Exhibit 99.3

A Global Packaging Company

John A. Luke, Jr.

Chairman and CEO

James A. Buzzard

President

E. Mark Rajkowski

Senior Vice President and CFO

January 18, 2005

Forward-Looking Statement

Certain statements in this document and elsewhere by management of the company that are neither reported financial results nor other historical information are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such information includes, without limitation, the business outlook, assessment of market conditions, anticipated financial and operating results, strategies, future plans, contingencies and contemplated transactions of the company. Such forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors which may cause or contribute to actual results of company operations, or the performance or achievements of each company, or industry results, to differ materially from those expressed or implied by the forward-looking statements. In addition to any such risks, uncertainties and other factors discussed elsewhere herein, risks, uncertainties and other factors that could cause or contribute to actual results differing materially from those expressed or implied for the forward-looking statements include, but are not limited to, events or circumstances which affect the ability of MeadWestvaco to realize improvements in operating earnings and cash flow expected from the company’s productivity initiative; competitive pricing for the company’s products; changes in raw materials pricing; energy and other costs; fluctuations in demand and changes in production capacities; changes to economic growth in the United States and international economies; government policies and regulations, including, but not limited to those affecting the environment and the tobacco industry; adverse results in current or future litigation, currency movements and other risk factors discussed in the company’s Annual Report on Form 10-K for the year ended December 31, 2003 and in other filings made from time to time with the SEC. MeadWestvaco undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Investors are advised, however, to consult any further disclosures made on related subjects in the company’s reports filed with the SEC.

2

Strategic Rationale

A focused global packaging company

Stronger, more consistent financial returns Frees up company to pursue profitable growth opportunities in global packaging markets Stronger balance sheet and greater financial flexibility

More competitive Papers business

Productivity improvements; market-share gains

Enables MWV to monetize improved business

Creates financially sound, competitive stand-alone Papers company

3

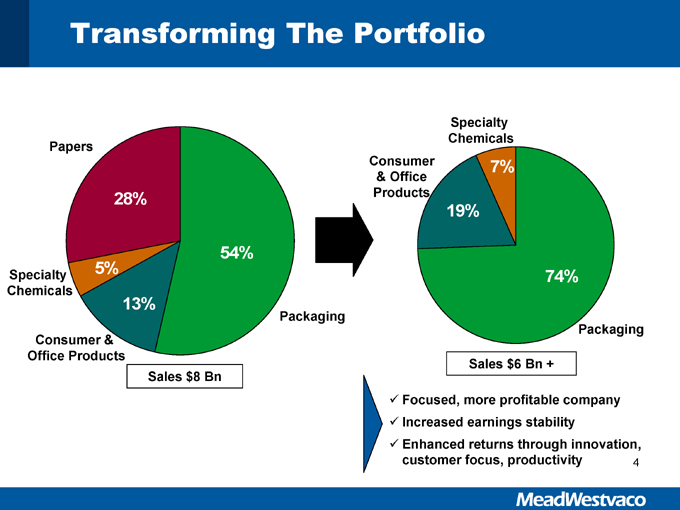

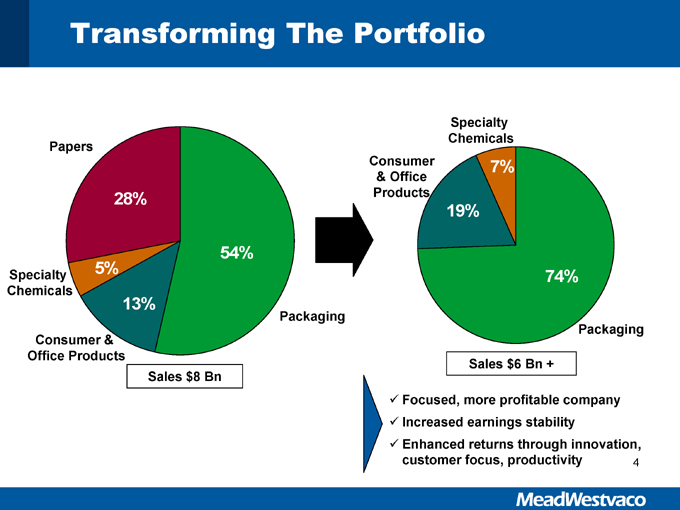

Focused, more profitable company Increased earnings stability Enhanced returns through innovation, customer focus, productivity 4

Transforming The Portfolio

Papers

28%

Specialty Chemicals

5%

Consumer & Office Products

13%

54%

Sales $8 Bn

Packaging

Consumer & Office Products

Specialty Chemicals

19%

7%

74%

Packaging

Sales $6 Bn +

4

Capitalize on Our Strengths

Global leadership position in differentiated, value-added packaging

Attractive Consumer & Office Products, Specialty Chemicals and Specialty Papers businesses

Identifiable, higher margin growth opportunities

Emerging markets – Asia, Latin America, Eastern Europe

Rewards for innovative solution

5

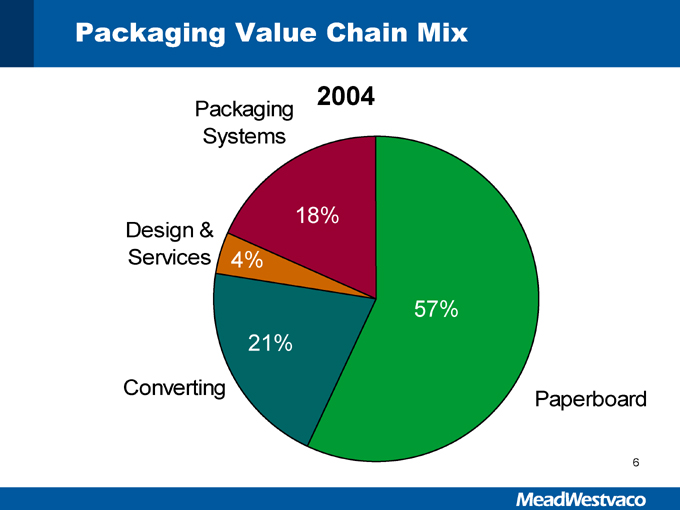

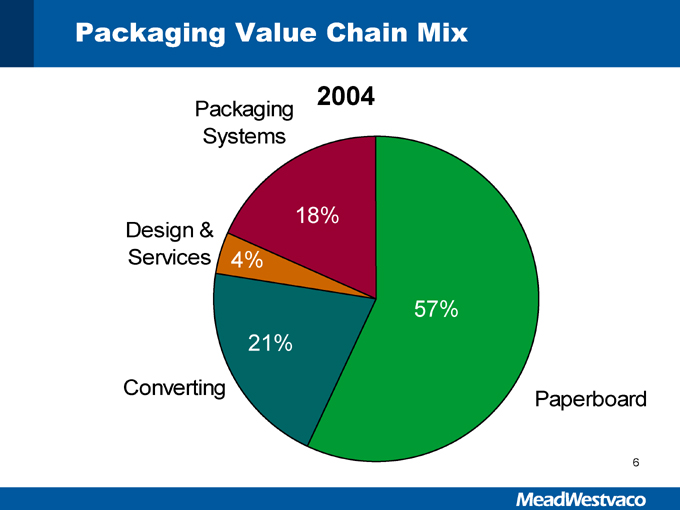

Paperboard

Packaging Value Chain Mix

2004

Packaging Systems

18%

Design & Services

4%

Converting

21%

57%

6

Substantial cash to MWV

Financially sound Papers company

Transaction: Overview

Achieves several goals:

Increased return profile

Improved earnings, cash-flow stability Accelerated debt paydown Strengthened balance sheet

The right deal at the right time

7

5 mills; 6,300 employees Coated paper = 2 mm tons/year Carbonless paper = 290,000 tons/year Forestlands = 900,000 acres

Transaction: Summary

Total value: $2.3 billion cash upon closing

Included in the sale:

8

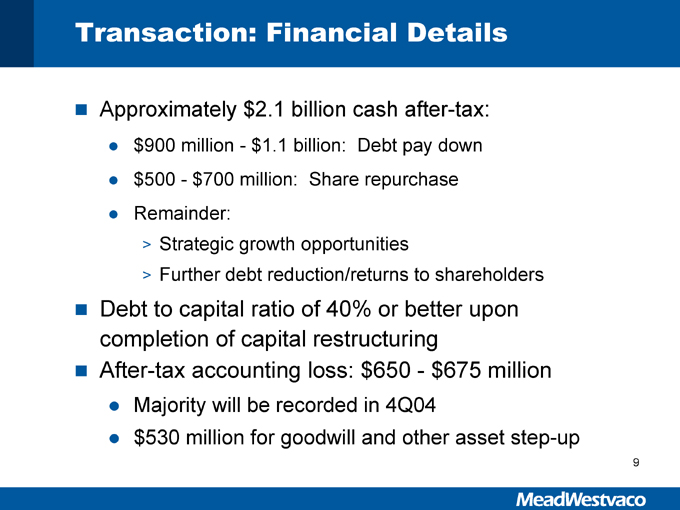

Majority will be recorded in 4Q04 $530 million for goodwill and other asset step-up

Transaction: Financial Details

Approximately $2.1 billion cash after-tax: $900 million—$1.1 billion: Debt pay down $500—$700 million: Share repurchase Remainder:

Strategic growth opportunities

Further debt reduction/returns to shareholders

Debt to capital ratio of 40% or better upon completion of capital restructuring After-tax accounting loss: $650—$675 million

9

*Operating EPS excludes gains on forestland, restructuring charges, and accounting loss related to the Papers business. See GAAP reconciliation on slide 17.

Financial Impact: 4Q04

Overall MWV 4Q04 segment operating results improved over 4Q03 Demand remained firm in each of our key markets

Papers business 4Q04 results impacted by previously announcedfactors:

Seasonality

Scheduled maintenance Higher raw material costs Sold-out inventories

Expect 4Q04 operating EPS* of $0.18 to $0.23

Details on 4Q04 provided on January 31 conference call

10

Report Papers business as discontinued operations in 1Q05

Closing expected 2Q05

Financial Impact

Overhead costs reduced for new size and structure

Corporate overhead reductions will result in additional restructuring charges in 2005 and 2006

Cash charges not to exceed $25 million

11

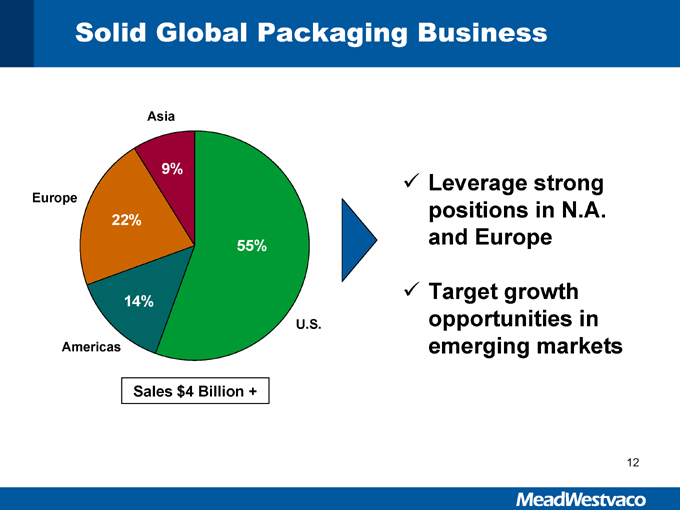

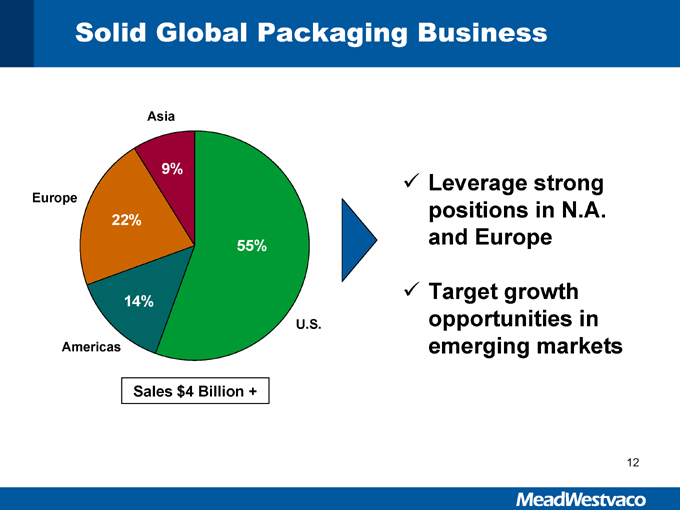

Target growth opportunities in emerging markets

Solid Global Packaging Business

Asia

9%

Europe

22%

Americas

14%

55%

Sales $4 Billion +

U.S.

Leverage strong positions in N.A. and Europe

12

Asphalt

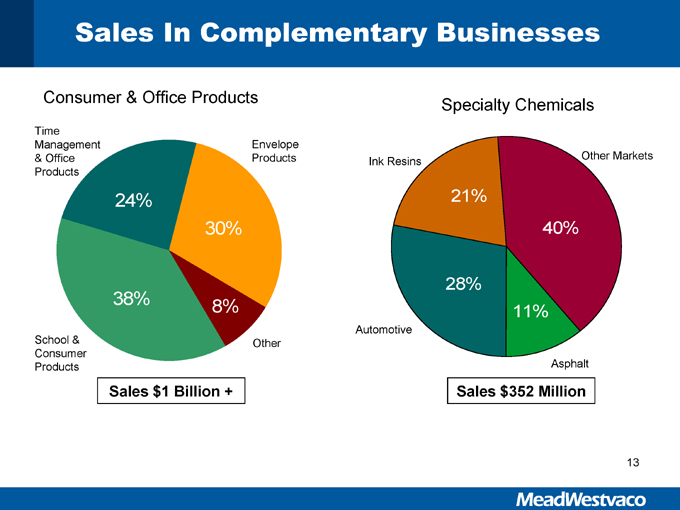

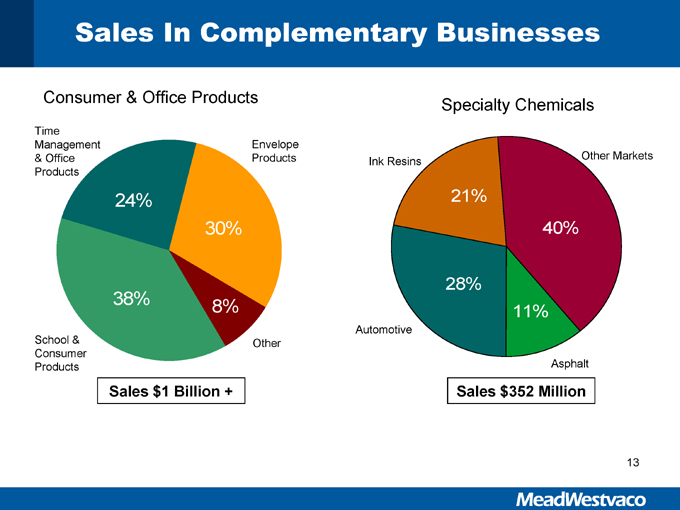

Sales In Complementary Businesses

Consumer & Office Products

Time Management & Office Products

24%

Envelope Products

30%

38%

School & Consumer Products

Other

8%

Sales $1 Billion +

Specialty Chemicals

Ink Resins

21%

Other Markets

40%

11%

28%

Automotive

Sales $352 Million

13

Achieving Our Goals

Completion of ongoing productivity initiatives $500 million goal

On track for end of 2005 target

Align overhead structure with new business after closing

Transformation of organizational structure

14

Large global growth opportunities

Strong capabilities & platform that can be leveraged Leadership in growing markets Rewards for innovative solutions Consistent returns

Summary:

A Winning Formula for Future Growth

15

Questions

17

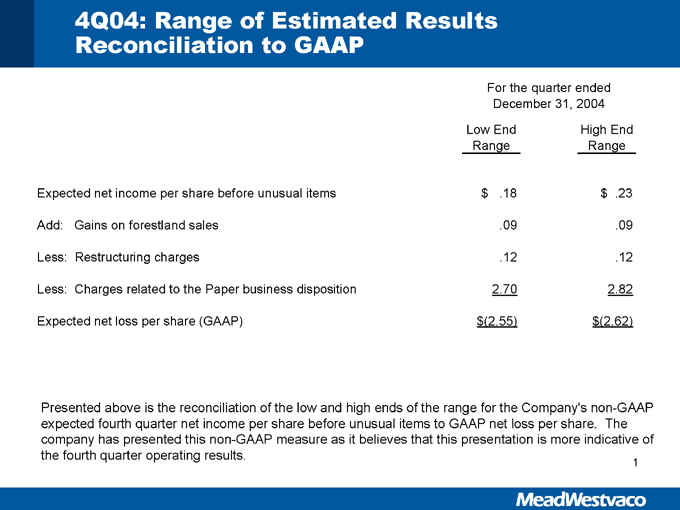

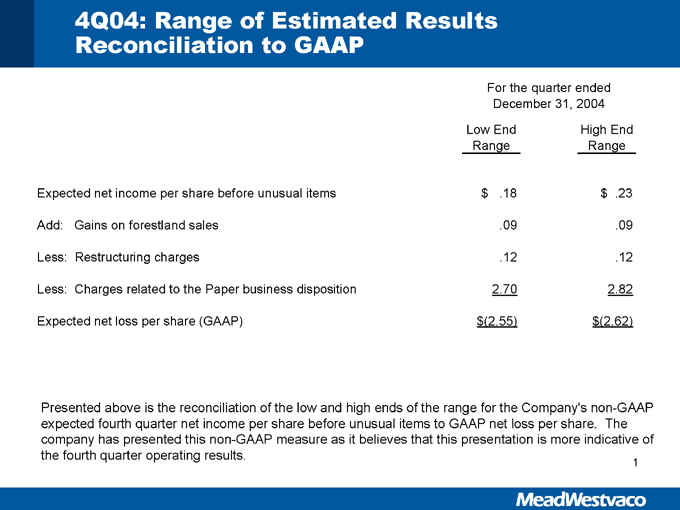

4Q04: Range of Estimated Results Reconciliation to GAAP

For the quarter ended

December 31, 2004

Low End High End

Range Range

Expected net income per share before unusual items $.18 $.23

Add: Gains on forestland sales .09 .09

Less: Restructuring charges .12 .12

Less: Charges related to the Paper business disposition 2.70 2.82

Expected net loss per share (GAAP) $ (2.55) $ (2.62)

Presented above is the reconciliation of the low and high ends of the range for the Company’s non-GAAP expected fourth quarter net income per share before unusual items to GAAP net loss per share. The company has presented this non-GAAP measures as it believes that this presentation is more indicative of the fourth quarter operating results.

17

A Global Packaging Company

January 18, 2005