Presentation to McGraw-Hill

August 22, 2011

2

Disclaimer

THESE MATERIALS ARE FOR GENERAL INFORMATIONAL PURPOSES ONLY. THEY DO NOT HAVE REGARD TO THE SPECIFIC INVESTMENT

OBJECTIVE, FINANCIAL SITUATION, SUITABILITY, OR THE PARTICULAR NEED OF ANY SPECIFIC PERSON WHO MAY RECEIVE THESE MATERIALS,

AND SHOULD NOT BE TAKEN AS ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. THE VIEWS EXPRESSED HEREIN REPRESENT THE

OPINIONS OF EACH OF JANA PARTNERS LLC AND ONTARIO TEACHERS’ PENSION PLAN (EACH, A “SHAREHOLDER”), WHICH OPINIONS MAY CHANGE

AT ANY TIME AND ARE BASED ON PUBLICLY AVAILABLE INFORMATION WITH RESPECT TO THE MCGRAW-HILL COMPANIES, INC. (THE “ISSUER”).

OPINIONS EXPRESSED HEREIN ARE CURRENT OPINIONS AS OF THE DATE APPEARING IN THIS MATERIAL ONLY. EACH OF THE SHAREHOLDERS

DISCLAIMS ANY OBLIGATION TO UPDATE THE DATA, INFORMATION OR OPINIONS CONTAINED HEREIN. UNLESS OTHERWISE INDICATED,

FINANCIAL INFORMATION AND DATA USED HEREIN HAVE BEEN DERIVED OR OBTAINED FROM FILINGS MADE WITH THE SECURITIES AND

EXCHANGE COMMISSION (“SEC”) BY THE ISSUER OR OTHER COMPANIES THAT EACH OF THE SHAREHOLDERS CONSIDERS COMPARABLE, AND

FROM OTHER THIRD PARTY REPORTS.

OBJECTIVE, FINANCIAL SITUATION, SUITABILITY, OR THE PARTICULAR NEED OF ANY SPECIFIC PERSON WHO MAY RECEIVE THESE MATERIALS,

AND SHOULD NOT BE TAKEN AS ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. THE VIEWS EXPRESSED HEREIN REPRESENT THE

OPINIONS OF EACH OF JANA PARTNERS LLC AND ONTARIO TEACHERS’ PENSION PLAN (EACH, A “SHAREHOLDER”), WHICH OPINIONS MAY CHANGE

AT ANY TIME AND ARE BASED ON PUBLICLY AVAILABLE INFORMATION WITH RESPECT TO THE MCGRAW-HILL COMPANIES, INC. (THE “ISSUER”).

OPINIONS EXPRESSED HEREIN ARE CURRENT OPINIONS AS OF THE DATE APPEARING IN THIS MATERIAL ONLY. EACH OF THE SHAREHOLDERS

DISCLAIMS ANY OBLIGATION TO UPDATE THE DATA, INFORMATION OR OPINIONS CONTAINED HEREIN. UNLESS OTHERWISE INDICATED,

FINANCIAL INFORMATION AND DATA USED HEREIN HAVE BEEN DERIVED OR OBTAINED FROM FILINGS MADE WITH THE SECURITIES AND

EXCHANGE COMMISSION (“SEC”) BY THE ISSUER OR OTHER COMPANIES THAT EACH OF THE SHAREHOLDERS CONSIDERS COMPARABLE, AND

FROM OTHER THIRD PARTY REPORTS.

EXCEPT FOR THE HISTORICAL INFORMATION CONTAINED HEREIN, THE MATTERS ADDRESSED IN THESE MATERIALS ARE FORWARD-LOOKING

STATEMENTS THAT INVOLVE CERTAIN RISKS AND UNCERTAINTIES. YOU SHOULD BE AWARE THAT ACTUAL RESULTS COULD DIFFER MATERIALLY

FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. NEITHER OF THE SHAREHOLDERS ASSUMES ANY OBLIGATION TO UPDATE

THE FORWARD-LOOKING INFORMATION. NEITHER OF THE SHAREHOLDERS HAS SOUGHT OR OBTAINED CONSENT FROM ANY THIRD PARTY TO

THE USE HEREIN OF PREVIOUSLY PUBLISHED INFORMATION. ANY SUCH INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT

OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN.

STATEMENTS THAT INVOLVE CERTAIN RISKS AND UNCERTAINTIES. YOU SHOULD BE AWARE THAT ACTUAL RESULTS COULD DIFFER MATERIALLY

FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. NEITHER OF THE SHAREHOLDERS ASSUMES ANY OBLIGATION TO UPDATE

THE FORWARD-LOOKING INFORMATION. NEITHER OF THE SHAREHOLDERS HAS SOUGHT OR OBTAINED CONSENT FROM ANY THIRD PARTY TO

THE USE HEREIN OF PREVIOUSLY PUBLISHED INFORMATION. ANY SUCH INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT

OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN.

ALTHOUGH DATA AND INFORMATION CONTAINED HEREIN HAVE BEEN OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE, NEITHER OF THE

SHAREHOLDERS GUARANTEES THEIR ACCURACY, COMPLETENESS OR FAIRNESS. EACH OF THE SHAREHOLDERS HAS RELIED UPON AND

ASSUMED, WITHOUT INDEPENDENT VERIFICATION, THE ACCURACY AND COMPLETENESS OF ALL DATA AND INFORMATION AVAILABLE FROM

PUBLIC SOURCES. NO WARRANTY IS MADE THAT ANY DATA OR INFORMATION CONTAINED HEREIN, WHETHER DERIVED OR OBTAINED FROM

FILINGS MADE WITH THE SEC OR FROM ANY THIRD PARTY, IS ACCURATE. NEITHER OF THE SHAREHOLDERS SHALL BE RESPONSIBLE OR HAVE

ANY LIABILITY FOR ANY MISINFORMATION CONTAINED IN ANY SEC FILING OR THIRD PARTY REPORT.

SHAREHOLDERS GUARANTEES THEIR ACCURACY, COMPLETENESS OR FAIRNESS. EACH OF THE SHAREHOLDERS HAS RELIED UPON AND

ASSUMED, WITHOUT INDEPENDENT VERIFICATION, THE ACCURACY AND COMPLETENESS OF ALL DATA AND INFORMATION AVAILABLE FROM

PUBLIC SOURCES. NO WARRANTY IS MADE THAT ANY DATA OR INFORMATION CONTAINED HEREIN, WHETHER DERIVED OR OBTAINED FROM

FILINGS MADE WITH THE SEC OR FROM ANY THIRD PARTY, IS ACCURATE. NEITHER OF THE SHAREHOLDERS SHALL BE RESPONSIBLE OR HAVE

ANY LIABILITY FOR ANY MISINFORMATION CONTAINED IN ANY SEC FILING OR THIRD PARTY REPORT.

THERE IS NO ASSURANCE OR GUARANTEE WITH RESPECT TO THE PRICES AT WHICH ANY SECURITIES OF THE ISSUER WILL TRADE, AND SUCH

SECURITIES MAY NOT TRADE AT PRICES THAT MAY BE IMPLIED HEREIN. THE ESTIMATES, PROJECTIONS, PRO FORMA INFORMATION AND

POTENTIAL IMPACT OF THE PROPOSALS SET FORTH HEREIN ARE BASED ON ASSUMPTIONS THAT EACH OF THE SHAREHOLDERS BELIEVES TO BE

REASONABLE, BUT THERE CAN BE NO ASSURANCE OR GUARANTEE THAT ACTUAL RESULTS OR PERFORMANCE OF THE ISSUER WILL NOT

DIFFER, AND SUCH DIFFERENCES MAY BE MATERIAL.

SECURITIES MAY NOT TRADE AT PRICES THAT MAY BE IMPLIED HEREIN. THE ESTIMATES, PROJECTIONS, PRO FORMA INFORMATION AND

POTENTIAL IMPACT OF THE PROPOSALS SET FORTH HEREIN ARE BASED ON ASSUMPTIONS THAT EACH OF THE SHAREHOLDERS BELIEVES TO BE

REASONABLE, BUT THERE CAN BE NO ASSURANCE OR GUARANTEE THAT ACTUAL RESULTS OR PERFORMANCE OF THE ISSUER WILL NOT

DIFFER, AND SUCH DIFFERENCES MAY BE MATERIAL.

EACH OF THE SHAREHOLDERS CURRENTLY HOLDS A SUBSTANTIAL AMOUNT OF SHARES OF COMMON STOCK OF THE ISSUER. EACH OF THE

SHAREHOLDERS MAY FROM TIME TO TIME SELL ALL OR A PORTION OF THEIR SHARES IN OPEN MARKET TRANSACTIONS OR OTHERWISE

(INCLUDING VIA SHORT SALES), BUY ADDITIONAL SHARES (IN OPEN MARKET OR PRIVATELY NEGOTIATED TRANSACTIONS OR OTHERWISE), OR

TRADE IN OPTIONS, PUTS, CALLS OR OTHER DERIVATIVE INSTRUMENTS RELATING TO SUCH SHARES. EACH OF THE SHAREHOLDERS ALSO

RESERVE THE RIGHT TO TAKE ANY ACTIONS WITH RESPECT TO EACH OF THEIR INVESTMENTS IN THE ISSUER AS THEY MAY DEEM APPROPRIATE,

INCLUDING, BUT NOT LIMITED TO, COMMUNICATING WITH MANAGEMENT OF THE ISSUER, THE BOARD OF DIRECTORS OF THE ISSUER, AND OTHER

INVESTORS. NEITHER THESE MATERIALS NOR ANYTHING CONTAINED HEREIN IS INTENDED TO BE, NOR SHOULD IT BE CONSTRUED OR USED AS,

INVESTMENT, TAX, LEGAL OR FINANCIAL ADVICE, AN OPINION OF THE APPROPRIATENESS OF ANY SECURITY OR INVESTMENT, OR AN OFFER, OR

THE SOLICITATION OF ANY OFFER, TO BUY OR SELL ANY SECURITY OR INVESTMENT.

SHAREHOLDERS MAY FROM TIME TO TIME SELL ALL OR A PORTION OF THEIR SHARES IN OPEN MARKET TRANSACTIONS OR OTHERWISE

(INCLUDING VIA SHORT SALES), BUY ADDITIONAL SHARES (IN OPEN MARKET OR PRIVATELY NEGOTIATED TRANSACTIONS OR OTHERWISE), OR

TRADE IN OPTIONS, PUTS, CALLS OR OTHER DERIVATIVE INSTRUMENTS RELATING TO SUCH SHARES. EACH OF THE SHAREHOLDERS ALSO

RESERVE THE RIGHT TO TAKE ANY ACTIONS WITH RESPECT TO EACH OF THEIR INVESTMENTS IN THE ISSUER AS THEY MAY DEEM APPROPRIATE,

INCLUDING, BUT NOT LIMITED TO, COMMUNICATING WITH MANAGEMENT OF THE ISSUER, THE BOARD OF DIRECTORS OF THE ISSUER, AND OTHER

INVESTORS. NEITHER THESE MATERIALS NOR ANYTHING CONTAINED HEREIN IS INTENDED TO BE, NOR SHOULD IT BE CONSTRUED OR USED AS,

INVESTMENT, TAX, LEGAL OR FINANCIAL ADVICE, AN OPINION OF THE APPROPRIATENESS OF ANY SECURITY OR INVESTMENT, OR AN OFFER, OR

THE SOLICITATION OF ANY OFFER, TO BUY OR SELL ANY SECURITY OR INVESTMENT.

3

Overview

„ McGraw-Hill has consistently underperformed its potential and traded at a sizable discount to its intrinsic

value, primarily due to the operational challenges, capital inefficiencies and structural complexity caused

by its conglomerate structure

value, primarily due to the operational challenges, capital inefficiencies and structural complexity caused

by its conglomerate structure

„ While the announcements of a portfolio review and the intention to take “significant actions” in 2011 are

encouraging, the muted market reaction immediately following the announcements reflects concerns that

McGraw-Hill will not go far enough in addressing its issues

encouraging, the muted market reaction immediately following the announcements reflects concerns that

McGraw-Hill will not go far enough in addressing its issues

„ The recent regulatory and political scrutiny around the S&P Ratings business highlights the drawbacks of

housing wholly unrelated businesses together and the risks of further delay in addressing this issue

housing wholly unrelated businesses together and the risks of further delay in addressing this issue

„ McGraw-Hill must move past long overdue “reviews” and finally execute on transforming its corporate

structure to improve operating performance and realize the true value potential of its assets

structure to improve operating performance and realize the true value potential of its assets

„ Specifically, McGraw-Hill should promptly:

- Separate McGraw-Hill Education

- Separate Information & Media

- Separate the S&P Index business

- Collapse its corporate overhead and right size its segment cost structures to achieve peer margins

- Accelerate its share buyback ahead of pursuing these value creating steps to maximize resulting

shareholder value

shareholder value

- Bolster S&P Ratings with a well-known independent oversight figure to help manage increasingly

complex global regulatory landscape and improve dialogue with investors, regulators and the public

complex global regulatory landscape and improve dialogue with investors, regulators and the public

4

„ Operational underperformance

§ MH Education and Information & Media are competitively disadvantaged in the current portfolio

§ Structure leads to management inefficiency, excess overhead and sub-peer segment margins

§ Equity alignment challenged given diluted impact of divisional performance on stock performance

„ Inefficient capital allocation

§ Different growth, regulatory and ROIC profiles create conflicting capital allocation priorities

§ Conglomerate structure limits strategic value-enhancing M&A

§ S&P Ratings limits capitalization options for other segments due to perceived conflicts in assuming

meaningful leverage

meaningful leverage

„ Structural complexity

§ Minimal commercial logic to structure; does not create unique value and complicates equity story

§ MH Education is a drag on operating metrics and valuation of the rest of the businesses

§ Information & Media is an exciting growth story lost in McGraw-Hill among larger businesses

§ MH Financial is itself a set of unrelated assets that is misunderstood in the broader McGraw-Hill

story; in particular the S&P Index business is lost within MH Financial

story; in particular the S&P Index business is lost within MH Financial

§ Public focus on S&P Ratings segment overshadows other segments

Failure To Maximize Value Comes Primarily From Three Sources

McGraw-Hill’s value creation plan should address the key structural elements of its

underperformance and undervaluation.

underperformance and undervaluation.

McGraw-Hill Portfolio Review & Assessment: Share Performance

6

„ S&P Ratings

§ Strong market position with barriers to entry, real pricing power and secular growth from

development of international capital markets

development of international capital markets

„ MH Financial

§ Growing and high margin S&P Index business combined with unrelated subscription-based

critical content with attractive growth and margin improvement opportunities

critical content with attractive growth and margin improvement opportunities

„ MH Education

§ Iconic industry brand in consolidated industry with strong content base and sales

relationships but facing headwinds; K-12 business faces state / local funding challenges

while business increasingly requires comprehensive digital learning platform and

assessment capabilities; Higher Ed business faces accelerating need for digital capabilities

relationships but facing headwinds; K-12 business faces state / local funding challenges

while business increasingly requires comprehensive digital learning platform and

assessment capabilities; Higher Ed business faces accelerating need for digital capabilities

„ Information & Media

§ Critical industry information in a number of sectors, with energy / materials accounting for

majority of profitability; well positioned to benefit from penetration and pricing growth;

strategic asset with opportunities to participate in industry consolidation

majority of profitability; well positioned to benefit from penetration and pricing growth;

strategic asset with opportunities to participate in industry consolidation

Each business has unique strengths and challenges. The question is: what is

McGraw-Hill’s logic for keeping any of these businesses together?

McGraw-Hill’s logic for keeping any of these businesses together?

McGraw-Hill Boasts A Portfolio Of Independently Attractive Assets

7

… That The Market Consistently Undervalues

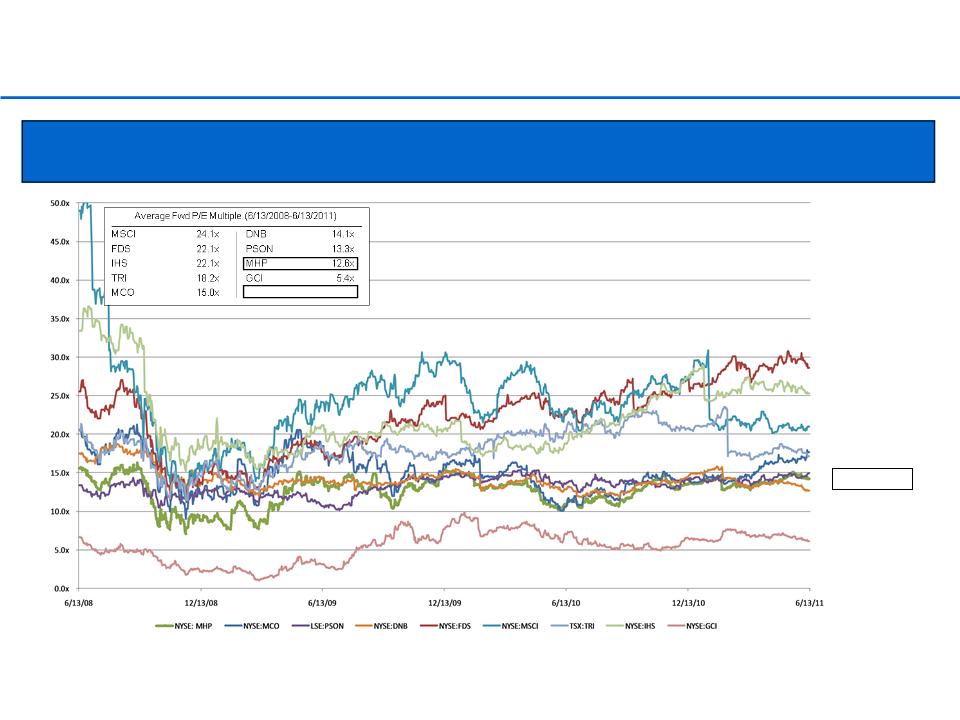

Note: Period ends at 6/13/2011, the day before McGraw-Hill announced its portfolio review, intention to sell broadcasting and review of G&A. Data per CapIQ. Peer group based on Piper Jaffray peer analysis for sum of

parts valuation. Weighted average represents average of peers according to McGraw-Hill annual segment EBIT composition (pre-corporate allocation). Peer analysis only possible beginning in 2008, as that is the earliest

period for which McGraw-Hill has provided separate segment disclosure for MH Financial. Moody’s used as peer for S&P Ratings; Pearson used as peer for MH Education; average of Dun & Bradstreet, FactSet, MSCI and

Thomson Reuters used as peer for MH Financial; IHS used as peer for non-broadcasting Information & Media; Gannett used as peer for broadcasting business within Information & Media.

parts valuation. Weighted average represents average of peers according to McGraw-Hill annual segment EBIT composition (pre-corporate allocation). Peer analysis only possible beginning in 2008, as that is the earliest

period for which McGraw-Hill has provided separate segment disclosure for MH Financial. Moody’s used as peer for S&P Ratings; Pearson used as peer for MH Education; average of Dun & Bradstreet, FactSet, MSCI and

Thomson Reuters used as peer for MH Financial; IHS used as peer for non-broadcasting Information & Media; Gannett used as peer for broadcasting business within Information & Media.

McGraw-Hill’s 3 year average valuation of 12.6x earnings is at a ~25% discount to the

15.9x weighted average of its peer group and trails all of its peers other than Gannett.

15.9x weighted average of its peer group and trails all of its peers other than Gannett.

FDS = 28.7x

IHS = 25.0x

MSCI = 21.1x

TRI = 17.0x

MCO = 17.7x

MHP =14.2x

DNB = 12.7x

GCI = 6.1x

PSON = 15.0x

Forward P/E

Valuations at

6/13/2011

Valuations at

6/13/2011

Peer Wtd. Avg

15.9x

8

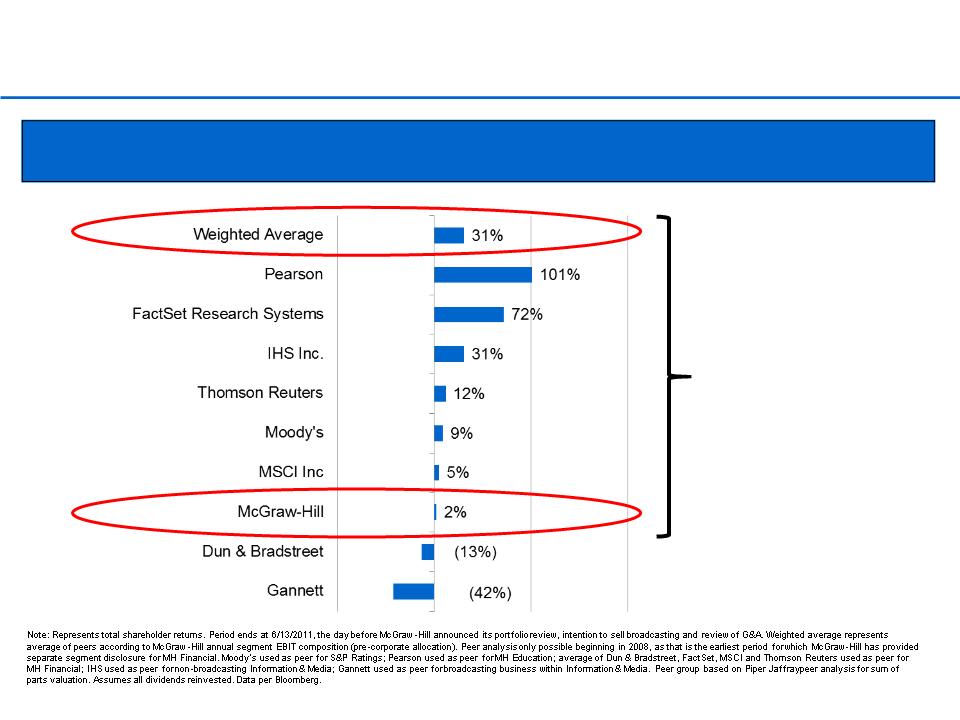

McGraw-Hill Has Trailed Peer Returns Over The Long Term

(1) Pearson total return for period excludes impact of changes in value attributable to its stake in Interactive Data Corporation, which was sold in 2010. Including changes to Pearson total return attributable to changes

in the value of its stake in Interactive Data Corporation results in a minimal (2%) change in Pearson’s total return over the period.

in the value of its stake in Interactive Data Corporation results in a minimal (2%) change in Pearson’s total return over the period.

(1)

„ McGraw Hill’s three

year total return of 2%

was 29% less than

the weighted average

of its peers over the

period

year total return of 2%

was 29% less than

the weighted average

of its peers over the

period

McGraw-Hill underperformed its peers in total shareholder return during the three year

period preceding the recently announced portfolio review.

period preceding the recently announced portfolio review.

9

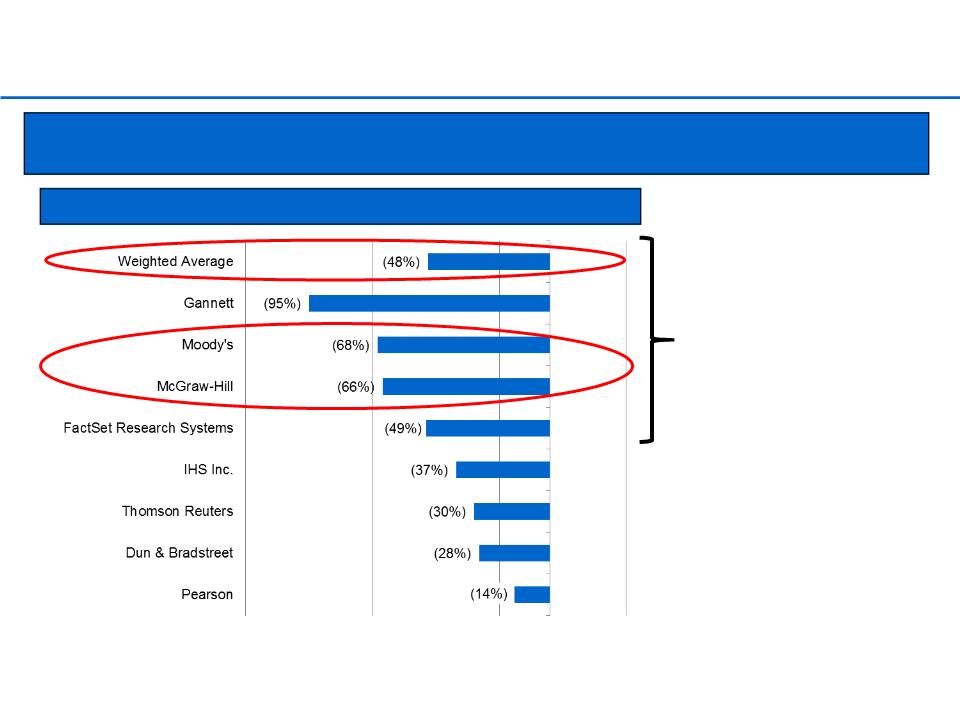

Note: Represents total shareholder returns. Weighted average represents average of peers according to McGraw-Hill segment EBIT composition for 2008 (pre-corporate allocation). Moody’s used as peer for S&P

Ratings; Pearson used as peer for MH Education; average of Dun & Bradstreet, FactSet and Thomson Reuters used as peer for MH Financial; IHS used as peer for non-broadcasting Information & Media; Gannett

used as peer for broadcasting business within Information & Media. Peer group based on Piper Jaffray peer analysis for sum of parts valuation. Assumes all dividends reinvested. Data per Bloomberg.

Ratings; Pearson used as peer for MH Education; average of Dun & Bradstreet, FactSet and Thomson Reuters used as peer for MH Financial; IHS used as peer for non-broadcasting Information & Media; Gannett

used as peer for broadcasting business within Information & Media. Peer group based on Piper Jaffray peer analysis for sum of parts valuation. Assumes all dividends reinvested. Data per Bloomberg.

(1) Represents total return for period from 6/13/2001-6/13/2011. Assumes all dividends reinvested. Data per CapIQ

McGraw-Hill’s diversification did not insulate shareholders during the financial crisis.

McGraw-Hill’s total return was 18% worse than the weighted average of its peers.

McGraw-Hill’s total return was 18% worse than the weighted average of its peers.

Total Return: S&P 500 Peak - Trough (10/09/07-3/09/09)

„ During the S&P 500’s

decline, McGraw-Hill

performed in line with

Moody’s and considerably

worse than all other peers

except Gannett

decline, McGraw-Hill

performed in line with

Moody’s and considerably

worse than all other peers

except Gannett

„ While McGraw-Hill matched

Moody’s on the way down,

it underperformed over the

past decade, with McGraw-

Hill’s 50% return falling

124% below Moody’s 174%

return over that period(1)

Moody’s on the way down,

it underperformed over the

past decade, with McGraw-

Hill’s 50% return falling

124% below Moody’s 174%

return over that period(1)

… And Its Diversification Provided No Benefit In The Market Downturn

McGraw-Hill Portfolio Review & Assessment: In-Depth Segment Review

11

Portfolio Review Focus

In conducting the portfolio review, a key question should be: if you were to start from

scratch today, would you construct McGraw-Hill in its current form?

scratch today, would you construct McGraw-Hill in its current form?

12

McGraw-Hill’s Diverse Portfolio: Snapshot Segment Comparison

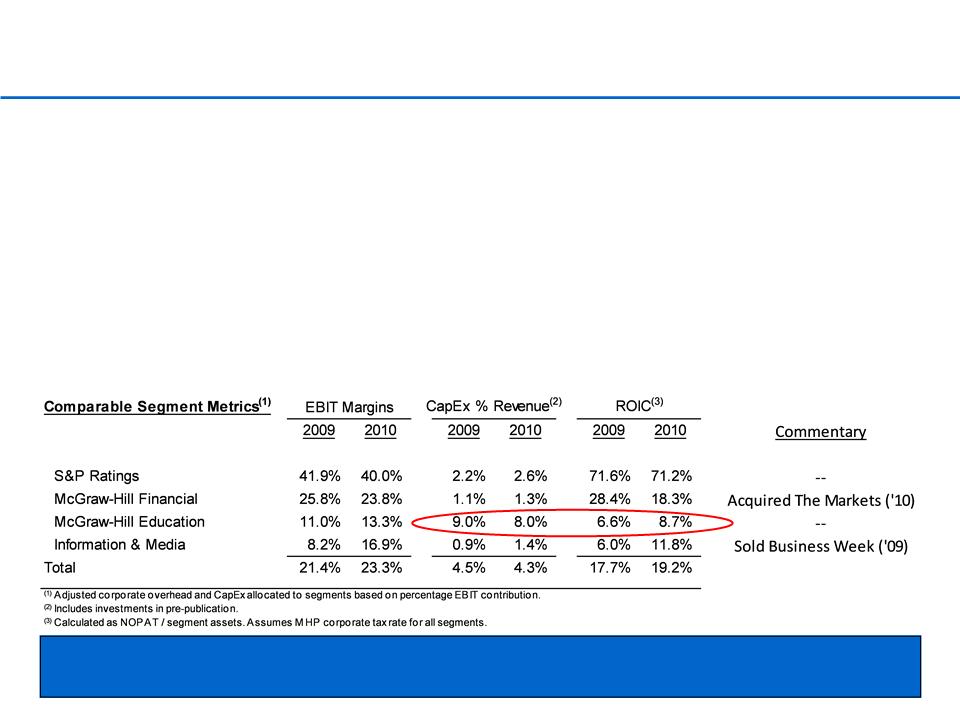

S&P Ratings | MH Financial | MH Education | Info. & Media | |

Key Business Lines | Ratings | Indices, CapIQ, Credit & Equity Research | K-12 and Higher Ed Learning and Support Materials, Testing | Platts, JD Power, Aviation / Construction Week, Broadcasting |

Key Markets | General Business, Government | Financial Services Businesses | K-12: State / Local Ed Higher Ed: Students | Diversified Businesses |

Growth Profile | MSD / HSD (price + secular volumes) | HSD / LDD (price + volume + cross-sales + new product) | Flat / LSD (state funding / enrollments) | MSD / HSD (price + volume + M&A) |

Key Revenue Drivers | Interest Rate & Financing Environment / Global New Debt Issuance Volume | Financial Services Seats / Adoptions of New Indices & AUM Growth | State & Local Ed Funding / Post-HS Enrollment Growth | Energy Price Volatility / Auto, Aviation and Construction Growth |

EBIT Margins(1) | Low / Mid 40% and Growing | Mid / High 20% and Growing | Low Teens and Flat / Declining | High Teens and Growing |

Capital Intensity | ~2% Revenue | ~1% Revenue | ~8%-10% Revenue | ~1% Revenue |

ROIC(2) | 71% | 18% | 9% | 12% |

Degree of Regulation | High | Low | Medium (federal / state / local ed) | Low |

McGraw-Hill’s segments exhibit distinct financial and qualitative characteristics with

different end market, growth, margin, capital intensity, ROIC and regulatory profiles.

different end market, growth, margin, capital intensity, ROIC and regulatory profiles.

(1) Segment margins shown excluding corporate allocations.

(2) 2010 ROIC as calculated on page 13.

13

„ MH Education compares unfavorably with other businesses in McGraw-Hill’s portfolio, as measured by

growth profile, operating margins, capital intensity and ROIC

growth profile, operating margins, capital intensity and ROIC

„ As a result, MH Education competes with substantially higher returning businesses for capital, resources

and management attention; this leaves MH Education competitively disadvantaged

and management attention; this leaves MH Education competitively disadvantaged

§ MH Education requires ~3-4x more capital than any other segment, and the segment will need

additional ongoing capital support to catch up with competition in development of digital

capabilities

additional ongoing capital support to catch up with competition in development of digital

capabilities

§ However, every dollar deployed to MH Education is a relatively less attractive investment because

the segment struggles to achieve its cost of capital and other segments offer higher returns

the segment struggles to achieve its cost of capital and other segments offer higher returns

§ Furthermore, these characteristics make it challenging to justify acquisitions in MH Education

MH Education: Disadvantaged Within McGraw-Hill’s Portfolio

MH Education needs substantial capital support and institutional prioritization, yet it

is among McGraw-Hill’s lowest returning investment opportunities.

is among McGraw-Hill’s lowest returning investment opportunities.

14

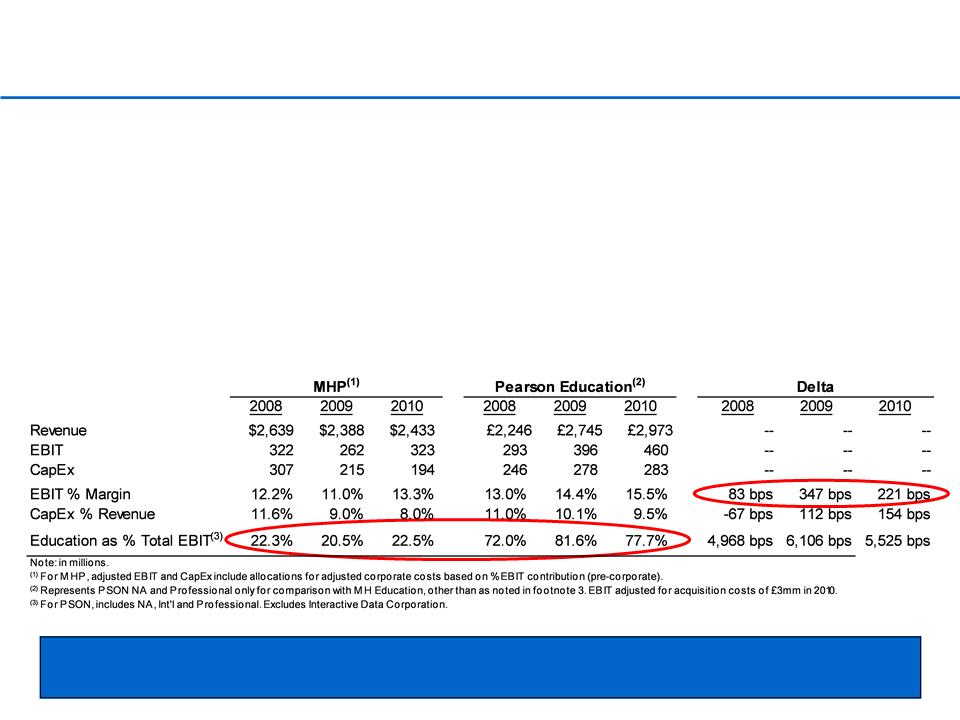

„ MH Education has underperformed principal peer Pearson (“PSON”) on an operational basis, a reflection

of MH Education’s position within the McGraw-Hill conglomerate structure (only ~23% of total EBIT)

of MH Education’s position within the McGraw-Hill conglomerate structure (only ~23% of total EBIT)

„ PSON has spent 10 years managing its portfolio to focus on education / learning as its core competency

§ As part of its portfolio reshuffling, PSON has sold over $5bn of assets - including high-quality and

growing but still non-core businesses - and used the proceeds to acquire over $4bn of assets that

enhanced its core strategy, with a particular focus on complementary education businesses

growing but still non-core businesses - and used the proceeds to acquire over $4bn of assets that

enhanced its core strategy, with a particular focus on complementary education businesses

§ As a result, education now accounts for ~80% of PSON’s total EBIT vs. ~35% 10 years ago

„ With clear focus, PSON has made the investments and acquisitions needed to become the leader in the

attractive areas of the education market and to grow its emerging markets education business

attractive areas of the education market and to grow its emerging markets education business

Also Disadvantaged Against More Focused Competition

Education is a core competency / most attractive business for the competition; this

leaves MH Education inherently disadvantaged.

leaves MH Education inherently disadvantaged.

15

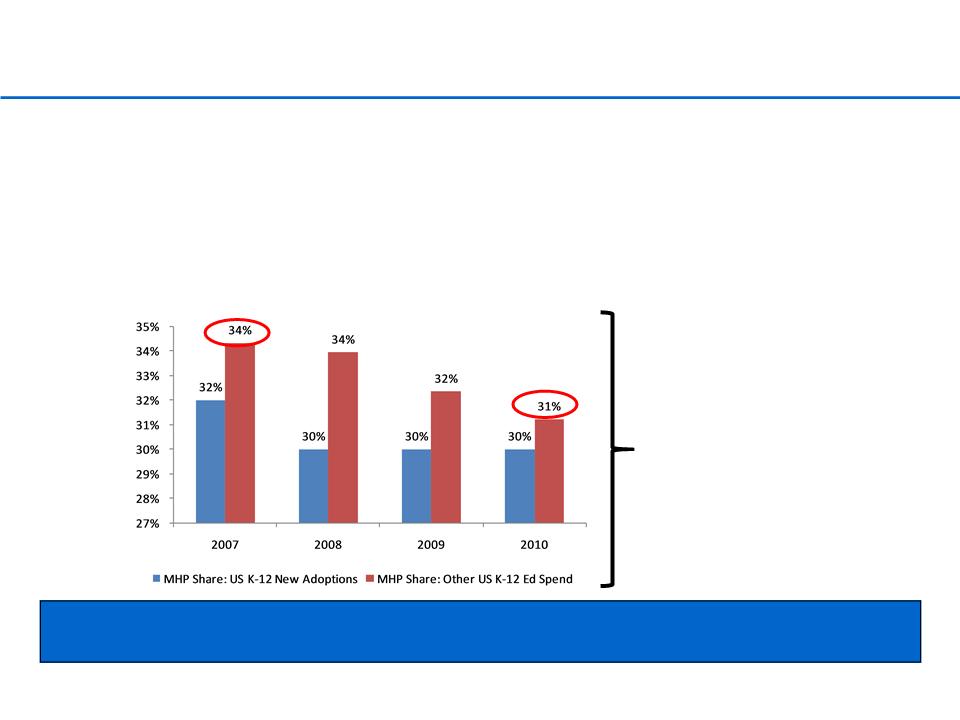

„ Despite its strong history and legacy market position, in recent years operating performance has

weakened and MH Education has significantly underperformed

weakened and MH Education has significantly underperformed

„ MH Education has lost share in its higher education business, as management acknowledged during its

2010 results call, though strong market conditions have still provided an avenue for growth

2010 results call, though strong market conditions have still provided an avenue for growth

„ Based on AAP data, MH Education’s K-12 business has experienced share loss outside of new adoptions

„ These losses are a major ongoing concern, as they appear to reflect McGraw-Hill’s competitive

disadvantage in the faster growing and more attractive areas of K-12 education spending

disadvantage in the faster growing and more attractive areas of K-12 education spending

As A Result, MH Education Appears To Be Losing Share

MH Education would be better positioned to compete standalone with greater

attention and incentives to reverse share loss and direct the business for success.

attention and incentives to reverse share loss and direct the business for success.

Note: “US K-12 New Adoptions” represents MHP share of new adoptions in adoption states, and “Other US K-12 Ed Spend” represents MHP share of open territory sales, residual sales in adoption states and

supplemental sales. Market data per AAP as disclosed in Stifel Nicolaus “2011 Outlook for El-hi Publishing” report dated January 19, 2011. While AAP data does not represent the entire US K-12 education market, it

does represent the key components of the market (largest and most direct competitors) with data contributed from the most significant market participants. McGraw-Hill adoptions share per Q4 earnings calls.

supplemental sales. Market data per AAP as disclosed in Stifel Nicolaus “2011 Outlook for El-hi Publishing” report dated January 19, 2011. While AAP data does not represent the entire US K-12 education market, it

does represent the key components of the market (largest and most direct competitors) with data contributed from the most significant market participants. McGraw-Hill adoptions share per Q4 earnings calls.

„ McGraw-Hill has largely

maintained share in new

adoptions, but appears to have

lost relative market share in the

more attractive non-adoption

market

maintained share in new

adoptions, but appears to have

lost relative market share in the

more attractive non-adoption

market

16

MH Education’s Weak Structural Position

MH Education’s performance is a drag on other McGraw-Hill businesses.

“We think that MHP could evaluate a potential sale/spin of the Education segment (22% of MHP

profits). We view the Education properties as relatively low growth (LSD) and low margin (essentially

10-15% since 1995) — which put it at odds with much of S&P Ratings, M-H Financial, and Platts.

Education has also struggled in recent years amid tough times for local/state budgets, and lagged

competitor Pearson.” - J.P. Morgan, August 1, 2011(1)

profits). We view the Education properties as relatively low growth (LSD) and low margin (essentially

10-15% since 1995) — which put it at odds with much of S&P Ratings, M-H Financial, and Platts.

Education has also struggled in recent years amid tough times for local/state budgets, and lagged

competitor Pearson.” - J.P. Morgan, August 1, 2011(1)

“Consider the following - 1) the financial profile of Education (more capital intensive, lower returns,

cyclical ~ K-12) is less attractive vs. McGraw-Hill Financial Services, in our opinion; 2) McGraw-Hill

Education has been losing share in both el-hi and college for the last several years which we think is

at least partially due to ‘under-investment’ in these businesses (at least on a relative basis) - School

revenue is nearly -30% off its '05 peak, the company's legacy testing biz (norm-referenced testing)

has been hurt by NCLB, and the higher education digital strategy has generally trailed competitors”

- Stifel Nicolaus, August 2, 2011(2)

cyclical ~ K-12) is less attractive vs. McGraw-Hill Financial Services, in our opinion; 2) McGraw-Hill

Education has been losing share in both el-hi and college for the last several years which we think is

at least partially due to ‘under-investment’ in these businesses (at least on a relative basis) - School

revenue is nearly -30% off its '05 peak, the company's legacy testing biz (norm-referenced testing)

has been hurt by NCLB, and the higher education digital strategy has generally trailed competitors”

- Stifel Nicolaus, August 2, 2011(2)

“The weak link in the MHP earnings outlook near-term is the educational publishing unit, reflecting

heavy spending on digital initiatives and a difficult K-12 funding environment. While we see long-

term payoff from the digital migration (as evidenced by the higher margins achieved in the more

technologically advanced college business), we expect spending to constrain margins in 2011 and

2012” - Piper Jaffray, May 19, 2011(3)

heavy spending on digital initiatives and a difficult K-12 funding environment. While we see long-

term payoff from the digital migration (as evidenced by the higher margins achieved in the more

technologically advanced college business), we expect spending to constrain margins in 2011 and

2012” - Piper Jaffray, May 19, 2011(3)

(1) “Activists Coming”; Michael A. Meltz; J.P. Morgan; August 1, 2011.

(2) “The McGraw-Hill Companies”; Drew E. Crum and David Pang; Stifel Nicolaus; August 2, 2011.

(3) “Management Visit Reinforces our Positive View”; Peter P. Appert and George K. Tong; Piper Jaffray; May 19, 2011.

17

„ From an investor’s perspective, the Information & Media business is lost within the broader McGraw-Hill

conglomerate structure and is too small to move the needle

conglomerate structure and is too small to move the needle

§ Information & Media represents only ~10% of EBIT and is overshadowed by three other

segments

segments

§ Management has recognized that Platts is “an underappreciated gem”(1) within the company

„ From an operational perspective, Information & Media does not receive the growth support,

organizational focus / prioritization or equity incentives needed to maximize performance

organizational focus / prioritization or equity incentives needed to maximize performance

§ In the media space there is a strong track record of ‘orphan’ assets like Info. & Media materially

improving performance once equipped with the appropriate attention, resources and incentives

improving performance once equipped with the appropriate attention, resources and incentives

„ Information & Media is well positioned to participate in information services industry consolidation

§ As a buyer: While McGraw-Hill has recently supported two Info. & Media acquisitions (Bentek and

Steel Business Briefing Group), a standalone Info. & Media business could be considerably more

acquisitive, in line with information services peers, to drive growth, margins and value creation

Steel Business Briefing Group), a standalone Info. & Media business could be considerably more

acquisitive, in line with information services peers, to drive growth, margins and value creation

§ As a seller: Information & Media would be a highly valued acquisition candidate for larger pure-

play info services companies or diversified media companies looking for info services exposure

play info services companies or diversified media companies looking for info services exposure

A standalone Information & Media business could better optimize operational

performance, garner investor attention and participate in consolidation.

performance, garner investor attention and participate in consolidation.

(1) CEO Harold McGraw III comment during Q2 2011 earnings call discussion of McGraw-Hill’s portfolio review.

Information & Media: Obscured Value And Disadvantaged In M&A

18

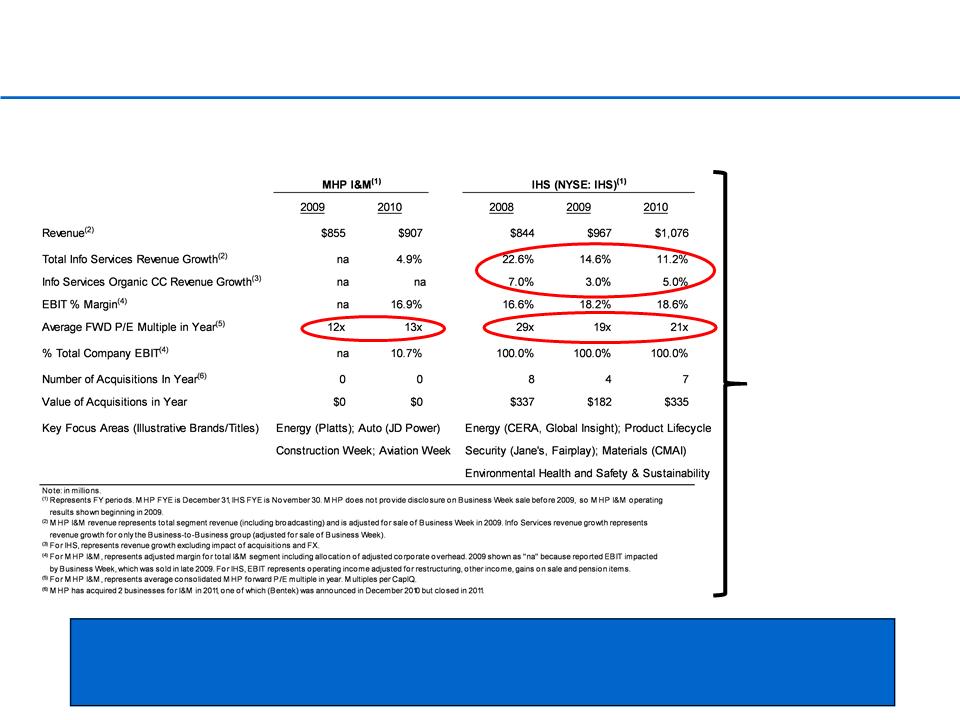

„ IHS enjoyed strong

revenue growth

through the market

downturn, generating

organic constant-

currency revenue

growth in every year

from 2008-2010

revenue growth

through the market

downturn, generating

organic constant-

currency revenue

growth in every year

from 2008-2010

„ IHS has also been a

leader in industry

consolidation, having

acquired over 30

companies since

2007

leader in industry

consolidation, having

acquired over 30

companies since

2007

„ The market has

rewarded IHS’

strategy and

performance with a

rich valuation

rewarded IHS’

strategy and

performance with a

rich valuation

Information & Media’s assets provide the foundation of a business that - with

improved focus and appropriate access to capital - should be capable of

similarly strong operational performance and warrant a premium valuation.

improved focus and appropriate access to capital - should be capable of

similarly strong operational performance and warrant a premium valuation.

„ Standalone competitor IHS’ focus and execution has resulted in strong performance and a high valuation

IHS Example Demonstrates Value Creation Potential

19

„ Despite separate disclosure, MH Financial remains overshadowed by the larger S&P Ratings segment

§ Regulation: S&P Ratings is subjected to considerable regulatory oversight

§ M&A / Growth: MH Financial is a diverse collection of businesses with variable growth and

profitability characteristics, ample opportunity to participate in value creating M&A and considerable

growth runway, while S&P Ratings is a mature business

profitability characteristics, ample opportunity to participate in value creating M&A and considerable

growth runway, while S&P Ratings is a mature business

§ Capital Structure: S&P Ratings limits overall company leverage due to perceived conflicts of interest

§ Margins / ROIC: Both have very strong margin and ROIC profiles in absolute terms, but S&P

Ratings has considerably better margins and ROIC on a relative basis

Ratings has considerably better margins and ROIC on a relative basis

„ Management has conceded that “McGraw-Hill Financial is a completely different business than S&P”(1)

„ MH Financial’s diversity and lack of transparency hinders management performance and valuation

§ S&P Index business is well positioned to realize value as a standalone business and would be an

attractive asset for strategic acquirors; however, today its value is unrecognized given poor

disclosure and unrelated assets within MH Financial

attractive asset for strategic acquirors; however, today its value is unrecognized given poor

disclosure and unrelated assets within MH Financial

§ Ratings Direct is a more natural fit with the S&P Ratings business

§ Capital IQ performance masked by disclosure (e.g. number of customers not a helpful performance

metric / indicator)

metric / indicator)

MH Financial’s lack of clear fit with S&P Ratings and its own complex asset mix

obfuscate its value and in particular conceal the value of the S&P Index business.

obfuscate its value and in particular conceal the value of the S&P Index business.

(1) Per commentary of CEO Harold McGraw III on Q2 2011 MHP earnings call Q&A.

MH Financial: Overshadowed by S&P Ratings And Overly Complex

20

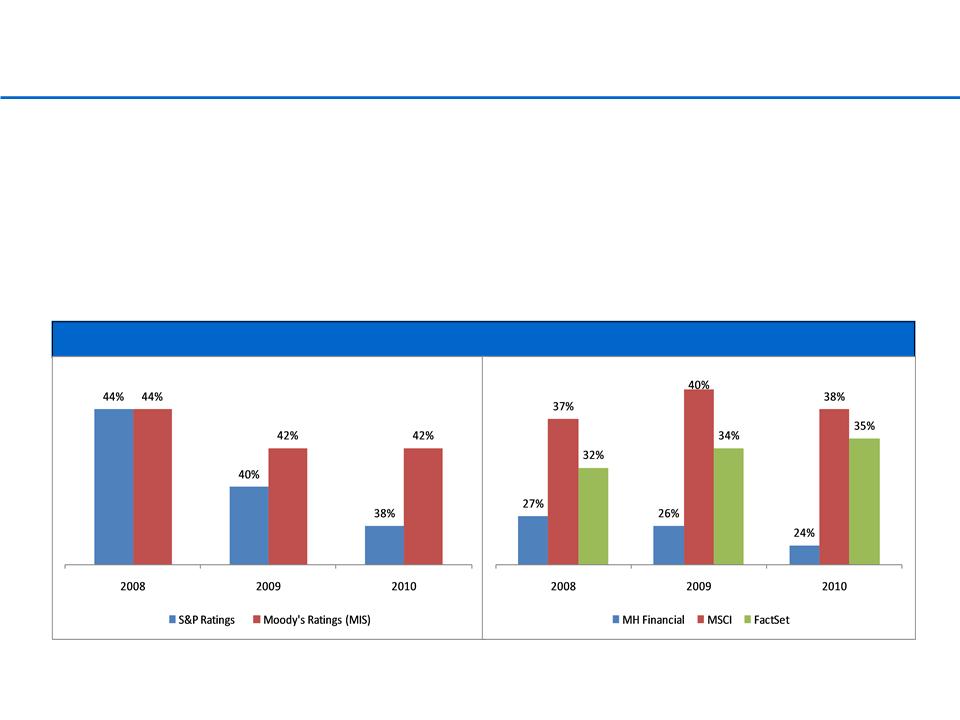

Note: All periods represent fiscal years. Excludes non-recurring items for S&P Ratings, MH Financial and all peers. For S&P Ratings and MH Financial, adjusted EBIT margins include allocation of adjusted corporate

overhead (based on % EBIT contribution). For S&P Ratings and Moody’s MIS, margins exclude intercompany royalty revenue and EBIT; intercompany royalty revenues assumed to have no associated costs. MSCI

2010 margins impacted by acquisition of lower margin business during fiscal year.

overhead (based on % EBIT contribution). For S&P Ratings and Moody’s MIS, margins exclude intercompany royalty revenue and EBIT; intercompany royalty revenues assumed to have no associated costs. MSCI

2010 margins impacted by acquisition of lower margin business during fiscal year.

Comparable EBIT Margins: S&P Ratings and MH Financial vs. Peers

„ While there are some differences in business model and mix, both S&P Ratings and MH Financial

operate at margins well below best-in-class pure play competitors

operate at margins well below best-in-class pure play competitors

„ Following the separation of MH Education, Information & Media and the S&P Index business, the

remaining S&P Ratings / MH Financial business will be positioned to improve its performance and

bridge its margin gap with peers

remaining S&P Ratings / MH Financial business will be positioned to improve its performance and

bridge its margin gap with peers

§ Senior management focused on one discrete business rather than four

§ Eliminate corporate costs

§ Better alignment of management incentives with business performance

MH Financial & S&P Ratings Underperform Pure Play Peers

21

S&P Ratings’ Issues: Overshadows McGraw-Hill’s Other Businesses

Separating other businesses would release them from unjustified S&P Ratings

overhang, and allow for greater focus from top management at S&P Ratings.

overhang, and allow for greater focus from top management at S&P Ratings.

“We remain long-term bullish on MHP (and MCO) but acknowledge that it will be difficult for the

shares to outperform near-term given increasing regulatory scrutiny, which has intensified

meaningfully since S&P’s downgrade of the US” - Piper Jaffray, August 18, 2011(1)

shares to outperform near-term given increasing regulatory scrutiny, which has intensified

meaningfully since S&P’s downgrade of the US” - Piper Jaffray, August 18, 2011(1)

“Negative headlines following S&P’s downgrade of the US sovereign rating reignited regulatory

fears. Here we believe incremental regulation beyond measures in Dodd-Frank seems unlikely.

Also, our price target includes a modest 10% discount [to McGraw-Hill’s total sum of the parts

enterprise value] for these risks” - Goldman Sachs, August 18, 2011(2)(3)

fears. Here we believe incremental regulation beyond measures in Dodd-Frank seems unlikely.

Also, our price target includes a modest 10% discount [to McGraw-Hill’s total sum of the parts

enterprise value] for these risks” - Goldman Sachs, August 18, 2011(2)(3)

„ Public scrutiny of the S&P Ratings business serves as an overhang on McGraw-Hill’s valuation

„ Analysts and investors have accounted for public focus and regulatory scrutiny by applying a

discount to the valuation of all McGraw-Hill’s businesses, not just to the S&P Ratings business

discount to the valuation of all McGraw-Hill’s businesses, not just to the S&P Ratings business

„ The result is that S&P Ratings (~50% of total EBIT) infects the valuation of the other businesses

rather than protecting them through diversification (as management has historically contended)

rather than protecting them through diversification (as management has historically contended)

„ McGraw-Hill can address this overhang through separation of MH Education, the S&P Index

business and Information & Media … S&P Ratings meanwhile should add a well-known independent

oversight figure to help manage the increasingly complex global regulatory landscape and external

dialogue

business and Information & Media … S&P Ratings meanwhile should add a well-known independent

oversight figure to help manage the increasingly complex global regulatory landscape and external

dialogue

(1) “Regulatory Worries Create Near-Term Headwind”; Peter P. Appert and George K. Tong; Piper Jaffray; August 18, 2011.

(2) “Reiterate Buy on ‘self-help’ headlines; we see 30% upside”; Sloan Bohlen and Conor Fennerty; The Goldman Sachs Group, Inc.; August 18, 2011.

(3) Goldman Sachs applies the same 10% valuation reserve to the value of Moody’s (GS report on Moody’s dated April 28, 2011: “Moody’s Corporation: Outsized 1Q is compelling but we are hesitant to chase; still

Neutral”), for whom the vast majority of EBIT is directly related to ratings vs. ~50% at MHP.

Neutral”), for whom the vast majority of EBIT is directly related to ratings vs. ~50% at MHP.

22

McGraw-Hill’s business segments lack clear commercial or cost synergies.

In particular, MH Education and Info. & Media enjoy no benefits from the structure.

S&P Ratings | MH Financial | MH Education | Information & Media | |

S&P Ratings | Commercial Relationship for S&P Index and Cross - Selling Ratings Direct; Limited Corporate Overhead | Limited Corporate Overhead | Limited Corporate Overhead | |

MH Financial | Commercial Relationship for S&P Index and Cross - Selling Ratings Direct; Limited Corporate Overhead | Limited Corporate Overhead | Limited Corporate Overhead | |

MH Education | Limited Corporate Overhead | Limited Corporate Overhead | Limited Corporate Overhead | |

Information & Media | Limited Corporate Overhead | Limited Corporate Overhead | Limited Corporate Overhead |

„ MH Education and Information & Media realize no meaningful commercial or cost benefits from each

other or the other McGraw-Hill segments

other or the other McGraw-Hill segments

„ S&P Ratings and MH Financial maintain a relationship for indices and credit research

§ S&P credit research reports should be housed within S&P Ratings (vs. MH Financial today)

§ A separation of the S&P Index business should be achieved through a branding agreement for

the S&P name, in line with comparable index transactions

the S&P name, in line with comparable index transactions

No Real Synergies To Justify Drawbacks Of Conglomerate Structure

McGraw-Hill Portfolio Review & Assessment: Value Potential

24

„ McGraw-Hill is an overly complex equity story for analysts and investors

§ For its size, McGraw-Hill is followed by a relatively small number of Wall Street analysts

§ Diverse primary coverage universes of analysts highlight the difficult equity story

„ A sum of parts valuation is the best means to recognize the value of McGraw-Hill’s distinct assets

„ All of McGraw-Hill’s analysts believe the company’s assets are worth more separately than together

§ ~25% average analyst sum of parts discount highlights substantial discount to fair value

§ “The company’s valuation suffers from a conglomerate discount vs. pure play segment peer

multiples … MHP can unlock additional value for shareholders through corporate actions

including potential segment divestiture or spin-offs”(1)

multiples … MHP can unlock additional value for shareholders through corporate actions

including potential segment divestiture or spin-offs”(1)

Peer / Competitor Coverage | ||||||

Firm (Analyst) | S&P | MH Fin | MH Ed | I & M | Sum of Parts / Upside (Date) | Other Coverage Areas |

Piper (Appert) | X | X | X | X | $52 / 22% (7/29) | For-Profit Education |

JP Morgan (Meltz) | X | X | X | $55 / 33% (8/1) | Radio, Publishing | |

Goldman (Bohlen) | X | $50 / 25% (8/18) | REITs, info services | |||

Stifel (Crum) | X | X | NA | Large Cap Diversified Media | ||

Lazard (Bird) | X | $55 / 33% (8/1) | Ad Agencies, Newspapers | |||

Benchmark (Atorino) | X | X | NA | Newspapers, Broadcasting | ||

Evercore (Arthur) | X | $45-58 / 16% (8/2) | Outdoor, Newspapers, Broadcast | |||

A clearer story would unlock value by improving analyst and investor focus

and free McGraw-Hill’s businesses to explore value-creation opportunities.

and free McGraw-Hill’s businesses to explore value-creation opportunities.

Note: ‘X’ indicates segments whose comparables / competitors the analysts covers as part of their primary coverage universe. Sum of parts upside percentage based on share price on date of research report.

(1) “Reiterate Buy on ‘self-help’ headlines; we see 30% upside”; Sloan Bohlen and Conor Fennerty; The Goldman Sachs Group, Inc.; August 18, 2011.

Corporate Structure Impedes Recognition Of True Value

25

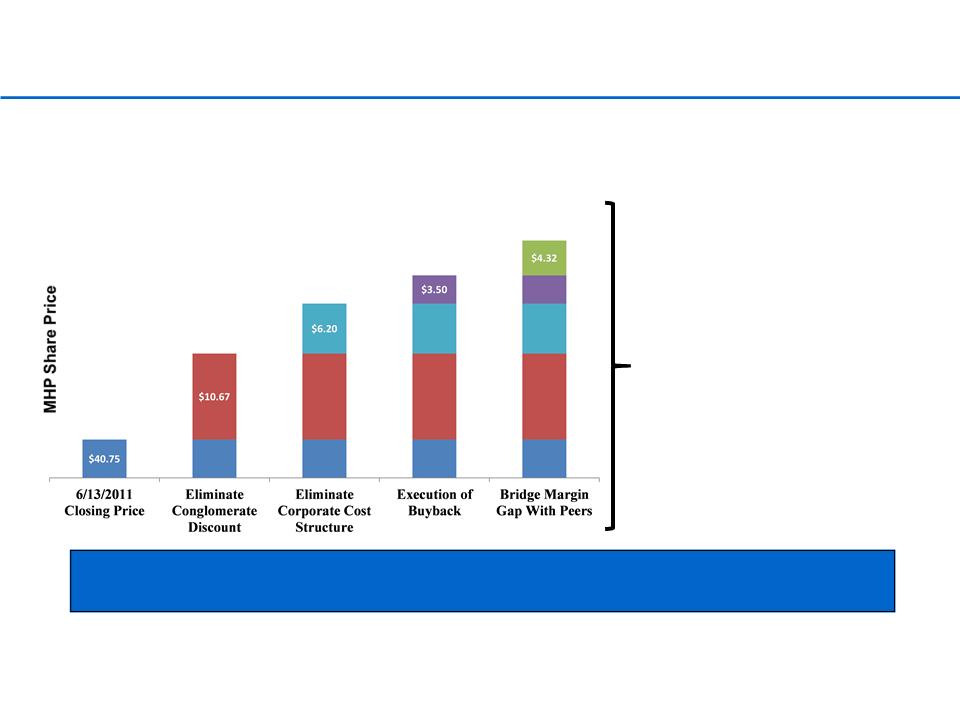

„ An immediate separation of McGraw-Hill’s businesses would unlock substantial shareholder value by

eliminating the current conglomerate discount, accelerating corporate and segment cost rationalization

which would lead to margin improvement, and facilitating appropriate capitalization

eliminating the current conglomerate discount, accelerating corporate and segment cost rationalization

which would lead to margin improvement, and facilitating appropriate capitalization

$51

$65

„ Unlocking McGraw-Hill’s long-term

conglomerate discount(2) would

result in ~$11 of value

conglomerate discount(2) would

result in ~$11 of value

„ Eliminating McGraw-Hill’s

corporate cost structure would

contribute ~$6 of value

corporate cost structure would

contribute ~$6 of value

„ Execution of McGraw-Hill’s

authorized buyback would create

$3.50 of immediate value

authorized buyback would create

$3.50 of immediate value

„ Bridging the remaining margin gap

with McGraw-Hill’s peers (gap

after collapsing the corporate

structure) would create an

additional ~$4 of value

with McGraw-Hill’s peers (gap

after collapsing the corporate

structure) would create an

additional ~$4 of value

$61

Separation would unlock substantial value and could create even greater value

through M&A activity for each segment.

through M&A activity for each segment.

(1)

(1) Represents closing price on 6/13/2011, the day before McGraw-Hill announced its portfolio review, intention to sell broadcasting and review of G&A.

(2) Based on McGraw-Hill’s long-term discount to the weighted average P/E multiple of its peers (as shown on page 7) and average conglomerate discount per analyst research (as shown on page 24).

(3) Represents elimination of McGraw-Hill’s $164.4mm of 2010 adjusted corporate costs valued at a 17.8x forward P/E multiple. Valuation multiple represents MHP’s 6/13/2011 multiple adjusted for elimination of

the company’s conglomerate discount; this is in line with the 17.9x weighted average multiple of MHP’s peers on 6/13/2011 (see page 7). Assumes MHP’s corporate tax rate.

the company’s conglomerate discount; this is in line with the 17.9x weighted average multiple of MHP’s peers on 6/13/2011 (see page 7). Assumes MHP’s corporate tax rate.

(4) Assumes repurchase at 6/13/2011 closing price. Assumes funding through new leverage of 2x EBITDA at MH Education, MH Financial and Information & Media segments, with no incremental leverage on S&P

Ratings (implies pro forma net leverage of ~1x EBITDA on all MHP). Assumes 4.5% after tax cost of debt.

Ratings (implies pro forma net leverage of ~1x EBITDA on all MHP). Assumes 4.5% after tax cost of debt.

(5) Represents value from bridging remaining margin gap with peers after elimination of $164.4mm of adjusted corporate costs. Peer margin comparison detail shown on pages 14, 18 and 20. Assumes multiple

and tax rate consistent with footnote 3.

and tax rate consistent with footnote 3.

$58

(2)

Portfolio Review Can Result In Substantial Value Creation

(3)

(4)

(5)

26

Conclusion

„ McGraw-Hill’s conglomerate structure acts as a significant constraint on each of its businesses,

hampering operational performance, strategic flexibility in allocating capital and share price valuation

hampering operational performance, strategic flexibility in allocating capital and share price valuation

„ McGraw-Hill has much more meaningful and beneficial opportunities to improve operating performance

and clarify the underlying value of its assets than the actions undertaken to date (such as seeking to

sell broadcasting, which accounts for only ~2% of total EBIT)

and clarify the underlying value of its assets than the actions undertaken to date (such as seeking to

sell broadcasting, which accounts for only ~2% of total EBIT)

„ A wide ranging, transformative and comprehensive resolution of the corporate structure and cost

structure is essential for McGraw-Hill to improve operating performance and shareholder return

structure is essential for McGraw-Hill to improve operating performance and shareholder return

§ Separating MH Education, Information & Media and the S&P Index business would position these

businesses to improve performance and participate in consolidation, thus unlocking value

businesses to improve performance and participate in consolidation, thus unlocking value

§ Collapsing McGraw-Hill’s corporate cost structure and eliminating duplicative overhead costs

would enhance this value creation

would enhance this value creation

§ Accelerated share buybacks would multiply the value creation impact of these changes

§ Bolstering S&P Ratings with an independent oversight figure would help the business navigate an

increasingly complex global regulatory environment and heightened public focus

increasingly complex global regulatory environment and heightened public focus

„ JANA and OTPP each look forward to providing an independent shareholder perspective to McGraw-

Hill’s management and Board of Directors as they conduct the current portfolio review

Hill’s management and Board of Directors as they conduct the current portfolio review

The real question is why would McGraw-Hill not promptly take these steps to

improve operating performance and unlock shareholder value?

improve operating performance and unlock shareholder value?