UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ Confidential, for Use of the Commission Only |

(as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Under Rule 14a-12 |

MeadWestvaco Corporation

(Name of Registrant as Specified In Its Certificate)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

March 18, 2003

Dear Fellow Shareholders:

You are cordially invited to join us at the 2003 Annual Meeting of Shareholders of MeadWestvaco Corporation. The meeting will begin at 10:00 a.m., local time, on Tuesday, April 22, 2003. The meeting will take place in the Astor Room of the Inter-Continental Barclay Hotel, 111 East 48th Street, in New York City.

Please vote on all matters listed in the enclosed Notice of 2003 Annual Meeting of Shareholders. This year our proxy material includes two proposals. Your Board of Directors recommends votingFOR Proposal 1, the election of our directors, andFOR Proposal 2, the ratification of the appointment of our independent auditors.

Your interest in your company as demonstrated by the representation of your shares at our Annual Meeting is a great source of strength for your company. Your vote is very important to us and, accordingly, whether or not you expect to attend the meeting, we ask that you sign, date and promptly return the enclosed proxy.

Very truly yours,

John A. Luke, Jr.

Chairman, President and

Chief Executive Officer

Notice of 2003 Annual Meeting of Shareholders

and Proxy Statement

The 2003 Annual Meeting of Shareholders of MeadWestvaco Corporation will be held in the Astor Room of the Inter-Continental Barclay Hotel, 111 East 48th Street, in New York City, on Tuesday, April 22, 2003, at 10:00 a.m., local time. Shareholders will be asked to vote on the following matters:

| 1. | | To elect six directors for terms of three years each; |

| 2. | | To consider and vote upon a proposal to ratify the action of the Audit Committee of the Board of Directors in appointing PricewaterhouseCoopers LLP as independent auditors for the corporation for the year 2003; and |

| 3. | | To transact such other business as may properly come before the Annual Meeting. |

All holders of common stock of record at the close of business on March 3, 2003 will be entitled to receive notice of and to vote at the Annual Meeting and at any adjournment or postponement. A list of those shareholders will be available for inspection at the executive offices of MeadWestvaco and will also be available for inspection at the Annual Meeting.Whether or not you expect to be at the meeting, please sign, date and promptly return the enclosed proxy.

By Order of the Board of Directors

Wendell L. Willkie, II

Senior Vice President, General Counsel and Secretary

March 18, 2003

Proxy Statement

MeadWestvaco Corporation

World Headquarters

One High Ridge Park

Stamford, Connecticut 06905

Your Board of Directors is providing you with this Proxy Statement in connection with the Board’s solicitation of proxies for the Annual Meeting of Shareholders of MeadWestvaco Corporation (“MeadWestvaco” or the “company”) to be held on April 22, 2003. On or about March 18, 2003, we will mail the Proxy Statement, a proxy card, and the Annual Report of MeadWestvaco for the year 2002 to shareholders of record of MeadWestvaco common stock at the close of business on March 3, 2003. Although the Annual Report and Proxy Statement are being mailed together, the Annual Report should not be deemed to be part of the Proxy Statement.

Who is entitled to vote at the meeting?

Only holders of record of MeadWestvaco’s common stock at the close of business on March 3, 2003 will be entitled to vote.

What are the voting rights of the holders of MeadWestvaco common stock?

Each share of outstanding common stock will be entitled to one vote on each matter considered at the meeting.

Who can attend the meeting?

Attendance at the meeting will be limited to holders of record as of March 3, 2003, or their authorized representatives (not to exceed one per shareholder), management, the board and guests of management.

What constitutes a quorum?

The presence, in person or by proxy, of the holders of a majority of the votes entitled to be cast at the Annual Meeting is necessary to constitute a quorum. As of the record date, March 3, 2003, 200,384,293 shares of MeadWestvaco common stock, representing the same number of votes, were outstanding. Therefore, the presence of the holders of common stock representing at least 100,192,147 votes will be required to establish a quorum.

How do I vote?

It is important that your stock be represented at the meeting. Whether or not you plan to attend, please sign, date and return the enclosed proxy promptly in order to be sure that your shares will be voted. If you are a registered shareholder and attend the meeting, you may deliver your completed proxy card in person. “Street name” shareholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares.

Can I vote by telephone or electronically?

If you are a registered shareholder (that is, if you hold your stock in certificate form, in safekeeping or if you participate in the MeadWestvaco Savings Plan), you may vote by telephone, or electronically through the Internet, by following the instructions included with your proxy card. The deadline for voting by telephone or electronically is 11:59 p.m., Eastern Daylight Savings Time, on April 21, 2003. If your shares are held in “street name”, please check your proxy card or contact your broker or nominee to determine whether you will be able to vote by telephone or electronically.

Can I change my vote after I return my proxy card?

Yes. You may revoke your proxy at any time before it is voted at the meeting by submitting a written revocation or a new proxy to the Secretary of MeadWestvaco, or by attending and voting at the Annual Meeting.

1

What vote is required to approve each item?

Election of Directors. The six director nominees receiving the highest number of all votes cast for directors will be elected. A properly executed proxy marked “Withhold Authority” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum.

Other Items. The affirmative vote of a majority of the votes cast by the holders of common stock is required to approve the other matters to be acted upon at the Annual Meeting. A properly executed proxy marked “Abstain” with respect to any such matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if you do not give your broker or nominee specific instructions, your shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. Shares represented by such “broker non-votes”, however, will be counted in determining whether there is a quorum.

What are the Board’s recommendations?

All shares of MeadWestvaco common stock entitled to vote and represented by properly executed proxies received prior to the Annual Meeting, and not revoked, will be voted as instructed on those proxies. If no instructions are indicated, the shares will be voted as recommended by the Board of Directors. The Board’s recommendation is set forth together with the description of each item in this proxy statement. In summary, the Board recommends a vote:

| | • | | FOR election of the nominated slate of directors (see Item 1); and |

| | • | | FOR ratification of the appointment of PricewaterhouseCoopers LLP as the company’s independent auditors for 2003 (see Item 2). |

If any other matters are properly presented at the Annual Meeting for consideration, the persons named in the enclosed form of proxy will have discretion to vote on those matters in accordance with their own judgment to the same extent as the person signing the proxy would be entitled to vote. The company does not currently anticipate that any other matters will be raised at the Annual Meeting.

2

Ownership of Directors and Executive Officers

How much stock do the company’s directors and executive officers own?

The following table shows the amount of MeadWestvaco common stock beneficially owned, unless otherwise indicated, by our directors, the executive officers named in the Summary Compensation Table below and the directors and executive officers as a group. Except as otherwise indicated and subject to applicable community property laws, each owner has sole voting and investment powers with respect to the securities listed.

Name

| | Shares Beneficially Owned (1)

| | Options Exercisable Within 60 Days

| | Percent of Shares

| |

Directors | | | | | | | |

John G. Breen (2) | | 17,415 | | 6,363 | | * | |

Michael E. Campbell (2) | | 8,290 | | 7,320 | | * | |

Dr. Thomas W. Cole, Jr. (2) | | 13,674 | | 13,140 | | * | |

Duane E. Collins (2) | | 10,442 | | 4,330 | | * | |

William E. Hoglund (2)(3) | | 15,467 | | 6,363 | | * | |

James G. Kaiser (2) | | 11,951 | | 6,363 | | * | |

Richard B. Kelson (2) | | 3,539 | | 2,955 | | * | |

John A. Krol (2) | | 12,230 | | 6,363 | | * | |

Susan J. Kropf (2) | | 12,315 | | 6,363 | | * | |

Douglas S. Luke (2) (4) | | 63,299 | | 10,230 | | * | |

John A. Luke, Jr. (5). | | 1,042,742 | | 904,515 | | * | |

Robert C. McCormack (2) | | 5,842 | | 2,955 | | * | |

Lee J. Styslinger, Jr. (2) | | 54,102 | | 6,363 | | * | |

Jane L. Warner (2) | | 10,886 | | 7,999 | | * | |

J. Lawrence Wilson (2) | | 13,093 | | 5,720 | | * | |

Richard A. Zimmerman (2) | | 17,581 | | 13,140 | | * | |

|

Other Named Executive Officers | | | | | | | |

James A. Buzzard (6) | | 237,682 | | 213,390 | | * | |

Rita V. Foley (6) | | 79,840 | | 77,597 | | * | |

Raymond W. Lane (6) | | 369,436 | | 321,696 | | * | |

Karen R. Osar (6) | | 96,672 | | 92,147 | | * | |

Jerome F. Tatar (6) | | 918,185 | | 834,004 | | * | |

All Directors and Executive Officers as a Group (29) | | 3,945,447 | | 3,390,078 | | 2 | % |

| * | | Less than 1% of MeadWestvaco common stock. |

| (1) | | Information concerning beneficial ownership of shares is as of March 1, 2003, the most recent practicable date. Includes the number of shares of which such person has the right to acquire beneficial ownership as of March 1, 2003, and which such person has the right to acquire beneficial ownership of within 60 days thereafter (such shares are also set forth in the column “Options Exercisable Within 60 Days”). |

| (2) | | Each non-employee director holds 938.325 stock units (representing the same number of shares of MeadWestvaco common stock) granted under the MeadWestvaco Corporation Compensation Plan for Non-Employee Directors. The rights of each non-employee director in respect of these stock units are vested at all times, and distributions of the stock units are required to be made in MeadWestvaco common stock on the earliest practicable date following the end of the calendar quarter in which the director’s board membership is terminated. |

| (3) | | Includes 2,000 MeadWestvaco shares held indirectly through an IRA. |

| (4) | | Includes 23,278 MeadWestvaco shares held in a trust of which Mr. Luke is a co-trustee. |

| (5) | | Includes 25,787 MeadWestvaco shares held indirectly through employee benefit plans and 20,188 shares held in trust for members of Mr. Luke’s immediate family. |

| (6) | | Includes MeadWestvaco shares held indirectly through employee benefit plans by Messrs. Tatar, Buzzard, Lane, and Mses. Osar and Foley in the amounts of 5,794 shares, 16,836 shares, 5,588 shares, 2,025 shares and 2,243 shares, respectively. |

3

Ownership of Certain Beneficial Owners

Who are the largest owners of the company’s stock?

The following investment advisers are believed to have beneficial ownership (as defined for certain purposes by the Securities and Exchange Commission) of more than 5% of the company’s common stock by virtue of having investment authority and, to some extent, voting authority over the number of shares indicated.

| | | Shares

| | Percent

of Class*

|

AXA Financial, Inc. and related entities** 1290 Avenue of the Americas New York, NY 10104 | | 26,412,444 | | 13.2% |

|

Capital Research and Management Company*** 333 South Hope Street Los Angeles, CA 90071 | | 22,401,010 | | 11.2% |

| ** | | Based on Schedule 13G/A filed by AXA Financial, Inc. and related entities on February 12, 2003. |

| *** | | Based on Schedule 13G/A filed by Capital Research and Management Company on February 13, 2003. |

The MeadWestvaco stock ownership plans for salaried and hourly employees held, as of March 3, 2003, an aggregate amount of 20,813,519 MeadWestvaco shares, or 10.4% of the total outstanding, for which full voting rights are exercisable by members of the plans. As of that date, there were approximately 22,966 participants in these plans.

Corporate Governance

1. Election of directors

Six directors will be elected to hold office for the terms set forth below and, in all cases, until their successors are elected and shall qualify. There is no provision for cumulative voting in the election of directors. At the meeting, one of the persons named in the enclosed proxy (or a substitute) will, if authorized, vote the shares covered by such proxy for election of the six nominees for directors listed on the following page.

The present nominees, John G. Breen, James G. Kaiser, Richard B. Kelson, John A. Krol, John A. Luke, Jr., and Richard A. Zimmerman, if elected, will be elected for terms expiring at the 2006 Annual Meeting of Shareholders.The Board of Directors unanimously recommends a vote FOR the named nominees. Should any of these nominees become unavailable for election for any reason presently unknown, a person named in the enclosed proxy (or a substitute) will vote for the election of such other person or persons, if any, as the Board of Directors may recommend.

William E. Hoglund, Douglas S. Luke, Robert C. McCormack, Lee J. Styslinger, Jr., and Jane L. Warner will continue to serve for a term expiring at the 2004 Annual Meeting. Michael E. Campbell, Dr. Thomas W. Cole, Jr., Duane E. Collins, Susan J. Kropf, and J. Lawrence Wilson, will continue to serve for a term expiring at the 2005 Annual Meeting.

4

All of the preceding 16 persons currently serve as directors of MeadWestvaco and have done so since the combination of Mead and Westvaco was completed in January 2002. Set forth below is the principal occupation of, and certain other information regarding the nominees and the other directors.

Nominees for Election as Directors

for a Term of Three Years Expiring in 2006

Name

| | Age*

| | Director of MeadWestvaco Since

|

JOHN G. BREEN | | 68 | | 2002 |

|

Chairman, The Sherwin-Williams Company, 1980-2000; Chief Executive Officer, 1979-1999. Director: Parker Hannifin Corporation, Goodyear Tire & Rubber Company, The Stanley Works, The Sherwin-Williams Company, The Armada Fund. | | | | |

|

JAMES G. KAISER | | 60 | | 2002 |

|

Chairman and Chief Executive Officer, Avenir Partners, Inc., since 1998. President and Chief Executive Officer, Quanterra Incorporated, 1994-1996. Director: Sunoco, Inc., Toyota Lexus Minority Dealers Association, Kaiser Services LLC, Pelican Banners and Signs, Inc. | | | | |

|

RICHARD B. KELSON | | 56 | | 2002 |

|

Executive Vice President and Chief Financial Officer, Alcoa, Inc., since 1997; Executive Vice President, Environment, Health and Safety and General Counsel, 1994-1997. Director: PNC Financial Services. Trustee: Carnegie Mellon University. | | | | |

|

JOHN A. KROL | | 66 | | 2002 |

|

Chairman of E.I. du Pont de Nemours and Company, 1997-1998; Chief Executive Officer, 1995-1998; President, 1995-1997. Director: Armstrong World Industries, Inc., Milliken & Company, Inc., ACE Insurance, Ltd., Tyco International Ltd. Trustee: University of Delaware. | | | | |

|

JOHN A. LUKE, JR. | | 54 | | 2002 |

|

Chairman, President and Chief Executive Officer, MeadWestvaco Corporation, since 2002. Chairman, President and Chief Executive Officer, Westvaco Corporation, 1996-2002; President and Chief Executive Officer, 1992-1996. Director: American Forest and Paper Association, The Bank of New York, The Timken Company, Factory Mutual Insurance Company, United Negro College Fund. Trustee: Lawrence University, American Enterprise Institute for Public Policy Research. Governor: National Council for Air and Stream Improvement, Inc. | | | | |

|

RICHARD A. ZIMMERMAN | | 70 | | 2002 |

|

Chairman and Chief Executive Officer, Hershey Foods Corporation, 1985-1993. Director: Stabler Companies, Inc. Trustee: United Theological Seminary. | | | | |

* Ages of directors are as of March 1, 2003. | | | | |

5

Directors Whose Terms Expire in 2004

Name

| | Age*

| | Director of MeadWestvaco Since

|

WILLIAM E. HOGLUND | | 68 | | 2002 |

|

Director and Executive Vice President, Corporate Affairs and Staff Support Group, General Motors Corporation, 1992-1995. Trustee: The Sloan Foundation, Capital Automotive REIT. | | | | |

|

DOUGLAS S. LUKE | | 61 | | 2002 |

|

President and Chief Executive Officer, HL Capital, Inc., since 1999, a private investment company with diversified interests in marketable securities and private equities. President and Chief Executive Officer, WLD Enterprises, Inc., 1991-1998, a private investment company with generally similar interests. Director: Regency Centers Corporation. Trustee: National Outdoor Leadership School. | | | | |

|

ROBERT C. McCORMACK | | 63 | | 2002 |

|

Partner, Trident Capital, a private equity investment firm, since 1993. Assistant Secretary of the Navy (Financial Management) and Comptroller of the Navy, 1990-1993. Director: DeVry, Inc., Illinois Tool Works, Inc., The Northern Trust Corporation, CCBN.com, The Revere Group, The Rehabilitation Institute of Chicago. | | | | |

|

LEE J. STYSLINGER, JR. | | 69 | | 2002 |

|

Chairman, ALTEC Industries, Inc., since 1989. Director: Global Rental Company, Jemison Investment Company, Inc., Electronic Healthcare Systems. | | | | |

|

JANE L. WARNER | | 56 | | 2002 |

|

President, EDS Global Manufacturing and Communications Industries, since 2002; Managing Director, 2000-2002. President, Kautex Textron, North America, 1998-1999. Executive Vice President, Textron Automotive Company, 1994-1999. Director: Original Equipment Supplies Association. Trustee: Kettering University. | | | | |

* Ages of directors are as of March 1, 2003. | | | | |

6

Directors Whose Terms Expire in 2005

Name

| | Age*

| | Director of MeadWestvaco Since

|

MICHAEL E. CAMPBELL | | 55 | | 2002 |

|

Chairman, President and Chief Executive Officer, Arch Chemicals, Inc., since 1999. Executive Vice President, Olin Corporation, 1996-1999. Director: American Chemistry Council. | | | | |

|

DR. THOMAS W. COLE, JR. | | 62 | | 2002 |

|

President Emeritus since 2002 and President, Clark Atlanta University, 1989-2002. Chancellor, West Virginia Board of Regents, 1986-1988; President, West Virginia State College, 1982-1986. Trustee: Knoxville College, Africa University, Andrews College. | | | | |

|

DUANE E. COLLINS | | 66 | | 2002 |

|

Chairman, Parker Hannifin Corporation, since 1999; Chief Executive Officer, 1993-2001; President, 1993-2000. Director: National City Corporation, The Sherwin-Williams Company, MTD Holdings Inc. | | | | |

|

SUSAN J. KROPF | | 54 | | 2002 |

|

President and Chief Operating Officer, Avon Products, Inc., since 2001; Chief Operating Officer, North America and Global Business Operations, 1999-2001; Executive Vice President and President, North America, 1998-1999; Executive Vice President and President, Avon U.S., 1997-1998. Director: Avon Products, Inc., The Sherwin-Williams Company, Wallace Reader’s Digest Funds. | | | | |

|

J. LAWRENCE WILSON | | 66 | | 2002 |

|

Chairman and Chief Executive Officer, Rohm and Haas Company, 1988-1999. Director: Cummins Inc., The Vanguard Group of Investment Companies, AmerisourceBergen Corporation. | | | | |

* Ages of directors are as of March 1, 2003. | | | | |

7

Director Compensation

How are directors compensated?

Each non-employee director of MeadWestvaco receives $30,000 as an annual payment for services as a director, $1,500 per meeting for attendance at meetings of the Board, and $1,200 per meeting for attendance at Committee meetings of the Board. Committee Chairmen receive an additional $4,000 annual payment. Board members may elect to defer this compensation under the MeadWestvaco Corporation Compensation Plan for Non-Employee Directors. Directors have the opportunity to defer all or a portion of their cash annual retainer and meetings’ fees into 10 phantom investment funds. Directors who are also employees of the company receive no additional compensation for service as a director.

Each year, non-employee directors receive a grant of (1) options to purchase 1,500 shares of the company’s common stock and (2) stock units equivalent to $30,000 at the time of grant.

How often did the Board meet during 2002?

During 2002, the Board of Directors of MeadWestvaco met eight times, and no incumbent director attended fewer than 83% percent of the aggregate of: (1) the total number of meetings of the Board of Directors held in 2002 while he or she was a director and (2) the total number of meetings held in 2002 by all committees of the Board of Directors on which he or she served while he or she was a director.

8

Board Committees

What committees has the Board established?

MeadWestvaco currently has five principal standing committees of the Board of Directors: Audit; Compensation and Organization Development; Finance; Nominating and Governance; and Safety, Health and Environment. MeadWestvaco also has an Executive Committee that may be convened under certain circumstances when a special meeting of the Board is not practical or is not warranted.

The current members of the Board committees are as follows:

Audit | | Finance |

Michael E. Campbell, Chairman | | Douglas S. Luke, Chairman |

Duane E. Collins | | John G. Breen |

James G. Kaiser | | Michael E. Campbell |

Richard B. Kelson | | William E. Hoglund |

Lee J. Styslinger, Jr. | | Robert C. McCormack |

Jane L. Warner | | J. Lawrence Wilson |

(all non-employee directors) | | (all non-employee directors) |

|

Compensation and Organization Development | | Nominating and Governance |

John G. Breen, Chairman | | Richard A. Zimmerman, Chairman |

Dr. Thomas W. Cole, Jr. | | William E. Hoglund |

Duane E. Collins | | John A. Krol |

Susan J. Kropf | | Susan J. Kropf |

Robert C. McCormack | | Douglas S. Luke |

Lee J. Styslinger, Jr. | | J. Lawrence Wilson |

Richard A. Zimmerman | | (all non-employee directors) |

(all non-employee directors) | | |

|

Executive | | Safety, Health and Environment |

John A. Luke, Jr., Chairman | | John A. Krol, Chairman |

John G. Breen | | Dr. Thomas W. Cole, Jr. |

Michael E. Campbell | | James G. Kaiser |

John A. Krol | | Richard B. Kelson |

Douglas S. Luke | | Jane L. Warner |

Richard A. Zimmerman | | (all non-employee directors) |

The functions of the current Board committees are as follows:

Audit Committee

Assists the Board of Directors in fulfilling its responsibilities to shareholders, potential shareholders and the investment community relating to corporate accounting, reporting practices of the company and the quality and integrity of the financial reports of the company. The Committee assists the Board of Directors in reviewing and monitoring (1) the integrity of the financial statements of the company, (2) the compliance by the company with legal and regulatory requirements, (3) the independence and qualifications of the company’s independent auditors and (4) the performance of the company’s internal audit function and independent auditors. The Audit Committee also has sole authority to appoint and replace the independent auditors, subject to shareholder ratification. All members are “financially literate” under New York Stock Exchange listing standards, and at least one member has such accounting or related financial management expertise as to be considered a “financial expert” under Securities and Exchange Commission rules. The Board has designated the Audit Committee Chair, Michael E. Campbell, and Richard B. Kelson as “financial experts” as a result of their experience in senior corporate executive positions with financial oversight responsibilities, including as Chief Executive Officer of Arch Chemicals, Inc.

9

and Executive Vice President and Chief Financial Officer of Alcoa, Inc., respectively. The Audit Committee met six times in 2002. A copy of the Amended Audit Committee Charter is included in this Proxy Statement as Exhibit A.

Compensation and Organization Development Committee

Reviews and approves the company’s compensation philosophy. It is charged with the responsibility for assuring that officers and key management personnel are effectively compensated in terms that are motivating, externally competitive and internally equitable. The Committee approves compensation of senior management, sets the criteria for awards under incentive compensation plans and determines whether such criteria have been met. The Committee generally oversees policies and practices of the company that advance its organizational development, including those designed to achieve the most productive engagement of the company’s workforce and the attainment of greater diversity. The Compensation and Organization Development Committee met seven times in 2002. Please refer to the report of the Compensation and Organization Development Committee that follows this section.

Executive Committee

Provides for the exercise of certain powers of the Board between meetings of the Board when a special meeting of the Board is not practical or is not warranted. The Executive Committee did not meet in 2002.

Finance Committee

Oversees the company’s financial affairs and recommends those financial actions and policies that are most appropriate to accommodate the company’s operating strategies while maintaining a sound financial condition. The Committee reviews the company’s financial forecasts and budgets as well as strategic actions proposed by the company��s management. The Committee also reviews funding recommendations concerning the salaried and hourly pension plans together with the investment performance of such plans and the company’s risk management policies and practices. The Finance Committee met three times in 2002.

Nominating and Governance Committee

Studies and makes recommendations concerning the qualifications of all directors, selects and recommends candidates for election and re-election to the Board, and persons to fill vacancies on the Board, as well as the compensation paid to non-employee directors. The Committee also reviews and considers other matters of corporate governance, including trends and emerging expectations, as well as what may be deemed best practices. In advising the Board and management, the Committee may consider a range of governance matters, including Board structure, Board composition, committees and criteria for committee appointment, Board meeting policies, and the ongoing relationship between the Board and management. The Committee will consider nominees for directors recommended by shareholders of MeadWestvaco. The Nominating & Governance Committee met three times in 2002.

Safety, Health and the Environment Committee

Reviews implementation of the company’s workplace safety and health program. The Committee also reviews the stewardship of the company with respect to conservation of natural resources and its ability to protect the natural environment. The Committee receives regular reports from management, reviews safety, health and environmental matters with management, and makes recommendations as needed. The Safety, Health & Environment Committee met three times in 2002.

10

Corporate Governance Principles

In February 2003, the Board of Directors adopted MeadWestvaco’sCorporate Governance Principles, addressing, among other things, standards for evaluating the independence of the company’s directors. The full text of thePrinciples can be found in the Investor Information section of the company’s website. A copy may also be obtained free of charge upon request from the company’s Corporate Secretary.

Pursuant to thePrinciples, the Board, with the support of the Nominating and Governance Committee, undertook a review of director independence in February 2003. During this review the Board considered transactions and relationships during the prior year between each director or any member of his or her immediate family and the company and its subsidiaries, including those reported under “Certain Relationships and Related Transactions” below. As provided in thePrinciples, the purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent.

As a result of this review, the Board affirmatively determined that all of the directors are independent of the company under the standards set forth in theCorporate Governance Principles, with the exception of John A. Luke, Jr., the Chairman and Chief Executive Officer of the company.

As of November 2002, the non-management directors meet in executive session after each regularly scheduled Board meeting. The director who presides at these meetings is chosen by rotation from among the chairmen of the Board’s five principal standing committees. The presiding director is responsible for chairing the executive sessions and providing appropriate reports to the Chief Executive Officer. Shareholders and other parties interested in communicating directly with the non-management directors as a group will be able to do so by contacting the Chairman of the Audit Committee of the Board of Directors by email, regular mail or telephone as shall be posted on the company’s internet website in the coming weeks.

Certain Relationships and Related Transactions

The Board, at the recommendation of the Nominating and Governance Committee, has determined that all of the non-employee directors are independent of the company under the standards set forth in theCorporate Governance Principles. None of the company’s non-employee directors are executive officers at a company where the annual sales to, or purchases from, MeadWestvaco are greater than one percent of either MeadWestvaco’s 2002 annual revenues or the 2002 annual revenues of the company at which he or she serves as an executive officer. MeadWestvaco regularly enters into transactions in the ordinary course of business with companies at which some of its directors serve as executive officers, including Arch Chemicals, Inc., where Michael E. Campbell is Chairman and Chief Executive Officer, Avon Products, Inc., where Susan J. Kropf is President and Chief Operating Officer, and Alcoa, Inc., where Richard B. Kelson is Executive Vice President and Chief Financial Officer. MeadWestvaco believes that the terms of these transactions are no more or less favorable to MeadWestvaco than the terms of any other arms-length transaction, and MeadWestvaco does not believe that its non-employee directors have any direct or indirect material interest in any of these transactions. None of the company’s non-employee directors serve as officers, directors or trustees of a charitable organization where the company’s charitable contributions to the organization are greater than one percent of that organization’s total annual operating budget. Dr. Thomas W. Cole, Jr., is the President Emeritus of Clark Atlanta University. In 2002, the Westvaco Foundation (a charitable trust established by the company) made the fourth annual installment in a six-year pledge to Clark Atlanta University. Douglas S. Luke is a distant relative of John A. Luke, Jr., the Chairman and Chief Executive Officer of the company. Douglas S. Luke is not an “immediate family member” of John A. Luke, Jr., under the independence standards set forth in the company’sCorporate Governance Principles.

11

Report of the Audit Committee of the Board of Directors

Membership and Role of the Audit Committee

The Audit Committee consists of six members of the company’s Board of Directors. Each member of the Audit Committee is independent and possesses other qualifications as required by the New York Stock Exchange. All of the members of the Audit Committee, moreover, are independent of the Company under the standards set forth in theCorporate Governance Principles. The Audit Committee operates under a written charter adopted by the Board of Directors and amended and restated as of January 28, 2003, which is included in this Proxy Statement as Exhibit A.

The primary function of the Audit Committee is to assist the Board of Directors in reviewing and monitoring (1) the integrity of the financial statements of the company, (2) the compliance by the company with legal and regulatory requirements, (3) the independence and qualifications of the company’s independent auditors and (4) the performance of the company’s internal audit function and independent auditors.

Review of the Company’s Audited Financial Statements for the Year Ended December 31, 2002

Management is responsible for the financial reporting process, including the system of internal control, and for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. PricewaterhouseCoopers LLP, the company’s independent auditors for 2002, is responsible for auditing those financial statements. The Audit Committee discussed with PricewaterhouseCoopers LLP the matters that are required to be discussed byStatement on Auditing Standards No. 61 as amended (Communication with Audit Committees). The Audit Committee also received the written disclosures and the letter from PricewaterhouseCoopers LLP required byIndependence Standards Board Standard No. 1 (Independence Discussion with Audit Committees), and has discussed with PricewaterhouseCoopers LLP the independence of PricewaterhouseCoopers LLP from MeadWestvaco and its management. The Audit Committee has reviewed and discussed the audited financial statements with management.

The Audit Committee met six times in 2002. The Audit Committee met in executive sessions with the independent auditor and the director of internal audit three times in 2002 to review, among other things, staffing, the audit plan and reports on effectiveness of internal financial controls.

The Audit Committee of MeadWestvaco reviewed and discussed the foregoing as reflected in the minutes of the Audit Committee, and on the basis of that review and those discussions, recommended to the Board of Directors that the audited financial statements of MeadWestvaco for the year ended December 31, 2002 be included in the Annual Report on Form 10-K for the year ended December 31, 2002 for filing by MeadWestvaco with the United States Securities and Exchange Commission.

12

PricewaterhouseCoopers LLP received the following fees from MeadWestvaco in the year ended December 31, 2002 and the fiscal year ended October 31, 2001 and the two-month transition period ended December 31, 2001:

| | | Year ended December 31, 2002

| | Year ended October 31, 2001 and two-month transition period ended December 31, 2001

|

Audit fees | | $ | 3,620,000 | | $ | 2,974,000 |

| | |

|

| |

|

|

Audit-related fees | | | | | | |

Audits of employee benefit plans | | $ | 300,000 | | $ | 102,000 |

Other attest services | | | 120,000 | | | 52,000 |

Divestiture audit | | | 210,000 | | | |

SAP control review | | | 156,000 | | | |

Merger and acquisition related accounting matters | | | | | | 584,000 |

Other audit-related | | | 37,000 | | | |

| | |

|

| |

|

|

Total audit-related fees | | $ | 823,000 | | $ | 738,000 |

| | |

|

| |

|

|

Tax fees | | | | | | |

Tax archiving and warehousing system | | $ | 670,000 | | | |

Tax compliance and other matters | | | 500,000 | | $ | 476,000 |

| | |

|

| |

|

|

Total tax fees | | $ | 1,170,000 | | $ | 476,000 |

| | |

|

| |

|

|

All other fees | | | | | | |

Sustainable Forestry Initiative audits | | | | | $ | 370,000 |

Controls evaluation and review | | $ | 200,000 | | | 729,000 |

| | |

|

| |

|

|

Total all other fees | | $ | 200,000 | | $ | 1,099,000 |

| | |

|

| |

|

|

The Audit Committee concluded that the provision of non-audit services in 2002 by PricewaterhouseCoopers LLP was compatible with their independence.

Submitted by:

Michael E. Campbell, Chairman | | Richard B. Kelson |

Duane E. Collins | | Lee J. Styslinger, Jr. |

James G. Kaiser | | Jane L. Warner |

2. Proposal to ratify appointment of independent auditors

The Audit Committee of the Board of Directors has appointed PricewaterhouseCoopers LLP to serve as independent auditors for the company for 2003 subject to approval by the shareholders at the 2003 Annual Meeting. PricewaterhouseCoopers LLP currently serves as the company’s independent auditors, and received $5,813,000 in fees and expenses during the year ended December 31, 2002. The Audit Committee has been advised by PricewaterhouseCoopers LLP that neither the firm, nor any of its partners or staff, has any direct financial interest or material indirect financial interest in the company or any of its subsidiaries. Representatives of PricewaterhouseCoopers LLP plan to attend the Annual Meeting, will have an opportunity to make a statement if they desire and will be available to respond to appropriate questions. If the shareholders do not ratify this appointment, the Audit Committee will consider the appointment of other independent auditors.

The Board of Directors unanimously recommends a vote FOR the ratification of the appointment of PricewaterhouseCoopers LLP as independent auditors.

13

Executive Compensation

Report of the Compensation and Organization Development Committee

The Compensation and Organization Development Committee, a Board committee, consists of seven members of the company’s Board of Directors, none of whom is or has been at any time an employee of the company or its subsidiaries, and none of whom is receiving any compensation from the company or its subsidiaries other than as a director. All of the members of the Compensation and Organization Development Committee, moreover, are independent of the company under the standards set forth in theCorporate Governance Principles. The Committee is charged with the responsibility for assuring that the company’s executive officers are effectively compensated in terms that are motivating, externally competitive and internally equitable. The Committee is responsible for the consideration and approval of all compensation of senior management, setting the criteria for awards under incentive compensation plans and determining whether such criteria have been met, overseeing matters relating to the company’s stock option plans, and reviewing the management of, and proposed changes to, the company’s various employee benefit plans. In addition, the Committee oversees the development of the company leadership succession plan and employee relations strategies.

Compensation Philosophy

MeadWestvaco’s executive compensation programs are designed to give executives strong incentives to achieve the company’s business objectives thereby increasing the value of the company for its shareholders over the long term. The contribution of an individual to the execution of corporate strategies, and to the pursuit of these objectives, continues to be a principal basis upon which the Committee evaluates executive job performance and, therefore, is a significant factor in determining salaries, incentive awards, and grants of stock options. The company also views its compensation programs as critical tools to recruit and retain key executive talent.

The incentive compensation program includes annual and long-term performance-based incentives paid in cash, as well as equity-based compensation. The Committee believes that a significant portion of its senior executives’ compensation must reflect a focus on sustained operational excellence, reward competitive long-term financial results, and be linked to the returns realized by shareholders.

Total Compensation

In order to gauge the competitiveness of the company’s executive compensation program, management annually reviews the total compensation of executive officers, including the Chief Executive Officer, at comparable companies and the performance of those companies and compares it to the company’s executive compensation and performance. For 2002, this review compared the company to the eight companies that constituted the Dow Jones Paper Index and other companies comparable in size to MeadWestvaco. Management also assessed the individual performance and retention issues for each executive. Management reported the results of its competitiveness review and individual assessments to the Committee, and presented recommendations for adjustments to total compensation and the specific components thereof. In addition, the Committee reviewed compensation data of comparable companies supplied by an independent compensation consultant in making decisions with respect to compensation levels. Based upon management recommendations, as appropriate, and the data supplied by an independent consultant, the Committee established executive compensation levels for 2002, taking into account individual job performance, extraordinary efforts required in the merger integration process, and the competitive dynamics of executive recruitment and retention.

Cash Compensation

Cash compensation has three components: base salaries, annual incentive awards and long-term incentive awards. The amount of each of these components is established pursuant to the total compensation review process described above, taking into account the base salaries and annual and long-term awards paid by comparable companies and individual and company performance levels.

14

The company’s annual and long-term cash incentive compensation is paid pursuant to the MeadWestvaco Corporation Annual and Long-Term Incentive Plan, which has been approved by shareholders and which is designed to allow full deductibility of awards for federal income tax purposes. See “Deductibility of Executive Compensation” below. Both annual and long-term awards for the current year and for succeeding years may be earned by participants based upon the achievement of objective company performance goals established by the Committee every year, as well as upon their individual performance.

For 2002, the Committee established performance goals for annual incentives based upon measures that reflected the financial and operational priorities for the company which the Board had reviewed and approved. They included targets for operating income, capturing integration cost synergies, debt reduction, including a stronger capital structure and improved workplace safety. For long-term incentives, the Committee established performance goals based upon targeted improvements in capital strength, returns on capital employed and the performance of the company’s common stock relative to a group of paper and packaging industry peers.

After the end of 2002, the Committee reviewed the company’s performance as compared to these goals, and, based upon the annual and long-term incentive Plan formulas, approved awards of annual and potential long-term awards. The 2002 annual incentive awards were paid in February 2003. Potential long-term awards based upon 2002 performance were credited to the accounts of Plan participants in February of 2003. These awards will be eligible for payment over a period of three years subject to the Committee’s review and adjustment based upon the achievement of performance goals established by the Committee over such time period.

Equity-Based Compensation

In addition to the cash-based incentives described above, the Committee periodically makes grants of stock options to executives. Options are granted with an exercise price equal to the market price of the related shares on the date of grant, so that individuals receiving those grants benefit only if shareholders benefited through subsequent appreciation in the value of the related shares. In May 2002, the Committee approved a leadership stock option grant to 194 officers and salaried employees, including the Chief Executive Officer and Chairman. The purpose of this grant, which was the only broad-based employee stock option grant made in 2002, was to recognize the officers’ and employees’ contributions to bringing about the merger that created the company and to the integration process following the merger, and to create a direct tie between the interests of these key employees and the company’s shareholders.

Compensation for the Chairman and Chief Executive Officer

Jerome F. Tatar served as Chairman of the company until December 30, 2002, when Mr. Tatar retired and the company’s Chief Executive Officer, John A. Luke, Jr., succeeded him as Chairman. Like the other executives of the company, Mr. Tatar and Mr. Luke both received compensation for 2002 that included a base salary and incentive compensation. Specific performance criteria (as described under the heading “Cash Compensation” above) were established against which the Committee measured the performance of the Chairman and the Chief Executive Officer for purposes of determining their total compensation and their incentive compensation.

The company made important progress during the year against a backdrop of very difficult economic and marketplace conditions. The progress included the formation of a strong leadership team, business integration and above-target cost synergy capture, the development of strategies for each business and an improved capital structure. Despite this progress, operating income fell short of the company’s financial objectives. Workplace safety performance, while reflecting steady year-over-year improvement, was also below targeted levels.

In considering compensation and incentive awards, the Committee expressed good satisfaction that there had been notable progress against established targets. However, neither executive received a base salary increase in 2002 from his 2001 salary level. Their incentive compensation

15

was paid pursuant to the MeadWestvaco Corporation Annual and Long-Term Incentive Plan, as described above under “Cash Compensation.” Based upon performance measured against the goals established by the Committee and the terms of the Plan, the Committee approved the following cash incentive awards for 2002: for Mr. Luke, an annual incentive payment of $546,300 and a potential long-term incentive award credit in the amount of $504,200 for 2002, subject to review for performance in 2003 as described above; and for Mr. Tatar, an annual incentive payment of $546,300. In addition, in May 2002, as part of the leadership stock option grant described above, the Committee also granted stock options for 50,000 shares to Mr. Luke, and a similar grant for 50,000 shares to Mr. Tatar.

Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public companies for individual compensation over one million dollars per year paid to a company’s chief executive officer and to the four other most highly compensated executive officers. However, compensation paid based upon the achievement of objective performance goals under shareholder-approved arrangements is generally exempt from this limitation. The company’s incentive program was designed to comply with the requirements for this exemption, permitting full deductibility of all annual and long-term incentive compensation. The Committee does not currently believe that Section 162(m) will affect the company’s tax deductions for compensation in 2002. However, the Committee believes that the company’s compensation programs should be managed in the overall best interests of the company’s shareholders, and it therefore reserves the right to pay non-deductible compensation in the future.

Summary

The Committee believes the caliber and motivation of its executives and all of MeadWestvaco’s employees is extremely important to its ability to meet future challenges and to deliver long-term value to its shareholders. The Committee is convinced that this will continue to be the case in future years. The current compensation program delivers a mix of compensation elements for 2002 (base pay, annual incentive, long-term incentive, equity-based and deferral opportunities) that are effective tools in supporting leadership excellence. The Committee is confident that these elements are key in rewarding executives who contribute to the success of the company.

Submitted By: | | |

|

John G. Breen, Chairman | | Robert C. McCormack |

Dr. Thomas W. Cole, Jr. | | Lee J. Styslinger, Jr. |

Duane E. Collins | | Richard A. Zimmerman |

Susan J. Kropf | | |

Compensation Committee Interlocks and Insider Participation

The Compensation and Organization Development Committee currently consists of Mr. Breen as Chairman, Dr. Cole, Messrs. Collins, McCormack, Styslinger and Zimmerman and Ms. Kropf. None of our executive officers served as:

| | (i) | | a member of the compensation committee (or other board committee performing equivalent functions, or in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on our Compensation and Organization Development Committee; |

| | (ii) | | a director of another entity, one of whose executive officers served on our Compensation and Organization Development Committee; or |

| | (iii) | | a member of the compensation committee (or other board committee performing equivalent functions, or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served as our director. |

16

Total Shareholder Return

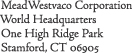

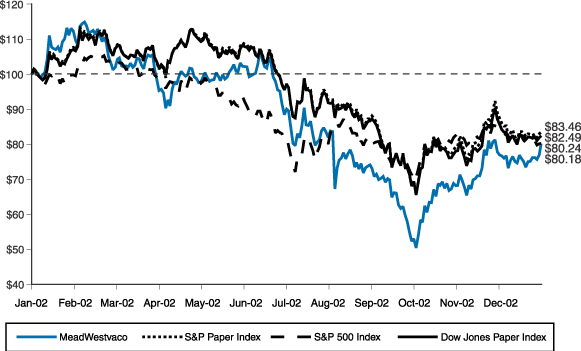

January 30, 2002-December 31, 2002

| | | MWV | | S&P Paper Index | | S&P 500 Index | | Dow Jones Paper Index |

|

Invest @ 1/30/02 | | $ | 100.00 | | $ | 100.00 | | $ | 100.00 | | $ | 100.00 |

|

Value @ 12/31/02 | | $ | 80.18 | | $ | 83.46 | | $ | 80.24 | | $ | 82.49 |

|

| | Data source: | | Standard & Poor’s Compustat Services, a division of McGraw-Hill Companies, except for Dow Jones Paper Index data which comes from Dow Jones & Company, Inc. |

This graph compares the cumulative total return to shareholders on MeadWestvaco common stock from January 30, 2002, the first day of trading of the company’s common stock after the merger, plus reinvested dividends and distributions through December 31, 2002 with the return on the Standard & Poor’s 500 Stock Index (S&P 500), the Standard & Poor’s Paper & Forest Products Index (S&P Paper Index) (the company’s new peer group index) and the Dow Jones Paper Index (the company’s old peer group index). This graph assumes $100 was invested on January 30, 2002 in each of the following: the company’s common stock, the S&P 500 Index, the S&P Paper Index and the Dow Jones Paper Index. The company believes that the S&P Paper Index is more representative of its competitors, considering recent consolidation in the industry, and intends to utilize this index, and not the Dow Jones Paper Index, in future annual proxy statements. This graph should not be taken to imply any assurance that past performance is predictive of future performance.

17

Summary Compensation Table

The following table presents information concerning total compensation paid to the Chief Executive Officer and certain other executive officers of the company (collectively, the “named executive officers”). Messrs. Tatar and Lane served with Mead prior to the merger, and Messrs. Luke and Buzzard and Mses. Osar and Foley served with Westvaco prior to the merger. This compensation information for periods prior to January 29, 2002 relates to compensation received by the named executive officer while employed by Mead or Westvaco prior to the merger. Prior to the merger, Westvaco’s fiscal year ended on October 31. In connection with the merger, Westvaco changed its fiscal year to a calendar year. As a result, the compensation shown for Messrs. Luke and Buzzard and Mses. Osar and Foley prior to 2002 is that paid with respect to Westvaco’s last two fiscal years and the last two months of 2001 (which is referred to as the “transition period”). All information related to common stock has been adjusted to reflect the exchange ratios of common stock of Mead and Westvaco for common stock of MeadWestvaco and the company’s assumption of the relevant Mead and Westvaco stock-based benefit plans as of the effective date of the merger.

| | | | | | | | | | | | Long-term Compensation

| |

| | | | | | | | Annual Compensation

| | Awards

| | Payouts

| |

Name and Principal Position

with MeadWestvaco

| | Year

| | | Salary

| | Bonus(1)

| | Other

Annual Compensation

| | Restricted Stock Awards

| | | Securities Underlying Options

| | LTIP Payouts

| | All Other Compensation (3, 4)

| |

Jerome F. Tatar Chairman of the Board (Retired December 30, 2002) | | 2002 2001 2000 | | | $

| 854,904

850,754

820,838 | | $

| 546,300

400,000 530,000 | | —

— — | |

| —

— — |

| | 50,000

114,113 98,678 | | $ | — — 383,950 | | $ | 23,540,319 64,477 62,468 | (5) |

|

John A. Luke, Jr. Chairman, President and CEO | | 2002 T/P 2001 2000 | * | | $ | 875,000 145,833 875,000 875,000 | | $ | 546,300 — — 500,000 | | — — — — | | $ | — — 298,185 — | (2) | | 50,000 155,200 150,350 116,400 | | | — — — — | | | $48,329 6,563 48,329 83,204 | |

|

James A. Buzzard Executive Vice President | | 2002 T/P 2001 2000 | * | | $ | 550,000 75,000 450,000 341,667 | | $ | 311,800 — 150,000 300,000 | | — — — — | | | — — — — | | | 20,000 58,200 48,500 29,100 | | | — — — — | | | $31,623 3,375 32,481 38,971 | |

|

Raymond W. Lane Executive Vice President | | 2002 2001 2000 | | | $ | 489,000 453,000 433,600 | | $ | 264,200 100,000 200,000 | | — — — | | | — — — | | | 20,000 33,923 30,000 | | $ | — — 218,625 | | | $28,327 30,327 28,927 | |

|

Karen R. Osar Senior Vice President and CFO | | 2002 T/P 2001 2000 | * | | $ | 450,000 75,000 450,000 441,923 | | $ | 164,100 — 100,000 300,000 | | — — — — | | | — — — — | | | 20,000 33,950 33,950 24,250 | | | — — — — | | | $25,731 3,375 30,231 41,931 | |

|

Rita V. Foley Senior Vice President | | 2002 T/P 2001 2000 | * | | $ | 425,000 70,833 383,333 350,000 | | $ | 170,000 — — 300,000 | | — — — — | | | — — — — | | | 20,000 33,949 29,099 14,549 | | | — — — — | | | $24,258 3,188 21,899 42,063 | |

| * | | References to “T/P” refer to Westvaco’s two-month transition period from November 1, 2001 through December 31, 2001. |

| (1) | | The awards paid to MeadWestvaco executives for 2002 represented an annual incentive payment pursuant to the MeadWestvaco Corporation Annual and Long-Term Incentive Plan. The awards for fiscal year 2001 paid to executives of Westvaco and Mead were made by the Westvaco Compensation Committee and the Mead Compensation Committee, as the case may be, to recognize performance in connection with the then-pending MeadWestvaco merger. The awards to Westvaco executives for fiscal year 2000 represented the variable component of total annual compensation under Westvaco’s Annual Incentive Plan. The awards to Mead executives in 2000 represented annual incentives paid under Mead’s Annual and Long-Term Incentive Plan. |

18

| (2) | | This represents the dollar value, on January 16, 2002, of 10,300 shares of restricted Westvaco stock granted to John A. Luke, Jr., (in lieu of a cash bonus) by the Westvaco Compensation Committee in recognition of his service to the company regarding the negotiation of the MeadWestvaco merger during fiscal year 2001, based on the market price of Westvaco common stock on the award date. As of December 31, 2002, the dollar value of the restricted stock was $256,070. |

| (3) | | With regard to Mr. Lane for 2002, “All Other Compensation” consists of executive life insurance premiums of $4,313 and company matches to qualified and non-qualified savings plans of $6,740 and $17,274, respectively. |

| (4) | | With regard to Messrs. Luke and Buzzard and Mses. Osar and Foley, for 2002 “All Other Compensation” represents executive life insurance premiums of $8,954 for Mr. Luke, $6,873 for Mr. Buzzard, $5,481 for Ms. Osar and $5,133 for Ms. Foley and company contributions to Westvaco’s Savings and Investment Plan and Westvaco’s Savings and Investment Restoration Plan of the following amounts, respectively, $7,650 and $31,725 for Mr. Luke, $7,650 and $17,100 for Mr. Buzzard, $6,562 and $13,688 for Ms. Osar and $6,375 and $12,750 for Ms. Foley. These four executive officers held interests equivalent to a total of 109,036 shares of MeadWestvaco common stock under these plans as of December 31, 2002. |

| (5) | | Effective December 30, 2002, Mr. Tatar retired as Chairman of the Board of the company. In connection with his retirement, and as a consequence of the change of control resulting from the merger, Mr. Tatar received a lump-sum severance payment equal to $9,269,764 and a lump-sum payment of an enhanced pension benefit payment of $5,166,501. These payments were made to Mr. Tatar in accordance with the terms of his pre-existing employment agreements with The Mead Corporation. In addition, Mr. Tatar received lump-sum payments of the following retirement benefits, which he was entitled to receive whether or not the merger had occurred: a supplemental executive retirement plan benefit of $4,153,409, a non-qualified benefit restoration benefit of $4,126,988, a qualified plan retirement benefit in the amount of $688,168 and $82,202 for accrued but unpaid vacation. Mr. Tatar also received $8,720 and $44,567, respectively, in company matches to qualified and non-qualified savings plans. |

19

Option Grants in the Year Ended December 31, 2002

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Appreciation for Option Term(1)

|

Name

| | Number of Securities Underlying Options Granted

| | % of Total Options Granted to Employees in Year(2)

| | Exercise Price($/Sh)

| | Expiration Date

| | 5%

| | 10%

|

Jerome F. Tatar | | 50,000 | | 4.73% | | $31.38 | | 5/24/2012 | | $986,728 | | $2,500,578 |

John A. Luke, Jr. | | 50,000 | | 4.73% | | $31.38 | | 5/24/2012 | | $986,728 | | $2,500,578 |

James A. Buzzard | | 20,000 | | 1.89% | | $31.38 | | 5/24/2012 | | $394,691 | | $1,000,231 |

Raymond W. Lane | | 20,000 | | 1.89% | | $31.38 | | 5/24/2012 | | $394,691 | | $1,000,231 |

Karen R. Osar | | 20,000 | | 1.89% | | $31.38 | | 5/24/2012 | | $394,691 | | $1,000,231 |

Rita V. Foley | | 20,000 | | 1.89% | | $31.38 | | 5/24/2012 | | $394,691 | | $1,000,231 |

All Optionees | | 1,056,000 | | 100% | | $31.18 | | | | $20,839,704 | | $52,812,209 |

All shareholders(3) | | | | | | | | | | $3,947,686,091 | | $10,004,269,793 |

Optionees gain as % of all shareholder gain | | | | | | | | | | 0.53% | | 0.53% |

|

| (1) | | The dollar amounts under these columns are not intended to and may not accurately forecast possible future appreciation, if any, of MeadWestvaco’s common stock price. These are purely hypothetical amounts resulting from calculations at the 5% and 10% rates as set forth in the regulations of the Securities and Exchange Commission. |

| (2) | | These options, excluding those of Mr. Tatar which became exercisable upon his retirement, become exercisable ratably over a three-year period beginning twelve months from the date of grant. |

| (3) | | As of December 31, 2002, there were 200,039,142 shares of common stock of MeadWestvaco outstanding. The calculations shown are based on the assumed rates of appreciation, compounded annually, from the stock’s fair market value of $31.38 on May 24, 2002 when the above options were granted. |

20

Aggregated Option Exercises in Last Year

and December 31, 2002 Option Values

Name

| | Shares Acquired on Exercise

| | Value Realized(1)

| | Number of Unexercised Options at December 31, 2002(2) Exercisable/Unexercisable

| | Value of Unexercised In-the-Money Options at December 31, 2002(2) Exercisable/Unexercisable

|

Jerome F. Tatar | | 34,780 | | $ | 319,652 | | 834,004/0 | | $ | 62,926/$0 |

John A. Luke, Jr. | | — | | | — | | 904,515/50,000 | | $ | 22,407/$0 |

James A. Buzzard | | — | | | — | | 213,390/20,000 | | $ | 3,221/$0 |

Raymond W. Lane | | 9,337 | | $ | 103,024 | | 321,696/20,000 | | $ | 106,440/$0 |

Karen R. Osar | | — | | | — | | 92,147/20,000 | | $ | 0/$0 |

Rita V. Foley | | — | | | — | | 77,597/20,000 | | $ | 0/$0 |

|

| (1) | | The value realized on stock option exercises represents the difference between the grant price of the options and the market price of the shares of underlying stock as of the date of exercise multiplied by the number of options exercised. All grants are made at the fair market value of the stock on the date of grant. |

| (2) | | The value of unexercised in-the-money options represents the difference between the grant price of the options and the market price of the underlying security at December 31, 2002, which was $24.24, multiplied by the number of in-the-money options outstanding. |

Equity Compensation Plan Information

At December 31, 2002, Shares in thousands

| | Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights

| | Weighted-average Exercise Price of Outstanding Options, Warrants and Rights

| | Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (excluding securities reflected in column (a))

|

Plan Category | | (a) | | (b) | | (c) |

Equity compensation plans approved by shareholders | | 17,580 | | $28.82 | | 5,040 |

Equity compensation plans not approved by shareholders | | — | | — | | — |

| | |

| |

| |

|

Total | | 17,580 | | $28.82 | | 5,040 |

| | |

| |

| |

|

There are no equity compensation plans of the company that have not been approved by shareholders.

21

Pension Plan Tables for Year 2002

Mead

| | | Years of Service

|

Remuneration

| | 5

| | 15

| | 20

| | 25

| | 30

| | 35

|

$ | 500,000 | | $ | 30,000 | | $ | 105,000 | | $ | 142,500 | | $ | 180,000 | | $ | 217,500 | | $ | 255,000 |

| 750,000 | | | 45,000 | | | 157,500 | | | 213,750 | | | 270,000 | | | 326,250 | | | 382,500 |

| 1,000,000 | | | 60,000 | | | 210,000 | | | 285,000 | | | 360,000 | | | 435,000 | | | 510,000 |

| 1,250,000 | | | 75,000 | | | 262,500 | | | 356,250 | | | 450,000 | | | 543,750 | | | 637,500 |

| 1,500,000 | | | 90,000 | | | 315,000 | | | 427,500 | | | 540,000 | | | 652,500 | | | 765,000 |

| 1,750,000 | | | 105,000 | | | 367,500 | | | 498,750 | | | 630,000 | | | 761,250 | | | 892,500 |

Salaried employees of Mead were participants in Mead’s non-contributory retirement plan that provides retirement income based upon years of employment and average annual earnings for the five highest years during the last 11 years of employment with no specific allocation of contributions to individuals. Benefits under the retirement plan become vested after five years. Benefits are also reduced by one-half of a participant’s primary Social Security Benefit. The table above sets forth the approximate annual benefits payable under the plan’s formula assuming the recipient retires at age 65, on a straight-life annuity basis without regard to optional forms of payment. At the time of his retirement on December 30, 2002, Mr. Tatar had 29 years of service credit under the plan. As of December 31, 2002, Mr. Lane had 28 years of service credit under the plan. Mead also maintains an unfunded supplemental retirement plan for senior level management personnel who become eligible to participate in the plan after they have completed three years of employment in a qualified job classification. The plan provides annual retirement benefits of 55% of a participant’s final average earnings (earnings include bonuses and incentive compensation other than long-term incentive payments, but may not exceed two times base compensation for any year) for the three highest years during the last 11 years of employment, less benefits received from other pension plans of Mead and from pension plans of previous employers. Benefits are also reduced by one-half of a participant’s primary Social Security Benefit. A participant may receive full benefits under this plan after he attains age 62. Mr. Lane has completed three years of employment in a qualified job classification and is currently eligible to participate in this plan.

Westvaco

| | | Years of Service

|

Remuneration

| | 5

| | 15

| | 20

| | 25

| | 30

| | 35

| | 40

|

$ | 500,000 | | $ | 34,600 | | $ | 103,800 | | $ | 138,400 | | $ | 173,000 | | $ | 207,600 | | $ | 242,300 | | $ | 276,900 |

| 750,000 | | | 52,500 | | | 157,400 | | | 209,900 | | | 262,300 | | | 314,800 | | | 367,300 | | | 419,700 |

| 1,000,000 | | | 70,300 | | | 211,000 | | | 281,300 | | | 351,600 | | | 422,000 | | | 492,300 | | | 562,600 |

| 1,250,000 | | | 88,200 | | | 264,600 | | | 352,800 | | | 440,900 | | | 529,100 | | | 617,300 | | | 705,500 |

| 1,500,000 | | | 106,000 | | | 318,100 | | | 424,200 | | | 530,200 | | | 636,300 | | | 742,300 | | | 848,400 |

| 1,750,000 | | | 123,900 | | | 371,700 | | | 495,600 | | | 619,500 | | | 743,400 | | | 867,400 | | | 991,300 |

Westvaco’s contributions to its retirement plan for salaried employees were computed on an aggregate actuarial basis with no specific allocation of contributions to individuals. The table above shows the approximate annual retirement benefits net of social security benefits that would be received under current plan provisions based upon the noted compensation levels and years of service. As of December 31, 2002, Mr. Luke had 24 years of service credit under the plan, Mr. Buzzard had 25 years of service credit under the plan and each of Mses. Osar and Foley had three years of service credit under the plan. These approximated annual retirement benefits have been calculated under the plan’s 50% joint and survivor annuity form of pension and on the assumption of retirement benefits beginning at age 62 (with twenty years of service) or age 65.

22

The obligations under these Mead and Westvaco pension plans have been assumed by MeadWestvaco; these plans were merged effective March 31, 2002, and MeadWestvaco continued to maintain these plans through December 31, 2002.

2002 Long-Term Incentive Table

| | | Number of Shares, Units or Other Rights

| | Performance Payout Period(2)

| | Estimated Future Payouts under Non-Stock Price-Based Plans

|

Name

| | | | Threshold ($ or #)

| | Target ($ or #)

| | Maximum(3) ($ or #)

|

Jerome F. Tatar | | — | | — | | | — | | | — | | | — |

|

John A. Luke, Jr.(1) | | — | | 2004-2006 | | $ | 420,200 | | $ | 840,400 | | $ | 1,680,000 |

|

James A. Buzzard(1) | | — | | 2004-2006 | | $ | 150,000 | | $ | 300,000 | | $ | 600,000 |

|

Raymond W. Lane(1) | | — | | 2004-2006 | | $ | 158,400 | | $ | 316,800 | | $ | 633,600 |

|

Karen R. Osar(1) | | — | | 2004-2006 | | $ | 88,350 | | $ | 176,700 | | $ | 353,400 |

|

Rita V. Foley(1) | | — | | 2004-2006 | | $ | 50,500 | | $ | 101,000 | | $ | 202,000 |

| (1) | | Based upon performance during 2002, potential long-term awards for the 2002 year were credited to Mr. Luke in the amount of $504,200, Mr. Buzzard in the amount of $180,000, Mr. Lane in the amount of $190,100, Ms. Osar in the amount of $106,000 and Ms. Foley in the amount of $60,600. These credits were based upon the financial performance objectives that had been established for 2002 by the Compensation and Organization Development Committee of the Board of Directors (the “Committee”), which related to the following financial performance measures: (1) relative stock performance, (2) return on capital employed and (3) debt to capital ratio. The same three criteria were used in establishing the performance objectives for 2003. The amounts credited as described are tentative only; they will be adjusted based upon the Committee’s evaluation of the degree to which the goals for the remainder of the performance period (through 2005) are actually attained. This adjustment may include an increase (or decrease) in the award up to 25% of the award account balance. A portion of the awards as so adjusted for 2003 performance will be eligible for payment in 2004 (see footnote (2)). |

| (2) | | After the close of the 2003 year, the Committee may authorize payment of one-third of the 2002 potential long-term awards, after adjustment as described in footnote (1) above. The same methodology will be used in succeeding years to adjust the awards based upon performance in those years; an additional one-third of the award, as so adjusted for performance in 2004, may be paid in 2005, and the final one-third, as so adjusted for performance in 2005, may be paid out in 2006. All payments are subject to review and approval of the Committee. |

| (3) | | The actual amount of any annual or long-term award may not exceed $2 million in any year. |

23

Change-of-Control Agreements

From November 1986 until Mead and Westvaco agreed to merge, Mead had intermittently entered into change-of-control agreements with some of its officers, including Messrs. Tatar and Lane. The merger of Mead and Westvaco qualified as a change of control under these agreements. Upon the completion of the merger of Mead and Westvaco, MeadWestvaco assumed the obligations under each of these change-of-control agreements other than Mr. Tatar’s change-of-control agreement, which was superseded by his new employment agreement with MeadWestvaco, which is described below.

Under the Mead change-of-control agreements, MeadWestvaco is obligated to provide severance benefits to the executive officer in the event of certain qualifying terminations of employment within the two-year period immediately following the change of control, including a termination by MeadWestvaco without cause or by the officer with good reason (as defined in the relevant agreement). The severance benefits include cash severance equal to two and one-half times the executive officer’s base salary and annual and long-term incentive compensation; a supplemental pension benefit computed taking into account the base salary and annual incentive compensation components of the foregoing cash severance amount and crediting the executive officer with an additional three years of age and service; two years’ continuation of health and welfare benefits; and, at the executive officer’s election, a cash payment in cancellation of his or her stock options, computed based upon the higher of the closing price on the date of termination of employment or the Mead merger consideration. In addition, to the extent any payments or benefits received by the executive officer are subject to the excise tax imposed by Section 4999 of the Internal Revenue Code, the executive officer will receive a payment to restore him or her to the after-tax position that he or she would have been in, had the excise tax not been imposed.

On August 27, 2002, MeadWestvaco entered into an amendment to its agreement with Mr. Lane under which MeadWestvaco agreed to preserve certain severance and pension payments payable to him in the event he continues to work beyond July 30, 2003, and terminates employment before he attains age 60. Under the terms of the amendment, Mr. Lane will receive an agreed upon lump-sum severance payment in the amount of $2,912,750 when he terminates employment and an enhanced pension benefit payment that varies in amount depending on whether he terminates employment before or after April 1, 2003.

From January 1999 until Mead and Westvaco agreed to merge, Westvaco also had previously entered into change-of-control agreements with a number of its executive officers, including Messrs. Luke and Buzzard and Mses. Osar and Foley. The merger of Mead and Westvaco constituted a change of control under these agreements. As discussed below, Mr. Luke’s new employment agreement supersedes his change-of-control agreement. From and after completion of the mergers, MeadWestvaco assumed and honored the other Westvaco change-of-control agreements, including those with Mr. Buzzard and Mses. Osar and Foley.

Under the Westvaco change-of-control agreements, MeadWestvaco is obligated to provide severance benefits to each such executive officer in the event his or her employment is terminated by MeadWestvaco without cause or by the executive officer for good reason (as defined in the relevant agreement) during the period of three years after the change of control. The severance benefits include a pro-rata annual bonus for the year of termination; cash severance equal to three times the executive officer’s base salary, annual bonus and annual company contribution to his or her defined contribution plan benefits; a lump-sum supplemental pension benefit equal to the additional benefits the executive officer would have accrued, had he or she remained employed for three additional years; and three years’ continuation of health and welfare benefits. In addition, to the extent that any payments or benefits received by the executive officer are subject to the excise tax imposed by Section 4999 of the Internal Revenue Code and exceed 110% of the maximum that can be received without the tax being imposed, the executive officer will receive a payment to restore him or her to the after-tax position that he or she would have been in, had the excise tax not been imposed.

24

Employment Agreements with Messrs. Tatar and Luke

At the time of the merger that created MeadWestvaco, the company entered into an employment agreement with Mr. Tatar providing for him to serve as Chairman of the Board during the integration of Mead’s and Westvaco’s operations. The payments and benefits to be provided to him at the conclusion of his service reflected the terms of Mr. Tatar’s earlier severance and change-of-control agreement with The Mead Corporation as previously described in Mead’s proxy statements.

In August 2002, MeadWestvaco and Mr. Tatar agreed and announced that his retirement would occur on December 30, 2002. Pursuant to his contract, Mr. Tatar received a lump-sum severance payment equal to $9,269,764. In addition, Mr. Tatar received $82,202 for accrued but unpaid vacation. Mr. Tatar’s enhanced pension benefit was determined to be $5,166,501, which amount was paid in a lump sum. Mr. Tatar also received his 2002 annual bonus in the amount of $546,300.