Exhibit 99.2

Exhibit 99.2

FOURTH QUARTER 2004 EARNINGS

John A. Luke, Jr.

Chairman and CEO

James A. Buzzard

President

E. Mark Rajkowski

Senior Vice President and CFO

January 31, 2005

FORWARD-LOOKING STATEMENT

Certain statements in this document and elsewhere by management of the company that are neither reported financial results nor other historical information are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such information includes, without limitation, the business outlook, assessment of market conditions, anticipated financial and operating results, strategies, future plans, contingencies and contemplated transactions of the company. Such forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors which may cause or contribute to actual results of company operations, or the performance or achievements of each company, or industry results, to differ materially from those expressed or implied by the forward-looking statements. In addition to any such risks, uncertainties and other factors discussed elsewhere herein, risks, uncertainties and other factors that could cause or contribute to actual results differing materially from those expressed or implied for the forward-looking statements include, but are not limited to, events or circumstances which affect the ability of MeadWestvaco to realize improvements in operating earnings and cash flow expected from the company’s productivity initiative; to close the sale of the papers business and uncertainties related to the timing of the closing; competitive pricing for the company’s products; changes in raw materials pricing; energy and other costs; fluctuations in demand and changes in production capacities; changes to economic growth in the United States and international economies; government policies and regulations, including, but not limited to those affecting the environment and the tobacco industry; adverse results in current or future litigation, currency movements and other risk factors discussed in the company’s Annual Report on Form 10-K for the year ended December 31, 2003 and in other filings made from time to time with the SEC. MeadWestvaco undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Investors are advised, however, to consult any further disclosures made on related subjects in the company’s reports filed with the SEC.

2

FOURTH QUARTER EPS

Net loss of $497 million, or $2.45 per share

> After-tax charge of $546 million, or $2,.69 per share

Sale of Papers business

$546 million, or $2.69 per share

Gains on forestland sales: 9 cents per share

Restructuring charges: 11 cents per share

3

John A. Luke Jr.

Chairman and

Chief Executive Officer

4

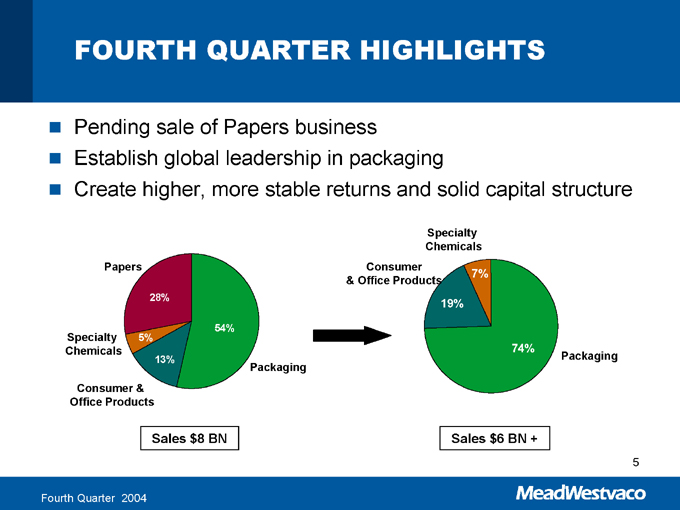

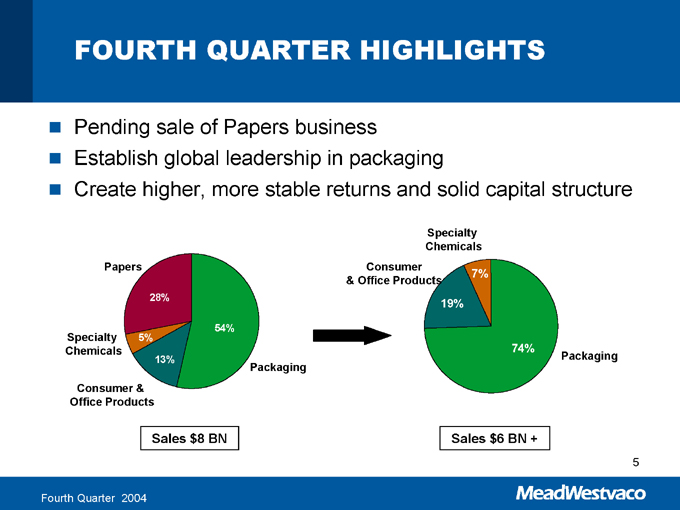

FOURTH QUARTER HIGHLIGHTS

Pending sale of Papers business

Establish global leadership in packaging

Create higher, more stable returns and solid capital structure

Papers

28%

Specialty Chemicals 5%

Consumer & Office Products 13%

Packaging 54%

Sales $8 BN

Specialty Chemicals 7%

Consumer & Office Products 19%

Packaging 74%

Sales $6 BN +

5

STRONG MARKET POSITIONS

Packaging—strong results in consumer packaging, paperboard

Results in 4Q doubled over prior year

Top-line and bottom-line growth in mill and converting business

Expanded global market position

Increased efficiencies in mills and converting operations

Consumer & Office Products

Strategic acquisitions delivering results

Revenue and profit growth resulting from strong product mix and innovation

6

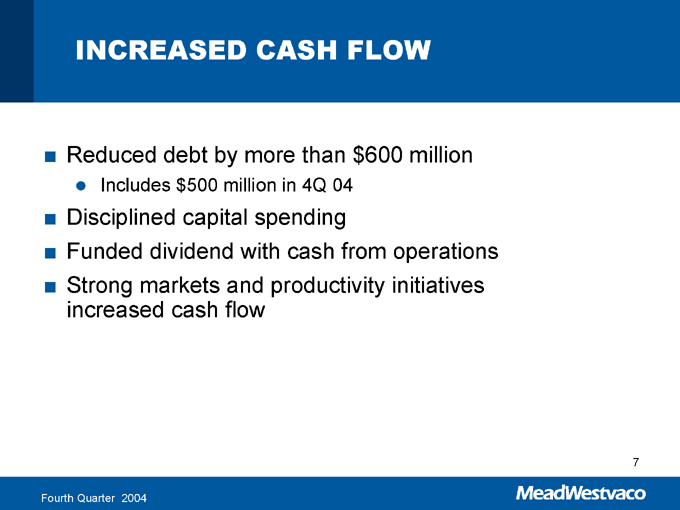

INCREASED CASH FLOW

Reduced debt by more than $600 million

Includes $500 million in 4Q 04

Disciplined capital spending

Funded dividend with cash from operations

Strong markets and productivity initiatives increased cash flow

7

James A. Buzzard

President

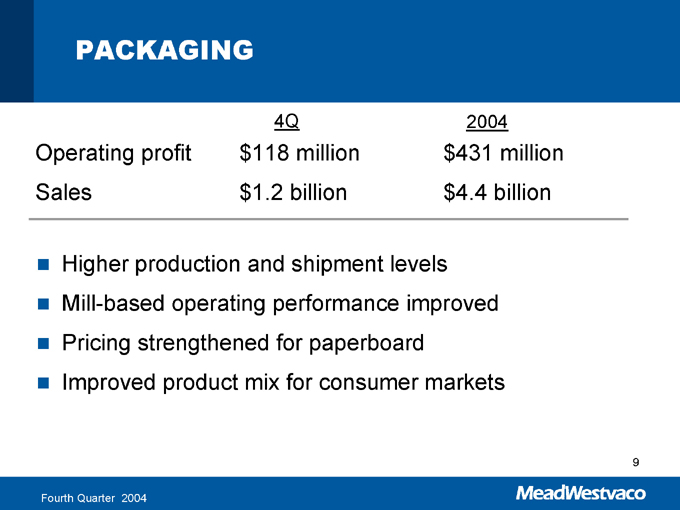

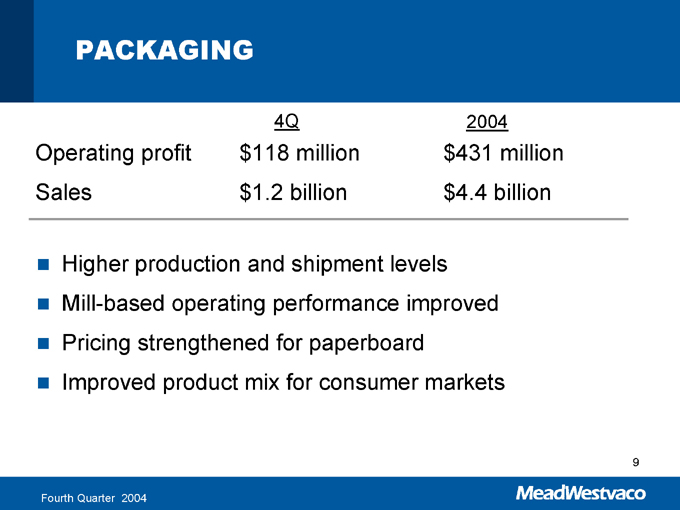

PACKAGING

4Q 2004

Operating profit $118 million $431 million

Sales $1.2 billion $4.4 billion

Higher production and shipment levels

Mill-based operating performance improved

Pricing strengthened for paperboard

Improved product mix for consumer markets

9

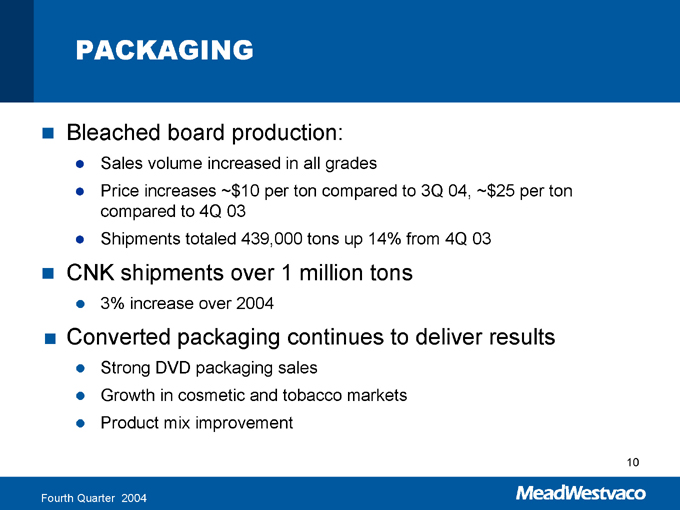

PACKAGING

Bleached board production:

Sales volume increased in all grades

Price increases ~$10 per ton compared to 3Q 04, ~$25 per ton compared to 4Q 03

Shipments totaled 439,000 tons up 14% from 4Q 03

CNK shipments over 1 million tons

3% increase over 2004

Converted packaging continues to deliver results

Strong DVD packaging sales

Growth in cosmetic and tobacco markets

Product mix improvement

10

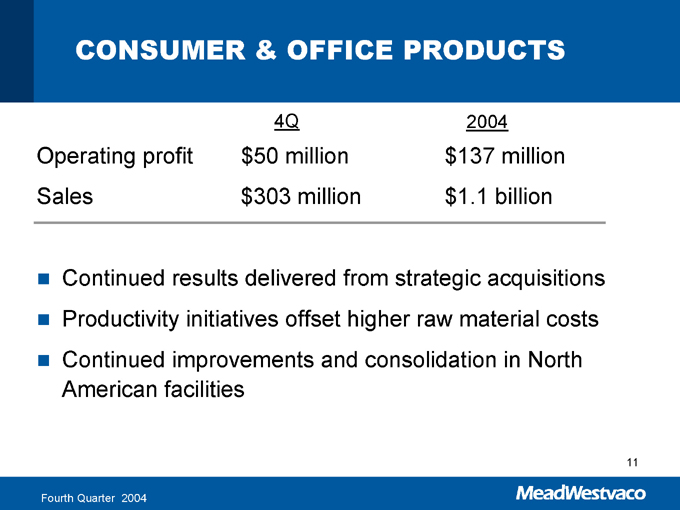

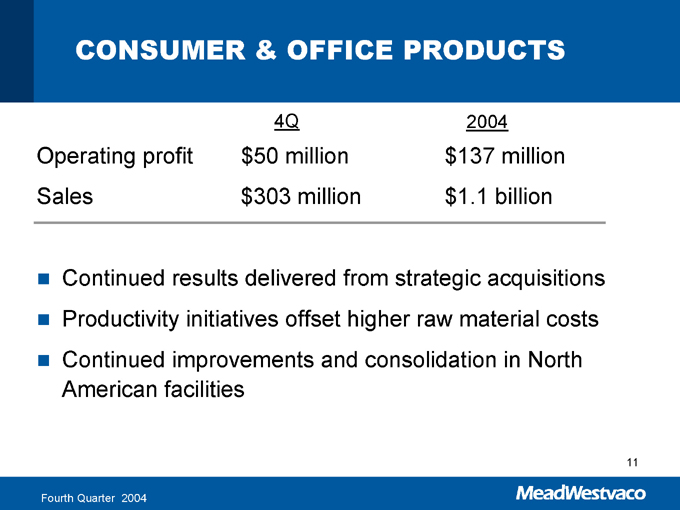

CONSUMER & OFFICE PRODUCTS

4Q 2004

Operating profit $50 million $137 million

Sales $303 million $1.1 billion

Continued results delivered from strategic acquisitions

Productivity initiatives offset higher raw material costs

Continued improvements and consolidation in North American facilities

11

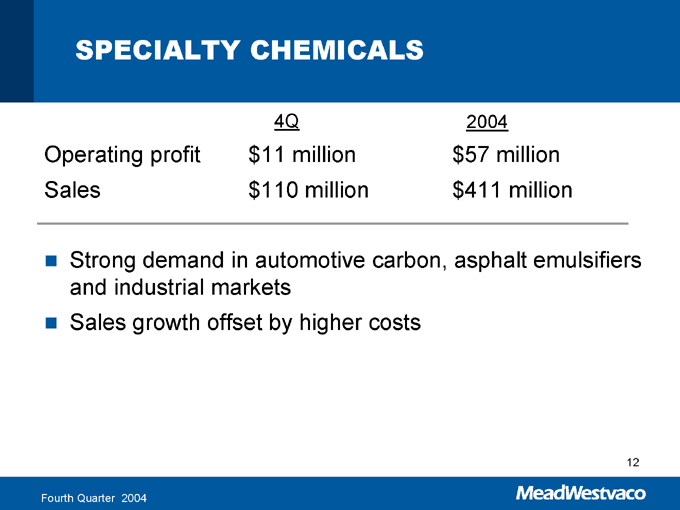

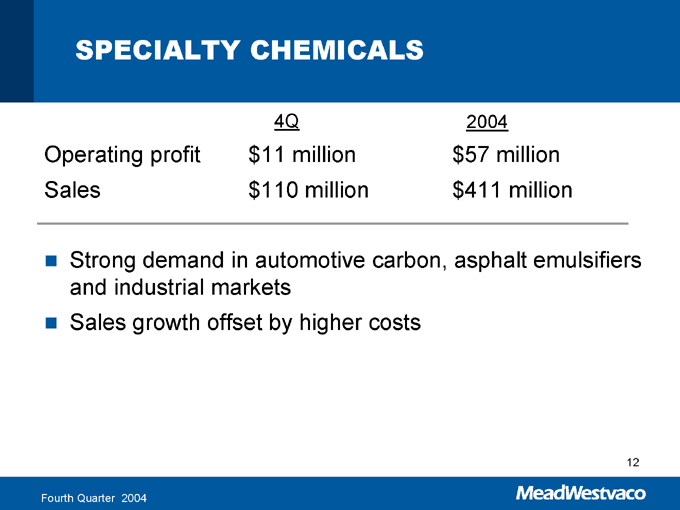

SPECIALTY CHEMICALS

4Q 2004

Operating profit $11 million $57 million

Sales $110 million $411 million

Strong demand in automotive carbon, asphalt emulsifiers and industrial markets

Sales growth offset by higher costs

12

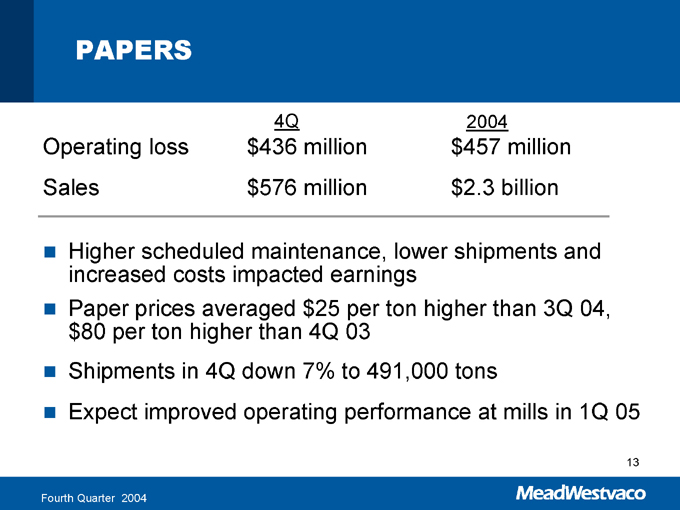

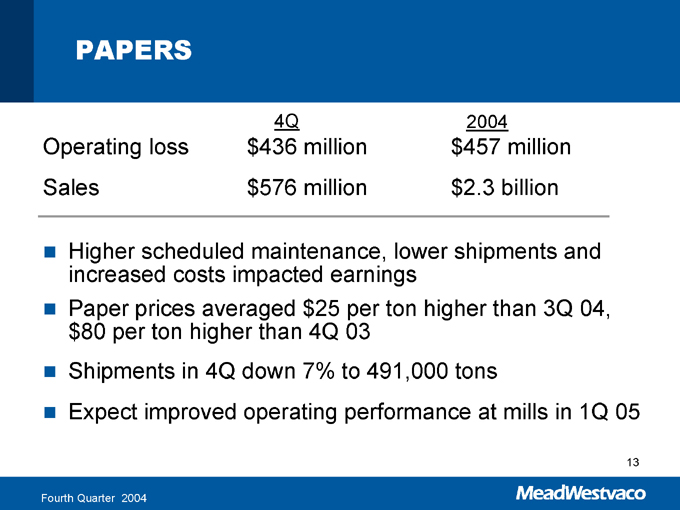

PAPERS

4Q 2004

Operating loss $436 million $457 million

Sales $576 million $2.3 billion

Higher scheduled maintenance, lower shipments and increased costs impacted earnings

Paper prices averaged $25 per ton higher than 3Q 04, $80 per ton higher than 4Q 03

Shipments in 4Q down 7% to 491,000 tons

Expect improved operating performance at mills in 1Q 05

13

E. Mark Rajkowski

Senior Vice President and CFO

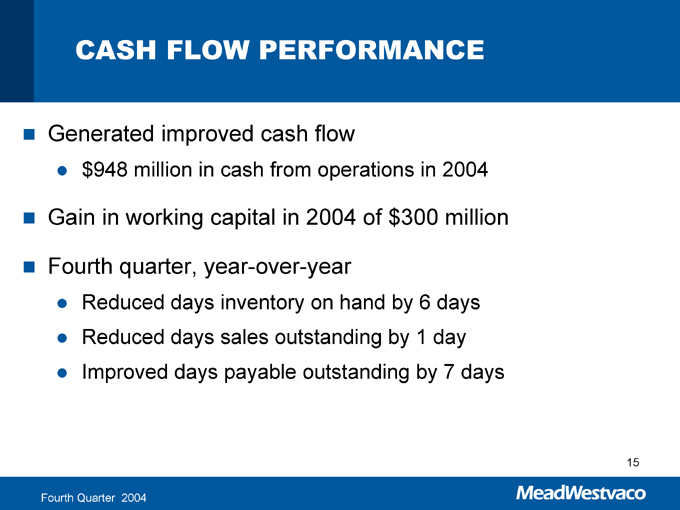

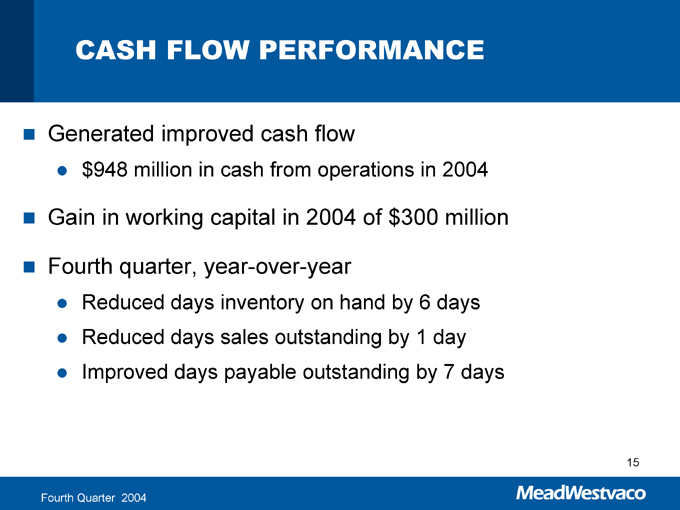

CASH FLOW PERFORMANCE

Generated improved cash flow

$948 million in cash from operations in 2004

Fourth quarter, year-over-year

Gain in working capital in 2004 of $300 million

Reduced days inventory on hand by 6 days

Reduced days sales outstanding by 1 day

Improved days payable outstanding by 7 days

15

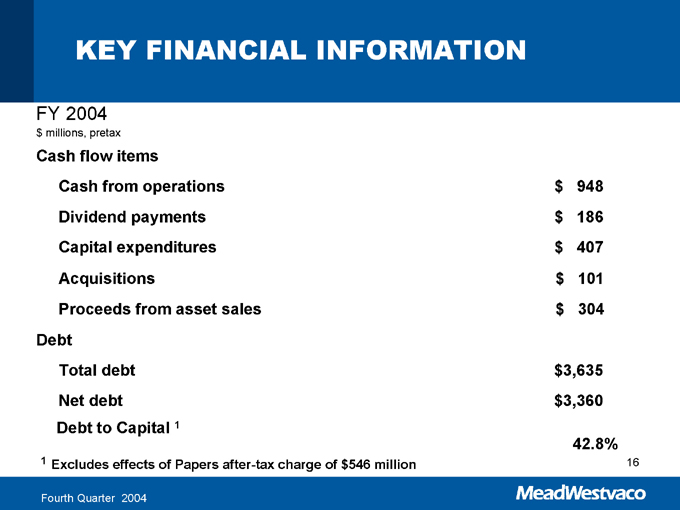

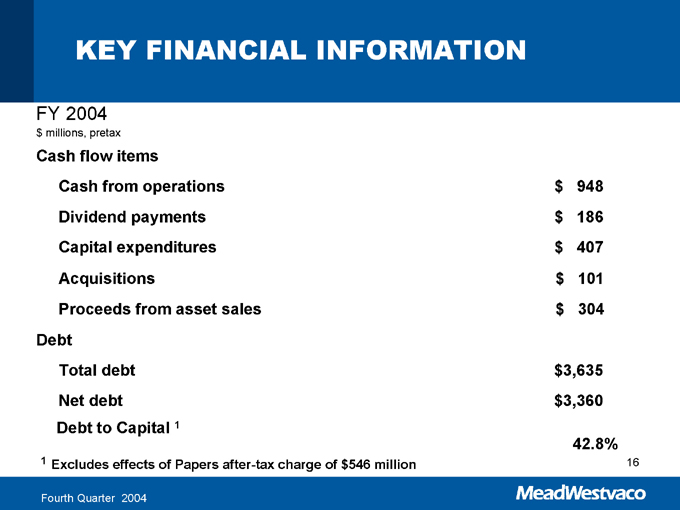

KEY FINANCIAL INFORMATION

FY 2004

$ millions, pretax

Cash flow items

Cash from operations $948

Dividend payments $186

Capital expenditures $407

Acquisitions $101

Proceeds from asset sales $304

Debt

Total debt $3,635

Net debt $3,360

Debt to Capital 1 42.8%

1 Excludes effects of Papers after-tax charge of $546 million

16

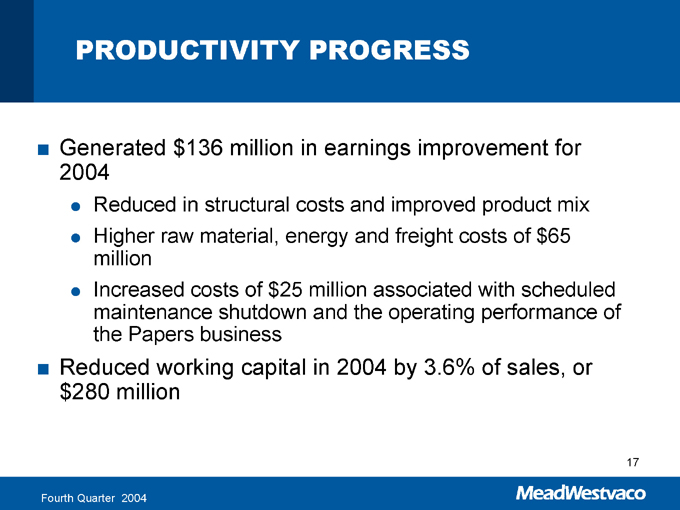

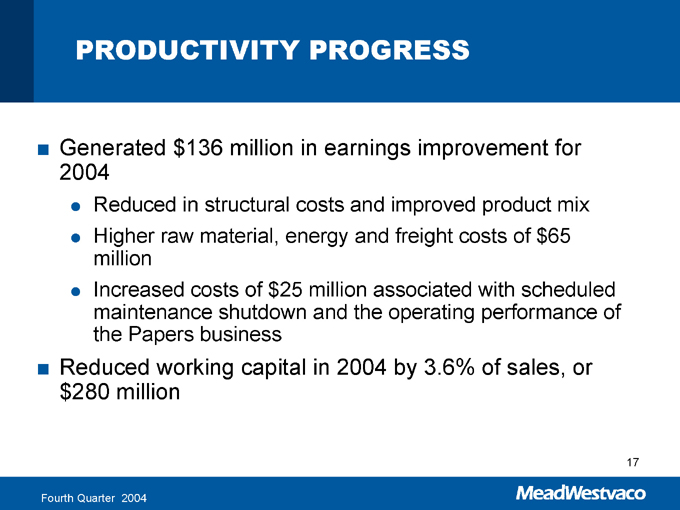

PRODUCTIVITY PROGRESS

Generated $136 million in earnings improvement for 2004

Reduced in structural costs and improved product mix

Higher raw material, energy and freight costs of $65 million

Increased costs of $25 million associated with scheduled maintenance shutdown and the operating performance of the Papers business

Reduced working capital in 2004 by 3.6% of sales, or $280 million

17

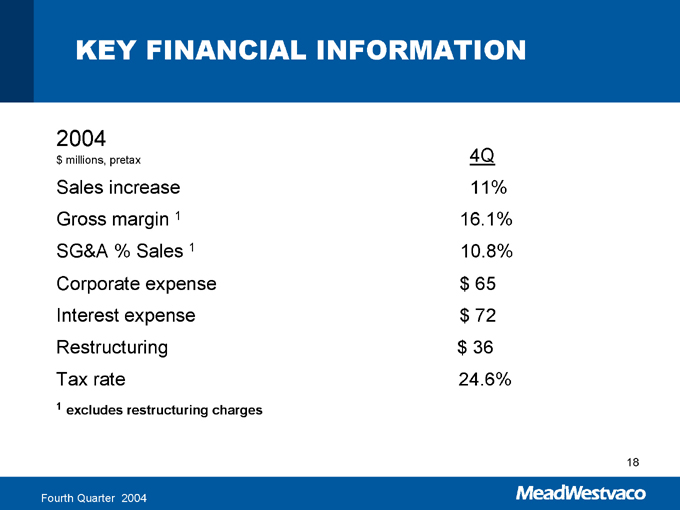

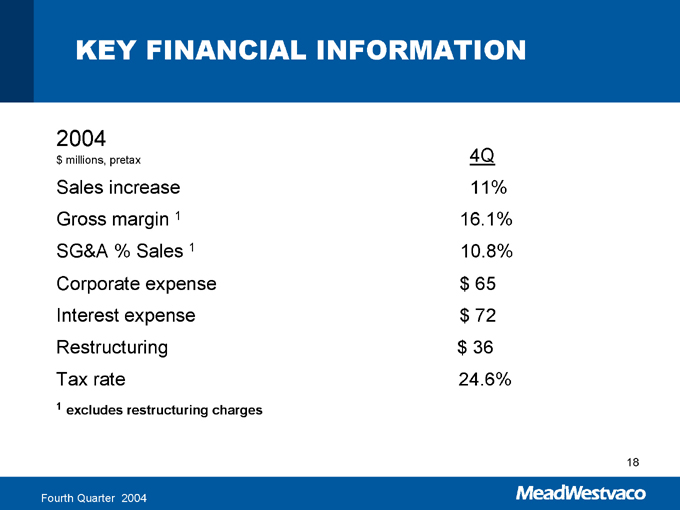

KEY FINANCIAL INFORMATION

2004

$ millions, pretax 4Q

Sales increase 11%

Gross margin 16.1%

SG&A % Sales 10.8%

Corporate expense $65

Interest expense $72

Restructuring $36

Tax rate 24.6%

1 excludes restructuring charges

18

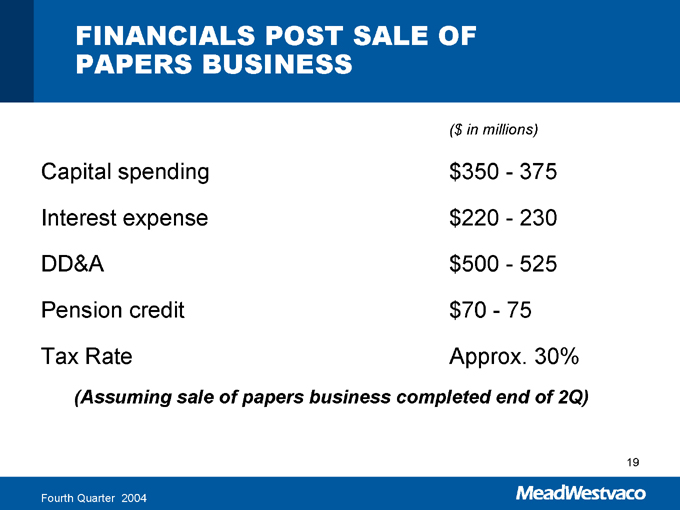

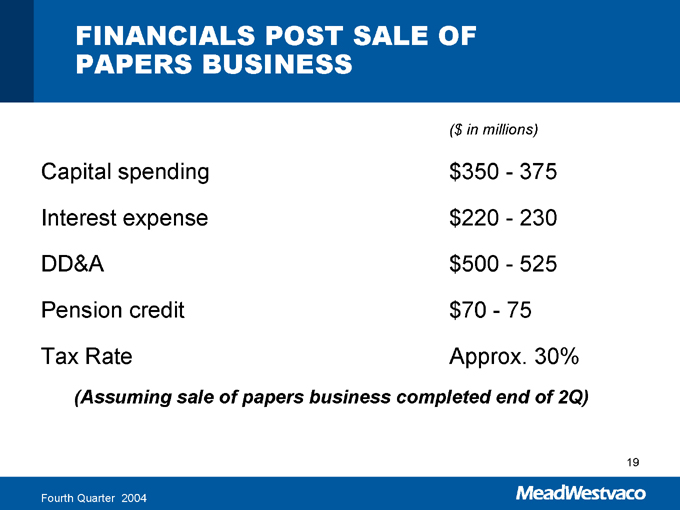

FINANCIALS POST SALE OF PAPERS BUSINESS

($ in millions)

Capital spending $350—375

Interest expense $220—230

DD&A $500—525

Pension credit $70—75

Tax Rate Approx. 30%

(Assuming sale of papers business completed end of 2Q)

19

MOVING FORWARD

Continued strengthening in core packaging markets

Challenges from rising costs for energy and raw materials

Focus on productivity improvements

Positioned for success with our strong packaging platform

20

QUESTIONS

APPENDIX

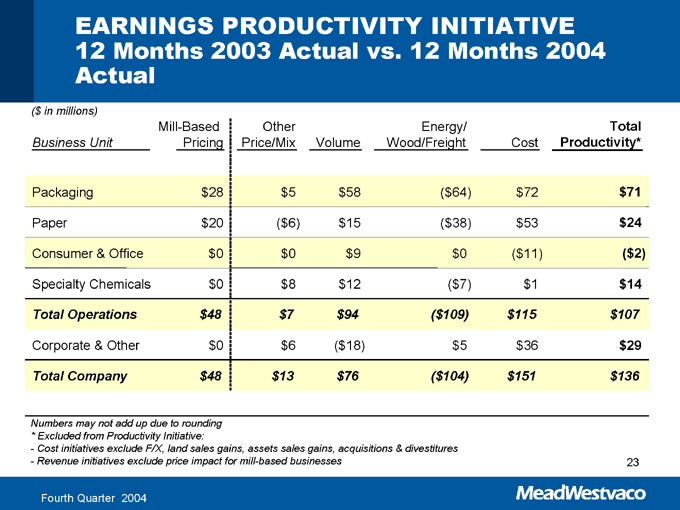

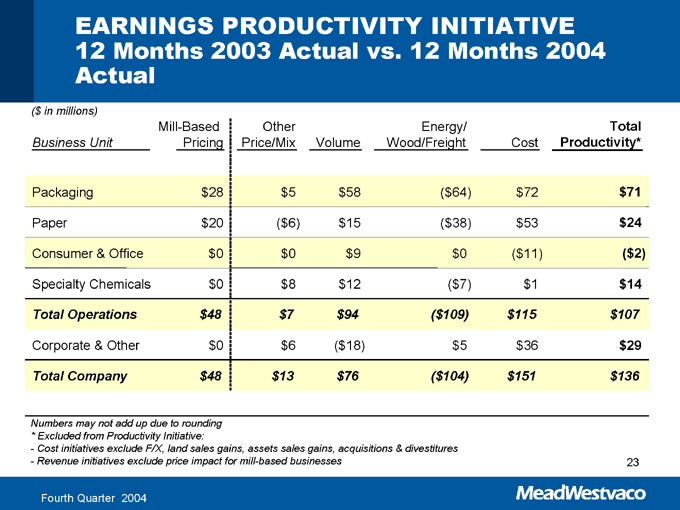

EARNINGS PRODUCTIVITY INITIATIVE

12 Months 2003 Actual vs. 12 Months 2004 Actual

($ in millions)

Mill-Based Other Energy/ Total

Business Unit Pricing Price/Mix Volume Wood/Freight Cost Productivity*

Packaging $28 $5 $58 ( $64) $72 $71

Paper $20 ( $6) $15 ( $38) $53 $24

Consumer & Office $0 $0 $9 $0 ( $11) ( $2)

Specialty Chemicals $0 $8 $12 ( $7) $1 $14

Total Operations $48 $7 $94 ($109) $115 $107

Corporate & Other $0 $6 ($18) $5 $36 $29

Total Company $48 $13 $76 ($104) $151 $136

Numbers may not add up due to rounding * Excluded from Productivity Initiative:

Cost initiatives exclude F/X, land sales gains, assets sales gains, acquisitions & divestitures Revenue initiatives exclude price impact for mill-based businesses

23

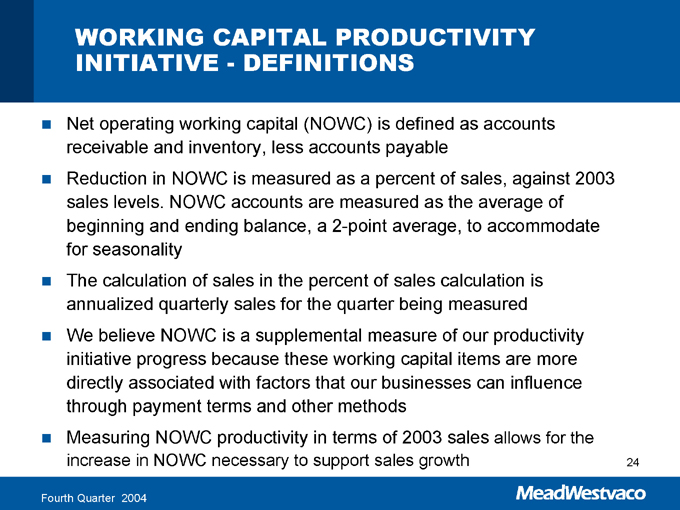

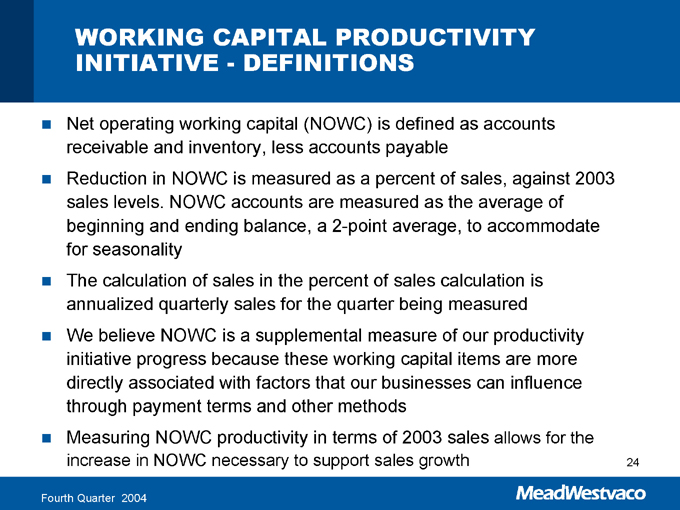

WORKING CAPITAL PRODUCTIVITY INITIATIVE—DEFINITIONS

Net operating working capital (NOWC) is defined as accounts receivable and inventory, less accounts payable

Reduction in NOWC is measured as a percent of sales, against 2003 sales levels. NOWC accounts are measured as the average of beginning and ending balance, a 2-point average, to accommodate for seasonality

The calculation of sales in the percent of sales calculation is annualized quarterly sales for the quarter being measured

We believe NOWC is a supplemental measure of our productivity initiative progress because these working capital items are more directly associated with factors that our businesses can influence through payment terms and other methods

Measuring NOWC productivity in terms of 2003 sales allows for the increase in NOWC necessary to support sales growth

24

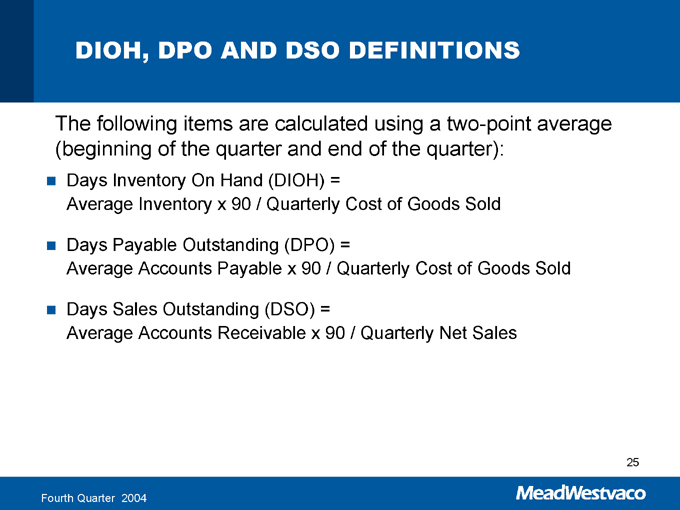

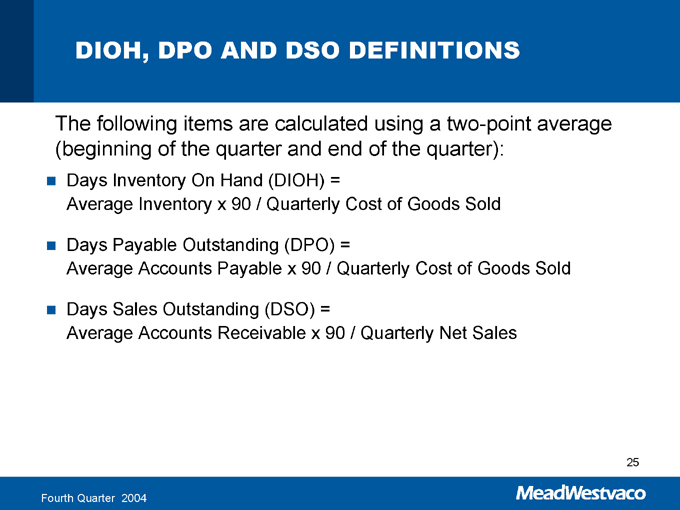

DIOH, DPO AND DSO DEFINITIONS

The following items are calculated using a two-point average (beginning of the quarter and end of the quarter):

Days Inventory On Hand (DIOH) = Average Inventory x 90 / Quarterly Cost of Goods Sold

Days Payable Outstanding (DPO) = Average Accounts Payable x 90 / Quarterly Cost of Goods Sold

Days Sales Outstanding (DSO) = Average Accounts Receivable x 90 / Quarterly Net Sales

25

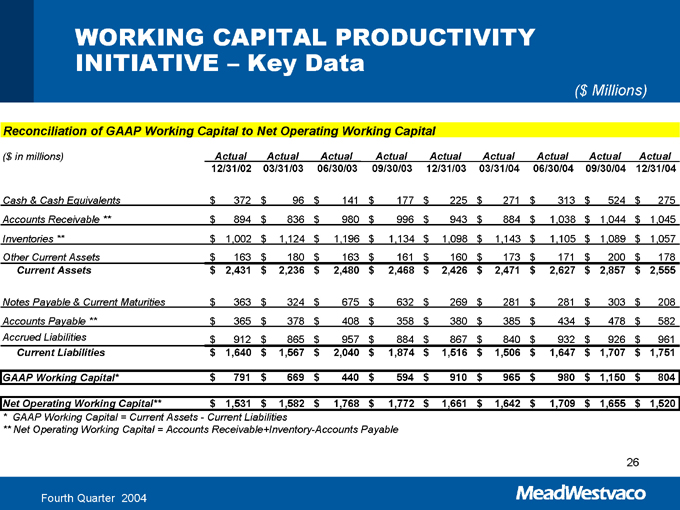

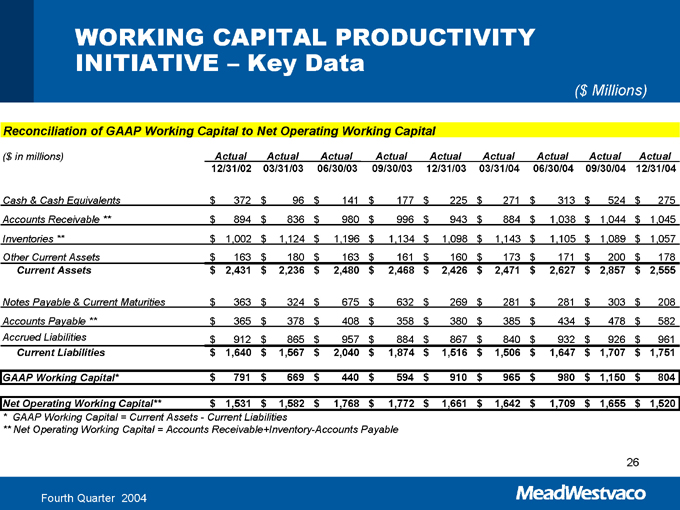

WORKING CAPITAL PRODUCTIVITY INITIATIVE – Key Data

($ Millions)

($ in millions) Actual Actual Actual Actual Actual Actual Actual Actual Actual

12/31/02 03/31/03 06/30/03 09/30/03 12/31/03 03/31/04 06/30/04 09/30/04 12/31/04

Cash & Cash Equivalents $372 $96 $141 $177 $225 $271 $313 $524 $275

Accounts Receivable ** $894 $836 $980 $996 $943 $884 $1,038 $1,044 $1,045

Inventories ** $1,002 $1,124 $1,196 $1,134 $1,098 $1,143 $1,105 $1,089 $1,057

Other Current Assets $163 $180 $163 $161 $160 $173 $171 $200 $178

Current Assets $2,431 $2,236 $2,480 $2,468 $2,426 $2,471 $2,627 $2,857 $2,555

Notes Payable & Current Maturities $363 $324 $675 $632 $269 $281 $281 $303 $208

Accounts Payable ** $365 $378 $408 $358 $380 $385 $434 $478 $582

Accrued Liabilities $912 $865 $957 $884 $867 $840 $932 $926 $961

Current Liabilities $1,640 $1,567 $2,040 $1,874 $1,516 $1,506 $1,647 $1,707 $1,751

GAAP Working Capital* $791 $669 $440 $594 $910 $965 $980 $1,150 $804

Net Operating Working Capital** $1,531 $1,582 $1,768 $1,772 $1,661 $1,642 $1,709 $1,655 $1,520

* GAAP Working Capital = Current Assets—Current Liabilities

** Net Operating Working Capital = Accounts Receivable+Inventory-Accounts Payable

26

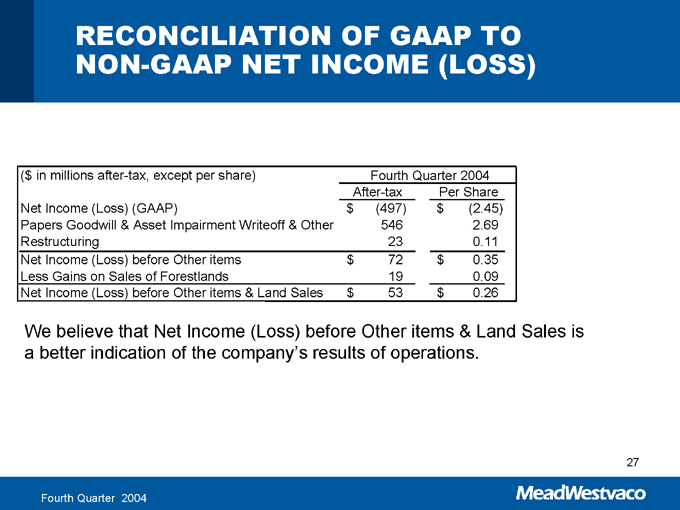

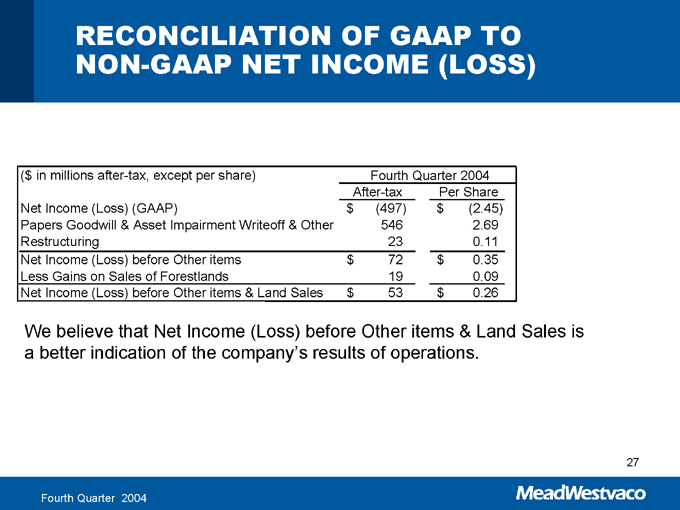

RECONCILIATION OF GAAP TO NON-GAAP NET INCOME (LOSS)

27

($ in millions after-tax, except per share) Fourth Quarter 2004 After-tax Per Share

Net Income (Loss) (GAAP) $(497) $(2.45)

Papers Goodwill & Asset Impairment Writeoff & Other 546 2.69

Restructuring 23 0.11

Net Income (Loss) before Other items $72 $0.35

Less Gains on Sales of Forestlands 19 0.095

Net Income (Loss) before Other items & Land Sales $53 $ 0.26

We believe that Net Income (loss) before Other items & Land Sales is a better indication of the company’s results of operation.