1934 Act Registration No. 333 - 13904

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of October 2005

MTR CORPORATION LIMITED

(Exact Name of Registrant as Specified in Its Charter)

MTR Tower

Telford Plaza

33 Wai Yip Street

Kowloon Bay

Hong Kong

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.)

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- )

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Report on Form 6-K may be viewed as “forward-looking statements” within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual performance, financial condition or results of operations of MTR Corporation Limited (the “Company”) to be materially different from any future performance, financial condition or results of operations implied by such forward-looking statements.

With respect to the Company’s business, including its railway operations and property operations, such factors include, among others, the following:

| | • | | general political, social and economic conditions in Hong Kong, the Mainland of China and elsewhere in Asia; |

| | • | | the level of interest rates prevailing in Hong Kong; |

| | • | | accidents and natural disasters; |

| | • | | the terms on which the Company finances its working capital and capital expenditure requirements; |

| | • | | the implementation of new projects and the timely and effective development of the railway and any disruptions to that implementation and development; |

| | • | | changes in the fares for the Company’s services; |

| | • | | competition from alternative modes of transportation, in particular franchised buses and public light buses; |

| | • | | the Company’s ability to complete property developments on time and within budget; |

| | • | | competition from other property developments; |

| | • | | the Company’s relationship with the Government of the Hong Kong Special Administrative Region (the “Government”); |

| | • | | the Government’s policies relating to transportation and land use planning in Hong Kong, which may change as a result of the Government’s population and employment growth projections (which themselves are subject to change); |

| | • | | the Government’s policies relating to property ownership and development, which may change as a result of the Government’s population and employment growth projections (which themselves are subject to change); |

| | • | | the possible merger of the Company with the Kowloon-Canton Railway Corporation; and |

| | • | | other factors beyond the Company’s control. |

2

EXHIBITS

| | | | |

Exhibit Number

| | | | Page

|

1.1 | | Announcement dated October 24, 2005 | | 5 |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

MTR CORPORATION LIMITED |

| |

By: | | /s/ Lila Fong

|

Name: | | Lila Fong |

Title: | | Legal Manager - Secretarial |

Date: October 24, 2005

4

Exhibit 1.1

The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this announcement, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

MTR CORPORATION LIMITED

(the “Company” or “MTRCL”)

(Incorporated in Hong Kong with limited liability)

(Stock code: 66)

ADJUSTMENT OF ARRANGEMENTS RELATING TO OCTOPUS CARDS LIMITED

CONNECTED TRANSACTIONS

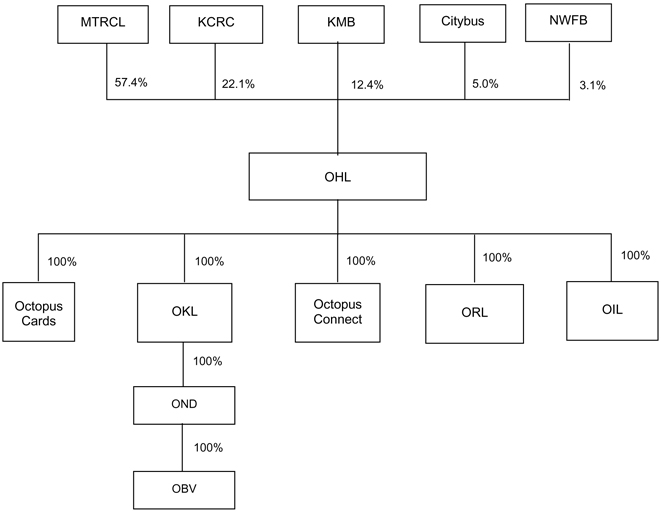

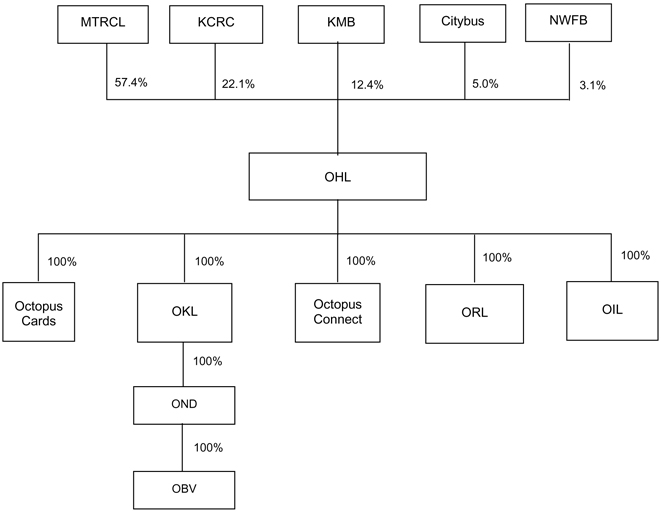

On 21 October 2005, the Company and the other shareholders of Octopus Cards entered into a number of agreements to adjust the arrangements relating to Octopus Cards, in order to spin off the non-payment businesses of Octopus Cards into new, separate subsidiaries independent of the payment business of Octopus Cards that is regulated by the Hong Kong Monetary Authority. Accordingly, a new holding company (OHL) has been interposed between Octopus Cards and its former shareholders to hold the entire issued share capital of each of these new companies as well as Octopus Cards (as illustrated below under the heading “Adjusted Structure”). The economic substance of the relationship between the shareholders of Octopus Cards has not changed as a result of the Adjustments, other than the fact that their interests in Octopus Cards have become indirect instead of direct.

As KCRC and KMB are both substantial shareholders of a subsidiary of the Company (namely, Octopus Cards), and Octopus Cards is a non wholly-owned subsidiary of the Company where KCRC and KMB are each entitled to exercise 10% or more of the voting power at any general meeting of Octopus Cards, each of KCRC, KMB and Octopus Cards is therefore a connected person of the Company and the Adjustments involve connected transactions for the Company under Rule 14A.13 of the Listing Rules. As disclosed in the announcement of the Company dated 13 January 2005, the Stock Exchange has granted the Waiver to the Company from strict compliance with the requirements of Chapter 14A of the Listing Rules which would otherwise apply to certain connected transactions, including transactions with associates of the Government (such as KCRC) and Octopus Cards. The Waiver is subject to the conditions described below under the heading “General”. The Stock Exchange has updated the Waiver to reflect the Adjustments.

Transactions with KMB are not within the terms of the Waiver and are therefore subject to the requirements of Chapter 14A of the Listing Rules.

Accordingly, this announcement is made in accordance with the conditions of the Waiver and Rule 14A.47 of the Listing Rules. Details of the Adjustments will be disclosed in the next annual report of the Company in accordance with the conditions of the Waiver and Rule 14A.45 of the Listing Rules.

5

Reasons for the Adjustments

On 21 October 2005, the Company and the other shareholders of Octopus Cards entered into a number of agreements to adjust the arrangements relating to Octopus Cards, in order to spin off the non-payment businesses of Octopus Cards into new, separate subsidiaries independent of the payment business of Octopus Cards that is regulated by the Hong Kong Monetary Authority. Octopus Cards has been involved in the non-payment business of international automatic fare collection consultancy services.

To effect these adjustments, a new holding company (OHL) has been interposed between Octopus Cards and its former shareholders to hold the entire issued share capital of each of the new companies set up in connection with the non-payment businesses of Octopus Cards as well as Octopus Cards (as illustrated below under the heading “Adjusted Structure”). The economic substance of the relationship between the shareholders of Octopus Cards has not changed as a result of the Adjustments, other than the fact that their interests in Octopus Cards have become indirect instead of direct. No other benefits are expected to accrue to the Company as a result of the Adjustments.

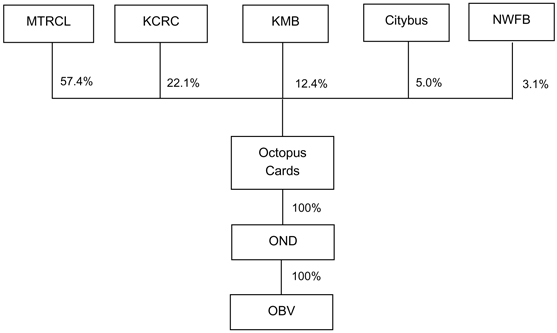

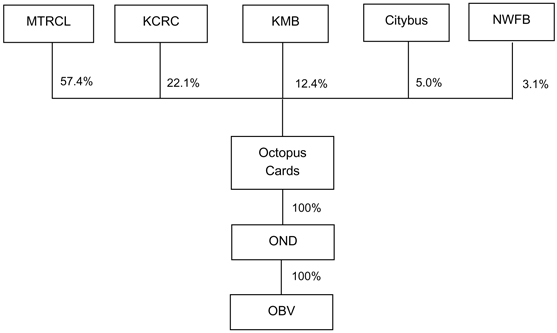

Old Structure

Adjusted Structure

The Adjustments - Connected Transactions

The Adjustments involve the following:

The Company has incorporated OHL as a new wholly-owned subsidiary. Pursuant to a Sale and Purchase Agreement dated 21 October 2005, the shareholders of Octopus Cards sold all their shares in Octopus Cards to OHL in consideration for the issue to them of new shares in OHL. As a consequence, the shareholding structure of OHL is the same as that of Octopus Cards immediately before such sale and purchase of shares in Octopus Cards. Octopus Cards has therefore become a wholly-owned subsidiary of OHL and OHL has been interposed between the current shareholders of Octopus Cards and Octopus Cards, with the result that the direct shareholding interests of Octopus Cards’ former shareholders in Octopus Cards are the same as their current indirect shareholding interests in Octopus Cards.

Immediately after completion of the sale and purchase of shares in Octopus Cards, the sellers under the Sale and Purchase Agreement entered into a Shareholders’ Agreement in respect of arrangements regarding OHL. The Shareholders’ Agreement is substantially the same as the shareholders’ agreement that was in place governing the arrangements regarding Octopus Cards and has replaced the Octopus Cards shareholders’ agreement.

At the same time, the shareholders of OHL made a loan in aggregate amounting to HK$150 million to OHL pursuant to a Subordinated Loan Agreement, with each shareholder lending an amount in proportion to its shareholding in OHL. The Company has therefore lent HK$86.1 million to OHL (or 57.4% of the total amount of the loan). The loan is for a term of five years and is unsecured, the rights of the lenders are subordinated in all respects to the rights of the other unsubordinated creditors of OHL in respect of all other unsubordinated liabilities, and interest on the loan is payable at a rate of 5.5% per annum. The loan was effectively funded by a dividend payment from Octopus Cards to its shareholders, which was then loaned back to OHL.

Octopus Cards then transferred the entire issued share capital of one of its wholly-owned subsidiaries, OND, to OKL, a wholly-owned subsidiary of OHL set up for all international consultancy activities.

The Directors (including the independent non-executive Directors) believe that the terms of the Adjustments and the related documentation are fair and reasonable and in the interests of the shareholders of the Company as a whole.

General

As KCRC and KMB are both substantial shareholders of a subsidiary of the Company (namely, Octopus Cards), and Octopus Cards is a non wholly-owned subsidiary of the Company where KCRC and KMB are each entitled to exercise 10% or more of the voting power at any general meeting of Octopus Cards, each of KCRC, KMB and Octopus Cards is therefore a connected person of the Company and the Adjustments described above involve connected transactions for the Company under Rule 14A.13 of the Listing Rules. To the best of the Directors’ knowledge, information and belief having made all reasonable enquiry, all of the other counterparties and their ultimate beneficial owners are third parties independent of the Company and connected persons of the Company.

As disclosed in the announcement of the Company dated 13 January 2005, the Stock Exchange has granted the Waiver to the Company from strict compliance with the requirements of Chapter 14A of the Listing Rules which would otherwise apply to certain connected transactions, including transactions with associates of the Government (such as KCRC) and Octopus Cards. The Waiver is subject to certain conditions. Following a written submission by the Company to the Stock Exchange, the Stock Exchange has updated the Waiver to reflect the Adjustments. Accordingly, the Waiver which previously related to Octopus Cards now also relates to (i) transactions between the Company and OHL, Octopus Cards and their respective subsidiaries and (ii) transactions between KCRC and OHL, Octopus Cards and their respective subsidiaries.

Under the Waiver (as adjusted), the Company is required to disclose details of the Adjustments which involve KCRC, OHL and Octopus Cards in its next annual report in accordance with Rule 14A.45 of the Listing Rules. The Company is also required under the Waiver to make those Adjustments subject to the approval of the Board of Directors, with the Directors appointed by the Government under section 8 of the Mass Transit Railway Ordinance (Cap. 556) and any Director who holds a position in the Government being required to abstain from voting. The Board of Directors of the Company approved the Adjustments at a Board meeting on 13 July 2005.

Under Chapter 14A of the Listing Rules (which is still relevant because the Waiver does not apply to transactions with KMB), the Company is required to make an announcement of the Adjustments in accordance with Rule 14A.47 of the Listing Rules.

This announcement is made in accordance with the conditions of the Waiver (as adjusted) and Rule 14A.47 of the Listing Rules. Details of the Adjustments will be disclosed in the next annual report of the Company in accordance with the conditions of the Waiver (as adjusted) and Rule 14A.45 of the Listing Rules.

Principal activities of the Company

The principal activities of the Company and its subsidiaries are (a) the operation of a mass transit railway system, (b) property development relating to the railway, (c) related commercial activities, (d) the construction of Disneyland Resort Line (formerly known as Penny’s Bay Rail Link), (e) the design, construction and operation of the Tung Chung Cable Car Project and related tourist development, (f) the planning and construction of future extensions to the railway system and other related infrastructure projects, (g) consultancy services, (h) the operation of a smart card system by Octopus Cards, and (i) equity investments and long term operation and maintenance contracts outside Hong Kong.

Definitions

| | |

| “Adjustments” | | means the adjustments to the arrangements relating to Octopus Cards, as described under the heading “The Adjustments – Connected Transactions”; |

| |

| “Agreements” | | means the Sale and Purchase Agreement, the Shareholders’ Agreement and the Subordinated Loan Agreement; |

| |

| “Citybus” | | means Citybus Limited, which operates a public bus franchise; |

| |

| “Directors” | | means members of the board of directors of the Company; |

| |

| “Government” | | means the Government of the Hong Kong Special Administrative Region of the People’s Republic of China; |

| |

| “KCRC” | | means Kowloon-Canton Railway Corporation, which operates the Kowloon-Canton rail franchise; |

| |

| “KMB” | | means KMB Public Bus Services Holdings Limited, which operates a public bus franchise; |

| | |

| “Listing Rules” | | means the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited; |

| |

| “NWFB” | | means New World First Bus Services Limited, which operates a public bus franchise; |

| |

| “OBV” | | means Octopus Cards (NL) B.V., which manages the project to introduce a smart card system in the Netherlands; |

| |

| “Octopus Cards” | | means Octopus Cards Limited, which operates a contactless smartcard ticketing system in Hong Kong; |

| |

| “Octopus Connect” | | means Octopus Connect Limited, which provides customer relationship management services; |

| |

| “OHL” | | means Octopus Holdings Limited, which is the holding company of Octopus Cards; |

| |

| “OIL” | | means Octopus Investments Limited, which is an investment holding company; |

| |

| “OKL” | | means Octopus Knowledge Limited, a holding company for international automatic fare collection consultancy projects; |

| |

| “OND” | | means Octopus Netherlands Limited, which provides consultancy services on introducing a smart card system in the Netherlands; |

| |

| “ORL” | | means Octopus Rewards Limited, which will develop and operate a common loyalty programme; |

| |

“Sale and Purchase Agreement” | | means the sale and purchase agreement dated 21 October 2005 between, inter alios, the Company, KCRC, KMB, Citybus, NWFB and OHL in relation to the entire issued share capital of Octopus Cards; |

| |

“Shareholders’ Agreement” | | means the shareholders’ agreement dated 21 October 2005 between, inter alios, the Company, KCRC, KMB, Citybus and NWFB in respect of OHL; |

| |

| “Stock Exchange” | | means The Stock Exchange of Hong Kong Limited; |

| |

“Subordinated Loan Agreement” | | means the subordinated loan agreement dated 21 October 2005 between, inter alios, the Company, KCRC, KMB, Citybus, NWFB and OHL; and |

| |

| “Waiver” | | means the waiver granted by the Stock Exchange to the Company from the requirements under Chapter 14A of the Listing Rules (subject to certain conditions) as announced on 13 January 2005. |

By Order of the Board

Leonard Bryan Turk

Secretary

Hong Kong, 24 October 2005

Members of the Board:Dr. Raymond Ch’ien Kuo-fung(Chairman)**, Chow Chung-kong(Chief Executive Officer), Professor Cheung Yau-kai*, David Gordon Eldon*, Christine Fang Meng-sang*, Edward Ho Sing-tin*, Lo Chung-hing*, T. Brian Stevenson*, Frederick Ma Si-hang (Secretary for Financial Services and the Treasury)**, Secretary for the Environment, Transport and Works (Dr. Sarah Liao Sau-tung)** and Commissioner for Transport (Alan Wong Chi-kong)**

Members of the Executive Directorate: Chow Chung-kong, Russell John Black, William Chan Fu-keung, Philip Gaffney, Thomas Ho Hang-kwong, Lincoln Leong Kwok-kuen, Francois Lung Ka-kui, Andrew McCusker and Leonard Bryan Turk

| * | independent non-executive Directors |

| ** | non-executive Directors |

This announcement is made in English and Chinese. In the case of any inconsistency, the English version shall prevail.