UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240 14a-12 | | |

MeadWestvaco Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

March 21, 2006

Dear Fellow Stockholders:

You are cordially invited to join us at the 2006 Annual Meeting of Stockholders of MeadWestvaco Corporation. The meeting will begin at 10:00 a.m., local time, on Tuesday, April 25, 2006. The meeting will take place at our offices at One High Ridge Park, Stamford, Connecticut 06905.

Please vote on all matters listed in the enclosed Notice of 2006 Annual Meeting of Stockholders. This year our proxy material includes five proposals. Your Board of Directors recommends votingFOR Proposal 1, the election of our directors,FOR Proposal 2, the ratification of the appointment of our independent registered public accounting firm,FOR Proposal 3, approval of the proposal for the annual election of our directors,FOR Proposal 4, approval of the proposal for the removal of directors by majority vote andAGAINST the stockholder proposal. Please refer to the proxy statement for detailed information on each of the proposals and the Annual Meeting.

Your interest in your company as demonstrated by the representation of your shares at our Annual Meeting is a great source of strength for your company. Your vote is very important to us and, accordingly, whether or not you expect to attend the meeting, we ask that you sign, date and promptly return the enclosed proxy.

Very truly yours,

John A. Luke, Jr.

Chairman and

Chief Executive Officer

Notice of 2006 Annual Meeting of Stockholders

and Proxy Statement

The 2006 Annual Meeting of Stockholders of MeadWestvaco Corporation will be held on Tuesday, April 25, 2006, at 10:00 a.m., local time. Stockholders will be asked to vote on the following matters:

| 1. | | To elect four directors for terms of three years each and until their successors are elected and qualified; |

| 2. | | To consider and vote upon a proposal to ratify the action of the Audit Committee of the Board of Directors in appointing PricewaterhouseCoopers LLP as the company’s independent registered public accounting firm for the year 2006; |

| 3. | | To act upon a proposal to amend our Amended and Restated Certificate of Incorporation to provide for the annual election of our Board of Directors; |

| 4. | | To act upon a proposal to amend our Amended and Restated Certificate of Incorporation to provide for the removal of directors by majority vote; |

| 5. | | To act on a stockholder proposal if properly presented at the Annual Meeting; and |

| 6. | | To transact other business that may properly come before the Annual Meeting. |

All holders of common stock of record at the close of business on March 1, 2006 will be entitled to receive notice of and to vote at the Annual Meeting and at any adjournment or postponement. A list of those stockholders will be available for inspection at the executive offices of MeadWestvaco and will also be available for inspection at the Annual Meeting.Whether or not you expect to be at the meeting, please sign, date and promptly return the enclosed proxy.

By Order of the Board of Directors

Wendell L. Willkie, II

Senior Vice President, General Counsel and Secretary

March 21, 2006

Proxy Statement

MeadWestvaco Corporation

One High Ridge Park

Stamford, Connecticut 06905

Your Board of Directors is providing you with this Proxy Statement in connection with the Board’s solicitation of proxies for the Annual Meeting of Stockholders of MeadWestvaco Corporation (“MeadWestvaco” or the “company”) to be held on April 25, 2006. On or about March 24, 2006, we will mail the Proxy Statement, a proxy card, and the Annual Report of MeadWestvaco for the year 2005 to stockholders of record of MeadWestvaco common stock at the close of business on March 1, 2006. Although the Annual Report and Proxy Statement are being mailed together, the Annual Report should not be deemed to be part of the Proxy Statement.

Who is entitled to vote at the meeting?

Only holders of record of MeadWestvaco’s common stock at the close of business on March 1, 2006 will be entitled to vote.

What are the voting rights of the holders of MeadWestvaco common stock?

Each share of outstanding common stock will be entitled to one vote on each matter considered at the meeting.

Who can attend the meeting?

Attendance at the meeting will be limited to holders of record as of March 1, 2006, or their authorized representatives (not to exceed one per stockholder), management, the board and guests of management.

What constitutes a quorum?

The presence, in person or by proxy, of the holders of a majority of the votes entitled to be cast at the Annual Meeting is necessary to constitute a quorum. As of the record date, March 1, 2006, 180,500,681 shares of MeadWestvaco common stock, representing the same number of votes, were outstanding. Therefore, the presence of the holders of common stock representing at least 140,250,341 votes will be required to establish a quorum.

How do I vote?

It is important that your stock be represented at the meeting. Whether or not you plan to attend, please sign, date and return the enclosed proxy promptly in order to be sure that your shares will be voted. If you are a registered stockholder and attend the meeting, you may deliver your completed proxy card in person. “Street name” stockholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares.

Can I vote by telephone or electronically?

If you are a registered stockholder (that is, if you hold your stock in certificate form, in safekeeping or if you participate in the MeadWestvaco Savings Plan), you may vote by telephone, or electronically through the Internet, by following the instructions included with your proxy card. The deadline for voting by telephone or electronically is 5:00 p.m., Eastern Daylight Savings Time, on April 24, 2006. If your shares are held in “street name,” please check your proxy card or contact your broker or nominee to determine whether you will be able to vote by telephone or electronically.

Can I change my vote after I return my proxy card?

Yes. You may revoke your proxy at any time before it is voted at the meeting by submitting a written revocation or a new proxy to the Secretary of MeadWestvaco, or by attending and voting at the Annual Meeting.

1

What vote is required to approve each item?

Election of Directors. The four director nominees receiving the highest number of all votes cast for directors will be elected. A properly executed proxy marked “Withhold Authority” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum.

Other Items. The affirmative vote of the majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the subject matter is required to approve the other matters to be acted upon at the Annual Meeting. In addition, in the case of the vote upon the proposal to amend the company’s Amended and Restated Certificate of Incorporation to provide for the annual election of the Board of Directors, the total number of votes cast in favor of the proposal must represent a majority of the outstanding shares and in the case of the vote upon the proposal to amend the company’s Amended and Restated Certificate of Incorporation to provide for the removal of directors by majority vote, the total number of votes cast in favor of the proposal must represent 75% of the outstanding shares. A properly executed proxy marked “Abstain” with respect to any such matter will not be voted, although it will be counted as entitled to vote on the matter. Accordingly, an abstention will have the effect of a negative vote. Abstentions will be counted in determining whether there is a quorum.

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if you do not give your broker or nominee specific instructions, your shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. Shares represented by such “broker non-votes,” however, will be counted in determining whether there is a quorum.

What are the Board’s recommendations?

All shares of MeadWestvaco common stock entitled to vote and represented by properly executed proxies received prior to the Annual Meeting, and not revoked, will be voted as instructed on those proxies. If no instructions are indicated, the shares will be voted as recommended by the Board of Directors. The Board’s recommendation is set forth together with the description of each item in this Proxy Statement. In summary, the Board recommends a vote:

| | • | | FOR election of the nominated slate of directors (see Item 1); |

| | • | | FOR ratification of the appointment of PricewaterhouseCoopers LLP as the company’s independent registered public accounting firm for 2006 (see Item 2); |

| | • | | FOR approval of the proposal to amend our Amended and Restated Certificate of Incorporation to provide for the annual election of our Board of Directors (see Item 3); |

| | • | | FOR approval of the proposal to amend our Amended and Restated Certificate of Incorporation to provide for the removal of directors by majority vote (see Item 4); and |

| | • | | AGAINST the stockholder proposal (see Item 5). |

If any other matters are properly presented at the Annual Meeting for consideration, the persons named in the enclosed form of proxy will have discretion to vote on those matters in accordance with their own judgment to the same extent as the person signing the proxy would be entitled to vote. The company does not currently anticipate that any other matters will be raised at the Annual Meeting.

2

Ownership of Directors and Executive Officers

How much stock do the company’s directors and executive officers own?

The following table shows the amount of MeadWestvaco common stock beneficially owned, unless otherwise indicated, by our directors, the executive officers named in the Summary Compensation Table and the directors and executive officers as a group. Except as otherwise indicated and subject to applicable community property laws, each owner has sole voting and investment powers with respect to the securities listed.

| | | | | | | |

Name

| | Shares

Beneficially

Owned (1)

| | Options

Exercisable

Within 60 Days

| | Percent of Class

| |

Directors | | | | | | | |

Michael E. Campbell (2) | | 16,738 | | 8,820 | | * | |

Dr. Thomas W. Cole, Jr. (2) | | 19,212 | | 11,730 | | * | |

Duane E. Collins (2) | | 18,890 | | 5,830 | | * | |

James G. Kaiser (2) | | 20,399 | | 7,863 | | * | |

Richard B. Kelson (2) | | 11,719 | | 4,455 | | * | |

John A. Krol (2) | | 20,727 | | 7,863 | | * | |

Susan J. Kropf (2) | | 20,439 | | 7,863 | | * | |

Douglas S. Luke (2)(3) | | 62,062 | | 11,730 | | * | |

John A. Luke, Jr. (4) | | 1,290,755 | | 990,062 | | * | |

Robert C. McCormack (2) | | 13,343 | | 4,455 | | * | |

Timothy H. Powers (2) | | 555 | | 0 | | * | |

Edward M. Straw (2) | | 1,184 | | 0 | | * | |

Jane L. Warner (2) | | 18,387 | | 9,499 | | * | |

J. Lawrence Wilson (2) | | 20,594 | | 7,220 | | * | |

| | | |

Other Named Executive Officers | | | | | | | |

James A. Buzzard (5) | | 372,322 | | 287,355 | | * | |

E. Mark Rajkowski (5) | | 90,472 | | 11,668 | | * | |

Mark T. Watkins (5) | | 148,075 | | 117,130 | | * | |

Wendell L. Willkie, II (5) | | 300,885 | | 262,328 | | * | |

All Directors and Executive Officers as a Group (22 persons) | | 2,728,593 | | 1,977,250 | | 1.5 | % |

| * | | Less than 1% of MeadWestvaco common stock. |

| (1) | | Information concerning beneficial ownership of shares is as of March 1, 2006, the most recent practicable date. Includes the number of shares of which such person has the right to acquire beneficial ownership as of March 1, 2006, and which such person will have the right to acquire beneficial ownership within 60 days thereafter (shares are also set forth in the column “Options Exercisable Within 60 Days”). Also includes shares granted under the MeadWestvaco Corporation Restricted Stock Plan. Restricted shares may be voted but not disposed of during the restriction period. |

| (2) | | Each non-employee director holds 6,948 stock units (representing the same number of shares of MeadWestvaco common stock) granted under the MeadWestvaco Corporation Compensation Plan for Non-Employee Directors, with the exception of Mr. Straw, who holds 1,184 stock units and Mr. Powers who holds 555 stock units. The rights of each non-employee director in respect of these stock units are vested at all times, and distributions of the stock units are required to be made in MeadWestvaco common stock on the earliest practicable date following the end of the calendar quarter in which the director’s board membership is terminated. |

| (3) | | Includes 17,778 MeadWestvaco shares held in a trust of which Mr. Luke is a co-trustee. |

| (4) | | Includes 29,054 MeadWestvaco shares held indirectly through employee benefit plans and 23,814 shares held in trust for members of Mr. Luke���s immediate family. |

| (5) | | Includes MeadWestvaco shares held indirectly through employee benefit plans by Messrs. Buzzard, Rajkowski, Watkins and Willkie in the amounts of 19,307 shares, 404 shares, 1,884 shares and 8,092 shares, respectively. |

3

Ownership of Certain Beneficial Owners

Who are the largest owners of the company’s stock?

Based upon Schedule 13D and 13G filings with the Securities and Exchange Commission, the following investment advisers are believed to have beneficial ownership (as defined for certain purposes by the Securities and Exchange Commission) of more than 5% of the company’s common stock by virtue of having investment authority and, to some extent, voting authority over the number of shares indicated.

| | | | | |

| | | Shares

| | Percent

of Class*

| |

Barclays Global Investors, NA and related entities** 43 Fremont Street San Francisco, CA 94105 | | 9,072,631 | | 5.0 | % |

| | |

Capital Research and Management Company*** 333 South Hope Street Los Angeles, CA 90071 | | 20,657,400 | | 11.4 | % |

| | |

Lord, Abbett & Co.**** 90 Hudson Street Jersey City, NJ 07302 | | 11,562,103 | | 6.37 | % |

| ** | | Based on Schedule 13G filed by Barclays Global Investors, NA on January 26, 2006. |

| *** | | Based on Schedule 13G filed by Capital Research and Management Company on February 10, 2006. |

| **** | | Based on Schedule 13G/A filed by Lord, Abbett & Co. on February 14, 2006. |

The MeadWestvaco stock ownership plans for salaried and hourly employees held, as of March 1, 2006, an aggregate amount of 14,604,208 MeadWestvaco shares, or 8% of the total outstanding, for which full voting rights are exercisable by members of the plans. As of that date, there were approximately 16,500 participants in these plans.

Corporate Governance

1. Election of directors

Four directors will be elected to hold office for the terms set forth below. There is no provision for cumulative voting in the election of directors. At the meeting, one of the persons named in the enclosed proxy (or a substitute) will, if authorized, vote the shares covered by such proxy for election of the four nominees for directors listed on the following page.

The present nominees, James G. Kaiser, Richard B. Kelson, John A. Krol, and John A. Luke, Jr., if elected, will be elected for terms expiring at the 2009 Annual Meeting of Stockholders.The Board of Directors unanimously recommends a vote FOR the named nominees. Should any of these nominees become unavailable for election for any reason presently unknown, a person named in the enclosed proxy (or a substitute) will vote for the election of such other person or persons, if any, as the Board of Directors may recommend.

Douglas S. Luke, Robert C. McCormack, Edward M. Straw, and Jane L. Warner will continue to serve for a term expiring at the 2007 Annual Meeting. Michael E. Campbell, Dr. Thomas W. Cole, Jr., Susan J. Kropf, and Timothy H. Powers will continue to serve for a term expiring at the 2008 Annual Meeting.

All of the preceding 12 persons currently serve as directors of MeadWestvaco and have done so since the combination of The Mead Corporation and Westvaco Corporation was completed in January 2002 with the exception of Edward M. Straw who became a director in the fall of 2005 and Timothy H. Powers who became a director in January 2006. Duane E. Collins and J. Lawrence Wilson will retire from the Board immediately prior to the Annual Meeting. Set forth below is the principal occupation of, and certain other information regarding, the nominees and the other directors who will continue to serve after the Annual Meeting.

4

Nominees for Election as Directors

for a Term of Three Years Expiring in 2009

| | | | |

Name

| | Age*

| | Director of

MeadWestvaco

Since

|

JAMES G. KAISER | | 63 | | 2002 |

| Chairman and Chief Executive Officer, Avenir Partners, Inc., since 1998. Manager, Kaiser Ridgeway LLC, since 2002, Manager, Ridgeway Avenir, LLC, since 2001. Chairman and Chief Executive Officer, Pelican Banners & Signs, Inc., 2001-2003. President and Chief Executive Officer of Quanterra Incorporated 1994-1996. Director: Sunoco, Inc. | | | | |

| | |

RICHARD B. KELSON | | 59 | | 2002 |

| Chairman’s Counsel, Alcoa, Inc., since 2006; Executive Vice President and Chief Financial Officer, 1997-2005. Director: PNC Financial Services. Trustee: Carnegie Mellon University. Member, University of Pittsburgh School of Law Board of Visitors. | | | | |

| | |

JOHN A. KROL | | 69 | | 2002 |

| Chairman, E.I. du Pont de Nemours and Company, 1997-1998; Chief Executive Officer, 1995-1998. Director: Milliken & Company, Inc., ACE Insurance, Ltd., Tyco International Ltd. Trustee: University of Delaware. Advisory Board: Bechtel (Advisory Board) | | | | |

| | |

JOHN A. LUKE, JR. | | 57 | | 2002 |

| Chairman and Chief Executive Officer, MeadWestvaco Corporation, since 2002. Chairman, President and Chief Executive Officer, MeadWestvaco, 2002-2003. Chairman, President and Chief Executive Officer, Westvaco Corporation, 1996-2002. Chairman, National Association of Manufacturers. Director: American Forest and Paper Association, The Bank of New York, The Timken Company. Trustee: Lawrence University, American Enterprise Institute for Public Policy Research. Governor, National Council for Air and Stream Improvement, Inc. | | | | |

Directors Whose Terms Expire in 2007

| | | | |

Name

| | | | |

DOUGLAS S. LUKE | | 64 | | 2002 |

| President and Chief Executive Officer, HL Capital, Inc., a private investment company with diversified interests in marketable securities and private equities, since 1999. Director: Regency Centers Inc. Trustee: National Outdoor Leadership School, The Adirondack Council, Adirondack Nature Conservancy/Adirondack Land Trust. | | | | |

* Ages of directors are as of March 1, 2006.

5

| | | | |

Name

| | Age*

| | Director of

MeadWestvaco

Since

|

ROBERT C. McCORMACK | | 66 | | 2002 |

| Partner, Trident Capital, a private equity investment firm, since 1993, Advisory Director, 2005. Director: DeVry, Inc., Illinois Tool Works, Inc., The Northern Trust Corporation, The Rehabilitation Institute of Chicago. | | | | |

| | |

EDWARD M. STRAW | | 66 | | 2005 |

| President of Global Operations, Estee Lauder Companies, 2000-2004; Senior Vice President, Global Supply Chain and Manufacturing, Compaq Computer Corporation, 1998-2000. Prior to joining the private sector, Mr. Straw had a 35 year career in the U.S. Navy, retiring as a three-star Vice Admiral in 1996. Director: Eddie Bauer Holding Inc. Board member: U.S. Chamber of Commerce, Board of Advisors of The George Washington University, National Eagle Scout Association. Trustee: U.S. Naval Academy Foundation. | | | | |

| | |

JANE L. WARNER | | 59 | | 2002 |

| Group President, Worldwide Finishing Systems, ITW since 2005; President, Plexus Systems, from 2004-2005; Vice President, EDS and President, Global Manufacturing and Communications Industries, 2002-2004; Managing Director, Automotive Industry Group, 2000-2002. Director: Tenneco Corporation, Original Equipment Supplier Association. Trustee: Kettering University Board of Trustees. | | | | |

Directors Whose Terms Expire in 2008

| | | | |

Name

| | | | |

MICHAEL E. CAMPBELL | | 58 | | 2002 |

| Chairman, President and Chief Executive Officer, Arch Chemicals, Inc., since 1999. Director: American Chemistry Council, National Association of Manufacturers. | | | | |

| | |

DR. THOMAS W. COLE, JR. | | 65 | | 2002 |

| President and Chief Executive Officer, Great Schools Atlanta, since 2004. President Emeritus since 2002 and President, Clark Atlanta University, 1989-2002. Trustee: Knoxville College, Africa University, Andrew College, University of Charleston. | | | | |

| | |

SUSAN J. KROPF | | 57 | | 2002 |

| President and Chief Operating Officer, Avon Products, Inc., since 2001; Chief Operating Officer, North America and Global Business Operations, 1999-2001. Director: Avon Products, Inc., The Sherwin-Williams Company, Wallace Foundation. | | | | |

| | |

TIMOTHY H. POWERS | | 58 | | 2006 |

Chairman, President and Chief Executive Officer, Hubbell Incorporated since September 2004; President and Chief Executive Officer, 2001-2004; Senior Vice President and Chief Financial Officer, 1998-2001. Director: Chairman, National Electrical Manufacturers Association | | | | |

* Ages of directors are as of March 1, 2006.

6

Director Compensation

How are directors compensated?

Each non-employee director of MeadWestvaco receives $50,000 as an annual cash payment for services as a director. Effective April 25, 2006 the annual cash payment shall increase by $5,000. Board members may elect to defer this compensation under the MeadWestvaco Corporation Compensation Plan for Non-Employee Directors. Directors have the opportunity to defer all or a portion of their annual cash retainer. Directors who are also employees of the company receive no additional compensation for service as a director.

Each year, non-employee directors receive a grant of MeadWestvaco stock units equivalent to $60,000 at the time of grant. Effective April 25, 2006 the annual grant of stock units shall increase by $5,000. Distributions of the stock units are made in MeadWestvaco common stock upon termination of a director’s board membership.

How are Committee Chairs and Audit Committee members compensated?

In addition to the compensation described above, the MeadWestvaco Audit Committee Chair receives a $20,000 annual retainer, the Compensation and Organization Development Committee Chair receives a $15,000 annual retainer, and the Chair of each of the other standing Committees of the Board receives an annual retainer of $10,000. Each of the members of the Audit Committee, other than the Chair, receives an annual retainer of $5,000.

How often did the Board meet during 2005?

During 2005, the Board of Directors of MeadWestvaco met eight times, and no incumbent director attended fewer than 75 percent of the aggregate of: (1) the total number of meetings of the Board of Directors held in 2005 while he or she was a director and (2) the total number of meetings held in 2005 by all committees of the Board of Directors on which he or she served while he or she was a director.

7

Board Committees

What committees has the Board established?

MeadWestvaco currently has five principal standing committees of the Board of Directors: Audit; Compensation and Organization Development; Finance; Nominating and Governance; and The Committee on Safety, Health and the Environment. Each of these committees operates under a written charter adopted by the Board and included on the company’s website. Printed copies are available to any stockholder upon request. MeadWestvaco also has an Executive Committee that may be convened under certain circumstances when a special meeting of the Board is not practical or is not warranted.

The current members of the Board committees are as follows:

| | |

| Audit | | Finance |

Michael E. Campbell, Chairman | | Douglas S. Luke, Chairman |

Duane E. Collins | | Susan J. Kropf |

James G. Kaiser | | Robert C. McCormack |

Richard B. Kelson | | J. Lawrence Wilson |

Timothy H. Powers** | | (all non-employee directors) |

Edward M. Straw* | | |

Jane L. Warner | | |

(all non-employee directors) | | |

| |

Compensation and Organization Development | | Nominating and Governance |

Susan J. Kropf, Chairman | | John A. Krol, Chairman |

Dr. Thomas W. Cole, Jr. | | Michael E. Campbell |

Duane E. Collins | | Robert C. McCormack |

Richard B. Kelson | | J. Lawrence Wilson |

(all non-employee directors) | | (all non-employee directors) |

| |

| Executive | | Safety, Health and Environment |

John A. Luke, Jr., Chairman | | Dr. Thomas W. Cole, Jr., Chairman |

Michael E. Campbell | | James G. Kaiser |

Dr. Thomas W. Cole, Jr. | | John A. Krol |

John A. Krol | | Douglas S. Luke |

Susan J. Kropf | | Edward M. Straw* |

Douglas S. Luke | | Jane L. Warner |

| | | (all non-employee directors) |

* Effective 10/25/05

** Effective 1/24/06

The functions of the current Board committees are as follows:

Audit Committee

Assists the Board of Directors in fulfilling its responsibilities to stockholders, potential stockholders and the investment community relating to corporate accounting, reporting practices of the company and the quality and integrity of the financial reports of the company. The Committee assists the Board of Directors in reviewing and monitoring (1) the integrity of the financial statements of the company and internal control over financial reporting, (2) the compliance by the company with legal and regulatory requirements, (3) the independence and qualifications of the company’s independent registered public accounting firm and (4) the performance of the company’s internal audit function and independent registered public accounting firm. The Audit Committee also has sole authority to appoint and replace the independent registered public accounting firm, subject to stockholder ratification. None of the members serve on more than three audit committees. All members are “financially literate” under New York Stock Exchange listing standards, and at least one member has such accounting or related financial

8

management expertise as to be considered a “financial expert” under Securities and Exchange Commission rules. The Board has designated the Audit Committee Chair, Michael E. Campbell and Committee members Richard B. Kelson and Timothy H. Powers as “audit committee financial experts” as a result of their experience in senior corporate executive positions with financial oversight responsibilities. The Audit Committee met seven times in 2005.

Compensation and Organization Development Committee

Reviews and approves the company’s compensation philosophy. It is charged with the responsibility for assuring that officers and key management personnel are effectively compensated in terms that are motivating, internally equitable and externally competitive. The Committee approves compensation of the Leadership Team (the Chairman and Chief Executive Officer and his direct reports), reviews compensation for remaining senior management, sets the criteria for awards under incentive compensation plans and determines whether such criteria have been met. The Committee generally oversees policies and practices of the company that advance its organization development, including succession planning as well as those designed to achieve the most productive engagement of the company’s workforce and the attainment of greater diversity. The Compensation and Organization Development Committee met six times in 2005 (including a half day retreat). Please refer to the report of the Compensation and Organization Development Committee below.

Executive Committee

Provides for the exercise of certain powers of the Board between meetings of the Board when a special meeting of the Board is not practical or is not warranted. The Executive Committee did not meet in 2005.

Finance Committee

Oversees the company’s financial affairs and recommends those financial actions and policies that are most appropriate to accommodate the company’s operating strategies while maintaining a sound financial condition. The Committee reviews the company’s capital structure, financial plans, policies and requirements as well as strategic actions proposed by the company’s management. The Committee also reviews funding recommendations concerning the company’s pension plans together with the investment performance of such plans and the company’s risk management policies and practices. The Finance Committee met five times in 2005.

Nominating and Governance Committee

Studies and makes recommendations concerning the qualifications of all directors, and selects and recommends candidates for election and re-election to the Board and persons to fill vacancies on the Board, as well as the compensation paid to non-employee directors. The Committee also reviews and considers other matters of corporate governance, including trends and emerging expectations, as well as best practices. In advising the Board and management, the Committee may consider a range of governance matters, including Board structure, Board composition, committees and criteria for committee appointment, Board meeting policies, and the ongoing relationship between the Board and management. The Nominating and Governance Committee met five times in 2005.

The Committee on Safety, Health and the Environment

Reviews implementation of the company’s workplace safety and health program. The Committee also reviews the stewardship of the company with respect to conservation of natural resources and its ability to protect the natural environment. The Committee receives regular reports from management, reviews safety, health and environmental matters with management, including the company’s compliance record and programs, and makes recommendations as needed. The Committee on Safety, Health and the Environment met three times in 2005.

Corporate Governance Principles

MeadWestvaco’sCorporate Governance Principles adopted by the Board of Directors in February 2003 and subsequently amended, address, among other things, standards for evaluating the independence of

9

the company’s directors. The full text of thePrinciples is included in this Proxy Statement as Annex A. The Principles are also available on the company’s website at the following address:http://www.meadwestvaco.com/corporate.nsf/investor/principles and printed copies are available to any stockholder upon request.

Pursuant to thePrinciples, the Board, with the support of the Nominating and Governance Committee, reviewed the independence of directors in February 2006. Transactions and relationships during the prior year between each director or any member of his or her immediate family and the company and its subsidiaries were considered. As provided in thePrinciples, the purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent.

As a result of this review, the Board affirmatively determined that, with the exception of John A. Luke, Jr., the Chairman and Chief Executive Officer of the company, all of the directors, including each of the members of the Audit, Compensation and Organization Development, and Nominating and Governance Committees, are independent of the company under the standards set forth in theCorporate Governance Principles and the New York Stock Exchange listing standards.

MeadWestvaco Nominating and Governance Committee

Charter

The Board of Directors of MeadWestvaco adopted a Nominating and Governance Committee charter on January 30, 2002 that was subsequently amended. The Nominating and Governance Committee Charter is included on the company’s website at the following address:http://www.meadwestvaco.com/corporate.nsf/investor/ngCommittee and printed copies are available to any stockholder upon request. The charter sets forth the purposes, goals and responsibilities of the Committee. The charter also provides that the Committee annually evaluate its performance. In accordance with the company’sCorporate Governance Principles, the members of the Nominating and Governance Committee are required to be independent directors under the criteria established by the Board, consistent with the requirements of the New York Stock Exchange and the Securities and Exchange Commission.

Director Candidates

In accordance with theCorporate Governance Principles, the Nominating and Governance Committee is responsible for recommending qualified individuals for membership on the Board of Directors. The Committee is dedicated to periodically reviewing with the Board the requisite qualifications of Board members as well as the composition of the Board as a whole. This assessment addresses independence of Board members, as well as the consideration of experience, judgment, knowledge and diversity in the context of the needs of the Board. General criteria for the nomination of all director candidates include:

| | • | | the highest integrity and ethical standards; |

| | • | | the ability to provide wise and informed guidance to management; |

| | • | | a willingness to pursue thoughtful, objective inquiry on important issues before the company; |

| | • | | a commitment to enhancing stockholder value; and |

| | • | | a range of experience and knowledge commensurate with the company’s needs as well as the expectations of knowledgeable investors. |

The board succession plan states that the Committee seeks the following additional attributes:

| | • | | a demonstrated track record of success; |

| | • | | independence, objectivity, perspective and judgment; |

| | • | | willingness to challenge prevailing opinion; |

10

| | • | | capacity for teamwork and compatibility with other Board members; |

| | • | | specific knowledge in significant areas; and |

| | • | | consistent availability. |

In addition, the background and specific competencies of candidates are considered. These include business management, financial background, manufacturing background, marketing experience, knowledge of the packaging industry, global experience, research and development, service in government, academia or other public sector professions, financial expertise and independence under the standards of the New York Stock Exchange. In 2005, the Nominating and Governance Committee recommended and the Board approved the election of a new member, Edward M. Straw. Mr. Straw was recommended by a third party search firm. In 2006, the Nominating and Governance Committee recommended and the Board approved the election of a new member, Timothy H. Powers. Mr. Powers was recommended by a third party search firm.

Stockholder Nominations

The Nominating and Governance Committee will consider stockholder recommendations for nominees to the Board of Directors. In addition, any stockholder entitled to vote for the election of directors at a meeting may nominate persons for election as directors if written notice of such stockholder’s intent to make such nomination is given, either by personal delivery or by the United States mail, postage prepaid, to the Secretary of the company, not later than (i) with respect to an election to be held at an annual meeting, 90 days in advance of such meeting, and (ii) with respect to an election to be held at a special meeting for the election of directors, the close of business on the seventh day following the date on which notice of such meeting is first given to stockholders. Each notice must set forth: (a) the name and address of the stockholder who intends to make the nomination and of the person or persons to be nominated, (b) a representation that the stockholder is a holder of record of stock of the company entitled to vote at the meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, (c) a description of all arrangements or understandings between such stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by such stockholder, (d) such other information regarding each nominee proposed by such stockholder as would have been required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission had each nominee been nominated, or intended to be nominated by the Board of Directors, and (e) the consent of each nominee to serve as a director of the company if so elected. Stockholders’ recommendations for nominees of directors should also provide to the Nominating and Governance Committee the foregoing information with respect to any individual they wish to recommend and such recommendations are treated in the same manner as other recommendations for nominees for director.

Policy on Voting for Directors

On December 22, 2005 the company’s Nominating and Governance Committee pursuant to a delegation of authority granted by the Board of Directors adopted the following policy:

In an uncontested election of directors, any director nominee who receives a greater number of votes “withheld” from his or her election than votes “for” his or her election will promptly tender his or her resignation to the Chairman of the Board and the Nominating and Governance Committee following certification of the shareholder vote.

The Nominating and Governance Committee will promptly consider the resignation submitted by a director receiving a greater number of votes “withheld” from his or her election than votes “for” his or her election, and the Nominating and Governance Committee will recommend to the Board whether to accept the tendered resignation or reject it. In considering whether to accept or reject the tendered resignation, the Nominating and Governance Committee will consider all factors deemed relevant by the members of the Nominating and Governance Committee, including, the reasons why shareholders

11

“withheld” votes for election from such director, the length of service and qualifications of the director, the director’s contributions to the company and the MeadWestvaco Corporate Governance Principles.

The Board will act on the Nominating and Governance Committee’s recommendation within 90 days following the date of the shareholders’ meeting. In considering the Nominating and Governance Committee’s recommendation, the Board will consider the factors considered by the Nominating and Governance Committee and such additional information deemed relevant by the Board. Following the Board’s decision, the company will promptly disclose the Board’s decision whether to accept the director’s resignation as tendered (including a full explanation of the process by which the decision was reached and, if applicable, the reasons for rejecting the resignation) in a filing with the Securities and Exchange Commission.

To the extent that one or more directors’ resignations are accepted by the Board, the Nominating and Governance Committee will recommend to the Board whether to fill such vacancy or vacancies or to reduce the size of the Board.

Any director who tenders his or her resignation pursuant to this provision will not participate in the Nominating and Governance Committee recommendation or Board consideration regarding whether or not to accept the tendered resignation. If a majority of the members of the Nominating and Governance Committee received a greater number of votes “withheld” from their election than votes “for” their election at the same election, then the independent directors who are on the Board who did not receive a greater number of votes “withheld” from their election than votes “for” their election (or who were not standing for election) will appoint a Board committee solely for the purpose of considering the tendered resignations and will recommend to the Board whether to accept or reject them. This policy will be included in each proxy statement relating to an election of directors of the company.

Code of Conduct

TheMeadWestvaco Code of Conduct applies to all MeadWestvaco directors and employees worldwide, including the Chief Executive Officer and the Chief Financial Officer. These policies and principles support the company’s core values of integrity, respect for the individual, commitment to excellence and teamwork. TheCode of Conduct can be found on the company’s website at the following address:http://www.meadwestvaco.com/corporate.nsf/investor/conduct and printed copies are available to any stockholder upon request.

Contact MeadWestvaco Board

Anyone who wants specifically to raise a concern to the non-management members of the Board of Directors, including concerns about the company’s accounting, internal accounting controls or auditing matters, may contact the Chair of the Audit Committee directly. Such communications will also be received and reviewed by the General Counsel and treated as confidentially as possible, consistent with ensuring appropriate and careful review of the matter. Communications may be anonymous. The Chair of the Audit Committee will report as appropriate to the Board of Directors regarding such concerns. The company’sCode of Conduct prohibits any employee from taking any adverse action against anyone who in good faith raises a concern about business integrity.

To convey a concern to the Chair of the Audit Committee, you may call 1-888-536-1502, or write to: Audit Committee Chair, MeadWestvaco Corporation, Attention: General Counsel, World Headquarters, One High Ridge Park, Stamford, Connecticut 06905. If preferred, concerns may be emailed using the form set forth at the following web address:http://www.meadwestvaco.com/shared/contactboard.nsf/email. Inclusion of your name and email address is optional.

Director Attendance at Annual Meetings

Directors are invited and encouraged to attend the company’s Annual Meeting of Stockholders. In April 2005, all 12 directors attended the meeting.

12

Executive Sessions

The non-management directors meet in executive session at each regularly scheduled Board meeting during the year. The director who presides at these meetings is chosen by annual rotation from among the chairmen of the following Board Committees: Audit, Compensation and Organization Development, and Nominating and Governance. The presiding director chairs the executive sessions and reports back as appropriate to the Chief Executive Officer.

Officer and Director Stock Ownership

In January 2005, the Compensation and Organization Development Committee approved stock ownership guidelines for corporate officers and key senior executives pursuant to which the Chief Executive Officer is required to hold shares of common stock of the company in an amount equal to five times his annual base salary. Certain senior executives are required to hold shares of common stock of the company in an amount equal to three times annual base salary and other senior management are required to hold shares of common stock in an amount equal to their annual base salary. Covered executives have five years to meet the guidelines, and the Committee has the authority to apply its discretion in granting exceptions during periods of volatile markets. The following types of share ownership are counted towards the requirement: shares owned outright, including shares held in street name accounts; shares jointly held with a spouse, or in trust for the officer’s benefit; shares held in a qualified plan; stock units payable in nonqualified deferred compensation accounts; and restricted stock shares.

In February 2005, the Board approved stock ownership guidelines for non-executive directors pursuant to which non-executive directors are encouraged to own, at a minimum, MeadWestvaco stock or stock units equal to three times their annual cash retainer within three years of joining the board. Discretion may be applied in periods of volatile markets.

Certain Relationships and Related Transactions

The Board, at the recommendation of the Nominating and Governance Committee, has determined that all of the non-employee directors are independent of the company under the standards set forth in theCorporate Governance Principles. None of the company’s non-employee directors or any members of their immediate family are executive officers at a company where, in the preceding three years, the annual payments to or payments from MeadWestvaco for property or services in any single fiscal year exceeded two percent of the annual consolidated gross revenues of the company at which he or she served as an executive officer. None of the company’s non-employee directors serve as executive officers of a tax-exempt organization where, in the preceding three years, the company’s contributions to the organization in any single fiscal year exceeded the greater of $1,000,000 or two percent of that organization’s consolidated gross revenues.

13

Report of the Audit Committee of the Board of Directors

Membership and Role of the Audit Committee

The Audit Committee consists of seven members of the company’s Board of Directors. Each member of the Audit Committee is independent and possesses other qualifications as required by the New York Stock Exchange. All of the members of the Audit Committee, moreover, are independent of the company under the standards set forth in theCorporate Governance Principles. The Audit Committee operates under a written charter adopted by the Board of Directors. The full text of the Audit Committee Charter is included in this Proxy Statement as Annex B. The Audit Committee charter is included on the company’s website at the following address:http://www.meadwestvaco.com/corporate.nsf/investor/audit and printed copies are available to any stockholder upon request.

The primary function of the Audit Committee is to assist the Board of Directors in reviewing and monitoring (1) the integrity of the financial statements of the company and internal control over financial reporting, (2) the compliance by the company with legal and regulatory requirements, (3) the independence and qualifications of the company’s independent registered public accounting firm and (4) the performance of the company’s internal audit function and independent registered public accounting firm.

Review of the Company’s Audited Financial Statements for the Year Ended December 31, 2005 and Internal Control over Financial Reporting as of December 31, 2005

Management is responsible for the financial reporting process, including the system of internal control, and for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. PricewaterhouseCoopers LLP, the company’s independent registered public accounting firm for 2005, is responsible for auditing those financial statements and the company’s internal control over financial reporting. The Audit Committee discussed with PricewaterhouseCoopers LLP the matters that are required to be discussed under Public Company Accounting Oversight Board Standards. The Audit Committee also received the written disclosures and letter from PricewaterhouseCoopers LLP required byIndependence Standards Board Standard No. 1 (Independence Discussion with Audit Committees), and has discussed with PricewaterhouseCoopers LLP the independence of PricewaterhouseCoopers LLP from MeadWestvaco and its management. The Audit Committee has reviewed and discussed the audited financial statements and management’s assessment of the effectiveness of internal control over financial reporting with management.

The Audit Committee of MeadWestvaco reviewed and discussed the foregoing as reflected in the minutes of the Audit Committee, and on the basis of that review and those discussions, recommended to the Board of Directors that the audited financial statements of MeadWestvaco for the year ended December 31, 2005 be included in the Annual Report on Form 10-K for the year ended December 31, 2005 for filing by MeadWestvaco with the United States Securities and Exchange Commission.

The Audit Committee met seven times in 2005. After each meeting, the Audit Committee met in executive sessions with the independent registered public accounting firm and the director of internal audit to review, among other things, staffing, the audit plan and reports on effectiveness of internal control over financial reporting.

The Audit Committee approved 100% of the audit, audit-related and tax services for the company performed by the independent auditor in 2005 and 2004. The company’s Audit Committee Pre-Approval Policy is included in this Proxy Statement as Annex C.

14

MeadWestvaco incurred the following fees for services rendered by PricewaterhouseCoopers LLP for the years ended December 31, 2005 and 2004:

| | | | | | |

| | | Year ended December 31,

2005

| | Year ended December 31,

2004

|

Audit fees | | $ | 7,472,000 | | $ | 8,288,000 |

| | |

|

| |

|

|

Audit-related fees | | | | | | |

Audits of employee benefit plans | | $ | 190,000 | | $ | 250,000 |

Other attest services | | | 205,000 | | | 215,000 |

Divestiture and closing balance sheet audits | | | 1,288,300 | | | 550,000 |

Other audit-related | | | 8,800 | | | 0 |

| | |

|

| |

|

|

Total audit-related fees | | $ | 1,692,100 | | $ | 1,015,000 |

| | |

|

| |

|

|

Tax fees | | | | | | |

Tax compliance and other matters | | $ | 395,000 | | $ | 470,000 |

| | |

|

| |

|

|

Total all other fees | | $ | 0 | | $ | 0 |

| | |

|

| |

|

|

The Audit Committee concluded that the provision of non-audit services in 2005 and 2004 by PricewaterhouseCoopers LLP was compatible with their independence.

Submitted by:

| | |

Michael E. Campbell, Chairman | | Timothy H. Powers |

Duane E. Collins | | Edward M. Straw |

James G. Kaiser | | Jane L. Warner |

Richard B. Kelson | | |

2. Proposal to ratify appointment of the independent registered public accounting firm.

The Audit Committee of the Board of Directors has appointed PricewaterhouseCoopers LLP to serve as the company’s independent registered public accounting firm for 2006 subject to approval by the stockholders at the 2006 Annual Meeting. PricewaterhouseCoopers LLP currently serves as the company’s independent registered public accounting firm, and received $9,421,100 in fees and expenses during the year ended December 31, 2005. The Audit Committee has been advised by PricewaterhouseCoopers LLP that neither the firm, nor any of its partners or staff, has any direct financial interest or material indirect financial interest in the company or any of its subsidiaries. Representatives of PricewaterhouseCoopers LLP plan to attend the Annual Meeting, will have an opportunity to make a statement if they desire and will be available to respond to appropriate questions. If the stockholders do not ratify this appointment, the Audit Committee will consider the appointment of another independent registered public accounting firm.

The Board of Directors unanimously recommends a vote FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the company’s independent registered public accounting firm.

Executive Compensation

Report of the Compensation and Organization Development Committee

The Compensation and Organization Development Committee, a Board committee, consists of four members of the company’s Board of Directors, none of whom is or has been at any time an employee of the company or its subsidiaries, and none of whom is receiving any compensation from the company or

15

its subsidiaries other than as a director. All of the members of the Compensation and Organization Development Committee, moreover, are independent of the company under the standards set forth in theCorporate Governance Principles. The Committee is charged with assuring that the company’s executive officers are effectively compensated in terms that are motivating, externally competitive and internally equitable. The Committee considers and approves all compensation of the Leadership Team (comprised of the Chairman and Chief Executive Officer and his direct reports). The Committee also reviews compensation of the company’s business unit presidents, key personnel and corporate officers. With regard to compensation, the Committee approves awards for cash and equity compensation and sets criteria for awards under incentive compensation plans for the Leadership Team and determines whether such criteria have been met. In addition, the Committee reviews and recommends for approval by the Board of Directors the company’s various employee benefit plans affecting all employees including, but not limited to, qualified and non-qualified retirement plans, change of control and severance arrangements. As part of this responsibility, the Committee reviews the design and financial implications of individual change of control agreements to insure the design is competitive and the benefits provided are reasonable. The Committee also oversees the development of the company’s leadership succession plan and employee relations strategies. The Compensation and Organization Development Committee Charter is included on the company’s website at the following address:http://www.meadwestvaco.com/corporate.nsf/investor/compensation and printed copies are available to any stockholder upon request.

Review and Approval Process

The Committee believes that its consideration of significant compensation and benefit programs is deliberative and thorough. The Committee ordinarily meets before every Board meeting and has authority to retain expert independent advice to assist in its deliberations.

Compensation Philosophy

MeadWestvaco’s executive compensation programs are designed to give executives strong incentives to achieve the company’s strategic business objectives thus increasing the company’s value for its stockholders over the long term. In addition to the achievement of key financial and operating metrics, the Committee considers an individual executive’s contribution to the execution of corporate strategies as critically important to its evaluation of an executive’s performance and, relies heavily on this criterion in its review and approval of salaries and cash and equity awards. The company also views its compensation programs as critical tools to recruit and retain key executive talent. Guided by principles that reinforce the company’s pay-for-performance philosophy, compensation generally includes a base salary and eligibility for annual and long-term incentives paid in cash and equity. The Committee believes that the company’s compensation program for senior executives must reflect a focus on sustained operational excellence that rewards competitive long-term financial results. The company’s pay-for-performance philosophy is designed by establishing and then evaluating actual performance relative to key financial performance goals, which are discussed in more detail below. The Committee’s role is to ensure that the company’s compensation philosophy is aligned with these performance goals.

Prior to 2004, a significant portion of the company’s long-term incentive compensation for the Leadership Team was paid in the form of cash. In 2004, the Committee initiated a re-design of the company’s long-term incentive compensation program to place greater emphasis on equity awards. The changes over the last two years reflect the Committee’s philosophy that long-term incentive compensation should serve to align the interests of executives with those of MeadWestvaco’s shareholders (through stock option awards), promote long-term performance goals (through performance based awards of restricted stock or stock units) and further executive retention (through service based awards of restricted stock or stock units). In 2005, the Committee authorized an equity award approach for the Leadership Team that is intended to deliver long-term incentive compensation primarily in the form of performance based restricted stock and stock options. These design changes insure that the ultimate payment and delivery of long-term compensation occurs only if the company’s financial performance improves as measured by identifiable objective performance metrics.

16

Total Compensation

The Committee annually reviews the total compensation of executive officers, including the Chairman and Chief Executive Officer, with that of a peer group of other companies, including, but not limited to forest products companies, paper and packaging companies, basic materials companies and designated high performing companies. The Committee then reviews the compensation and performance of that group and compares it to the company’s executive compensation program and performance levels.

The Committee also reviews management’s assessment of individual performance and retention issues for each executive and conducts its own assessment of the Chairman and Chief Executive Officer. Based upon its review and assessment, the Committee reviewed and approved executive compensation levels for 2005, taking into account individual job performance and the competitive dynamics of executive recruitment and retention. While competitive data are useful in this exercise, the Committee uses such information as important input and not the sole basis for adjusting executive compensation levels.

Perquisites

The Committee notes that the company does not maintain any special perquisites for executives and senior management such as company cars, country club memberships and generally provides no special travel benefits (such as personal use of corporate planes). All executives participate in the same broad-based benefit programs offered to all salaried and non-union hourly employees. The company does provide reimbursement for financial counseling in the amount of $10,000 in the first year and then $5,000 per year thereafter for members of senior management, including Leadership Team members.

Supplemental Executive Retirement Plan

The company maintains a supplemental executive retirement plan, designed to recruit and retain executives who join the company in mid career. As the plan is designed to benefit mid-career hires, the Chairman and Chief Executive Officer as well as the President (due to their long-standing service with the Company) derive only minimal benefit from the plan.

Deferred Compensation Plan

The Company maintains a non-qualified deferred compensation program, which permits executives above a particular salary grade to defer voluntarily a portion of base salary and annual or long-term incentive cash compensation on a pre-tax basis. Such deferrals remain an unfunded liability of the company. Plan participants are offered a choice of conventional investment vehicles with market rates of return and are not assured of any particular return on their investments.

Restoration Plans

The company maintains a non-qualified defined benefit plan as well as a defined contribution plan for executive officers, the purpose of which is to restore benefits that are not available under the company’s qualified retirement and 401(k) savings plans because of compensation limitations imposed by federal laws. These plans mirror the benefits provided under the company’s qualified plans that are available to all employees. Benefits provided under such plans are unfunded liabilities of the company.

Cash Compensation

Cash compensation has three components: base salary, annual incentive award and long-term incentive award. The amount of each of these components is established pursuant to the total compensation review process, taking into account the base salaries and annual and long-term awards paid by other peer group and comparable companies with particular emphasis on each individual’s performance and company performance levels.

The company’s annual incentive and long-term cash incentive compensation is paid pursuant to the MeadWestvaco Corporation Annual and Long-Term Incentive Plan (the “Plan”), which has been approved by stockholders and which is designed to allow full deductibility of cash awards for federal

17

income tax purposes. See “Deductibility of Executive Compensation” below. Annual and long-term awards for the current year are earned by participants based upon the achievement of annual and long-term measurable company performance goals reviewed and approved by the Committee, as well as upon their individual performance.

Beginning in 2005, the company discontinued the cash portion of its long-term program and no additional amounts will be awarded under this Plan. However, the Committee retains responsibility for approving Plan distributions with respect to amounts earned in prior years. To this end, the Committee reviewed the distribution of long-term cash incentive balances reflecting amounts credited to executives’ accounts for the 2002 and 2004 calendar years (based on the attainment of certain goals in those years). In accordance with Plan design, the Committee authorized payment of the second one-third of such accounts and payment of such amounts was made in February of 2006. The remaining account balances in executives’ long-term credit accounts will be eligible for payment in February of 2007, subject to the Committee’s review and approval.

For 2005, the Committee established performance goals for annual cash incentives based upon measurable results that reflected the following financial and operational priorities reviewed by the Board of Directors: earnings before interest & taxes (EBIT) weighted at 60%, working capital (as a percentage of sales) weighted at 35% and safety weighted at 5%.

For 2005, the Committee established a long-term incentive approach based on a 3-year performance period utilizing the following metrics: return on invested capital (ROIC) weighted at 40%, reduction in selling, general & administrative expenses as a percent of sales (SG&A) weighted at 20%, total procurement savings (net of inflation) weighted at 20% and revenue from new products (with increased product margins) weighted at 20%. If threshold criteria are achieved, payment may be 50% of a participant’s target. The minimum award payable is zero and the maximum award possible is 150% of a participant’s target payout. For 2005 long-term awards for the Leadership Team are payable in the form of cash (one-third) with the remaining two-thirds in company stock at the end of the performance period. (For other key employees, long-term awards are payable 50% in company stock and 50% in the form of non-qualified stock options.) At the beginning of the performance period the executive is issued restricted stock based on the target payout which vests subject to achievement of the performance metrics established by the Committee. At the end of the performance period, if targeted performance is exceeded, the executive will be awarded additional shares to reflect the above target performance.

The Committee reviewed the company’s 2005 performance as compared to the annual incentive goals described above. The Committee noted that the 2005 financial performance had been significantly affected by weaker market conditions and by the sudden increase in energy and related costs during the year. Based upon the plan formula and the recommendation of management, the Committee determined that there would be no payment of annual incentive awards for the Leadership Team for 2005. With respect to long-term cash incentive compensation, no long-term cash incentive award was available based on the new long-term design tied to a 3-year performance period.

Stock Ownership Guidelines

In January 2005, the Company adopted stock ownership guidelines to reinforce the alignment of the long-term financial interest of the company’s stockholders and its senior management. These guidelines require certain executives to hold company stock valued at a multiple of their base salary. For the Chairman and Chief Executive Officer the amount is five times base salary and for Leadership Team Members (direct reports to the Chairman and Chief Executive Officer) the amount is three times base salary. A lower threshold has been established for other members of the management organization. Executives are expected to meet these ownership guidelines within a five year period of their hire or promotion date.

Equity-Based Compensation

In addition to the cash-based compensation incentives described above, the Committee periodically makes grants of equity to executives. As noted above, the Committee redesigned the company’s 2005

18

long-term compensation program to insure that two-thirds of all such compensation is equity based. In 2006 the Committee continued this trend and made further refinements to the company’s long-term incentive program so that 2006 long-term incentive compensation awards will be paid entirely in equity. For the Leadership Team the awards were 60% in the form of performance based restricted stock units and 40% in the form of stock options. In February 2006 the Committee awarded stock options and other equity compensation awards (in the form of performance based and service based restricted stock units) to 426 employees. Stock options vest pro rata over the 3-year period, and the performance based restricted stock units vest after three years subject to attainment of certain financial metrics established by the Committee as well as Committee approval. Service based restricted stock units vest after three years.

Compensation for the Chairman and Chief Executive Officer

John A. Luke, Jr. received compensation for 2005 that included a base salary, but no annual cash incentive award. He also received a performance-based long-term award payable one-third in cash with the remaining two-thirds in company stock at the end of the 3-year performance period. The cash award assuming target performance is $1,462,725 and the restricted stock award assuming target performance covers 98,300 shares. Both awards vest after three years, subject to the satisfactory completion of financial metrics established by the Committee for the 2005-2007 performance period. The ultimate value of the cash award and the actual number of shares issued under the restricted stock award are subject to adjustment but may not exceed 150% of the initial award.

Specific performance criteria (described under the heading “Cash Compensation” above) was established against which the Committee measured the performance of the Chairman and the Chief Executive Officer for purposes of determining his total compensation and for purposes of determining his eligibility for any incentive compensation.

There was no adjustment to Mr. Luke’s base salary in 2005. The Committee noted that the 2005 financial performance had been significantly affected by weaker market conditions and by the sudden increase in energy and related costs during the year. Based upon the plan formula and the recommendation of management, the Committee determined that there would be no payment of an annual incentive award to Mr. Luke for 2005. With respect to long-term cash incentive compensation, no long-term cash incentive award was available based on 2005 performance. In accordance with the long-term plan design, in January 2006, the Committee authorized the payment of amounts previously credited to Mr. Luke for performance in the years 2002 and 2004 (based on the attainment of certain goals in these years), representing one-third of Mr. Luke’s previously credited account, or $597,000. As part of a 2006 long-term incentive compensation equity award described above, the Committee also granted 94,980 performance-based restricted stock units to Mr. Luke, which are subject to adjustment based on the attainment of certain financial metrics established by the Committee as well as Committee approval. In addition, Mr. Luke was awarded a non-qualified stock option grant covering 192,300 shares.

Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code permits a tax deduction to public companies for individual compensation over one million dollars per year paid to a company’s chief executive officer and to the four other most highly compensated executive officers, provided the compensation paid is based upon the achievement of objective performance goals under a stockholder-approved arrangement. The company’s cash and equity incentive compensation program was designed to comply with the requirements for this exemption, permitting full deductibility of all annual and long-term cash incentive compensation as well as cash and equity compensation payable under the company’s 2005 Performance Incentive Plan approved by shareholders in 2005. The Committee does not currently believe that Section 162(m) will affect the company’s tax deductions for compensation in 2005. However, the Committee believes that the company’s compensation programs should be managed in the overall best interests of the company’s stockholders, and it therefore reserves the right to pay non-deductible compensation.

19

Summary

The Committee believes the caliber and motivation of its executives and all of MeadWestvaco’s employees are extremely important to its ability to meet future challenges and to deliver long-term value to its stockholders.

Submitted by:

| | |

| |

Susan J. Kropf, Chair | | Duane E. Collins |

Dr. Thomas W. Cole, Jr. | | Richard B. Kelson |

Compensation Committee Interlocks and Insider Participation

The Compensation and Organization Development Committee currently consists of Ms. Kropf as Chairman, Dr. Cole, Messrs. Collins and Kelson. None of our executive officers served as:

| | (i) | | a member of the compensation committee (or other board committee performing equivalent functions, or in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on our Compensation and Organization Development Committee; |

| | (ii) | | a director of another entity, one of whose executive officers served on our Compensation and Organization Development Committee; or |

| | (iii) | | a member of the compensation committee (or other board committee performing equivalent functions, or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served as our director. |

20

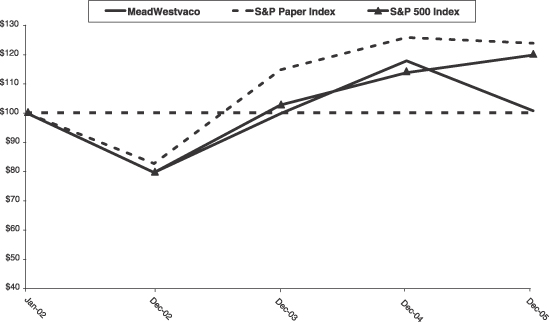

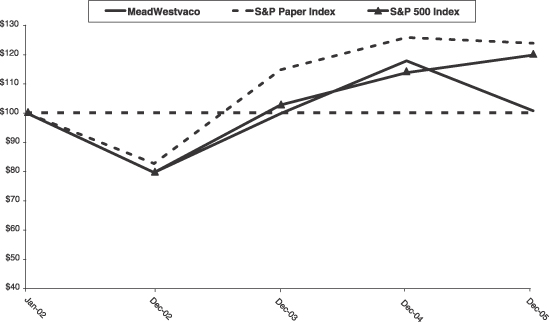

Total Stockholder Return

January 30, 2002-December 31, 2005

| | | | | | | | | |

| | | MWV | | S&P Paper

Index | | S&P 500 Index |

Invest @ 1/30/02 | | $ | 100 | | $ | 100 | | $ | 100 |

Value @ 12/31/02 | | $ | 80 | | $ | 83 | | $ | 80 |

Value @ 12/31/03 | | $ | 100 | | $ | 115 | | $ | 103 |

Value @ 12/31/04 | | $ | 118 | | $ | 126 | | $ | 114 |

Value @ 12/31/05 | | $ | 101 | | $ | 124 | | $ | 120 |

This graph compares the cumulative total return to stockholders on MeadWestvaco common stock from January 30, 2002, the first day of trading of the company’s common stock after the merger, plus reinvested dividends and distributions through December 31, 2005 with the return on the Standard & Poor’s 500 Stock Index (S&P 500) and the Standard & Poor’s Paper & Forest Products Index (S&P Paper Index) (the company’s peer group index) during the same period. As of December 31, 2005, the S&P Paper Index included the following companies: International Paper Company, Louisiana-Pacific Corporation, MeadWestvaco and Weyerhaeuser Company (Georgia-Pacific Corporation was also a component of this index until it was acquired by Koch Industries, Inc. on December 23, 2005). This graph assumes $100 was invested on January 30, 2002 in each of the following: the company’s common stock, the S&P 500 Index and the S&P Paper Index. This graph should not be taken to imply any assurance that past performance is predictive of future performance.

21

Summary Compensation Table

The following table presents information concerning total compensation paid to the Chief Executive Officer and certain other executive officers of the company (collectively, the “named executive officers”).

| | | | | | | | | | | | | | | | | |

Name and Principal

Position with

MeadWestvaco

| | Year

| | Salary

| | Annual Compensation

| | Long-Term Compensation

|

| | | | | Awards

| | Payouts

|

| | | | Bonus

| | Other Annual Compensation(1)

| | Restricted

Stock

Awards

| | Securities

Underlying Options

| | LTIP Payouts(2)

| | All Other

Compensation

(3)

|

| John A. Luke, Jr. Chairman and CEO | | 2005

2004

2003 | | $

$

$ | 977,917

918,000

897,917 | | $0

$1,250,750

$197,900 | | $0

$185,438

$229,035 | | $0

$1,152,000

— | | 0

100,000

175,000 | | $596,990

$597,000

$168,000 | | $102,658

$53,671

$64,941 |

| | | | | | | | |

James A. Buzzard President | | 2005

2004

2003 | | $

$

$ | 649,500

612,000

583,333 | | $0

$561,000

$93,600 | | $0

$31,069

$39,835 | | $0

$576,000

— | | 0

45,000

55,000 | | $225,447

$225,466

$60,000 | | $41,093

$31,398

$37,718 |

| | | | | | | | |

E. Mark Rajkowski Senior VP and CFO | | 2005

2004

— | | $

$

| 550,008

208,336

— | | $0

$528,180

— | | $0

$98

— | | $0

$1,611,900

— | | 0

35,000

— | | $82,457

$82,467

— | | $35,836

$8,565

— |

| | | | | | | | |

Wendell L. Willkie, II Senior VP, General Counsel and Secretary | | 2005

2004

2003 | | $

$

$ | 439,250

428,400

418,333 | | $0

$265,740

$44,300 | | $0

$84,946

$182,633 | | $0

$345,600

— | | 0

20,000

35,000 | | $90,000

$90,000

$30,000 | | $29,045

$21,136

$24,083 |

| | | | | | | | |

Mark T. Watkins Senior VP | | 2005

2004

2003 | | $

$

$ | 432,796

429,600

421,200 | | $0

$243,600

$97,400 | | $44,144

$45,866

$108,972 | | $0

$288,000

— | | 0

17,500

31,000 | | $87,600

$87,600

$29,200 | | $28,112

$24,247

$26,597 |

| (1) | | “Other Annual Compensation” reflects the appreciation in the value of assets held in the executives’ deferred compensation accounts. For all but one executive, there was a decline in the value of the deferred compensation accounts. |

| (2) | | “LTIP Payouts” represent amounts earned for the 2002 and 2004 calendar years (not 2005). This Plan was discontinued as of January 1, 2005. The amounts earned were payable in three annual installments commencing in 2004. The 2006 installment is payable in 2007 subject to Committee discretion. |