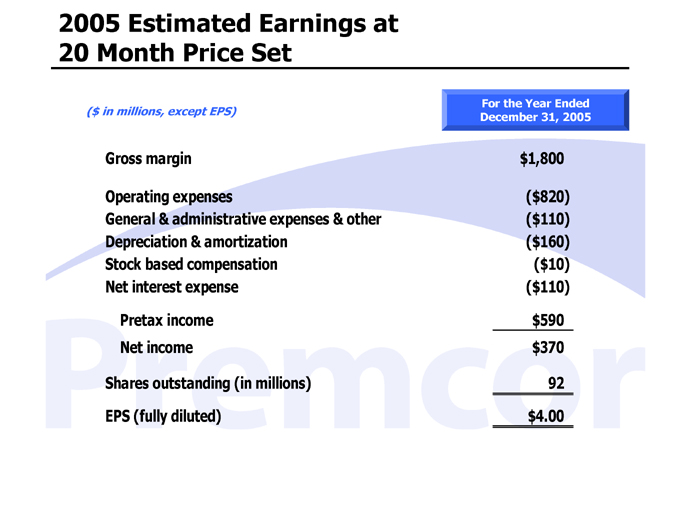

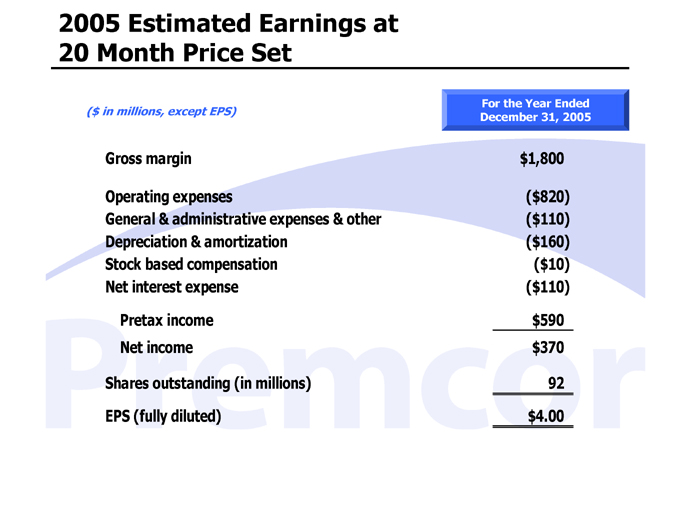

2005 Estimated Earnings at 20 Month Price Set

($ in millions, except EPS)

For the Year Ended December 31, 2005

Gross margin $1,800

Operating expenses ($820)

General & administrative expenses & other ($110)

Depreciation & amortization ($160)

Stock based compensation ($10)

Net interest expense ($110)

Pretax income $590

Net income $370

Shares outstanding (in millions) 92

EPS (fully diluted) $4.00

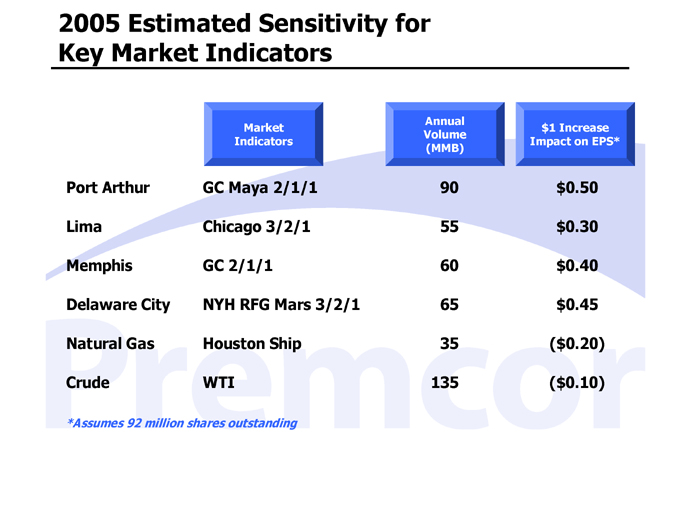

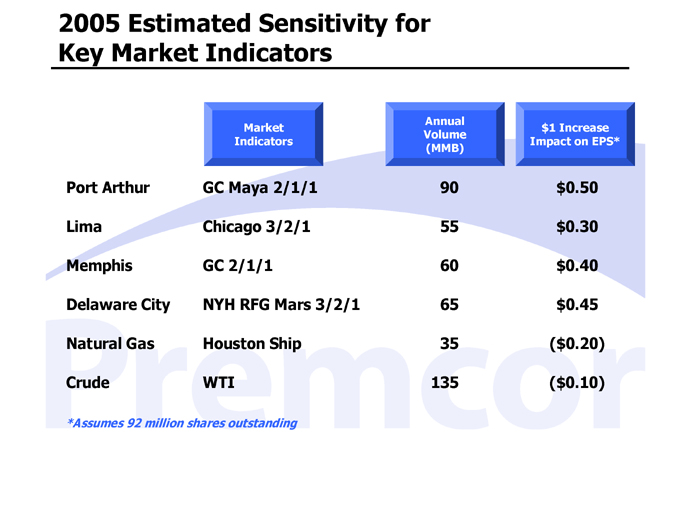

2005 Estimated Sensitivity for Key Market Indicators

Market Indicators Annual Volume (MMB) $1 Increase Impact on EPS*

Port Arthur GC Maya 2/1/1 90 $0.50

Lima Chicago 3/2/1 55 $0.30

Memphis GC 2/1/1 60 $0.40

Delaware City NYH RFG Mars 3/2/1 65 $0.45

Natural Gas Houston Ship 35 ($0.20)

Crude WTI 135 ($0.10)

*Assumes 92 million shares outstanding

Premcor’s Strategic Advantage and Plan

Large pure-play refiner

Intend to stay that way

Over 50% heavy, high sulfur crude oil conversion capacity

Intend to grow our throughput in this category both internally and externally

Management has a track record of finding high quality growth opportunities

We will continue to uncover new opportunities

An Investment in Premcor Represents...

Great market environment for pure refiners

First class assets

Management team with a strong track record of delivering value to shareholders